Commodities

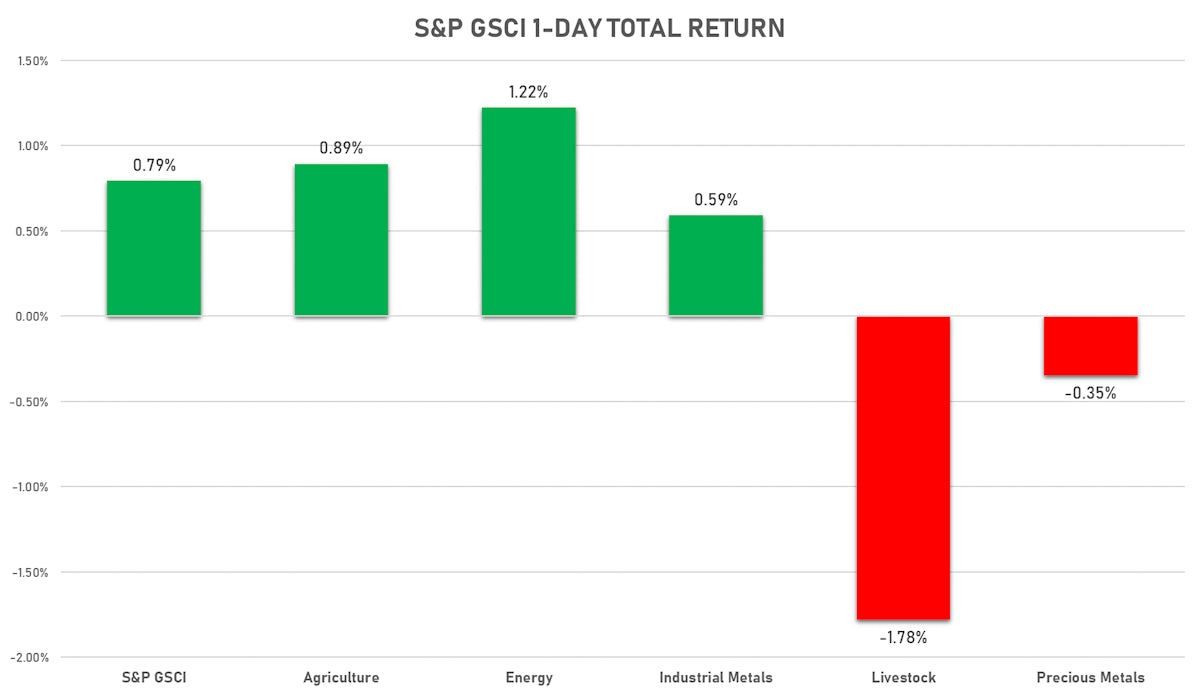

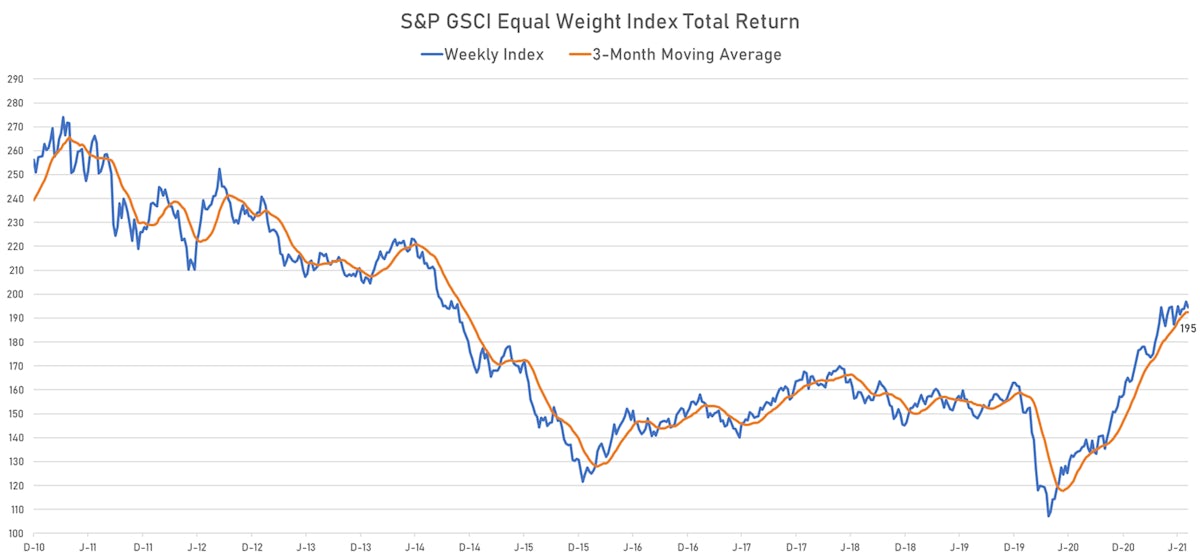

Most Commodity Groups Rose Today, With A Good Bounce In Crude And Ags

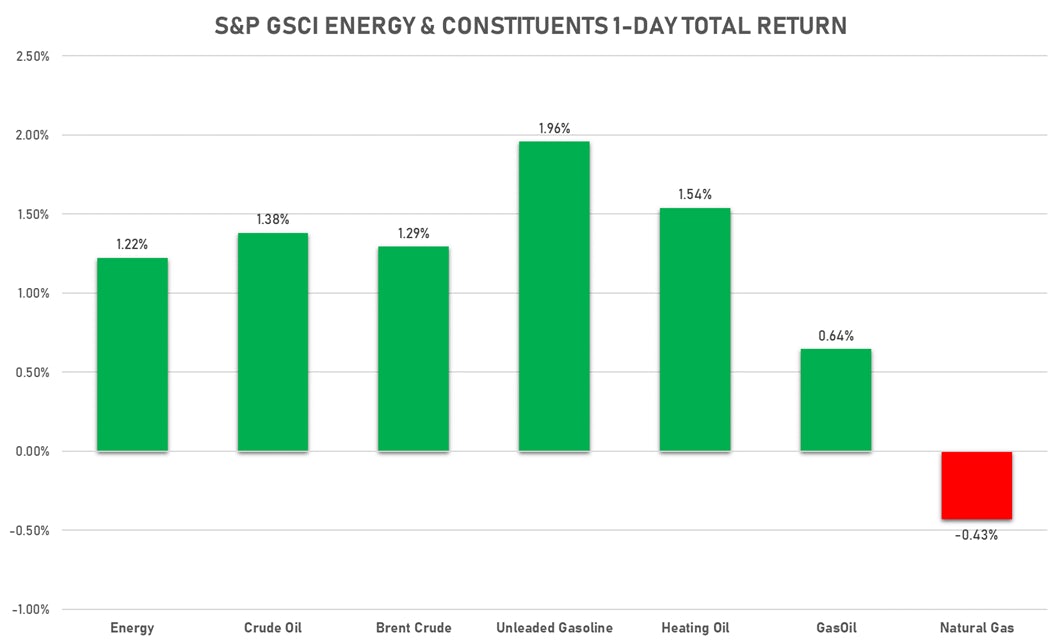

Natural gas prices fell despite a bullish EIA report, an indication that the huge year-to-date run may be, at least temporarily, peaking

Published ET

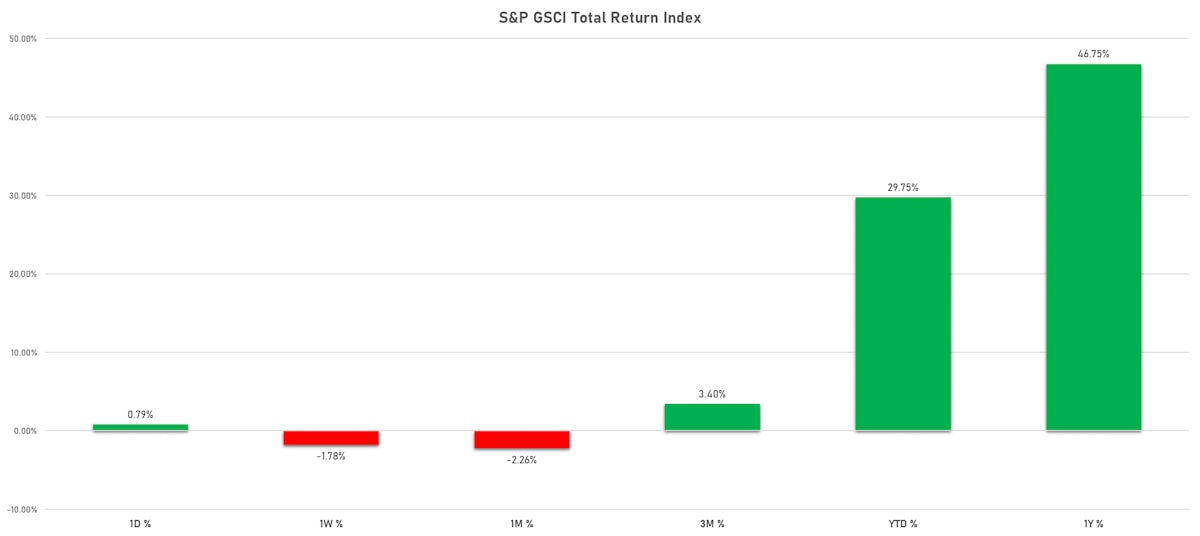

S&P GSCI Total Return Index | Sources: ϕpost, FactSet data

HEADLINES & MACRO

- EIA data showed a smaller natural gas inventory build than expected in the US: natural gas in underground storage, lower 48 States, Absolute change, Volume for W 30 Jul (EIA, United States) at 13.00 bcf, below consensus estimate of 21.00 bcf

NOTABLE GAINERS TODAY

- Pork Primal Cutout Butt up 8.9% (YTD: 68.8%)

- DCE Coking Coal Continuation Month 1 up 8.0% (YTD: 47.5%)

- ICE-US Sugar No. 11 up 3.8% (YTD: 20.2%)

- NYMEX RBOB Gasoline up 2.0% (YTD: 62.9%)

- ICE Europe Newcastle Coal up 1.8% (YTD: 95.3%)

- CBoT Corn up 1.8% (YTD: 14.8%)

- Zhengzhou Exchange Thermal Coal up 1.6% (YTD: 32.8%)

- NYMEX NY Harbor ULSD up 1.5% (YTD: 42.7%)

- NYMEX Light Sweet Crude Oil (WTI) up 1.4% (YTD: 42.4%)

- ICE Europe Brent Crude up 1.3% (YTD: 37.6%)

- CBoT Soybean Meal up 1.1% (YTD: -17.8%)

NOTABLE LOSERS TODAY

- CME Dry Whey down -9.1% (YTD: 24.4%)

- CME Random Length Lumber down -7.4% (YTD: -40.1%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -5.8% (YTD: 10.3%)

- CME Cash settled Butter down -5.8% (YTD: 11.2%)

- SGX Iron Ore 62% China CFR Swap Monthly down -4.8% (YTD: 11.4%)

- Gold/US Dollar 1 Month ATM Option IV down -2.4% (YTD: -22.6%)

- Bursa Malaysia Crude Palm Oil down -2.2% (YTD: 16.3%)

- Silver/US Dollar 1 Month ATM Option IV down -2.0% (YTD: -45.6%)

- Platinum spot down -1.8% (YTD: -6.0%)

- CME Live Cattle down -1.2% (YTD: 8.5%)

ENERGY COMPLEX UP TODAY

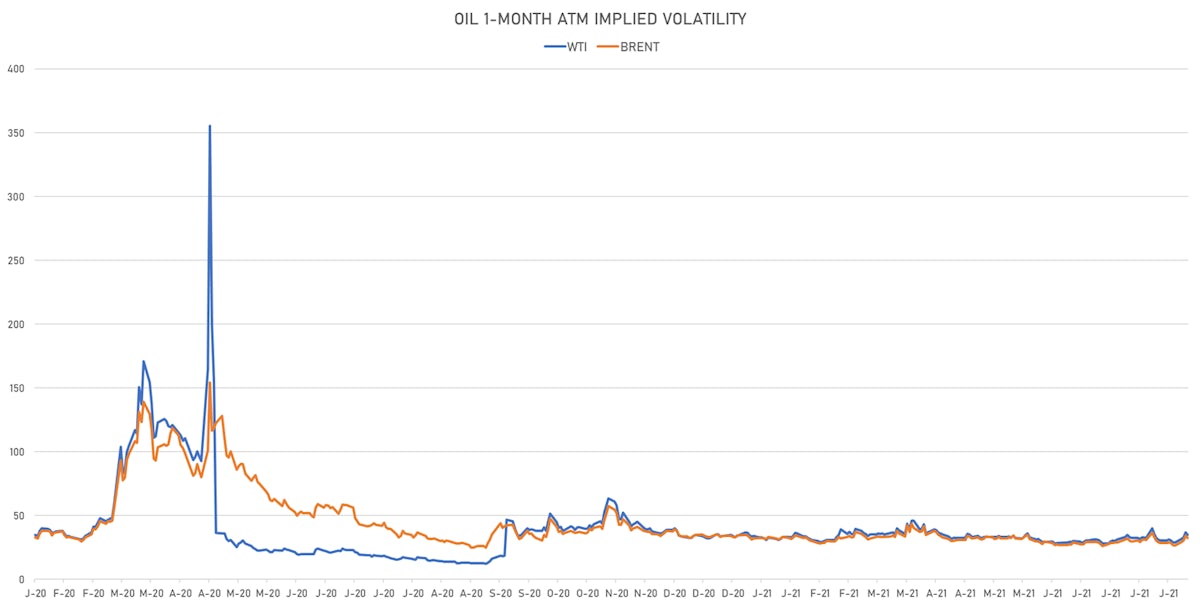

- WTI crude front month currently at US$ 69.08 per barrel, up 1.4% (YTD: +42.4%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 71.29 per barrel, up 1.3% (YTD: +37.6%); 6-month term structure in tightening backwardation

- Brent volatility at 32.3, down -4.3% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 157.25 per tonne, up 1.8% (YTD: +95.3%)

- Natural Gas (Henry Hub) currently at US$ 4.15 per MMBtu, down -0.4% (YTD: +63.1%)

- Gasoline (NYMEX) currently at US$ 2.30 per gallon, up 2.0% (YTD: +62.9%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 585.00 per tonne, up 0.6% (YTD: +39.0%)

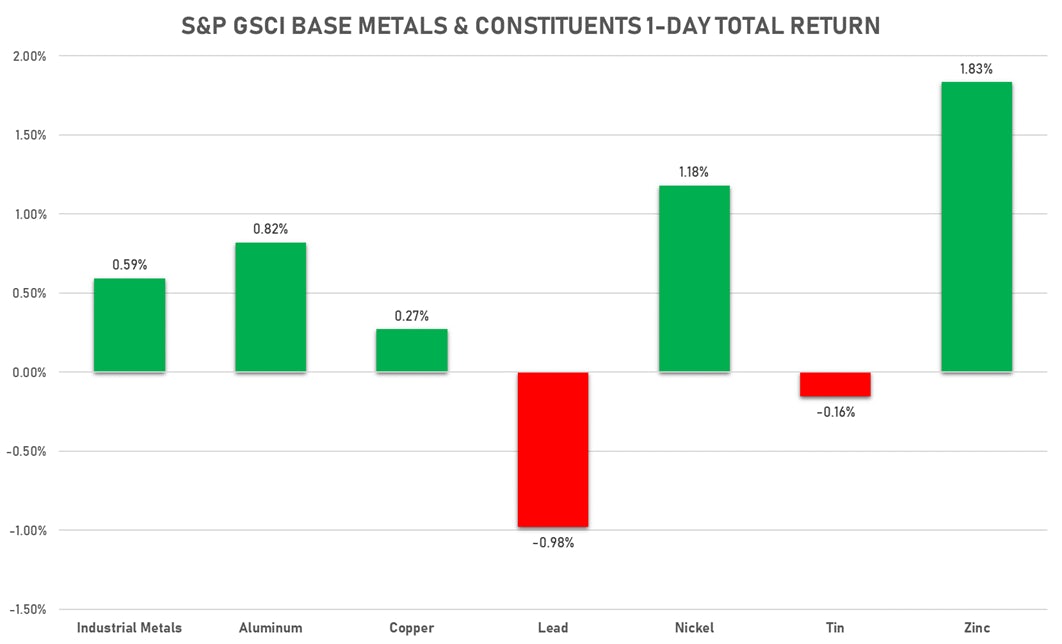

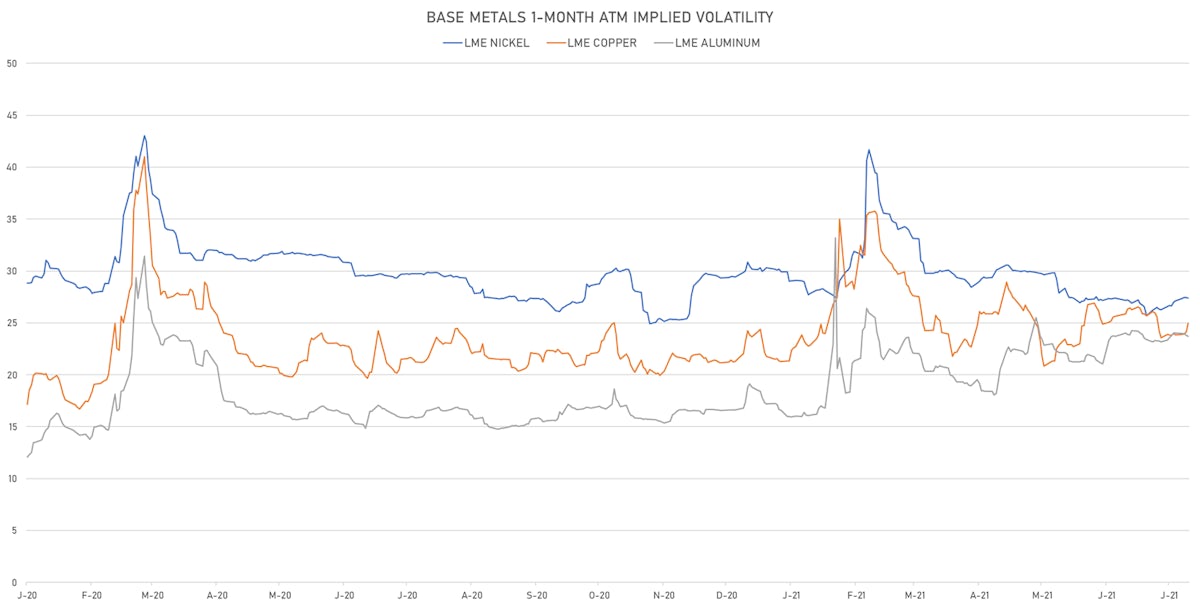

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) currently at US$ 4.35 per pound, up 0.4% (YTD: +23.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,135.00 per tonne, down 0.0% (YTD: +5.2%)

- Aluminium (Shanghai) currently at CNY 19,840 per tonne, down -0.1% (YTD: +25.8%)

- Nickel (Shanghai) currently at CNY 144,530 per tonne, down -0.2% (YTD: +15.8%)

- Lead (Shanghai) currently at CNY 15,675 per tonne, down -0.8% (YTD: +6.8%)

- Rebar (Shanghai) currently at CNY 5,390 per tonne, up 0.5% (YTD: +29.3%)

- Tin (Shanghai) currently at CNY 232,220 per tonne, up 0.1% (YTD: +54.3%)

- Zinc (Shanghai) currently at CNY 22,415 per tonne, up 0.1% (YTD: +5.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 377,000 per tonne, unchanged (YTD: +37.6%)

- Lithium (Shanghai) spot price currently at CNY 620,000 per tonne, unchanged (YTD: +27.8%)

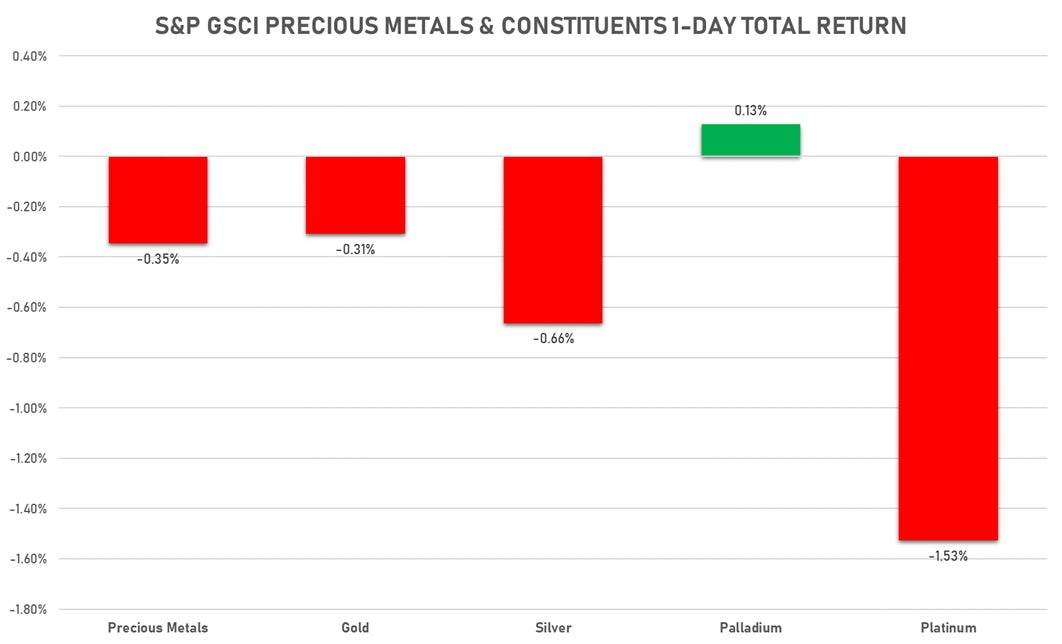

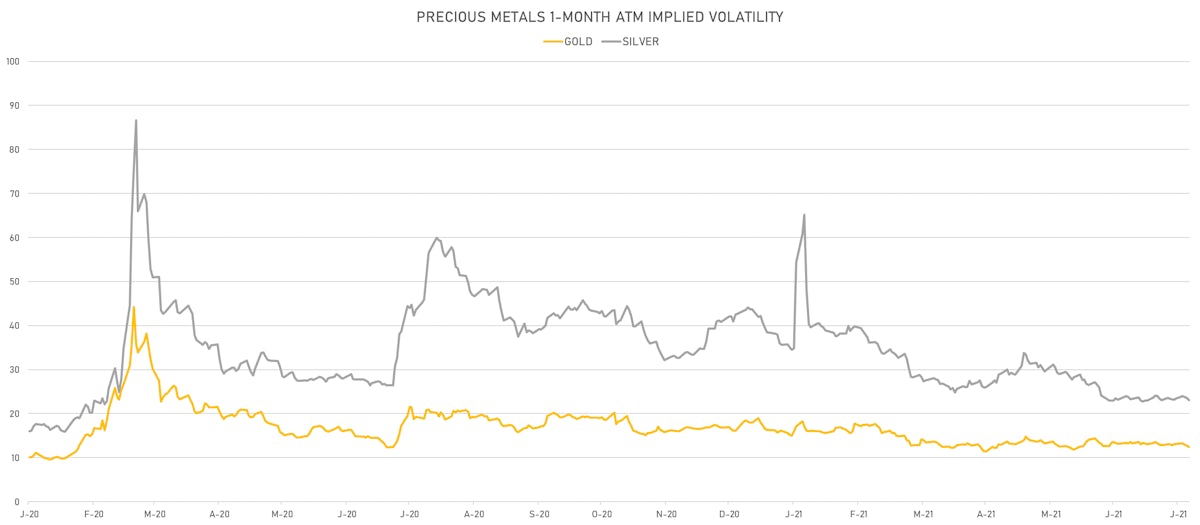

PRECIOUS METALS FELL BROADLY TODAY

- Gold spot currently at US$ 1,803.46 per troy ounce, down -0.5% (YTD: -4.9%)

- Gold 1-Month ATM implied volatility currently at 12.03, down -2.4% (YTD: -22.6%)

- Silver spot currently at US$ 25.12 per troy ounce, down -0.9% (YTD: -4.7%)

- Silver 1-Month ATM implied volatility currently at 22.11, down -2.0% (YTD: -45.6%)

- Palladium spot currently at US$ 2,649.27 per troy ounce, up 0.1% (YTD: +8.4%)

- Platinum spot currently at US$ 1,007.31 per troy ounce, down -1.8% (YTD: -6.0%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,400 per troy ounce, unchanged (YTD: +107.7%)

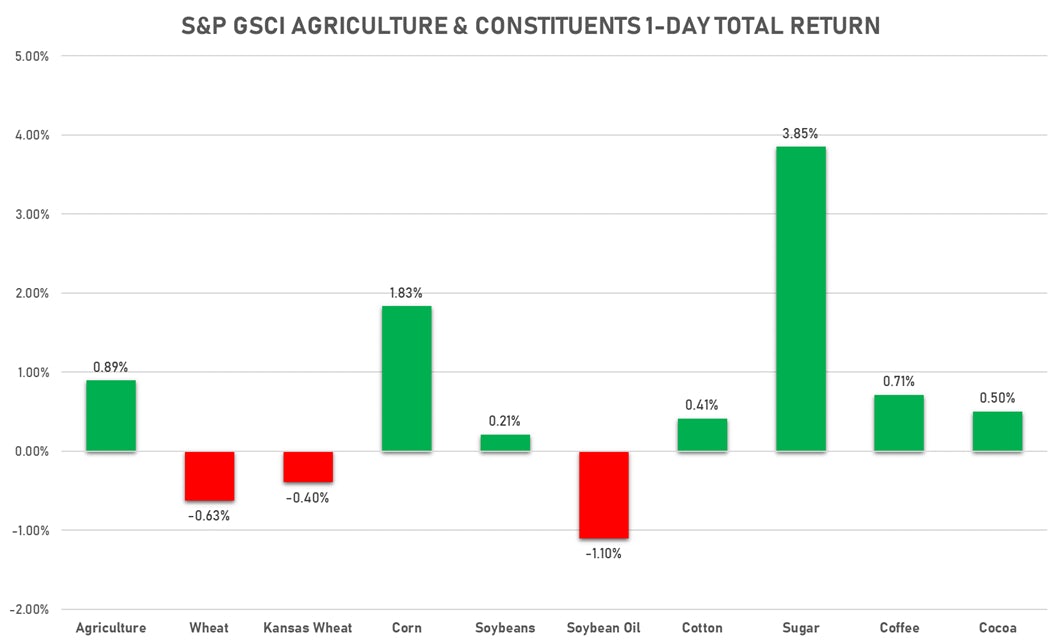

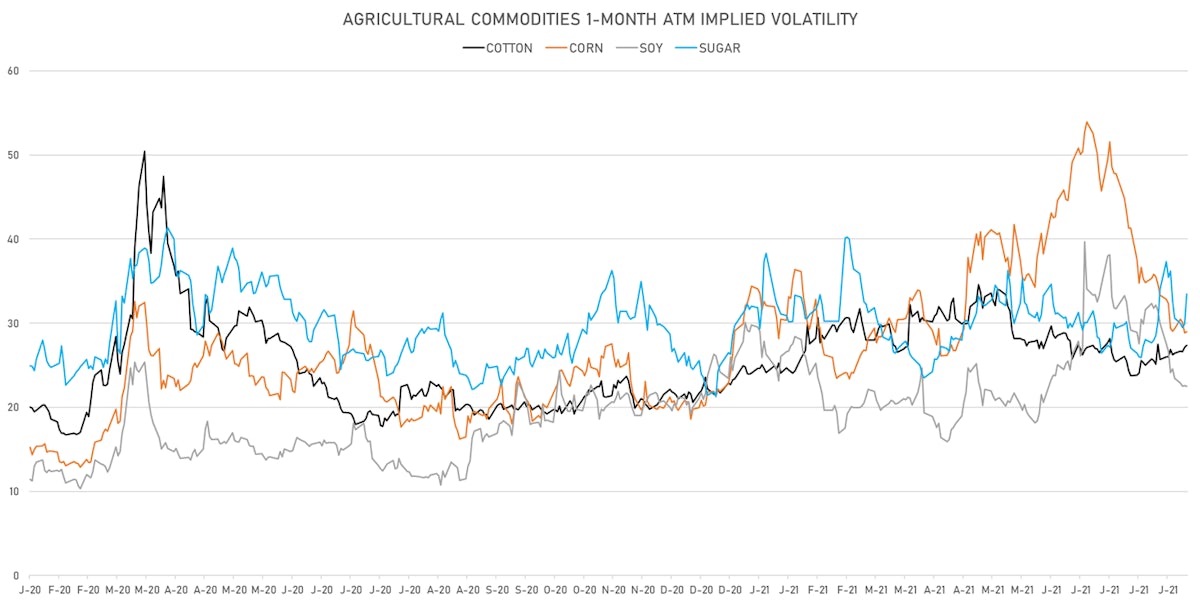

CORN, SUGAR RISE ON MIXED DAY FOR AGS

- Live Cattle (CME) currently at US$ 122.58 cents per pound, down 1.2% (YTD: +8.5%)

- Lean Hogs (CME) unchanged at US$ 109.48 cents per pound (YTD: +55.8%)

- Rough Rice (CBOT) currently at US$ 13.29 cents per hundredweight, up 0.7% (YTD: +7.1%)

- Soybeans Composite (CBOT) currently at US$ 1,402.50 cents per bushel, down -0.1% (YTD: +6.6%)

- Corn (CBOT) currently at US$ 555.75 cents per bushel, up 1.8% (YTD: +14.8%)

- Wheat Composite (CBOT) currently at US$ 712.75 cents per bushel, down -0.6% (YTD: +11.3%)

- Sugar No.11 (ICE US) currently at US$ 18.62 cents per pound, up 3.8% (YTD: +20.2%)

- Cotton No.2 (ICE US) currently at US$ 91.17 cents per pound, up 0.5% (YTD: +16.7%)

- Cocoa (ICE US) currently at US$ 2,405 per tonne, up 0.5% (YTD: -7.6%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,221 per tonne, up 0.4% (YTD: +33.4%)

- Random Length Lumber (CME) currently at US$ 522.90 per 1,000 board feet, down -7.4% (YTD: -40.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,880 per tonne, up 0.4% (YTD: +8.5%)

- Soybean Oil Composite (CBOT) currently at US$ 62.47 cents per pound, down -0.5% (YTD: +44.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,526 per tonne, down -2.2% (YTD: +16.3%)

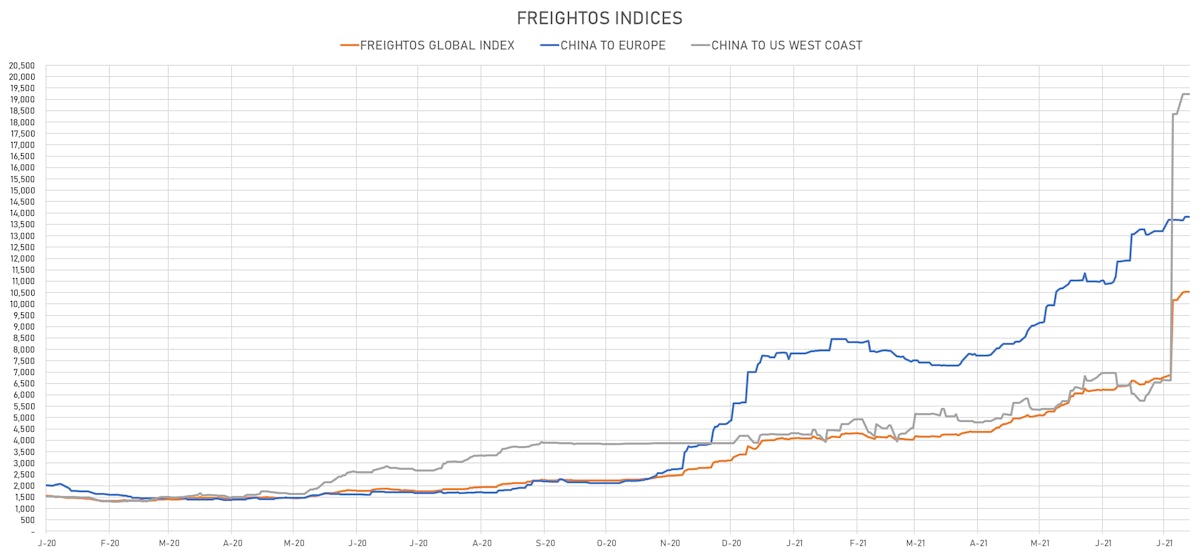

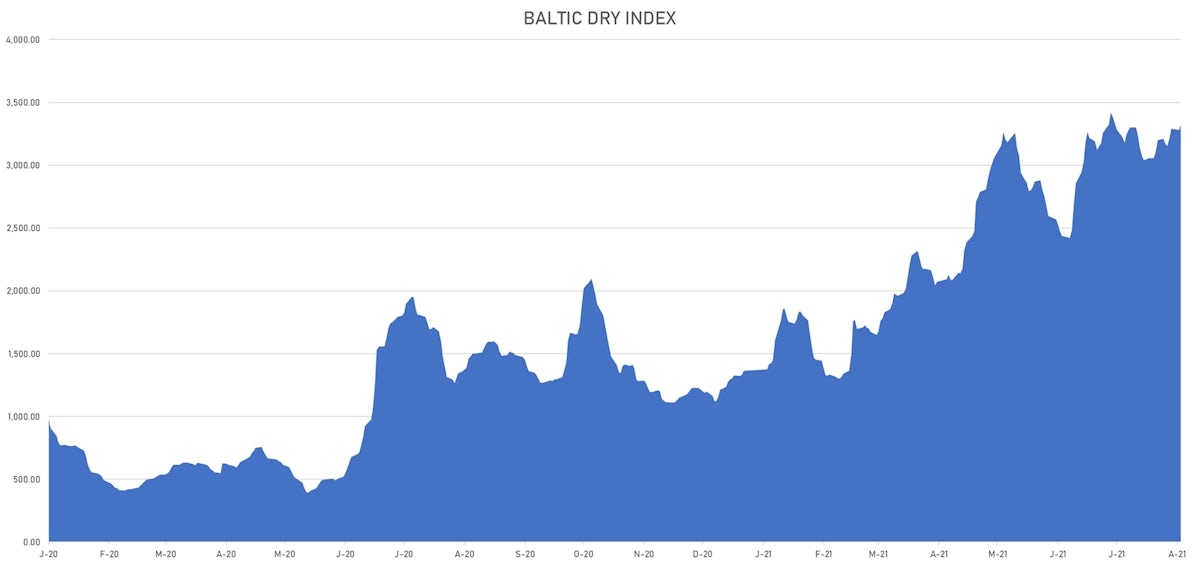

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,318, up 1.1% (YTD: +142.9%)

- Freightos China To North America West Coast Container Index currently at 19,237, unchanged (YTD: +358.1%)

- Freightos North America West Coast To China Container Index currently at 1,128, down -0.4% (YTD: +117.9%)

- Freightos North America East Coast To Europe Container Index currently at 670, unchanged (YTD: +84.6%)

- Freightos Europe To North America East Coast Container Index currently at 6,031, up 1.0% (YTD: +222.7%)

- Freightos China To North Europe Container Index currently at 13,836, unchanged (YTD: +144.3%)

- Freightos North Europe To China Container Index currently at 1,644, unchanged (YTD: +19.5%)

- Freightos Europe To South America West Coast Container Index currently at 4,621, unchanged (YTD: +173.2%)

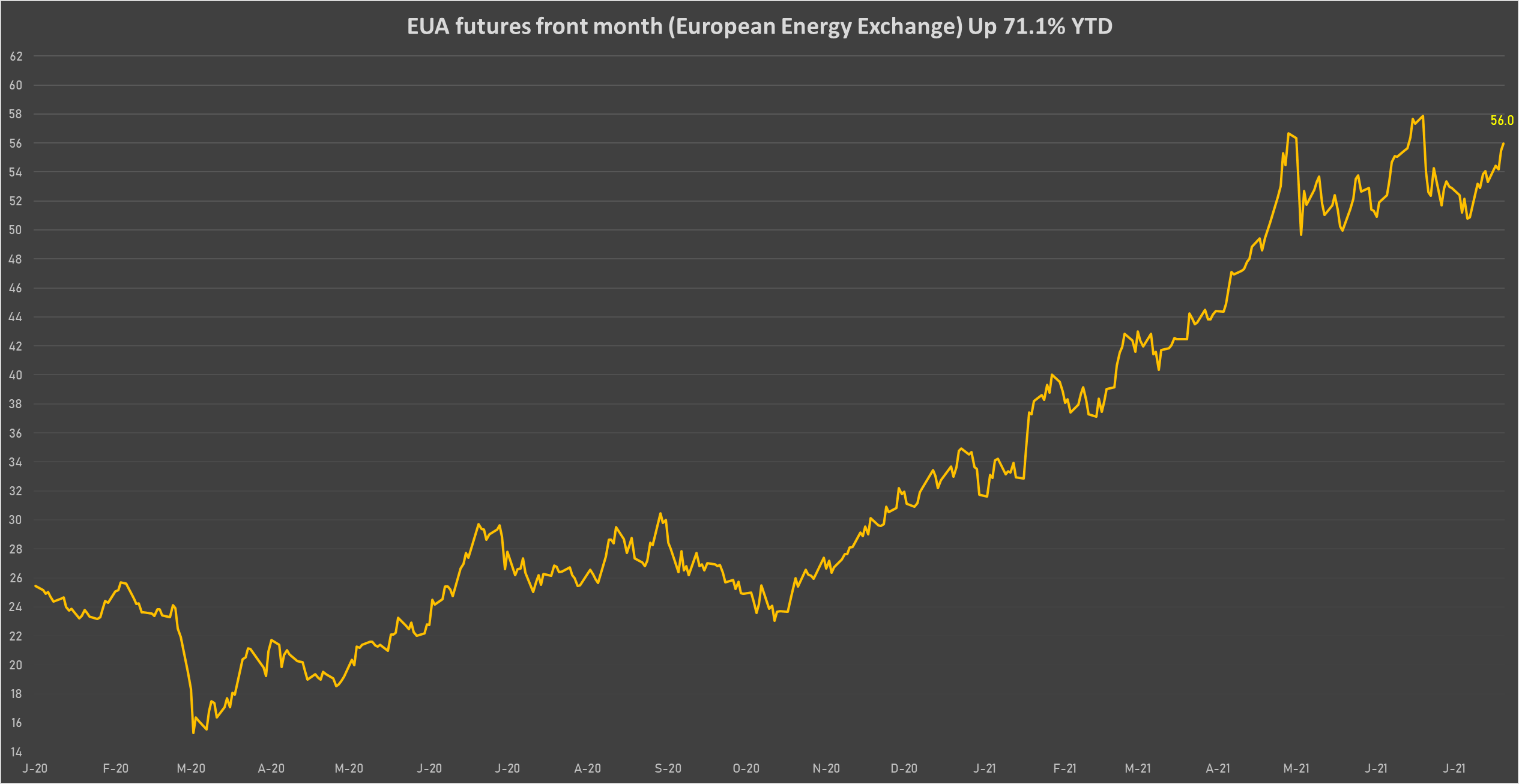

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 55.98 per tonne, up 0.9% (YTD: +71.1%)