Commodities

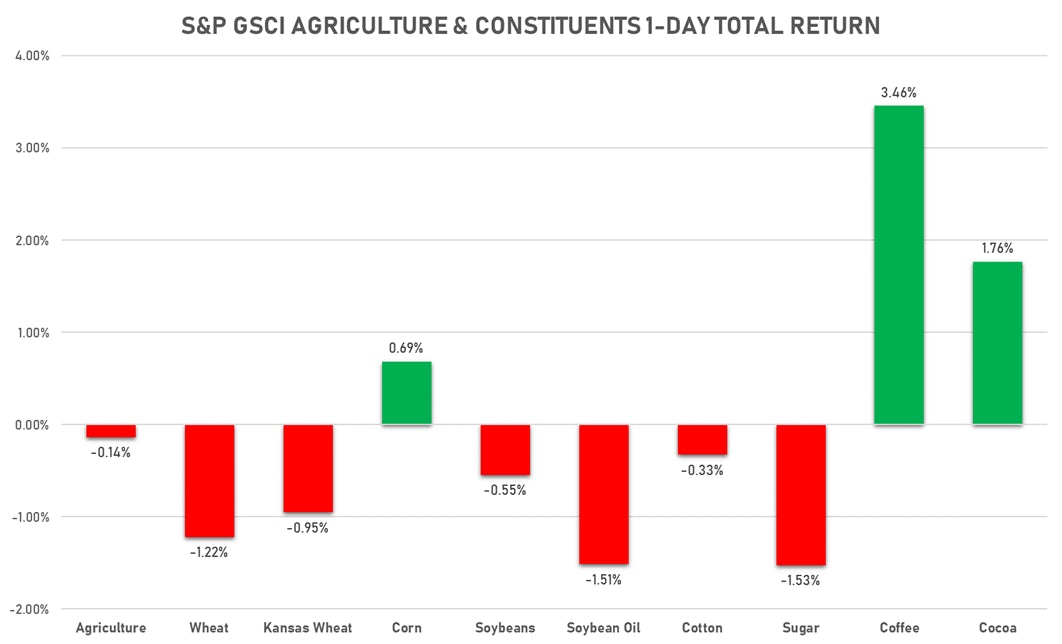

Decent Day For Commodities; Coffee, Cocoa, Natural Gas Top Gainers

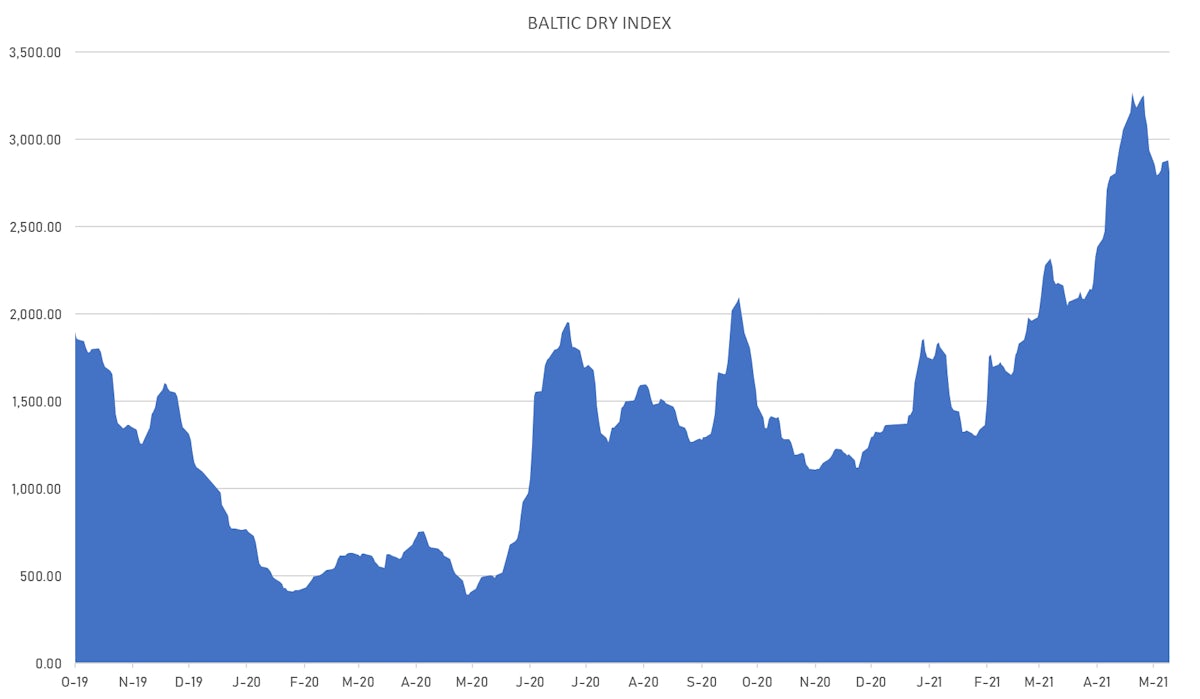

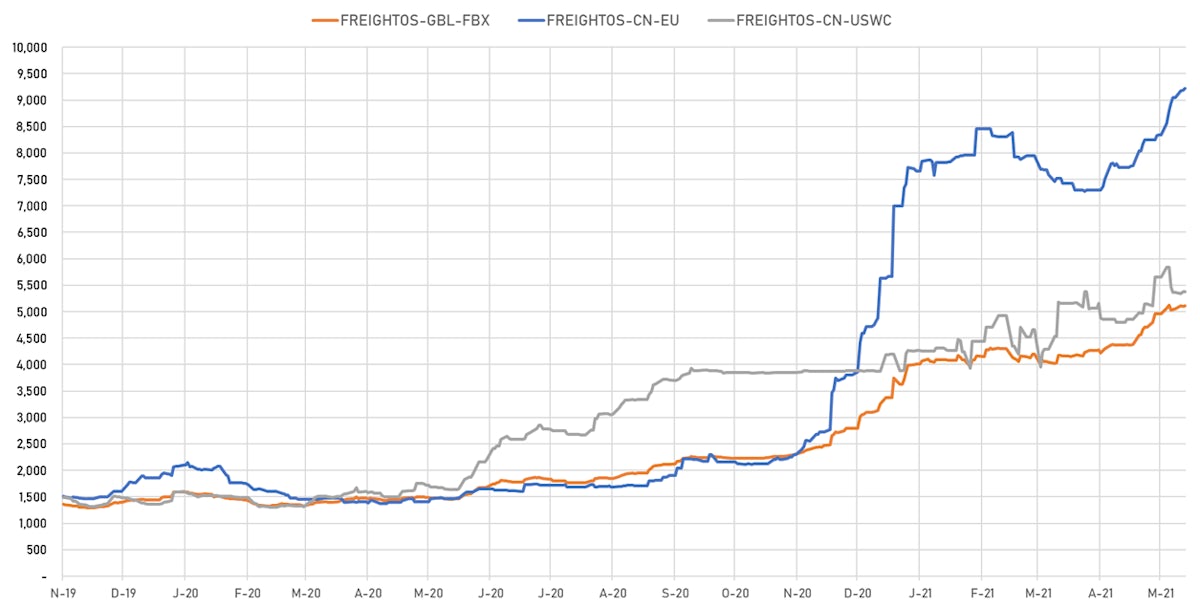

With shipping rates still increasing on some routes, the Baltic Dry Index has now more than doubled so far this year and the Freightos Europe to North America index is up 116% YTD

Published ET

Brent Calendar Spread (front month - 6 month forward) Backwardation Now At Levels Similar to 2019 | Sources: ϕpost, Refinitiv data

EIA WEEKLY RELEASES SHOW BIGGER STOCK DRAW THAN EXPECTED

- United States, Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 21 May (EIA, United States) at -1.66, below consensus estimate of -1.05

- United States, Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 21 May (EIA, United States) at -3.01, below consensus estimate of -1.90

- United States, Stock Levels, EIA, Gasoline, Absolute change, Volume for W 21 May (EIA, United States) at -1.75, below consensus estimate of -0.61

- United States, Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 21 May (EIA, United States) at 0.70, above consensus estimate of 0.20

NOTABLE GAINERS

- ICE-US Coffee up 3.5% (YTD: 21.4%)

- Freightos Baltic China/East Asia To Mediterranean 40 Container Index up 2.9% (YTD: 81.0%)

- NYMEX Henry Hub Natural Gas up 2.4% (YTD: 17.5%)

- ICE-US Cocoa up 1.8% (YTD: -7.0%)

- Gold/US Dollar 1 Month ATM Option Volatility up 1.7% (YTD: -13.4%)

- NYMEX RBOB Gasoline up 1.5% (YTD: 52.7%)

- Silver/US Dollar 1 Month ATM Option Volatility up 1.5% (YTD: -27.0%)

- SMM Rare Earth Terbium Metal Spot Price Daily up 1.2% (YTD: -10.1%)

- Coffee Arabica Colombia Excelso EP Spot up 1.2% (YTD: 14.6%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 1.2% (YTD: -9.7%)

NOTABLE LOSERS

- Freightos Baltic Europe To North America East Coast 40 Container Index down -6.8% (YTD: 116.5%)

- CBOE Crude Oil Volatility Index down -6.5% (YTD: -10.4%)

- Johnson Matthey Rhodium New York 0930 down -4.3% (YTD: 29.0%)

- CME Random Length Lumber down -4.1% (YTD: 53.4%)

- SHFE Rebar down -3.7% (YTD: 12.0%)

- NYMEX Light Sweet Crude Oil vs 6 down -3.4% (YTD: 0.0%)

- SHFE Hot Rolled Coil down -1.9% (YTD: 17.8%)

- DCE Iron Ore Continuation Month 1 down -1.9% (YTD: 6.9%)

- DCE Coking Coal Continuation Month 1 down -1.6% (YTD: 7.9%)

- ICE-US Sugar No. 11 down -1.5% (YTD: 8.3%)

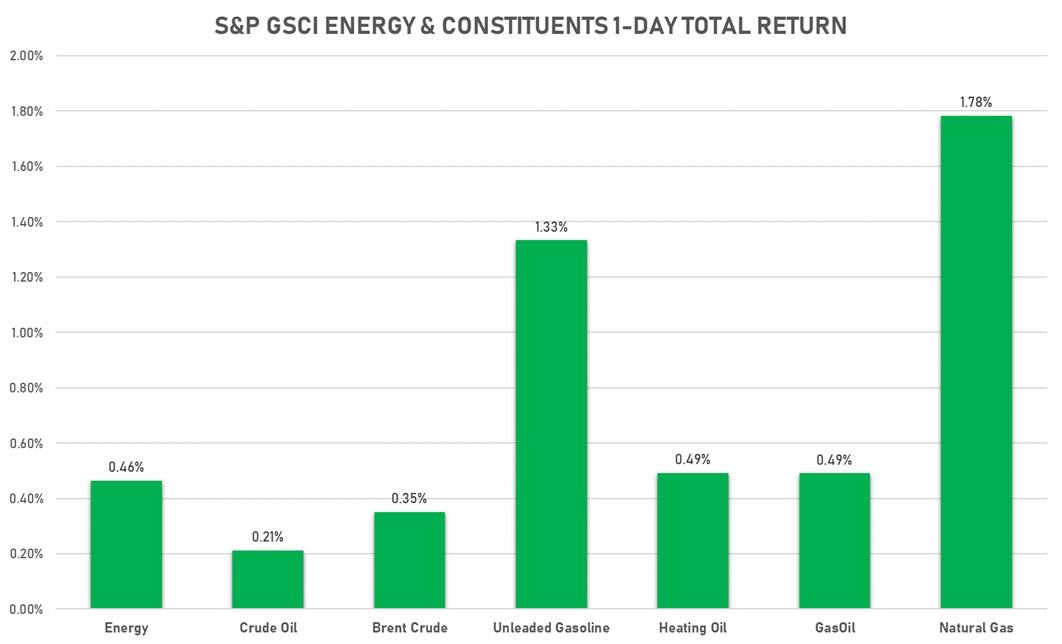

ENERGY

- WTI crude front month currently at US$ 66.12 per barrel, up 0.2% on the day (YTD: +36.5%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 68.79 per barrel, up 0.3% on the day (YTD: +33.0%); 6-month term structure in tightening backwardation

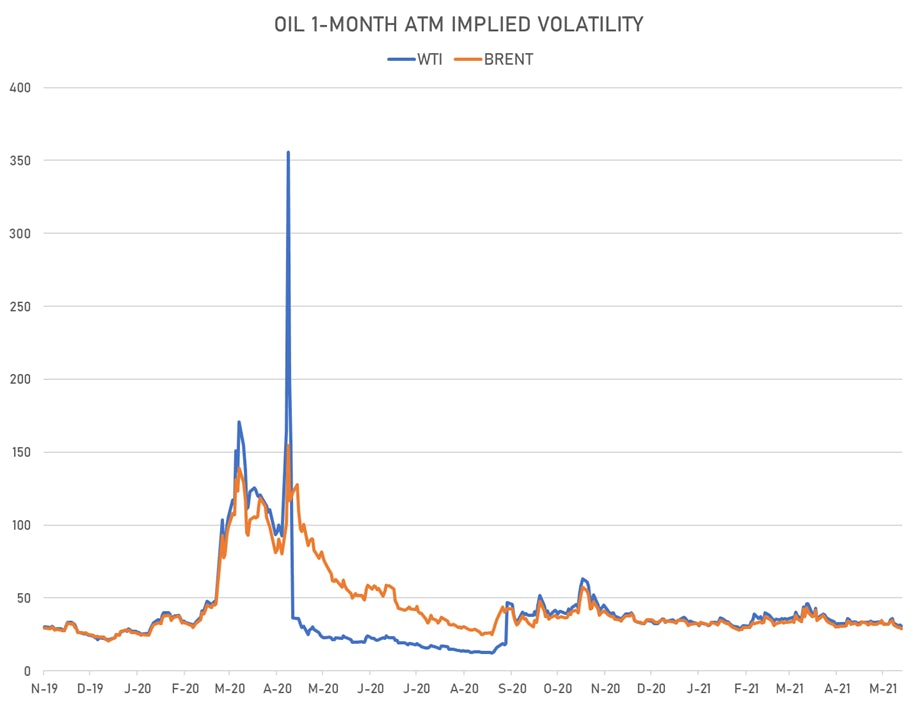

- Brent volatility at 28.8, down -2.8% on the day (12-month range: 24.7 - 58.9)

- Newcastle Coal (ICE Europe) currently at US$ 105.10 per tonne, up 0.1% on the day (YTD: +30.6%)

- Natural Gas (Henry Hub) currently at US$ 3.02 per MMBtu, up 2.4% on the day (YTD: +17.5%)

- Gasoline (NYMEX) currently at US$ 2.15 per gallon, up 1.5% on the day (YTD: +52.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 562.00 per tonne, up 0.4% on the day (YTD: +33.3%)

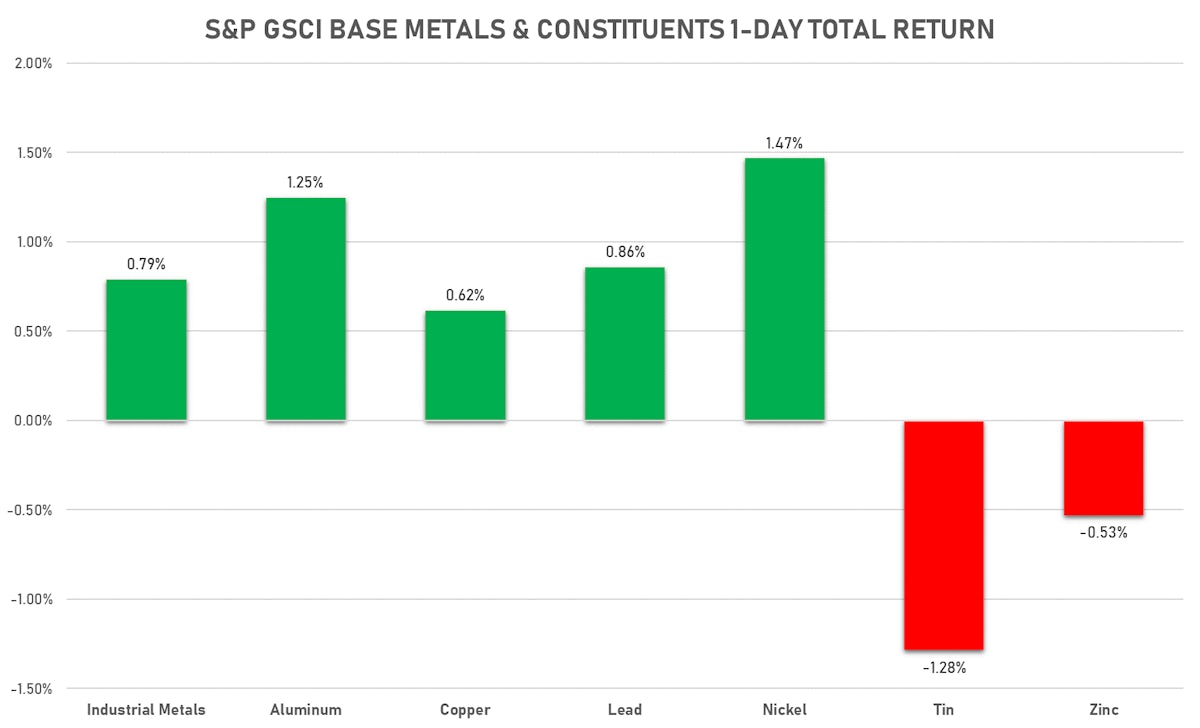

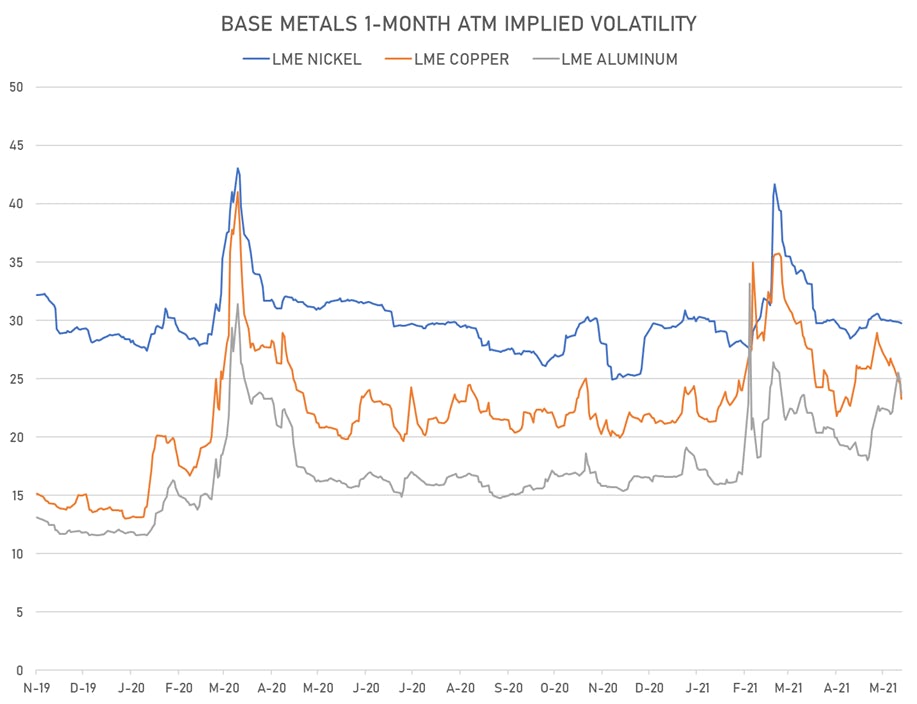

BASE METALS

- Copper (COMEX) currently at US$ 4.53 per pound, up 0.2% on the day (YTD: +29.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,116.50 per tonne, down -1.9% on the day (YTD: +6.9%)

- Aluminium (Shanghai) currently at CNY 18,385 per tonne, down -0.1% on the day (YTD: +16.8%)

- Nickel (Shanghai) currently at CNY 126,550 per tonne, up 0.1% on the day (YTD: +1.4%)

- Lead (Shanghai) currently at CNY 15,300 per tonne, unchanged on the day (YTD: +4.1%)

- Rebar (Shanghai) currently at CNY 4,650 per tonne, down -3.7% on the day (YTD: +12.0%)

- Tin (Shanghai) currently at CNY 197,990 per tonne, up 0.5% on the day (YTD: +31.2%)

- Zinc (Shanghai) currently at CNY 22,250 per tonne, up 0.4% on the day (YTD: +7.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged on the day (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged on the day (YTD: +27.8%)

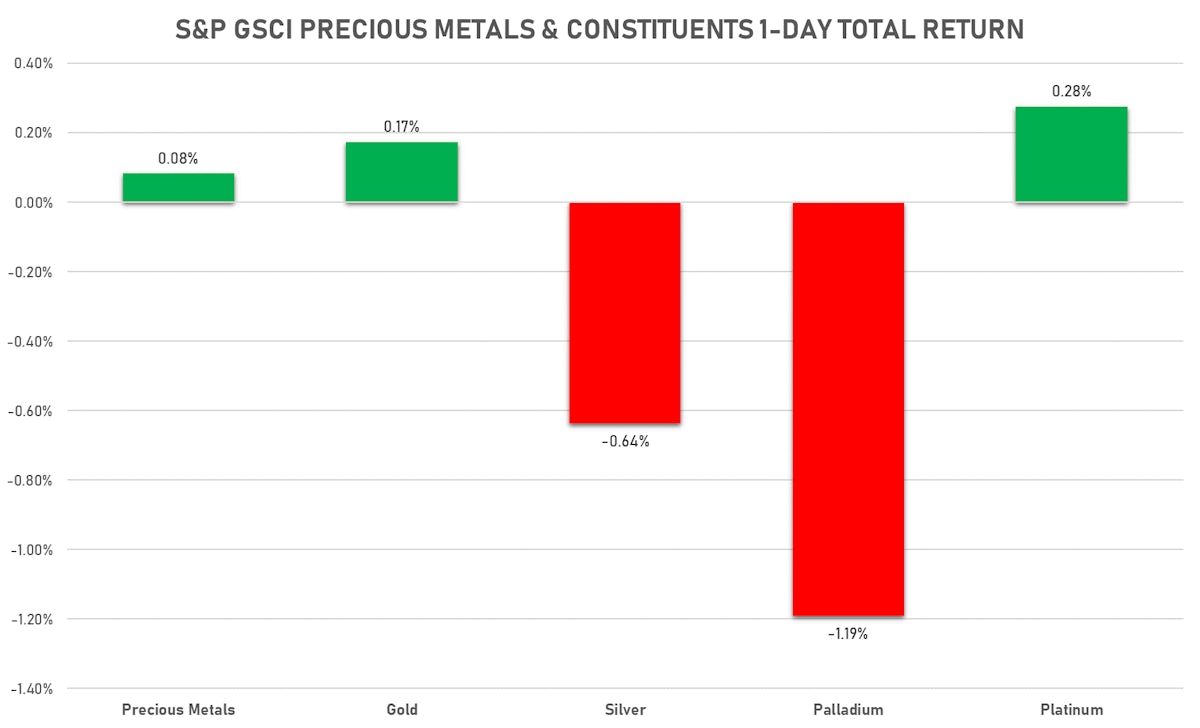

PRECIOUS METALS

- Gold spot currently at US$ 1,894.48 per troy ounce, down -0.1% on the day (YTD: -0.1%)

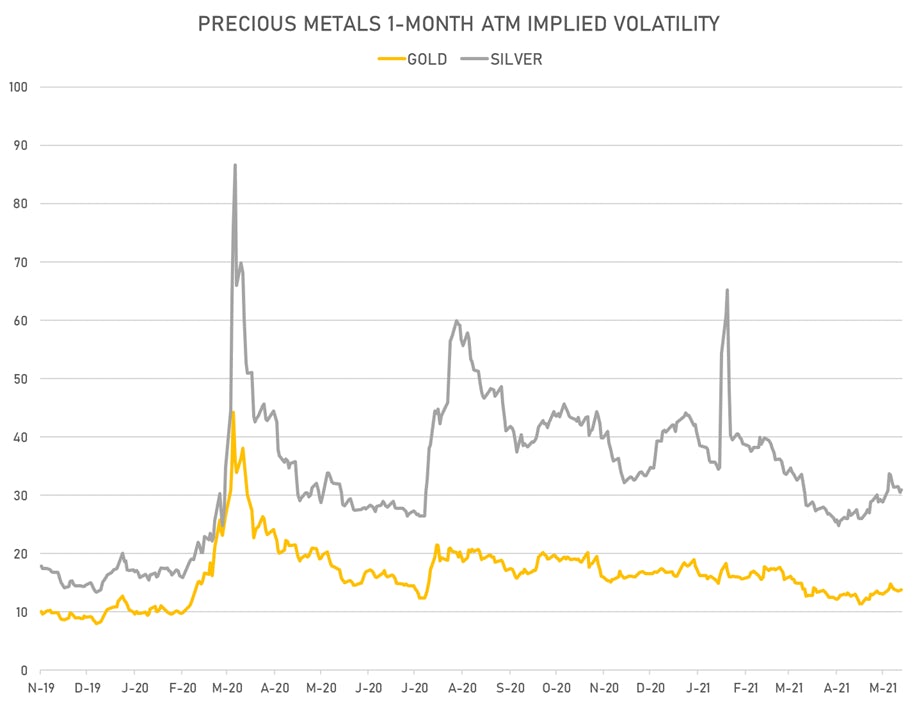

- Gold 1-Month ATM implied volatility currently at 13.70, up 1.7% on the day (YTD: -13.4%)

- Silver spot currently at US$ 27.64 per troy ounce, down -1.2% on the day (YTD: +4.9%)

- Silver 1-Month ATM implied volatility currently at 30.00, up 1.5% on the day (YTD: -27.0%)

- Palladium spot currently at US$ 2,737.71 per troy ounce, down -1.0% on the day (YTD: +12.2%)

- Platinum spot currently at US$ 1,188.37 per troy ounce, down -0.1% on the day (YTD: +11.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 22,000 per troy ounce, down -4.3% on the day (YTD: +29.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

AGRO

- Live Cattle (CME) currently at US$ 116.45 cents per pound, down 0.2% on the day (YTD: +3.1%)

- Lean Hogs (CME) currently at US$ 115.28 cents per pound, unchanged (YTD: +64.0%)

- Rough Rice (CBOT) currently at US$ 13.19 cents per hundredweight, down -0.1% on the day (YTD: +6.4%)

- Soybeans Composite (CBOT) currently at US$ 1,504.75 cents per bushel, down -0.5% on the day (YTD: +14.3%)

- Corn (CBOT) currently at US$ 625.25 cents per bushel, up 0.7% on the day (YTD: +29.0%)

- Wheat Composite (CBOT) currently at US$ 650.50 cents per bushel, down -1.2% on the day (YTD: +1.2%)

- Sugar No.11 (ICE US) currently at US$ 16.78 cents per pound, down -1.5% on the day (YTD: +8.3%)

- Cotton No.2 (ICE US) currently at US$ 82.44 cents per pound, down -0.3% on the day (YTD: +5.5%)

- Cocoa (ICE US) currently at US$ 2,422 per tonne, up 1.8% on the day (YTD: -7.0%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,627 per tonne, up 1.2% on the day (YTD: +14.6%)

- Random Length Lumber (CME) currently at US$ 1,339.40 per 1,000 board feet, down -4.1% on the day (YTD: +53.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,965 per tonne, up 0.2% on the day (YTD: +9.1%)

- Soybean Oil Composite (CBOT) currently at US$ 65.96 cents per pound, down -1.5% on the day (YTD: +51.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,371 per tonne, up 3.3% on the day (YTD: +12.3%)

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,809, down -2.5% on the day (YTD: +105.6%)

- Freightos China To North America West Coast Container Index currently at 5,379, unchanged (YTD: +28.1%)

- Freightos North America West Coast To China Container Index currently at 799, unchanged (YTD: +54.4%)

- Freightos North America East Coast To Europe Container Index currently at 503, unchanged (YTD: +38.7%)

- Freightos Europe To North America East Coast Container Index currently at 4,046, down -6.8% on the day (YTD: +116.5%)

- Freightos China To North Europe Container Index currently at 9,220, up 0.4% on the day (YTD: +62.8%)

- Freightos North Europe To China Container Index currently at 1,753, unchanged (YTD: +27.5%)

- Freightos Europe To South America West Coast Container Index currently at 3,060, unchanged (YTD: +80.9%)

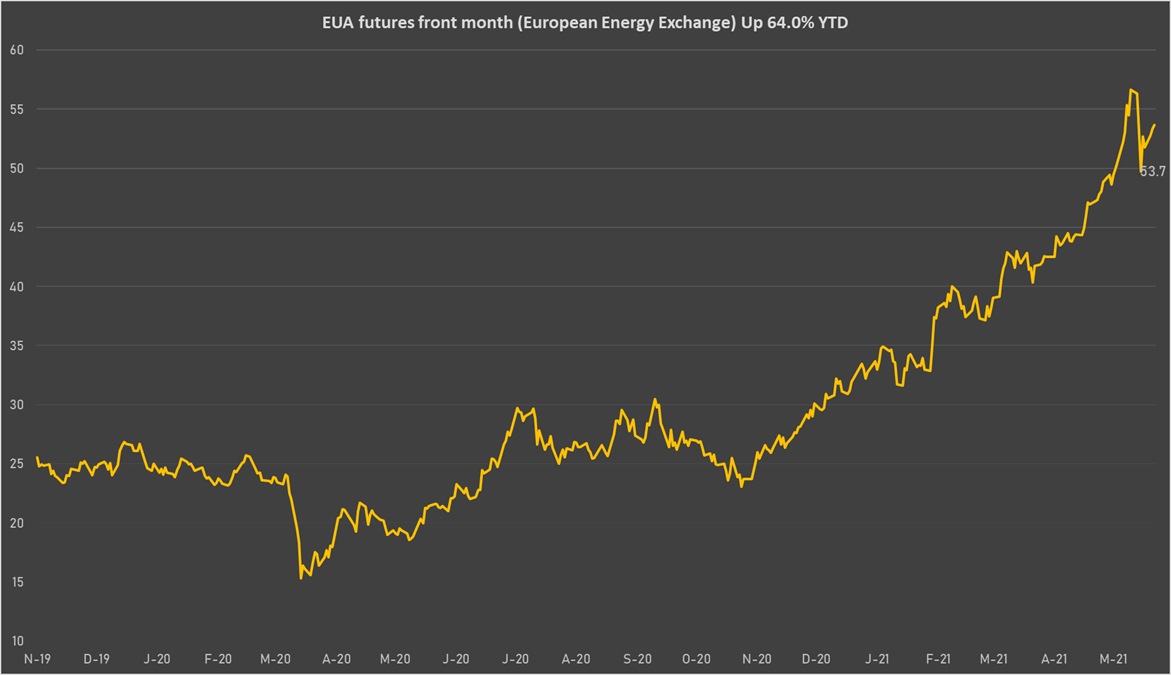

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 53.67 per tonne, up 0.7% on the day (YTD: +64.0%)