Cross Asset

Macro Markets Saw Heightened Volatility, With Both The US Dollar And Commodities Rising This Week

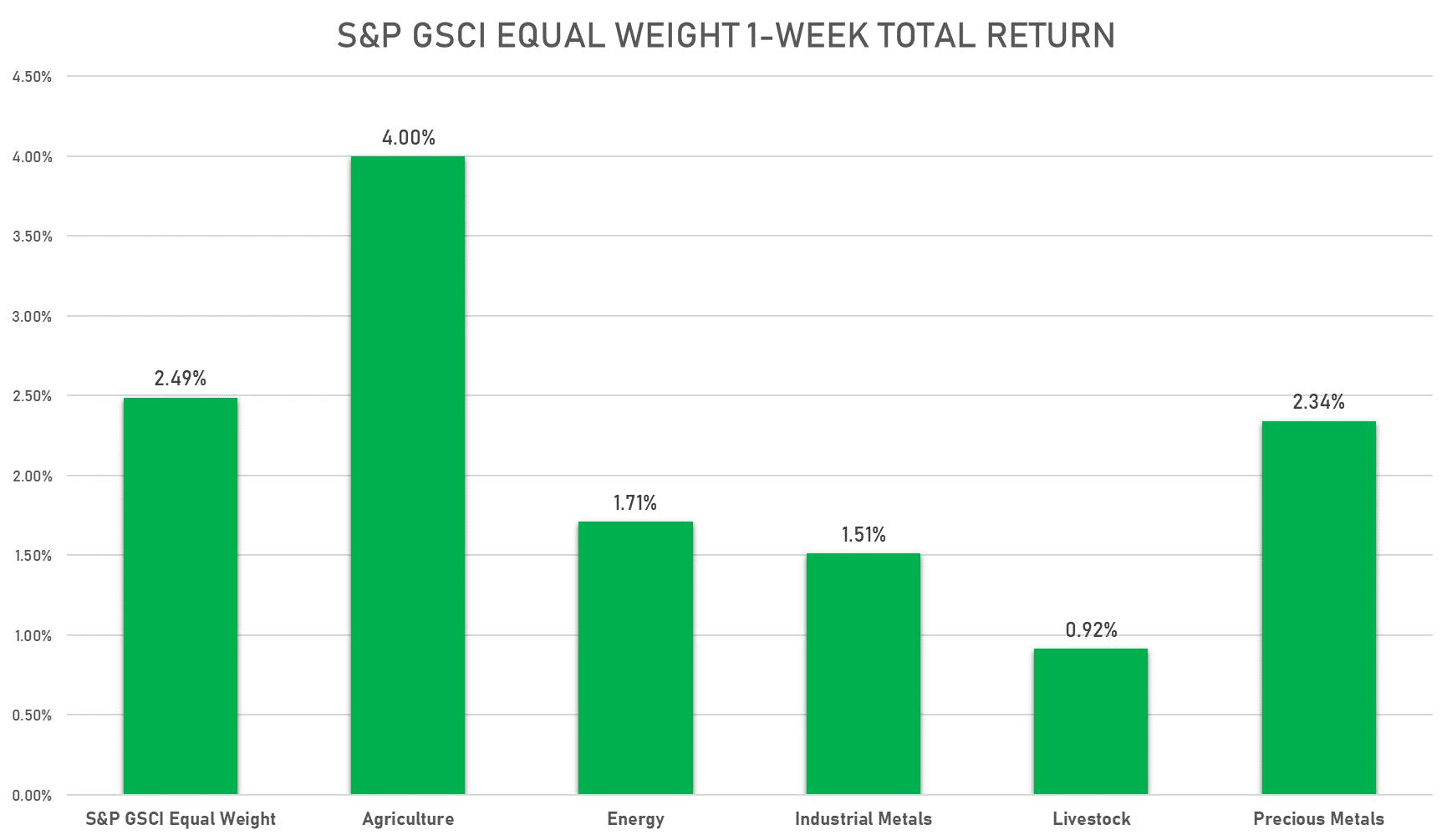

All GSCI sub-indices rose this week, led by agriculture and precious metals; Chinese markets were open again and saw big gains after the new year holiday, most notably iron ore, thermal coal, and copper

Published ET

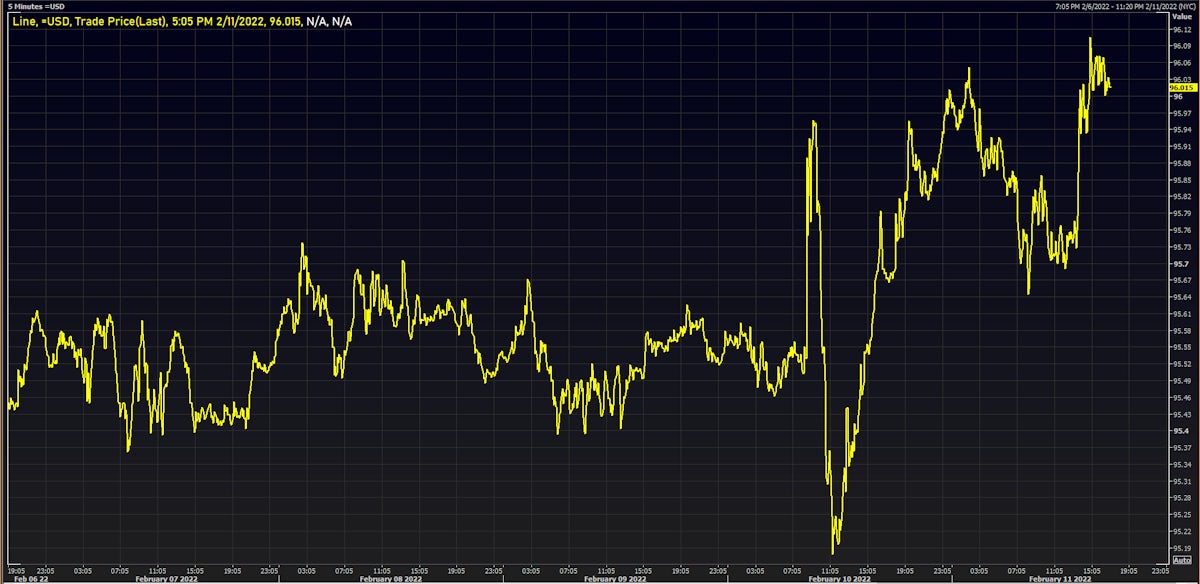

US Dollar Index Intraday This Week | Source: Refinitiv

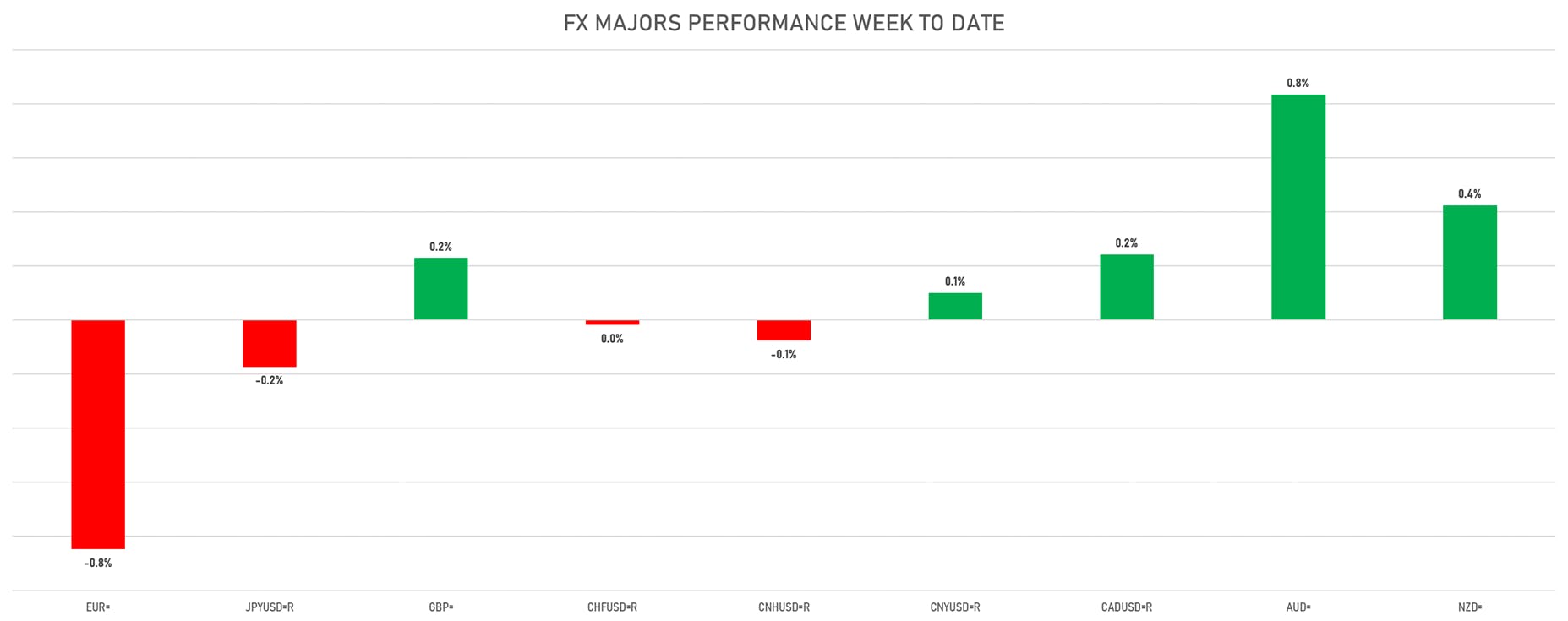

WEEKLY PERFORMANCE OF MAJOR CURRENCIES

- The US Dollar Index at 96.02 (YTD: +0.37%)

- Euro down at 1.1349 (YTD: -0.2%)

- Yen down at 115.41 (YTD: -0.3%)

- Onshore Yuan at 6.3540 (YTD: +0.1%)

- Swiss franc down at 0.9256 (YTD: -1.5%)

- Sterling up at 1.3560 (YTD: +0.2%)

- Canadian up dollar at 1.2736 (YTD: -0.8%)

- Australian up dollar at 0.7135 (YTD: -1.7%)

- NZ dollar up at 0.6647 (YTD: -2.6%)

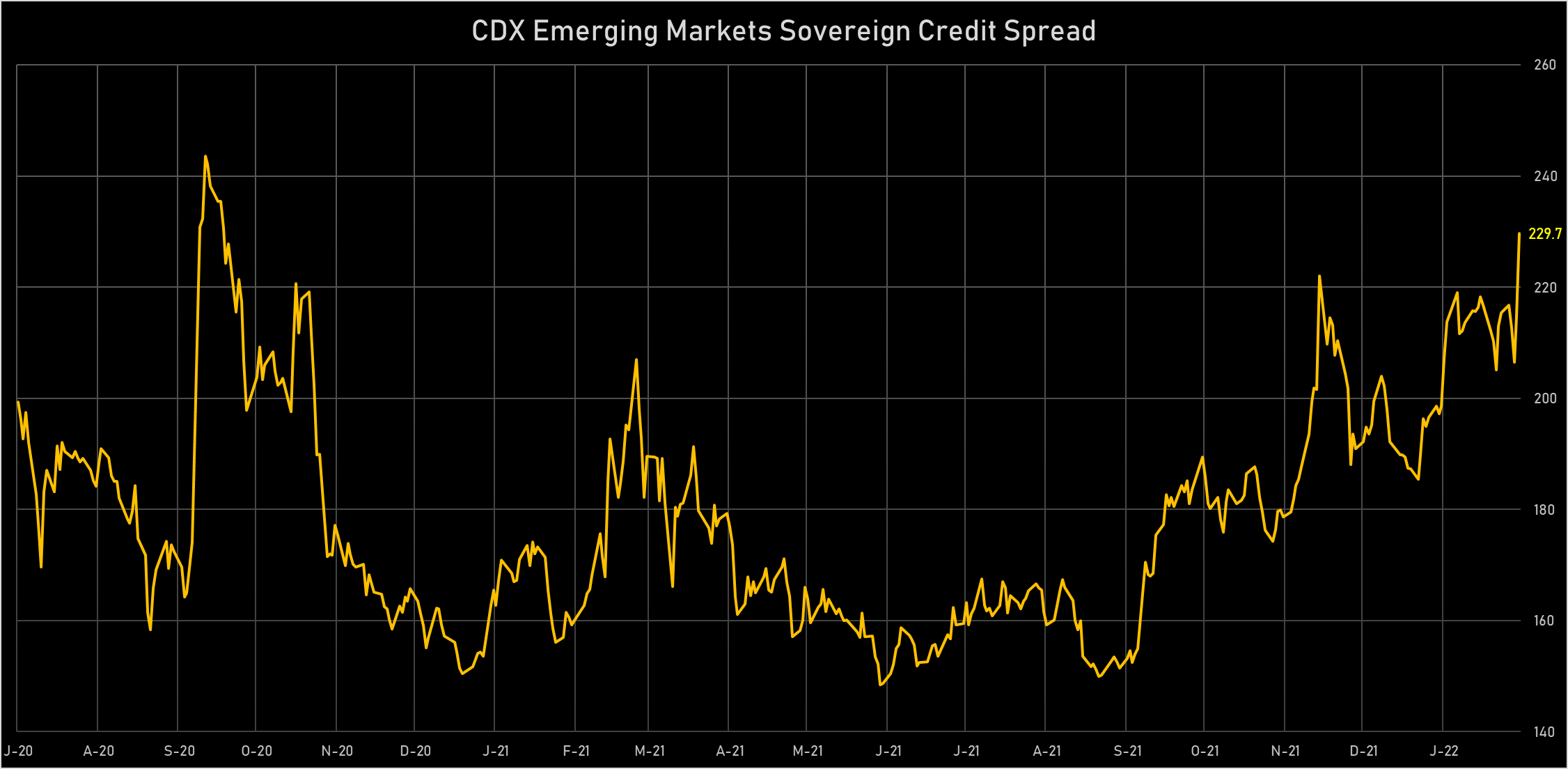

NOTABLE MOVES IN SOVEREIGN CDS THIS WEEK

- Russia (rated BBB): up 12.0 % to 220 bp (1Y range: 75-254bp)

- Brazil (rated BB-): up 4.8 % to 231 bp (1Y range: 152-266bp)

- Mexico (rated BBB-): up 10.1 % to 115 bp (1Y range: 80-124bp)

- Vietnam (rated BB): up 4.8 % to 114 bp (1Y range: 89-114bp)

- Philippines (rated BBB): up 8.5 % to 80 bp (1Y range: 36-78bp)

- Indonesia (rated BBB): up 5.4 % to 95 bp (1Y range: 66-96bp)

- Malaysia (rated BBB+): up 6.4 % to 64 bp (1Y range: 36-65bp)

- Turkey (rated B+): down 6.1 % to 509 bp (1Y range: 282-614bp)

- China (rated A+): up 7.2 % to 53 bp (1Y range: 28-58bp)

- Chile (rated A-): up 4.3 % to 83 bp (1Y range: 43-95bp)

LARGEST FX MOVES THIS WEEK

- Seychelles rupee up 8.3% (YTD: +4.0%)

- CFA Franc BEAC up 4.2% (YTD: +4.1%)

- Tonga Pa'anga up 3.8% (YTD: +2.2%)

- Peru Sol down 2.4% (YTD: +6.0%)

- Samoa Tala up 2.1% (YTD: +0.8%)

- Namibian Dollar down 2.0% (YTD: +4.9%)

- South Africa Rand down 1.9% (YTD: +5.1%)

- Czech Koruna down 2.1% (YTD: +1.1%)

- Swedish Krona down 2.4% (YTD: -3.3%)

- Russian Rouble down 2.5% (YTD: -3.2%)

YTD BIGGEST WINNERS & LOSERS

- Afghani up 12.7%

- Angolan Kwanza up 6.5%

- Brazilian Real up 6.1%

- Peru Sol up 6.0%

- Chilean Peso up 5.2%

- South Africa Rand up 5.1%

- Georgian Lari up 5.1%

- Namibian Dollar up 4.9%

- Liberian Dollar down 5.5%

- New Zambian Kwacha down 11.2%

COMMODITIES - GAINERS THIS WEEK

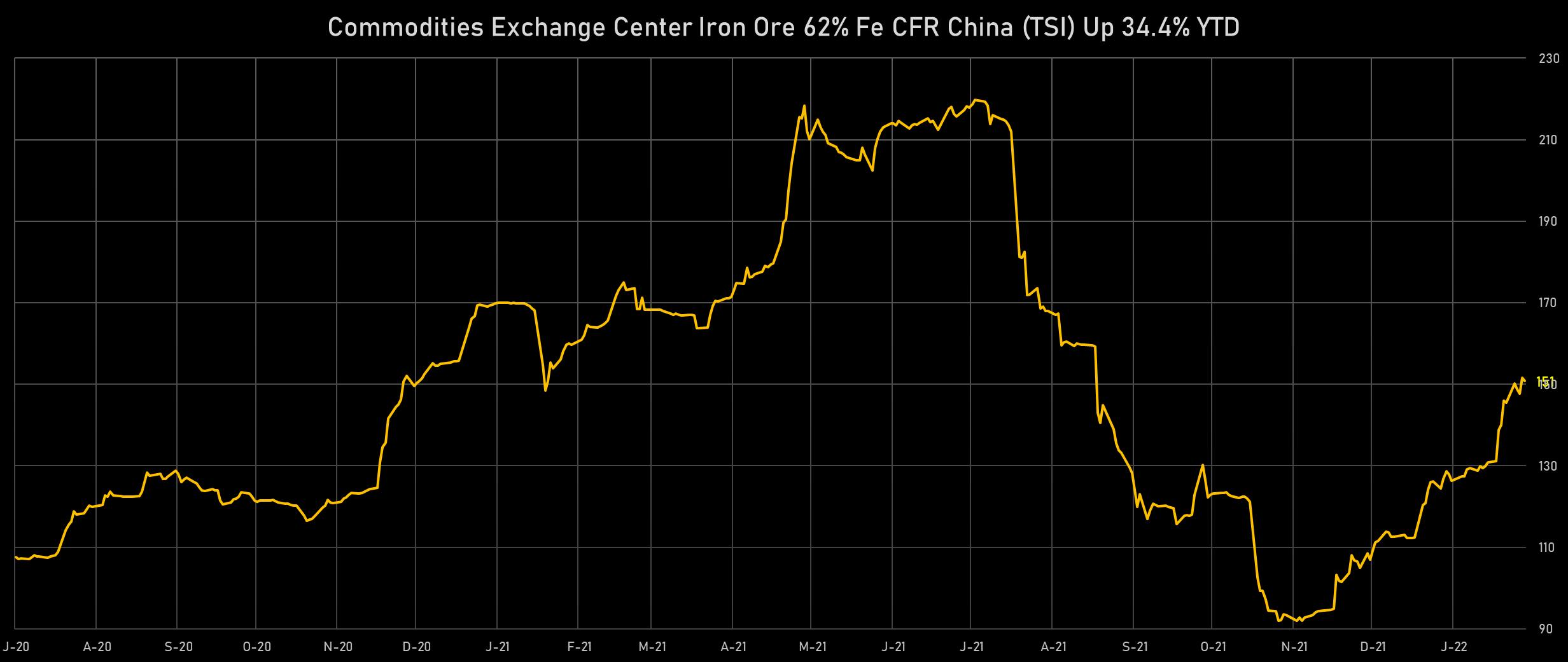

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 15.3% (YTD: 34.4%), now at 151.57

- Zhengzhou Exchange Thermal Coal up 14.1% (YTD: 3.6%), now at 834.80

- SGX Iron Ore 62% China CFR Swap Monthly up 14.0% (YTD: 32.9%), now at 149.75

- CME Random Length Lumber up 13.7% (YTD: 5.0%), now at 1,216.00

- Baltic Exchange Clean Tank Index up 9.5% (YTD: -18.7%), now at 645.00

- Rhodium Johnson Matthey New York 0930 up 8.9% (YTD: 30.1%), now at 18,350.00

- Newcastle Coal ICE Europe Monthly up 7.8% (YTD: 44.0%), now at 245.00

- Bonded Copper Shanghai International Exchange up 6.6% (YTD: 7.7%), now at 66,880.00

- SHFE Aluminum up 5.8% (YTD: 13.1%), now at 22,360.00

- SHFE Nickel up 5.3% (YTD: 16.8%), now at 175,550.00

COMMODITIES - LOSERS THIS WEEK

- Henry Hub Natural Gas down -13.8% (YTD: 10.7%), now at 03.94

- European Union Aviation Allowance Continuation Month 1 down -3.7% (YTD: 16.0%), now at 90.16

- Low Sulphur Gasoil ICE Europe down -2.8% (YTD: 22.1%), now at 827.25

- Iridium Johnson Matthey New York 0930 down -1.3% (YTD: -2.5%), now at 3,900.00

- ICE-US Cotton No. 2 down -1.2% (YTD: 9.6%), now at 124.96

- CME Dry Whey down -1.0% (YTD: 21.3%), now at 77.50

- CME Non Fat Dry Milk down -1.0% (YTD: 12.6%), now at 173.78

- CBoT Rough Rice down -0.4% (YTD: 4.4%), now at 15.21

- SHFE Lead Continuation Month 1 down -0.1% (YTD: -0.5%), now at 15,235.00

- CME Live Cattle down -0.1% (YTD: 2.0%), now at 141.88

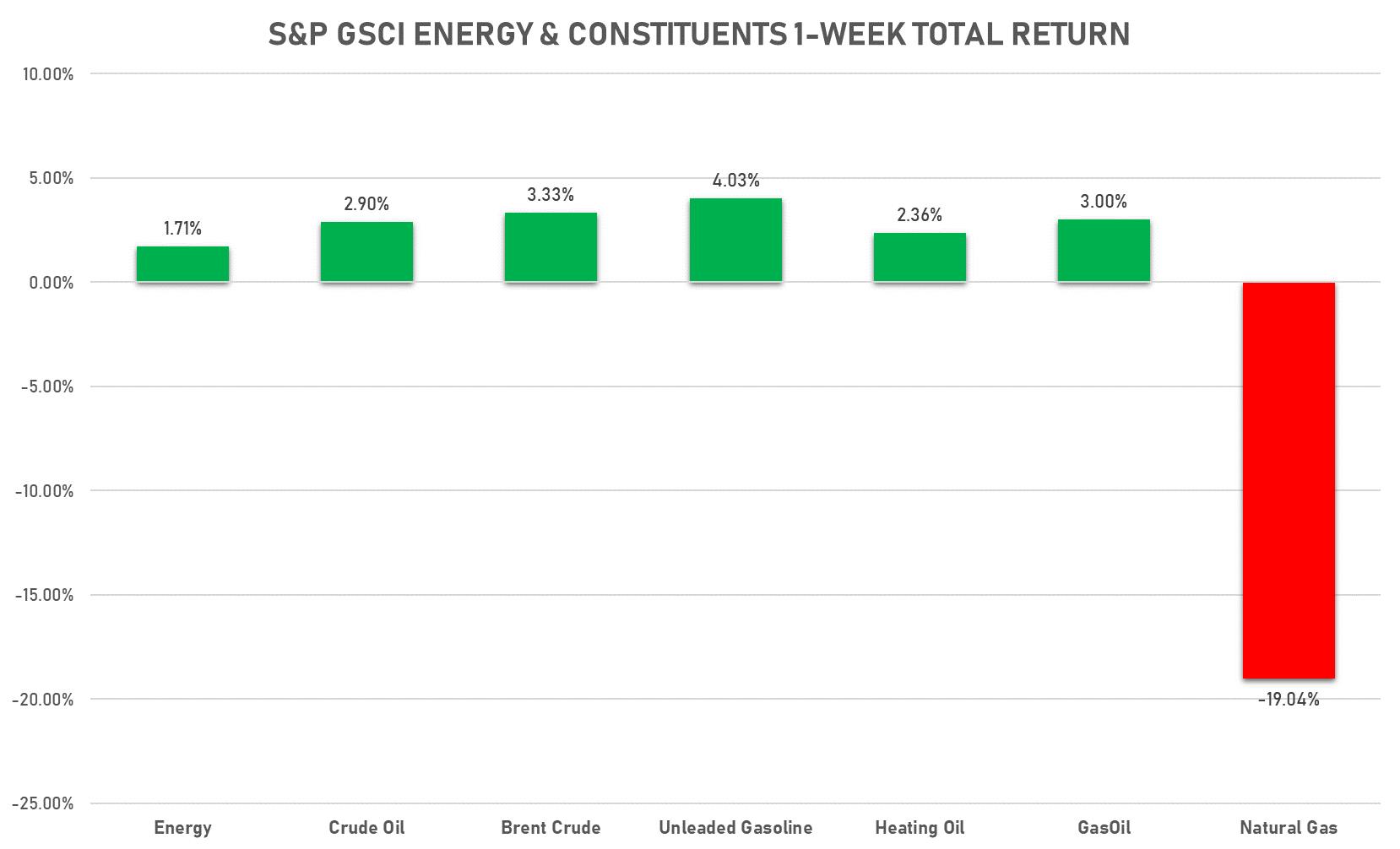

ENERGY THIS WEEK

- WTI crude front month currently at US$ 93.10 per barrel, up 0.9% (YTD: +20.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 94.44 per barrel, up 1.3% (YTD: +19.1%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 245.00 per tonne, up 7.8% (YTD: +44.0%)

- Natural Gas (Henry Hub) currently at US$ 3.94 per MMBtu, down -13.8% (YTD: +10.7%)

- Gasoline (NYMEX) currently at US$ 2.74 per gallon, up 2.2% (YTD: +19.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 827.25 per tonne, down -2.8% (YTD: +22.1%)

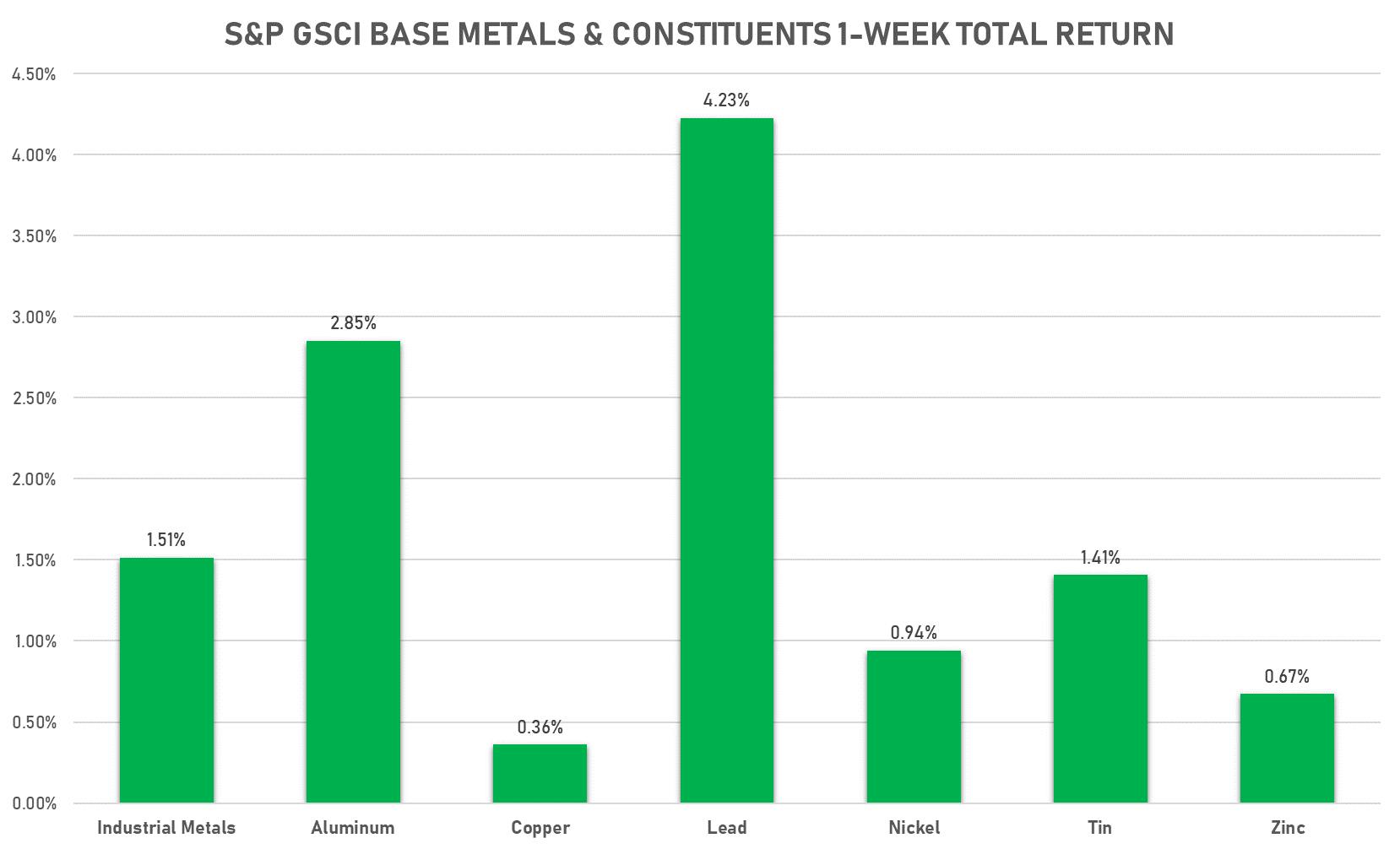

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.48 per pound, up 0.5% (YTD: +2.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 842.50 per tonne, up 5.1% (YTD: +22.8%)

- Aluminum (Shanghai) currently at CNY 22,360 per tonne, up 5.8% (YTD: +13.1%)

- Nickel (Shanghai) currently at CNY 175,550 per tonne, up 5.3% (YTD: +16.8%)

- Lead (Shanghai) currently at CNY 15,235 per tonne, down -0.1% (YTD: -0.5%)

- Rebar (Shanghai) currently at CNY 4,800 per tonne, up 4.6% (YTD: +9.4%)

- Tin (Shanghai) currently at CNY 337,180 per tonne, up 3.1% (YTD: +13.8%)

- Zinc (Shanghai) currently at CNY 25,370 per tonne, up 1.7% (YTD: +7.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 514,000 per tonne, up 3.0% (YTD: +5.5%)

- Lithium (Shanghai) spot price currently at CNY 2,030,000 per tonne, up 5.2% (YTD: +52.1%)

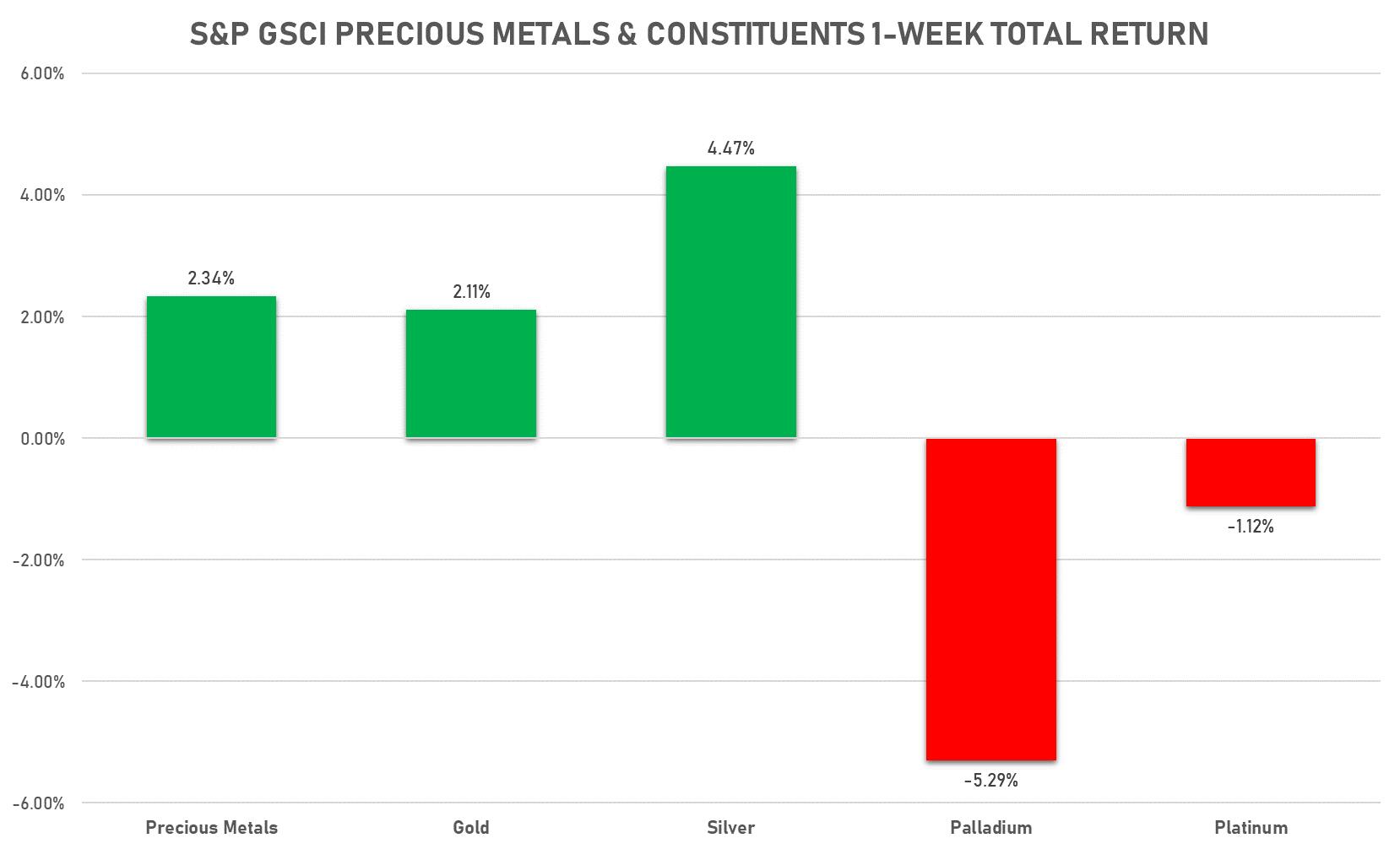

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,858.95 per troy ounce, up 2.8% (YTD: +2.4%)

- Gold 1-Month ATM implied volatility currently at 12.11, down -2.9% (YTD: -4.8%)

- Silver spot currently at US$ 23.55 per troy ounce, up 4.7% (YTD: +2.3%)

- Silver 1-Month ATM implied volatility currently at 23.03, down -4.7% (YTD: +0.3%)

- Palladium spot currently at US$ 2,310.34 per troy ounce, up 0.9% (YTD: +17.6%)

- Platinum spot currently at US$ 1,027.00 per troy ounce, up 0.4% (YTD: +6.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,350 per troy ounce, up 8.9% (YTD: +30.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 3,900 per troy ounce, down -1.3% (YTD: -2.5%)

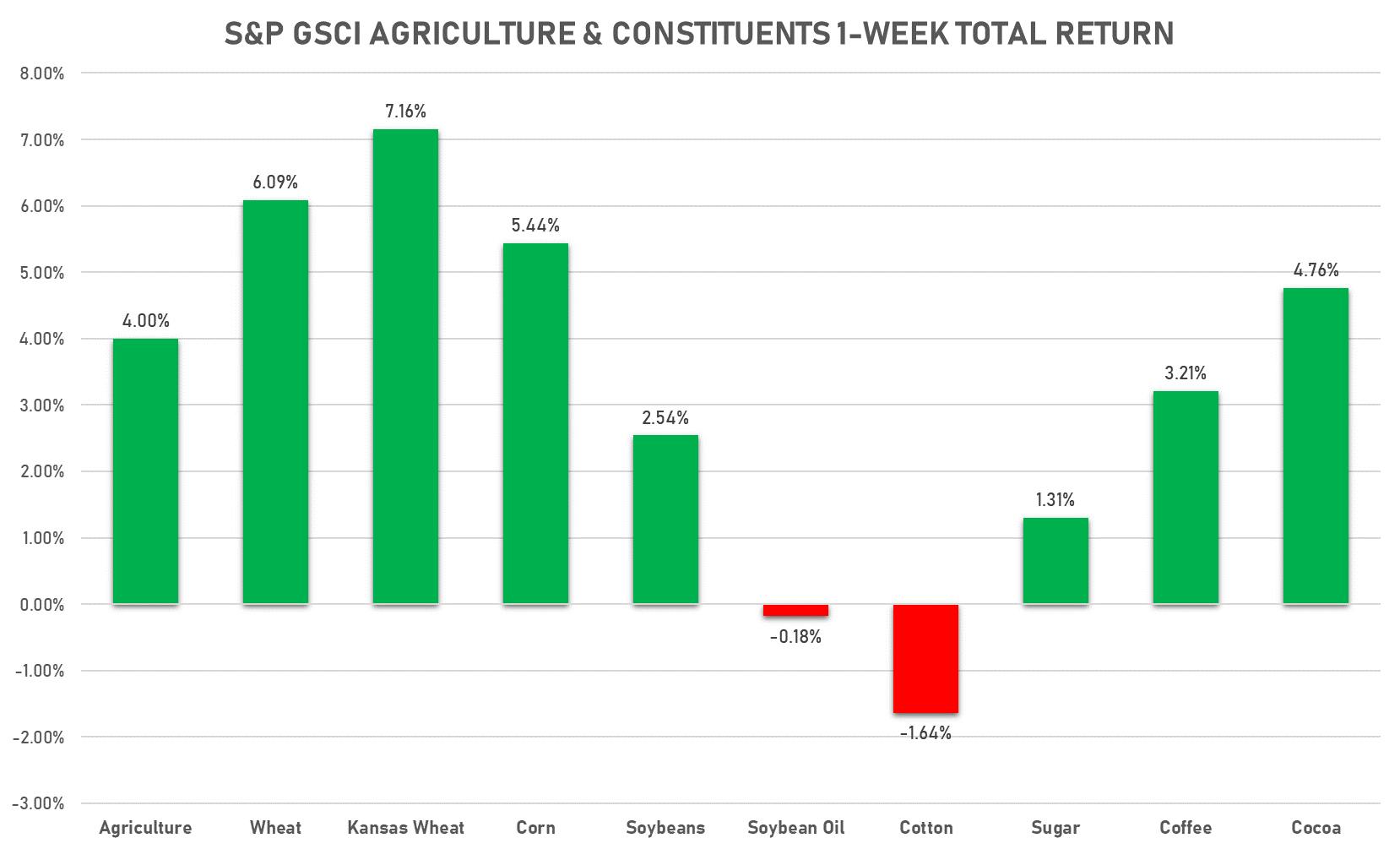

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 141.88 cents per pound, down 0.1% (YTD: +2.0%)

- Lean Hogs (CME) currently at US$ 90.50 cents per pound, up 4.0% (YTD: +9.4%)

- Rough Rice (CBOT) currently at US$ 15.21 cents per hundredweight, down -0.4% (YTD: +4.4%)

- Soybeans Composite (CBOT) currently at US$ 1,583.00 cents per bushel, up 1.9% (YTD: +19.2%)

- Corn (CBOT) currently at US$ 651.00 cents per bushel, up 4.9% (YTD: +9.2%)

- Wheat Composite (CBOT) currently at US$ 797.75 cents per bushel, up 4.5% (YTD: +2.3%)

- Sugar No.11 (ICE US) currently at US$ 18.29 cents per pound, up 0.2% (YTD: -2.8%)

- Cotton No.2 (ICE US) currently at US$ 124.96 cents per pound, down -1.2% (YTD: +9.6%)

- Cocoa (ICE US) currently at US$ 2,764 per tonne, up 3.7% (YTD: +8.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 6,089 per tonne, up 5.1% (YTD: +10.5%)

- Random Length Lumber (CME) currently at US$ 1,216.00 per 1,000 board feet, up 13.7% (YTD: +5.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,520 per tonne, up 0.1% (YTD: +0.4%)

- Soybean Oil Composite (CBOT) currently at US$ 65.72 cents per pound, up 0.6% (YTD: +17.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,800 per tonne, up 0.4% (YTD: +12.6%)

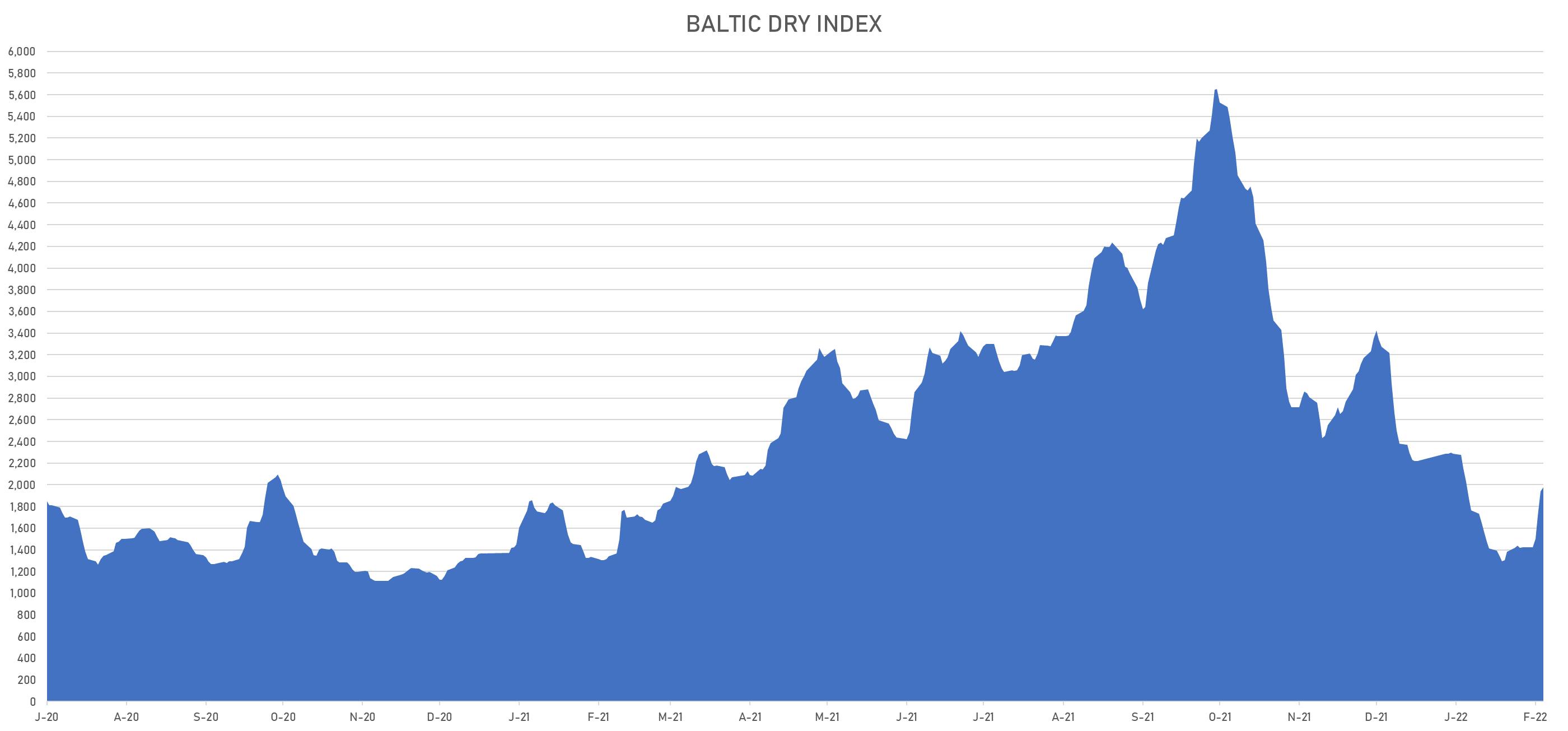

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 1,977, up 38.9% (YTD: -10.9%)

- Freightos China To North America West Coast Container Index currently at 15,218, unchanged (YTD: +11.0%)

- Freightos North America West Coast To China Container Index currently at 958, down -11.8% (YTD: +9.5%)

- Freightos North America East Coast To Europe Container Index currently at 571, down -3.4% (YTD: +5.7%)

- Freightos Europe To North America East Coast Container Index currently at 6,964, unchanged (YTD: -1.9%)

- Freightos China To North Europe Container Index currently at 14,483, down -1.2% (YTD: +2.0%)

- Freightos North Europe To China Container Index currently at 989, up 0.1% (YTD: -12.5%)

- Freightos Europe To South America West Coast Container Index currently at 8,399, unchanged (YTD: +7.5%)

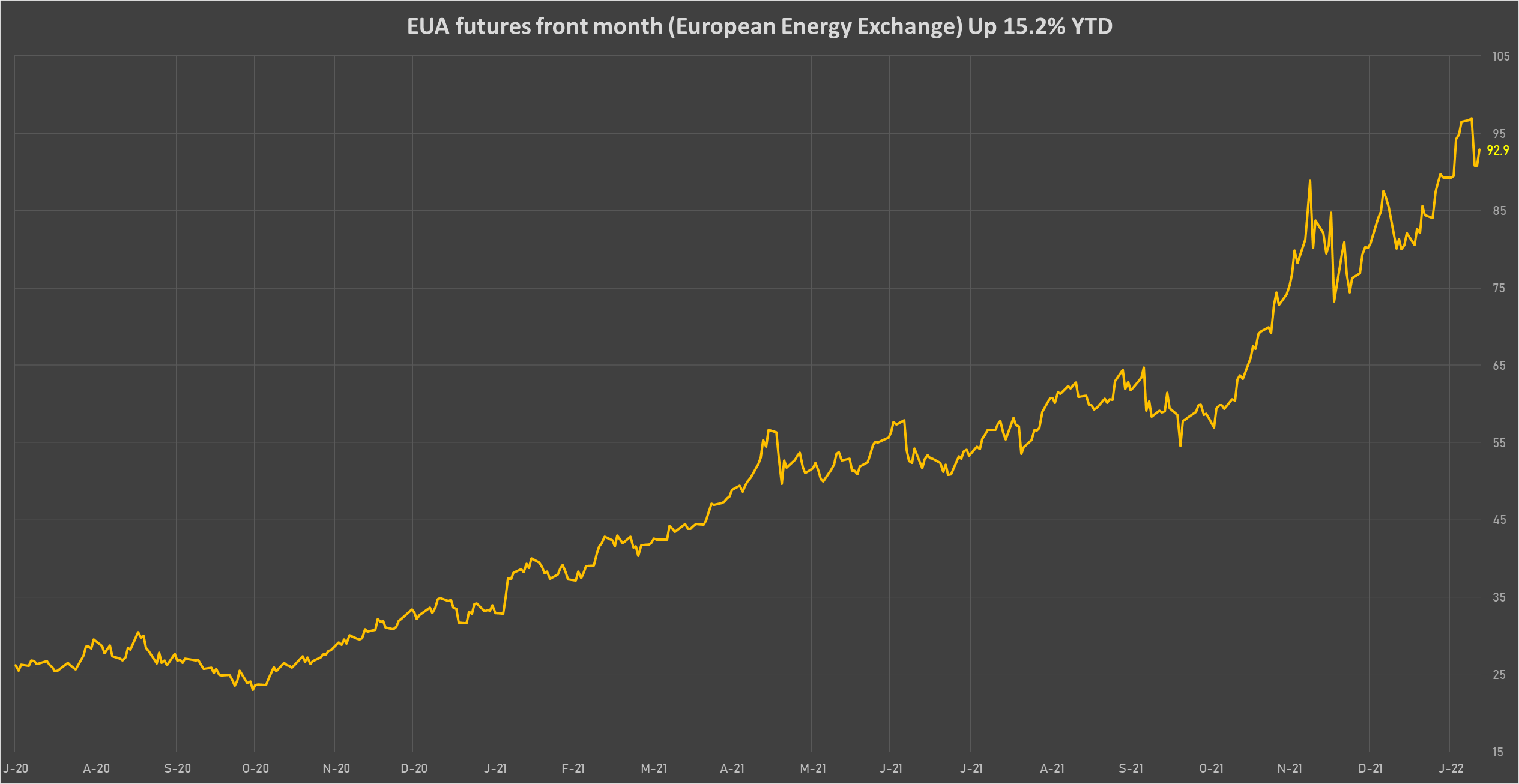

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 92.87 per tonne, down -3.7% (YTD: +15.9%)