Commodities

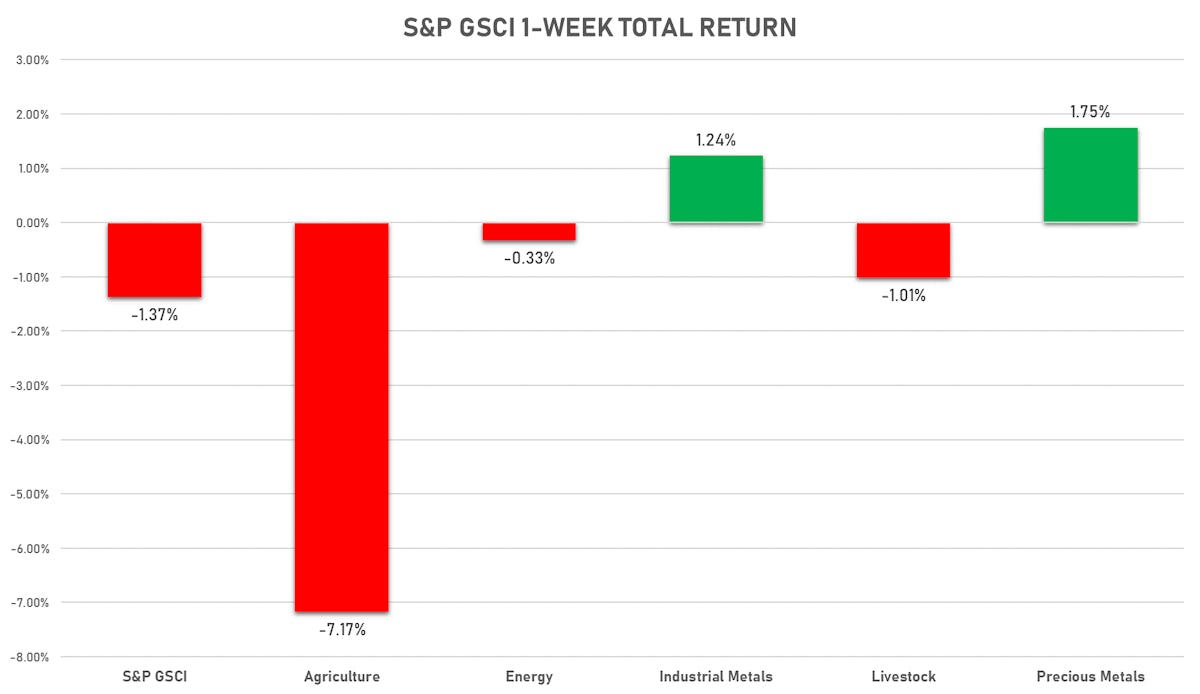

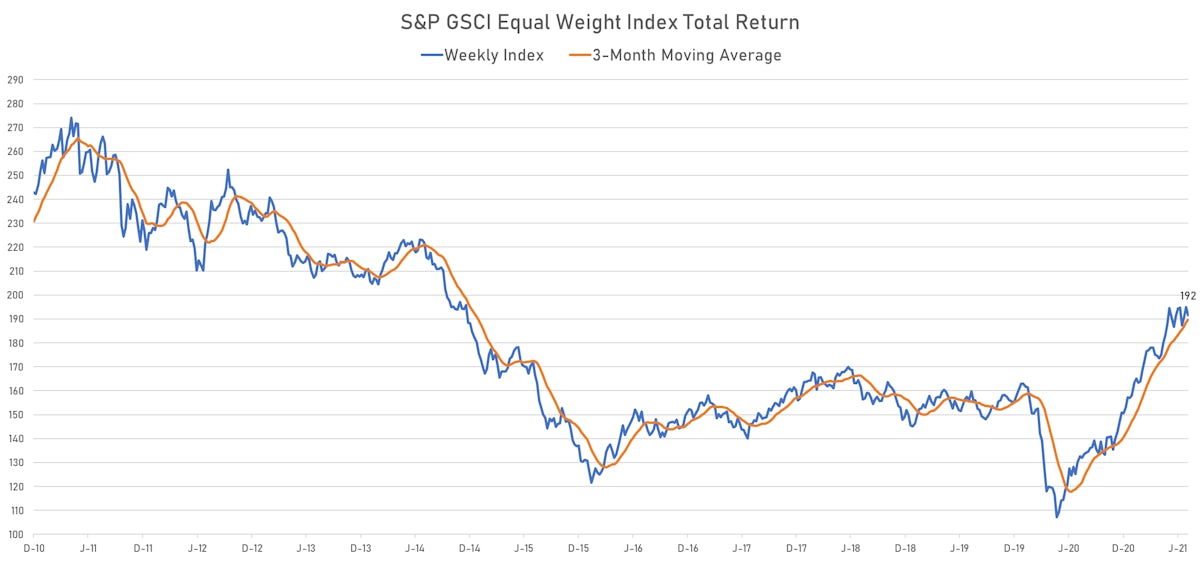

Broad Based Rebound In Commodities On Lower Dollar, Tweak In Chinese Reserve Ratio Requirements

In the absence of news regarding OPEC+ production or Iran, the path of least resistance is up for crude oil spot prices as supplies increases are off in the short term

Published ET

Brent Crude 1-Year Calendar Spread Showing Deepening Backwardation This Week | Source: Refinitiv

NOTABLE GAINERS TODAY

- SMM Rare Earth Yttrium Oxide Spot Price Daily up 10.3% (YTD: 56.1%)

- SMM Rare Earth Neodymium Metal Spot Price Daily up 7.7% (YTD: 5.2%)

- DCE Coking Coal Continuation Month 1 up 6.8% (YTD: 44.6%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily up 4.0% (YTD: 2.9%)

- EEX CO2 European-Carbon- Secondary Trading up 3.7% (YTD: 69.0%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 3.2% (YTD: 53.9%)

- SMM Erbium Oxide Spot Price Daily up 3.1% (YTD: 18.3%)

- ICE Europe Low Sulphur Gasoil up 3.0% (YTD: 45.0%)

- Bursa Malaysia Crude Palm Oil up 2.6% (YTD: 3.3%)

- Platinum spot up 2.5% (YTD: 3.3%)

NOTABLE LOSERS TODAY

- Pork Primal Cutout Butt down -4.6% (YTD: 91.9%)

- CBoT Soybean Oil down -2.9% (YTD: 44.0%)

- CME Random Length Lumber down -2.2% (YTD: -19.5%)

- Gold/US Dollar 1 Month ATM Option IV down -1.7% (YTD: -17.5%)

- CME Class III Milk down -1.4% (YTD: 6.6%)

- CBoT Corn down -1.3% (YTD: 30.1%)

- SHFE Rebar down -1.0% (YTD: 16.1%)

- ICE-US Sugar No. 11 down -1.0% (YTD: 11.6%)

- CME Cash Settled Cheese down -1.0% (YTD: -0.3%)

- CBoT Soybean Meal down -0.8% (YTD: -18.9%)

- SHFE Lead Continuation Month 1 down -0.7% (YTD: 6.5%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline Rbob reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice increased net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum reduced net long position

- Palladium increased net long position

- Copper-Grade#1 increased net long position

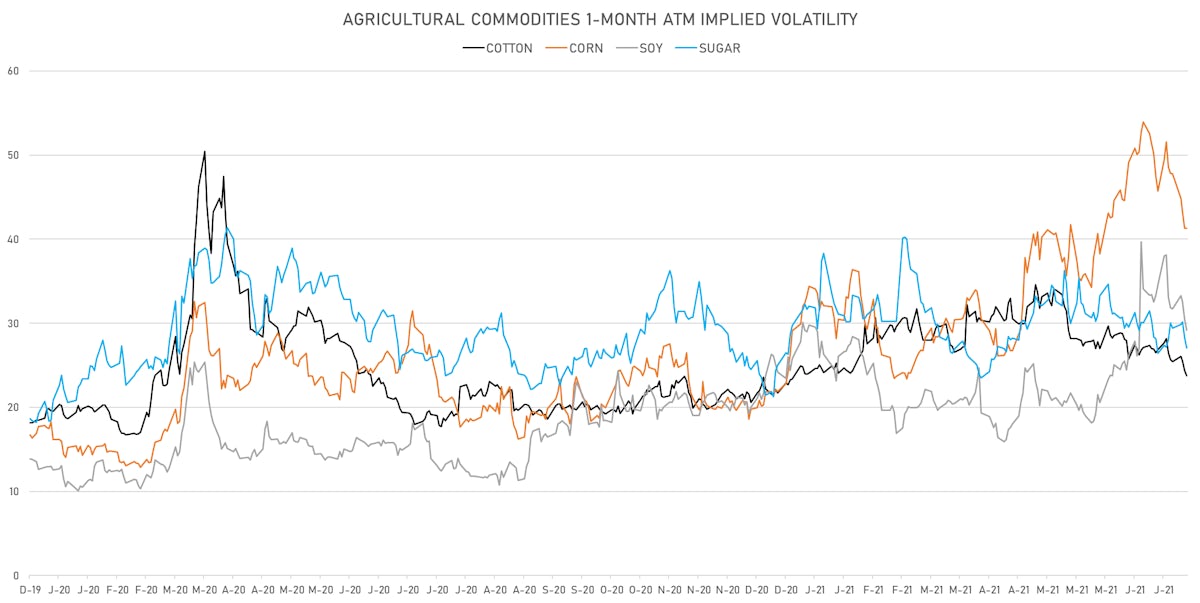

AGRICULTURE

- Wheat turned to net short

- Corn reduced net long position

- Rough Rice reduced net short position

- Oats increased net short position

- Soybeans increased net long position

- Soybean Oil reduced net long position

- Soybean Meal increased net long position

- Lean Hogs reduced net long position

- Live Cattle reduced net long position

- Feeder Cattle increased net long position

- Cocoa increased net short position

- Coffee reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position

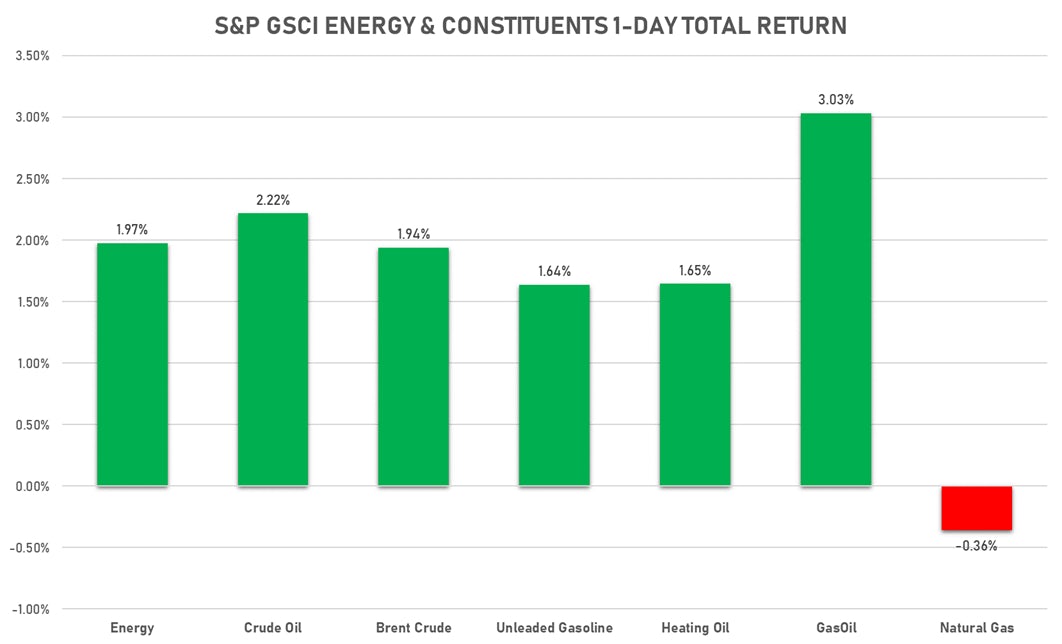

ENERGY TODAY

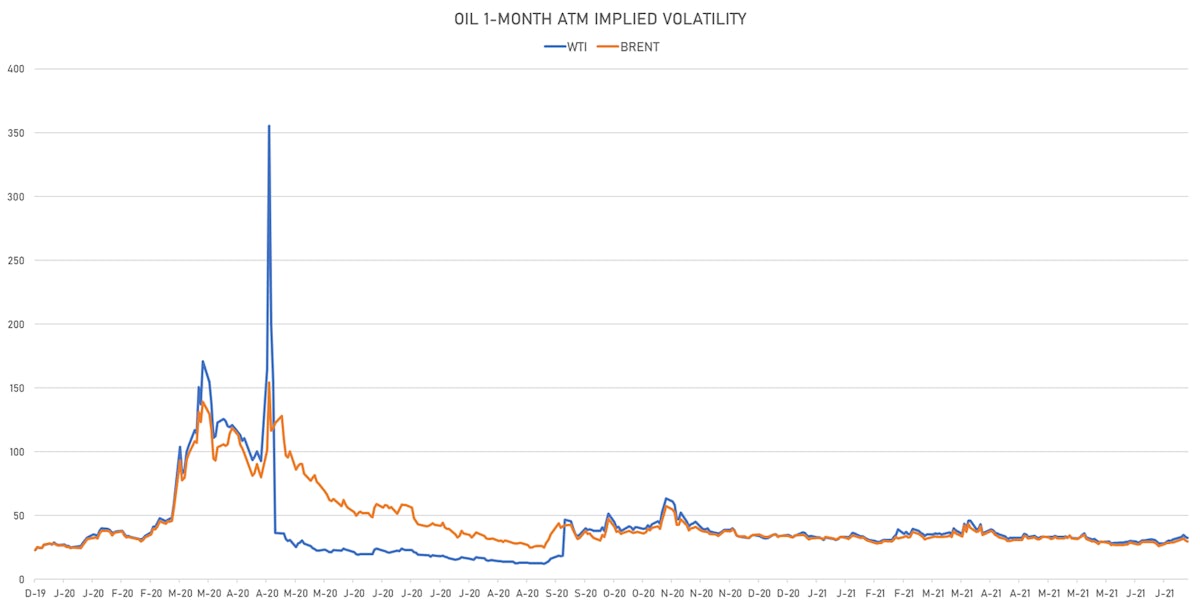

- WTI crude front month currently at US$ 74.56 per barrel, up 2.2% (YTD: +53.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.55 per barrel, up 1.9% (YTD: +45.8%); 6-month term structure in widening backwardation

- Brent volatility at 29.8, down -2.0% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 143.00 per tonne, up 0.5% (YTD: +77.6%)

- Natural Gas (Henry Hub) currently at US$ 3.67 per MMBtu, down -0.4% (YTD: +44.7%)

- Gasoline (NYMEX) currently at US$ 2.29 per gallon, up 1.6% (YTD: +62.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 610.00 per tonne, up 3.0% (YTD: +45.0%)

BASE METALS TODAY

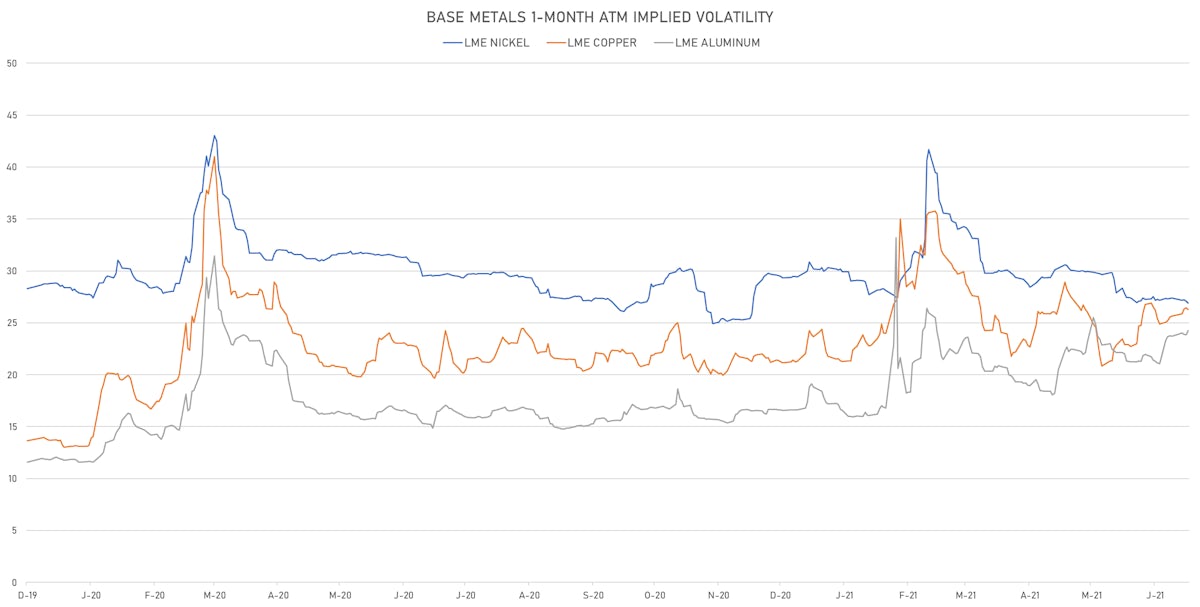

- Copper (COMEX) currently at US$ 4.35 per pound, up 1.9% (YTD: +23.9%)

- Iron Ore (Dalian Commodity Exchange) currently unchanged at CNY 1,346.00 per tonne (YTD: +24.7%)

- Aluminium (Shanghai) currently at CNY 19,080 per tonne, up 0.3% (YTD: +20.3%)

- Nickel (Shanghai) currently at CNY 140,040 per tonne, up 1.8% (YTD: +12.4%)

- Lead (Shanghai) currently at CNY 15,850 per tonne, down -0.7% (YTD: +6.5%)

- Rebar (Shanghai) currently at CNY 4,899 per tonne, down -1.0% (YTD: +16.1%)

- Tin (Shanghai) currently at CNY 221,550 per tonne, up 0.9% (YTD: +45.8%)

- Zinc (Shanghai) currently at CNY 22,475 per tonne, up 0.5% (YTD: +7.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 370,500 per tonne, up 0.8% (YTD: +35.2%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

PRECIOUS METALS TODAY

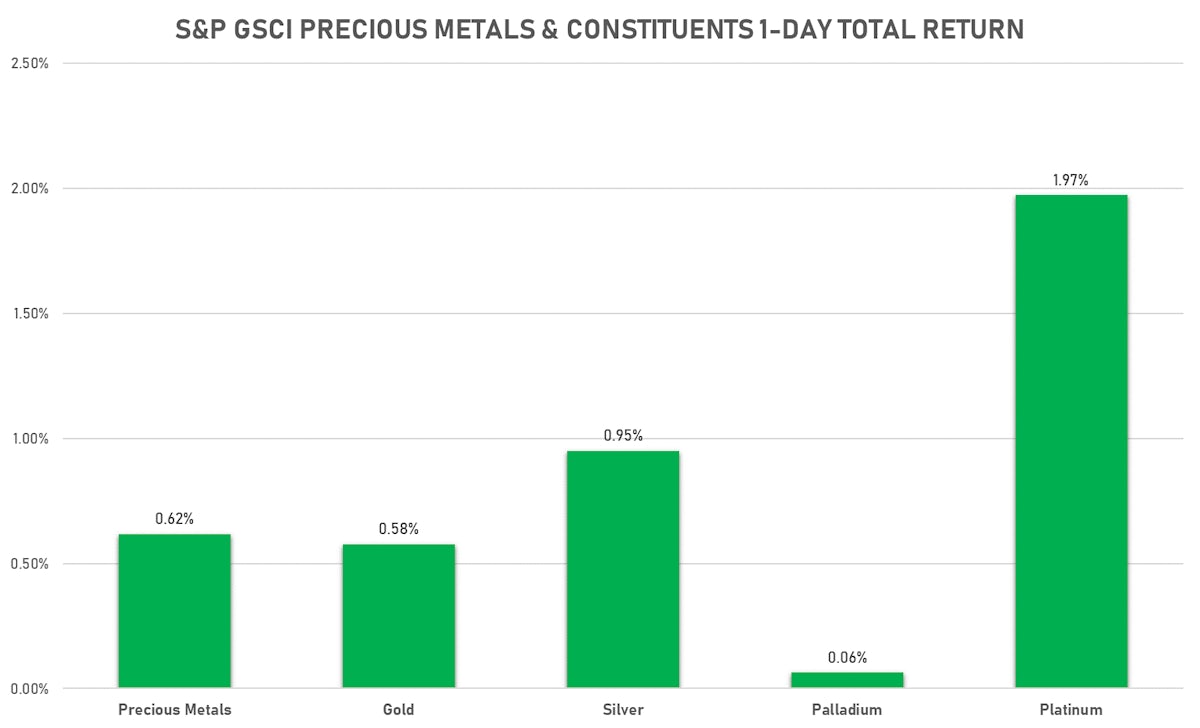

- Gold spot currently at US$ 1,807.95 per troy ounce, up 0.3% (YTD: -4.7%)

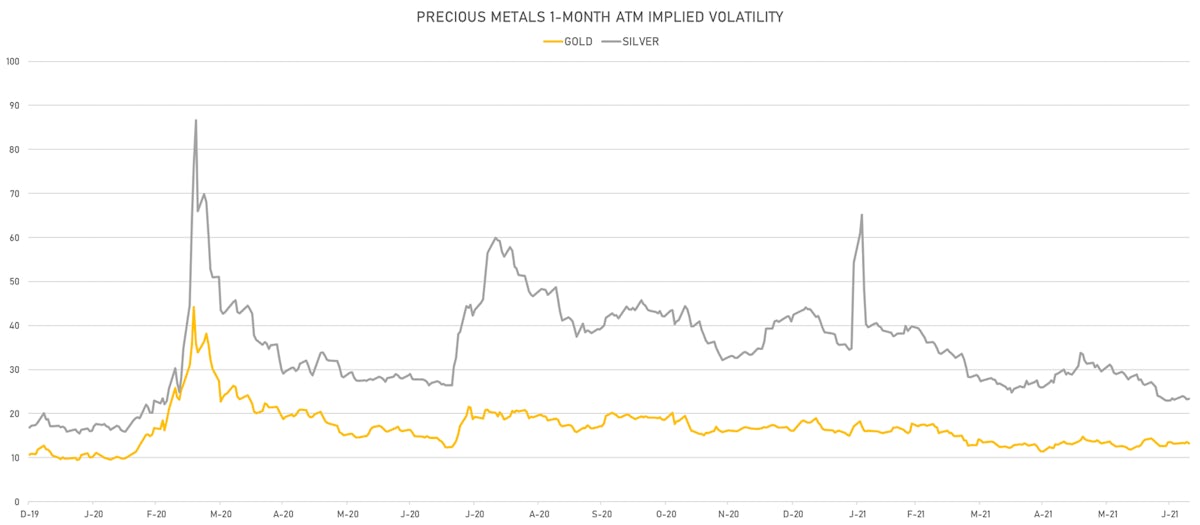

- Gold 1-Month ATM implied volatility currently at 12.85, down -1.7% (YTD: -17.5%)

- Silver spot currently at US$ 26.08 per troy ounce, up 0.6% (YTD: -1.1%)

- Silver 1-Month ATM implied volatility currently at 22.48, up 0.5% (YTD: -44.9%)

- Palladium spot currently at US$ 2,809.34 per troy ounce, up 0.2% (YTD: +14.9%)

- Platinum spot currently at US$ 1,103.92 per troy ounce, up 2.5% (YTD: +3.3%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,500 per troy ounce, down -0.6% (YTD: +2.6%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,650 per troy ounce, unchanged (YTD: +117.3%)

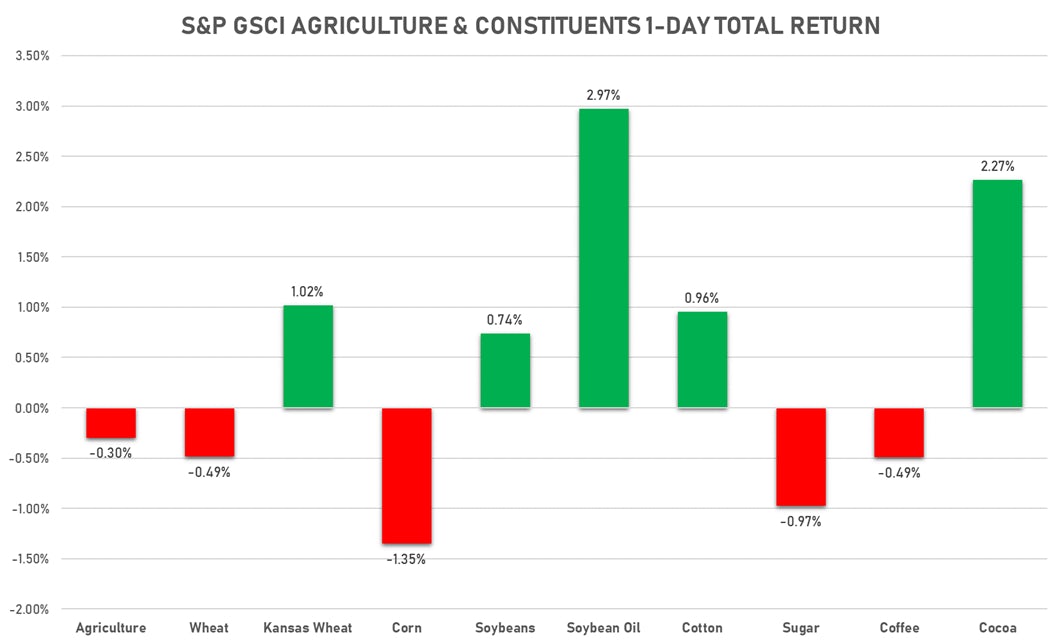

AGS TODAY

- Live Cattle (CME) currently unchanged at US$ 119.23 cents per pound (YTD: +5.6%)

- Lean Hogs (CME) currently at US$ 111.00 cents per pound, up 0.8% (YTD: +58.0%)

- Rough Rice (CBOT) currently at US$ 12.60 cents per hundredweight, up 0.9% (YTD: +1.6%)

- Soybeans Composite (CBOT) currently at US$ 1,404.00 cents per bushel, up 1.0% (YTD: +6.7%)

- Corn (CBOT) currently at US$ 629.75 cents per bushel, down -1.3% (YTD: +30.1%)

- Wheat Composite (CBOT) currently at US$ 608.50 cents per bushel, down -0.6% (YTD: -5.0%)

- Sugar No.11 (ICE US) currently at US$ 17.24 cents per pound, down -1.0% (YTD: +11.6%)

- Cotton No.2 (ICE US) currently at US$ 87.80 cents per pound, up 2.5% (YTD: +12.6%)

- Cocoa (ICE US) currently at US$ 2,266 per tonne, up 2.3% (YTD: -10.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,775 per tonne, up 0.9% (YTD: +19.3%)

- Random Length Lumber (CME) currently at US$ 702.50 per 1,000 board feet, down -2.2% (YTD: -19.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,480 per tonne, down -0.3% (YTD: +3.4%)

- Soybean Oil Composite (CBOT) currently at US$ 62.41 cents per pound, down -2.9% (YTD: +44.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,020 per tonne, up 2.6% (YTD: +3.3%)

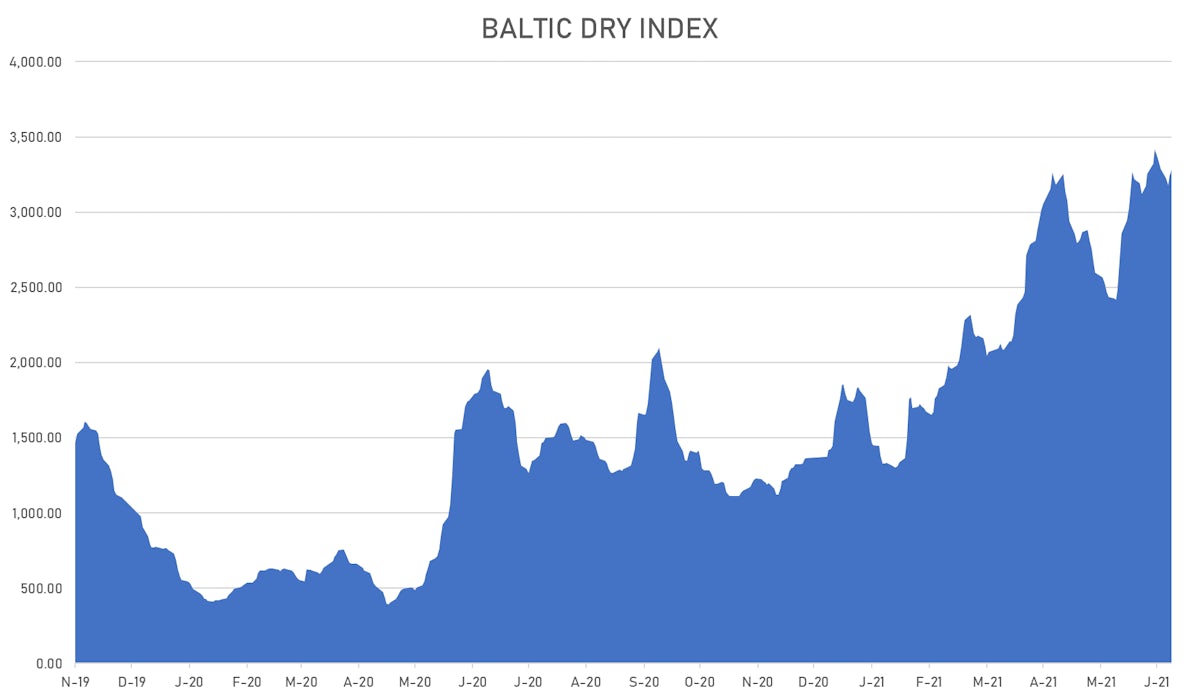

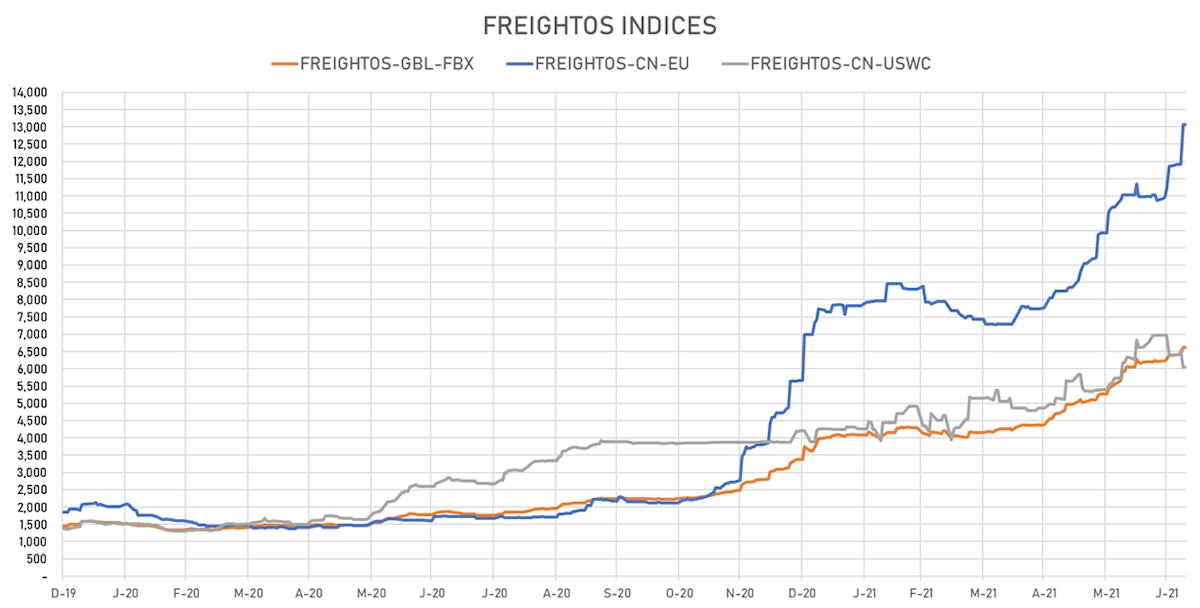

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,281, up 1.2% (YTD: +140.2%)

- Freightos China To North America West Coast Container Index currently at 6,046, unchanged (YTD: +44.0%)

- Freightos North America West Coast To China Container Index currently at 1,023, up 1.0% (YTD: +97.6%)

- Freightos North America East Coast To Europe Container Index currently at 652, unchanged (YTD: +79.7%)

- Freightos Europe To North America East Coast Container Index currently at 5,838, unchanged (YTD: +212.4%)

- Freightos China To North Europe Container Index currently at 13,073, unchanged (YTD: +130.9%)

- Freightos North Europe To China Container Index currently at 1,590, unchanged (YTD: +15.6%)

- Freightos Europe To South America West Coast Container Index currently at 4,248, unchanged (YTD: +151.1%)

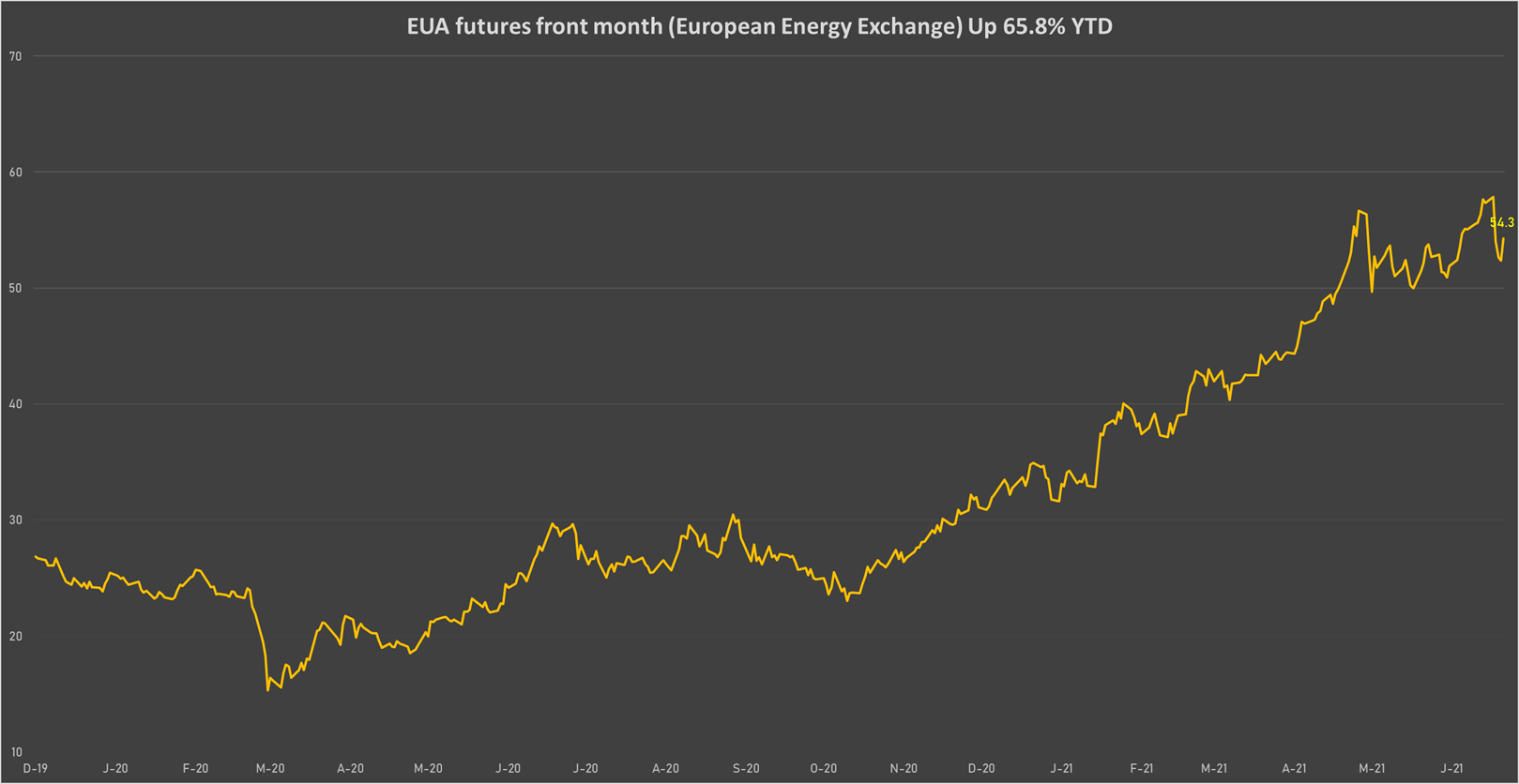

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 54.26 per tonne, up 3.6% (YTD: +65.8%)