Commodities

Industrial Metals Rise Further In Asia With Announcement Of US Infrastructure Deal

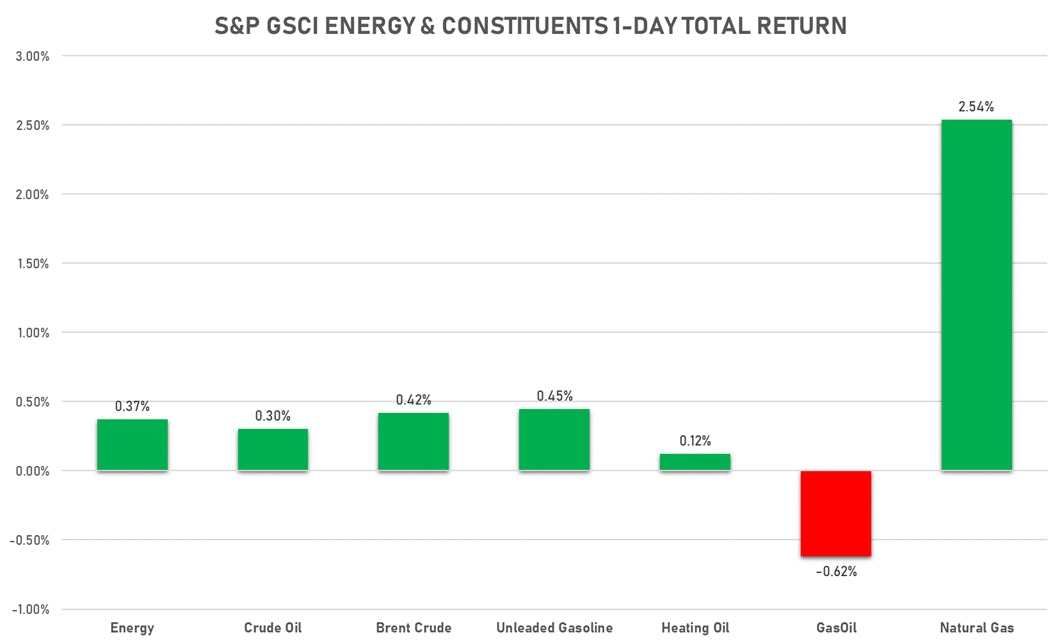

Natural gas was up again today, as storage was below the consensus estimate as well as the five-year average

Published ET

S&P GSCI sub-indices 10-year total returns | Sources: ϕpost, FactSet data

HEADLINES & MACRO

- United States, Stock Levels, EIA, Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 18 Jun (EIA, United States) at 55.00 bcf, below consensus estimate of 66.00 bcf

NOTABLE GAINERS

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index up 5.7% (YTD: 86.0%)

- DCE Iron Ore Continuation Month 1 up 5.3% (YTD: 22.5%)

- DCE Coking Coal Continuation Month 1 up 3.3% (YTD: 51.1%)

- NYMEX Henry Hub Natural Gas up 2.6% (YTD: 34.6%)

- SHFE Rebar up 1.7% (YTD: 15.4%)

- SHFE Stannum up 1.5% (YTD: 39.5%)

- DCE Coke up 1.5% (YTD: 0.4%)

- ICE Brent Crude Spread Spread up 1.5% (YTD: 668.9%)

- ICE-US Sugar No. 11 up 1.4% (YTD: 9.3%)

- Shanghai International Exchange Bonded Copper up 1.2% (YTD: 18.7%)

- SHFE Nickel up 1.2% (YTD: 8.8%)

NOTABLE LOSERS

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index down -10.7% (YTD: 70.5%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index down -9.3% (YTD: 80.2%)

- CBOE Crude Oil Volatility Index down -7.6% (YTD: -15.3%)

- Silver/US Dollar 1 Month ATM Option down -7.4% (YTD: -43.3%)

- Pork Primal Cutout Butt down -5.5% (YTD: 127.6%)

- CME Random Length Lumber down -4.7% (YTD: -3.5%)

- NYMEX Light Sweet Crude Oil vs 6 down -4.6% (YTD: 0.0%)

- CME Lean Hogs down -4.3% (YTD: 42.3%)

- Gold/US Dollar 1 Month ATM Option down -2.8% (YTD: -18.6%)

- CBoT Soybean Meal down -2.4% (YTD: -20.4%)

ENERGY

- WTI crude front month currently at US$ 73.23 per barrel, up 0.3% on the day (YTD: +51.1%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 75.56 per barrel, up 0.5% on the day (YTD: +45.9%); 6-month term structure in widening backwardation

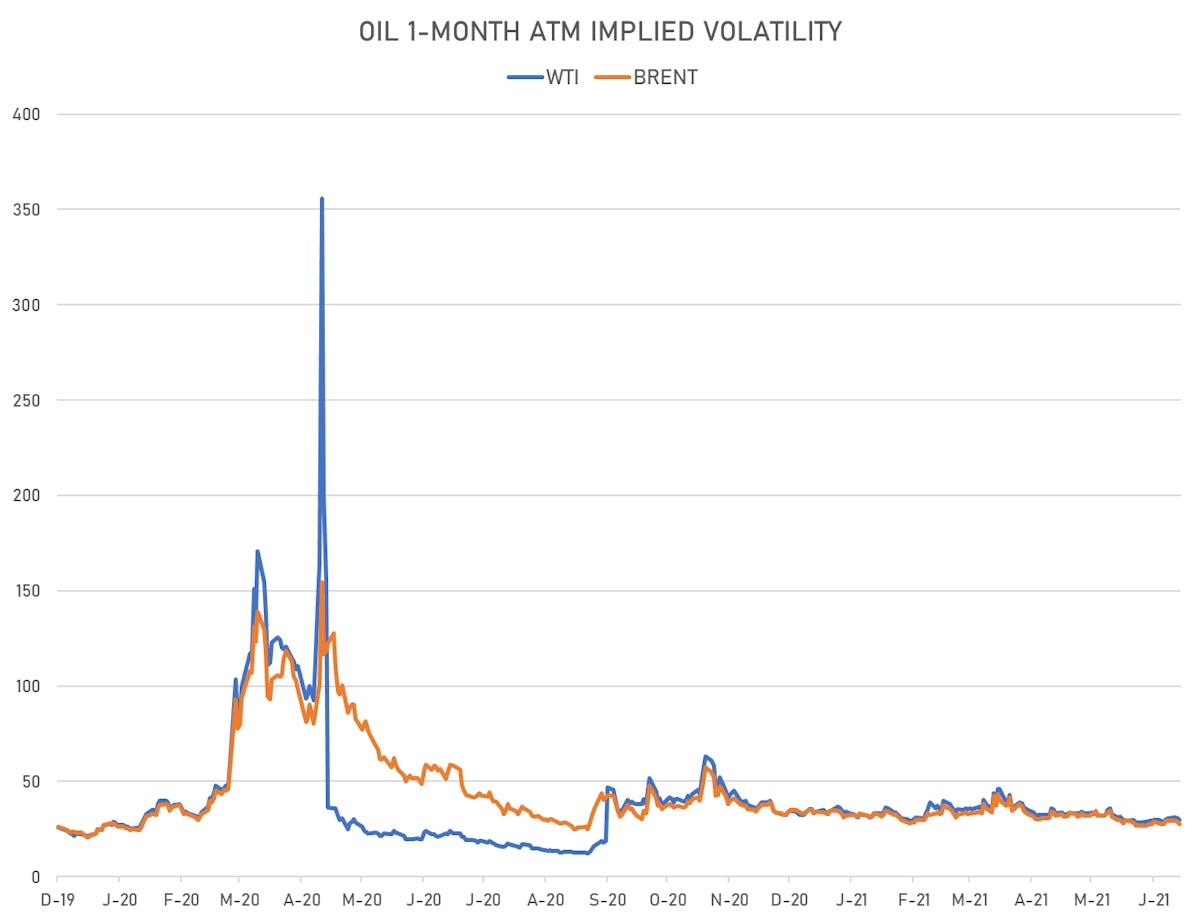

- Brent volatility at 27.6, down -3.9% on the day (12-month range: 24.7 - 58.3)

- Newcastle Coal (ICE Europe) currently at US$ 127.50 per tonne, down 0.0% on the day (YTD: +58.4%)

- Natural Gas (Henry Hub) currently at US$ 3.42 per MMBtu, up 2.6% on the day (YTD: +34.6%)

- Gasoline (NYMEX) currently at US$ 2.28 per gallon, up 0.6% on the day (YTD: +61.9%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 603.25 per tonne, down -0.6% on the day (YTD: +43.4%)

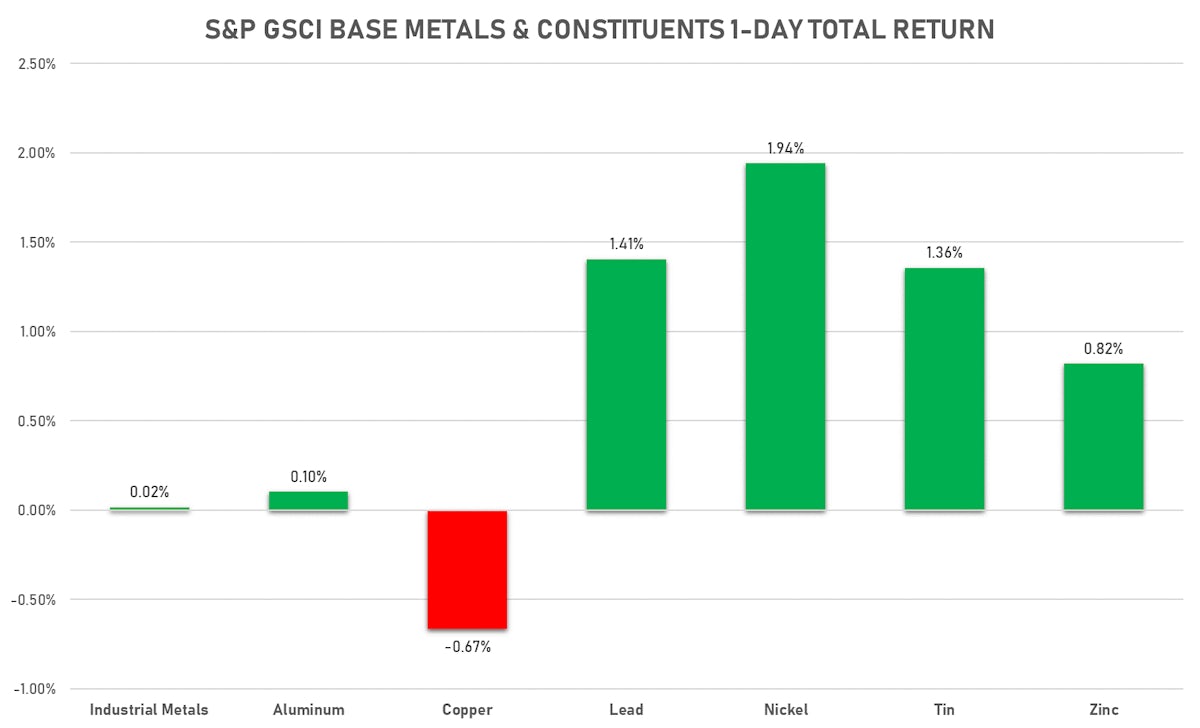

BASE METALS

- Copper (COMEX) currently at US$ 4.31 per pound, down -0.5% on the day (YTD: +22.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,311.00 per tonne, up 5.3% on the day (YTD: +22.5%)

- Aluminium (Shanghai) currently at CNY 18,770 per tonne, up 0.2% on the day (YTD: +19.6%)

- Nickel (Shanghai) currently at CNY 137,890 per tonne, up 1.2% on the day (YTD: +8.8%)

- Lead (Shanghai) currently at CNY 15,515 per tonne, down -0.3% on the day (YTD: +5.1%)

- Rebar (Shanghai) currently at CNY 4,895 per tonne, up 1.7% on the day (YTD: +15.4%)

- Tin (Shanghai) currently at CNY 211,850 per tonne, up 1.5% on the day (YTD: +39.5%)

- Zinc (Shanghai) currently at CNY 21,955 per tonne, up 0.6% on the day (YTD: +4.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 346,500 per tonne, unchanged (YTD: +26.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

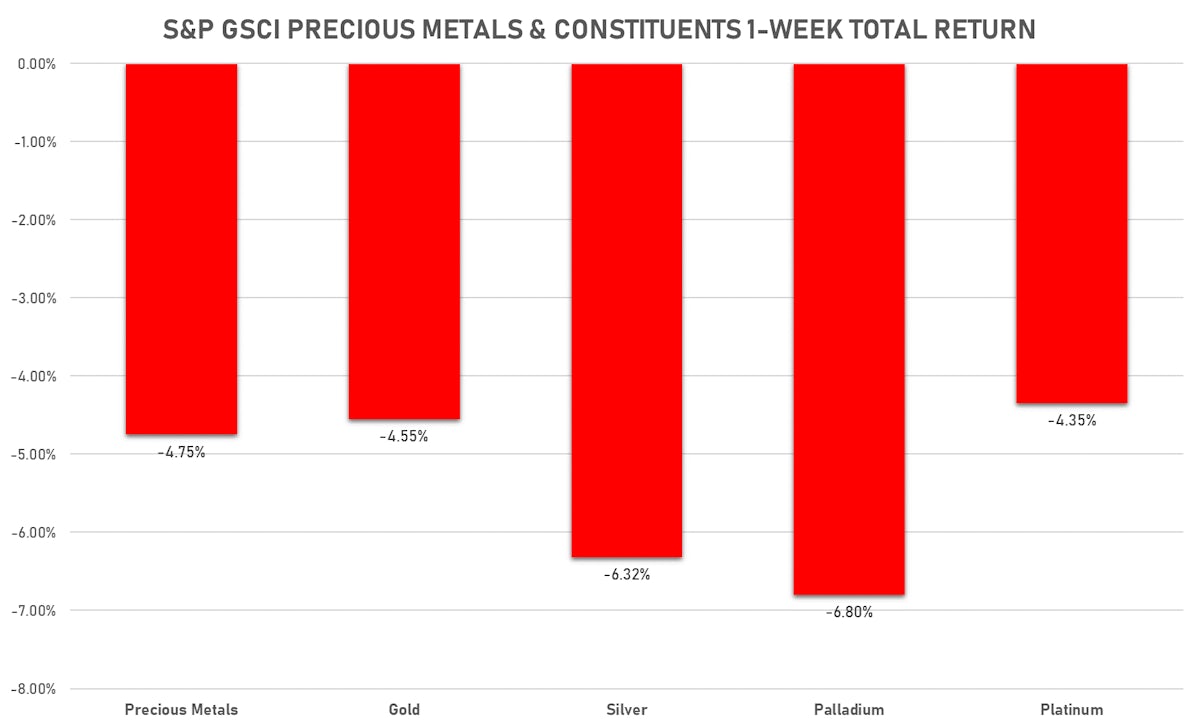

PRECIOUS METALS

- Gold spot currently at US$ 1,774.28 per troy ounce, down -0.2% on the day (YTD: -6.5%)

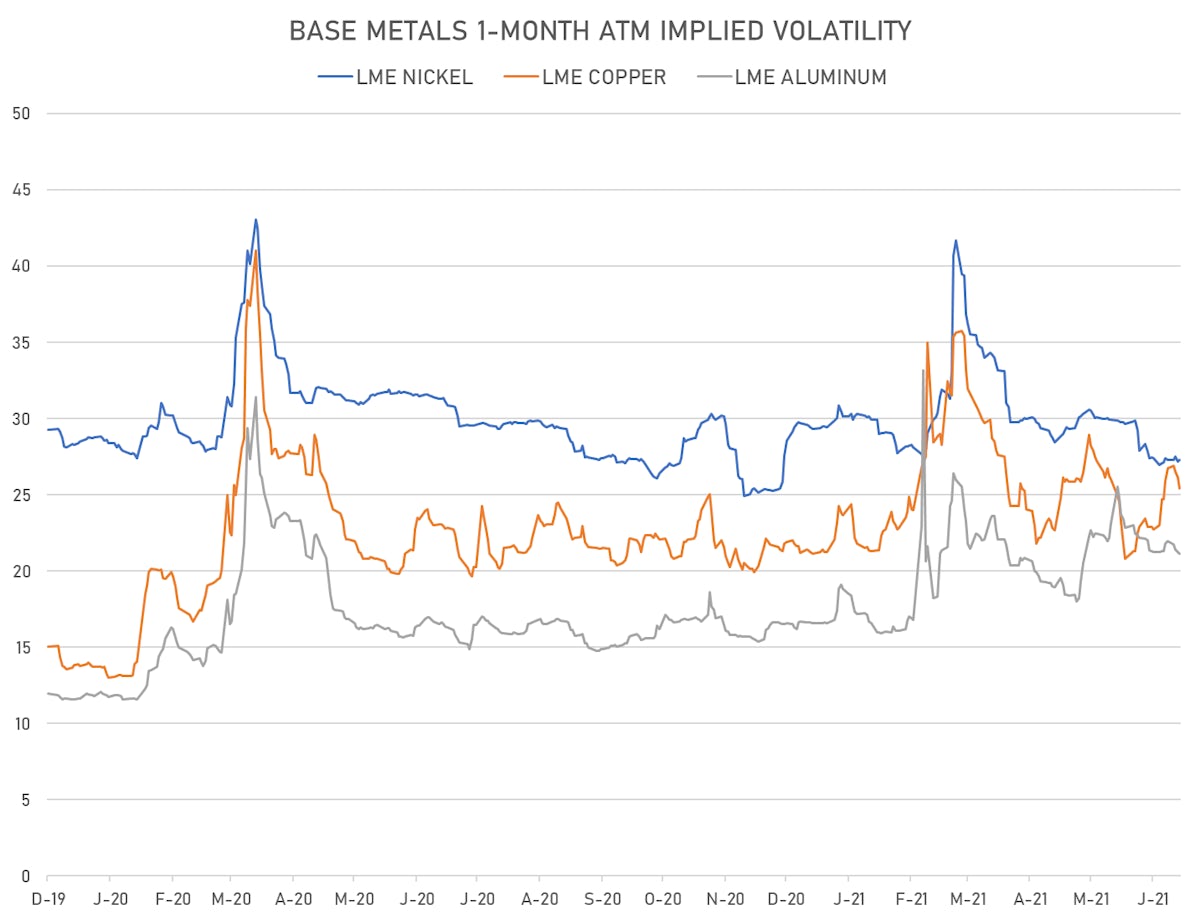

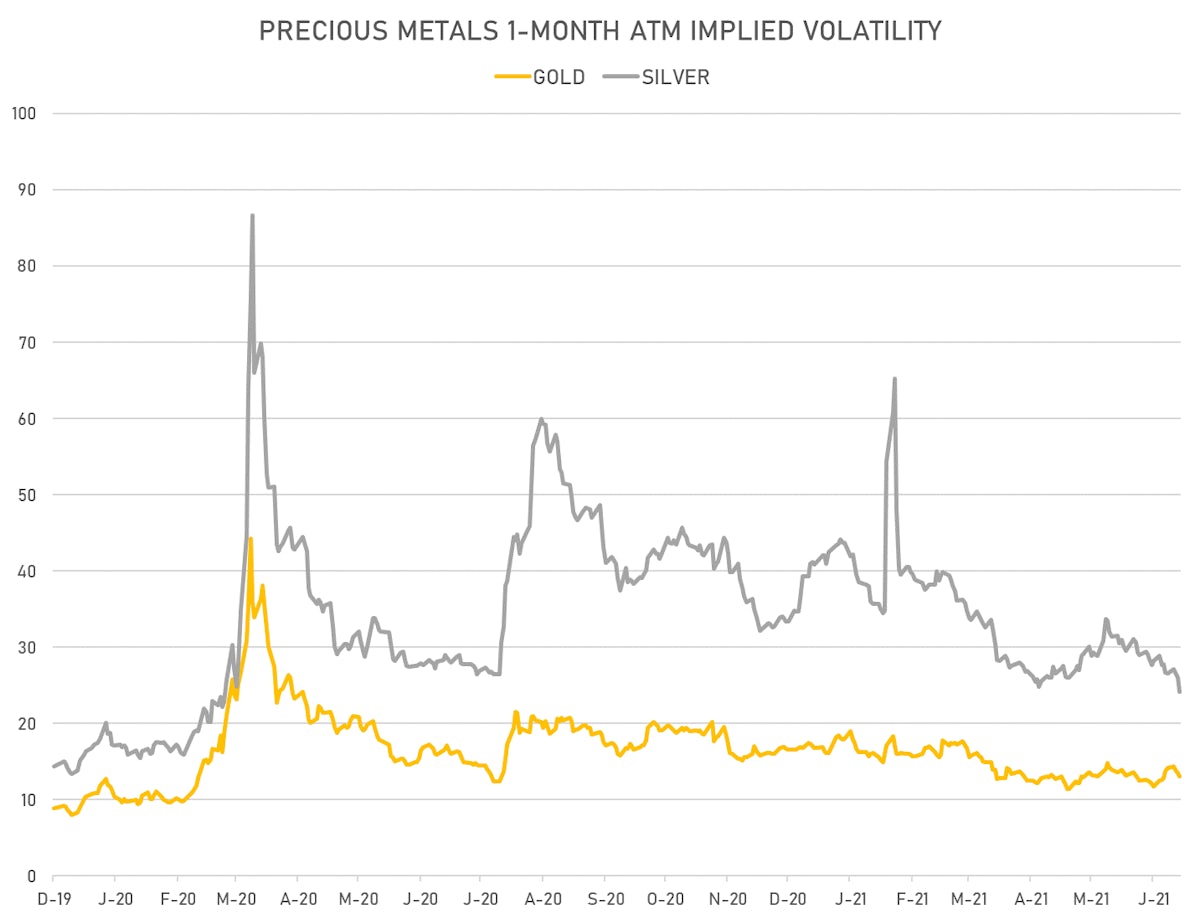

- Gold 1-Month ATM implied volatility currently at 12.68, down -2.8% on the day (YTD: -18.6%)

- Silver spot currently at US$ 25.90 per troy ounce, up 0.2% on the day (YTD: -1.7%)

- Silver 1-Month ATM implied volatility currently at 23.11, down -7.4% on the day (YTD: -43.3%)

- Palladium spot currently at US$ 2,646.43 per troy ounce, up 1.2% on the day (YTD: +8.0%)

- Platinum spot currently at US$ 1,093.03 per troy ounce, up 1.1% on the day (YTD: +2.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,250 per troy ounce, unchanged (YTD: +12.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,900 per troy ounce, down -1.7% on the day (YTD: +126.9%)

AGRO

- Live Cattle (CME) currently at US$ 122.83 cents per pound, up 0.3% on the day (YTD: +8.7%)

- Lean Hogs (CME) currently at US$ 100.03 cents per pound, down -4.3% on the day (YTD: +42.3%)

- Rough Rice (CBOT) currently at US$ 13.24 cents per hundredweight, down -0.8% on the day (YTD: +6.7%)

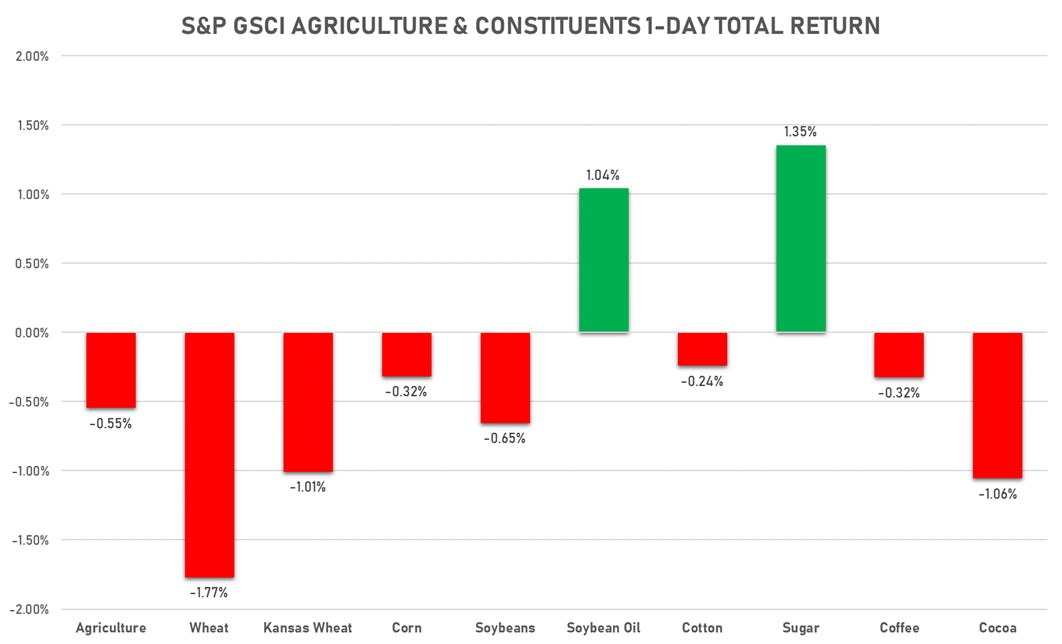

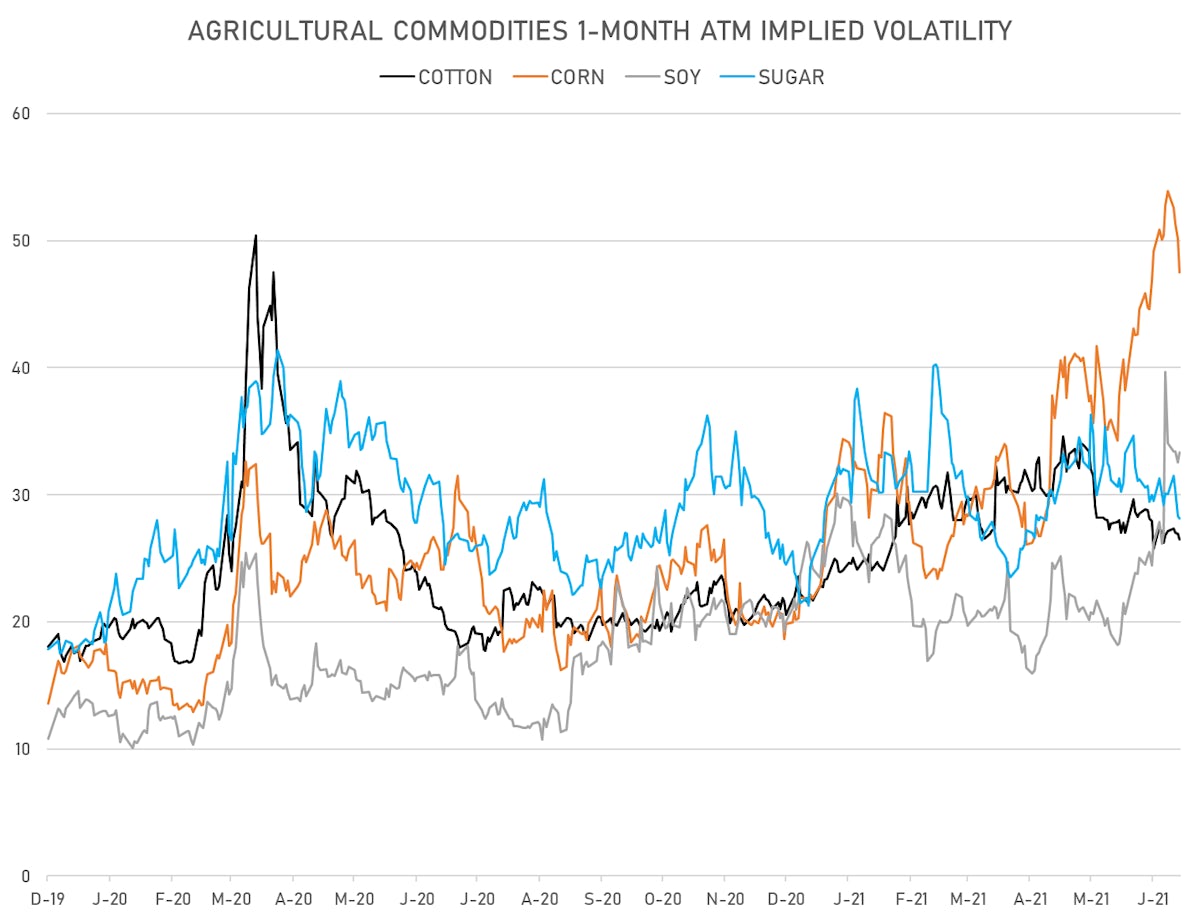

- Soybeans Composite (CBOT) currently at US$ 1,371.25 cents per bushel, down -1.0% on the day (YTD: +4.3%)

- Corn (CBOT) currently at US$ 653.25 cents per bushel, down -1.7% on the day (YTD: +35.0%)

- Wheat Composite (CBOT) currently at US$ 651.25 cents per bushel, down -1.5% on the day (YTD: +1.7%)

- Sugar No.11 (ICE US) currently at US$ 16.93 cents per pound, up 1.4% on the day (YTD: +9.3%)

- Cotton No.2 (ICE US) currently at US$ 86.03 cents per pound, down -0.5% on the day (YTD: +10.1%)

- Cocoa (ICE US) currently at US$ 2,315 per tonne, up 0.8% on the day (YTD: -11.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,773 per tonne, up 1.0% on the day (YTD: +19.2%)

- Random Length Lumber (CME) currently at US$ 842.30 per 1,000 board feet, down -4.7% on the day (YTD: -3.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,555 per tonne, up 1.0% on the day (YTD: +4.4%)

- Soybean Oil Composite (CBOT) currently at US$ 62.70 cents per pound, up 0.9% on the day (YTD: +44.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,605 per tonne, down -0.3% on the day (YTD: -7.4%)

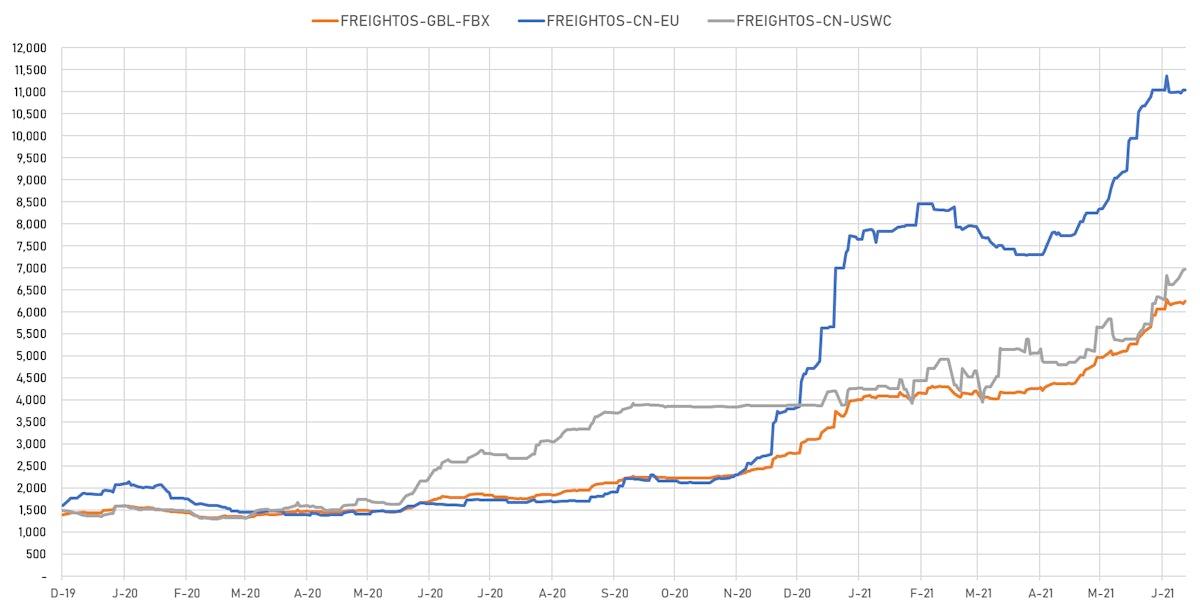

SHIPPING

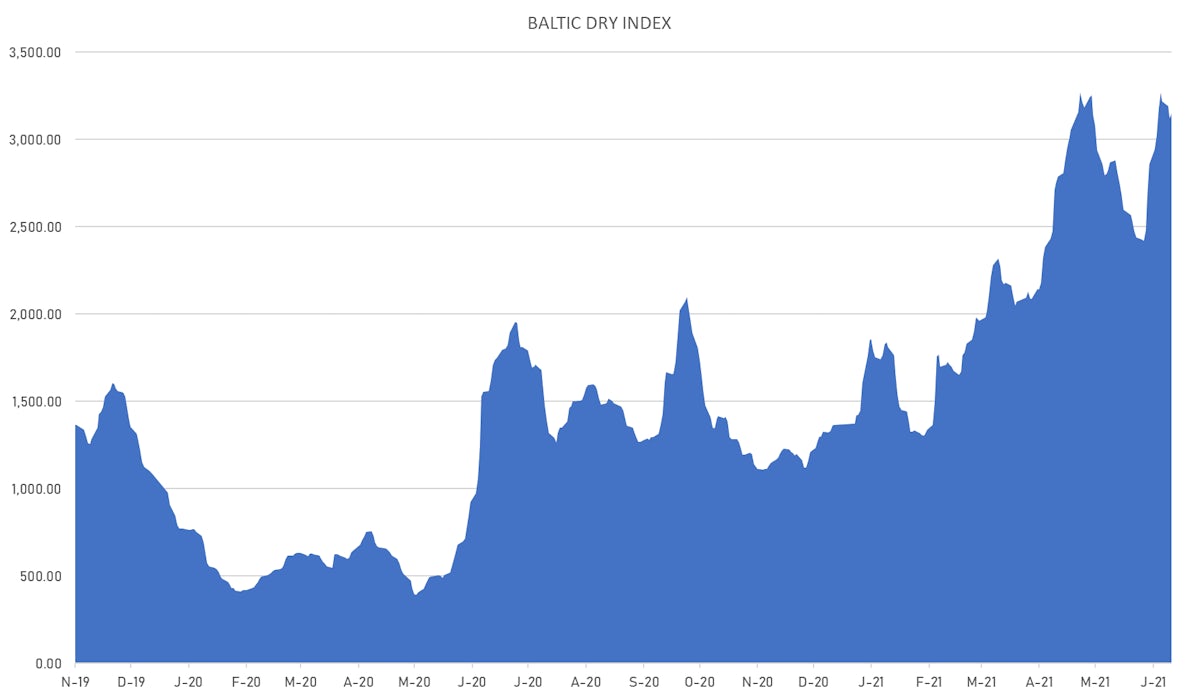

- Baltic Dry Index (Baltic Exchange) currently at 3,147, up 0.9% on the day (YTD: +130.4%)

- Freightos China To North America West Coast Container Index currently at 6,972, up 0.3% on the day (YTD: +66.0%)

- Freightos North America West Coast To China Container Index currently at 933, down -9.3% on the day (YTD: +80.2%)

- Freightos North America East Coast To Europe Container Index currently at 591, unchanged (YTD: +62.9%)

- Freightos Europe To North America East Coast Container Index currently at 5,232, up 0.8% on the day (YTD: +179.9%)

- Freightos China To North Europe Container Index currently at 11,031, unchanged (YTD: +94.8%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,798, unchanged (YTD: +183.6%)

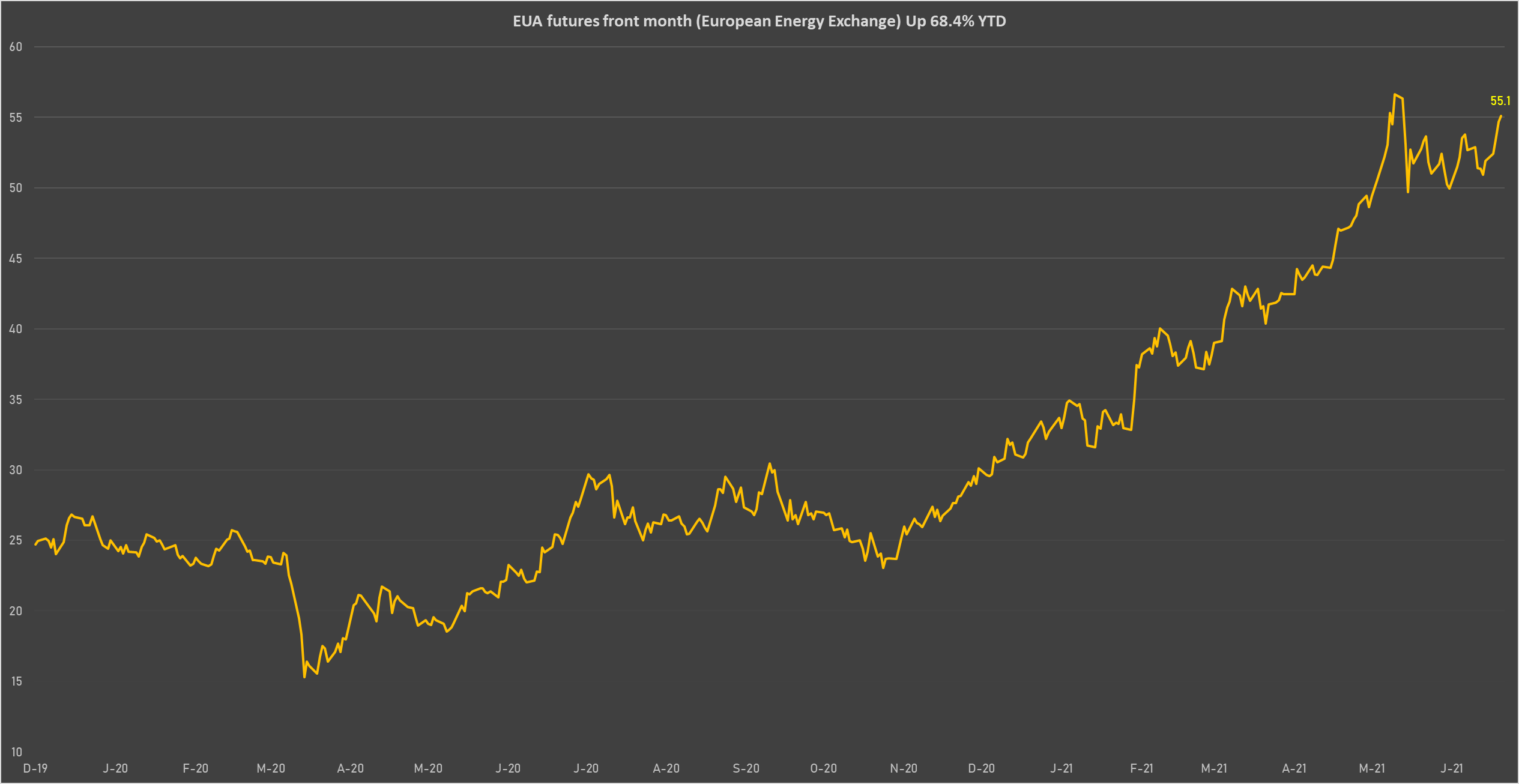

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 55.09 per tonne, up 0.8% on the day (YTD: +68.4%)