Commodities

Precious Metals Fall Big On More Hawkish Fed Policy, Stronger Dollar

Crude managed eke out a small gain today as the weekly EIA report showed a bigger-than-expected crude inventory draw, while natural gas built inventory (a draw was expected)

Published ET

Gold spot prices Intraday | Source: Refinitiv

HEADLINES & MACRO

- United States, Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 11 Jun (EIA, United States) at -7.36 Mln, below consensus estimate of -3.29 Mln

- United States, Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 11 Jun (EIA, United States) at -1.02 Mln, below consensus estimate of 0.19 Mln

- United States, Stock Levels, EIA, Gasoline, Absolute change, Volume for W 11 Jun (EIA, United States) at 1.95 Mln, above consensus estimate of -0.61 Mln

- United States, Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 11 Jun (EIA, United States) at 1.30 %, above consensus estimate of 0.30 %

NOTABLE GAINERS

- DCE Coking Coal Continuation Month 1 up 18.5% (YTD: 35.4%)

- DCE Coke up 11.0% (YTD: -11.8%)

- CBOE Crude Oil Volatility Index up 7.2% (YTD: -10.6%)

- SHFE Bitumen Continuation Month 1 up 7.0% (YTD: 36.4%)

- Shanghai International Exchange TSR 20 Rubber up 3.1% (YTD: 3.5%)

- SHFE Rubber up 2.6% (YTD: -7.4%)

- SHFE Rebar up 2.3% (YTD: 17.7%)

- CBoT Soybean Meal up 1.8% (YTD: -12.7%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 1.8% (YTD: 46.5%)

- Gold/US Dollar 1 Month ATM Option IV up 1.7% (YTD: -20.6%)

NOTABLE LOSERS

- DCE RBD Palm Oil down -14.2% (YTD: 7.2%)

- CBoT Soybean Oil down -5.3% (YTD: 43.2%)

- CME Random Length Lumber down -4.2% (YTD: 10.9%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index down -3.5% (YTD: 112.3%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index down -3.2% (YTD: 94.1%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index down -3.1% (YTD: 57.5%)

- Platinum spot down -3.0% (YTD: 4.6%)

- CME Lean Hogs down -2.5% (YTD: 64.4%)

- Silver spot down -2.5% (YTD: 2.3%)

- Gold spot down -2.4% (YTD: -4.5%)

- Shanghai International Exchange Bonded Copper down -2.2% (YTD: 19.2%)

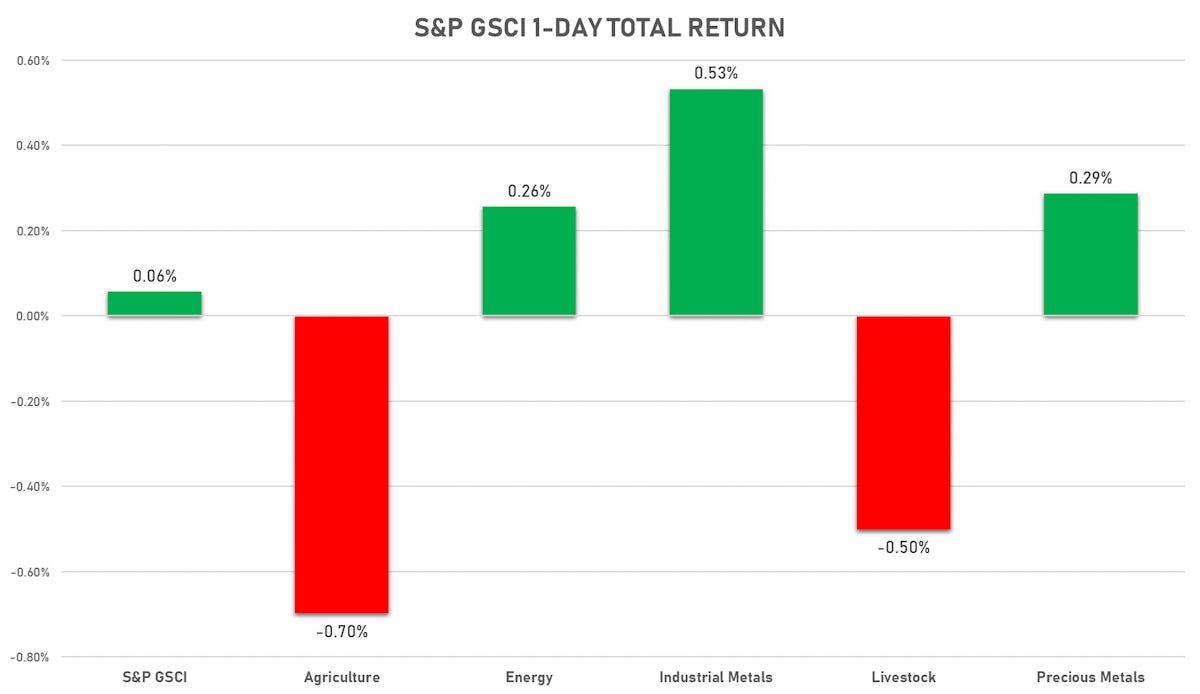

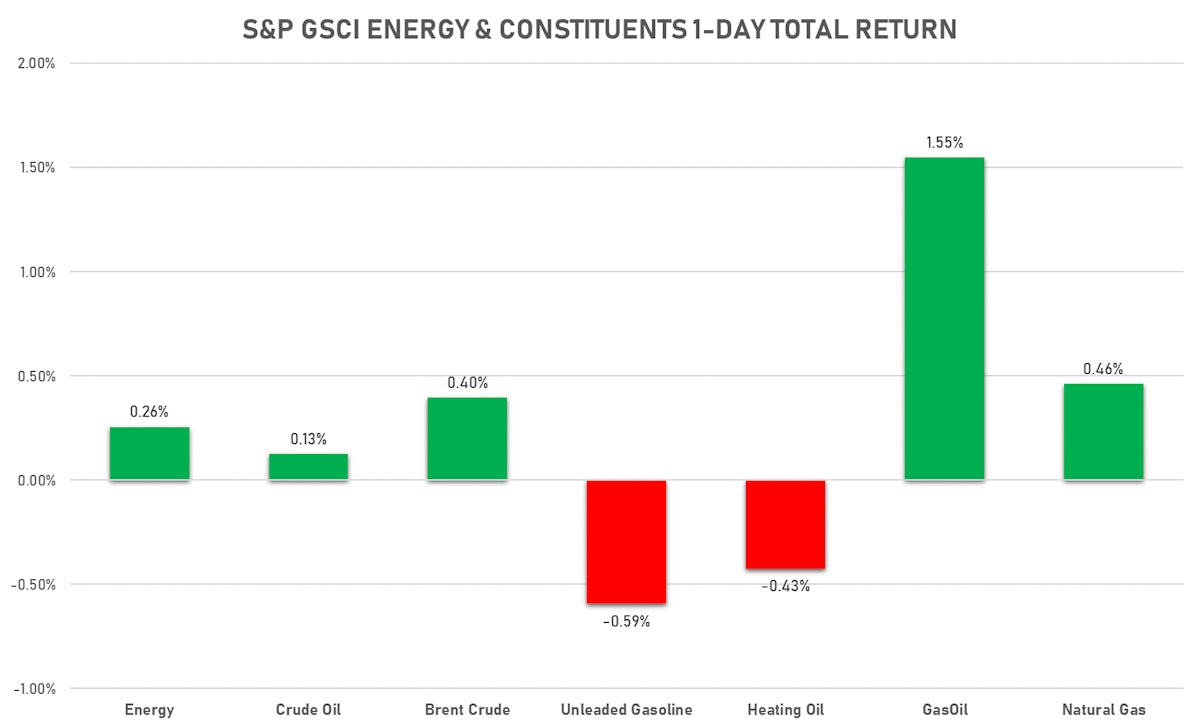

ENERGY

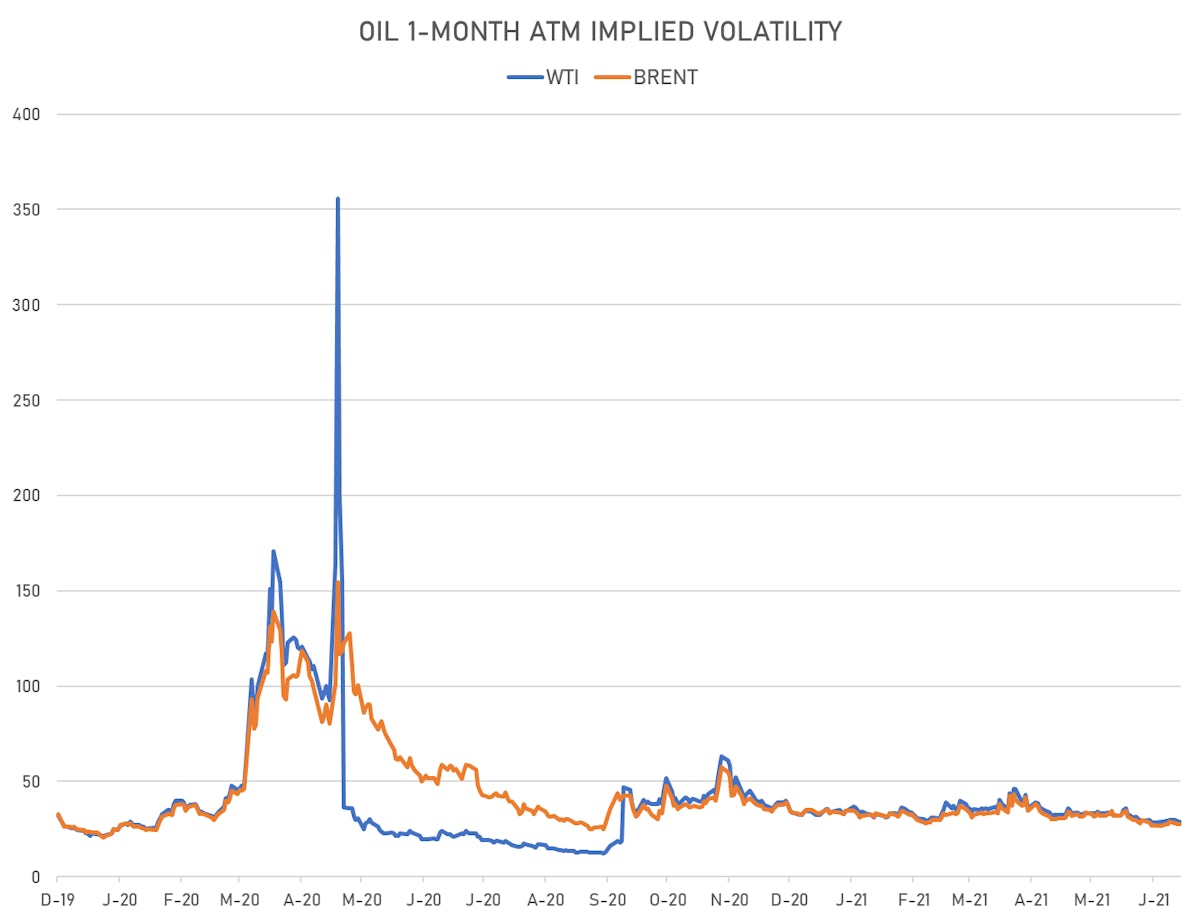

- WTI crude front month currently at US$ 71.54 per barrel, unchanged (YTD: +48.7%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 74.39 per barrel, up 0.5% on the day (YTD: +43.6%); 6-month term structure in widening backwardation

- Brent volatility at 27.7, up 0.9% on the day (12-month range: 24.7 - 58.6)

- Newcastle Coal (ICE Europe) currently at US$ 125.25 per tonne, up 0.2% on the day (YTD: +55.6%)

- Natural Gas (Henry Hub) currently at US$ 3.25 per MMBtu, up 0.3% on the day (YTD: +28.0%)

- Gasoline (NYMEX) currently at US$ 2.13 per gallon, down -0.7% on the day (YTD: +53.1%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 605.75 per tonne, up 1.6% on the day (YTD: +44.0%)

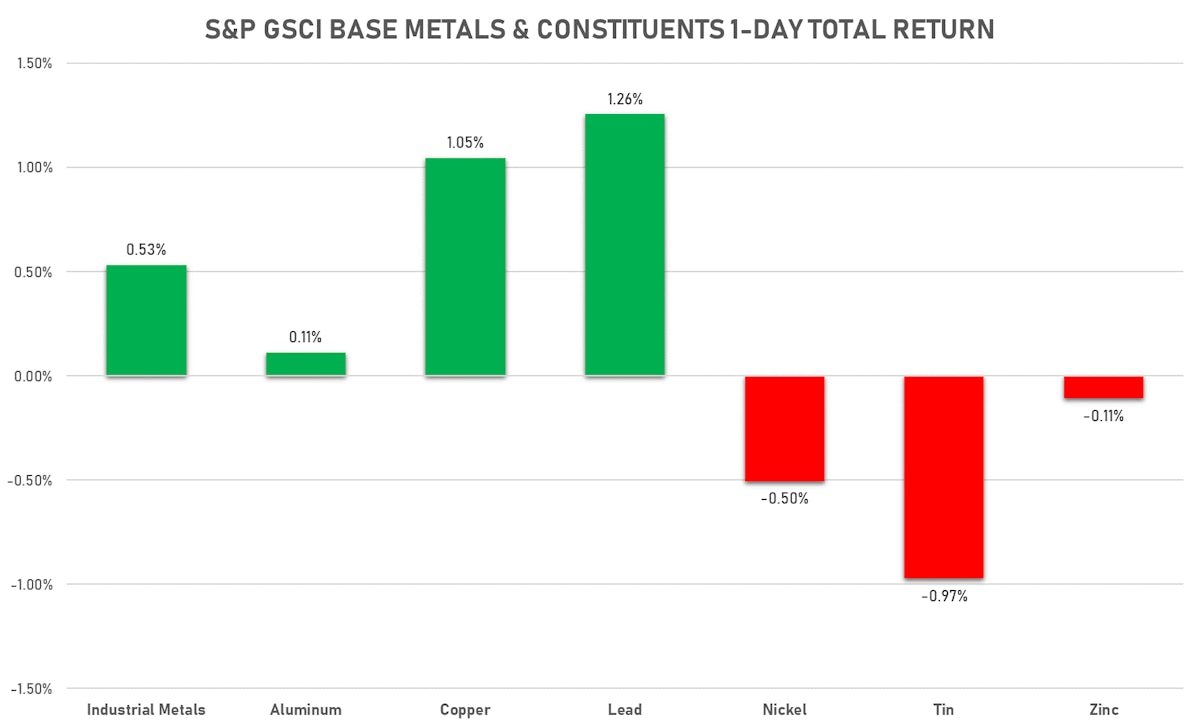

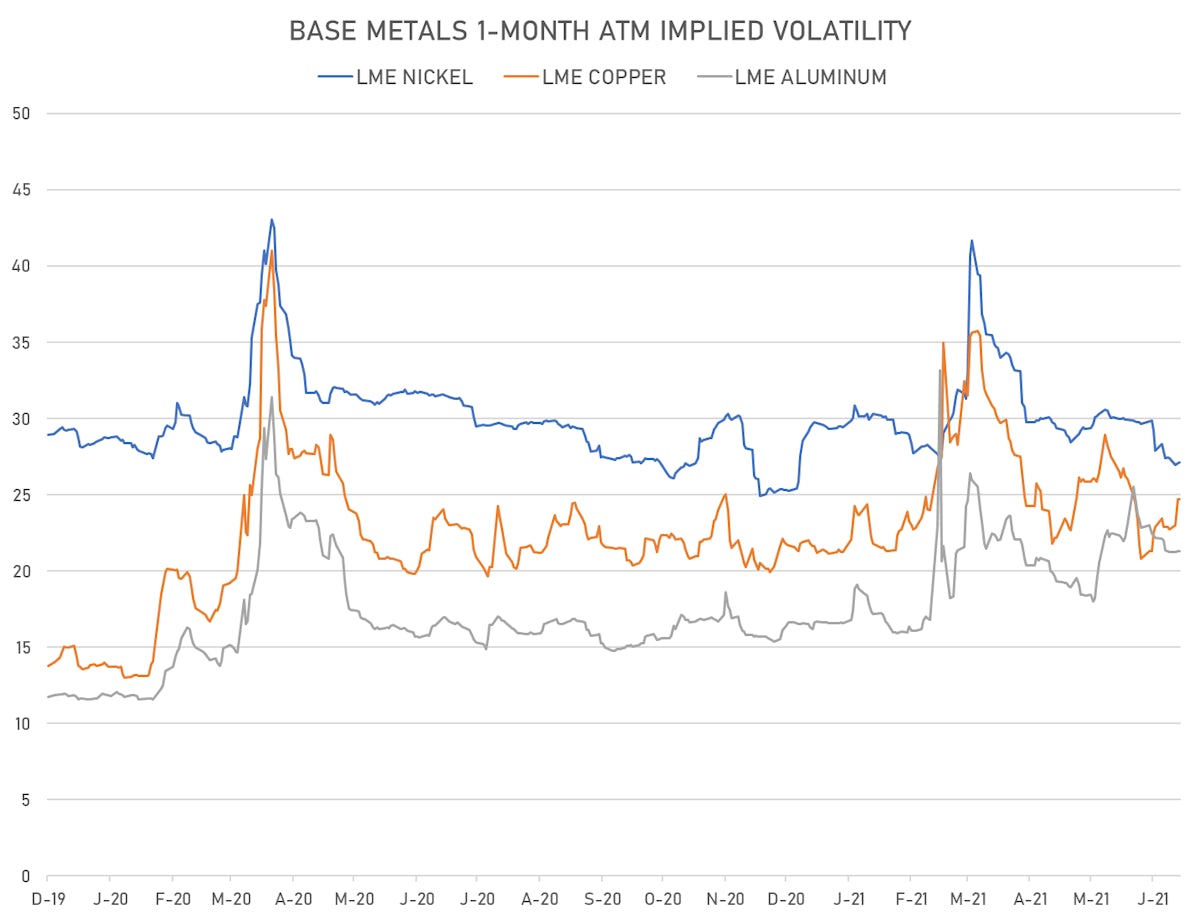

BASE METALS

- Copper (COMEX) currently at US$ 4.30 per pound, up 1.2% on the day (YTD: +25.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,289.50 per tonne, down -0.6% on the day (YTD: +19.0%)

- Aluminium (Shanghai) currently at CNY 18,790 per tonne, down -1.5% on the day (YTD: +19.4%)

- Nickel (Shanghai) currently at CNY 128,730 per tonne, down -1.2% on the day (YTD: +5.2%)

- Lead (Shanghai) currently at CNY 15,375 per tonne, unchanged (YTD: +3.6%)

- Rebar (Shanghai) currently at CNY 4,930 per tonne, up 2.3% on the day (YTD: +17.7%)

- Tin (Shanghai) currently at CNY 206,720 per tonne, up 0.1% on the day (YTD: +37.2%)

- Zinc (Shanghai) currently at CNY 22,760 per tonne, up 0.9% on the day (YTD: +8.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

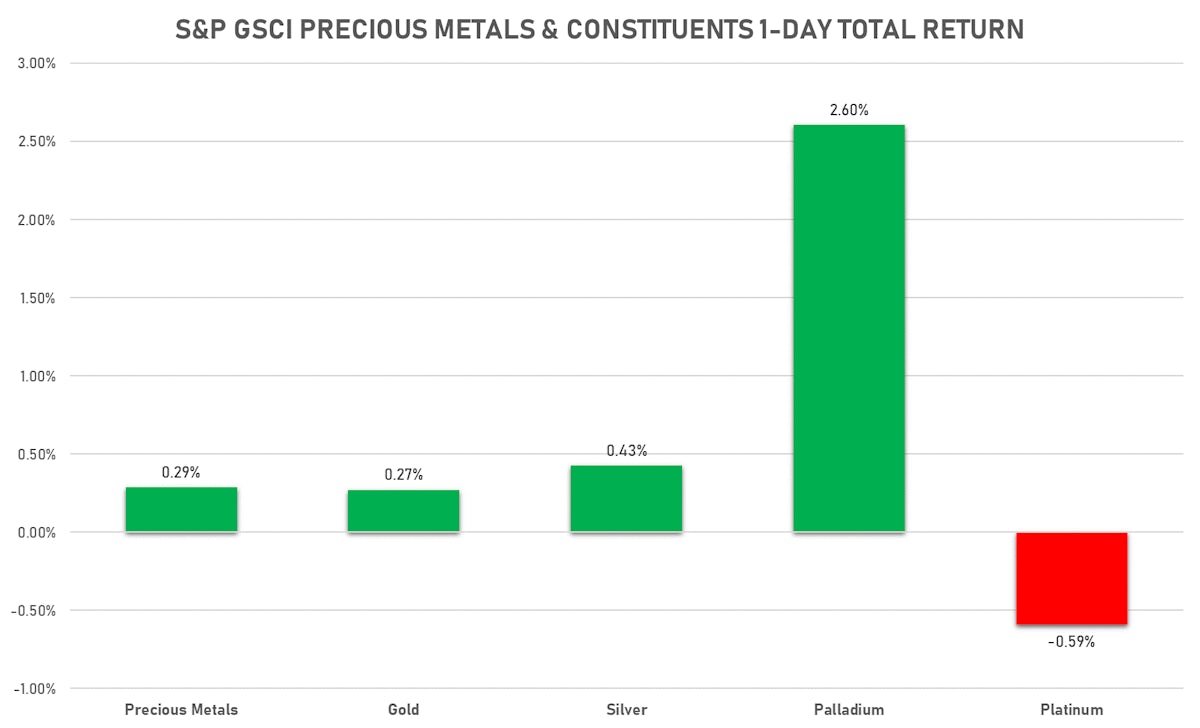

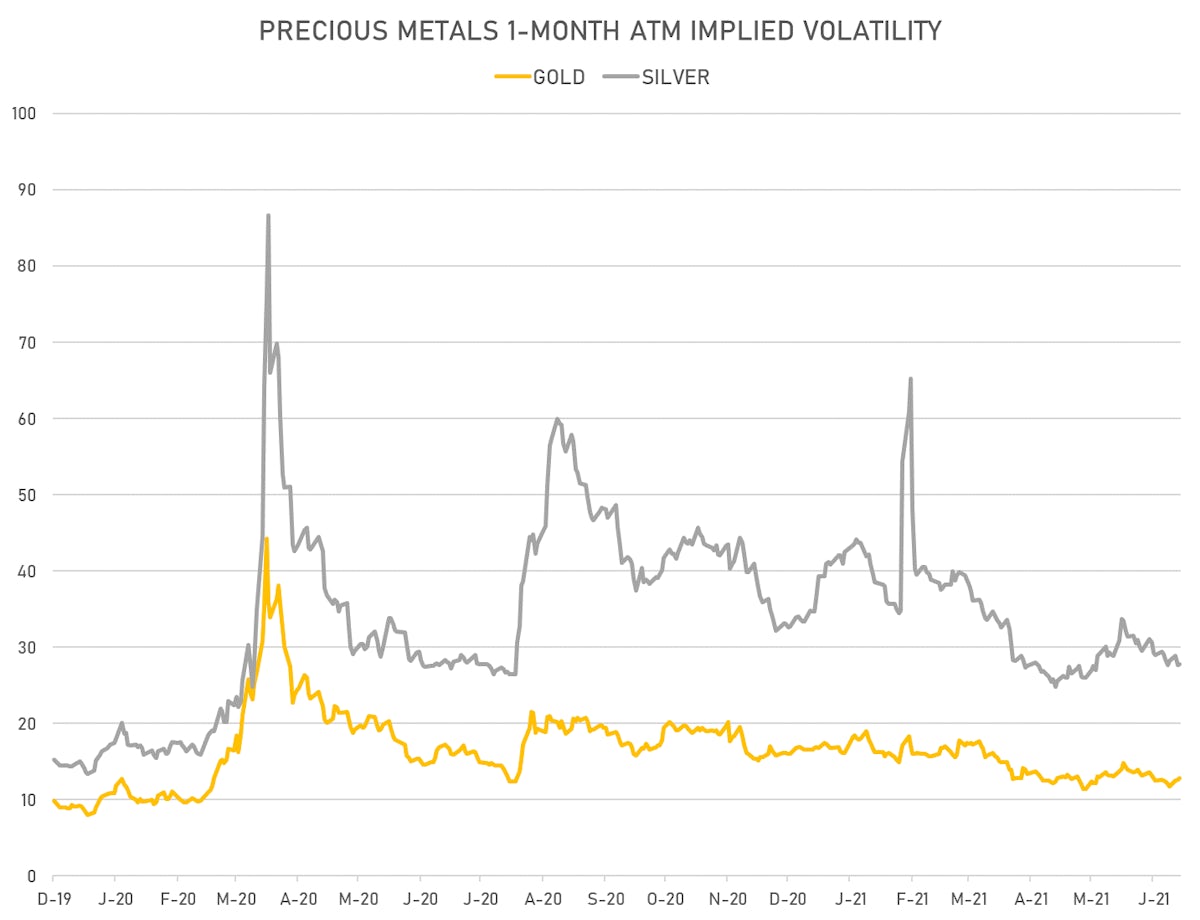

PRECIOUS METALS

- Gold spot currently at US$ 1,817.42 per troy ounce, down -2.4% on the day (YTD: -4.5%)

- Gold 1-Month ATM implied volatility currently at 12.37, up 1.7% on the day (YTD: -20.6%)

- Silver spot currently at US$ 27.17 per troy ounce, down -2.5% on the day (YTD: +2.3%)

- Silver 1-Month ATM implied volatility currently at 26.79, up 0.3% on the day (YTD: -34.6%)

- Palladium spot currently at US$ 2,789.46 per troy ounce, up 1.2% on the day (YTD: +14.3%)

- Platinum spot currently at US$ 1,120.67 per troy ounce, down -3.0% on the day (YTD: +4.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 22,750 per troy ounce, down -1.1% on the day (YTD: +33.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,100 per troy ounce, unchanged (YTD: +134.6%)

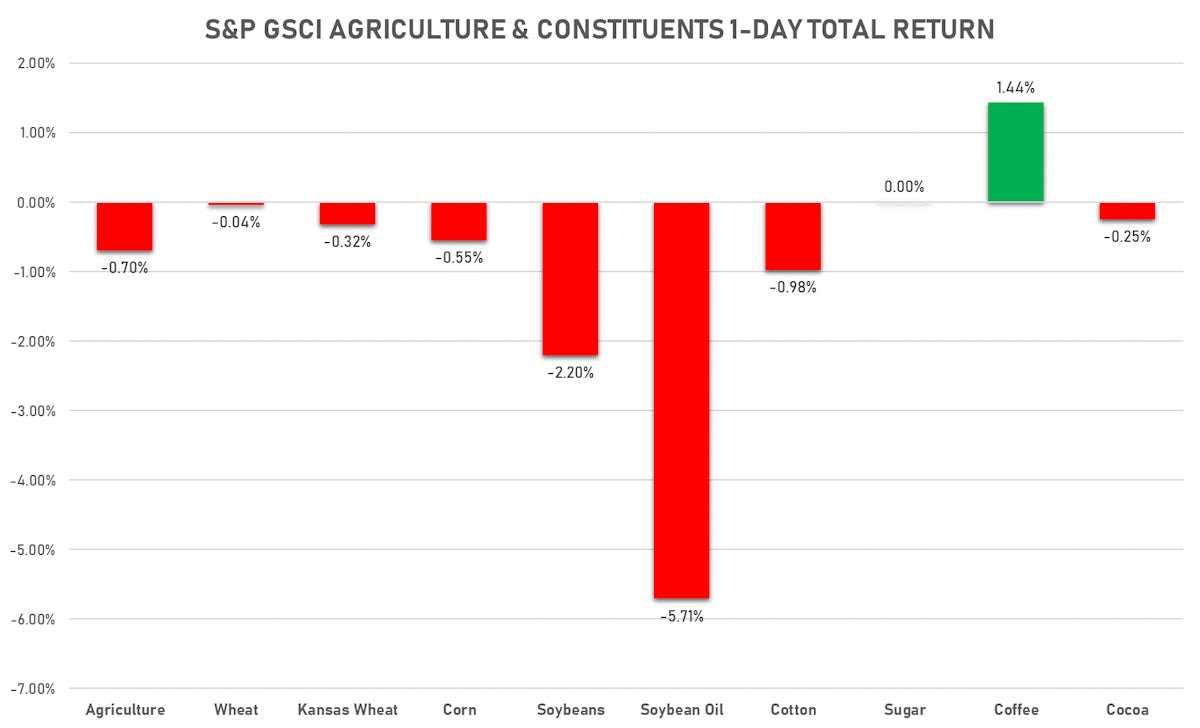

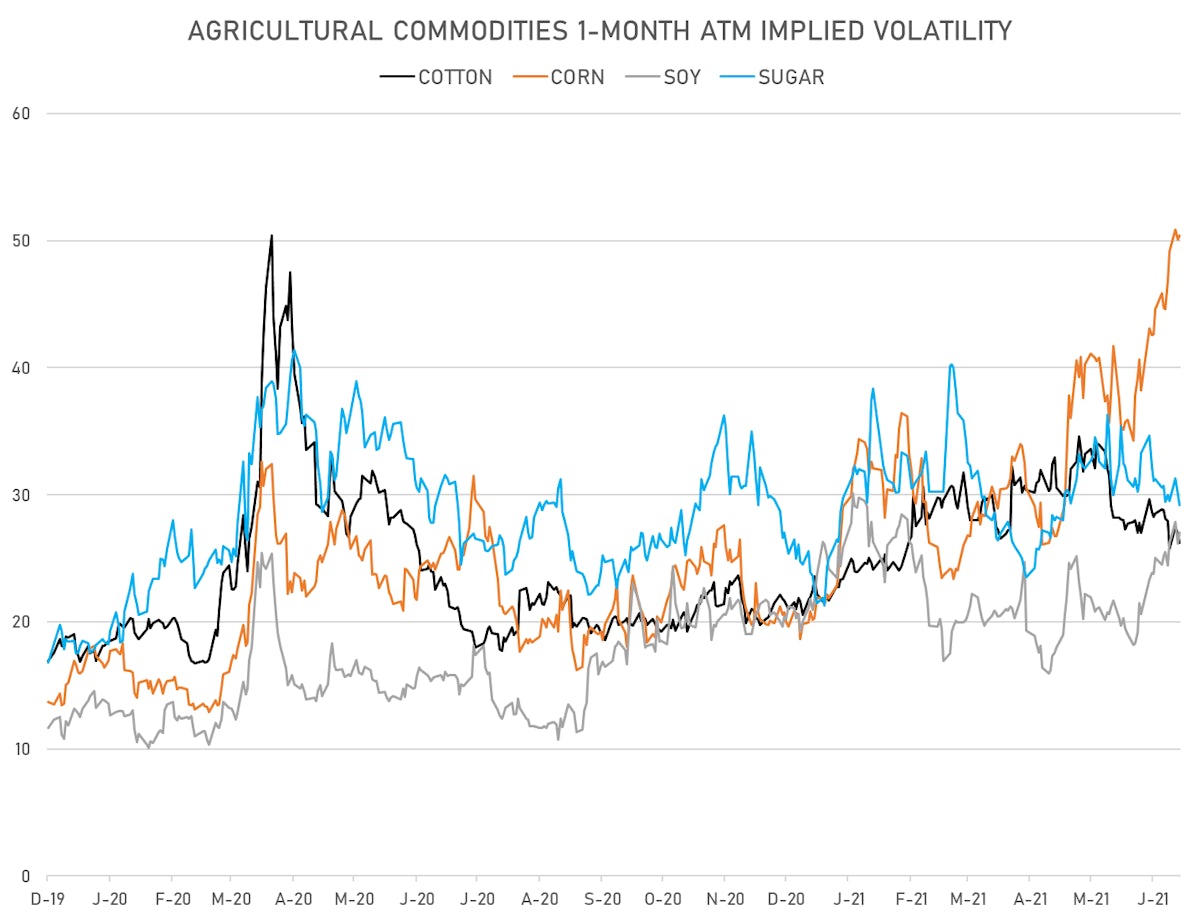

AGRO

- Live Cattle (CME) currently at US$ 122.30 cents per pound, up 0.9% on the day (YTD: +8.3%)

- Lean Hogs (CME) currently at US$ 115.50 cents per pound, down -2.5% on the day (YTD: +64.4%)

- Rough Rice (CBOT) currently at US$ 12.36 cents per hundredweight, up 0.4% on the day (YTD: -0.3%)

- Soybeans Composite (CBOT) currently at US$ 1,448.50 cents per bushel, down -1.2% on the day (YTD: +10.1%)

- Corn (CBOT) currently at US$ 673.00 cents per bushel, up 0.8% on the day (YTD: +39.0%)

- Wheat Composite (CBOT) currently at US$ 662.75 cents per bushel, up 0.2% on the day (YTD: +3.5%)

- Sugar No.11 (ICE US) currently at US$ 17.04 cents per pound, down -0.1% on the day (YTD: +10.0%)

- Cotton No.2 (ICE US) currently at US$ 85.33 cents per pound, up 0.1% on the day (YTD: +9.2%)

- Cocoa (ICE US) currently at US$ 2,347 per tonne, down -1.1% on the day (YTD: -9.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,700 per tonne, down -1.3% on the day (YTD: +16.9%)

- Random Length Lumber (CME) currently at US$ 967.90 per 1,000 board feet, down -4.2% on the day (YTD: +10.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,395 per tonne, up 3.1% on the day (YTD: +3.5%)

- Soybean Oil Composite (CBOT) currently at US$ 62.07 cents per pound, down -5.3% on the day (YTD: +43.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,566 per tonne, up 0.2% on the day (YTD: -8.4%)

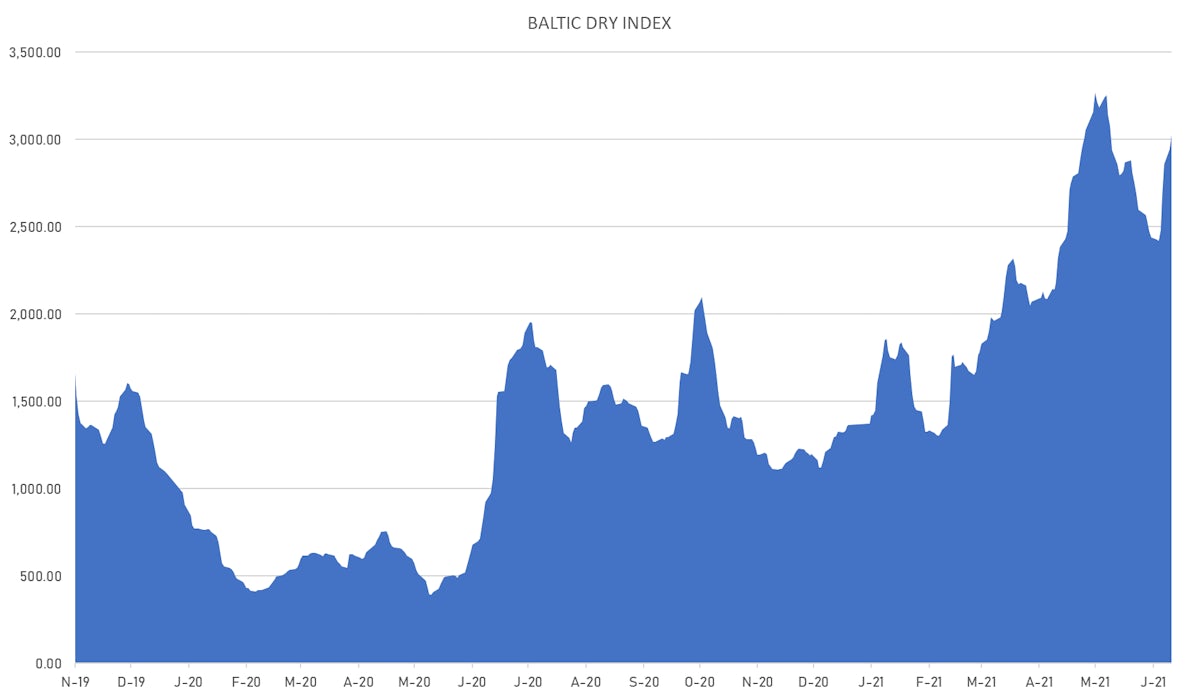

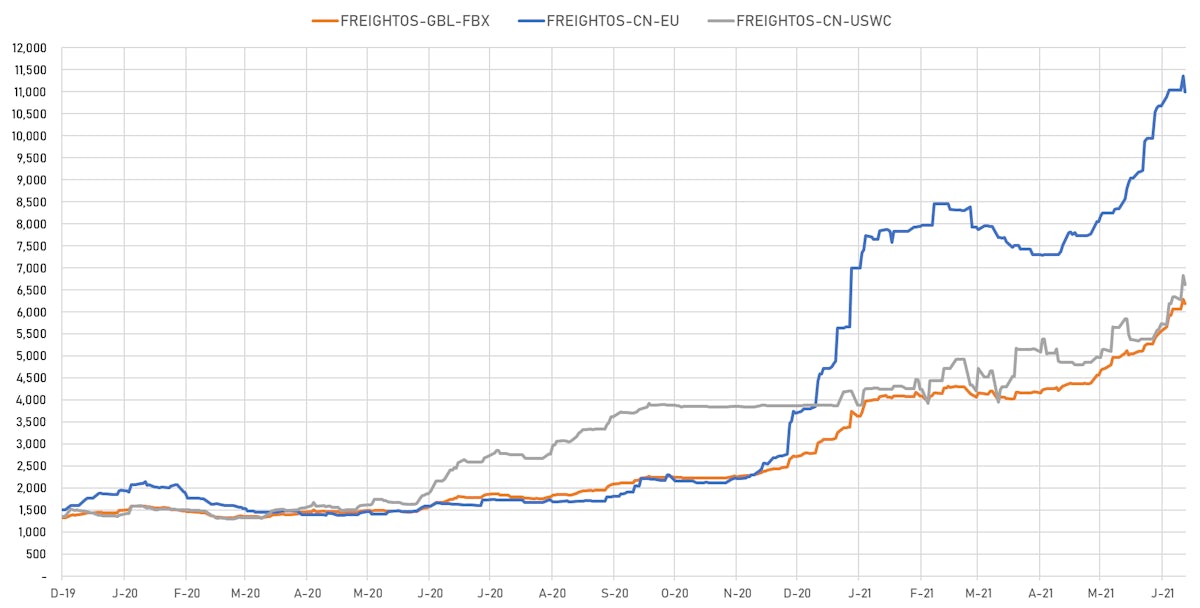

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,025, up 2.8% on the day (YTD: +121.4%)

- Freightos China To North America West Coast Container Index currently at 6,614, down -3.1% on the day (YTD: +57.5%)

- Freightos North America West Coast To China Container Index currently at 1,134, unchanged (YTD: +119.1%)

- Freightos North America East Coast To Europe Container Index currently at 685, unchanged (YTD: +88.8%)

- Freightos Europe To North America East Coast Container Index currently at 5,193, unchanged (YTD: +177.8%)

- Freightos China To North Europe Container Index currently at 10,989, down -3.2% on the day (YTD: +94.1%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,790, unchanged (YTD: +183.2%)

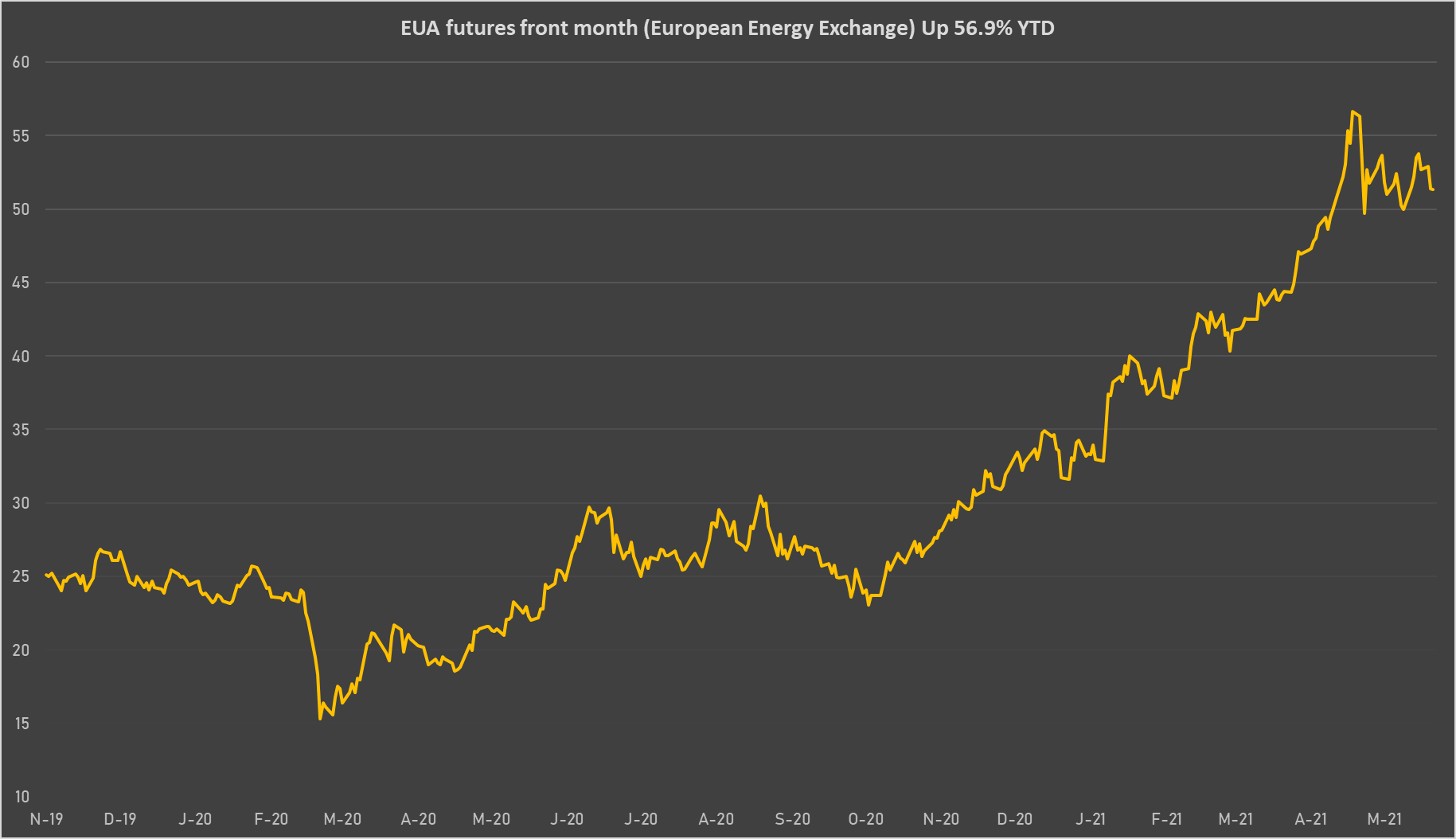

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 51.34 per tonne, down -0.1% on the day (YTD: +56.9%)