Rates

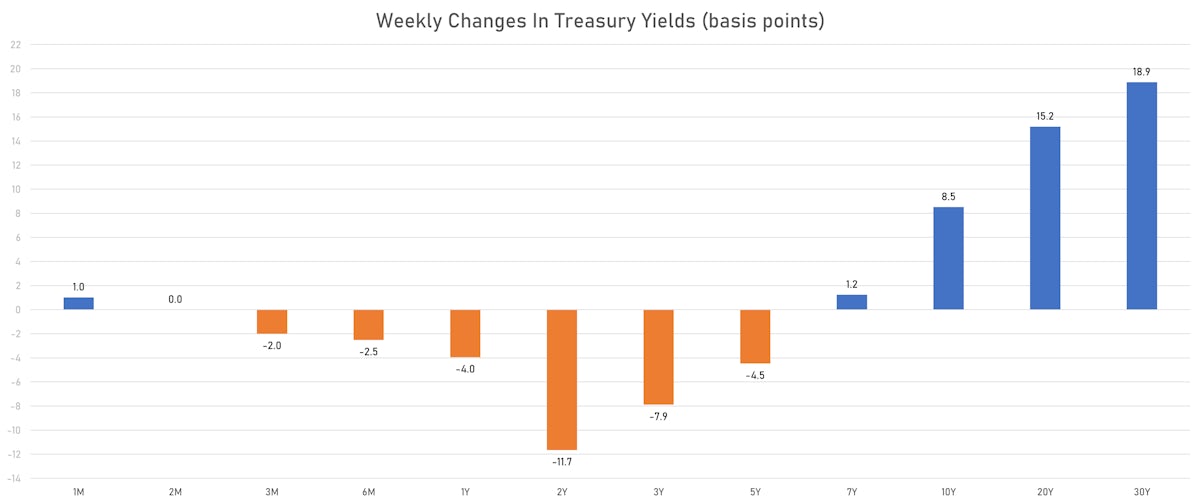

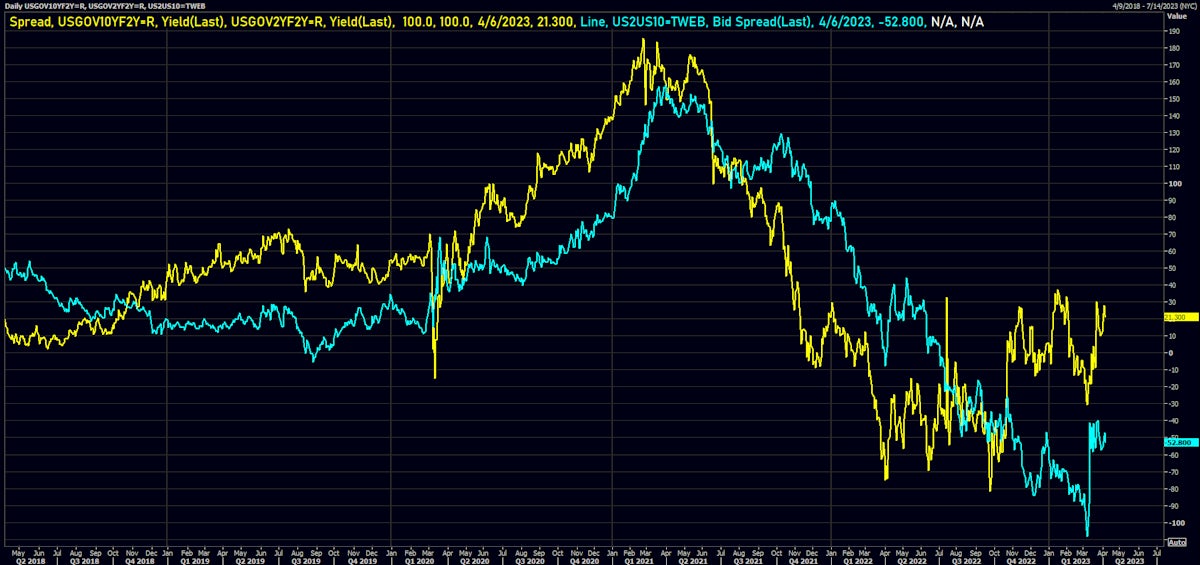

US Duration Rebounded This Week, Curve Inversion Deepened As 2s10s Spread Fell 16bp

Fed officials seemed to indicate last week that a decision has been made to keep rates unchanged at the next FOMC, pointing to the tightening in US financial conditions to justify their position

Rates

Continued Duration Selloff In The US This Week: 2y3y Up 22bp, 5y5y Up 28bp, 5s10s Spread Turned Positive

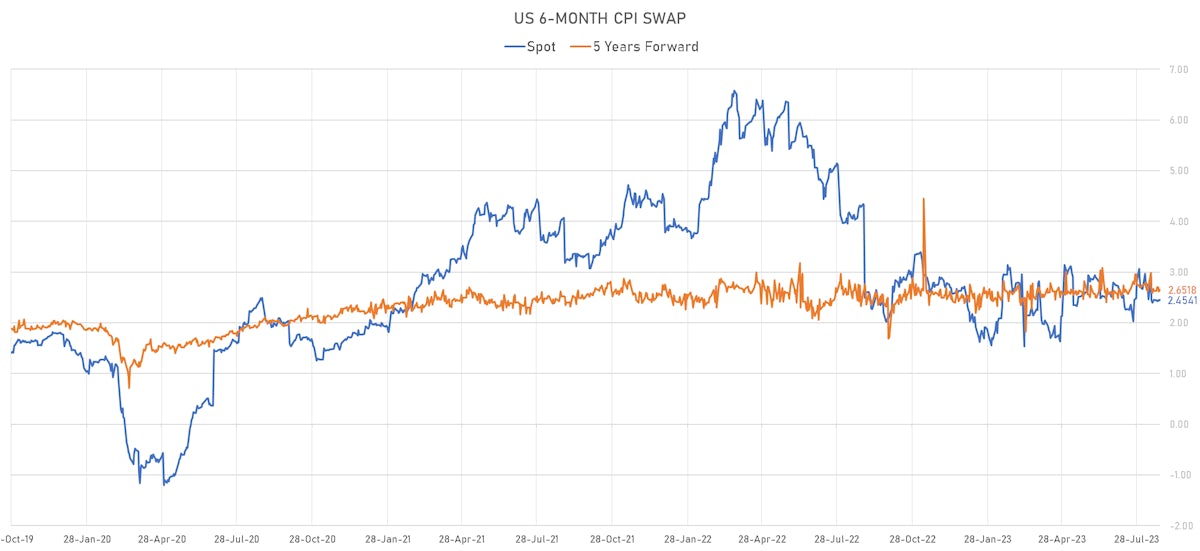

The CPI data this week will be critical for the Fed to determine its next step, with the November FOMC likely to the be the last live meeting of the year, considering that a delayed shutdown could overshadow the December meeting

Rates

Continued Selloff At The Back End Of The US Curve, With 10Y Real Yields Up Another 18bp

The interesting thing about the move at the long end is that it's been more about risk management from the long side than speculative shorts, which have remained largely unchanged over the past weeks

Rates

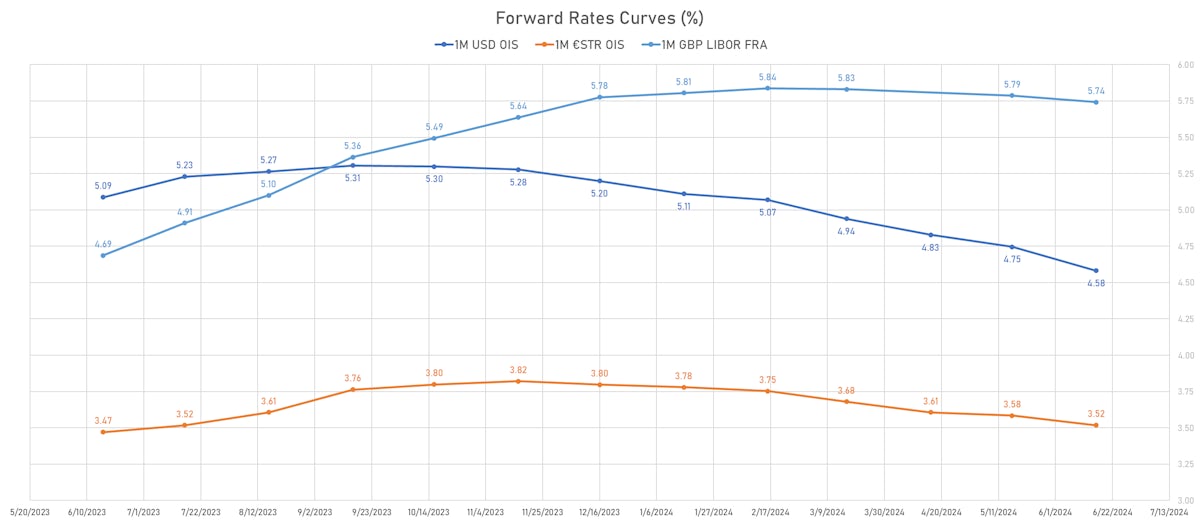

Hawkish FOMC Leads To Repricing Higher In USD Curves, Forward Inversion Still High Compared To Fed Forecasts

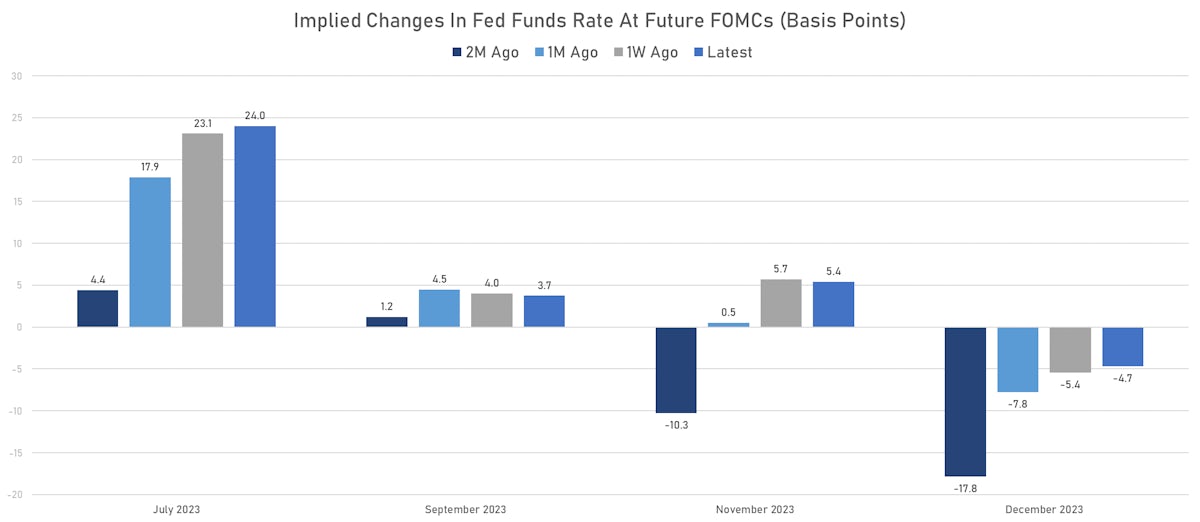

The market is currently giving roughly equal probability to a Fed hike in November and in December, but the former sounds increasingly unlikely if the Federal government shuts down for weeks in October

Rates

Modest Sell-Off At The Long End, With The US Curve Steepening, Driven By Real Rates

The September FOMC decision not to hike is well-telegraphed, but it will be interesting to see what the Fed's latest economic projections and dot plot show, as the strength of the recent data continues to justify one more hike

Rates

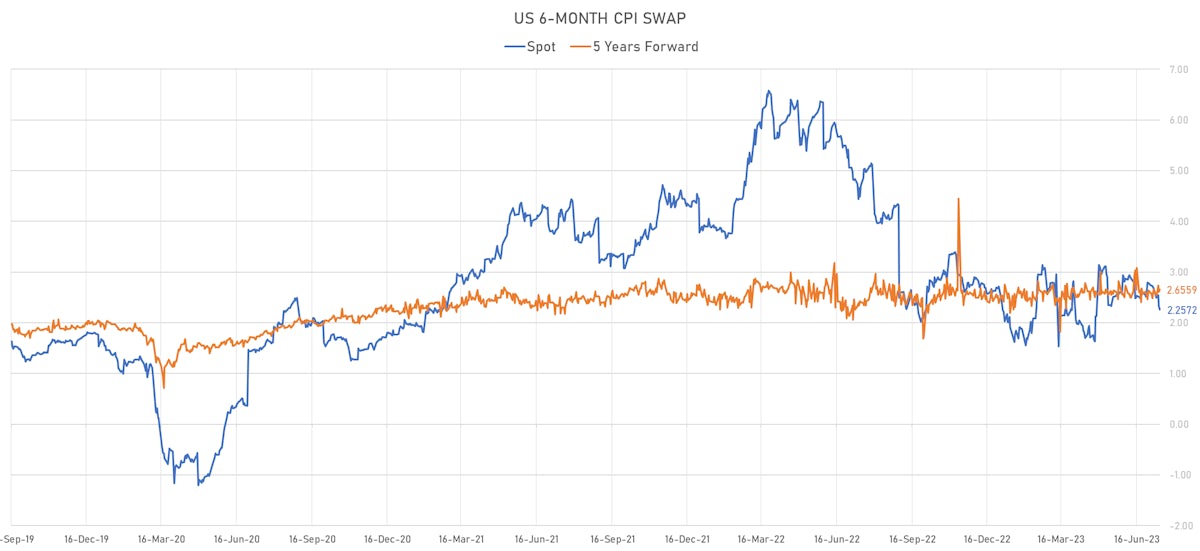

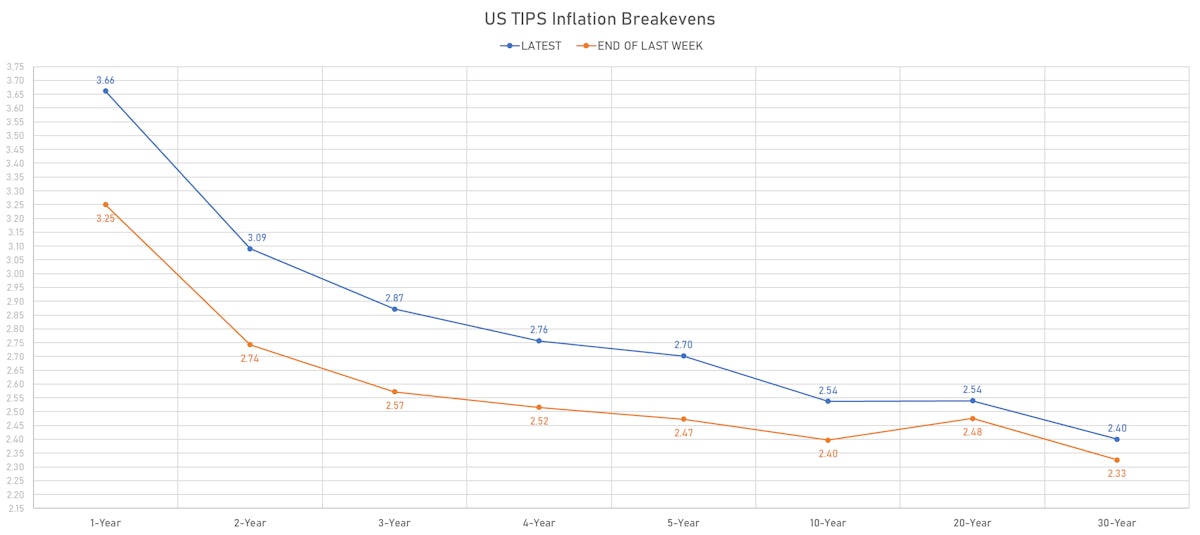

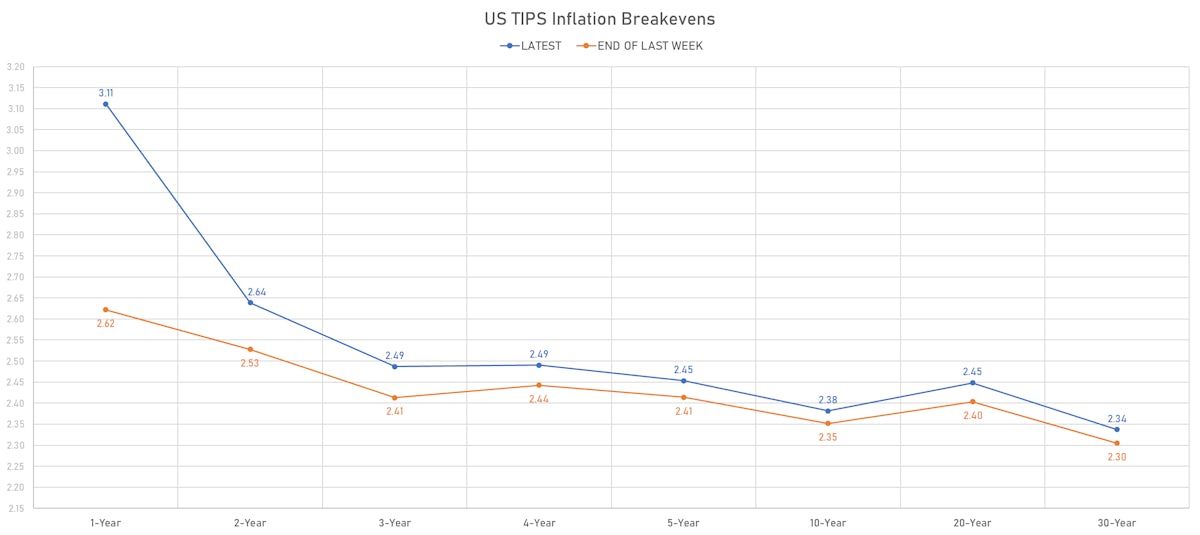

Rates Sold Off This Week, With The OPEC Decision Adding Some Pressure To The Front-End Of The Inflation Curve

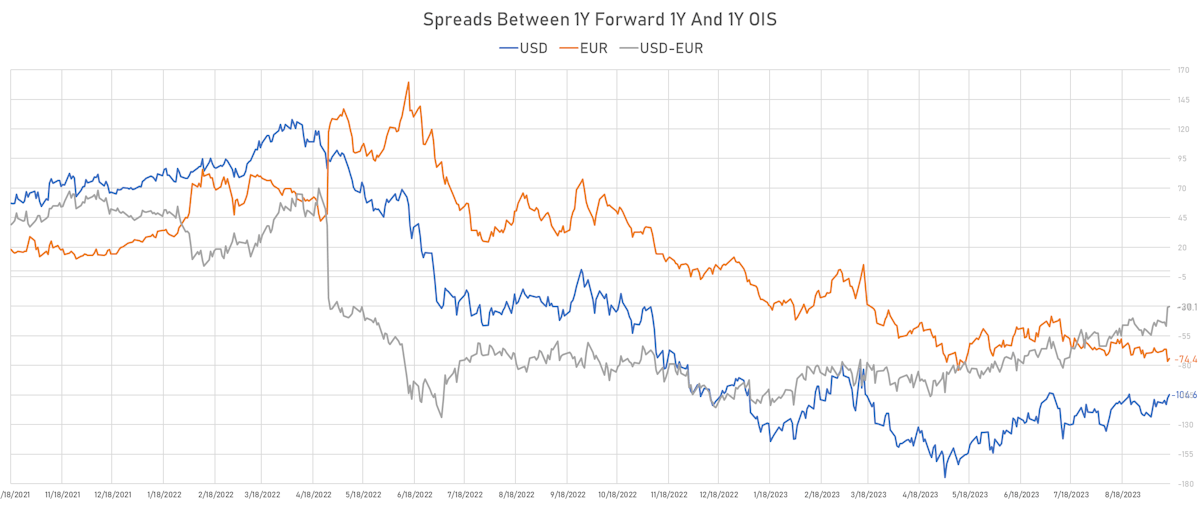

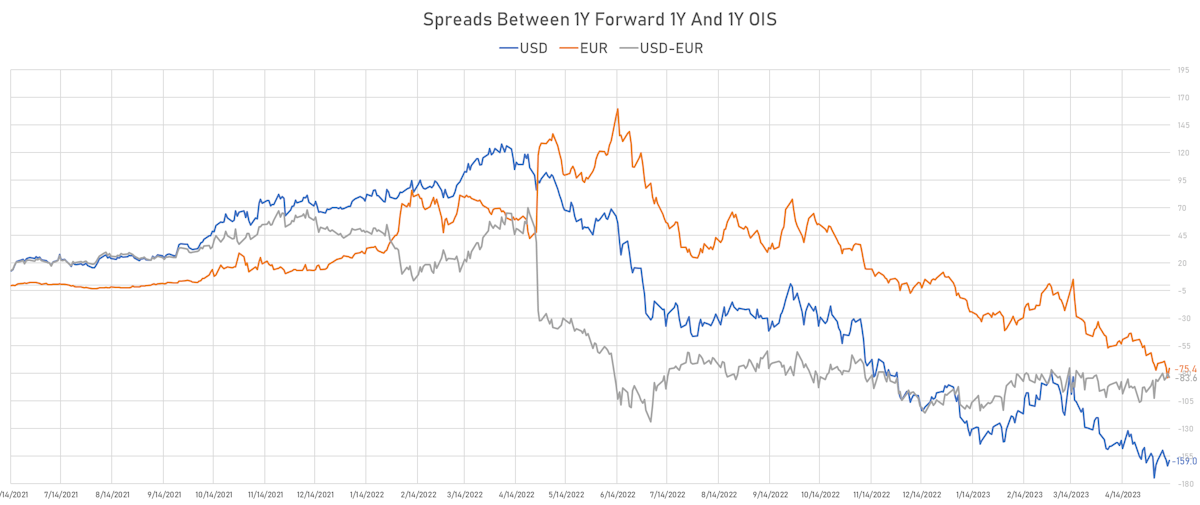

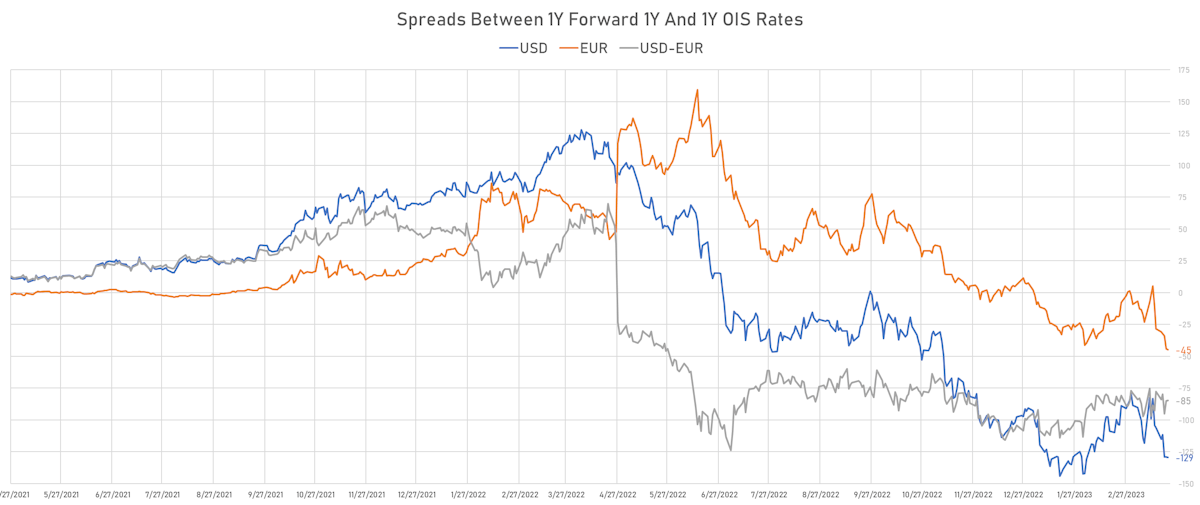

The main driver of the recent moves in US rates has been the robustness of US economic growth, pushing up 1y forward 1y and repricing the belly of the curve towards a higher neutral rate

Rates

US Yield Curve Twist Flattens As The Fed Seems To Maintain A Hawkish Bias At Jackson Hole

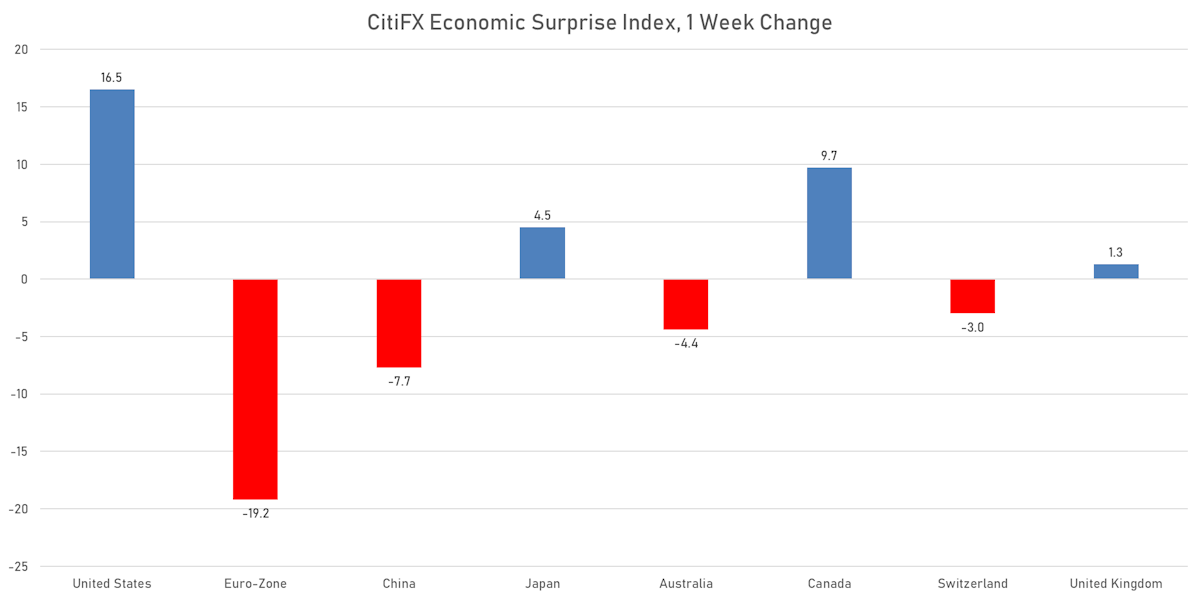

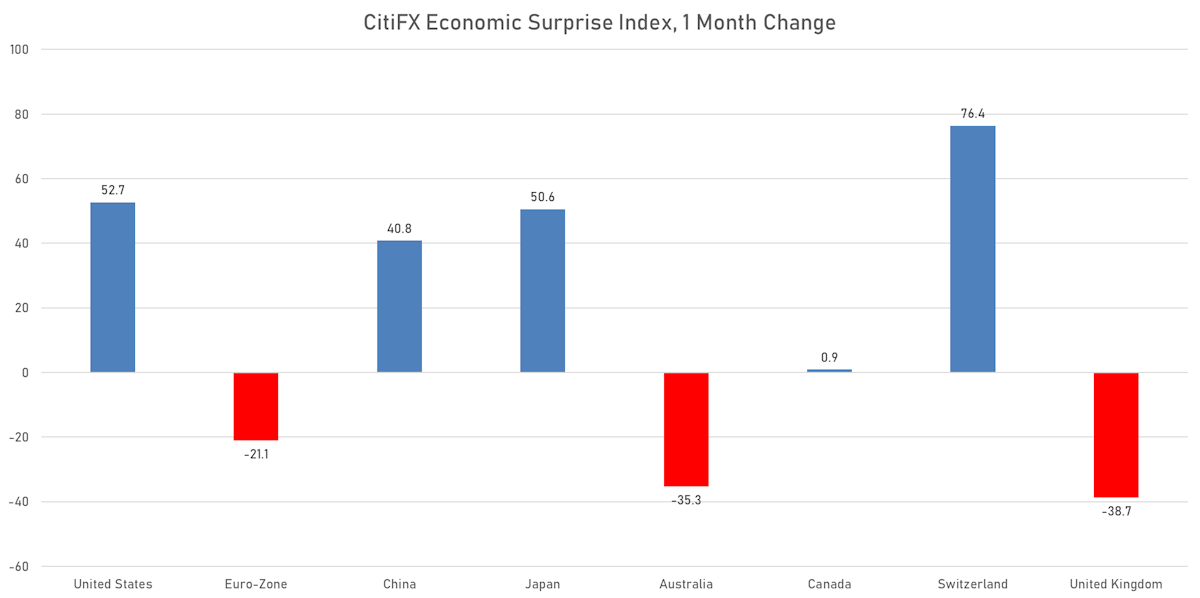

Although Powell strategically skirted around the neutral rate question, the policy focus in the US is to prevent the risk of a possible reacceleration of inflation, as the macro picture is still much healthier than in Europe or China

Rates

Duration Sold Off This Week, With 30Y Bond Yields Touching 4.3% For The First Time In 2023

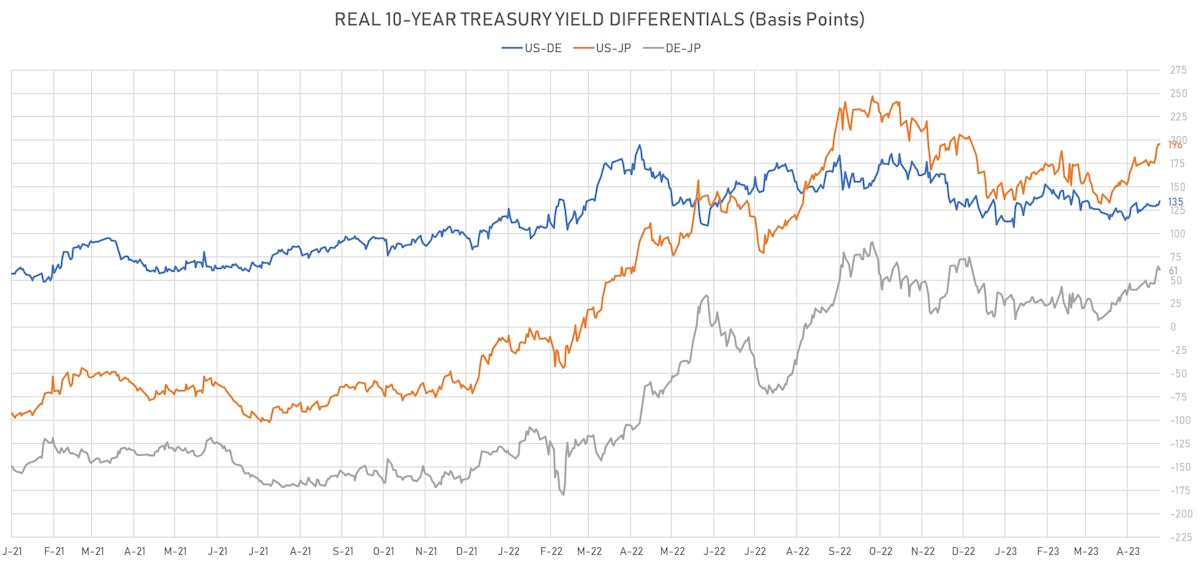

The US economy has been able to withstand Fed hikes much better than anticipated, causing multiple investment banks to abandon their calls for a recession this year, and putting pressure on the level of the real neutral rate

Rates

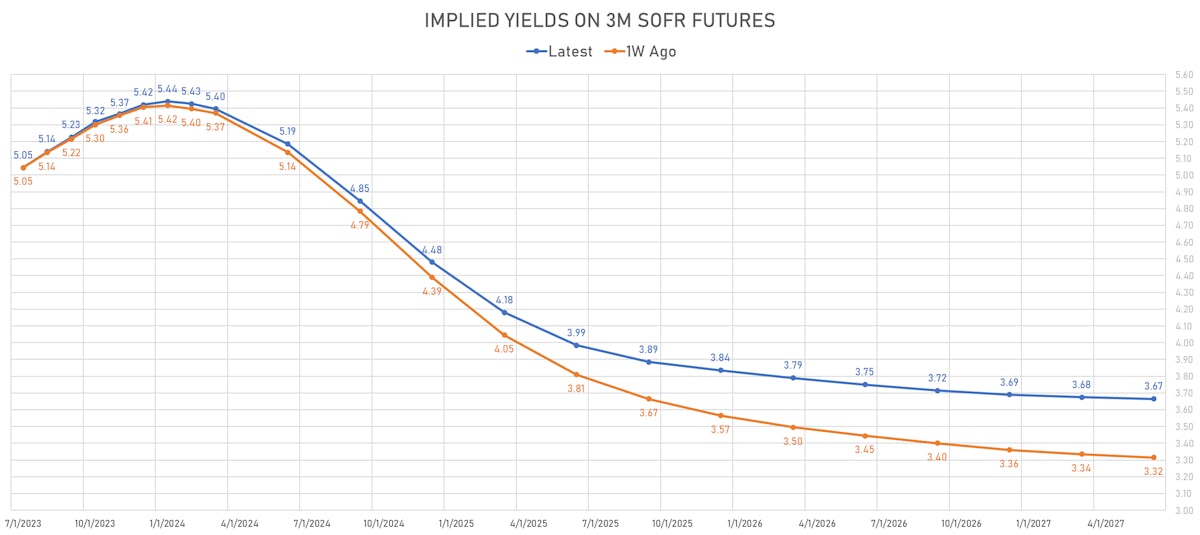

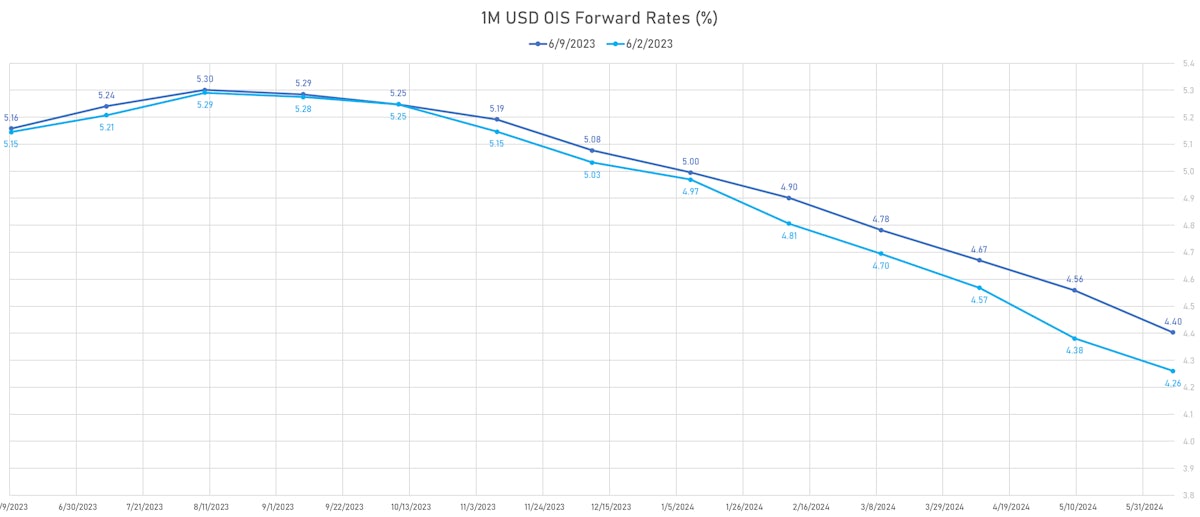

Strong US Macro Data Leads To Higher-For-Longer Shift In Forward Curve, With Fewer Cuts Priced In 2024

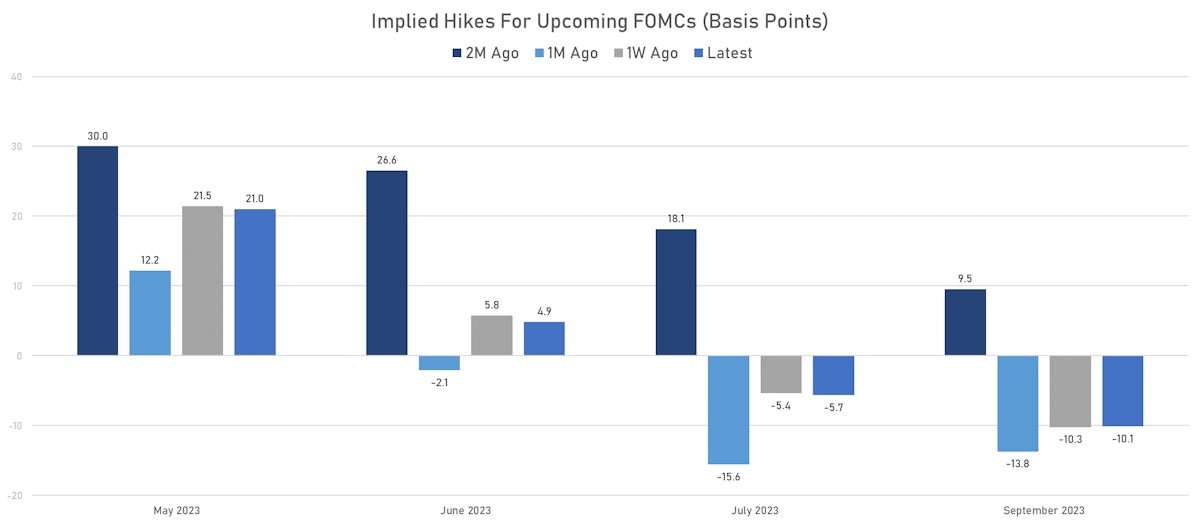

The low implied rates for the September and November FOMCs make sense (no clear asymmetry), as the inflation path is likely to stay favorable for the remainder of the year, putting little pressure on the Fed to tighten further

Rates

Well-Telegraphed 25bp Hike Will Surprise No One, But The Fed Is Likely To Highlight Strength In US Data

In the triple whopper of monetary decisions macro markets will have to digest this week, the BoJ is probably the most interesting, as even a baby step towards ending YCC would have huge repercussions across the complex

Rates

Soft CPI Surprise Pushes Down USD Forward Curves, Encourages Flows Into Carry Trades

It would be prudent for the Fed not to relax too much on the inflation front, as economic surprises have been mostly positive in the US over the past month, and it could take more efforts to win out this fight

Rates

Fairly Volatile Week In US Rates, With Squeezy Moves Higher In Yields On Mostly Stronger Data

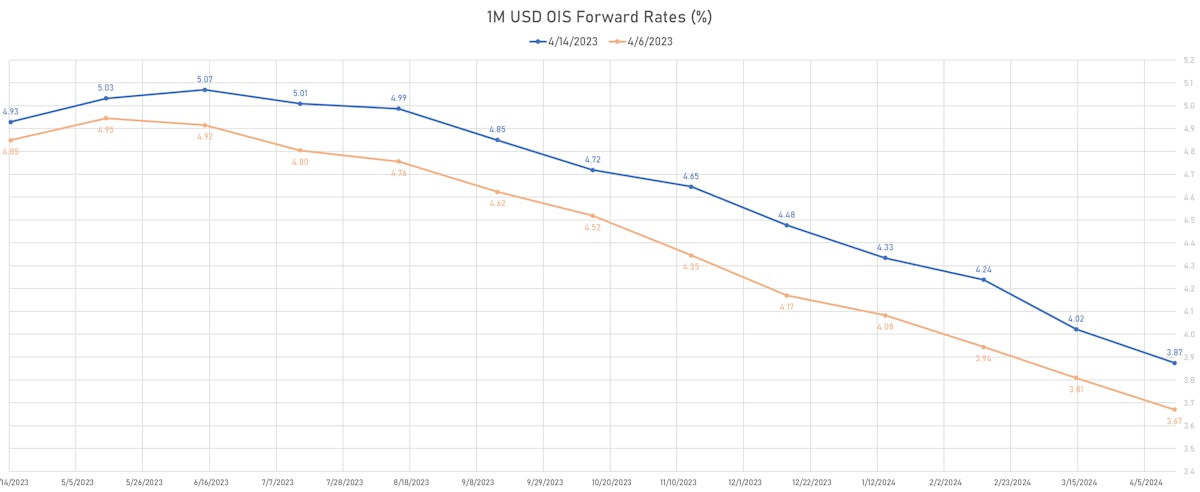

Recession pricing has been taken down, with a marked steepening in the USD forward curve: 3M SOFR 3 years forward rising by over 30bp over the week. The peak FF rate is not moving higher but the magnitude of the subsequent easing has been significantly marked down

Rates

The Fed's Current Plan Is To Hike In July, Skip September, And Announce A Pause In November

The FOMC decision on Wednesday confused the market, with the hawkish messaging largely ignored to focus on the decision not to hike in June despite strong recent data

Rates

The FOMC This Week Should Show A Patient Fed, Willing To Wait Until July For The Next Hike

US economic data has been consistently better than expected, and so far the credit impact from the regional financial crisis has been mininal, but Fed's leaders have expressed a desire to wait for more clarity before hiking further

Rates

Sizable Bear Flattening Of US Yield Curve Over The Past Week, As Economic Data Surprises To The Upside

Against market expectations (based on the Fed's dovish forward guidance), the June FOMC is back in play, with about 2/3 chance of a 25bp hike now priced in

Rates

Strong Selloff In USD Rates Partially Undone Before The Weekend, As The Debt Ceiling Issue Remains Top Of Mind

The US dollar has benefited from the positive dynamics in rates differentials across currencies, especially with the JPY where too much was expected too soon from the new CB governor

Rates

US Short-Term Rates Volatility Dropped This Week As Conviction In A Fed Pause Increased

With the right tail of the peak rate distribution now all but priced out, strength in incoming data could slowly tip the scale away from worries about a recession and regional banks failures

Rates

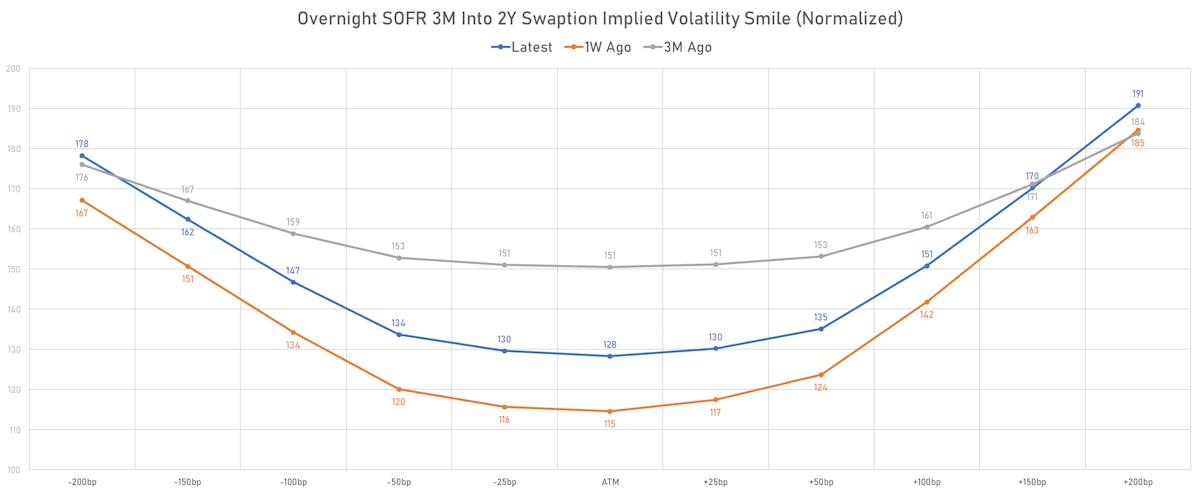

US Front-End Rates Inversion Deepens As FOMC Takes A Backseat To Other Concerns

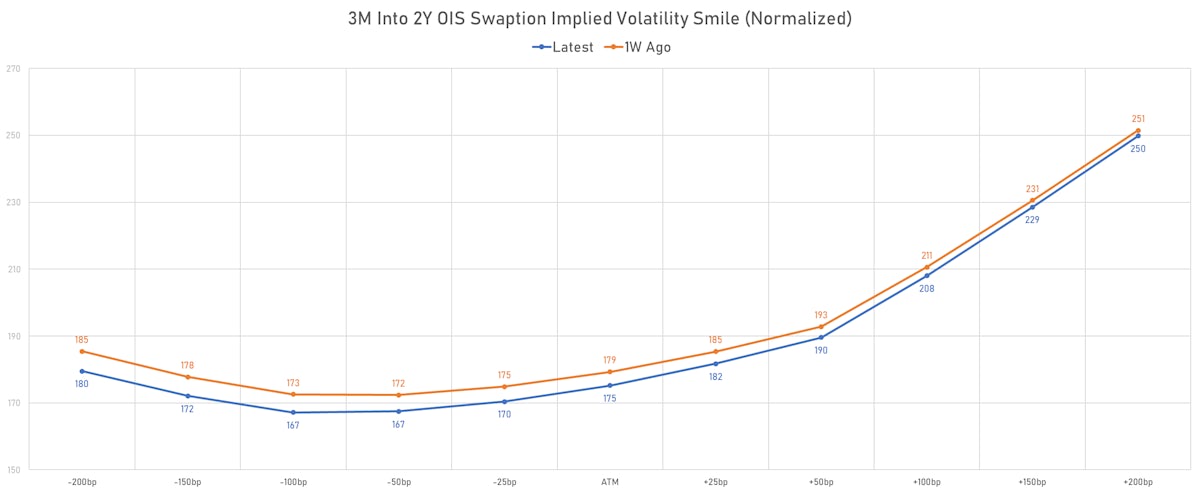

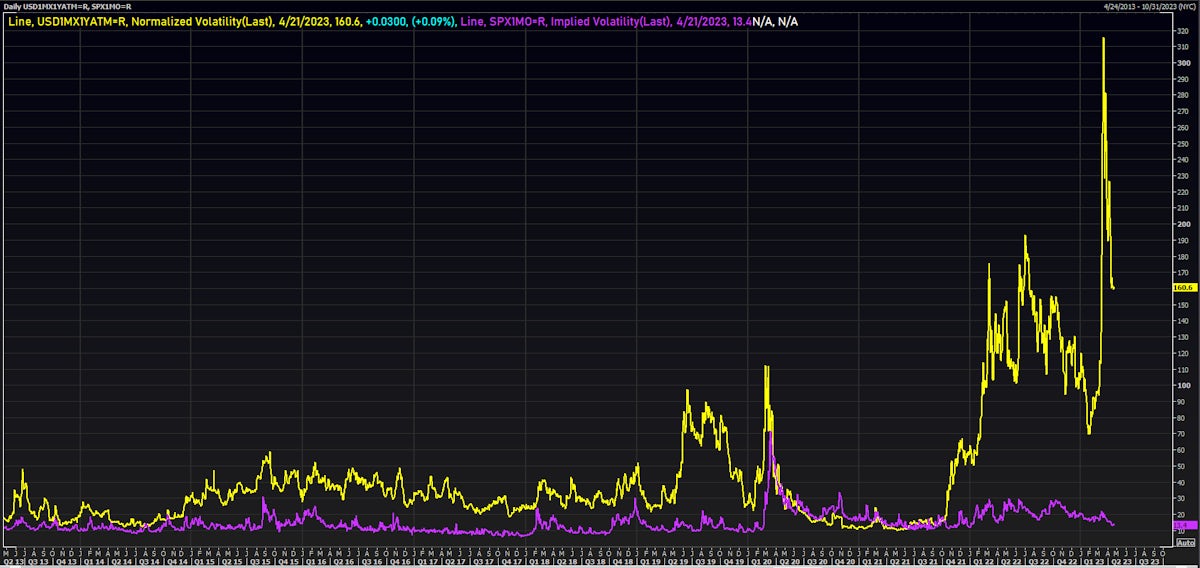

USD rates volatility remains extremely high, especially in the right tail: forward rates have come down to reflect a more benign policy path for the Fed, but market participants are hedging the possibility of dislocation over the next 3 months

Rates

Front End Rates Volatility Remains High, With Decent Economic Data And Some More Drama From FRC

The Fed will undoubtedly lift its policy rate by 25bp to 5+1/8 this week, but we would be surprised if they explicitly called it the last hike of the current cycle

Rates

With A Hike At The May FOMC Now Locked In, June Pricing Drifts Higher On Hawkish Fed Speak

Volatility in US rates remains elevated, especially compared to the depressed level for equities, with considerable uncertainty surrounding the June FOMC hike and possible easing later this year

Rates

Bear Flattening After Busy Week Of US Data, Fed On Course To Raise By 25bp In Two Weeks

The most active debate in rates is the June FOMC, where market pricing has shifted to a small hike (from a hold last week), with the latest CPI print showing further indications of sticky inflation in core services

Rates

US Front-End Inversion Deepens As Rates Expectations For May And June FOMCs Firm Up

After a quiet holiday week, it will be interesting to see whether the Treasury market returns to more normal liquidity and pricing, with volumes likely to rise into the latest CPI print on Wednesday

Rates

Reversal Of Short-Term Financial Stability Concerns Brought Front End Selloff, Bear Flattening Across US Rates

Most of the move this week can be traced to higher inflation breakevens, which simply reflects unease around the end of the hiking cycle while inflationary pressures are still very sticky

Rates

US Interest Rates Fall At The Front End Of The Curve After Latest FOMC As Hiking Cycle Close To The End

During his FOMC Q&A session Powell expressed how difficult it is to quantify the impact of the recent regional banking crisis, which has led to widely different market interpretations: some traders think the Fed is done, while others see two more hikes

Rates

Crazily Volatile Week For Rates, US Money Markets Now Price In More Than 3 Rate Cuts Through Year End

Regardless of whether the FOMC results in a 25bp hike or no hike, clarity of purpose will be critical as the Fed fights to restore confidence in the regional banking sector

Rates

The US Yield Curve Bull Flattened For The Week, Driven By Much Lower Inflation Breakevens

The market fright around Western regional banks impacted mostly equities, but did cause a jolt to money markets: basis swaps were extremely tight on Tuesday and got wider into the weekend, though nothing to worry about for the moment

Rates

US Inflation Expectations Rose Further This Week, With 1Y TIPS Breakeven Now Up 200bp Since Early January

The front end of the curve continues to lead the action, as the market stays focused on very short-term event risk: Powell's appearance before the Senate this week and the latest employment report coming on Friday

Rates

The Front End Rates Selloff Continues: Peak Fed Funds Rate Now Above 5.40%, As June FOMC Fully In Play

If confirmed over the coming weeks, the positive recent data in the US could put the Fed in a difficult position at the March FOMC, with the soft-landing scenario becoming increasingly challenged by a more hawkish outlook

Rates

US Rates Sell Off Across The Curve, Led By The Front End, Driven By A Repricing Of Short-Term Inflation Expectations

The recent US activity data has been strong, and core inflation has been coming down very slowly, pointing to a possible reacceleration of inflation: the risk of overtightening has come down and the risk of not doing enough has gone up

Rates

Sharp Rise In Front-End Rates, Inflation Breakevens And Volatility Ahead Of Upcoming January CPI Report

The rise in implied volatilities reflects diminished comfort about the distribution of inflation / rates outcomes, and we've seen slightly more hedging of the left tail (i.e. lower rates) with the recent reduction in the curve inversion