Credit

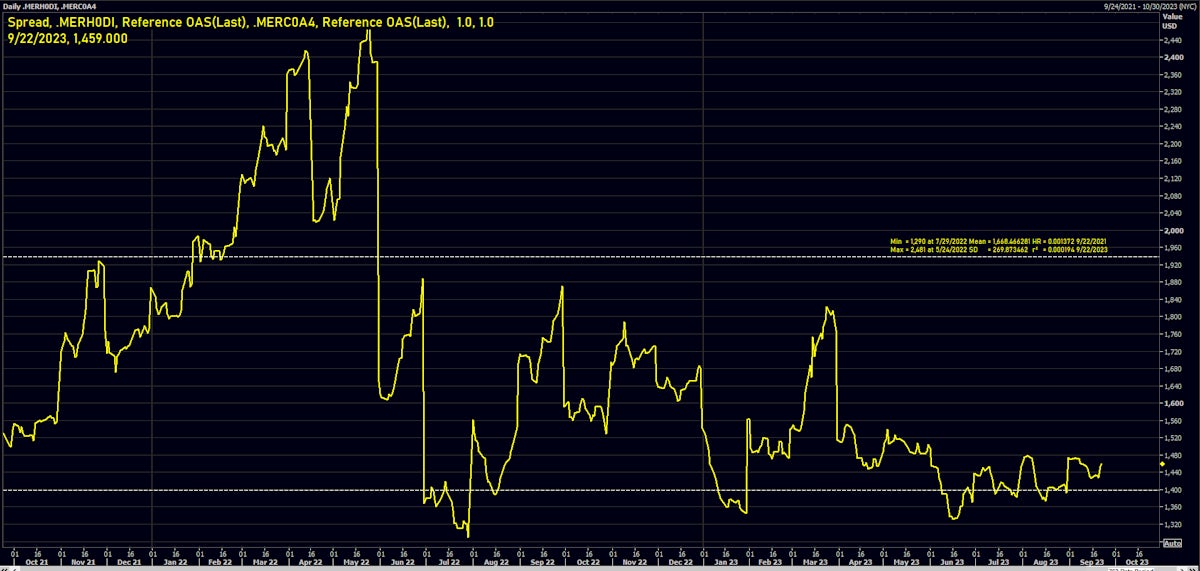

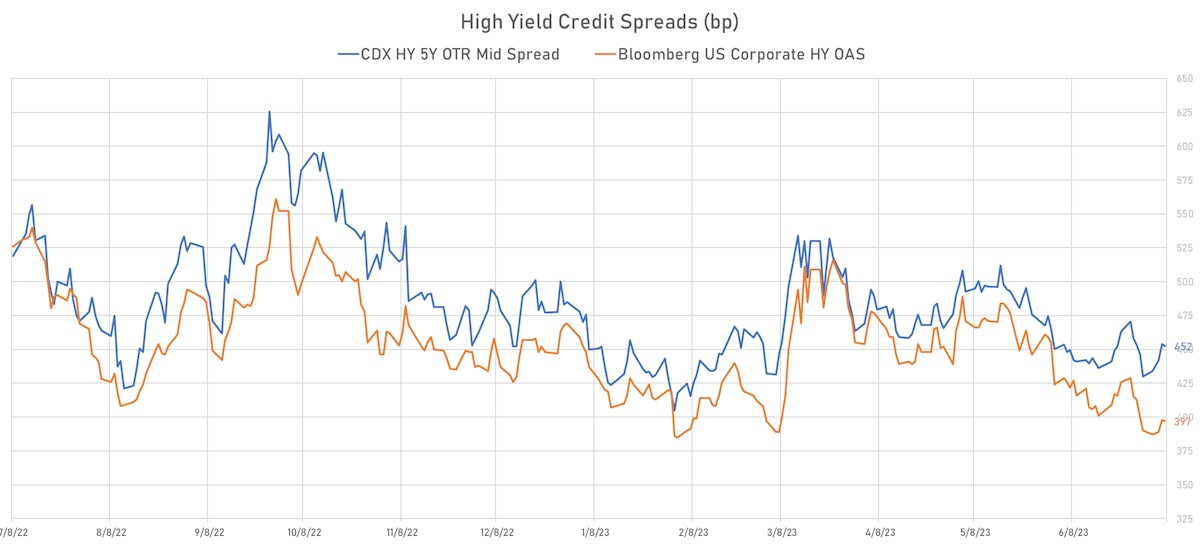

Cash Spreads Tightened Slightly While Payer Skew In CDX Swaptions Pushed Up By Geopolitical Risk

Limited USD bond supply as 3Q23 earnings season kicks off: 14 tranches for $13.25bn in IG (2023 YTD volume US$1.027trn vs 2022 YTD US$1.031trn), 4 tranches for $2.705bn in HY (2023 YTD volume US$137.436bn vs 2022 YTD US$87.661bn)

Credit

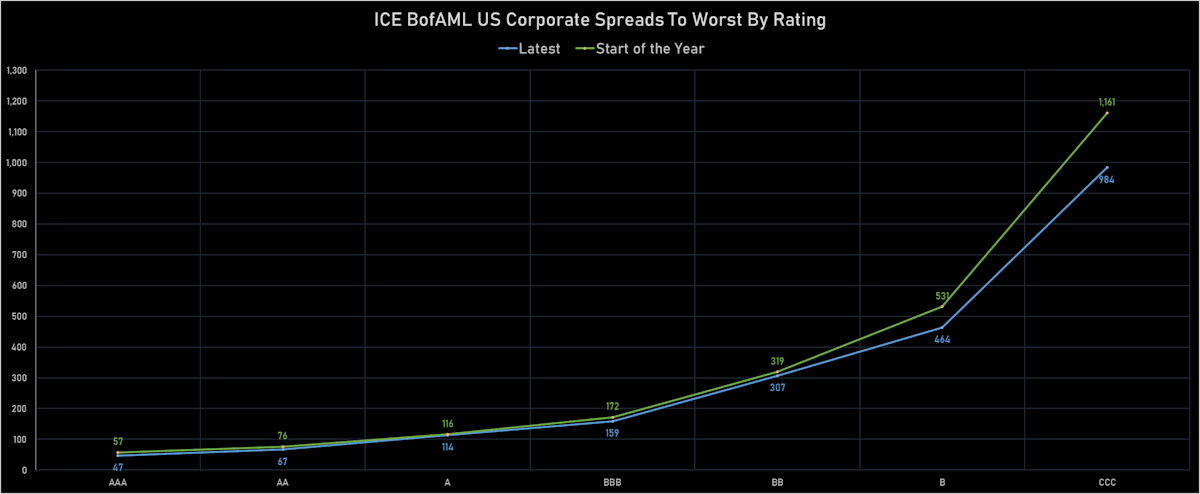

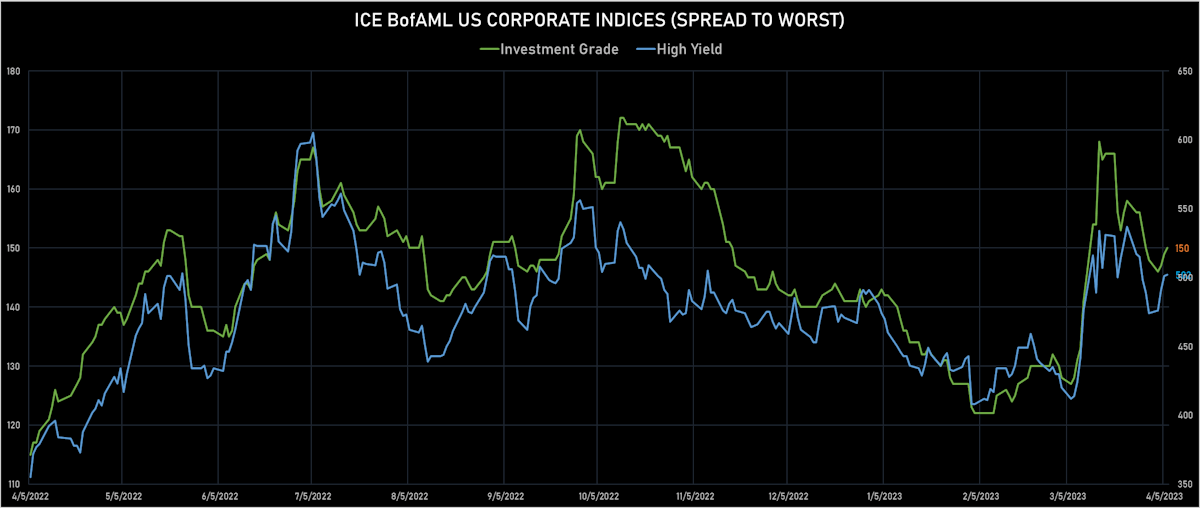

Despite Recent Widening, Cash Spreads Are Still At Reasonable Historical Levels, Credit Fundamentals Healthy For Most Sectors

Limited amount of corporate bond issuance this week: 15 tranches for US$8.9bn in IG (2023 YTD volume US$1.013trn vs 2022 YTD US$1.030trn), none in HY (2023 YTD volume US$134.731bn vs 2022 YTD US$87.001bn)

Credit

Broad Selloff In USD Credit, As Yields Rise, Spreads Widen Across The Complex

Decent levels of issuance considering the backdrop this week: 23 tranches for $19.6bn in IG (2023 YTD volume $1.004trn vs 2022 YTD $1.016trn), 7 tranches for $5.1bn in HY (2023 YTD volume $134.731bn vs 2022 YTD $86.376bn)

Credit

Move To Quality In USD Credit Pushes HY Spreads Wider, IG Spreads Tighter

More modest levels of USD bond issuance this week: 21 tranches for $16.65bn in IG (2023 YTD volume $984.959bn vs 2022 YTD $1.014trn), 12 tranches for $8.333bn in HY (2023 YTD volume $129.631bn vs 2022 YTD $86.376bn)

Credit

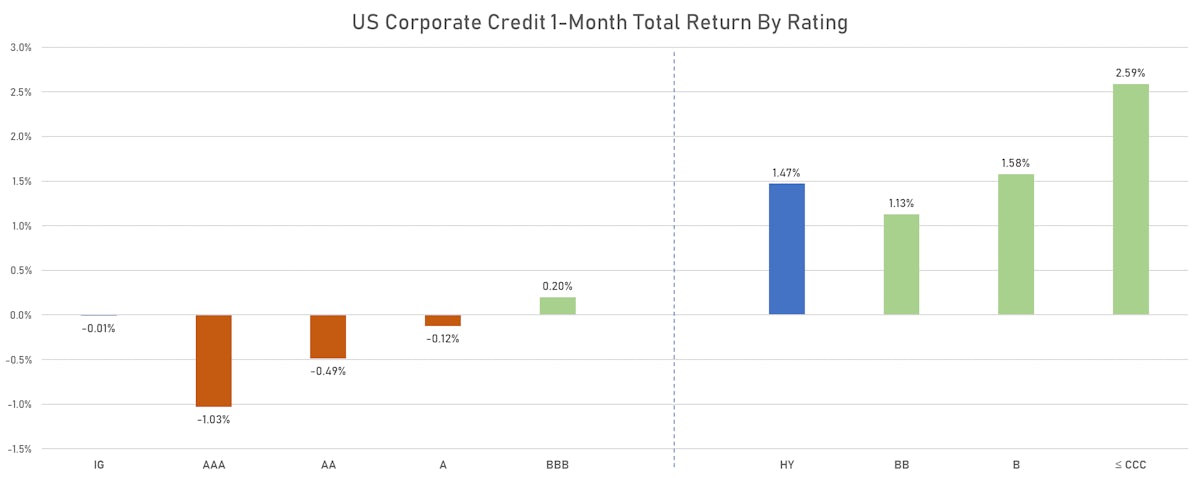

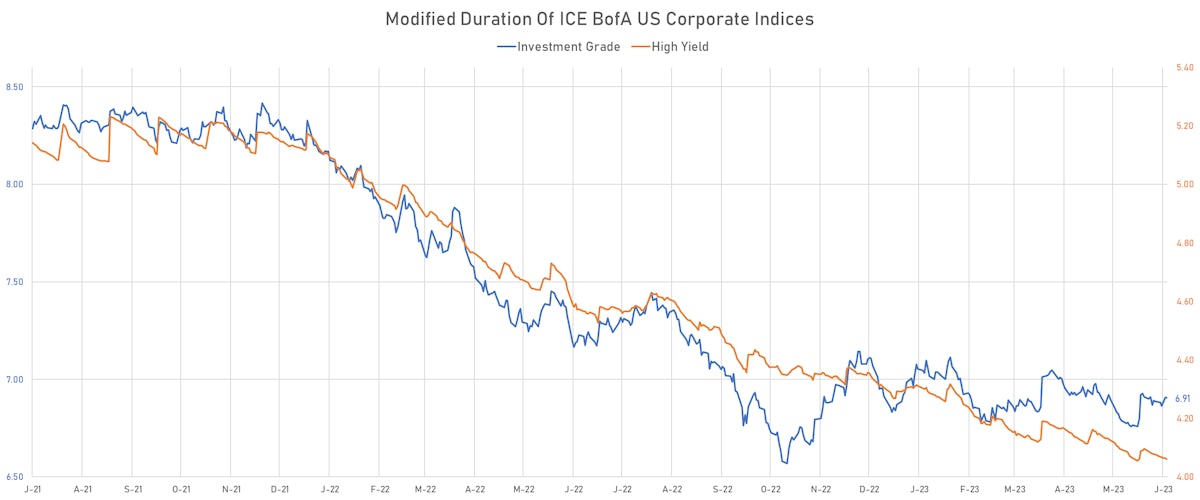

USD HY Overperformed IG This Week, As Spreads Tightened While Duration Sold Off

A decent week for USD bond issuance: 45 tranches for $36.085bn in IG (2023 YTD volume $968.309bn vs 2022 YTD $1.008trn), 14 tranches for $9.15bn (2023 YTD volume $121.297bn vs 2022 YTD $80.376bn)

Credit

Losses Across The US Credit Complex, With Modest Spread Widening Amplifying The Move In Rates

High-quality bond issuance jumped this week as corporates are back to work: 74 tranches for $57.53bn in IG (2023 YTD volume $932.224bn vs 2022 YTD $988.591bn), 3 tranches for $815m in HY (2023 YTD volume $112.147bn vs 2022 YTD $78.876bn)

Credit

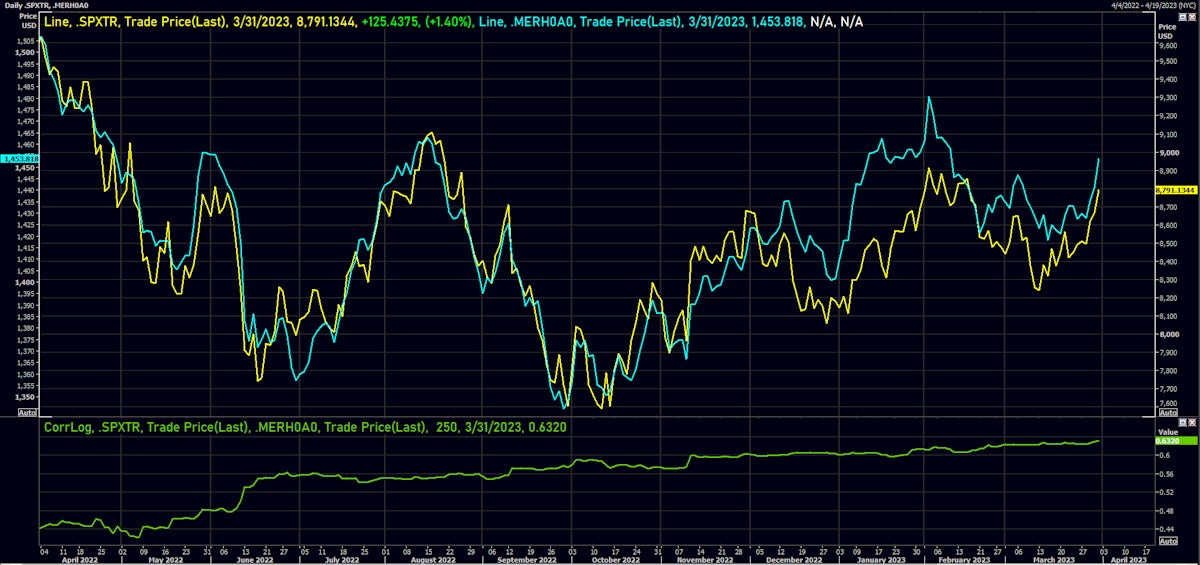

High Yield USD Cash Credit Has Outperformed Equities Over The Month Of August On A Vol Adjusted Basis

Very little activity in the USD primary bond market this week: 4 tranches for $3.45bn in IG (2023 YTD volume $873.694bn vs 2022 YTD $936.09bn), no new issue in HY (2023 YTD volume $111.332bn vs 2022 YTD $77.37)

Credit

Broad Widening In Credit Spreads, HY-IG Decompression As Risk Markets Take A Breather

Healthy issuance volumes of USD corporate bonds this week: 44 tranches for $34.6bn in IG (2023 YTD volume $820.91bn vs 2022 YTD $881.941bn), and 5 tranches for $2.995bn in HY (2023 YTD volume $102.907bn vs 2022 YTD $71.301bn)

Credit

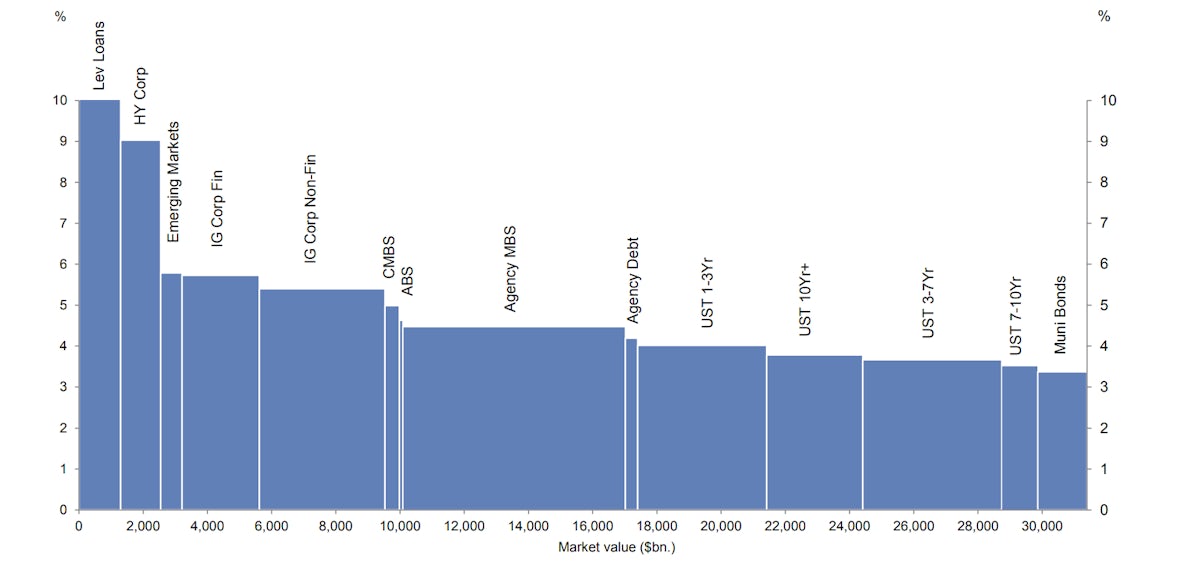

Spread Compression Across The Credit Complex, Led By The Riskiest Assets Classes

Limited supply of new corporate bonds this week: 18 tranches for $15.65bn in IG (2023 YTD volume $786.310bn vs 2022 YTD $824.091bn), 4 tranches for $2.61bn in HY (2023 YTD volume $99.952bn vs 2022 YTD $68.576bn)

Credit

USD Credit Largely Unchanged This Week, With Slight HY-IG Spread Decompression

USD corporate bond issuance reopens with 2Q23 earnings season: 25 tranches for $30.575bn in IG this week (2023 YTD volume $770.66bn vs 2022 YTD $805.491bn, -4.3% YoY), 6 tranches for $2.835bn in HY (2023 YTD volume $97.342bn vs 2022 YTD $68.576bn, +41.9% YoY)

Credit

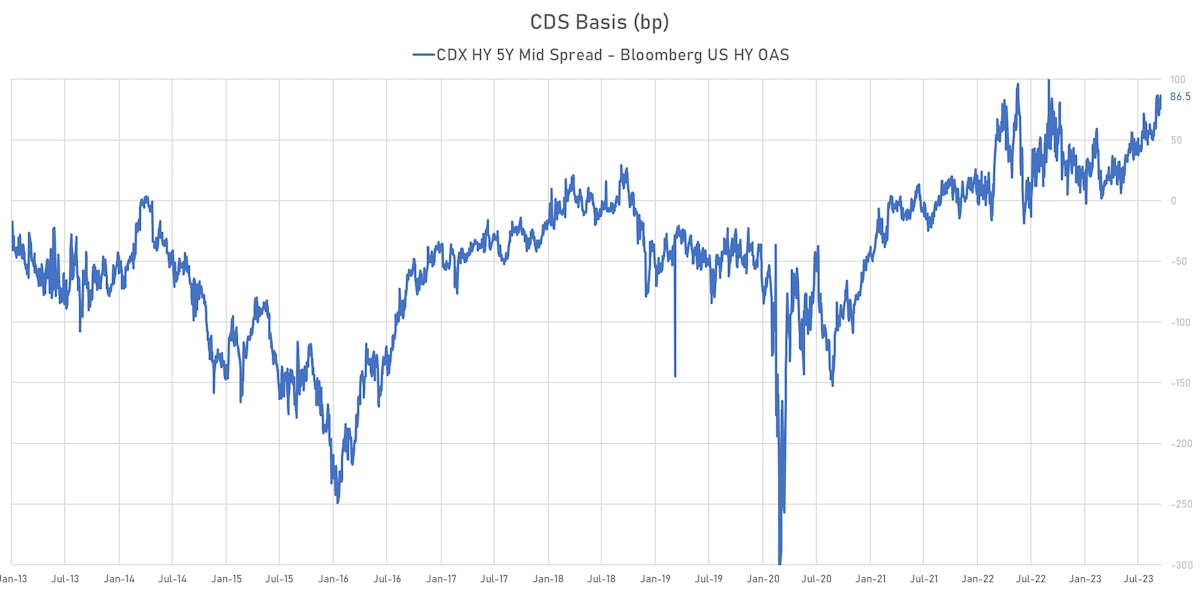

Continued Hedging In USD HY Reflected In Wider Cash-CDX Basis And Payer-Receiver Swaptions Skew

Tepid weekly volumes for USD corporate issuance: 14 tranches for US$11.6bn in IG (2023 YTD volume US$740.085bn vs 2022 YTD US$759.641bn), 1 tranche for US$500m in HY (2023 YTD volume US$94.507bn vs 2022 YTD US$67.816bn)

Credit

Spreads Mixed This Week In The US Credit Complex, With Cash Outperforming Synthetics

Fairly quiet week of USD corporate bond issuance (IFR data): 17 tranches for US$12.8bn in IG (2023 YTD volume US$728bn vs 2022 YTD US$750bn), none in HY(2023 YTD volume US$94bn vs 2022 YTD US$68bn)

Credit

Continued Spread Tightening Across The USD Credit Complex, As Distressed Bonds Total Returns Near 12% YTD

Pretty quiet week for USD corporate bond issuance: 13 tranches for $10.395bn in IG (2023 YTD volume $683.385bn vs 2022 YTD $716.791bn), and just 2 tranches for $895m in HY (2023 YTD volume $86.537bn vs 2022 YTD $67.366bn)

Credit

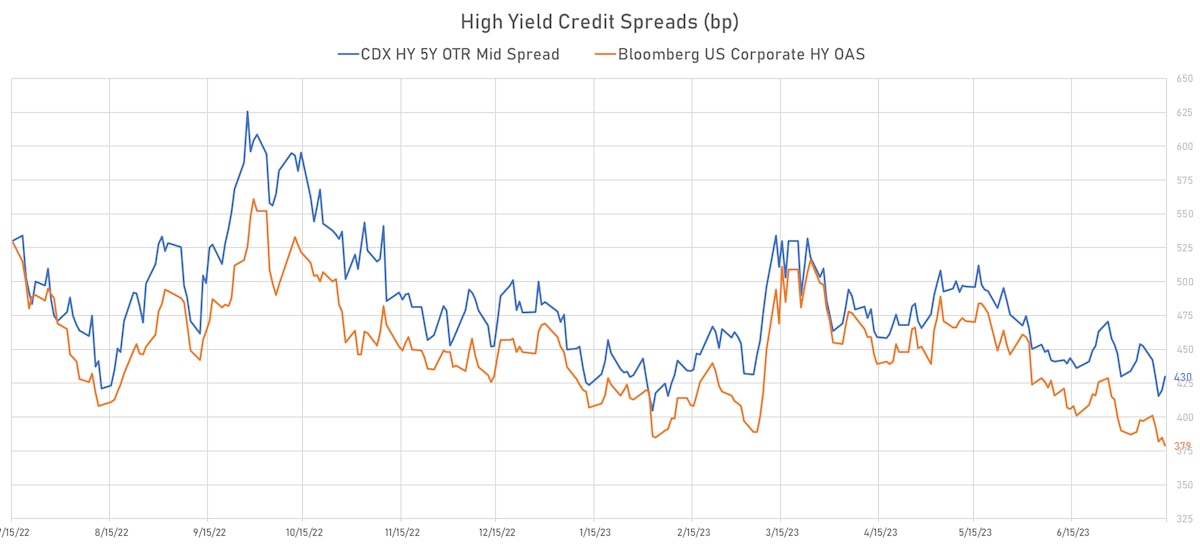

Lower Odds Of US Recession / Credit Crunch Continue To Support Spread Compression In High Yield

A good rebound in issuance volumes of US$ corporate bonds this week: 57 tranches for $48.45bn in IG (2023 YTD volume $672.99bn vs 2022 YTD $716.791bn), 4 tranches for $4.325bn in HY (2023 YTD volume $85.642.6bn vs 2022 YTD $66.071bn)

Credit

Decent Price Action In US Credit This Week Despite Duration Sell-Off, With Spreads Slightly Tighter

Modest amount of corporate bond issuance in the past week: 17 tranches for $14.45bn in IG (2023 YTD volume $610.04bn vs 2022 YTD $652.141bn), 9 tranches for $5.1bn (2023 YTD volume $80.692.6bn vs 2022 YTD $56.371bn)

Credit

Decent Credit Spread Compression This Week, As Duration Sell-Off Hit The Complex

Solid levels of corporate bond issuance as 1Q23 earnings season ended: 51 tranches for $60.55bn in IG (2023 YTD volume $595.59bn vs 2022 YTD $651.441bn), 7 tranches for $7.48bn in HY (2023 YTD volume $75.592.6bn vs 2022 YTD $56.371bn)

Credit

Duration In Driver's Seat, As US Cash Spreads Broadly Unchanged Over The Past Week

Solid weekly US new issue volumes: 43 tranches for $35.1bn in IG (2023 YTD volume $535.04bn vs 2022 YTD $618.041bn), 5 tranches for $3.74bn in IG (2023 YTD volume $68.112.6bn vs 2022 YTD $55.371bn)

Credit

USD Cash Spreads Broadly Wider This Week, Despite Strong Finish On Friday

USD corporate bond issuance rebounded this week (IFR Markets data): 29 tranches for $30.05bn in IG (2023 YTD volume $499.94bn vs 2022 YTD $593.89bn), 6 tranches for $5.8bn in HY (2023 YTD volume $64.372bn vs 2022 YTD $54.171bn)

Credit

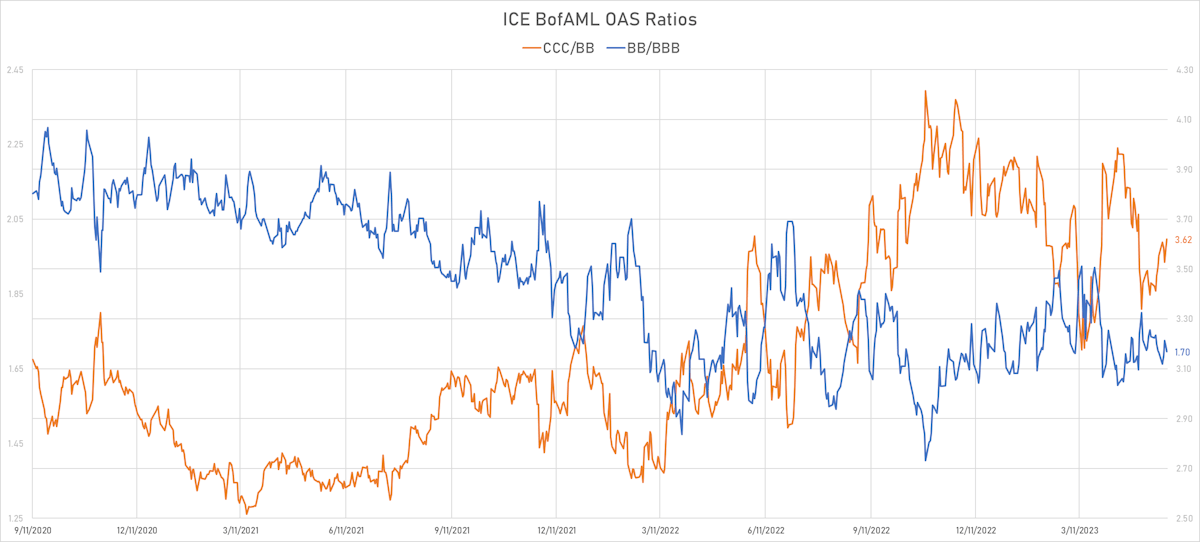

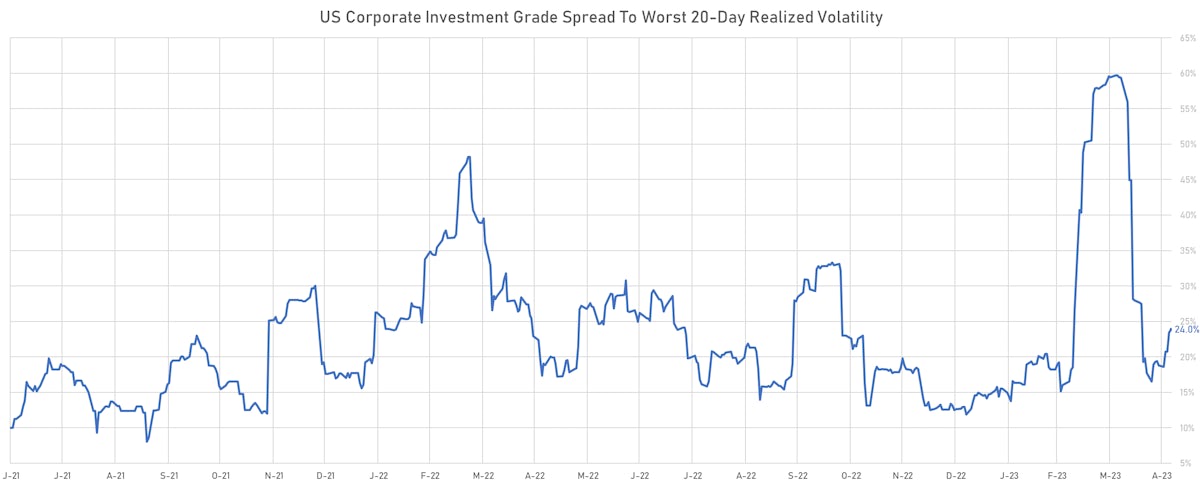

Despite The Volatility Scare In March, USD Cash Spreads Have Barely Moved YTD

Modest amount of US$ bond issuance for corporates this week: 21 tranches for $17.85bn in IG (2023 YTD volume $469.89bn vs 2022 YTD $577.641bn), 4 tranches for $3.12bn in HY (2023 YTD volume $58.572bn vs 2022 YTD $54.171bn)

Credit

USD Cash Spreads Mixed This Week, With Renewed Compression In The CCCs/BBs OAS Ratio

USD bond issuance returns as earnings start rolling in: 19 tranches for $30.75bn in IG (2023 YTD volume $452.04bn vs 2022 YTD $567.541bn), 6 tranches for $3.615bn in HY (2023 YTD volume $53.327bn vs 2022 YTD $49.646bn)

Credit

Solid Spread Compression Across The US Credit Complex, With Cash CCCs 65bp Tighter This Week

Weekly USD corporate bond issuance on the light side: 16 tranches for $10.95bn in IG (2023 YTD volume $421.29bn vs 2022 YTD $512.391bn, down 18 % YoY), 6 tranches for $3.325bn in HY (2023 YTD volume $51.837bn vs 2022 YTD $48.746bn, up 6%YoY)

Credit

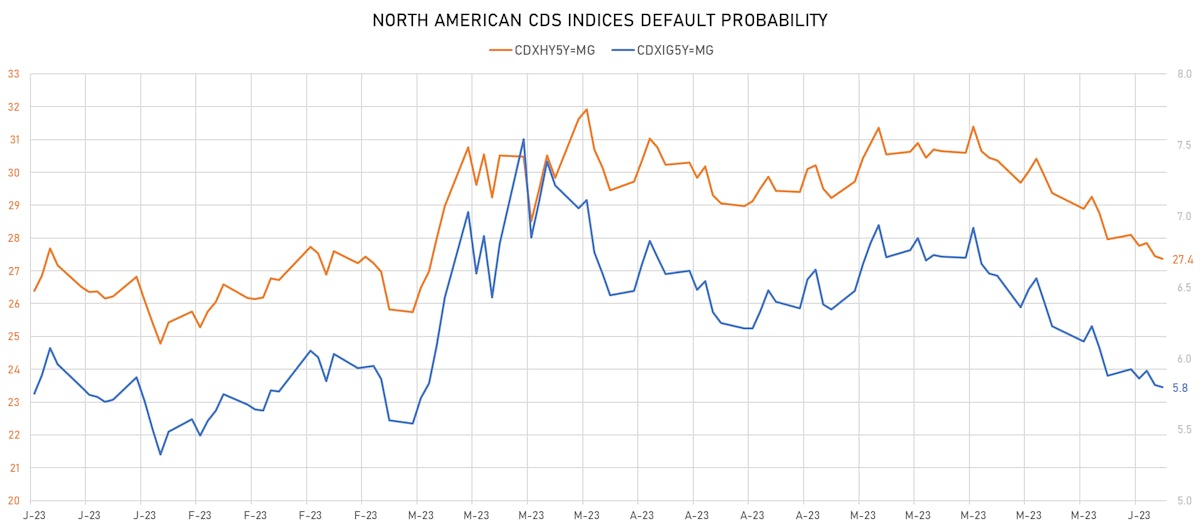

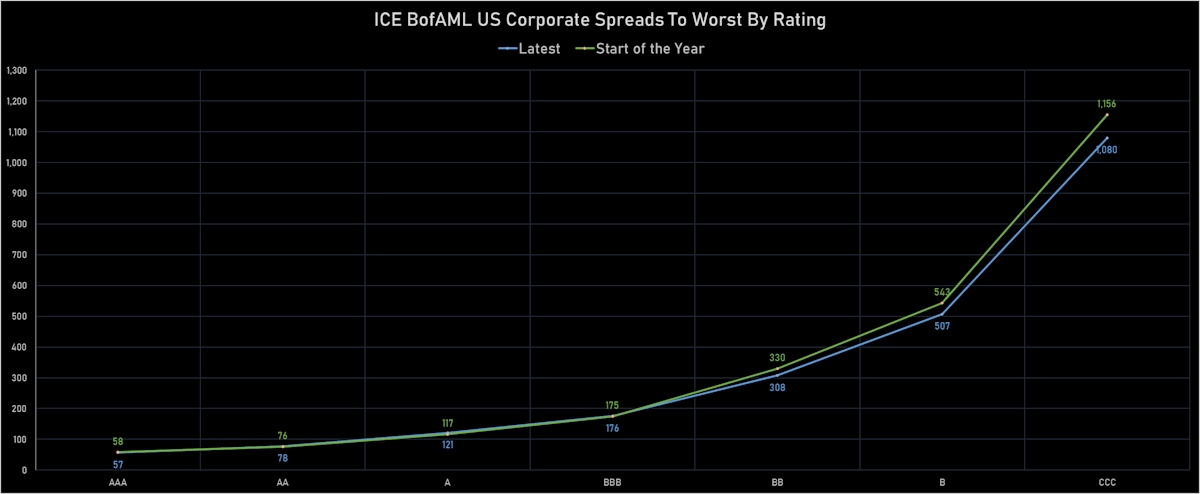

Despite The Significant Recent Widening Across The Complex, USD Credit Spreads Are Close To Unchanged YTD

Short week to kick off April after a very slow month of March: 15 tranches for $9.8bn in USD IG (2023 YTD volume $410.34bn vs 2022 YTD $480.291bn) in IG, 7 tranches for $8.337bn in HY (2023 YTD volume $48.512bn vs 2022 YTD $47.611bn)

Credit

Strong Rebound In USD HY Credit, Led By BBs Overperformance (OAS -73bp WoW)

Decent week for US$ bond issuance: 39 tranches for $24.825bn in IG (2023 YTD volume $400.54bn vs 2022 YTD $466.941bn), 2 tranches for $600m in HY (2023 YTD volume $40.175bn vs 2022 YTD $41.626bn)

Credit

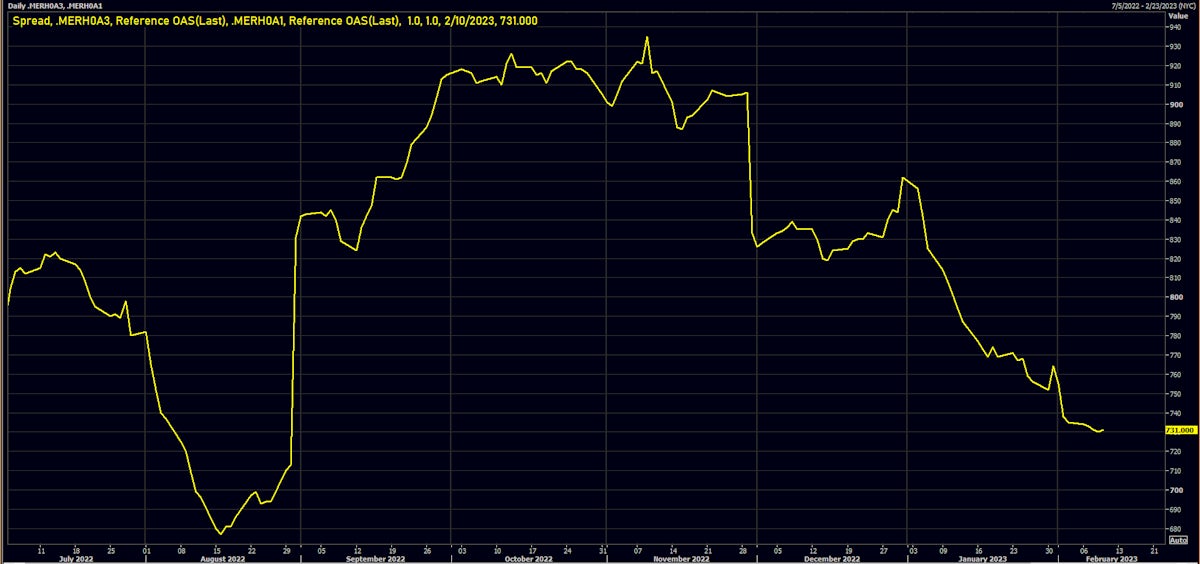

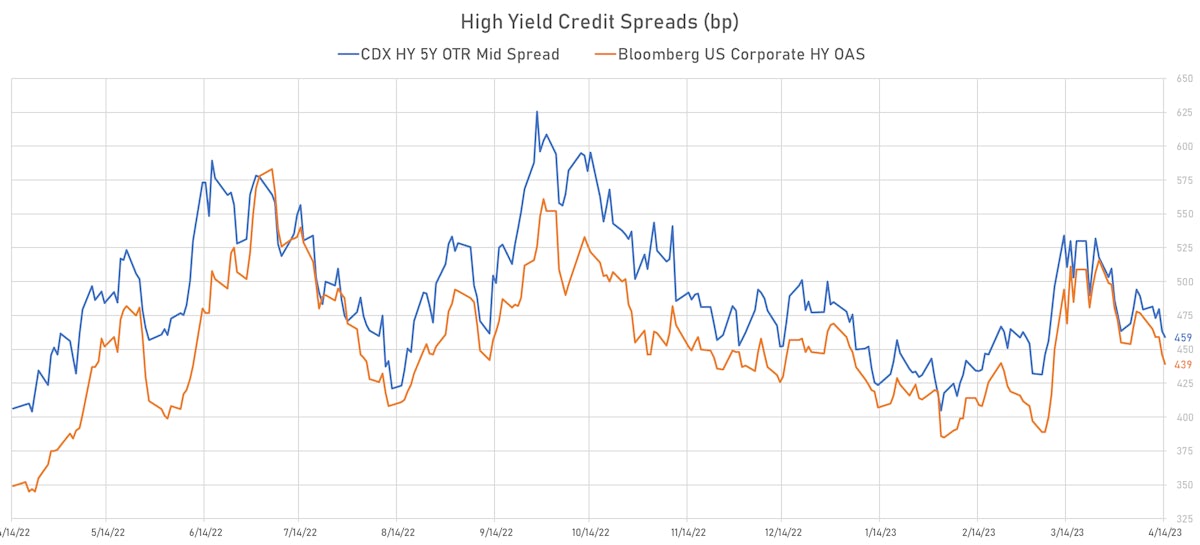

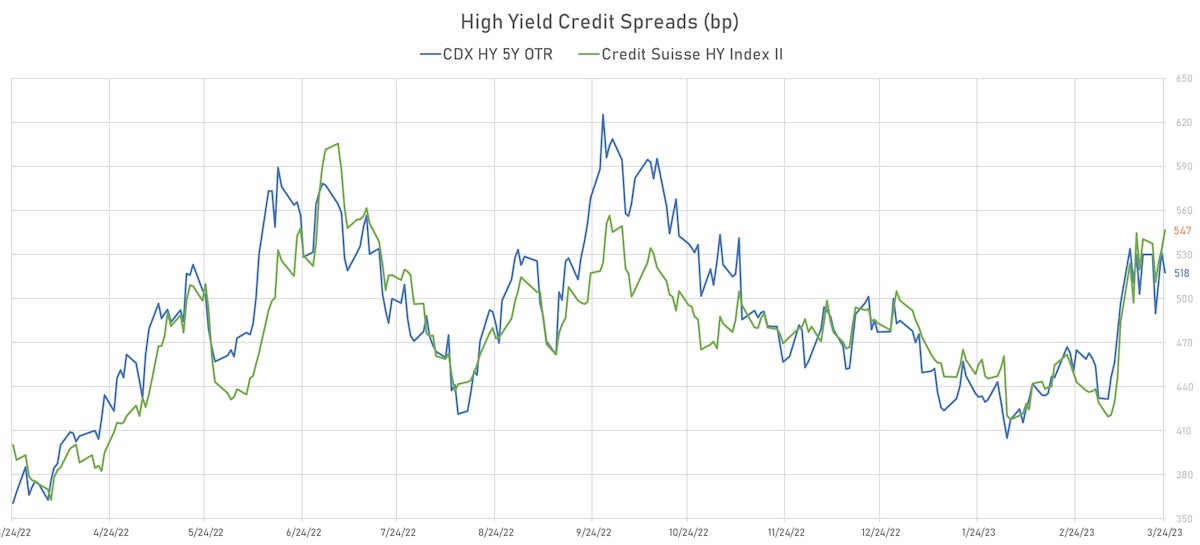

USD HY-IG Cash Spreads Over 100bp Wider In Past 3 weeks While Synthetics Do Slightly Better

The IG bond primary market reopened in the US this week with 28 Tranches for $21.05bn (2023 YTD volume $375.715bn vs 2022 YTD $430.541bn, down 12.7% YoY), while high yield issuance was nonexistent for the third straight week (2023 YTD volume $39.575bn vs 2022 YTD $38.676bn, up 2% YoY)

Credit

Wider Spreads Across The Credit Complex Driven By The Higher Likelihood Of A Credit Crunch

A quiet week for USD DCM syndicates: zero issuance in IG (2023 YTD volume $354.665bn vs 2022 YTD $392.19bn), and zero issuance in HY for the second straight week (2023 YTD volume $39.575bn vs 2022 YTD $34.876bn)

Credit

Broad Widening In Spreads Across The US Credit Complex, With IG Overperforming On Duration Bid

USD IG bond issuance continued at a fast clip this week: 53 tranches for $39.275bn in IG (2023 YTD volume $354.665bn vs 2022 YTD $361.14bn), no new issuance in HY (2023 YTD volume $39.575bn vs 2022 YTD $34.076bn)

Credit

Tighter Spreads Across The USD Credit Complex, Led By Single Bs, As BBs Continued To Underperform

Strong volumes of issuance this week (IFR Markets data): 66 tranches for $48.09bn in IG (2023 YTD volume $315.69bn vs 2022 YTD $287.841bn), 11 tranches for $7bn in HY (2023 YTD volume $39.575bn vs 2022 YTD $33.875bn)

Credit

Dealer Inventory For USD HY Bonds Estimated To Be At 12-Month High, While The CDS-Cash Basis Widened This Week

Investors' appetite for high grade USD corporate bonds remains undiminished for now: 29 tranches for US$22.525bn in IG this week (2023 YTD volume US$267.3bn vs 2022 YTD US$234.091bn), 1 tranche for US$1.1bn in HY (2023 YTD volume US$32.757bn vs 2022 YTD US$31.686bn)

Credit

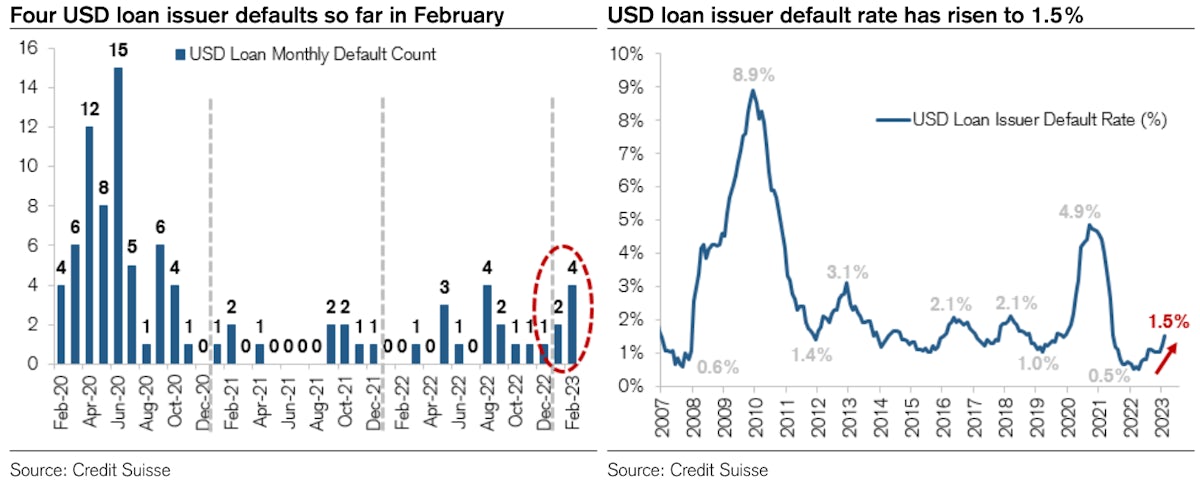

With Default Rates Still At Very Low Levels, Distressed USD HY Is Overperforming US Equities YTD

A strong week for investment grade USD bond issuance: 42 tranches for $54.175bn in IG (2023 YTD volume $245.075bn vs 2022 YTD $216.041bn), no new issuance in HY (2023 YTD volume $31.475bn vs 2022 YTD $30.686bn)

Credit

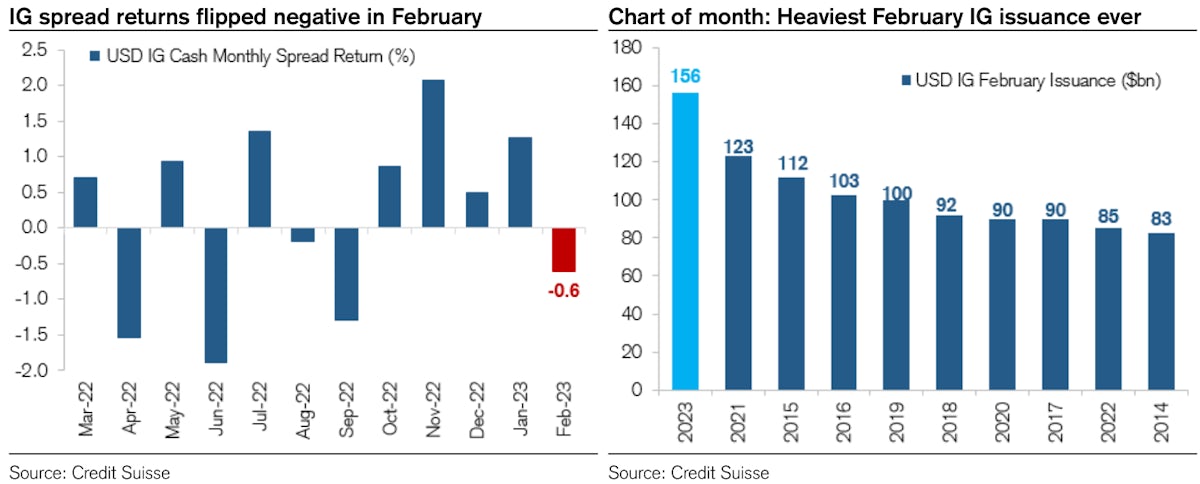

Despite Broadly Wider Spreads, The Compression In US High Yield Continues With CCC-BB Back To August Level

After a good week, YTD volumes of corporate USD bond issuance are now ahead of last year: 33 tranches for $33.7bn in IG (2023 YTD volume $190.9bn vs 2022 YTD $184.465bn), 12 tranches for $8.425bn in HY (2023 YTD 38 Tranches for $31.475bn vs 2022 YTD $30.686bn)