Commodities

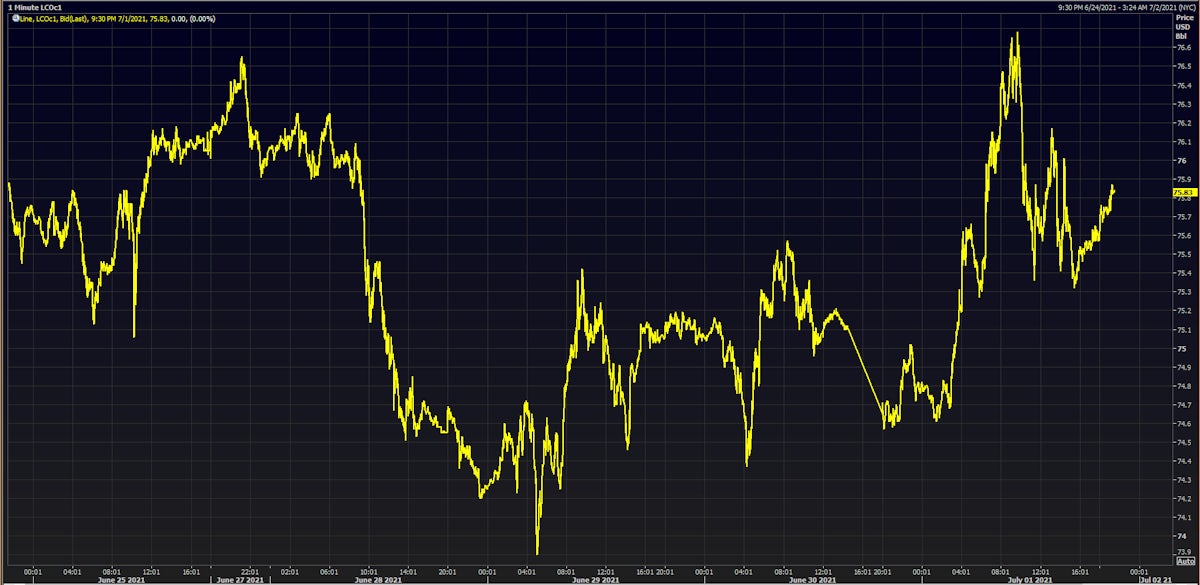

Crude Spot Prices And Volatility Rise Sharply Ahead Of OPEC+ Decision

It is worth noting that the cartel does not favor prices rising too fast, as that would lead to demand destruction in a potentially fragile recovery

Published ET

Brent Crude Intraday Prices | Source: Refinitiv

HEADLINES & MACRO

- EIA natural gas storage injection +76 Bcf vs. Bloomberg consensus +68 Bcf, which is modestly bearish (not that meaningful in the current bullish context)

- OPEC+ meeting adjourned to Friday, might raise supply 500k-1m bpd in order to avoid market overheating (OPEC sweet spot in terms of crude price is currently thought to be around $68 per barrel)

NOTABLE GAINERS

- Freightos Baltic Europe To South America East Coast 40 Container Index up 25.0% (YTD: 210.0%)

- DCE RBD Palm Oil up 8.0% (YTD: 17.0%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index up 5.9% (YTD: 109.4%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index up 4.5% (YTD: 89.0%)

- Freightos Baltic Europe To North America East Coast 40 Container Index up 3.5% (YTD: 214.0%)

- Freightos Baltic China/East Asia To Mediterranean 40 Container Index up 3.3% (YTD: 106.1%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 3.2% (YTD: -11.0%)

- CME Random Length Lumber up 2.7% (YTD: -15.8%)

- Crude Oil WTI Cushing US FOB up 2.5% (YTD: 55.8%)

NOTABLE LOSERS

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index down -8.1% (YTD: 52.6%)

- CME Dry Whey down -4.5% (YTD: 39.1%)

- DCE Iron Ore Continuation Month 1 down -2.5% (YTD: 24.7%)

- Freightos Baltic North Europe To China/East Asia 40 Container Index down -2.5% (YTD: 15.2%)

- CME Cash settled Butter down -2.4% (YTD: 18.7%)

- ICE-US Coffee down -2.1% (YTD: 21.6%)

- Johnson Matthey Rhodium New York 0930 down -2.0% (YTD: 15.5%)

- CBoT Wheat down -1.9% (YTD: 2.8%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index down -1.9% (YTD: 68.5%)

- Gold/US Dollar 1 Month ATM Option IV down -1.7% (YTD: -17.3%)

- Shanghai International Exchange TSR 20 rubber down -1.6% (YTD: 1.0%)

- ICE-US Cocoa down -1.5% (YTD: -10.7%)

ENERGY

- WTI crude front month currently at US$ 75.14 per barrel, up 2.4% on the day (YTD: +55.0%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.72 per barrel, up 0.9% on the day (YTD: +46.4%); 6-month term structure in widening backwardation

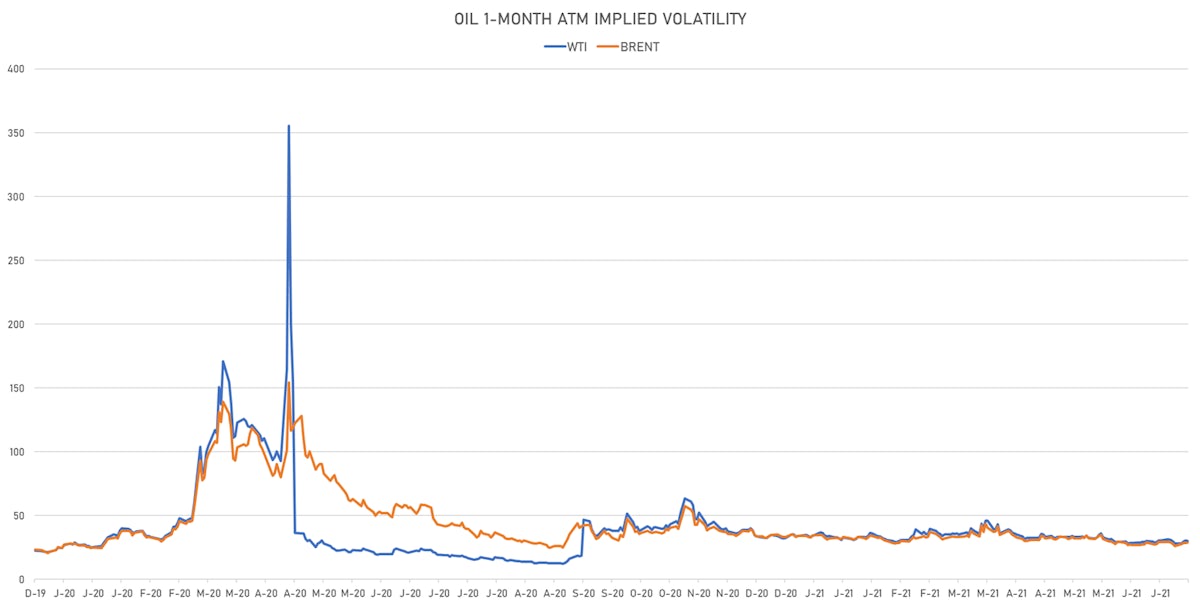

- Brent volatility at 28.7, up 0.5% on the day (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 137.75 per tonne, up 2.3% on the day (YTD: +71.1%)

- Natural Gas (Henry Hub) currently at US$ 3.67 per MMBtu, up 0.3% on the day (YTD: +44.2%)

- Gasoline (NYMEX) currently at US$ 2.26 per gallon, up 1.0% on the day (YTD: +61.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 606.25 per tonne, up 1.6% on the day (YTD: +44.0%)

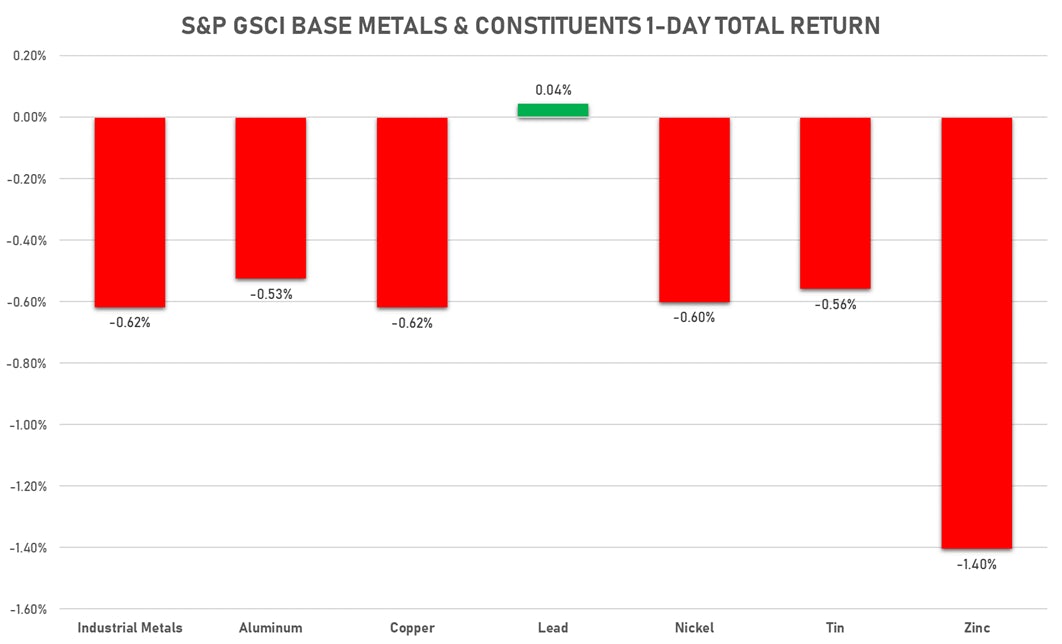

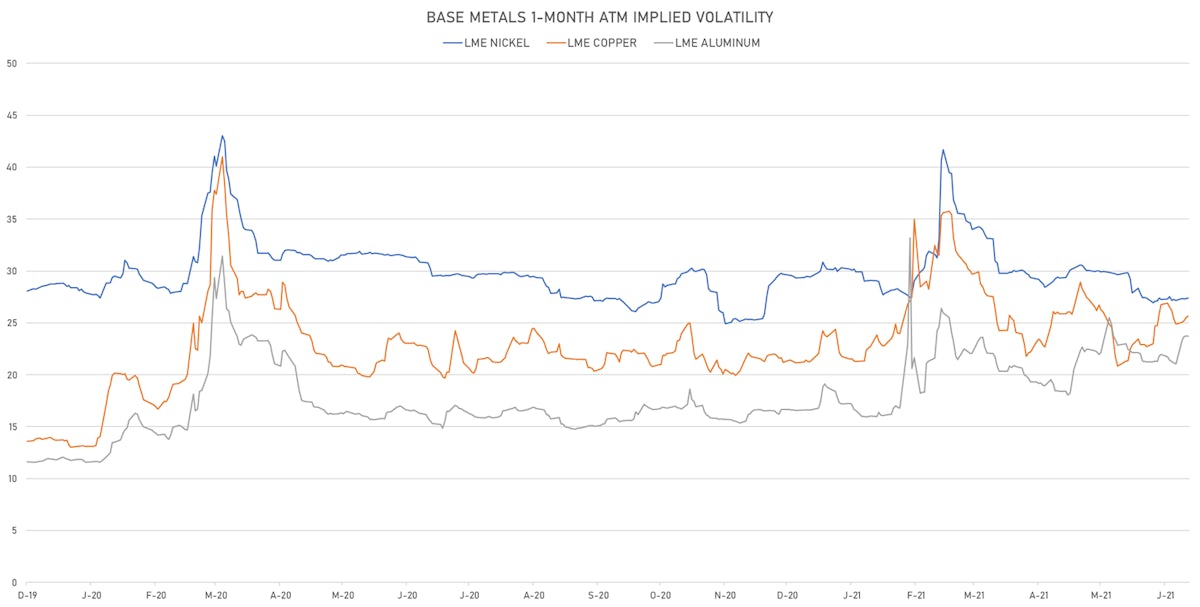

BASE METALS

- Copper (COMEX) currently at US$ 4.24 per pound, down -1.3% on the day (YTD: +20.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,346.00 per tonne, down -2.5% on the day (YTD: +24.7%)

- Aluminium (Shanghai) currently at CNY 18,640 per tonne, down -0.4% on the day (YTD: +19.4%)

- Nickel (Shanghai) currently at CNY 135,120 per tonne, down -0.4% on the day (YTD: +9.7%)

- Lead (Shanghai) currently at CNY 15,650 per tonne, up 0.4% on the day (YTD: +7.3%)

- Rebar (Shanghai) currently at CNY 4,900 per tonne, up 1.6% on the day (YTD: +17.8%)

- Tin (Shanghai) currently at CNY 213,800 per tonne, up 0.5% on the day (YTD: +42.7%)

- Zinc (Shanghai) currently at CNY 21,975 per tonne, up 1.0% on the day (YTD: +6.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 351,500 per tonne, up 0.6% on the day (YTD: +28.3%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

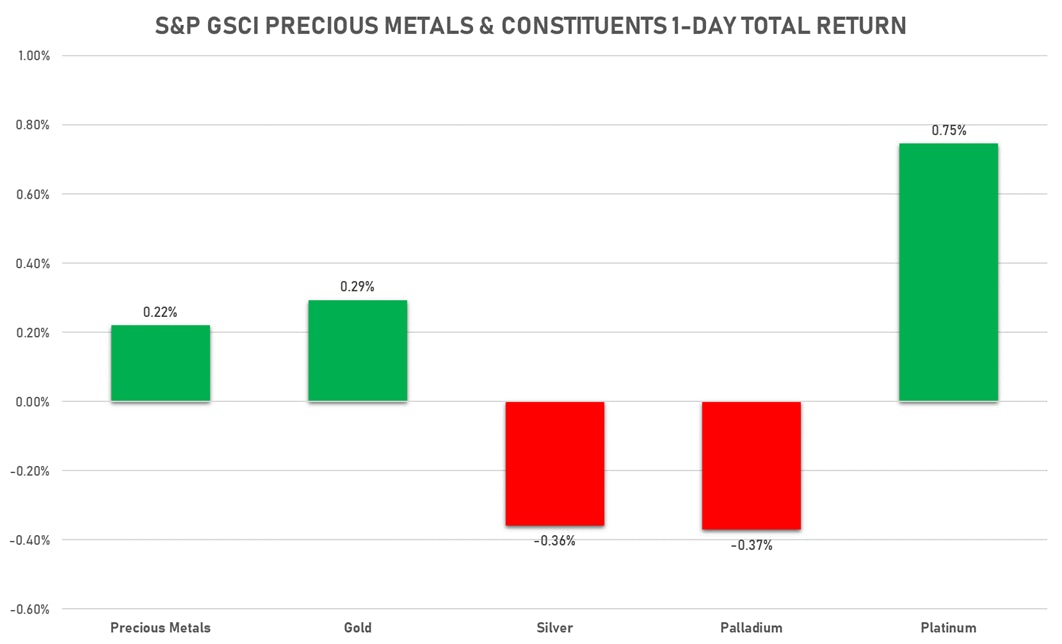

PRECIOUS METALS

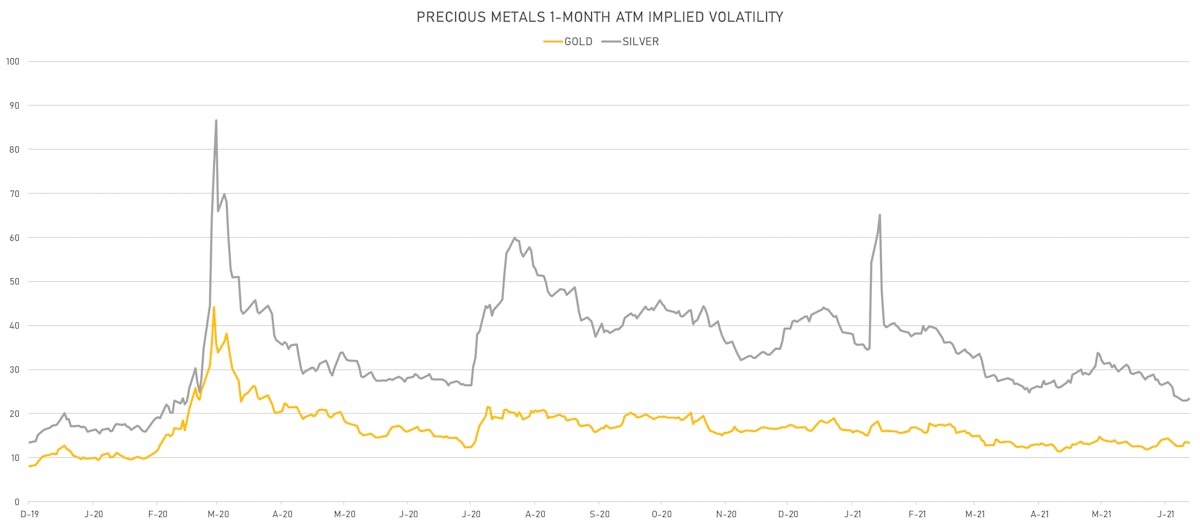

- Gold spot currently at US$ 1,777.38 per troy ounce, up 0.4% on the day (YTD: -6.4%)

- Gold 1-Month ATM implied volatility currently at 13.04, down -1.7% on the day (YTD: -17.3%)

- Silver spot currently at US$ 26.00 per troy ounce, down -0.4% on the day (YTD: -1.4%)

- Silver 1-Month ATM implied volatility currently at 22.51, up 2.1% on the day (YTD: -44.9%)

- Palladium spot currently at US$ 2,761.42 per troy ounce, down -0.6% on the day (YTD: +13.0%)

- Platinum spot currently at US$ 1,083.45 per troy ounce, up 0.8% on the day (YTD: +1.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,700 per troy ounce, down -2.0% on the day (YTD: +15.5%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,750 per troy ounce, unchanged (YTD: +121.2%)

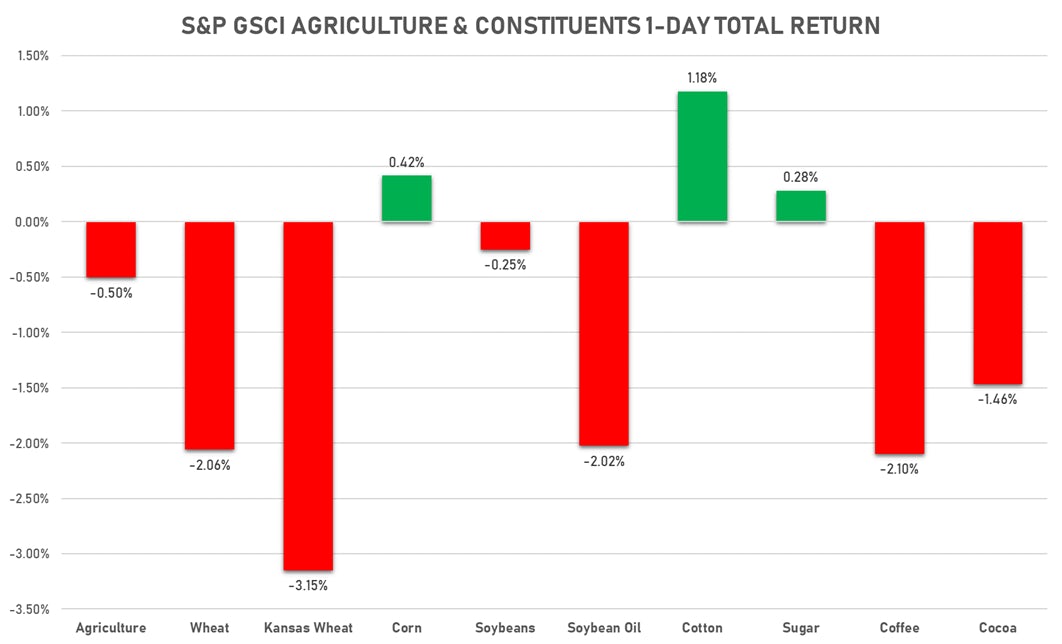

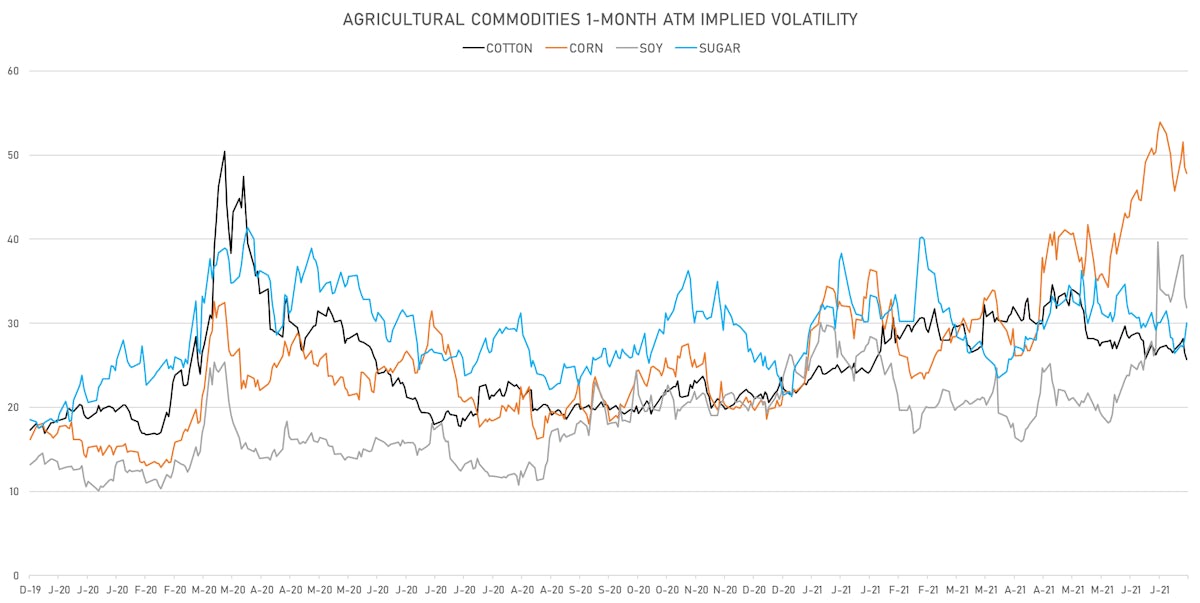

AGRO

- Live Cattle (CME) currently at US$ 123.58 cents per pound, up 0.9% on the day (YTD: +9.4%)

- Lean Hogs (CME) currently at US$ 107.30 cents per pound, down -0.2% on the day (YTD: +52.7%)

- Rough Rice (CBOT) currently at US$ 13.16 cents per hundredweight, down -0.2% on the day (YTD: +6.1%)

- Soybeans Composite (CBOT) currently at US$ 1,445.50 cents per bushel, down -0.2% on the day (YTD: +10.0%)

- Corn (CBOT) currently at US$ 723.00 cents per bushel, unchanged (YTD: +48.7%)

- Wheat Composite (CBOT) currently at US$ 662.00 cents per bushel, down -1.9% on the day (YTD: +2.8%)

- Sugar No.11 (ICE US) currently at US$ 17.94 cents per pound, up 1.8% on the day (YTD: +15.8%)

- Cotton No.2 (ICE US) currently at US$ 85.01 cents per pound, up 1.2% on the day (YTD: +8.8%)

- Cocoa (ICE US) currently at US$ 2,325 per tonne, down -1.5% on the day (YTD: -10.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,919 per tonne, unchanged (YTD: +23.8%)

- Random Length Lumber (CME) currently at US$ 735.30 per 1,000 board feet, up 2.7% on the day (YTD: -15.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,110 per tonne, down -1.6% on the day (YTD: +1.0%)

- Soybean Oil Composite (CBOT) currently at US$ 65.20 cents per pound, down -0.2% on the day (YTD: +50.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,842 per tonne, up 1.6% on the day (YTD: -1.3%)

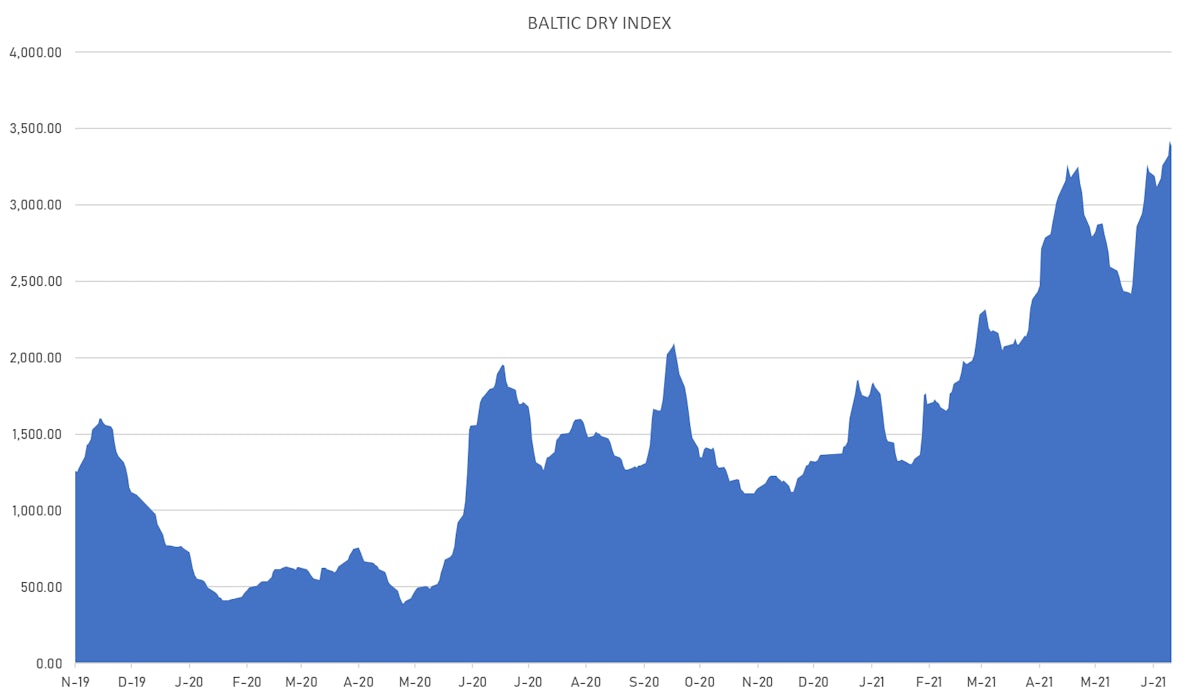

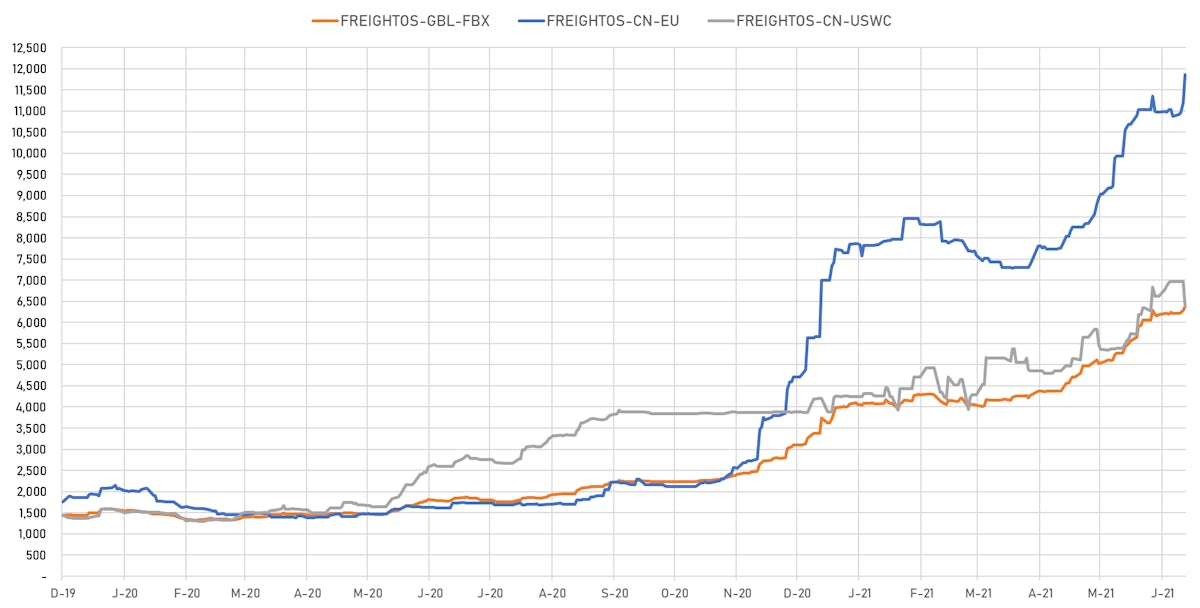

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,383, down -1.0% on the day (YTD: +147.7%)

- Freightos China To North America West Coast Container Index currently at 6,407, down -8.1% on the day (YTD: +52.6%)

- Freightos North America West Coast To China Container Index currently at 965, unchanged (YTD: +86.4%)

- Freightos North America East Coast To Europe Container Index currently at 595, up 0.6% on the day (YTD: +63.9%)

- Freightos Europe To North America East Coast Container Index currently at 5,868, up 3.5% on the day (YTD: +214.0%)

- Freightos China To North Europe Container Index currently at 11,858, up 5.9% on the day (YTD: +109.4%)

- Freightos North Europe To China Container Index currently at 1,584, down -2.5% on the day (YTD: +15.2%)

- Freightos Europe To South America West Coast Container Index currently at 4,769, up 0.9% on the day (YTD: +181.9%)

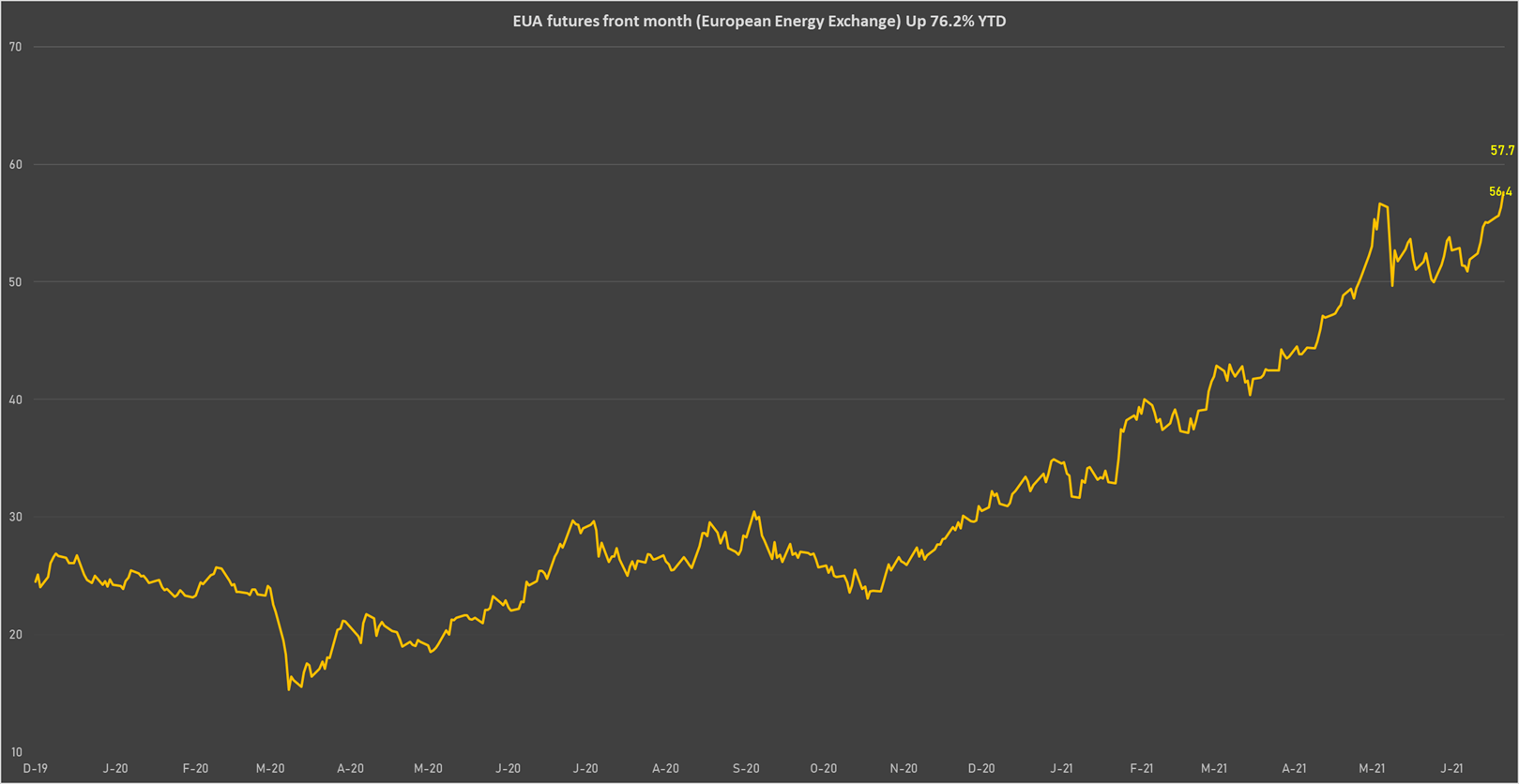

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 57.65 per tonne, up 2.3% on the day (YTD: +76.2%)