Commodities

Industrial Commodities Rise In China As The Market Awaits Update on Further Metal Supply Measures

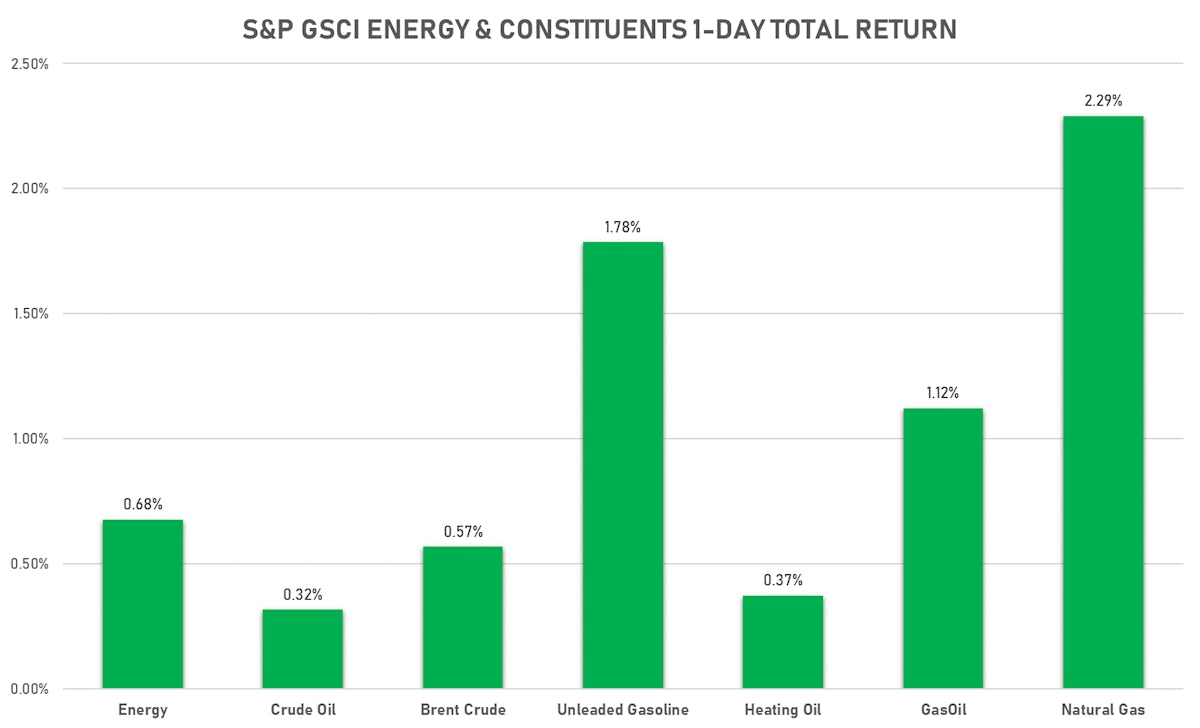

Gasoline rose sharply today as EIA data showed an inventory draw (when a build was expected) and refinery capacity utilization was down

Published ET

Dalian Commodity Exchange Coking Coal Front Month Future | Source: Refinitiv

HEADLINES & MACRO

- United States, Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 18 Jun (EIA, United States) at -7.61 Mln, below consensus estimate of -3.94 Mln

- United States, Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 18 Jun (EIA, United States) at 1.75 Mln, above consensus estimate of 1.08 Mln

- United States, Stock Levels, EIA, Gasoline, Absolute change, Volume for W 18 Jun (EIA, United States) at -2.93 Mln, below consensus estimate of 0.83 Mln

- United States, Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 18 Jun (EIA, United States) at -0.40 %, below consensus estimate of 0.50 %

NOTABLE GAINERS

- DCE Coking Coal Continuation Month 1 up 4.0% (YTD: 46.2%)

- DCE Iron Ore Continuation Month 1 up 3.2% (YTD: 16.3%)

- DCE Coke up 2.8% (YTD: -1.1%)

- SHFE Bitumen Continuation Month 1 up 2.7% (YTD: 38.7%)

- ICE-US Cotton No. 2 up 2.7% (YTD: 10.7%)

- SHFE Stannum up 2.5% (YTD: 37.3%)

- CBoT Soybean Oil up 2.4% (YTD: 43.4%)

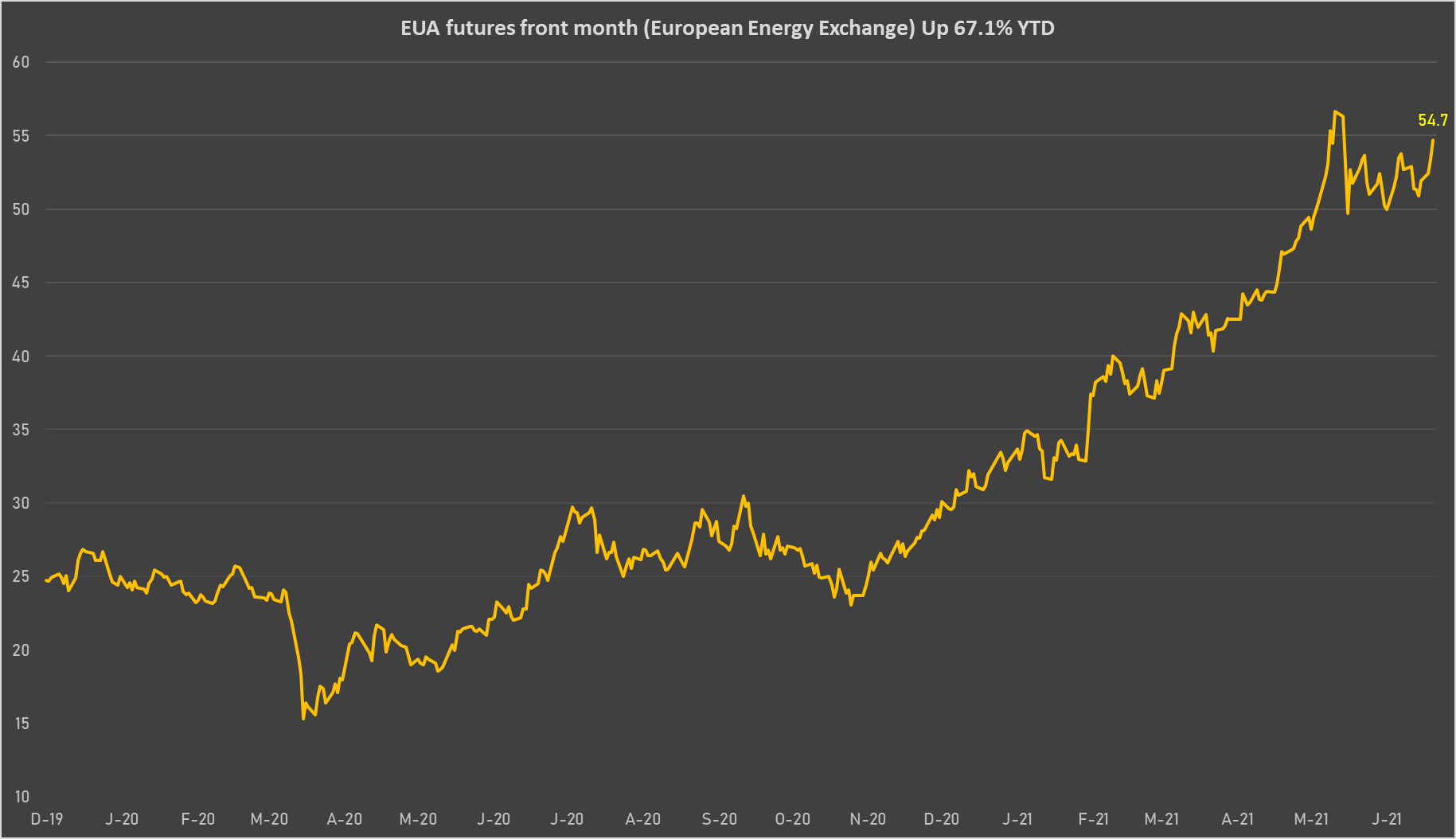

- ICE CO2 European Union Allowance (EUA) Yearly up 2.4% (YTD: 67.1%)

- EEX European-Carbon- Secondary Trading up 2.3% (YTD: 70.2%)

- NYMEX Henry Hub Natural Gas up 2.3% (YTD: 31.3%)

- COMEX Copper up 2.3% (YTD: 23.2%)

- Shanghai International Exchange Bonded Copper up 2.2% (YTD: 17.2%)

- SHFE Rubber up 2.2% (YTD: -6.3%)

NOTABLE LOSERS

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index down -4.9% (YTD: 76.0%)

- Pork Primal Cutout Butt down -3.7% (YTD: 140.9%)

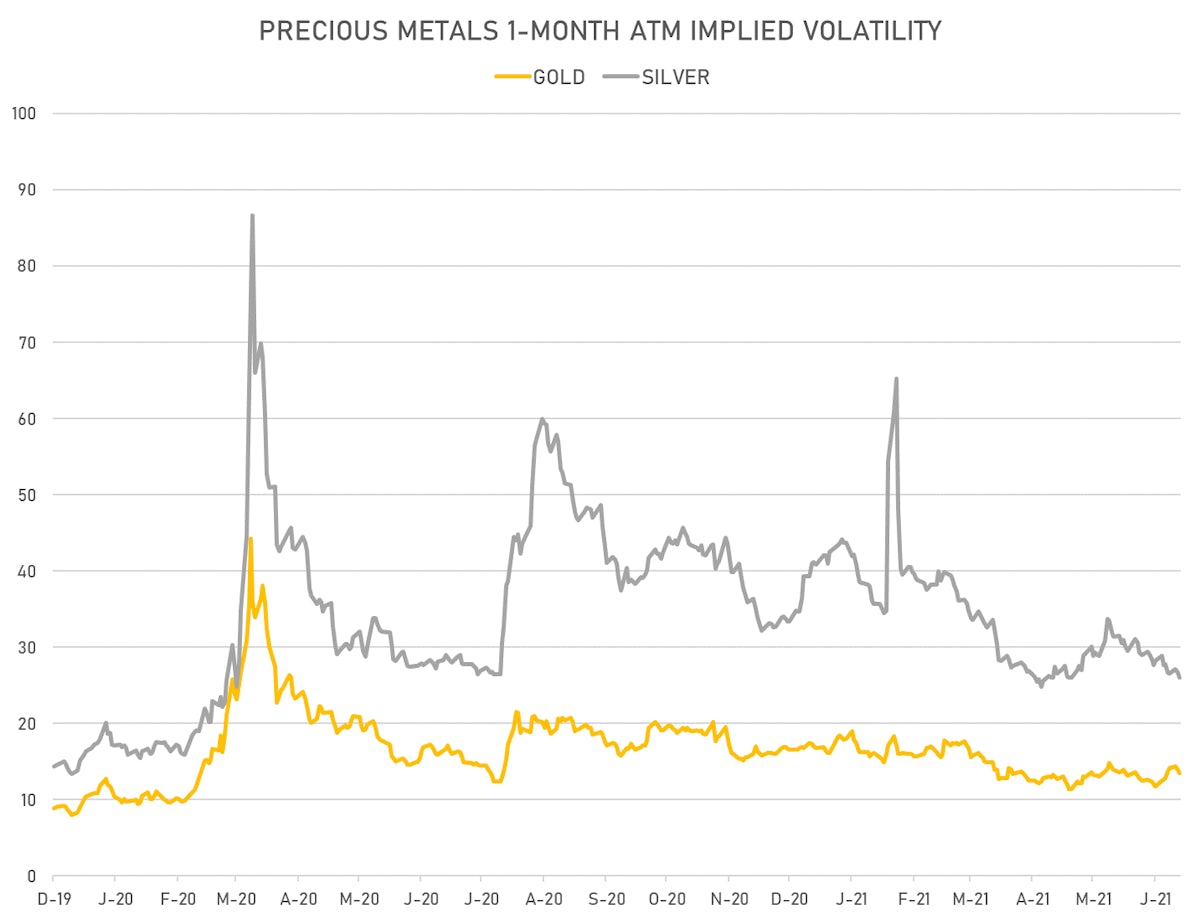

- Gold/US Dollar 1 Month ATM Option IV down -3.6% (YTD: -16.2%)

- SMM Rare Earth Yttrium Oxide Spot Price Daily down -3.4% (YTD: 36.6%)

- CME Lean Hogs down -2.8% (YTD: 48.7%)

- Johnson Matthey Rhodium New York 0930 down -2.5% (YTD: 12.9%)

- CBoT Soybean Meal down -2.5% (YTD: -18.5%)

- Silver/US Dollar 1 Month ATM Option IV down -2.3% (YTD: -38.7%)

- CME Cattle(Feeder) down -1.7% (YTD: 12.1%)

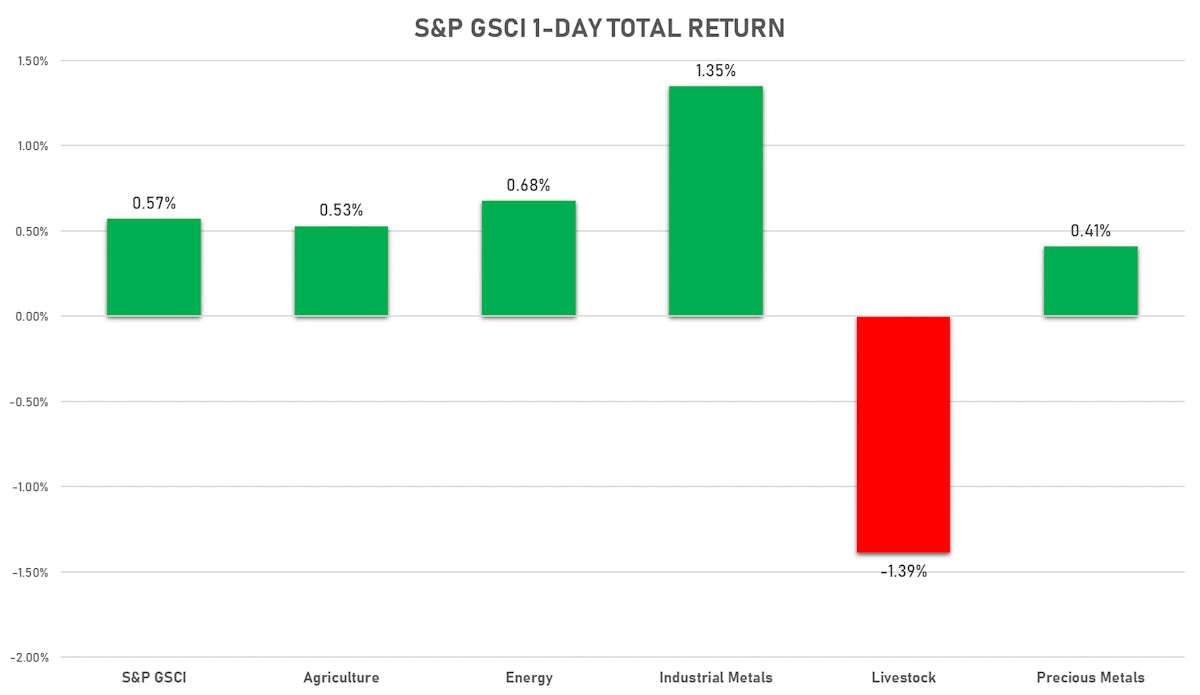

ENERGY

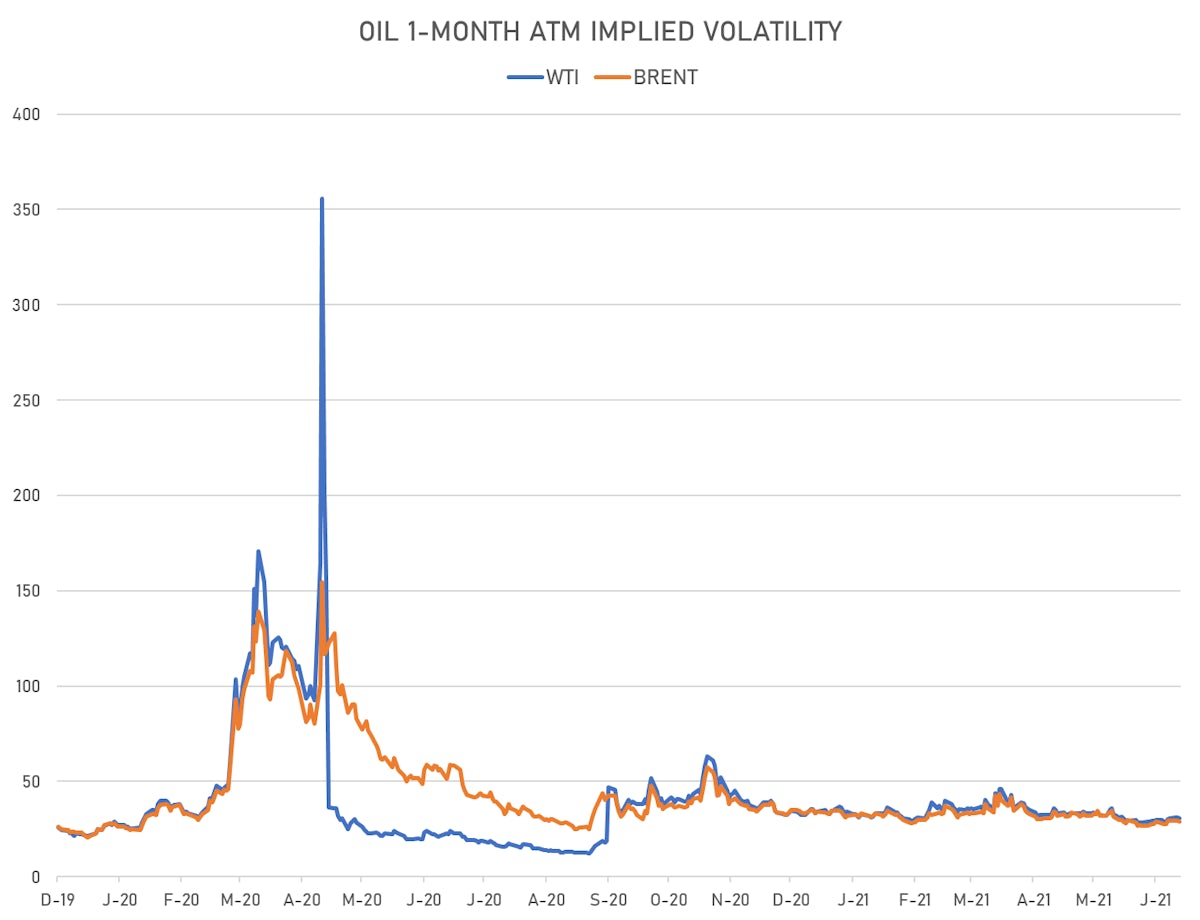

- WTI crude front month unchanged at US$ 73.24 per barrel (YTD: +50.6%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 75.19 per barrel, up 0.5% on the day (YTD: +45.2%); 6-month term structure in tightening backwardation

- Brent volatility at 28.7, down -1.8% on the day (12-month range: 24.7 - 58.6)

- Newcastle Coal (ICE Europe) currently at US$ 127.50 per tonne, up 0.2% on the day (YTD: +58.4%)

- Natural Gas (Henry Hub) currently at US$ 3.32 per MMBtu, up 2.3% on the day (YTD: +31.3%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, up 1.9% on the day (YTD: +61.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 607.00 per tonne, up 1.1% on the day (YTD: +44.3%)

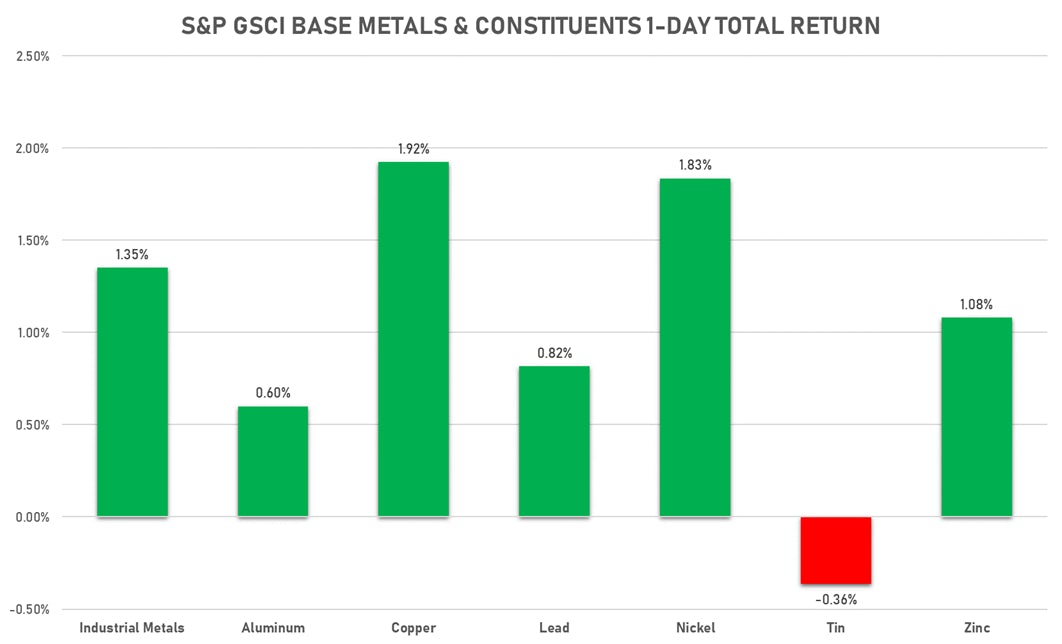

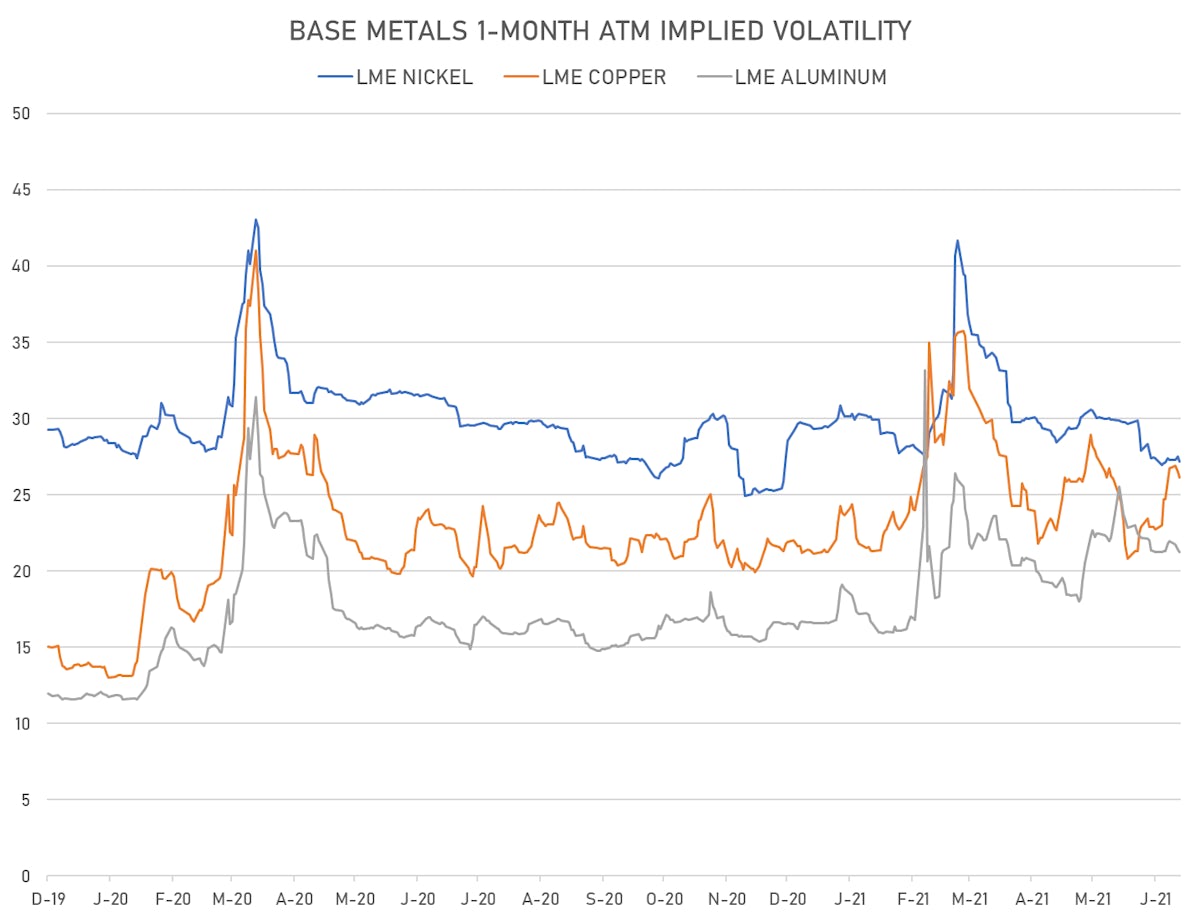

BASE METALS

- Copper (COMEX) currently at US$ 4.33 per pound, up 2.3% on the day (YTD: +23.2%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,325.00 per tonne, up 3.2% on the day (YTD: +16.3%)

- Aluminium (Shanghai) currently at CNY 18,840 per tonne, up 1.2% on the day (YTD: +19.4%)

- Nickel (Shanghai) currently at CNY 134,990 per tonne, up 2.2% on the day (YTD: +7.5%)

- Lead (Shanghai) currently at CNY 15,535 per tonne, up 0.2% on the day (YTD: +5.3%)

- Rebar (Shanghai) currently at CNY 4,896 per tonne, up 0.5% on the day (YTD: +13.4%)

- Tin (Shanghai) currently at CNY 210,810 per tonne, up 2.5% on the day (YTD: +37.3%)

- Zinc (Shanghai) currently at CNY 21,860 per tonne, up 0.4% on the day (YTD: +4.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

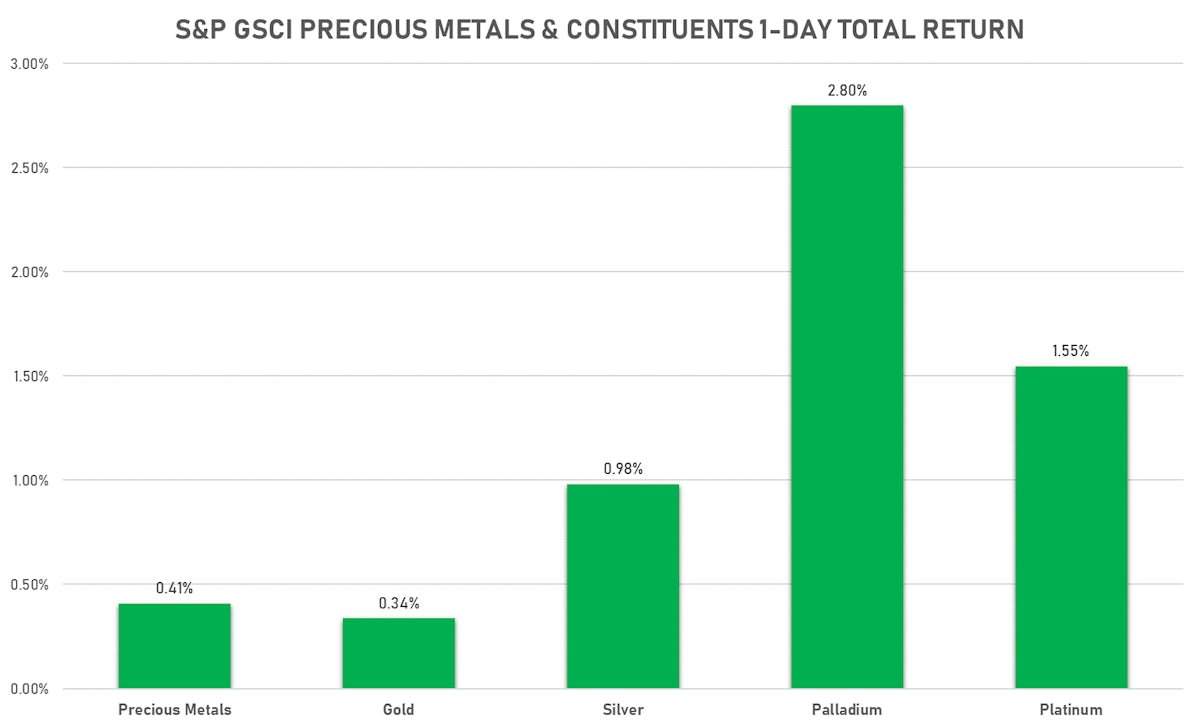

PRECIOUS METALS

- Gold spot currently at US$ 1,775.93 per troy ounce, up 0.0% on the day (YTD: -6.3%)

- Gold 1-Month ATM implied volatility currently at 13.06, down -3.6% on the day (YTD: -16.2%)

- Silver spot currently at US$ 25.81 per troy ounce, up 0.4% on the day (YTD: -1.9%)

- Silver 1-Month ATM implied volatility currently at 25.04, down -2.3% on the day (YTD: -38.7%)

- Palladium spot currently at US$ 2,617.06 per troy ounce, up 2.1% on the day (YTD: +6.8%)

- Platinum spot currently at US$ 1,084.10 per troy ounce, up 0.5% on the day (YTD: +1.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,250 per troy ounce, down -2.5% on the day (YTD: +12.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 6,000 per troy ounce, down -1.6% on the day (YTD: +130.8%)

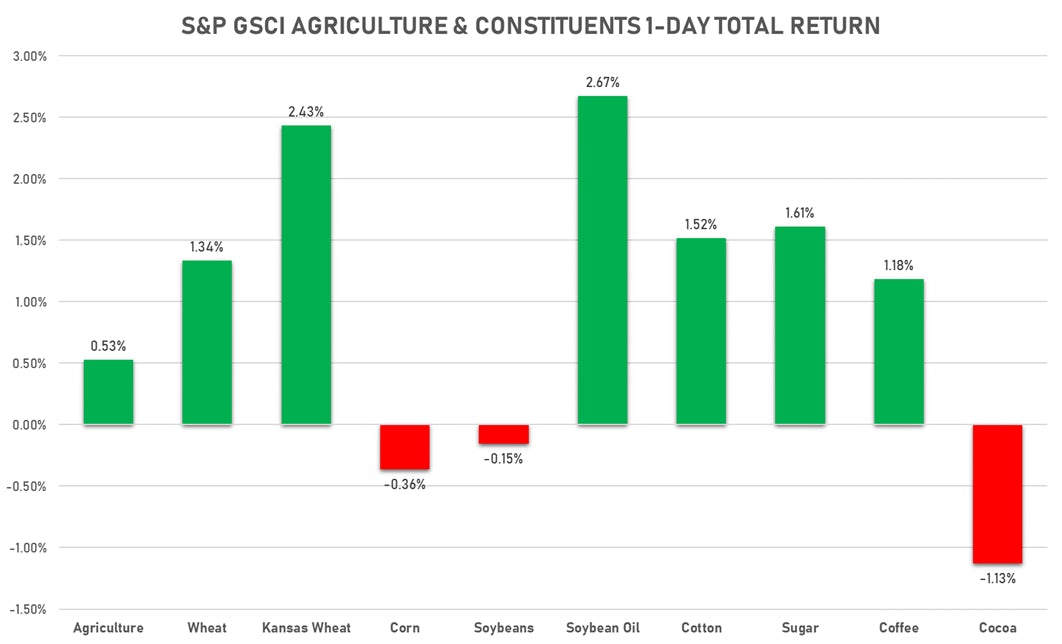

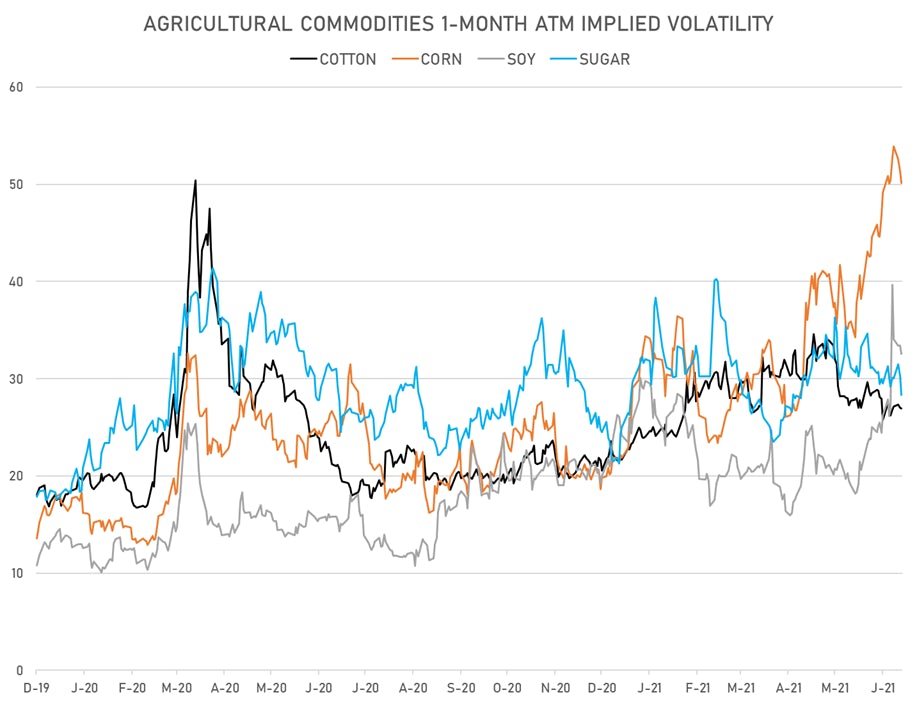

AGRO

- Live Cattle (CME) currently at US$ 122.50 cents per pound, down 0.5% on the day (YTD: +8.5%)

- Lean Hogs (CME) currently at US$ 104.53 cents per pound, down -2.8% on the day (YTD: +48.7%)

- Rough Rice (CBOT) currently at US$ 13.35 cents per hundredweight, up 1.5% on the day (YTD: +7.6%)

- Soybeans Composite (CBOT) currently at US$ 1,385.00 cents per bushel, down -0.7% on the day (YTD: +5.3%)

- Corn (CBOT) currently at US$ 664.25 cents per bushel, up 0.7% on the day (YTD: +37.2%)

- Wheat Composite (CBOT) currently at US$ 661.25 cents per bushel, up 1.6% on the day (YTD: +3.2%)

- Sugar No.11 (ICE US) currently at US$ 16.69 cents per pound, up 1.6% on the day (YTD: +7.7%)

- Cotton No.2 (ICE US) currently at US$ 86.46 cents per pound, up 2.7% on the day (YTD: +10.7%)

- Cocoa (ICE US) currently at US$ 2,297 per tonne, down -1.2% on the day (YTD: -11.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,737 per tonne, down -0.5% on the day (YTD: +18.1%)

- Random Length Lumber (CME) currently at US$ 884.30 per 1,000 board feet, down -0.7% on the day (YTD: +1.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,405 per tonne, up 1.7% on the day (YTD: +3.3%)

- Soybean Oil Composite (CBOT) currently at US$ 62.13 cents per pound, up 2.4% on the day (YTD: +43.4%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,615 per tonne, up 1.7% on the day (YTD: -7.1%)

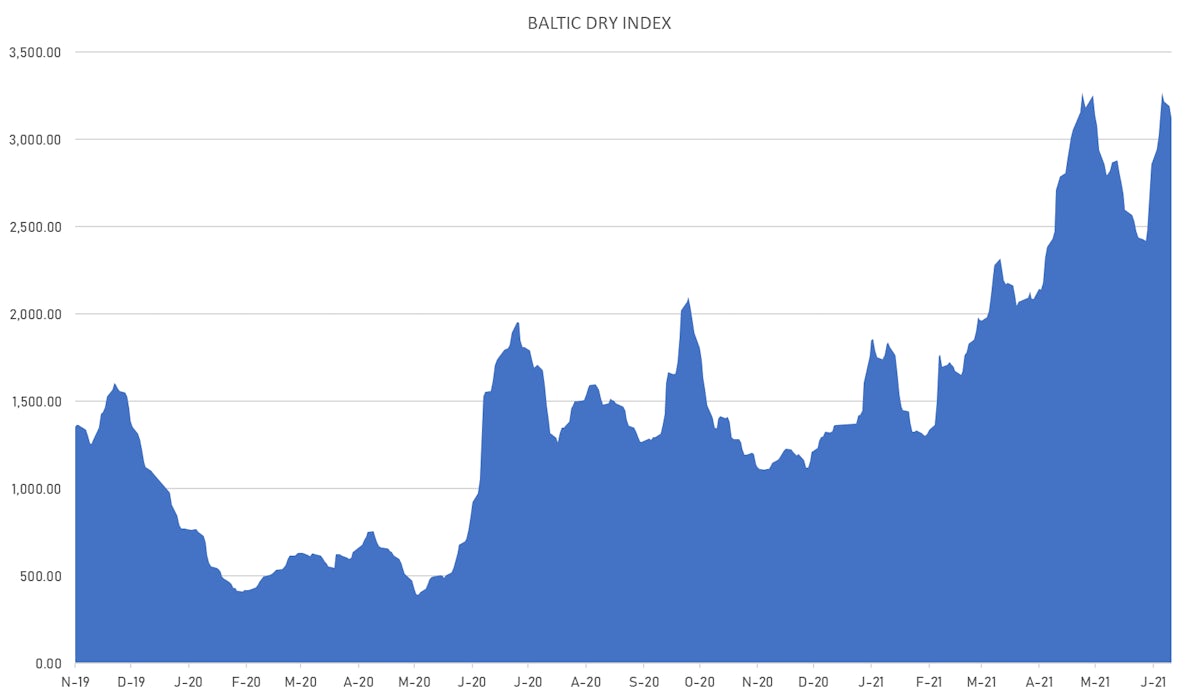

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,119, down -2.2% on the day (YTD: +128.3%)

- Freightos China To North America West Coast Container Index currently at 6,949, up 1.3% on the day (YTD: +65.5%)

- Freightos North America West Coast To China Container Index currently at 1,028, unchanged (YTD: +98.6%)

- Freightos North America East Coast To Europe Container Index currently at 591, unchanged (YTD: +62.9%)

- Freightos Europe To North America East Coast Container Index currently at 5,193, unchanged (YTD: +177.8%)

- Freightos China To North Europe Container Index currently at 11,031, up 0.5% on the day (YTD: +94.8%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,798, unchanged (YTD: +183.6%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 54.67 per tonne, up 2.4% on the day (YTD: +67.1%)