Commodities

Industrial Commodities Rise In China As The Producer Price Index Grew Faster Than Market Expectations

Credit Suisse technical analysts upgrade their bullish views of Brent crude: "look for strength to $75.60 initially, then our original 'flag objective' from earlier this year at $79.10 and now we think on to $82.50. Big picture, we see scope for the $86.74 high of 2018" (20% above today's close of $72.22)

Published ET

Shanghai-traded Stannum (tin) Daily Prices | Source: Refinitiv

HEADLINES & MACRO

- Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 04 Jun (EIA, United States) at -5.24, below consensus estimate of -2.04

- Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 04 Jun (EIA, United States) at 4.41, above consensus estimate of 1.36

- Stock Levels, EIA, Gasoline, Absolute change, Volume for W 04 Jun (EIA, United States) at 7.05, above consensus estimate of 0.70

- Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 04 Jun (EIA, United States) at 2.60%, above consensus estimate of 0.60%

NOTABLE GAINERS

- DCE Coking Coal Continuation Month 1 up 6.5% (YTD: 15.0%)

- Pork Primal Cutout Butt up 3.4% (YTD: 162.6%)

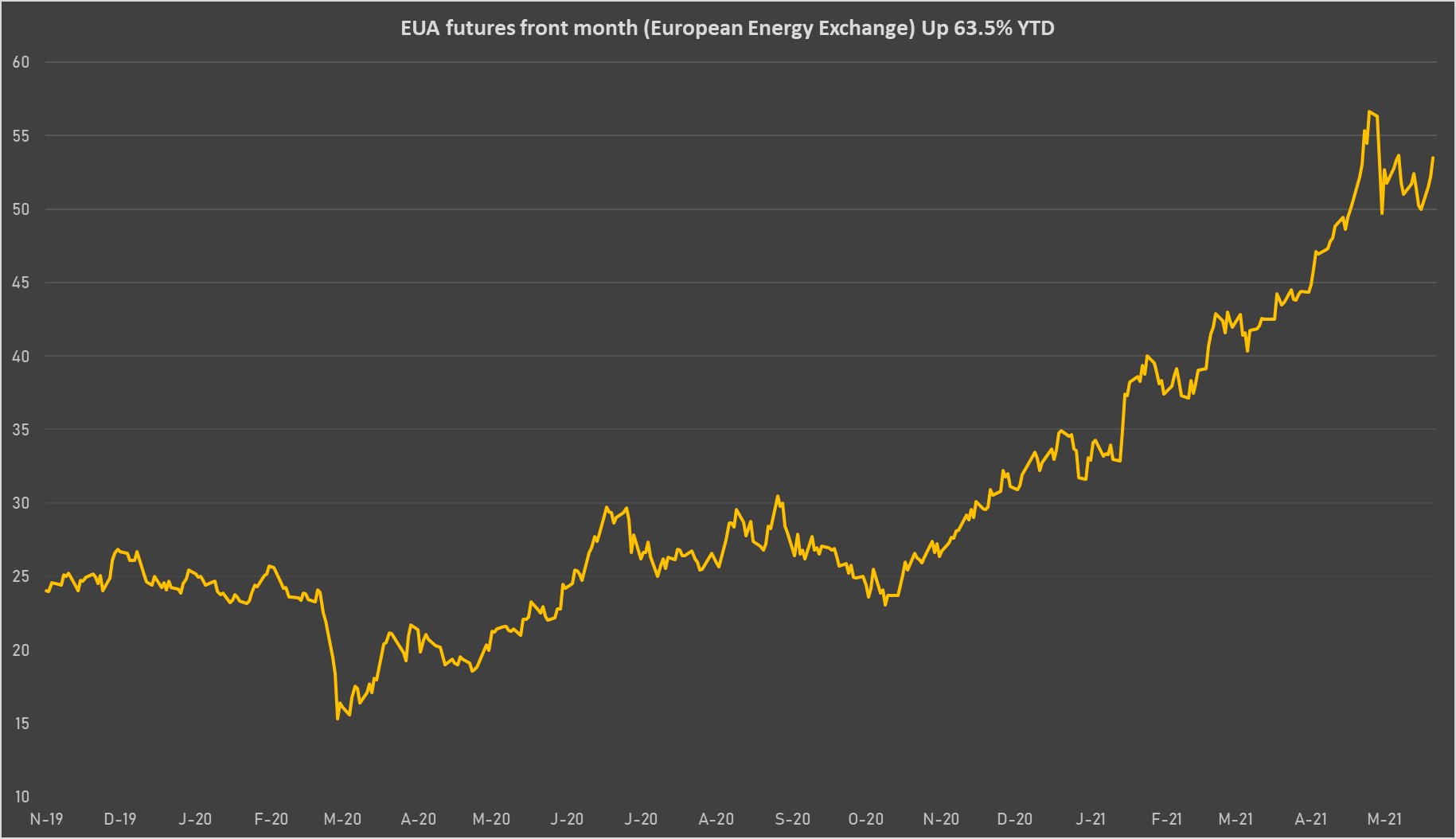

- CO2 European Union Allowance (EUA) Yearly up 2.6% (YTD: 63.5%)

- SHFE Stannum (tin) up 2.1% (YTD: 39.0%)

- SHFE Lead Continuation Month 1 up 1.9% (YTD: 3.6%)

- ICE-US Cotton No. 2 up 1.7% (YTD: 10.9%)

- CBoT Corn up 1.6% (YTD: 42.7%)

- DCE Iron Ore Continuation Month 1 up 1.4% (YTD: 17.7%)

- SHFE Nickel up 1.2% (YTD: 7.0%)

- Zhengzhou Exchange Thermal Coal up 1.2% (YTD: 10.5%)

NOTABLE LOSERS

- Johnson Matthey Rhodium New York 0930 down -2.5% (YTD: 24.3%)

- Silver/US Dollar 1 Month ATM Option down -2.5% (YTD: -33.2%)

- Bursa Malaysia Crude Palm Oil down -2.2% (YTD: 5.1%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -1.6% (YTD: 7.1%)

- Gold/US Dollar 1 Month ATM Option down -1.4% (YTD: -23.3%)

- Coffee Arabica Colombia Excelso EP Spot down -1.2% (YTD: 20.0%)

- Palladium spot down -1.2% (YTD: 13.4%)

- ICE-US Cocoa down -1.1% (YTD: -9.8%)

- CBoT Soybeans down -1.1% (YTD: 18.8%)

ENERGY

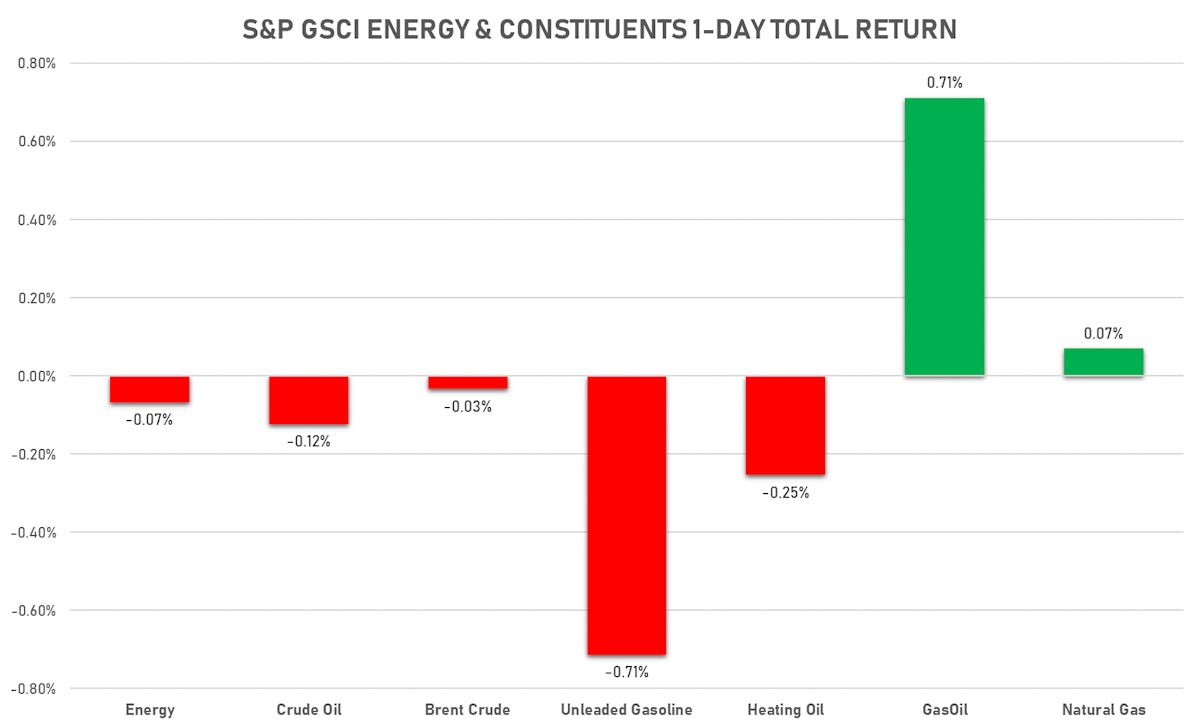

- WTI crude front month currently at US$ 69.70 per barrel, down -0.1% on the day (YTD: +44.2%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 72.22 per barrel, unchanged (YTD: +39.4%); 6-month term structure in widening backwardation

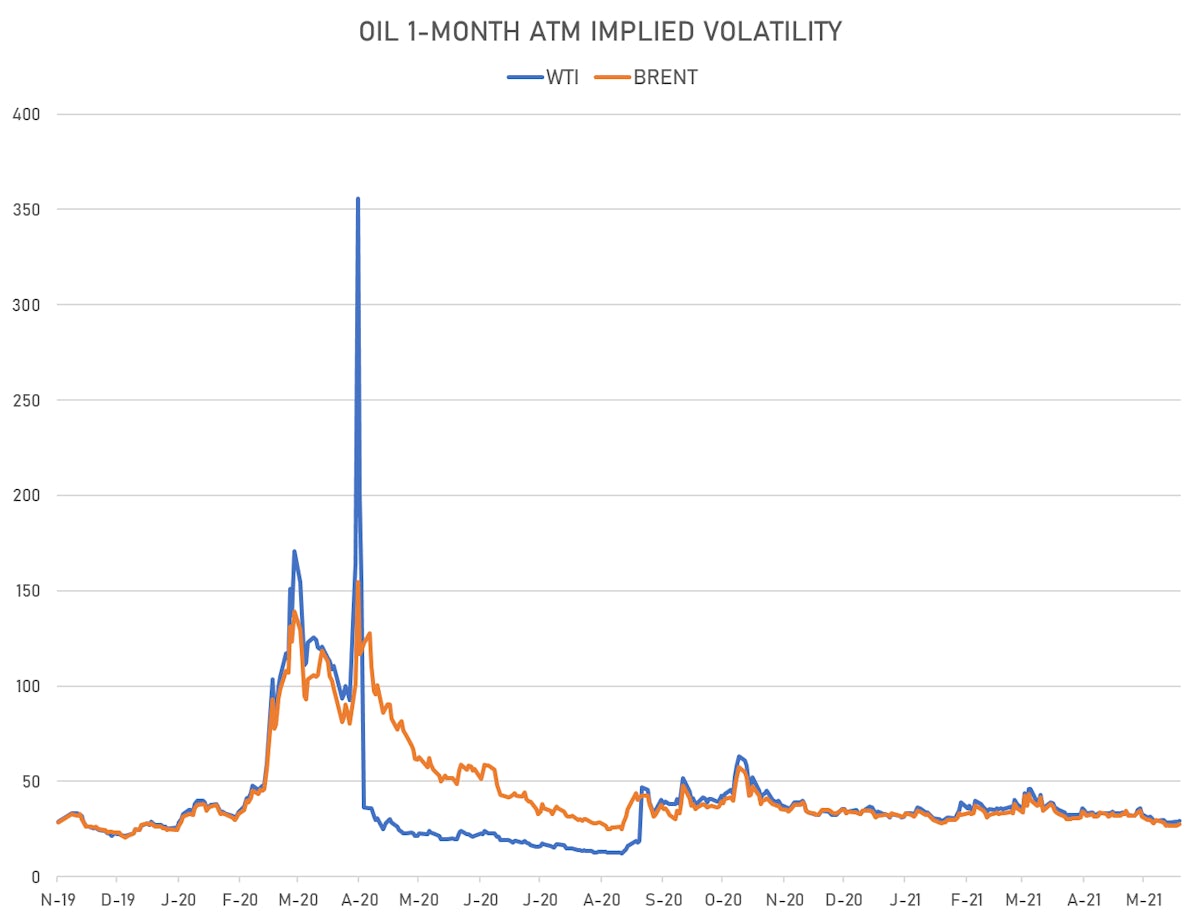

- Brent volatility at 27.4, up 1.6% on the day (12-month range: 24.7 - 58.9)

- Newcastle Coal (ICE Europe) currently at US$ 123.70 per tonne, up 0.8% on the day (YTD: +53.7%)

- Natural Gas (Henry Hub) currently at US$ 3.16 per MMBtu, unchanged (YTD: +23.2%)

- Gasoline (NYMEX) currently at US$ 2.20 per gallon, down -0.7% on the day (YTD: +56.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 584.75 per tonne, up 0.7% on the day (YTD: +39.0%)

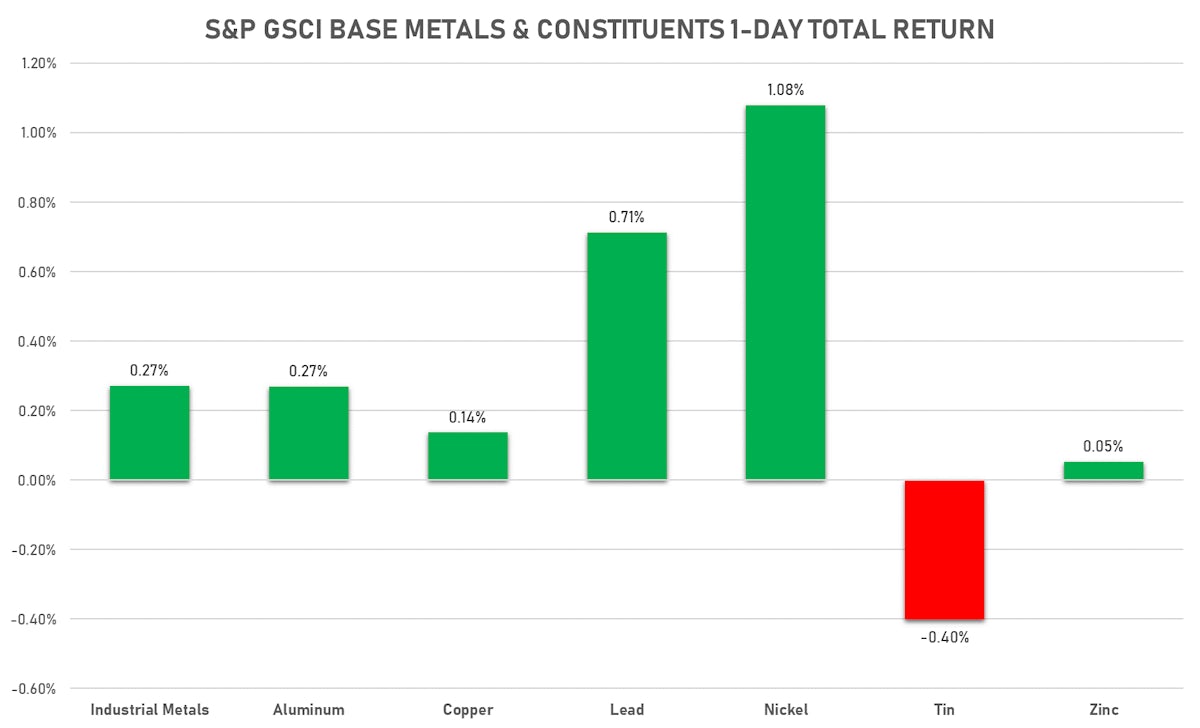

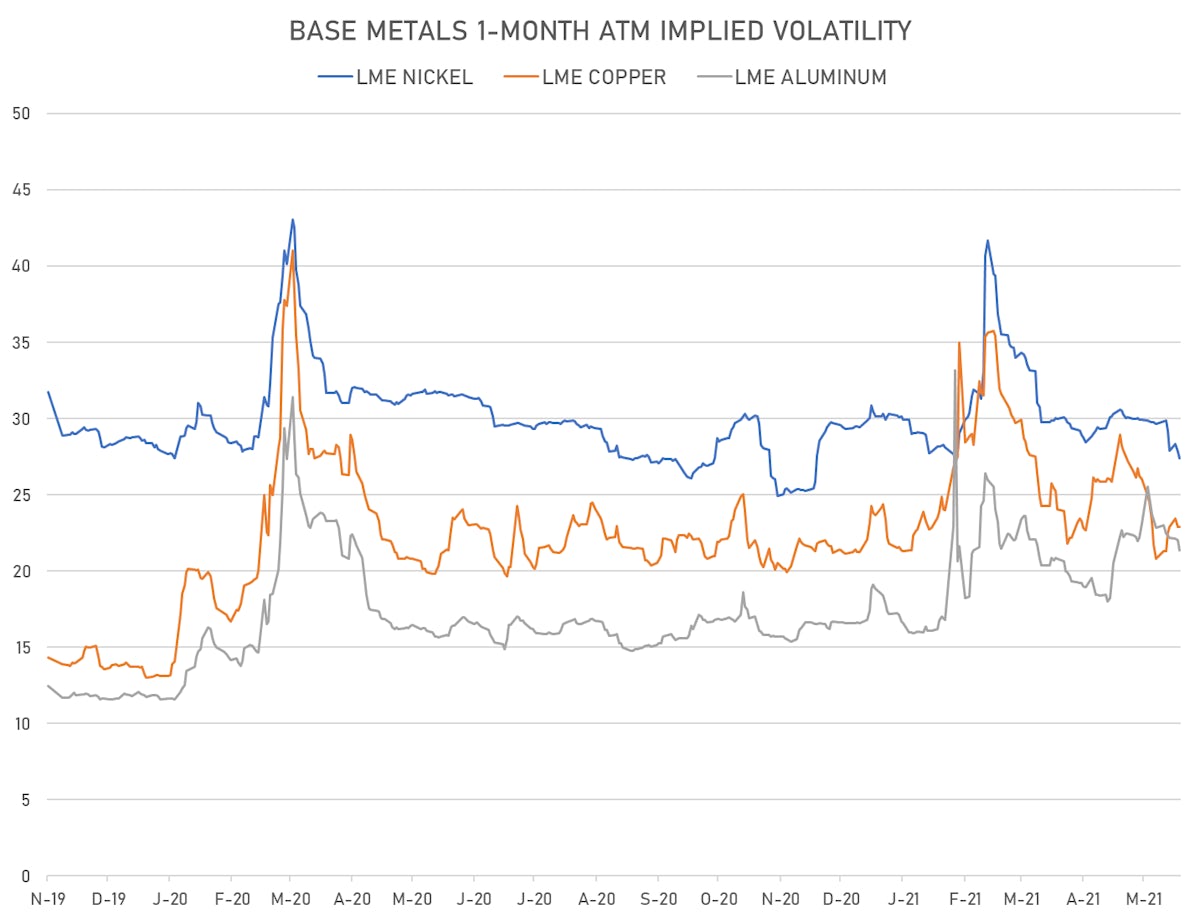

BASE METALS

- Copper (COMEX) currently at US$ 4.54 per pound, down -0.6% on the day (YTD: +29.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,270.00 per tonne, up 1.4% on the day (YTD: +17.7%)

- Aluminium (Shanghai) currently at CNY 18,610 per tonne, up 0.2% on the day (YTD: +17.3%)

- Nickel (Shanghai) currently at CNY 132,900 per tonne, up 1.2% on the day (YTD: +7.0%)

- Lead (Shanghai) currently at CNY 15,330 per tonne, up 1.9% on the day (YTD: +3.6%)

- Rebar (Shanghai) currently at CNY 4,898 per tonne, unchanged (YTD: +16.1%)

- Tin (Shanghai) currently at CNY 209,150 per tonne, up 2.1% on the day (YTD: +39.0%)

- Zinc (Shanghai) currently at CNY 22,630 per tonne, up 0.2% on the day (YTD: +8.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

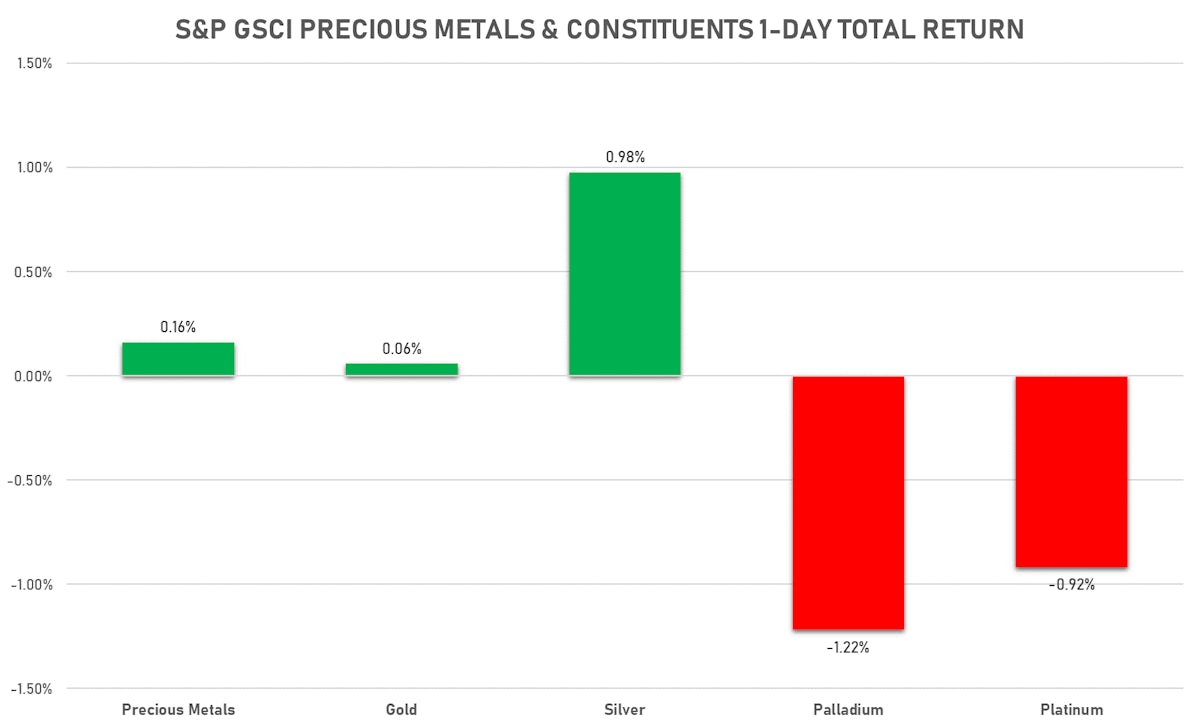

PRECIOUS METALS

- Gold spot currently at US$ 1,888.39 per troy ounce, down -0.2% on the day (YTD: -0.5%)

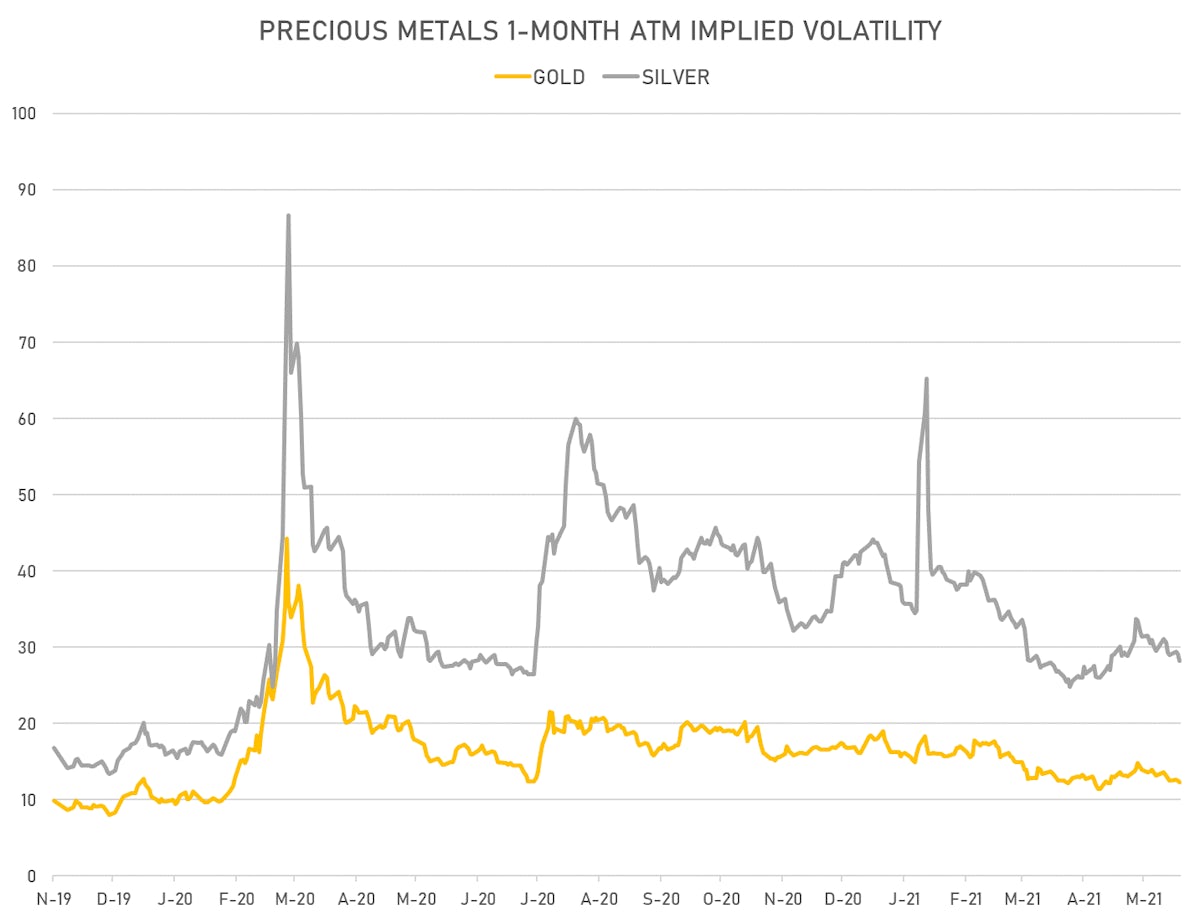

- Gold 1-Month ATM implied volatility currently at 11.94, down -1.4% on the day (YTD: -23.3%)

- Silver spot currently at US$ 27.78 per troy ounce, up 0.6% on the day (YTD: +5.3%)

- Silver 1-Month ATM implied volatility currently at 27.41, down -2.5% on the day (YTD: -33.2%)

- Palladium spot currently at US$ 2,781.54 per troy ounce, down -1.2% on the day (YTD: +13.4%)

- Platinum spot currently at US$ 1,149.36 per troy ounce, down -1.0% on the day (YTD: +7.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 21,200 per troy ounce, down -2.5% on the day (YTD: +24.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,300 per troy ounce, unchanged (YTD: +142.3%)

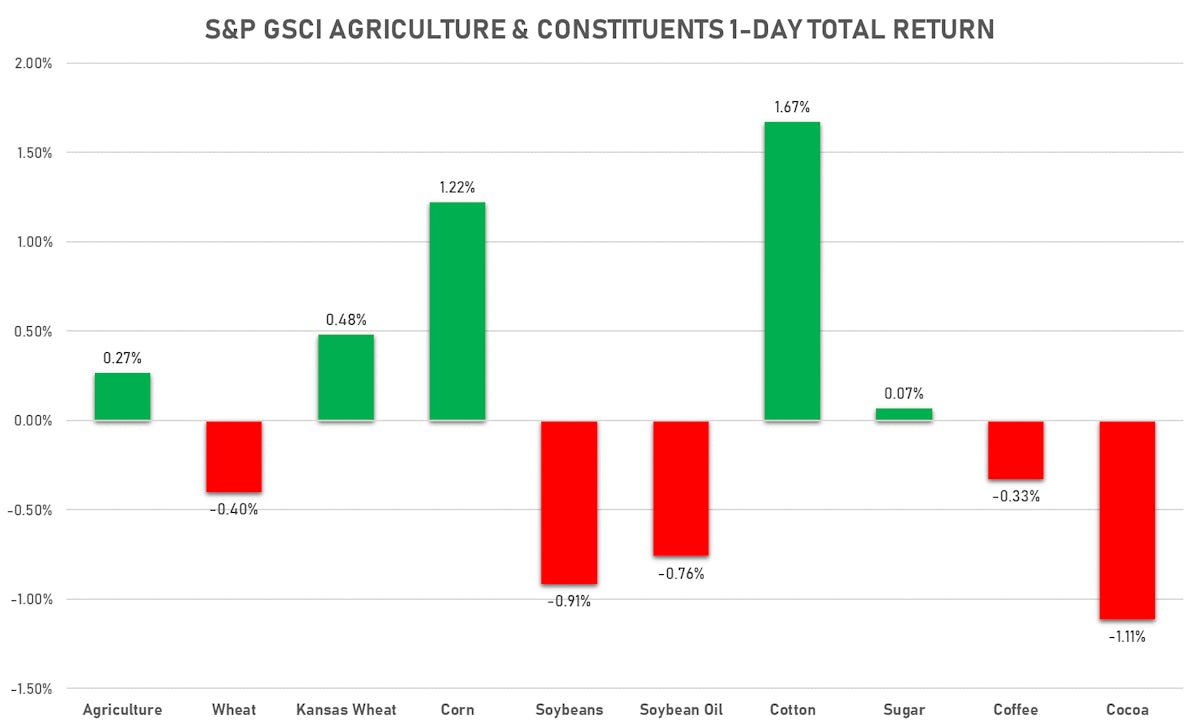

AGRO

- Live Cattle (CME) currently at US$ 117.40 cents per pound, up 0.6% on the day (YTD: +3.9%)

- Lean Hogs (CME) currently at US$ 121.95 cents per pound, up 1.0% on the day (YTD: +73.5%)

- Rough Rice (CBOT) currently at US$ 13.09 cents per hundredweight, down -0.4% on the day (YTD: +5.5%)

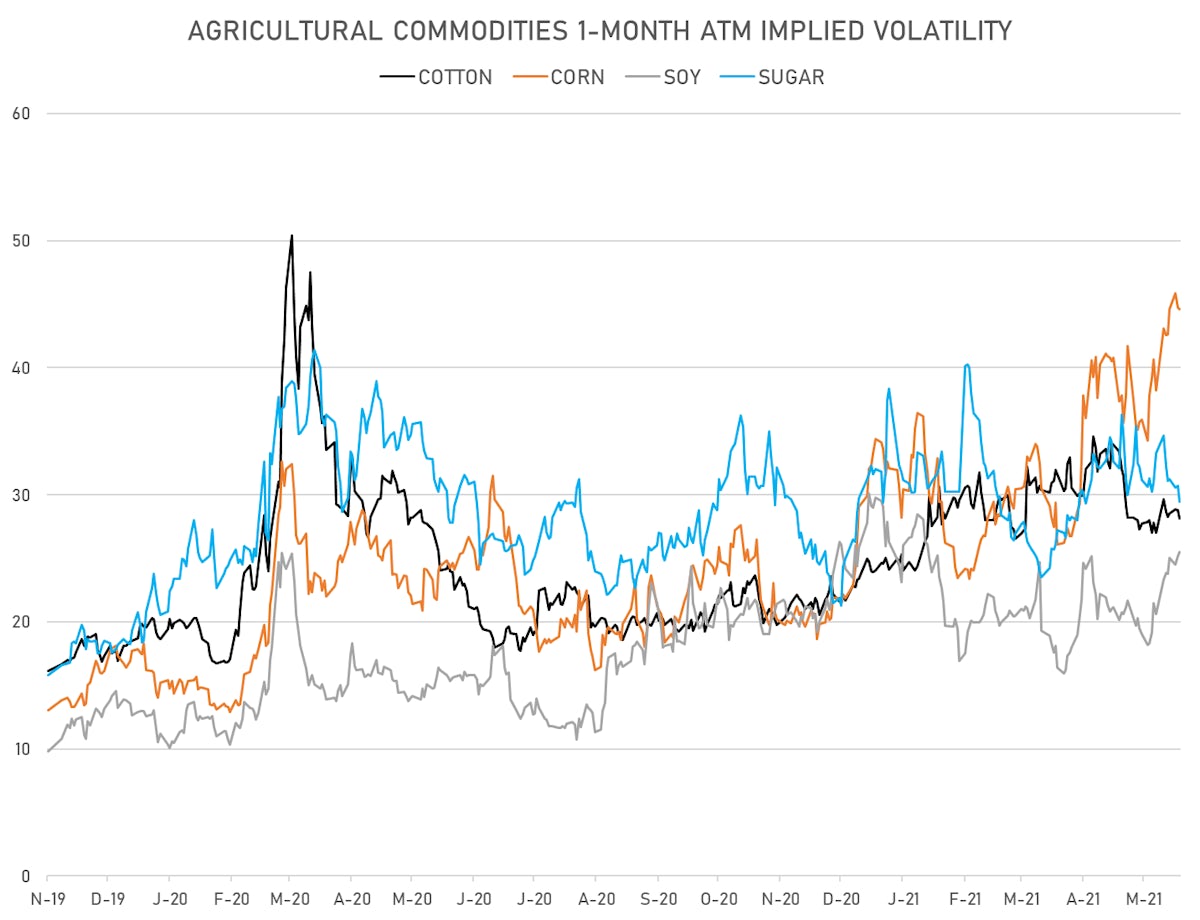

- Soybeans Composite (CBOT) currently at US$ 1,562.50 cents per bushel, down -1.1% on the day (YTD: +18.8%)

- Corn (CBOT) currently at US$ 690.75 cents per bushel, up 1.6% on the day (YTD: +42.7%)

- Wheat Composite (CBOT) currently at US$ 682.25 cents per bushel, down -0.4% on the day (YTD: +6.5%)

- Sugar No.11 (ICE US) currently at US$ 17.73 cents per pound, up 0.1% on the day (YTD: +14.5%)

- Cotton No.2 (ICE US) currently at US$ 86.62 cents per pound, up 1.7% on the day (YTD: +10.9%)

- Cocoa (ICE US) currently at US$ 2,348 per tonne, down -1.1% on the day (YTD: -9.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,797 per tonne, down -1.2% on the day (YTD: +20.0%)

- Random Length Lumber (CME) currently at US$ 1,164.20 per 1,000 board feet, down -0.2% on the day (YTD: +33.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,500 per tonne, up 0.3% on the day (YTD: +5.3%)

- Soybean Oil Composite (CBOT) currently at US$ 71.59 cents per pound, down -0.7% on the day (YTD: +65.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,090 per tonne, down -2.2% on the day (YTD: +5.1%)

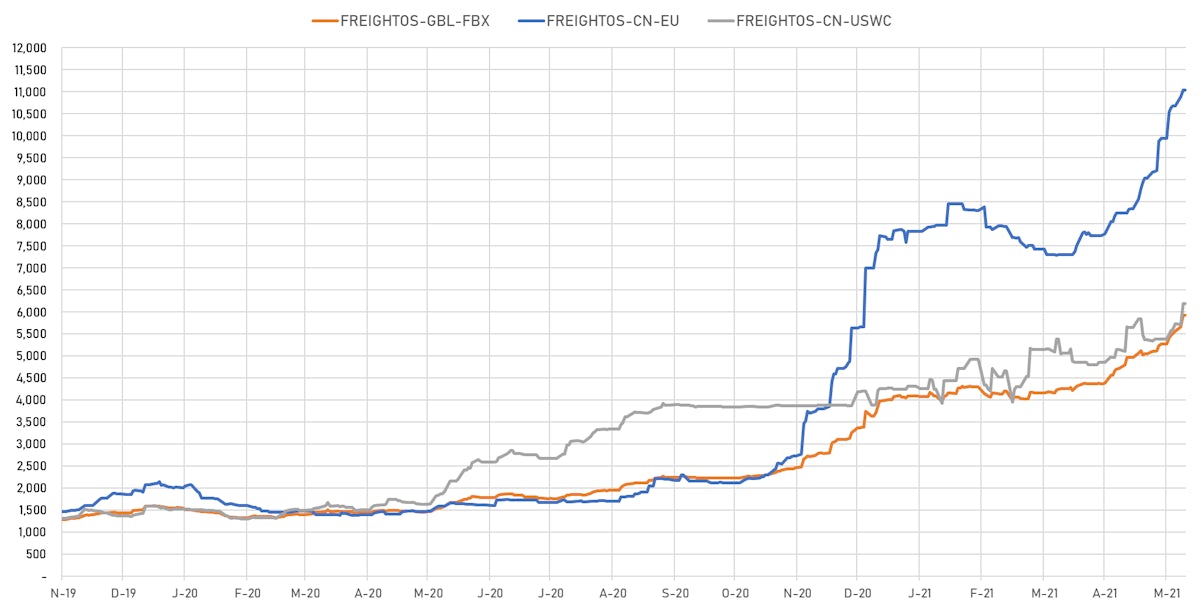

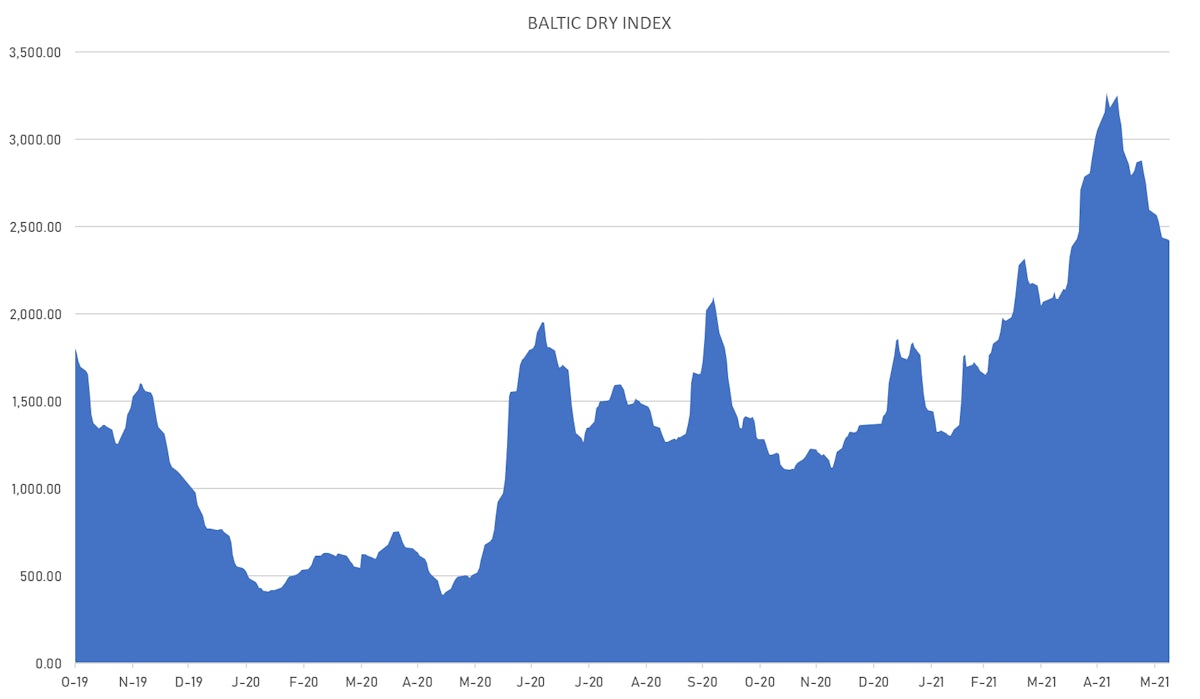

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 2,420, down -0.3% on the day (YTD: +77.2%)

- Freightos China To North America West Coast Container Index currently at 6,181, unchanged (YTD: +47.2%)

- Freightos North America West Coast To China Container Index currently at 1,266, unchanged (YTD: +144.5%)

- Freightos North America East Coast To Europe Container Index currently at 699, unchanged (YTD: +92.5%)

- Freightos Europe To North America East Coast Container Index currently at 5,051, unchanged (YTD: +170.3%)

- Freightos China To North Europe Container Index currently at 11,037, unchanged (YTD: +94.9%)

- Freightos North Europe To China Container Index currently at 1,659, unchanged (YTD: +20.7%)

- Freightos Europe To South America West Coast Container Index currently at 3,754, unchanged (YTD: +121.9%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 53.51 per tonne, up 2.6% on the day (YTD: +63.5%)