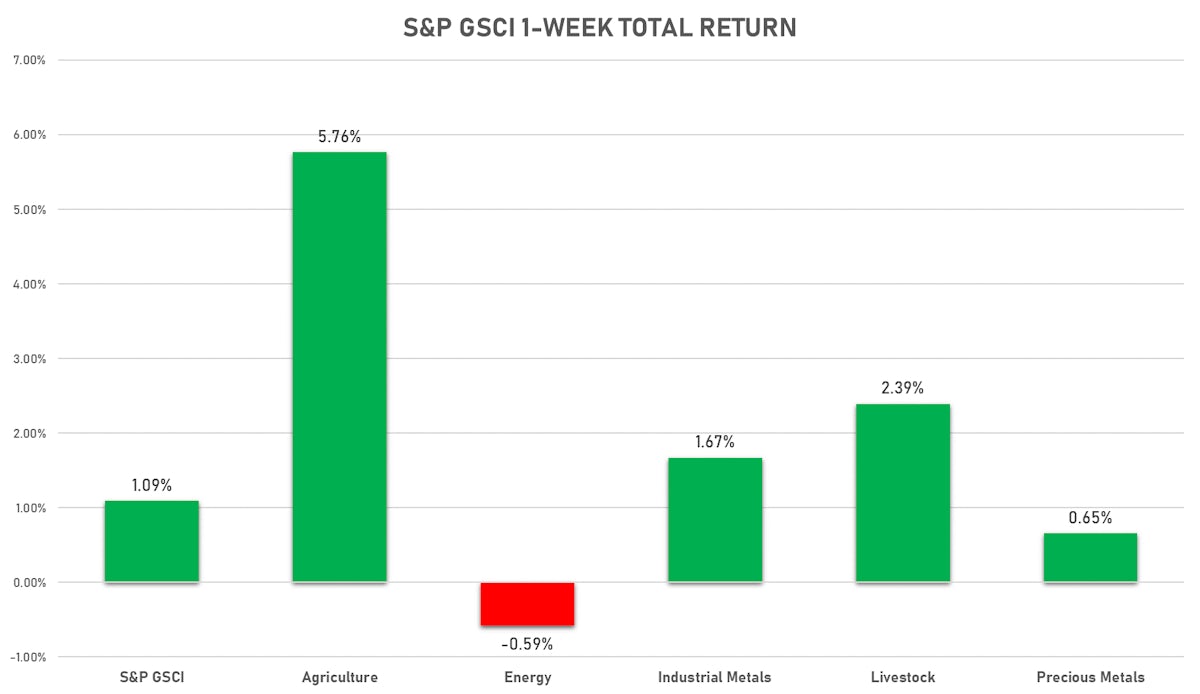

Commodities

Ags Capped A Positive Week With Further Gains Today In Wheat, Sugar, Cotton

Chinese-traded metals and industrial commodities rose sharply to close out the week, led by rebar, rubber, and copper

Published ET

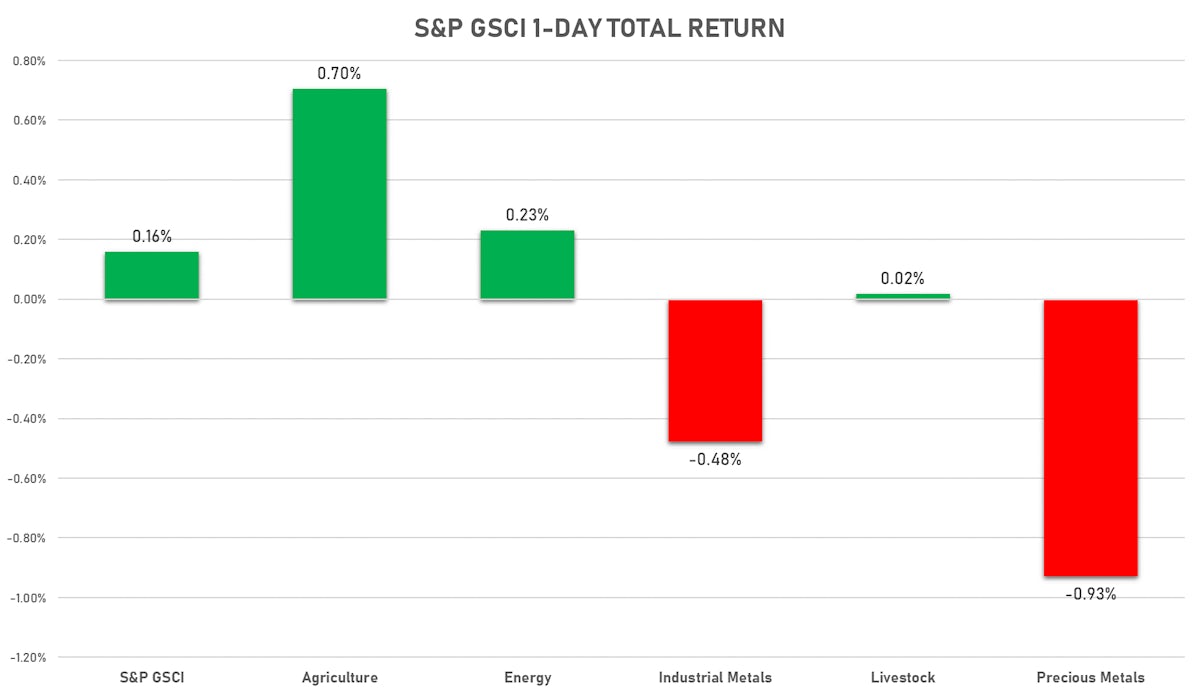

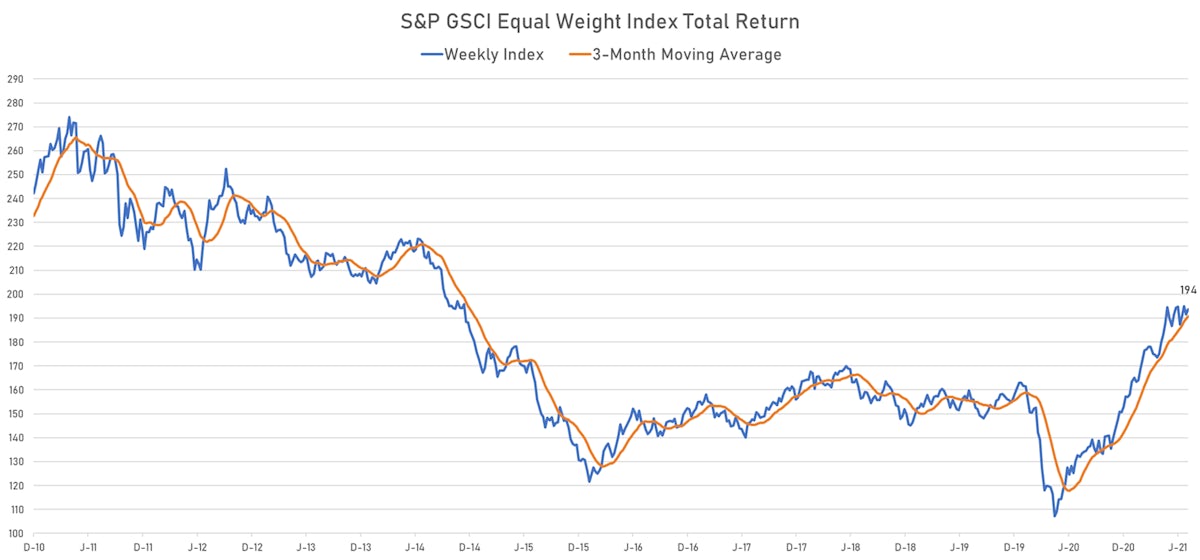

S&P GSCI Sub-Indices This Week | Sources: ϕpost, FactSet data

NOTABLE GAINERS TODAY

- CME Random Length Lumber up 9.3% (YTD: -38.6%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 9.1% (YTD: 41.9%)

- SHFE Rebar up 8.0% (YTD: 29.2%)

- Bursa Malaysia Crude Palm Oil up 3.6% (YTD: 10.5%)

- SHFE Rubber up 3.1% (YTD: -1.5%)

- CBoT Wheat up 3.1% (YTD: 8.1%)

- ICE-US Coffee up 2.7% (YTD: 25.7%)

- SMM Rare Earth Praseodymium Neodymium Alloy Spot Price Daily up 2.5% (YTD: 39.1%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily up 2.5% (YTD: 30.5%)

- Shanghai International Exchange Bonded Copper up 2.4% (YTD: 19.3%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily up 2.4% (YTD: 30.2%)

- ICE-US Sugar No. 11 up 2.2% (YTD: 14.3%)

NOTABLE LOSERS TODAY

- ICE Brent Crude Spread Spread down -6.5% (YTD: 568.9%)

- CME Lean Hogs down -5.8% (YTD: 50.3%)

- Palladium spot down -3.7% (YTD: 7.4%)

- SHFE Bitumen Continuation Month 1 down -3.7% (YTD: 33.3%)

- Platinum spot down -3.3% (YTD: 3.1%)

- Pork Primal Cutout Butt down -2.7% (YTD: 66.7%)

- Freightos Baltic China/East Asia To Mediterranean 40 Container Index down -2.7% (YTD: 108.4%)

- Silver spot down -2.5% (YTD: -2.7%)

- Johnson Matthey Rhodium New York 0930 down -1.5% (YTD: 13.8%)

- CBoT Corn down -1.5% (YTD: 14.9%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -1.3% (YTD: 48.4%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent increased net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver reduced net long position

- Platinum increased net long position

- Palladium increased net long position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat increased net short position

- Corn reduced net long position

- Rough Rice increased net short position

- Oats increased net short position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa reduced net short position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

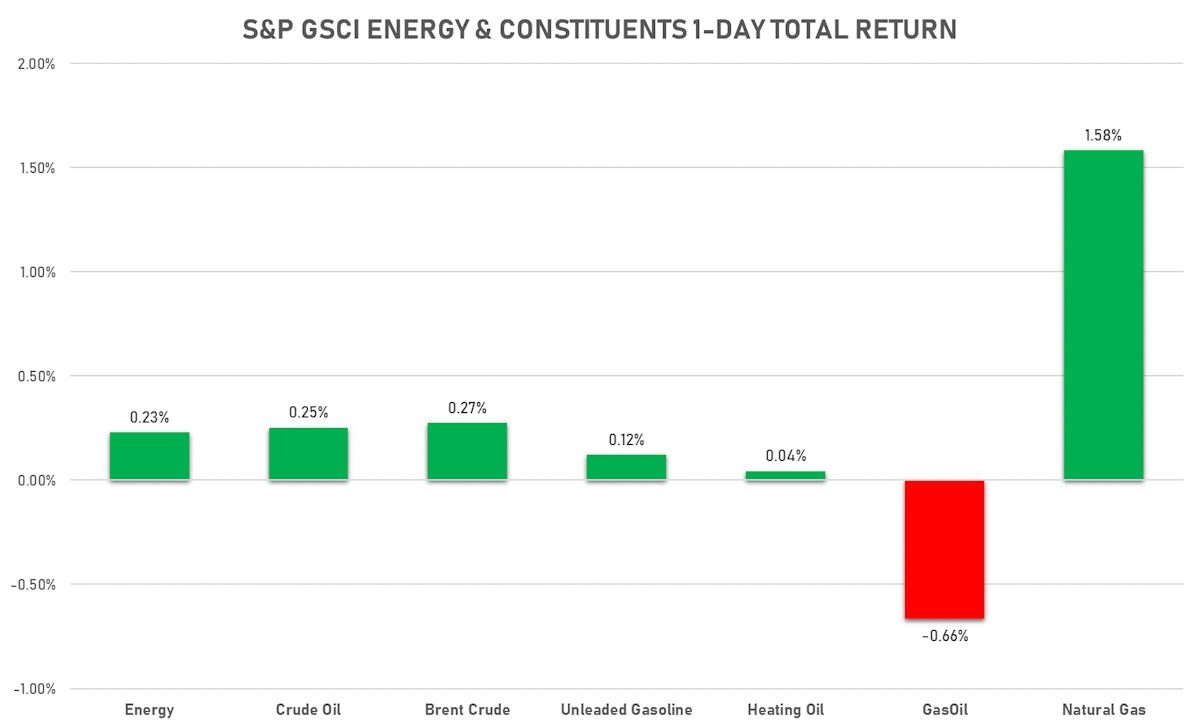

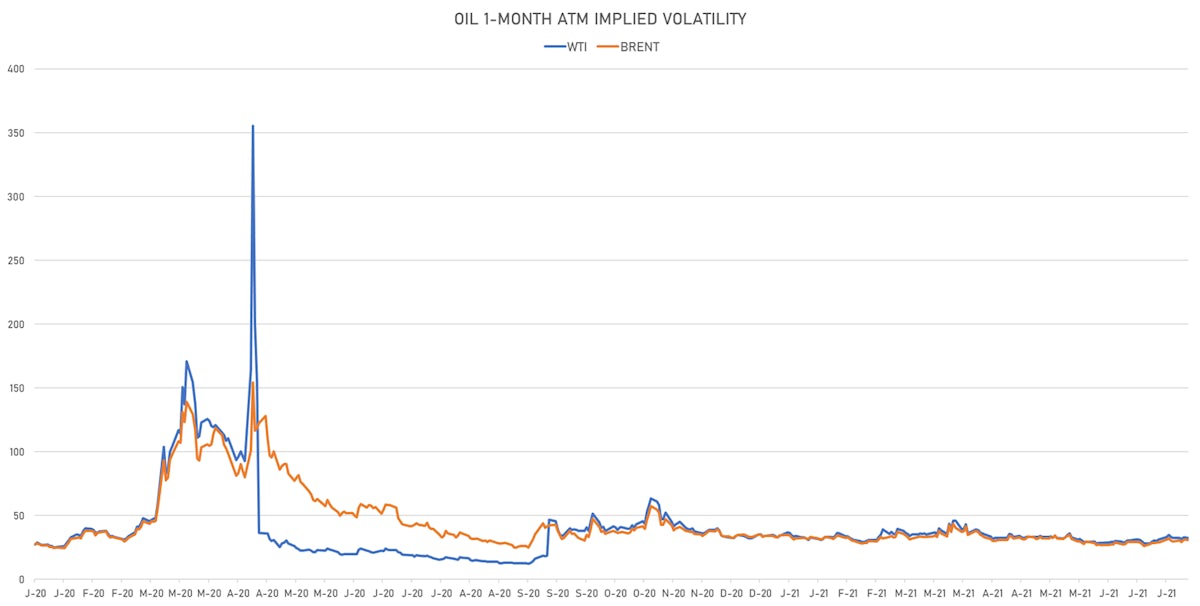

ENERGY UP SLIGHTLY TODAY

- WTI crude front month currently at US$ 71.81 per barrel, up 0.2% (YTD: +48.0%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 73.59 per barrel, up 0.2% (YTD: +42.1%); 6-month term structure in tightening backwardation

- Brent volatility at 30.8, down -1.1% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 148.10 per tonne, up 1.4% (YTD: +84.0%)

- Natural Gas (Henry Hub) currently at US$ 3.67 per MMBtu, up 1.7% (YTD: +44.7%)

- Gasoline (NYMEX) currently at US$ 2.25 per gallon, up 0.1% (YTD: +60.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 597.00 per tonne, down -0.7% (YTD: +41.9%)

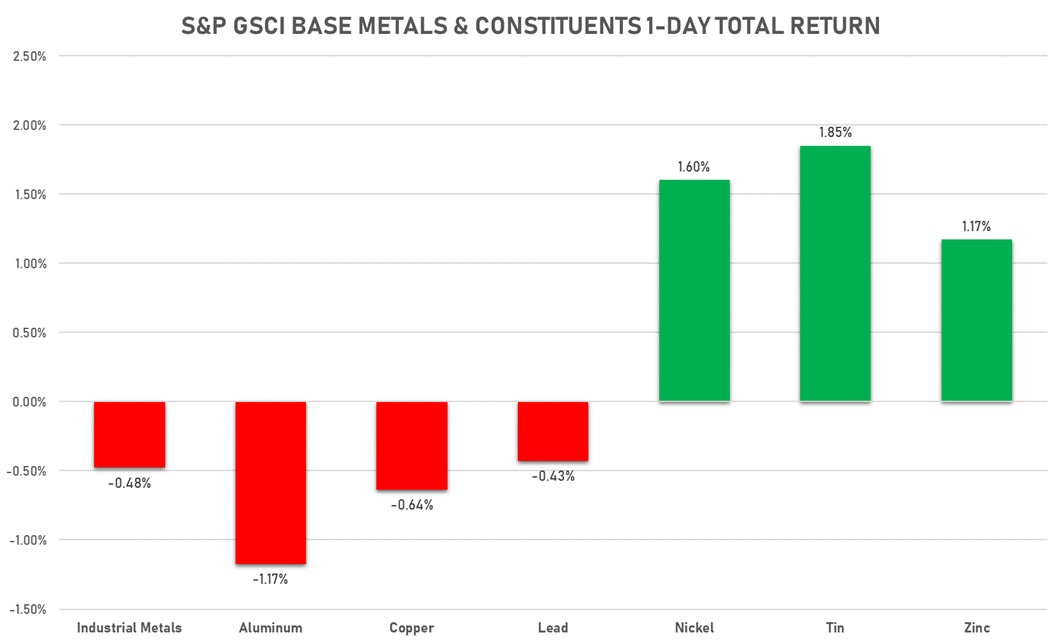

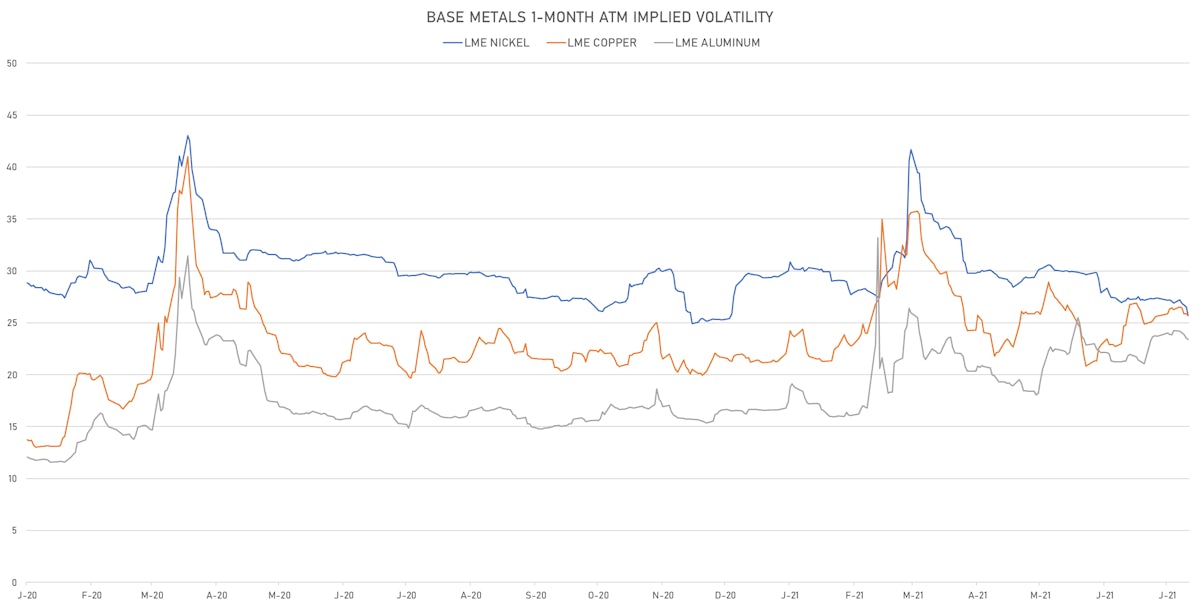

MIXED DAY FOR BASE METALS

- Copper (COMEX) unchanged at US$ 4.32 per pound (YTD: +23.3%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,307.50 per tonne, up 0.2% (YTD: +21.2%)

- Aluminum (Shanghai) currently at CNY 19,410 per tonne, up 0.9% (YTD: +24.3%)

- Nickel (Shanghai) currently at CNY 142,930 per tonne, up 1.8% (YTD: +13.8%)

- Lead (Shanghai) currently at CNY 15,840 per tonne, up 1.0% (YTD: +8.3%)

- Rebar (Shanghai) currently at CNY 5,593 per tonne, up 8.0% (YTD: +29.2%)

- Tin (Shanghai) currently at CNY 233,620 per tonne, up 1.4% (YTD: +49.9%)

- Zinc (Shanghai) currently at CNY 22,575 per tonne, up 2.0% (YTD: +6.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, up 1.1% (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

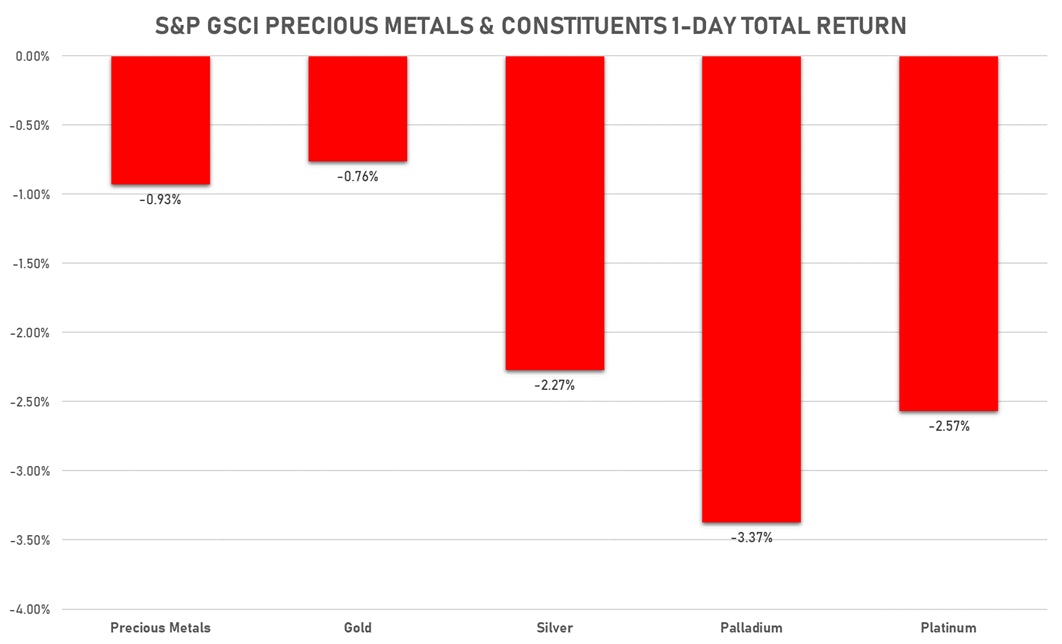

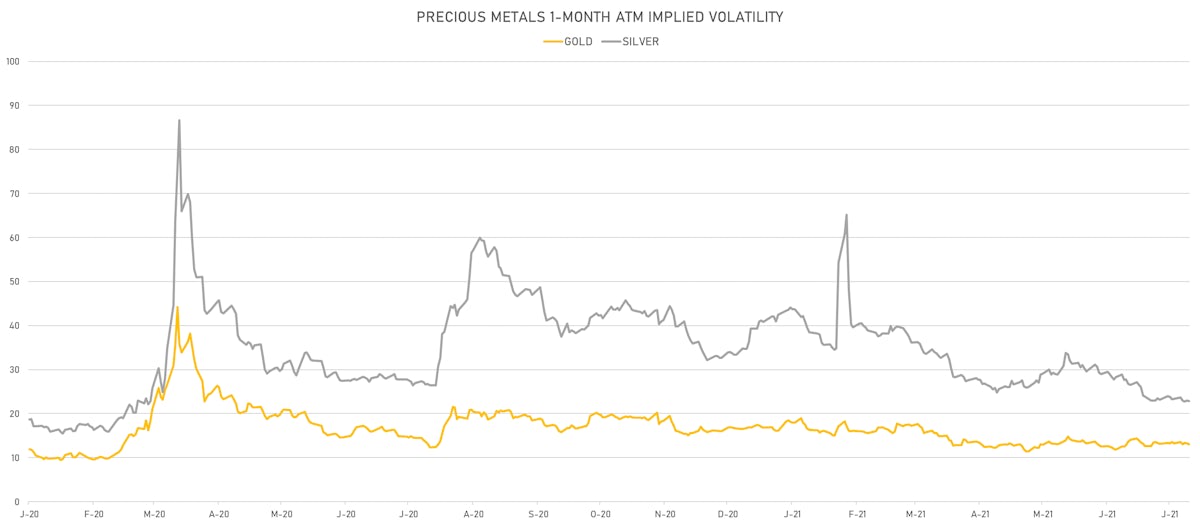

PRECIOUS METALS FELL BROADLY TODAY

- Gold spot currently at US$ 1,811.68 per troy ounce, down -1.0% (YTD: -4.5%)

- Gold 1-Month ATM implied volatility currently at 12.64, down -1.1% (YTD: -18.9%)

- Silver spot currently at US$ 25.65 per troy ounce, down -2.5% (YTD: -2.7%)

- Silver 1-Month ATM implied volatility currently at 21.90, up 0.1% (YTD: -46.1%)

- Palladium spot currently at US$ 2,626.70 per troy ounce, down -3.7% (YTD: +7.4%)

- Platinum spot currently at US$ 1,101.50 per troy ounce, down -3.3% (YTD: +3.1%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,400 per troy ounce, down -1.5% (YTD: +13.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

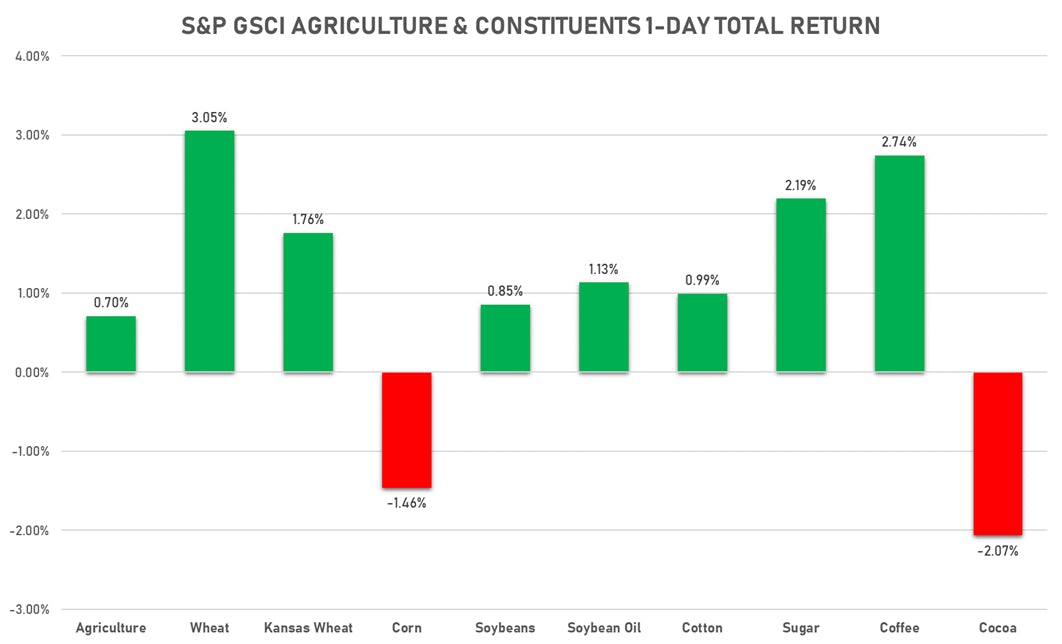

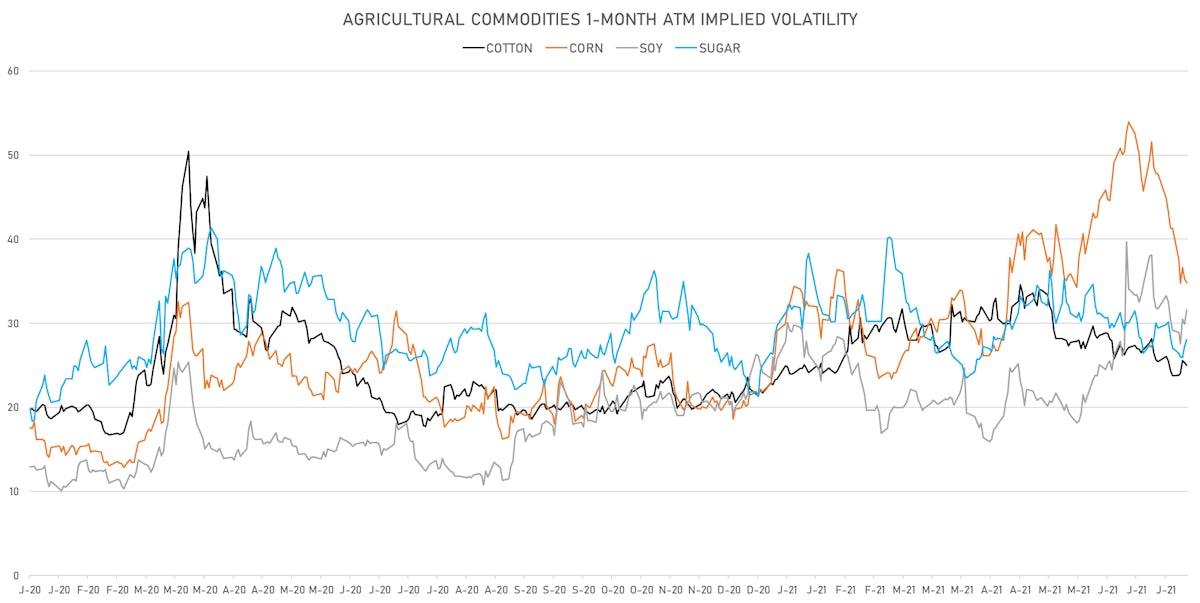

AGS MADE FURTHER GAINS TODAY

- Live Cattle (CME) currently at US$ 120.18 cents per pound, down 0.8% (YTD: +6.4%)

- Lean Hogs (CME) currently at US$ 105.65 cents per pound, down -5.8% (YTD: +50.3%)

- Rough Rice (CBOT) currently at US$ 13.23 cents per hundredweight, up 0.1% (YTD: +6.7%)

- Soybeans Composite (CBOT) currently at US$ 1,454.75 cents per bushel, up 0.5% (YTD: +10.6%)

- Corn (CBOT) currently at US$ 556.00 cents per bushel, down -1.5% (YTD: +14.9%)

- Wheat Composite (CBOT) currently at US$ 692.50 cents per bushel, up 3.1% (YTD: +8.1%)

- Sugar No.11 (ICE US) currently at US$ 17.66 cents per pound, up 2.2% (YTD: +14.3%)

- Cotton No.2 (ICE US) currently at US$ 90.67 cents per pound, up 1.0% (YTD: +16.1%)

- Cocoa (ICE US) currently at US$ 2,310 per tonne, down -0.9% (YTD: -10.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 3,900 per tonne, up 0.1% (YTD: +23.2%)

- Random Length Lumber (CME) currently at US$ 536.40 per 1,000 board feet, up 9.3% (YTD: -38.6%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,740 per tonne, up 1.8% (YTD: +7.0%)

- Soybean Oil Composite (CBOT) currently at US$ 68.31 cents per pound, up 1.5% (YTD: +57.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,293 per tonne, up 3.6% (YTD: +10.5%)

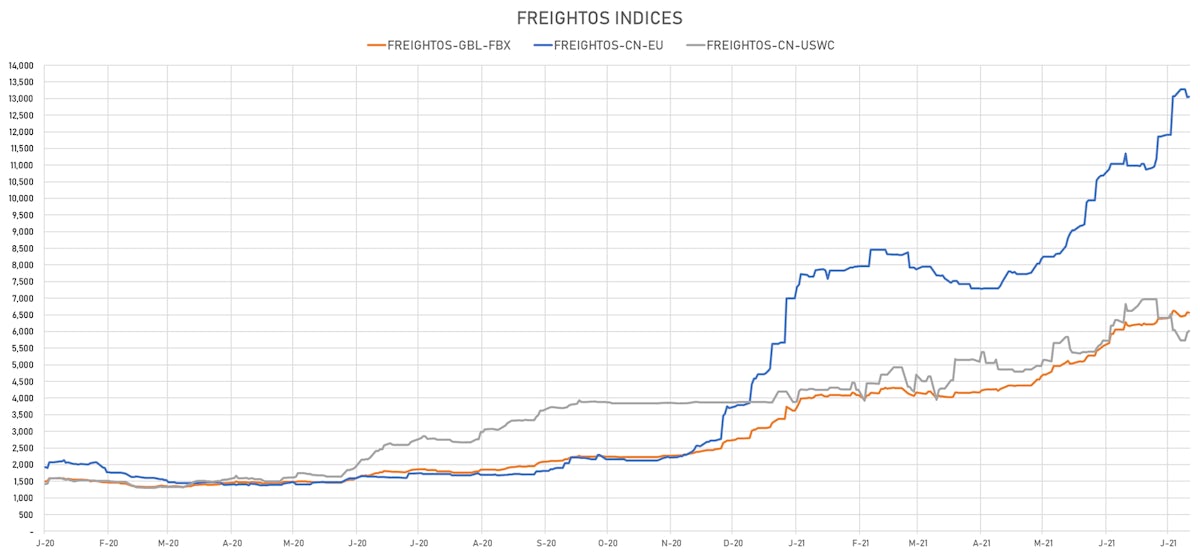

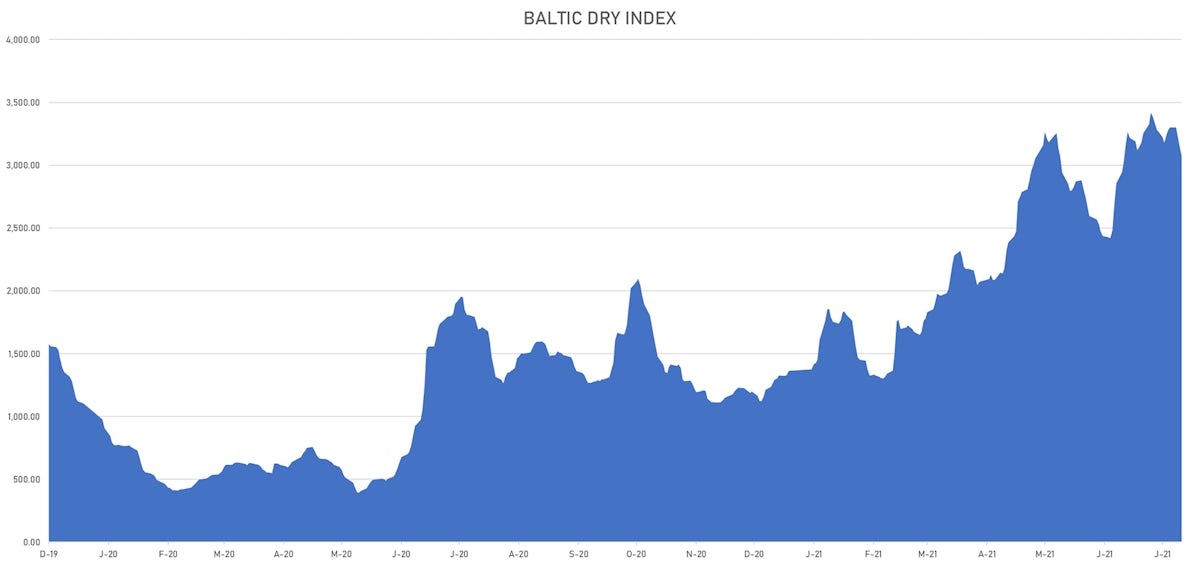

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,073, down -2.1% (YTD: +125.0%)

- Freightos China To North America West Coast Container Index currently at 6,023, up 0.9% (YTD: +43.4%)

- Freightos North America West Coast To China Container Index currently at 1,076, unchanged (YTD: +107.7%)

- Freightos North America East Coast To Europe Container Index currently at 697, unchanged (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,024, unchanged (YTD: +222.3%)

- Freightos China To North Europe Container Index currently at 13,055, up 0.1% (YTD: +130.6%)

- Freightos North Europe To China Container Index currently at 1,608, unchanged (YTD: +16.9%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

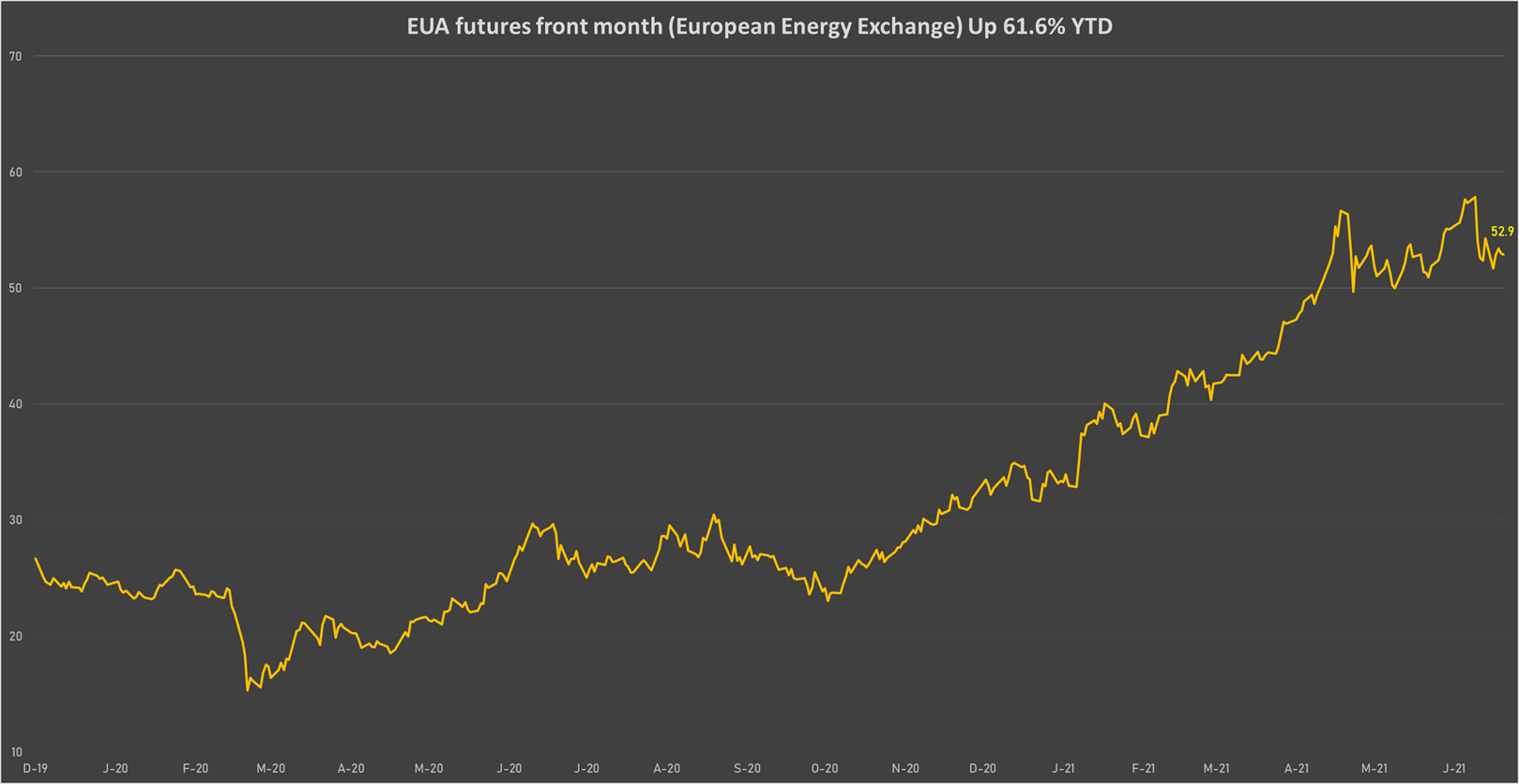

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.89 per tonne, down -0.2% (YTD: +61.6%)