Commodities

Strong Rebound For Grains, While Nat Gas Closes Higher Again

Crude settles slightly higher following a larger-than-expected inventory draw, but the market is waiting for OPEC+ decision on Thursday; analysts suggest that anything below 300k bpd in additional OPEC+ supply would be bullish

Published ET

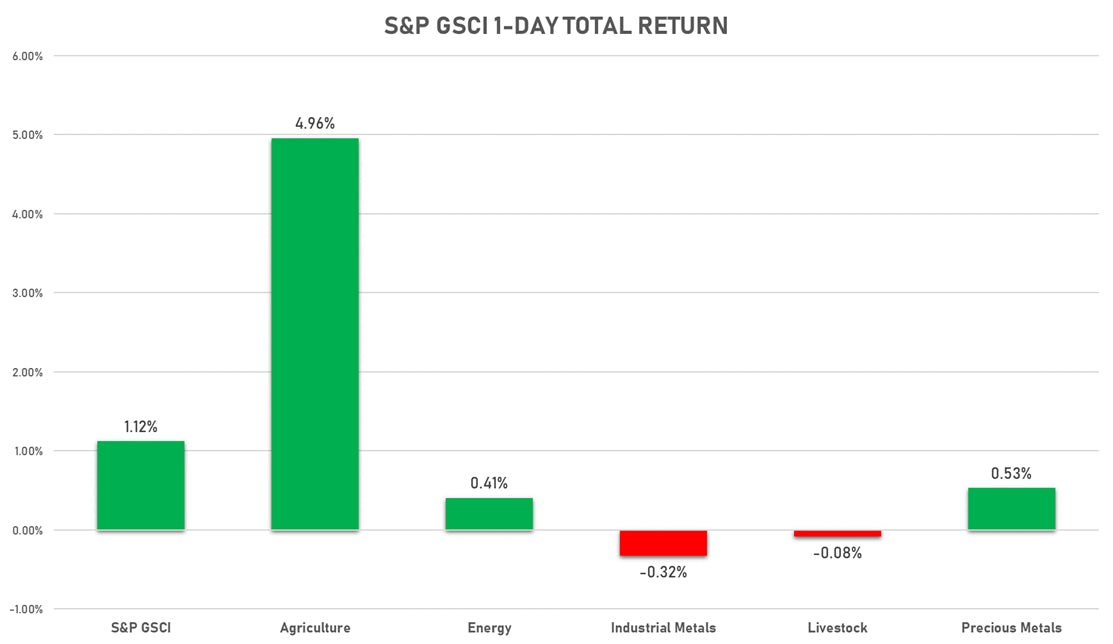

S&P GSCI Sub-Indices Total Returns Year To Date | Sources: ϕpost, FactSet data

MACRO RELEASES

- United States, Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 25 Jun (EIA, United States) at -6.72 Mln, below consensus estimate of -4.69 Mln

- United States, Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 25 Jun (EIA, United States) at -0.87 Mln, below consensus estimate of 0.49 Mln

- United States, Stock Levels, EIA, Gasoline, Absolute change, Volume for W 25 Jun (EIA, United States) at 1.52 Mln, above consensus estimate of -0.89 Mln

- United States, Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 25 Jun (EIA, United States) at 0.70 %, above consensus estimate of 0.50 %

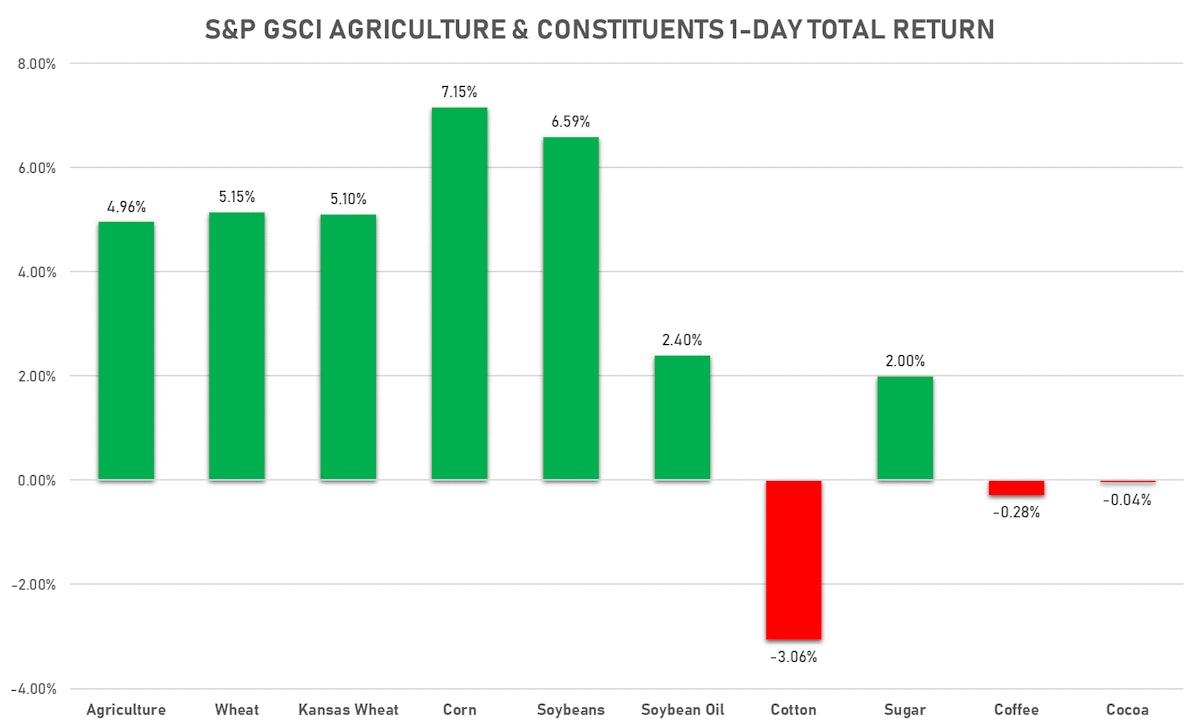

NOTABLE GAINERS

- Soybeans Composite (CBOT) currently at US$ 1,450.00 cents per bushel, up 6.6% on the day (YTD: +10.2%)

- Wheat Composite (CBOT) currently at US$ 669.25 cents per bushel, up 5.0% on the day (YTD: +4.8%)

- Corn (CBOT) currently at US$ 723.75 cents per bushel, up 3.7% on the day (YTD: +48.8%)

- Newcastle Coal (ICE Europe) currently up 2.8% (YTD: +67.3%)

- Sugar No.11 (ICE US) currently at US$ 17.63 cents per pound, up 2.3% on the day (YTD: +13.8%)

- NYMEX Henry Hub Natural Gas up 1.9% (YTD: 46.5%)

- NYMEX Light Sweet Crude Oil (WTI) up 0.1% (YTD: 51.5%)

- COMEX Copper up 0.1% (YTD: 22.4%)

- NYMEX NY Harbor ULSD up 0.1% (YTD: 44.3%)

NOTABLE LOSERS

- Pork Primal Cutout Butt down -6.5% (YTD: 116.2%)

- CME Random Length Lumber down -5.5% (YTD: -18.0%)

- ICE-US Cotton No. 2 down -2.8% (YTD: 7.6%)

- Shanghai International Exchange TSR 20 Rubber down -2.0% (YTD: 2.6%)

- CME Cattle(Feeder) down -1.8% (YTD: 11.3%)

- CME Class III Milk down -1.6% (YTD: 7.0%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -1.6% (YTD: 14.0%)

- SHFE Rubber down -1.6% (YTD: -7.1%)

- SHFE Hot Rolled Coil down -1.0% (YTD: 21.0%)

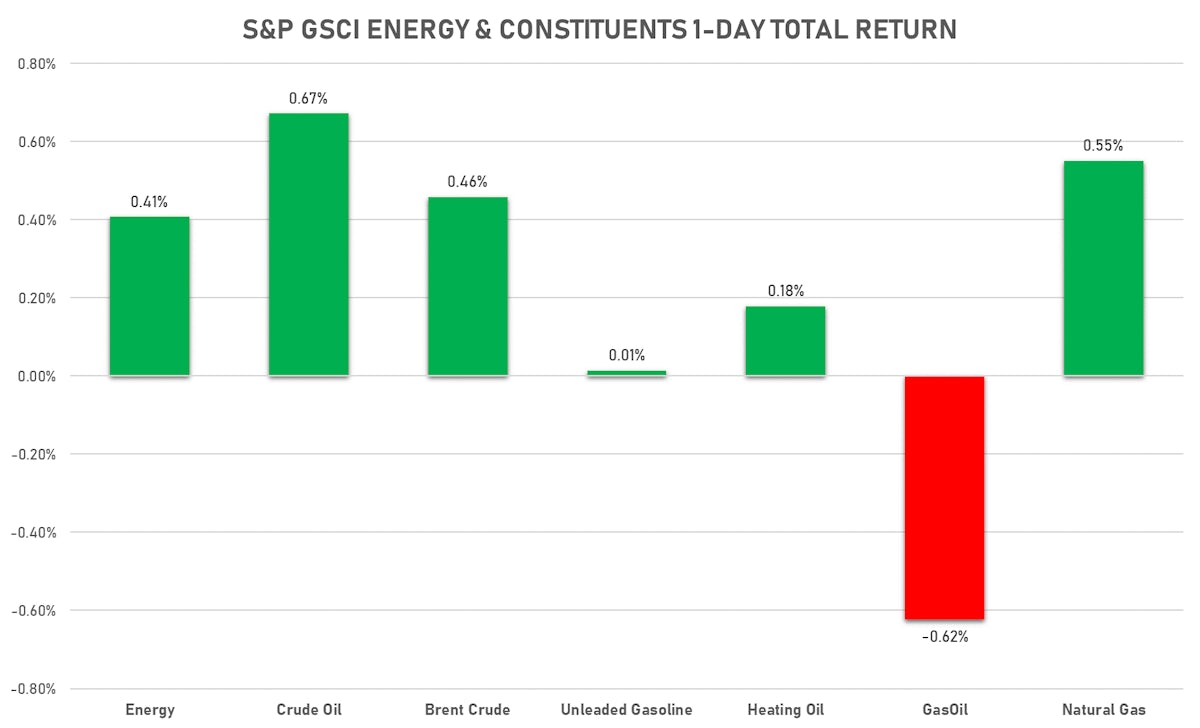

ENERGY

- WTI crude front month currently at US$ 73.55 per barrel, up 0.1% on the day (YTD: +51.5%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 74.73 per barrel, up 0.5% on the day (YTD: +45.0%); 6-month term structure in widening backwardation

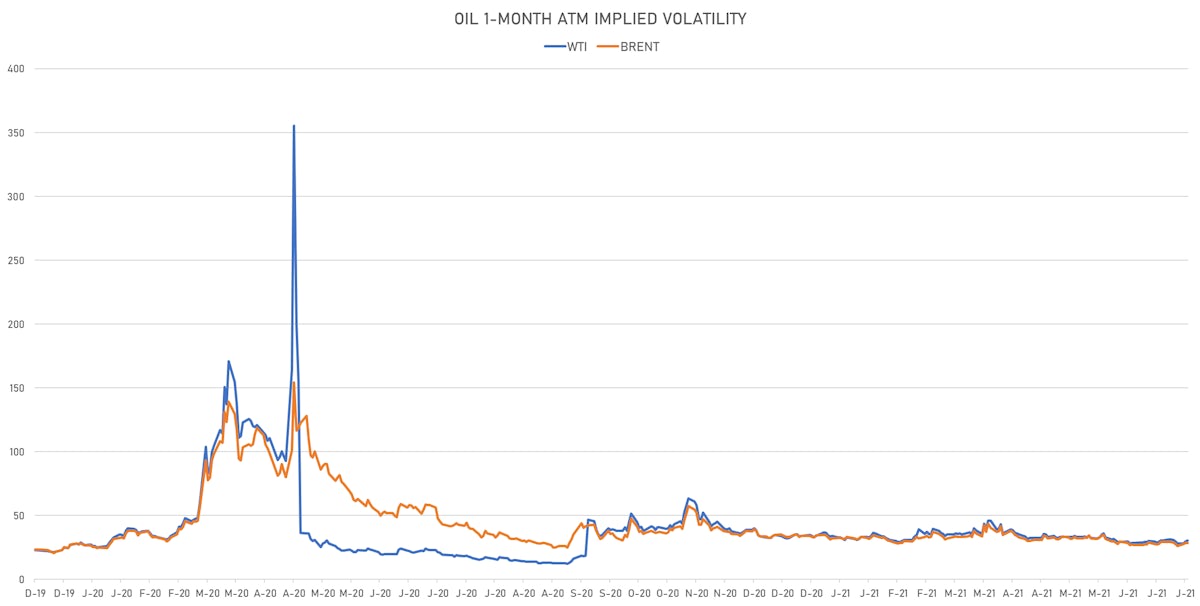

- Brent volatility at 28.6, up 0.1% on the day (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 134.70 per tonne, up 2.8% on the day (YTD: +67.3%)

- Natural Gas (Henry Hub) currently at US$ 3.69 per MMBtu, up 1.9% on the day (YTD: +46.5%)

- Gasoline (NYMEX) currently at US$ 2.24 per gallon, unchanged (YTD: +59.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 599.50 per tonne, down -0.6% on the day (YTD: +41.8%)

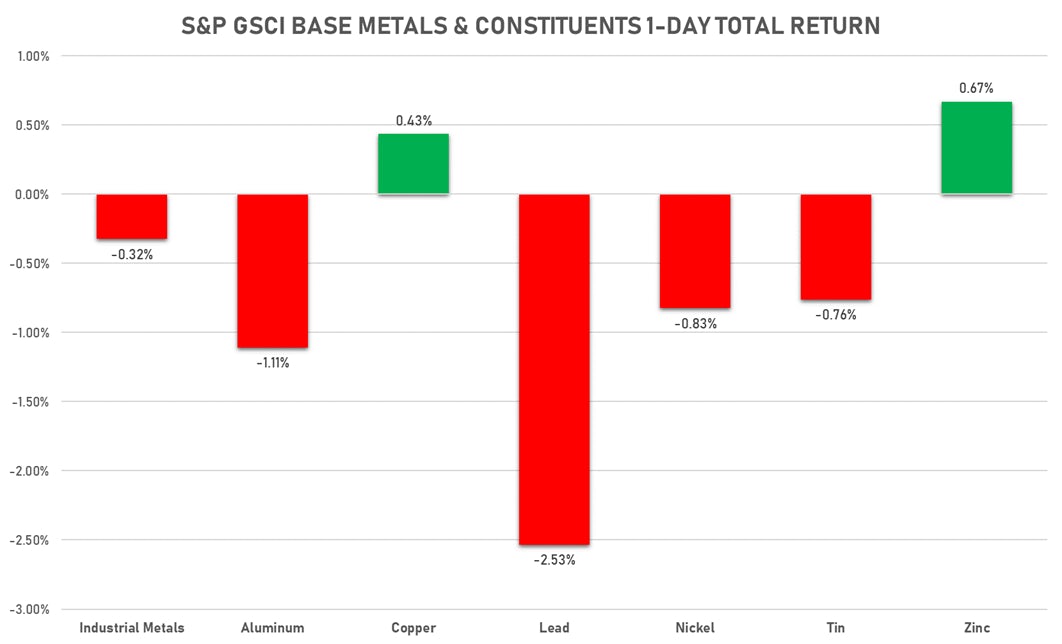

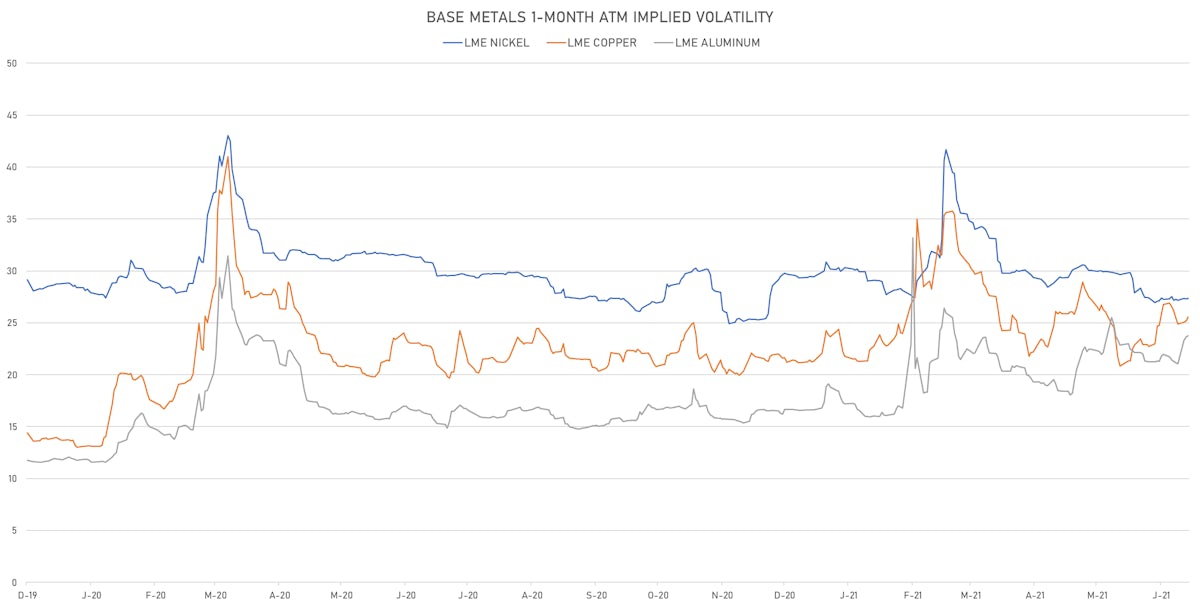

BASE METALS

- Copper (COMEX) currently at US$ 4.30 per pound, up 0.1% on the day (YTD: +22.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,382.50 per tonne, down -0.4% on the day (YTD: +28.0%)

- Aluminium (Shanghai) currently at CNY 18,780 per tonne, down -0.2% on the day (YTD: +19.9%)

- Nickel (Shanghai) currently at CNY 135,600 per tonne, up 0.2% on the day (YTD: +10.1%)

- Lead (Shanghai) currently at CNY 15,850 per tonne, up 2.6% on the day (YTD: +6.9%)

- Rebar (Shanghai) currently at CNY 4,980 per tonne, down -0.4% on the day (YTD: +15.9%)

- Tin (Shanghai) currently at CNY 214,050 per tonne, up 0.3% on the day (YTD: +42.0%)

- Zinc (Shanghai) currently at CNY 22,185 per tonne, up 0.7% on the day (YTD: +5.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 349,500 per tonne, unchanged (YTD: +27.6%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

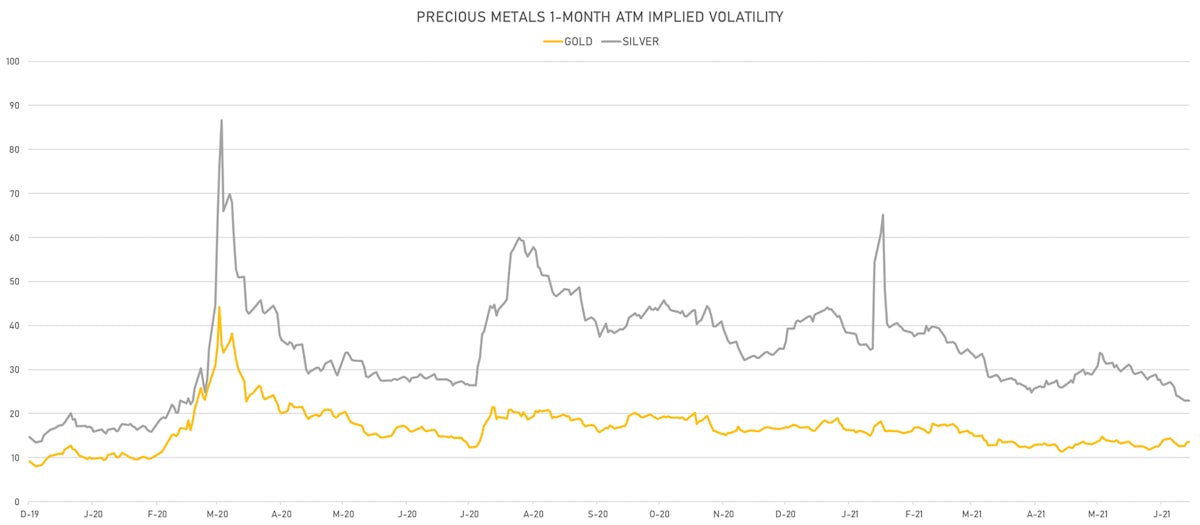

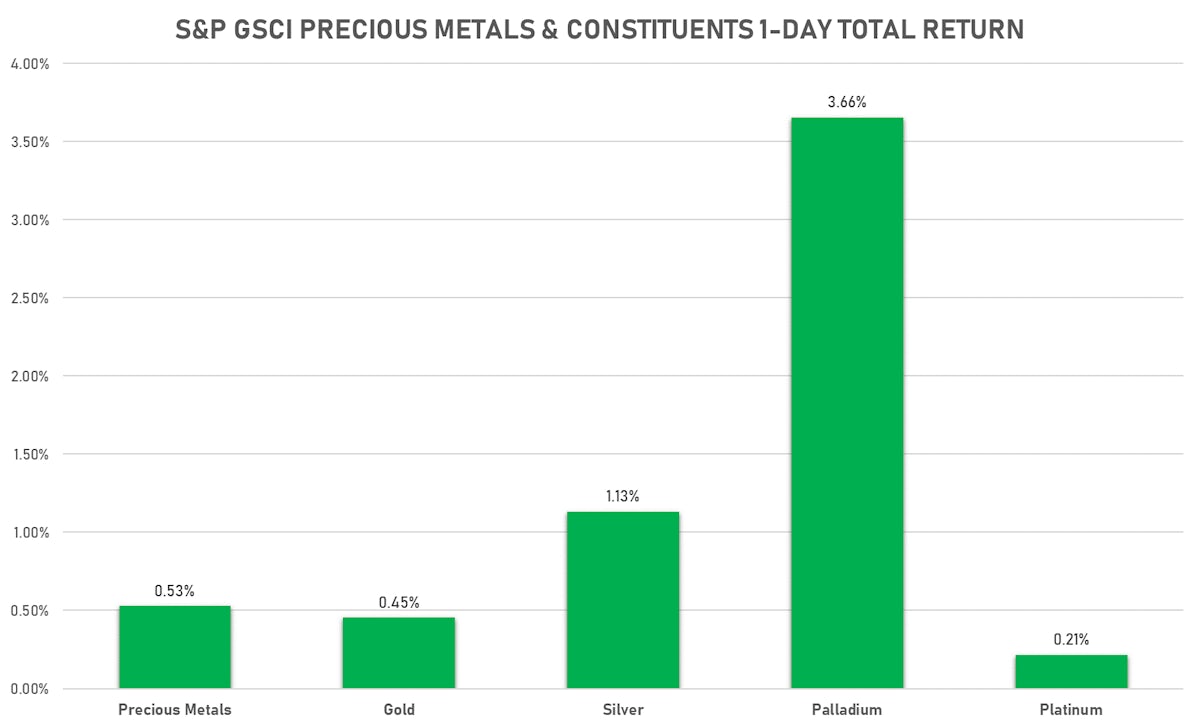

PRECIOUS METALS

- Gold spot currently at US$ 1,767.94 per troy ounce, up 0.5% on the day (YTD: -6.7%)

- Gold 1-Month ATM implied volatility currently at 13.08, up 0.5% on the day (YTD: -15.8%)

- Silver spot currently at US$ 26.09 per troy ounce, up 1.4% on the day (YTD: -1.0%)

- Silver 1-Month ATM implied volatility currently at 22.08, unchanged (YTD: -46.0%)

- Palladium spot currently at US$ 2,773.72 per troy ounce, up 3.8% on the day (YTD: +13.7%)

- Platinum spot currently at US$ 1,063.68 per troy ounce, up 0.7% on the day (YTD: +0.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 20,100 per troy ounce, unchanged (YTD: +17.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,750 per troy ounce, unchanged (YTD: +121.2%)

AGRO

- Live Cattle (CME) currently at US$ 122.73 cents per pound, unchanged (YTD: +8.5%)

- Lean Hogs (CME) currently at US$ 107.48 cents per pound, up 0.5% on the day (YTD: +52.9%)

- Rough Rice (CBOT) currently at US$ 13.18 cents per hundredweight, down -0.6% on the day (YTD: +6.3%)

- Soybeans Composite (CBOT) currently at US$ 1,450.00 cents per bushel, up 6.6% on the day (YTD: +10.2%)

- Corn (CBOT) currently at US$ 723.75 cents per bushel, up 3.7% on the day (YTD: +48.8%)

- Wheat Composite (CBOT) currently at US$ 669.25 cents per bushel, up 5.0% on the day (YTD: +4.8%)

- Sugar No.11 (ICE US) currently at US$ 17.63 cents per pound, up 2.3% on the day (YTD: +13.8%)

- Cotton No.2 (ICE US) currently at US$ 84.03 cents per pound, down -2.8% on the day (YTD: +7.6%)

- Cocoa (ICE US) currently at US$ 2,360 per tonne, unchanged (YTD: -9.3%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,919 per tonne, down -0.9% on the day (YTD: +23.8%)

- Random Length Lumber (CME) currently at US$ 716.00 per 1,000 board feet, down -5.5% on the day (YTD: -18.0%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,180 per tonne, down -2.0% on the day (YTD: +2.6%)

- Soybean Oil Composite (CBOT) currently at US$ 65.16 cents per pound, up 1.6% on the day (YTD: +50.4%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,782 per tonne, up 0.9% on the day (YTD: -2.8%)

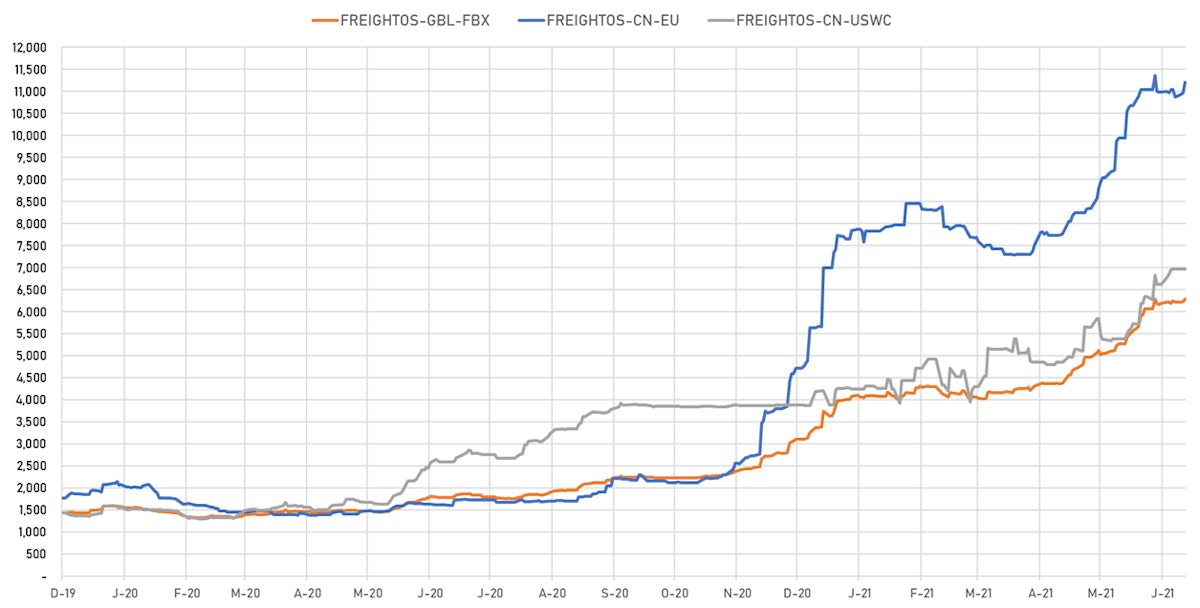

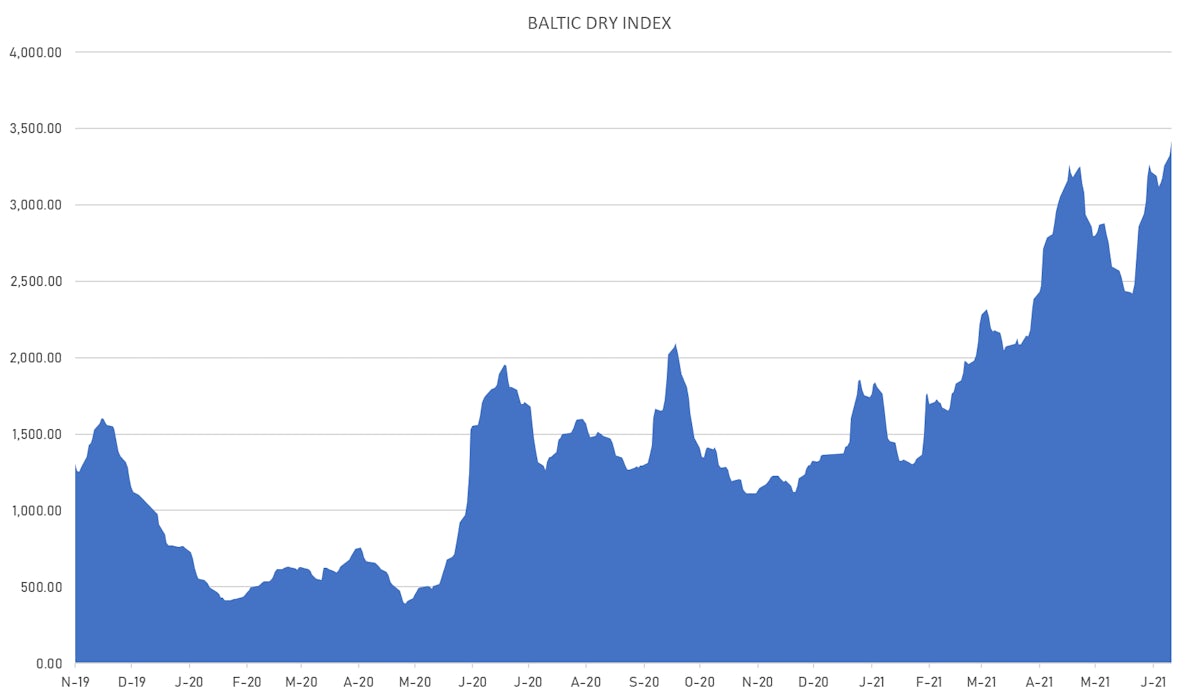

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,418, up 2.8% on the day (YTD: +150.2%)

- Freightos China To North America West Coast Container Index currently at 6,969, unchanged (YTD: +66.0%)

- Freightos North America West Coast To China Container Index currently at 965, up 1.9% on the day (YTD: +86.4%)

- Freightos North America East Coast To Europe Container Index currently at 591, unchanged (YTD: +62.9%)

- Freightos Europe To North America East Coast Container Index currently at 5,668, unchanged (YTD: +203.3%)

- Freightos China To North Europe Container Index currently at 11,199, up 2.2% on the day (YTD: +97.8%)

- Freightos North Europe To China Container Index currently at 1,625, unchanged (YTD: +18.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,727, unchanged (YTD: +179.4%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 56.37 per tonne, up 1.3% on the day (YTD: +72.3%)