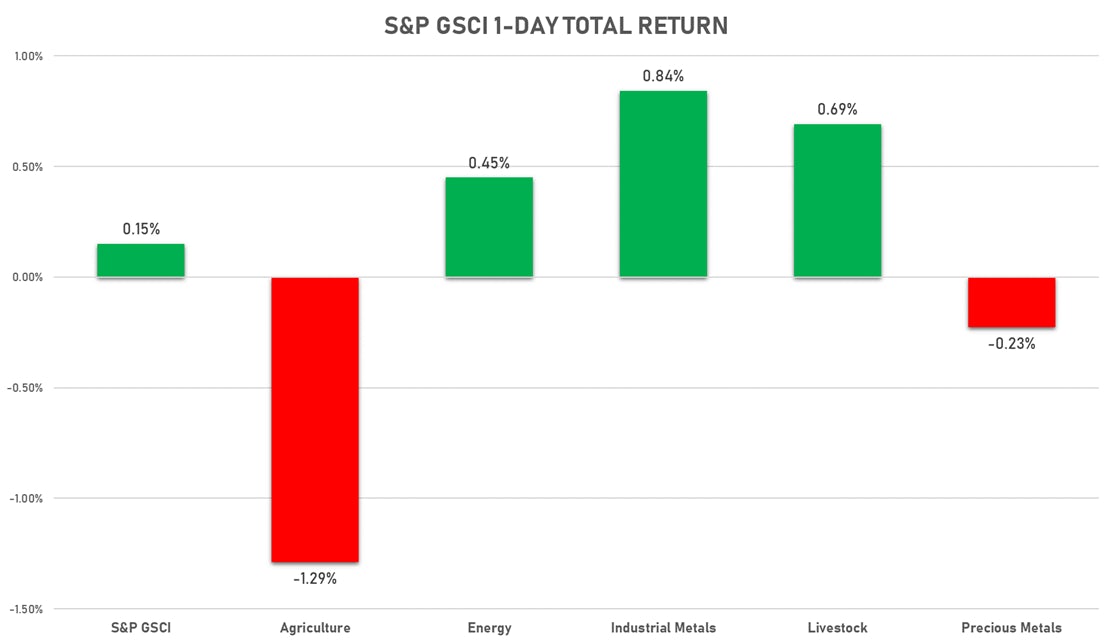

Commodities

Energy Commodities And Base Metals Rise Further

Natural Gas settled above $4, as hot summer weather and growing Asian demand pushed prices up 11% this week

Published ET

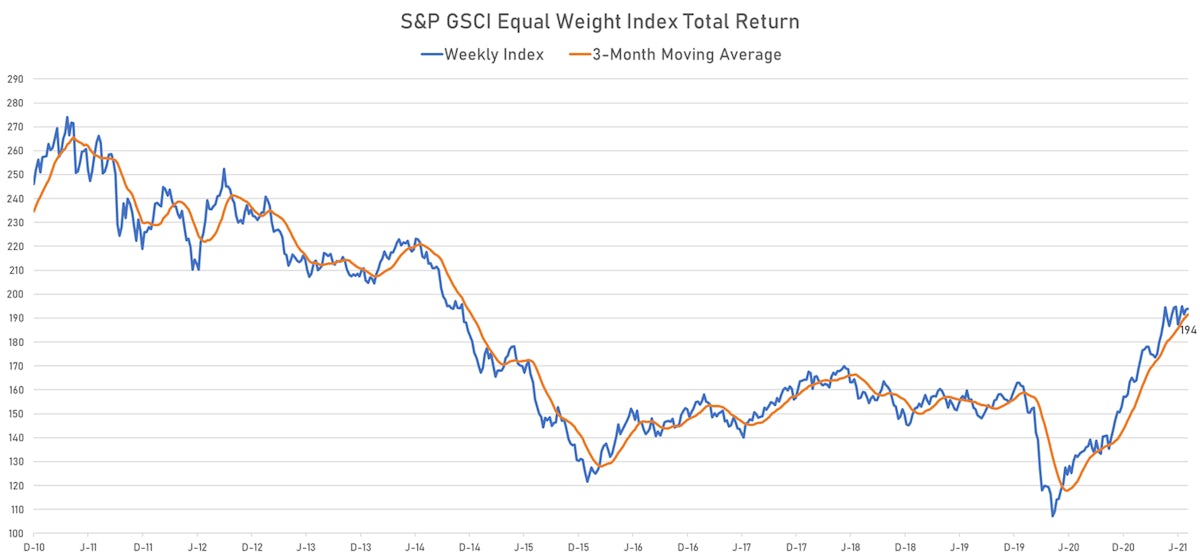

S&P GSCI Sub-Indices Performance Over The Past 10 Years | Sources: ϕpost, FactSet data

BAKER HUGHES NORTH AMERICAN RIG COUNT

- US rig count +7 to 491 in latest week and +240 year on year

- Land-based rigs +7 to 473 in latest week and +234 year on year

- Offshore unchanged at 17 in latest week and +5 year on year

- Oil +7 to 387 in latest week and +206 year on year

- Gas unchanged at 104 in latest week and +36 year on year

NOTABLE GAINERS TODAY

- Coffee Arabica Colombia Excelso EP Spot up 7.6% (YTD: 45.3%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 5.4% (YTD: 27.2%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 4.5% (YTD: 124.5%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 3.6% (YTD: 95.8%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index up 3.5% (YTD: 95.9%)

- ICE-US Sugar No. 11 up 3.1% (YTD: 17.3%)

- SHFE Stannum up 2.9% (YTD: 54.4%)

- DCE RBD Palm Oil up 2.8% (YTD: 18.6%)

- Bursa Malaysia Crude Palm Oil up 2.5% (YTD: 16.7%)

- SHFE Nickel up 2.3% (YTD: 14.3%)

- SHFE Lead up 1.9% (YTD: 10.1%)

NOTABLE LOSERS TODAY

- CBoT Corn down -3.1% (YTD: 13.1%)

- Platinum spot down -2.8% (YTD: -0.7%)

- CBoT Soybean Meal down -2.6% (YTD: -18.6%)

- Pork Primal Cutout Butt down -2.6% (YTD: 27.3%)

- ICE-US Coffee down -2.4% (YTD: 47.4%)

- CME Random Length Lumber down -2.0% (YTD: -27.4%)

- DCE Iron Ore down -1.8% (YTD: 10.8%)

- Palladium spot down -1.7% (YTD: 9.3%)

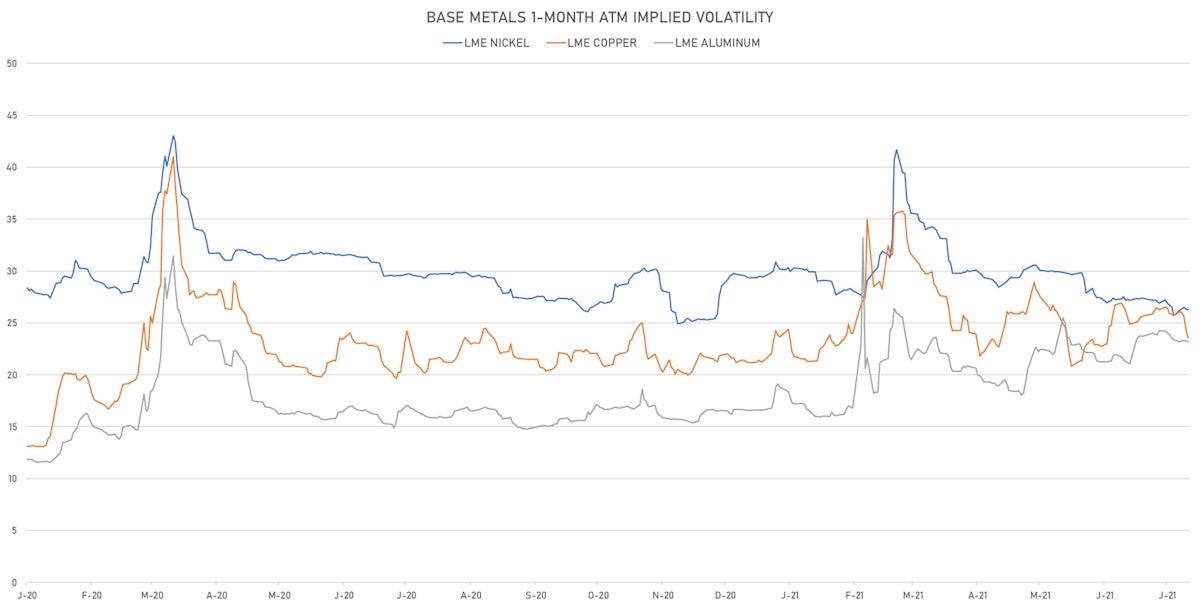

- Silver/US Dollar 1 Month ATM Option IV down -1.4% (YTD: -45.8%)

- Gold/US Dollar 1 Month ATM Option IV down -1.3% (YTD: -20.5%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily down -1.2% (YTD: 39.0%)

- CBoT Wheat down -1.2% (YTD: 6.8%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline Rbob reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver reduced net long position

- Platinum reduced net long position

- Palladium reduced net long position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net short position

- Corn increased net long position

- Rough Rice reduced net short position

- Oats turned to net long

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs increased net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa increased net short position

- Coffee C increased net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

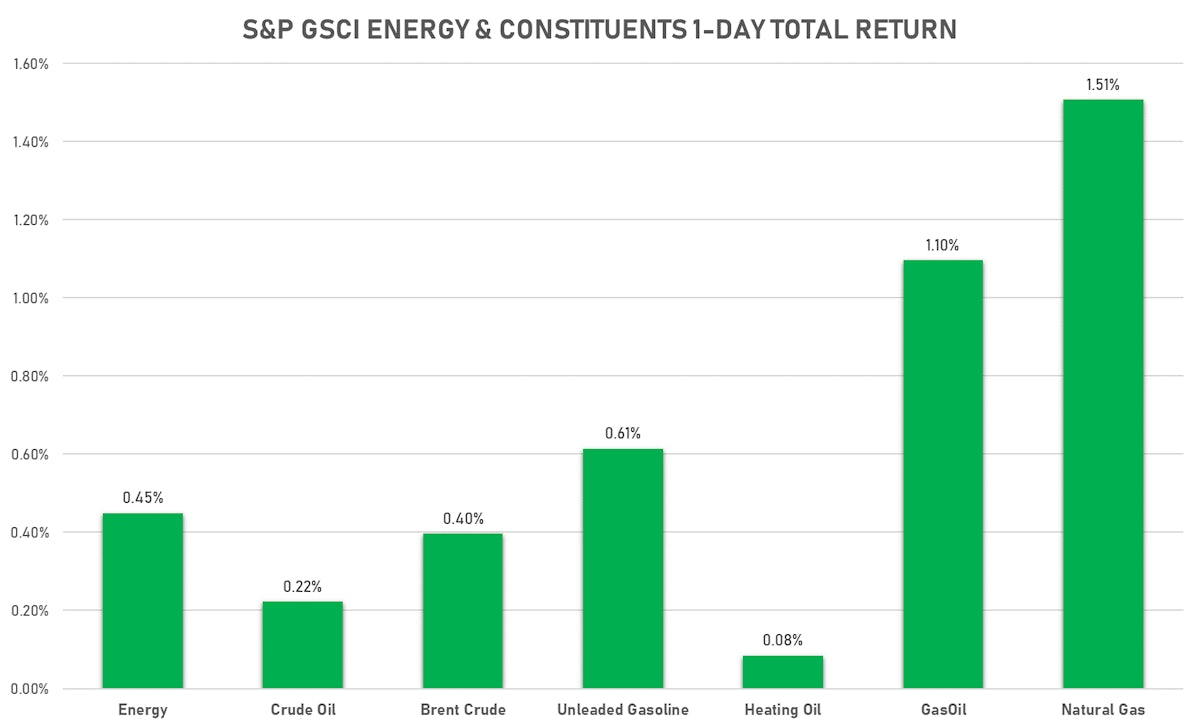

ENERGY UP AGAIN TODAY

- WTI crude front month currently at US$ 72.07 per barrel, up 0.2% (YTD: +48.5%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 74.10 per barrel, up 0.4% (YTD: +43.1%); 6-month term structure in widening backwardation

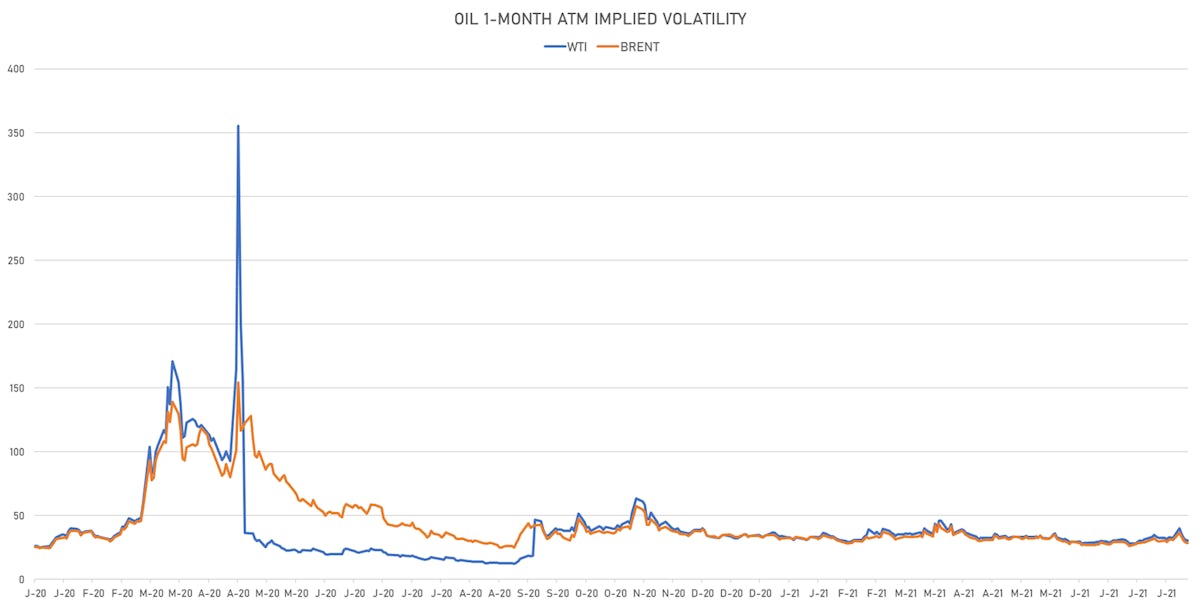

- Brent volatility at 28.5, down -0.4% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) unchanged at US$ 149.75 per tonne (YTD: +86.0%)

- Natural Gas (Henry Hub) currently at US$ 4.06 per MMBtu, up 1.4% (YTD: +59.9%)

- Gasoline (NYMEX) currently at US$ 2.29 per gallon, up 0.8% (YTD: +62.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 599.00 per tonne, up 1.1% (YTD: +42.4%)

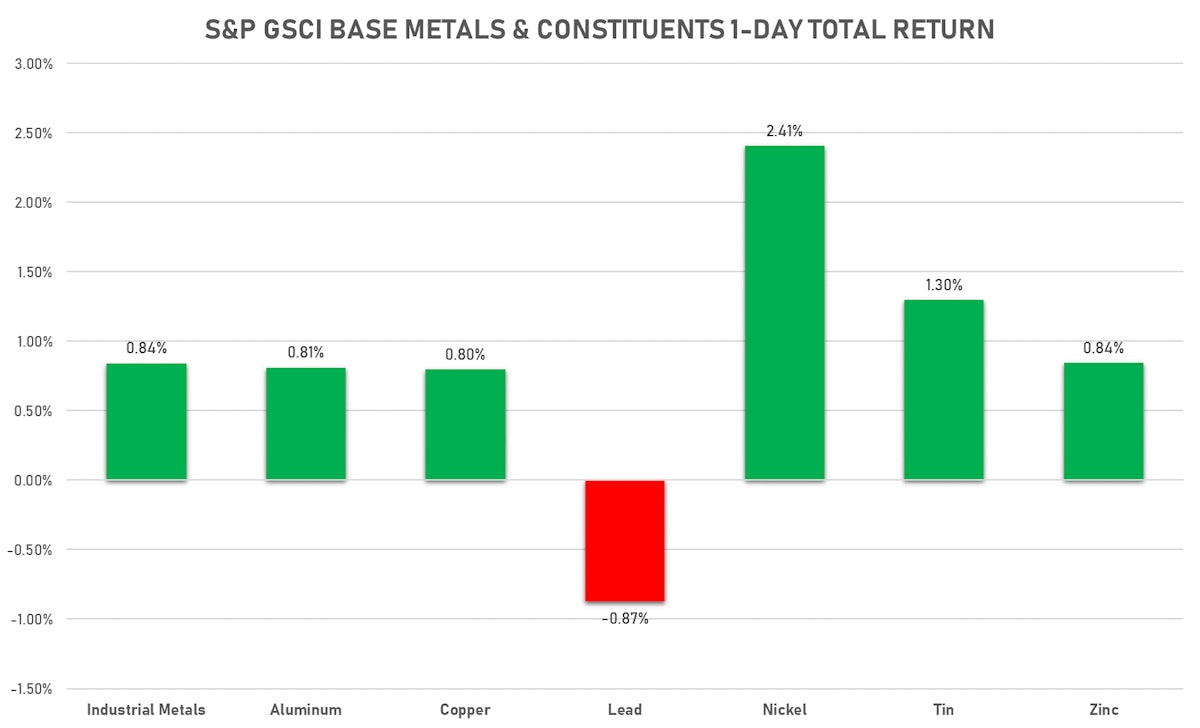

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) currently at US$ 4.46 per pound, up 1.3% (YTD: +25.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,204.00 per tonne, down -1.8% (YTD: +10.8%)

- Aluminium (Shanghai) currently at CNY 19,520 per tonne, up 1.2% (YTD: +23.1%)

- Nickel (Shanghai) currently at CNY 145,600 per tonne, up 2.3% (YTD: +14.3%)

- Lead (Shanghai) currently at CNY 16,165 per tonne, up 1.9% (YTD: +10.1%)

- Rebar (Shanghai) currently at CNY 5,590 per tonne, up 1.4% (YTD: +32.6%)

- Tin (Shanghai) currently at CNY 235,960 per tonne, up 2.9% (YTD: +54.4%)

- Zinc (Shanghai) currently at CNY 22,340 per tonne, up 0.1% (YTD: +6.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

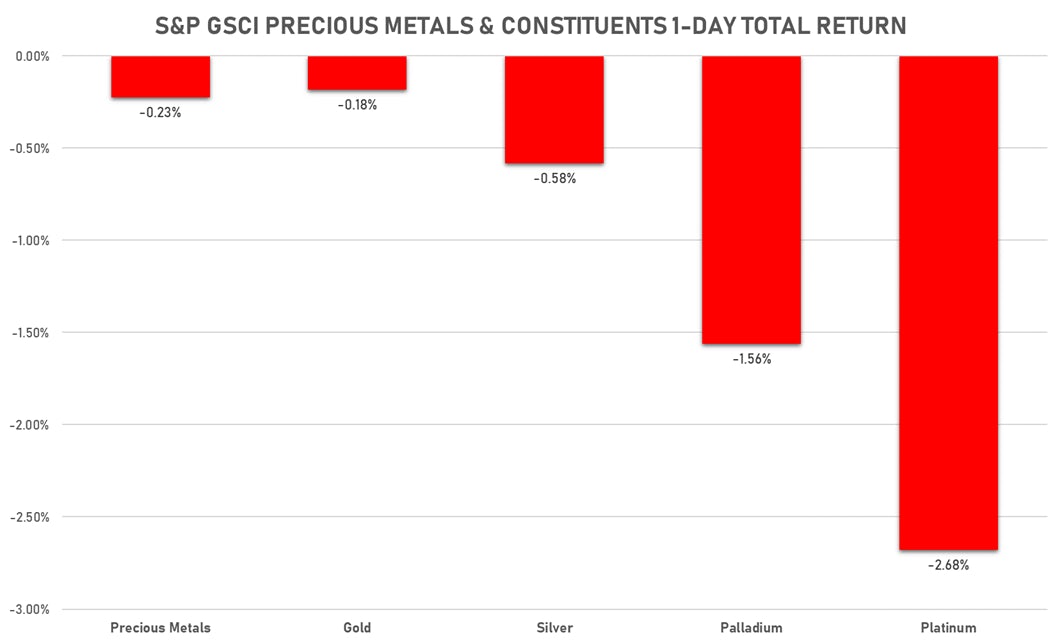

PRECIOUS METALS FELL TODAY

- Gold spot currently at US$ 1,801.48 per troy ounce, down -0.3% (YTD: -5.1%)

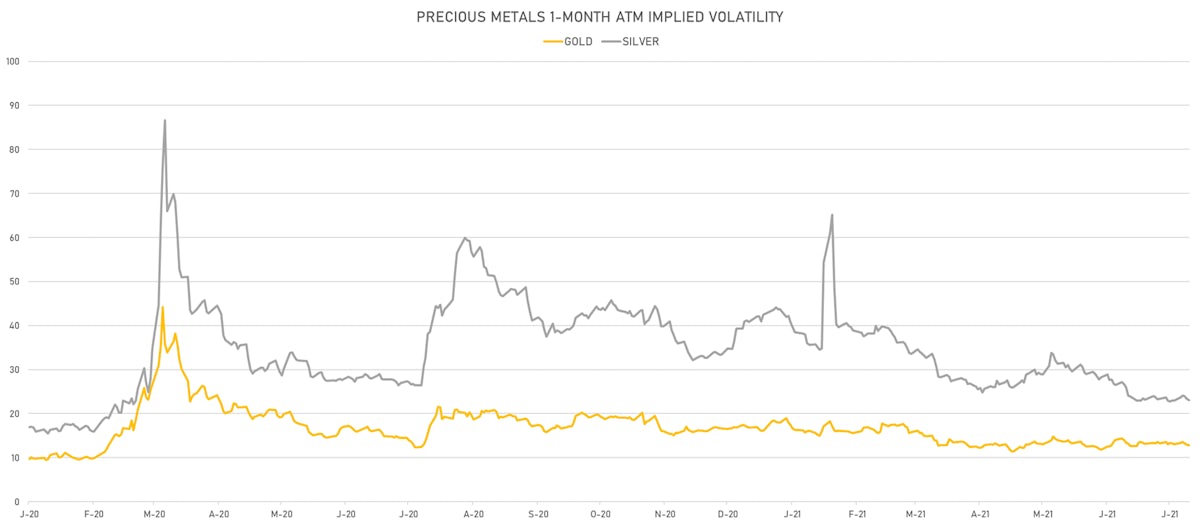

- Gold 1-Month ATM implied volatility currently at 12.55, down -1.3% (YTD: -20.5%)

- Silver spot currently at US$ 25.15 per troy ounce, down -1.0% (YTD: -4.6%)

- Silver 1-Month ATM implied volatility currently at 22.15, down -1.4% (YTD: -45.8%)

- Palladium spot currently at US$ 2,672.34 per troy ounce, down -1.7% (YTD: +9.3%)

- Platinum spot currently at US$ 1,061.31 per troy ounce, down -2.8% (YTD: -0.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,400 per troy ounce, down -1.1% (YTD: +7.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

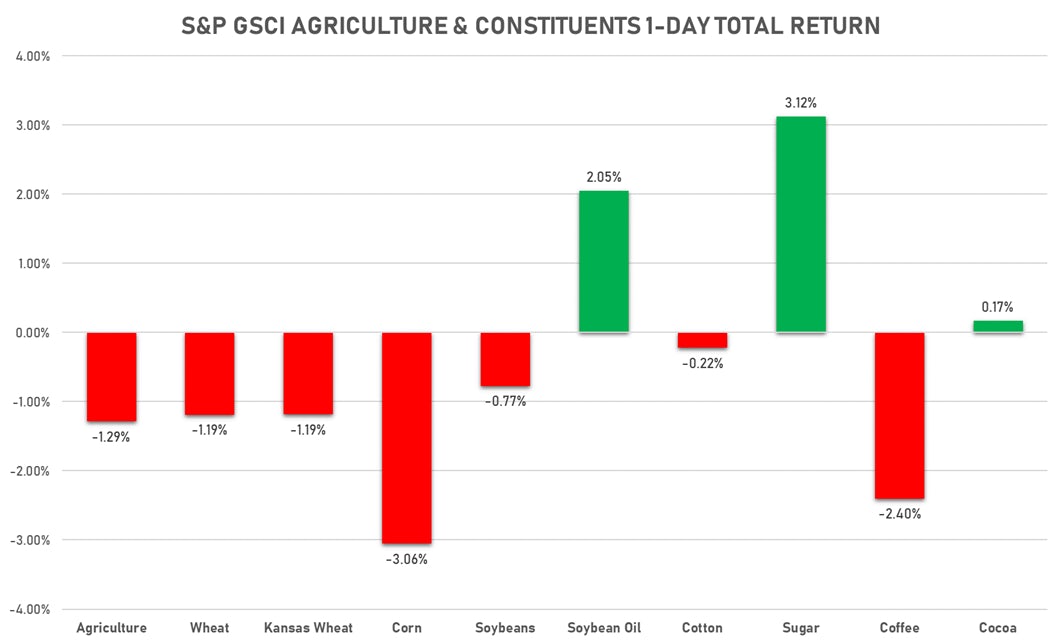

AGS MOSTLY DOWN TODAY

- Live Cattle (CME) currently at US$ 121.50 cents per pound, up 0.6% (YTD: +7.6%)

- Lean Hogs (CME) currently at US$ 107.35 cents per pound, up 0.7% (YTD: +52.8%)

- Rough Rice (CBOT) currently at US$ 13.62 cents per hundredweight, up 0.6% (YTD: +9.8%)

- Soybeans Composite (CBOT) currently at US$ 1,401.00 cents per bushel, down -1.1% (YTD: +6.5%)

- Corn (CBOT) currently at US$ 547.25 cents per bushel, down -3.1% (YTD: +13.1%)

- Wheat Composite (CBOT) currently at US$ 684.00 cents per bushel, down -1.2% (YTD: +6.8%)

- Sugar No.11 (ICE US) currently at US$ 18.10 cents per pound, up 3.1% (YTD: +17.3%)

- Cotton No.2 (ICE US) currently at US$ 89.73 cents per pound, up 0.1% (YTD: +15.6%)

- Cocoa (ICE US) currently at US$ 2,320 per tonne, up 0.2% (YTD: -10.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,598 per tonne, up 7.6% (YTD: +45.3%)

- Random Length Lumber (CME) currently at US$ 634.00 per 1,000 board feet, down -2.0% (YTD: -27.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,590 per tonne, up 1.1% (YTD: +5.6%)

- Soybean Oil Composite (CBOT) currently at US$ 65.66 cents per pound, up 1.0% (YTD: +51.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,540 per tonne, up 2.5% (YTD: +16.7%)

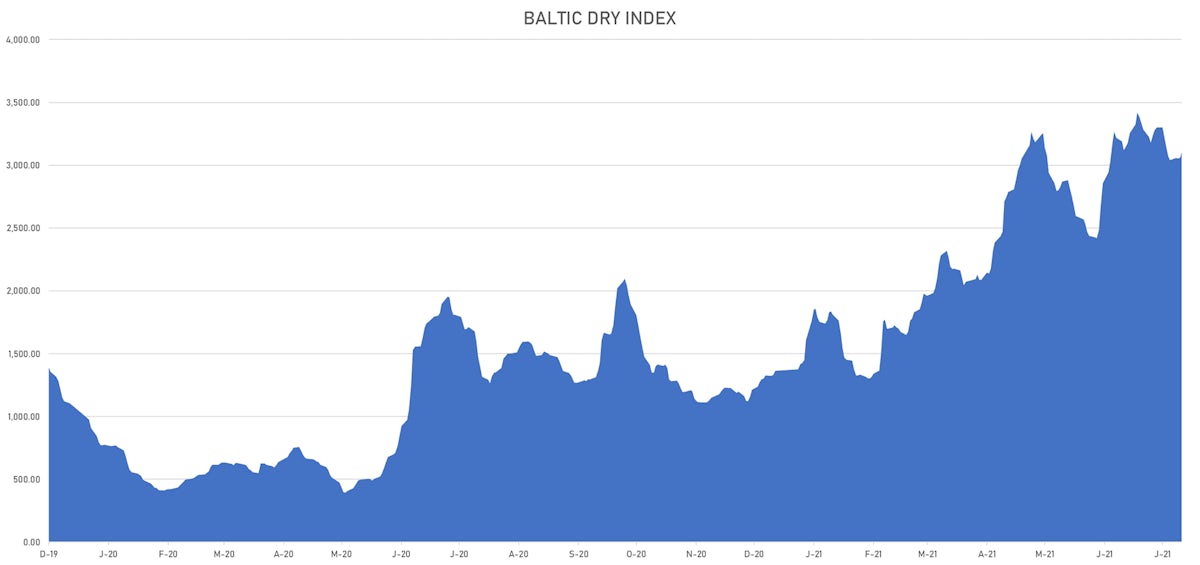

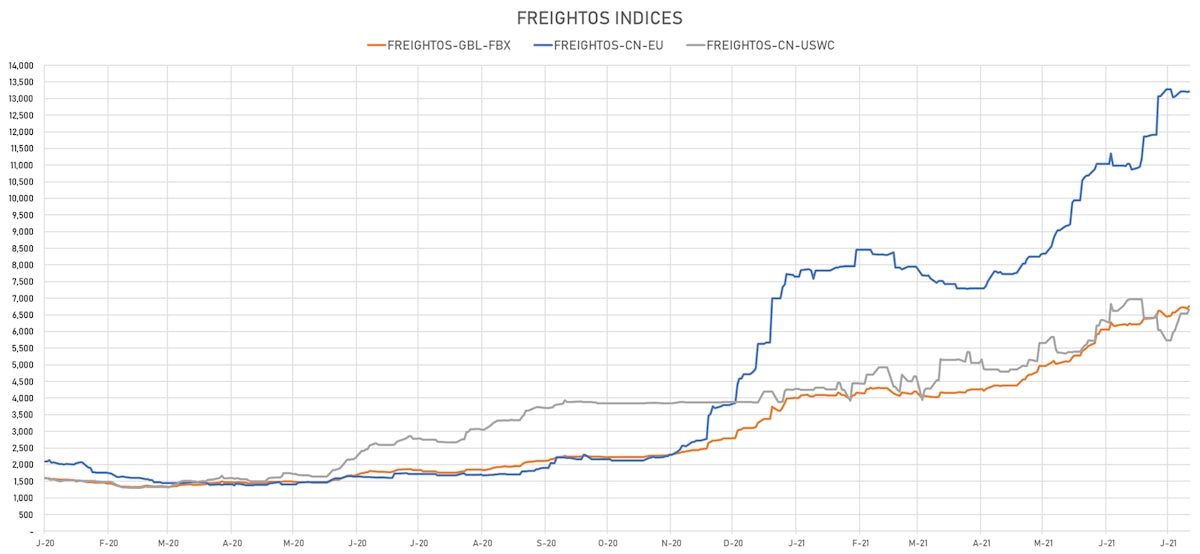

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,103, up 1.5% (YTD: +127.2%)

- Freightos China To North America West Coast Container Index currently at 6,654, up 1.6% (YTD: +58.5%)

- Freightos North America West Coast To China Container Index currently at 1,162, up 4.5% (YTD: +124.5%)

- Freightos North America East Coast To Europe Container Index currently at 697, unchanged (YTD: +91.9%)

- Freightos Europe To North America East Coast Container Index currently at 6,013, unchanged (YTD: +221.7%)

- Freightos China To North Europe Container Index currently at 13,209, up 0.1% (YTD: +133.3%)

- Freightos North Europe To China Container Index currently at 1,617, unchanged (YTD: +17.6%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 50.89 per tonne, up 0.2% (YTD: +55.5%)