Commodities

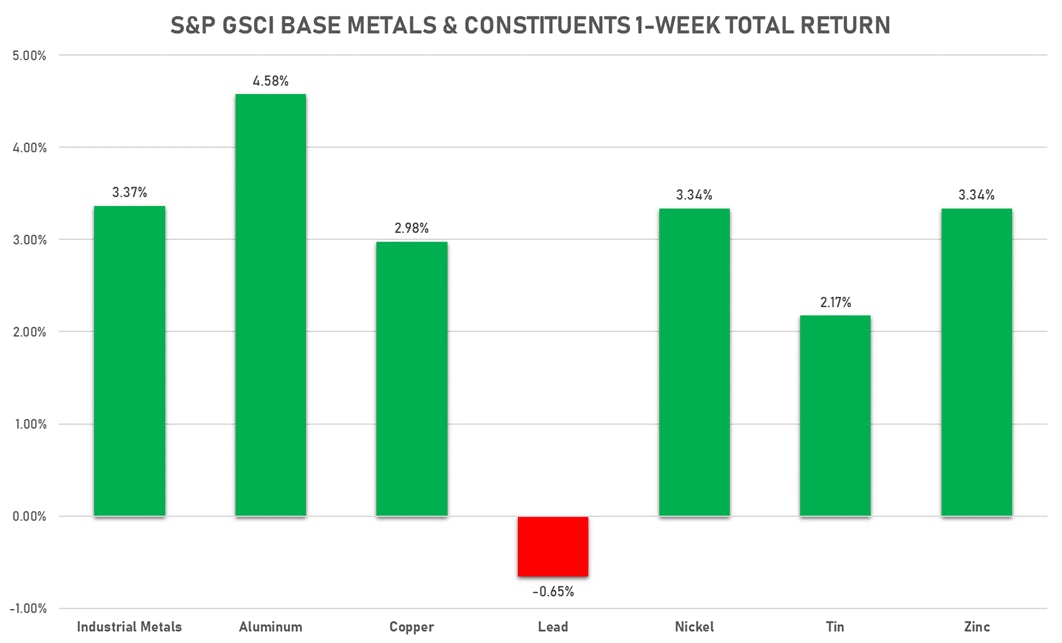

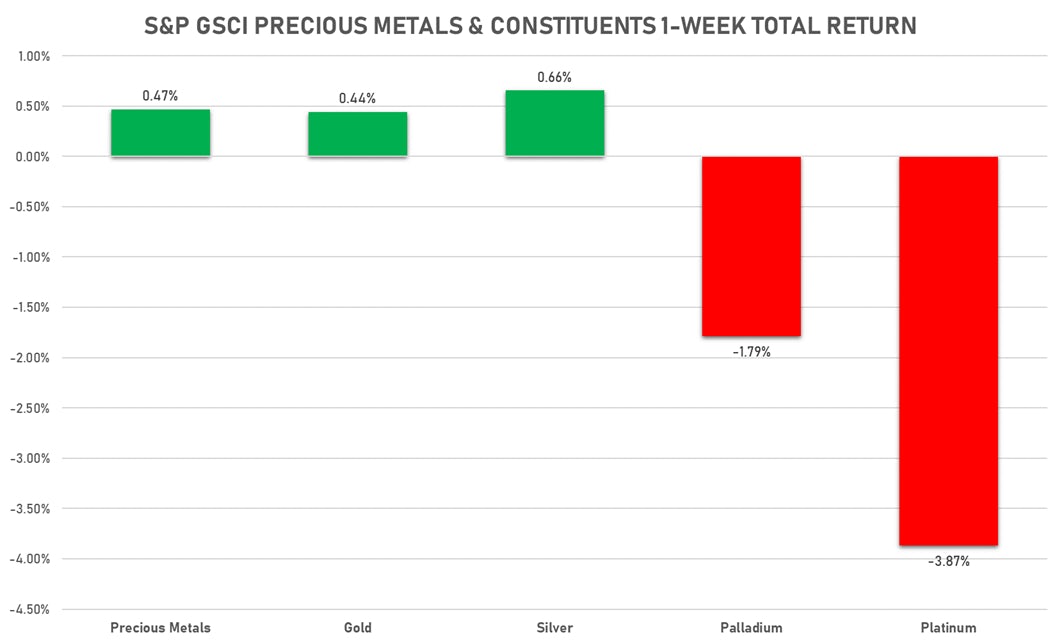

Good Week For Commodities, With Base Metals And Energy Leading The Way

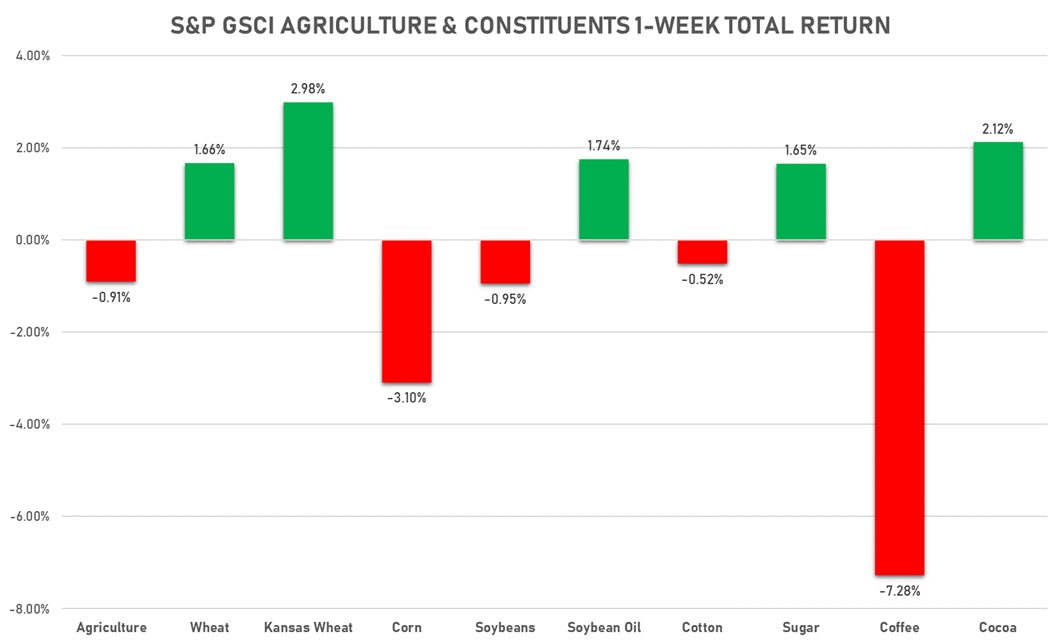

Ags and precious metals had more mixed performances: gold and wheat did well while platinum and corn fell

Published ET

Coke rose sharply this week on the Dalian Commodity Exchange | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- SMM Rare Earth Dysprosium Metal Spot Price Daily up 3.7% (YTD: 43.3%)

- DCE Coke up 3.0% (YTD: 2.9%)

- SMM Rare Earth Neodymium Metal Spot Price Daily up 3.0% (YTD: 24.5%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily up 2.1% (YTD: 19.1%)

- SHFE Hot Rolled Coil up 2.1% (YTD: 34.8%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily up 1.9% (YTD: 50.3%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 1.8% (YTD: 14.5%)

- Brent Forties and Oseberg Dated FOB Northsea Crude up 1.7% (YTD: 51.3%)

- SHFE Aluminum up 1.7% (YTD: 26.7%)

- SMM Rare Earth Carbonate Domestic Spot Price Daily up 1.5% (YTD: 120.9%)

- Silver/US Dollar 1 Month ATM Option IV up 1.2% (YTD: -44.9%)

NOTABLE LOSERS TODAY

- DCE Iron Ore Continuation Month 1 down -8.6% (YTD: -4.4%)

- ICE-US Coffee Columbia down -8.6% (YTD: 40.0%)

- SMM Rare Earth Praseodymium Metal Spot Price Daily down -5.8% (YTD: 44.2%)

- Johnson Matthey Iridium New York 0930 down -3.6% (YTD: 107.7%)

- WUXI Metal Cobalt Bi-Monthly down -2.9% (YTD: 30.1%)

- ICE-US Cocoa down -2.8% (YTD: -9.1%)

- ICE-US Sugar No. 11 down -2.1% (YTD: 15.6%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -2.0% (YTD: 24.5%)

- CBoT Corn down -2.0% (YTD: 13.0%)

- CBoT Soybean Oil down -1.7% (YTD: 51.9%)

- CBoT Soybeans down -1.4% (YTD: 7.6%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude increased net long position

- Ice Brent increased net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil increased net long position

- Henry Hub Ice reduced net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum reduced net long position

- Palladium reduced net long position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat turned to net long

- Corn increased net long position

- Rough Rice reduced net short position

- Oats increased net long position

- Soybeans reduced net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa reduced net short position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 increased net long position

- White Sugar reduced net long position

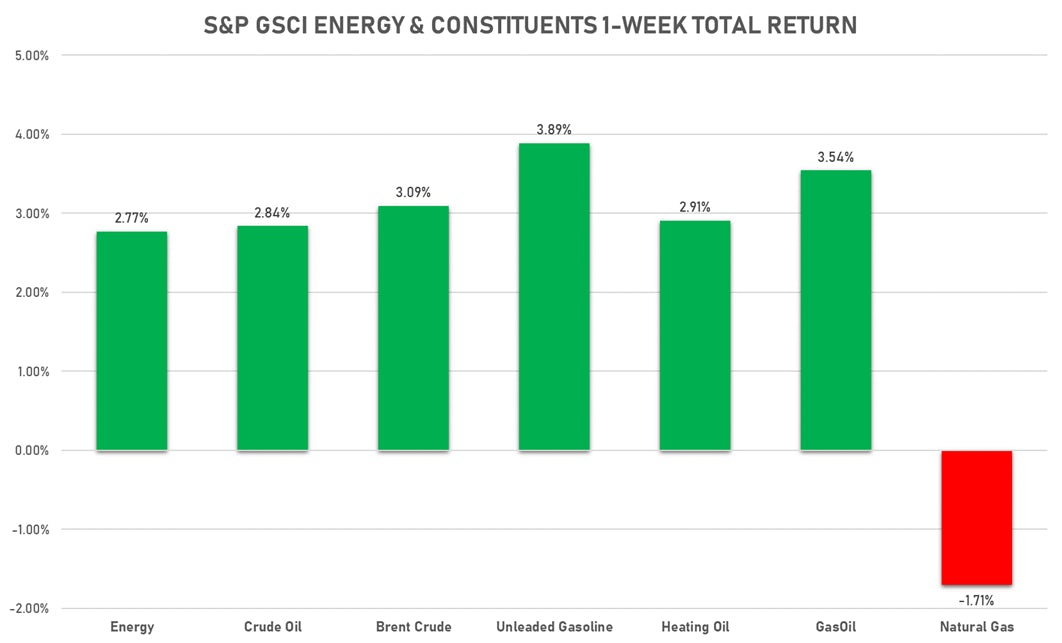

ENERGY TODAY

- WTI crude front month currently at US$ 73.95 per barrel, up 1.7% (YTD: +51.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 75.41 per barrel, up 0.4% (YTD: +47.4%); 6-month term structure in widening backwardation

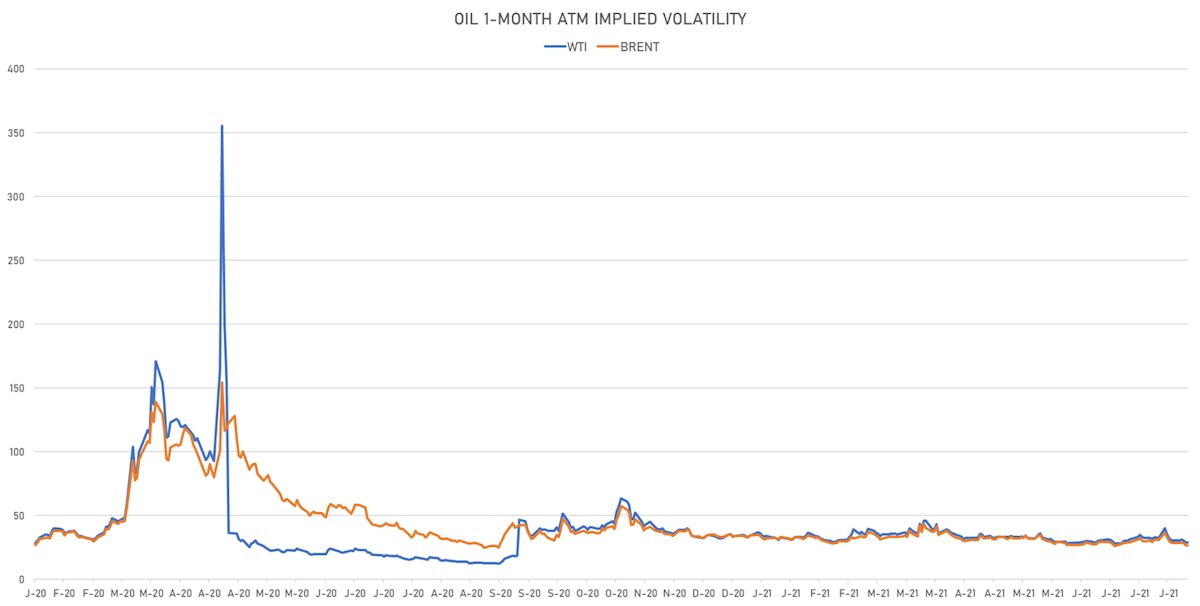

- Brent volatility at 26.3, down -1.7% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 152.75 per tonne, down -0.2% (YTD: +86.0%)

- Natural Gas (Henry Hub) currently at US$ 3.91 per MMBtu, up 0.4% (YTD: +59.9%)

- Gasoline (NYMEX) currently at US$ 2.33 per gallon, up 1.9% (YTD: +67.0%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 613.25 per tonne, up 0.7% (YTD: +45.8%)

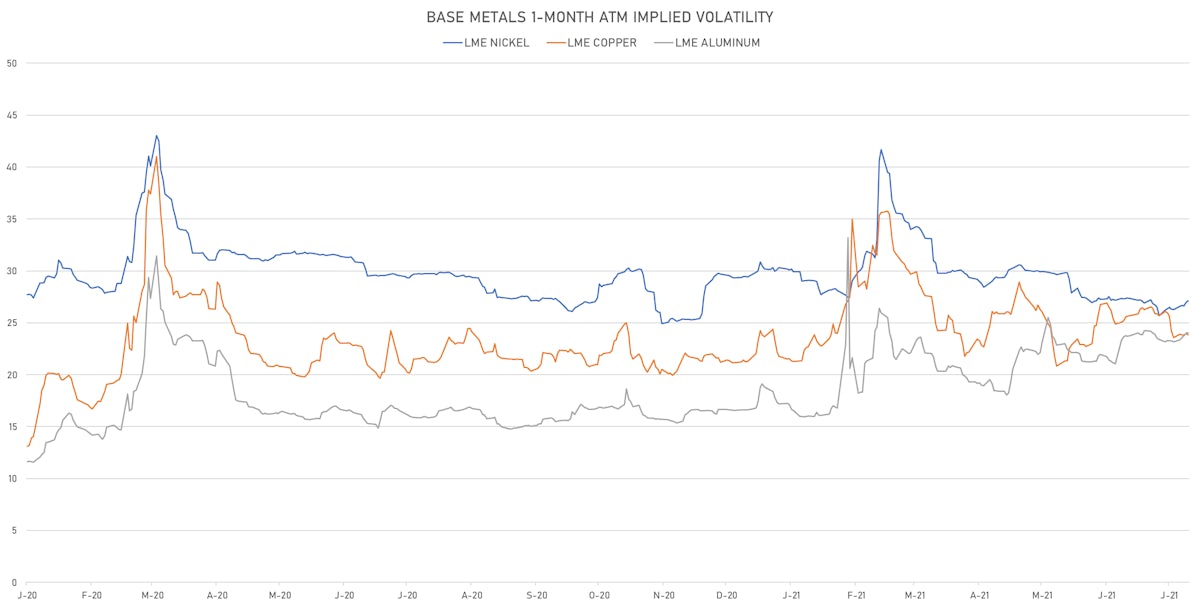

BASE METALS TODAY

- Copper (COMEX) currently at US$ 4.47 per pound, up 0.9% (YTD: +28.6%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,031.50 per tonne, down -8.6% (YTD: -4.4%)

- Aluminium (Shanghai) currently at CNY 19,890 per tonne, up 1.7% (YTD: +26.7%)

- Nickel (Shanghai) currently at CNY 145,580 per tonne, up 0.5% (YTD: +19.0%)

- Lead (Shanghai) currently at CNY 15,995 per tonne, down 0.0% (YTD: +7.8%)

- Rebar (Shanghai) currently at CNY 5,561 per tonne, up 0.8% (YTD: +35.2%)

- Tin (Shanghai) currently at CNY 236,240 per tonne, up 1.2% (YTD: +56.3%)

- Zinc (Shanghai) currently at CNY 22,495 per tonne, up 0.6% (YTD: +7.4%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

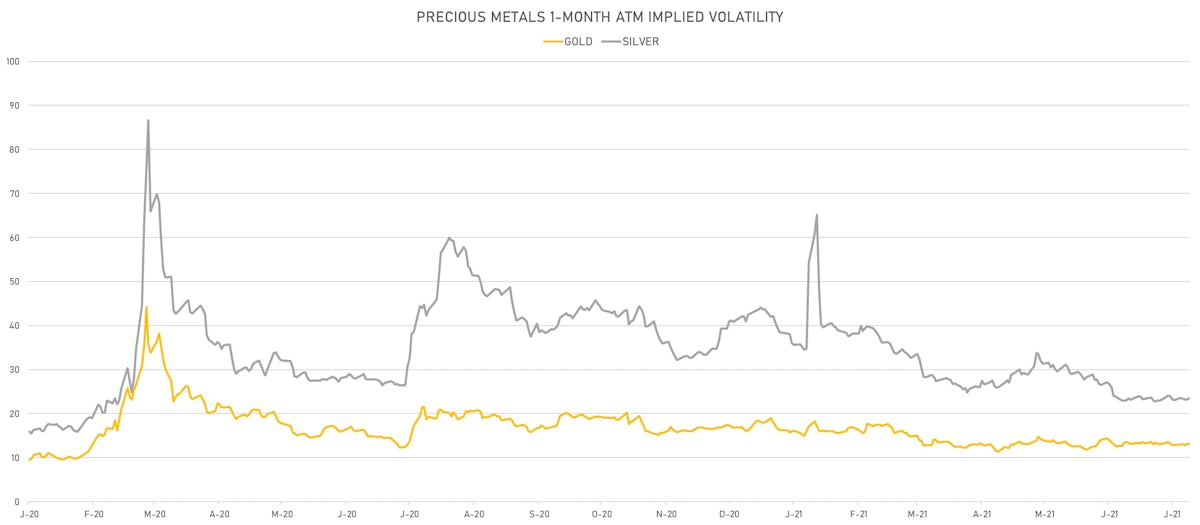

PRECIOUS METALS TODAY

- Gold spot currently at US$ 1,813.58 per troy ounce, down -0.8% (YTD: -4.4%)

- Gold 1-Month ATM implied volatility currently at 12.83, up 0.9% (YTD: -18.3%)

- Silver spot currently at US$ 25.47 per troy ounce, down -0.1% (YTD: -3.4%)

- Silver 1-Month ATM implied volatility currently at 22.43, up 1.2% (YTD: -44.9%)

- Palladium spot currently at US$ 2,658.82 per troy ounce, up 0.5% (YTD: +8.7%)

- Platinum spot currently at US$ 1,048.36 per troy ounce, down -1.1% (YTD: -1.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,500 per troy ounce, up 0.5% (YTD: +8.5%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,400 per troy ounce, down -3.6% (YTD: +107.7%)

AGS TODAY

- Live Cattle (CME) currently at US$ 122.08 cents per pound, down 0.3% (YTD: +8.1%)

- Lean Hogs (CME) currently at US$ 106.20 cents per pound, down -0.1% (YTD: +51.1%)

- Rough Rice (CBOT) currently at US$ 13.68 cents per hundredweight, down 0.0% (YTD: +10.3%)

- Soybeans Composite (CBOT) currently at US$ 1,414.75 cents per bushel, down -1.4% (YTD: +7.6%)

- Corn (CBOT) currently at US$ 547.00 cents per bushel, down -2.0% (YTD: +13.0%)

- Wheat Composite (CBOT) currently at US$ 703.75 cents per bushel, down -0.2% (YTD: +9.9%)

- Sugar No.11 (ICE US) currently at US$ 17.93 cents per pound, down -2.1% (YTD: +15.6%)

- Cotton No.2 (ICE US) currently at US$ 90.10 cents per pound, down -1.0% (YTD: +15.0%)

- Cocoa (ICE US) currently at US$ 2,359 per tonne, down -2.8% (YTD: -9.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,617 per tonne, down -1.3% (YTD: +45.9%)

- Random Length Lumber (CME) currently at US$ 621.20 per 1,000 board feet, down -0.1% (YTD: -28.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,660 per tonne, up 1.1% (YTD: +7.9%)

- Soybean Oil Composite (CBOT) currently at US$ 65.82 cents per pound, down -1.7% (YTD: +51.9%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,659 per tonne, down -0.4% (YTD: +19.7%)

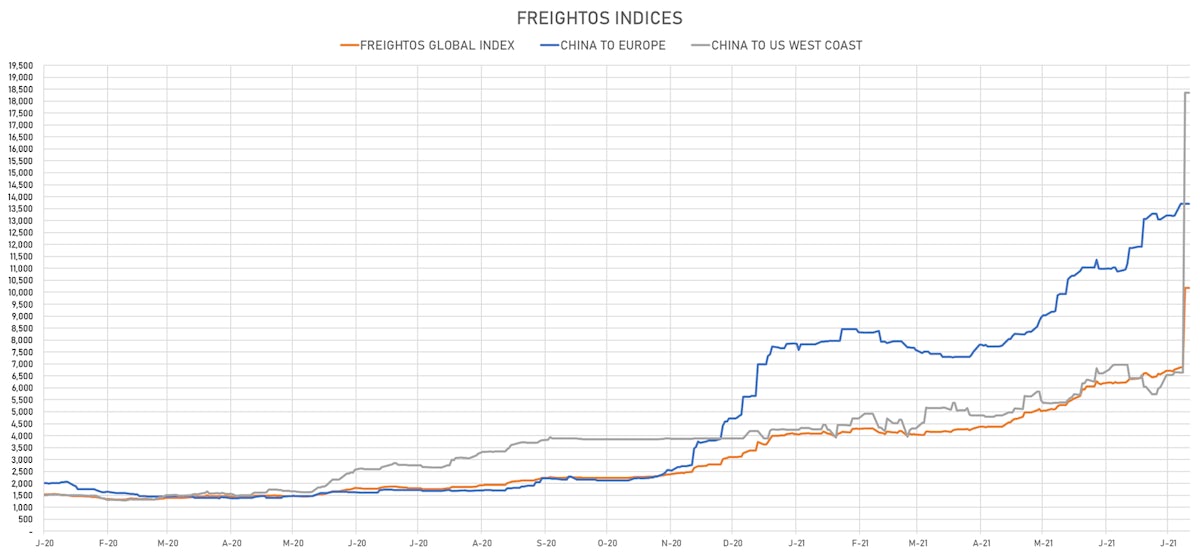

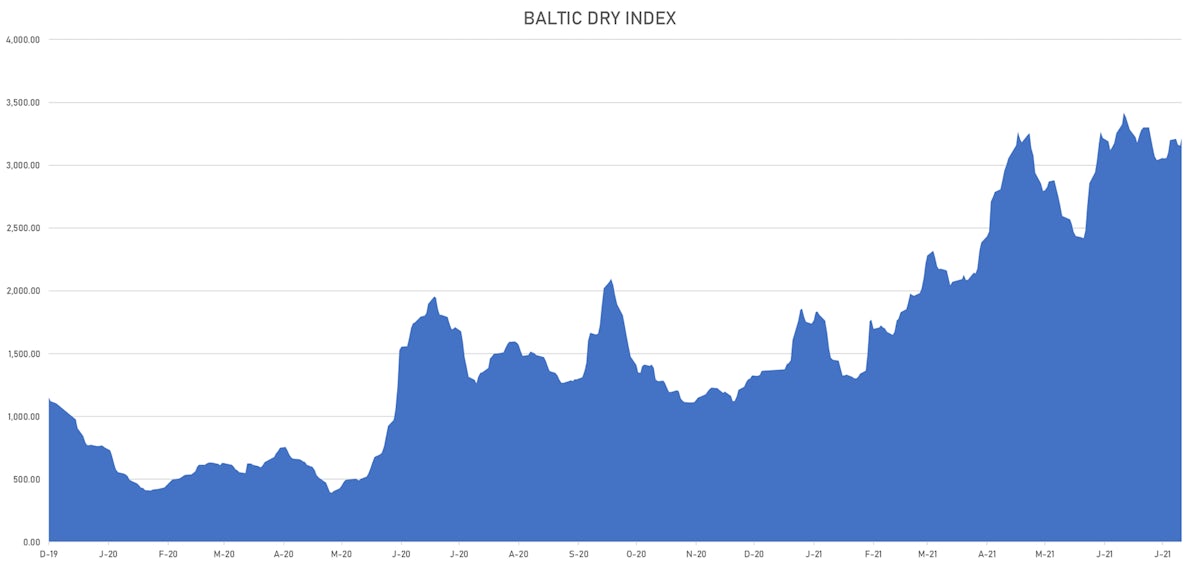

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,214, up 1.9% (YTD: +135.3%)

- Freightos China To North America West Coast Container Index currently at 18,346, unchanged (YTD: +336.9%)

- Freightos North America West Coast To China Container Index currently at 1,132, unchanged (YTD: +118.7%)

- Freightos North America East Coast To Europe Container Index currently at 670, unchanged (YTD: +84.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,015, unchanged (YTD: +221.8%)

- Freightos China To North Europe Container Index currently at 13,706, unchanged (YTD: +142.0%)

- Freightos North Europe To China Container Index currently at 1,634, unchanged (YTD: +18.8%)

- Freightos Europe To South America West Coast Container Index currently at 4,463, unchanged (YTD: +163.8%)

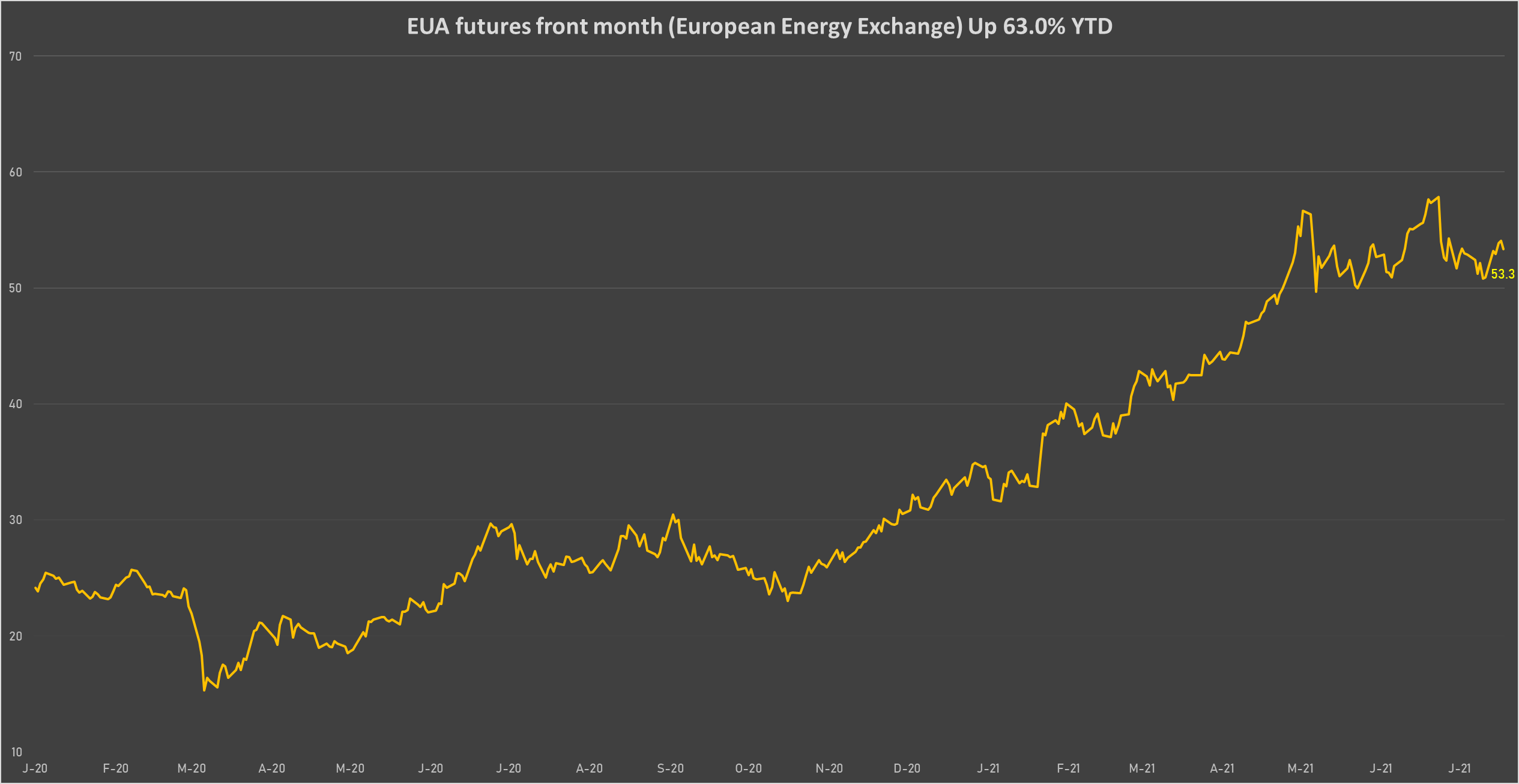

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 53.33 per tonne, down -1.3% (YTD: +63.0%)