Commodities

Energy And Base Metals Rise On Lower-For-Longer Impetus

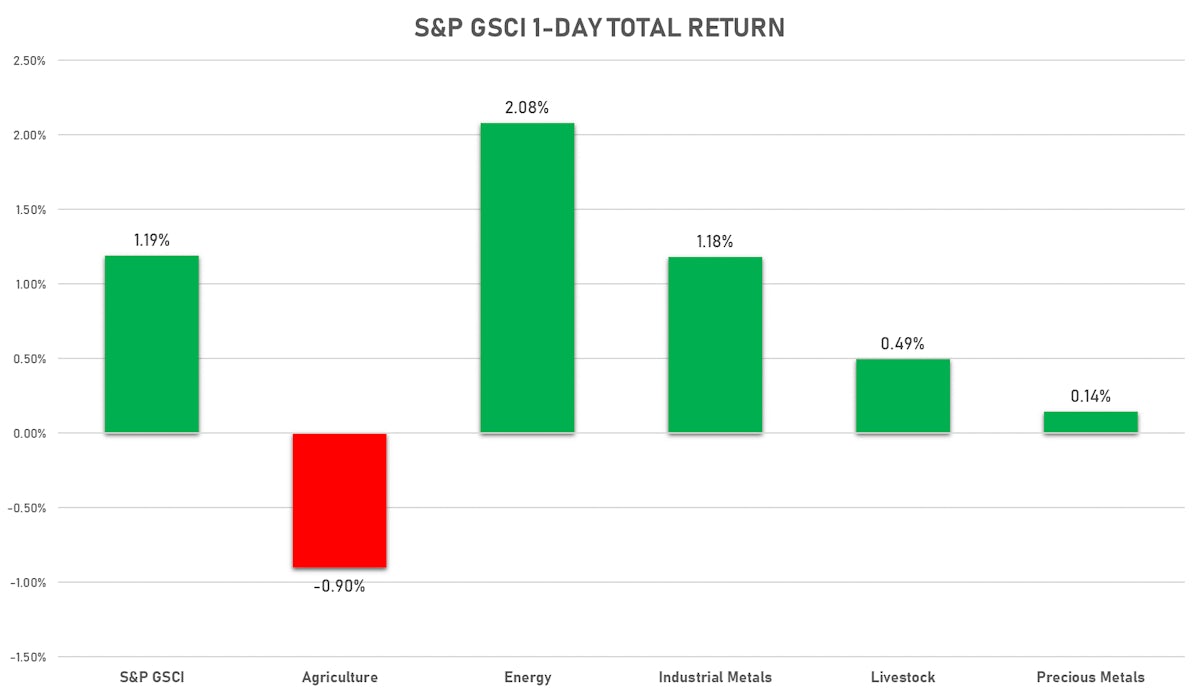

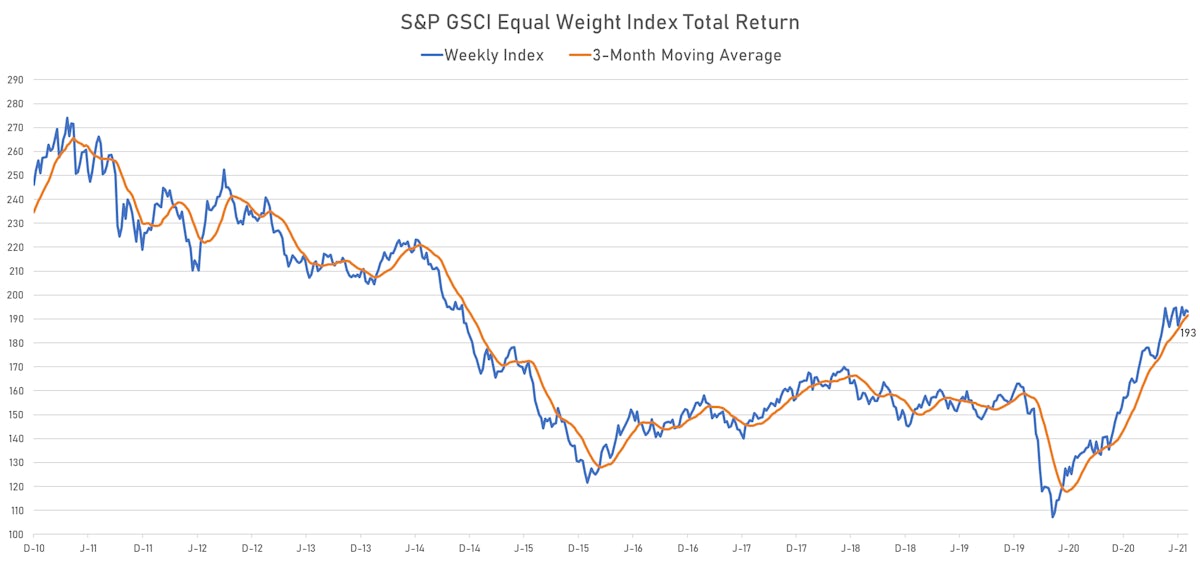

Disappointing macro data led to a fall in US rates, while the ECB extended their dovish stance on forward rates, both seen as stimulative for commodities demand

Published ET

S&P GSCI Total Return Index Performance | Sources: ϕpost, FactSet data

HEADLINES & MACRO

- EIA reports higher than expected natural gas inventory build: Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 16 Jul (EIA, United States) at 49.00 bcf, above consensus estimate of 44.00 bcf

NOTABLE GAINERS TODAY

- CME Random Length Lumber up 10.8% (YTD: -25.9%)

- ICE-US Coffee up 10.0% (YTD: 51.0%)

- SMM Rare Earth Terbium Metal Spot Price Daily up 4.8% (YTD: 8.5%)

- Coffee Arabica Colombia Excelso EP Spot up 4.5% (YTD: 35.0%)

- DCE Coke up 4.4% (YTD: -3.7%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 3.4% (YTD: 114.9%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily up 3.1% (YTD: 36.2%)

- Crude Oil WTI Cushing US FOB up 2.7% (YTD: 49.2%)

- NYMEX RBOB Gasoline up 2.5% (YTD: 61.4%)

- Palladium spot up 2.3% (YTD: 11.2%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -3.6% (YTD: 12.8%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index down -3.2% (YTD: 89.2%)

- Silver/US Dollar 1 Month ATM Option IV down -2.6% (YTD: -45.1%)

- CBoT Wheat down -2.6% (YTD: 8.1%)

- EEX European-Carbon- Secondary Trading down -2.6% (YTD: 58.2%)

- Gold/US Dollar 1 Month ATM Option IV down -2.4% (YTD: -19.5%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -2.1% (YTD: 37.2%)

- CBoT Soybean Meal down -1.8% (YTD: -16.4%)

- SGX Iron Ore 62% China CFR Swap Monthly down -1.6% (YTD: 37.3%)

- CBoT Soybeans down -1.6% (YTD: 7.7%)

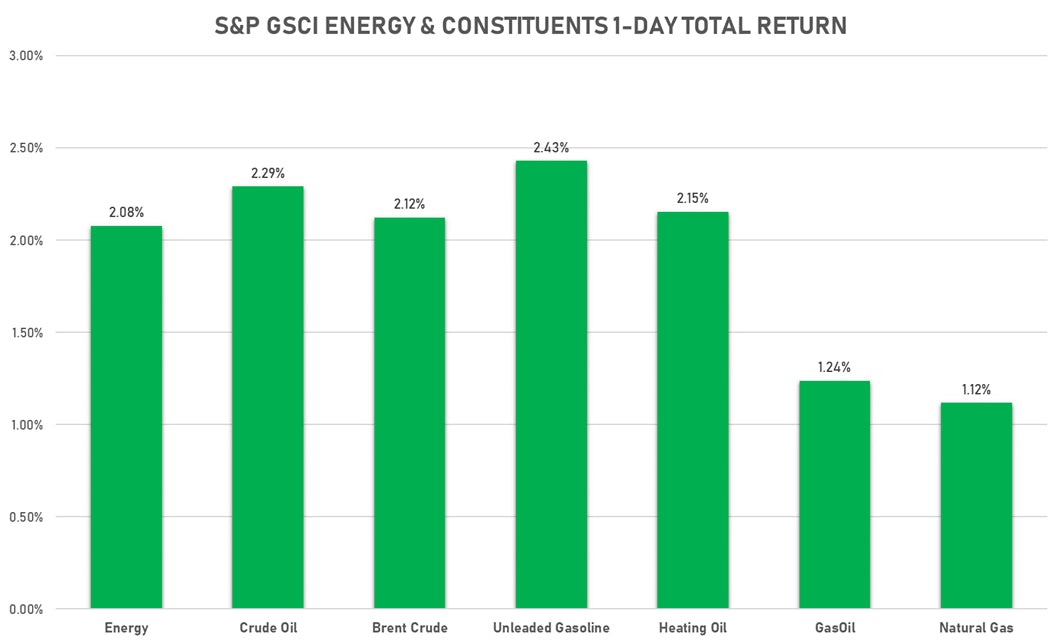

ENERGY TODAY

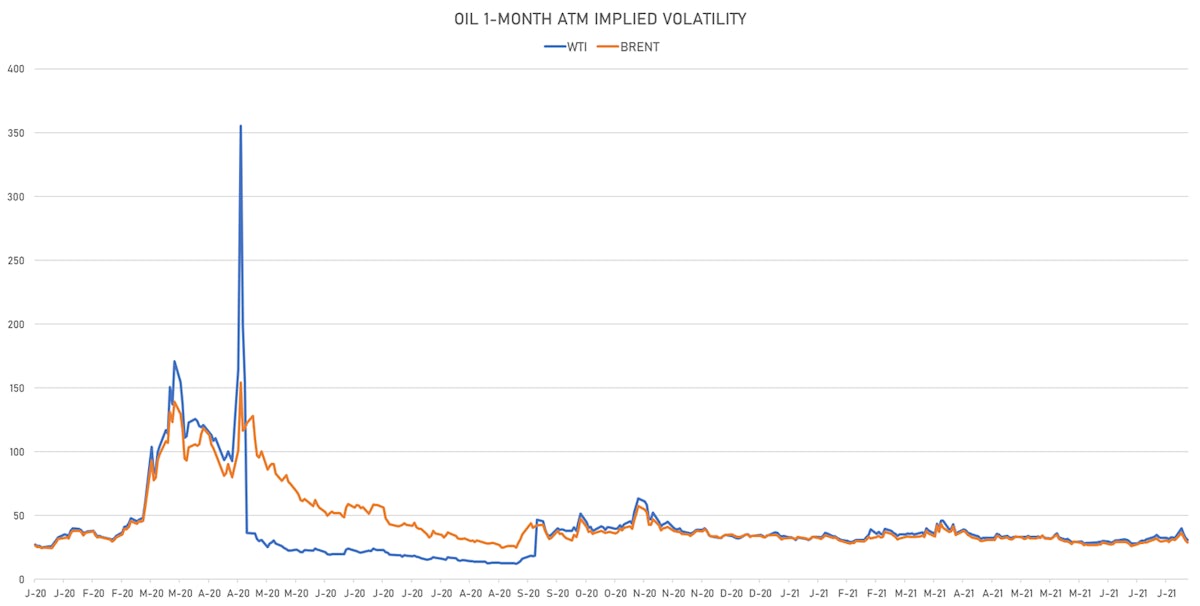

- WTI crude front month currently at US$ 71.84 per barrel, up 2.3% (YTD: +48.2%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 73.74 per barrel, up 2.2% (YTD: +42.5%); 6-month term structure in widening backwardation

- Brent volatility at 28.6, down -5.3% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) unchanged at US$ 149.75 per tonne (YTD: +86.0%)

- Natural Gas (Henry Hub) currently at US$ 4.01 per MMBtu, up 1.1% (YTD: +57.7%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, up 2.5% (YTD: +61.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 600.00 per tonne, up 1.2% (YTD: +40.8%)

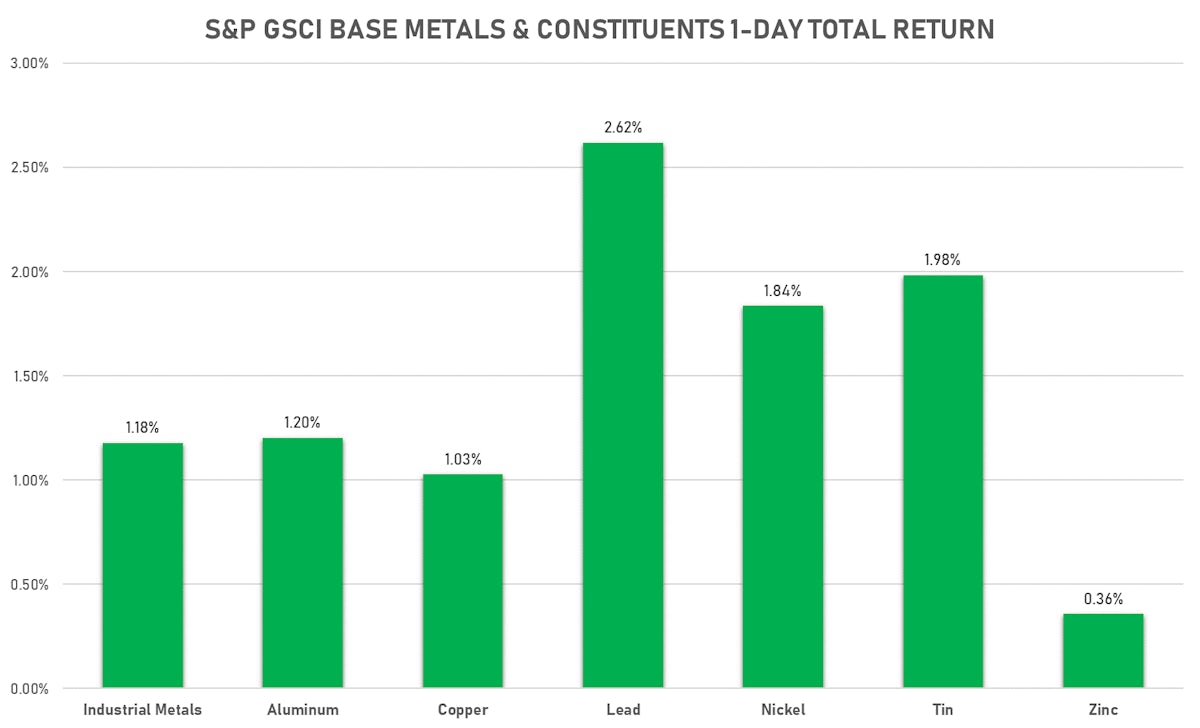

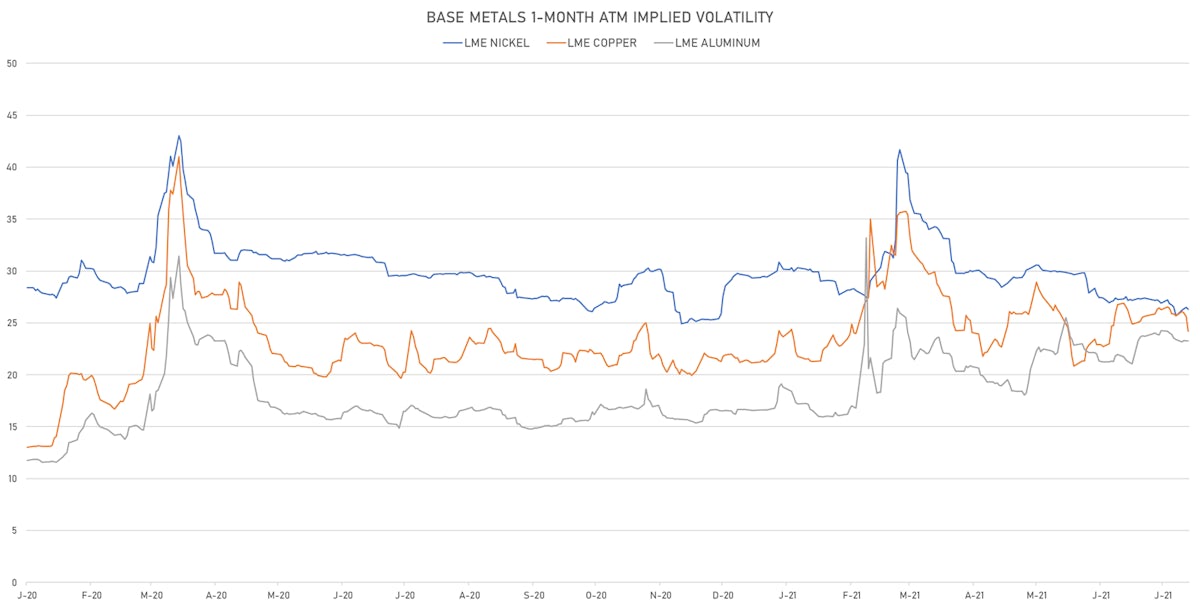

BASE METALS TODAY

- Copper (COMEX) currently at US$ 4.35 per pound, up 1.5% (YTD: +23.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,198.00 per tonne, down -3.6% (YTD: +12.8%)

- Aluminum (Shanghai) currently at CNY 19,275 per tonne, up 0.3% (YTD: +21.7%)

- Nickel (Shanghai) currently at CNY 140,580 per tonne, up 0.1% (YTD: +11.8%)

- Lead (Shanghai) currently at CNY 16,230 per tonne, up 0.8% (YTD: +8.1%)

- Rebar (Shanghai) currently at CNY 5,596 per tonne, up 0.2% (YTD: +30.8%)

- Tin (Shanghai) currently at CNY 231,400 per tonne, down -0.6% (YTD: +50.1%)

- Zinc (Shanghai) currently at CNY 22,130 per tonne, down -0.8% (YTD: +6.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

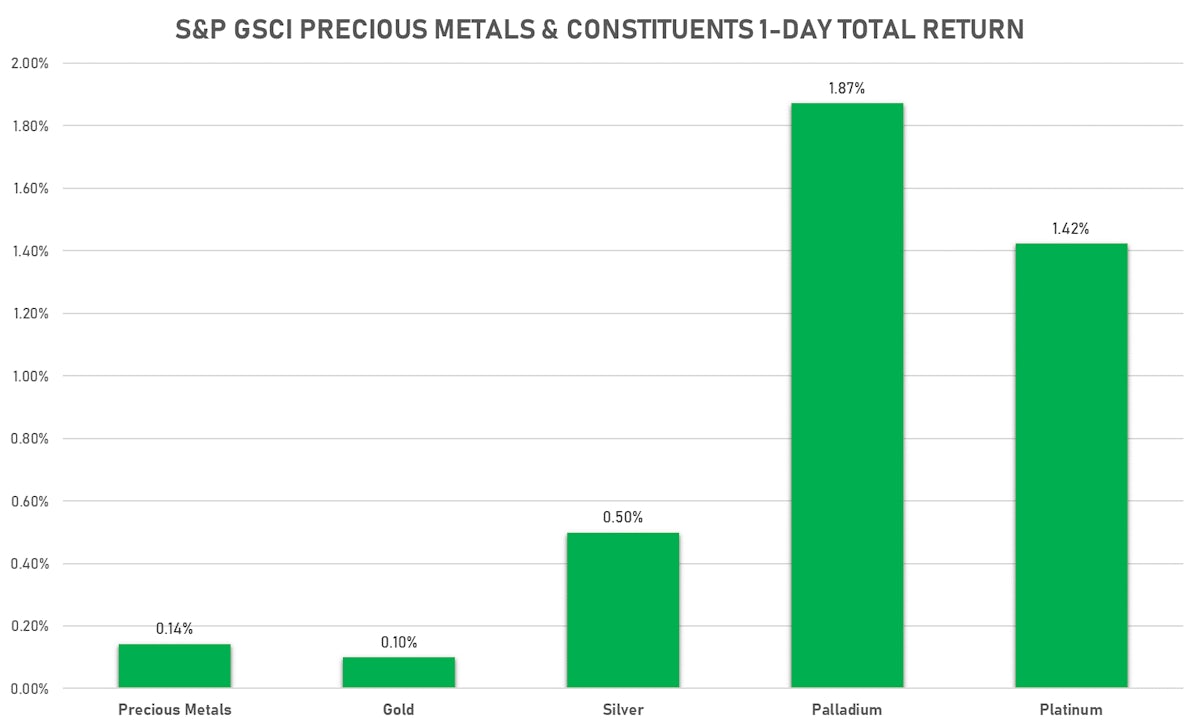

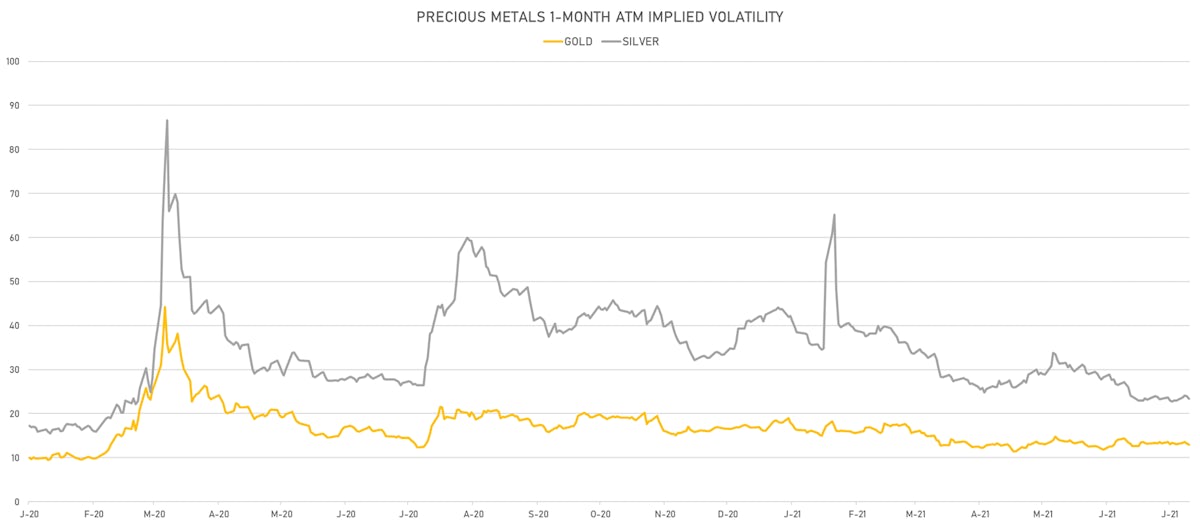

PRECIOUS METALS TODAY

- Gold spot currently at US$ 1,806.69 per troy ounce, up 0.2% (YTD: -4.8%)

- Gold 1-Month ATM implied volatility currently at 12.52, down -2.4% (YTD: -19.5%)

- Silver spot currently at US$ 25.41 per troy ounce, up 0.6% (YTD: -3.7%)

- Silver 1-Month ATM implied volatility currently at 22.38, down -2.6% (YTD: -45.1%)

- Palladium spot currently at US$ 2,724.58 per troy ounce, up 2.3% (YTD: +11.2%)

- Platinum spot currently at US$ 1,093.68 per troy ounce, up 1.0% (YTD: +2.2%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,600 per troy ounce, down -0.5% (YTD: +9.1%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

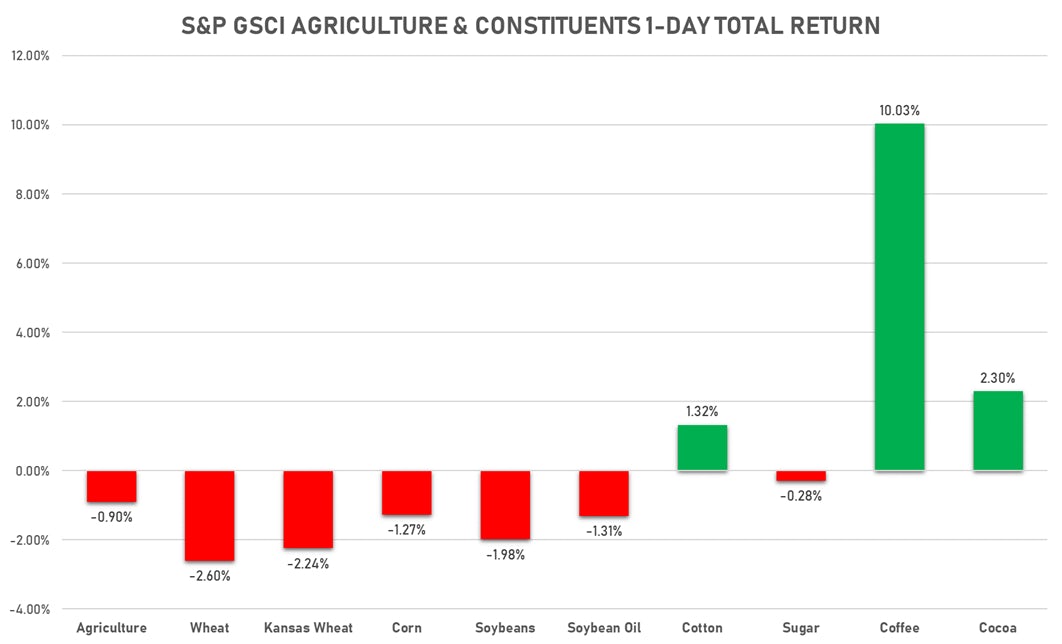

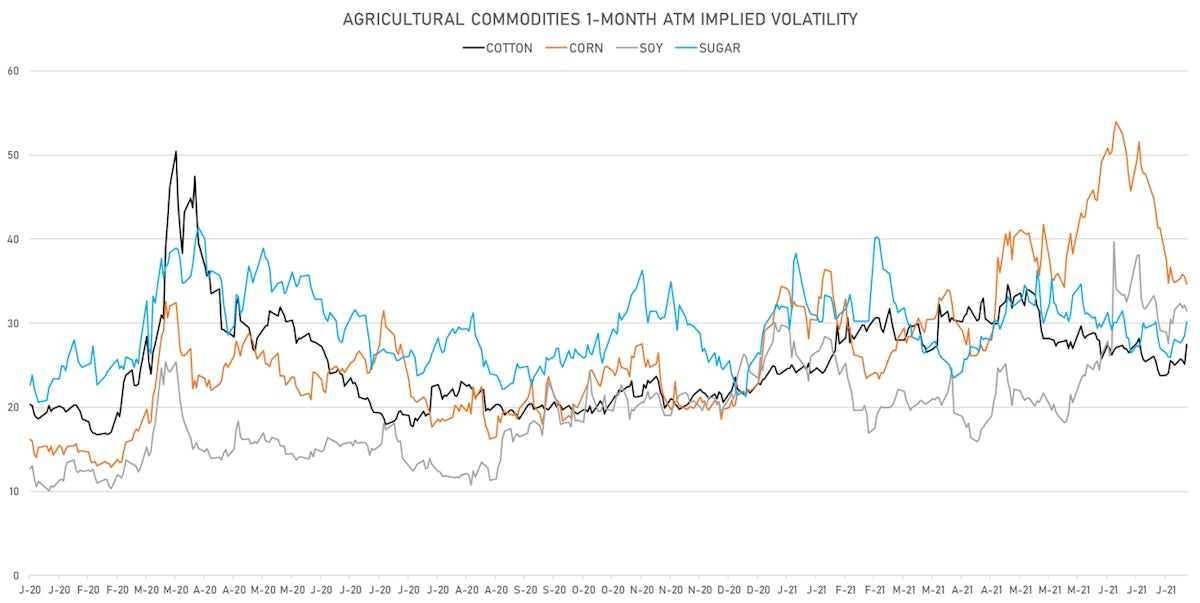

AGS TODAY

- Live Cattle (CME) currently at US$ 120.80 cents per pound, up 0.6% (YTD: +6.9%)

- Lean Hogs (CME) currently at US$ 106.65 cents per pound, up 0.1% (YTD: +51.8%)

- Rough Rice (CBOT) currently at US$ 13.54 cents per hundredweight, up 1.7% (YTD: +9.2%)

- Soybeans Composite (CBOT) currently at US$ 1,408.50 cents per bushel, down -1.6% (YTD: +7.7%)

- Corn (CBOT) currently at US$ 564.50 cents per bushel, down -1.3% (YTD: +16.6%)

- Wheat Composite (CBOT) currently at US$ 688.25 cents per bushel, down -2.6% (YTD: +8.1%)

- Sugar No.11 (ICE US) currently at US$ 17.62 cents per pound, down -0.3% (YTD: +13.8%)

- Cotton No.2 (ICE US) currently at US$ 90.27 cents per pound, up 1.3% (YTD: +15.6%)

- Cocoa (ICE US) currently at US$ 2,317 per tonne, up 2.3% (YTD: -11.0%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,274 per tonne, up 4.5% (YTD: +35.0%)

- Random Length Lumber (CME) currently at US$ 647.00 per 1,000 board feet, up 10.8% (YTD: -25.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,490 per tonne, up 1.4% (YTD: +4.5%)

- Soybean Oil Composite (CBOT) currently at US$ 64.64 cents per pound, down -0.7% (YTD: +50.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,432 per tonne, up 0.8% (YTD: +13.9%)

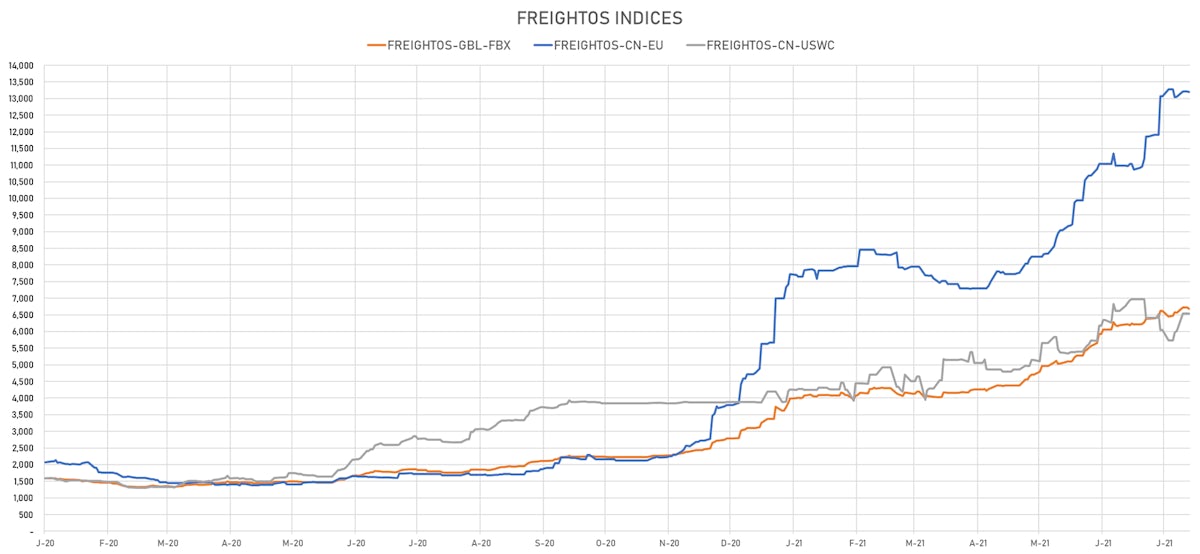

SHIPPING TODAY

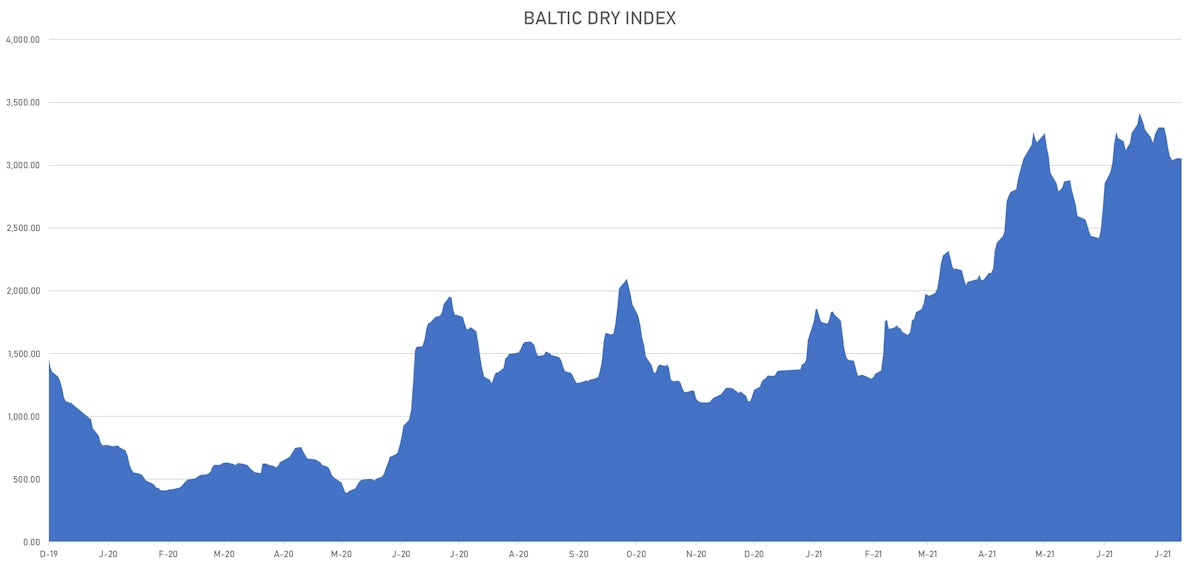

- Baltic Dry Index (Baltic Exchange) currently at 3,058, up 0.2% (YTD: +123.9%)

- Freightos China To North America West Coast Container Index currently at 6,547, up 0.1% (YTD: +55.9%)

- Freightos North America West Coast To China Container Index currently at 1,112, up 3.4% (YTD: +114.9%)

- Freightos North America East Coast To Europe Container Index currently at 697, unchanged (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,013, unchanged (YTD: +221.7%)

- Freightos China To North Europe Container Index currently at 13,202, down -0.1% (YTD: +133.2%)

- Freightos North Europe To China Container Index currently at 1,617, unchanged (YTD: +17.6%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

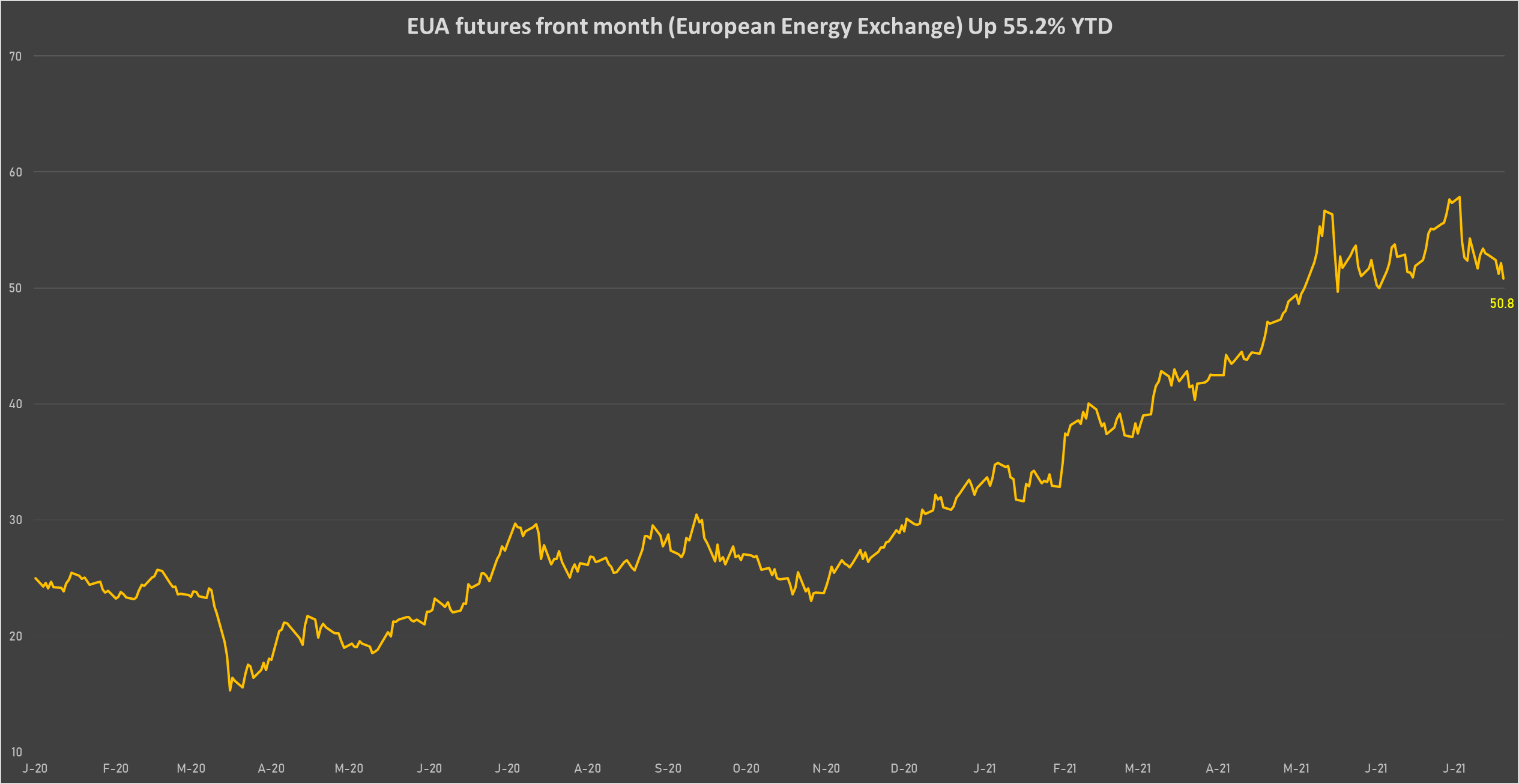

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 50.79 per tonne, down -2.6% (YTD: +55.2%)