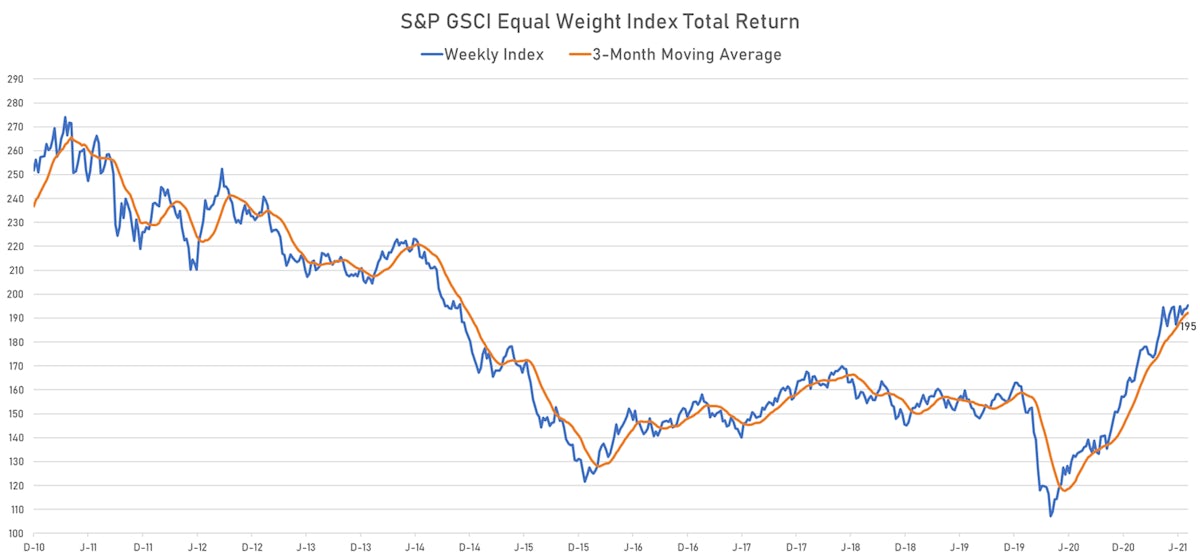

Commodities

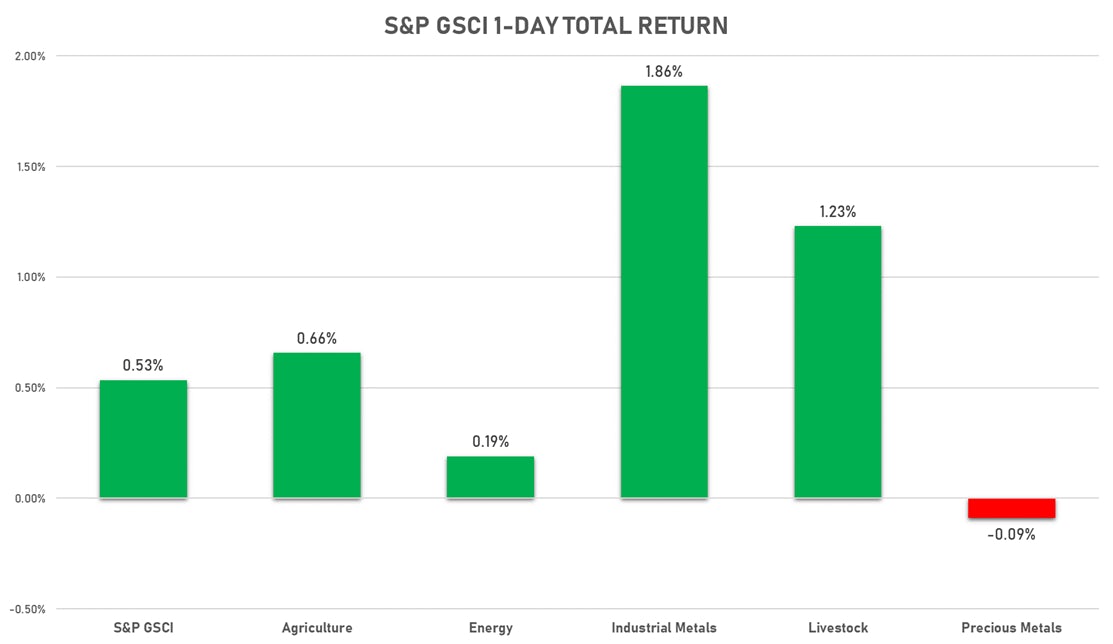

Commodities Rise, Base Metals Lead The Gains

ICE Coffee Has Spiked Up, With Gains Of Over 40% Since Early July Because Of Frost-Related Supply Worries In Brazil

Published ET

ICE Coffee Front Month Future | Source: Refinitiv

NOTABLE GAINERS TODAY

- ICE-US Coffee up 9.9% (YTD: 62.0%)

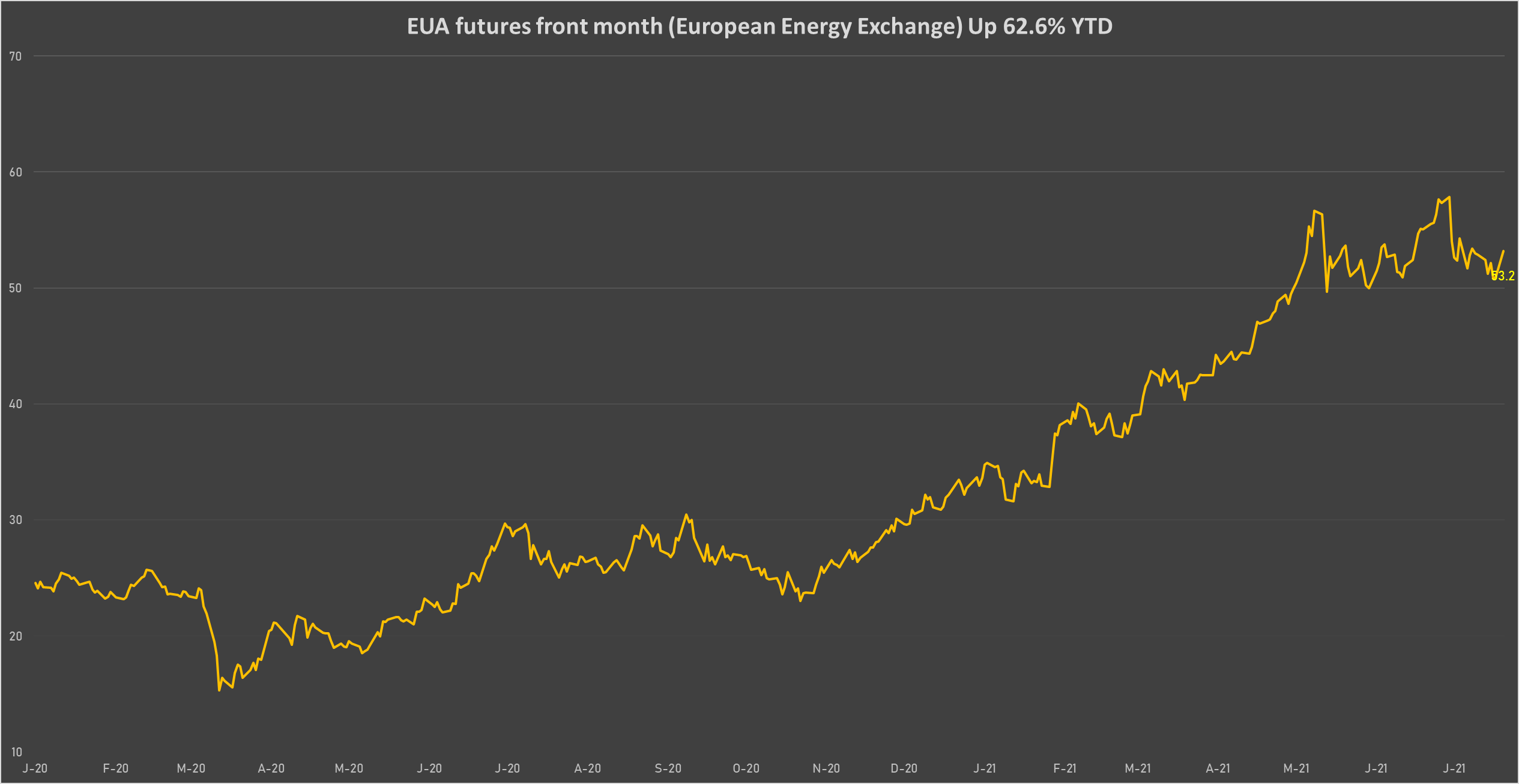

- Intercontinental Exchange European Union CO2 Allowance (EUA) Yearly up 4.5% (YTD: 62.6%)

- EEX European-Carbon- Secondary Trading up 4.5% (YTD: 65.7%)

- COMEX Copper up 4.1% (YTD: 30.6%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index up 3.8% (YTD: 142.0%)

- ICE-US Cocoa up 3.1% (YTD: -8.1%)

- SHFE Nickel up 2.5% (YTD: 17.2%)

- Silver/US Dollar 1 Month ATM Option IV up 2.5% (YTD: -44.5%)

- Gold/US Dollar 1 Month ATM Option IV up 2.0% (YTD: -18.9%)

- Bursa Malaysia Crude Palm Oil up 1.9% (YTD: 19.0%)

NOTABLE LOSERS TODAY

- Coffee Arabica Colombia Excelso EP Spot down -2.2% (YTD: 42.1%)

- CME Random Length Lumber down -1.6% (YTD: -28.5%)

- SHFE Bitumen Continuation Month 1 down -1.1% (YTD: 29.9%)

- CBoT Wheat down -1.0% (YTD: 5.7%)

- DCE Coke down -0.9% (YTD: -5.0%)

- Palladium spot down -0.5% (YTD: 8.7%)

- Zhengzhou Exchange Thermal Coal down -0.5% (YTD: 20.1%)

- CBoT Rough Rice down -0.5% (YTD: 9.2%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -0.4% (YTD: 38.1%)

- CME Class III Milk down -0.4% (YTD: 4.6%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -0.4% (YTD: 47.4%)

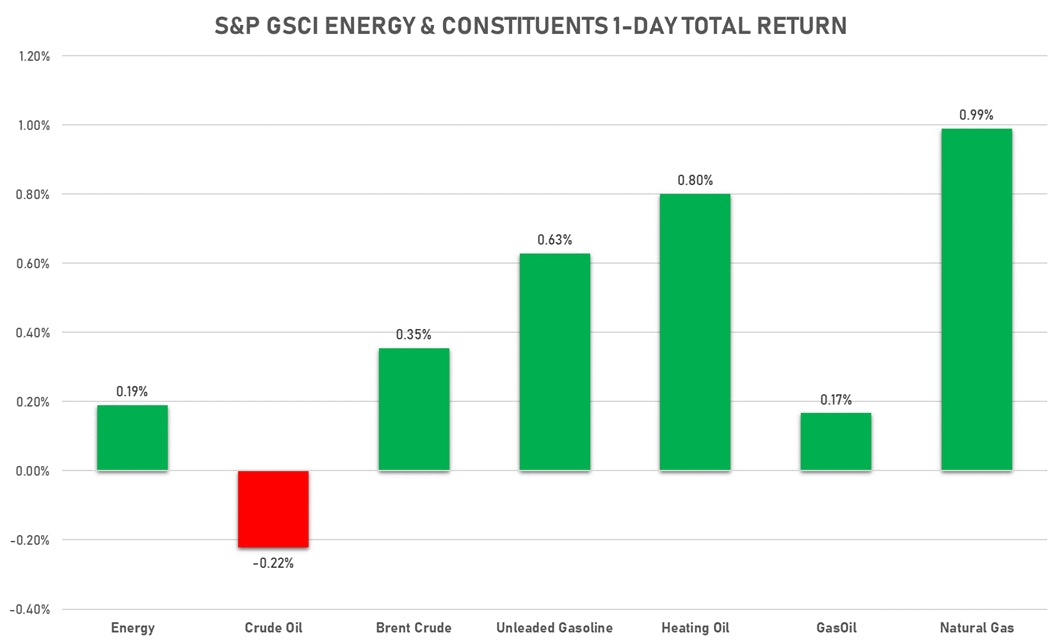

ENERGY UP TODAY DESPITE FALL IN CRUDE OIL

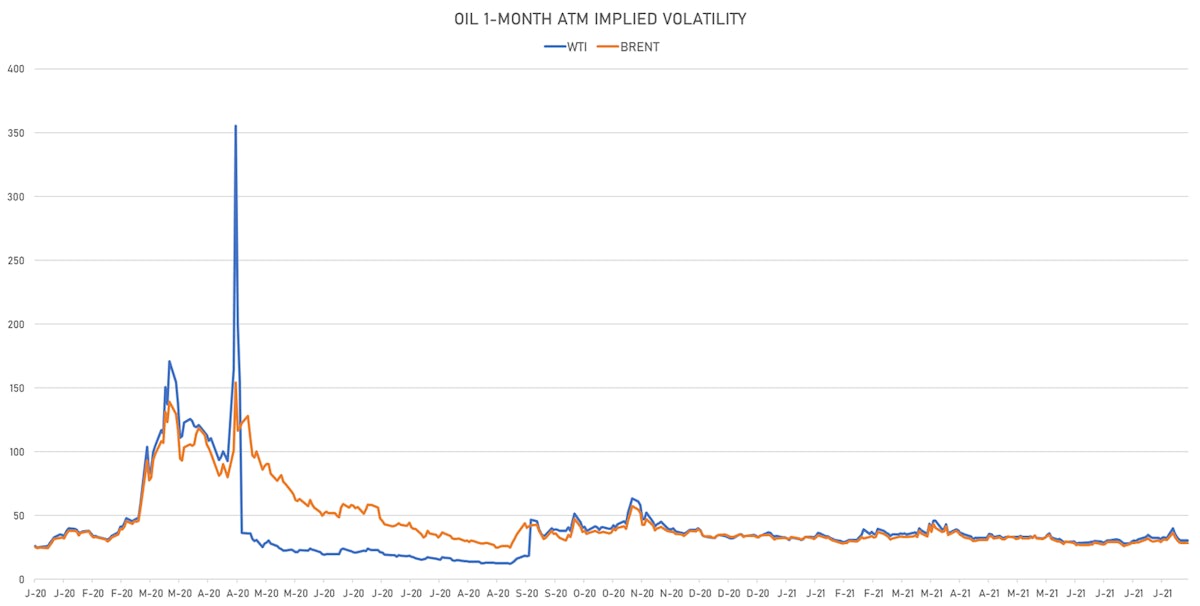

- WTI crude front month currently at US$ 72.08 per barrel, down -0.2% (YTD: +48.2%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 74.73 per barrel, up 0.5% (YTD: +43.8%); 6-month term structure in widening backwardation

- Brent volatility at 28.6, up 0.2% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) unchanged at US$ 149.75 per tonne (YTD: +86.0%)

- Natural Gas (Henry Hub) currently at US$ 4.10 per MMBtu, up 1.0% (YTD: +61.6%)

- Gasoline (NYMEX) currently at US$ 2.32 per gallon, up 0.7% (YTD: +63.9%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 603.50 per tonne, up 0.2% (YTD: +42.6%)

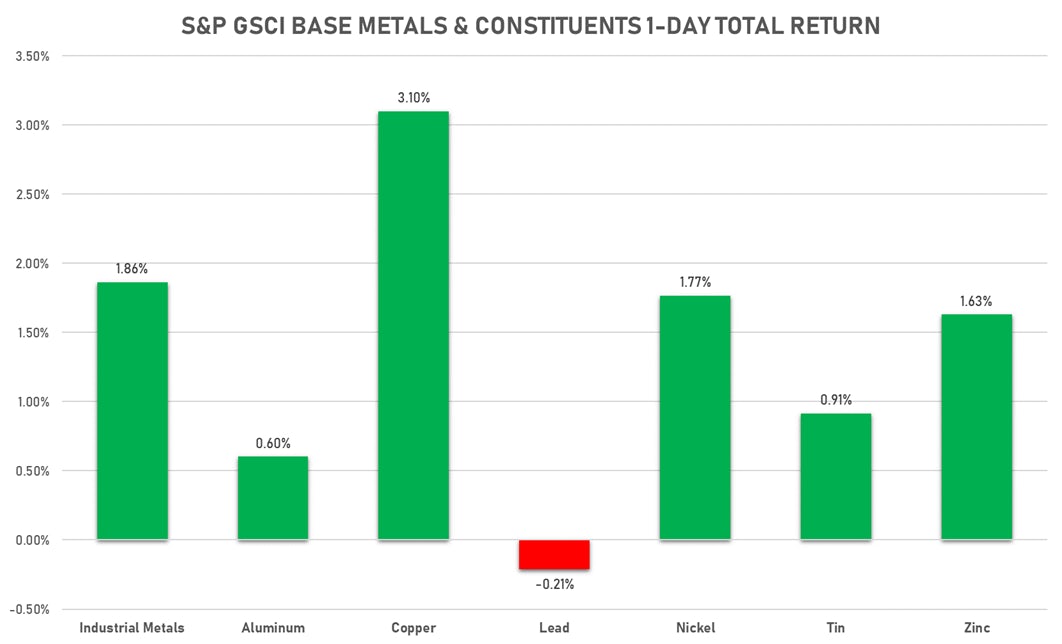

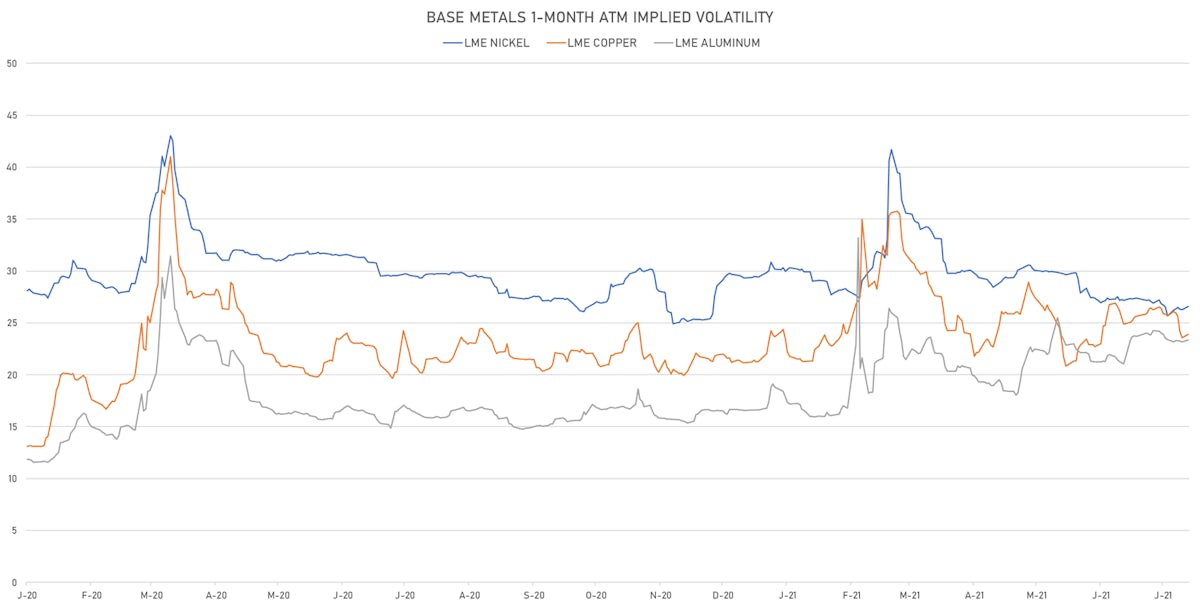

BASE METALS BROADLY UP TODAY

- Copper (COMEX) currently at US$ 4.59 per pound, up 4.1% (YTD: +30.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,200.50 per tonne, up 0.3% (YTD: +11.1%)

- Aluminum (Shanghai) currently at CNY 19,635 per tonne, up 1.2% (YTD: +24.6%)

- Nickel (Shanghai) currently at CNY 147,400 per tonne, up 2.5% (YTD: +17.2%)

- Lead (Shanghai) currently at CNY 16,100 per tonne, down -0.1% (YTD: +10.0%)

- Rebar (Shanghai) currently at CNY 5,644 per tonne, up 0.3% (YTD: +33.0%)

- Tin (Shanghai) currently at CNY 237,030 per tonne, up 1.2% (YTD: +56.2%)

- Zinc (Shanghai) currently at CNY 22,565 per tonne, up 0.7% (YTD: +7.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

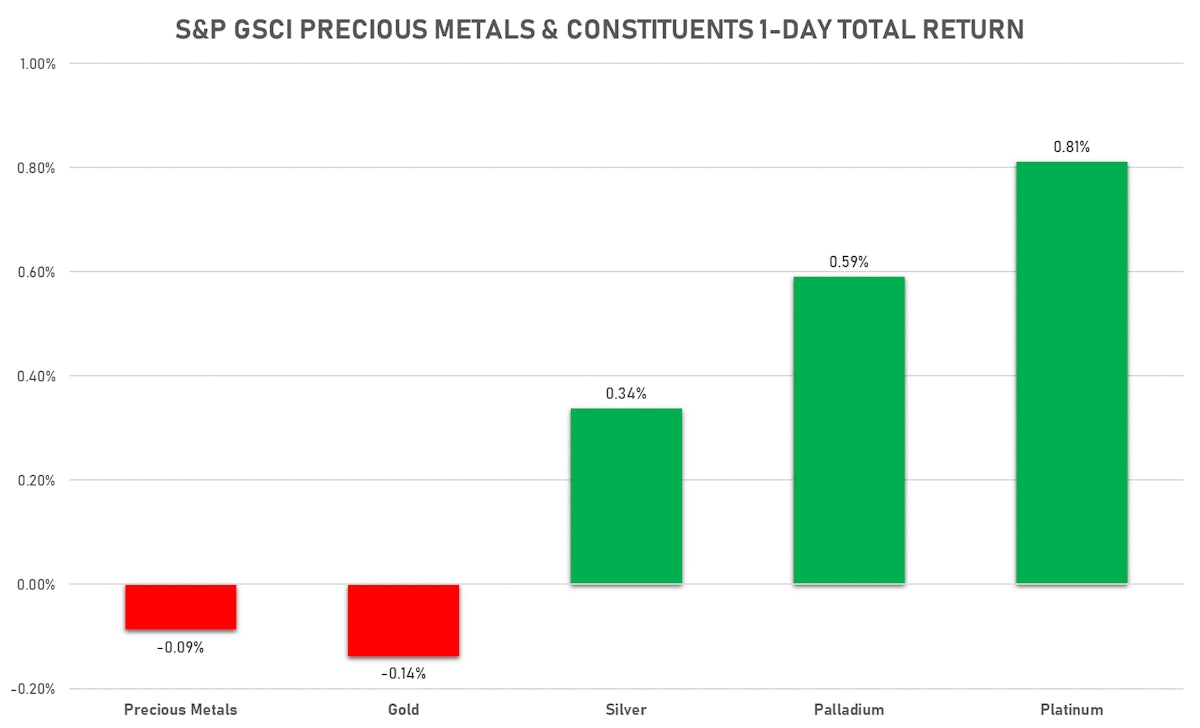

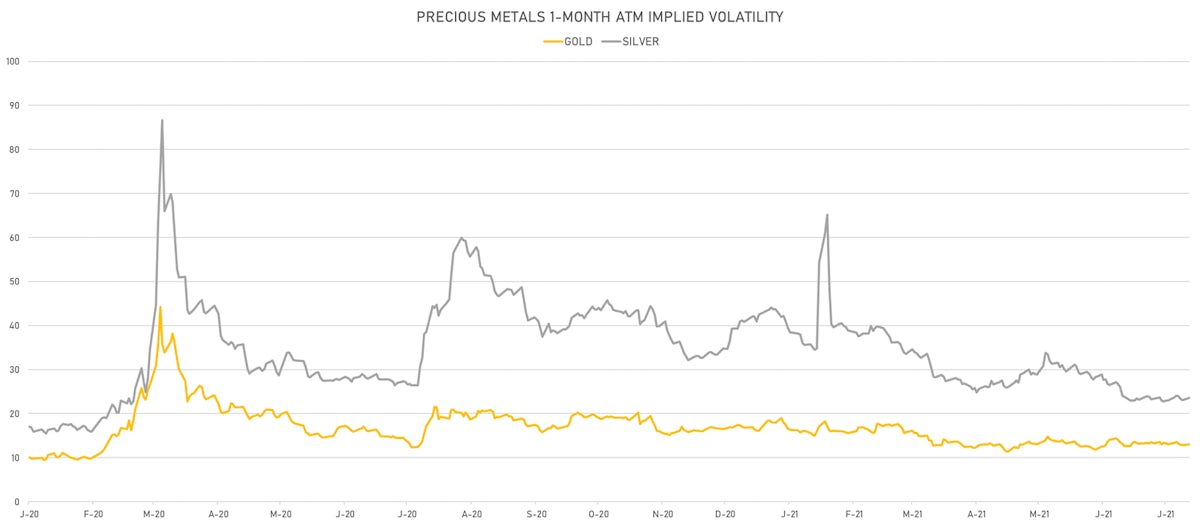

PRECIOUS METALS TODAY: GOLD DOWN, SILVER & PLATINUM UP

- Gold spot currently at US$ 1,797.18 per troy ounce, down -0.3% (YTD: -5.3%)

- Gold 1-Month ATM implied volatility currently at 12.81, up 2.0% (YTD: -18.9%)

- Silver spot currently at US$ 25.13 per troy ounce, up 0.1% (YTD: -4.5%)

- Silver 1-Month ATM implied volatility currently at 22.75, up 2.5% (YTD: -44.5%)

- Palladium spot currently at US$ 2,651.11 per troy ounce, down -0.5% (YTD: +8.7%)

- Platinum spot currently at US$ 1,064.00 per troy ounce, up 0.7% (YTD: 0.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,400 per troy ounce, unchanged (YTD: +7.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

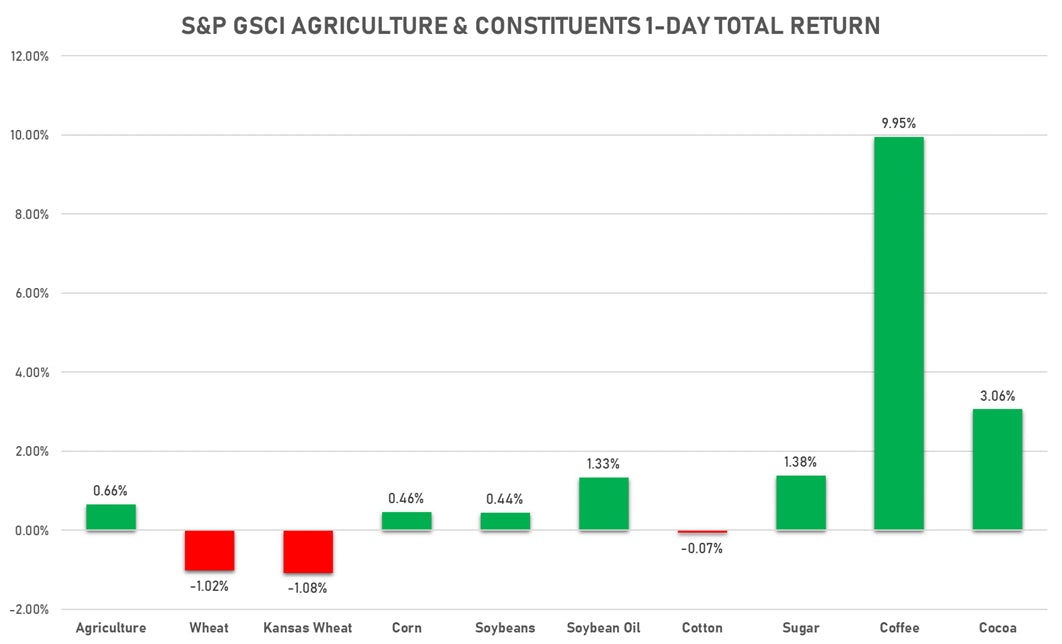

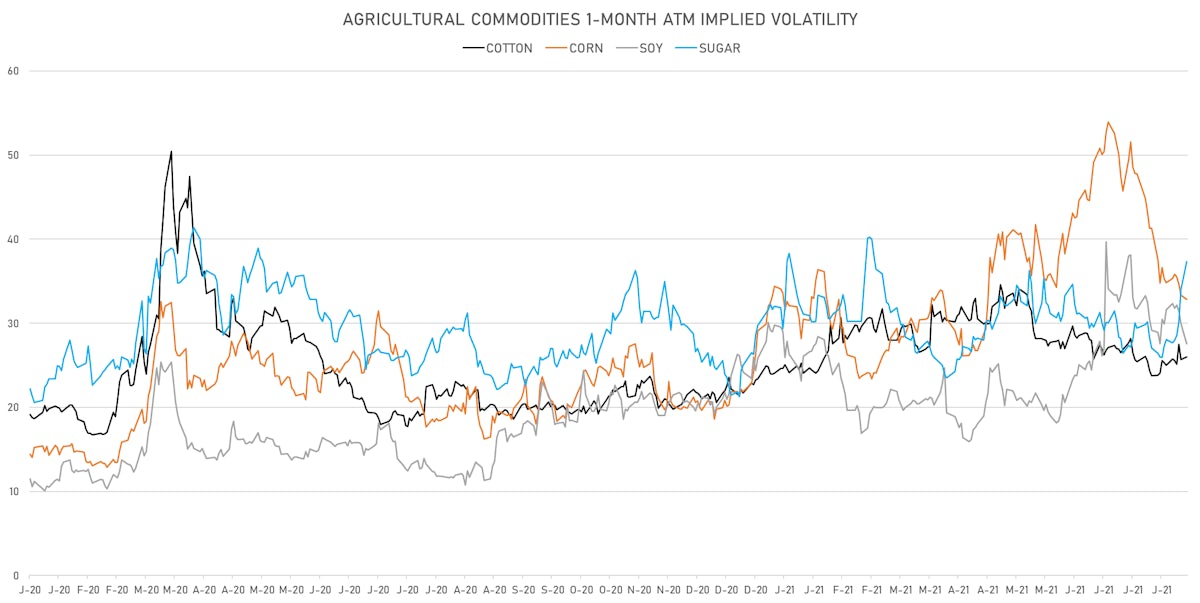

AGS MOSTLY UP TODAY

- Live Cattle (CME) currently at US$ 123.45 cents per pound, up 1.6% (YTD: +9.3%)

- Lean Hogs (CME) currently at US$ 107.40 cents per pound (YTD: +52.8%)

- Rough Rice (CBOT) currently at US$ 13.56 cents per hundredweight, down -0.5% (YTD: +9.2%)

- Soybeans Composite (CBOT) currently at US$ 1,424.25 cents per bushel, up 0.8% (YTD: +7.4%)

- Corn (CBOT) currently at US$ 553.50 cents per bushel, up 0.5% (YTD: +13.6%)

- Wheat Composite (CBOT) currently at US$ 681.00 cents per bushel, down -1.0% (YTD: +5.7%)

- Sugar No.11 (ICE US) currently at US$ 18.42 cents per pound, up 1.4% (YTD: +18.9%)

- Cotton No.2 (ICE US) unchanged at US$ 90.29 cents per pound (YTD: +15.6%)

- Cocoa (ICE US) currently at US$ 2,392 per tonne, up 3.1% (YTD: -8.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,496 per tonne, down -2.2% (YTD: +42.1%)

- Random Length Lumber (CME) currently at US$ 624.00 per 1,000 board feet, down -1.6% (YTD: -28.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,740 per tonne, up 0.8% (YTD: +6.4%)

- Soybean Oil Composite (CBOT) currently at US$ 67.04 cents per pound, up 1.2% (YTD: +53.3%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,630 per tonne, up 1.9% (YTD: +19.0%)

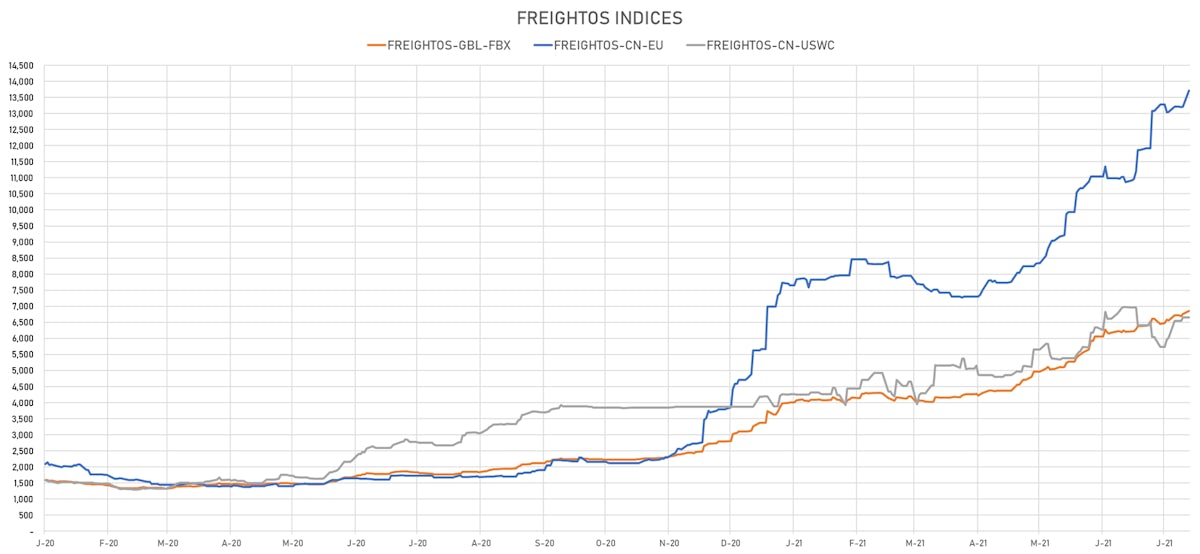

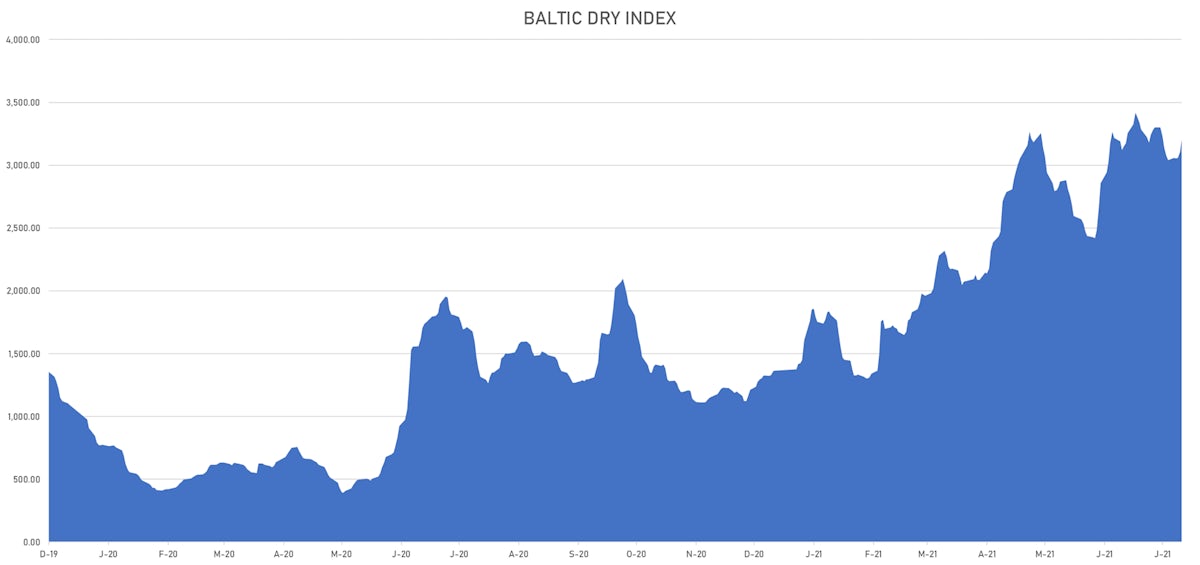

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,103, up 3.1% (YTD: +134.2%)

- Freightos China To North America West Coast Container Index currently at 6,647, down -0.1% (YTD: +58.3%)

- Freightos North America West Coast To China Container Index currently at 1,162, unchanged (YTD: +124.4%)

- Freightos North America East Coast To Europe Container Index currently at 697, up 0.1% (YTD: +92.0%)

- Freightos Europe To North America East Coast Container Index currently at 6,013, unchanged (YTD: +221.7%)

- Freightos China To North Europe Container Index currently at 13,706, up 3.8% (YTD: +142.0%)

- Freightos North Europe To China Container Index currently at 1,617, up 0.0% (YTD: +17.6%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 53.20 per tonne, up 4.5% (YTD: +62.6%)