Commodities

WTI Crude Stabilizes In The Mid 60's And CO2 Emission Permits Rise To New Record

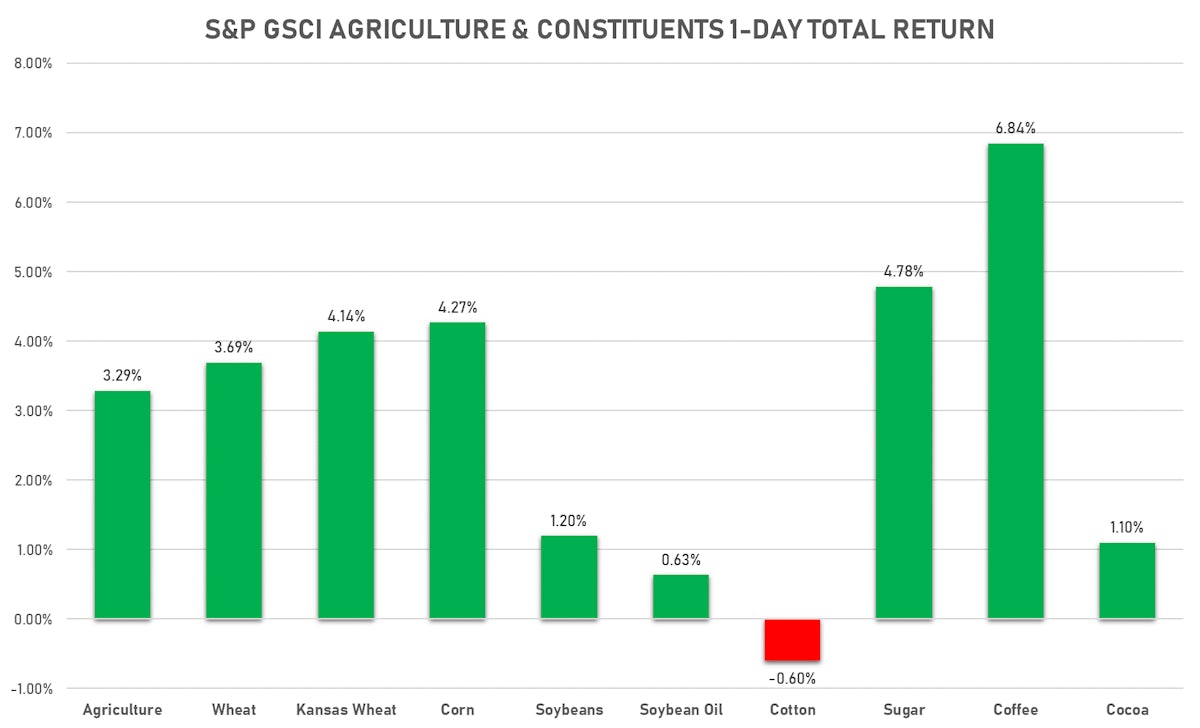

Food-related commodities (such as milk, cheese, coffee) up on the day, stoking short-term inflation concerns

Published ET

Sources: ϕpost, Refinitiv data

NOTABLE GAINERS

- Freightos Baltic China/East Asia To Mediterranean 40 Container Index up 9.5% (YTD: 65.7%)

- CME Class III Milk up 8.6% (YTD: 21.2%)

- CME Non Fat Dry Milk up 7.9% (YTD: 11.8%)

- CME Cash Settled Cheese up 7.6% (YTD: 11.7%)

- ICE-US Coffee up 6.9% (YTD: 15.8%)

- Pork Primal Cutout Butt up 4.0% (YTD: 59.1%)

- CBOE Crude Oil Volatility Index up 3.2% (YTD: 1.3%)

- ICE-US Cocoa up 3.1% (YTD: -9.6%)

- Pork Primal Cutout Belly up 2.9% (YTD: 46.6%)

NOTABLE LOSERS

- Pork Loads Cuts down -39.9% (YTD: -20.4%)

- Pork Primal Cutout Picnic down -5.7% (YTD: 43.5%)

- Freightos Baltic Europe To South America East Coast 40 Container Index down -5.2% (YTD: 128.4%)

- Silver/US Dollar 1 Month ATM Option down -1.9% (YTD: -36.4%)

- CBoT Soybean Oil down -1.8% (YTD: 54.0%)

- ICE Brent Crude Spread Spread down -1.7% (YTD: 415.6%)

- NYMEX Henry Hub Natural Gas down -1.0% (YTD: 15.7%)

- Freightos Baltic Europe To North America East Coast 40 Container Index down -0.9% (YTD: 81.9%)

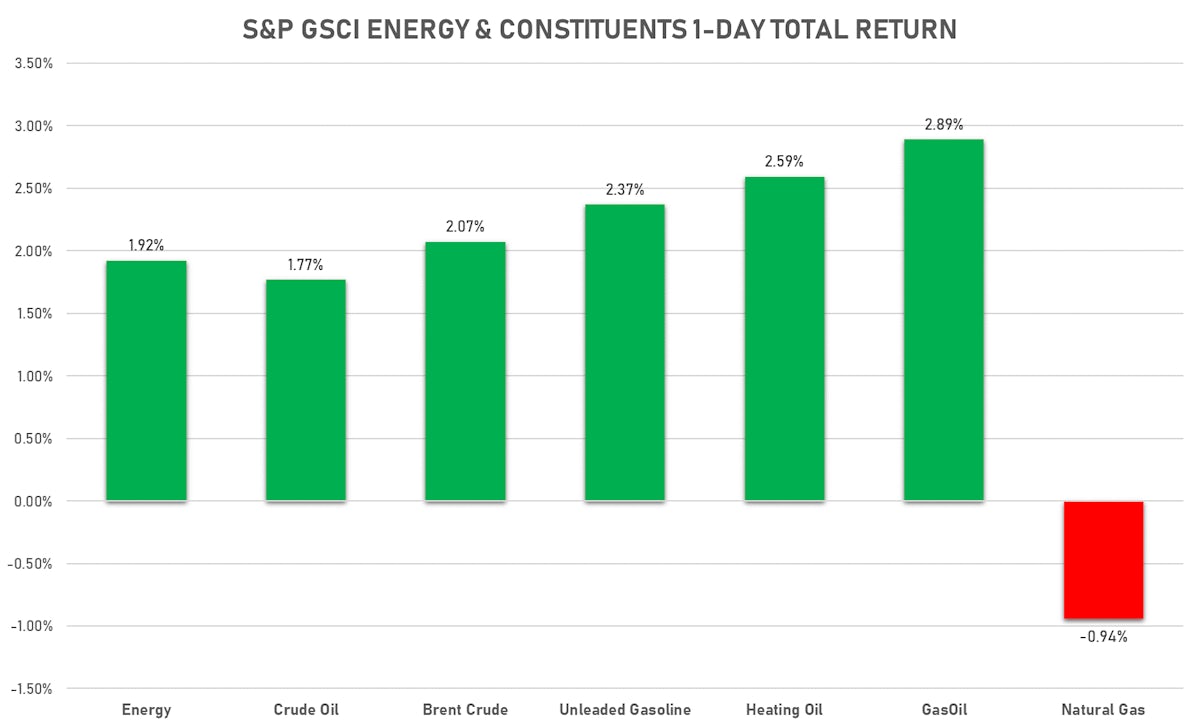

ENERGY

- WTI crude front month currently at US$ 65.42 per barrel, down -0.1% on the day (YTD: +35.3%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 68.80 per barrel, up 0.1% on the day (YTD: +33.1%); 6-month term structure in tightening backwardation

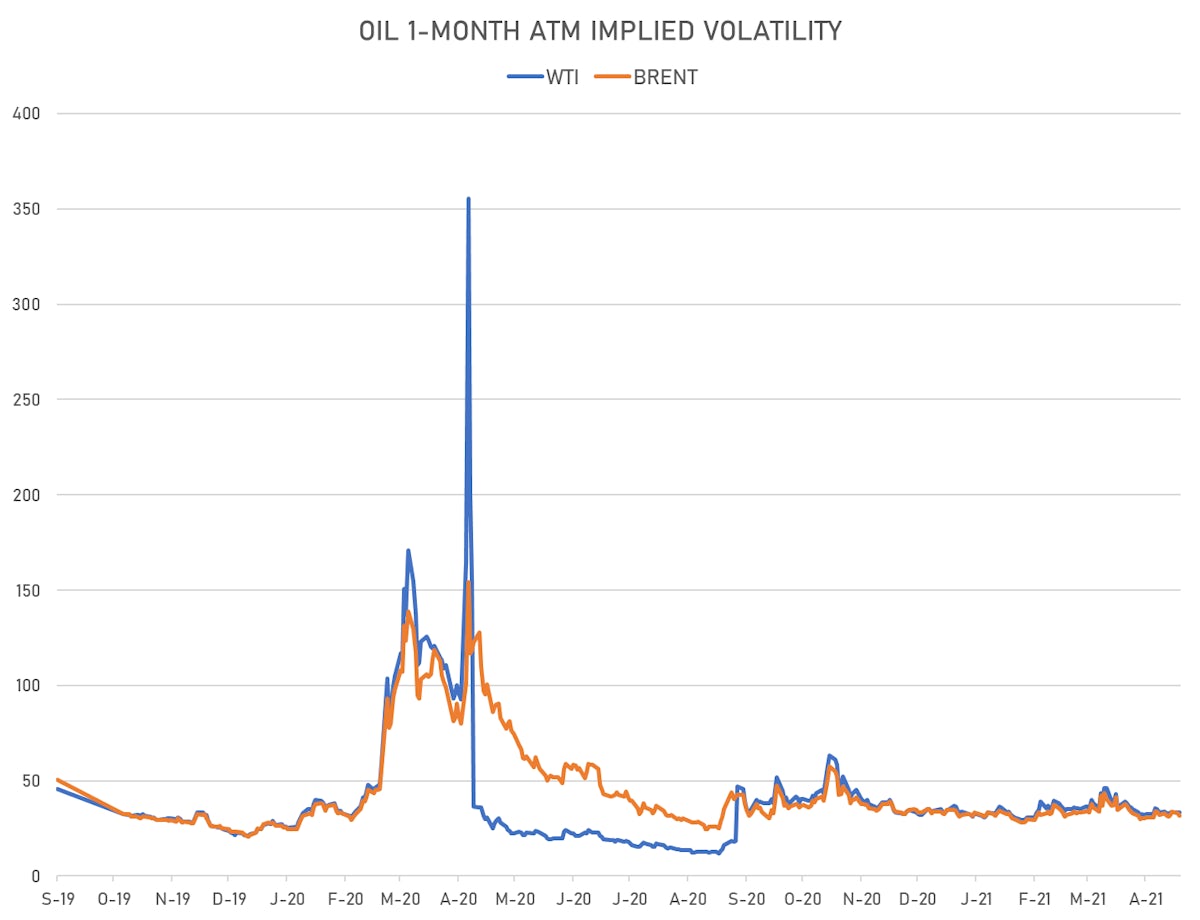

- Brent volatility at 31.5, down -4.6% on the day (12-month range: 24.7 - 90.3)

- Newcastle Coal (ICE Europe) currently at US$ 93.80 per tonne, up 0.9% on the day (YTD: +16.5%)

- Natural Gas (Henry Hub) currently at US$ 2.95 per MMBtu, down -1.0% on the day (YTD: +15.7%); 6-month term structure in widening backwardation

- Gasoline (NYMEX) currently at US$ 2.14 per gallon, unchanged (YTD: +52.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 553.25 per tonne, up 1.5% on the day (YTD: +32.9%); 6-month term structure in widening backwardation

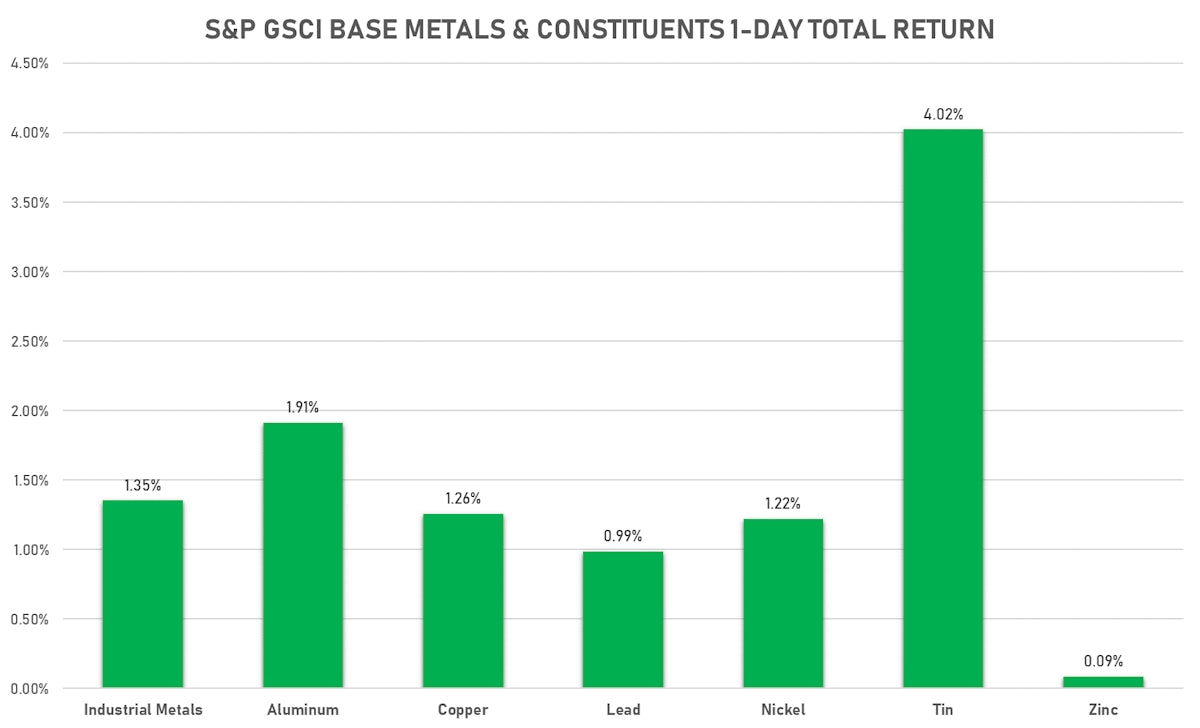

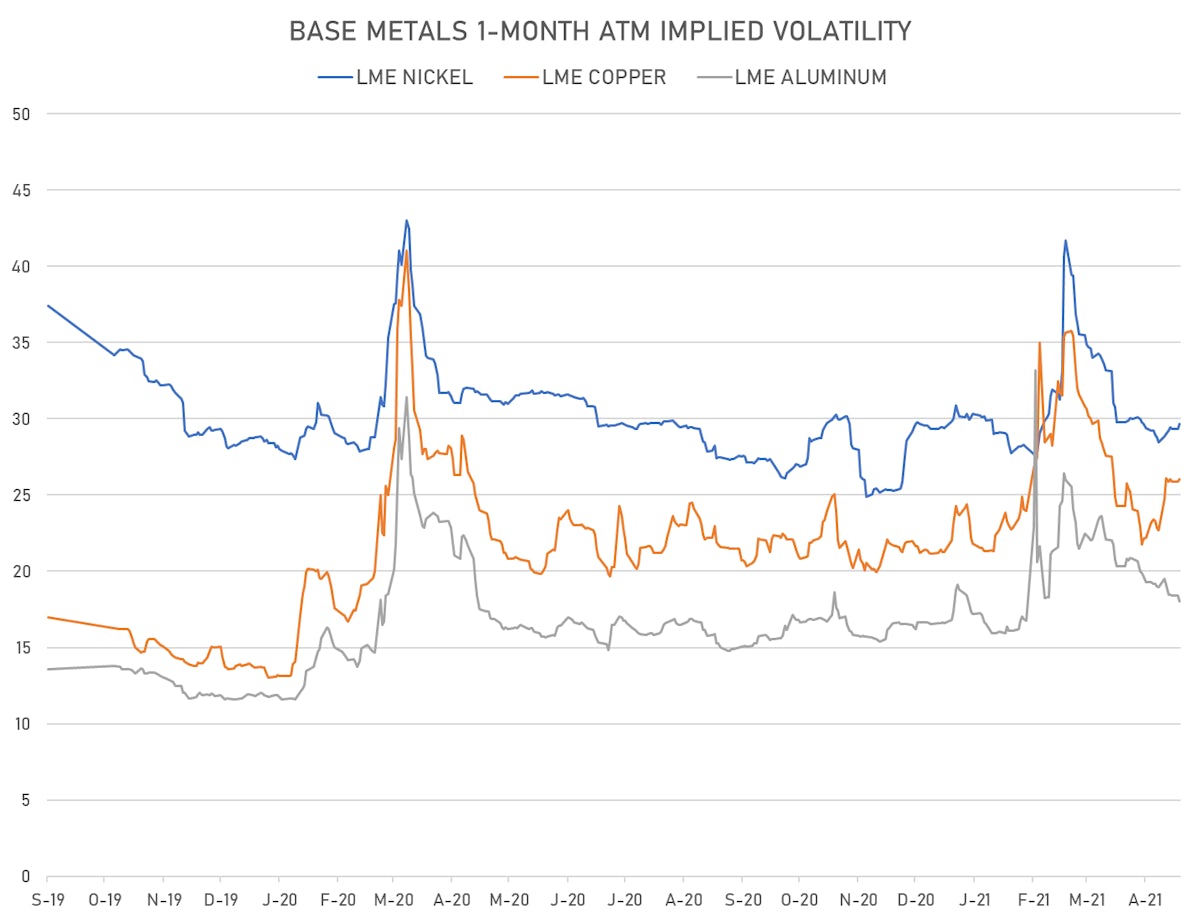

BASE METALS

- Copper (COMEX) currently at US$ 4.52 per pound, up 0.1% on the day (YTD: +29.2%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,214.00 per tonne, down -1.2% on the day (YTD: +14.5%)

- Aluminium (Shanghai) currently at CNY 19,200 per tonne, up 0.6% on the day (YTD: +20.2%)

- Nickel (Shanghai) currently at CNY 132,590 per tonne, up 0.1% on the day (YTD: +4.9%)

- Lead (Shanghai) currently at CNY 15,360 per tonne, down -0.9% on the day (YTD: +2.7%)

- Rebar (Shanghai) currently at CNY 5,441 per tonne, unchanged (YTD: +27.1%)

- Tin (Shanghai) currently at CNY 197,870 per tonne, up 1.0% on the day (YTD: +27.6%)

- Zinc (Shanghai) currently at CNY 21,875 per tonne, down -1.4% on the day (YTD: +5.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 350,500 per tonne, unchanged (YTD: +27.9%)

- Lithium (Shanghai) spot price currently at CNY 585,000 per tonne, unchanged (YTD: +20.6%)

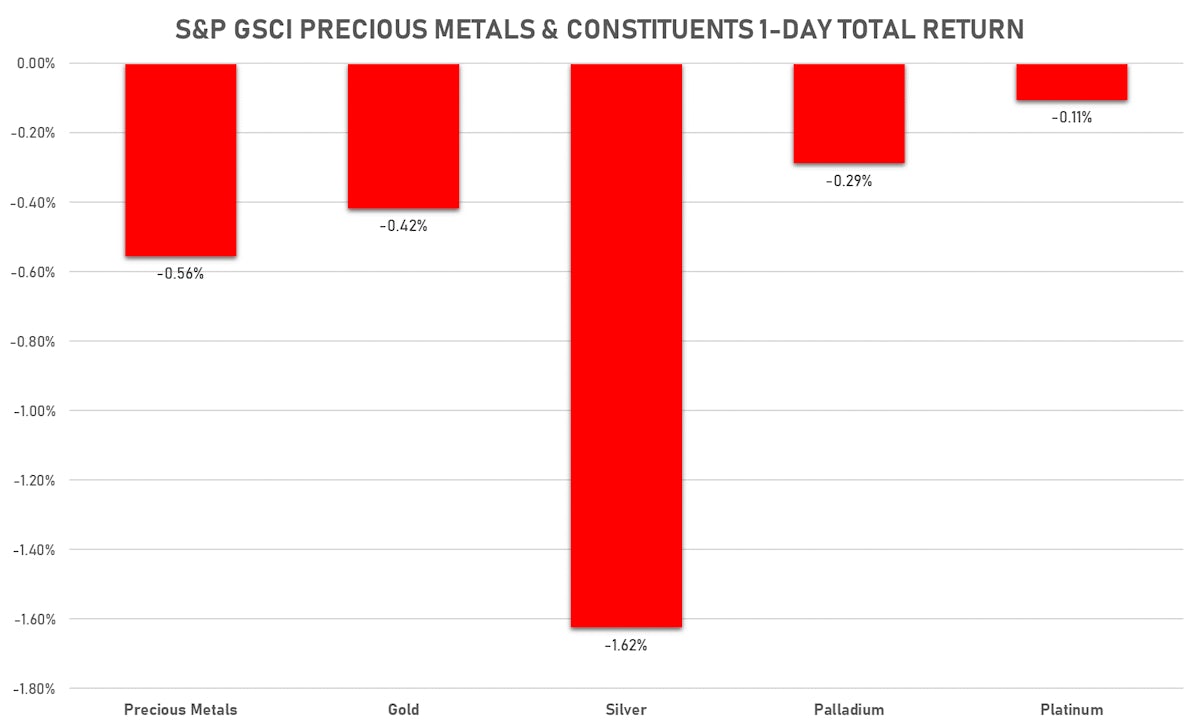

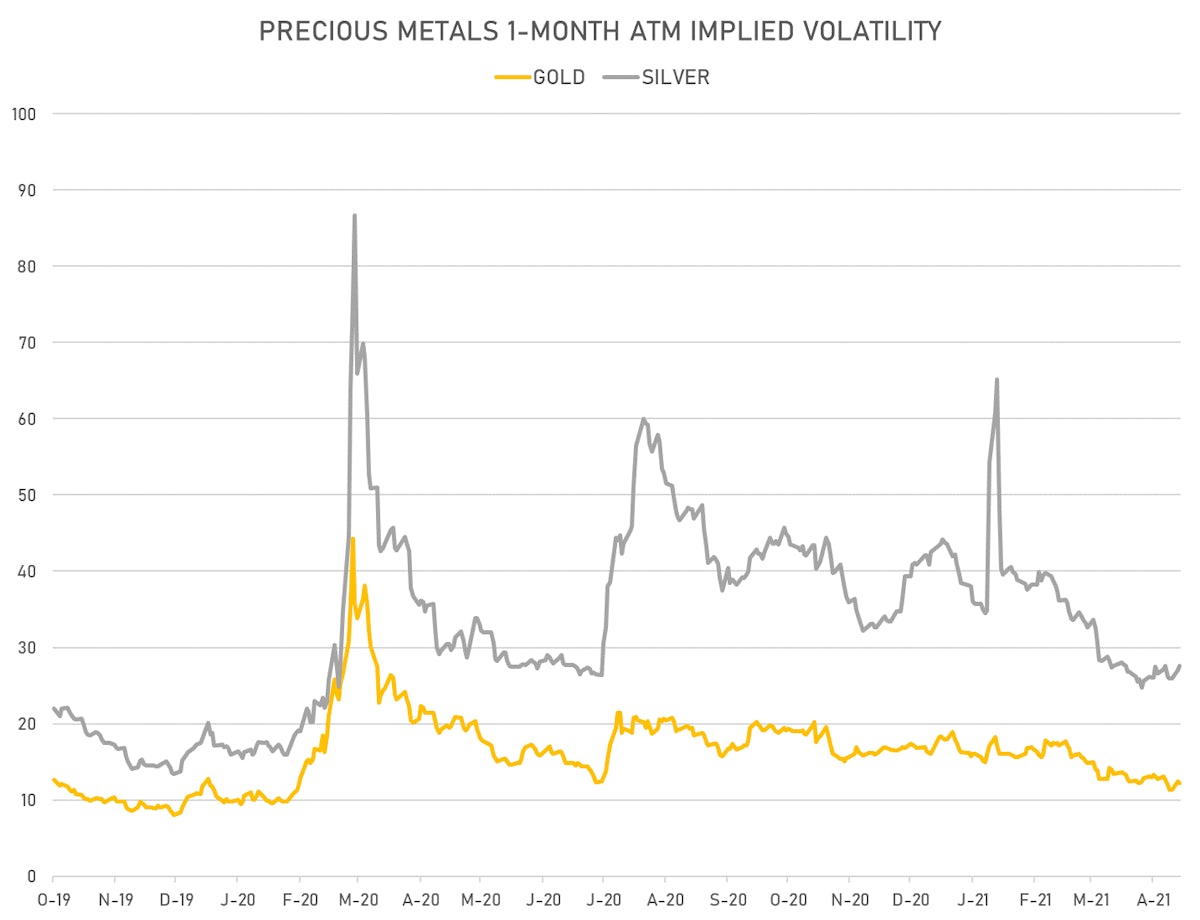

PRECIOUS METALS

- Gold spot currently at US$ 1,785.00 per troy ounce, up 0.4% on the day (YTD: -5.9%)

- Gold 1-Month ATM implied volatility currently at 11.73, unchanged (YTD: -24.2%)

- Silver spot currently at US$ 26.39 per troy ounce, down -0.1% on the day (YTD: +0.4%)

- Silver 1-Month ATM implied volatility currently at 25.87, down -1.9% on the day (YTD: -36.4%)

- Palladium spot currently at US$ 2,968.16 per troy ounce, down -0.2% on the day (YTD: +21.6%)

- Platinum spot currently at US$ 1,219.20 per troy ounce, down -0.7% on the day (YTD: +14.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 29,300 per troy ounce, down -0.7% on the day (YTD: +71.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

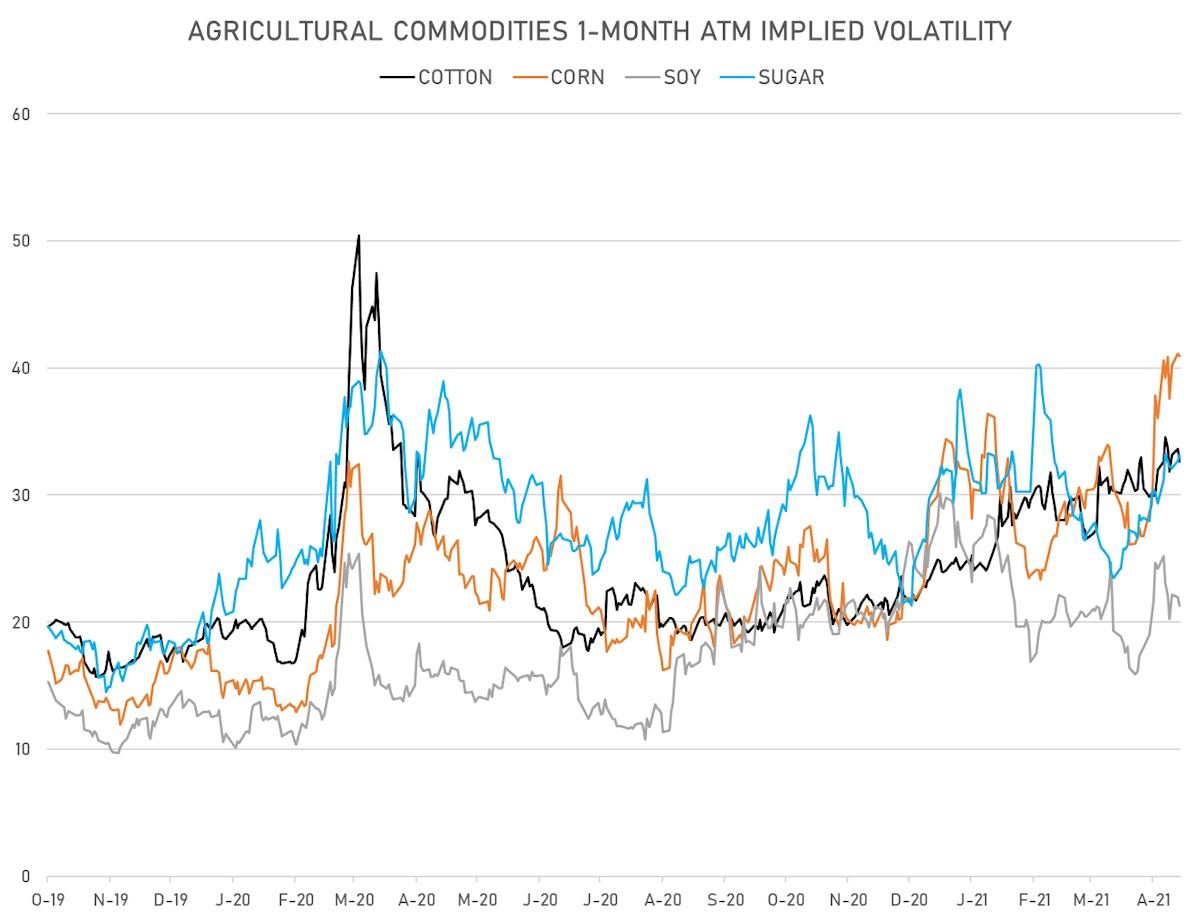

AGRO

- Live Cattle (CME) currently at US$ 114.43 cents per pound, up 1.2% on the day (YTD: +1.3%)

- Lean Hogs (CME) currently at US$ 111.38 cents per pound, up 0.2% on the day (YTD: +58.5%)

- Rough Rice (CBOT) currently at US$ 14.13 cents per hundredweight, up 2.1% on the day (YTD: +13.9%)

- Soybeans Composite (CBOT) currently at US$ 1,582.00 cents per bushel, up 0.3% on the day (YTD: +20.3%)

- Corn (CBOT) currently at US$ 767.50 cents per bushel, up 1.1% on the day (YTD: +55.6%)

- Wheat Composite (CBOT) currently at US$ 760.00 cents per bushel, up 2.5% on the day (YTD: +18.0%)

- Sugar No.11 (ICE US) currently at US$ 17.53 cents per pound, up 2.4% on the day (YTD: +13.2%)

- Cotton No.2 (ICE US) currently at US$ 86.23 cents per pound, up 0.1% on the day (YTD: +10.4%)

- Cocoa (ICE US) currently at US$ 2,354 per tonne, up 3.1% on the day (YTD: -9.6%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,444 per tonne, up 0.3% on the day (YTD: +8.8%)

- Random Length Lumber (CME) currently at US$ 1,634.90 per 1,000 board feet, up 1.6% on the day (YTD: +87.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,100 per tonne, down -0.2% on the day (YTD: +10.2%)

- Soybean Oil Composite (CBOT) currently at US$ 66.74 cents per pound, down -1.8% on the day (YTD: +54.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,598 per tonne, up 0.1% on the day (YTD: +18.2%)

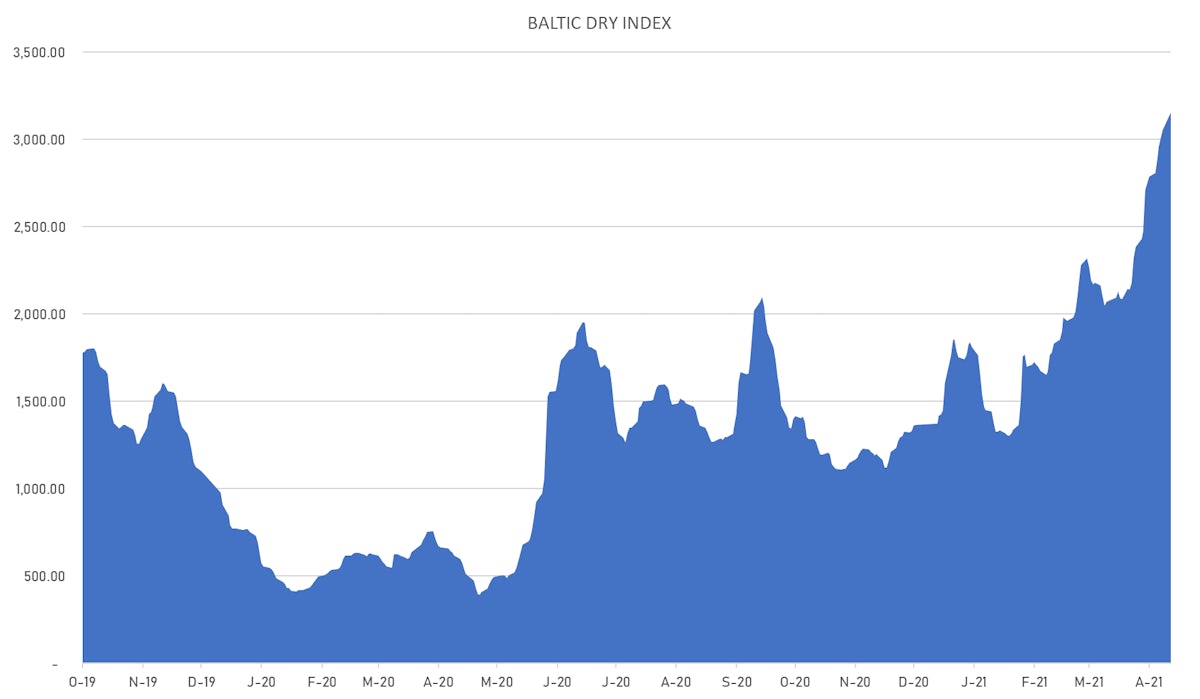

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,157, up 3.4% on the day (YTD: +131.1%)

- Freightos China To North America West Coast Container Index currently at 4,968, unchanged (YTD: +28.2%)

- Freightos North America West Coast To China Container Index currently at 812, unchanged (YTD: +56.9%)

- Freightos North America East Coast To Europe Container Index currently at 495, unchanged (YTD: +47.3%)

- Freightos Europe To North America East Coast Container Index currently at 3,501, down -0.9% on the day (YTD: +81.9%)

- Freightos China To North Europe Container Index currently at 8,169, up 1.6% on the day (YTD: +67.3%)

- Freightos North Europe To China Container Index currently at 1,747, unchanged (YTD: +27.1%)

- Freightos Europe To South America West Coast Container Index currently at 3,043, unchanged (YTD: +79.9%)

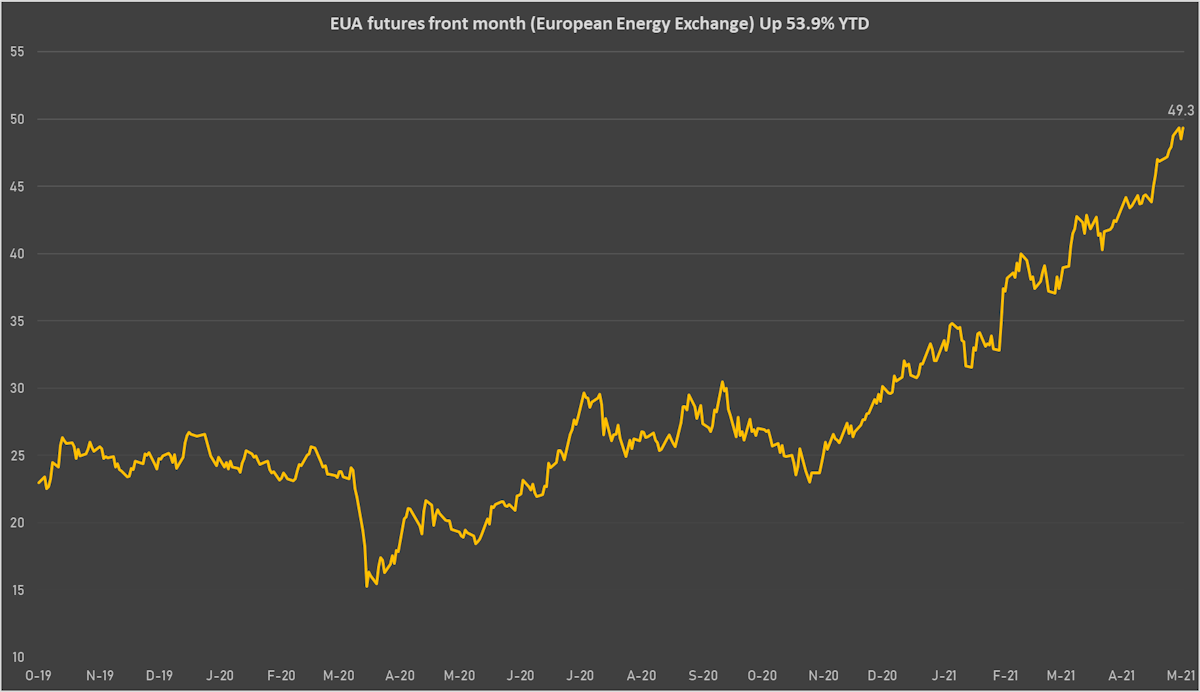

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 48.50 per tonne, up 1.7% on the day (YTD: +53.9%)