Commodities

Chinese Deleveraging And Disappointing Trade Data Are Driving Down Industrial Commodities

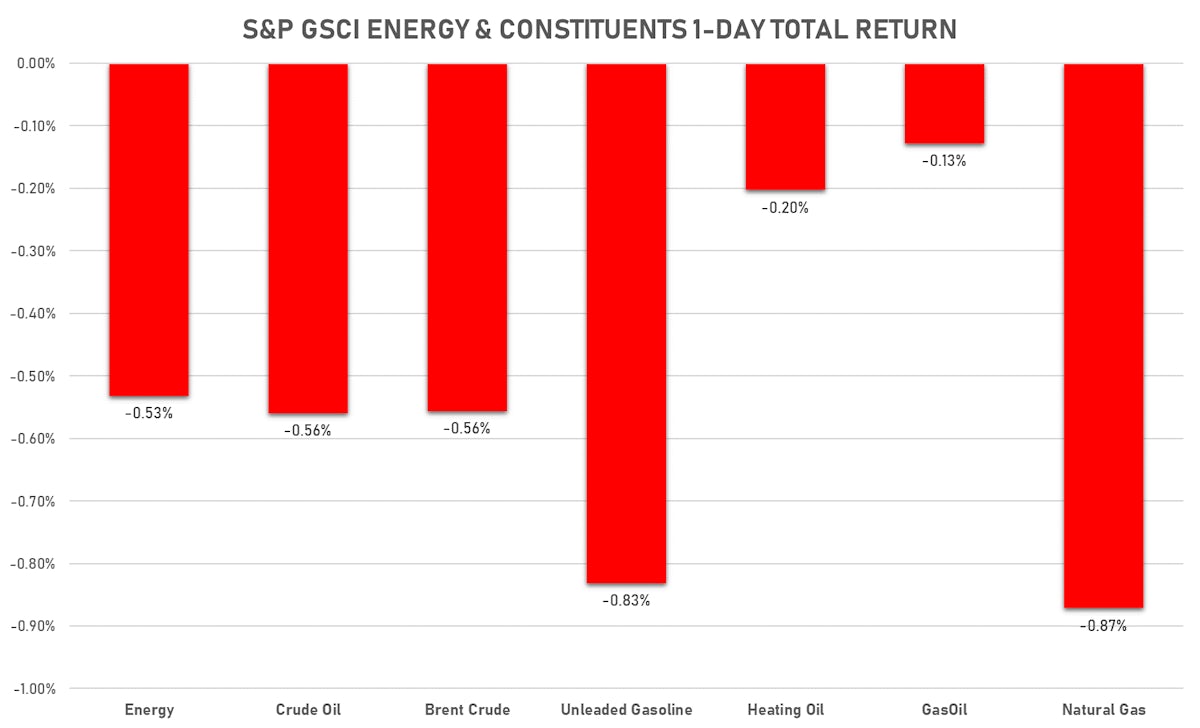

Energy commodities down on profit taking after a solid run, Brent is consolidating over $70 and may test short-term support

Published ET

Commodities are not great long-term investments (scarcity never lasts): GSCI Total Return vs S&P 500 Total Return Since 1988 | Source: Refinitiv

NOTABLE GAINERS

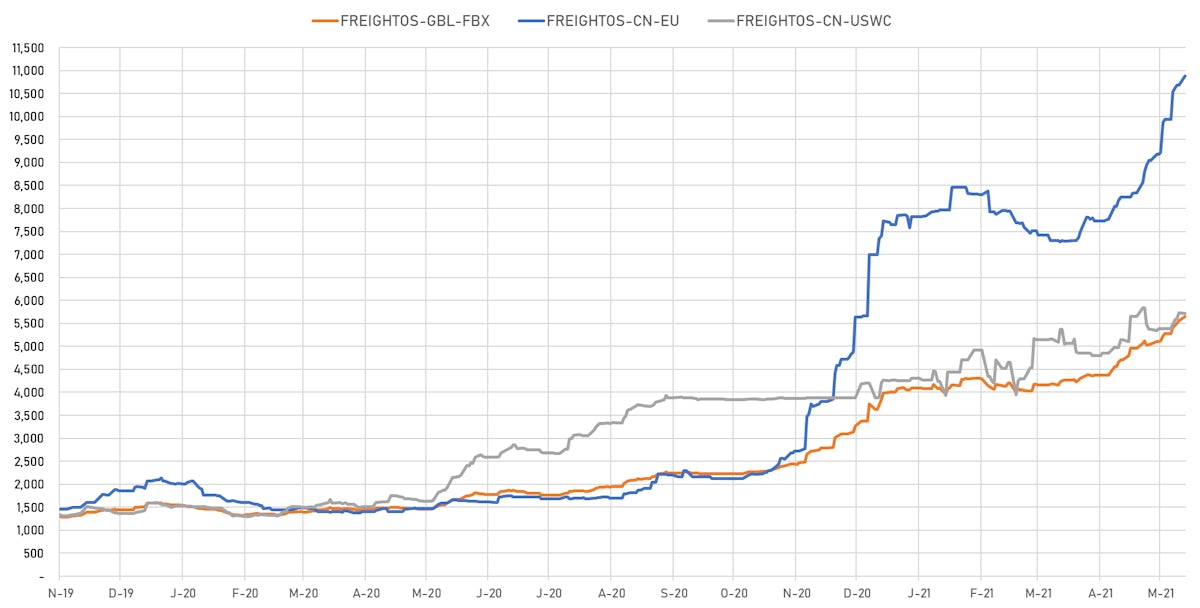

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 23.1% (YTD: 141.2%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 18.4% (YTD: 133.1%)

- Freightos Baltic Europe To North America East Coast 40 Container Index up 9.8% (YTD: 166.4%)

- Freightos Baltic North America East Coast To Europe 40 Container Index up 8.4% (YTD: 92.5%)

- European Union CO2 Allowance (EUA) up 3.0% (YTD: 57.3%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index up 1.9% (YTD: 92.2%)

- Silver/US Dollar 1 Month ATM Option Implied Volatility up 1.8% (YTD: -30.7%)

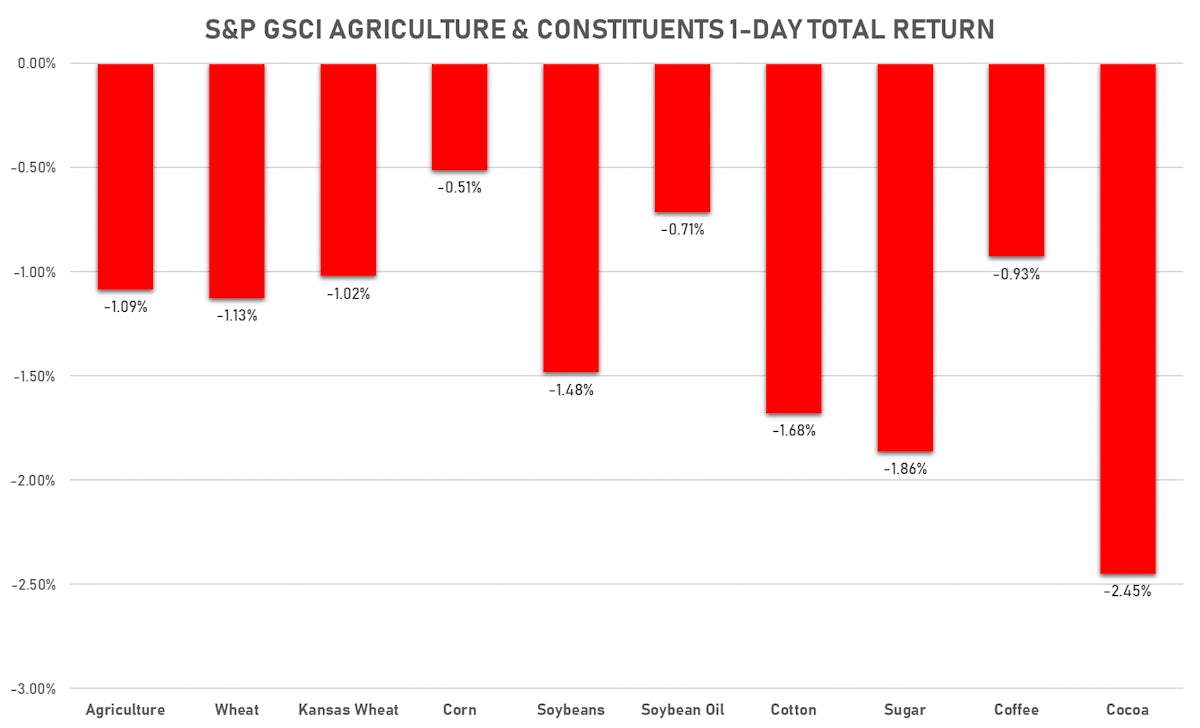

NOTABLE LOSERS

- CME Random Length Lumber down -4.9% (YTD: 39.9%)

- Pork Primal Cutout Ham down -4.1% (YTD: 30.9%)

- SMM Erbium Oxide Spot Price Daily down -2.7% (YTD: 9.3%)

- ICE-US Cocoa down -2.4% (YTD: -9.7%)

- CBoT Soybean Meal down -2.3% (YTD: -10.9%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily down -2.1% (YTD: 23.2%)

- SGX Iron Ore 62% China CFR Swap Monthly down -2.1% (YTD: 29.2%)

- ICE-US Sugar No. 11 down -1.9% (YTD: 12.2%)

- ICE-US Cotton No. 2 down -1.7% (YTD: 8.0%)

- CBoT Soybeans down -1.5% (YTD: 18.6%)

- SMM Rare Earth Terbium Oxide Spot Price Daily down -1.1% (YTD: -11.0%)

ENERGY

- WTI crude front month currently at US$ 68.85 per barrel, down -0.6% on the day (YTD: +42.7%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 71.10 per barrel, down -0.6% on the day (YTD: +38.0%); 6-month term structure in tightening backwardation

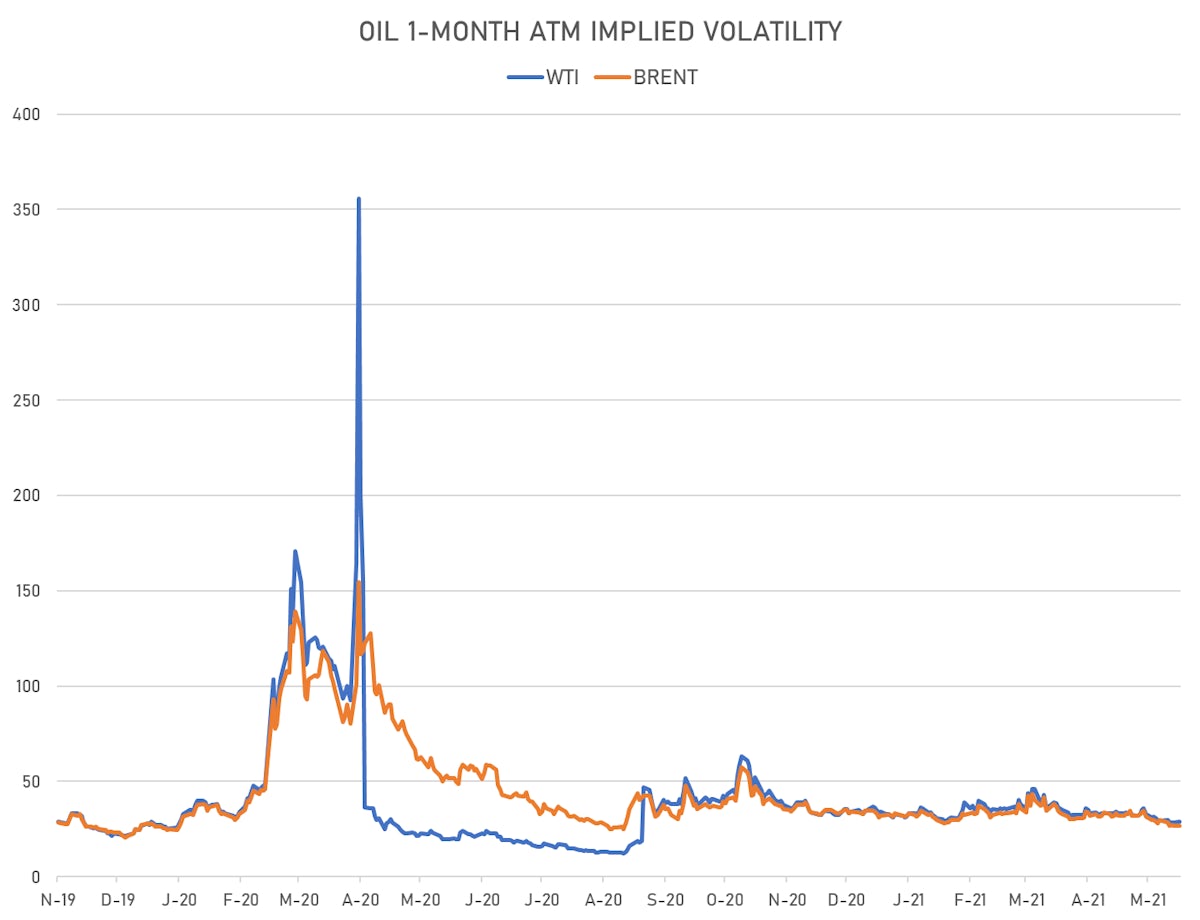

- Brent volatility at 26.8, up 0.3% on the day (12-month range: 24.7 - 58.9)

- Newcastle Coal (ICE Europe) currently at US$ 121.60 per tonne, up 1.5% on the day (YTD: +51.1%)

- Natural Gas (Henry Hub) currently at US$ 3.11 per MMBtu, down -0.9% on the day (YTD: +20.9%)

- Gasoline (NYMEX) currently at US$ 2.18 per gallon, down -0.8% on the day (YTD: +55.7%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 578.00 per tonne, down -0.1% on the day (YTD: +38.0%)

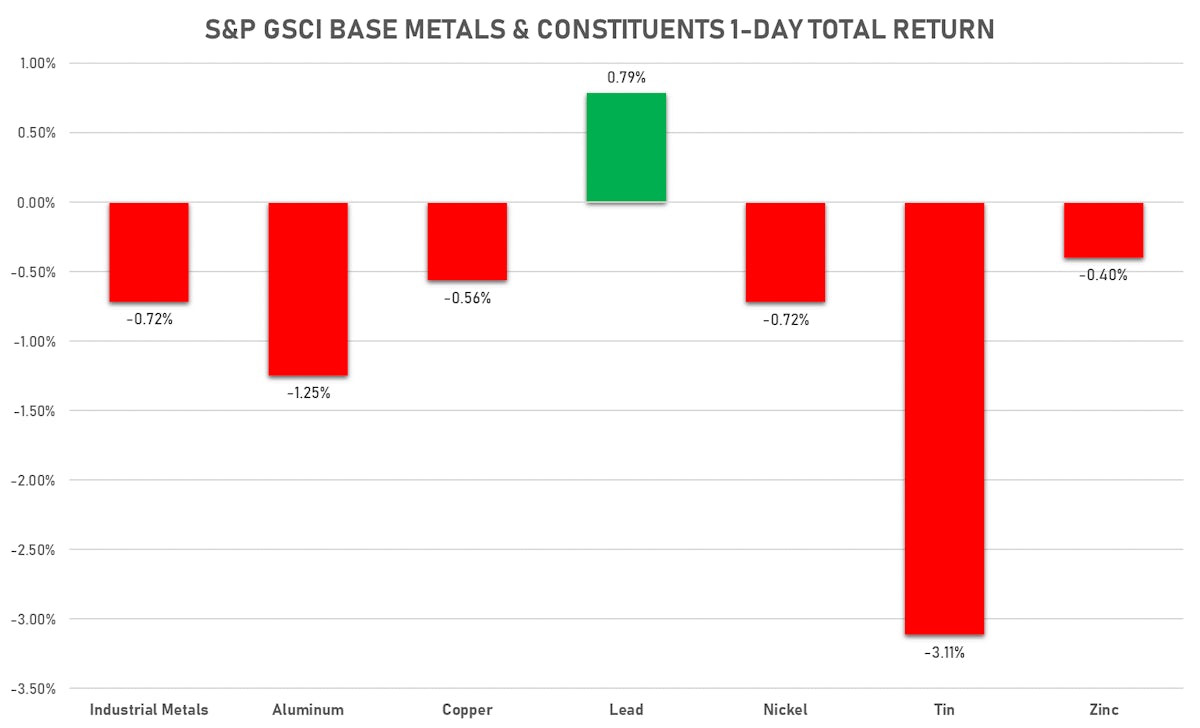

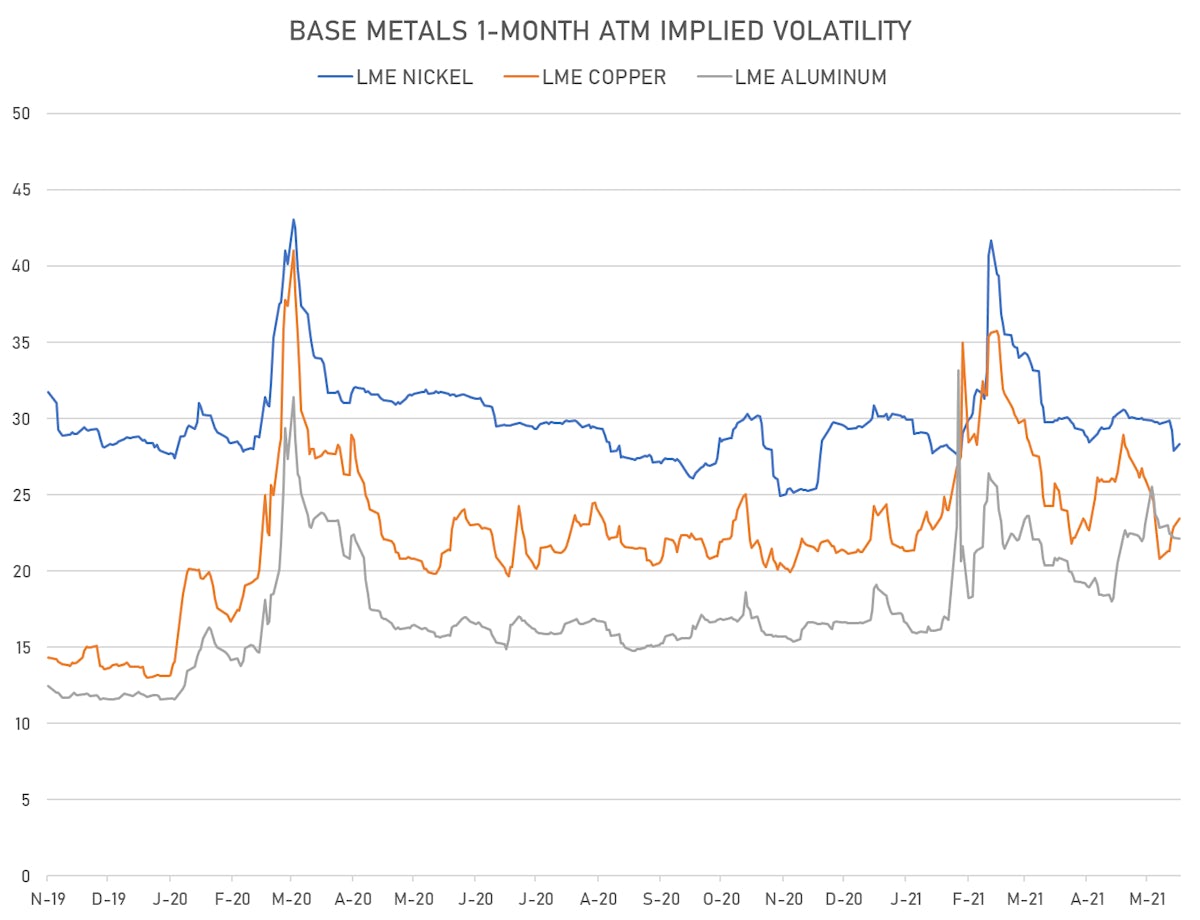

BASE METALS

- Copper (COMEX) currently at US$ 4.54 per pound, down -0.1% on the day (YTD: +29.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,279.50 per tonne, unchanged (YTD: +18.6%)

- Aluminium (Shanghai) currently at CNY 18,485 per tonne, up 1.0% on the day (YTD: +17.9%)

- Nickel (Shanghai) currently at CNY 131,130 per tonne, unchanged (YTD: +5.5%)

- Lead (Shanghai) currently at CNY 15,000 per tonne, down -0.8% on the day (YTD: +1.4%)

- Rebar (Shanghai) currently at CNY 4,878 per tonne, up 0.4% on the day (YTD: +15.6%)

- Tin (Shanghai) currently at CNY 204,500 per tonne, up 1.0% on the day (YTD: +36.2%)

- Zinc (Shanghai) currently at CNY 22,725 per tonne, up 0.2% on the day (YTD: +7.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

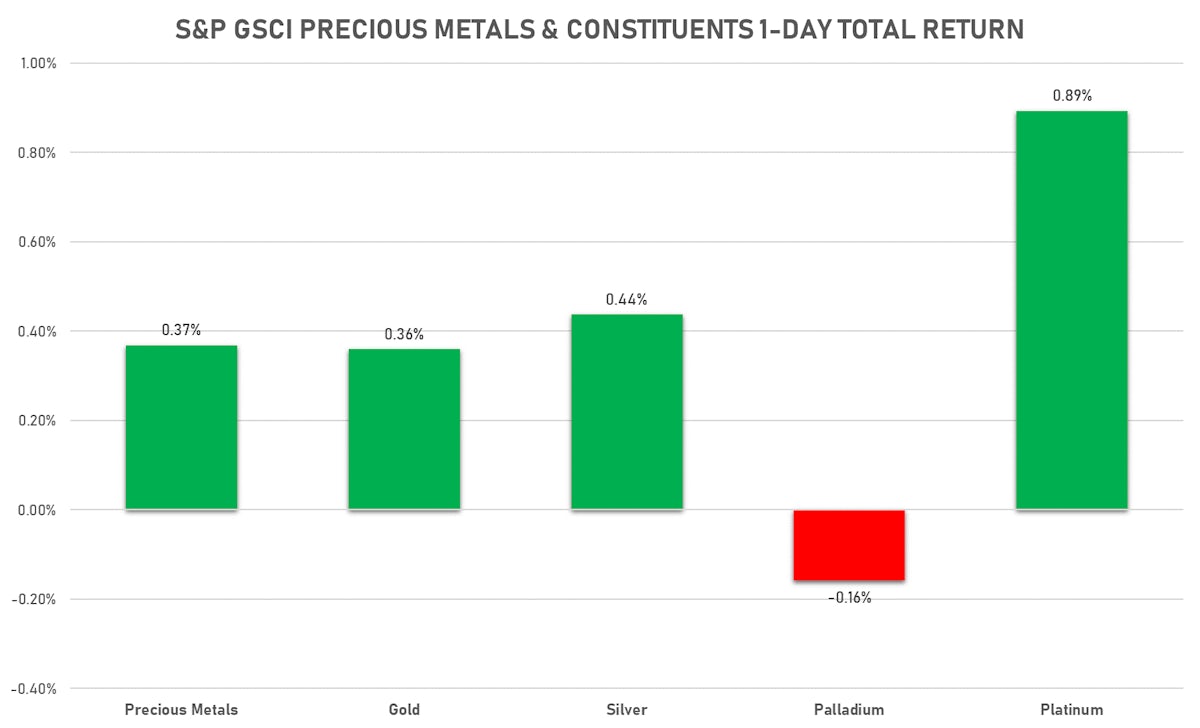

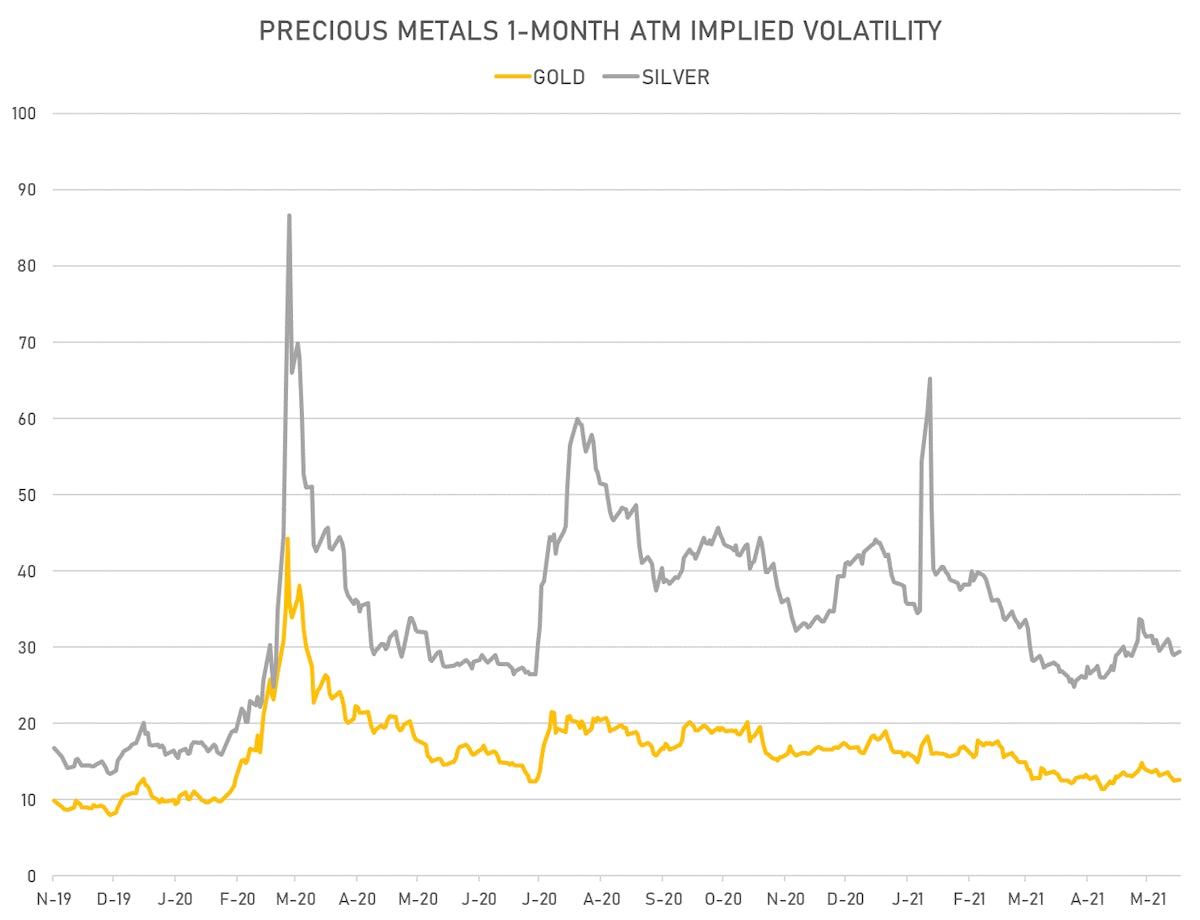

PRECIOUS METALS

- Gold spot currently at US$ 1,901.85 per troy ounce, up 0.4% on the day (YTD: +0.1%)

- Gold 1-Month ATM implied volatility currently at 12.36, up 1.1% on the day (YTD: -21.5%)

- Silver spot currently at US$ 27.92 per troy ounce, up 0.3% on the day (YTD: +5.7%)

- Silver 1-Month ATM implied volatility currently at 28.46, up 1.8% on the day (YTD: -30.7%)

- Palladium spot currently at US$ 2,842.51 per troy ounce, down -0.3% on the day (YTD: +16.0%)

- Platinum spot currently at US$ 1,175.50 per troy ounce, up 0.7% on the day (YTD: +9.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 22,250 per troy ounce, down -1.1% on the day (YTD: +30.5%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

AGRO

- Live Cattle (CME) currently at US$ 116.23 cents per pound, down 0.5% on the day (YTD: +2.9%)

- Lean Hogs (CME) currently at US$ 119.90 cents per pound, up 0.3% on the day (YTD: +70.6%)

- Rough Rice (CBOT) currently at US$ 13.23 cents per hundredweight, down -0.3% on the day (YTD: +7.0%)

- Soybeans Composite (CBOT) currently at US$ 1,571.25 cents per bushel, down -1.5% on the day (YTD: +18.6%)

- Corn (CBOT) currently at US$ 685.25 cents per bushel, down -0.5% on the day (YTD: +40.3%)

- Wheat Composite (CBOT) currently at US$ 686.50 cents per bushel, down -1.1% on the day (YTD: +6.2%)

- Sugar No.11 (ICE US) currently at US$ 17.38 cents per pound, down -1.9% on the day (YTD: +12.2%)

- Cotton No.2 (ICE US) currently at US$ 84.65 cents per pound, down -1.7% on the day (YTD: +8.0%)

- Cocoa (ICE US) currently at US$ 2,350 per tonne, down -2.4% on the day (YTD: -9.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,864 per tonne, up 1.7% on the day (YTD: +22.1%)

- Random Length Lumber (CME) currently at US$ 1,221.20 per 1,000 board feet, down -4.9% on the day (YTD: +39.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,510 per tonne, up 0.5% on the day (YTD: +5.7%)

- Soybean Oil Composite (CBOT) currently at US$ 70.75 cents per pound, down -0.7% on the day (YTD: +63.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,230 per tonne, down -0.8% on the day (YTD: +8.7%)

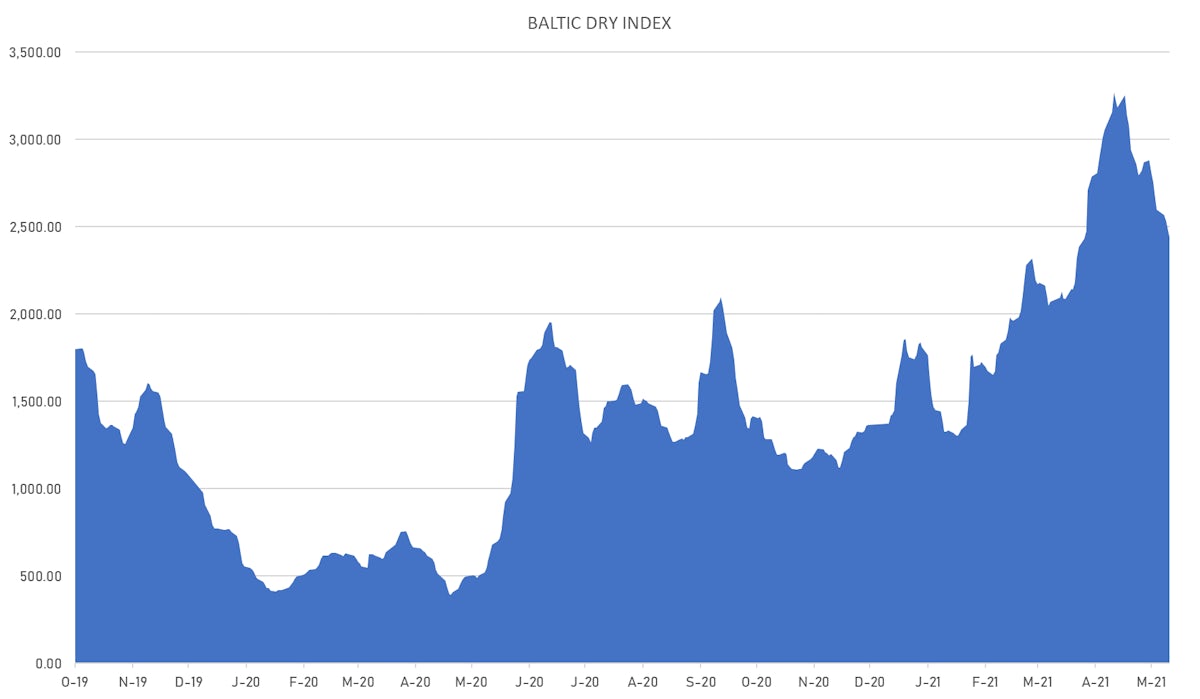

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,438, down -1.4% on the day (YTD: +78.5%)

- Freightos China To North America West Coast Container Index currently at 5,722, down -0.1% on the day (YTD: +36.3%)

- Freightos North America West Coast To China Container Index currently at 1,249, up 23.1% on the day (YTD: +141.2%)

- Freightos North America East Coast To Europe Container Index currently at 699, up 8.4% on the day (YTD: +92.5%)

- Freightos Europe To North America East Coast Container Index currently at 4,979, up 9.8% on the day (YTD: +166.4%)

- Freightos China To North Europe Container Index currently at 10,882, up 1.9% on the day (YTD: +92.2%)

- Freightos North Europe To China Container Index currently at 1,762, up 1.3% on the day (YTD: +28.1%)

- Freightos Europe To South America West Coast Container Index currently at 3,520, unchanged (YTD: +108.1%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 51.47 per tonne, up 3.0% on the day (YTD: +57.3%)