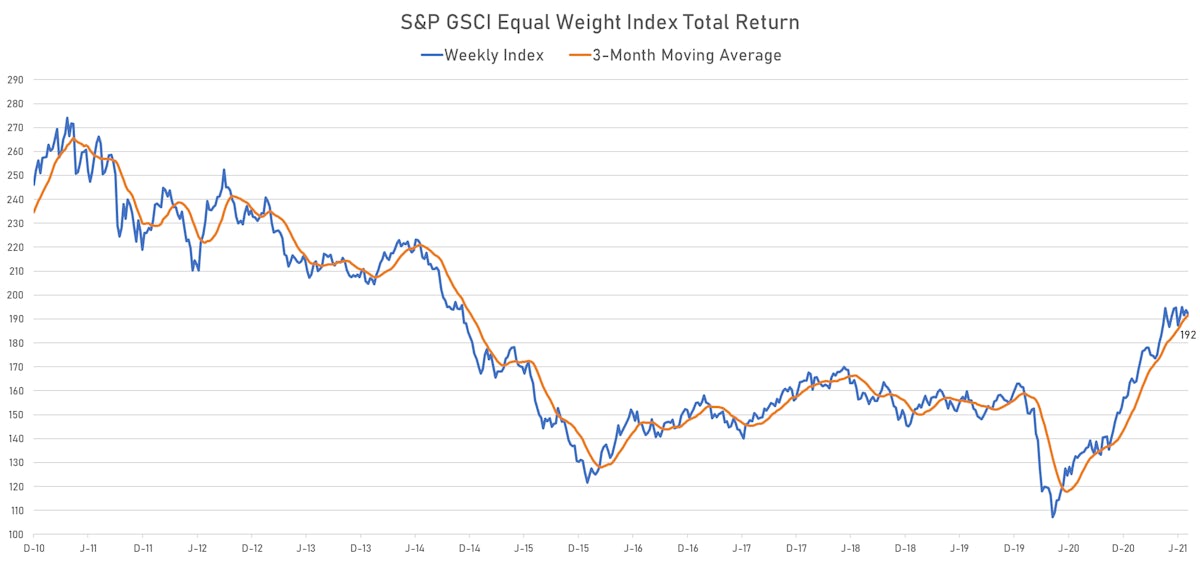

Commodities

Energy Commodities Jump, Brent Settles Back Above $72

Crude oil rose despite a bearish EIA weekly report, which showed an unexpected inventory build last week, with US refining capacity utilization declining

Published ET

Brent Crude Front-Month And 6-month Forward Futures + Backwardation | Source: Refinitiv

US EIA WEEKLY INVENTORY REPORT

- Total Crude Oil excluding SPR, Absolute change, Volume for W 16 Jul (EIA, United States) at 2.11 Mln, above consensus estimate of -4.47 Mln

- Total Distillate, Absolute change, Volume for W 16 Jul (EIA, United States) at -1.35 Mln, below consensus estimate of 0.56 Mln

- Gasoline, Absolute change, Volume for W 16 Jul (EIA, United States) at -0.12 Mln, above consensus estimate of -1.04 Mln

- Refinery Capacity Utilization, Absolute change, Volume for W 16 Jul (EIA, United States) at -0.40 %, below consensus estimate of 0.40 %

NOTABLE GAINERS TODAY

- CME Random Length Lumber up 7.7% (YTD: -33.1%)

- ICE-US Coffee up 6.2% (YTD: 37.2%)

- Coffee Arabica Colombia Excelso EP Spot up 5.2% (YTD: 29.2%)

- NYMEX Light Sweet Crude Oil (WTI) up 4.3% (YTD: 44.9%)

- ICE Europe Brent Crude up 4.2% (YTD: 39.4%)

- ICE Europe Low Sulphur Gasoil up 4.1% (YTD: 39.1%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 4.1% (YTD: 6.2%)

- NYMEX RBOB Gasoline up 4.0% (YTD: 57.4%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -2.5% (YTD: 17.0%)

- CBoT Soybean Oil down -2.3% (YTD: 51.1%)

- Gold/US Dollar 1 Month ATM Option IV down -2.2% (YTD: -17.5%)

- SHFE Bitumen down -1.7% (YTD: 28.5%)

- SGX Iron Ore 62% China CFR Swap Monthly down -0.8% (YTD: 39.5%)

- SHFE Zinc down -0.6% (YTD: 7.1%)

- Silver/US Dollar 1 Month ATM Option IV down -0.5% (YTD: -43.6%)

- SHFE Nickel down -0.5% (YTD: 11.6%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -0.5% (YTD: 40.1%)

- SHFE Stannum (Tin) down -0.4% (YTD: 51.0%)

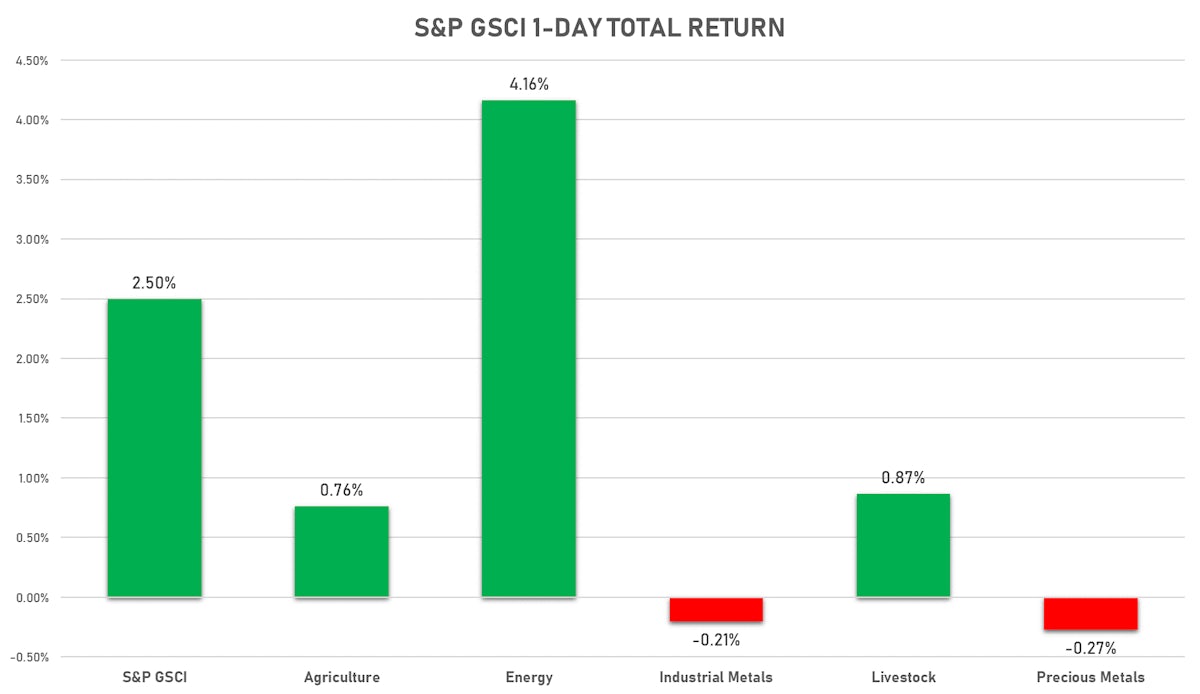

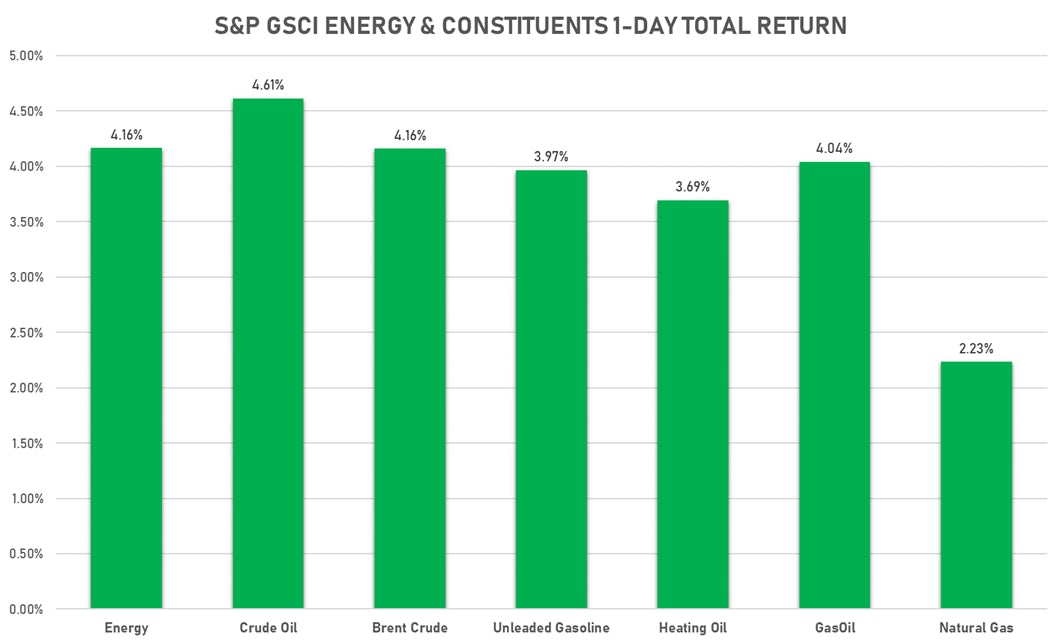

BIG GAINS IN ENERGY TODAY

- WTI crude front month currently at US$ 70.23 per barrel, up 4.3% (YTD: +44.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 72.15 per barrel, up 4.2% (YTD: +39.4%); 6-month term structure in widening backwardation

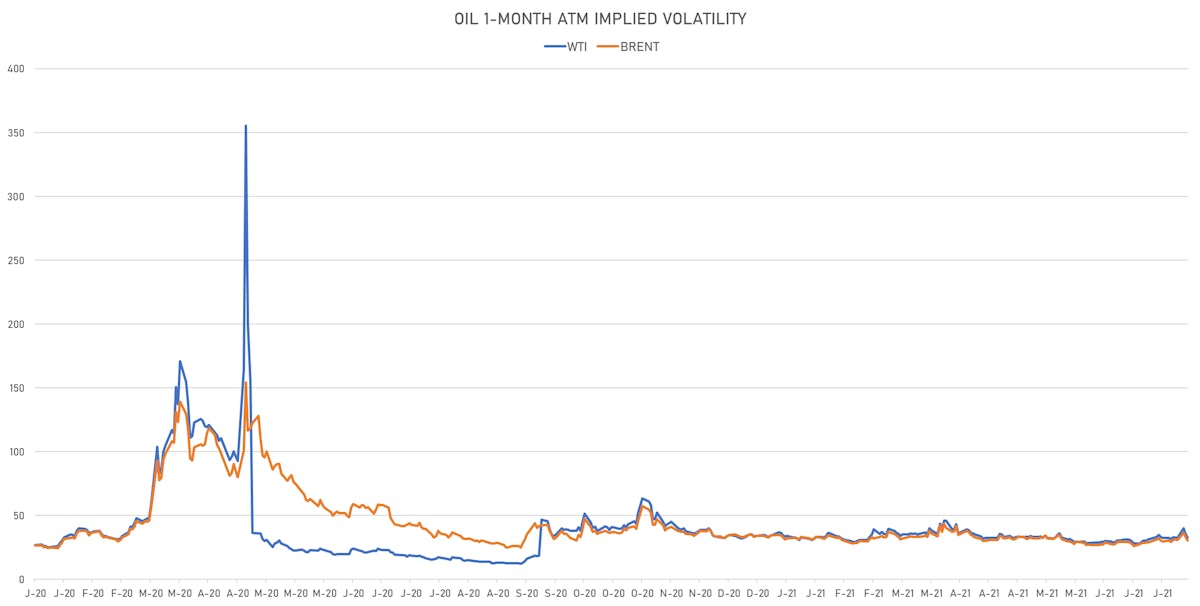

- Brent volatility at 30.2, down -8.7% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 149.75 per tonne, up 0.0% (YTD: +86.0%)

- Natural Gas (Henry Hub) currently at US$ 3.90 per MMBtu, up 2.1% (YTD: +55.9%)

- Gasoline (NYMEX) currently at US$ 2.21 per gallon, up 4.0% (YTD: +57.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 586.75 per tonne, up 4.1% (YTD: +39.1%)

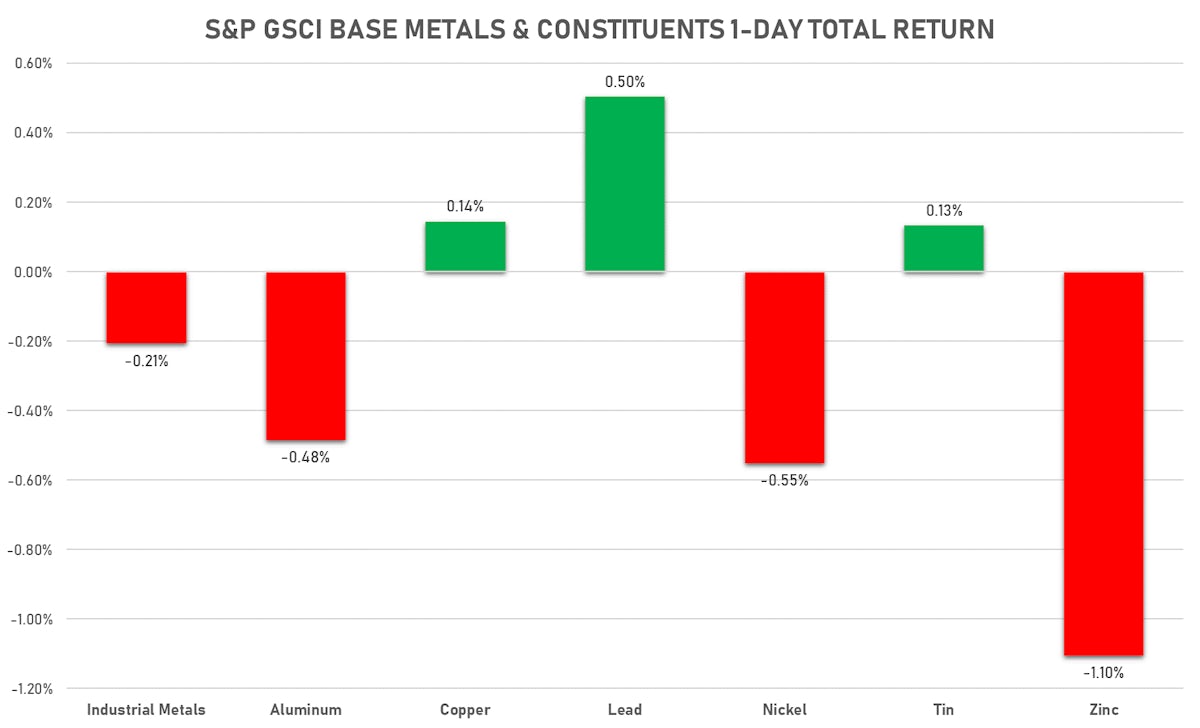

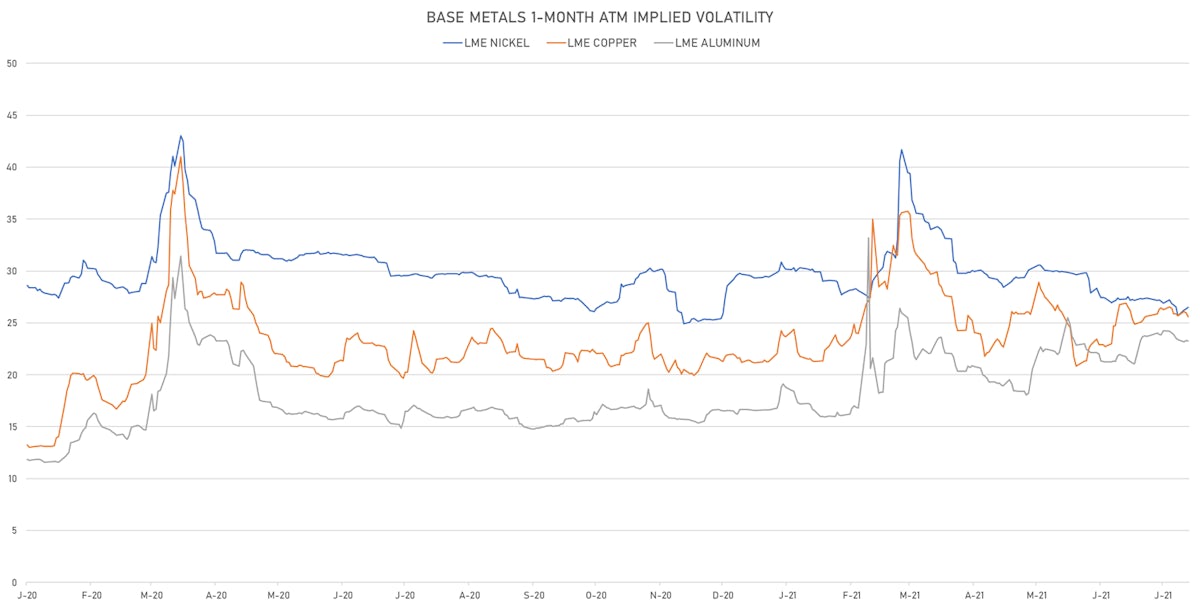

BASE METALS MIXED TODAY

- Copper (COMEX) currently at US$ 4.28 per pound, up 0.2% (YTD: +21.9%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,228.00 per tonne, down -2.5% (YTD: +17.0%)

- Aluminum (Shanghai) currently at CNY 19,095 per tonne, down -0.1% (YTD: +21.3%)

- Nickel (Shanghai) currently at CNY 138,950 per tonne, down -0.5% (YTD: +11.6%)

- Lead (Shanghai) currently at CNY 15,940 per tonne, up 0.9% (YTD: +7.2%)

- Rebar (Shanghai) currently at CNY 5,477 per tonne, up 0.9% (YTD: +30.6%)

- Tin (Shanghai) currently at CNY 225,700 per tonne, down -0.4% (YTD: +51.0%)

- Zinc (Shanghai) currently at CNY 22,180 per tonne, down -0.6% (YTD: +7.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

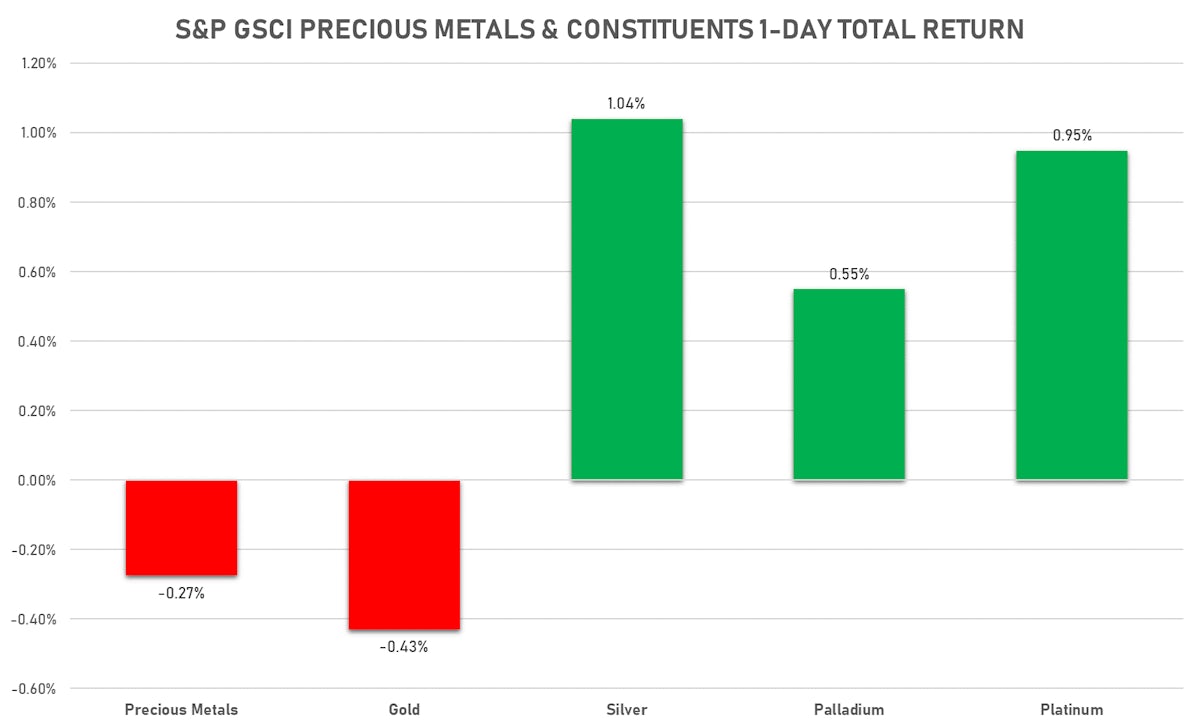

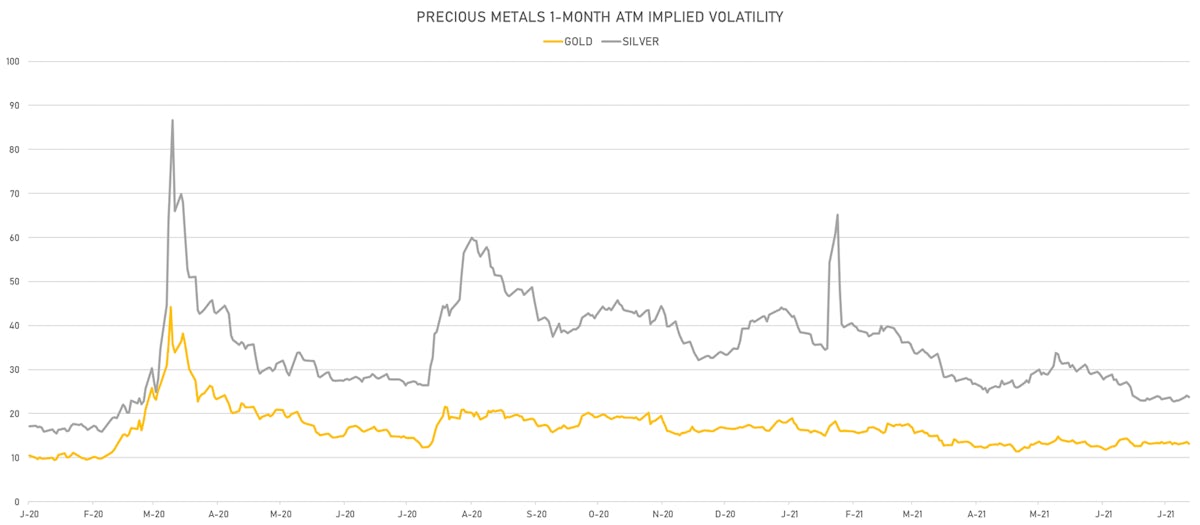

PRECIOUS METALS UP TODAY EXCEPT GOLD

- Gold spot currently at US$ 1,800.41 per troy ounce, down -0.4% (YTD: -5.0%)

- Gold 1-Month ATM implied volatility currently at 12.68, down -2.2% (YTD: -17.5%)

- Silver spot currently at US$ 25.20 per troy ounce, up 1.3% (YTD: -4.2%)

- Silver 1-Month ATM implied volatility currently at 22.98, down -0.5% (YTD: -43.6%)

- Palladium spot currently at US$ 2,659.92 per troy ounce, up 0.7% (YTD: +8.7%)

- Platinum spot currently at US$ 1,080.02 per troy ounce, up 1.5% (YTD: +1.2%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,700 per troy ounce, unchanged (YTD: +9.7%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

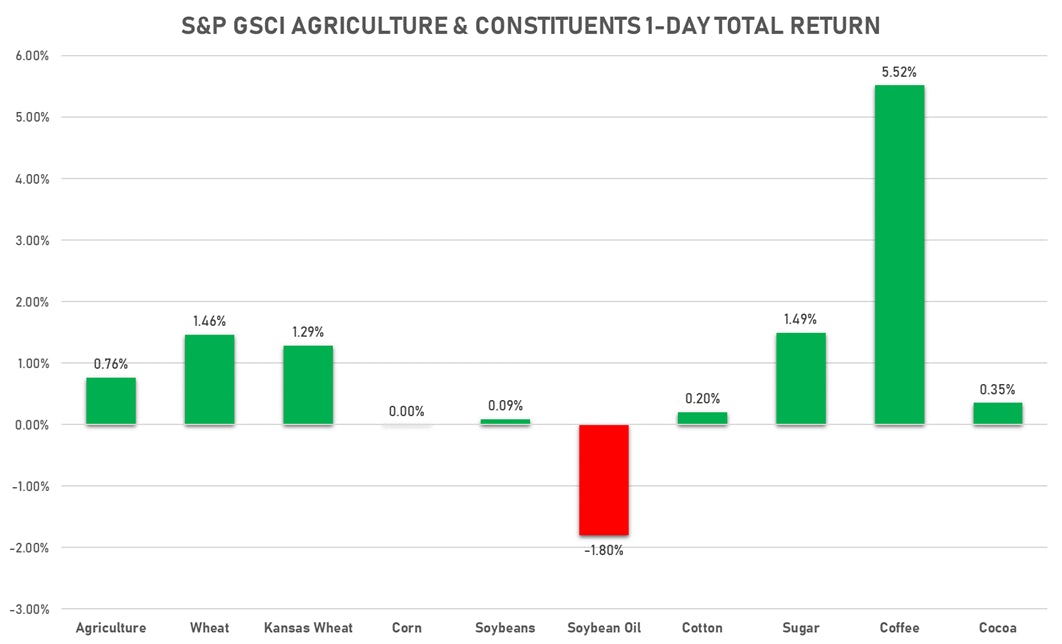

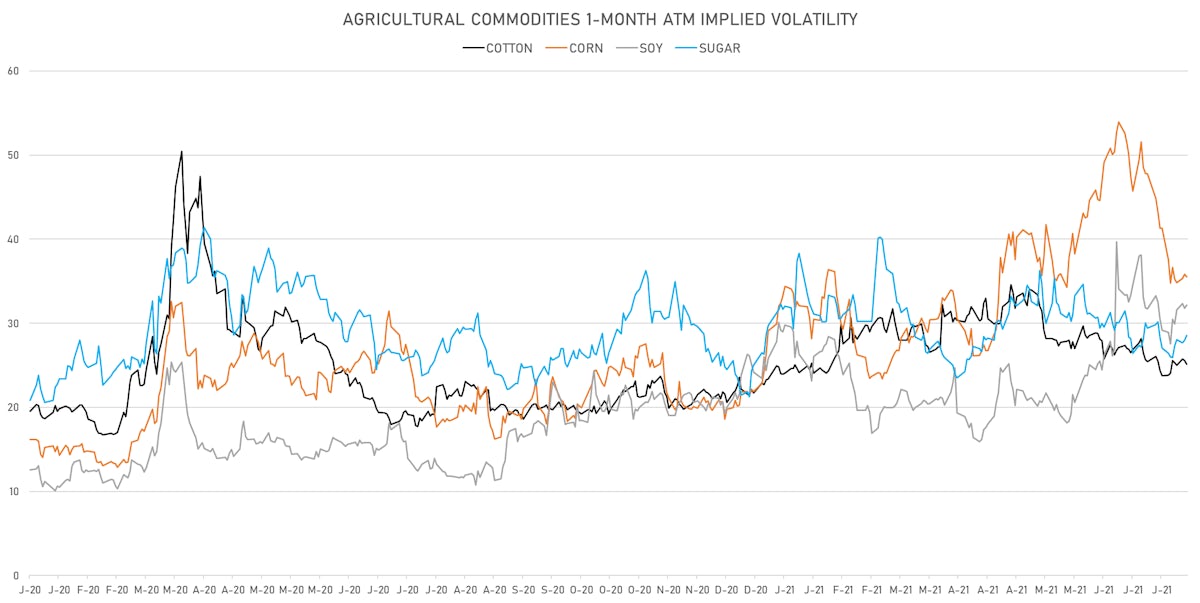

AGS MOSTLY GREEN TODAY

- Live Cattle (CME) currently at US$ 120.05 cents per pound, up 0.2% (YTD: +6.3%)

- Lean Hogs (CME) currently at US$ 106.58 cents per pound, up 1.5% (YTD: +51.7%)

- Rough Rice (CBOT) currently at US$ 13.31 cents per hundredweight, up 0.9% (YTD: +7.3%)

- Soybeans Composite (CBOT) currently at US$ 1,429.75 cents per bushel, down -0.3% (YTD: +9.4%)

- Corn (CBOT) currently at US$ 566.75 cents per bushel, down 0.0% (YTD: +18.1%)

- Wheat Composite (CBOT) currently at US$ 704.75 cents per bushel, up 1.5% (YTD: +11.0%)

- Sugar No.11 (ICE US) currently at US$ 17.67 cents per pound, up 1.5% (YTD: +14.1%)

- Cotton No.2 (ICE US) currently at US$ 89.09 cents per pound, up 0.2% (YTD: +14.0%)

- Cocoa (ICE US) currently at US$ 2,265 per tonne, up 0.4% (YTD: -13.0%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,089 per tonne, up 5.2% (YTD: +29.2%)

- Random Length Lumber (CME) currently at US$ 584.00 per 1,000 board feet, up 7.7% (YTD: -33.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,465 per tonne, up 0.2% (YTD: +3.1%)

- Soybean Oil Composite (CBOT) currently at US$ 65.17 cents per pound, down -2.3% (YTD: +51.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,395 per tonne, up 1.3% (YTD: +13.0%)

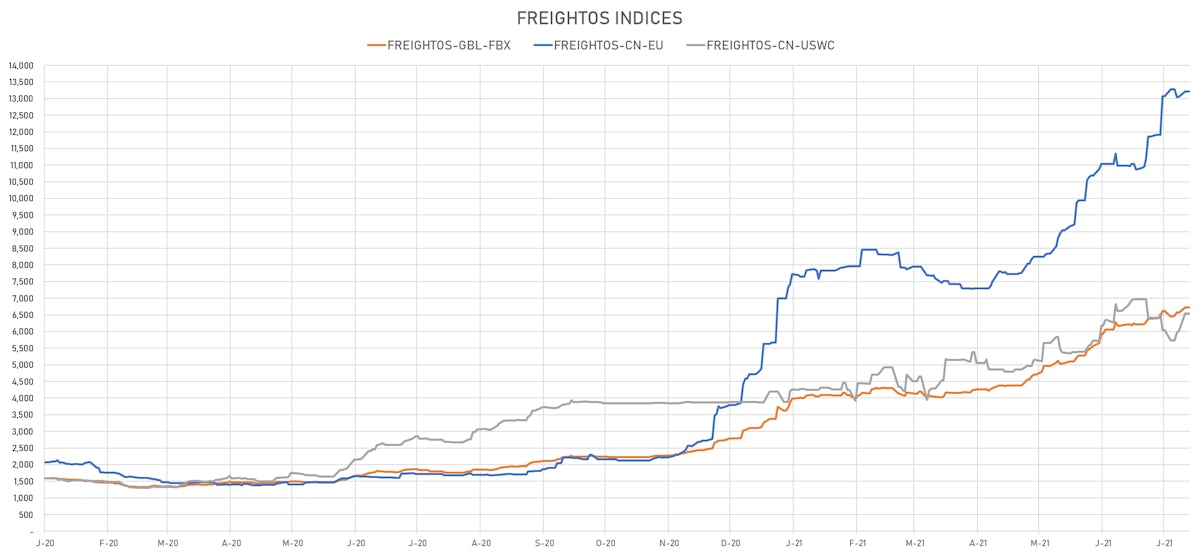

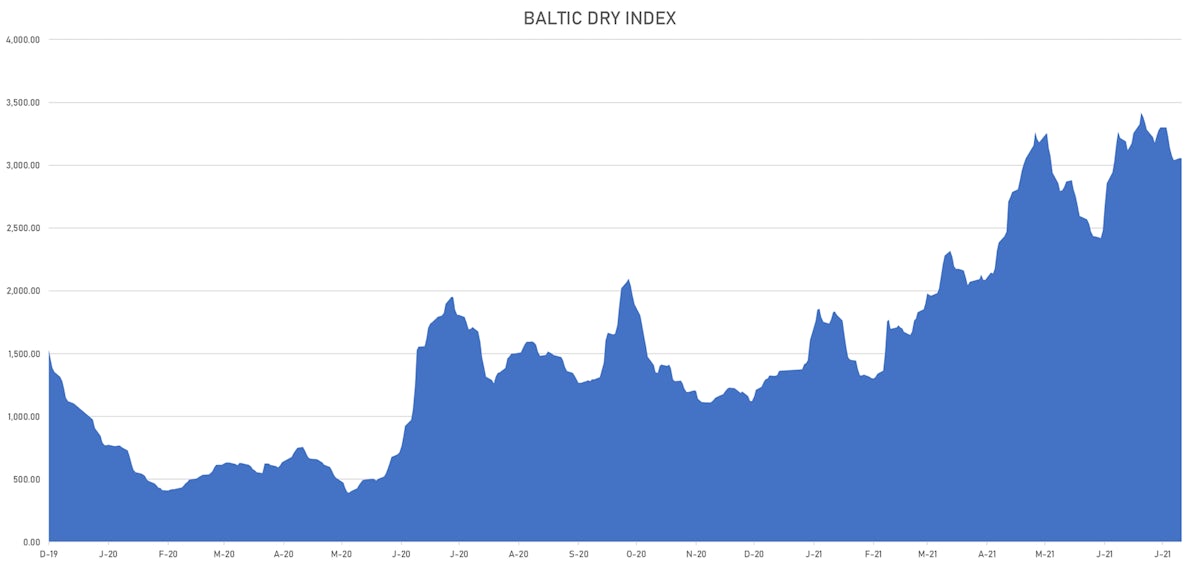

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,053, down -0.2% (YTD: +123.5%)

- Freightos China To North America West Coast Container Index currently at 6,540, unchanged (YTD: +55.7%)

- Freightos North America West Coast To China Container Index currently at 1,076, unchanged (YTD: +107.7%)

- Freightos North America East Coast To Europe Container Index currently at 697, unchanged (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,013, unchanged (YTD: +221.7%)

- Freightos China To North Europe Container Index currently at 13,209, unchanged (YTD: +133.3%)

- Freightos North Europe To China Container Index currently at 1,617, unchanged (YTD: +17.6%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

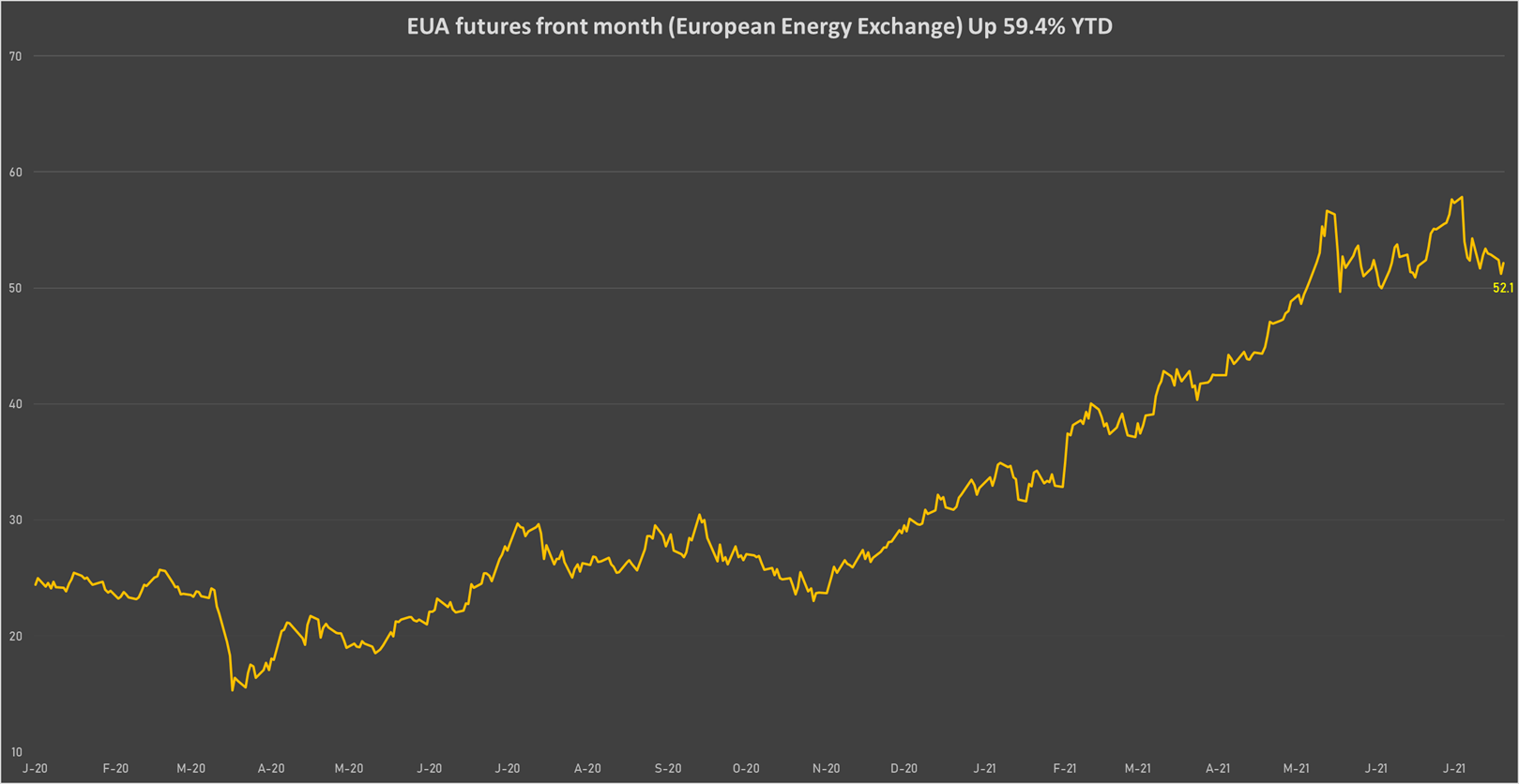

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 52.14 per tonne, up 1.8% (YTD: +59.4%)