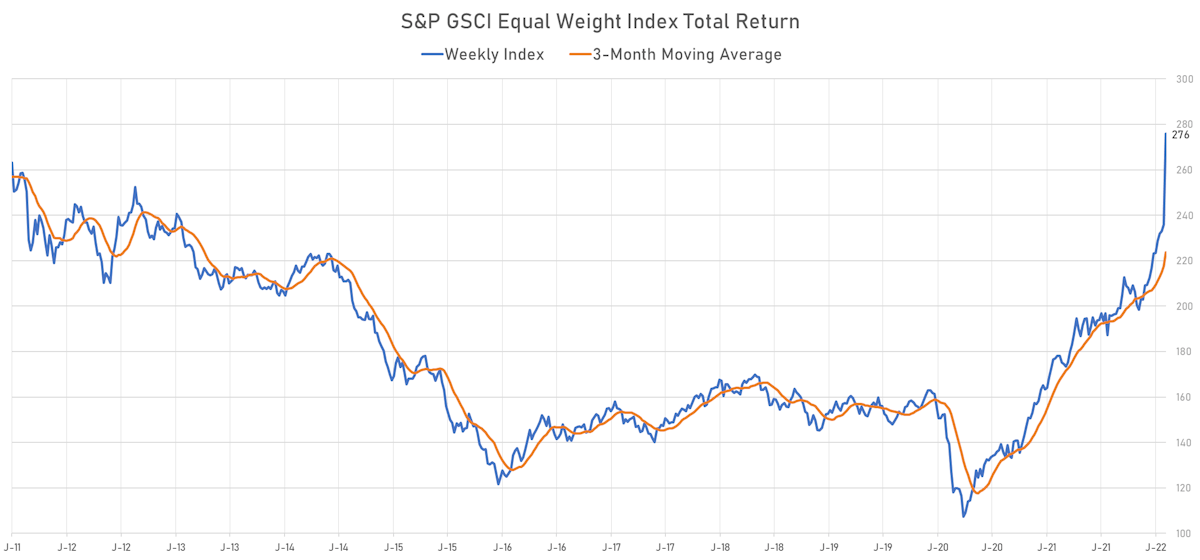

Commodities

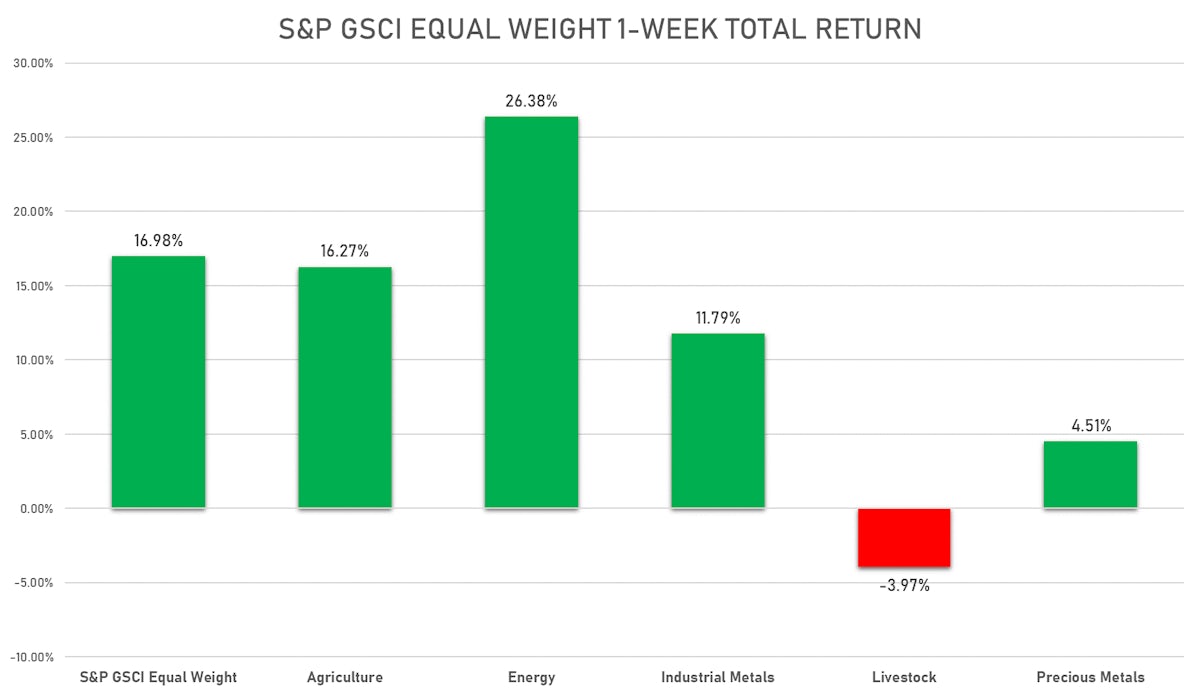

Crazy Week In Commodities, With The S&P GSCI Equal-Weighted Index Up 17%, Led By Energy And Agriculture

Uncertainty around Russian supplies saw the prices of European energy benchmarks jump this week: Newcastle Coal up 75%, TTF natural gas up 125%, Brent Forties up 25%

Published ET

TTF Natural Gas vs Newcastle Coal Prices | Source: Refinitiv

NOTABLE GAINERS THIS WEEK

- TRPC Natural Gas TTF Day 1 up 125.7% (YTD: 158.6%), now at 203.00

- TRPC Natural Gas TTF Monthly up 121.6% (YTD: 136.7%), now at 205.00

- ICE Europe Newcastle Coal Monthly up 75.5% (YTD: 146.2%), now at 418.75

- CBoT Wheat up 59.9% (YTD: 72.9%), now at 1,348.00

- Baltic Exchange Clean Tank Index up 42.1% (YTD: 24.7%), now at 989.00

- ICE Europe Low Sulphur Gasoil up 41.6% (YTD: 74.7%), now at 1,184.25

- NYMEX NY Harbor ULSD up 32.5% (YTD: 57.6%), now at 03.78

- NYMEX RBOB Gasoline up 29.9% (YTD: 54.3%), now at 03.54

- Baltic Exchange Dirty Tank Index up 28.5% (YTD: 87.1%), now at 1,474.00

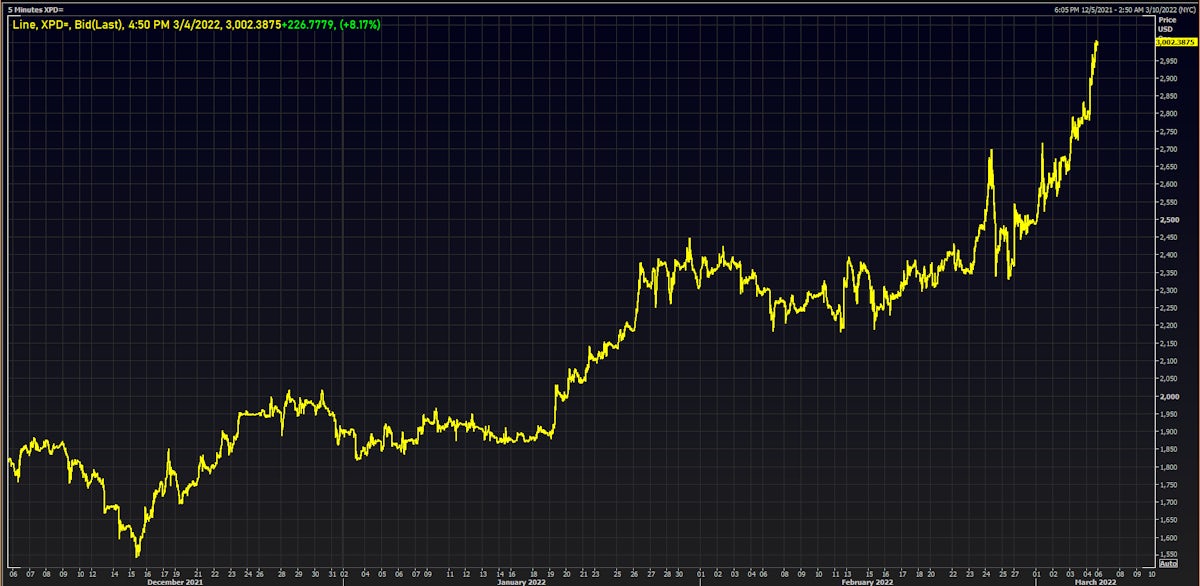

- Palladium spot up 27.3% (YTD: 53.2%), now at 3,009.84

- NYMEX Light Sweet Crude Oil (WTI) up 26.3% (YTD: 50.3%), now at 115.68

- Crude Oil WTI Cushing US FOB up 26.3% (YTD: 50.7%), now at 115.72

- Brent Forties and Oseberg Dated FOB North Sea Crude up 25.3% (YTD: 56.8%), now at 123.73

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 21.5% (YTD: 56.8%), now at 123.34

NOTABLE LOSERS THIS WEEK

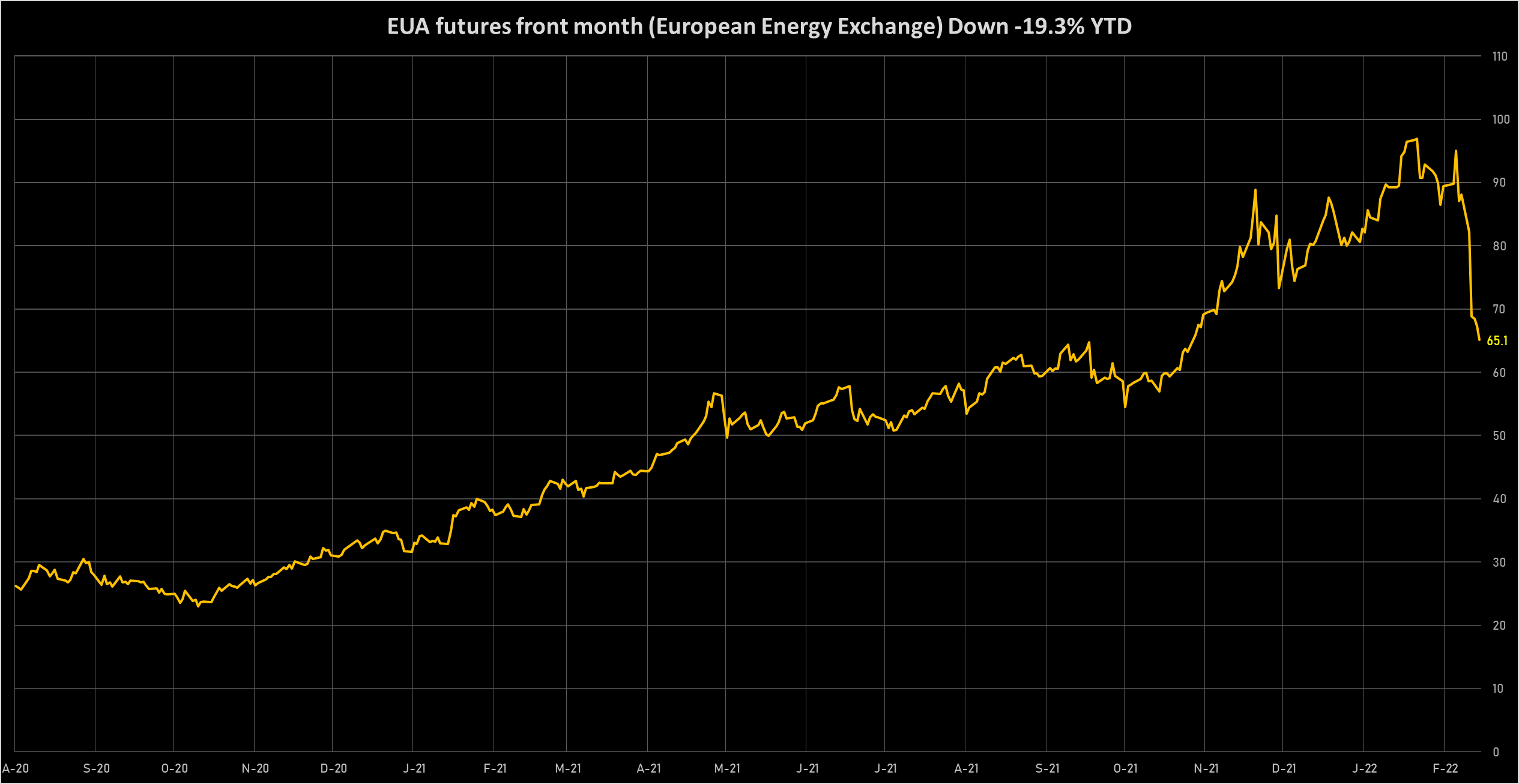

- EEX European Union Aviation Allowance Continuation Month 1 down -26.4% (YTD: -19.0%), now at 66.70

- EEX European-Carbon- Secondary Trading down -26.1% (YTD: -18.6%), now at 64.61

- Intercontinental Exchange Endex European Union Allowance (EUA) Yearly down -26.1% (YTD: -18.8%), now at 65.10

- ICE-US Coffee C down -6.6% (YTD: -2.1%), now at 224.90

- Shanghai International Exchange TSR 20 Rubber down -5.0% (YTD: -3.2%), now at 11,130.00

- CME Cattle (Feeder) down -4.3% (YTD: -7.9%), now at 153.13

- Baltic Exchange Capesize Index down -3.3% (YTD: -30.5%), now at 1,635.00

- CME Lean Hogs down -3.1% (YTD: 21.5%), now at 100.45

- Coffee Robusta Vietnam Grade 1 Wet Pol spot down -2.7% (YTD: -11.0%), now at 1,933.00

- CME Live Cattle down -2.5% (YTD: -2.4%), now at 135.78

- SHFE Rubber down -2.4% (YTD: -6.8%), now at 13,425.00

- Coffee Arabica Colombia Excelso EP spot down -2.2% (YTD: 4.7%), now at 5,769.00

- ICE-US Cotton No. 2 down -1.6% (YTD: 5.1%), now at 120.40

- SHFE Lead Continuation Month 1 down -0.8% (YTD: 0.6%), now at 15,570.00

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent increased net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum reduced net long position

- Palladium turned to net long

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net short position

- Corn reduced net long position

- Rough Rice increased net long position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle turned to net short

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice reduced net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position

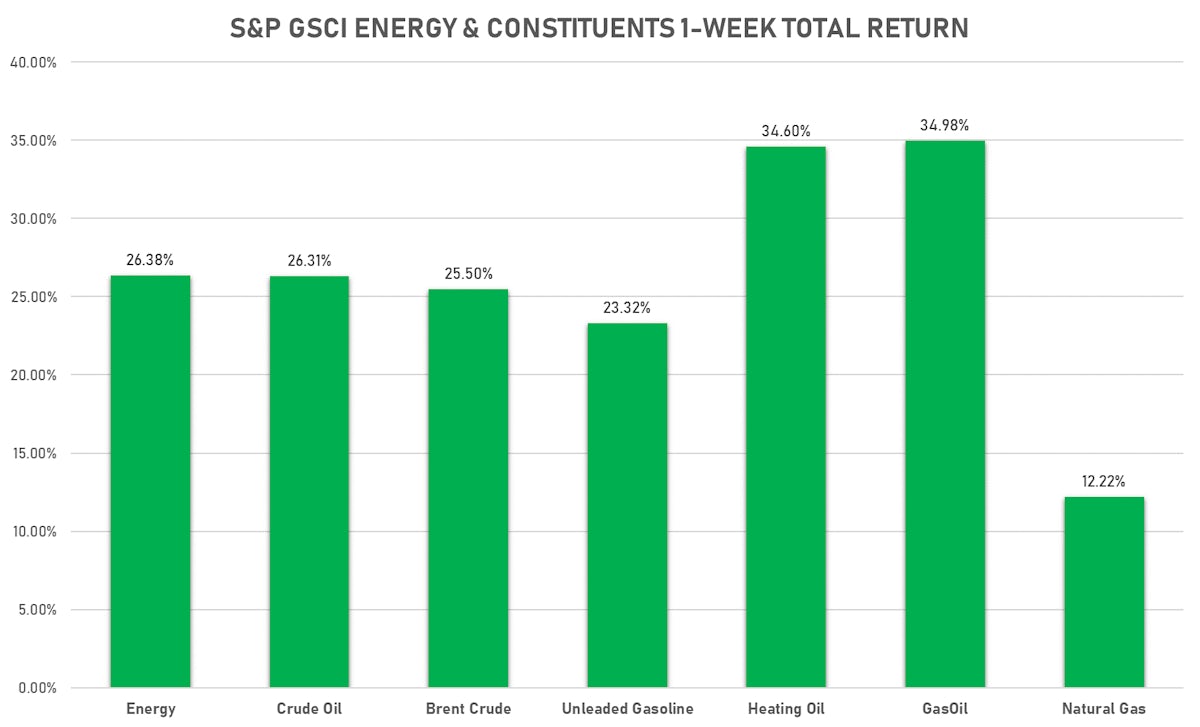

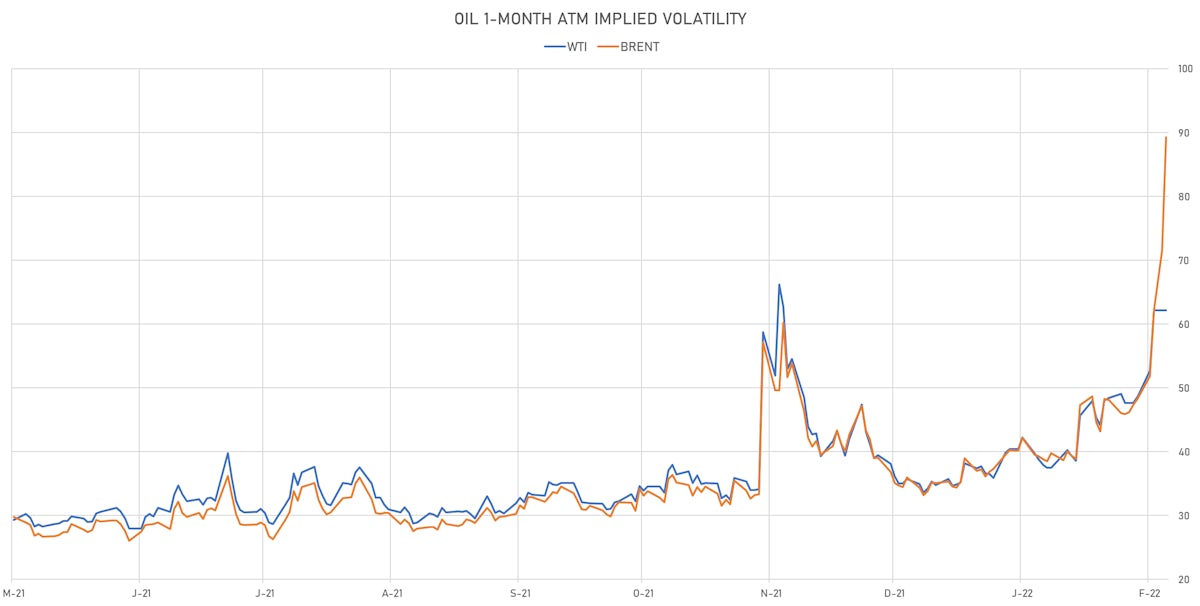

ENERGY THIS WEEK

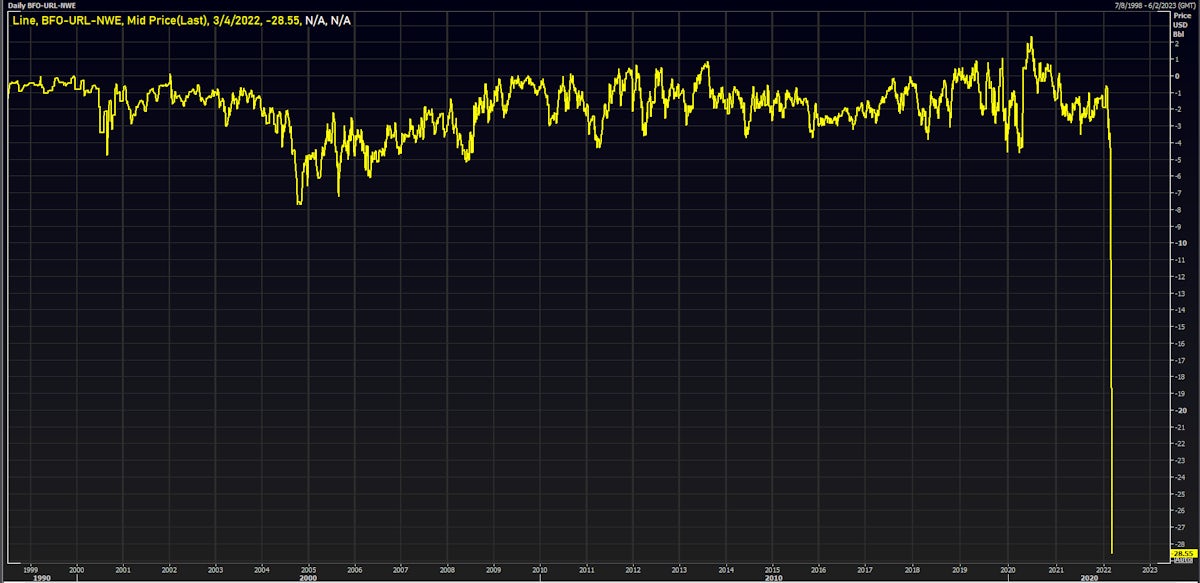

- WTI crude front month currently at US$ 115.68 per barrel, up 26.3% (YTD: +50.3%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 118.11 per barrel, up 20.6% (YTD: +48.9%)

- Newcastle Coal (ICE Europe) currently at US$ 418.75 per tonne, up 75.5% (YTD: +146.2%)

- Natural Gas (Henry Hub) currently at US$ 5.02 per MMBtu, up 12.2% (YTD: +40.9%)

- Gasoline (NYMEX) currently at US$ 3.54 per gallon, up 29.9% (YTD: +54.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1184.25 per tonne, up 41.6% (YTD: +74.7%)

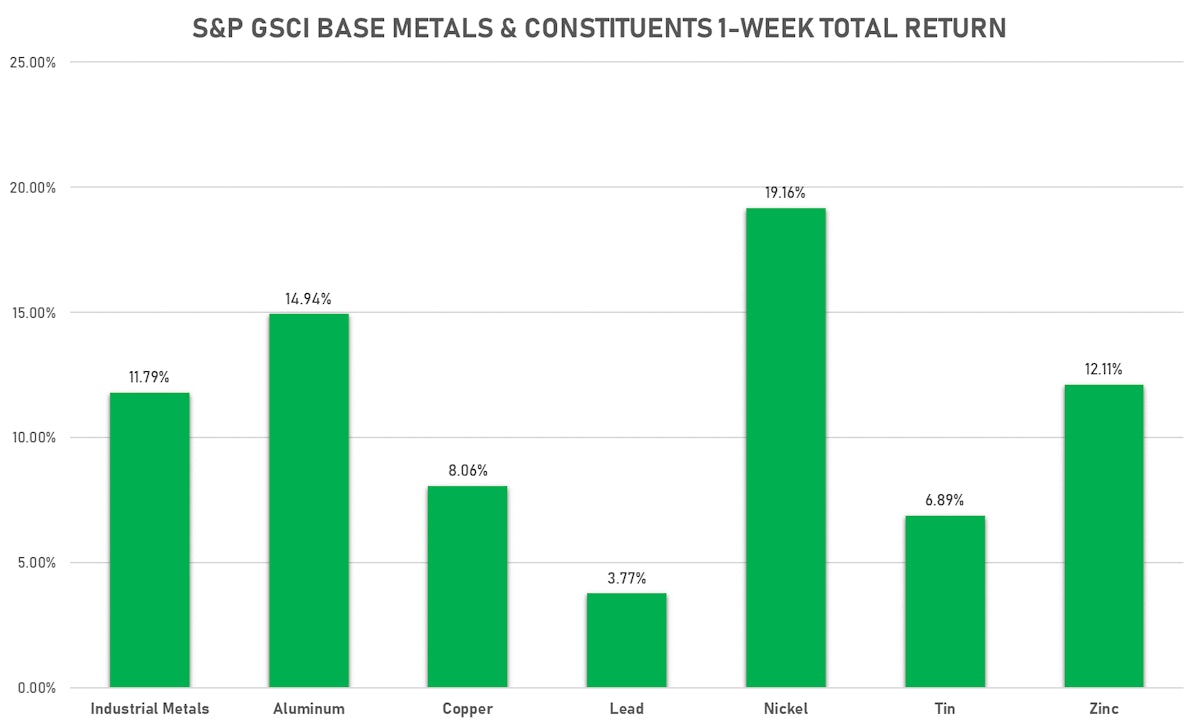

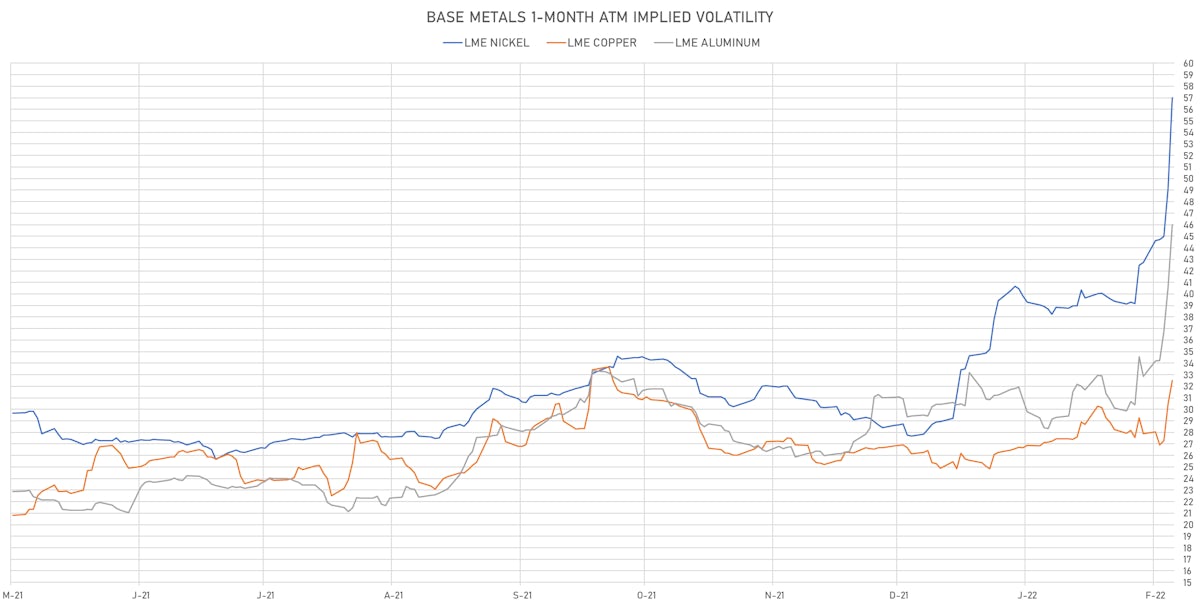

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.90 per pound, up 10.2% (YTD: +12.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 822.00 per tonne, up 15.4% (YTD: +19.8%)

- Aluminum (Shanghai) currently at CNY 23,575 per tonne, up 3.2% (YTD: +16.3%)

- Nickel (Shanghai) currently at CNY 197,760 per tonne, up 6.2% (YTD: +26.2%)

- Lead (Shanghai) currently at CNY 15,570 per tonne, down -0.8% (YTD: +0.6%)

- Rebar (Shanghai) currently at CNY 5,100 per tonne, up 7.1% (YTD: +9.1%)

- Tin (Shanghai) currently at CNY 345,900 per tonne, up 0.4% (YTD: +14.0%)

- Zinc (Shanghai) currently at CNY 25,970 per tonne, up 4.3% (YTD: +7.6%)

- Refined Cobalt (Shanghai) spot price currently at CNY 553,500 per tonne, up 0.2% (YTD: +13.7%)

- Lithium (Shanghai) spot price currently at CNY 2,734,000 per tonne, up 7.6% (YTD: +104.8%)

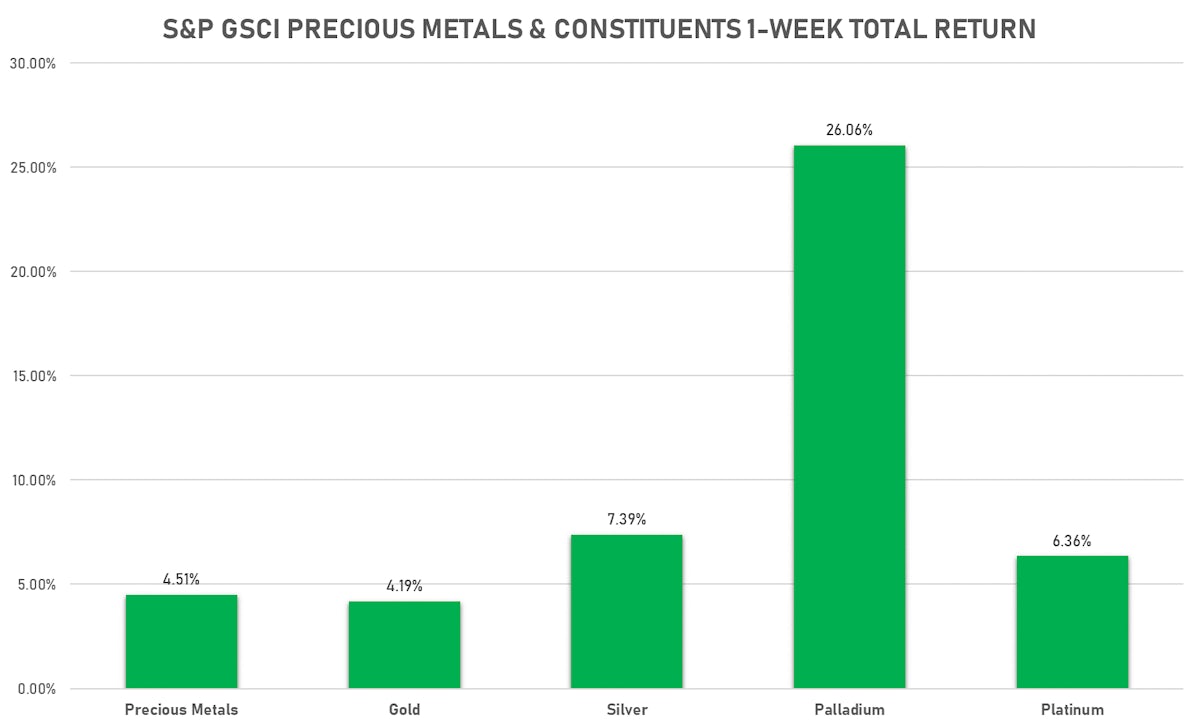

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,970.17 per troy ounce, up 4.3% (YTD: +8.6%)

- Gold 1-Month ATM implied volatility currently at 21.50

- Silver spot currently at US$ 25.68 per troy ounce, up 5.9% (YTD: +11.6%)

- Silver 1-Month ATM implied volatility currently at 33.08

- Palladium spot currently at US$ 3,009.84 per troy ounce, up 27.3% (YTD: +53.2%)

- Platinum spot currently at US$ 1,122.87 per troy ounce, up 6.4% (YTD: +16.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 21,000 per troy ounce, up 5.0% (YTD: +48.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 4,500 per troy ounce, up 15.4% (YTD: +12.5%)

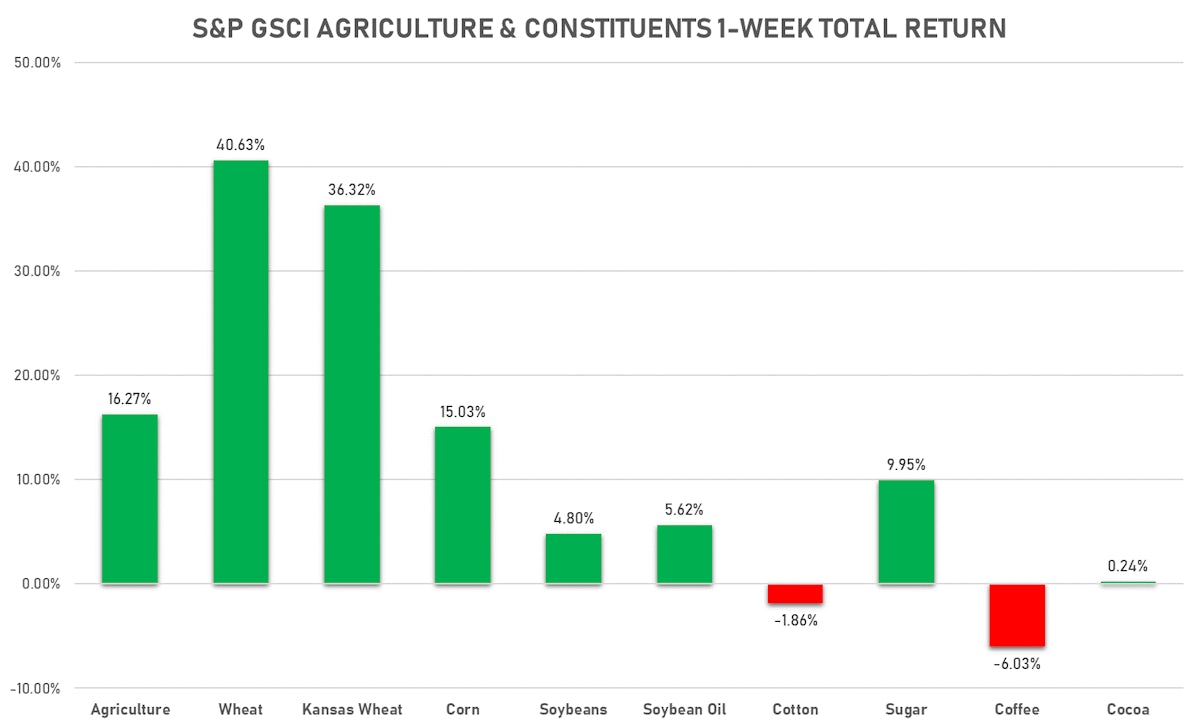

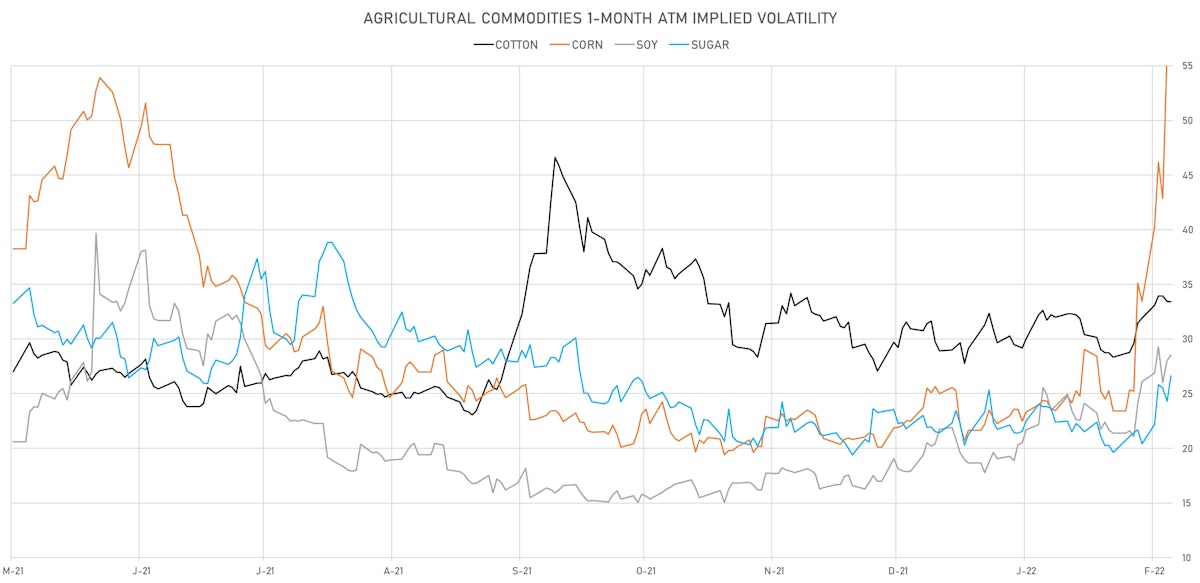

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 135.78 cents per pound, down 2.5% (YTD: -2.4%)

- Lean Hogs (CME) currently at US$ 100.45 cents per pound, down -3.1% (YTD: +21.5%)

- Rough Rice (CBOT) currently at US$ 16.12 cents per hundredweight, up 6.7% (YTD: +10.6%)

- Soybeans Composite (CBOT) currently at US$ 1,676.25 cents per bushel, up 5.4% (YTD: +26.2%)

- Corn (CBOT) currently at US$ 756.50 cents per bushel, up 14.7% (YTD: +26.9%)

- Wheat Composite (CBOT) currently at US$ 1,348.00 cents per bushel, up 59.9% (YTD: +72.9%)

- Sugar No.11 (ICE US) currently at US$ 19.38 cents per pound, up 7.6% (YTD: +3.0%)

- Cotton No.2 (ICE US) currently at US$ 120.40 cents per pound, down -1.6% (YTD: +5.1%)

- Cocoa (ICE US) currently at US$ 2,524 per tonne, up 0.2% (YTD: +0.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,769 per tonne, down -2.2% (YTD: +4.7%)

- Random Length Lumber (CME) currently at US$ 1,441.00 per 1,000 board feet, up 9.8% (YTD: +24.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,130 per tonne, down -5.0% (YTD: -3.2%)

- Soybean Oil Composite (CBOT) currently at US$ 76.80 cents per pound, up 11.7% (YTD: +37.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 6,780 per tonne, up 0.9% (YTD: +31.7%)

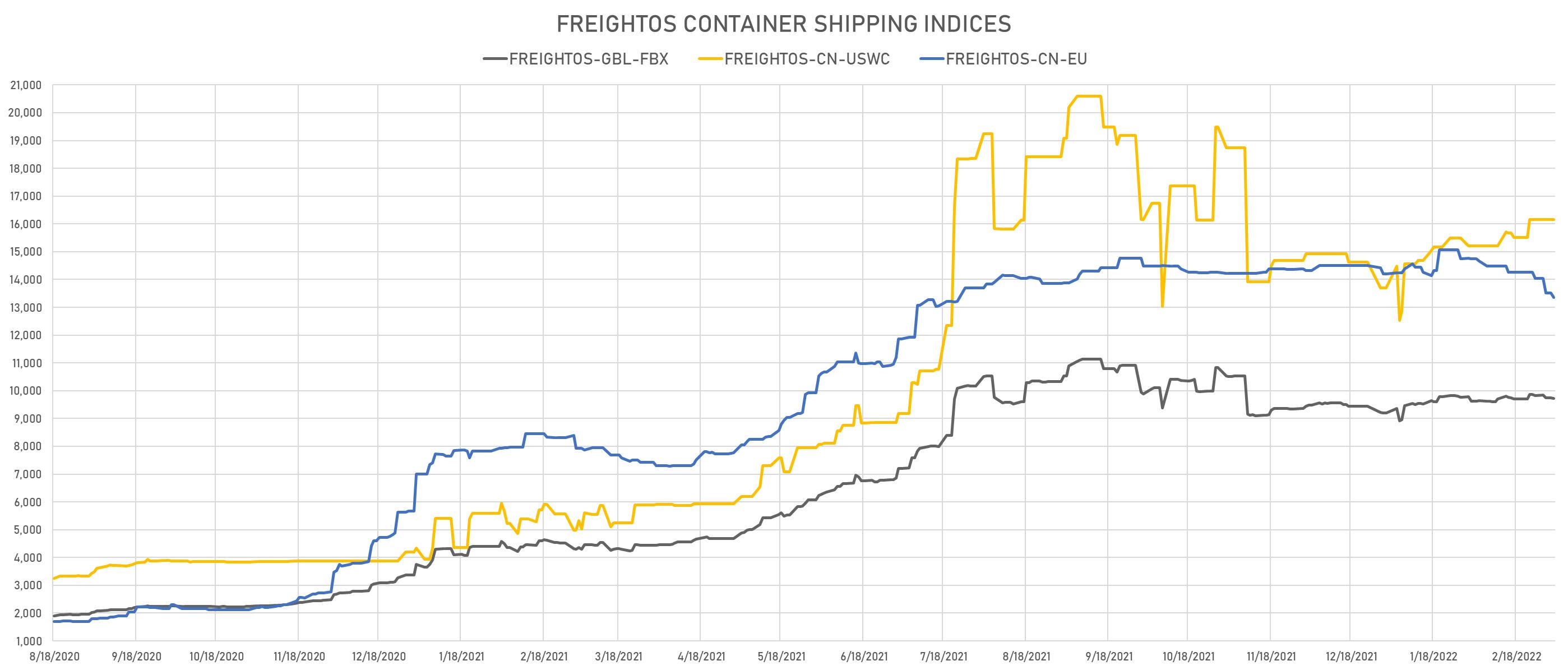

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,148, up 3.5% (YTD: -3.2%)

- Freightos China To North America West Coast Container Index currently at 16,155, unchanged (YTD: +17.9%)

- Freightos North America West Coast To China Container Index currently at 996, up 11.8% (YTD: +13.8%)

- Freightos North America East Coast To Europe Container Index currently at 682, up 21.1% (YTD: +26.3%)

- Freightos Europe To North America East Coast Container Index currently at 6,851, down -0.5% (YTD: -3.5%)

- Freightos China To North Europe Container Index currently at 13,350, down -5.0% (YTD: -6.0%)

- Freightos North Europe To China Container Index currently at 888, up 0.2% (YTD: -21.4%)

- Freightos Europe To South America West Coast Container Index currently at 8,160, up 1.1% (YTD: +4.5%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 65.10 per tonne, down -26.1% (YTD: -18.8%)