Commodities

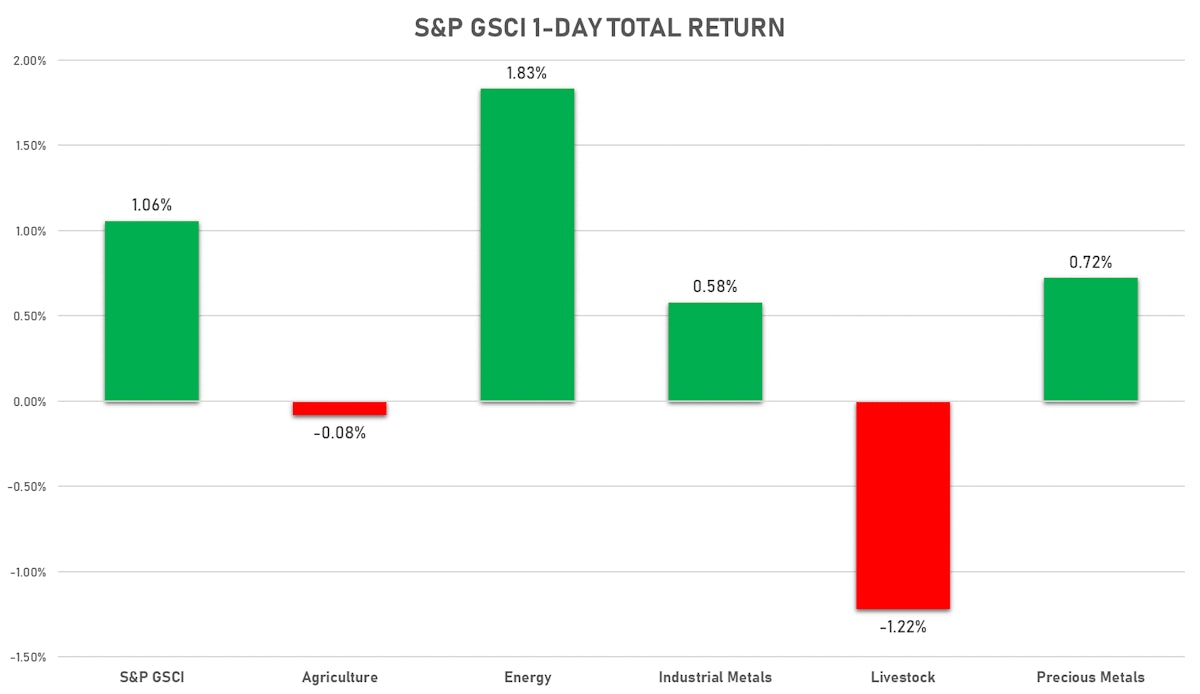

Commodities Recover Slightly On Weaker Dollar To Start The Week

Crude oil rises, settling higher for a second session on the back of the Iranian presidential election and its implications for nuclear talks

Published ET

S&P GSCI Equal Weight Index Bounced Off 3-month moving average | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS

- Pork Primal Cutout Butt up 9.8% (YTD: 157.6%)

- Palladium Spot up 4.7% (YTD: 5.6%)

- CME Random Length Lumber up 3.9% (YTD: 6.8%)

- CBoT Soybean Oil up 3.8% (YTD: 39.2%)

- CBOE Crude Oil Volatility Index up 3.1% (YTD: -7.5%)

- NYMEX Light Sweet Crude Oil (WTI) up 2.8% (YTD: 51.8%)

- Crude Oil WTI Cushing US FOB up 2.8% (YTD: 52.3%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index up 2.4% (YTD: 61.3%)

- DCE Coke up 2.3% (YTD: -3.8%)

NOTABLE LOSERS

- Johnson Matthey Rhodium New York 0930 down -5.8% (YTD: 18.8%)

- DCE Iron Ore Continuation Month 1 down -3.9% (YTD: 15.0%)

- SHFE Hot Rolled Coil down -3.0% (YTD: 18.3%)

- SHFE Zinc down -2.6% (YTD: 3.2%)

- SHFE Rebar down -2.1% (YTD: 15.5%)

- SHFE Stannum down -2.1% (YTD: 32.7%)

- Shanghai International Exchange Bonded Copper down -2.0% (YTD: 15.1%)

- SHFE Copper down -1.5% (YTD: 15.4%)

- SGX Iron Ore 62% China CFR Swap Monthly down -1.5% (YTD: 35.3%)

- CME Lean Hogs down -1.5% (YTD: 52.3%)

- SHFE Bitumen Continuation Month 1 down -1.2% (YTD: 33.6%)

- Bursa Malaysia Crude Palm Oil down -0.8% (YTD: -8.4%)

- NYMEX Henry Hub Natural Gas down -0.7% (YTD: 25.7%)

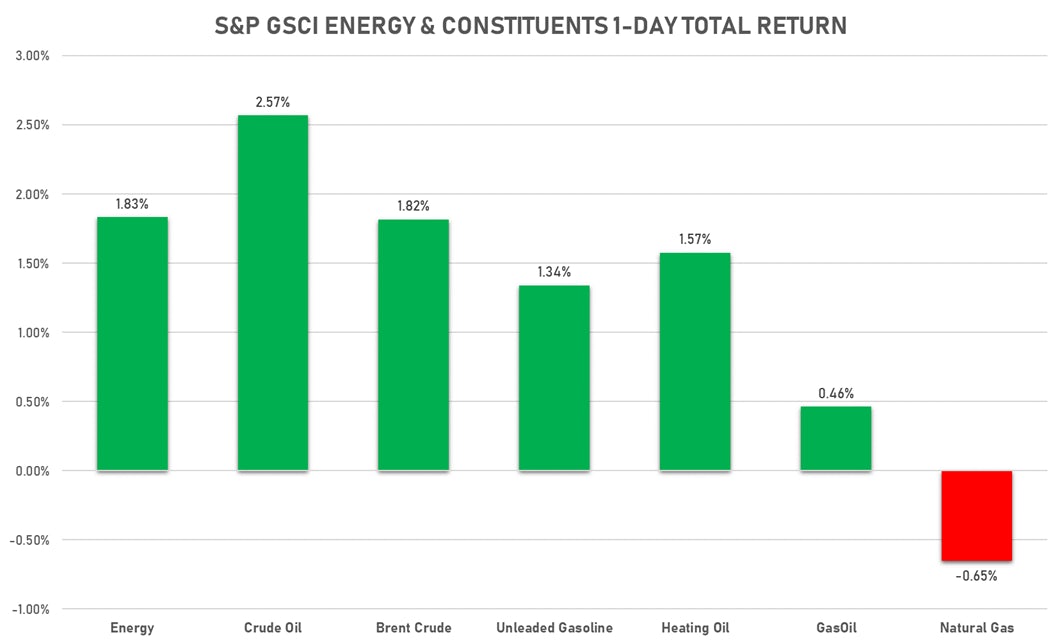

ENERGY

- WTI crude front month currently at US$ 73.44 per barrel, up 2.8% on the day (YTD: +51.8%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 74.81 per barrel, up 1.9% on the day (YTD: +44.6%); 6-month term structure in widening backwardation

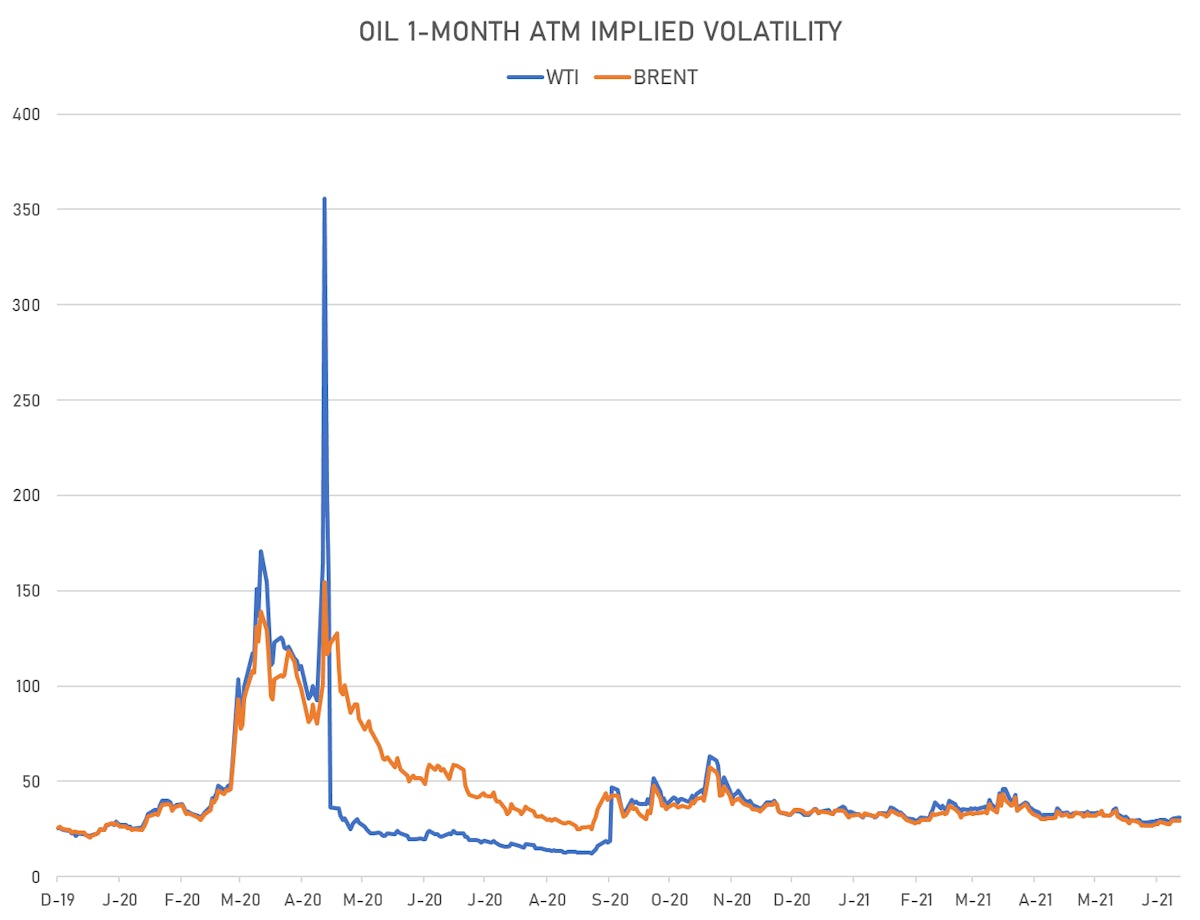

- Brent volatility at 29.2, up 0.4% on the day (12-month range: 24.7 - 58.6)

- Newcastle Coal (ICE Europe) currently at US$ 125.50 per tonne, up 0.4% on the day (YTD: +55.9%)

- Natural Gas (Henry Hub) currently at US$ 3.20 per MMBtu, down -0.7% on the day (YTD: +25.7%)

- Gasoline (NYMEX) currently at US$ 2.19 per gallon, up 1.3% on the day (YTD: +56.0%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 598.50 per tonne, up 0.4% on the day (YTD: +41.7%)

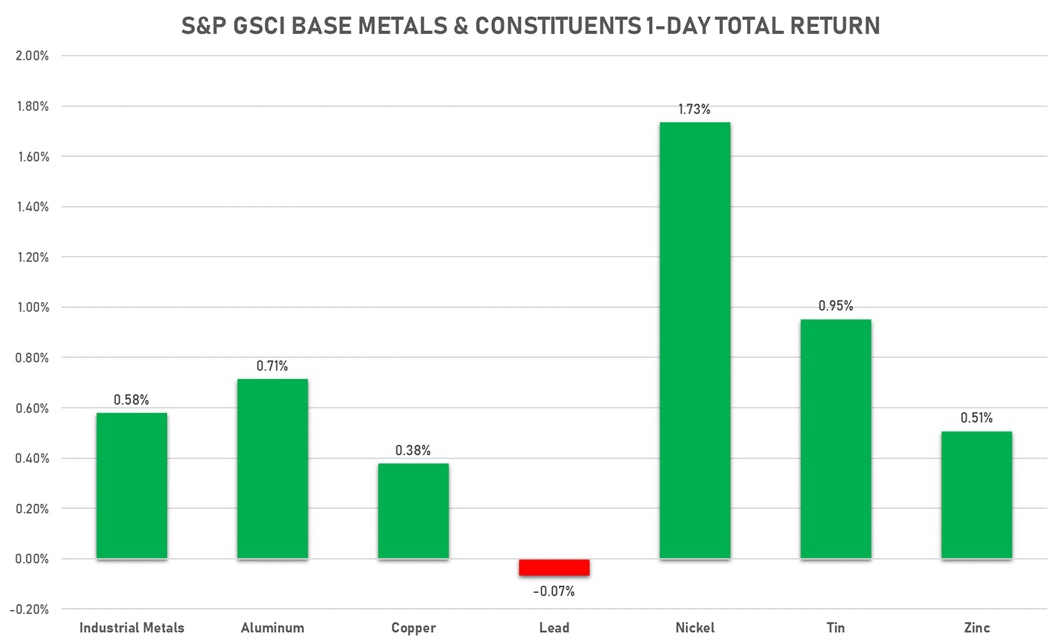

BASE METALS

- Copper (COMEX) currently at US$ 4.19 per pound, up 0.6% on the day (YTD: +19.2%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,218.00 per tonne, down -3.9% on the day (YTD: +15.0%)

- Aluminium (Shanghai) currently at CNY 18,505 per tonne, down -0.7% on the day (YTD: +16.9%)

- Nickel (Shanghai) currently at CNY 130,050 per tonne, up 0.1% on the day (YTD: +3.5%)

- Lead (Shanghai) currently at CNY 15,465 per tonne, up 1.4% on the day (YTD: +4.4%)

- Rebar (Shanghai) currently at CNY 4,795 per tonne, down -2.1% on the day (YTD: +15.5%)

- Tin (Shanghai) currently at CNY 201,140 per tonne, down -2.1% on the day (YTD: +32.7%)

- Zinc (Shanghai) currently at CNY 21,595 per tonne, down -2.6% on the day (YTD: +3.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

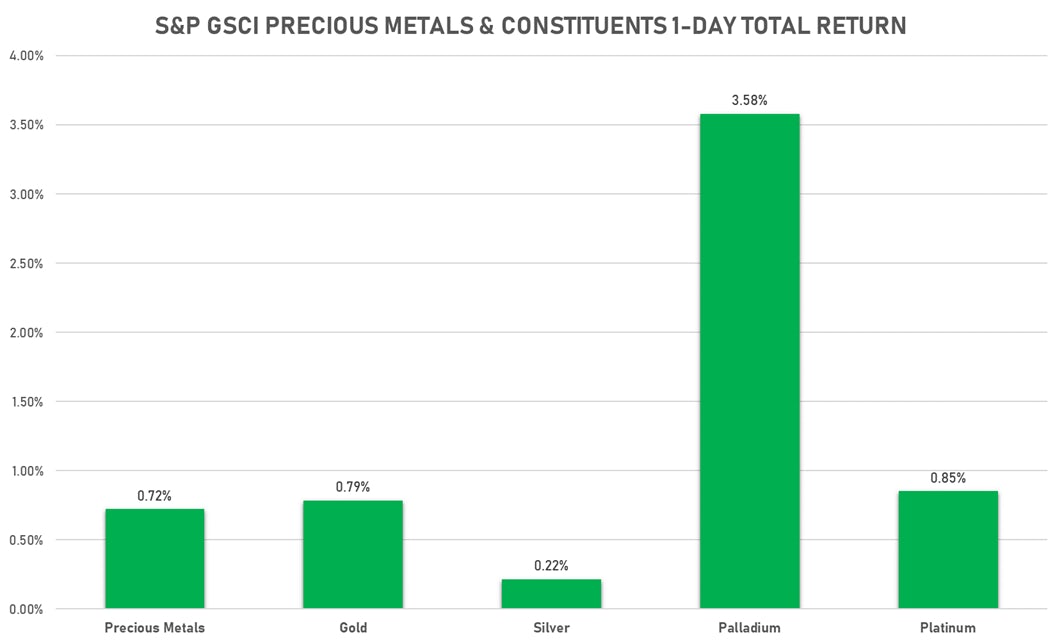

PRECIOUS METALS

- Gold spot currently at US$ 1,784.51 per troy ounce, up 1.1% on the day (YTD: -6.0%)

- Gold 1-Month ATM implied volatility currently at 14.15, up 2.1% on the day (YTD: -10.6%)

- Silver spot currently at US$ 25.89 per troy ounce, up 0.6% on the day (YTD: -1.6%)

- Silver 1-Month ATM implied volatility currently at 26.09, up 2.1% on the day (YTD: -36.1%)

- Palladium spot currently at US$ 2,582.96 per troy ounce, up 4.7% on the day (YTD: +5.6%)

- Platinum spot currently at US$ 1,058.34 per troy ounce, up 1.7% on the day (YTD: -1.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 20,250 per troy ounce, down -5.8% on the day (YTD: +18.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,100 per troy ounce, unchanged (YTD: +134.6%)

AGRO

- Live Cattle (CME) currently at US$ 120.98 cents per pound, down 0.1% on the day (YTD: +7.1%)

- Lean Hogs (CME) currently at US$ 107.05 cents per pound, down -1.5% on the day (YTD: +52.3%)

- Rough Rice (CBOT) currently at US$ 12.72 cents per hundredweight, up 0.9% on the day (YTD: +2.6%)

- Soybeans Composite (CBOT) currently at US$ 1,416.25 cents per bushel, up 1.4% on the day (YTD: +7.6%)

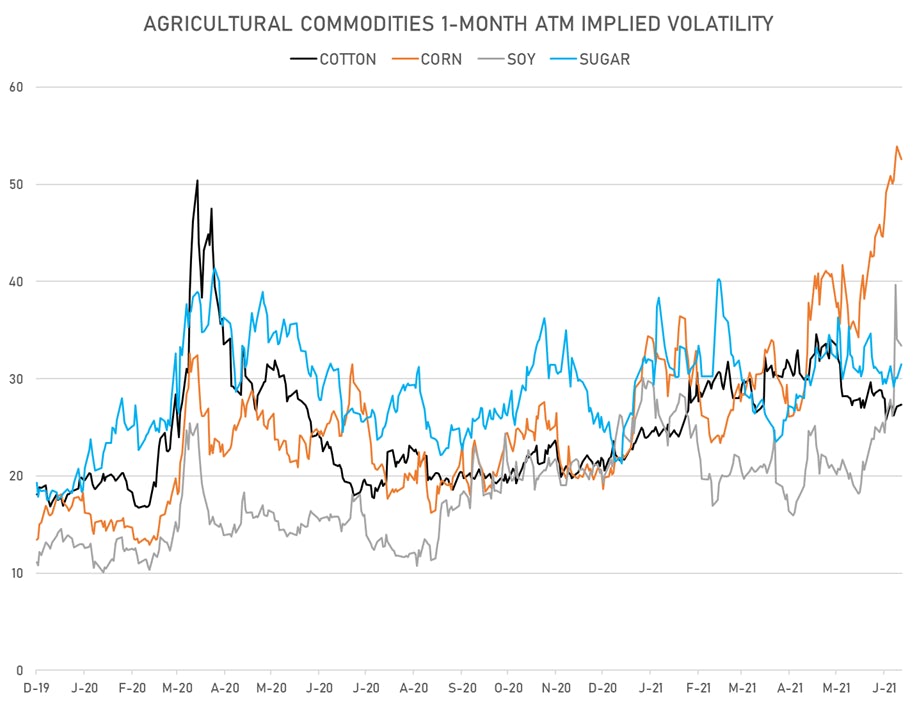

- Corn (CBOT) currently at US$ 661.75 cents per bushel, up 0.6% on the day (YTD: +36.2%)

- Wheat Composite (CBOT) currently at US$ 668.25 cents per bushel, down -0.2% on the day (YTD: +3.3%)

- Sugar No.11 (ICE US) currently at US$ 16.78 cents per pound, up 2.1% on the day (YTD: +8.3%)

- Cotton No.2 (ICE US) currently at US$ 83.84 cents per pound, down -0.4% on the day (YTD: +7.6%)

- Cocoa (ICE US) currently at US$ 2,308 per tonne, up 0.3% on the day (YTD: -11.3%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,717 per tonne, down -0.2% on the day (YTD: +17.4%)

- Random Length Lumber (CME) currently at US$ 932.50 per 1,000 board feet, up 3.9% on the day (YTD: +6.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,180 per tonne, down -0.3% on the day (YTD: +2.5%)

- Soybean Oil Composite (CBOT) currently at US$ 60.38 cents per pound, up 3.8% on the day (YTD: +39.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,565 per tonne, down -0.8% on the day (YTD: -8.4%)

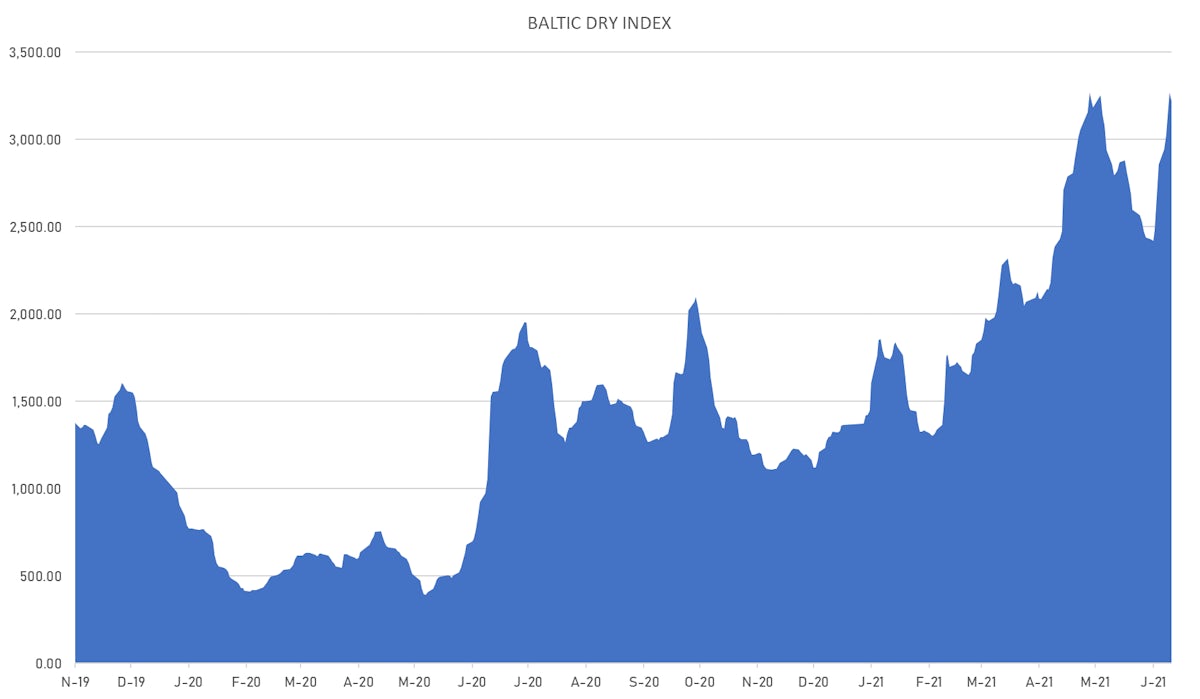

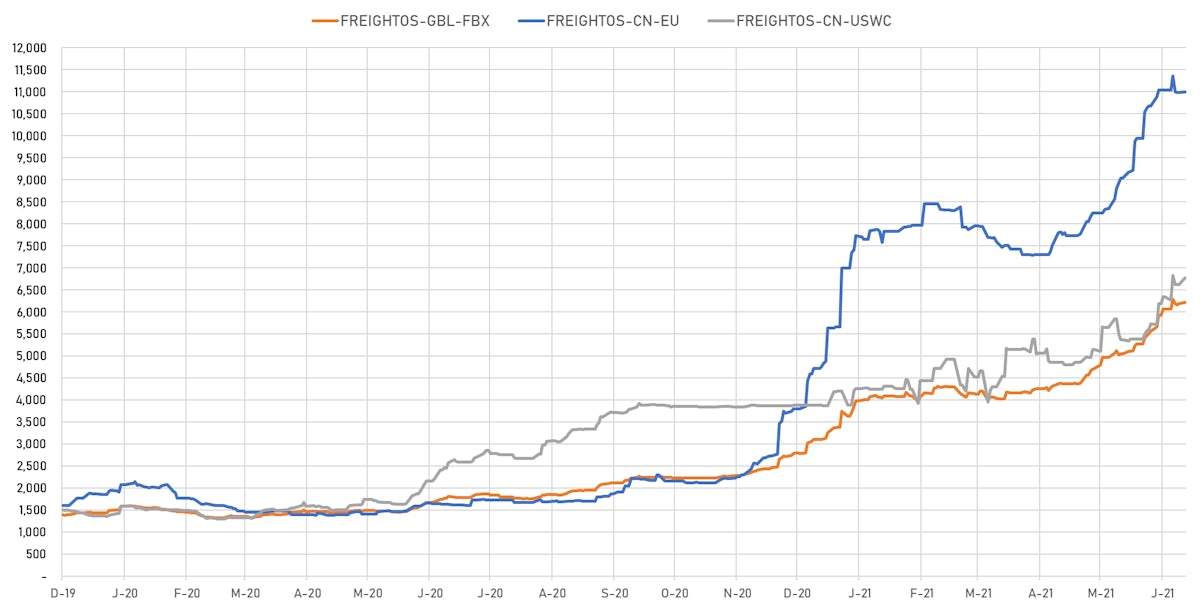

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,218, down -1.5% on the day (YTD: +135.6%)

- Freightos China To North America West Coast Container Index currently at 6,772, up 2.4% on the day (YTD: +61.3%)

- Freightos North America West Coast To China Container Index currently at 1,028, unchanged (YTD: +98.6%)

- Freightos North America East Coast To Europe Container Index currently at 685, unchanged (YTD: +88.8%)

- Freightos Europe To North America East Coast Container Index currently at 5,193, unchanged (YTD: +177.8%)

- Freightos China To North Europe Container Index currently at 10,989, up 0.1% on the day (YTD: +94.1%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,798, unchanged (YTD: +183.6%)

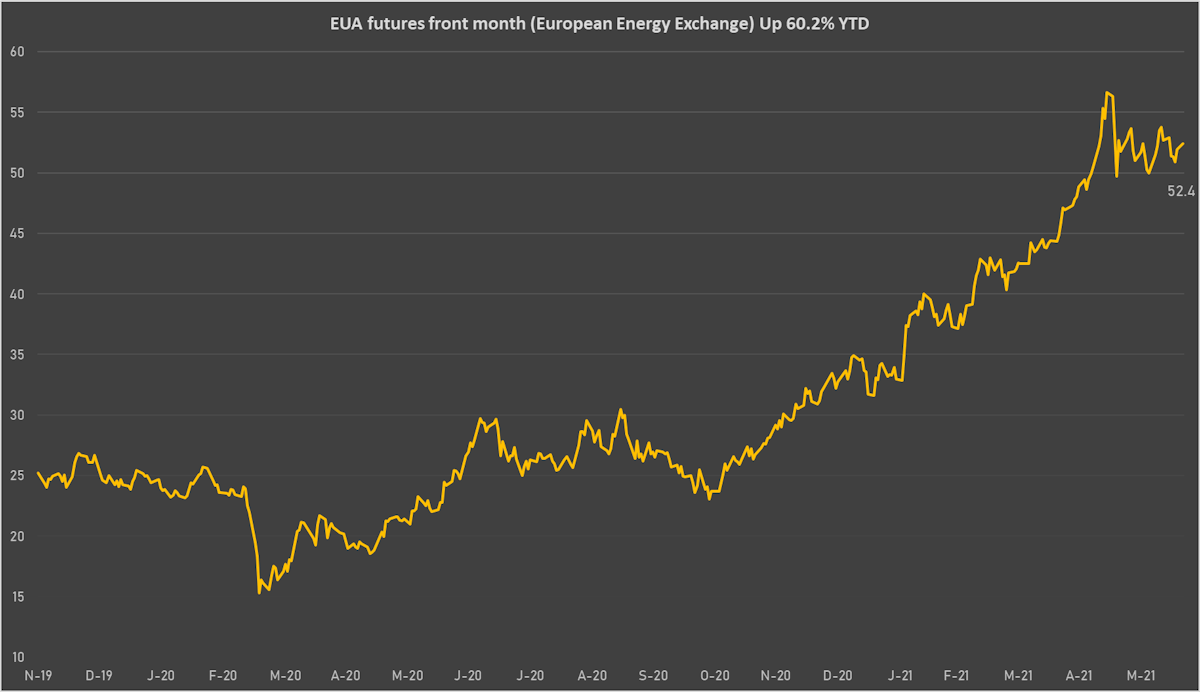

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.42 per tonne, up 1.0% on the day (YTD: +60.2%)