Commodities

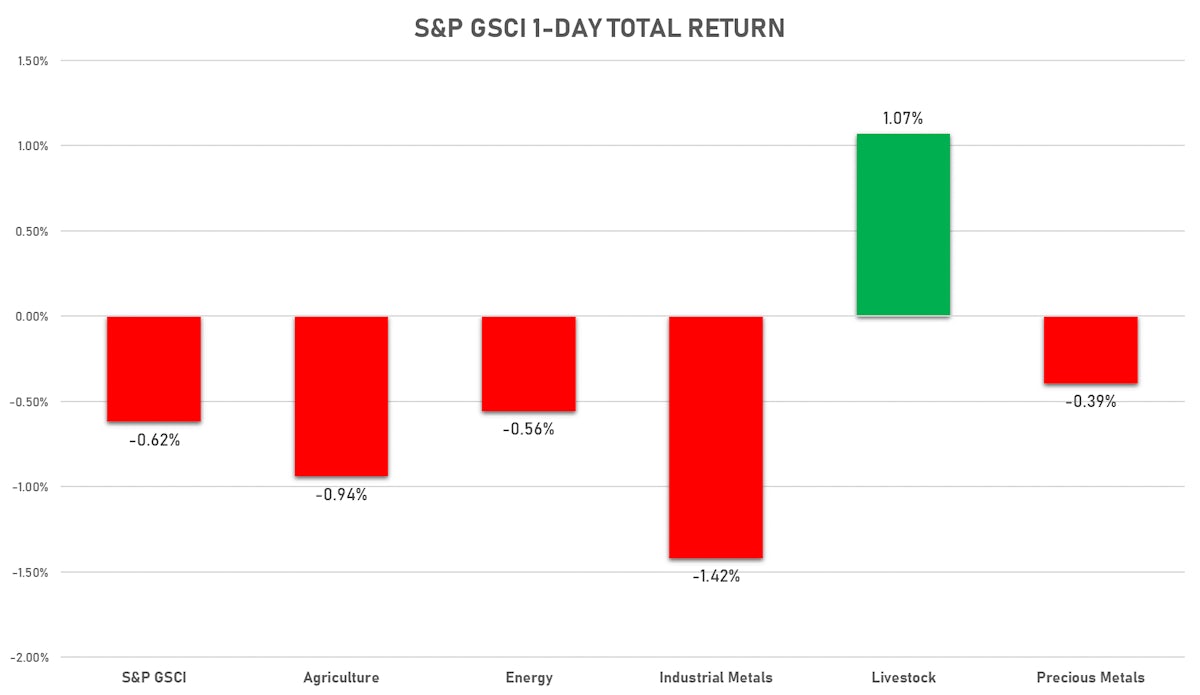

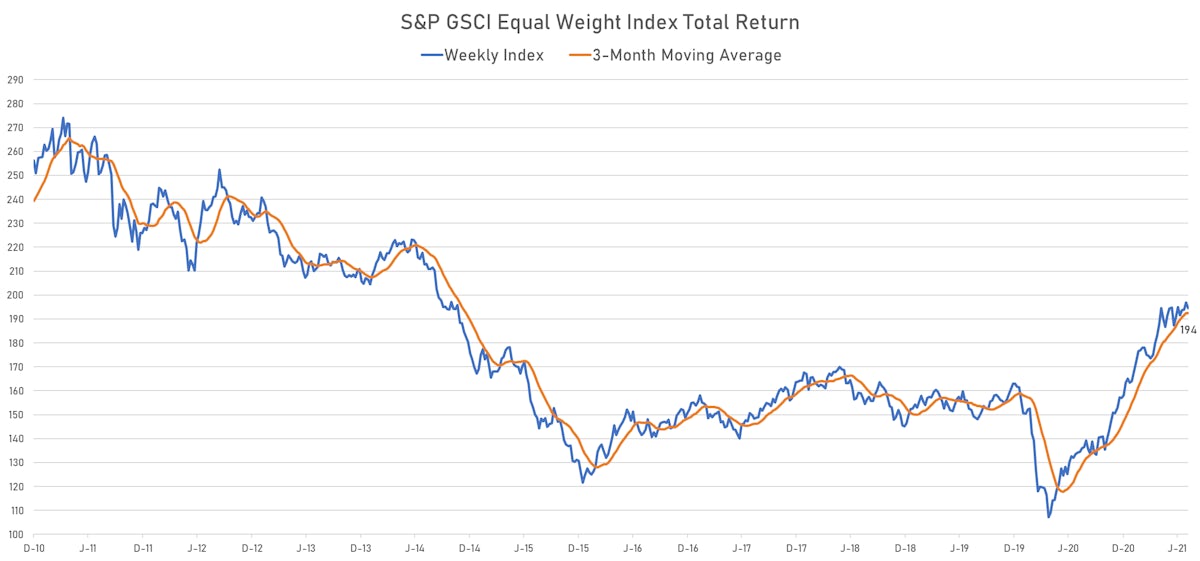

Not A Good Day Across The Commodities Complex, With Both Crude And Copper Ending Lower

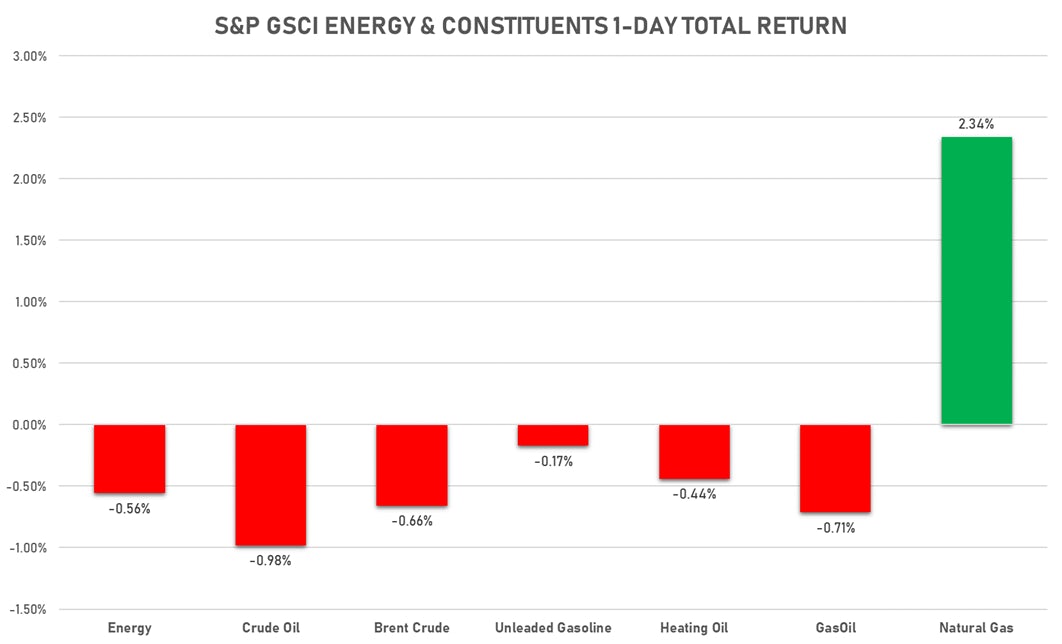

Front-month natural gas futures prices rose, as NOAA's short-term temperature forecasts predict hotter-than-normal conditions over the next couple of weeks

Published ET

Rare Earth Praseodymium Oxide Has Doubled Since Last Year | Source: Refinitiv

NOTABLE GAINERS TODAY

- DCE Iron Ore Continuation Month 1 up 4.3% (YTD: 5.2%)

- SMM Rare Earth Praseodymium Metal Spot Price Daily up 3.1% (YTD: 48.7%)

- SMM Rare Earth Terbium Oxide Spot Price Daily up 2.7% (YTD: 19.3%)

- ICE-US Cocoa up 2.7% (YTD: -6.8%)

- Pork Primal Cutout Butt up 2.6% (YTD: 62.6%)

- SMM Rare Earth Praseodymium Oxide Spot Price Daily up 2.3% (YTD: 80.7%)

- NYMEX Henry Hub Natural Gas up 2.3% (YTD: 58.6%)

- SMM Rare Earth Neodymium Metal Spot Price Daily up 1.9% (YTD: 26.9%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily up 1.9% (YTD: 40.1%)

NOTABLE LOSERS TODAY

- Freightos Baltic Europe To South America East Coast 40 Container Index down -10.7% (YTD: 260.7%)

- SHFE Hot Rolled Coil down -7.2% (YTD: 25.1%)

- CME Random Length Lumber down -4.6% (YTD: -30.5%)

- Coffee Arabica Colombia Excelso EP Spot down -2.8% (YTD: 32.0%)

- CBoT Soybean Meal down -2.6% (YTD: -19.9%)

- Gold/US Dollar 1 Month ATM Option IV down -2.5% (YTD: -19.9%)

- CBoT Soybean Oil down -2.1% (YTD: 46.0%)

- CBoT Soybeans down -1.9% (YTD: 5.9%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot down -1.6% (YTD: 16.4%)

- SHFE Rebar down -1.5% (YTD: 27.7%)

- CBoT Corn down -1.5% (YTD: 13.7%)

CRUDE DOWN, NAT GAS UP TODAY

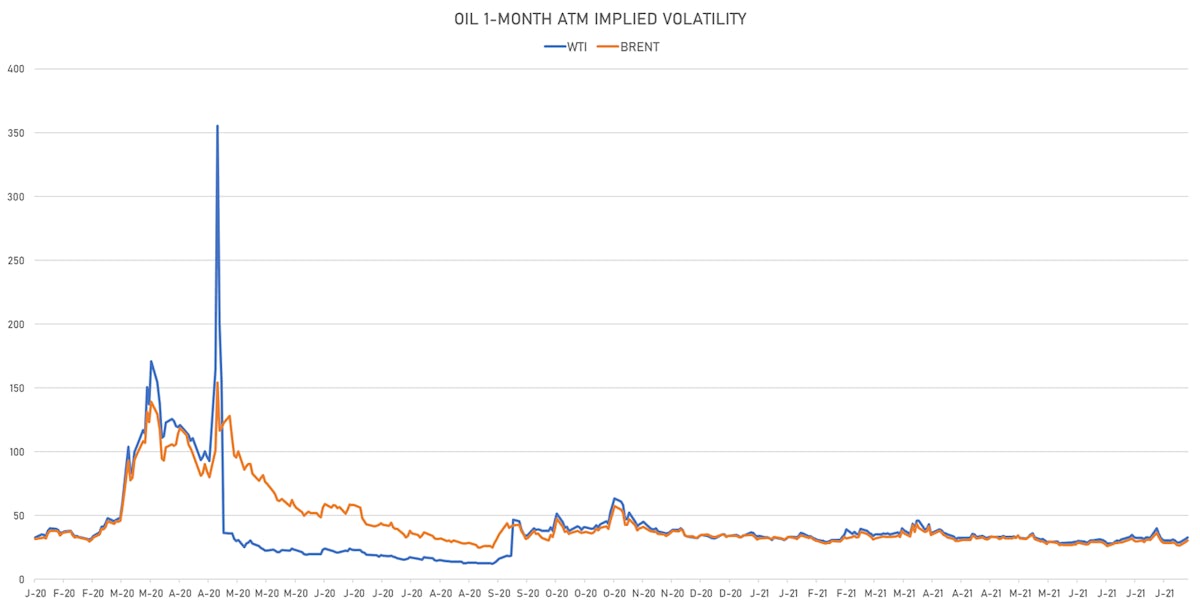

- WTI crude front month currently at US$ 70.26 per barrel, down -1.0% (YTD: +45.4%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 72.24 per barrel, down -0.7% (YTD: +39.8%); 6-month term structure in tightening backwardation

- Brent volatility at 30.6, up 4.2% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 152.75 per tonne, up 0.1% (YTD: +89.8%)

- Natural Gas (Henry Hub) currently at US$ 4.07 per MMBtu, up 2.3% (YTD: +58.6%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, down -0.2% (YTD: +61.2%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 591.50 per tonne, down -0.8% (YTD: +40.6%)

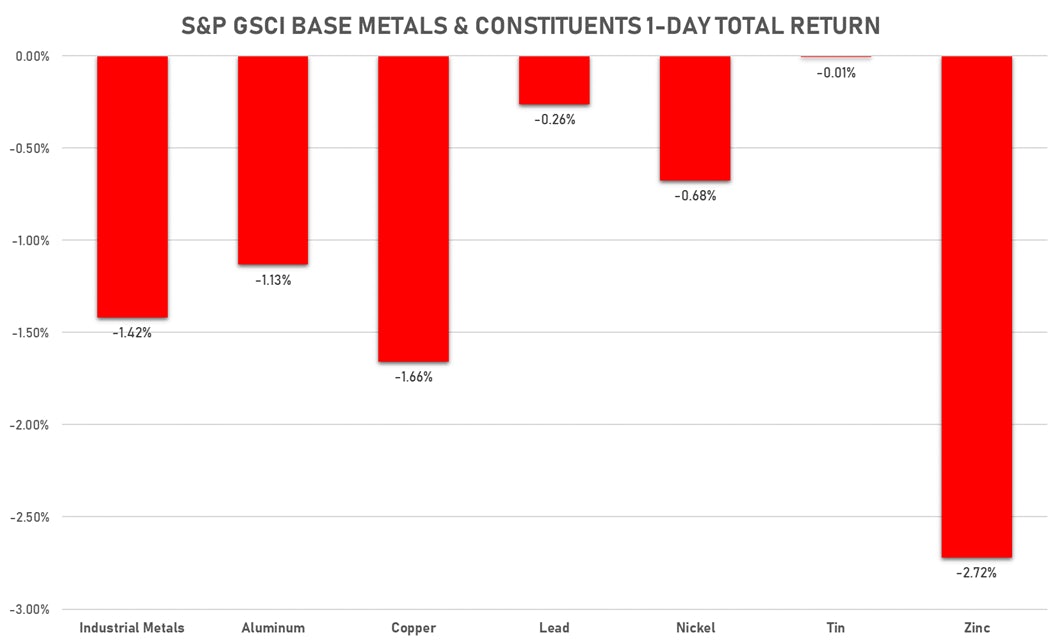

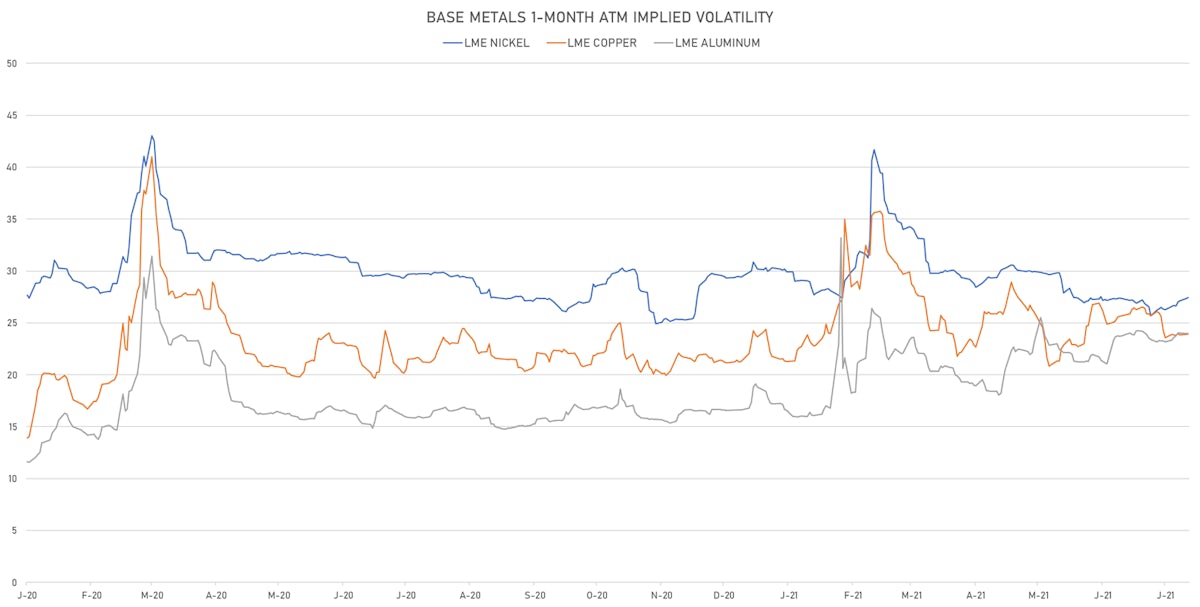

BASE METALS FELL BROADLY TODAY

- Copper (COMEX) currently at US$ 4.38 per pound, down -1.1% (YTD: +24.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,135.00 per tonne, up 4.3% (YTD: +5.2%)

- Aluminum (Shanghai) currently at CNY 19,750 per tonne, down -0.6% (YTD: +26.3%)

- Nickel (Shanghai) currently at CNY 143,910 per tonne, down -1.3% (YTD: +16.6%)

- Lead (Shanghai) currently at CNY 15,860 per tonne, down -0.6% (YTD: +8.3%)

- Rebar (Shanghai) currently at CNY 5,391 per tonne, down -1.5% (YTD: +27.7%)

- Tin (Shanghai) currently at CNY 232,640 per tonne, down -0.9% (YTD: +55.9%)

- Zinc (Shanghai) currently at CNY 22,090 per tonne, down -1.2% (YTD: +7.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 379,500 per tonne, unchanged (YTD: +38.5%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

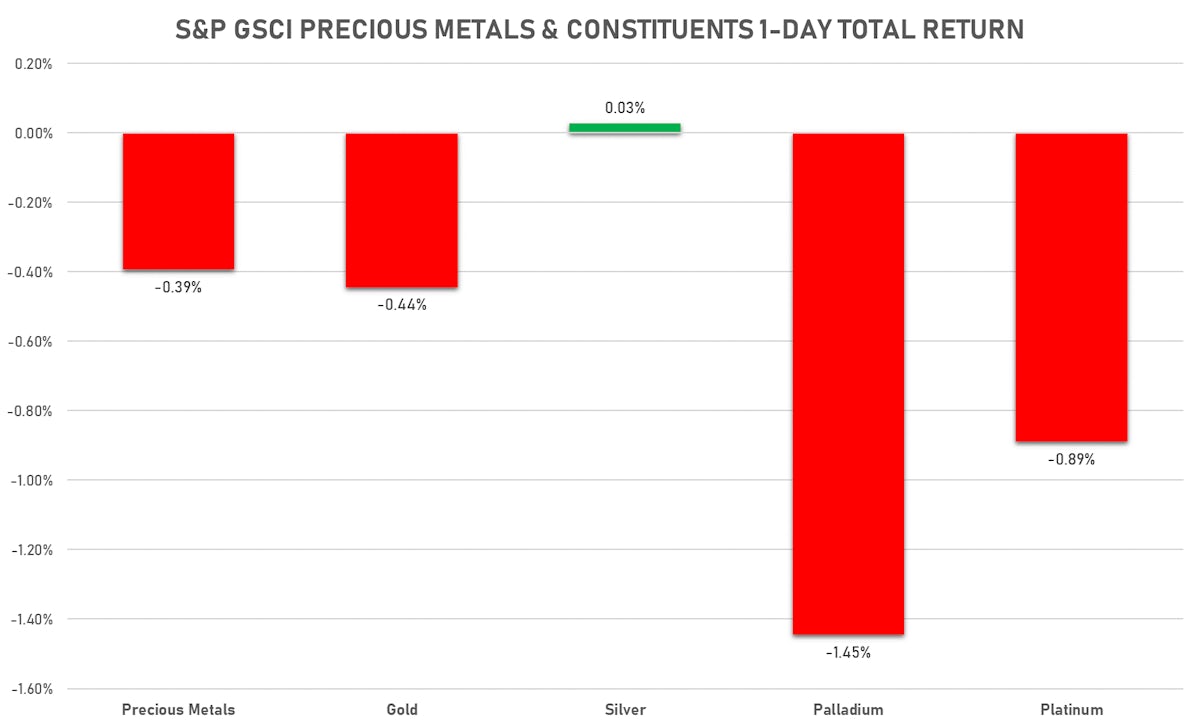

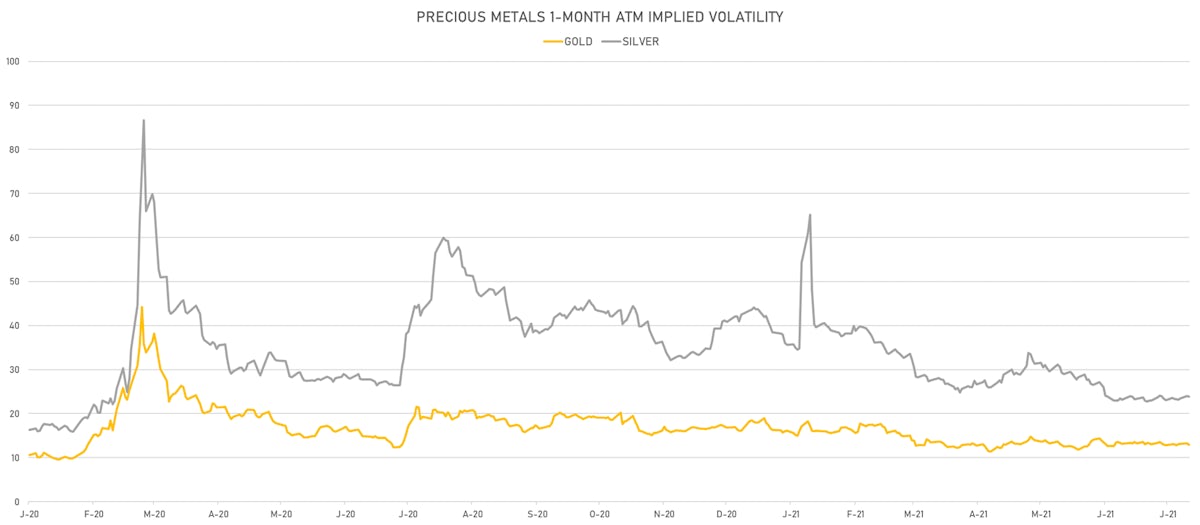

PRECIOUS METALS DOWN TODAY

- Gold spot currently at US$ 1,809.89 per troy ounce, down -0.2% (YTD: -4.6%)

- Gold 1-Month ATM implied volatility currently at 12.51, down -2.5% (YTD: -19.9%)

- Silver spot currently at US$ 25.53 per troy ounce, up 0.5% (YTD: -3.3%)

- Silver 1-Month ATM implied volatility currently at 22.63, down -0.9% (YTD: -44.1%)

- Palladium spot currently at US$ 2,644.02 per troy ounce, down -1.3% (YTD: +8.3%)

- Platinum spot currently at US$ 1,045.61 per troy ounce, down -0.5% (YTD: -1.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,900 per troy ounce, up 1.6% (YTD: +10.9%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,400 per troy ounce, unchanged (YTD: +107.7%)

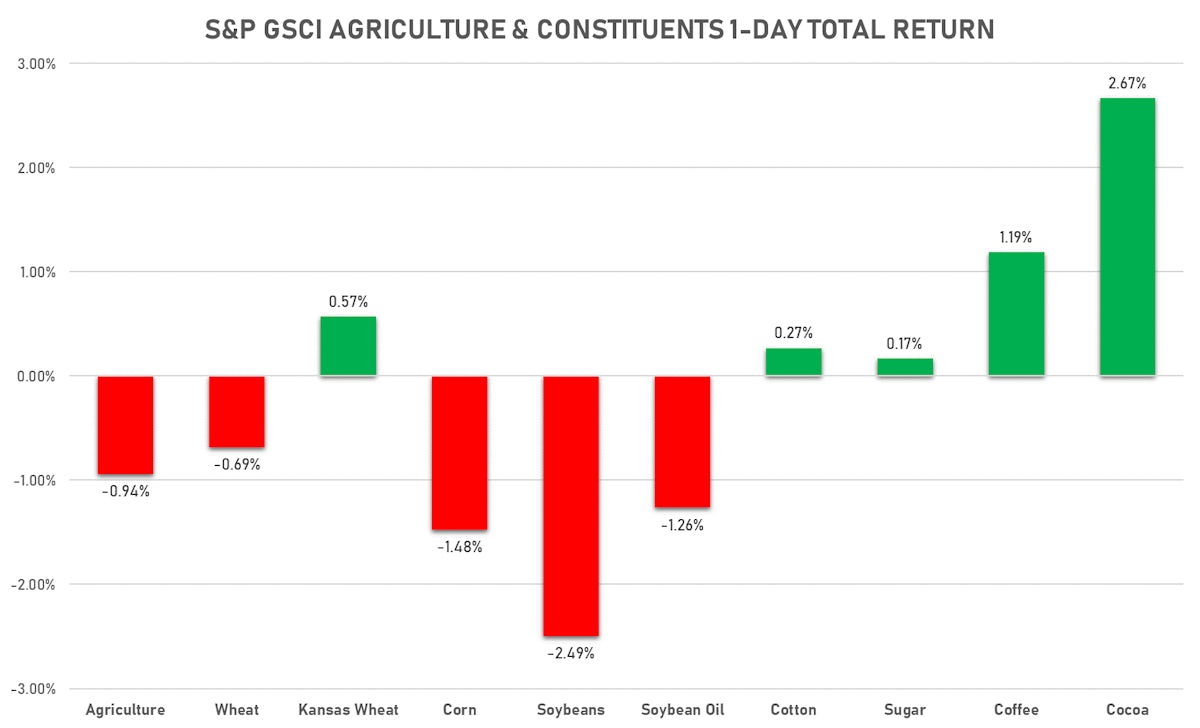

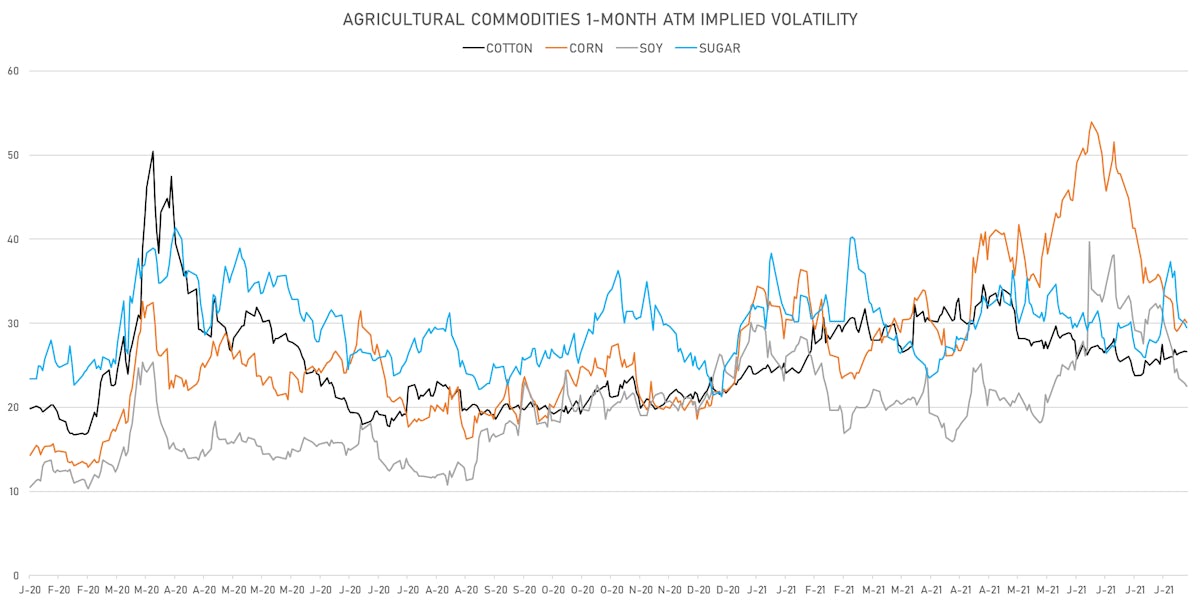

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 123.25 cents per pound, up 0.9% (YTD: +9.1%)

- Lean Hogs (CME) currently at US$ 109.08 cents per pound, up 1.5% (YTD: +55.2%)

- Rough Rice (CBOT) currently at US$ 13.36 cents per hundredweight, down -0.7% (YTD: +8.1%)

- Soybeans Composite (CBOT) currently at US$ 1,394.75 cents per bushel, down -1.9% (YTD: +5.9%)

- Corn (CBOT) currently at US$ 551.00 cents per bushel, down -1.5% (YTD: +13.7%)

- Wheat Composite (CBOT) currently at US$ 726.25 cents per bushel, down -0.7% (YTD: +13.1%)

- Sugar No.11 (ICE US) currently at US$ 17.98 cents per pound, up 0.2% (YTD: +16.1%)

- Cotton No.2 (ICE US) currently at US$ 90.30 cents per pound, up 0.3% (YTD: +15.6%)

- Cocoa (ICE US) currently at US$ 2,426 per tonne, up 2.7% (YTD: -6.8%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,178 per tonne, down -2.8% (YTD: +32.0%)

- Random Length Lumber (CME) currently at US$ 606.50 per 1,000 board feet, down -4.6% (YTD: -30.5%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,835 per tonne, up 0.3% (YTD: +7.9%)

- Soybean Oil Composite (CBOT) currently at US$ 63.27 cents per pound, down -2.1% (YTD: +46.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,489 per tonne, up 1.0% (YTD: +15.4%)

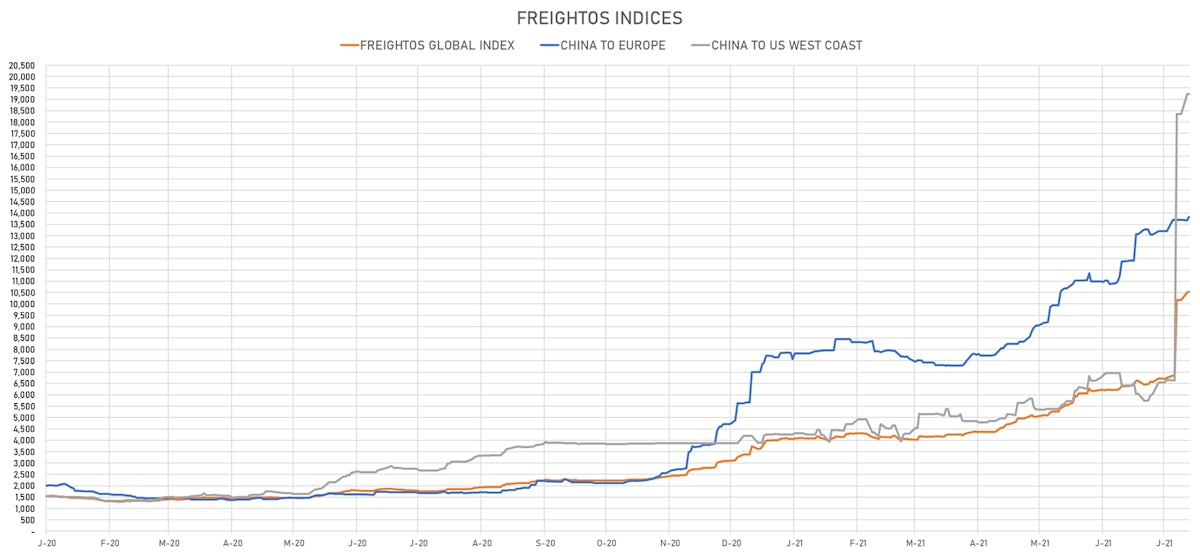

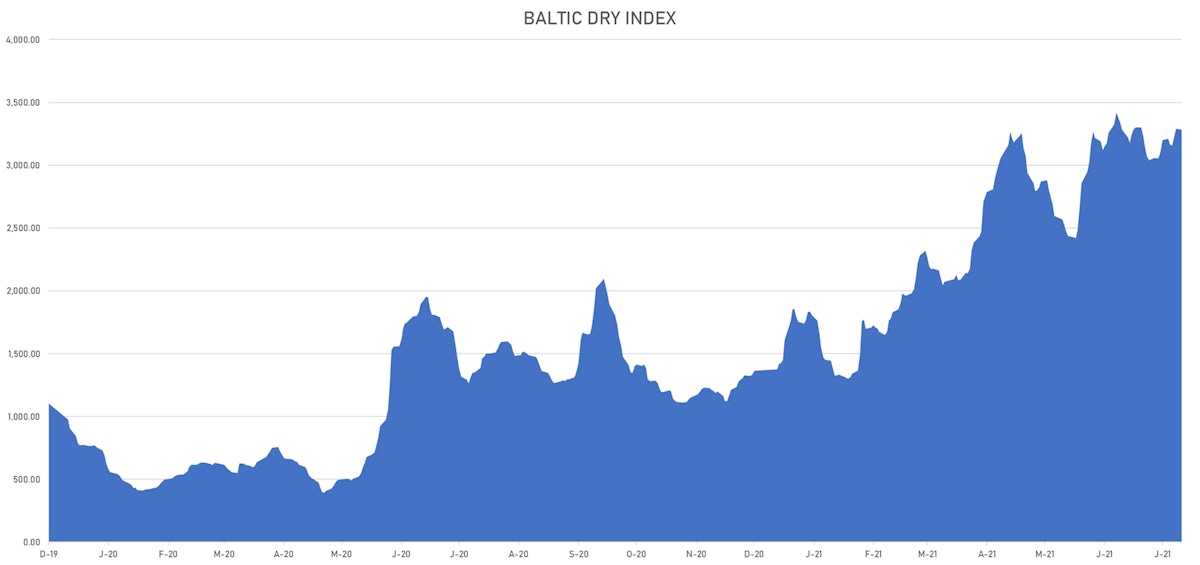

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,282, down -0.3% (YTD: +140.3%)

- Freightos China To North America West Coast Container Index currently at 19,237, unchanged (YTD: +358.1%)

- Freightos North America West Coast To China Container Index currently at 1,132, unchanged (YTD: +118.7%)

- Freightos North America East Coast To Europe Container Index currently at 670, unchanged (YTD: +84.6%)

- Freightos Europe To North America East Coast Container Index currently at 5,971, unchanged (YTD: +219.5%)

- Freightos China To North Europe Container Index currently at 13,836, up 1.1% (YTD: +144.3%)

- Freightos North Europe To China Container Index currently at 1,632, unchanged (YTD: +18.7%)

- Freightos Europe To South America West Coast Container Index currently at 4,621, down -0.2% (YTD: +173.2%)

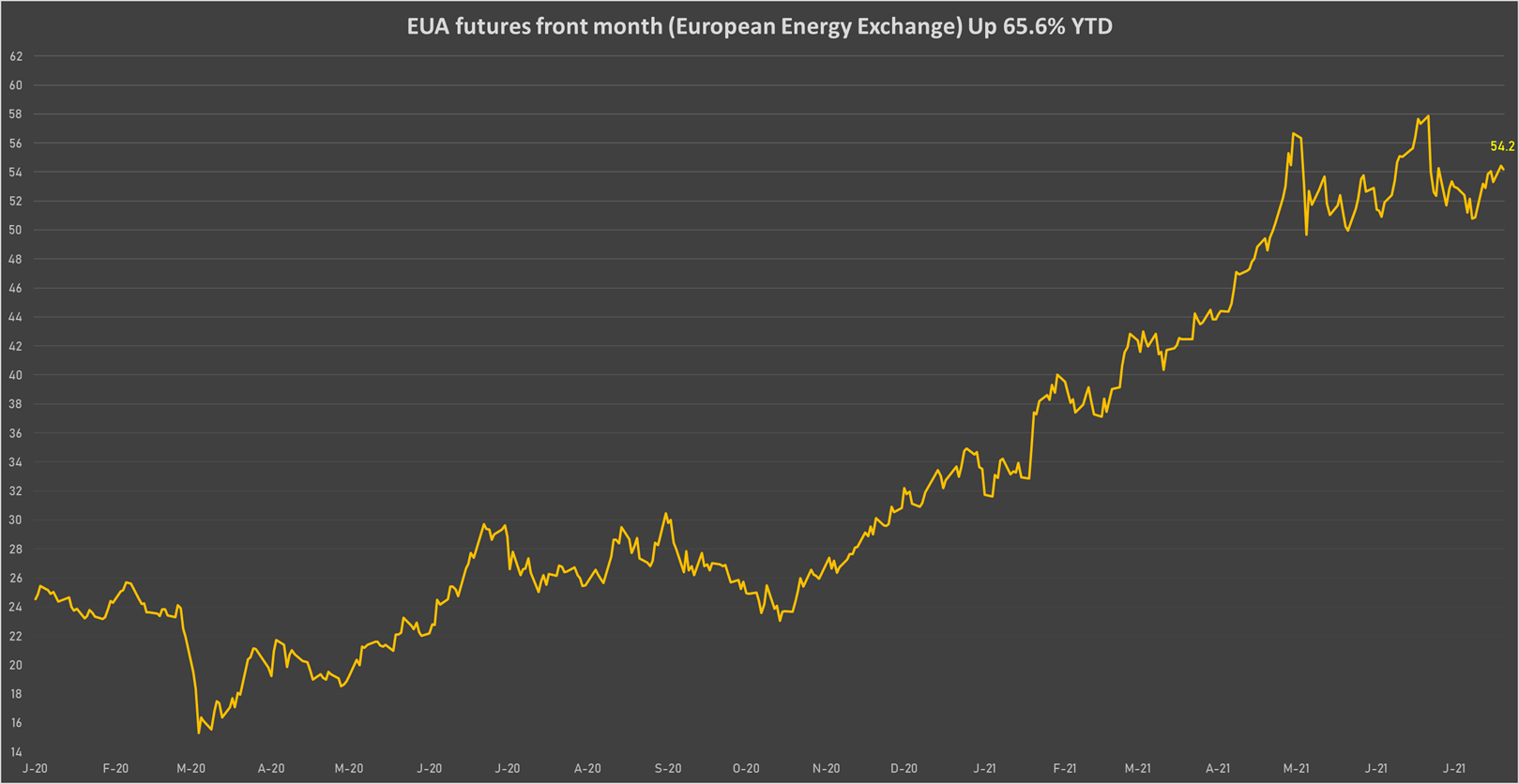

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 54.19 per tonne, down -0.4% (YTD: +65.6%)