Commodities

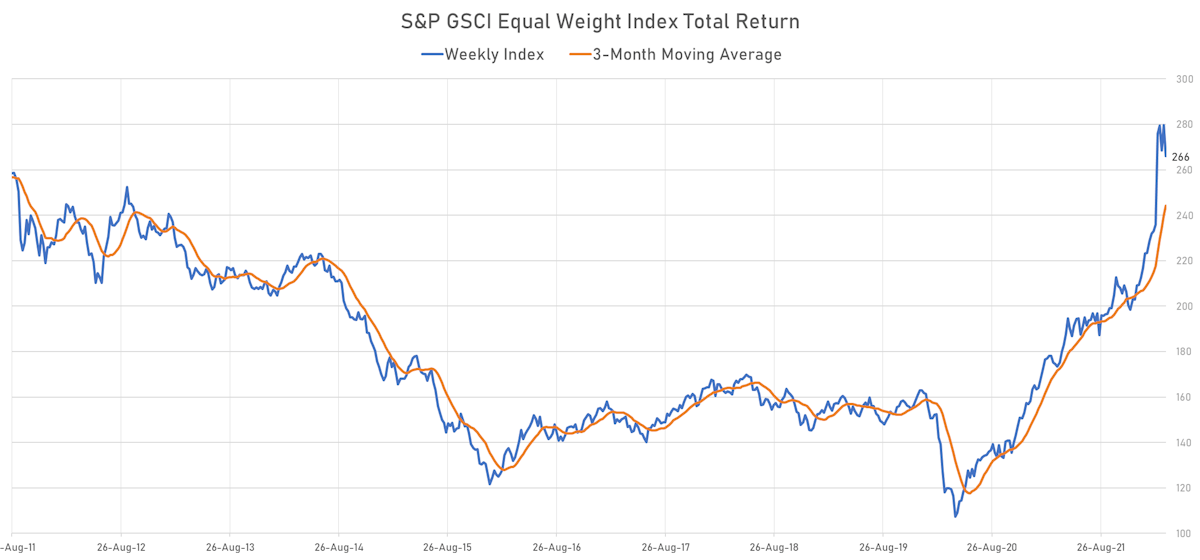

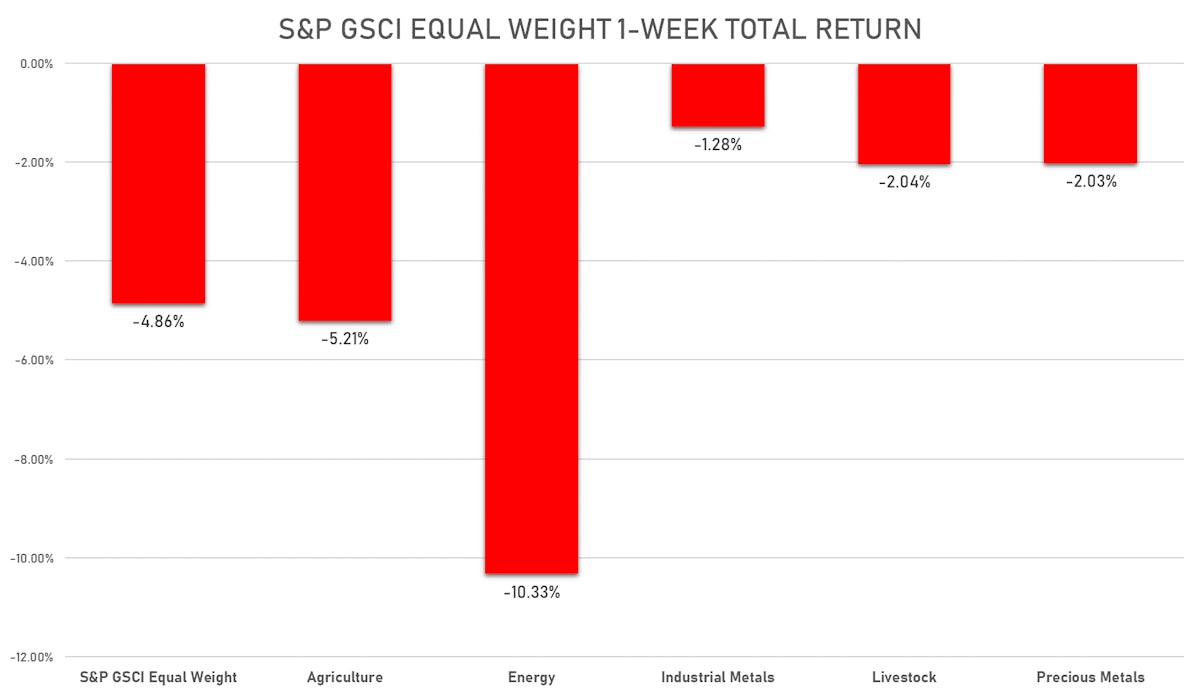

Broad Fall Across The Commodities Complex, With All GSCI Sub-Indices Ending The Week In Red

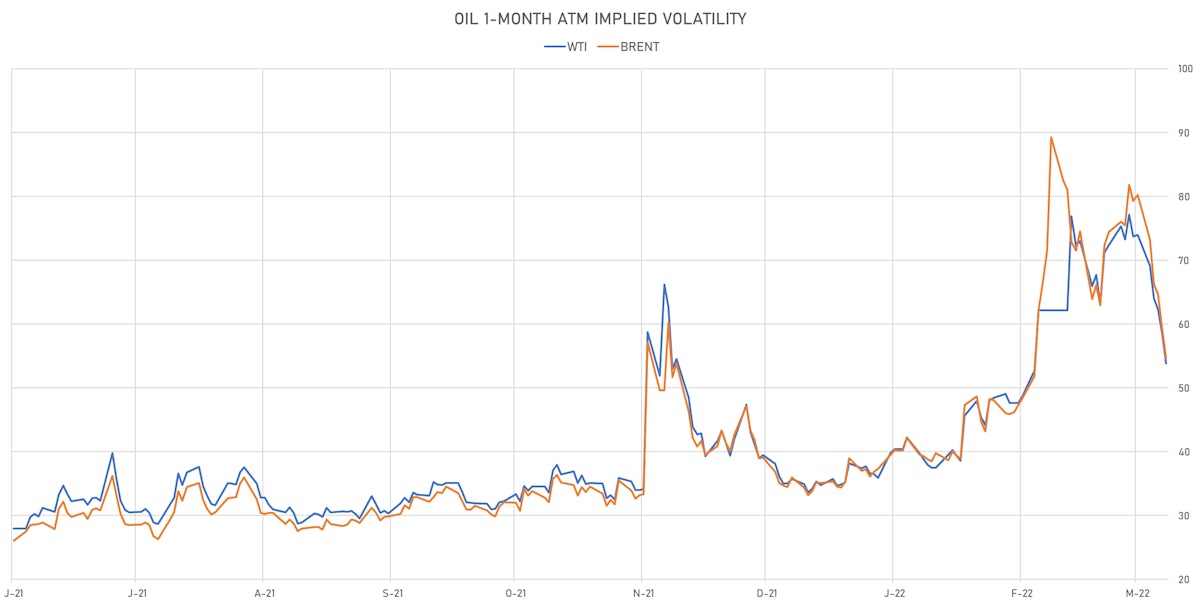

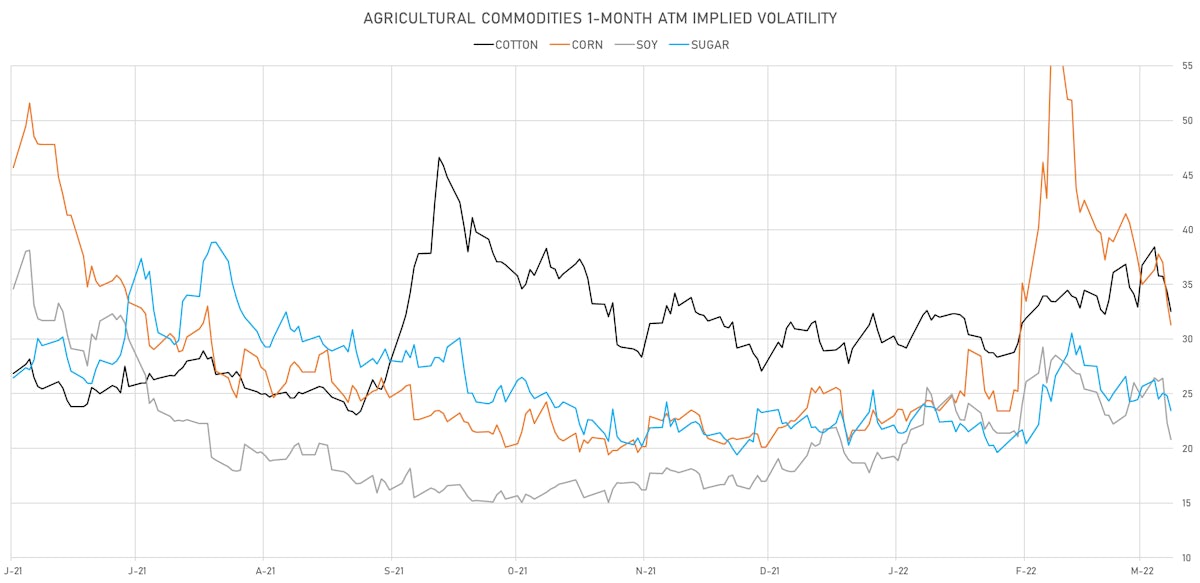

Most of the big recent gainers (crude oil, nickel, wheat, etc.) had a decent selloff and the skew in their implied volatilities dropped back to less extreme levels

Published ET

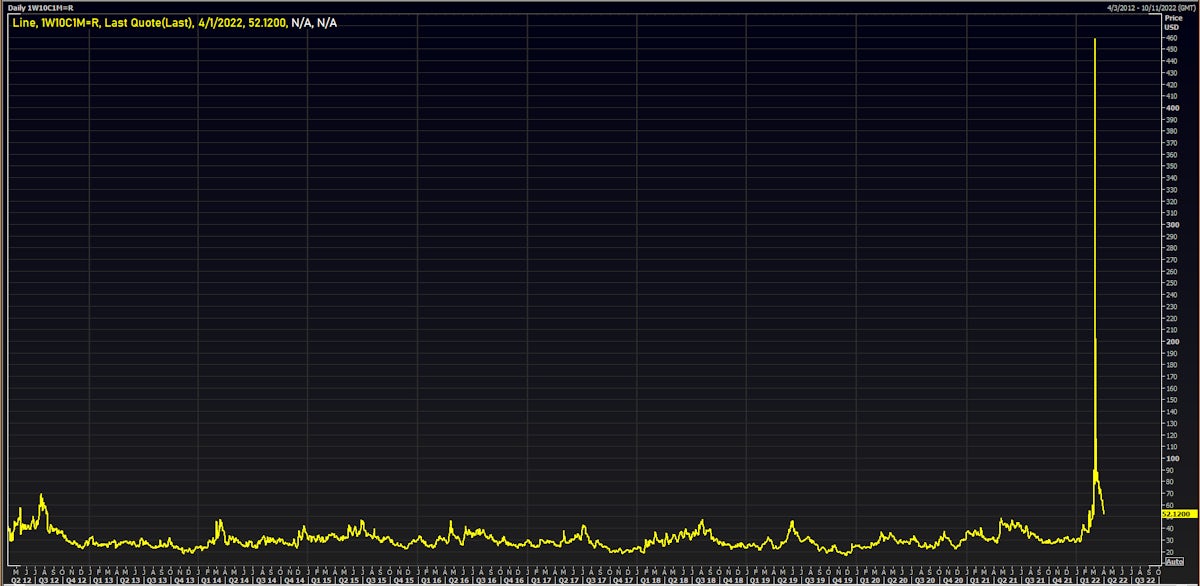

Wheat 1-Month 10-Delta Call Implied Volatility | Source: Refinitiv

NOTABLE GAINERS THIS WEEK

- DCE Coke up 20.9% (YTD: 52.6%), now at 4,450.00

- Baltic Exchange dirty tank index up 18.8% (YTD: 67.6%), now at 1,321.00

- DCE Coking Coal Continuation Month 1 up 15.3% (YTD: 80.9%), now at 3,741.00

- TRPC Natural Gas TTF Monthly up 14.1% (YTD: 30.5%), now at 113.00

- DCE Iron Ore Continuation Month 1 up 10.0% (YTD: 37.1%), now at 940.50

- TRPC Natural Gas TTF Day 1 up 10.0% (YTD: 41.5%), now at 111.10

- CME Cash Settled Cheese up 8.7% (YTD: 26.8%), now at 02.23

- Commodities Exchange Center Iron Ore 62% Fe CFR China (Platts) up 6.7% (YTD: 42.4%), now at 158.81

- SGX Iron Ore 62% China CFR Swap Monthly up 6.5% (YTD: 41.9%), now at 159.98

- Zhengzhou Exchange Thermal Coal up 5.7% (YTD: 15.0%), now at 893.20

- CME Class III Milk up 5.7% (YTD: 28.5%), now at 23.69

- Johnson Matthey; Rhodium New York 0930 up 4.3% (YTD: 38.3%), now at 19,500.00

- CME Cattle (Feeder) up 3.3% (YTD: -2.9%), now at 161.58

- SHFE Rebar up 3.2% (YTD: 12.0%), now at 5,115.00

- ICE-US Coffee up 3.0% (YTD: -0.2%), now at 228.40

NOTABLE LOSERS THIS WEEK

- ICE Europe Newcastle Coal Monthly down -20.9% (YTD: 52.1%), now at 258.75

- NYMEX NY Harbor ULSD down -16.8% (YTD: 42.9%), now at 03.42

- SHFE Nickel down -16.1% (YTD: 46.5%), now at 221,010.00

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -15.8% (YTD: 37.9%), now at 108.47

- Crude Oil WTI Cushing US FOB down -14.5% (YTD: 29.3%), now at 99.27

- ICE Europe Brent Crude down -13.5% (YTD: 31.6%), now at 104.39

- Brent Forties and Oseberg Dated FOB North Sea Crude down -13.3% (YTD: 34.9%), now at 106.50

- NYMEX Light Sweet Crude Oil (WTI) down -12.8% (YTD: 28.9%), now at 99.27

- CBoT Wheat down -10.7% (YTD: 26.3%), now at 984.50

- Baltic Exchange Panamax Index down -10.0% (YTD: 22.2%), now at 3,073.00

- NYMEX RBOB Gasoline down -9.1% (YTD: 37.3%), now at 03.15

- CME Dry Whey down -8.9% (YTD: 12.8%), now at 72.05

- Baltic Exchange Supramax Index down -8.8% (YTD: 19.6%), now at 2,755.00

- ICE Europe Low Sulphur Gasoil down -8.8% (YTD: 61.0%), now at 1,091.00

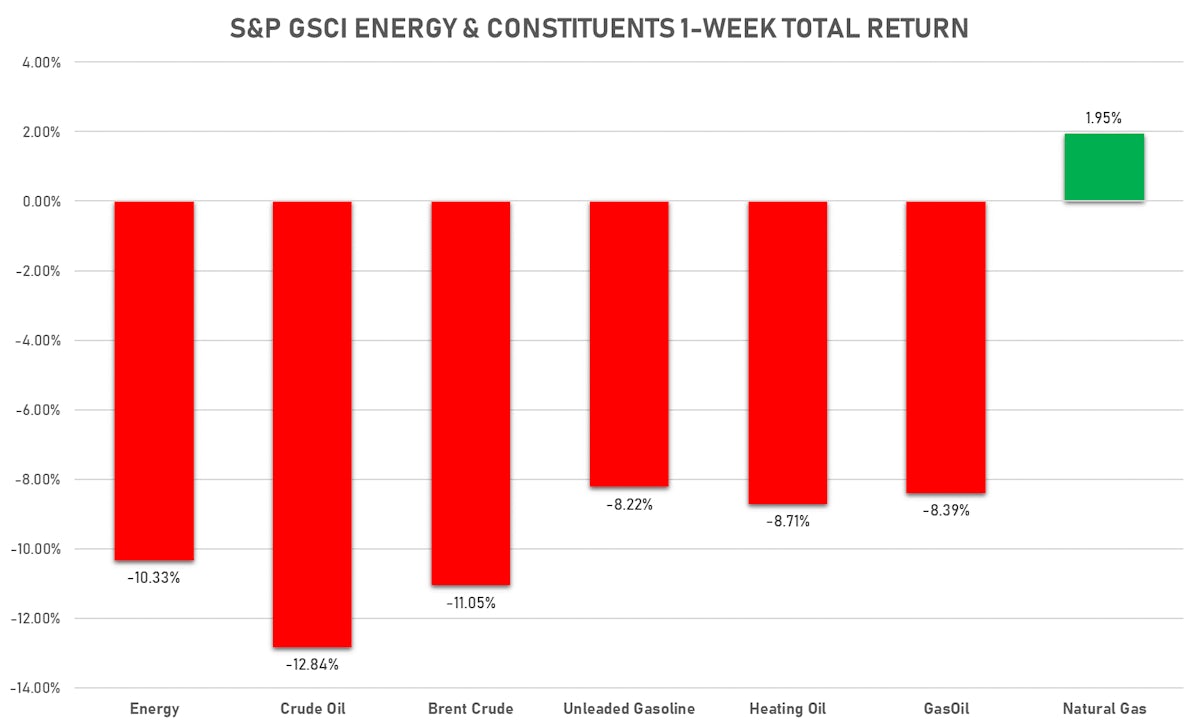

ENERGY THIS WEEK

- WTI crude front month currently at US$ 99.27 per barrel, down -12.8% (YTD: +28.9%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 104.39 per barrel, down -13.5% (YTD: +31.6%)

- Newcastle Coal (ICE Europe) currently at US$ 258.75 per tonne, down -20.9% (YTD: +52.1%)

- Natural Gas (Henry Hub) currently at US$ 5.72 per MMBtu, up 2.7% (YTD: +60.6%)

- Gasoline (NYMEX) currently at US$ 3.15 per gallon, down -9.1% (YTD: +37.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1091.00 per tonne, down -8.8% (YTD: +61.0%)

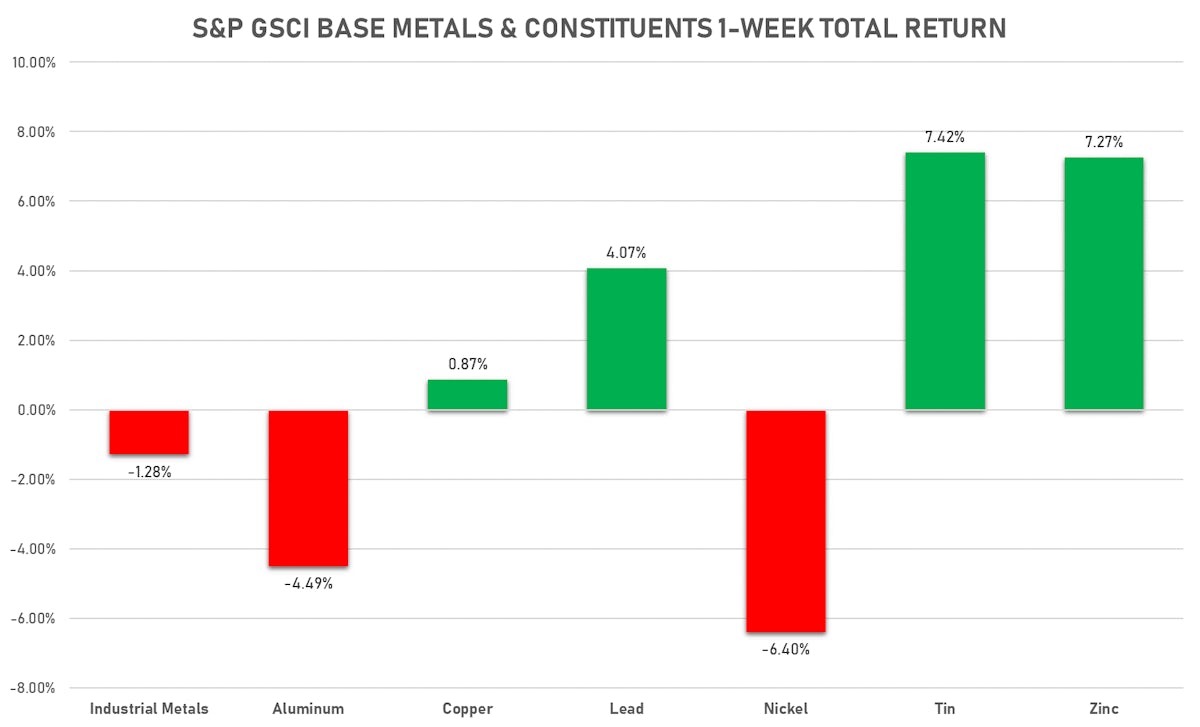

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.70 per pound, down -0.1% (YTD: +6.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 940.50 per tonne, up 10.0% (YTD: +37.1%)

- Aluminum (Shanghai) currently at CNY 22,725 per tonne, down -1.3% (YTD: +12.3%)

- Nickel (Shanghai) currently at CNY 221,010 per tonne, down -16.1% (YTD: +46.5%)

- Lead (Shanghai) currently at CNY 15,635 per tonne, up 2.0% (YTD: +2.2%)

- Rebar (Shanghai) currently at CNY 5,115 per tonne, up 3.2% (YTD: +12.0%)

- Tin (Shanghai) currently at CNY 344,060 per tonne, down -1.2% (YTD: +14.7%)

- Zinc (Shanghai) currently at CNY 26,865 per tonne, up 2.3% (YTD: +12.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 562,500 per tonne, down -0.7% (YTD: +15.5%)

- Lithium (Shanghai) spot price currently at CNY 3,150,750 per tonne, up 0.3% (YTD: +136.0%)

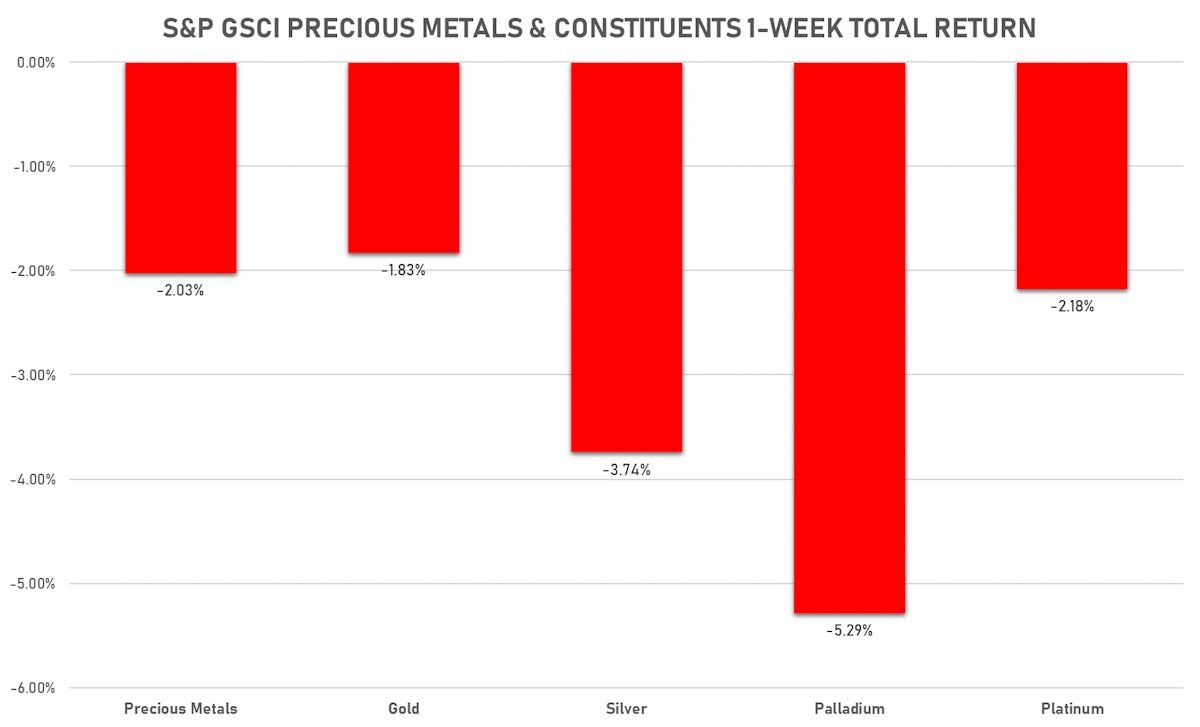

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,924.37 per troy ounce, down -1.7% (YTD: +6.0%)

- Gold 1-Month ATM implied volatility currently at 15.80, down -18.5% (YTD: +24.6%)

- Silver spot currently at US$ 24.61 per troy ounce, down -3.5% (YTD: +6.9%)

- Silver 1-Month ATM implied volatility currently at 24.83, down -13.9% (YTD: +9.6%)

- Palladium spot currently at US$ 2,277.52 per troy ounce, down -2.8% (YTD: +15.9%)

- Platinum spot currently at US$ 985.60 per troy ounce, down -1.5% (YTD: +2.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,500 per troy ounce, up 4.3% (YTD: +38.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,100 per troy ounce, unchanged (YTD: +27.5%)

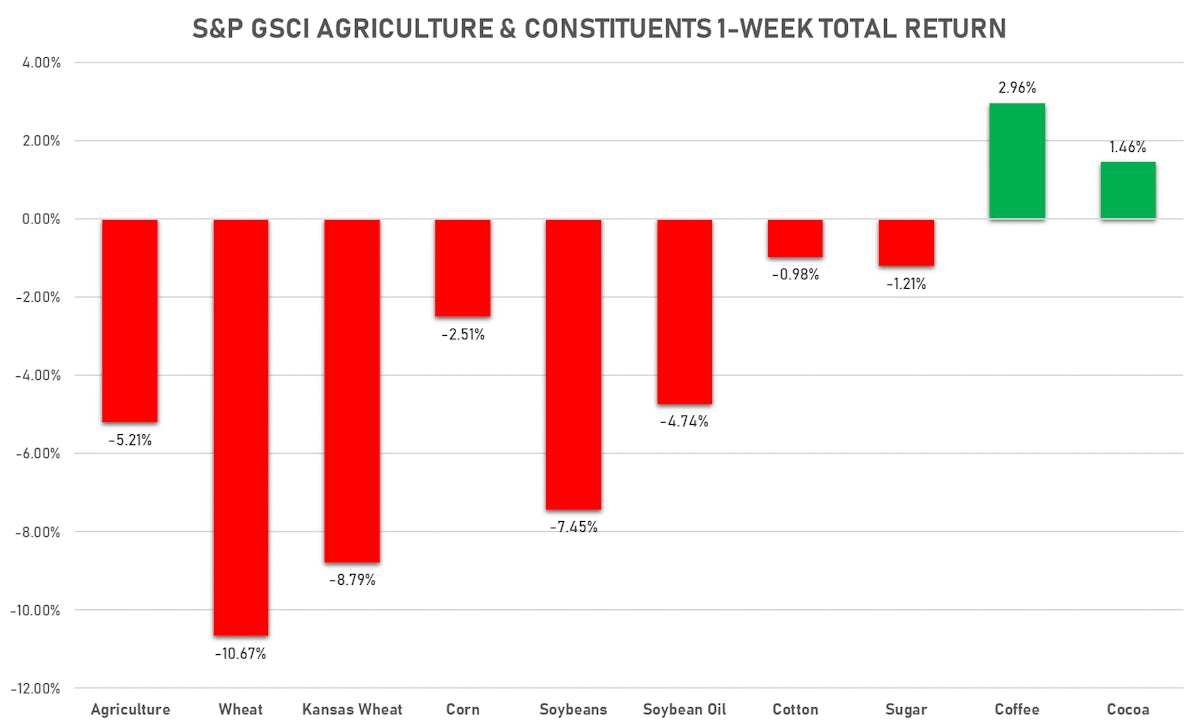

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 138.65 cents per pound, down 1.3% (YTD: -0.3%)

- Lean Hogs (CME) currently at US$ 101.30 cents per pound, down -5.7% (YTD: +22.5%)

- Rough Rice (CBOT) currently at US$ 16.01 cents per hundredweight, down -1.5% (YTD: +9.8%)

- Soybeans Composite (CBOT) currently at US$ 1,582.75 cents per bushel, down -7.5% (YTD: +19.2%)

- Corn (CBOT) currently at US$ 735.00 cents per bushel, down -2.5% (YTD: +23.3%)

- Wheat Composite (CBOT) currently at US$ 984.50 cents per bushel, down -10.7% (YTD: +26.3%)

- Sugar No.11 (ICE US) currently at US$ 19.34 cents per pound, down -1.2% (YTD: +3.1%)

- Cotton No.2 (ICE US) currently at US$ 134.84 cents per pound, down -1.0% (YTD: +17.7%)

- Cocoa (ICE US) currently at US$ 2,598 per tonne, up 1.4% (YTD: +1.6%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,794 per tonne, up 1.5% (YTD: +5.2%)

- Random Length Lumber (CME) currently at US$ 964.90 per 1,000 board feet, down -4.3% (YTD: -16.7%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,390 per tonne, up 2.1% (YTD: -0.7%)

- Soybean Oil Composite (CBOT) currently at US$ 71.20 cents per pound, down -4.7% (YTD: +27.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 6,383 per tonne, down -3.8% (YTD: +23.6%)

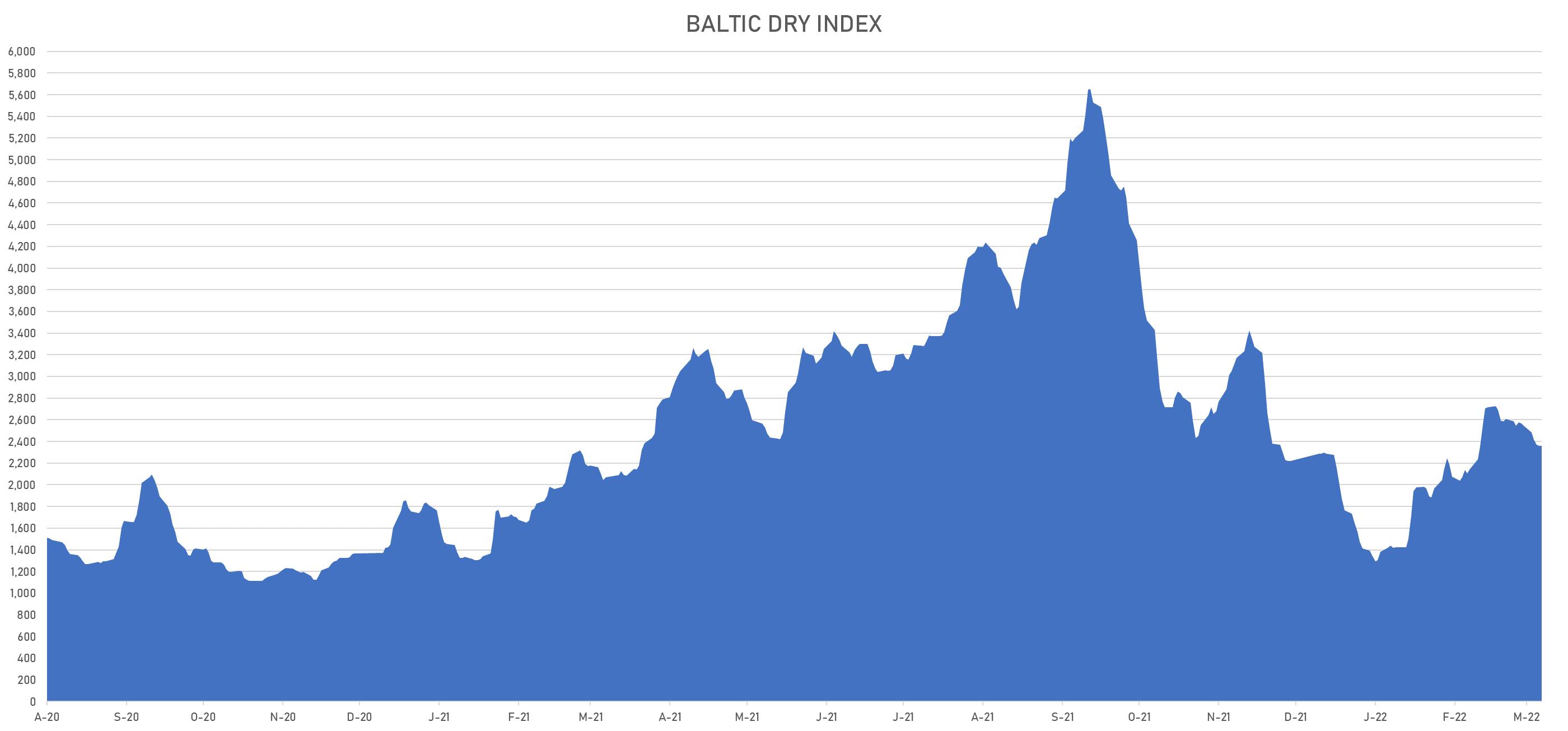

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 2,357, down -7.4% (YTD: +6.2%)

- Freightos China To North America West Coast Container Index currently at 15,928, up 0.7% (YTD: +16.2%)

- Freightos North America West Coast To China Container Index currently at 1,008, up 0.4% (YTD: +15.2%)

- Freightos North America East Coast To Europe Container Index currently at 626, down -0.2% (YTD: +15.9%)

- Freightos Europe To North America East Coast Container Index currently at 7,627, down -6.3% (YTD: +7.4%)

- Freightos China To North Europe Container Index currently at 12,050, down -1.5% (YTD: -15.2%)

- Freightos North Europe To China Container Index currently at 859, down -6.0% (YTD: -24.0%)

- Freightos Europe To South America West Coast Container Index currently at 8,496, up 3.7% (YTD: +8.8%)

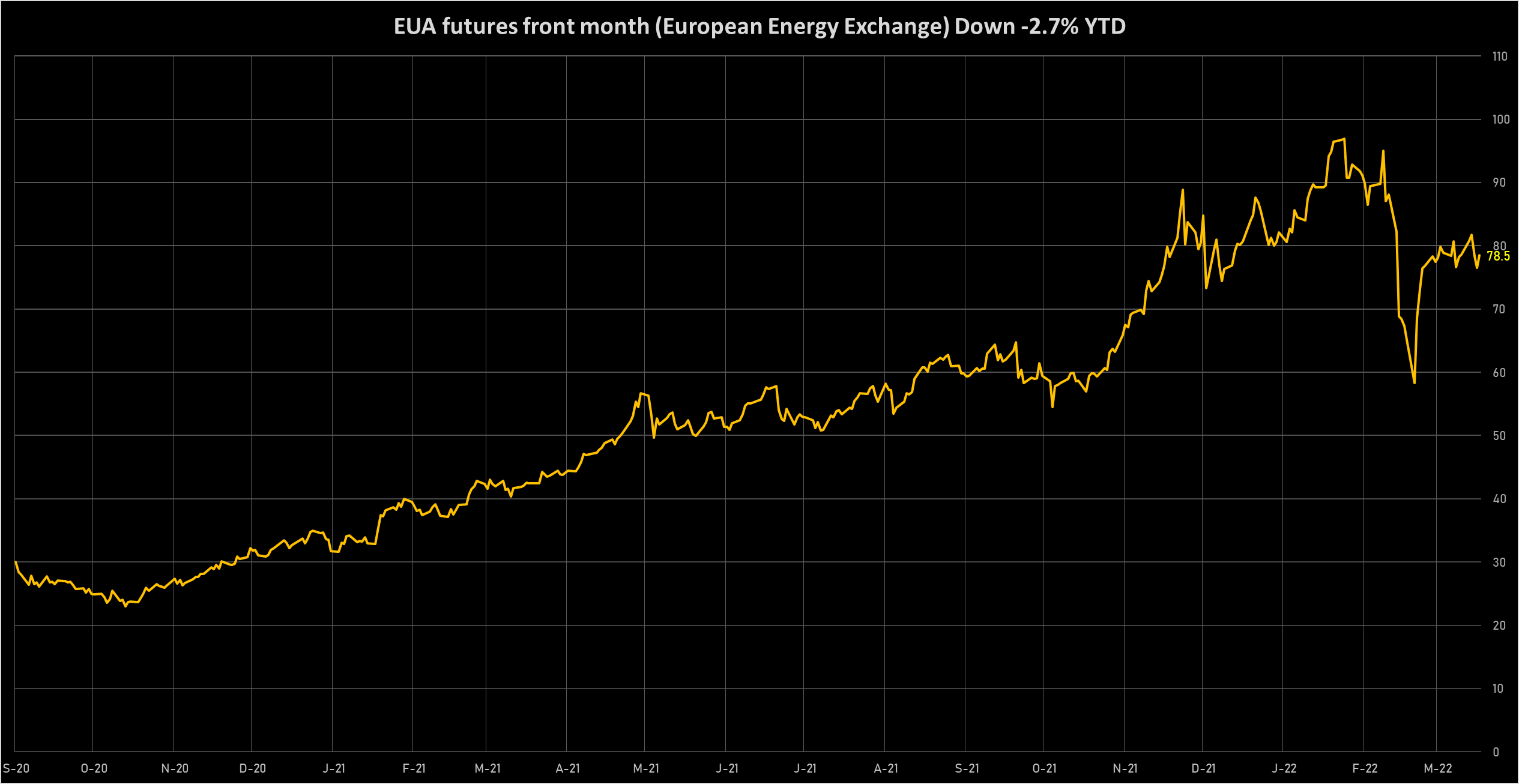

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 78.49 per tonne, down -0.1% (YTD: -2.1%)

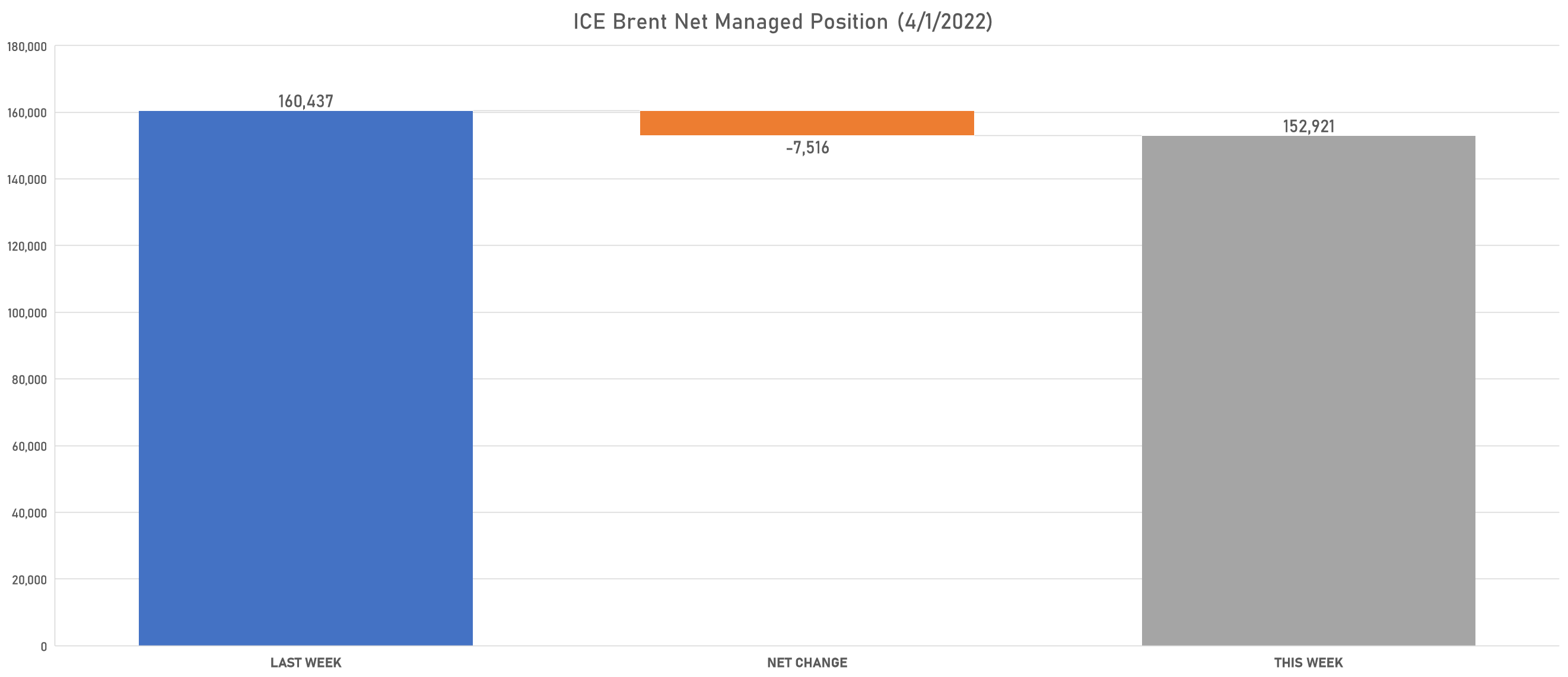

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum reduced net long position

- Palladium turned to net short

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat reduced net long position

- Corn reduced net long position

- Rough Rice reduced net long position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle reduced net short position

- Cocoa increased net long position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position