Commodities

WTI Crude And Gasoline Down, Close To 3-Year High, Ahead Of Memorial Day Weekend

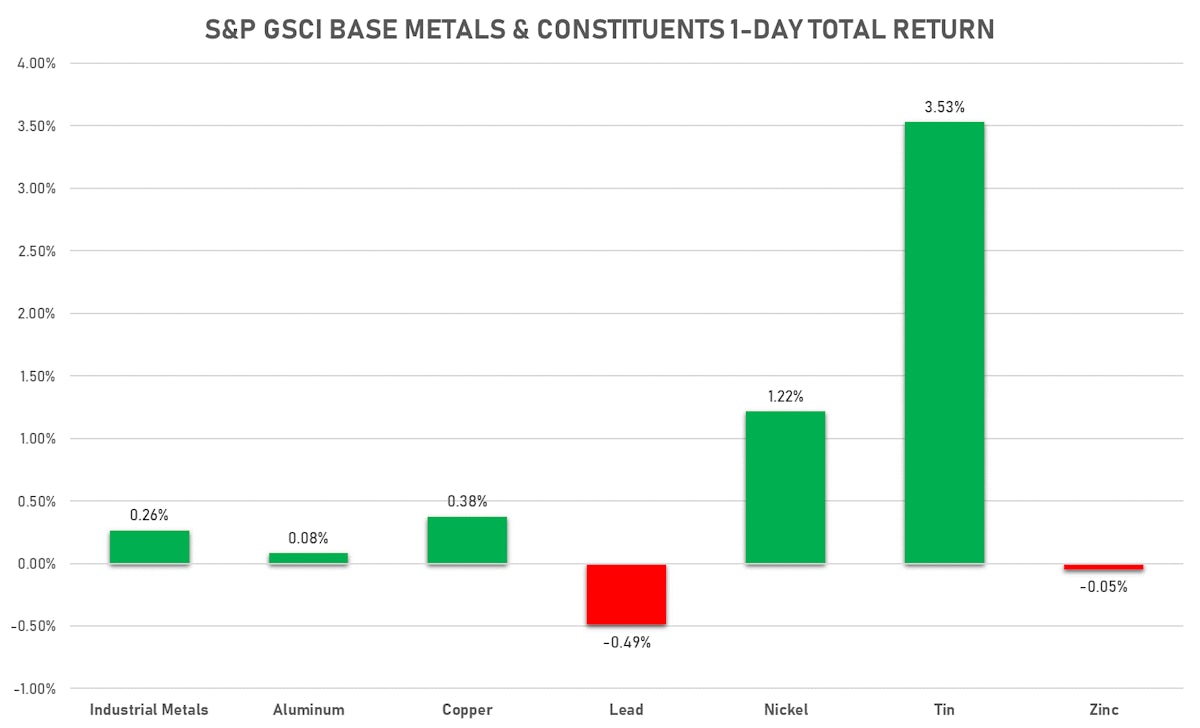

Base metals rebound in China to end the week, led by tin, zinc, nickel and rolled coils; Copper also closes up slightly in NY

Published ET

Gasoline Front-Month Future Prices | Source: Refinitiv

NOTABLE GAINERS

- CME Cattle (Feeder) up 11.0% (YTD: 8.9%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 10.6% (YTD: 64.9%)

- Johnson Matthey Rhodium New York 0930 up 9.7% (YTD: 49.6%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 9.2% (YTD: 68.6%)

- ICE-US Coffee up 4.5% (YTD: 26.6%)

- SHFE Hot Rolled Coil up 4.1% (YTD: 19.8%)

- SHFE Stannum (Tin) up 3.6% (YTD: 36.9%)

- SHFE Nickel up 3.1% (YTD: 5.0%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 3.1% (YTD: -6.9%)

- Shanghai International Exchange Bonded Copper up 2.4% (YTD: 26.4%)

- SHFE Copper up 2.3% (YTD: 26.5%)

NOTABLE LOSERS

- Gold/US Dollar 1 Month ATM Option Volatility down -2.9% (YTD: -18.0%)

- Silver/US Dollar 1 Month ATM Option Volatility down -2.3% (YTD: -30.5%)

- CBoT Wheat down -1.9% (YTD: 3.6%)

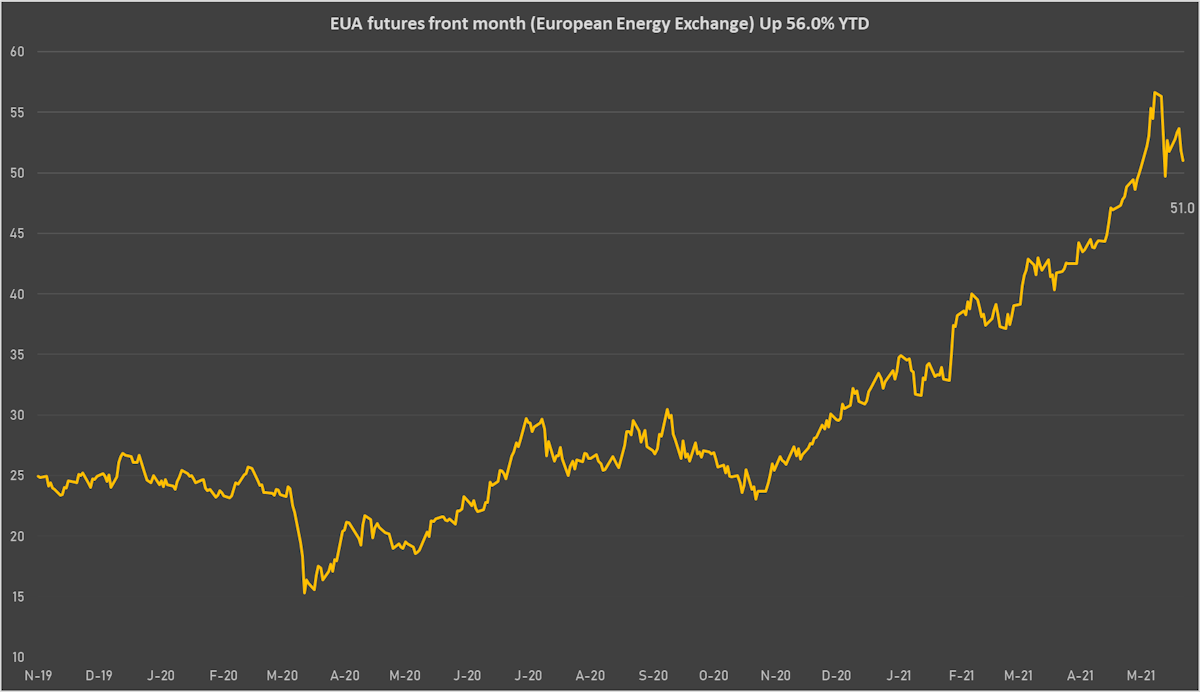

- EEX European-Carbon- Secondary Trading down -1.6% (YTD: 59.0%)

- ICE Europe CO2 EUA Yearly down -1.6% (YTD: 56.0%)

- CBoT Soybean Oil down -1.5% (YTD: 51.8%)

- CBoT Corn down -1.2% (YTD: 35.7%)

- CME Random Length Lumber down -1.0% (YTD: 50.0%)

- NYMEX Light Sweet Crude Oil (WTI) down -0.8% (YTD: 36.7%)

- ICE-US Cocoa down -0.7% (YTD: -7.3%)

- DCE Coke down -0.7% (YTD: -16.7%)

- ICE-US Cotton No. 2 down -0.6% (YTD: 5.1%)

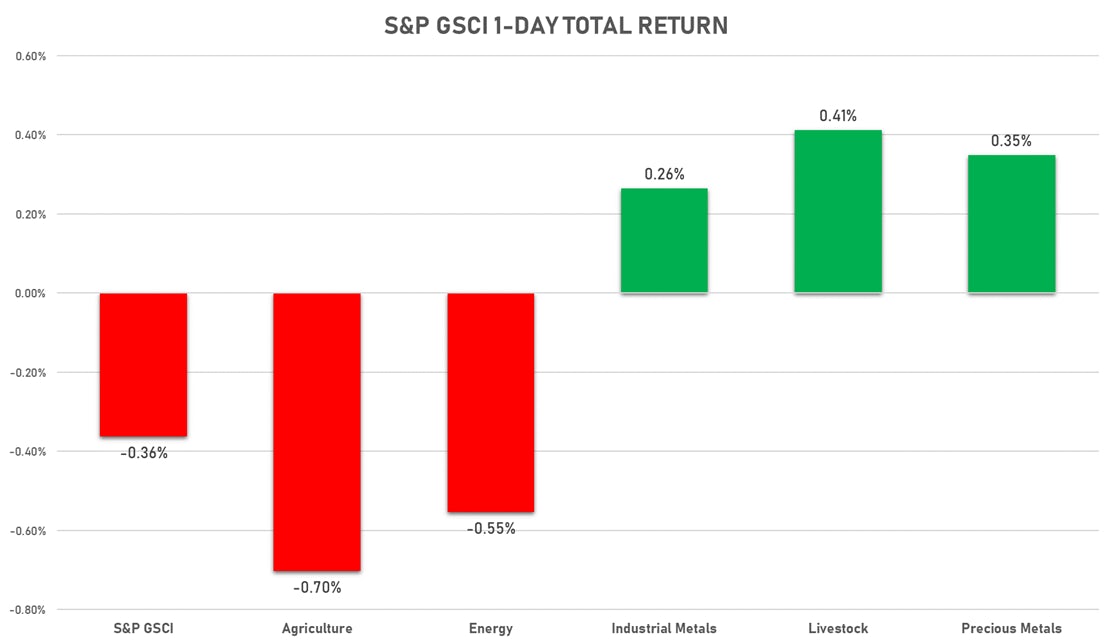

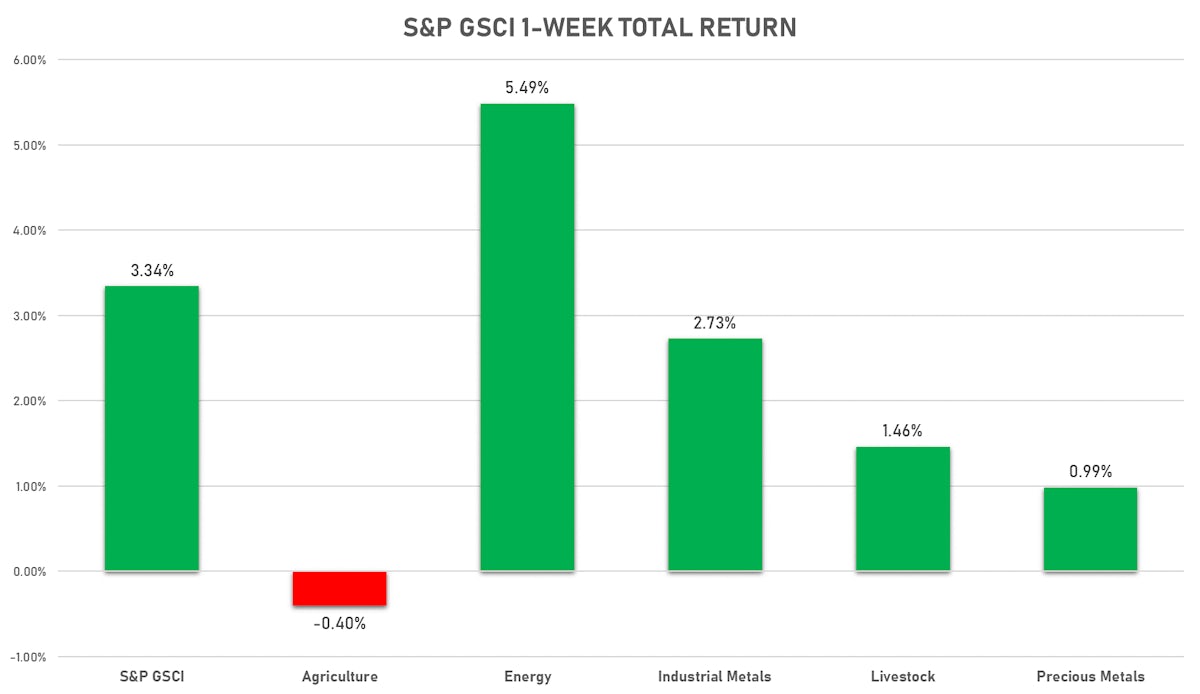

ENERGY

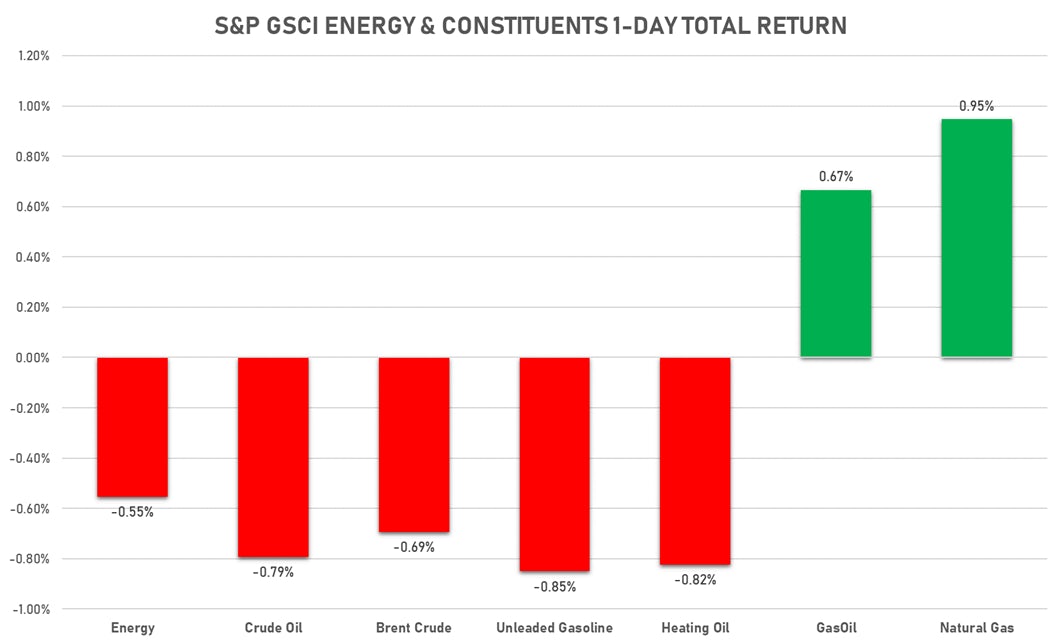

- WTI crude front month currently at US$ 66.32 per barrel, down -0.8% on the day (YTD: +36.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 68.72 per barrel, up 0.2% on the day (YTD: +34.4%); 6-month term structure in widening backwardation

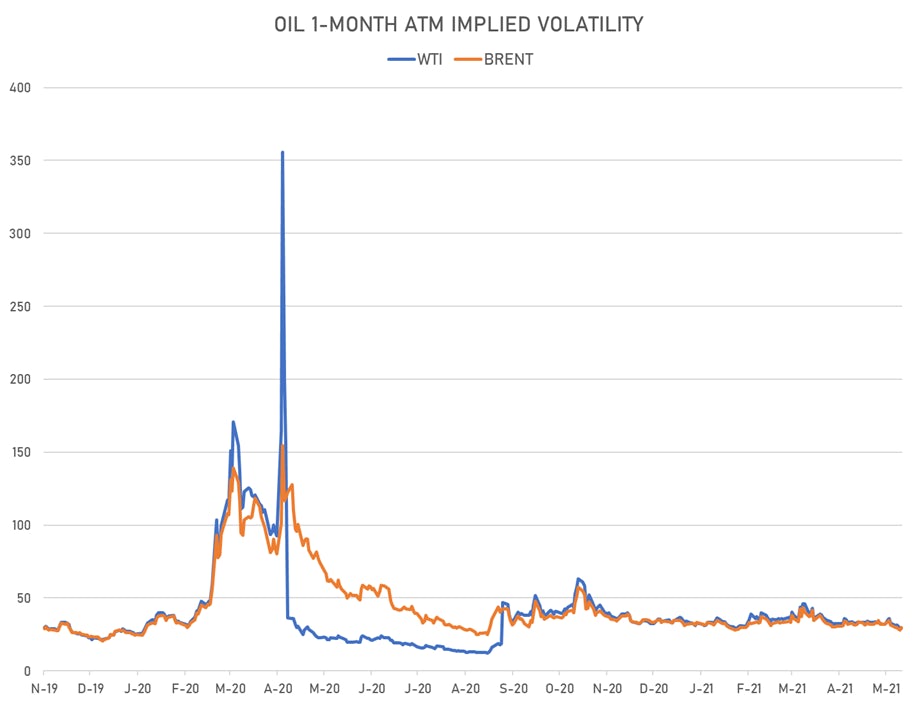

- Brent volatility at 29.7, up 6.9% on the day (12-month range: 24.7 - 58.9)

- Newcastle Coal (ICE Europe) currently at US$ 118.90 per tonne, up 0.5% on the day (YTD: +31.7%)

- Natural Gas (Henry Hub) currently at US$ 2.99 per MMBtu, up 0.9% on the day (YTD: +17.6%)

- Gasoline (NYMEX) currently at US$ 2.14 per gallon, down -0.5% on the day (YTD: +52.0%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 565.50 per tonne, up 0.7% on the day (YTD: +34.4%)

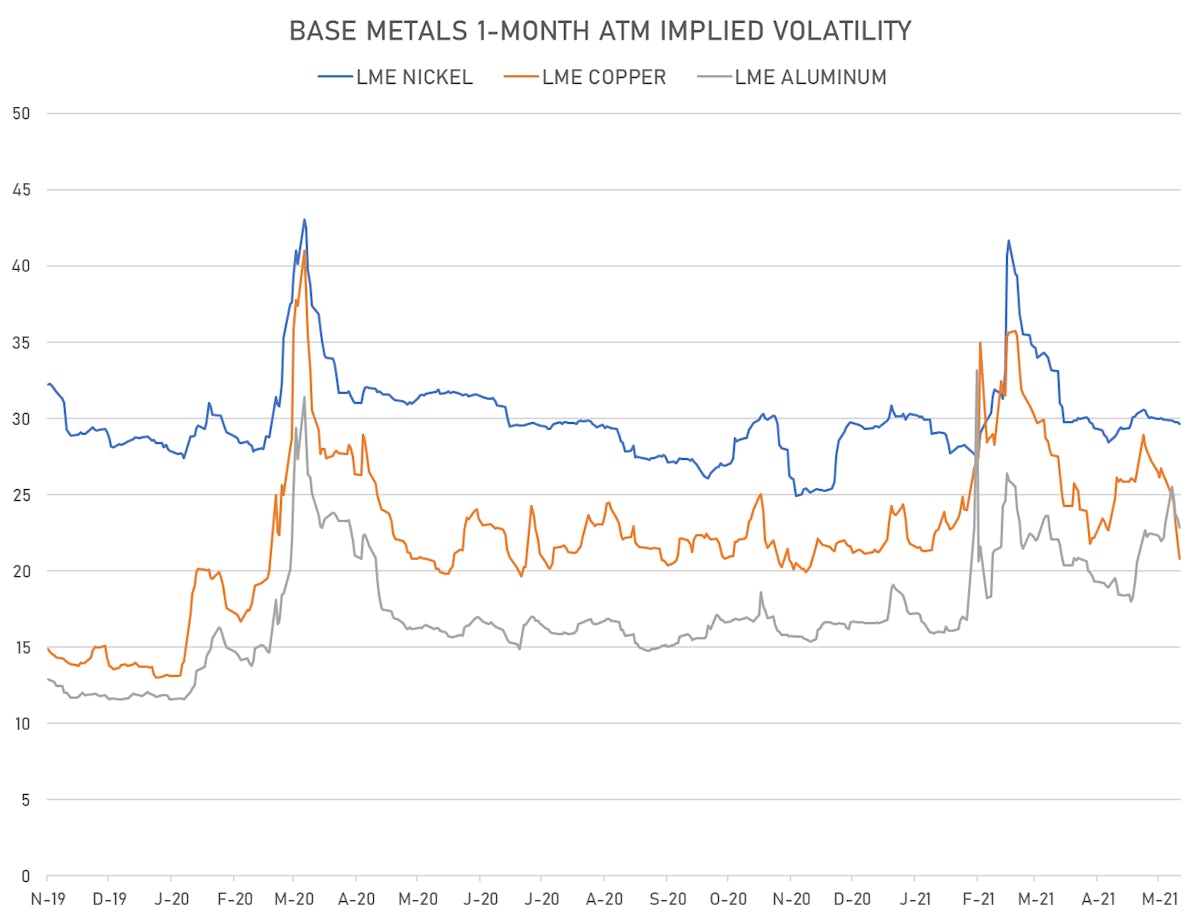

BASE METALS

- Copper (COMEX) currently at US$ 4.67 per pound, up 0.3% on the day (YTD: +33.3%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,175.00 per tonne, up 1.9% on the day (YTD: +7.0%)

- Aluminium (Shanghai) currently at CNY 18,995 per tonne, up 1.8% on the day (YTD: +19.5%)

- Nickel (Shanghai) currently at CNY 132,090 per tonne, up 3.1% on the day (YTD: +5.0%)

- Lead (Shanghai) currently at CNY 15,490 per tonne, up 0.8% on the day (YTD: +4.9%)

- Rebar (Shanghai) currently at CNY 4,799 per tonne, up 2.1% on the day (YTD: +12.7%)

- Tin (Shanghai) currently at CNY 208,800 per tonne, up 3.6% on the day (YTD: +36.9%)

- Zinc (Shanghai) currently at CNY 22,930 per tonne, up 2.2% on the day (YTD: +9.6%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

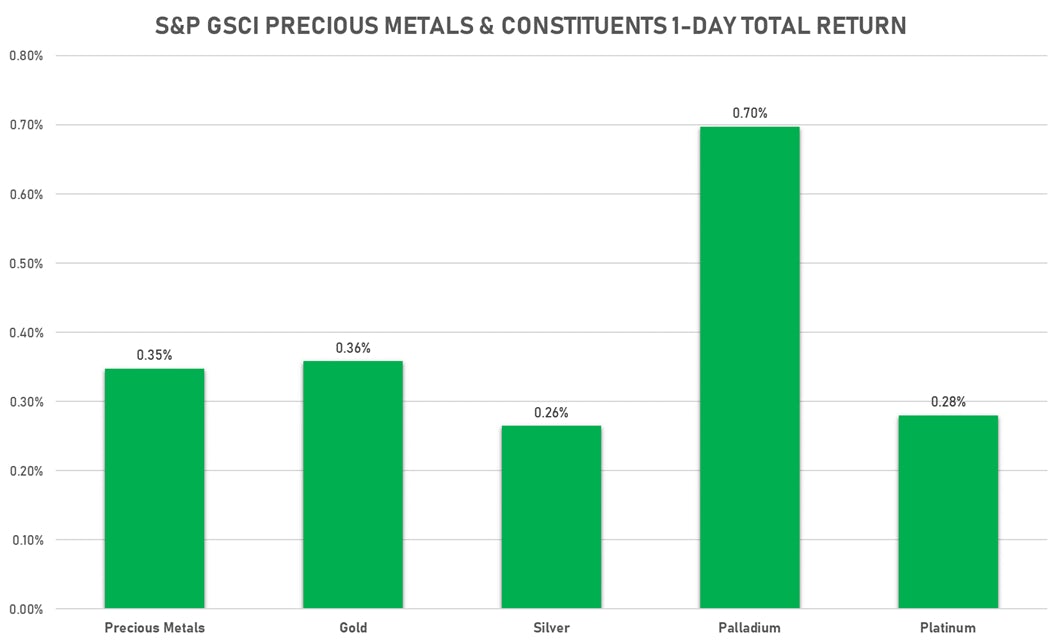

PRECIOUS METALS

- Gold spot currently at US$ 1,903.39 per troy ounce, up 0.4% on the day (YTD: +0.3%)

- Gold 1-Month ATM implied volatility currently at 12.77, down -2.9% on the day (YTD: -18.0%)

- Silver spot currently at US$ 27.91 per troy ounce, up 0.3% on the day (YTD: +5.8%)

- Silver 1-Month ATM implied volatility currently at 28.55, down -2.3% on the day (YTD: -30.5%)

- Palladium spot currently at US$ 2,823.23 per troy ounce, up 0.6% on the day (YTD: +15.5%)

- Platinum spot currently at US$ 1,180.90 per troy ounce, up 0.1% on the day (YTD: +10.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 25,500 per troy ounce, up 9.7% on the day (YTD: +49.6%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

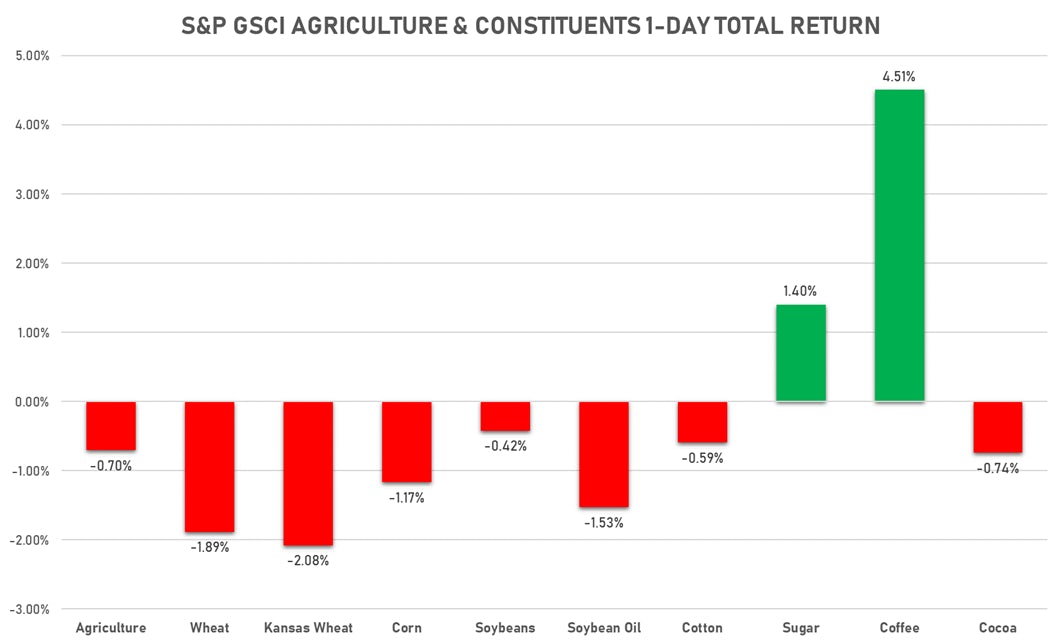

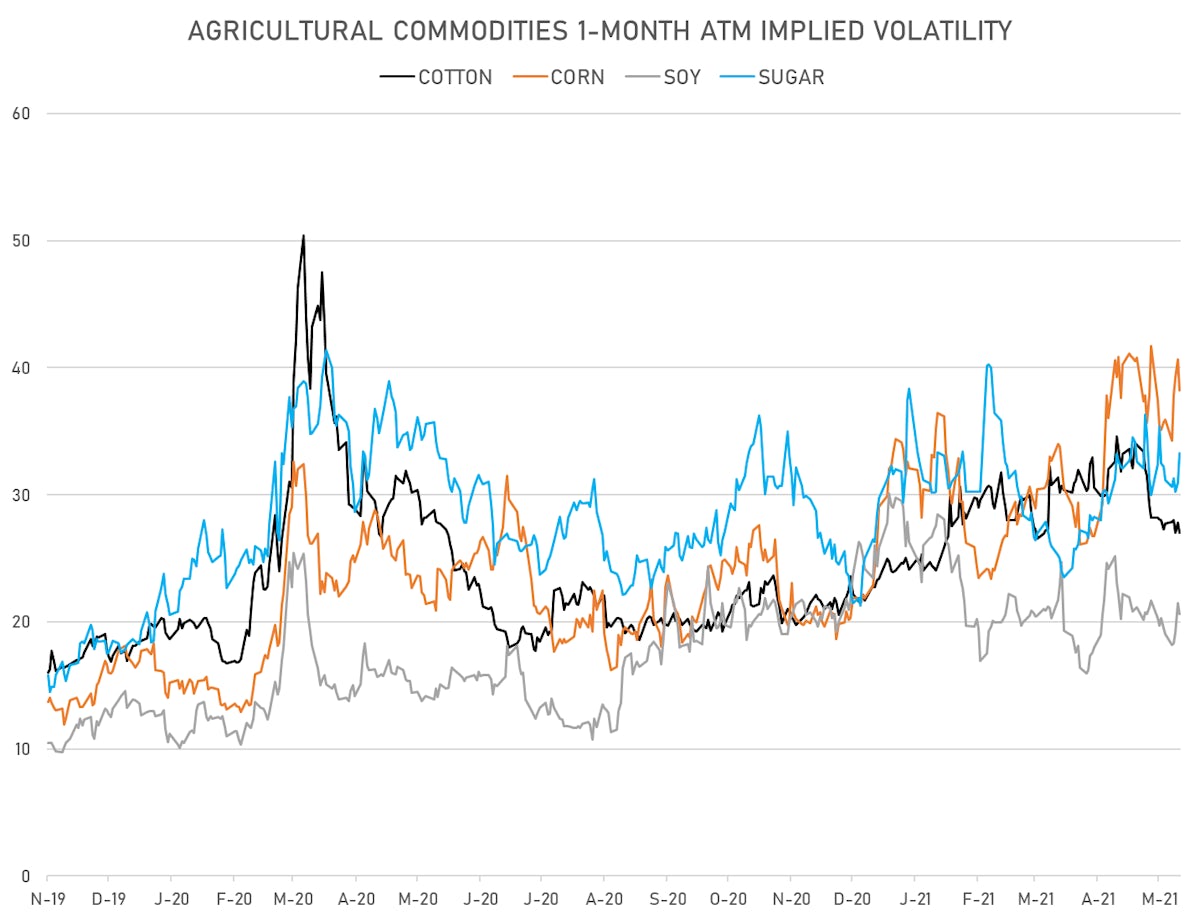

AGRO

- Live Cattle (CME) currently at US$ 115.88 cents per pound, down 0.4% on the day (YTD: +2.6%)

- Lean Hogs (CME) currently at US$ 117.25 cents per pound, up 1.3% on the day (YTD: +66.8%)

- Rough Rice (CBOT) currently at US$ 13.30 cents per hundredweight, up 0.5% on the day (YTD: +7.3%)

- Soybeans Composite (CBOT) currently at US$ 1,530.50 cents per bushel, down -0.4% on the day (YTD: +16.4%)

- Corn (CBOT) currently at US$ 656.75 cents per bushel, down -1.2% on the day (YTD: +35.7%)

- Wheat Composite (CBOT) currently at US$ 663.50 cents per bushel, down -1.9% on the day (YTD: +3.6%)

- Sugar No.11 (ICE US) currently at US$ 17.37 cents per pound, up 1.4% on the day (YTD: +12.1%)

- Cotton No.2 (ICE US) currently at US$ 82.05 cents per pound, down -0.6% on the day (YTD: +5.1%)

- Cocoa (ICE US) currently at US$ 2,410 per tonne, down -0.7% on the day (YTD: -7.3%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,747 per tonne, down -0.3% on the day (YTD: +18.4%)

- Random Length Lumber (CME) currently at US$ 1,309.50 per 1,000 board feet, down -1.0% on the day (YTD: +50.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,845 per tonne, up 0.6% on the day (YTD: +9.9%)

- Soybean Oil Composite (CBOT) currently at US$ 65.79 cents per pound, down -1.5% on the day (YTD: +51.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,310 per tonne, up 0.8% on the day (YTD: +10.5%)

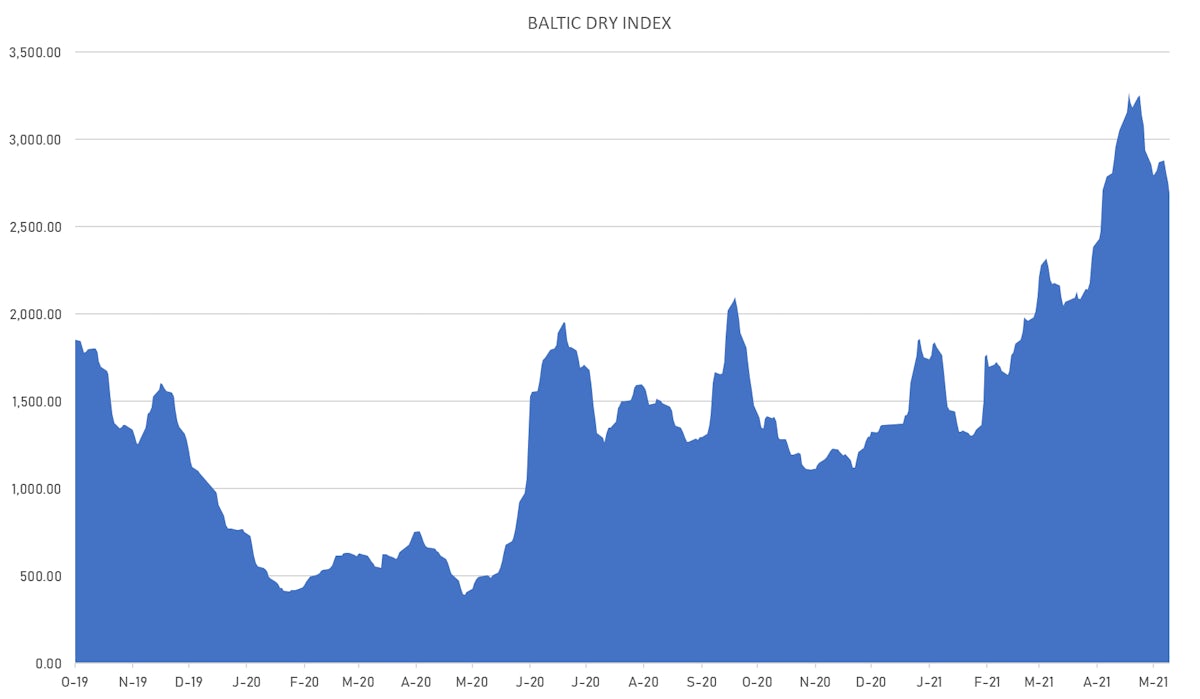

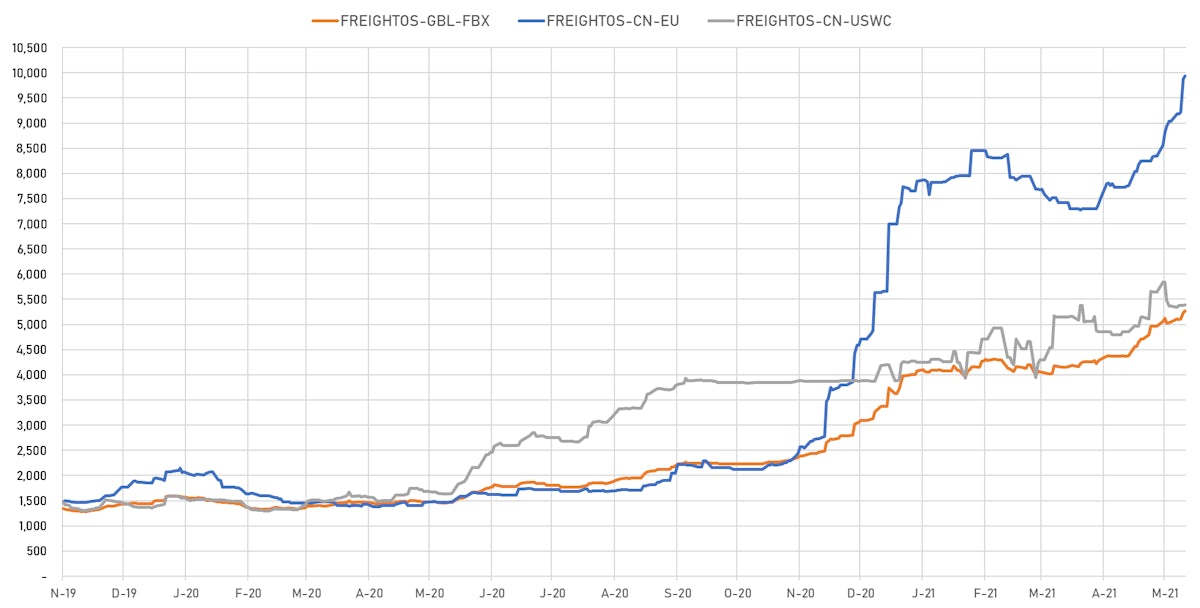

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,688, down -2.4% on the day (YTD: +96.8%)

- Freightos China To North America West Coast Container Index currently at 5,389, up 0.2% on the day (YTD: +28.3%)

- Freightos North America West Coast To China Container Index currently at 873, up 9.2% on the day (YTD: +68.6%)

- Freightos North America East Coast To Europe Container Index currently at 503, unchanged (YTD: +38.7%)

- Freightos Europe To North America East Coast Container Index currently at 4,046, unchanged (YTD: +116.5%)

- Freightos China To North Europe Container Index currently at 9,935, up 0.6% on the day (YTD: +75.5%)

- Freightos North Europe To China Container Index currently at 1,753, unchanged (YTD: +27.5%)

- Freightos Europe To South America West Coast Container Index currently at 3,060, unchanged (YTD: +80.9%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 51.03 per tonne, down -1.6% on the day (YTD: +56.0%)