Commodities

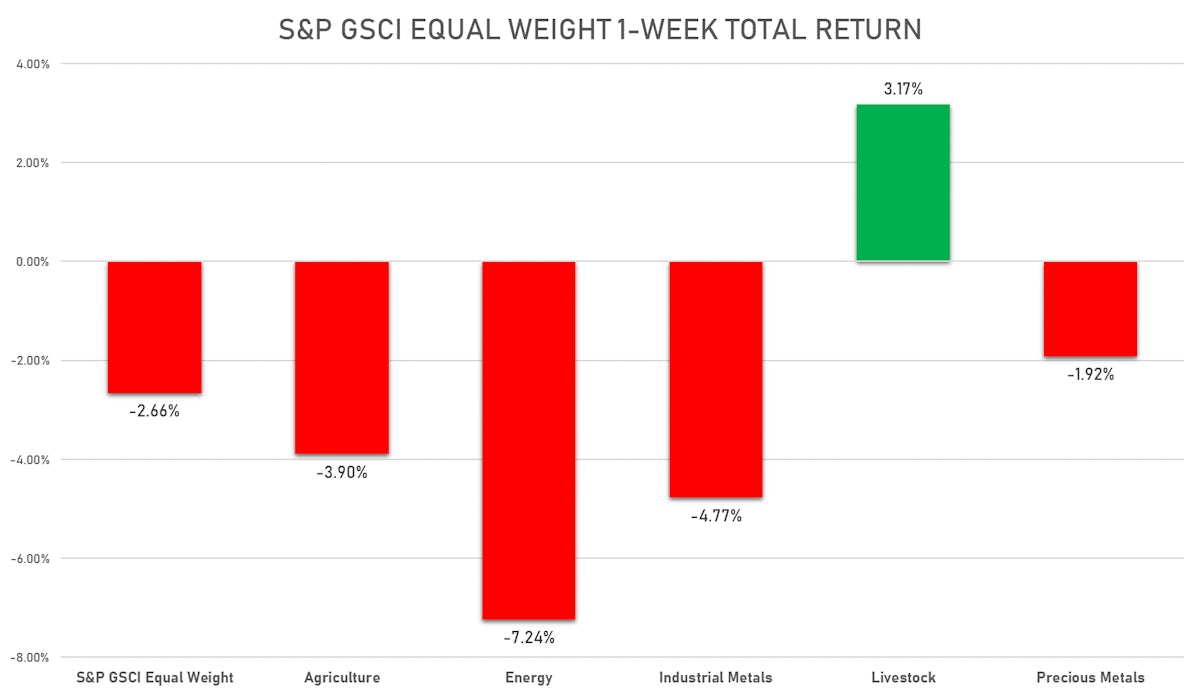

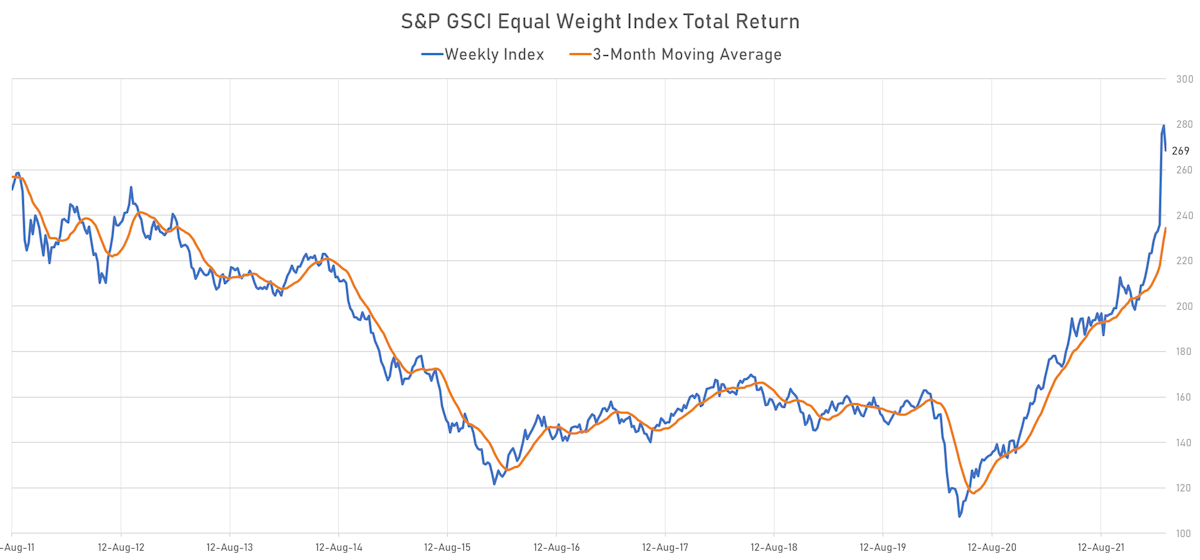

Most Commodity Groups Fell This Week, With The Exception Of Livestock; The GSCI Energy Was Down Over 7%

As the war in Ukraine continues, fertilizers spot prices keep rising: the Urea New Orleans FOB Index is now up nearly 70% since the middle of February

Published ET

Direct Hedge Urea New Orleans FOB Index | Source: Refinitiv

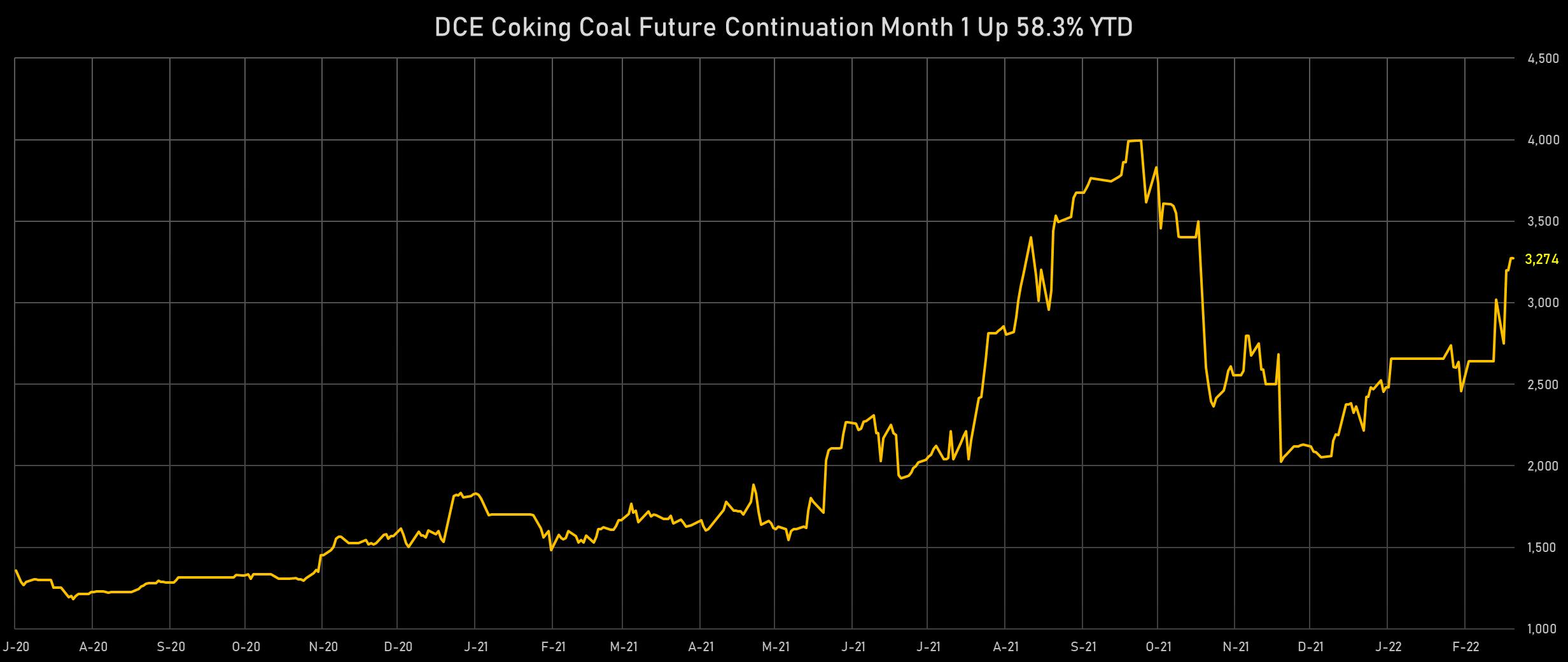

NOTABLE GAINERS THIS WEEK

- DCE Coking Coal Continuation Month 1 up 8.4% (YTD: 58.3%), now at 3,051.00

- DCE Coke up 7.7% (YTD: 30.3%), now at 3,800.00

- NYMEX NY Harbor ULSD up 5.3% (YTD: 50.2%), now at 03.60

- ICE-US Cotton No. 2 up 4.8% (YTD: 10.9%), now at 126.86

- DCE Iron Ore Continuation Month 1 up 3.5% (YTD: 24.1%), now at 864.00

- SHFE Aluminum up 3.0% (YTD: 11.6%), now at 22,920.00

- NYMEX Henry Hub Natural Gas up 2.9% (YTD: 36.6%), now at 04.86

- EEX European Union Aviation Allowance Continuation Month 1 up 2.8% (YTD: -1.7%), now at 79.24

- EEX European-Carbon- Secondary Trading up 2.8% (YTD: -1.4%), now at 79.53

- Intercontinental Exchange Endex European Union Allowance (EUA) Yearly up 2.8% (YTD: -1.6%), now at 78.89

- Johnson Matthey Rhodium New York 0930 up 2.7% (YTD: 34.8%), now at 19,000.00

- COMEX Copper up 2.5% (YTD: 7.9%), now at 04.72

- CME Cattle (Feeder) up 2.4% (YTD: -5.6%), now at 157.00

- Shanghai International Exchange Bonded Copper up 2.3% (YTD: 5.3%), now at 65,890.00

- CME Live Cattle up 2.3% (YTD: 1.0%), now at 140.50

NOTABLE LOSERS THIS WEEK

- TRPC Natural Gas TTF Day 1 down -23.9% (YTD: 27.9%), now at 100.40

- TRPC Natural Gas TTF Monthly down -23.4% (YTD: 16.8%), now at 101.10

- Bursa Malaysia Crude Palm Oil down -17.0% (YTD: 18.8%), now at 6,118.00

- CME Random Length Lumber down -15.9% (YTD: 2.4%), now at 1,185.30

- DCE RBD Palm Oil down -12.9% (YTD: 30.2%), now at 11,602.00

- CBoT Soybean Oil down -12.0% (YTD: 29.4%), now at 72.29

- Palladium spot down -11.3% (YTD: 26.6%), now at 2,487.21

- SHFE Bitumen Continuation Month 1 down -9.5% (YTD: 14.9%), now at 3,582.00

- Platinum spot down -4.9% (YTD: 6.4%), now at 1,023.56

- NYMEX Light Sweet Crude Oil (WTI) down -4.2% (YTD: 36.0%), now at 104.70

- Crude Oil WTI Cushing US FOB down -4.2% (YTD: 36.3%), now at 104.64

- Coffee Arabica Colombia Excelso EP spot down -3.9% (YTD: 1.0%), now at 5,562.00

- Silver spot down -3.4% (YTD: 8.4%), now at 24.96

- Gold spot down -3.4% (YTD: 5.9%), now at 1,921.09

- CBoT Soybean Meal down -3.3% (YTD: 15.3%), now at 477.00

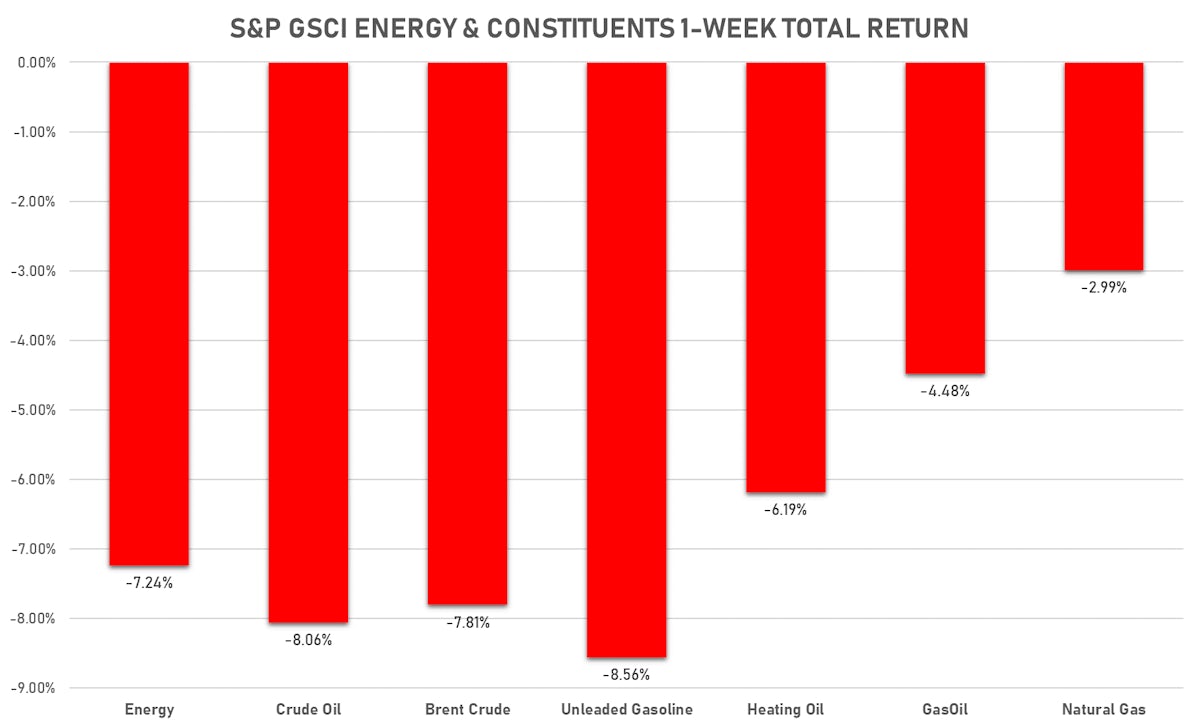

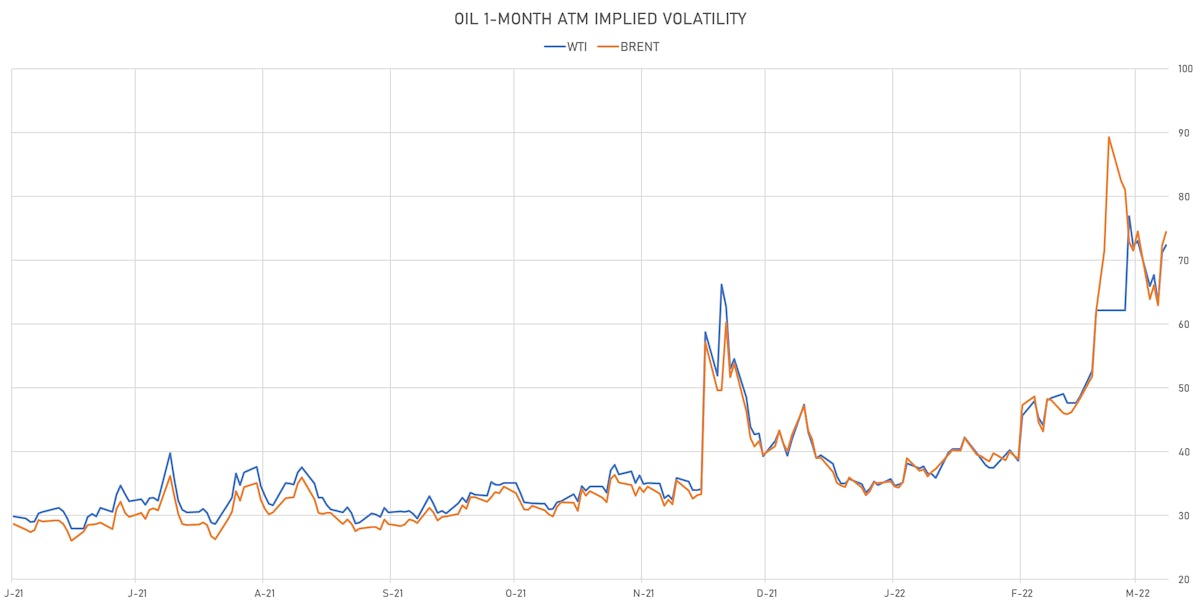

ENERGY THIS WEEK

- WTI crude front month currently at US$ 104.70 per barrel, down -4.2% (YTD: +36.0%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 107.93 per barrel, down -4.0% (YTD: +34.4%)

- Newcastle Coal (ICE Europe) currently at US$ 336.00 per tonne, down -19.8% (YTD: +98.3%)

- Natural Gas (Henry Hub) currently at US$ 4.86 per MMBtu, up 2.9% (YTD: +36.6%)

- Gasoline (NYMEX) currently at US$ 3.24 per gallon, down -2.2% (YTD: +41.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1064.75 per tonne, down -30.6% (YTD: +55.9%)

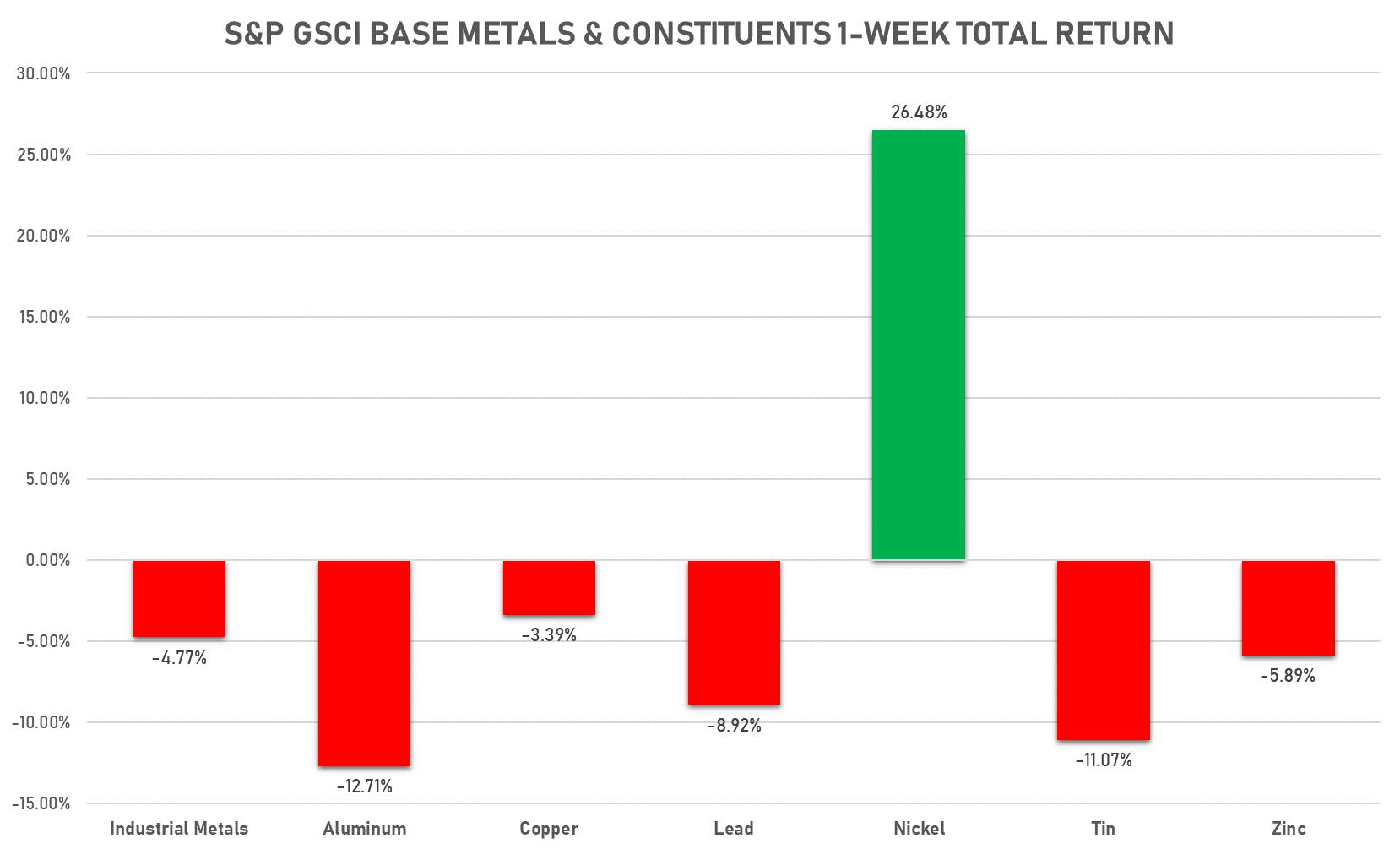

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.72 per pound, up 2.5% (YTD: +7.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 864.00 per tonne, up 3.5% (YTD: +24.1%)

- Aluminum (Shanghai) currently at CNY 22,920 per tonne, up 3.0% (YTD: +11.6%)

- Nickel (Shanghai) currently at CNY 218,520 per tonne, down -2.4% (YTD: +45.7%)

- Lead (Shanghai) currently at CNY 15,235 per tonne, up 0.4% (YTD: -0.5%)

- Rebar (Shanghai) currently at CNY 4,965 per tonne, up 0.9% (YTD: +8.2%)

- Tin (Shanghai) currently at CNY 347,000 per tonne, down -2.8% (YTD: +12.9%)

- Zinc (Shanghai) currently at CNY 25,310 per tonne, down -0.4% (YTD: +6.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 568,500 per tonne, down -0.9% (YTD: +16.7%)

- Lithium (Shanghai) spot price currently at CNY 3,134,000 per tonne, up 3.3% (YTD: +134.8%)

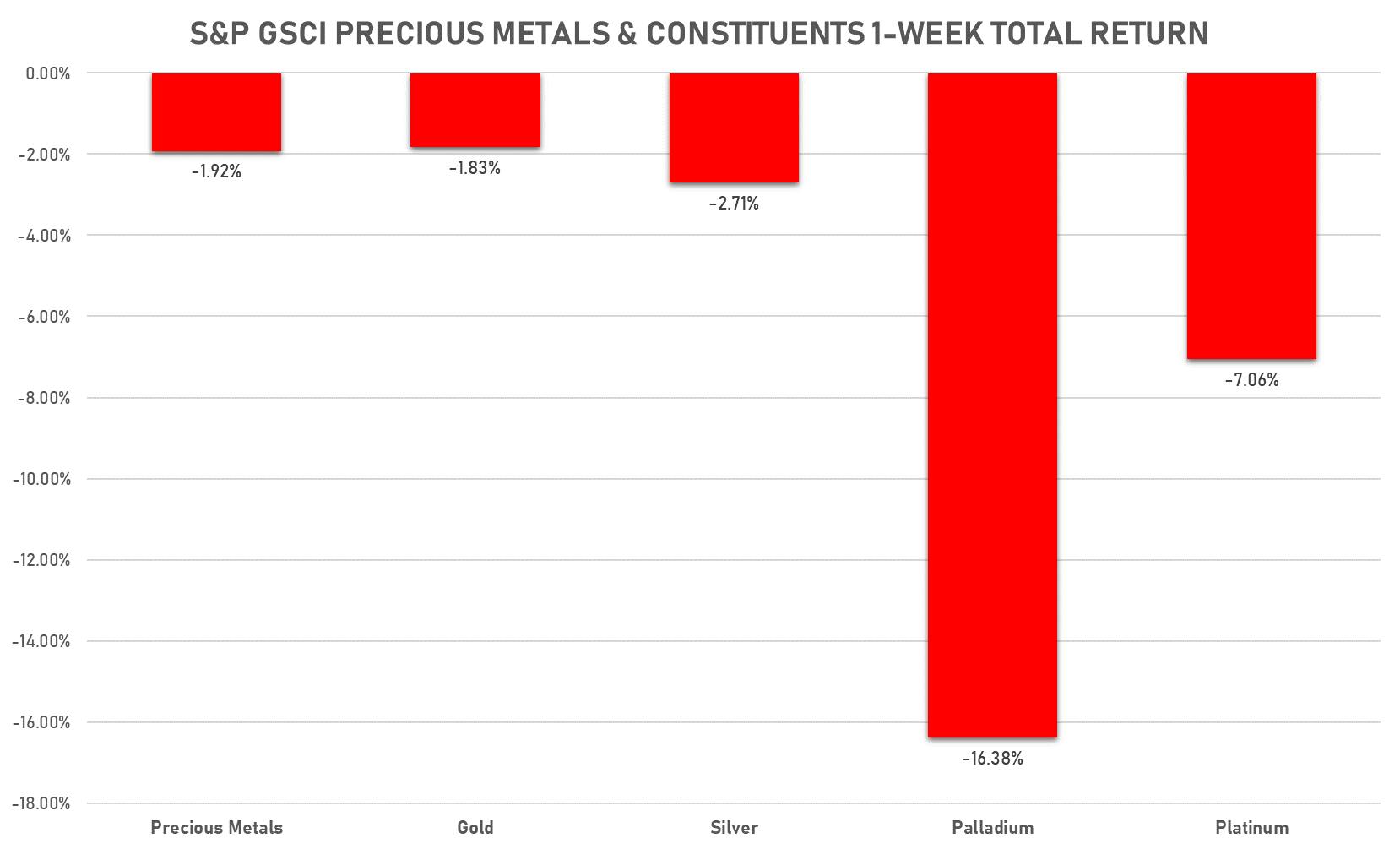

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,921.09 per troy ounce, down -3.4% (YTD: +5.9%)

- Gold 1-Month ATM implied volatility currently at 18.45, down -15.8% (YTD: +44.8%)

- Silver spot currently at US$ 24.96 per troy ounce, down -3.4% (YTD: +8.4%)

- Silver 1-Month ATM implied volatility currently at 30.01, down -13.8% (YTD: +31.2%)

- Palladium spot currently at US$ 2,487.21 per troy ounce, down -11.3% (YTD: +26.6%)

- Platinum spot currently at US$ 1,023.56 per troy ounce, down -4.9% (YTD: +6.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, up 2.7% (YTD: +34.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,100 per troy ounce, up 2.0% (YTD: +27.5%)

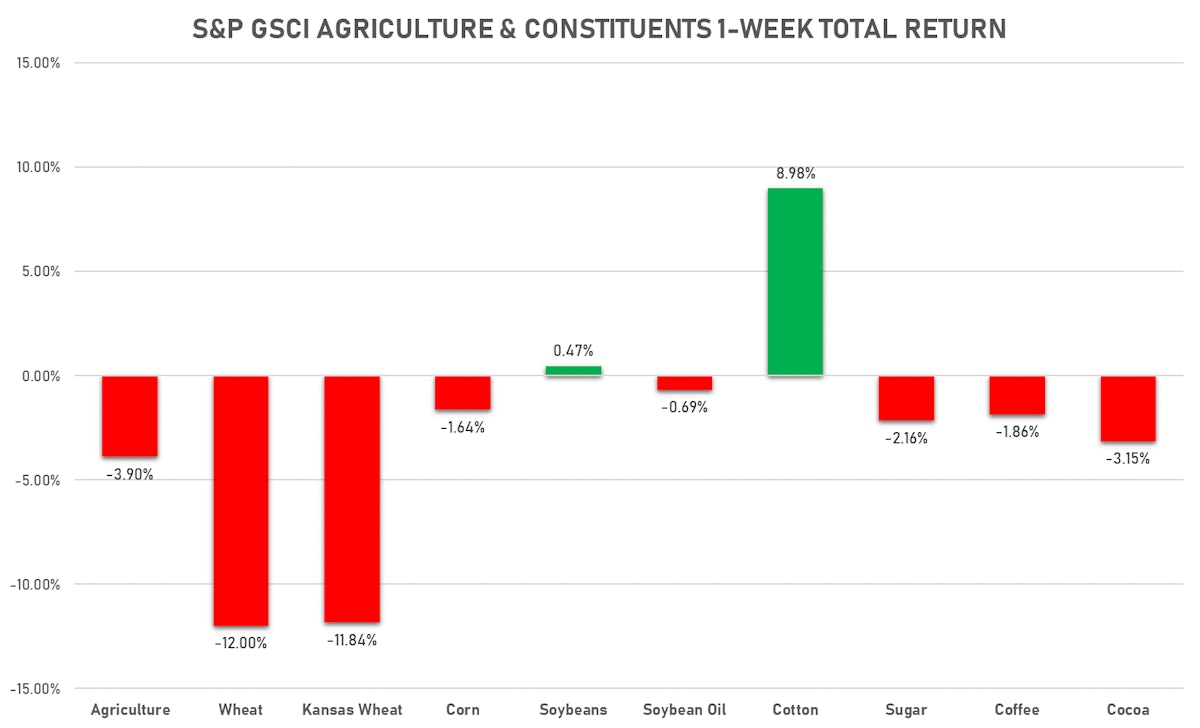

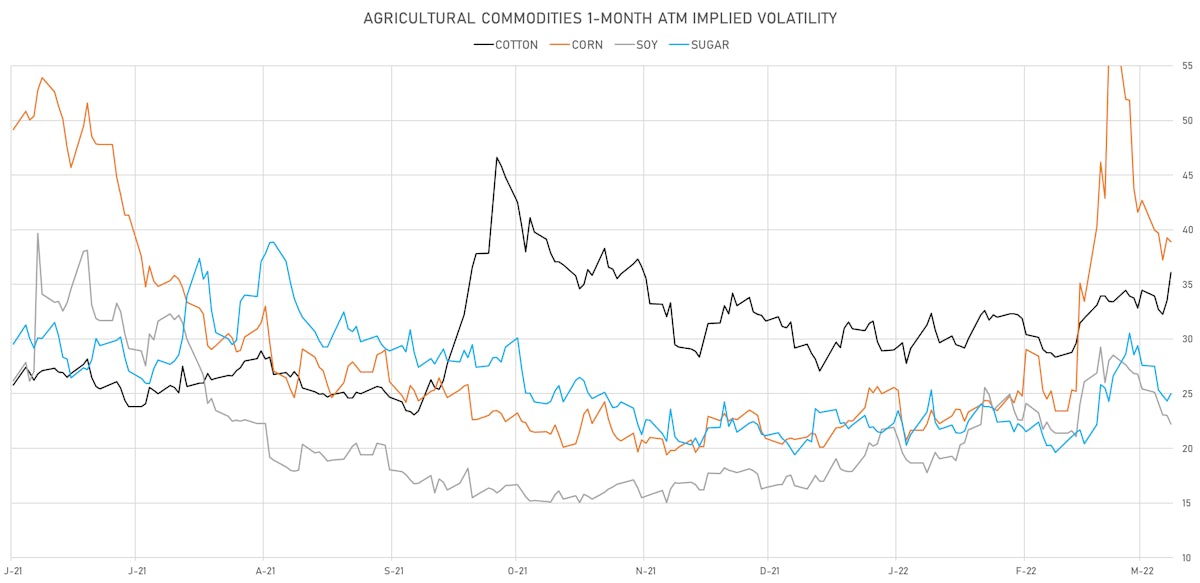

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 140.50 cents per pound, up 2.3% (YTD: +1.0%)

- Lean Hogs (CME) currently at US$ 99.40 cents per pound, down -3.2% (YTD: +20.2%)

- Rough Rice (CBOT) currently at US$ 15.63 cents per hundredweight, up 0.7% (YTD: +7.2%)

- Soybeans Composite (CBOT) currently at US$ 1,668.00 cents per bushel, down -1.3% (YTD: +25.6%)

- Corn (CBOT) currently at US$ 741.75 cents per bushel, down -3.0% (YTD: +24.5%)

- Wheat Composite (CBOT) currently at US$ 1,063.75 cents per bushel, down -2.4% (YTD: +36.4%)

- Sugar No.11 (ICE US) currently at US$ 18.94 cents per pound, down -1.6% (YTD: +0.8%)

- Cotton No.2 (ICE US) currently at US$ 126.86 cents per pound, up 4.8% (YTD: +10.9%)

- Cocoa (ICE US) currently at US$ 2,536 per tonne, down -1.7% (YTD: -0.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,562 per tonne, down -3.9% (YTD: +1.0%)

- Random Length Lumber (CME) currently at US$ 1,185.30 per 1,000 board feet, down -15.9% (YTD: +2.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,040 per tonne, down -2.3% (YTD: -3.7%)

- Soybean Oil Composite (CBOT) currently at US$ 72.29 cents per pound, down -12.0% (YTD: +29.4%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 6,118 per tonne, down -17.0% (YTD: +18.8%)

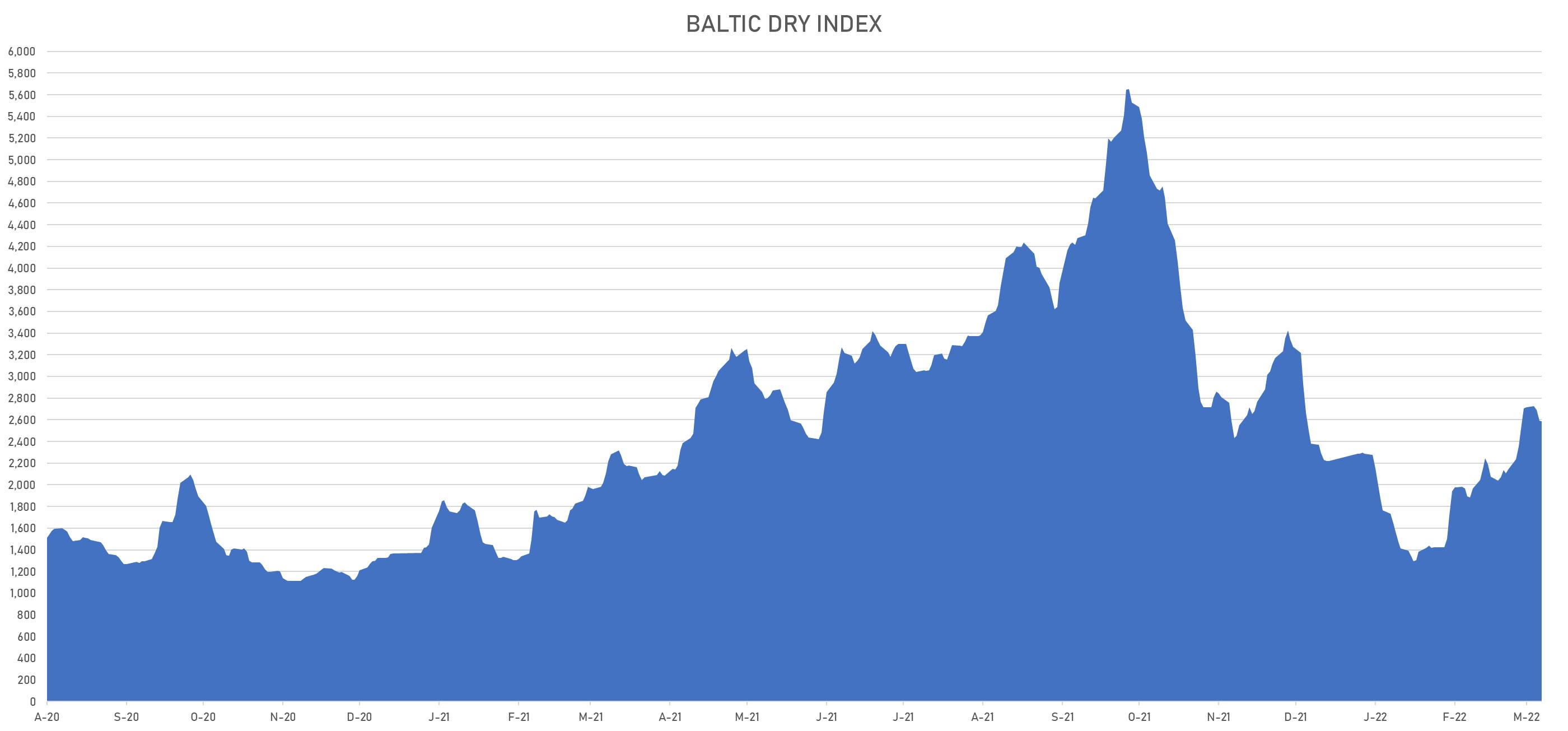

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,588, down -4.3% (YTD: +16.6%)

- Freightos China To North America West Coast Container Index currently at 15,908, down -3.0% (YTD: +16.1%)

- Freightos North America West Coast To China Container Index currently at 1,004, down -1.3% (YTD: +14.7%)

- Freightos North America East Coast To Europe Container Index currently at 648, down -4.3% (YTD: +20.0%)

- Freightos Europe To North America East Coast Container Index currently at 6,775, down -1.6% (YTD: -4.6%)

- Freightos China To North Europe Container Index currently at 12,564, down -5.4% (YTD: -11.6%)

- Freightos North Europe To China Container Index currently at 922, down -2.2% (YTD: -18.4%)

- Freightos Europe To South America West Coast Container Index currently at 8,190, up 0.2% (YTD: +4.9%)

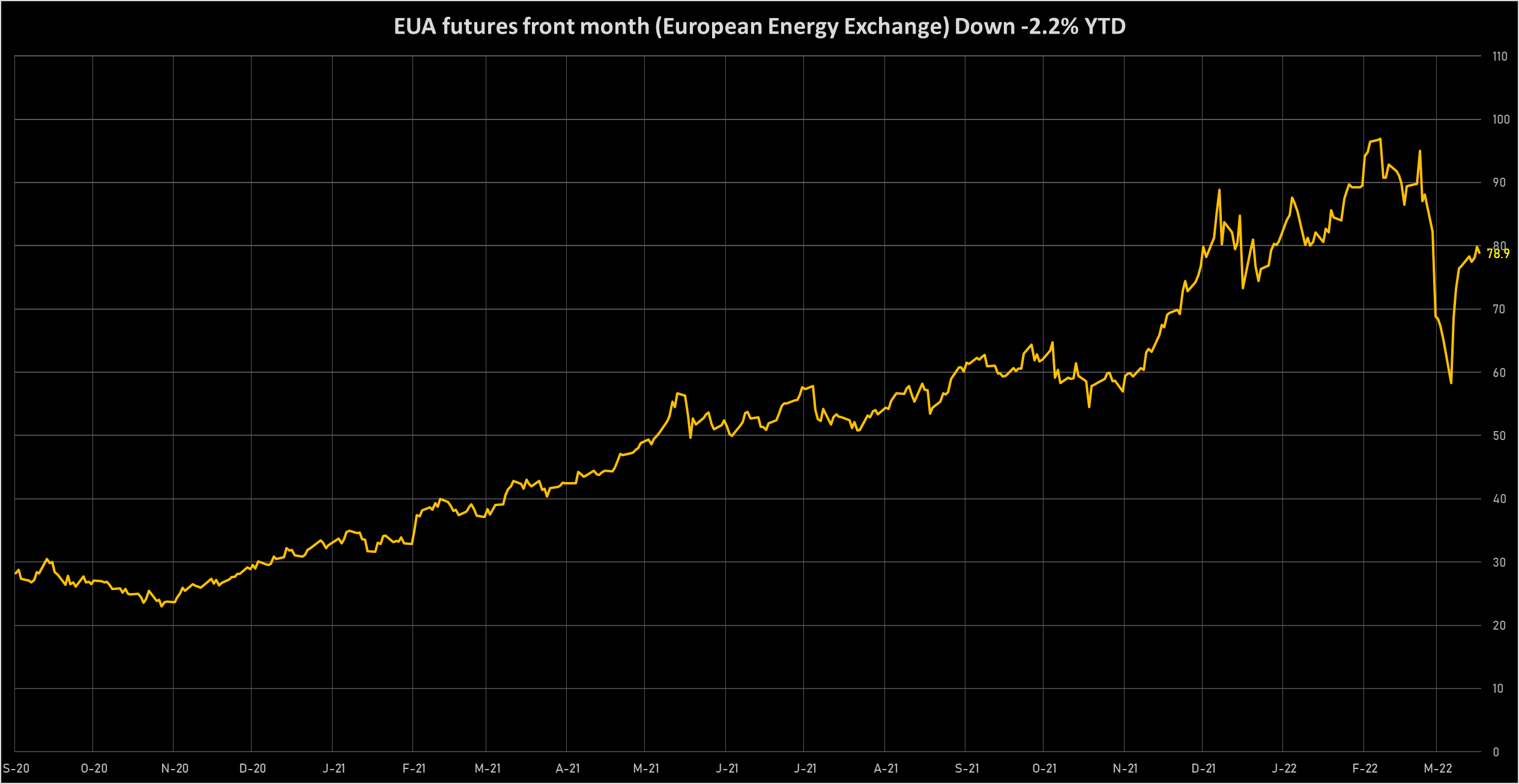

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 78.89 per tonne, up 2.8% (YTD: -1.6%)