Commodities

Brent Settles Over $71, While Backwardation Grows As Market Pushes Back Potential Additional Iranian Supply To Q3 At Earliest

Gold and silver up slightly on inflation concerns and soybean oil rises to 10-year high on tight global supplies of edible oils

Published ET

Brent Crude Hourly | Source: Refinitiv

HEADLINES & MACRO

- Nuclear talks with Iran to adjourn until 10 June

- Fed Beige Book flags increased pricing pressures since previous report. Firms expected to start passing higher costs, charging higher prices in months ahead.

- API inventory report: Gasoline +2.51M barrels, Distillates +1.59M barrels, Cushing +741K barrels

NOTABLE GAINERS

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 12.8% (YTD: 96.9%)

- Freightos Baltic North America East Coast To Europe 40 Container Index up 12.1% (YTD: 77.6%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 7.7% (YTD: 95.9%)

- DCE Coke up 7.2% (YTD: -16.2%)

- Pork Primal Cutout Butt up 6.1% (YTD: 128.6%)

- CME Random Length Lumber up 5.0% (YTD: 52.4%)

- DCE RBD Palm Oil up 4.4% (YTD: 21.7%)

- CBoT Soybean Oil up 4.4% (YTD: 62.4%)

- Bursa Malaysia Crude Palm Oil up 3.7% (YTD: 7.1%)

- DCE Coking Coal Continuation Month 1 up 3.6% (YTD: 6.6%)

- CME Live Cattle up 3.1% (YTD: 3.7%)

NOTABLE LOSERS

- SMM Erbium Oxide Spot Price Daily down -7.4% (YTD: 12.3%)

- DCE Iron Ore Continuation Month 1 down -2.7% (YTD: 14.2%)

- Johnson Matthey Rhodium New York 0930 down -2.2% (YTD: 45.2%)

- CBoT Corn down -2.0% (YTD: 39.5%)

- CBOE Crude Oil Volatility Index down -2.0% (YTD: -13.4%)

- EEX European-Carbon- Secondary Trading down -1.9% (YTD: 60.1%)

- ICE Europe CO2 EUA Yearly down -1.9% (YTD: 57.1%)

- Shanghai International Exchange TSR 20 Rubber down -1.7% (YTD: 4.1%)

- COMEX Copper down -1.3% (YTD: 30.9%)

- CBoT Soybean Meal down -1.2% (YTD: -9.3%)

- SHFE Lead Continuation Month 1 down -1.2% (YTD: 4.2%)

- SMM Rare Earth Terbium Oxide Spot Price Daily down -1.1% (YTD: -9.3%)

ENERGY

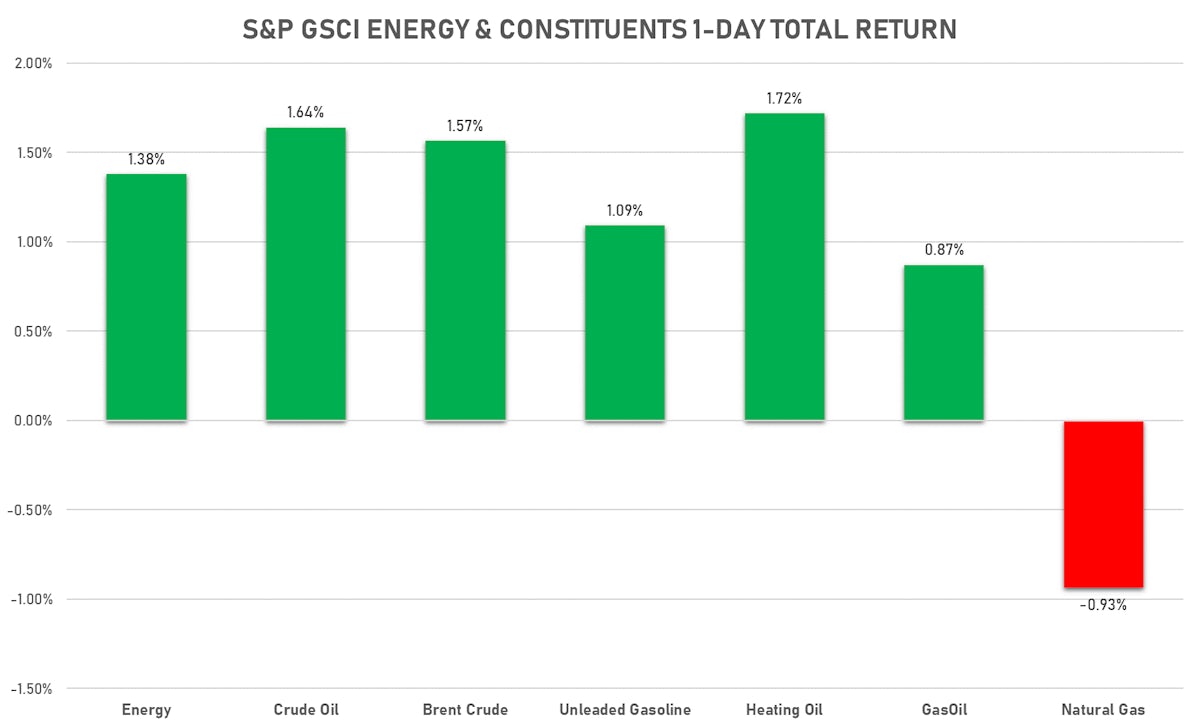

- WTI crude front month currently at US$ 68.73 per barrel, up 1.6% on the day (YTD: +41.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 71.26 per barrel, up 1.6% on the day (YTD: +37.7%); 6-month term structure in widening backwardation

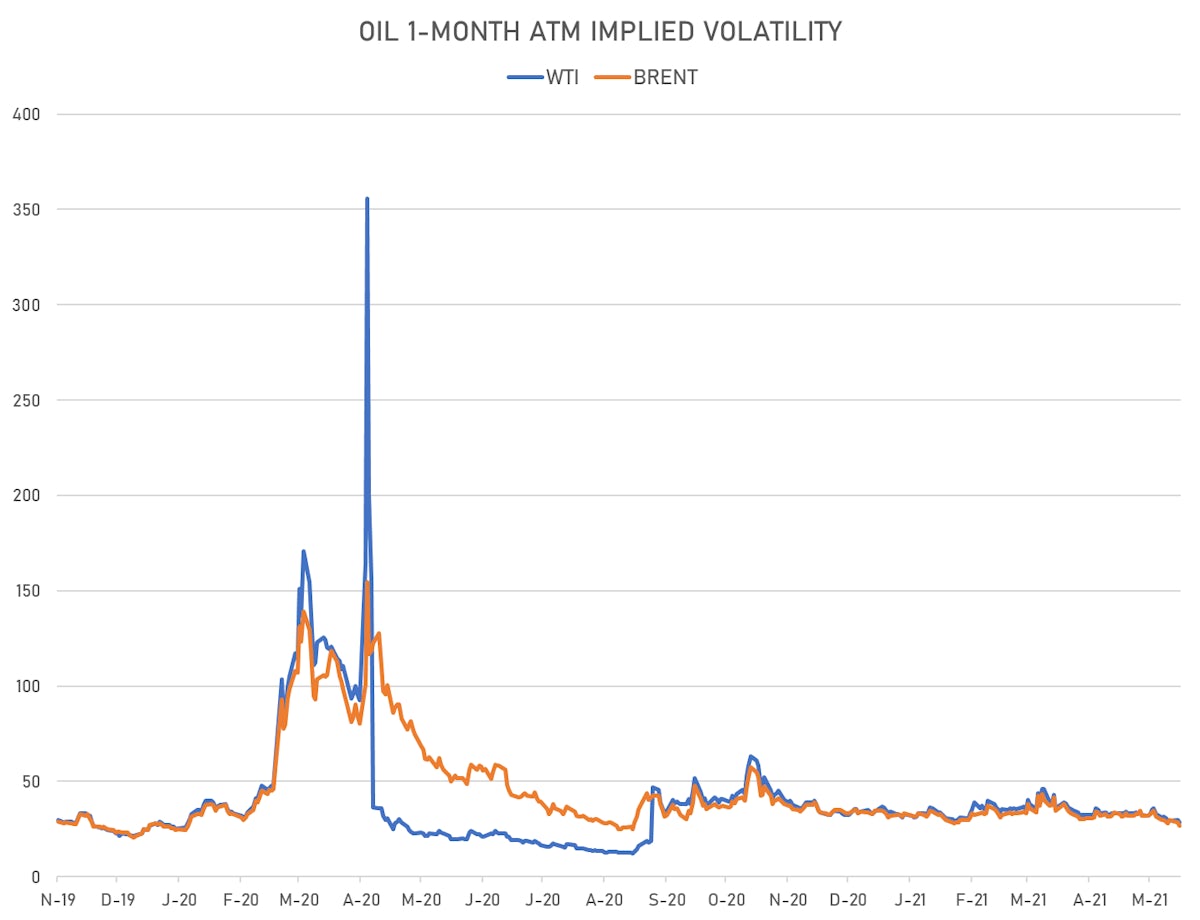

- Brent volatility at 26.9, down -5.8% on the day (12-month range: 24.7 - 58.9)

- Newcastle Coal (ICE Europe) currently at US$ 119.95 per tonne, down -0.5% on the day (YTD: +49.0%)

- Natural Gas (Henry Hub) currently at US$ 3.08 per MMBtu, down -0.9% on the day (YTD: +21.1%)

- Gasoline (NYMEX) currently at US$ 2.19 per gallon, up 1.1% on the day (YTD: +55.8%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 579.75 per tonne, up 0.8% on the day (YTD: +37.3%)

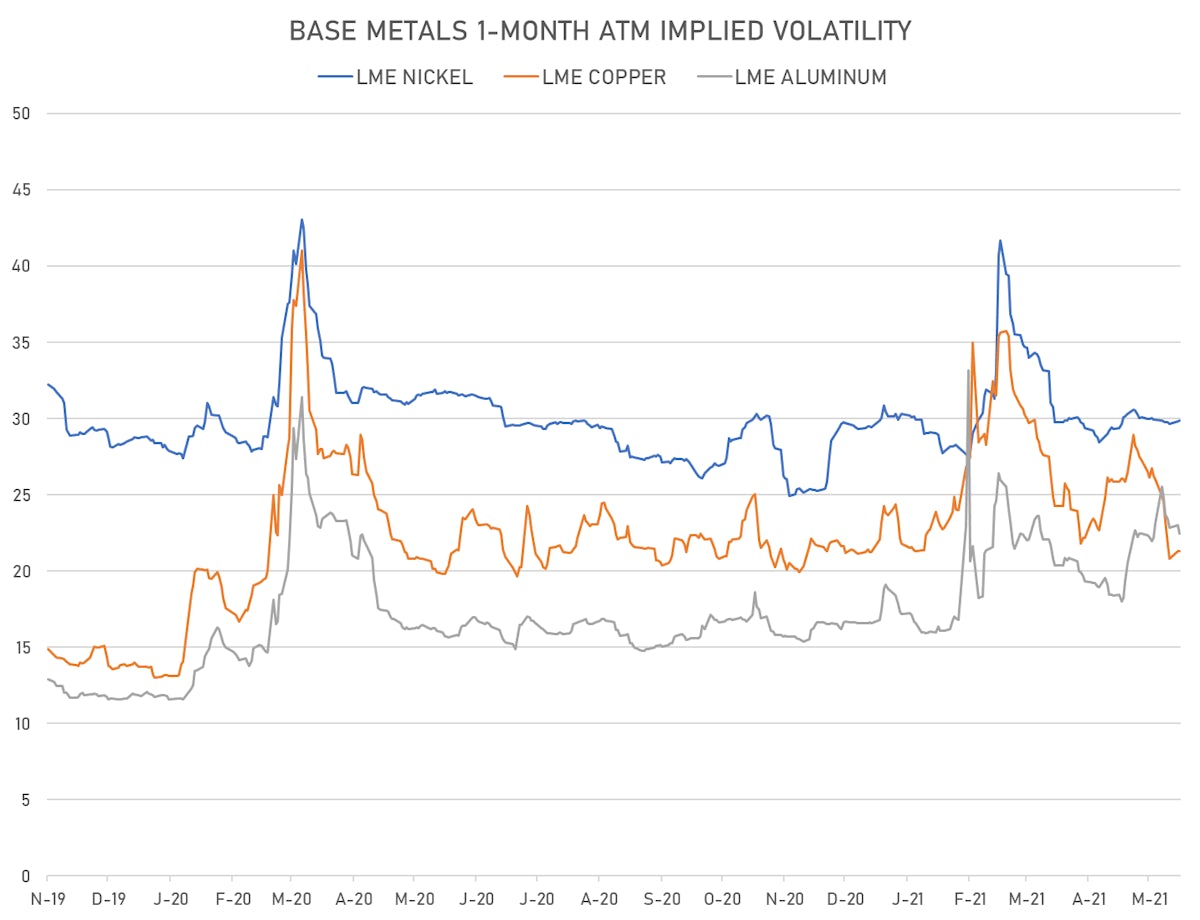

BASE METALS

- Copper (COMEX) currently at US$ 4.60 per pound, down -1.3% on the day (YTD: +30.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,232.50 per tonne, down -2.7% on the day (YTD: +14.2%)

- Aluminium (Shanghai) currently at CNY 18,475 per tonne, down -0.6% on the day (YTD: +18.9%)

- Nickel (Shanghai) currently at CNY 133,800 per tonne, unchanged (YTD: +7.3%)

- Lead (Shanghai) currently at CNY 15,385 per tonne, down -1.2% on the day (YTD: +4.2%)

- Rebar (Shanghai) currently at CNY 4,830 per tonne, up 0.7% on the day (YTD: +14.5%)

- Tin (Shanghai) currently at CNY 206,120 per tonne, up 0.7% on the day (YTD: +37.7%)

- Zinc (Shanghai) currently at CNY 22,945 per tonne, up 0.9% on the day (YTD: +10.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

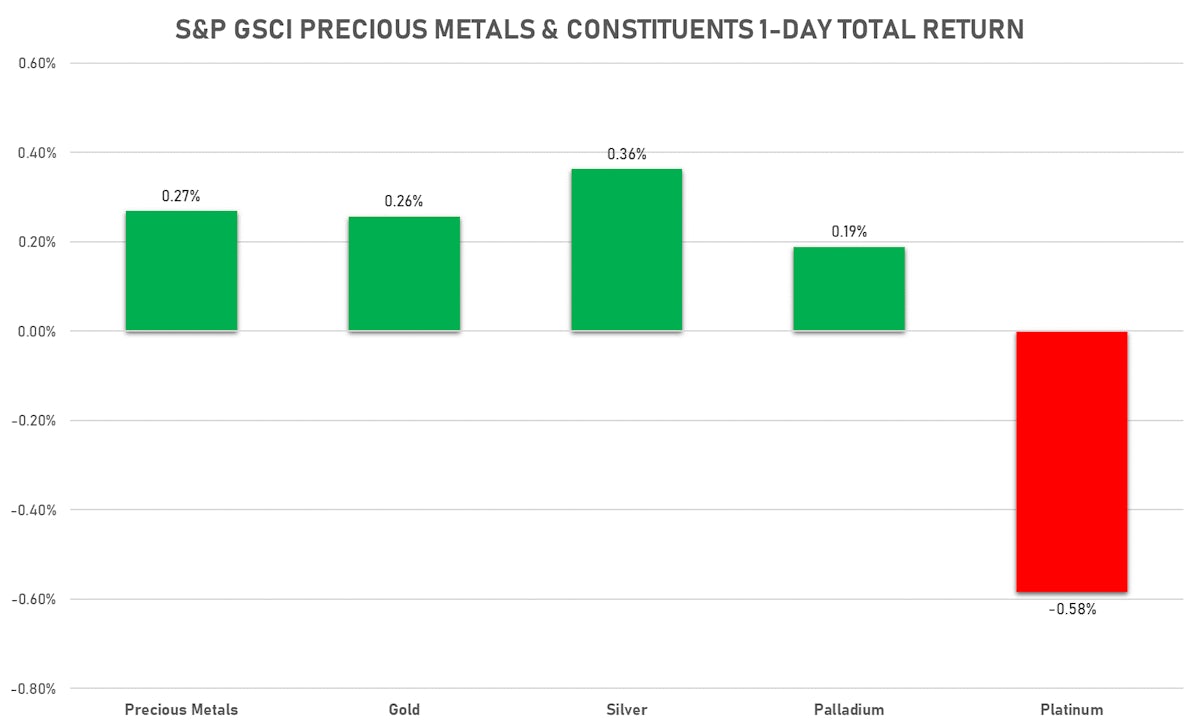

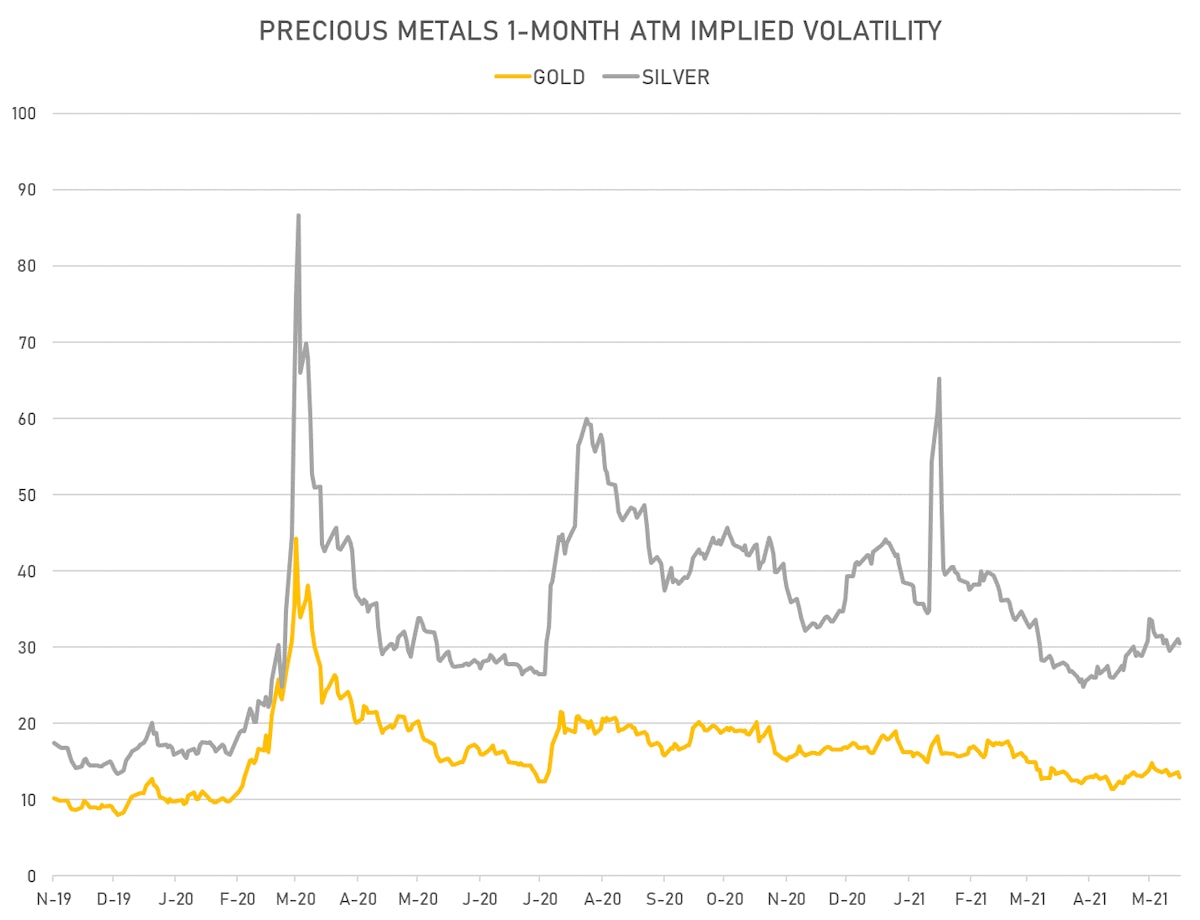

PRECIOUS METALS

- Gold spot currently at US$ 1,907.46 per troy ounce, up 0.4% on the day (YTD: +0.5%)

- Gold 1-Month ATM implied volatility currently at 12.53, down -3.4% on the day (YTD: -18.4%)

- Silver spot currently at US$ 28.15 per troy ounce, up 1.0% on the day (YTD: +6.8%)

- Silver 1-Month ATM implied volatility currently at 29.52, down -1.5% on the day (YTD: -27.9%)

- Palladium spot currently at US$ 2,866.52 per troy ounce, down -0.2% on the day (YTD: +16.8%)

- Platinum spot currently at US$ 1,194.82 per troy ounce, down -0.1% on the day (YTD: +11.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 24,750 per troy ounce, down -2.2% on the day (YTD: +45.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

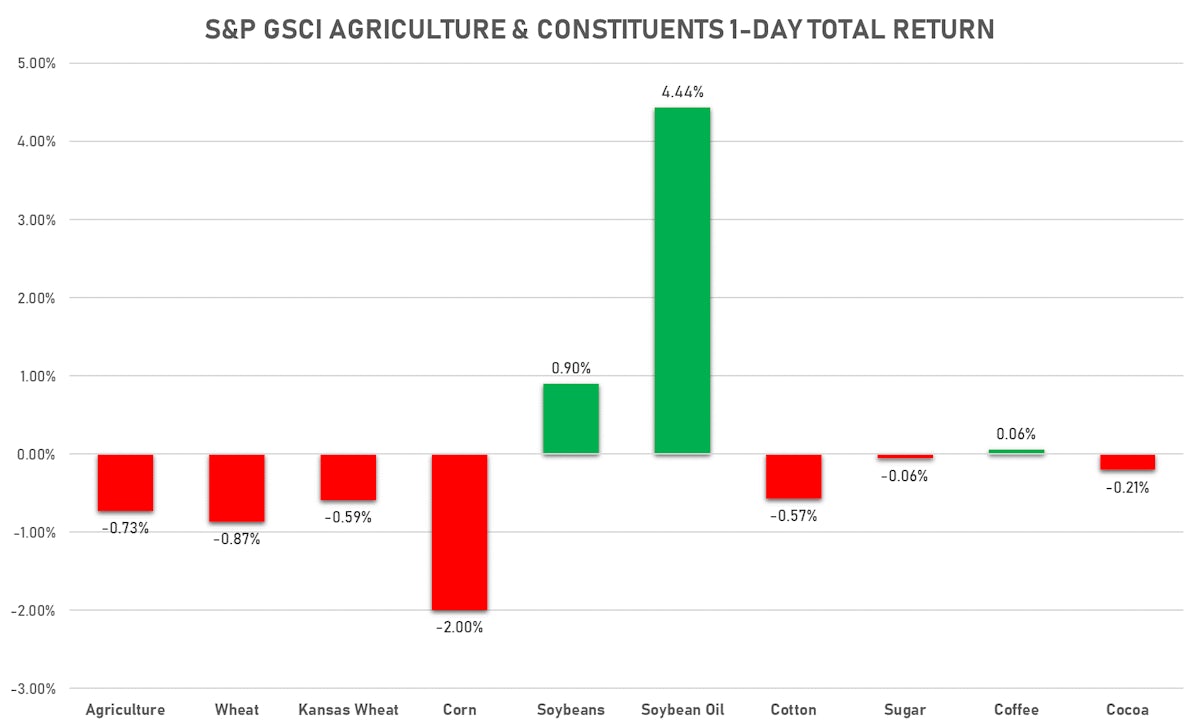

AGRO

- Live Cattle (CME) currently at US$ 117.13 cents per pound, up 3.1% on the day (YTD: +3.7%)

- Lean Hogs (CME) currently at US$ 118.25 cents per pound, down -0.3% on the day (YTD: +68.3%)

- Rough Rice (CBOT) currently at US$ 13.31 cents per hundredweight, up 0.2% on the day (YTD: +7.3%)

- Soybeans Composite (CBOT) currently at US$ 1,571.25 cents per bushel, up 0.9% on the day (YTD: +18.8%)

- Corn (CBOT) currently at US$ 678.00 cents per bushel, down -2.0% on the day (YTD: +39.5%)

- Wheat Composite (CBOT) currently at US$ 690.75 cents per bushel, down -0.9% on the day (YTD: +7.3%)

- Sugar No.11 (ICE US) currently at US$ 17.68 cents per pound, down -0.1% on the day (YTD: +14.1%)

- Cotton No.2 (ICE US) currently at US$ 83.77 cents per pound, down -0.6% on the day (YTD: +7.2%)

- Cocoa (ICE US) currently at US$ 2,426 per tonne, down -0.2% on the day (YTD: -6.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,848 per tonne, down -0.4% on the day (YTD: +21.6%)

- Random Length Lumber (CME) currently at US$ 1,330.50 per 1,000 board feet, up 5.0% on the day (YTD: +52.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,485 per tonne, down -1.7% on the day (YTD: +4.1%)

- Soybean Oil Composite (CBOT) currently at US$ 71.15 cents per pound, up 4.4% on the day (YTD: +62.4%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,166 per tonne, up 3.7% on the day (YTD: +7.1%)

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,568, down -1.1% on the day (YTD: +88.0%)

- Freightos China To North America West Coast Container Index currently at 5,577, up 1.5% on the day (YTD: +32.8%)

- Freightos North America West Coast To China Container Index currently at 1,014, up 7.7% on the day (YTD: +95.9%)

- Freightos North America East Coast To Europe Container Index currently at 645, up 12.1% on the day (YTD: +77.6%)

- Freightos Europe To North America East Coast Container Index currently at 4,366, unchanged (YTD: +133.6%)

- Freightos China To North Europe Container Index currently at 10,627, up 0.9% on the day (YTD: +87.7%)

- Freightos North Europe To China Container Index currently at 1,739, down -0.2% on the day (YTD: +26.4%)

- Freightos Europe To South America West Coast Container Index currently at 3,099, up 0.3% on the day (YTD: +83.2%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 51.40 per tonne, down -1.9% on the day (YTD: +57.1%)