Commodities

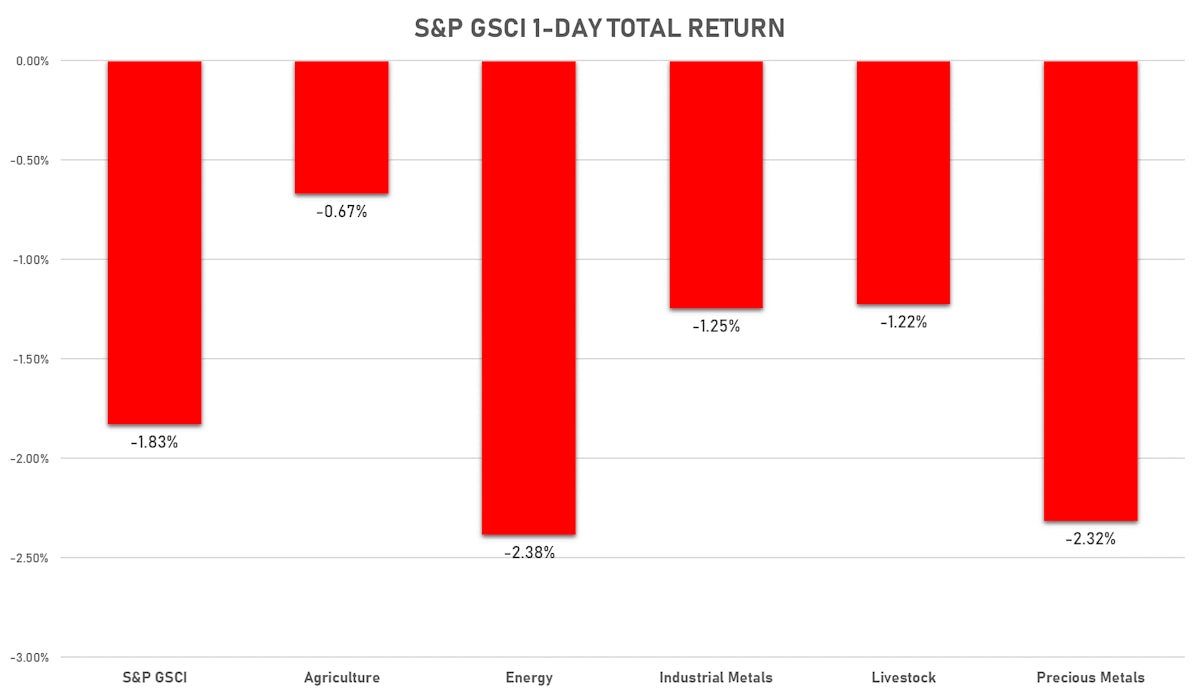

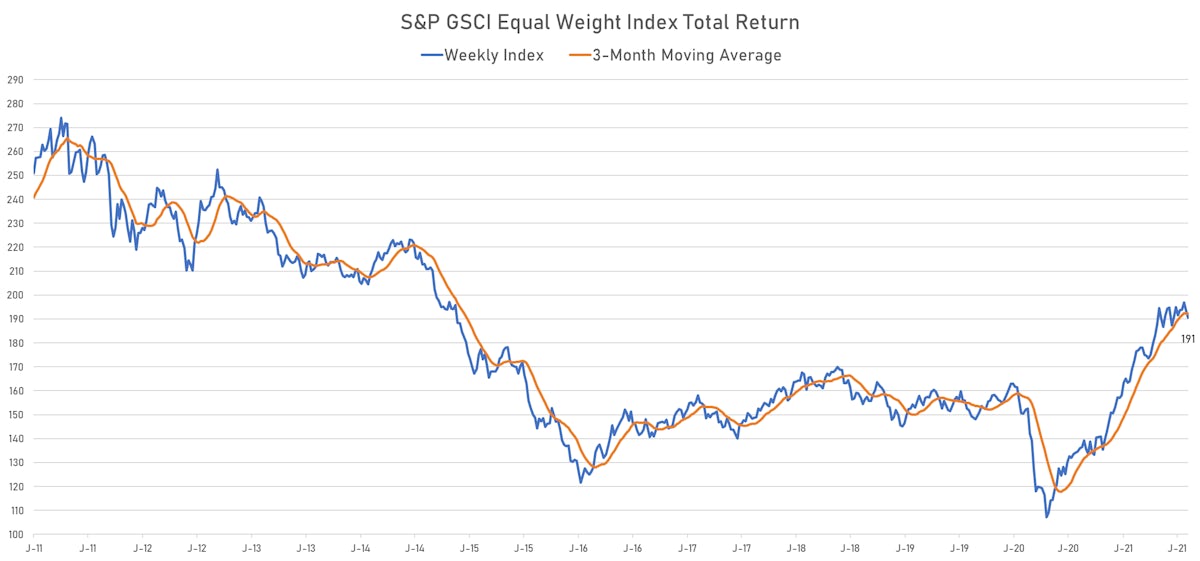

Commodities Fall On Asian Growth Worries And Stronger US Dollar

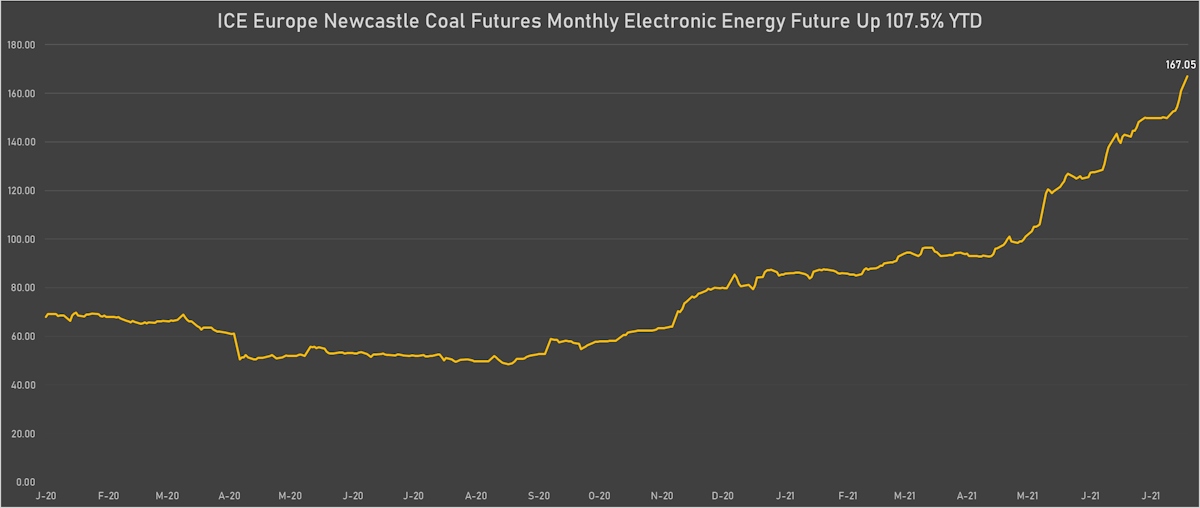

Coal prices keep rising because of limited capacity growth on the supply side, and high natural gas prices are turning power producers towards a cheaper input

Published ET

Newcastle Coal Front-Month Future | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- Gold/US Dollar 1 Month ATM Option IV up 14.6% (YTD: -9.6%)

- Freightos Baltic Europe To South America West Coast Container Index up 13.7% (YTD: 210.6%)

- Freightos Baltic Europe To South America East Coast 40 Container Index up 12.2% (YTD: 304.7%)

- Freightos Baltic Europe To North America East Coast 40 Container Index up 7.2% (YTD: 245.8%)

- Silver/US Dollar 1 Month ATM Option IV up 6.5% (YTD: -42.5%)

- DCE Coking Coal Continuation Month 1 up 4.9% (YTD: 42.6%)

- ICE Europe Newcastle Coal Monthly up 3.8% (YTD: 107.5%)

- CBoT Soybean Oil up 3.6% (YTD: 51.7%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index up 1.9% (YTD: 150.1%)

- ICE-US Coffee C up 1.9% (YTD: 39.8%)

- SMM Lithium Metal Spot Price Daily up 1.6% (YTD: 29.9%)

NOTABLE LOSERS TODAY

- Freightos Baltic North America East Coast To Europe 40 Container Index down -16.1% (YTD: 50.7%)

- Zhengzhou Exchange Thermal Coal down -15.6% (YTD: 10.9%)

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index down -15.1% (YTD: 66.3%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index down -12.0% (YTD: 91.8%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index down -11.9% (YTD: 225.3%)

- Freightos Baltic North Europe To China/East Asia 40 Container Index down -8.3% (YTD: 9.7%)

- Freightos Baltic Mediterranean To China/East Asia 40 Container Index down -4.6% (YTD: 9.0%)

- SHFE Bitumen Continuation Month 1 down -4.2% (YTD: 29.4%)

- CME Random Length Lumber down -3.9% (YTD: -39.3%)

- Silver spot down -3.7% (YTD: -11.1%)

- SGX Iron Ore 62% China CFR Swap Monthly down -3.6% (YTD: 6.6%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -3.3% (YTD: 38.0%)

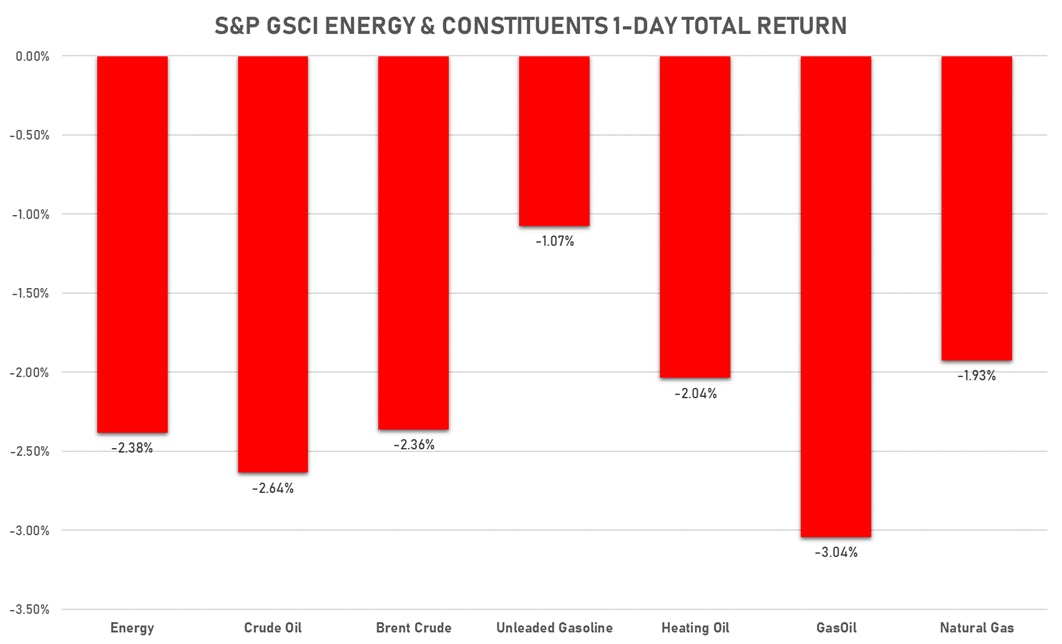

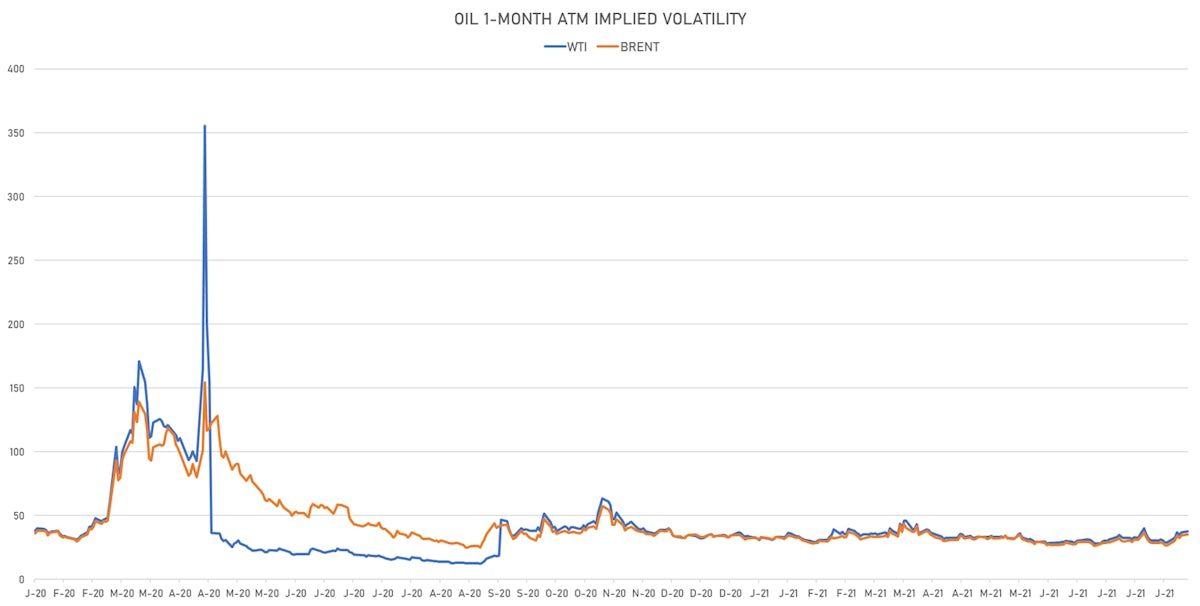

BIG FALL FOR THE ENERGY COMPLEX TODAY

- WTI crude front month currently at US$ 66.75 per barrel, down -2.6% (YTD: +37.0%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 69.14 per barrel, down -2.3% (YTD: +33.3%); 6-month term structure in widening backwardation

- Brent volatility at 35.1, up 1.7% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) currently at US$ 167.05 per tonne, up 3.8% (YTD: +107.5%)

- Natural Gas (Henry Hub) currently at US$ 4.04 per MMBtu, down -1.9% (YTD: +59.9%)

- Gasoline (NYMEX) currently at US$ 2.24 per gallon, down -1.0% (YTD: +58.7%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 565.50 per tonne, down -3.1% (YTD: +33.6%)

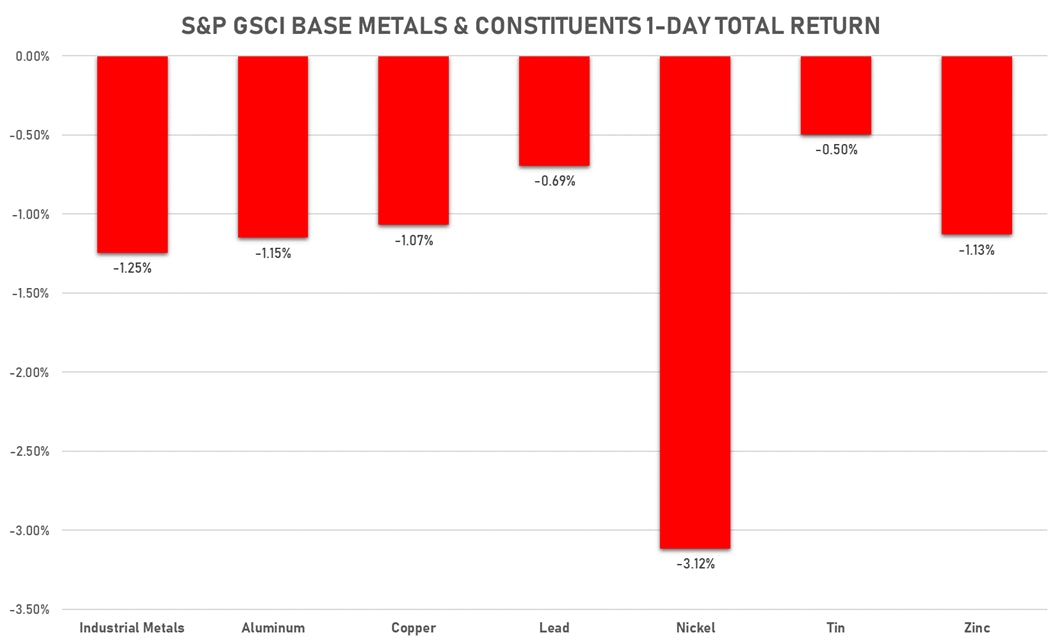

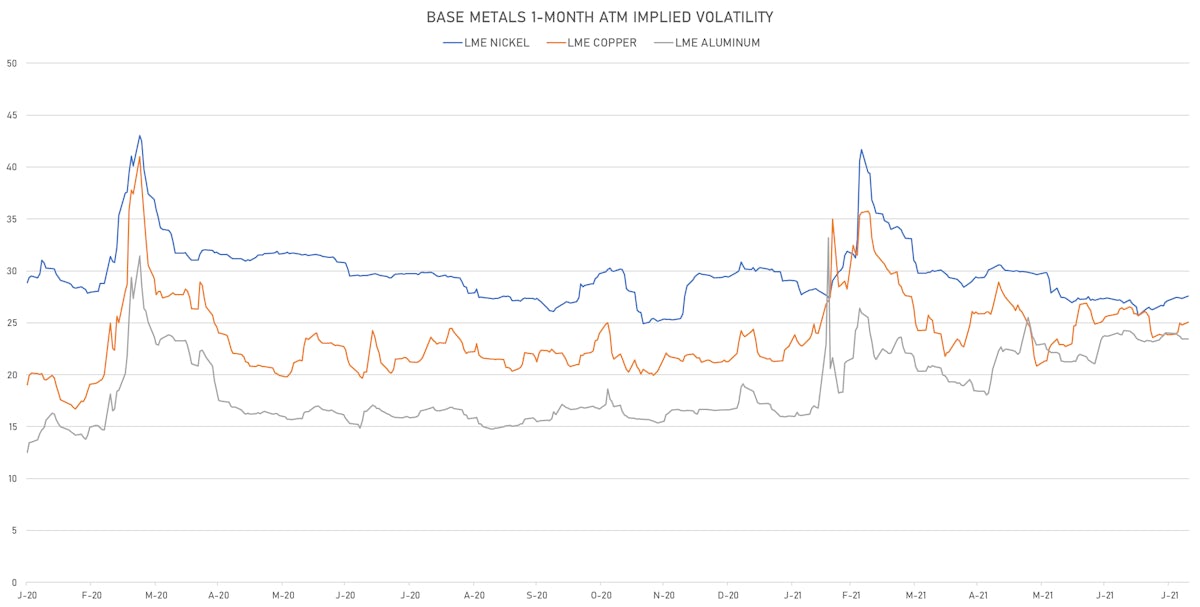

BASE METALS DOWN TODAY

- Copper (COMEX) currently at US$ 4.29 per pound, down -1.3% (YTD: +22.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,135.00 per tonne, down 0.0% (YTD: +5.2%)

- Aluminium (Shanghai) currently at CNY 19,850 per tonne, up 0.2% (YTD: +27.1%)

- Nickel (Shanghai) currently at CNY 139,010 per tonne, down -2.2% (YTD: +14.6%)

- Lead (Shanghai) currently at CNY 15,370 per tonne, down -1.4% (YTD: +5.2%)

- Rebar (Shanghai) currently at CNY 5,300 per tonne, down -1.5% (YTD: +25.8%)

- Tin (Shanghai) currently at CNY 236,200 per tonne, up 0.2% (YTD: +54.7%)

- Zinc (Shanghai) currently at CNY 22,255 per tonne, down -0.5% (YTD: +7.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 372,000 per tonne, down -0.7% (YTD: +35.8%)

- Lithium (Shanghai) spot price currently at CNY 630,000 per tonne, up 1.6% (YTD: +29.9%)

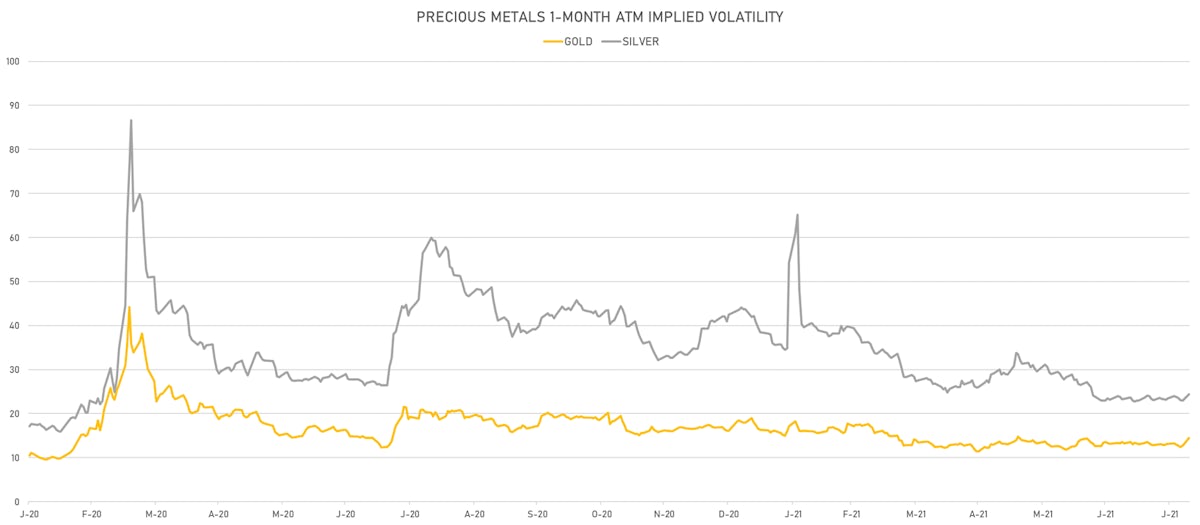

PRECIOUS METALS FELL HARD TODAY

- Gold spot currently at US$ 1,734.48 per troy ounce, down -1.9% (YTD: -8.9%)

- Gold 1-Month ATM implied volatility currently at 14.08, up 14.6% (YTD: -9.6%)

- Silver spot currently at US$ 23.51 per troy ounce, down -3.7% (YTD: -11.1%)

- Silver 1-Month ATM implied volatility currently at 23.31, up 6.5% (YTD: -42.5%)

- Palladium spot currently at US$ 2,606.54 per troy ounce, down -0.9% (YTD: +6.5%)

- Platinum spot currently at US$ 981.36 per troy ounce, down 0.0% (YTD: -8.3%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,300 per troy ounce, unchanged (YTD: +103.8%)

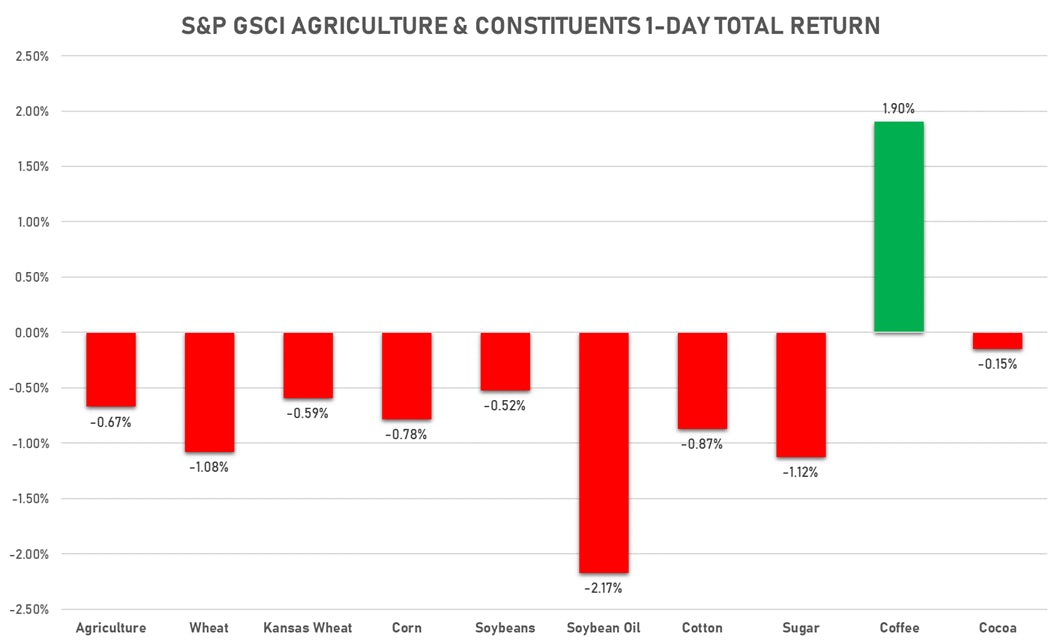

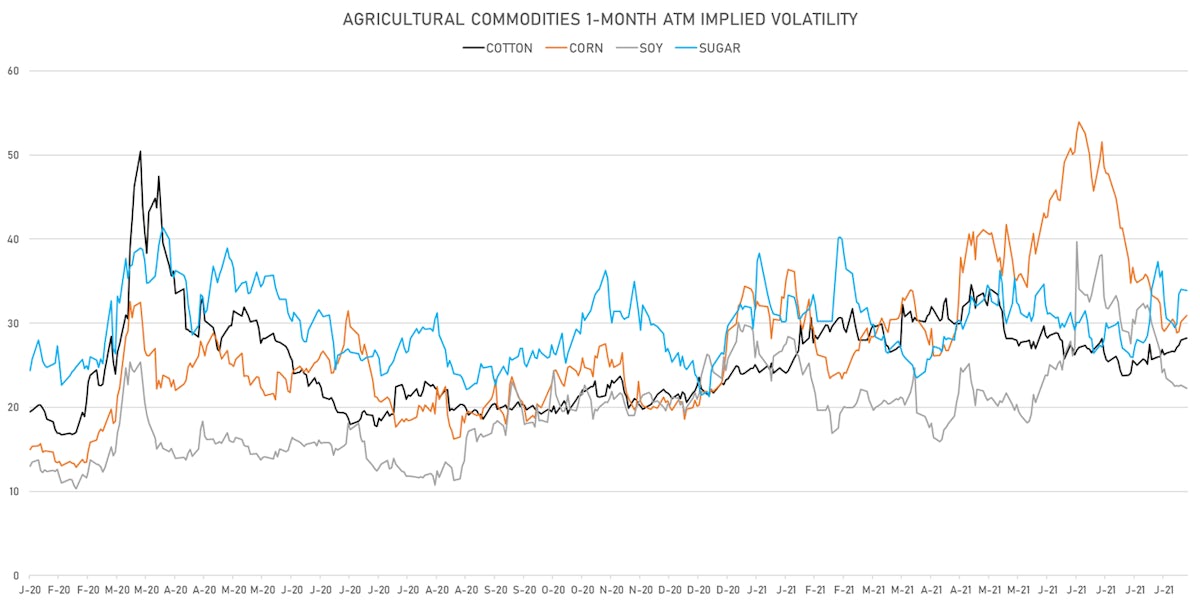

AGS MOSTLY DOWN TODAY

- Live Cattle (CME) currently at US$ 123.00 cents per pound, unchanged (YTD: +8.9%)

- Lean Hogs (CME) currently at US$ 108.90 cents per pound, up 0.1% (YTD: +55.0%)

- Rough Rice (CBOT) currently at US$ 13.41 cents per hundredweight, up 0.5% (YTD: +8.0%)

- Soybeans Composite (CBOT) currently at US$ 1,439.50 cents per bushel, up 0.8% (YTD: +9.0%)

- Corn (CBOT) currently at US$ 547.00 cents per bushel, down -0.9% (YTD: +13.7%)

- Wheat Composite (CBOT) currently at US$ 711.25 cents per bushel, down -1.1% (YTD: +11.0%)

- Sugar No.11 (ICE US) currently at US$ 18.47 cents per pound, down -1.1% (YTD: +19.2%)

- Cotton No.2 (ICE US) currently at US$ 91.30 cents per pound, down -1.2% (YTD: +16.9%)

- Cocoa (ICE US) currently at US$ 2,411 per tonne, down -0.2% (YTD: -7.4%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,261 per tonne, down -0.3% (YTD: +34.6%)

- Random Length Lumber (CME) currently at US$ 530.10 per 1,000 board feet, down -3.9% (YTD: -39.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,940 per tonne, up 0.2% (YTD: +9.5%)

- Soybean Oil Composite (CBOT) currently at US$ 65.72 cents per pound, up 3.6% (YTD: +51.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,453 per tonne, down -1.5% (YTD: +14.4%)

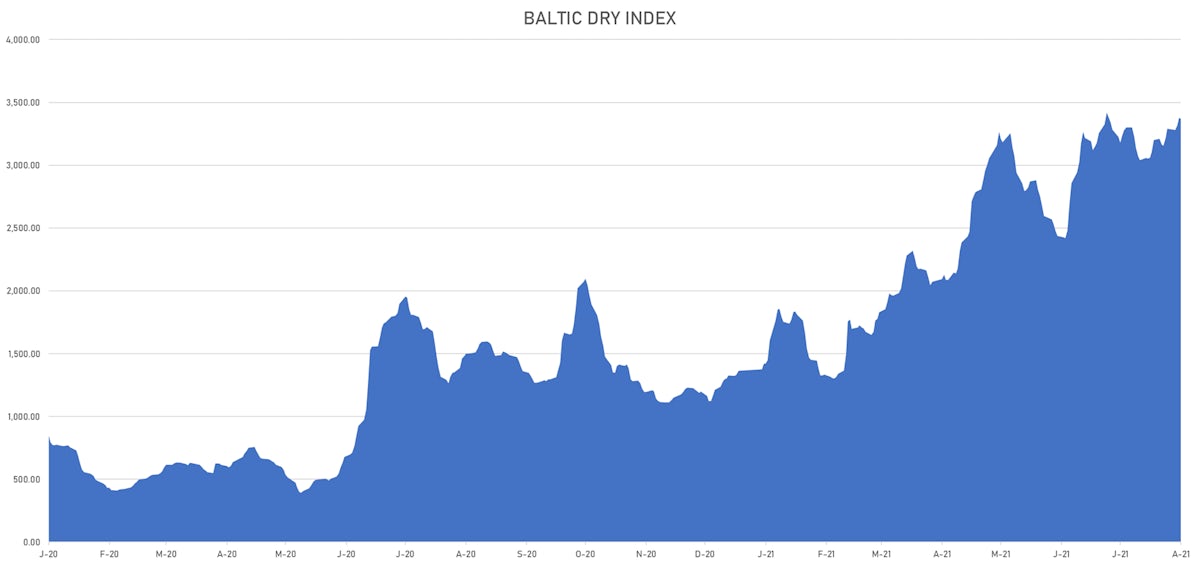

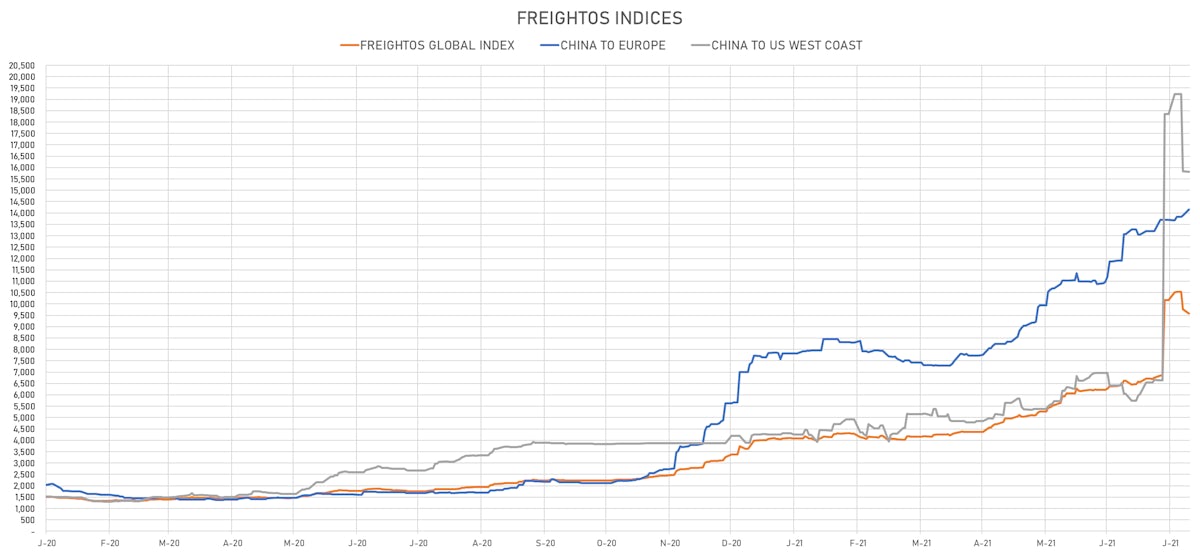

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,371, down -0.1% (YTD: +146.8%)

- Freightos China To North America West Coast Container Index currently at 15,809, down -0.1% (YTD: +276.4%)

- Freightos North America West Coast To China Container Index currently at 993, down -12.0% (YTD: +91.8%)

- Freightos North America East Coast To Europe Container Index currently at 547, down -16.1% (YTD: +50.7%)

- Freightos Europe To North America East Coast Container Index currently at 6,464, up 7.2% (YTD: +245.8%)

- Freightos China To North Europe Container Index currently at 14,163, up 1.9% (YTD: +150.1%)

- Freightos North Europe To China Container Index currently at 1,508, down -8.3% (YTD: +9.7%)

- Freightos Europe To South America West Coast Container Index currently at 5,255, up 13.7% (YTD: +210.6%)

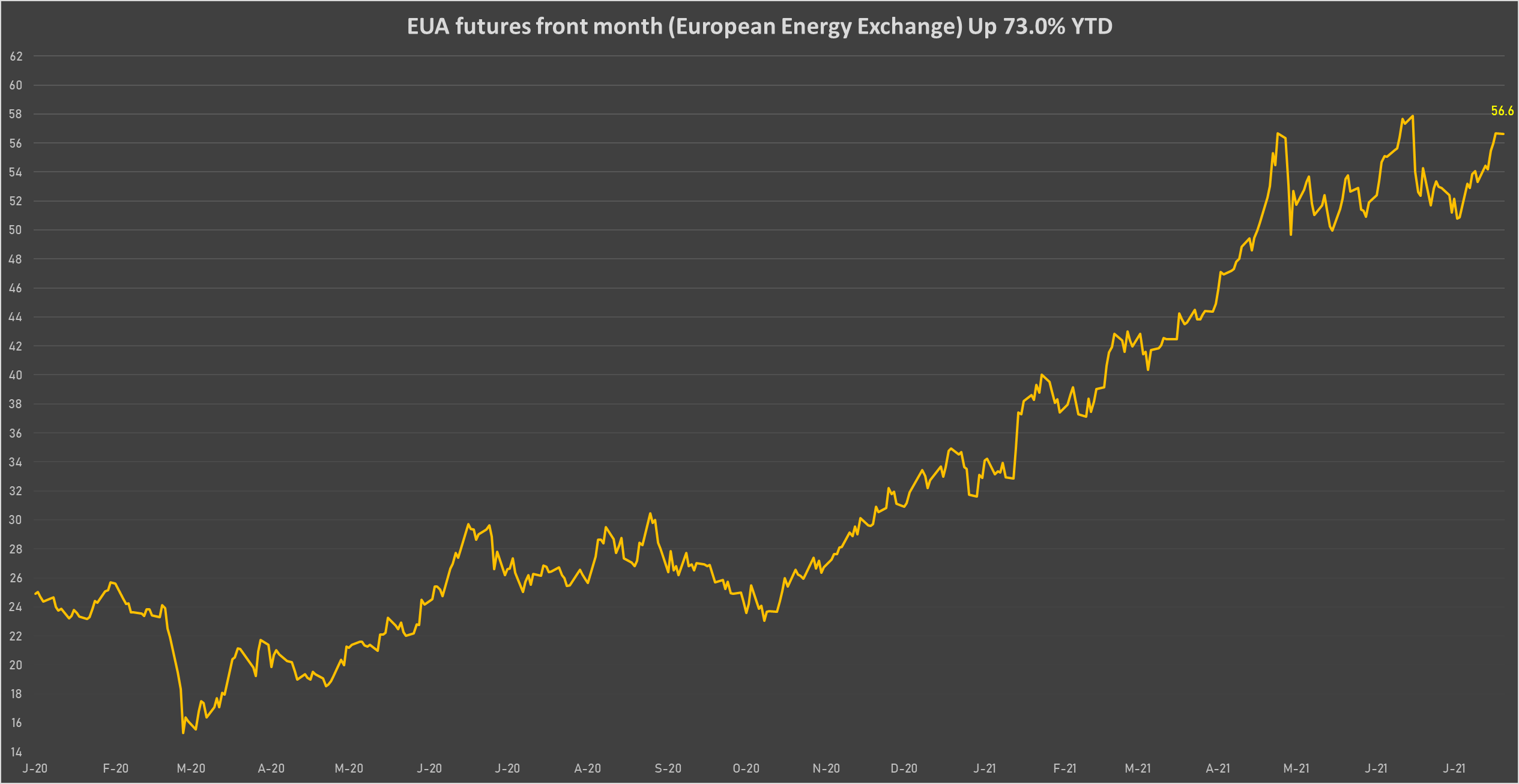

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 56.62 per tonne, down -0.1% (YTD: +73.0%)