Commodities

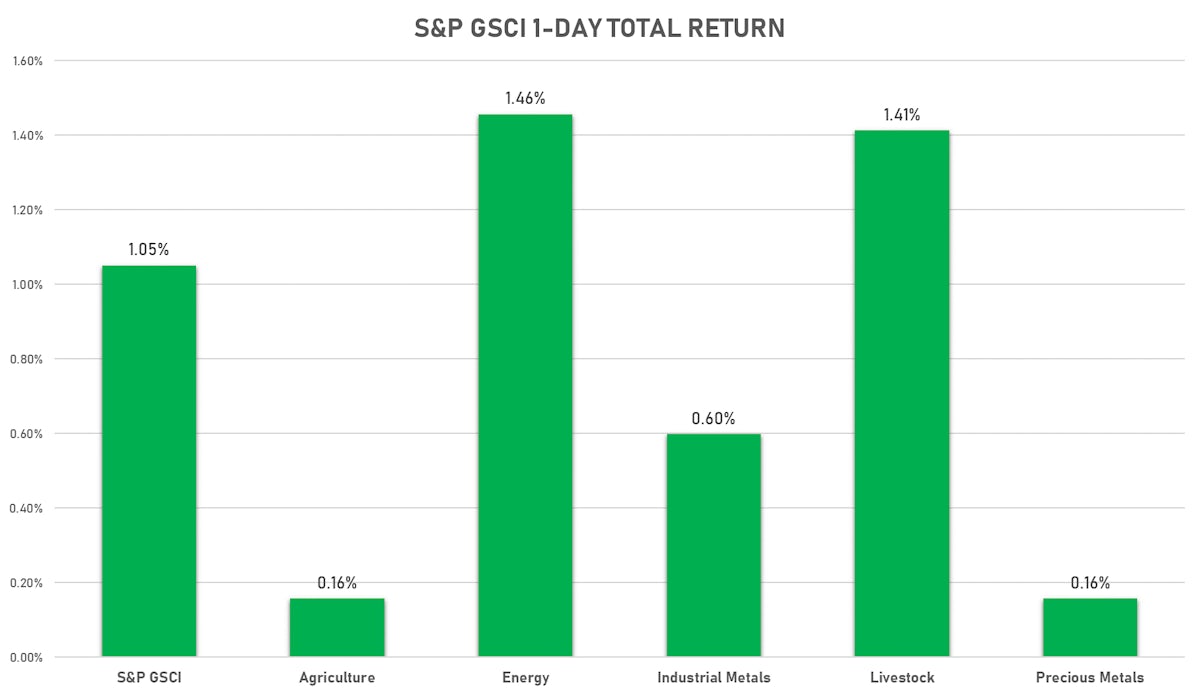

Broad Rise For Commodities Today, Led By Energy And Livestock

Iran nuclear talks have been delayed until August, which is short-term bullish for spot crude prices, as no negative surprise to expect on that side for at least a month

Published ET

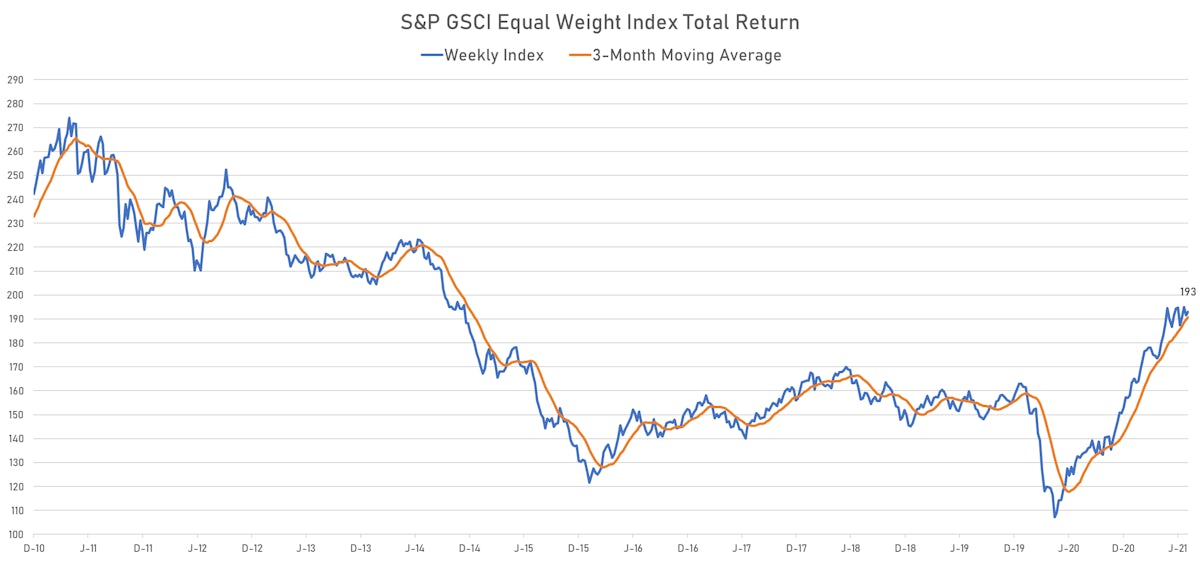

GSCI Main And Sub-Indices Over The Last 10 Years | Sources: ϕpost, FactSet data

HEADLINES & MACRO

API WEEKLY INVENTORIES DATA

- Crude draw of 4.08M barrels

- Gasoline draw of 1.55M barrels

- Distillates build of 3.70M barrels

- Cushing draw of 1.59M barrels

CONSENSUS ESTIMATES FOR DOE DATA TOMORROW

- Crude draw of 4.15M

- Gasoline draw of 1.90M

- Distillates build of 1.3M

NOTABLE GAINERS TODAY

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 15.7% (YTD: 88.7%)

- Freightos Baltic North America East Coast To Europe 40 Container Index up 6.8% (YTD: 91.9%)

- Johnson Matthey Rhodium New York 0930 up 5.9% (YTD: 15.0%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 5.6% (YTD: 108.7%)

- SMM Rare Earth Yttrium Oxide Spot Price Daily up 4.7% (YTD: 63.4%)

- Zhengzhou Exchange Thermal Coal up 3.7% (YTD: 17.5%)

- CBoT Soybean Oil up 2.5% (YTD: 53.8%)

- EEX European-Carbon- Secondary Trading up 2.2% (YTD: 64.6%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly up 2.2% (YTD: 61.5%)

- NYMEX RBOB Gasoline up 1.8% (YTD: 64.6%)

NOTABLE LOSERS TODAY

- CME Random Length Lumber down -12.6% (YTD: -31.4%)

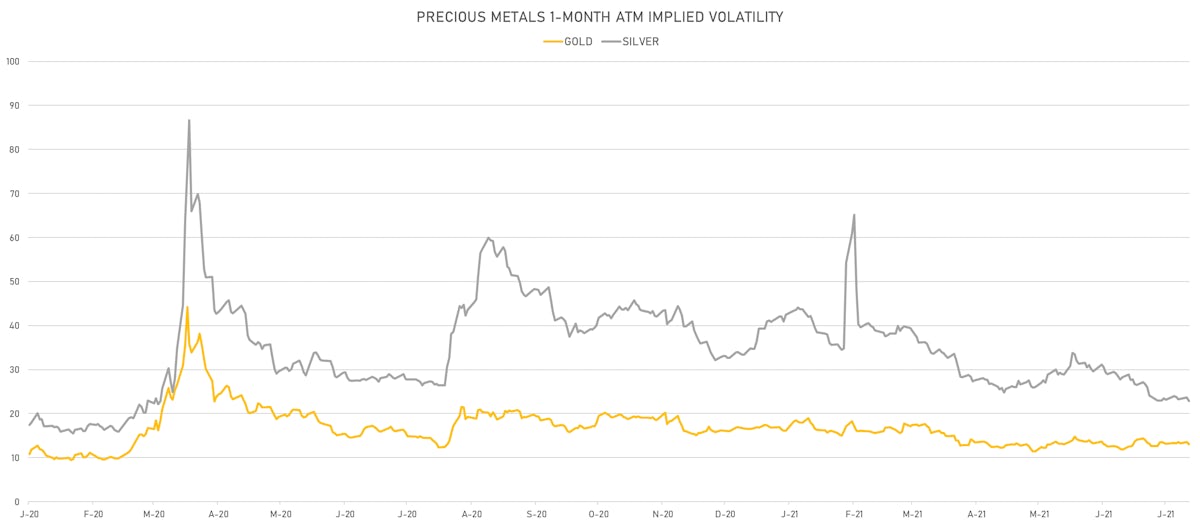

- Gold/US Dollar 1 Month ATM Option IV down -4.1% (YTD: -19.3%)

- Silver/US Dollar 1 Month ATM Option IV down -2.9% (YTD: -46.0%)

- DCE Coking Coal Continuation Month 1 down -2.2% (YTD: 46.6%)

- NYMEX Henry Hub Natural Gas down -1.4% (YTD: 45.6%)

- Platinum spot down -1.4% (YTD: 3.4%)

- SHFE Bitumen Continuation Month 1 down -1.3% (YTD: 38.4%)

- ICE-US Cocoa down -1.3% (YTD: -9.0%)

- SHFE Zinc down -1.3% (YTD: 5.9%)

- ICE-US Coffee C down -1.1% (YTD: 18.6%)

- SHFE Lead Continuation Month 1 down -1.1% (YTD: 6.5%)

- Palladium spot down -1.0% (YTD: 15.6%)

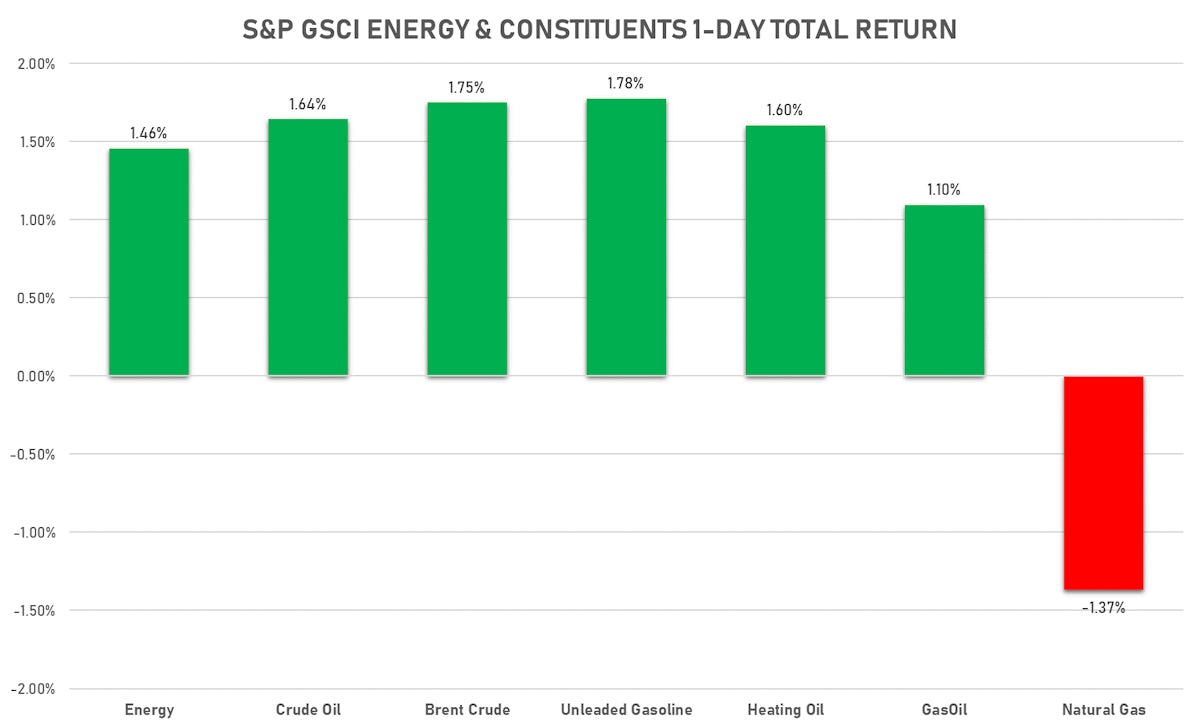

ENERGY TODAY

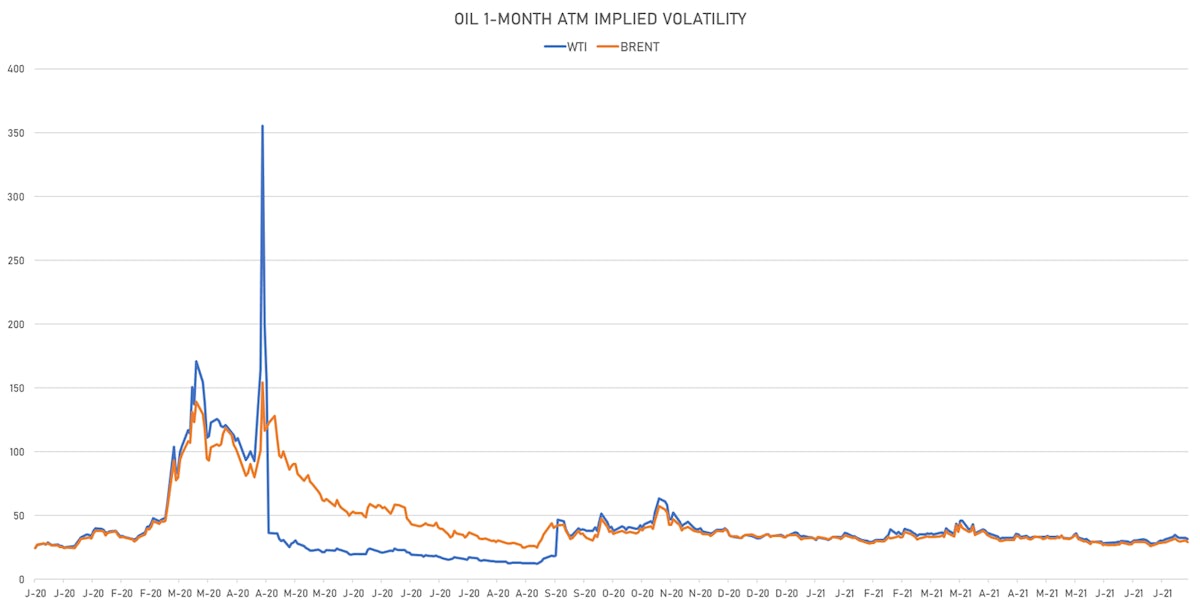

- WTI crude front month currently at US$ 75.03 per barrel, up 1.6% (YTD: +55.1%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 76.28 per barrel, up 1.8% (YTD: +47.7%); 6-month term structure in widening backwardation

- Brent volatility at 29.4, down -3.3% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 144.60 per tonne, up 1.7% (YTD: +79.6%)

- Natural Gas (Henry Hub) currently at US$ 3.69 per MMBtu, down -1.4% (YTD: +45.6%)

- Gasoline (NYMEX) currently at US$ 2.31 per gallon, up 1.8% (YTD: +64.6%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 616.25 per tonne, up 0.5% (YTD: +45.7%)

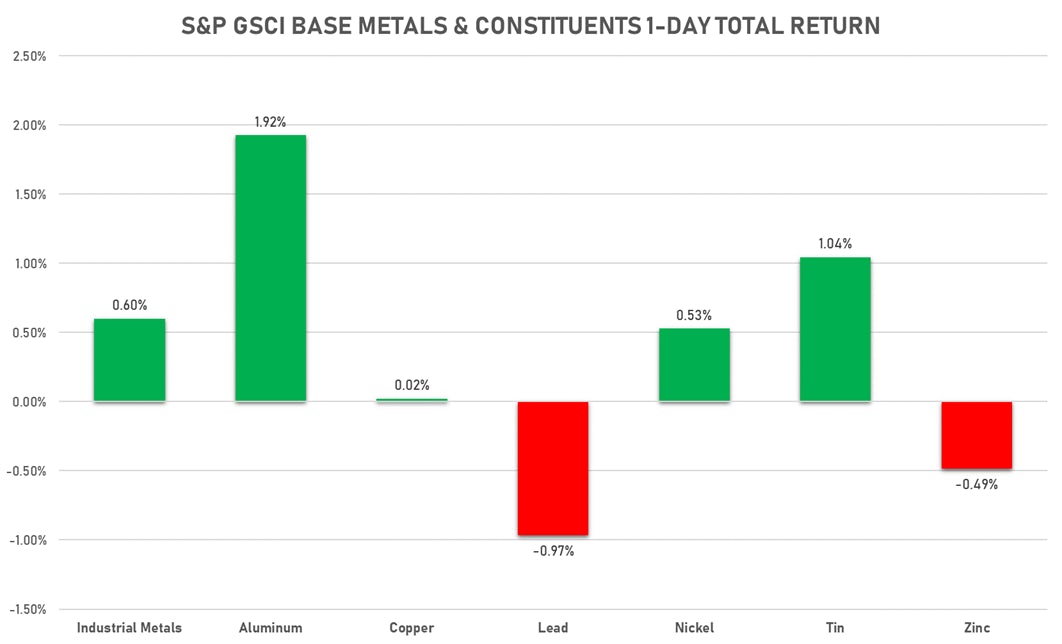

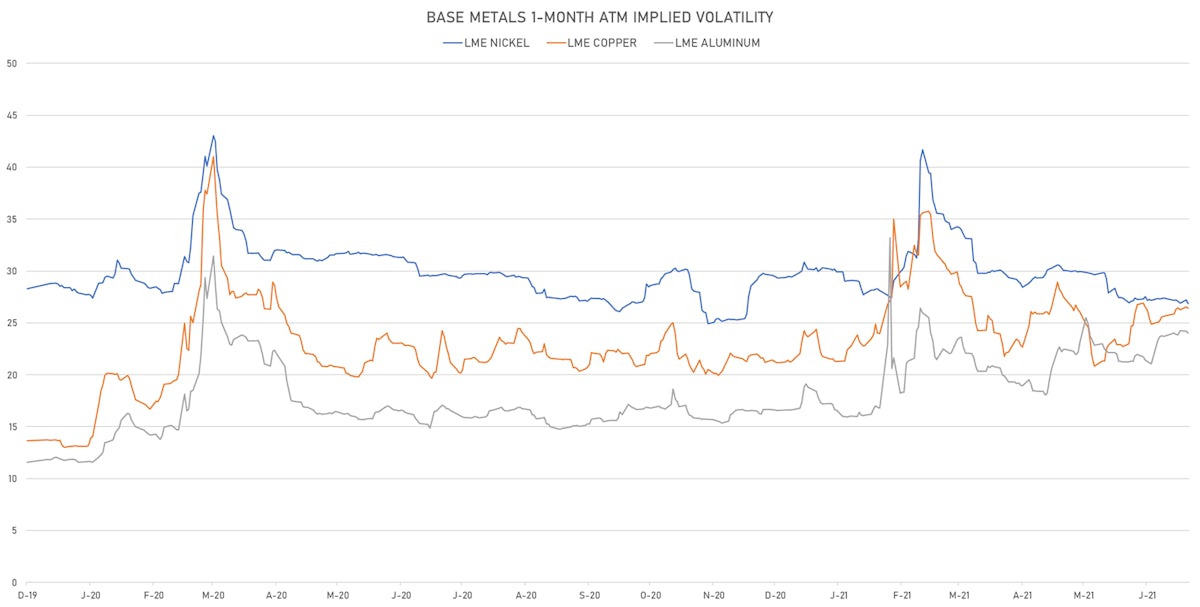

BASE METALS TODAY

- Copper (COMEX) currently at US$ 4.29 per pound, down -0.2% (YTD: +22.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,346.00 per tonne, unchanged (YTD: +24.7%)

- Aluminum (Shanghai) currently at CNY 19,280 per tonne, up 0.6% (YTD: +22.6%)

- Nickel (Shanghai) currently at CNY 140,330 per tonne, up 0.2% (YTD: +13.4%)

- Lead (Shanghai) currently at CNY 15,550 per tonne, down -1.1% (YTD: +6.5%)

- Rebar (Shanghai) currently at CNY 4,946 per tonne, up 1.4% (YTD: +17.2%)

- Tin (Shanghai) currently at CNY 221,550 per tonne, up 1.2% (YTD: +47.8%)

- Zinc (Shanghai) currently at CNY 21,800 per tonne, down -1.3% (YTD: +5.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 370,500 per tonne, unchanged (YTD: +35.2%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

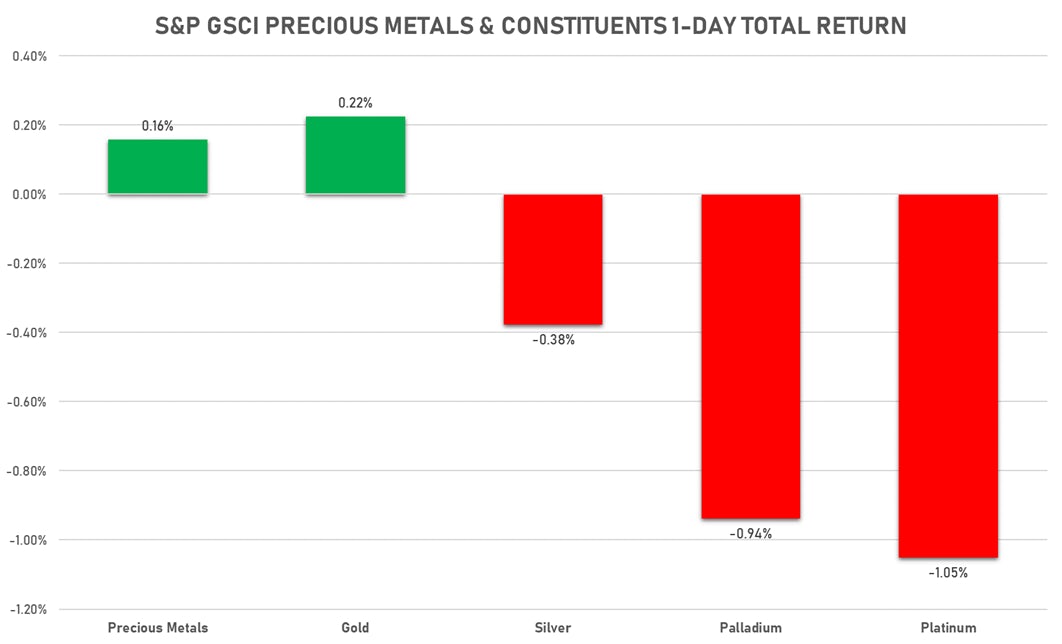

PRECIOUS METALS TODAY

- Gold spot currently at US$ 1,805.33 per troy ounce, up 0.0% (YTD: -4.8%)

- Gold 1-Month ATM implied volatility currently at 12.59, down -4.1% (YTD: -19.3%)

- Silver spot currently at US$ 25.94 per troy ounce, down -0.8% (YTD: -1.5%)

- Silver 1-Month ATM implied volatility currently at 21.90, down -2.9% (YTD: -46.0%)

- Palladium spot currently at US$ 2,822.70 per troy ounce, down -1.0% (YTD: +15.6%)

- Platinum spot currently at US$ 1,102.77 per troy ounce, down -1.4% (YTD: +3.4%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,600 per troy ounce, up 5.9% (YTD: +15.0%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,650 per troy ounce, unchanged (YTD: +117.3%)

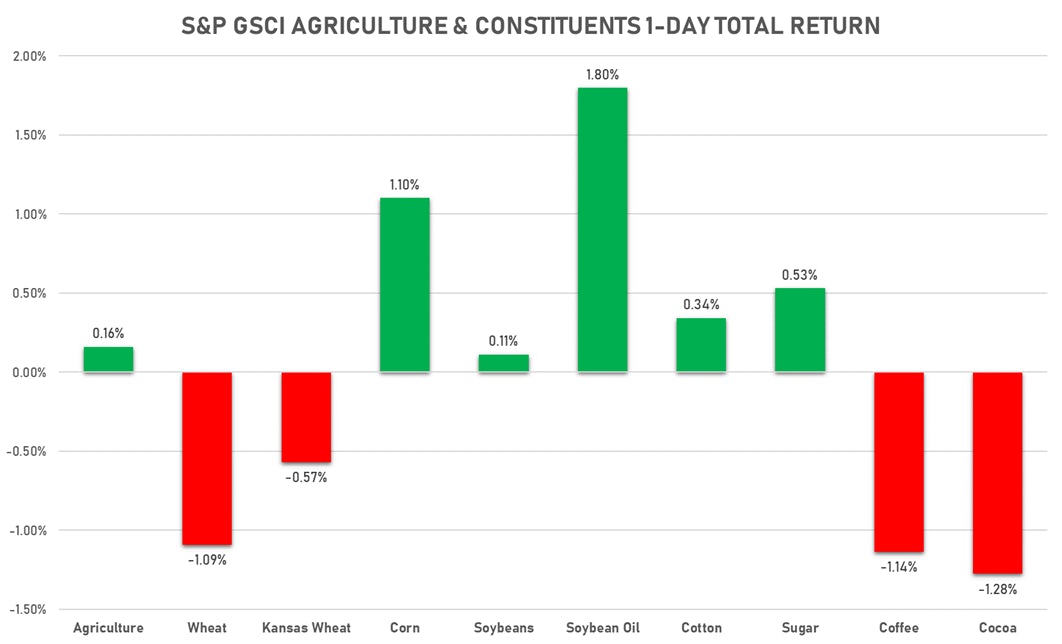

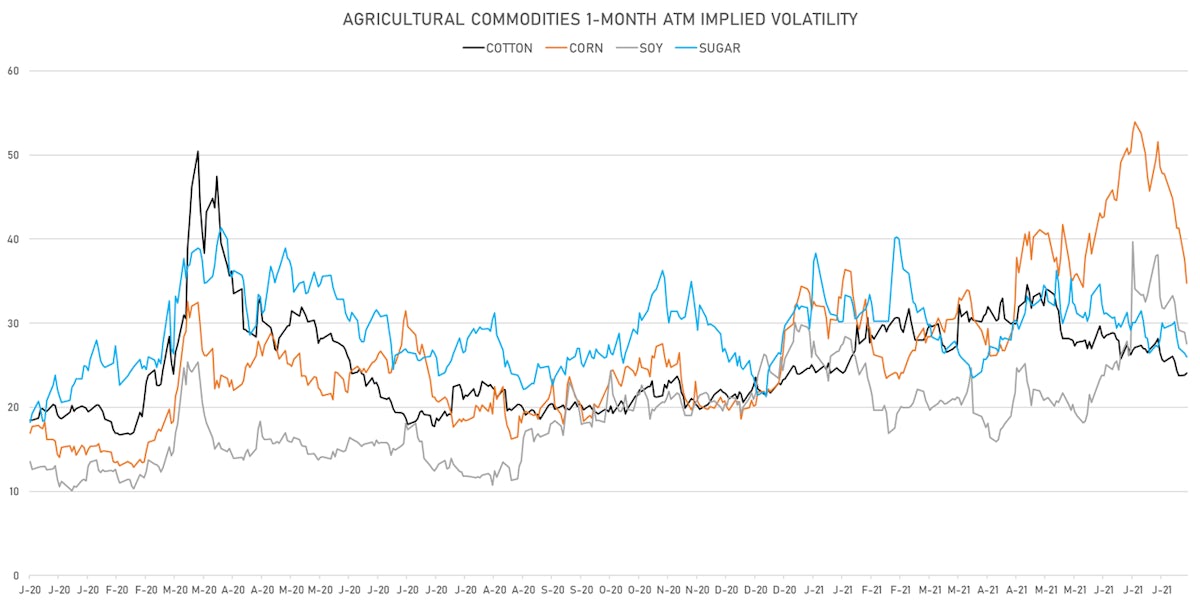

AGROS TODAY

- Live Cattle (CME) currently at US$ 121.75 cents per pound, up 1.6% (YTD: +7.8%)

- Lean Hogs (CME) currently at US$ 112.25 cents per pound, down -0.2% (YTD: +59.7%)

- Rough Rice (CBOT) currently at US$ 12.83 cents per hundredweight, up 1.3% (YTD: +3.5%)

- Soybeans Composite (CBOT) currently at US$ 1,438.00 cents per bushel, up 0.4% (YTD: +9.3%)

- Corn (CBOT) currently at US$ 677.00 cents per bushel, up 1.2% (YTD: +39.9%)

- Wheat Composite (CBOT) currently at US$ 628.75 cents per bushel, down -1.0% (YTD: -1.8%)

- Sugar No.11 (ICE US) currently at US$ 17.08 cents per pound, up 0.5% (YTD: +10.3%)

- Cotton No.2 (ICE US) currently at US$ 88.77 cents per pound, up 0.3% (YTD: +13.6%)

- Cocoa (ICE US) currently at US$ 2,370 per tonne, down -1.3% (YTD: -9.0%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,830 per tonne, up 1.8% (YTD: +21.0%)

- Random Length Lumber (CME) currently at US$ 599.00 per 1,000 board feet, down -12.6% (YTD: -31.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,505 per tonne, unchanged (YTD: +5.1%)

- Soybean Oil Composite (CBOT) currently at US$ 66.63 cents per pound, up 2.5% (YTD: +53.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,048 per tonne, up 1.5% (YTD: +4.0%)

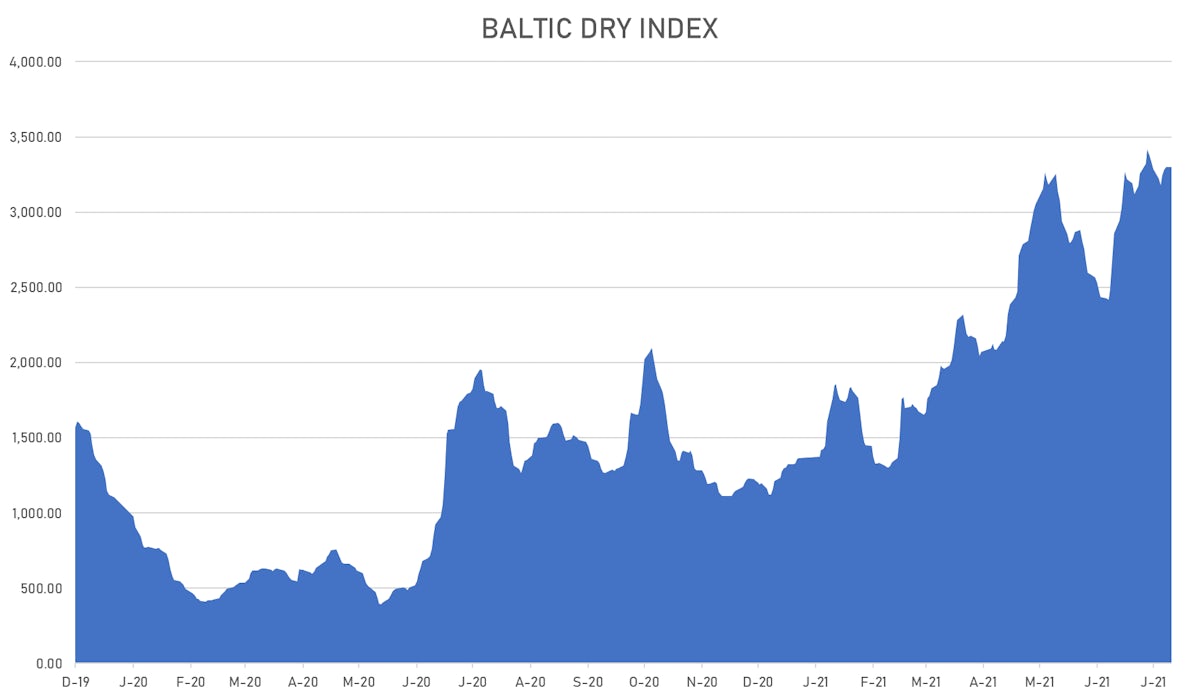

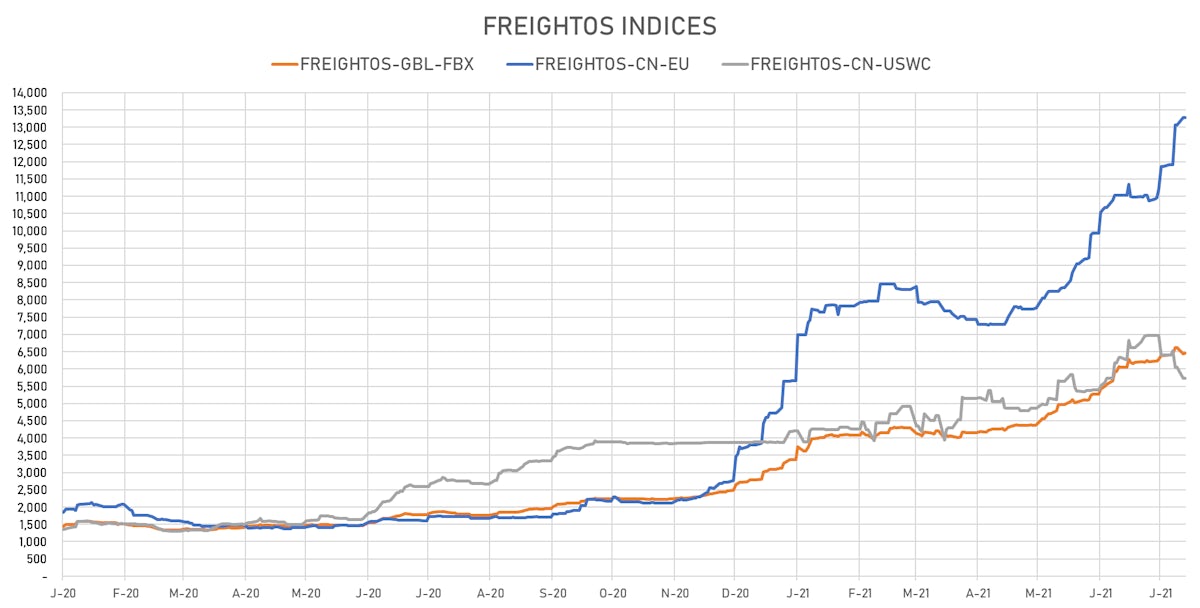

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,300, unchanged (YTD: +141.6%)

- Freightos China To North America West Coast Container Index currently at 5,738, unchanged (YTD: +36.6%)

- Freightos North America West Coast To China Container Index currently at 1,081, up 5.6% (YTD: +108.7%)

- Freightos North America East Coast To Europe Container Index currently at 697, up 6.8% (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 5,838, unchanged (YTD: +212.4%)

- Freightos China To North Europe Container Index currently at 13,281, unchanged (YTD: +134.5%)

- Freightos North Europe To China Container Index currently at 1,608, unchanged (YTD: +16.9%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

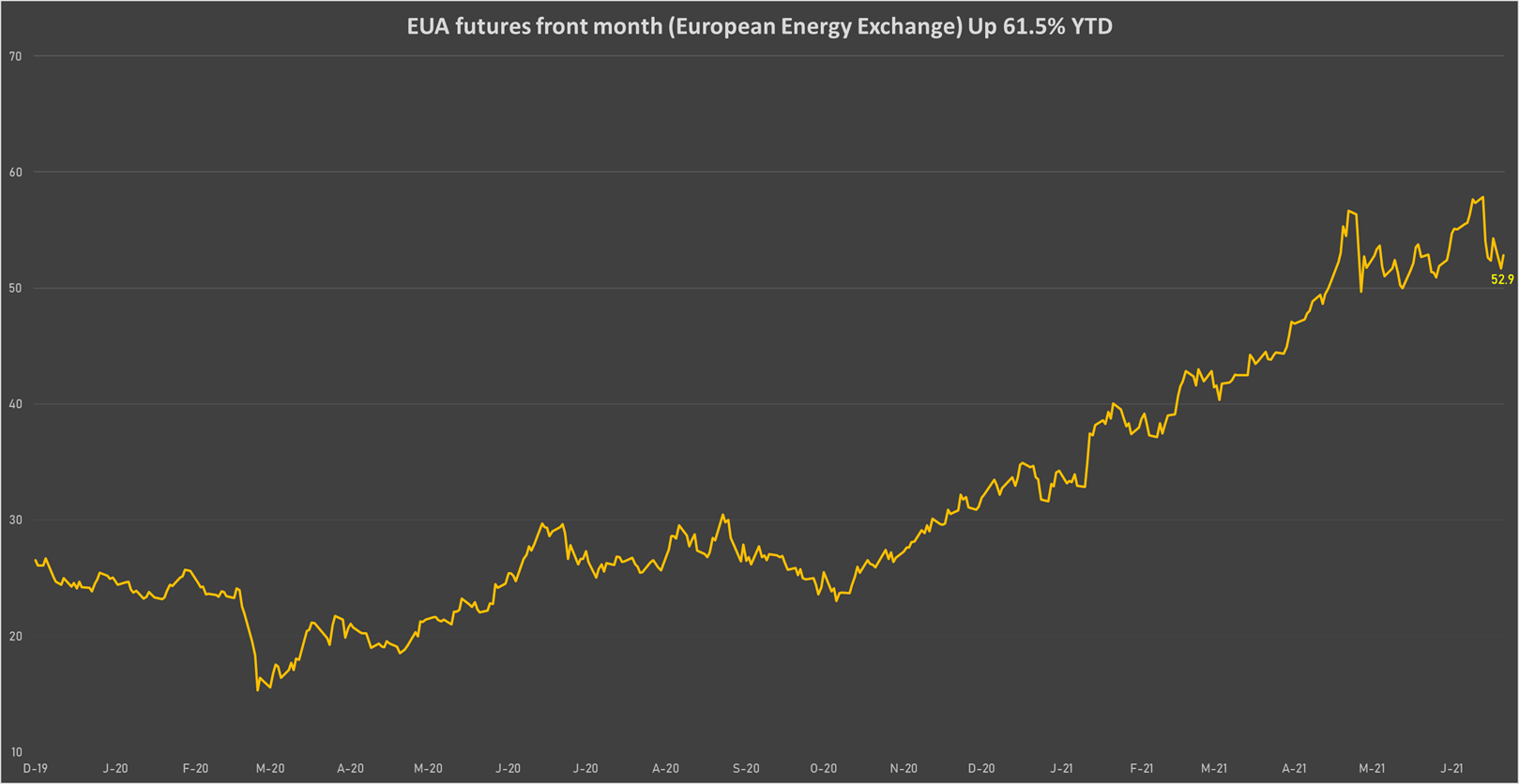

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.85 per tonne, up 2.2% (YTD: +61.5%)