3 Things The Bond Markets Are Telling Us Right Now

Several rate hikes are already priced into the curve; both their pace and magnitude look sensible

Published ET

Source: Factset

Not a day goes by without new articles telling us how fast rates are increasing, and how inflation is about to make a huge come back.

Looking at market data, what is clear is the following:

- Inflation expectations have come back to normal levels seen pre-covid

- The Fed is not expected to raise rates until the end of 2022

- After 2022, rates are expected to rise by about 0.50% per year for the following 3 years

None of those facts are particularly dramatic, and it's not clear yet whether current market expectations are too optimistic, too pessimistic or just right.

Let's dive into each of those points:

1) Inflation expectations are back to normal

Inflation-linked swaps show us that inflation expectation have indeed risen very rapidly from the depressed levels of March 2020, but they are at levels seen recently in 2014 and 2018. In addition, it seems that inflation expectations peaked in mid February and are starting to recede slightly.

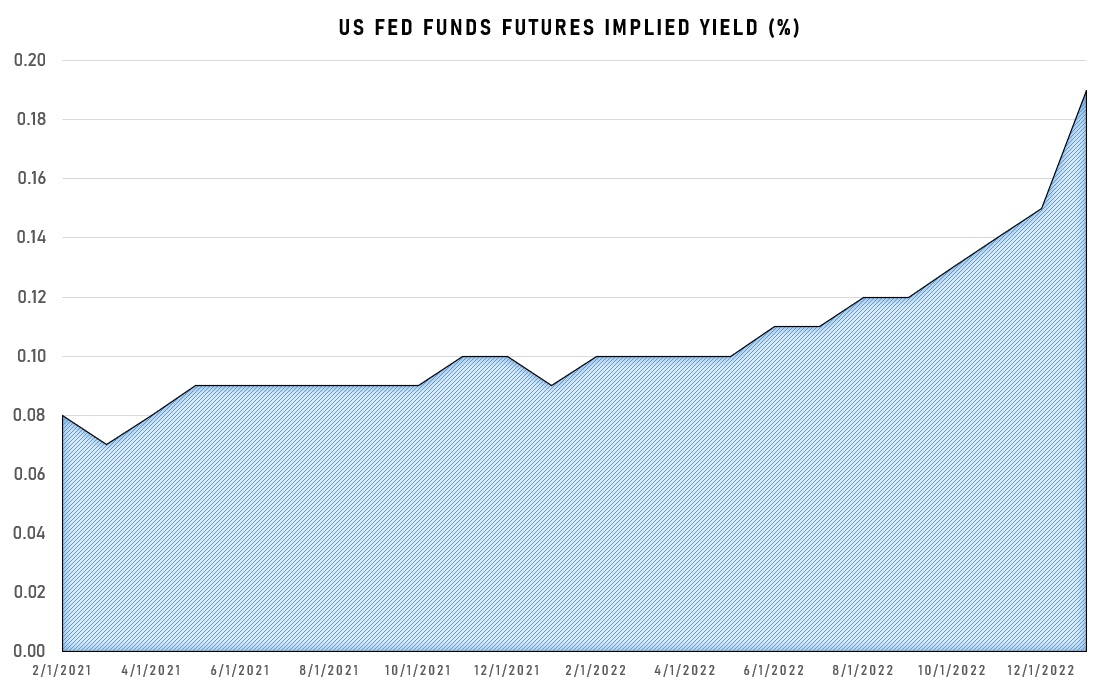

2) Fed funds futures imply that the Federal Reserve won't take any action until the end of 2022

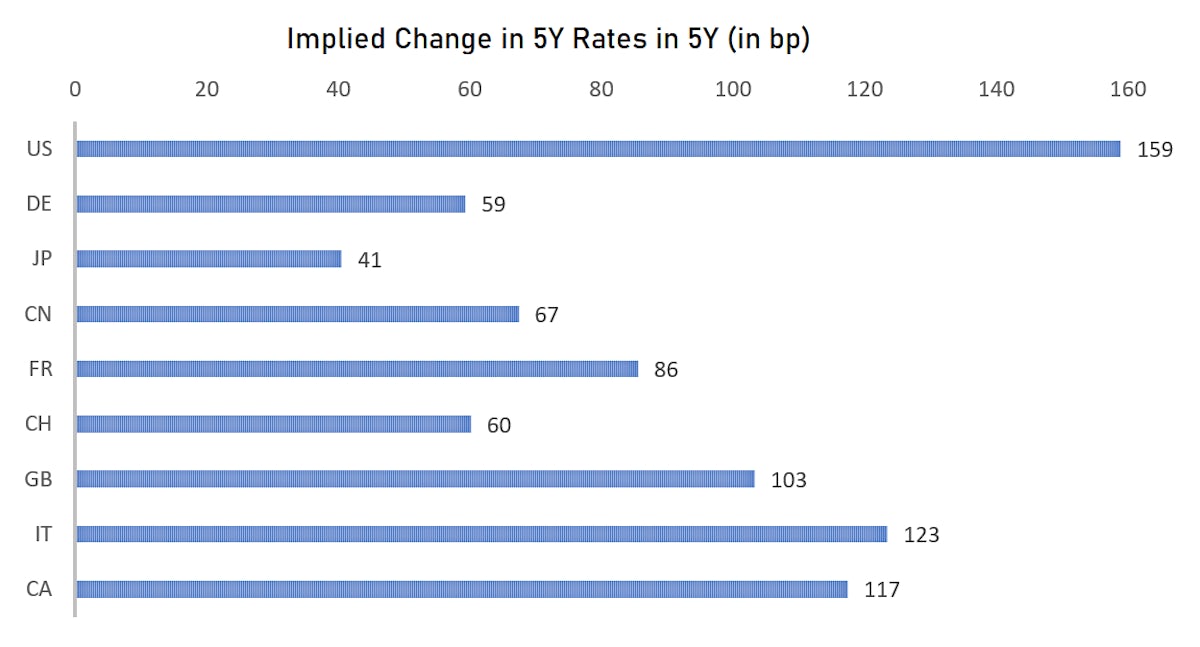

3) Sovereign yield curves tell us that the US is expected to raise rates faster than the rest of the world

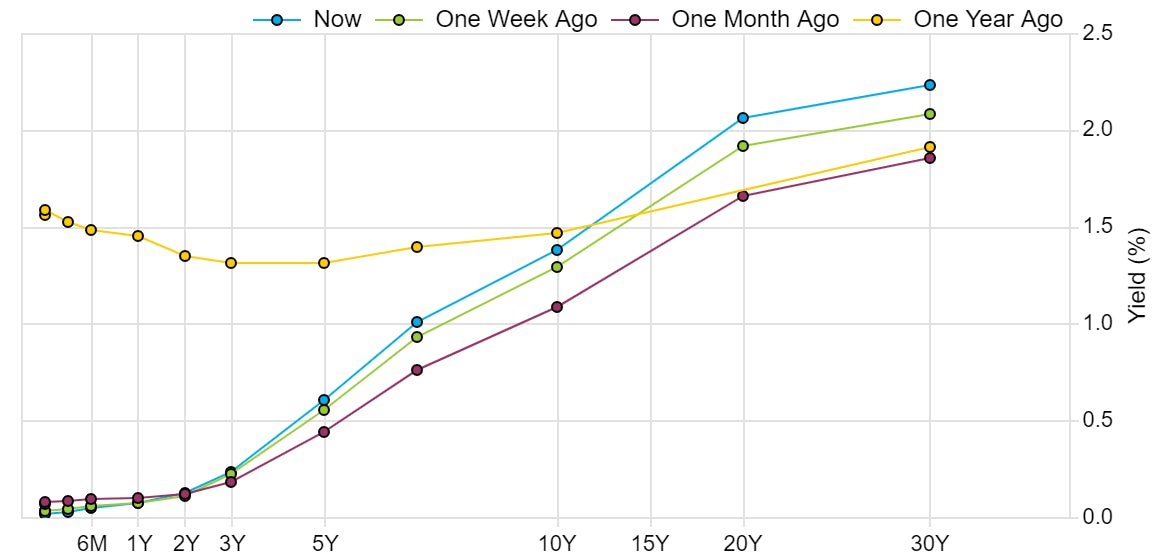

Our analysis of interest rates says something simple: the 5-year US rate is expected to rise by about 160bp over the next 5 years. An increase for sure, but one that looks pretty reasonable: if nothing much happens until the end of 2022, markets expect to see increases of about 50bp per year for the following 3 years.

Actually what strikes us more about this chart is the glacial pace of expected rate rises in other countries, particularly Asia and Europe. If the latter raised in fact faster than current expectations, that would give another blow to the US dollar. But that's another story..