Commodities

Broad Rise In The Commodities Complex On Dollar Weakness

Silver spot prices closed just below $26, Brent crude oil front-month just under $76

Published ET

Brent Crude Oil Futures Prices And Rising Backwardation | Source: Refinitiv

HEADLINES & MACRO

- United States, Stock Levels, EIA, Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 23 Jul (EIA, United States) at 36.00 bcf, below consensus estimate of 43.00 bcf

NOTABLE GAINERS TODAY

- SMM Rare Earth Terbium Metal Spot Price Daily up 16.2% (YTD: 26.0%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 4.0% (YTD: 47.5%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 3.5% (YTD: 12.4%)

- SMM Rare Earth Yttrium Oxide Spot Price Daily up 3.0% (YTD: 68.3%)

- SMM Rare Earth Praseodymium Neodymium Alloy Spot Price Daily up 2.7% (YTD: 48.9%)

- DCE Coke up 2.5% (YTD: -0.1%)

- CBoT Wheat up 2.4% (YTD: 10.1%)

- CME Random Length Lumber up 2.3% (YTD: -28.8%)

- Silver spot up 2.2% (YTD: -3.3%)

- SMM Rare Earth Carbonate Domestic Spot Price Daily up 2.1% (YTD: 117.6%)

- NYMEX RBOB Gasoline up 1.9% (YTD: 67.0%)

- Bursa Malaysia Crude Palm Oil up 1.8% (YTD: 20.1%)

- ICE Europe Brent Crude up 1.8% (YTD: 46.8%)

- Crude Oil WTI Cushing US FOB up 1.7% (YTD: 52.3%)

- NYMEX Light Sweet Crude Oil (WTI) up 1.7% (YTD: 51.7%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -2.4% (YTD: 4.6%)

- ICE-US Coffee down -2.0% (YTD: 53.2%)

- ICE-US Sugar No. 11 down -1.7% (YTD: 18.1%)

- Shanghai International Exchange Bonded Copper down -1.2% (YTD: 23.3%)

- Coffee Arabica Colombia Excelso EP Spot down -1.1% (YTD: 47.9%)

- CME Cattle (Feeder) down -1.0% (YTD: 14.1%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -0.9% (YTD: 27.0%)

- SHFE Copper down -0.8% (YTD: 23.4%)

- Platinum spot down -0.7% (YTD: -0.8%)

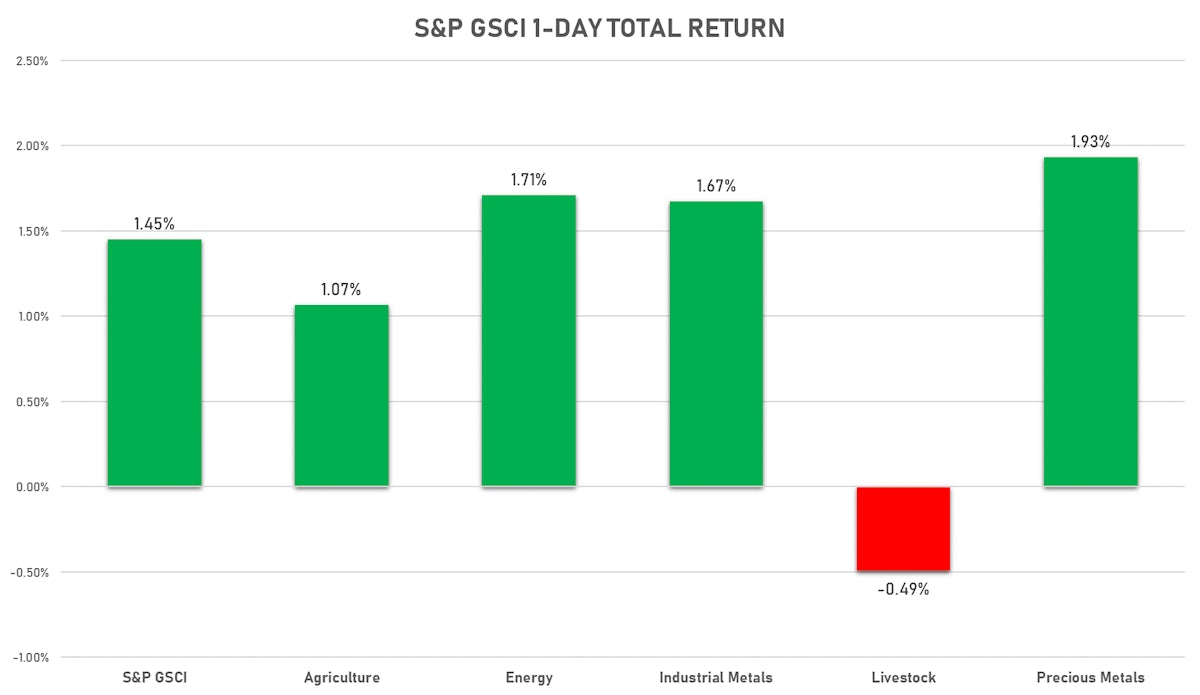

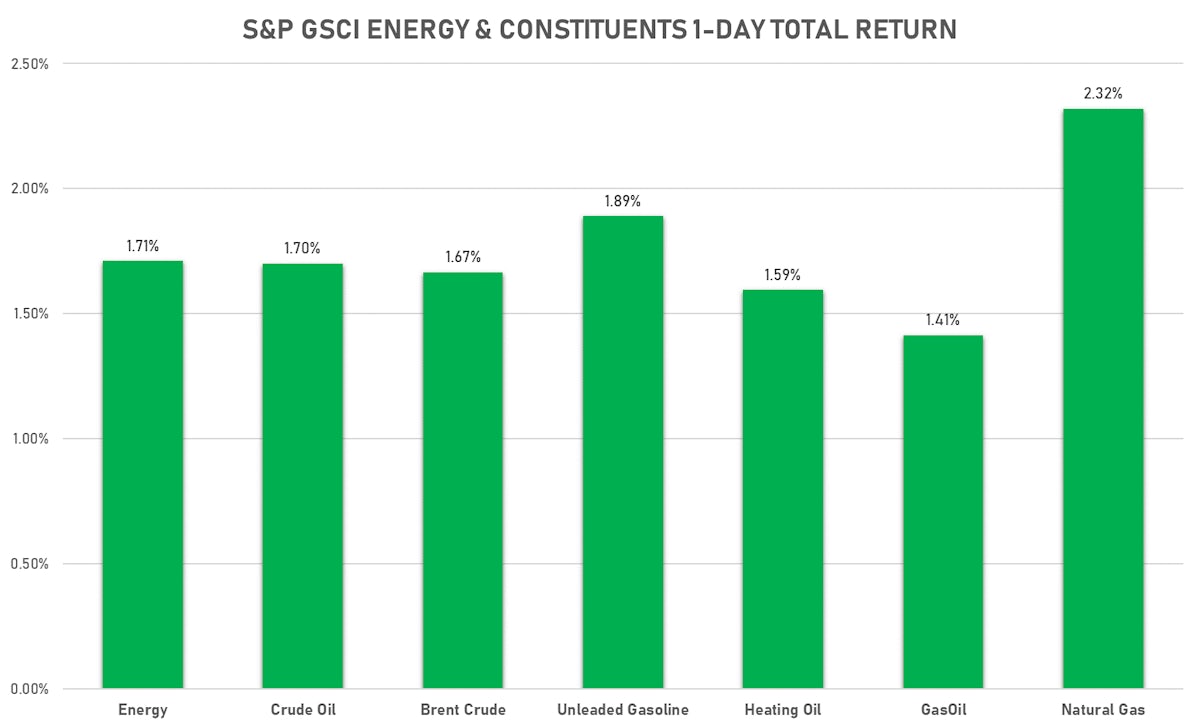

ENERGY UP AGAIN TODAY

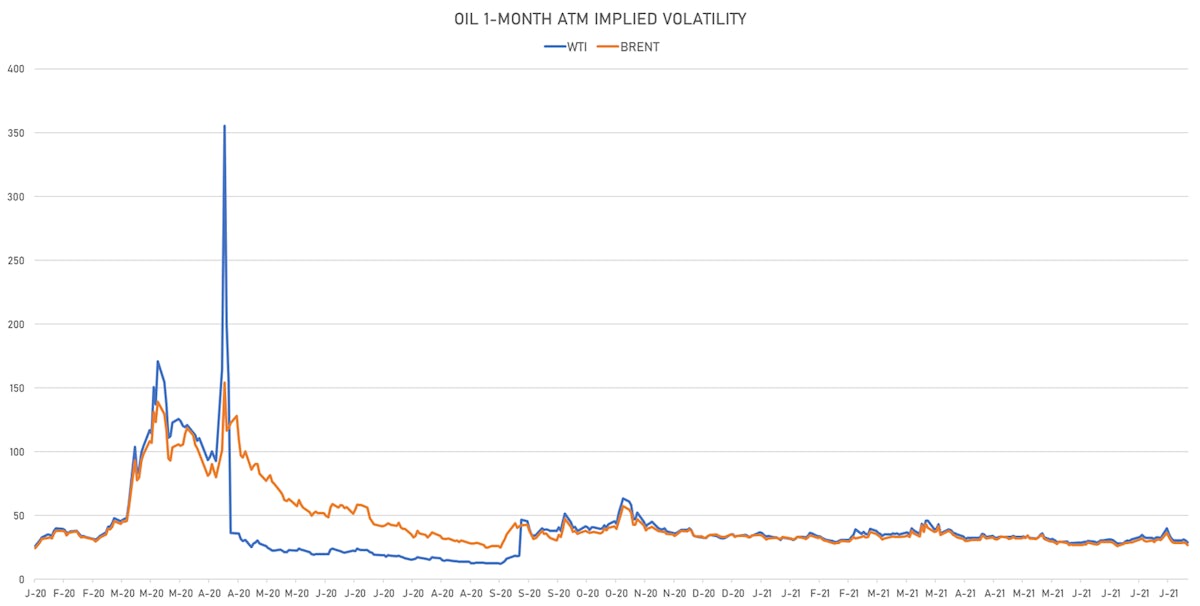

- WTI crude front month currently at US$ 73.35 per barrel, up 1.7% (YTD: +51.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.83 per barrel, up 1.8% (YTD: +46.8%); 6-month term structure in widening backwardation

- Brent volatility at 26.8, down -6.2% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 150.00 per tonne, down -0.1% (YTD: +86.3%)

- Natural Gas (Henry Hub) currently at US$ 4.01 per MMBtu, up 0.4% (YTD: +59.9%)

- Gasoline (NYMEX) currently at US$ 2.35 per gallon, up 1.9% (YTD: +67.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 610.50 per tonne, up 1.4% (YTD: +44.8%)

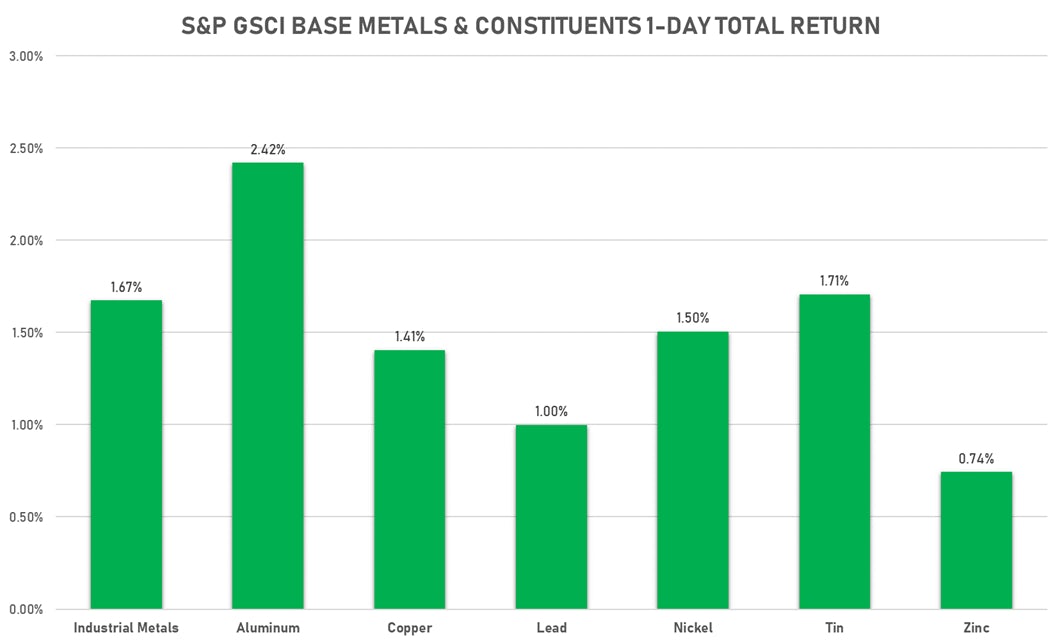

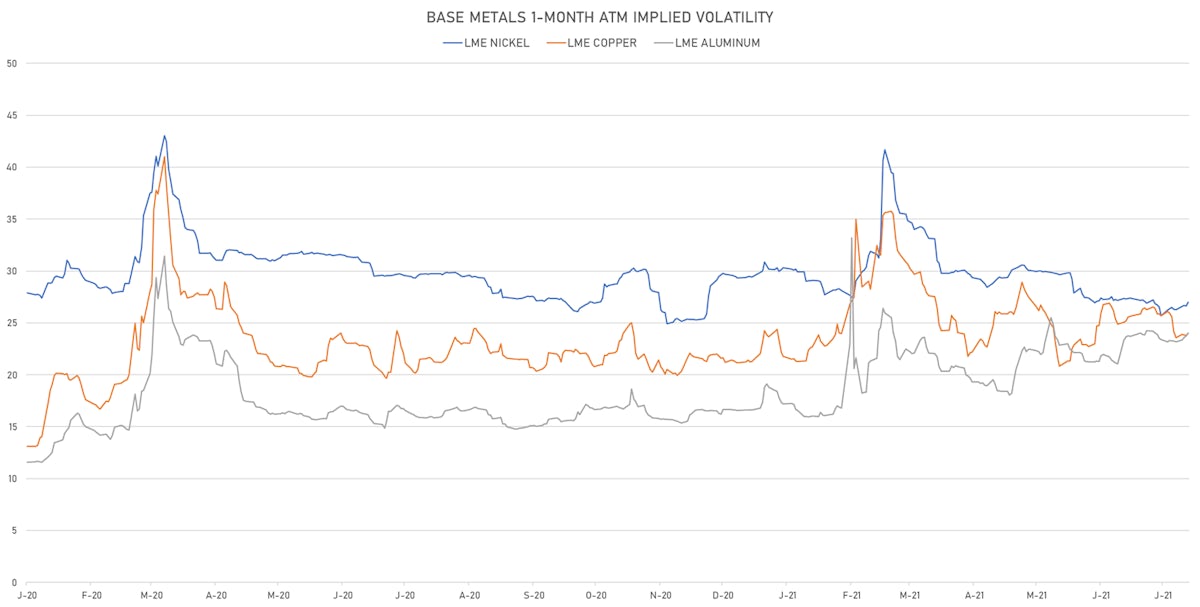

BASE METALS RISE TODAY

- Copper (COMEX) currently at US$ 4.53 per pound, up 0.9% (YTD: +28.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,106.50 per tonne, down -2.4% (YTD: +4.6%)

- Aluminium (Shanghai) currently at CNY 19,920 per tonne, up 0.7% (YTD: +24.7%)

- Nickel (Shanghai) currently at CNY 148,010 per tonne, up 0.6% (YTD: +18.4%)

- Lead (Shanghai) currently at CNY 15,915 per tonne, down -0.2% (YTD: +7.9%)

- Rebar (Shanghai) currently at CNY 5,740 per tonne, up 0.4% (YTD: +34.1%)

- Tin (Shanghai) unchanged at CNY 234,430 per tonne (YTD: +54.5%)

- Zinc (Shanghai) currently at CNY 22,430 per tonne, down -0.1% (YTD: +6.7%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

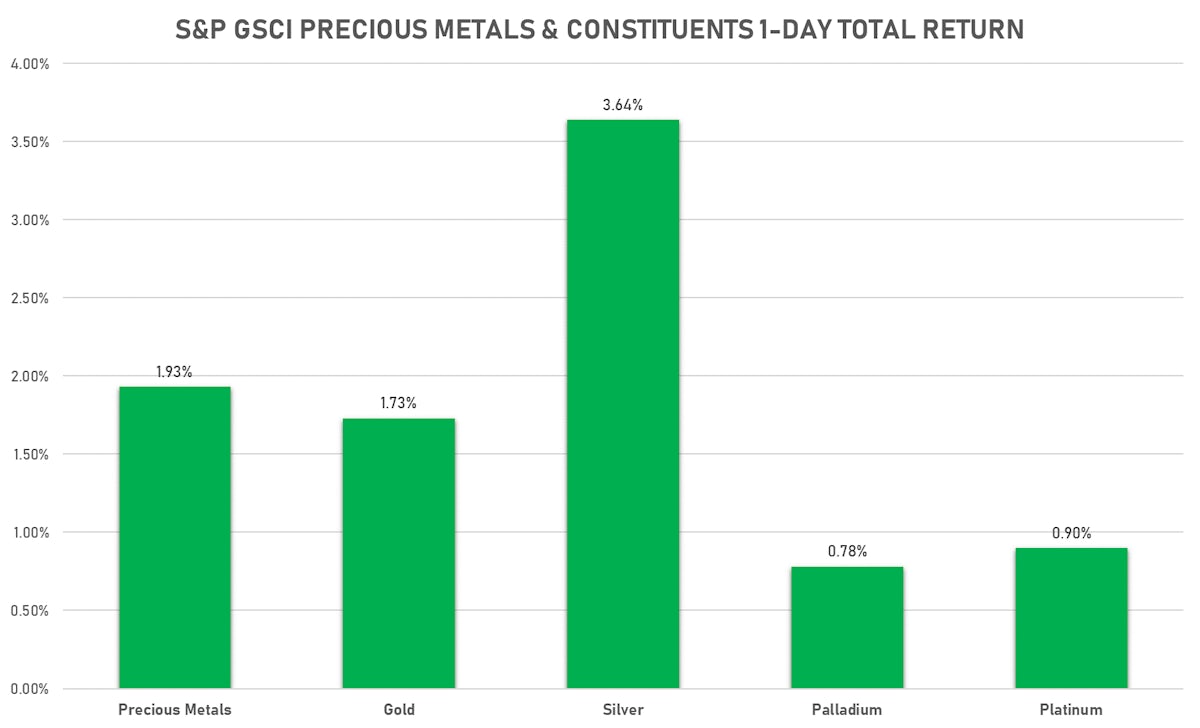

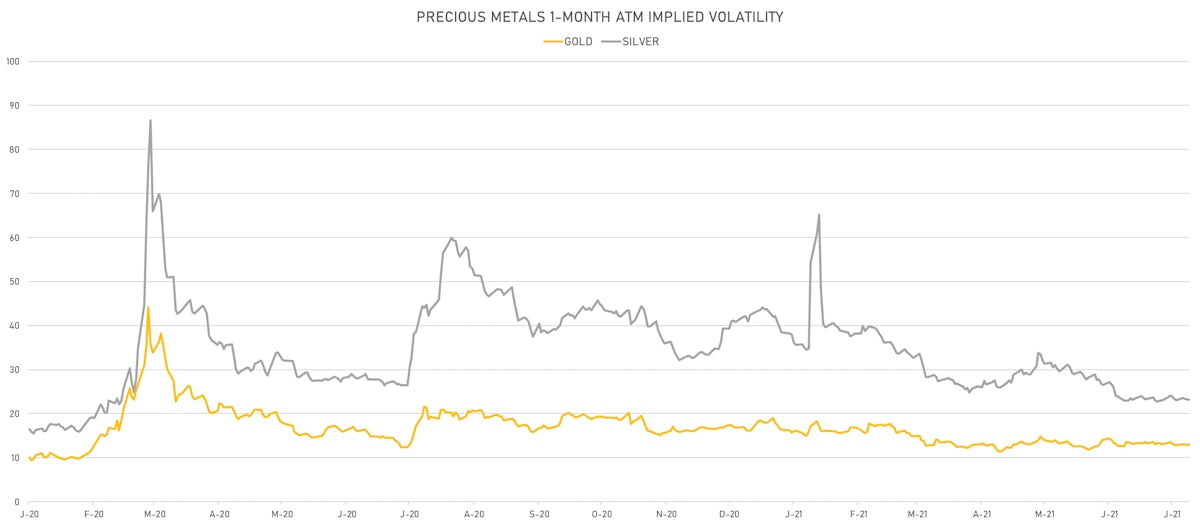

PRECIOUS METALS UP TODAY AS SILVER JUMPS

- Gold spot currently at US$ 1,828.70 per troy ounce, up 1.2% (YTD: -3.7%)

- Gold 1-Month ATM implied volatility currently at 12.71, up 1.4% (YTD: -19.0%)

- Silver spot currently at US$ 25.48 per troy ounce, up 2.2% (YTD: -3.3%)

- Silver 1-Month ATM implied volatility currently at 22.15, down -0.5% (YTD: -45.5%)

- Palladium spot currently at US$ 2,657.24 per troy ounce, up 0.8% (YTD: +8.2%)

- Platinum spot currently at US$ 1,056.53 per troy ounce, down -0.7% (YTD: -0.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,400 per troy ounce, unchanged (YTD: +7.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,600 per troy ounce, unchanged (YTD: +115.4%)

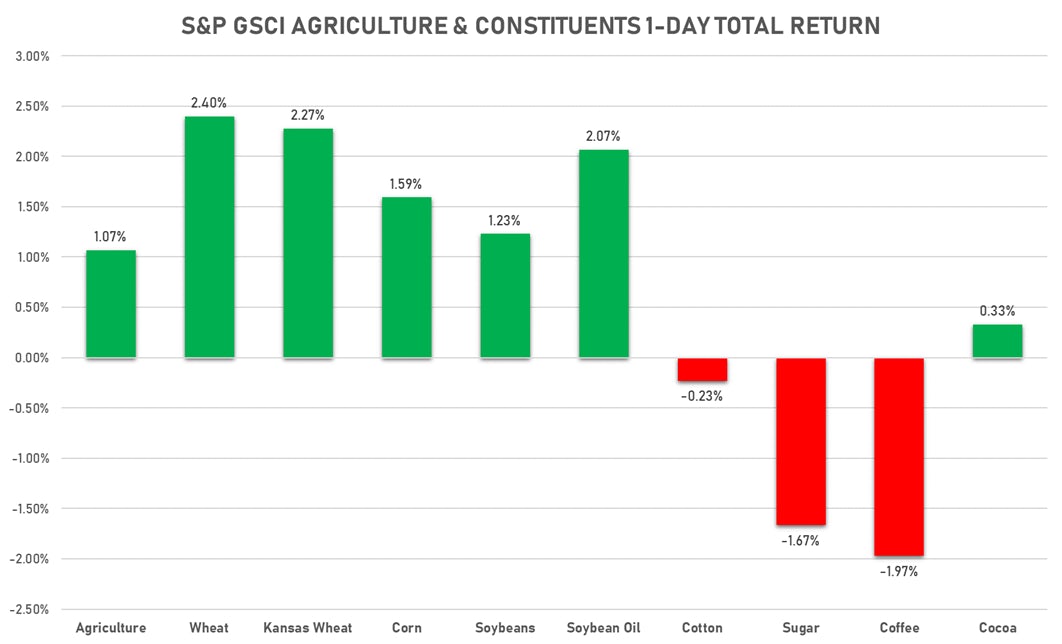

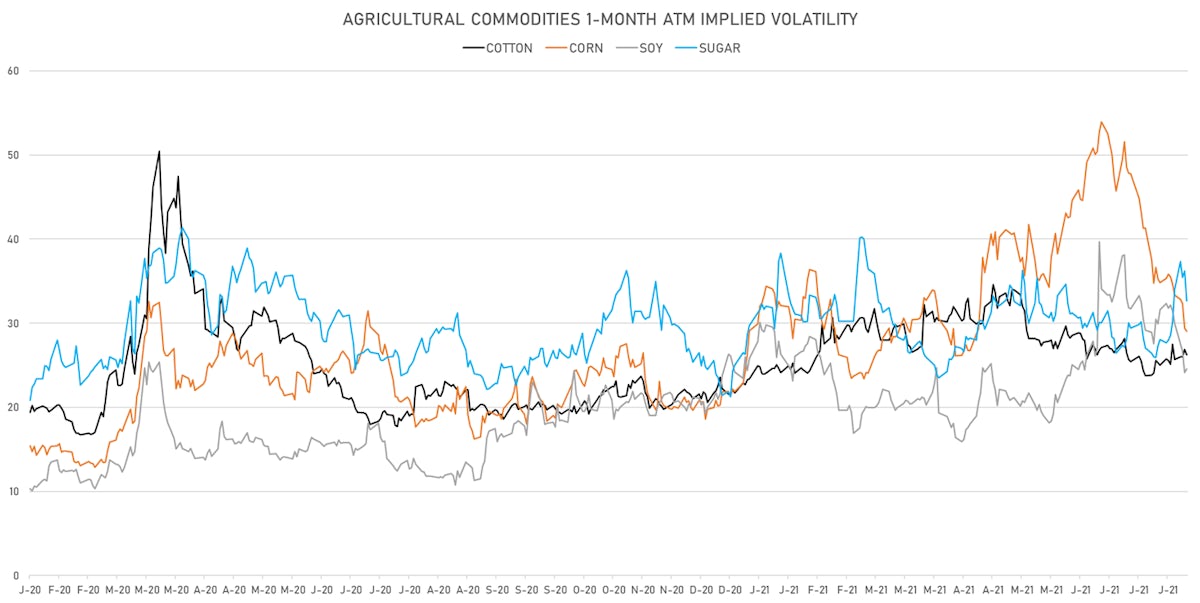

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 122.50 cents per pound, down 0.5% (YTD: +8.5%)

- Lean Hogs (CME) currently at US$ 106.30 cents per pound, up 0.6% (YTD: +51.3%)

- Rough Rice (CBOT) currently at US$ 13.65 cents per hundredweight, up 0.1% (YTD: +10.3%)

- Soybeans Composite (CBOT) currently at US$ 1,433.75 cents per bushel, up 0.2% (YTD: +9.0%)

- Corn (CBOT) currently at US$ 556.00 cents per bushel, up 1.6% (YTD: +15.3%)

- Wheat Composite (CBOT) currently at US$ 702.50 cents per bushel, up 2.4% (YTD: +10.1%)

- Sugar No.11 (ICE US) currently at US$ 18.30 cents per pound, down -1.7% (YTD: +18.1%)

- Cotton No.2 (ICE US) currently at US$ 90.76 cents per pound, down -0.2% (YTD: +16.2%)

- Cocoa (ICE US) currently at US$ 2,435 per tonne, up 0.3% (YTD: -6.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,680 per tonne, down -1.1% (YTD: +47.9%)

- Random Length Lumber (CME) currently at US$ 621.90 per 1,000 board feet, up 2.3% (YTD: -28.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,800 per tonne, up 0.8% (YTD: +6.8%)

- Soybean Oil Composite (CBOT) currently at US$ 66.64 cents per pound, up 0.6% (YTD: +54.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,673 per tonne, up 1.8% (YTD: +20.1%)

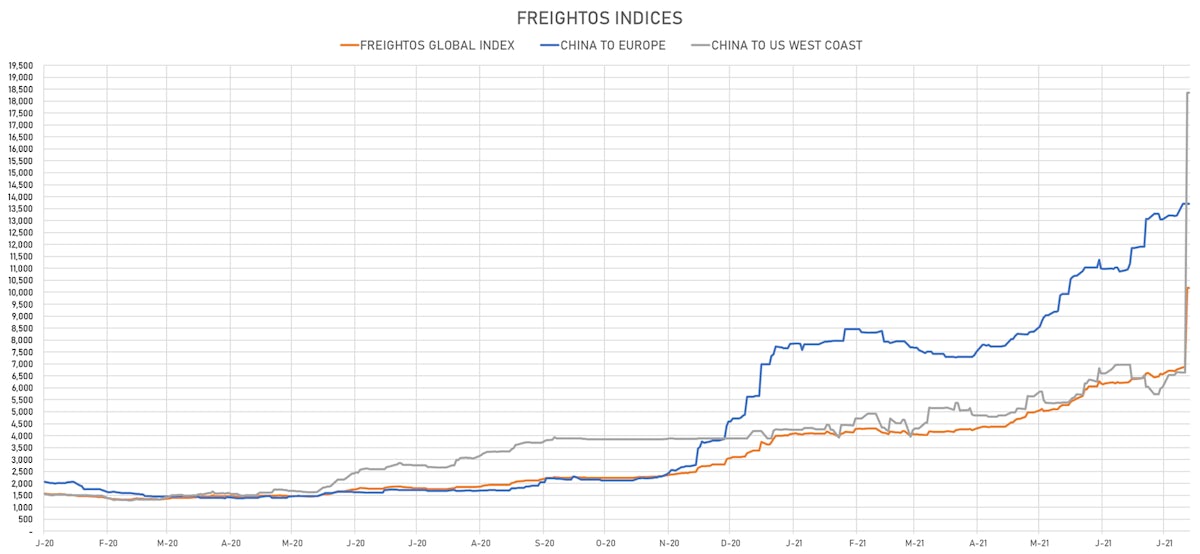

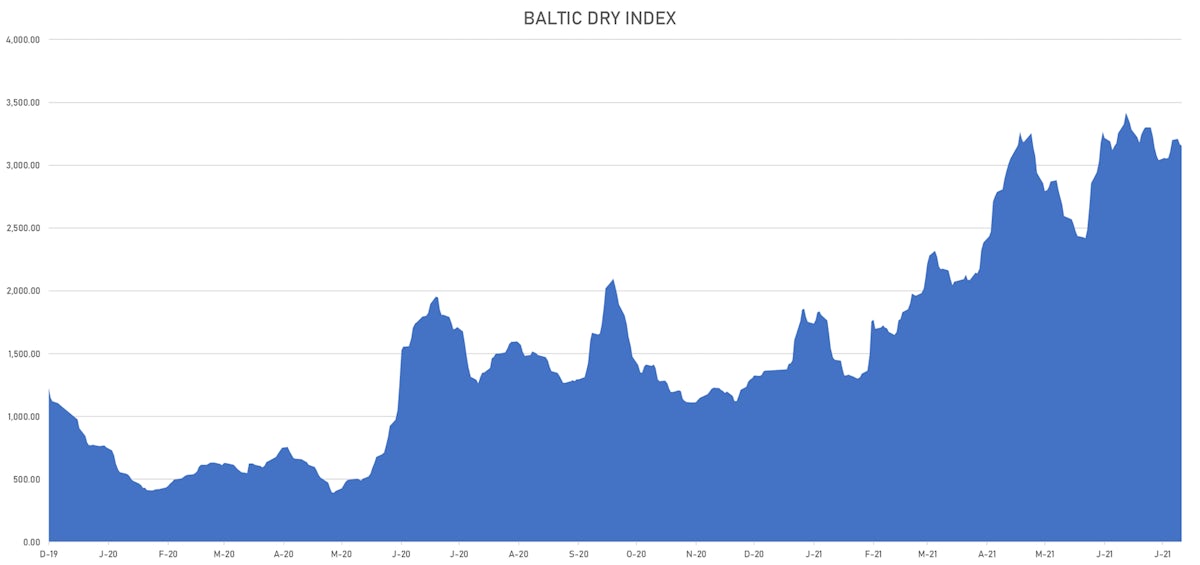

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,154, down -0.4% (YTD: +130.9%)

- Freightos China To North America West Coast Container Index currently at 18,346, unchanged (YTD: +336.9%)

- Freightos North America West Coast To China Container Index currently at 1,132, unchanged (YTD: +118.7%)

- Freightos North America East Coast To Europe Container Index currently at 670, unchanged (YTD: +84.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,015, up 0.0% (YTD: +221.8%)

- Freightos China To North Europe Container Index currently at 13,706, unchanged (YTD: +142.0%)

- Freightos North Europe To China Container Index currently at 1,634, unchanged (YTD: +18.8%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

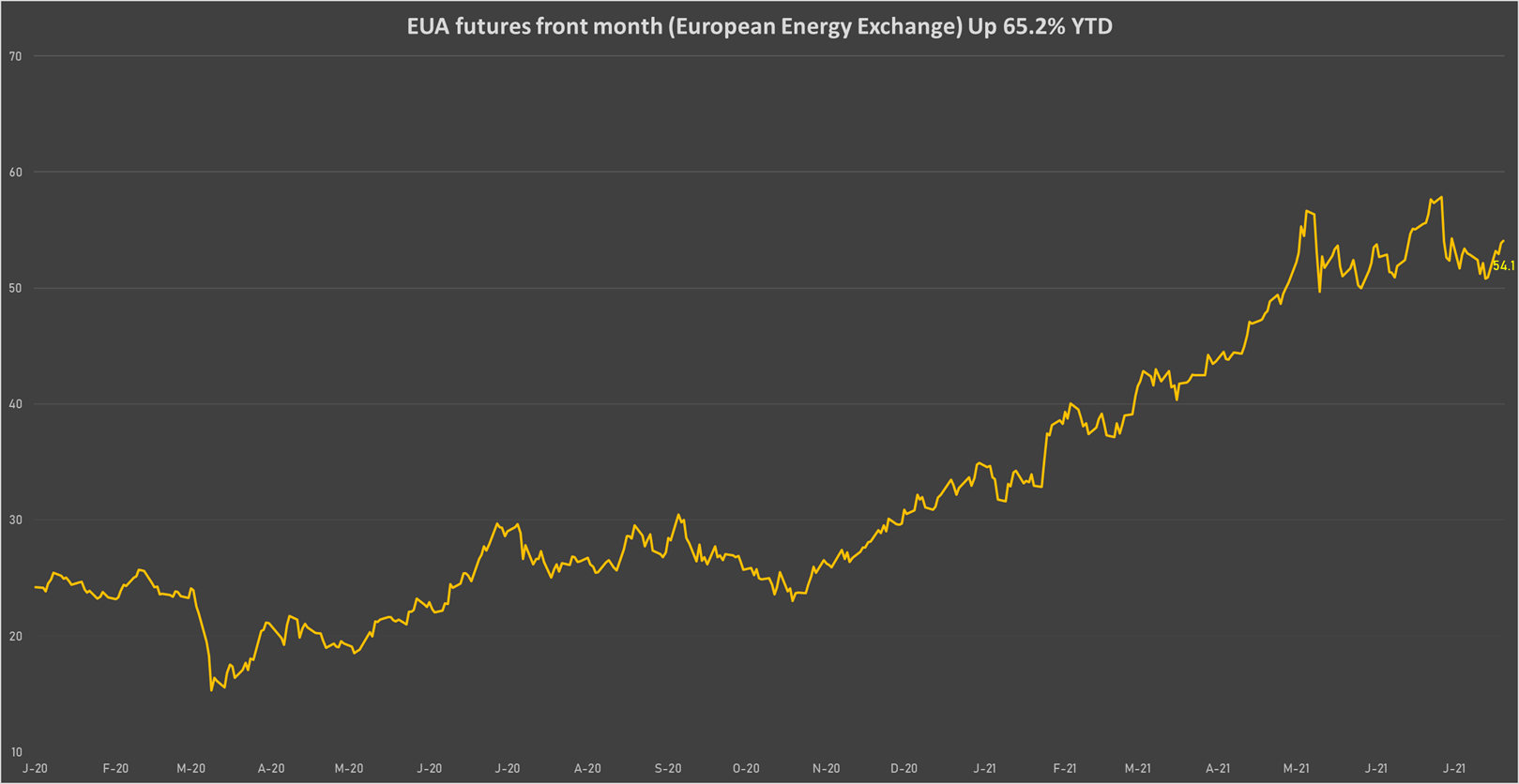

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 54.05 per tonne, up 0.4% (YTD: +65.2%)