Commodities

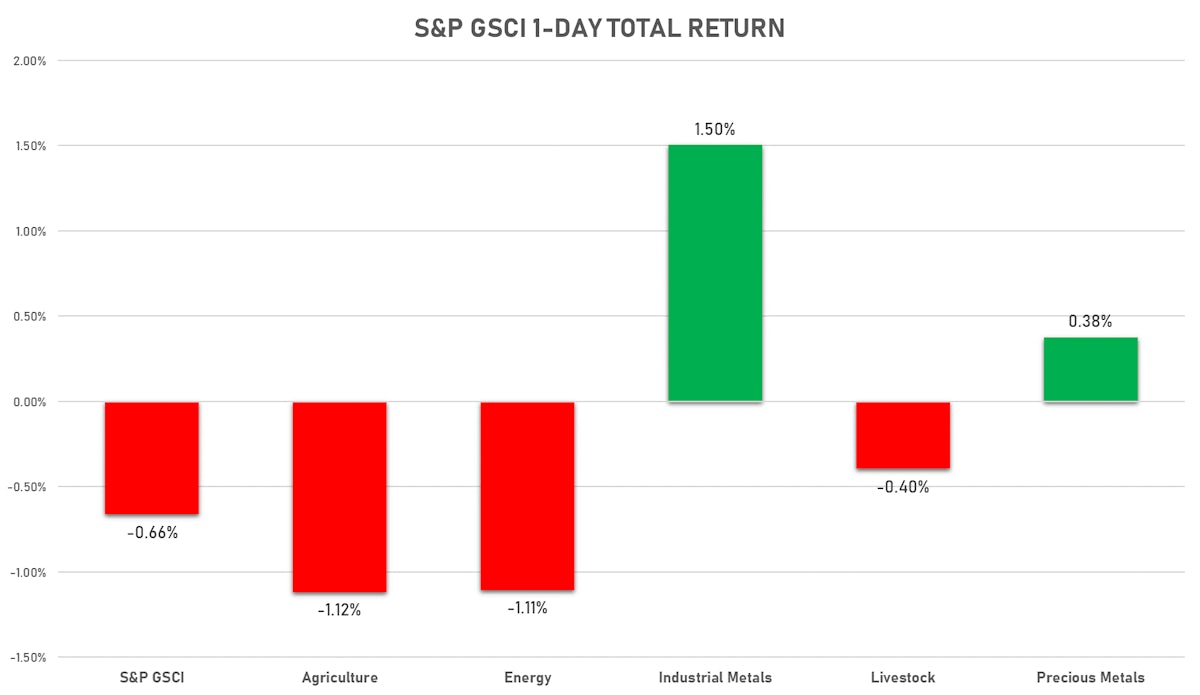

Crude Oil Down, While Base Metals And Precious Metals Rise On Weaker Dollar

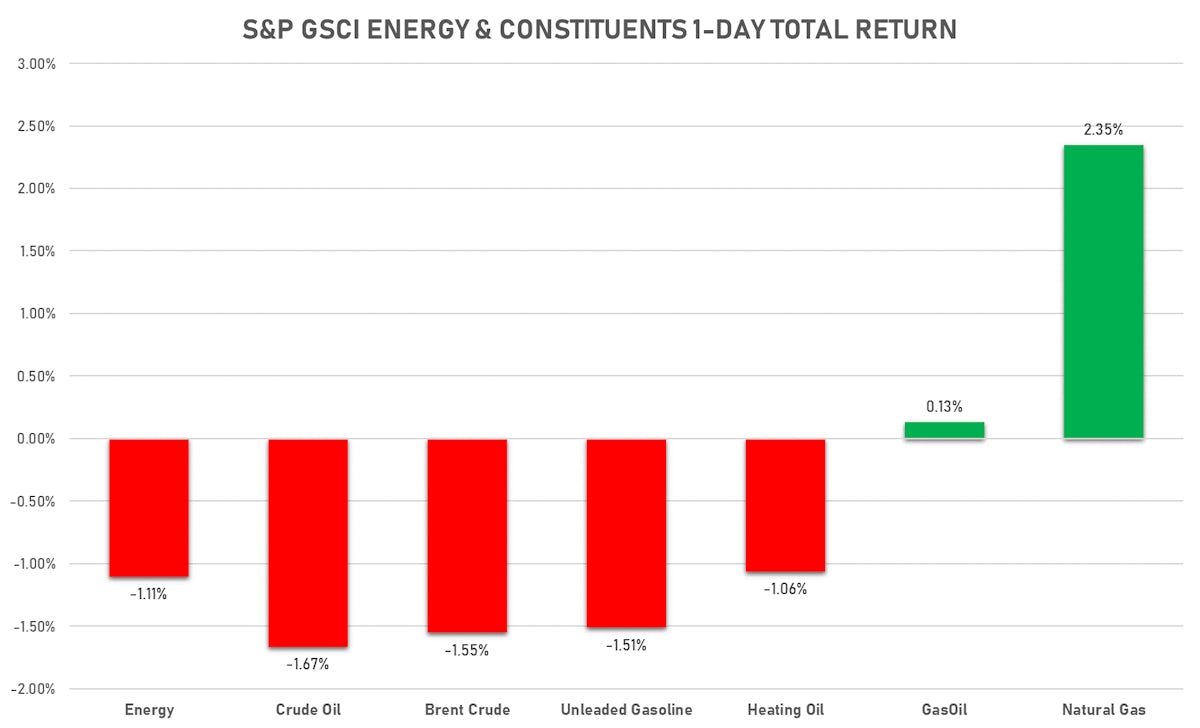

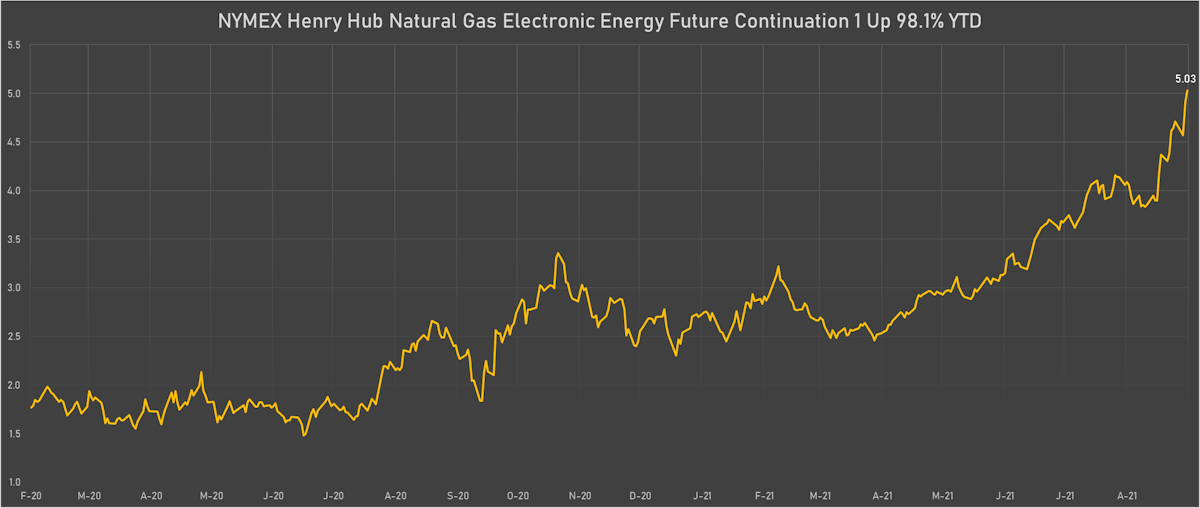

New seven-year high for natural gas prices despite larger than estimated weekly EIA injection report, with the market expected to remain tight into winter

Published ET

Natural gas front-month futures prices settled above $5 | Sources: ϕpost, Refinitiv data

HEADLINES & MACRO

- Bloomberg reports that China intervened in the oil market by releasing crude from its strategic reserve for the first time, in order to bring prices down

- EIA report shows a smaller-than-expected draw in crude stockpiles and larger-than-expected draw in gasoline

WEEKLY EIA INVENTORIES REPORT

- Stock Levels, Total Crude Oil excluding SPR, Absolute change, Volume for W 03 Sep (United States) at -1.53 Mln, above consensus estimate of -4.61 Mln

- Stock Levels, Total Distillate, Absolute change, Volume for W 03 Sep (United States) at -3.14 Mln, below consensus estimate of -2.62 Mln

- Stock Levels, Gasoline, Absolute change, Volume for W 03 Sep (United States) at -7.22 Mln, below consensus estimate of -3.39 Mln

- Stock Levels, Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 03 Sep (United States) at 52.00 bcf, above consensus estimate of 40.00 bcf

- Production, Refinery Capacity Utilization, Absolute change, Volume for W 03 Sep (United States) at -9.40 %, below consensus estimate of -4.90 %

NOTABLE GAINERS TODAY

- DCE Coke up 5.3% (YTD: 45.1%)

- SHFE Rebar up 3.0% (YTD: 32.1%)

- NYMEX Henry Hub Natural Gas up 2.4% (YTD: 98.1%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 1.9% (YTD: 10.3%)

- SHFE Aluminum up 1.9% (YTD: 42.0%)

- SHFE Stannum up 1.5% (YTD: 67.2%)

- SHFE Bitumen Continuation Month 1 up 1.4% (YTD: 25.0%)

- SHFE Nickel up 1.2% (YTD: 20.8%)

- COMEX Copper up 1.2% (YTD: 21.9%)

- Zhengzhou Exchange Thermal Coal up 1.1% (YTD: 37.8%)

- SHFE Lead Continuation Month 1 up 0.9% (YTD: 1.6%)

- SMM Refined Cobalt Grade Spot Price Daily up 0.8% (YTD: 34.5%)

- SHFE Zinc up 0.8% (YTD: 9.3%)

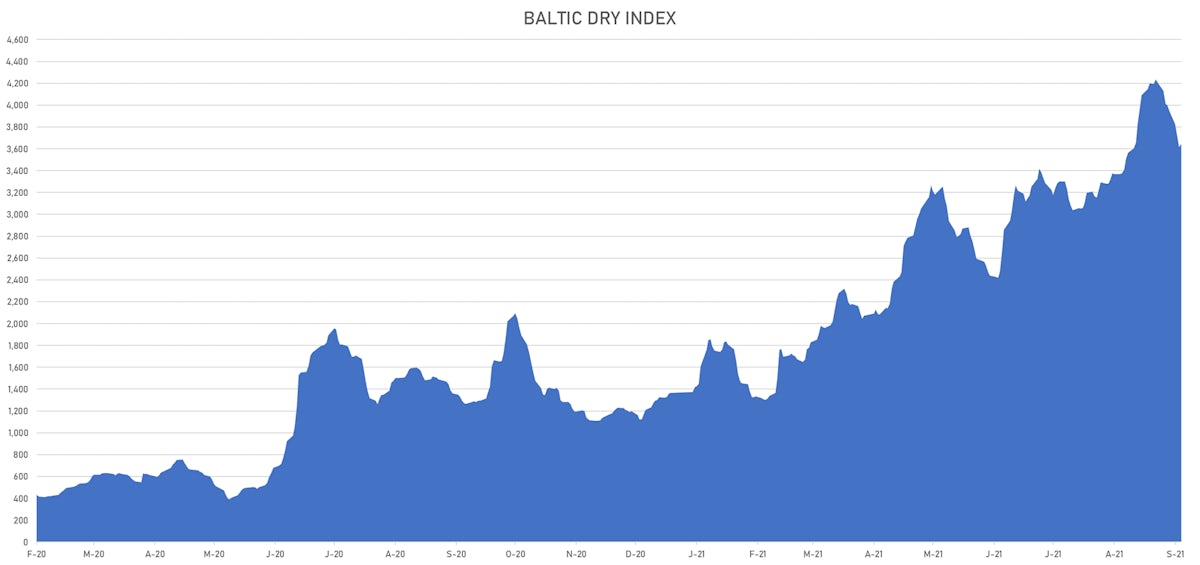

- BALTIC EXCH DRY up 0.7% (YTD: 166.7%)

- CME Random Length Lumber up 0.6% (YTD: -42.7%)

NOTABLE LOSERS TODAY

- DCE Coking Coal Continuation Month 1 down -4.9% (YTD: 100.7%)

- Johnson Matthey Rhodium New York 0930 down -4.5% (YTD: -6.2%)

- Palladium spot down -3.2% (YTD: -11.0%)

- CBoT Soybean Oil down -2.5% (YTD: 29.3%)

- CBoT Wheat down -2.4% (YTD: 6.4%)

- CME Lean Hogs down -2.2% (YTD: 21.6%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -2.1% (YTD: 30.9%)

- SHFE Rubber down -1.7% (YTD: -8.5%)

- Brent Forties and Oseberg Dated FOB North Sea Crude down -1.7% (YTD: 39.2%)

- NYMEX Light Sweet Crude Oil (WTI) down -1.7% (YTD: 40.4%)

- Coffee Arabica Colombia Excelso EP Spot down -1.6% (YTD: 41.0%)

- Crude Oil WTI Cushing US FOB down -1.6% (YTD: 41.2%)

- ICE Europe Brent Crude down -1.6% (YTD: 37.9%)

- NYMEX RBOB Gasoline down -1.5% (YTD: 49.1%)

- Bursa Malaysia Crude Palm Oil down -1.5% (YTD: 19.5%)

ENERGY MOSTLY DOWN TODAY

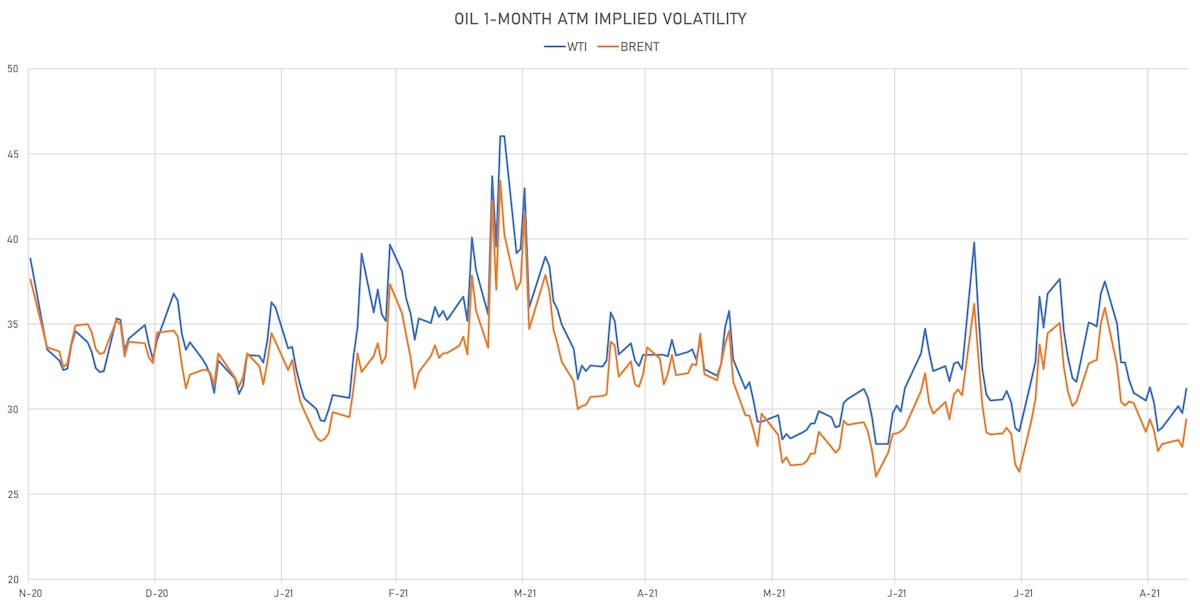

- WTI crude front month currently at US$ 68.24 per barrel, down -1.7% (YTD: +40.4%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 71.59 per barrel, down -1.6% (YTD: +37.9%); 6-month term structure in tightening backwardation

- Brent volatility at 29.4, up 5.9% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 177.50 per tonne, up 0.1% (YTD: +120.5%)

- Natural Gas (Henry Hub) currently at US$ 5.01 per MMBtu, up 2.4% (YTD: +98.1%)

- Gasoline (NYMEX) currently at US$ 2.11 per gallon, down -1.5% (YTD: +49.1%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 605.50 per tonne, up 0.1% (YTD: +43.9%)

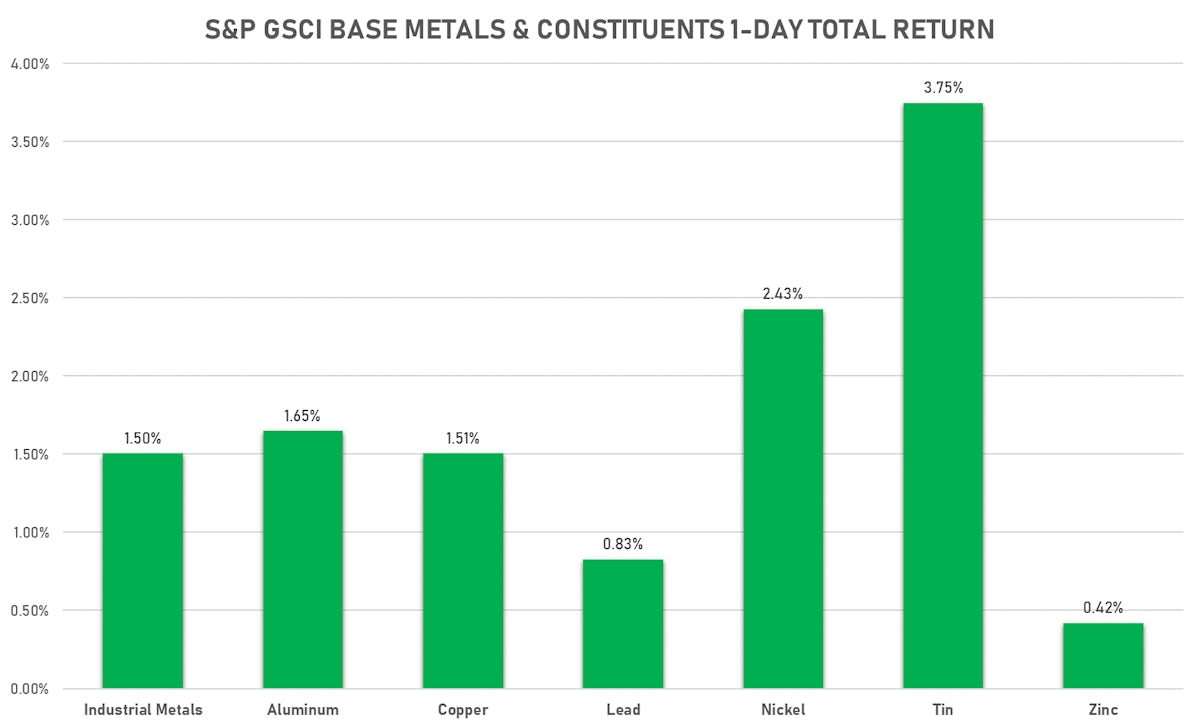

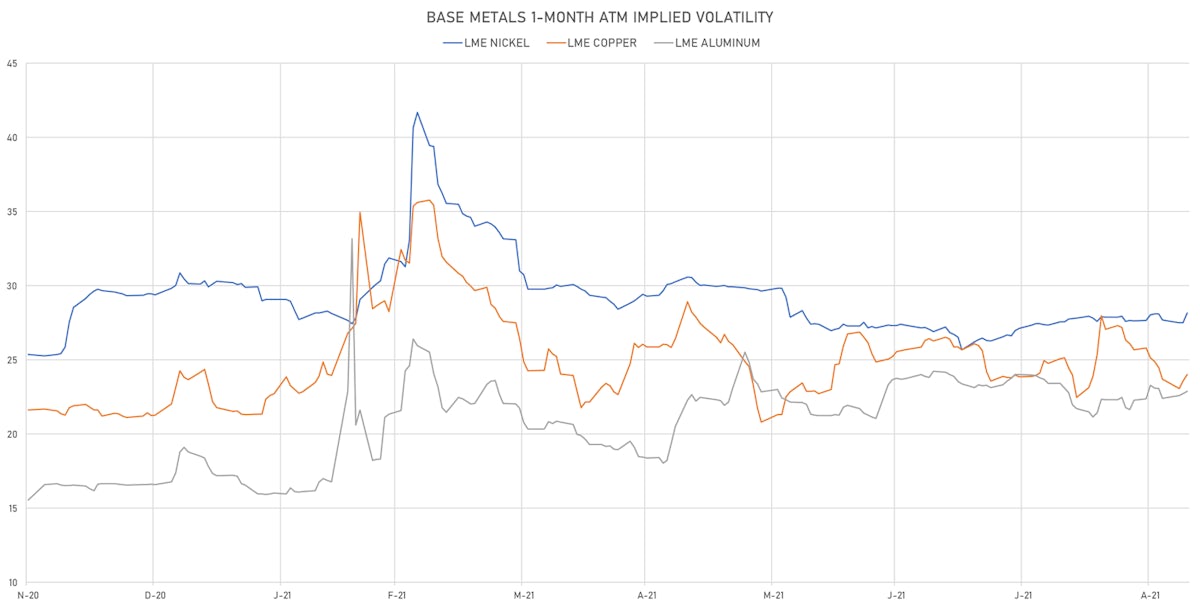

BASE METALS UP TODAY

- Copper (COMEX) currently at US$ 4.31 per pound, up 1.2% (YTD: +21.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 825.00 per tonne, down -0.4% (YTD: -25.3%)

- Aluminum (Shanghai) currently at CNY 22,700 per tonne, up 1.9% (YTD: +42.0%)

- Nickel (Shanghai) currently at CNY 153,780 per tonne, up 1.2% (YTD: +20.8%)

- Lead (Shanghai) currently at CNY 15,045 per tonne, up 0.9% (YTD: +1.6%)

- Rebar (Shanghai) currently at CNY 5,620 per tonne, up 3.0% (YTD: +32.1%)

- Tin (Shanghai) currently at CNY 259,780 per tonne, up 1.5% (YTD: +67.2%)

- Zinc (Shanghai) currently at CNY 22,910 per tonne, up 0.8% (YTD: +9.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 368,500 per tonne, up 0.8% (YTD: +34.5%)

- Lithium (Shanghai) spot price currently at CNY 735,000 per tonne, unchanged (YTD: +51.5%)

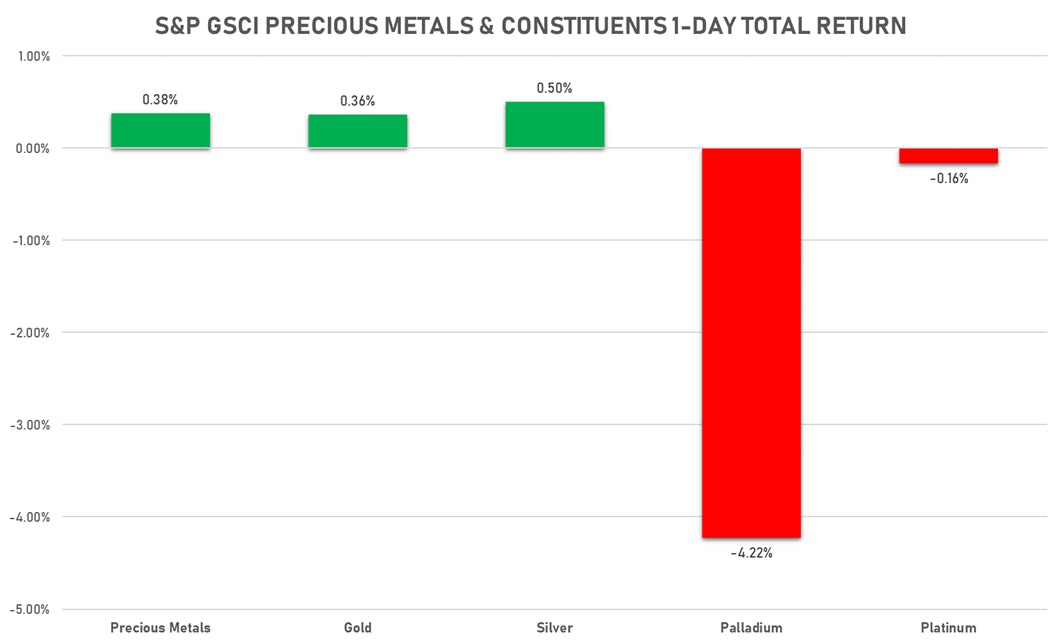

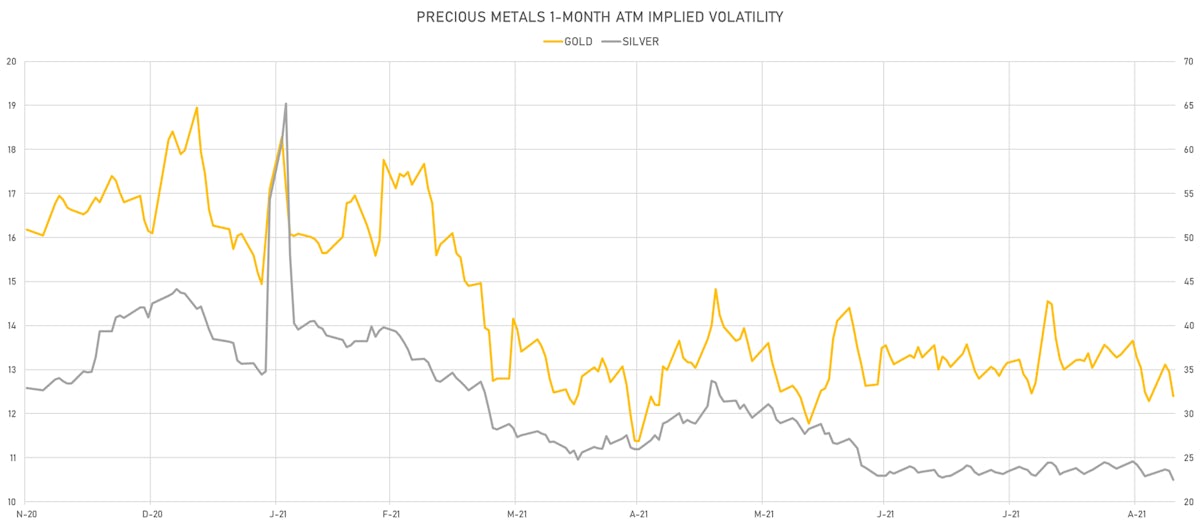

PRECIOUS METALS MIXED TODAY

- Gold spot currently at US$ 1,797.11 per troy ounce, up 0.3% (YTD: -5.4%)

- Gold 1-Month ATM implied volatility currently at 11.98, down -4.2% (YTD: -23.0%)

- Silver spot currently at US$ 24.10 per troy ounce, up 0.5% (YTD: -8.9%)

- Silver 1-Month ATM implied volatility currently at 21.50, down -4.7% (YTD: -47.3%)

- Palladium spot currently at US$ 2,202.10 per troy ounce, down -3.2% (YTD: -11.0%)

- Platinum spot currently at US$ 981.08 per troy ounce, down -0.2% (YTD: -8.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 16,000 per troy ounce, down -4.5% (YTD: -6.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, unchanged (YTD: +92.3%)

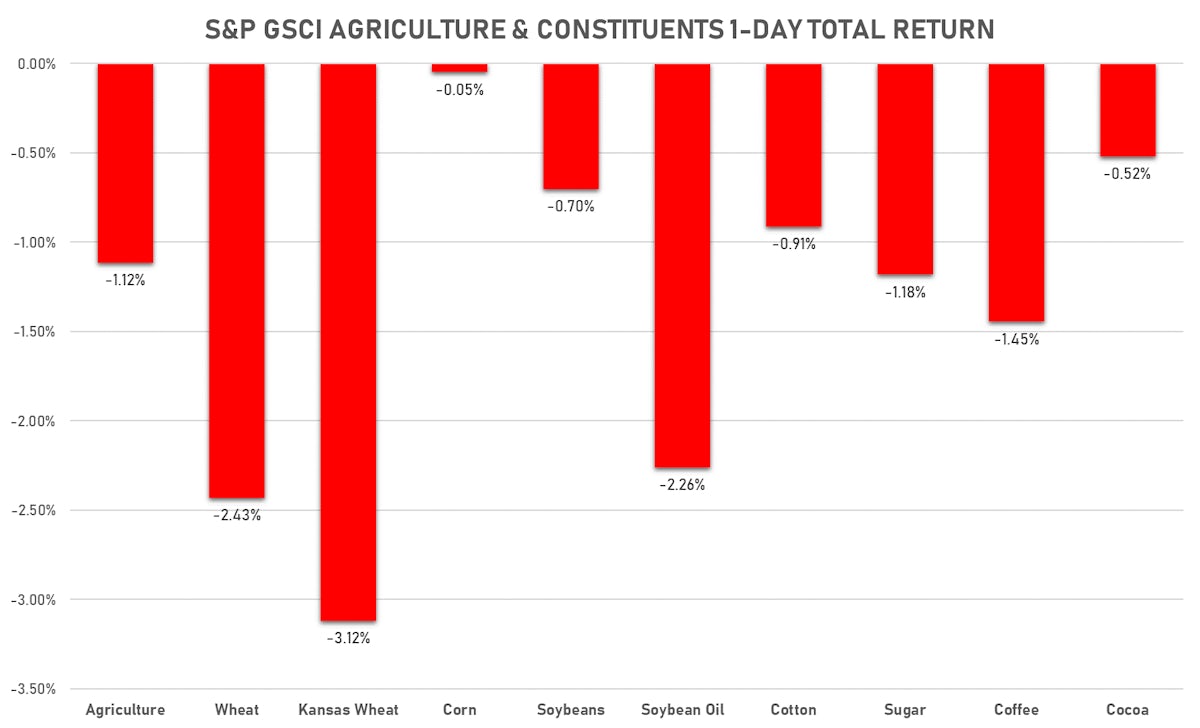

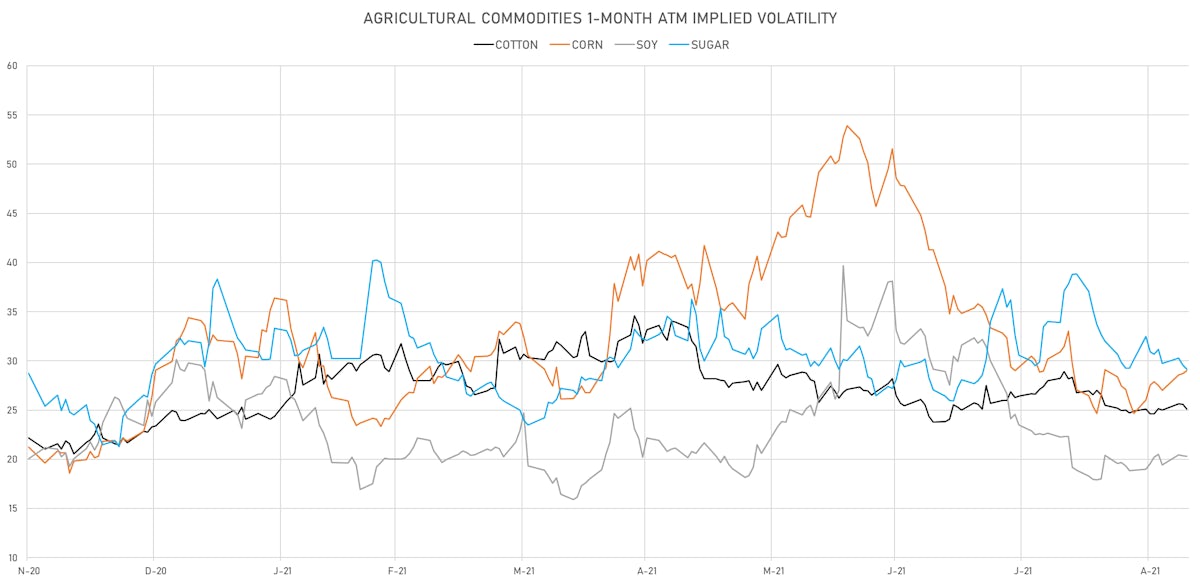

AGS DOWN TODAY

- Live Cattle (CME) currently at US$ 123.75 cents per pound, up 0.5% (YTD: +9.6%)

- Lean Hogs (CME) currently at US$ 85.48 cents per pound, down -2.2% (YTD: +21.6%)

- Rough Rice (CBOT) currently at US$ 13.09 cents per hundredweight, down -0.1% (YTD: +5.5%)

- Soybeans Composite (CBOT) currently at US$ 1,258.75 cents per bushel, down -0.9% (YTD: -4.3%)

- Corn (CBOT) currently at US$ 499.00 cents per bushel, down -0.5% (YTD: +2.5%)

- Wheat Composite (CBOT) currently at US$ 681.50 cents per bushel, down -2.4% (YTD: +6.4%)

- Sugar No.11 (ICE US) currently at US$ 19.24 cents per pound, down -1.3% (YTD: +24.2%)

- Cotton No.2 (ICE US) currently at US$ 94.56 cents per pound, down -0.7% (YTD: +21.0%)

- Cocoa (ICE US) currently at US$ 2,713 per tonne, down -0.5% (YTD: +4.2%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,464 per tonne, down -1.6% (YTD: +41.0%)

- Random Length Lumber (CME) currently at US$ 500.60 per 1,000 board feet, up 0.6% (YTD: -42.7%)

- TSR 20 Rubber (Shanghai) unchanged at CNY 10,690 per tonne (YTD: +7.6%)

- Soybean Oil Composite (CBOT) currently at US$ 56.02 cents per pound, down -2.5% (YTD: +29.3%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,650 per tonne, down -1.5% (YTD: +19.5%)

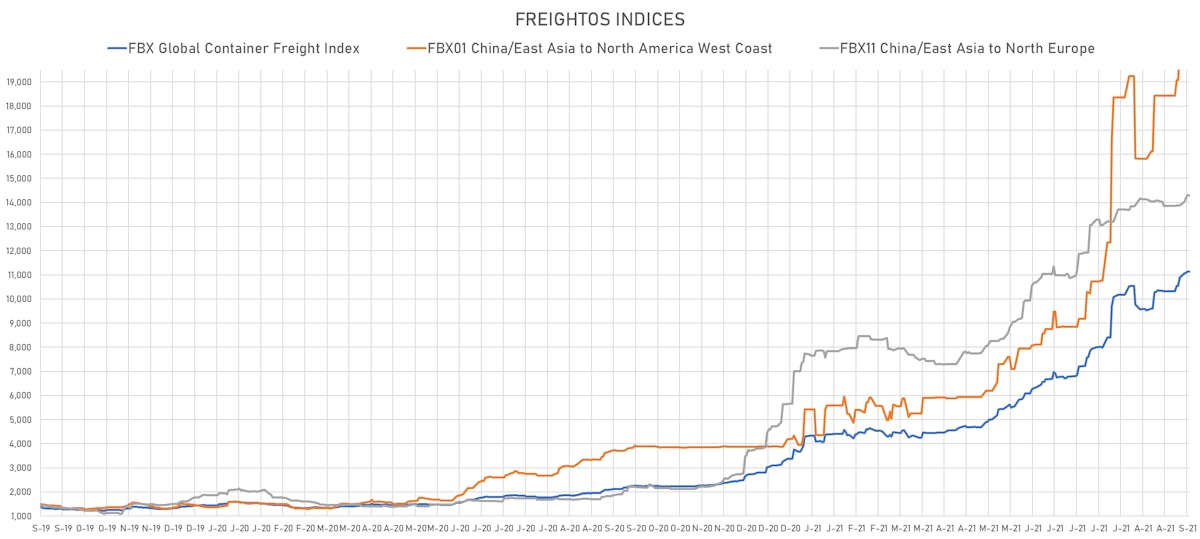

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,643, up 0.7% (YTD: +166.7%)

- Freightos China To North America West Coast Container Index currently at 20,586, unchanged (YTD: +390.2%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 366, unchanged (YTD: +0.8%)

- Freightos Europe To North America East Coast Container Index currently at 6,984, unchanged (YTD: +273.7%)

- Freightos China To North Europe Container Index currently at 14,299, unchanged (YTD: +152.5%)

- Freightos North Europe To China Container Index currently at 1,503, unchanged (YTD: +9.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,622, unchanged (YTD: +232.3%)

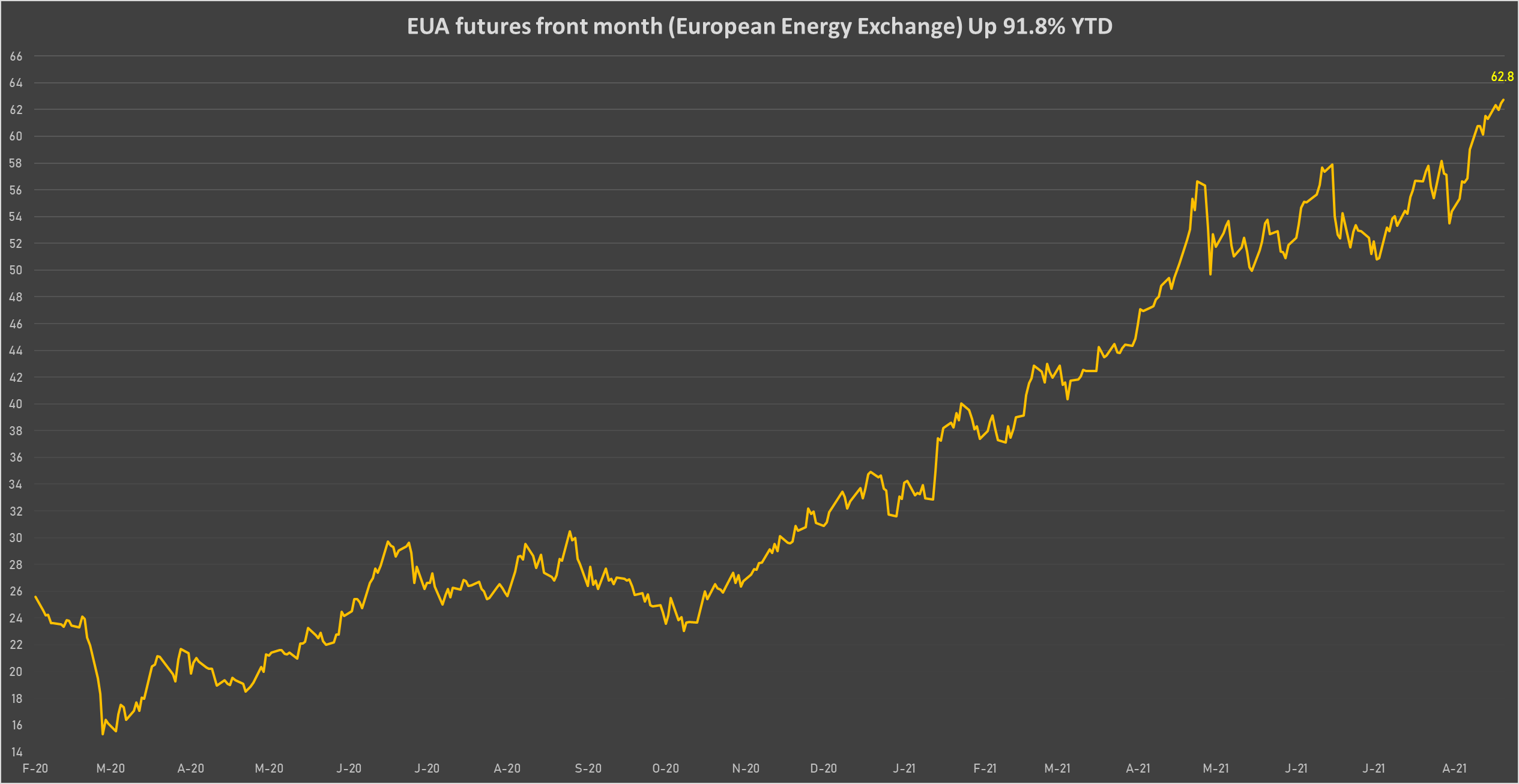

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 62.75 per tonne, up 0.5% (YTD: +91.8%)