Commodities

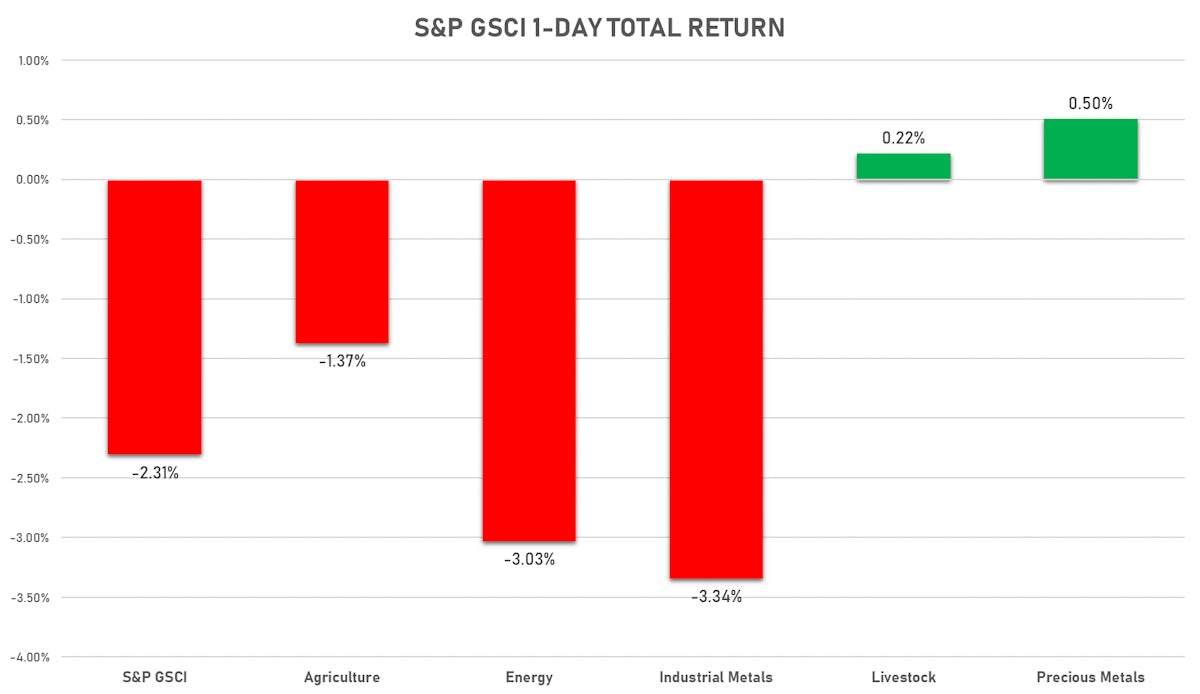

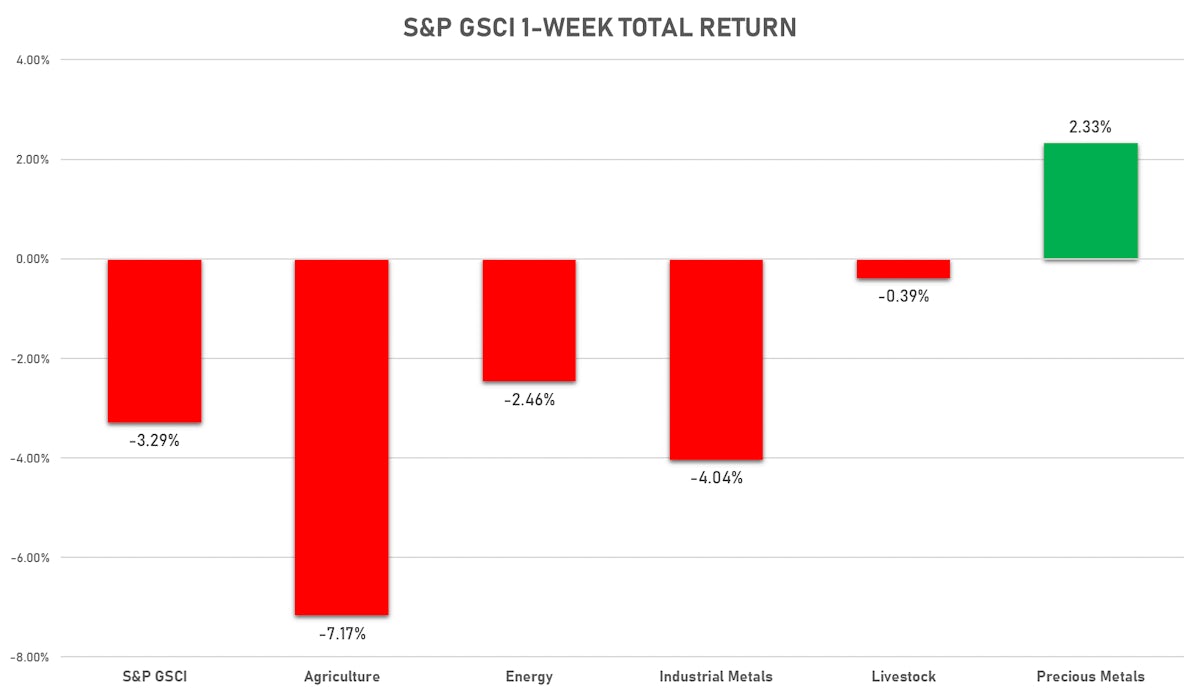

Energy, Agriculture, Base Metals All End Up In The Red As Volatility Rises

Lumber Up 5% Today For The First Daily Gain This Week after a big fall

Published ET

10-Year investment in commodities a big loser except for precious metals | Sources: ϕpost, FactSet data

NOTABLE GAINERS

- Gold/US Dollar 1 Month ATM Option Volatility up 5.9% (YTD: -7.9%)

- CME Random Length Lumber up 5.0% (YTD: 52.0%)

- CBOE Crude Oil Volatility Index up 4.9% (YTD: 2.6%)

- Coffee Arabica Colombia Excelso Spot up 4.0% (YTD: 14.6%)

- Coffee Robusta Vietnam Grade 1 Spot up 3.5% (YTD: 3.5%)

- SHFE Lead Continuation Month 1 up 1.7% (YTD: 6.0%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index up 1.6% (YTD: 58.0%)

- DCE Iron Ore Continuation Month 1 up 0.9% (YTD: 20.0%)

NOTABLE LOSERS

- SMM Rare Earth Terbium Oxide Spot Price Daily down -8.1% (YTD: -13.8%)

- ICE Europe CO2 EUA Yearly down -6.4% (YTD: 51.8%)

- EEX European-Carbon- Secondary Trading down -6.3% (YTD: 54.6%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index down -6.2% (YTD: 30.3%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index down -5.0% (YTD: 38.4%)

- ICE Europe Low Sulphur Gasoil down -4.0% (YTD: 29.2%)

- SHFE Hot Rolled Coil down -4.0% (YTD: 28.2%)

- SMM Rare Earth Praseodymium Metal Spot Price Daily down -3.5% (YTD: 21.2%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily down -3.5% (YTD: 21.9%)

- Crude Oil WTI Cushing US FOB down -3.4% (YTD: 30.9%)

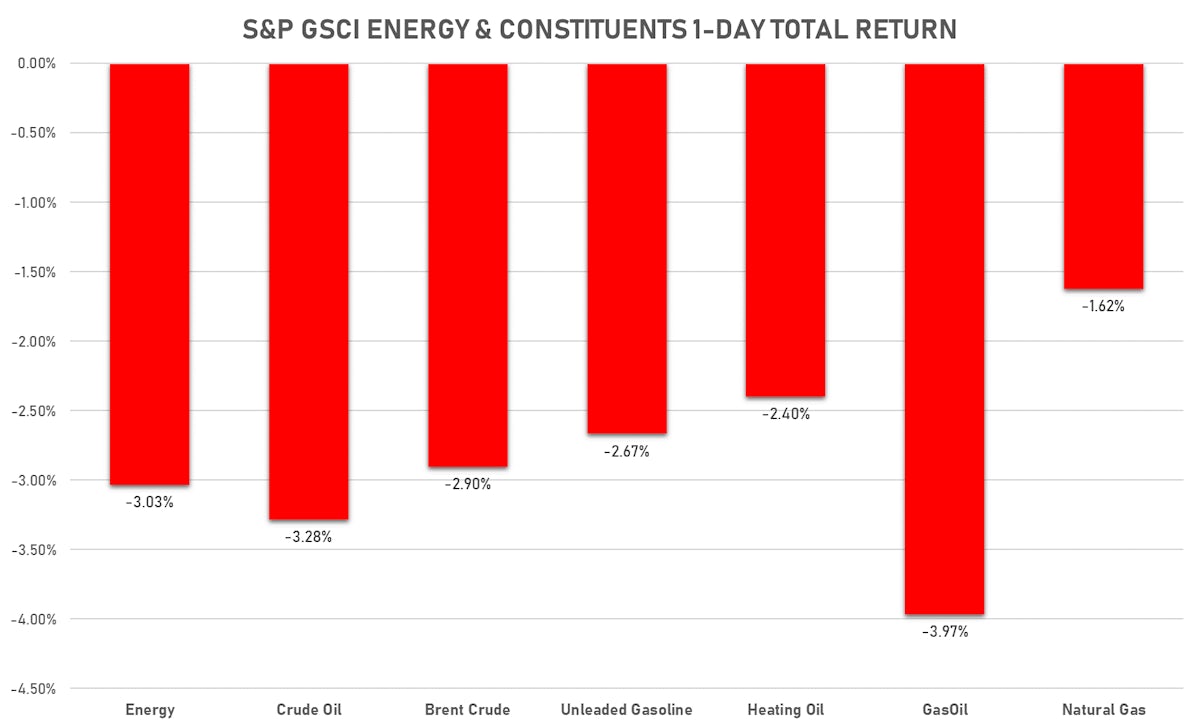

ENERGY

- WTI crude front month currently at US$ 63.37 per barrel, down -3.3% on the day (YTD: +30.6%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 66.62 per barrel, down -3.0% on the day (YTD: +28.7%); 6-month term structure in tightening backwardation

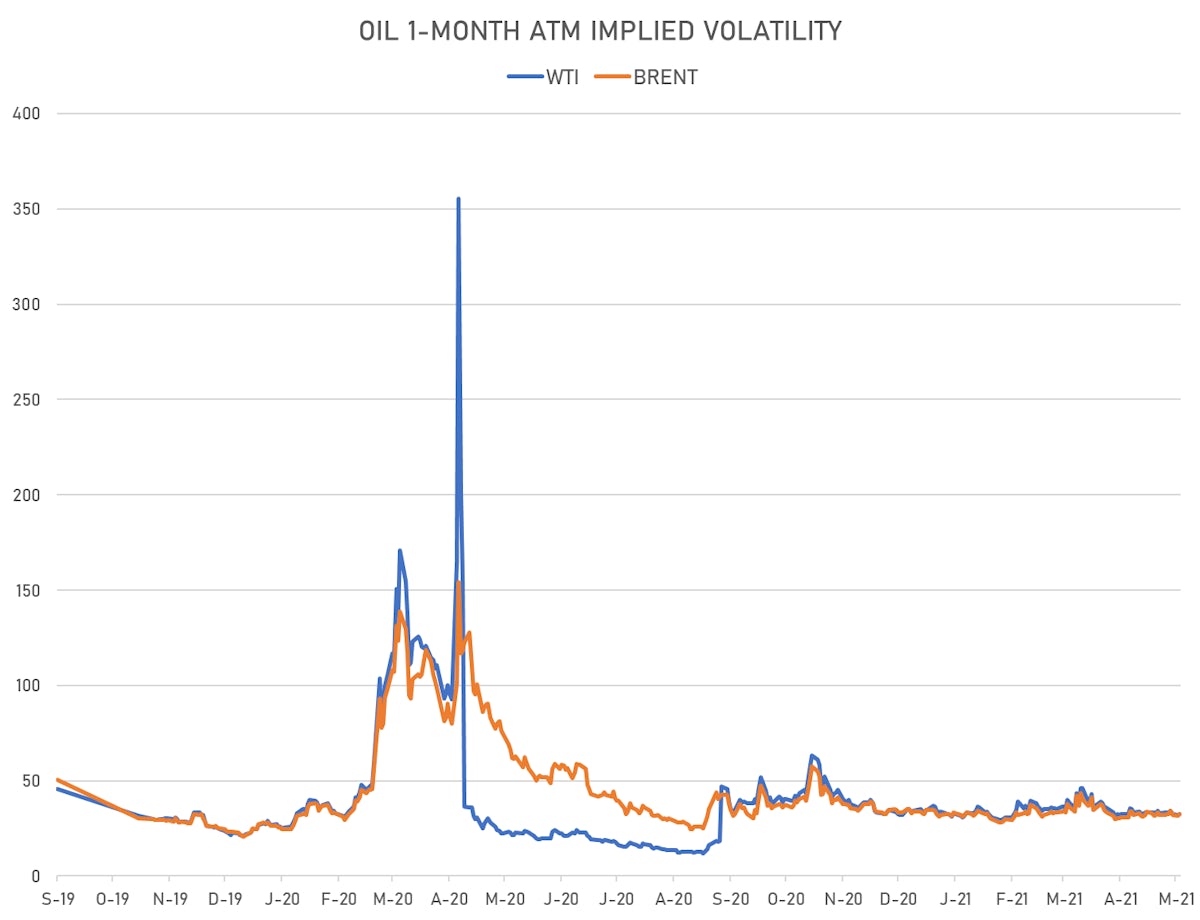

- Brent volatility at 32.7, up 3.0% on the day (12-month range: 24.7 - 66.4)

- Newcastle Coal (ICE Europe) currently at US$ 99.10 per tonne, unchanged (YTD: +23.1%)

- Natural Gas (Henry Hub) currently at US$ 2.96 per MMBtu, down -1.6% on the day (YTD: +16.7%); 6-month term structure in tightening backwardation

- Gasoline (NYMEX) currently at US$ 2.10 per gallon, down -2.7% on the day (YTD: +49.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 548.00 per tonne, down -4.0% on the day (YTD: +29.2%); 6-month term structure in tightening backwardation

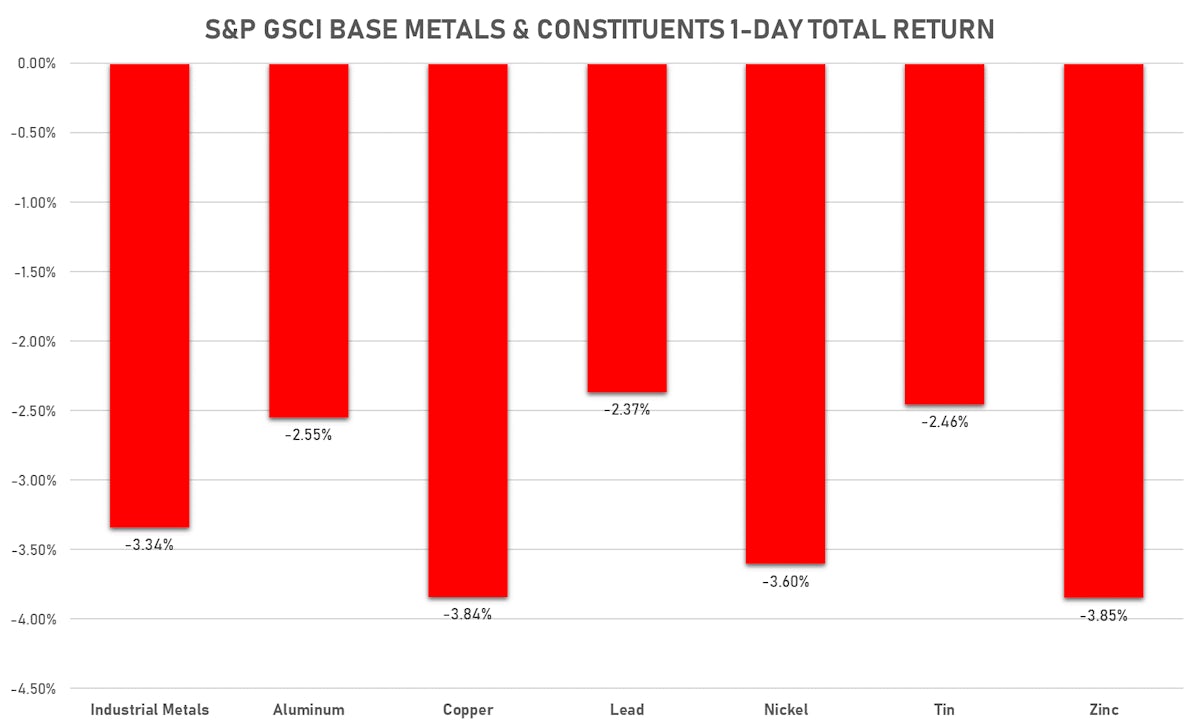

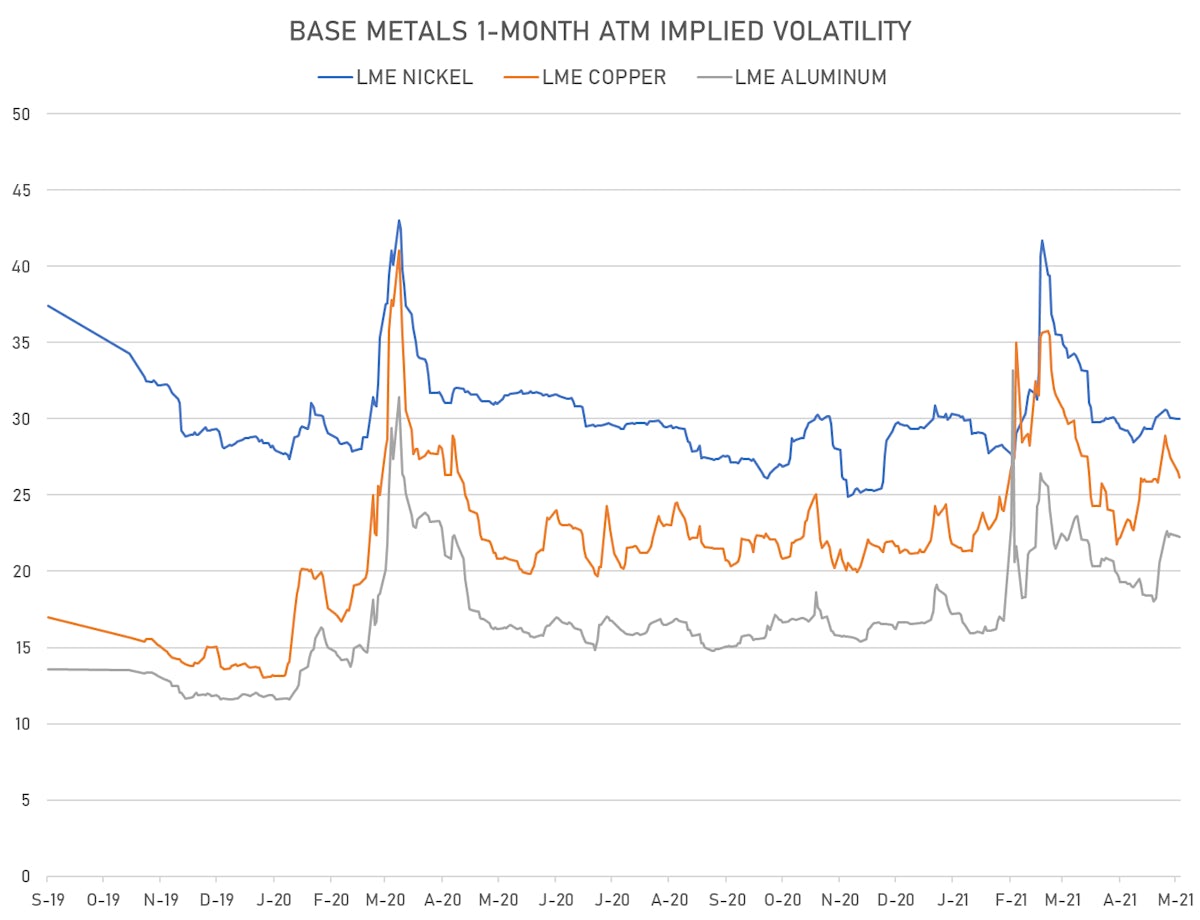

BASE METALS

- Copper (COMEX) currently at US$ 4.59 per pound, down -3.1% on the day (YTD: +30.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,198.50 per tonne, up 0.9% on the day (YTD: +20.0%)

- Aluminium (Shanghai) currently at CNY 18,970 per tonne, down -1.2% on the day (YTD: +24.4%)

- Nickel (Shanghai) currently at CNY 127,740 per tonne, up 0.3% on the day (YTD: +7.7%)

- Lead (Shanghai) currently at CNY 15,470 per tonne, up 1.7% on the day (YTD: +6.0%)

- Rebar (Shanghai) currently at CNY 5,044 per tonne, down -2.7% on the day (YTD: +27.5%)

- Tin (Shanghai) currently at CNY 194,200 per tonne, up 0.3% on the day (YTD: +32.5%)

- Zinc (Shanghai) currently at CNY 22,250 per tonne, up 0.1% on the day (YTD: +10.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 615,000 per tonne, unchanged (YTD: +26.8%)

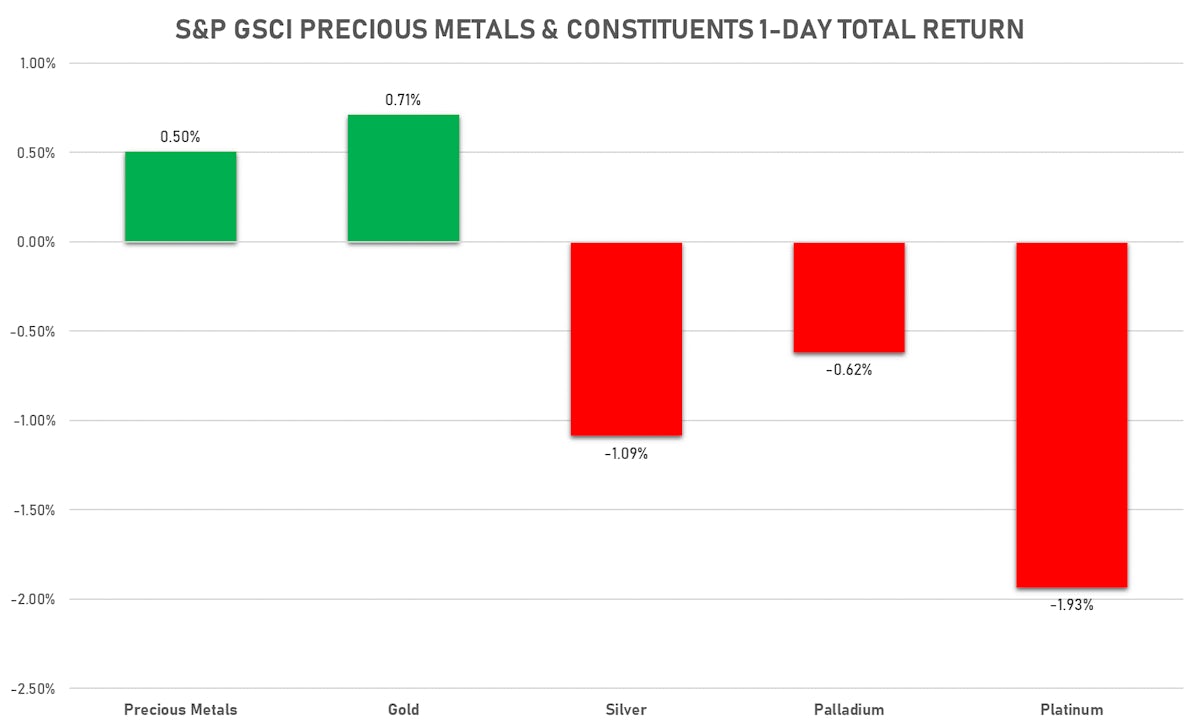

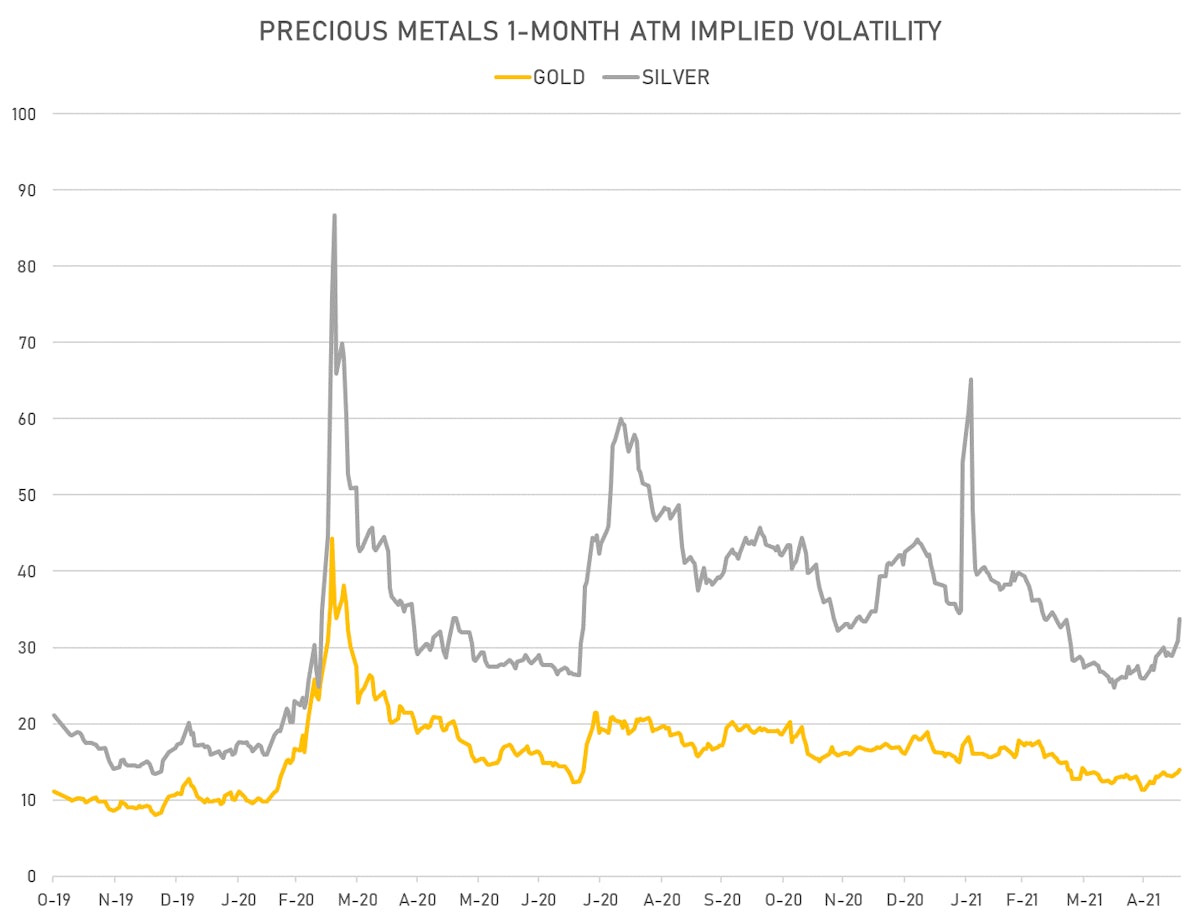

PRECIOUS METALS

- Gold spot currently at US$ 1,864.83 per troy ounce, unchanged (YTD: -1.5%)

- Gold 1-Month ATM implied volatility currently at 14.38, up 5.9% on the day (YTD: -7.9%)

- Silver spot currently at US$ 27.57 per troy ounce, down -1.6% on the day (YTD: +5.1%)

- Silver 1-Month ATM implied volatility currently at 32.52, down -0.7% on the day (YTD: -21.1%)

- Palladium spot currently at US$ 2,866.53 per troy ounce, down -1.1% on the day (YTD: +17.3%)

- Platinum spot currently at US$ 1,191.29 per troy ounce, down -2.3% on the day (YTD: +11.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 28,200 per troy ounce, unchanged (YTD: +65.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

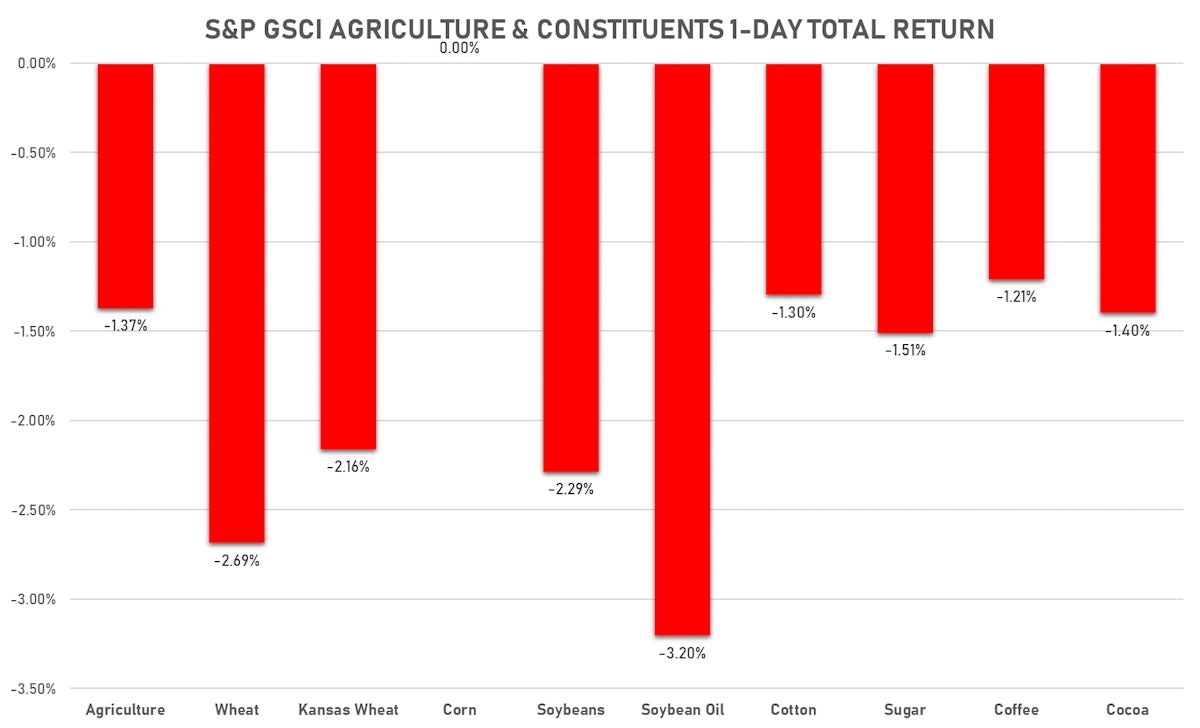

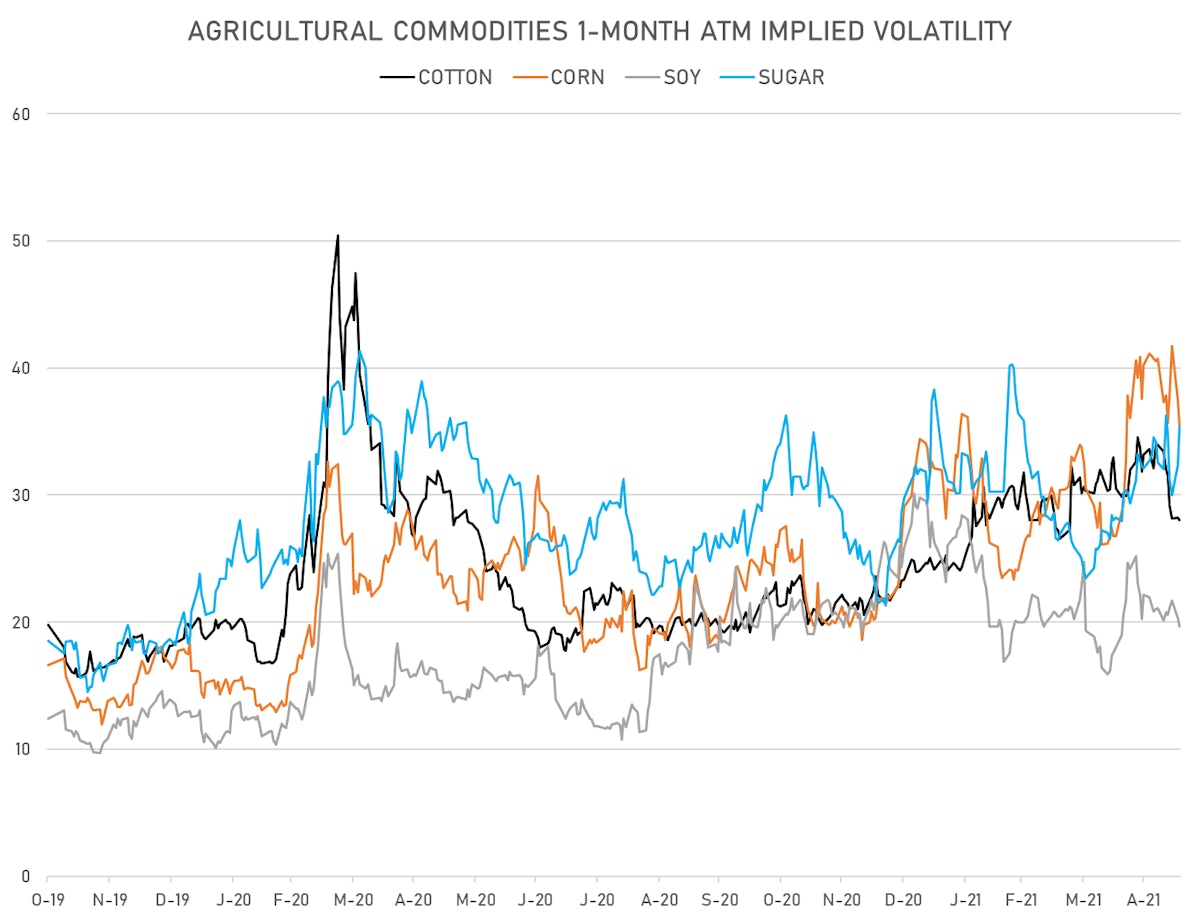

AGRO

- Live Cattle (CME) currently at US$ 116.90 cents per pound, up 0.1% on the day (YTD: +3.5%)

- Lean Hogs (CME) currently at US$ 110.95 cents per pound, up 0.3% on the day (YTD: +57.9%)

- Rough Rice (CBOT) currently at US$ 13.37 cents per hundredweight, up 0.1% on the day (YTD: +7.8%)

- Soybeans Composite (CBOT) currently at US$ 1,552.00 cents per bushel, down -2.3% on the day (YTD: +17.0%)

- Corn (CBOT) currently at US$ 666.00 cents per bushel, unchanged (YTD: +36.0%)

- Wheat Composite (CBOT) currently at US$ 686.00 cents per bushel, down -2.7% on the day (YTD: +6.0%)

- Sugar No.11 (ICE US) currently at US$ 16.95 cents per pound, down -1.5% on the day (YTD: +9.4%)

- Cotton No.2 (ICE US) currently at US$ 82.92 cents per pound, down -1.3% on the day (YTD: +6.1%)

- Cocoa (ICE US) currently at US$ 2,469 per tonne, down -1.4% on the day (YTD: -5.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,627 per tonne, up 4.0% on the day (YTD: +14.6%)

- Random Length Lumber (CME) currently at US$ 1,327.00 per 1,000 board feet, up 5.0% on the day (YTD: +52.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,345 per tonne, down -0.9% on the day (YTD: +5.4%)

- Soybean Oil Composite (CBOT) currently at US$ 66.76 cents per pound, down -3.2% on the day (YTD: +53.4%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,669 per tonne, down -3.3% on the day (YTD: +20.0%)

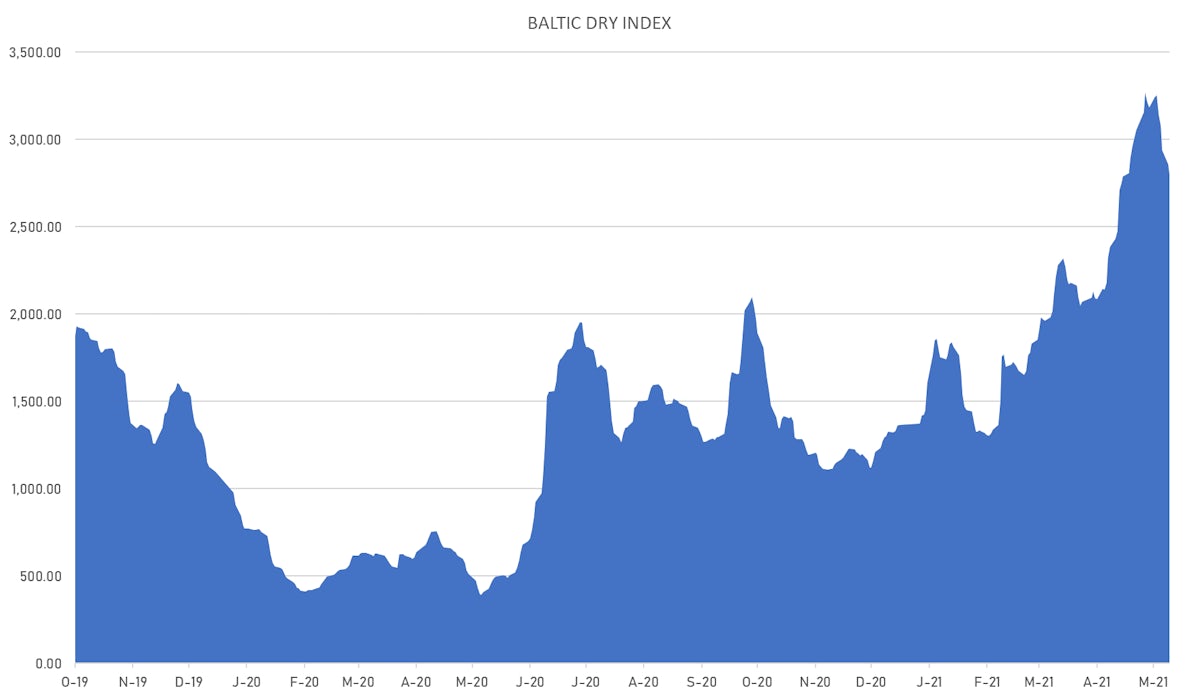

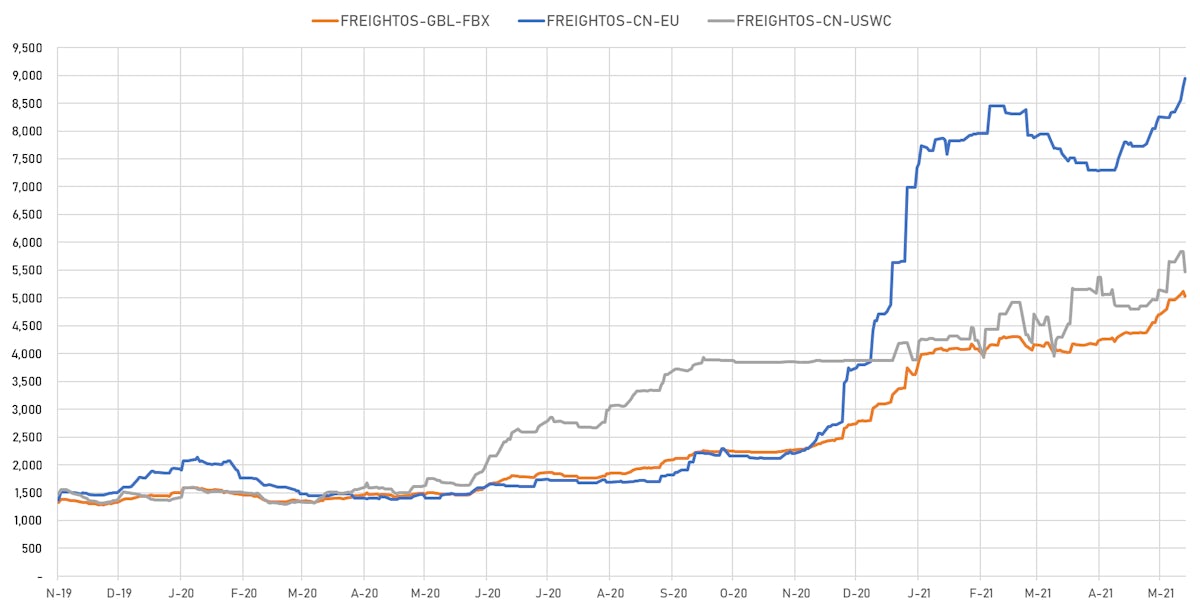

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,795, down -2.1% on the day (YTD: +104.6%)

- Freightos China To North America West Coast Container Index currently at 5,473, down -6.2% on the day (YTD: +30.3%)

- Freightos North America West Coast To China Container Index currently at 817, unchanged (YTD: +57.7%)

- Freightos North America East Coast To Europe Container Index currently at 443, unchanged (YTD: +22.0%)

- Freightos Europe To North America East Coast Container Index currently at 4,274, unchanged (YTD: +128.7%)

- Freightos China To North Europe Container Index currently at 8,945, up 1.6% on the day (YTD: +58.0%)

- Freightos North Europe To China Container Index currently at 1,753, unchanged (YTD: +27.5%)

- Freightos Europe To South America West Coast Container Index currently at 3,054, unchanged (YTD: +80.5%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 49.68 per tonne, down -6.4% on the day (YTD: +51.8%)