Commodities

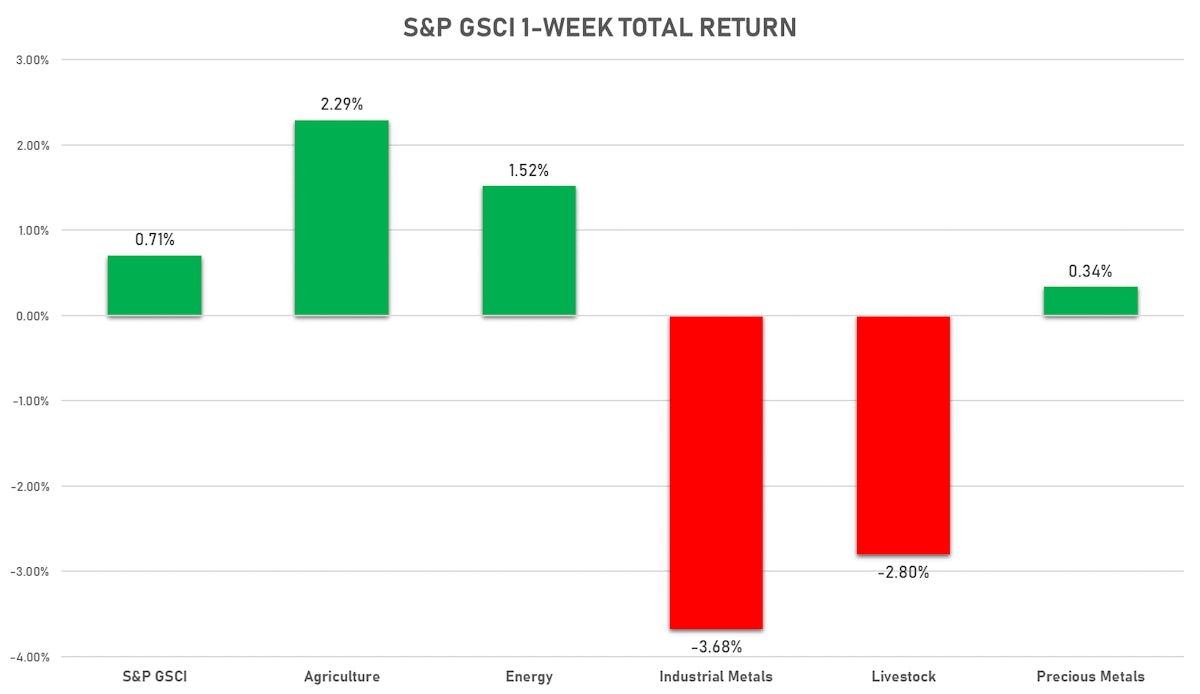

Mixed Week For Commodities, With Ags And Energy Rising While Base Metals Fell

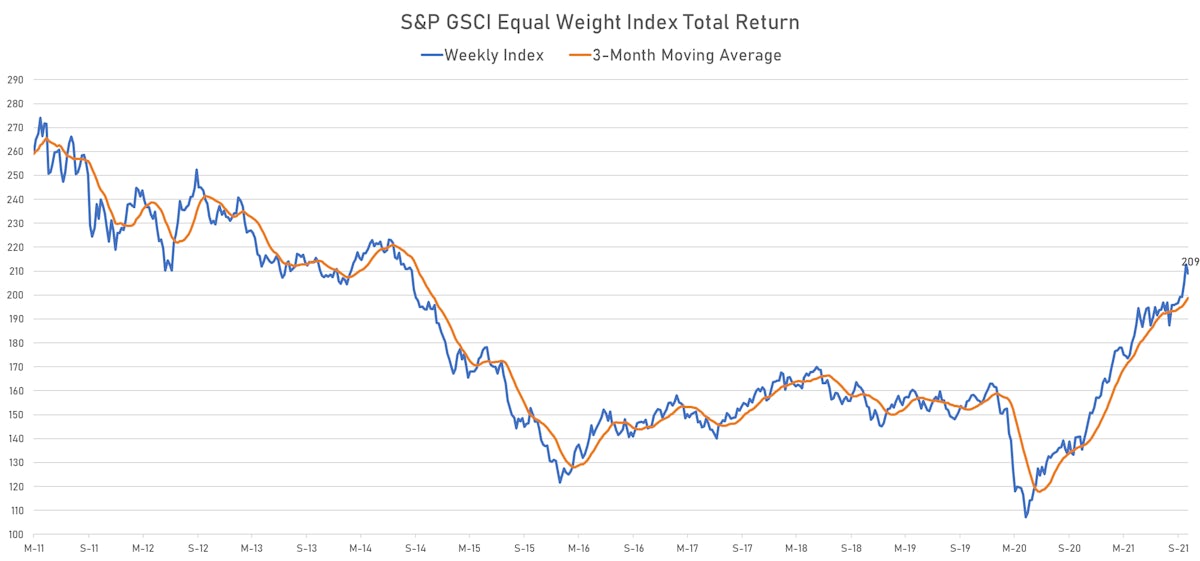

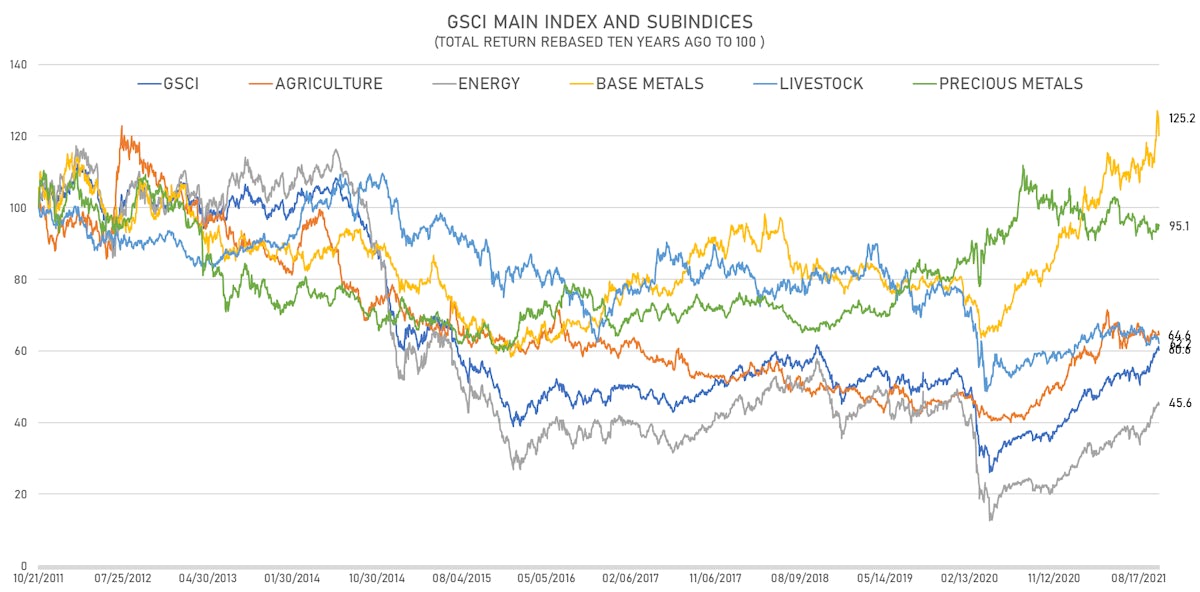

Despite the phenomenal run some commodities have been on in the past year, the long-term (10-year) total return of commodities has been terrible on an absolute basis, and even worse on a risk-adjusted basis

Published ET

Comparison Of The 10-Year Total Returns Of S&P GSCI Sub Indices | Sources: ϕpost, Refinitiv data

HEADLINES

- The ongoing energy crisis, an overall bullish EIA petroleum status report, and today's Baker Hughes data showing a decline in the US oil rigs count, all helped crude end the week higher

- Putin said OPEC+ is already increasing output slightly more than in its current agreement

- Saudi Energy Prime Minister doesn't see a need for OPEC+ to raise production faster, says oil supply growth in line with demand

- Venture Global LNG has signed three long-term LNG supply contracts with Chinese firms China Petroleum & Chemical (Sinopec) and Sinopec's trading arm Unipec, which will double US LNG exports to China. The agreements will supply four million tonnes per annum (mtpa) of LNG, coming from the LNG export facility in Plaquemines Parish, Louisiana.

- Precious metals doing well in this environment, with Fed Chair Powell recognizing that inflationary pressures may remain for longer than initially thought

- Natural gas prices fell this week, as Germany's energy regulator was reported to be in touch with Nord Stream 2 over its clearance requirements

NOTABLE GAINERS THIS WEEK

- SMM Erbium Oxide Spot Price Daily up 11.7% (YTD: 72.2%), now at 287,500.00

- SMM Rare Earth Yttrium Oxide Spot Price Daily up 10.1% (YTD: 139.0%), now at 49,000.00

- DCE Coke up 9.8% (YTD: 45.3%), now at 4,260.00

- SMM Rare Earth Praseodymium Neodymium Alloy Spot Price Daily up 6.3% (YTD: 56.2%), now at 797,500.00

- Shanghai International Exchange Bonded Copper up 6.3% (YTD: 26.1%), now at 64,410.00

- SMM Rare Earth Carbonate Domestic Spot Price Daily up 4.9% (YTD: 126.4%), now at 51,500.00

- Silver spot up 4.4% (YTD: -7.8%), now at 24.31

- SMM Rare Earth Neodymium Oxide Spot Price Daily up 4.3% (YTD: 30.4%), now at 665,000.00

- SHFE Lead Continuation Month 1 up 4.0% (YTD: 8.1%), now at 15,985.00

- SMM Rare Earth Praseodymium Metal Spot Price Daily up 3.9% (YTD: 65.5%), now at 935,000.00

- SMM Rare Earth Cerium Misch Metal Spot Price Daily up 3.8% (YTD: -3.6%), now at 27,000.00

- SMM Rare Earth Neodymium Metal Spot Price Daily up 3.4% (YTD: 32.5%), now at 825,000.00

- CBoT Soybean Meal up 3.4% (YTD: -24.6%), now at 327.40

- SHFE Nickel up 3.2% (YTD: 22.3%), now at 148,610.00

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 3.0% (YTD: 61.5%), now at 287,500.00

NOTABLE LOSERS THIS WEEK

- Zhengzhou Exchange Thermal Coal down -15.2% (YTD: 114.9%), now at 1,717.60

- CME Random Length Lumber down -12.1% (YTD: -23.5%), now at 667.60

- SHFE Rebar down -11.9% (YTD: 18.7%), now at 4,965.00

- DCE Coking Coal Continuation Month 1 down -9.3% (YTD: 141.1%), now at 3,789.00

- DCE Iron Ore Continuation Month 1 down -8.0% (YTD: -36.2%), now at 697.50

- SHFE Aluminium down -7.1% (YTD: 40.2%), now at 21,435.00

- CME Lean Hogs down -6.3% (YTD: 4.3%), now at 73.33

- SHFE Hot Rolled Coil down -5.3% (YTD: 20.6%), now at 5,455.00

- COMEX Copper down -4.4% (YTD: 28.8%), now at 04.52

- ICE Europe Newcastle Coal Monthly down -4.2% (YTD: 185.7%), now at 230.00

- ICE-US Sugar No. 11 down -3.6% (YTD: 23.2%), now at 19.07

- SHFE Zinc down -3.5% (YTD: 18.5%), now at 24,515.00

- CBoT Rough Rice down -2.5% (YTD: 8.9%), now at 13.51

- Coffee Arabica Colombia Excelso EP spot down -2.5% (YTD: 54.1%), now at 4,876.00

- Palladium spot down -2.5% (YTD: -17.3%), now at 2,021.79

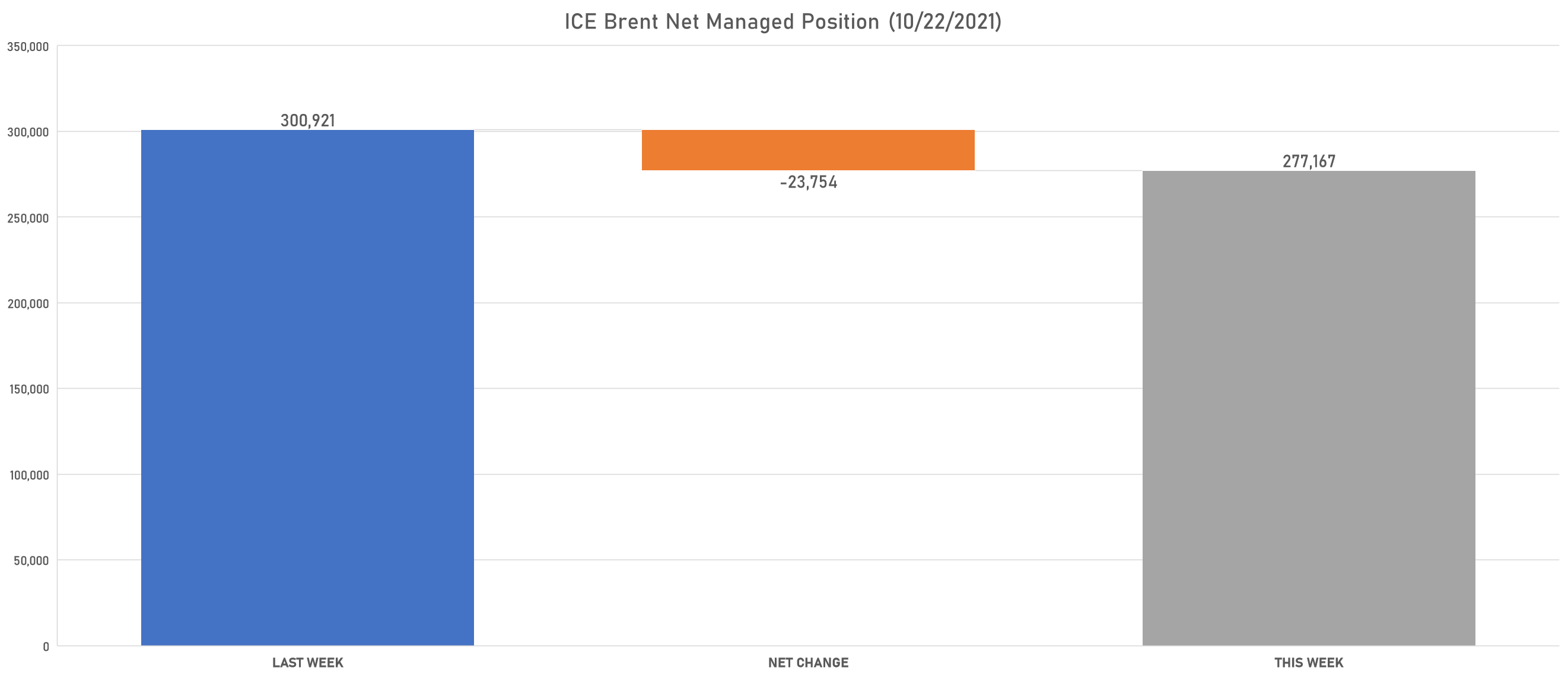

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent reduced net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil increased net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver increased net long position

- Platinum increased net long position

- Palladium increased net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat increased net short position

- Corn reduced net long position

- Rough Rice increased net long position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil increased net long position

- Soybean Meal reduced net short position

- Lean Hogs reduced net long position

- Live Cattle increased net long position

- Feeder Cattle reduced net short position

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice turned to net short

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

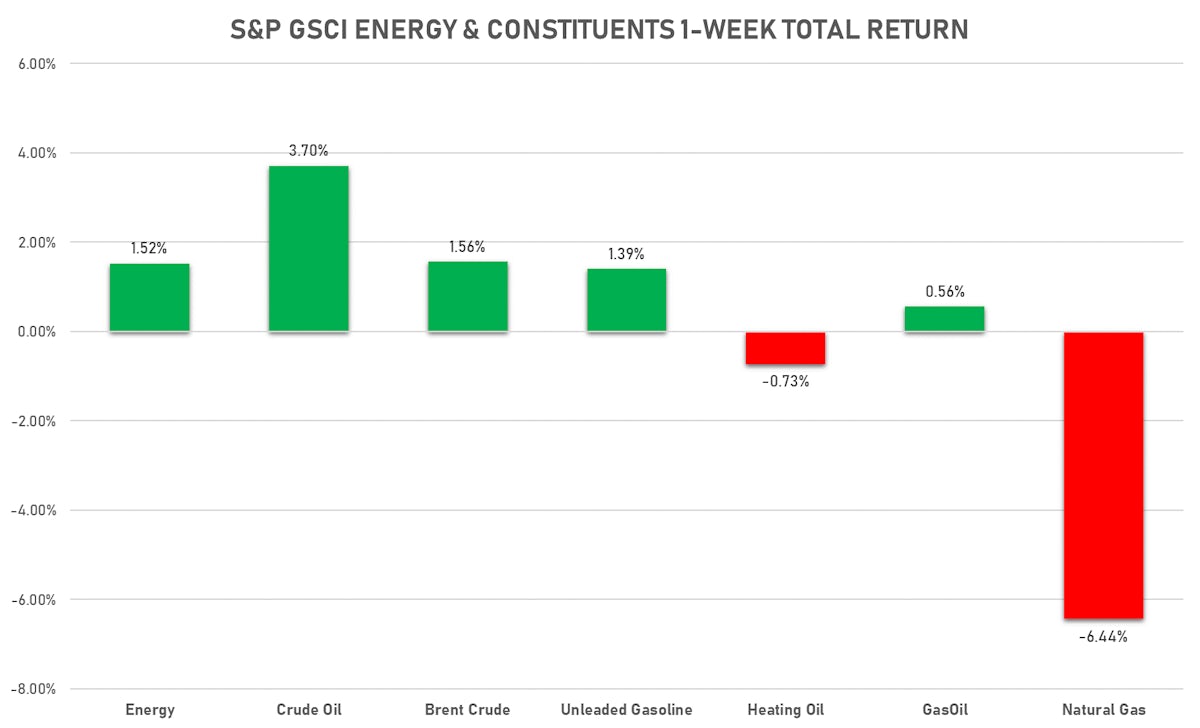

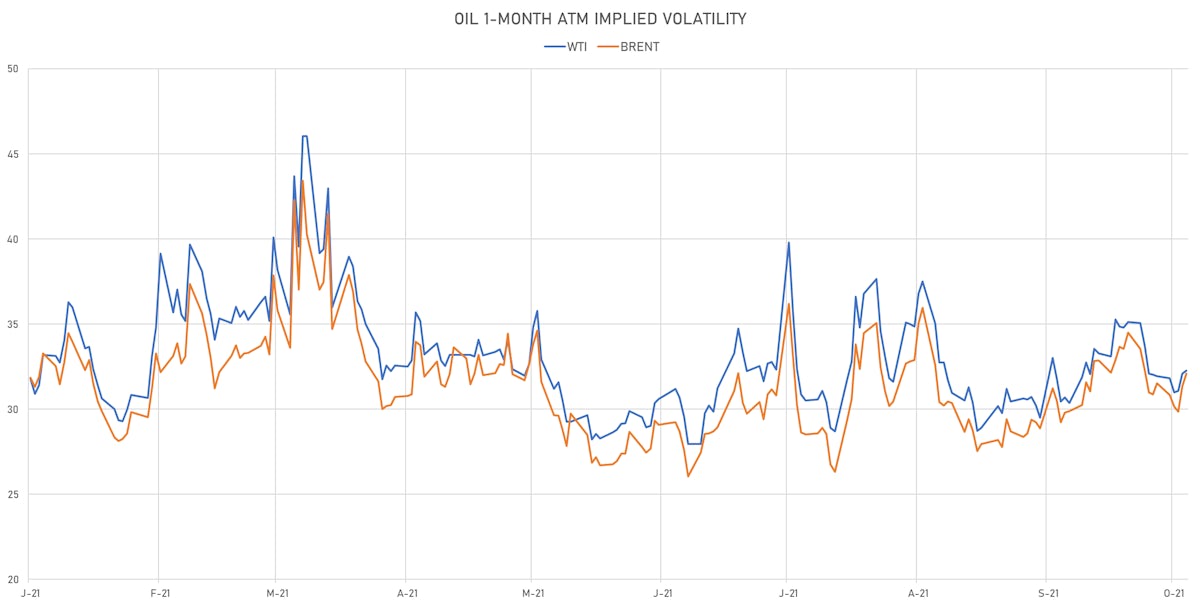

ENERGY ROSE THIS WEEK EXCEPT NAT GAS

- WTI crude front month currently at US$ 83.76 per barrel, up 1.8% (YTD: +72.6%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 85.53 per barrel, up 0.8% (YTD: +65.1%); 6-month term structure in widening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 230.00 per tonne, down -4.2% (YTD: +185.7%)

- Natural Gas (Henry Hub) currently at US$ 5.28 per MMBtu, down -2.4% (YTD: +108.0%)

- Gasoline (NYMEX) currently at US$ 2.48 per gallon, down -0.2% (YTD: +76.2%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 732.25 per tonne, down -1.9% (YTD: +74.0%)

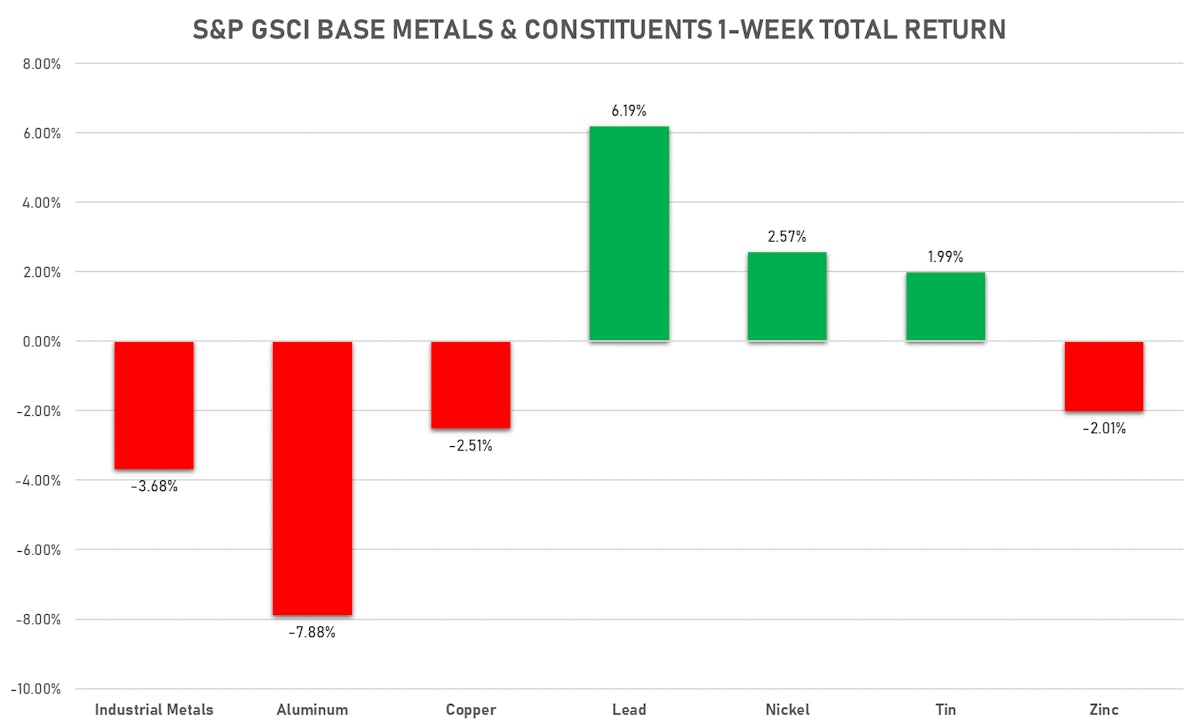

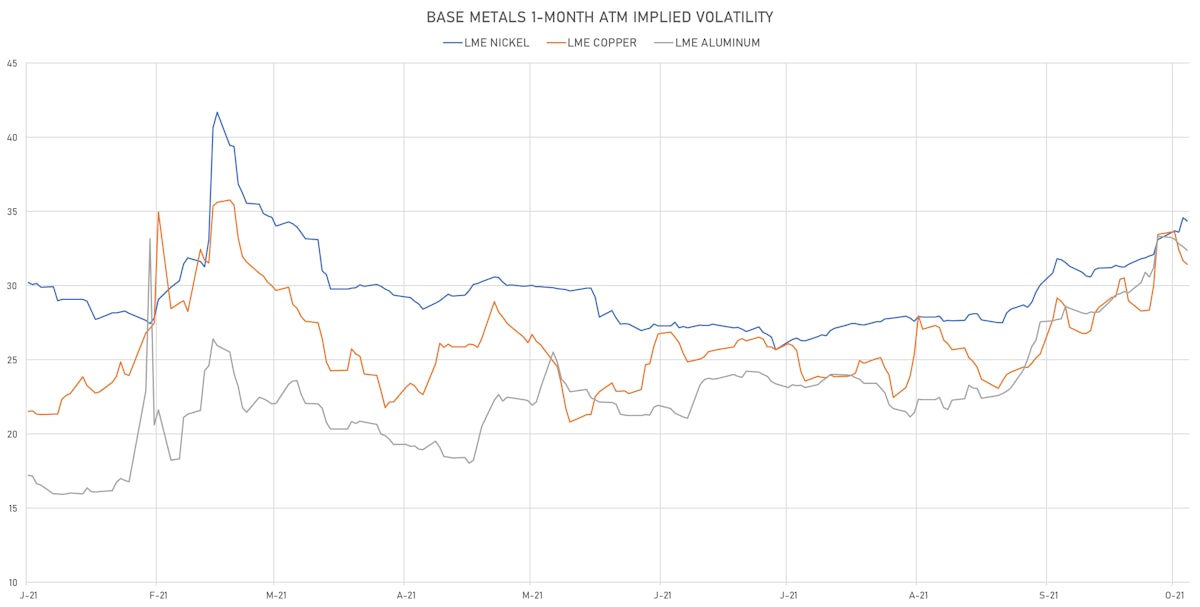

BASE METALS MOSTLY DOWN THIS WEEK

- Copper (COMEX) currently at US$ 4.52 per pound, down -4.4% (YTD: +28.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 697.50 per tonne, down -8.0% (YTD: -36.2%)

- Aluminium (Shanghai) currently at CNY 21,435 per tonne, down -7.1% (YTD: +40.2%)

- Nickel (Shanghai) currently at CNY 148,610 per tonne, up 3.2% (YTD: +22.3%)

- Lead (Shanghai) currently at CNY 15,985 per tonne, up 4.0% (YTD: +8.1%)

- Rebar (Shanghai) currently at CNY 4,965 per tonne, down -11.9% (YTD: +18.7%)

- Tin (Shanghai) currently at CNY 285,040 per tonne, down -0.5% (YTD: +88.1%)

- Zinc (Shanghai) currently at CNY 24,515 per tonne, down -3.5% (YTD: +18.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 399,000 per tonne, up 1.0% (YTD: +45.6%)

- Lithium (Shanghai) spot price currently at CNY 955,000 per tonne, up 2.1% (YTD: +96.9%)

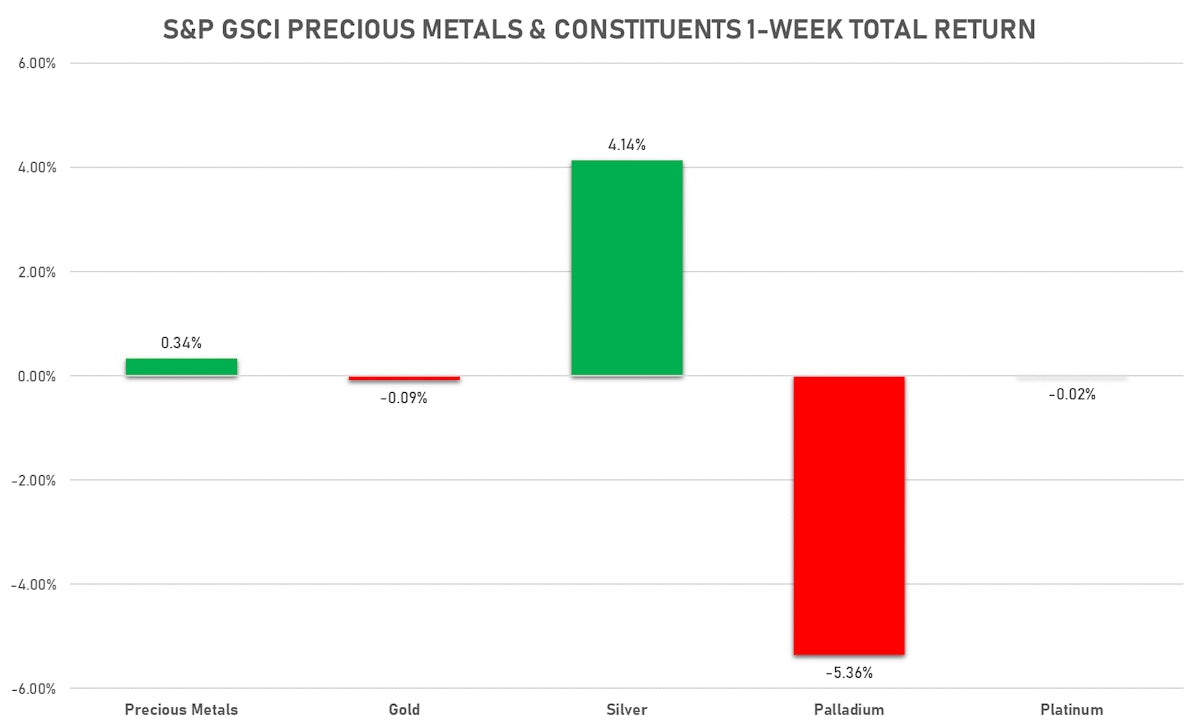

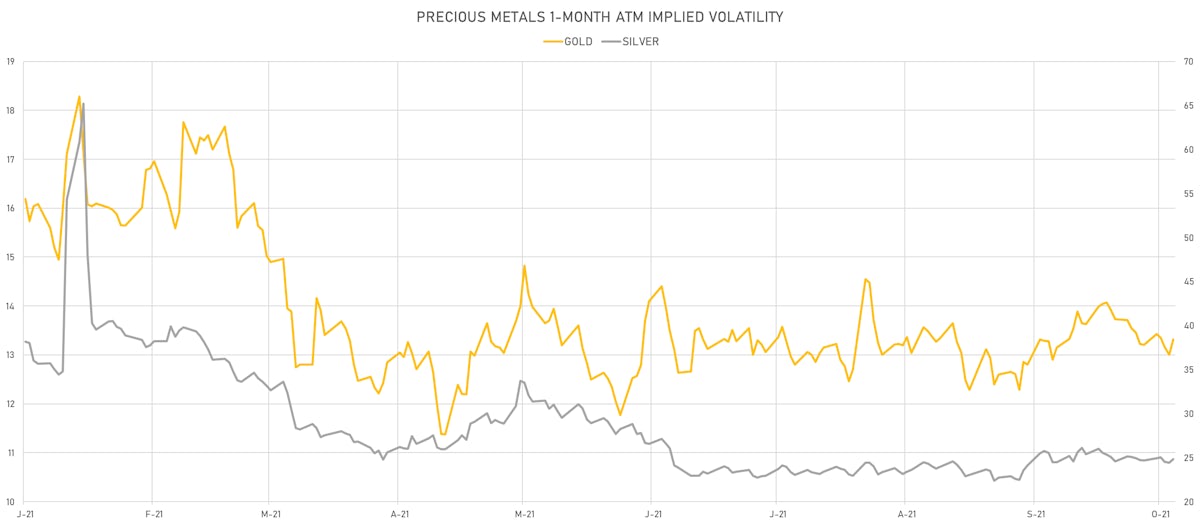

PRECIOUS METALS MIXED THIS WEEK

- Gold spot currently at US$ 1,792.48 per troy ounce, up 1.4% (YTD: -5.5%)

- Gold 1-Month ATM implied volatility currently at 12.89, up 0.8% (YTD: -17.3%)

- Silver spot currently at US$ 24.31 per troy ounce, up 4.4% (YTD: -7.8%)

- Silver 1-Month ATM implied volatility currently at 23.58, up 0.5% (YTD: -41.6%)

- Palladium spot currently at US$ 2,021.79 per troy ounce, down -2.5% (YTD: -17.3%)

- Platinum spot currently at US$ 1,040.47 per troy ounce, down -1.3% (YTD: -2.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 14,000 per troy ounce, down -1.4% (YTD: -17.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,600 per troy ounce, unchanged (YTD: +76.9%)

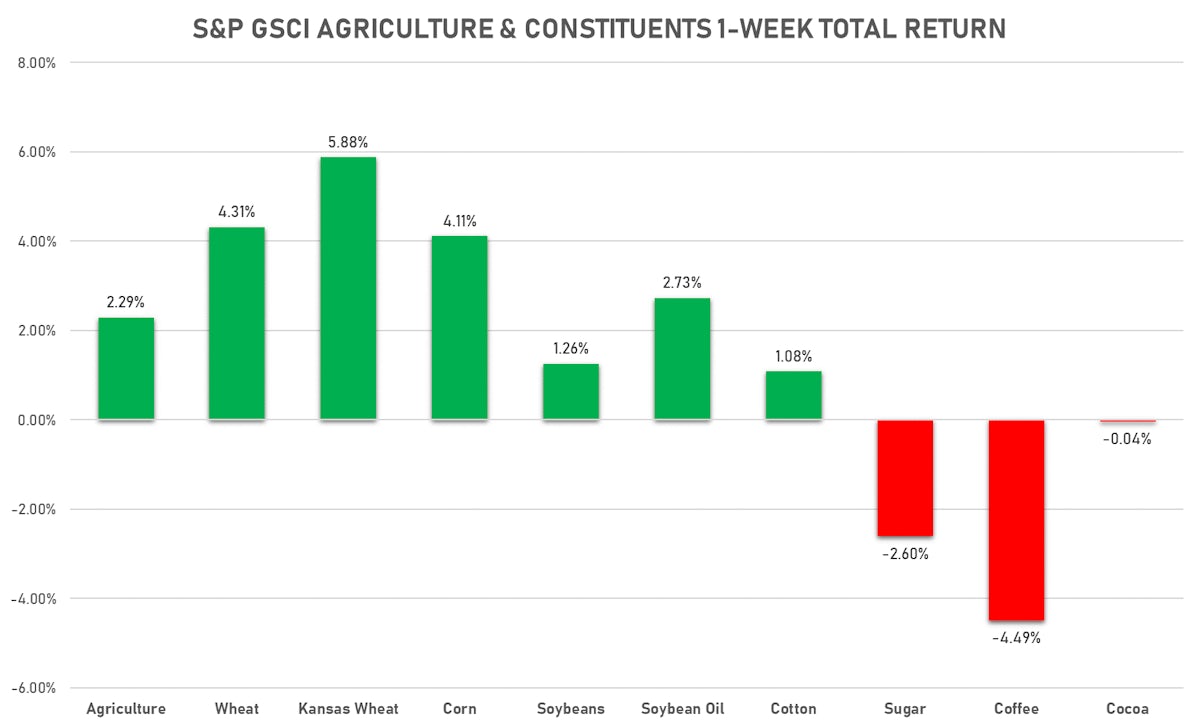

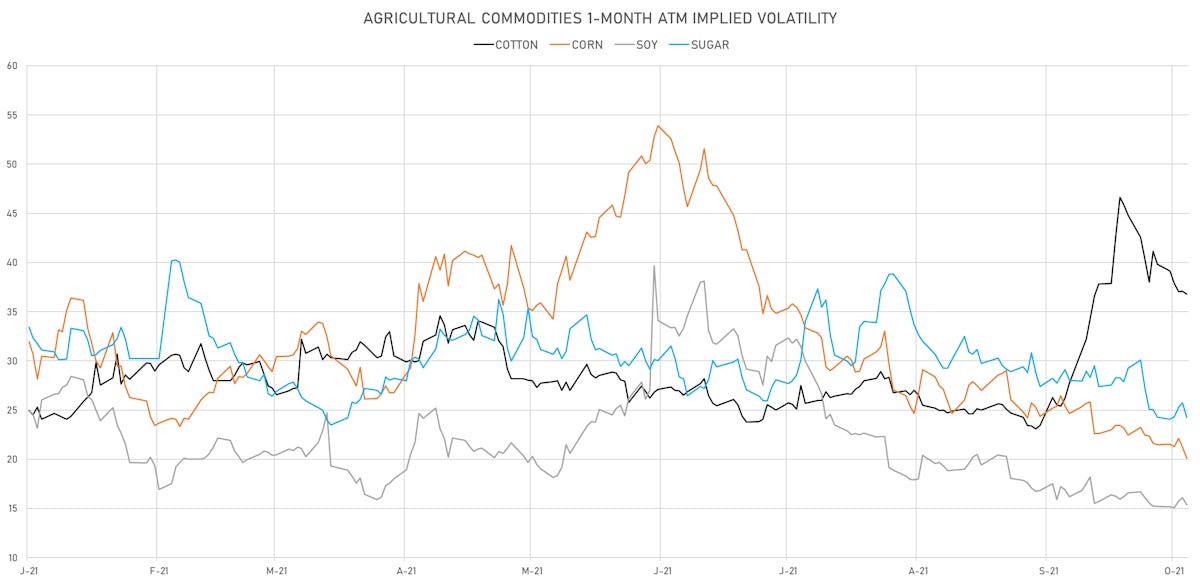

AGS MOSTLY UP THIS WEEK

- Live Cattle (CME) currently at US$ 124.10 cents per pound, down 1.5% (YTD: +9.9%)

- Lean Hogs (CME) currently at US$ 73.33 cents per pound, down -6.3% (YTD: +4.3%)

- Rough Rice (CBOT) currently at US$ 13.51 cents per hundredweight, down -2.5% (YTD: +8.9%)

- Soybeans Composite (CBOT) currently at US$ 1,220.50 cents per bushel, up 0.2% (YTD: -7.2%)

- Corn (CBOT) currently at US$ 538.00 cents per bushel, up 2.3% (YTD: +11.2%)

- Wheat Composite (CBOT) currently at US$ 756.00 cents per bushel, up 3.0% (YTD: +18.0%)

- Sugar No.11 (ICE US) currently at US$ 19.07 cents per pound, down -3.6% (YTD: +23.2%)

- Cotton No.2 (ICE US) currently at US$ 108.30 cents per pound, up 0.9% (YTD: +38.6%)

- Cocoa (ICE US) currently at US$ 2,590 per tonne, down -0.9% (YTD: -0.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,876 per tonne, down -2.5% (YTD: +54.1%)

- Random Length Lumber (CME) currently at US$ 667.60 per 1,000 board feet, down -12.1% (YTD: -23.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,170 per tonne, down -1.3% (YTD: +17.5%)

- Soybean Oil Composite (CBOT) currently at US$ 62.09 cents per pound, up 1.3% (YTD: +43.3%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 5,189 per tonne, up 0.5% (YTD: +33.3%)

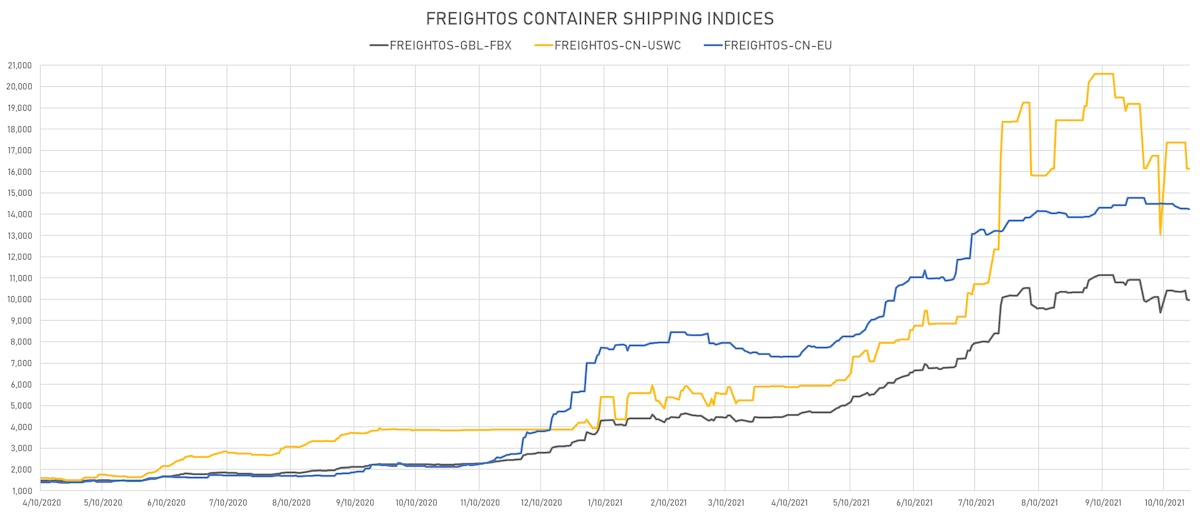

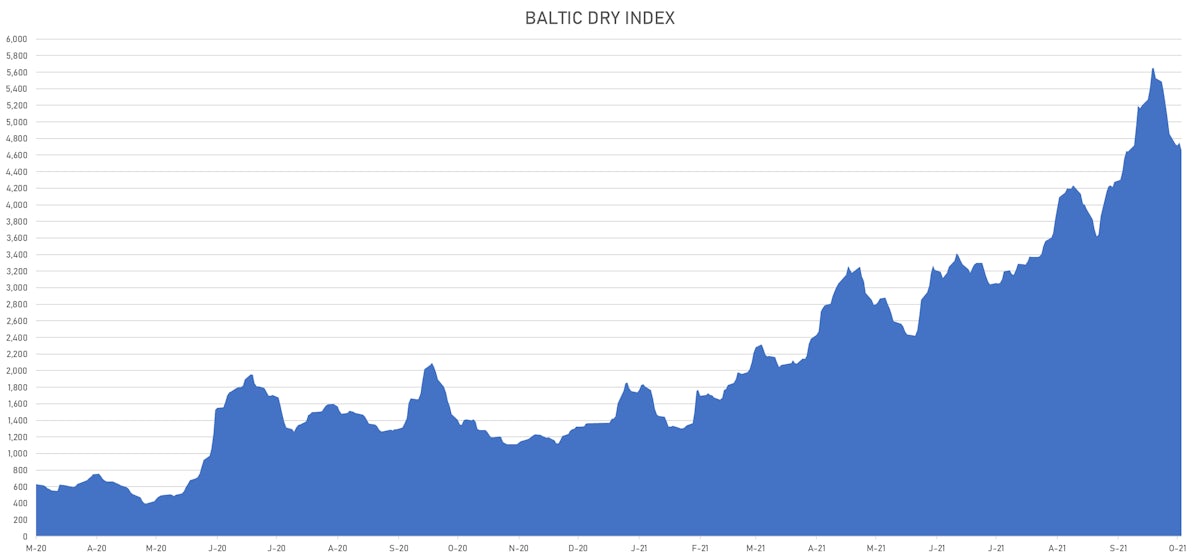

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 4,653, down -8.1% (YTD: +240.6%)

- Freightos China To North America West Coast Container Index currently at 16,145, down -7.1% (YTD: +284.4%)

- Freightos North America West Coast To China Container Index currently at 1,064, unchanged (YTD: +105.5%)

- Freightos North America East Coast To Europe Container Index currently at 397, down -15.9% (YTD: +9.4%)

- Freightos Europe To North America East Coast Container Index currently at 7,178, unchanged (YTD: +284.0%)

- Freightos China To North Europe Container Index currently at 14,241, down -0.9% (YTD: +151.5%)

- Freightos North Europe To China Container Index currently at 1,332, unchanged (YTD: -3.1%)

- Freightos Europe To South America West Coast Container Index currently at 5,558, unchanged (YTD: +228.5%)

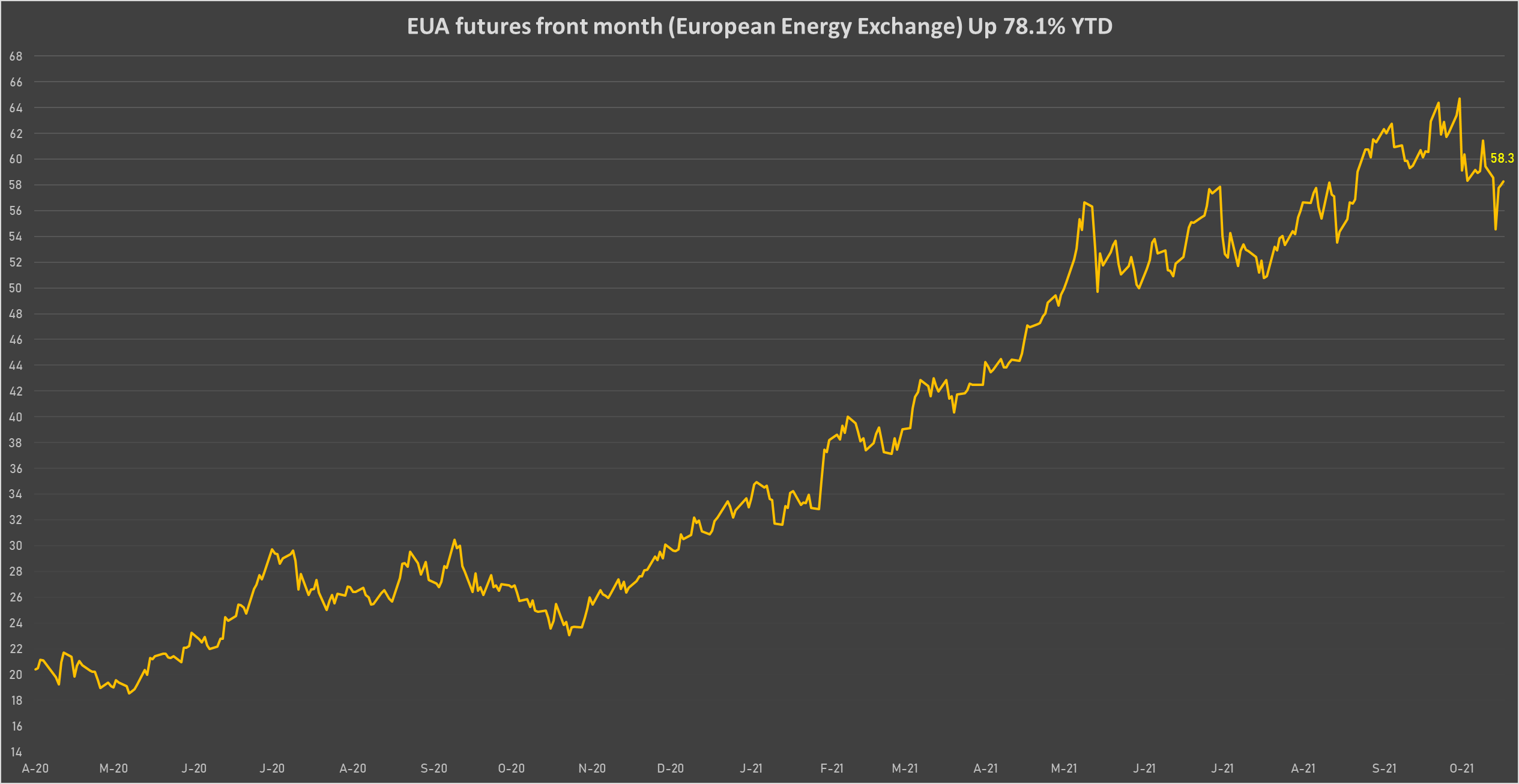

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 58.27 per tonne, down -2.0% (YTD: +78.1%)