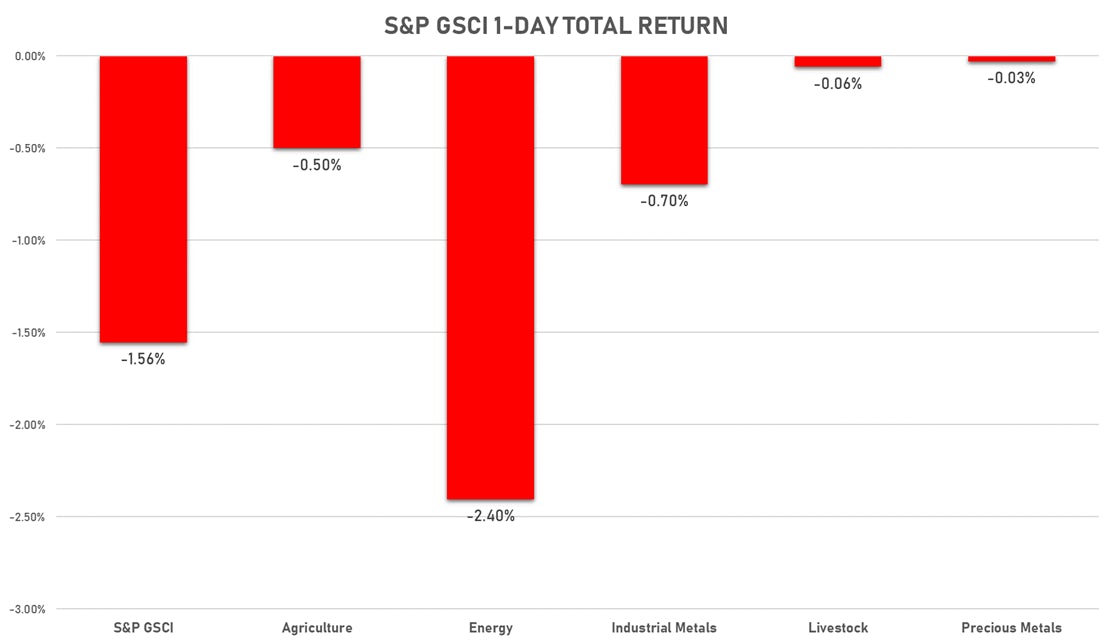

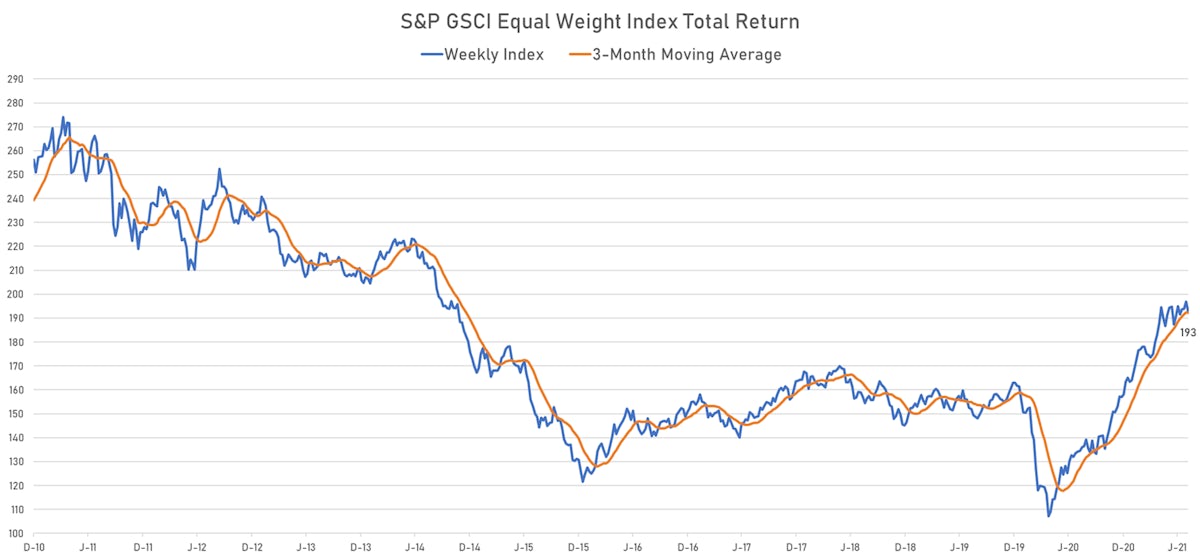

Commodities

Crude Oil, Gasoline Prices Fall Following Unexpected EIA Inventory Build

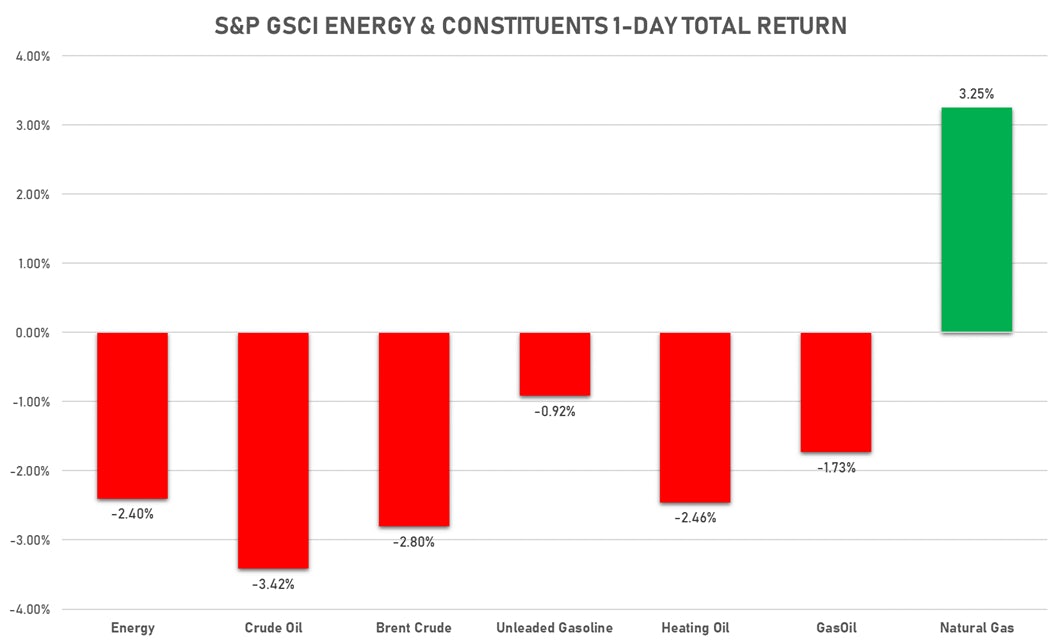

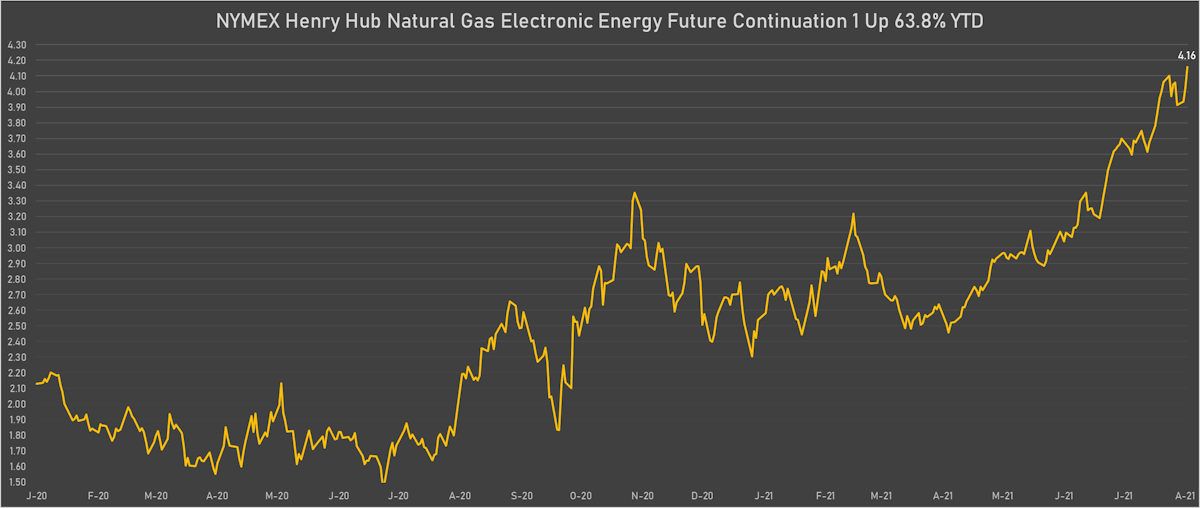

Although the energy complex was down today, natural gas made further gains to reach prices not seen since late 2018

Published ET

Natural Gas Front-Month Futures prices Up 64% This Year | Sources: ϕpost, Refinitiv data

HEADLINES & MACRO

EIA STOCK LEVELS

- Total Crude Oil excluding SPR, Absolute change, Volume for W 30 Jul (EIA, United States) at 3.63 Mln, above consensus estimate of -3.10 Mln

- Total Distillate, Absolute change, Volume for W 30 Jul (EIA, United States) at 0.83 Mln, above consensus estimate of -0.54 Mln

- Gasoline, Absolute change, Volume for W 30 Jul (EIA, United States) at -5.29 Mln, below consensus estimate of -1.78 Mln

- Refinery Capacity Utilization, Absolute change, Volume for W 30 Jul (EIA, United States) at 0.20 %, below consensus estimate of 0.60 %

RAIL TRAFFIC DATA

- Combined North American rail traffic +3.0%, up 22 of the last 23 weeks

- Carloads +5.8%, up 20 consecutive weeks

- Intermodal +1.9%, up 22 of the last 23 weeks

NOTABLE GAINERS TODAY

- NYMEX Henry Hub Natural Gas up 3.3% (YTD: 63.8%)

- Bursa Malaysia Crude Palm Oil up 3.1% (YTD: 19.0%)

- EEX European-Carbon- Secondary Trading up 2.3% (YTD: 72.9%)

- Zhengzhou Exchange Thermal Coal up 1.6% (YTD: 30.6%)

- CBoT Soybean Meal up 1.5% (YTD: -18.7%)

- SHFE Hot Rolled Coil up 1.4% (YTD: 26.9%)

- CME Dry Whey up 1.4% (YTD: 36.9%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 1.2% (YTD: 17.8%)

- ICE Europe Newcastle Coal Monthly up 1.1% (YTD: 91.8%)

- WUXI Metal Cobalt Bi-Monthly up 0.9% (YTD: 28.7%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 0.8% (YTD: 17.1%)

NOTABLE LOSERS TODAY

- CME Random Length Lumber down -6.9% (YTD: -35.3%)

- Pork Primal Cutout Butt down -4.7% (YTD: 55.0%)

- NYMEX Light Sweet Crude Oil (WTI) down -3.4% (YTD: 40.5%)

- ICE Europe Brent Crude down -2.8% (YTD: 35.9%)

- CME Class III Milk down -2.5% (YTD: 1.5%)

- NYMEX NY Harbor ULSD down -2.5% (YTD: 40.5%)

- Platinum spot down -2.4% (YTD: -4.2%)

ENERGY DOWN TODAY EXCEPT NAT GAS

- WTI crude front month currently at US$ 68.38 per barrel, down -3.4% (YTD: +40.5%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 70.58 per barrel, down -2.8% (YTD: +35.9%); 6-month term structure in tightening backwardation

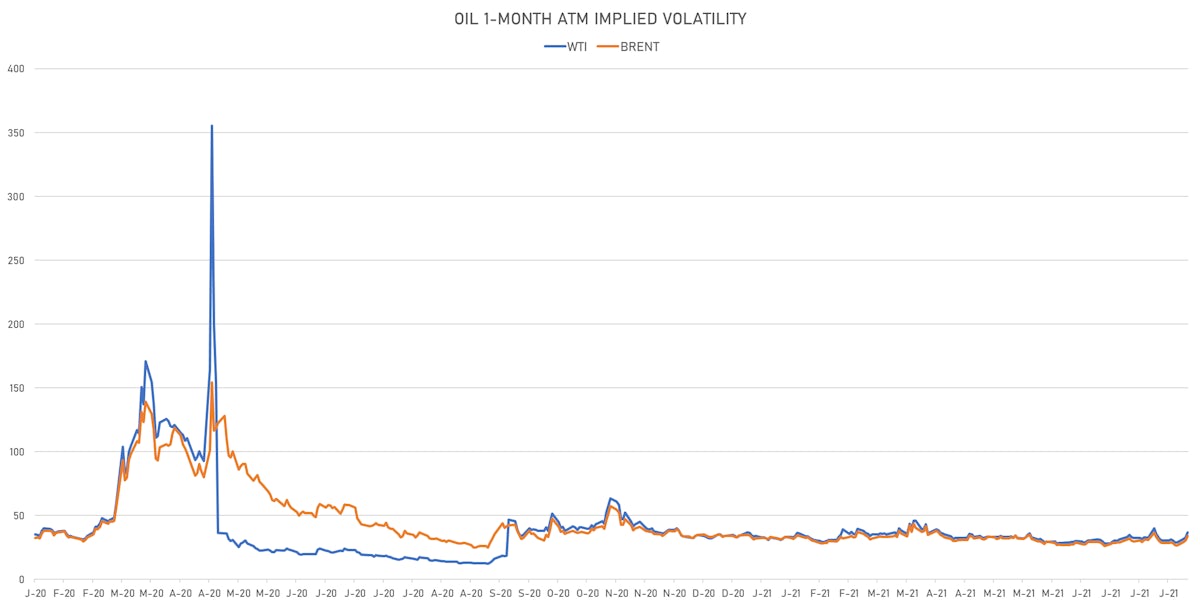

- Brent volatility at 33.8, up 10.5% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 154.40 per tonne, up 1.1% (YTD: +91.8%)

- Natural Gas (Henry Hub) currently at US$ 4.17 per MMBtu, up 3.3% (YTD: +63.8%)

- Gasoline (NYMEX) currently at US$ 2.25 per gallon, down -0.9% (YTD: +59.8%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 579.00 per tonne, down -1.7% (YTD: +38.2%)

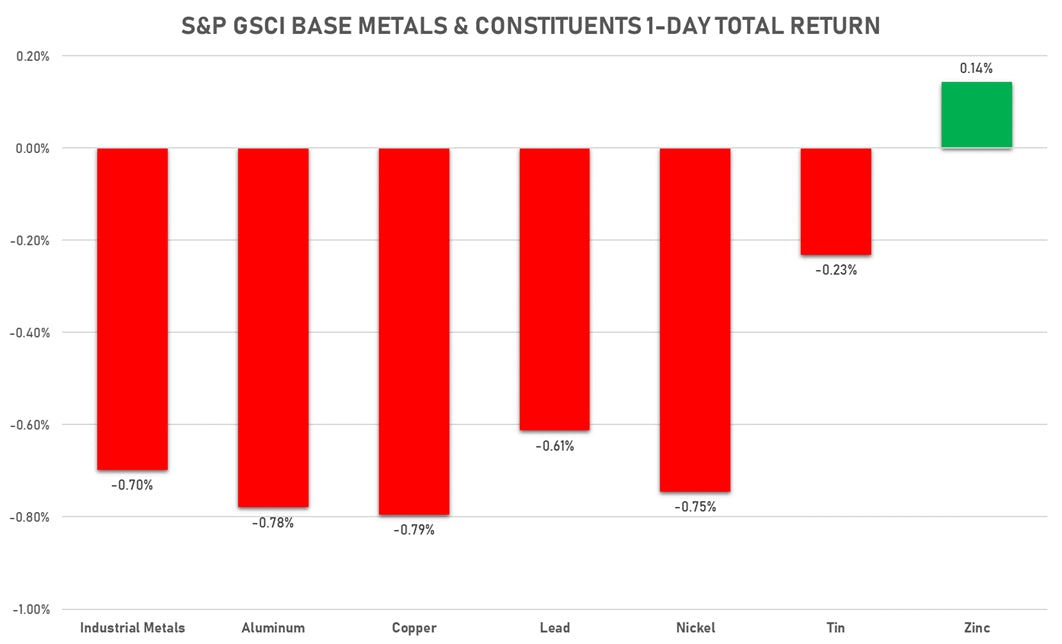

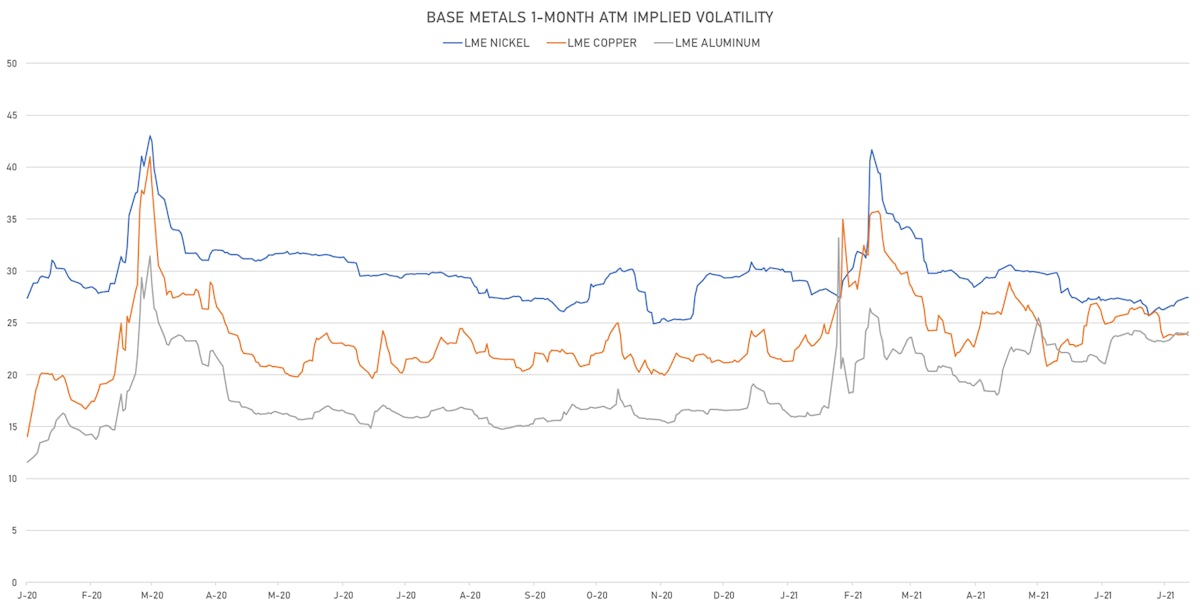

BASE METALS FELL BROADLY TODAY

- Copper (COMEX) currently at US$ 4.33 per pound, down -1.2% (YTD: +23.2%)

- Iron Ore (Dalian Commodity Exchange) unchanged at CNY 1,135.00 per tonne (YTD: +5.2%)

- Aluminium (Shanghai) currently at CNY 19,740 per tonne, down -0.2% (YTD: +26.0%)

- Nickel (Shanghai) currently at CNY 142,920 per tonne, down -0.4% (YTD: +16.0%)

- Lead (Shanghai) currently at CNY 15,725 per tonne, down -0.6% (YTD: +7.6%)

- Rebar (Shanghai) currently at CNY 5,518 per tonne, up 0.7% (YTD: +28.7%)

- Tin (Shanghai) currently at CNY 232,850 per tonne, down -1.2% (YTD: +54.1%)

- Zinc (Shanghai) currently at CNY 22,035 per tonne, down -1.1% (YTD: +5.8%)

- Refined Cobalt (Shanghai) spot price currently at CNY 377,000 per tonne, down -0.7% (YTD: +37.6%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

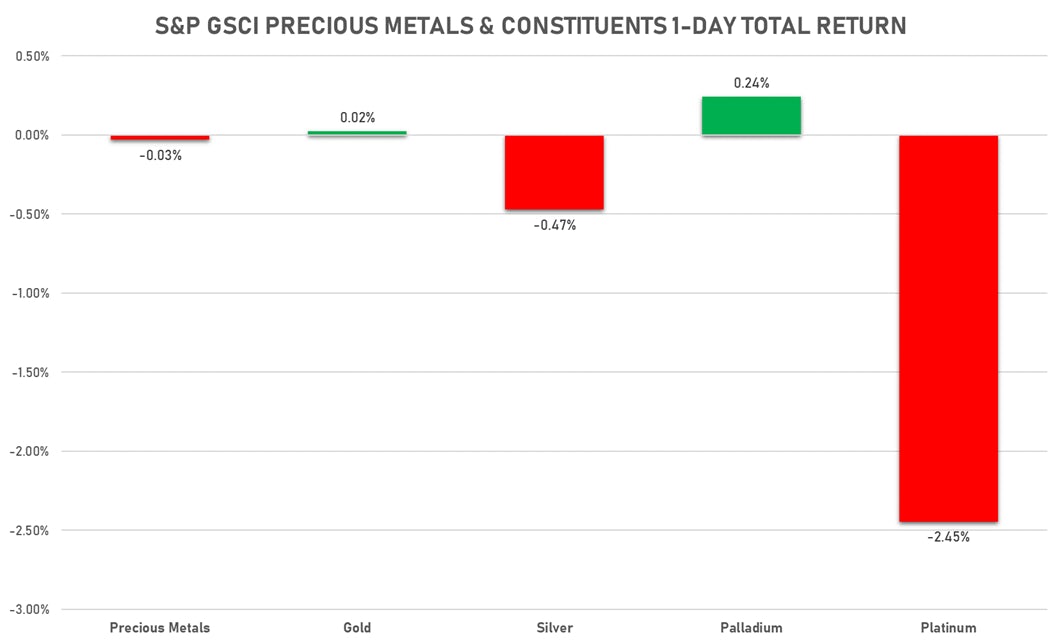

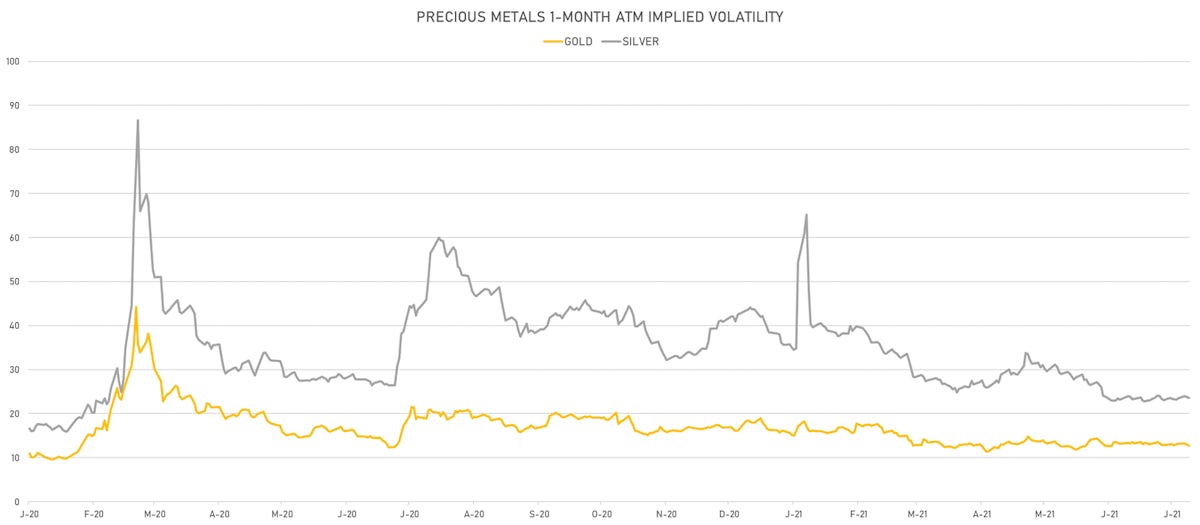

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,811.46 per troy ounce, up 0.1% (YTD: -4.5%)

- Gold 1-Month ATM implied volatility currently at 12.32, down -1.1% (YTD: -20.7%)

- Silver spot currently at US$ 25.37 per troy ounce, down -0.6% (YTD: -3.8%)

- Silver 1-Month ATM implied volatility currently at 22.74, down -0.7% (YTD: -44.5%)

- Palladium spot currently at US$ 2,648.76 per troy ounce, up 0.0% (YTD: +8.3%)

- Platinum spot currently at US$ 1,013.81 per troy ounce, down -2.4% (YTD: -4.2%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, up 0.5% (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,400 per troy ounce, unchanged (YTD: +107.7%)

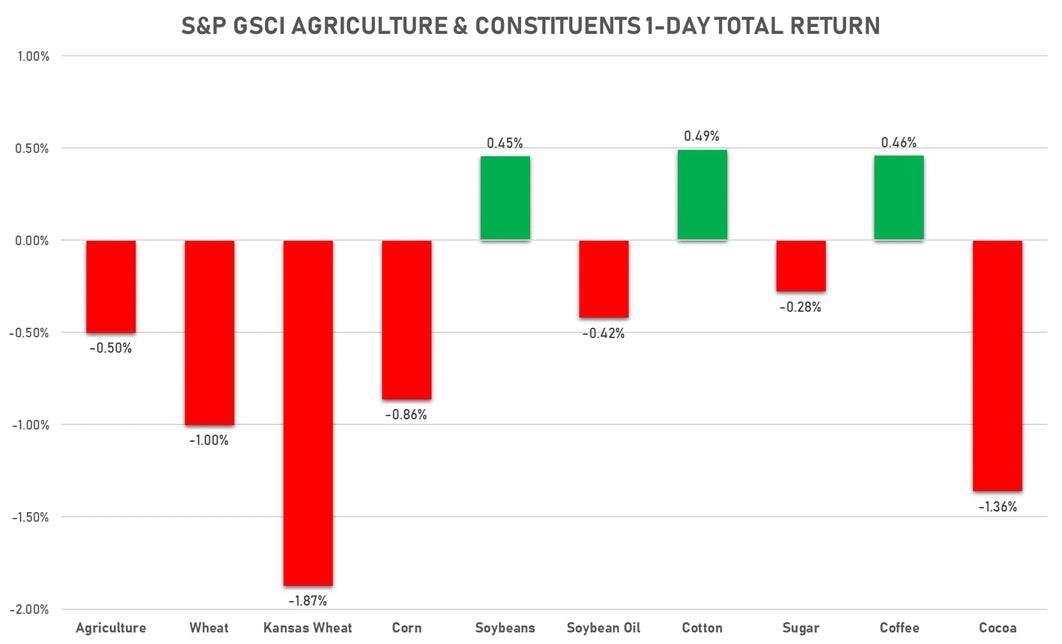

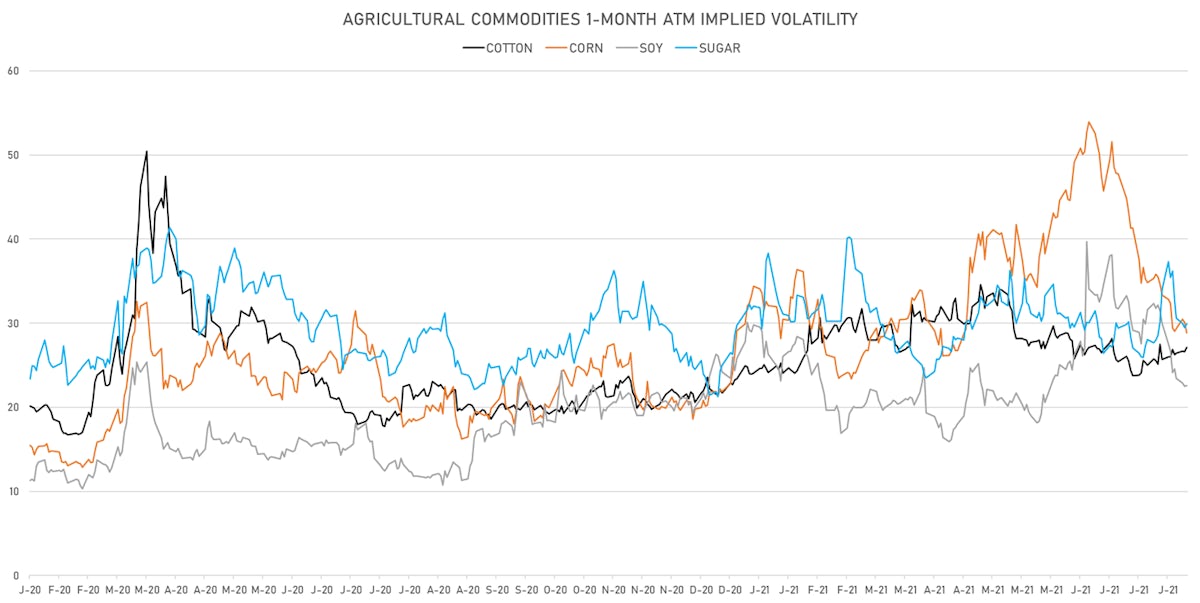

AGS TODAY

- Live Cattle (CME) currently at US$ 124.05 cents per pound, up 0.6% (YTD: +9.8%)

- Lean Hogs (CME) currently at US$ 109.48 cents per pound, up 0.4% (YTD: +55.8%)

- Rough Rice (CBOT) currently at US$ 13.20 cents per hundredweight, down -1.5% (YTD: +6.4%)

- Soybeans Composite (CBOT) currently at US$ 1,400.75 cents per bushel, up 0.8% (YTD: +6.7%)

- Corn (CBOT) currently at US$ 548.00 cents per bushel, down -0.9% (YTD: +12.8%)

- Wheat Composite (CBOT) currently at US$ 717.75 cents per bushel, down -1.0% (YTD: +12.0%)

- Sugar No.11 (ICE US) currently at US$ 17.93 cents per pound, down -0.3% (YTD: +15.8%)

- Cotton No.2 (ICE US) currently at US$ 90.72 cents per pound, up 0.5% (YTD: +16.1%)

- Cocoa (ICE US) currently at US$ 2,393 per tonne, down -1.4% (YTD: -8.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,204 per tonne, up 0.6% (YTD: +32.8%)

- Random Length Lumber (CME) currently at US$ 564.50 per 1,000 board feet, down -6.9% (YTD: -35.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,830 per tonne, up 0.1% (YTD: +8.0%)

- Soybean Oil Composite (CBOT) currently at US$ 62.77 cents per pound, down -0.8% (YTD: +44.9%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,630 per tonne, up 3.1% (YTD: +19.0%)

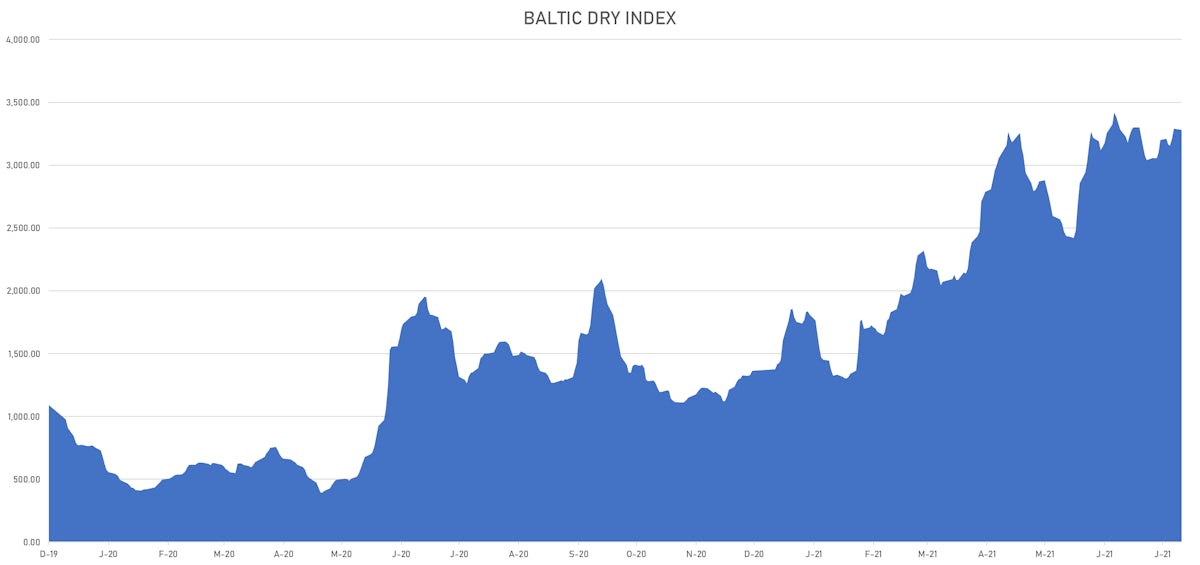

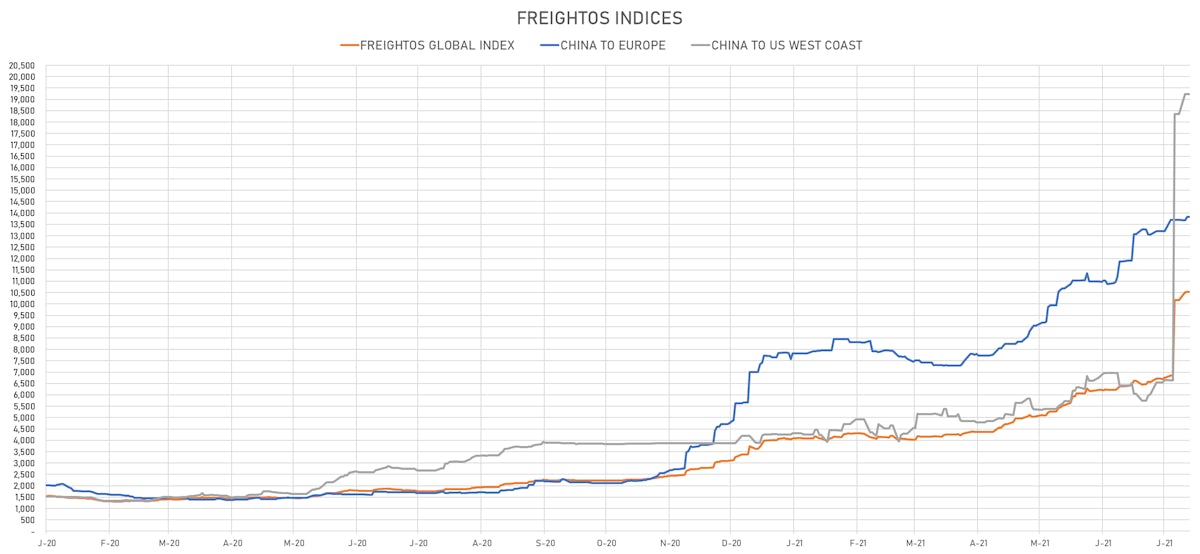

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,281, unchanged (YTD: +140.2%)

- Freightos China To North America West Coast Container Index currently at 19,237, unchanged (YTD: +358.1%)

- Freightos North America West Coast To China Container Index currently at 1,132, unchanged (YTD: +118.7%)

- Freightos North America East Coast To Europe Container Index currently at 670, unchanged (YTD: +84.6%)

- Freightos Europe To North America East Coast Container Index currently at 5,971, unchanged (YTD: +219.5%)

- Freightos China To North Europe Container Index currently at 13,836, unchanged (YTD: +144.3%)

- Freightos North Europe To China Container Index currently at 1,644, up 0.7% (YTD: +19.5%)

- Freightos Europe To South America West Coast Container Index currently at 4,621, unchanged (YTD: +173.2%)

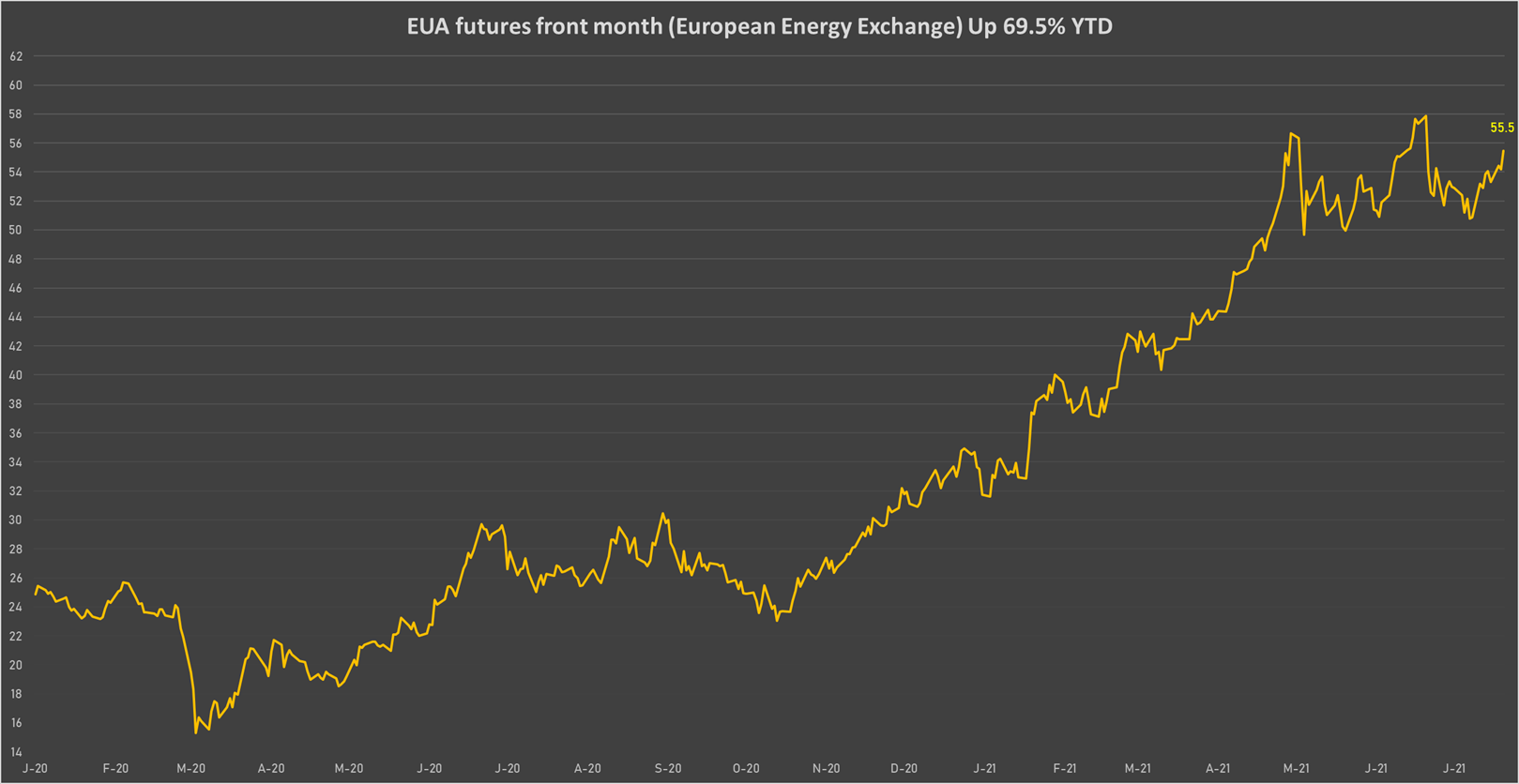

CARBON EMISSION ALLOWANCES (CO2) UP TODAY

- EUA futures front month (European Energy Exchange) currently at EUR 55.46 per tonne, up 2.3% (YTD: +69.5%)