Commodities

Base Metals And Precious Metals Rise, Crude And Nat Gas Fall

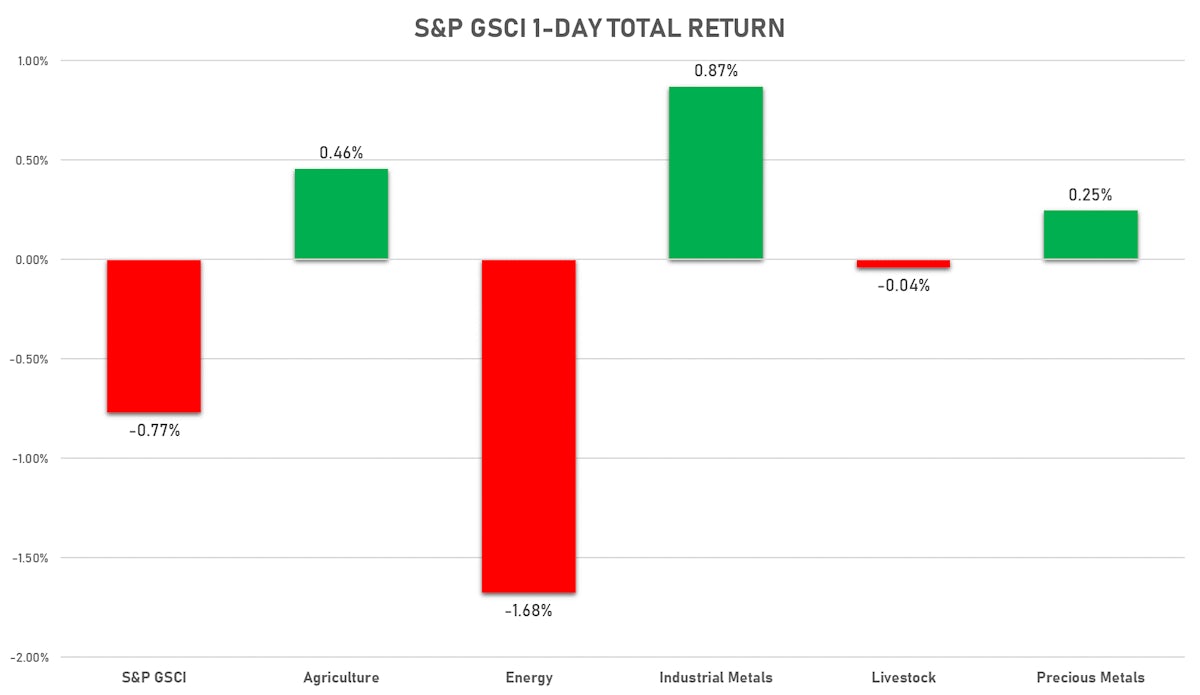

Positive Chinese macro data lead industrial metals higher, while crude oil took a breather on OPEC demand forecast below 100mbpd

Published ET

Brent Crude Prices And 6-month Term Structure (backwardation) | Source: Refinitiv

HEADLINES & MACRO

- Larger inventory build than expected in Natural Gas: Stock Levels, EIA, Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 09 Jul (EIA, United States) at 55.00 bcf, above consensus estimate of 47.00 bcf

NOTABLE GAINERS TODAY

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index up 8.8% (YTD: 90.9%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 6.4% (YTD: 30.1%)

- CBoT Wheat up 4.2% (YTD: 4.9%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index up 4.0% (YTD: 42.2%)

- SMM Rare Earth Praseodymium Neodymium Alloy Spot Price Daily up 3.4% (YTD: 35.7%)

- CBoT Rough Rice up 3.0% (YTD: 6.6%)

- Coffee Arabica Colombia Excelso EP Spot up 2.9% (YTD: 23.1%)

- ICE-US Sugar No. 11 up 2.4% (YTD: 11.9%)

- SHFE Rebar up 2.0% (YTD: 19.7%)

- WUXI Metal Cobalt Bi-Monthly up 1.9% (YTD: 35.7%)

NOTABLE LOSERS TODAY

- DCE Coking Coal Continuation Month 1 down -11.2% (YTD: 29.6%)

- CME Random Length Lumber down -5.9% (YTD: -43.8%)

- Pork Primal Cutout Butt down -4.1% (YTD: 71.4%)

- Palladium spot down -3.4% (YTD: 11.6%)

- DCE Iron Ore Continuation Month 1 down -3.1% (YTD: 20.9%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -2.1% (YTD: 50.3%)

- NYMEX Light Sweet Crude Oil (WTI) down -2.0% (YTD: 47.7%)

- NYMEX RBOB Gasoline down -1.9% (YTD: 59.8%)

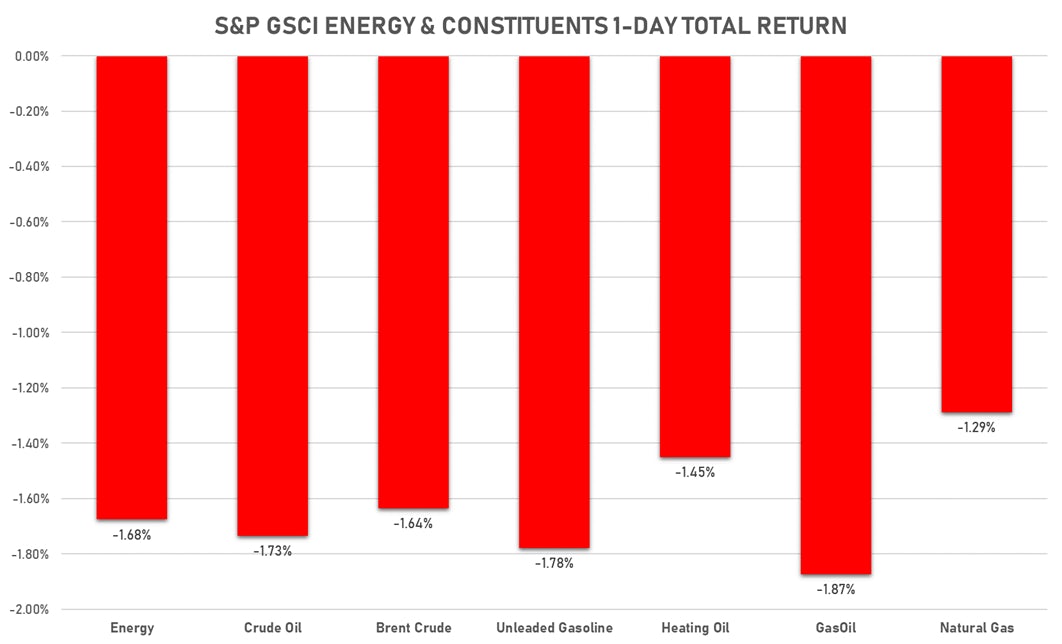

ENERGY FELL HARD TODAY

- WTI crude front month currently at US$ 71.43 per barrel, down -2.0% (YTD: +47.7%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 73.47 per barrel, down -1.7% (YTD: +41.8%); 6-month term structure in tightening backwardation

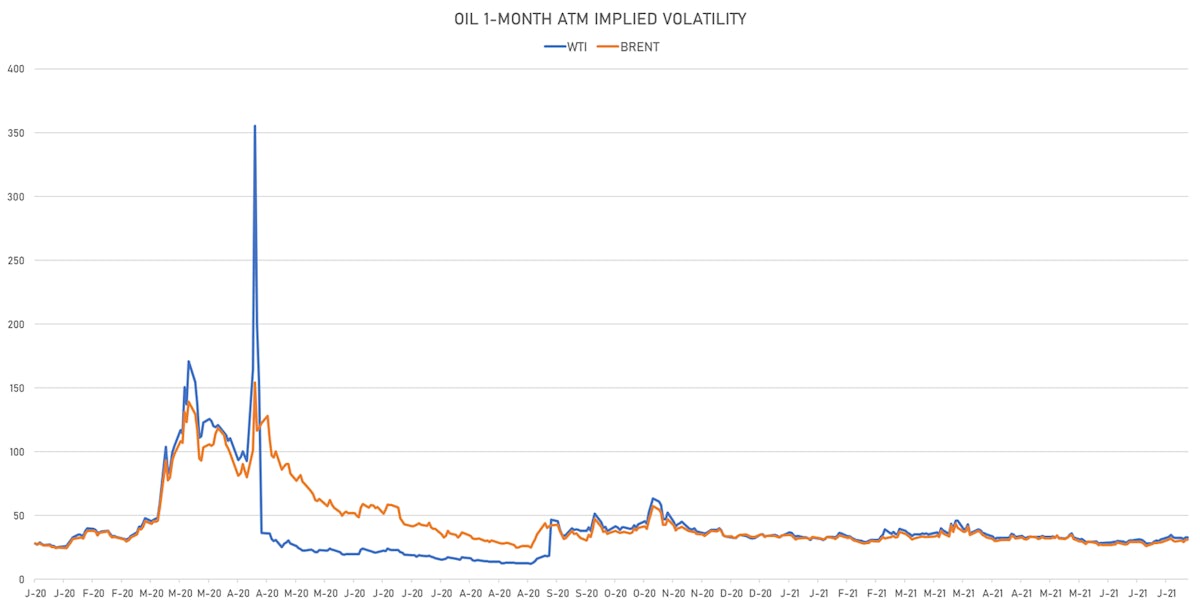

- Brent volatility at 31.2, up 0.9% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 146.00 per tonne, up 1.0% (YTD: +81.4%)

- Natural Gas (Henry Hub) currently at US$ 3.62 per MMBtu, down -1.3% (YTD: +42.3%)

- Gasoline (NYMEX) currently at US$ 2.25 per gallon, down -1.9% (YTD: +59.8%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 601.25 per tonne, down -1.8% (YTD: +42.9%)

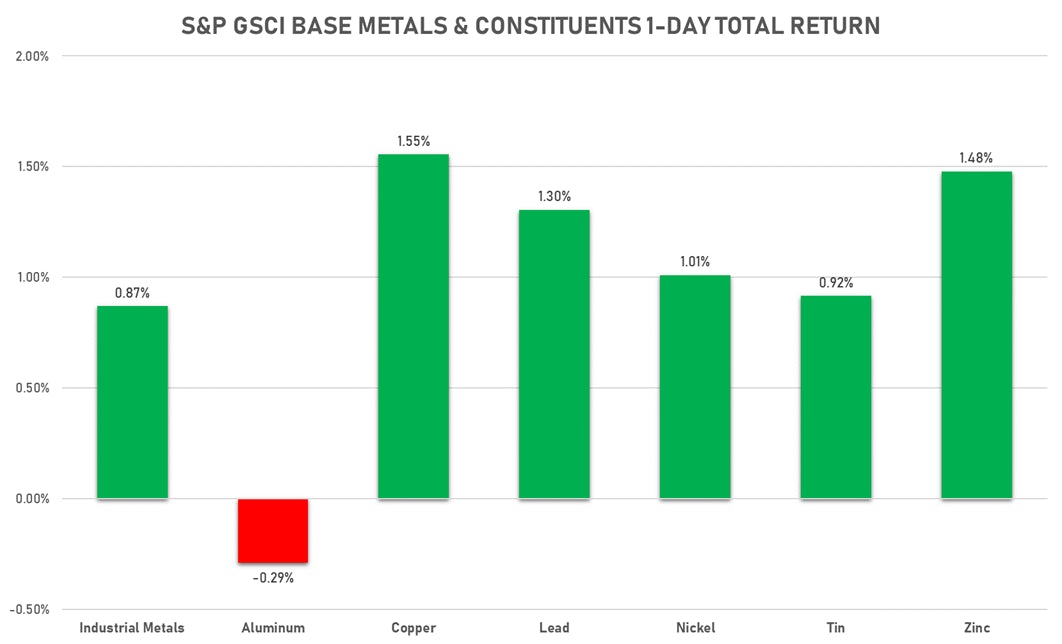

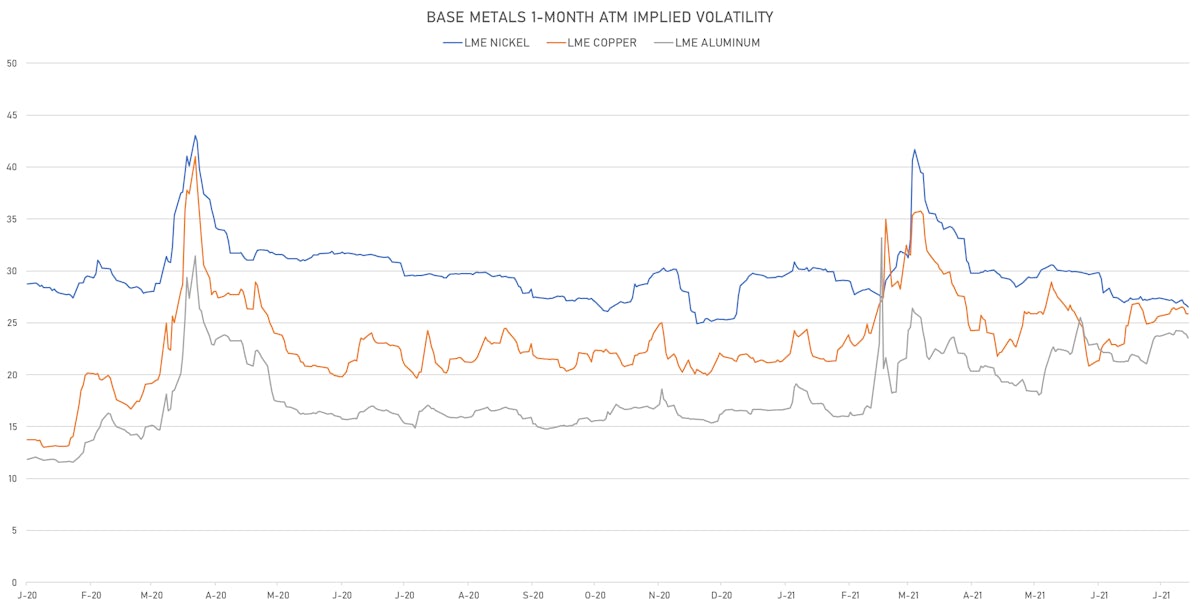

BASE METALS UP BROADLY TODAY

- Copper (COMEX) currently at US$ 4.33 per pound, up 1.3% (YTD: +23.3%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,315.00 per tonne, down -3.1% (YTD: +20.9%)

- Aluminium (Shanghai) currently at CNY 19,470 per tonne, up 0.4% (YTD: +23.2%)

- Nickel (Shanghai) currently at CNY 139,550 per tonne, down -0.9% (YTD: +11.8%)

- Lead (Shanghai) currently at CNY 15,950 per tonne, up 1.6% (YTD: +7.2%)

- Rebar (Shanghai) currently at CNY 5,458 per tonne, up 2.0% (YTD: +19.7%)

- Tin (Shanghai) currently at CNY 224,200 per tonne, up 0.5% (YTD: +47.8%)

- Zinc (Shanghai) currently at CNY 22,190 per tonne, unchanged (YTD: +4.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 375,500 per tonne, up 1.3% (YTD: +37.0%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

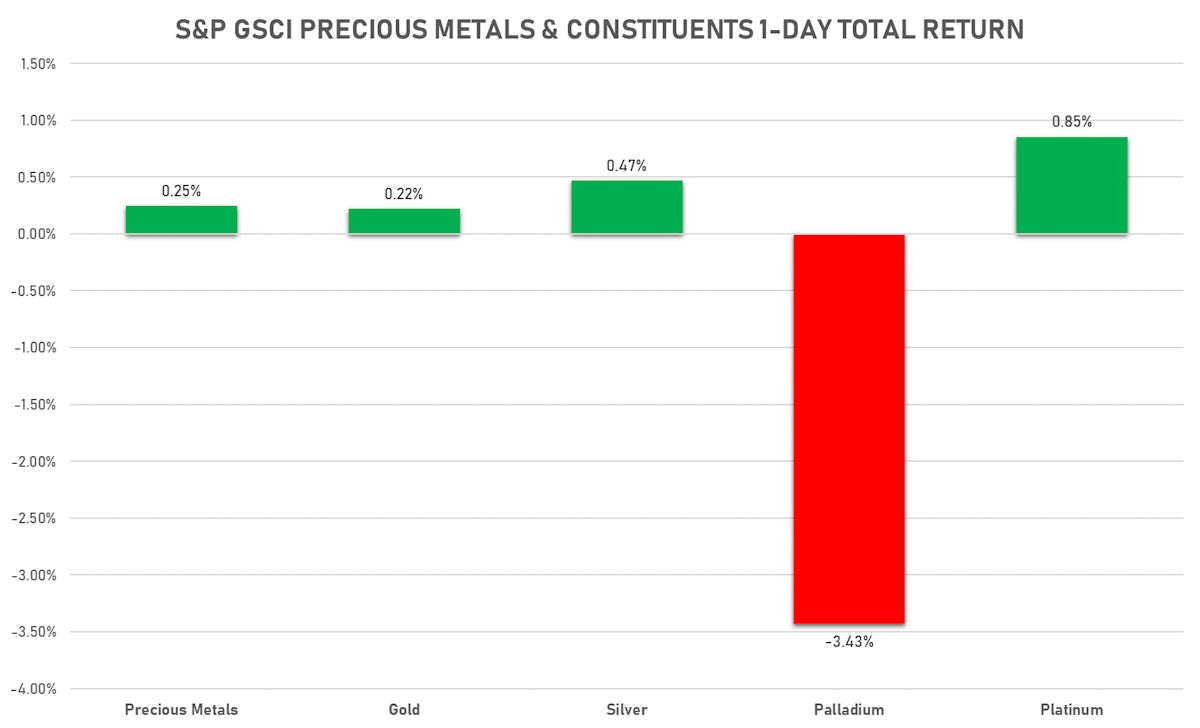

PRECIOUS METALS UP SLIGHTLY TODAY, THOUGH PALLADIUM TUMBLES

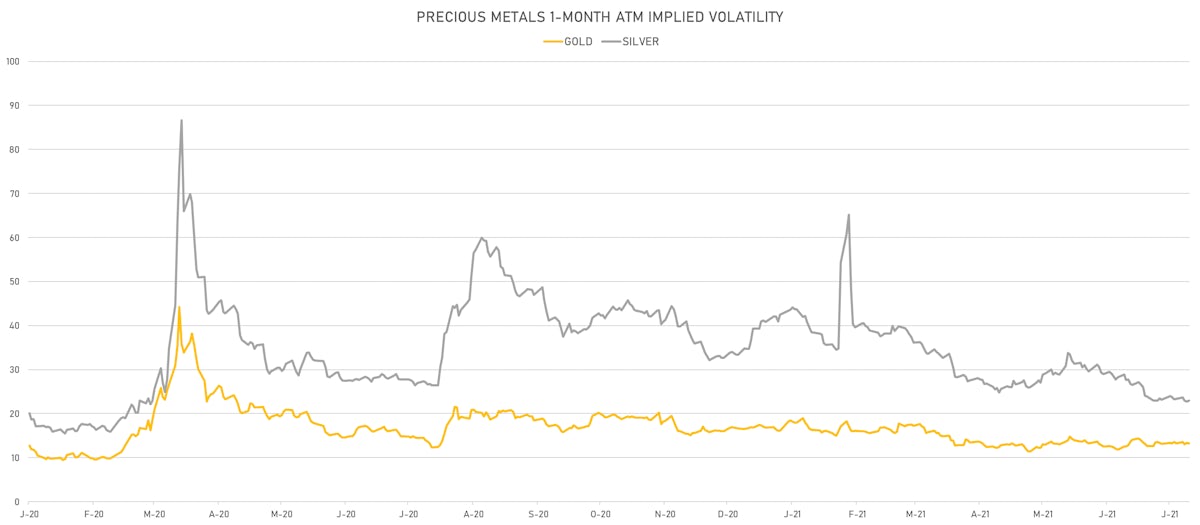

- Gold spot currently at US$ 1,831.10 per troy ounce, up 0.2% (YTD: -3.6%)

- Gold 1-Month ATM implied volatility currently at 12.81, down -0.7% (YTD: -17.9%)

- Silver spot currently at US$ 26.35 per troy ounce, up 0.3% (YTD: -0.2%)

- Silver 1-Month ATM implied volatility currently at 21.92, up 0.7% (YTD: -46.1%)

- Palladium spot currently at US$ 2,733.81 per troy ounce, down -3.4% (YTD: +11.6%)

- Platinum spot currently at US$ 1,139.65 per troy ounce, up 0.9% (YTD: +6.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,700 per troy ounce, unchanged (YTD: +15.5%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

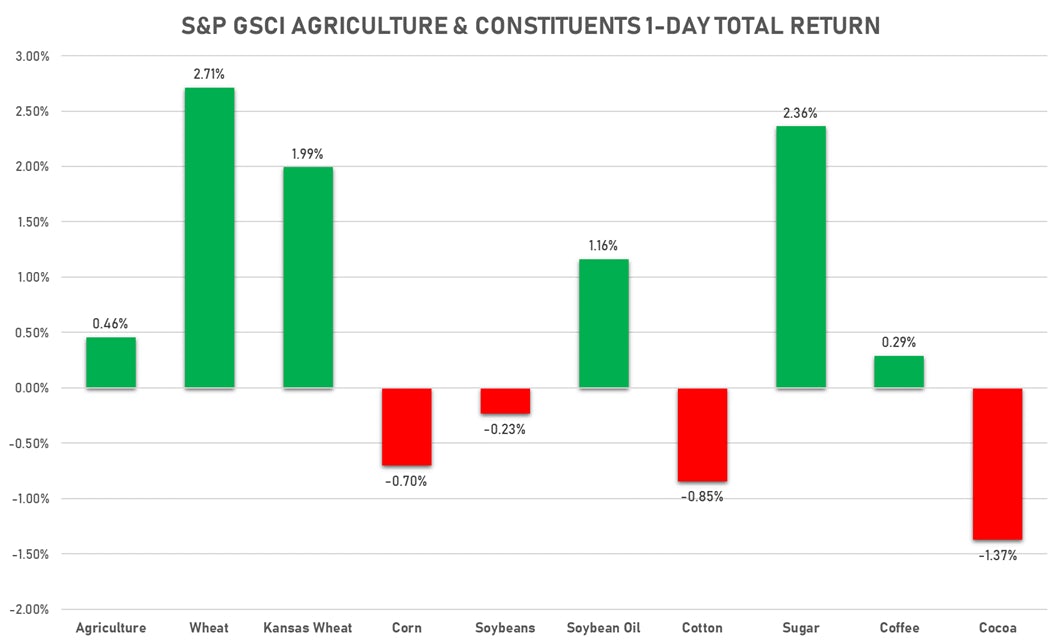

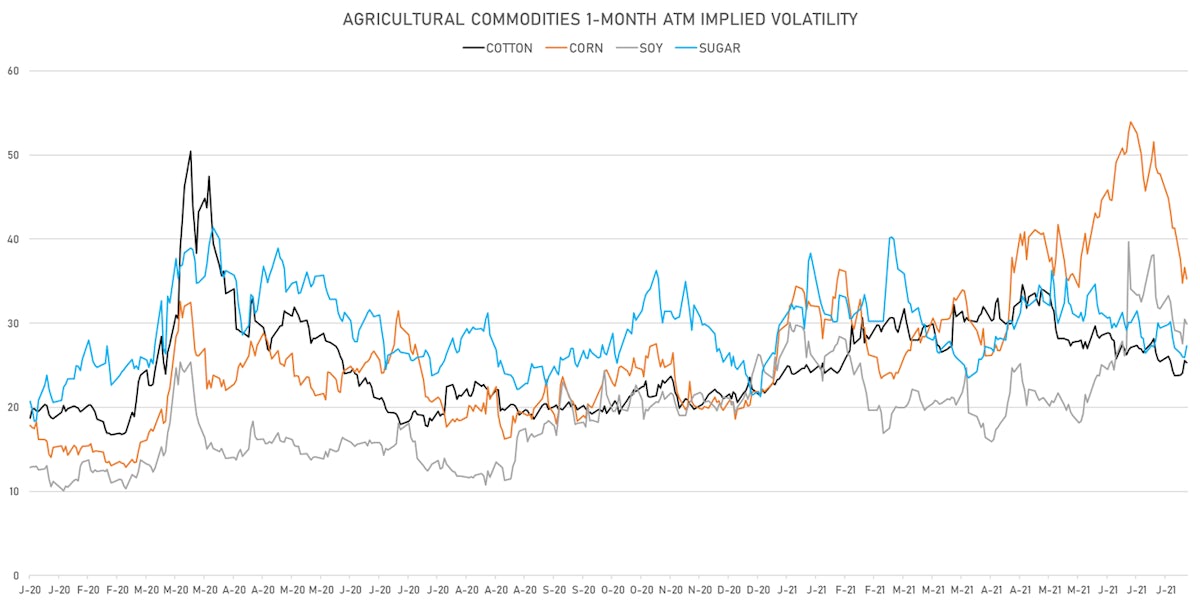

MIXED DAY FOR AGS

- Live Cattle (CME) currently at US$ 121.13 cents per pound, down 0.1% (YTD: +7.2%)

- Lean Hogs (CME) currently at US$ 104.30 cents per pound, down -0.2% (YTD: +59.6%)

- Rough Rice (CBOT) currently at US$ 13.22 cents per hundredweight, up 3.0% (YTD: +6.6%)

- Soybeans Composite (CBOT) currently at US$ 1,447.50 cents per bushel, down -1.4% (YTD: +10.1%)

- Corn (CBOT) currently at US$ 564.25 cents per bushel, down -17.4% (YTD: +16.6%)

- Wheat Composite (CBOT) currently at US$ 672.00 cents per bushel, up 4.2% (YTD: +4.9%)

- Sugar No.11 (ICE US) currently at US$ 17.33 cents per pound, up 2.4% (YTD: +11.9%)

- Cotton No.2 (ICE US) currently at US$ 89.84 cents per pound, down -0.8% (YTD: +15.0%)

- Cocoa (ICE US) currently at US$ 2,369 per tonne, down -1.4% (YTD: -10.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,895 per tonne, up 2.9% (YTD: +23.1%)

- Random Length Lumber (CME) currently at US$ 574.90 per 1,000 board feet, down -5.9% (YTD: -43.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,625 per tonne, down 0.0% (YTD: +5.1%)

- Soybean Oil Composite (CBOT) currently at US$ 67.31 cents per pound, up 1.0% (YTD: +55.3%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,238 per tonne, up 1.3% (YTD: +6.6%)

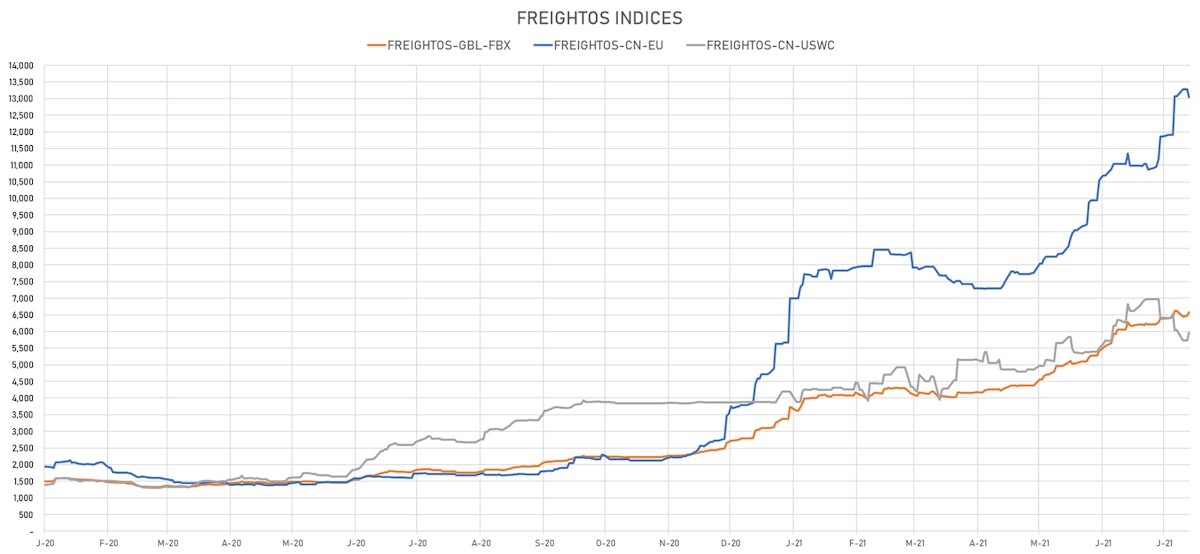

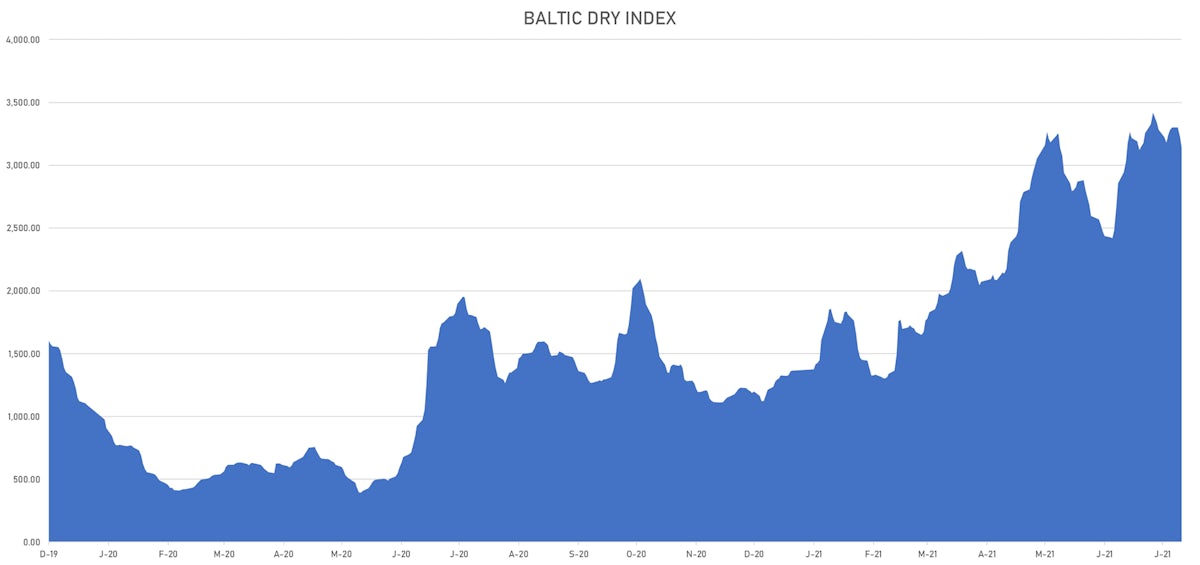

SHIPPING

- Baltic Dry Index (Baltic Exchange) currently at 3,139, down -2.8% (YTD: +129.8%)

- Freightos China To North America West Coast Container Index currently at 5,970, up 4.0% (YTD: +42.2%)

- Freightos North America West Coast To China Container Index currently at 1,076, down -0.5% (YTD: +107.7%)

- Freightos North America East Coast To Europe Container Index currently at 697, unchanged (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,024, up 0.5% (YTD: +222.3%)

- Freightos China To North Europe Container Index currently at 13,040, down -1.8% (YTD: +130.3%)

- Freightos North Europe To China Container Index currently at 1,608, unchanged (YTD: +16.9%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.97 per tonne, down -0.7% (YTD: +61.9%)