Commodities

Commodities That Gained The Most In The Early Days Of The Ukrainian Invasion Saw A Reversal This Week, With TTF Nat Gas Down 35% And Wheat Down 19%

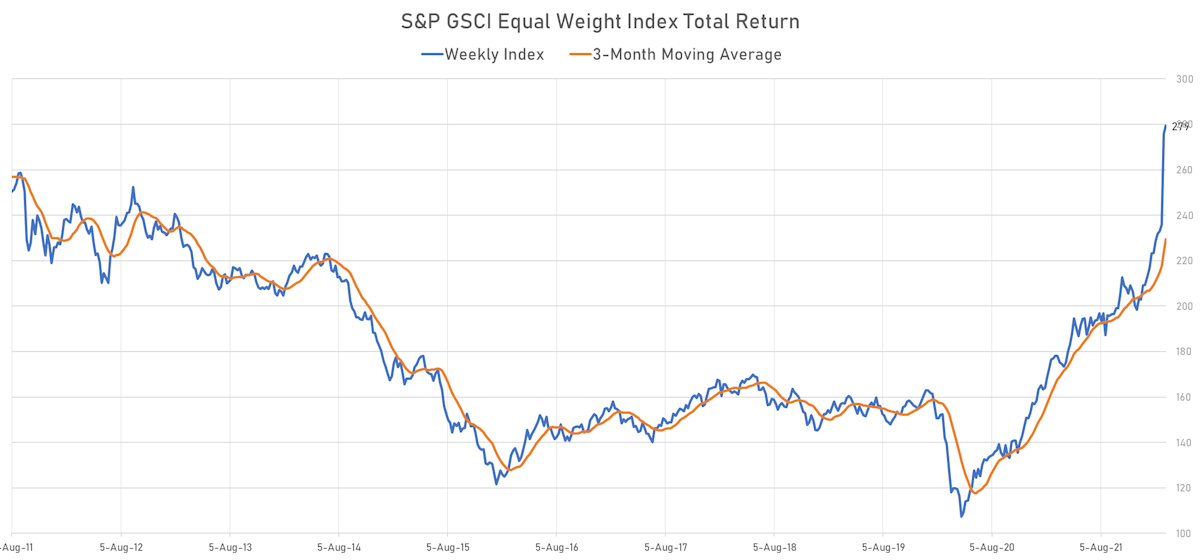

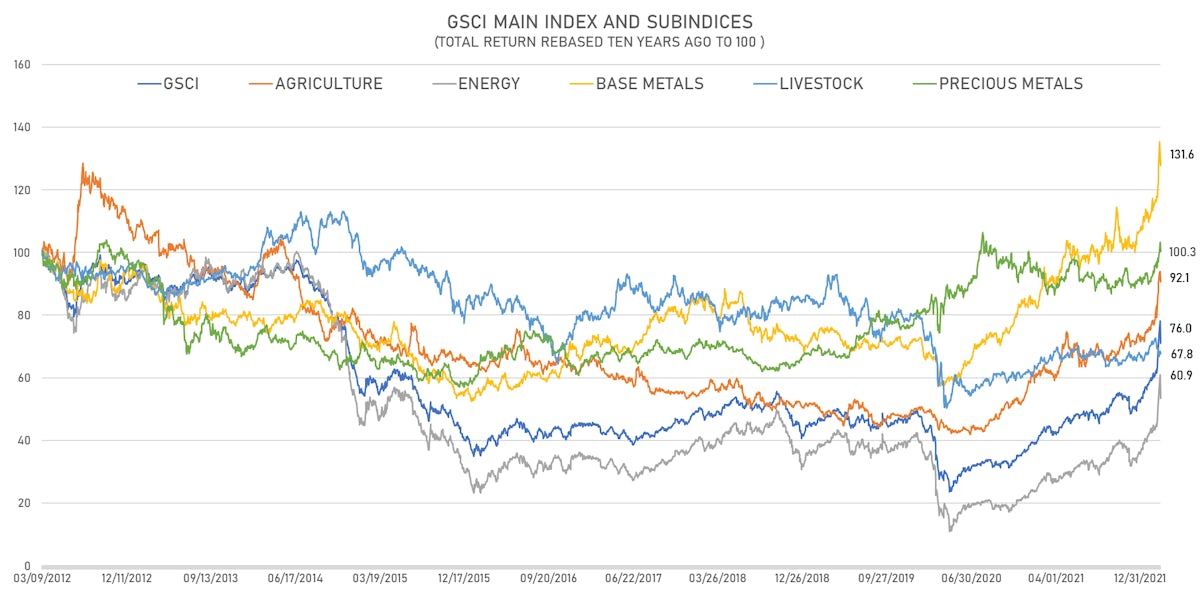

Despite an amazing run over the past year, commodities still terrible longer-term performance, with base metals and precious metals the only groups having had positive total returns over the last 10 years

Published ET

S&P GSCI Sub Indices Total Returns Over The Past 10 Years (Rebased to 100) | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS THIS WEEK

- Baltic Exchange Capesize Index up 63.7% (YTD: 13.8%), now at 2,676.00

- Baltic Exchange Dry Index up 26.5% (YTD: 22.5%), now at 2,718.00

- SHFE Nickel up 18.3% (YTD: 49.3%), now at 214,100.00

- EEX European Union Aviation Allowance Continuation Month 1 up 18.1% (YTD: -4.3%), now at 75.76

- ICE European Union Allowance (EUA) Yearly up 17.9% (YTD: -4.2%), now at 76.76

- EEX European-Carbon- Secondary Trading up 17.9% (YTD: -4.1%), now at 75.90

- Baltic Exchange Panamax Index up 14.4% (YTD: 26.7%), now at 3,187.00

- DCE Coking Coal Continuation Month 1 up 14.3% (YTD: 46.0%), now at 3,020.00

- Baltic Exchange Supramax Index up 13.7% (YTD: 27.6%), now at 2,939.00

- Johnson Matthey Iridium New York 0930 up 11.1% (YTD: 25.0%), now at 5,000.00

- SHFE Bitumen Continuation Month 1 up 11.0% (YTD: 27.0%), now at 4,030.00

- Bursa Malaysia Crude Palm Oil up 8.6% (YTD: 43.0%), now at 7,390.00

- Baltic Exchange Handysize Index up 7.3% (YTD: 4.7%), now at 1,548.00

- CBoT Soybean Oil up 7.0% (YTD: 47.1%), now at 82.18

NOTABLE LOSERS THIS WEEK

- TRPC Natural Gas TTF Monthly down -35.6% (YTD: 52.4%), now at 132.00

- TRPC Natural Gas TTF Day 1 down -35.0% (YTD: 68.2%), now at 132.00

- CBoT Wheat down -19.1% (YTD: 39.8%), now at 1,090.00

- ICE Europe Low Sulphur Gasoil down -14.5% (YTD: 49.3%), now at 1,012.00

- ICE Europe Newcastle Coal Monthly down -12.0% (YTD: 116.7%), now at 368.65

- Zhengzhou Exchange Thermal Coal down -11.9% (YTD: 9.3%), now at 849.00

- Johnson Matthey Rhodium New York 0930 down -11.9% (YTD: 31.2%), now at 18,500.00

- Baltic Exchange Dry Tank Index down -11.0% (YTD: 66.5%), now at 1,312.00

- NYMEX NY Harbor ULSD down -9.5% (YTD: 42.6%), now at 03.42

- SHFE Aluminum down -6.9% (YTD: 8.3%), now at 21,905.00

- Palladium spot down -6.9% (YTD: 42.7%), now at 2,803.15

- NYMEX RBOB Gasoline down -6.5% (YTD: 44.2%), now at 03.31

- COMEX Copper down -6.4% (YTD: 5.3%), now at 04.59

- NYMEX Henry Hub Natural Gas down -5.8% (YTD: 32.7%), now at 04.73

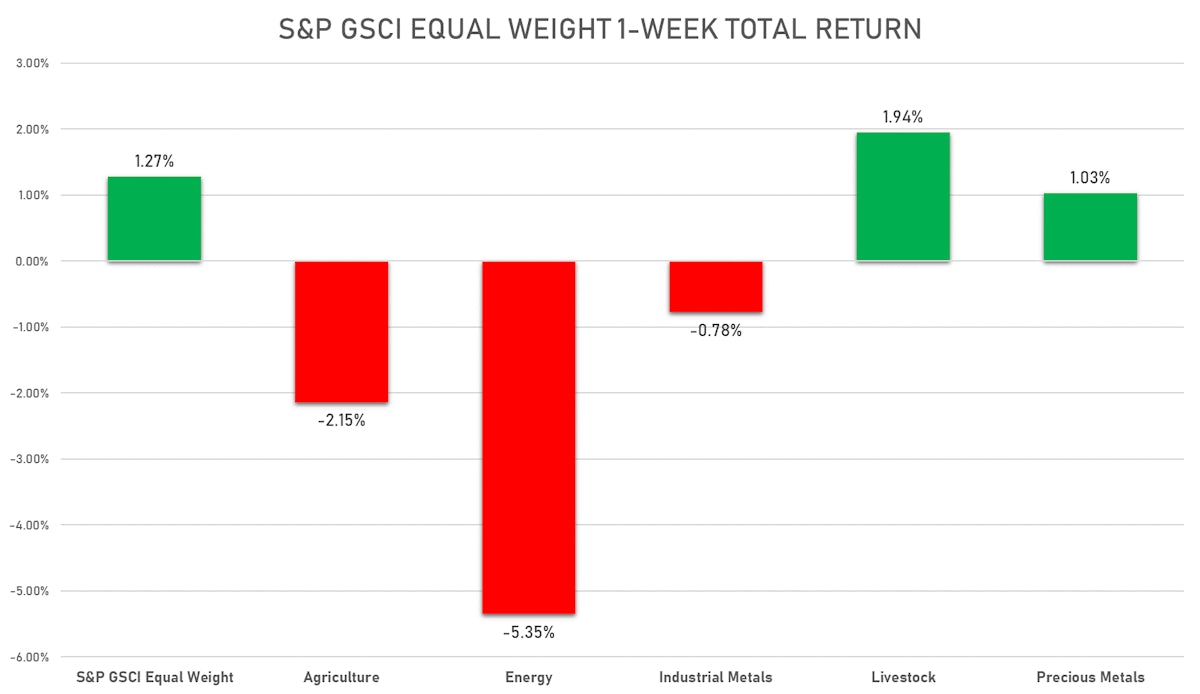

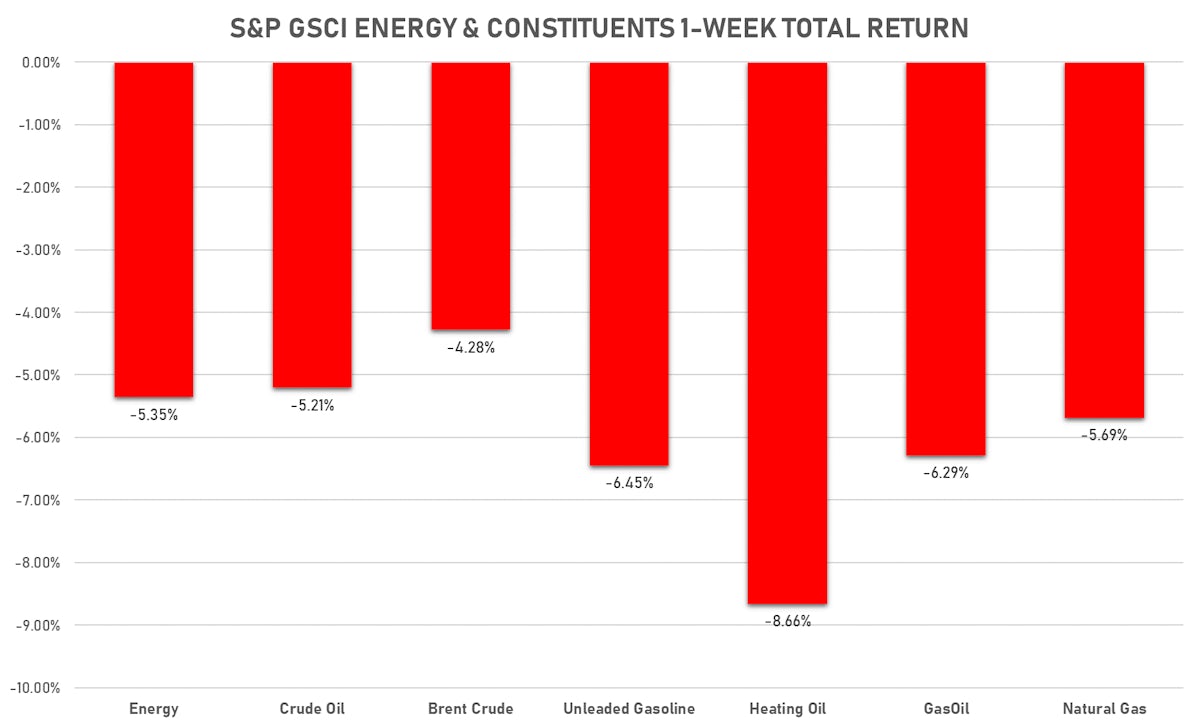

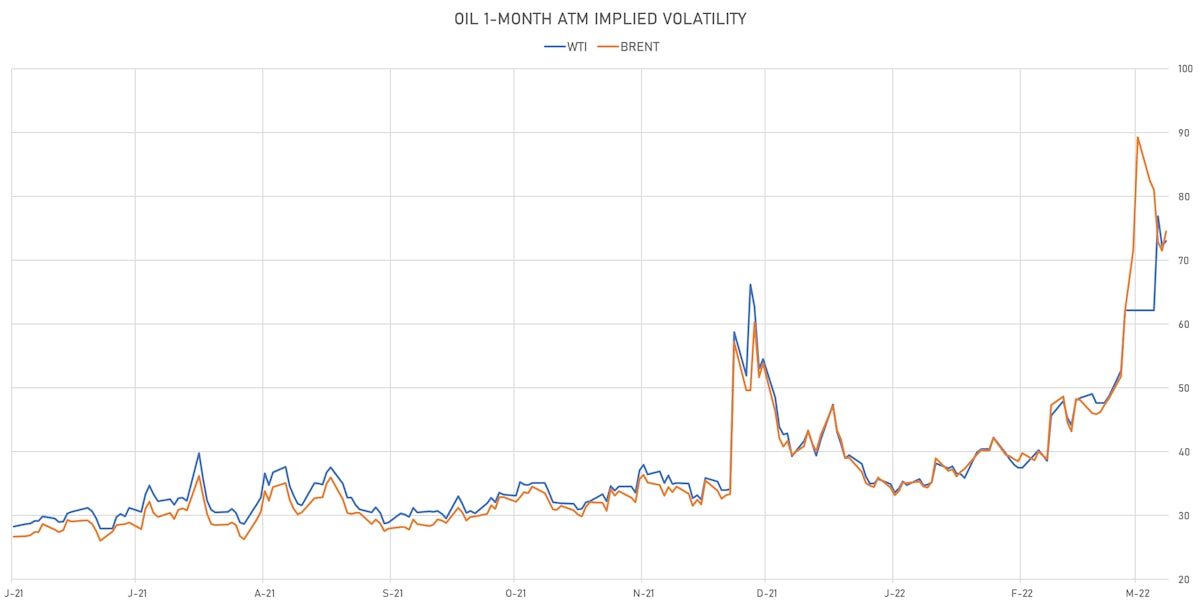

ENERGY THIS WEEK

- WTI crude front month currently at US$ 109.33 per barrel, down -5.5% (YTD: +42.0%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 112.67 per barrel, down -4.6% (YTD: +42.0%)

- Newcastle Coal (ICE Europe) currently at US$ 368.65 per tonne, down -12.0% (YTD: +116.7%)

- Natural Gas (Henry Hub) currently at US$ 4.73 per MMBtu, down -5.8% (YTD: +32.7%)

- Gasoline (NYMEX) currently at US$ 3.31 per gallon, down -6.5% (YTD: +44.2%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1012.00 per tonne, down -14.5% (YTD: +49.3%)

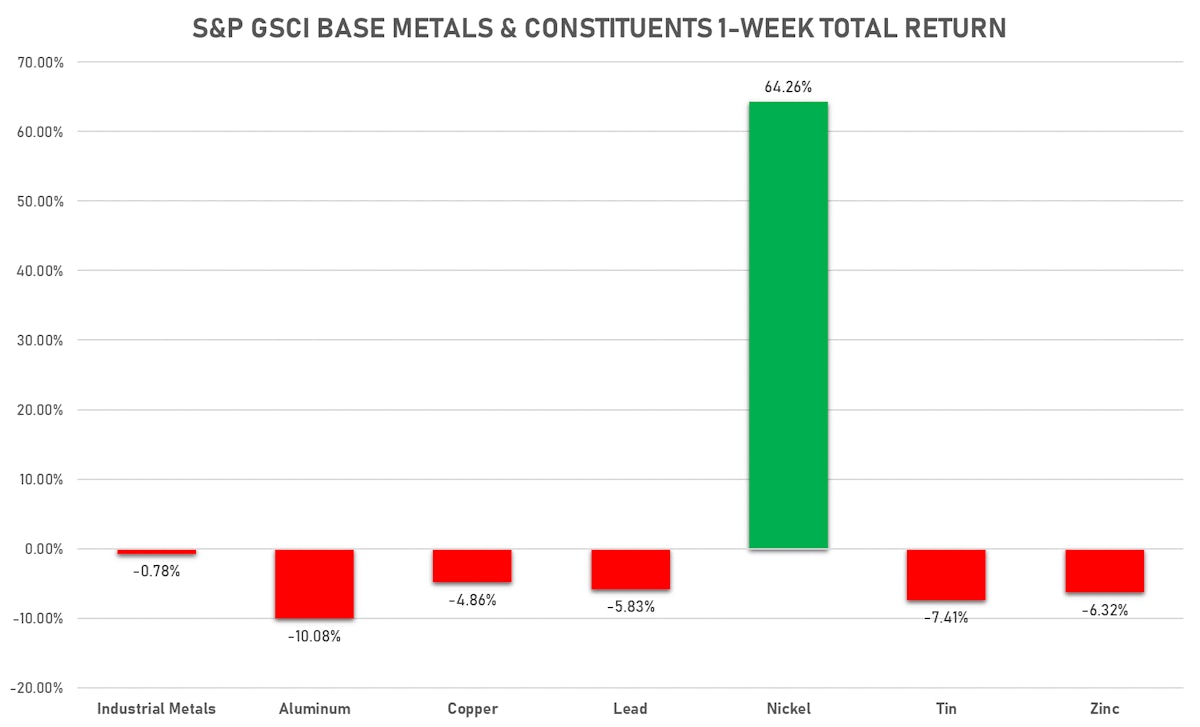

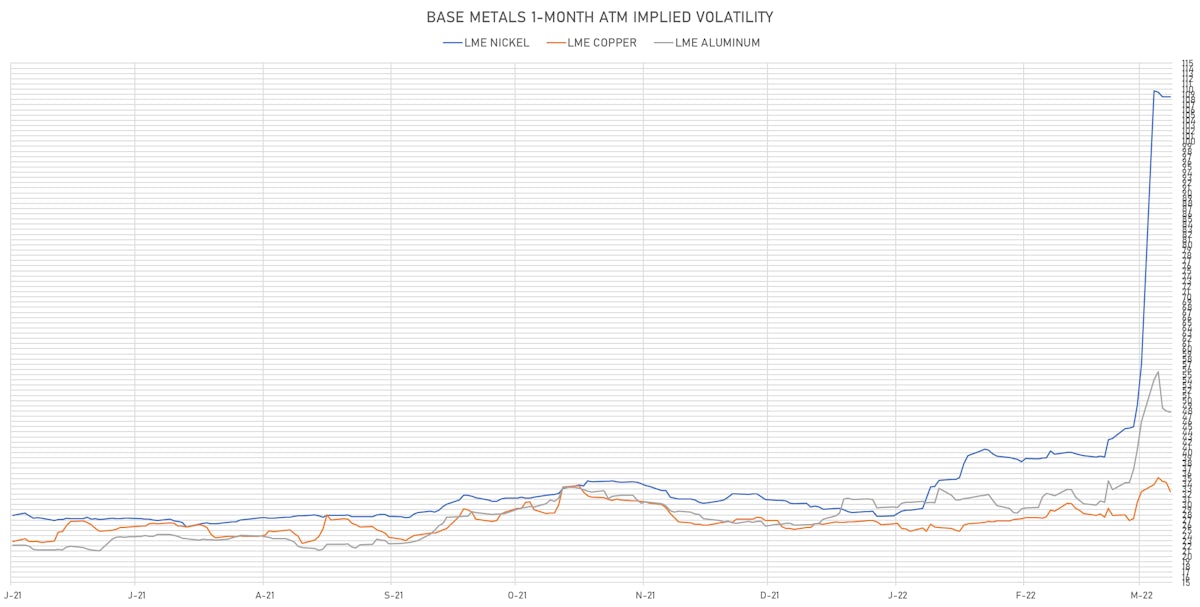

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.59 per pound, down -6.4% (YTD: +5.3%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 822.00 per tonne, down 0.0% (YTD: +19.8%)

- Aluminum (Shanghai) currently at CNY 21,905 per tonne, down -6.9% (YTD: +8.3%)

- Nickel (Shanghai) currently at CNY 214,100 per tonne, up 18.3% (YTD: +49.3%)

- Lead (Shanghai) currently at CNY 15,200 per tonne, down -1.5% (YTD: -0.9%)

- Rebar (Shanghai) currently at CNY 4,900 per tonne, down -1.7% (YTD: +7.3%)

- Tin (Shanghai) currently at CNY 344,830 per tonne, up 1.9% (YTD: +16.2%)

- Zinc (Shanghai) currently at CNY 25,370 per tonne, down -1.2% (YTD: +6.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 573,500 per tonne, up 3.6% (YTD: +17.8%)

- Lithium (Shanghai) spot price currently at CNY 3,034,000 per tonne, up 11.0% (YTD: +127.3%)

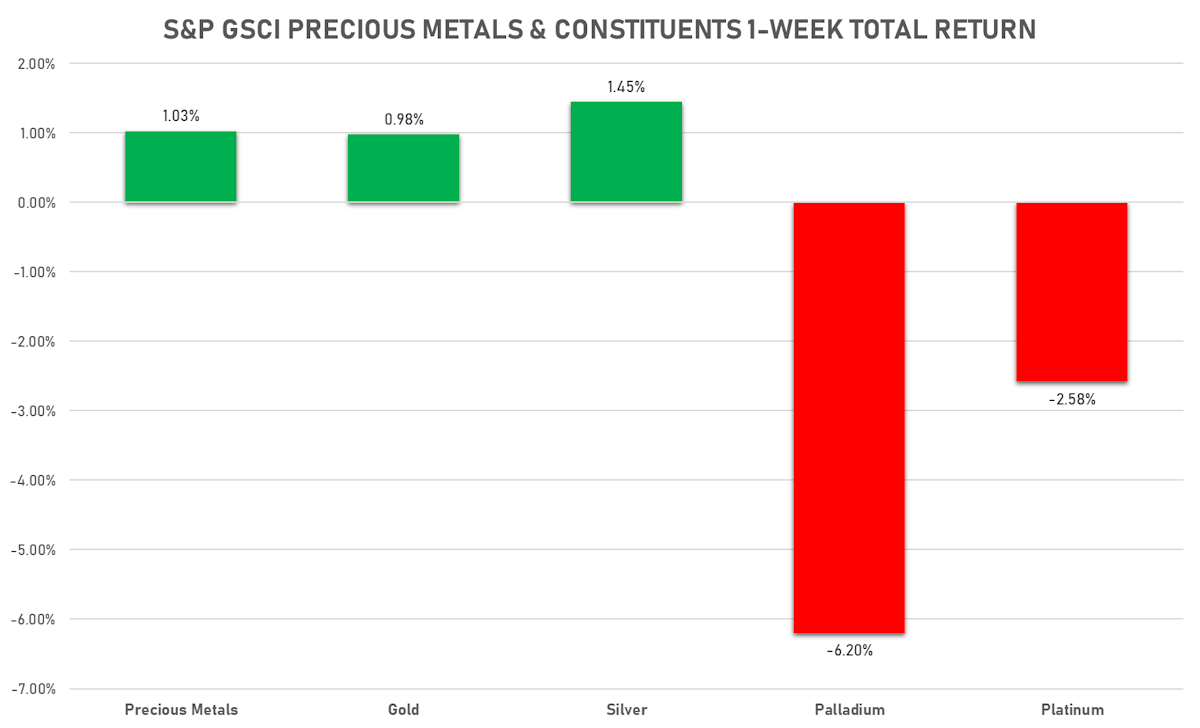

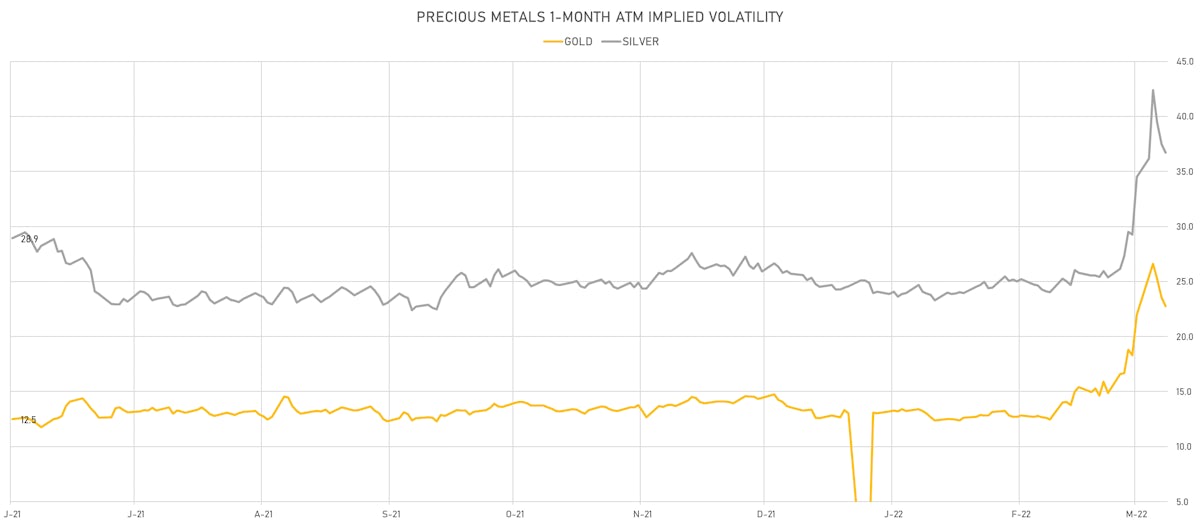

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,987.72 per troy ounce, up 0.9% (YTD: +9.5%)

- Gold 1-Month ATM implied volatility currently at 22.25, up 2.3% (YTD: +72.0%)

- Silver spot currently at US$ 25.84 per troy ounce, up 0.6% (YTD: +12.2%)

- Silver 1-Month ATM implied volatility currently at 35.30, up 5.8% (YTD: +52.3%)

- Palladium spot currently at US$ 2,803.15 per troy ounce, down -6.9% (YTD: +42.7%)

- Platinum spot currently at US$ 1,076.78 per troy ounce, down -4.1% (YTD: +11.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,500 per troy ounce, down -11.9% (YTD: +31.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,000 per troy ounce, up 11.1% (YTD: +25.0%)

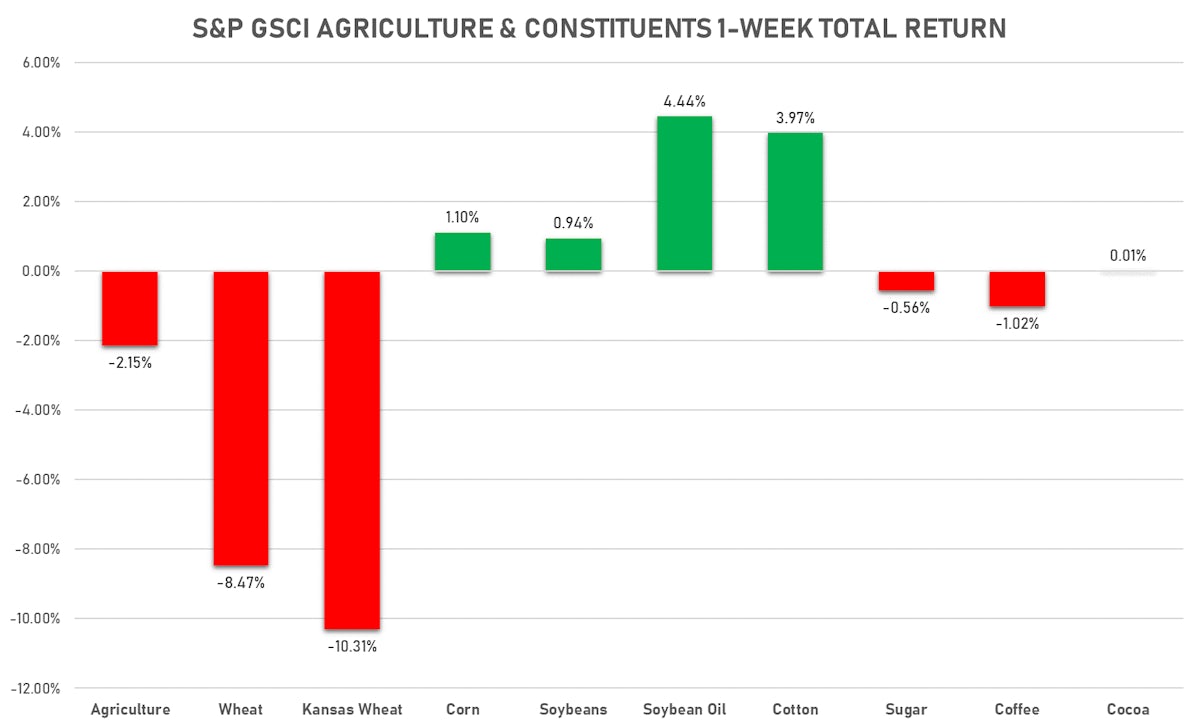

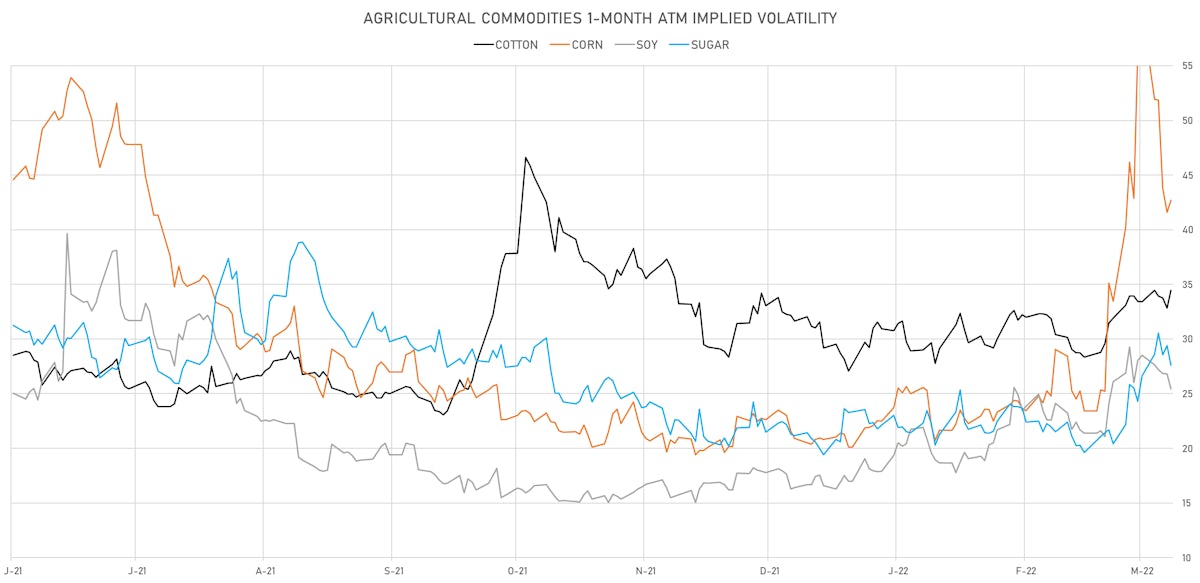

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 137.30 cents per pound, up 1.1% (YTD: -1.3%)

- Lean Hogs (CME) currently at US$ 102.73 cents per pound, up 2.3% (YTD: +24.2%)

- Rough Rice (CBOT) currently at US$ 15.51 cents per hundredweight, down -3.8% (YTD: +6.4%)

- Soybeans Composite (CBOT) currently at US$ 1,690.75 cents per bushel, up 0.9% (YTD: +27.3%)

- Corn (CBOT) currently at US$ 764.50 cents per bushel, up 1.1% (YTD: +28.3%)

- Wheat Composite (CBOT) currently at US$ 1,090.00 cents per bushel, down -19.1% (YTD: +39.8%)

- Sugar No.11 (ICE US) currently at US$ 19.26 cents per pound, down -0.6% (YTD: +2.4%)

- Cotton No.2 (ICE US) currently at US$ 121.14 cents per pound, up 0.7% (YTD: +5.9%)

- Cocoa (ICE US) currently at US$ 2,643 per tonne, down -0.1% (YTD: +0.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,786 per tonne, up 0.3% (YTD: +5.0%)

- Random Length Lumber (CME) currently at US$ 1,410.00 per 1,000 board feet, down -2.2% (YTD: +21.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,200 per tonne, up 1.8% (YTD: -1.5%)

- Soybean Oil Composite (CBOT) currently at US$ 82.18 cents per pound, up 7.0% (YTD: +47.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 7,390 per tonne, up 8.6% (YTD: +43.0%)

SHIPPING THIS WEEK

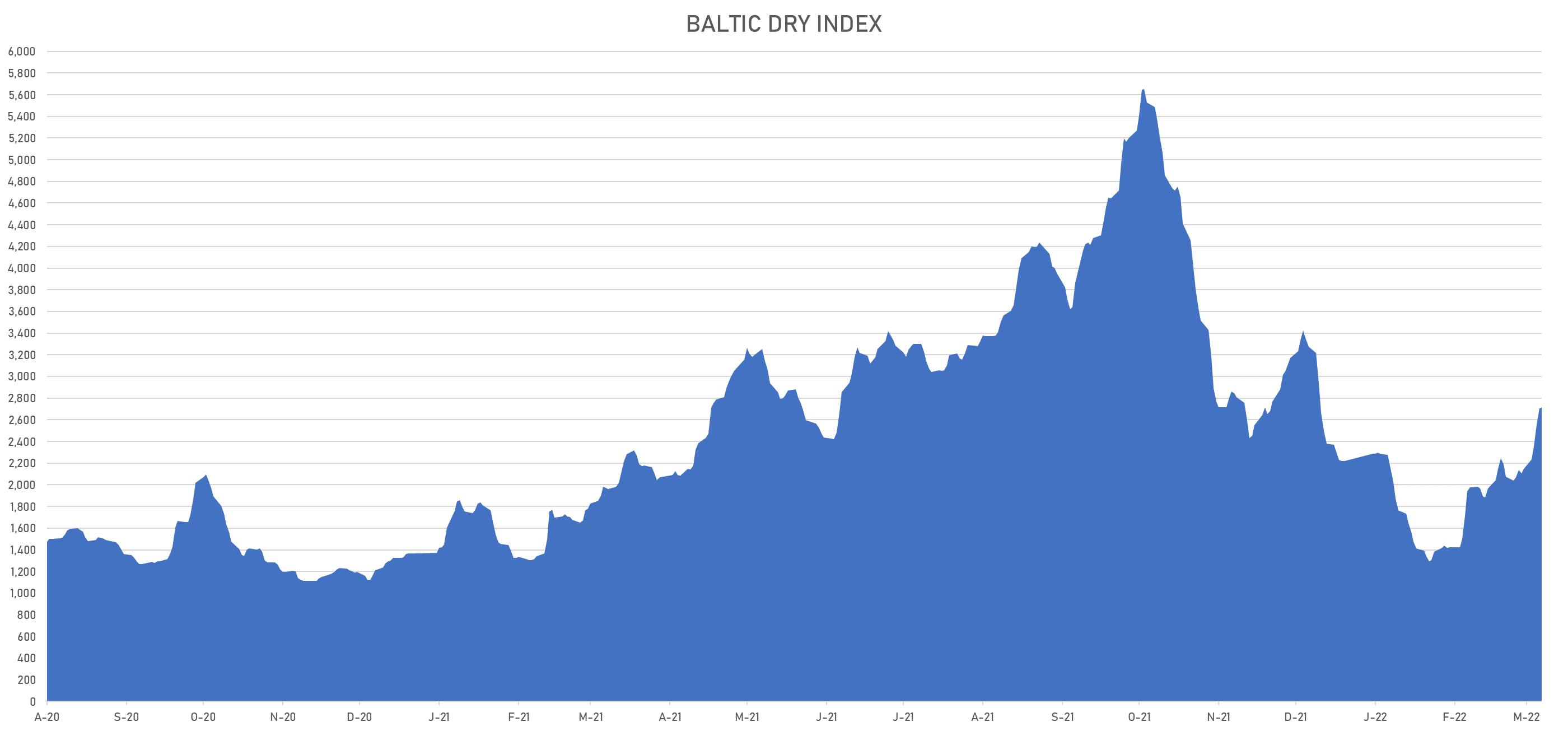

- Baltic Dry Index (Baltic Exchange) currently at 2,718, up 26.5% (YTD: +22.5%)

- Freightos China To North America West Coast Container Index currently at 16,403, up 1.5% (YTD: +19.7%)

- Freightos North America West Coast To China Container Index currently at 1,017, up 2.1% (YTD: +16.2%)

- Freightos North America East Coast To Europe Container Index currently at 677, down -0.7% (YTD: +25.4%)

- Freightos Europe To North America East Coast Container Index currently at 6,884, up 0.5% (YTD: -3.0%)

- Freightos China To North Europe Container Index currently at 13,283, down -0.5% (YTD: -6.5%)

- Freightos North Europe To China Container Index currently at 943, up 6.2% (YTD: -16.5%)

- Freightos Europe To South America West Coast Container Index currently at 8,176, up 0.2% (YTD: +4.7%)

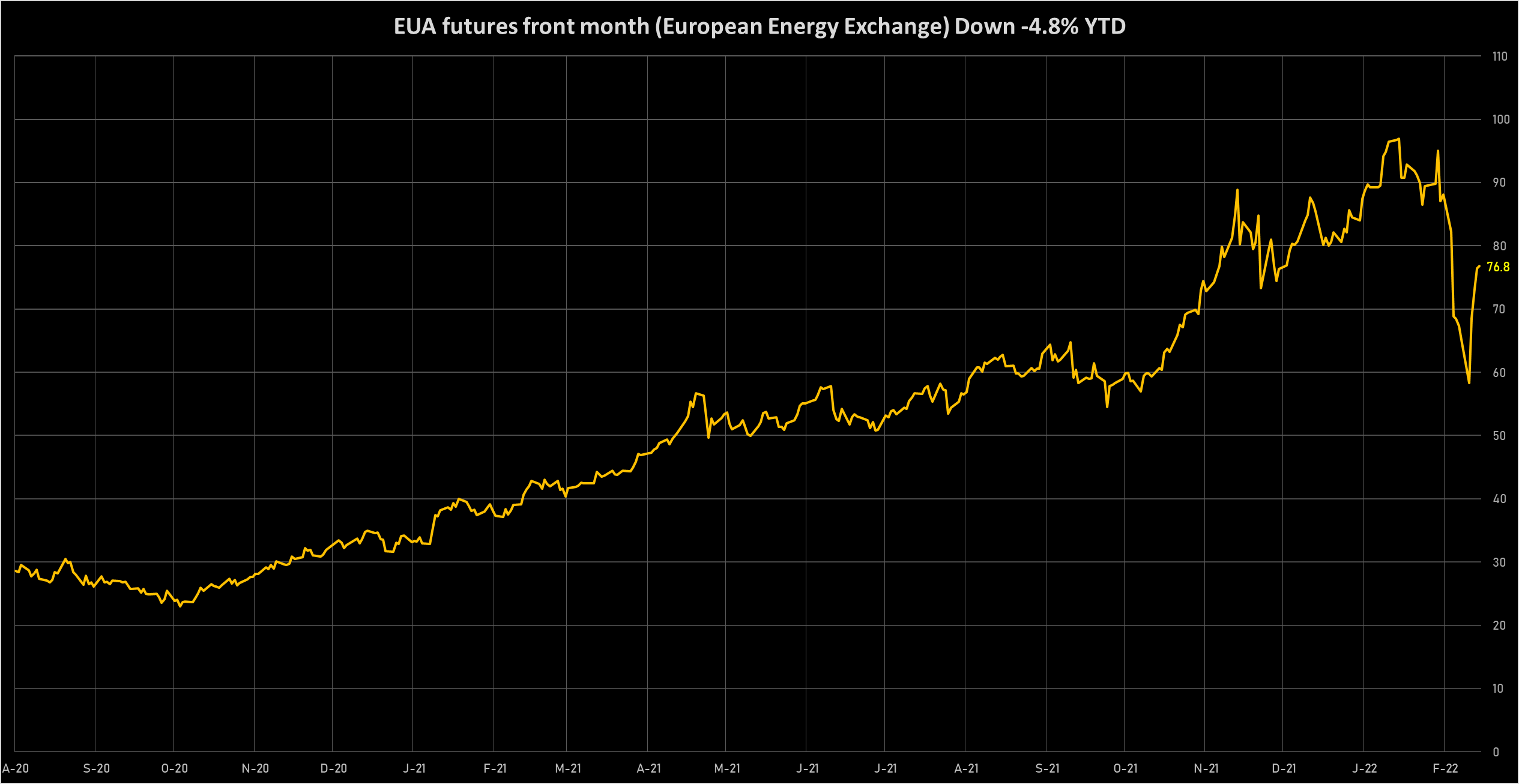

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 76.76 per tonne, up 17.9% (YTD: -4.2%)