Commodities

Crude Settled Lower Today As The Possibility Of A Deeper OPEC+ Rift Cools Market

According to the Financial Times, the UAE is looking at the benefits of possibly leaving OPEC in order to produce as much as they want in a long period of economic diversification away from oil

Published ET

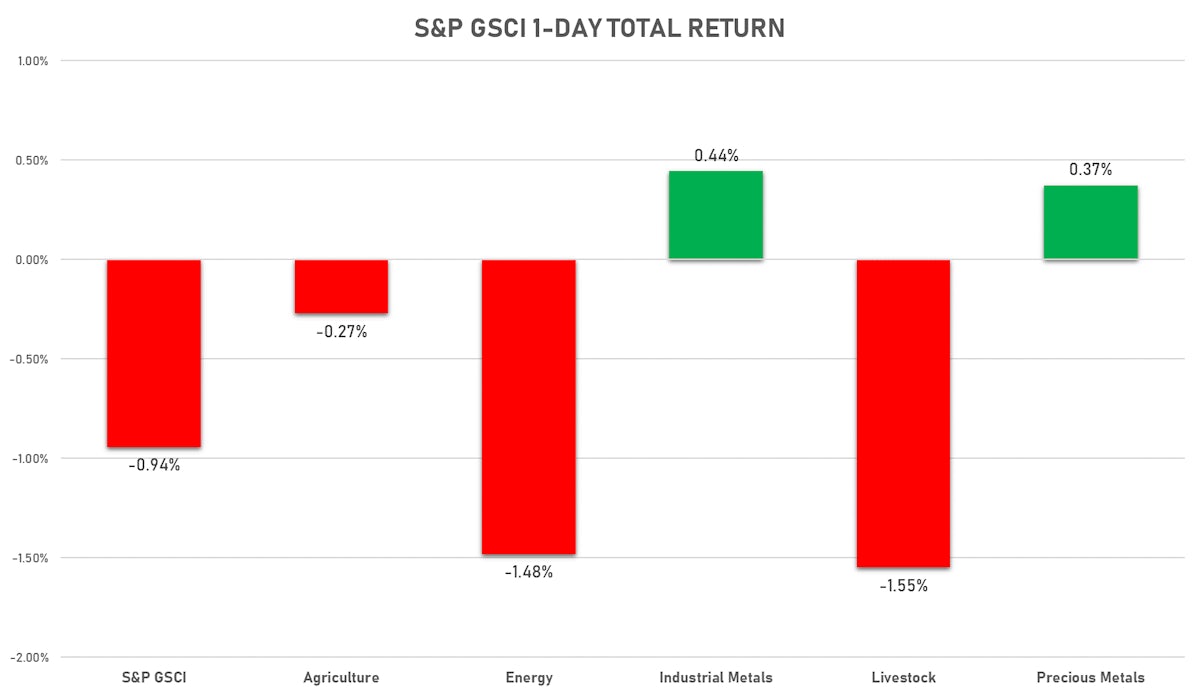

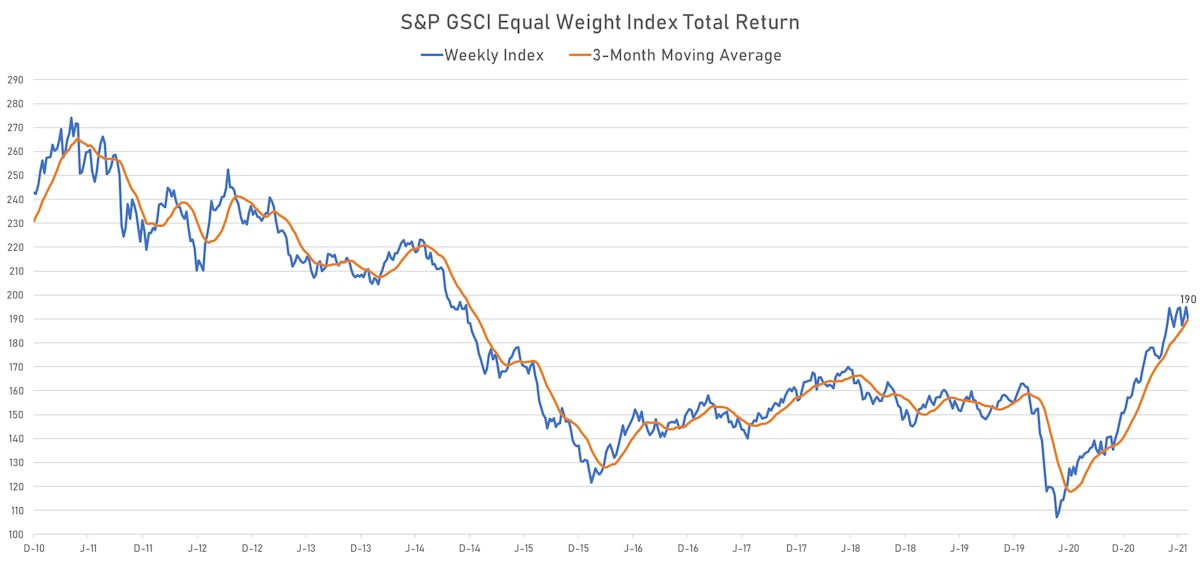

S&P GSCI Sub Indices Over The Last Month | Sources: ϕpost, FactSet data

NOTABLE GAINERS

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 7.1% (YTD: 27.8%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 3.8% (YTD: -6.2%)

- SMM Rare Earth Praseodymium Neodymium Alloy Spot Price Daily up 2.4% (YTD: 26.8%)

- SHFE Hot Rolled Coil up 2.3% (YTD: 26.1%)

- SMM Rare Earth Terbium Metal Spot Price Daily up 2.2% (YTD: -9.3%)

- Palladium spot up 2.1% (YTD: 16.5%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index up 2.0% (YTD: 55.6%)

- CBoT Soybeans up 1.7% (YTD: 5.4%)

- COMEX Copper up 1.7% (YTD: 23.2%)

- Freightos Baltic Europe To South America West Coast Container Index up 1.6% (YTD: 189.0%)

- CBoT Soybean Oil up 1.5% (YTD: 49.5%)

NOTABLE LOSERS

- Freightos Baltic Europe To South America East Coast 40 Container Index down -5.4% (YTD: 193.3%)

- Pork Primal Cutout Butt down -3.8% (YTD: 108.3%)

- SHFE Bitumen Continuation Month 1 down -3.7% (YTD: 40.3%)

- Johnson Matthey Rhodium New York 0930 down -3.2% (YTD: 7.3%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -2.7% (YTD: 47.9%)

- EEX European-Carbon- Secondary Trading down -2.6% (YTD: 63.8%)

- Intercontinental Exchange CO2 European Union Allowance (EUA) Yearly down -2.6% (YTD: 60.8%)

- Shanghai International Exchange Bonded Copper down -2.5% (YTD: 17.4%)

- Brent Forties and Oseberg Dated FOB Northsea Crude down -2.5% (YTD: 45.2%)

- ICE Europe Low Sulphur Gasoil down -2.2% (YTD: 39.2%)

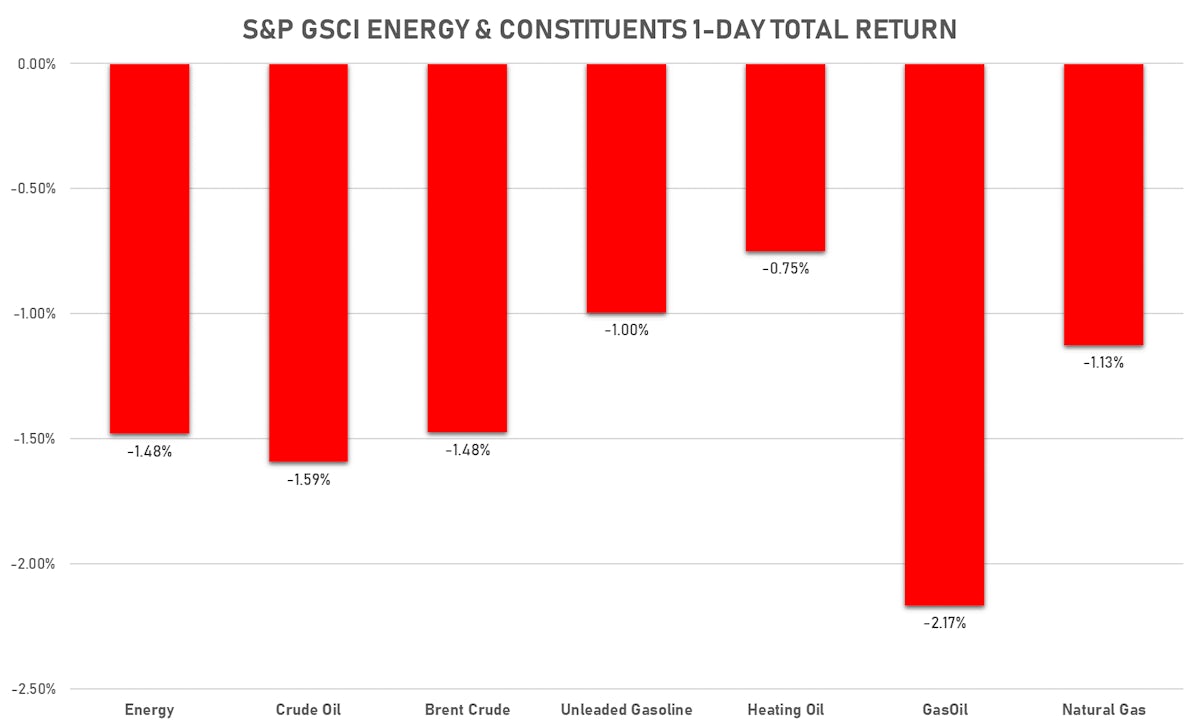

ENERGY

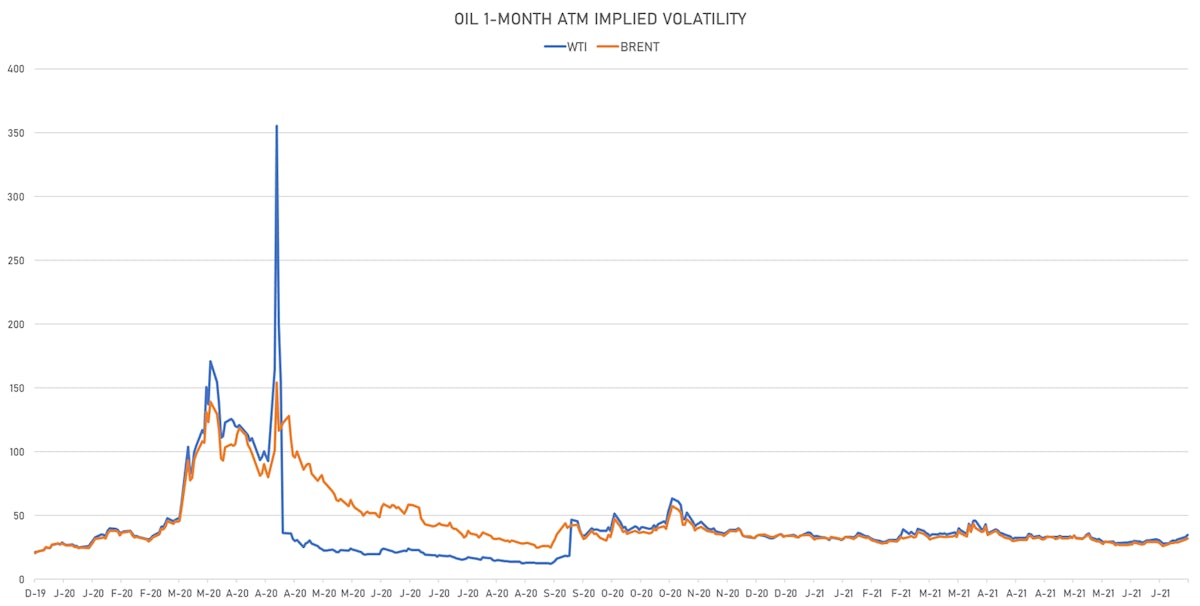

- WTI crude front month currently at US$ 71.92 per barrel, down -1.6% on the day (YTD: +48.8%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 73.24 per barrel, down -1.5% on the day (YTD: +41.8%); 6-month term structure in tightening backwardation

- Brent volatility at 32.1, up 3.4% on the day (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 139.55 per tonne, down -0.9% on the day (YTD: +73.4%)

- Natural Gas (Henry Hub) currently at US$ 3.58 per MMBtu, down -1.1% on the day (YTD: +41.6%)

- Gasoline (NYMEX) currently at US$ 2.21 per gallon, down -1.0% on the day (YTD: +56.6%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 590.00 per tonne, down -2.2% on the day (YTD: +39.2%)

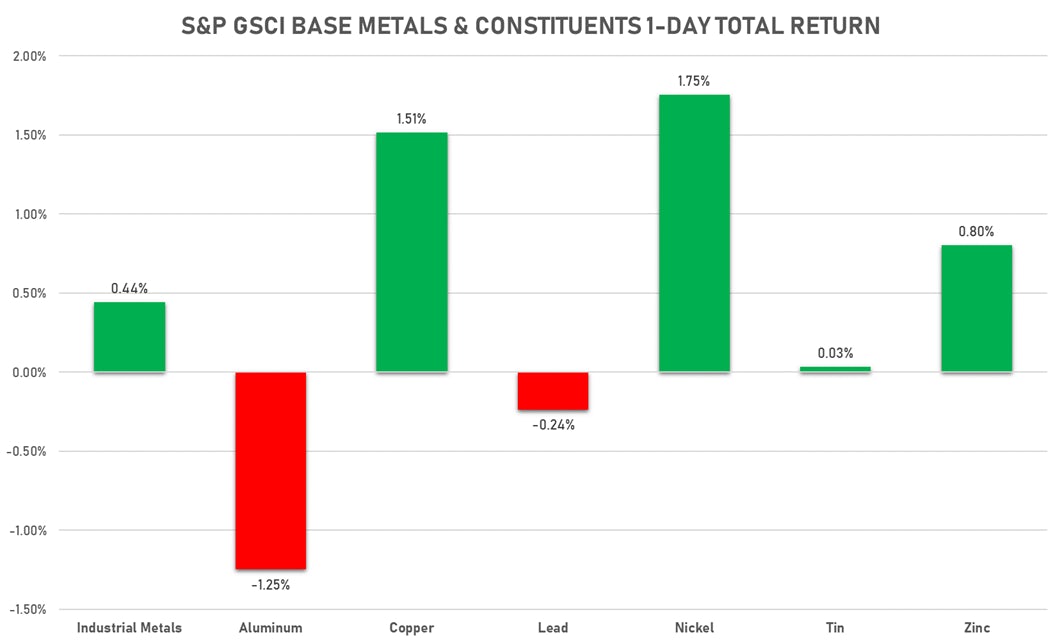

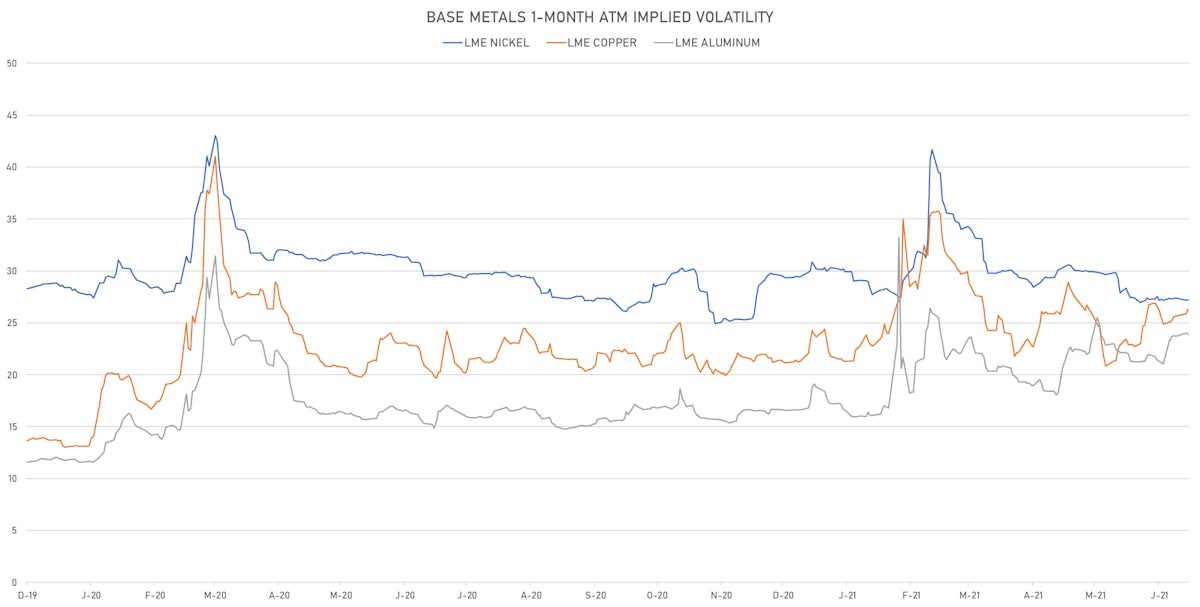

BASE METALS

- Copper (COMEX) currently at US$ 4.32 per pound, up 1.7% on the day (YTD: +23.2%)

- Iron Ore (Dalian Commodity Exchange) unchanged at CNY 1,346.00 per tonne YTD: +24.7%)

- Aluminium (Shanghai) currently at CNY 18,845 per tonne, down -1.4% on the day (YTD: +20.4%)

- Nickel (Shanghai) currently at CNY 136,530 per tonne, down -1.6% on the day (YTD: +9.3%)

- Lead (Shanghai) currently at CNY 15,800 per tonne, up 0.3% on the day (YTD: +7.3%)

- Rebar (Shanghai) currently at CNY 4,924 per tonne, down -1.6% on the day (YTD: +16.7%)

- Tin (Shanghai) currently at CNY 217,800 per tonne, down -0.6% on the day (YTD: +44.9%)

- Zinc (Shanghai) currently at CNY 22,260 per tonne, down -0.2% on the day (YTD: +6.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 366,500 per tonne, up 0.5% on the day (YTD: +33.8%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

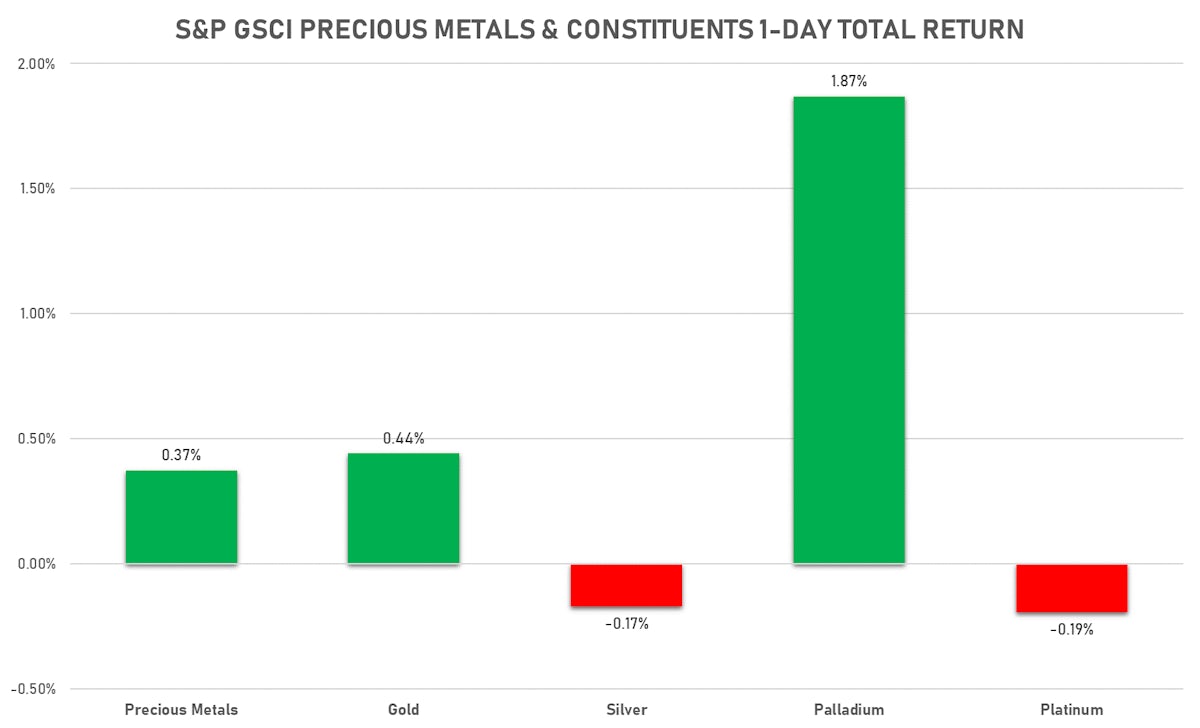

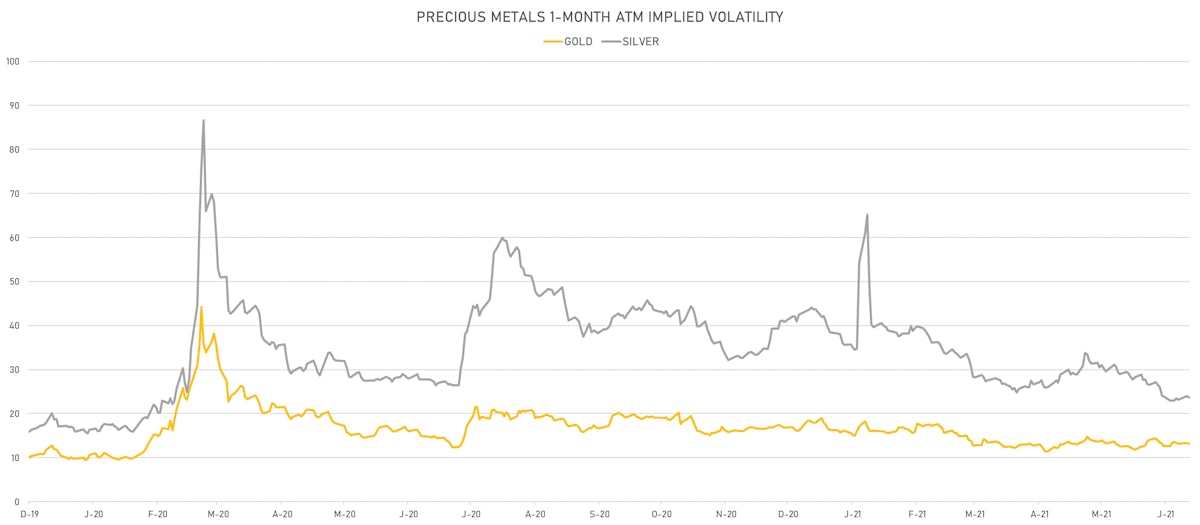

PRECIOUS METALS

- Gold spot currently at US$ 1,804.16 per troy ounce, up 0.4% on the day (YTD: -5.0%)

- Gold 1-Month ATM implied volatility currently at 13.02, down -0.5% on the day (YTD: -17.6%)

- Silver spot currently at US$ 26.09 per troy ounce, down -0.1% on the day (YTD: -0.9%)

- Silver 1-Month ATM implied volatility currently at 22.77, down -1.0% on the day (YTD: -44.0%)

- Palladium spot currently at US$ 2,852.97 per troy ounce, up 2.1% on the day (YTD: +16.5%)

- Platinum spot currently at US$ 1,084.89 per troy ounce, down -0.5% on the day (YTD: +1.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,300 per troy ounce, down -3.2% on the day (YTD: +7.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,650 per troy ounce, unchanged (YTD: +117.3%)

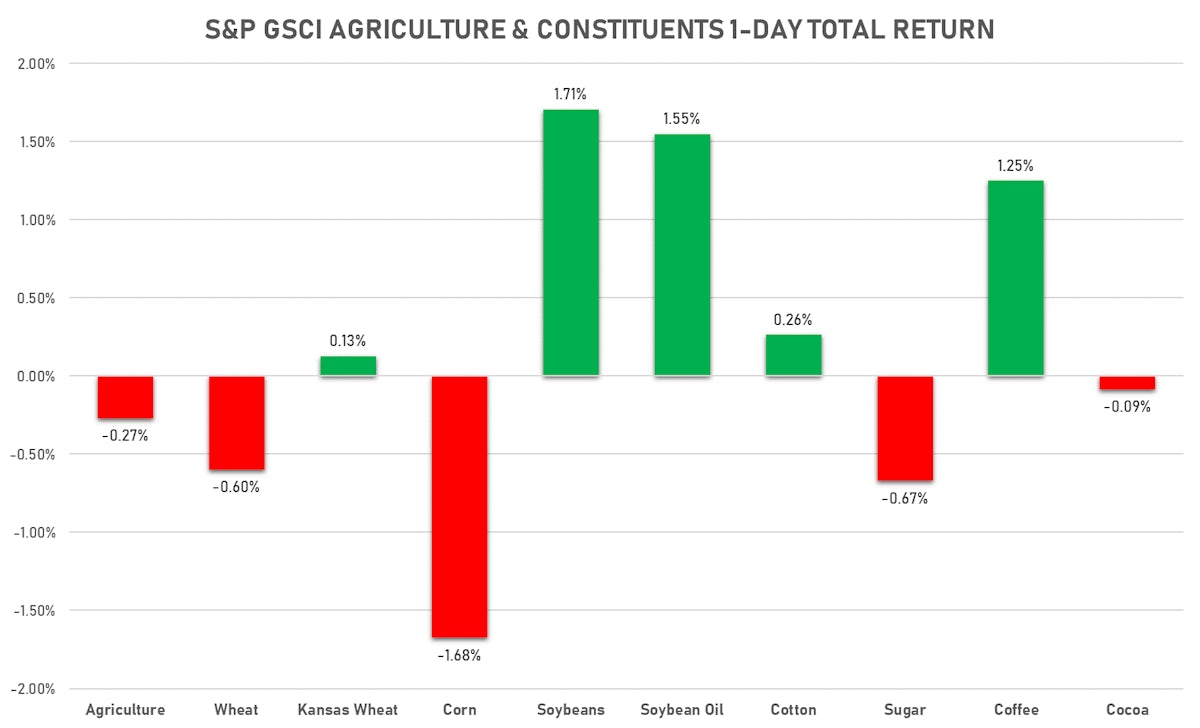

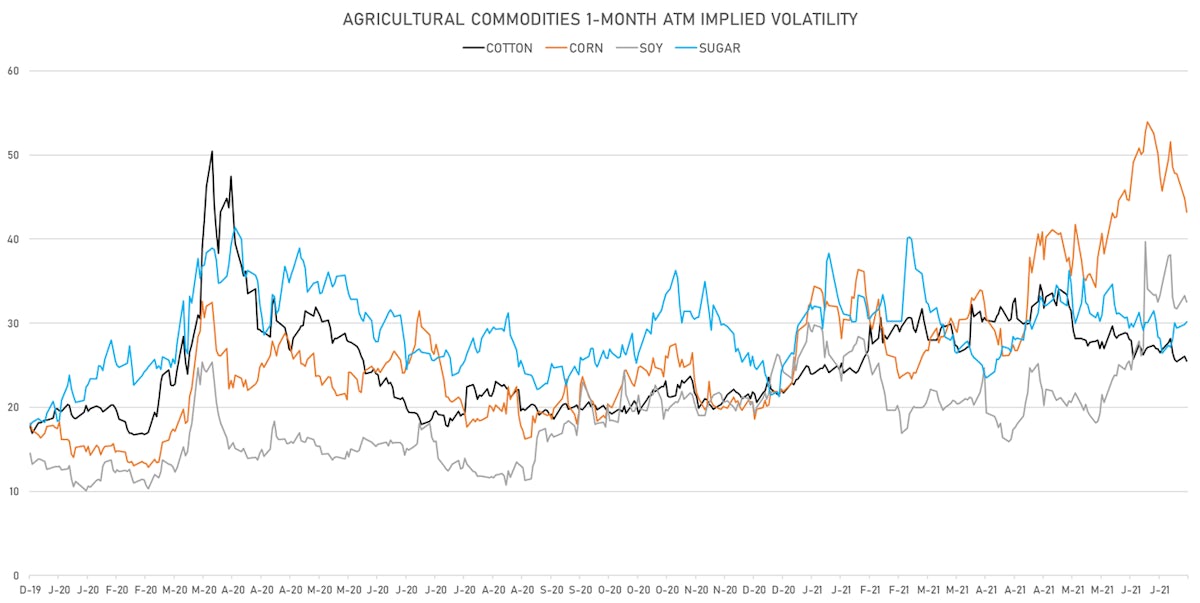

AGRO

- Live Cattle (CME) currently at US$ 120.60 cents per pound, down 1.5% on the day (YTD: +6.8%)

- Lean Hogs (CME) currently at US$ 109.15 cents per pound, down -0.7% on the day (YTD: +55.3%)

- Rough Rice (CBOT) currently at US$ 12.61 cents per hundredweight, up 0.7% on the day (YTD: +1.7%)

- Soybeans Composite (CBOT) currently at US$ 1,386.50 cents per bushel, up 1.7% on the day (YTD: +5.4%)

- Corn (CBOT) currently at US$ 657.50 cents per bushel, down -0.5% on the day (YTD: +34.8%)

- Wheat Composite (CBOT) currently at US$ 614.75 cents per bushel, down -0.8% on the day (YTD: -4.0%)

- Sugar No.11 (ICE US) currently at US$ 17.75 cents per pound, down -0.7% on the day (YTD: +14.6%)

- Cotton No.2 (ICE US) currently at US$ 86.63 cents per pound, up 0.3% on the day (YTD: +10.9%)

- Cocoa (ICE US) currently at US$ 2,267 per tonne, down -0.1% on the day (YTD: -12.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,718 per tonne, down -2.2% on the day (YTD: +17.5%)

- Random Length Lumber (CME) currently at US$ 780.00 per 1,000 board feet, down -1.6% on the day (YTD: -10.7%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,455 per tonne, down -0.4% on the day (YTD: +4.6%)

- Soybean Oil Composite (CBOT) currently at US$ 64.46 cents per pound, up 1.5% on the day (YTD: +49.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 3,936 per tonne, down -0.3% on the day (YTD: +1.2%)

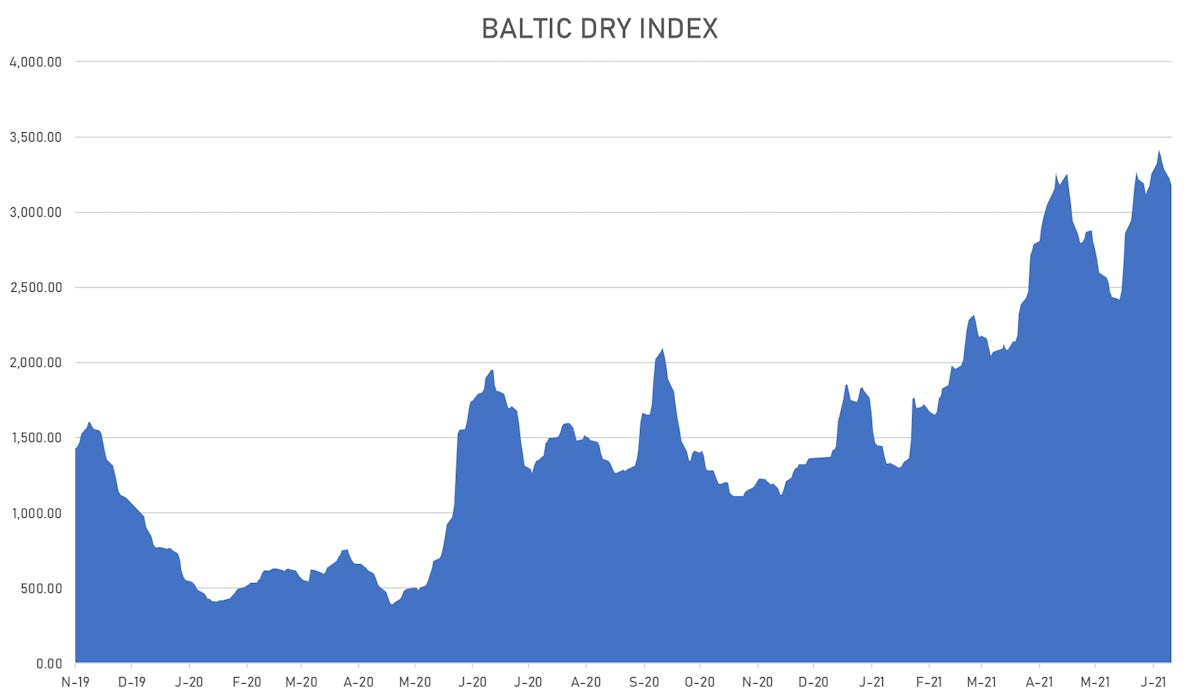

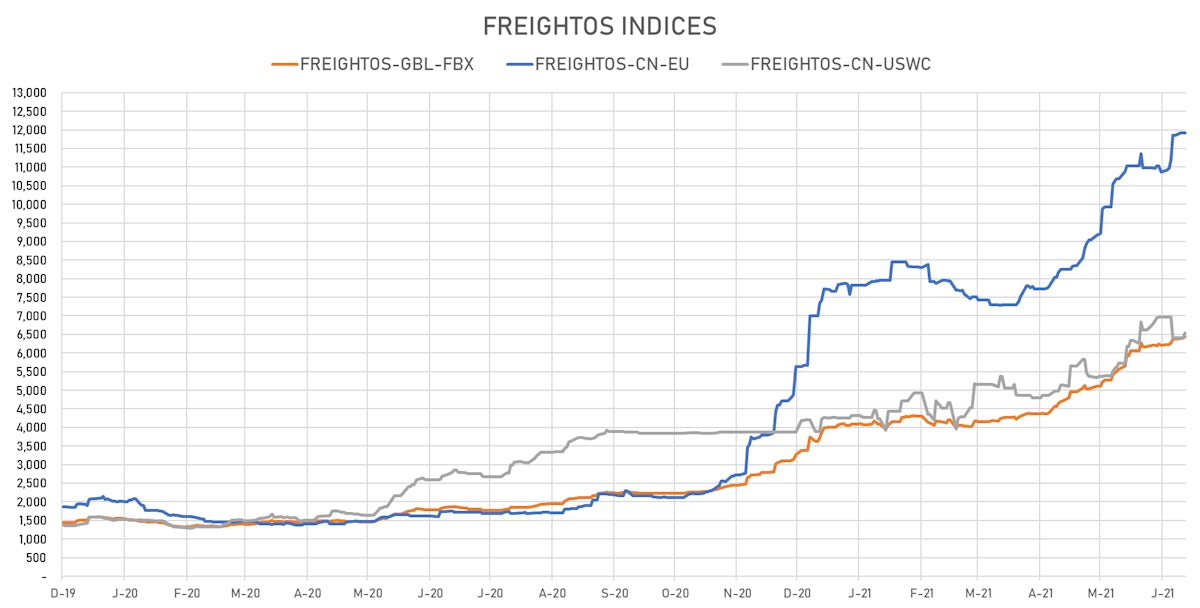

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,179, down -1.4% on the day (YTD: +132.7%)

- Freightos China To North America West Coast Container Index currently at 6,533, up 2.0% on the day (YTD: +55.6%)

- Freightos North America West Coast To China Container Index currently at 965, unchanged (YTD: +86.4%)

- Freightos North America East Coast To Europe Container Index currently at 604, unchanged (YTD: +66.4%)

- Freightos Europe To North America East Coast Container Index currently at 5,989, unchanged (YTD: +220.4%)

- Freightos China To North Europe Container Index currently at 11,913, unchanged (YTD: +110.4%)

- Freightos North Europe To China Container Index currently at 1,596, unchanged (YTD: +16.1%)

- Freightos Europe To South America West Coast Container Index currently at 4,889, up 1.6% on the day (YTD: +189.0%)

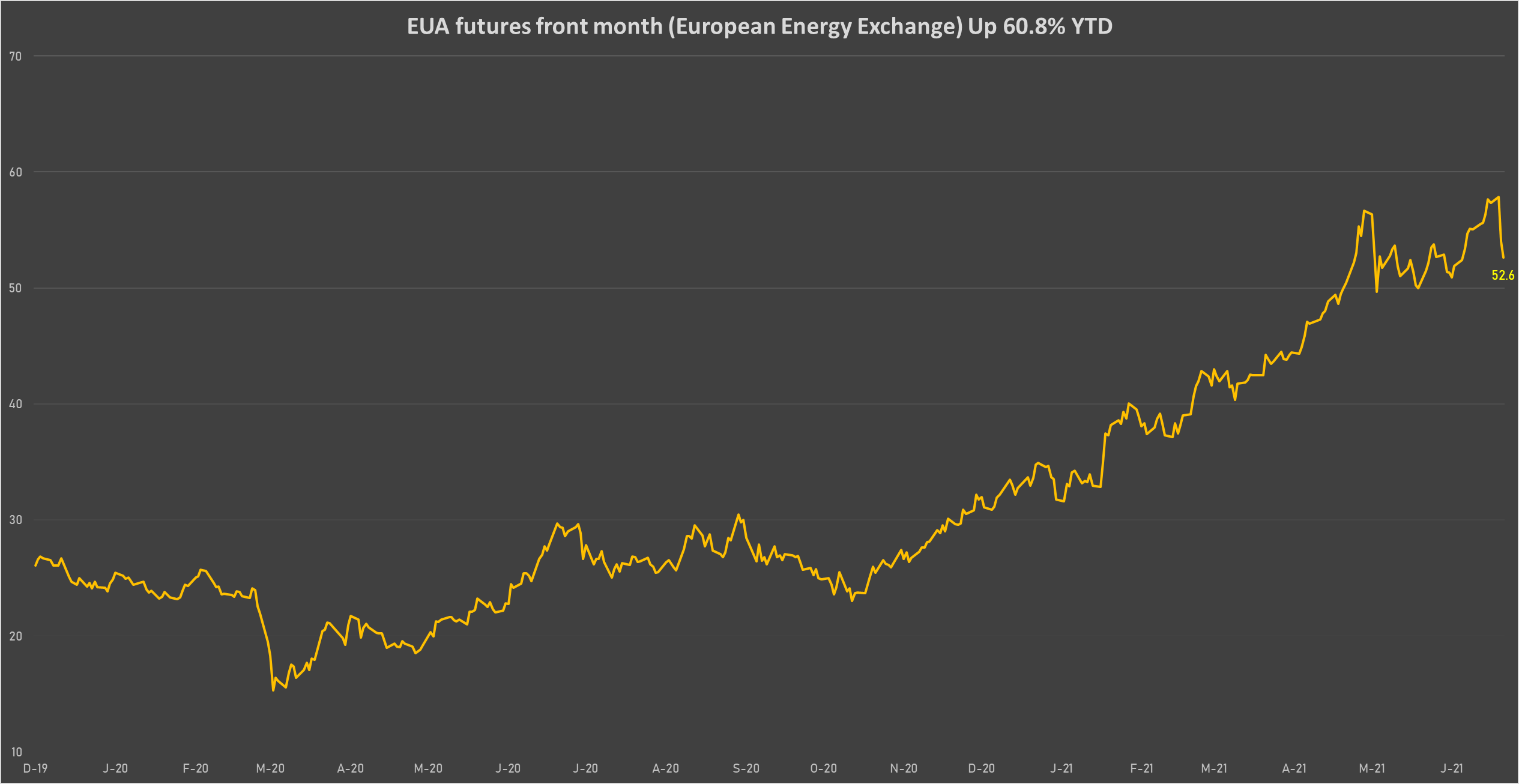

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.62 per tonne, down -2.6% on the day (YTD: +60.8%)