Commodities

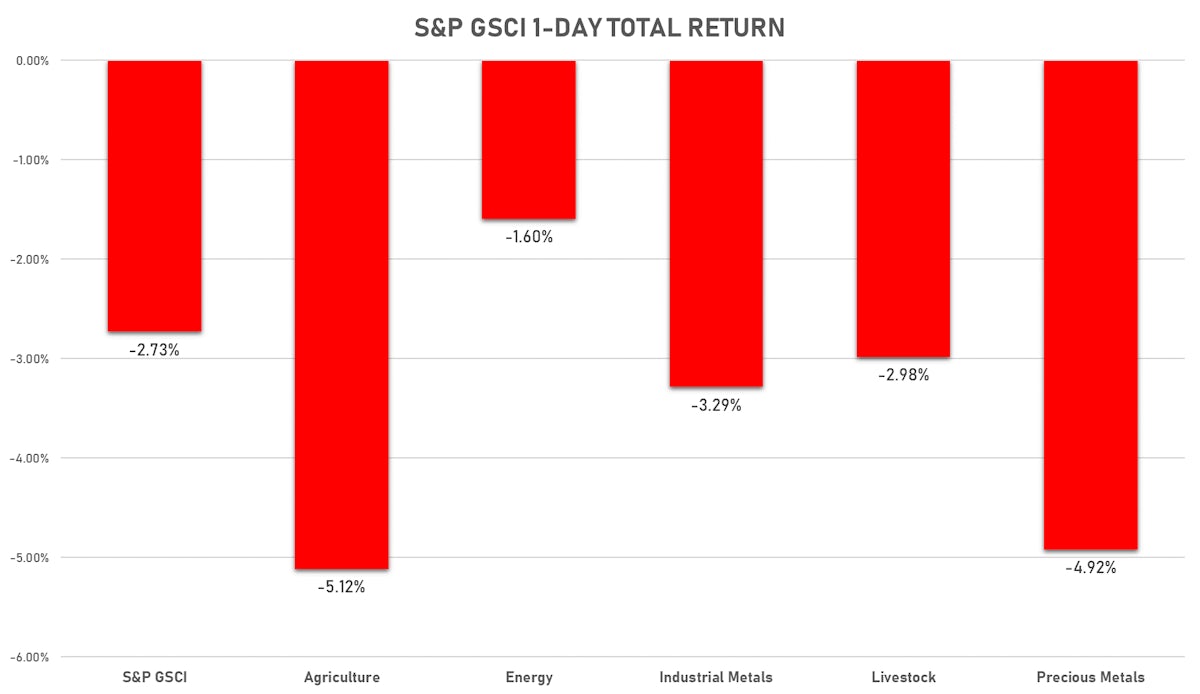

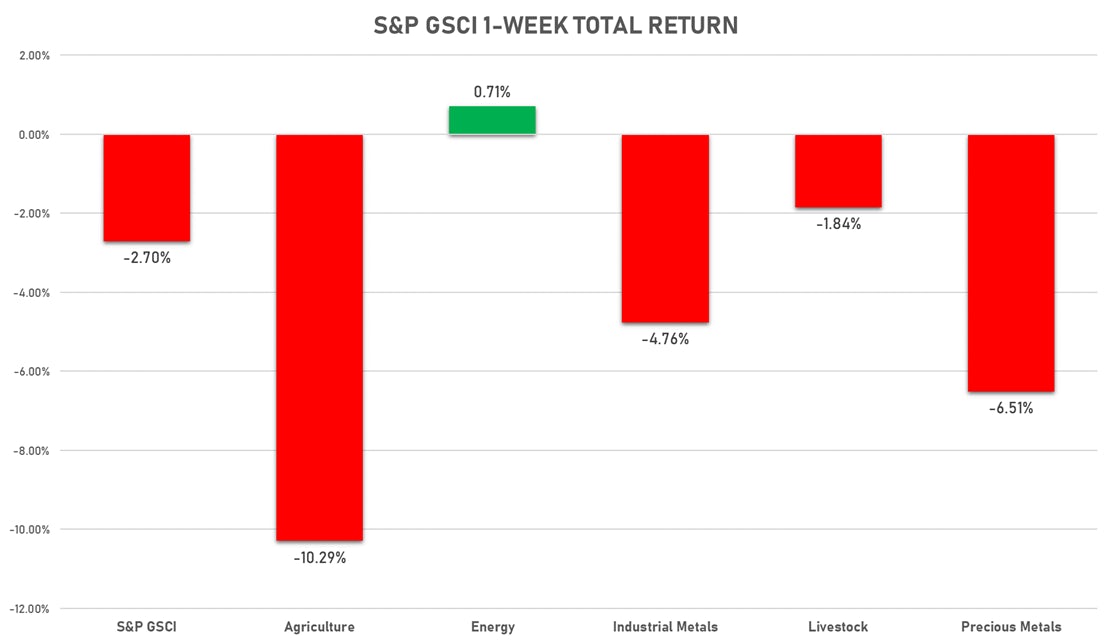

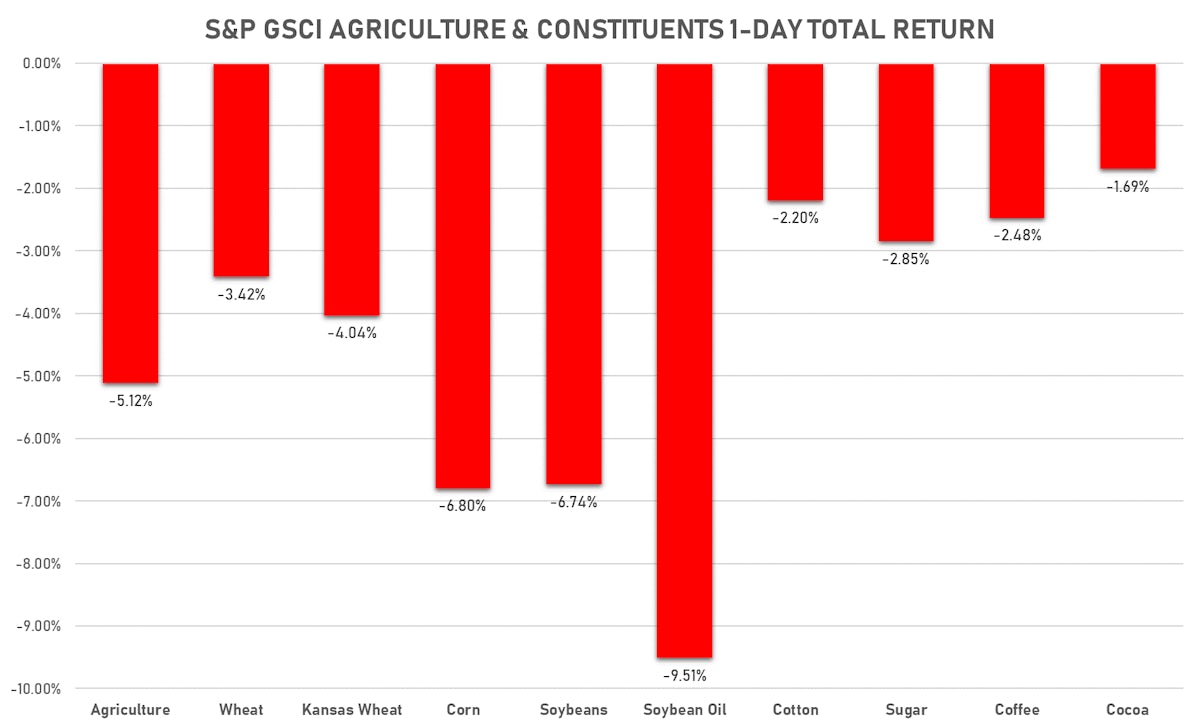

A Tough Day For Commodities, With The S&P GSCI Down 2.75%

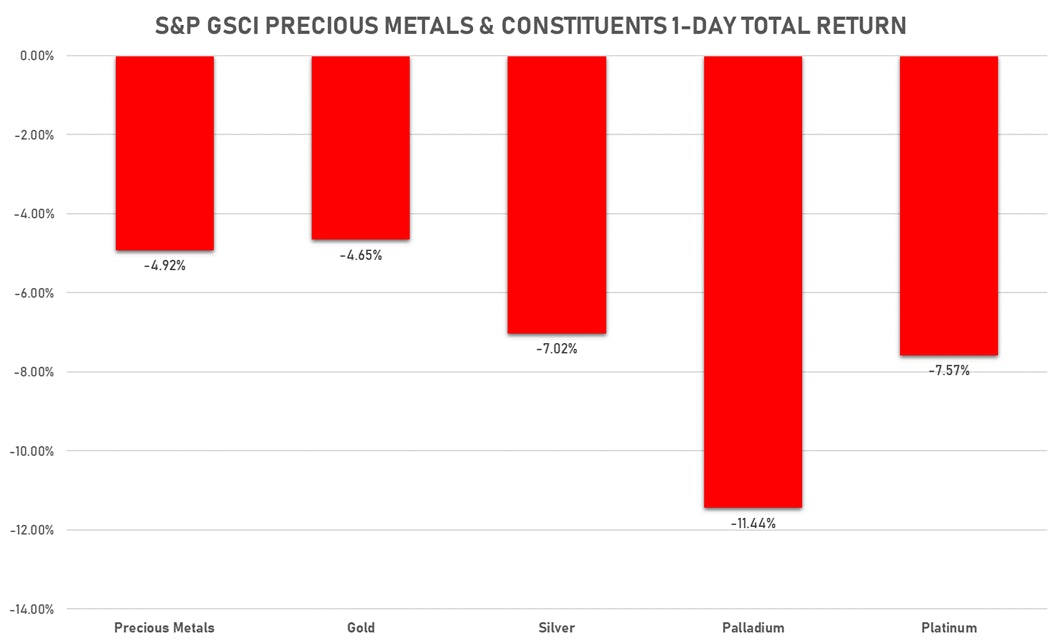

Precious metals are falling hard on a higher dollar: palladium down 11% today, platinum down 5%, silver down 4%, gold down 2%

Published ET

Palladium crashing | Source: Refinitiv

NOTABLE GAINERS

- CBOE Crude Oil Volatility Index up 8.9% (YTD: -2.6%)

- Gold/US Dollar 1 Month ATM Option up 7.1% (YTD: -14.9%)

- NYMEX Light Sweet Crude Oil vs 6 up 6.1% (YTD: 0.0%)

- DCE Coke up 4.7% (YTD: -7.7%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 3.4% (YTD: 9.9%)

- DCE Coking Coal Continuation Month 1 up 3.1% (YTD: 39.6%)

- Coffee Arabica Colombia Excelso EP Spot up 2.3% (YTD: 19.6%)

- WUXI Metal Cobalt Bi-Monthly up 1.7% (YTD: 22.4%)

- Zhengzhou Exchange Thermal Coal up 1.0% (YTD: 13.6%)

- CME Dry Whey up 0.6% (YTD: 46.2%)

NOTABLE LOSERS

- Palladium down -11.1% (YTD: 1.7%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index down -10.1% (YTD: 90.8%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index down -9.3% (YTD: 98.6%)

- CBoT Soybean Oil down -8.9% (YTD: 30.6%)

- CBoT Soybeans down -8.2% (YTD: 1.1%)

- CME Random Length Lumber down -6.5% (YTD: 3.6%)

- CBoT Corn down -5.9% (YTD: 30.8%)

- Pork Primal Cutout Picnic down -5.7% (YTD: 54.8%)

- Platinum down -5.2% (YTD: -0.9%)

- COMEX Copper down -4.7% (YTD: 19.1%)

- CBoT Soybean Meal down -4.7% (YTD: -16.8%)

- Silver down -4.0% (YTD: -1.8%)

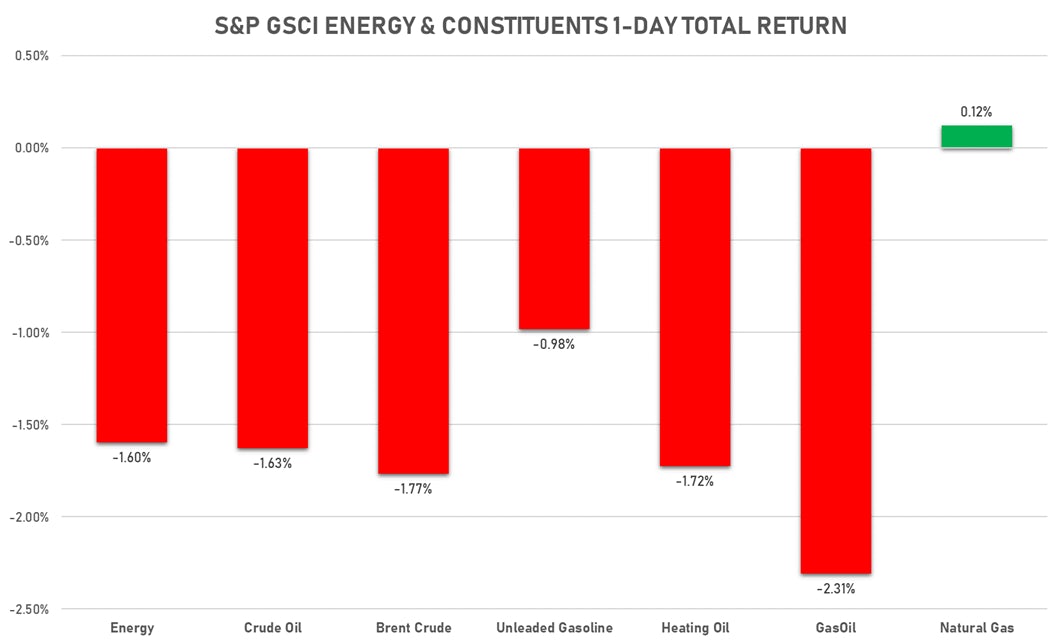

ENERGY

- WTI crude front month currently at US$ 70.90 per barrel, down -1.5% on the day (YTD: +46.4%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 72.97 per barrel, down -1.8% on the day (YTD: +41.1%); 6-month term structure in widening backwardation

- Brent volatility at 29.3, up 5.9% on the day (12-month range: 24.7 - 58.6)

- Newcastle Coal (ICE Europe) currently at US$ 126.00 per tonne, up 0.6% on the day (YTD: +56.5%)

- Natural Gas (Henry Hub) currently at US$ 3.20 per MMBtu, up 0.1% on the day (YTD: +28.1%)

- Gasoline (NYMEX) currently at US$ 2.13 per gallon, down -1.0% on the day (YTD: +51.5%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 589.50 per tonne, down -2.4% on the day (YTD: +40.6%)

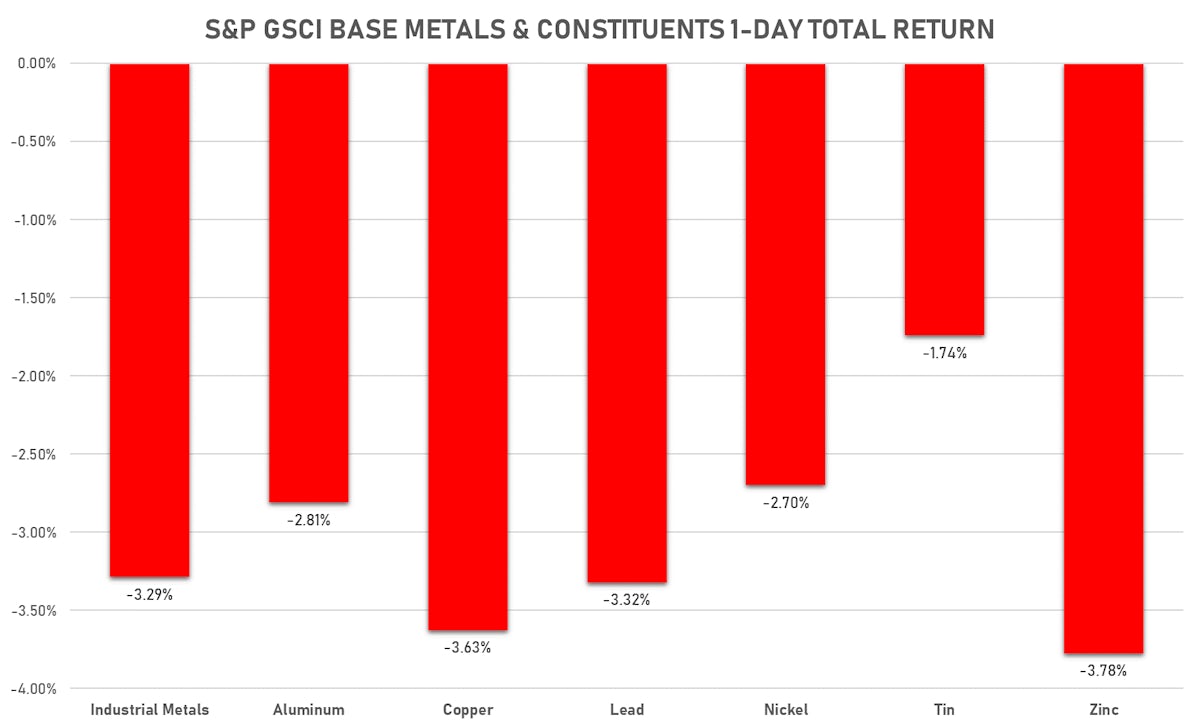

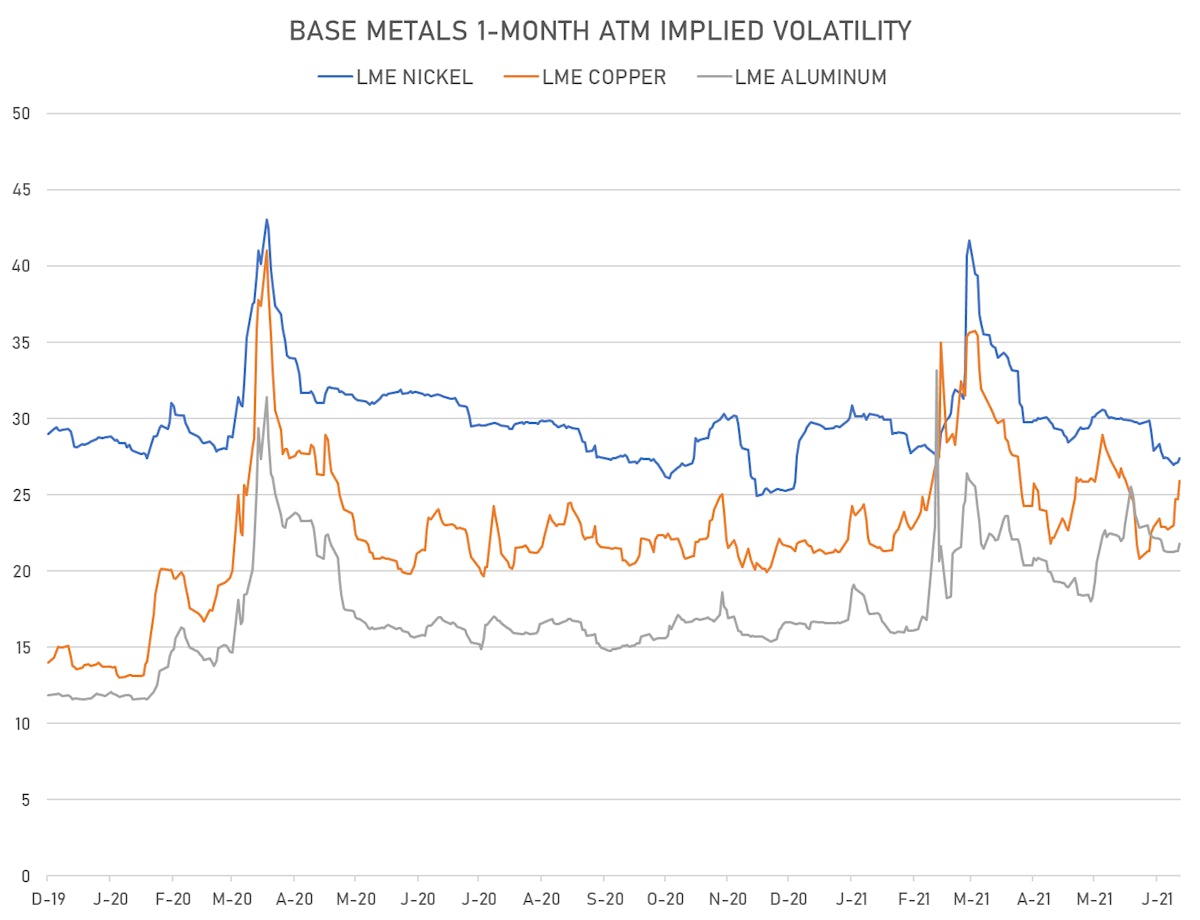

BASE METALS

- Copper (COMEX) currently at US$ 4.18 per pound, down -4.7% on the day (YTD: +19.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,315.00 per tonne, down -0.3% on the day (YTD: +18.6%)

- Aluminium (Shanghai) currently at CNY 18,450 per tonne, down -0.1% on the day (YTD: +19.4%)

- Nickel (Shanghai) currently at CNY 127,110 per tonne, down -1.6% on the day (YTD: +3.6%)

- Lead (Shanghai) currently at CNY 15,100 per tonne, up 0.5% on the day (YTD: +4.1%)

- Rebar (Shanghai) currently at CNY 4,999 per tonne, down -1.1% on the day (YTD: +16.3%)

- Tin (Shanghai) currently at CNY 202,440 per tonne, down -0.3% on the day (YTD: +36.9%)

- Zinc (Shanghai) currently at CNY 21,850 per tonne, up 0.4% on the day (YTD: +8.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

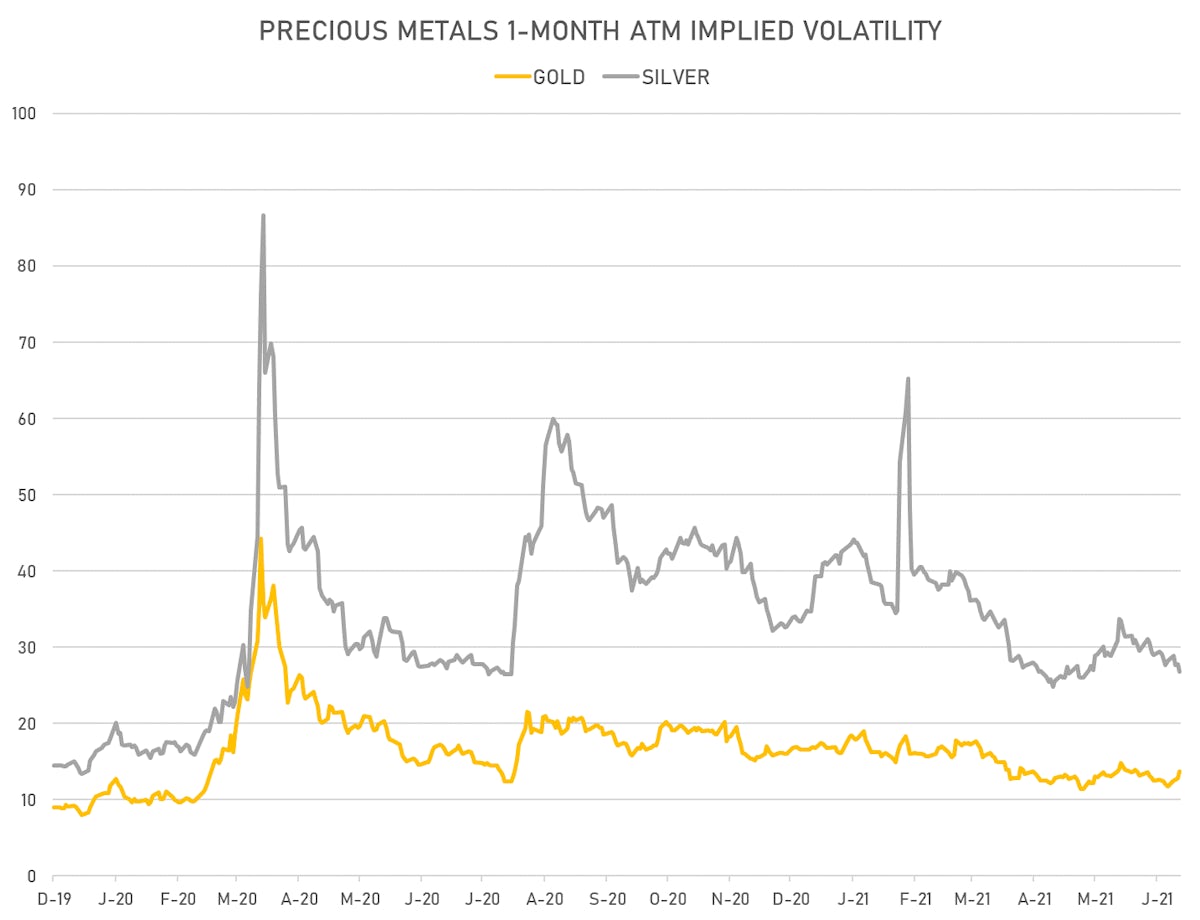

PRECIOUS METALS

- Gold spot currently at US$ 1,777.43 per troy ounce, down -2.2% on the day (YTD: -6.6%)

- Gold 1-Month ATM implied volatility currently at 13.22, up 7.1% on the day (YTD: -14.9%)

- Silver spot currently at US$ 26.12 per troy ounce, down -4.0% on the day (YTD: -1.8%)

- Silver 1-Month ATM implied volatility currently at 25.69, down -4.0% on the day (YTD: -37.2%)

- Palladium spot currently at US$ 2,515.11 per troy ounce, down -11.1% on the day (YTD: +1.7%)

- Platinum spot currently at US$ 1,072.76 per troy ounce, down -5.2% on the day (YTD: -0.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 22,000 per troy ounce, down -3.3% on the day (YTD: +29.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,100 per troy ounce, unchanged (YTD: +134.6%)

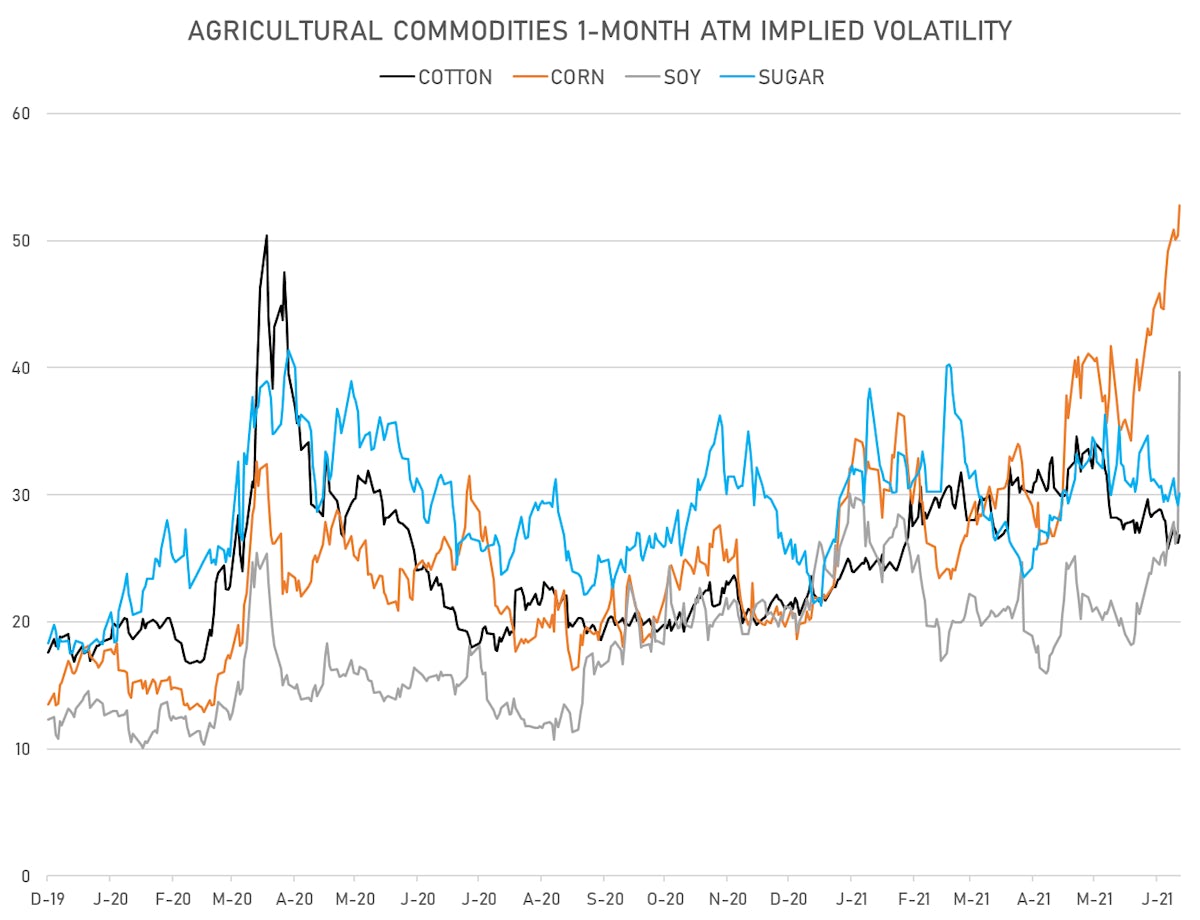

AGRO

- Live Cattle (CME) currently at US$ 120.10 cents per pound, down 1.8% on the day (YTD: +6.3%)

- Lean Hogs (CME) currently at US$ 111.00 cents per pound, down -3.9% on the day (YTD: +58.0%)

- Rough Rice (CBOT) currently at US$ 12.22 cents per hundredweight, down -1.1% on the day (YTD: -1.4%)

- Soybeans Composite (CBOT) currently at US$ 1,347.50 cents per bushel, down -8.2% on the day (YTD: +1.1%)

- Corn (CBOT) currently at US$ 632.00 cents per bushel, down -5.9% on the day (YTD: +30.8%)

- Wheat Composite (CBOT) currently at US$ 642.25 cents per bushel, down -3.6% on the day (YTD: -0.2%)

- Sugar No.11 (ICE US) currently at US$ 16.55 cents per pound, down -2.9% on the day (YTD: +6.8%)

- Cotton No.2 (ICE US) currently at US$ 84.17 cents per pound, down -1.4% on the day (YTD: +7.7%)

- Cocoa (ICE US) currently at US$ 2,311 per tonne, down -1.5% on the day (YTD: -11.2%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,785 per tonne, up 2.3% on the day (YTD: +19.6%)

- Random Length Lumber (CME) currently at US$ 904.90 per 1,000 board feet, down -6.5% on the day (YTD: +3.6%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,265 per tonne, up 0.2% on the day (YTD: +3.7%)

- Soybean Oil Composite (CBOT) currently at US$ 56.42 cents per pound, down -8.9% on the day (YTD: +30.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,549 per tonne, down -0.5% on the day (YTD: -8.8%)

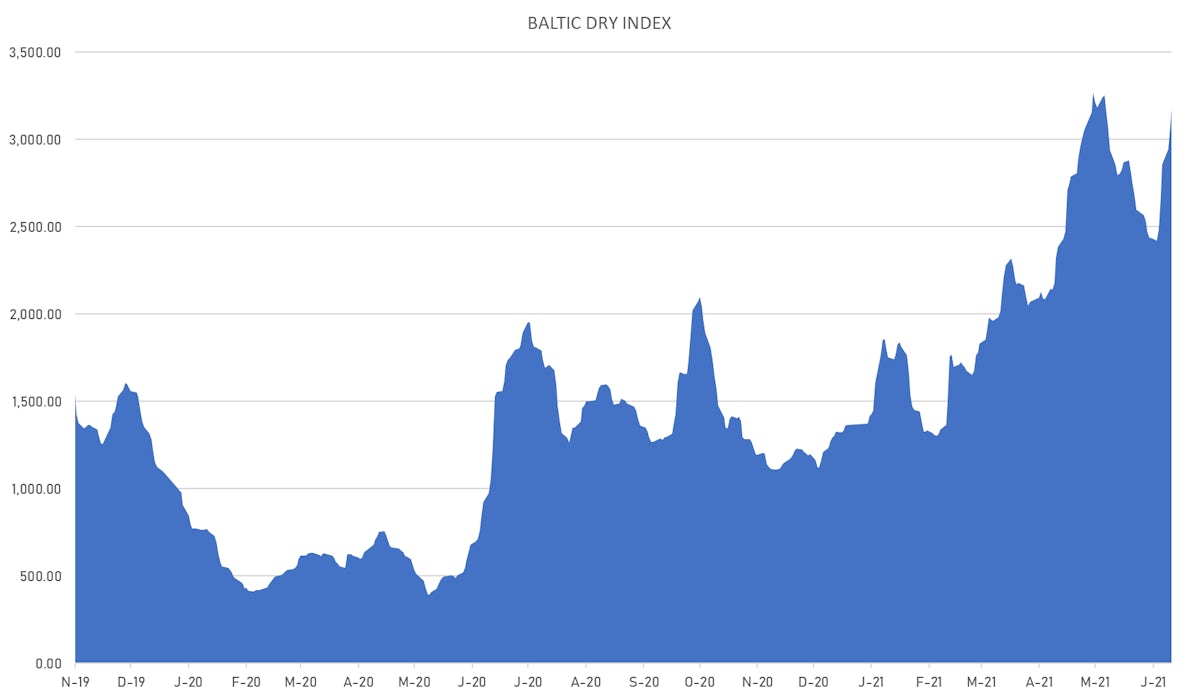

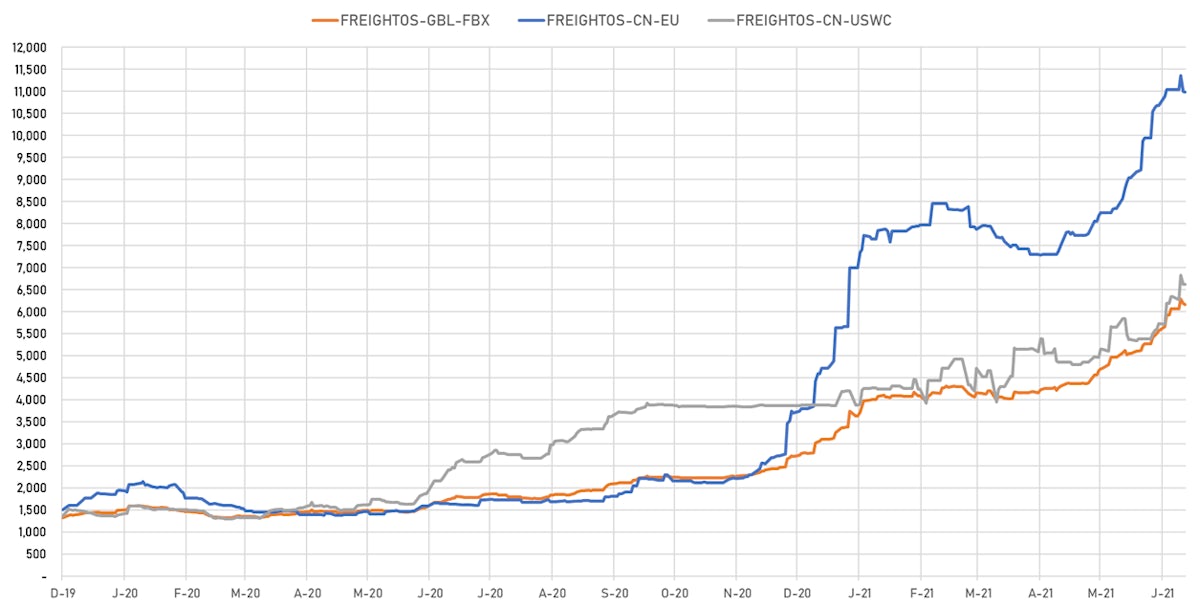

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,176, up 5.0% on the day (YTD: +132.5%)

- Freightos China To North America West Coast Container Index currently at 6,614, unchanged (YTD: +57.5%)

- Freightos North America West Coast To China Container Index currently at 1,028, down -9.3% on the day (YTD: +98.6%)

- Freightos North America East Coast To Europe Container Index currently at 685, unchanged (YTD: +88.8%)

- Freightos Europe To North America East Coast Container Index currently at 5,193, unchanged (YTD: +177.8%)

- Freightos China To North Europe Container Index currently at 10,981, down -0.1% on the day (YTD: +93.9%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,790, unchanged (YTD: +183.2%)

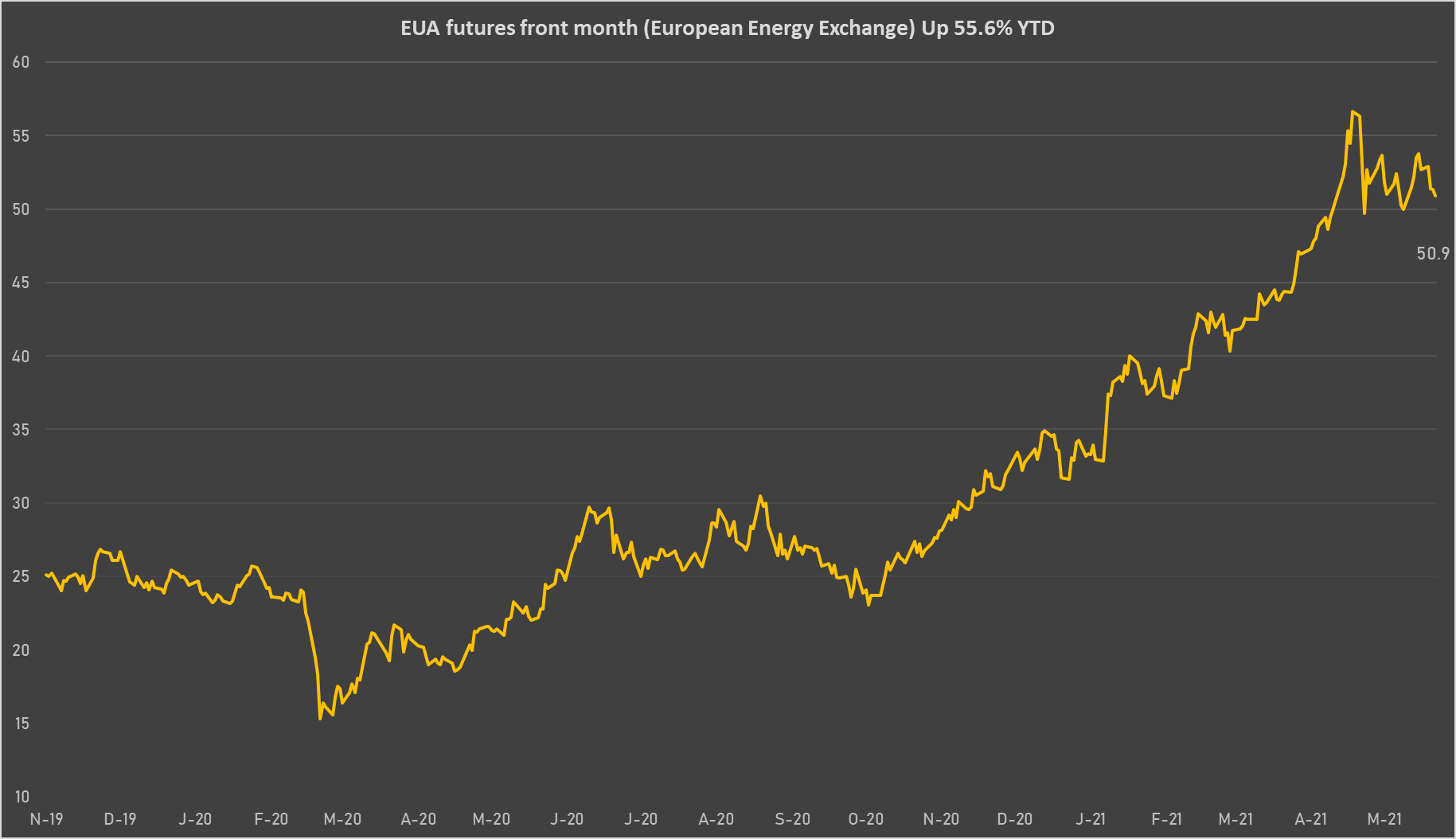

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 50.91 per tonne, down -0.8% on the day (YTD: +55.6%)