Commodities

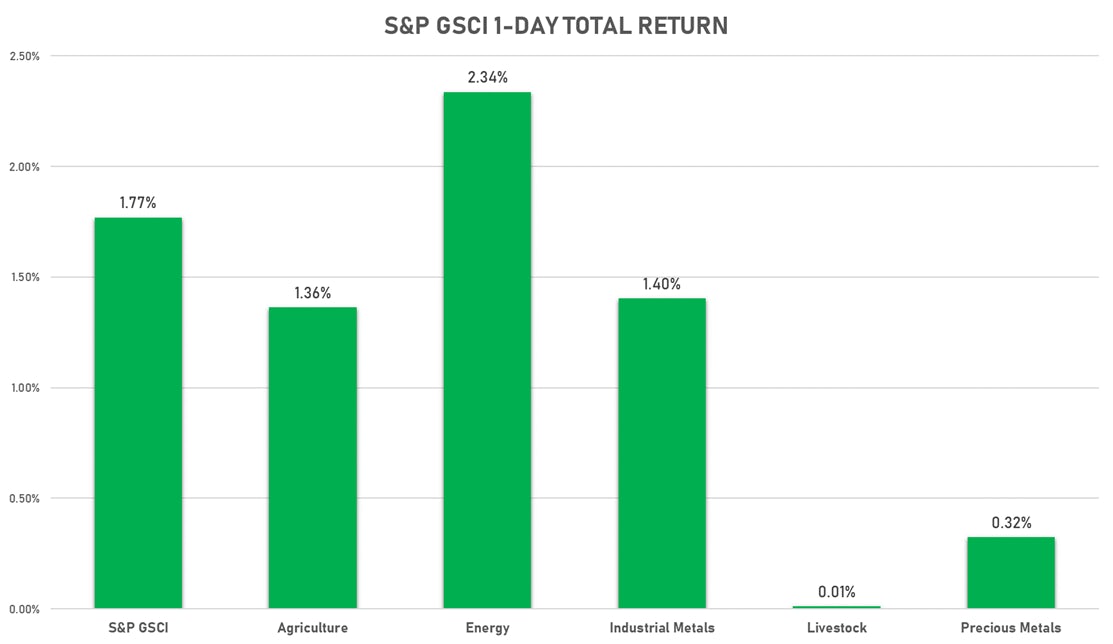

Broad Bounce For Commodities Today, With Energy Leading The GSCI Higher

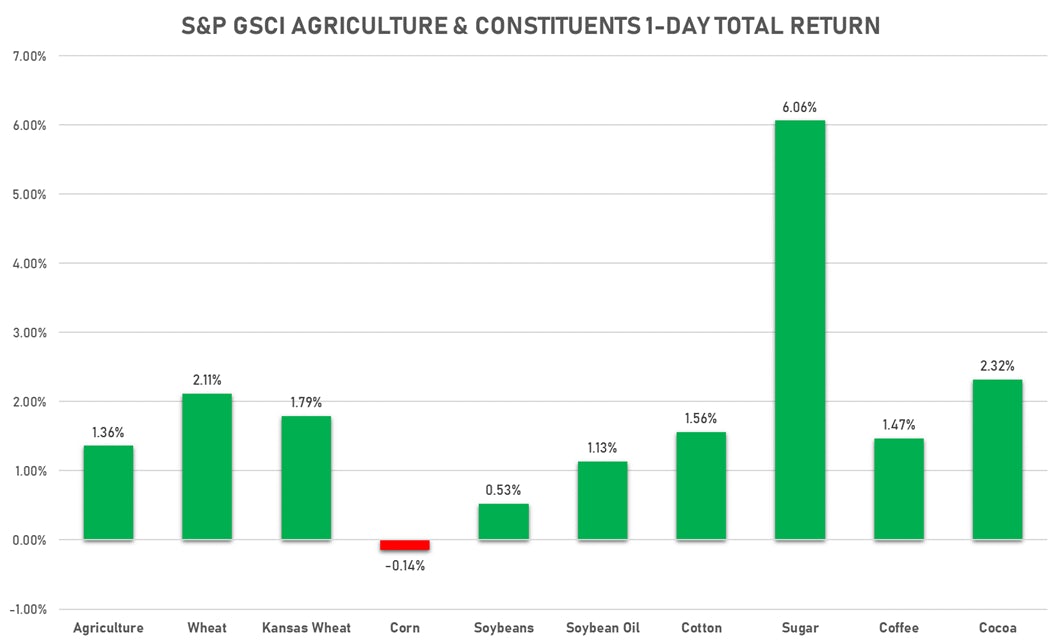

Sugar was up 6% on news that cold weather in Brazil had reduced sugar production by close to 12% during the last 2 weeks of July

Published ET

Sugar Futures Prices Up Almost 10% In The Last Week | Sources: ϕpost, Refinitiv data

HEADLINES & MACRO

- API Weekly Inventories Data: a -816K barrels for crude oil, -1.11m for gasoline, +673k for distillates, -413k for Cushing

Cushing - FactSet consensus estimate for DOE report tomorrow: crude +225k, gasoline -3.39m, distillate +100k

NOTABLE GAINERS TODAY

- ICE-US Sugar No. 11 up 6.1% (YTD: 26.5%)

- Freightos Baltic Europe To North America East Coast 40 Container Index up 5.2% (YTD: 263.9%)

- ICE Europe Low Sulphur Gasoil up 3.1% (YTD: 37.7%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 2.9% (YTD: 42.0%)

- NYMEX Light Sweet Crude Oil (WTI) up 2.7% (YTD: 40.7%)

- Crude Oil WTI Cushing US FOB up 2.7% (YTD: 41.3%)

- Freightos Baltic North Europe To China/East Asia 40 Container Index up 2.4% (YTD: 12.3%)

- ICE-US Cocoa up 2.4% (YTD: -5.2%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 2.3% (YTD: 19.8%)

- ICE Europe Brent Crude up 2.3% (YTD: 36.4%)

NOTABLE LOSERS TODAY

- CME Random Length Lumber down -4.7% (YTD: -42.1%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -2.8% (YTD: 8.2%)

- SHFE Nickel down -1.4% (YTD: 13.0%)

- SMM Refined Cobalt Grade Spot Price Daily down -1.3% (YTD: 33.9%)

- SHFE Bitumen Continuation Month 1 down -0.9% (YTD: 28.3%)

- SHFE Lead Continuation Month 1 down -0.7% (YTD: 4.5%)

- CME Dry Whey down -0.5% (YTD: 23.6%)

- Gold/US Dollar 1 Month ATM Option IV down -0.5% (YTD: -10.1%)

- CBoT Soybean Oil down -0.5% (YTD: 51.0%)

- Silver spot down -0.5% (YTD: -11.6%)

- SHFE Aluminum down -0.3% (YTD: 26.7%)

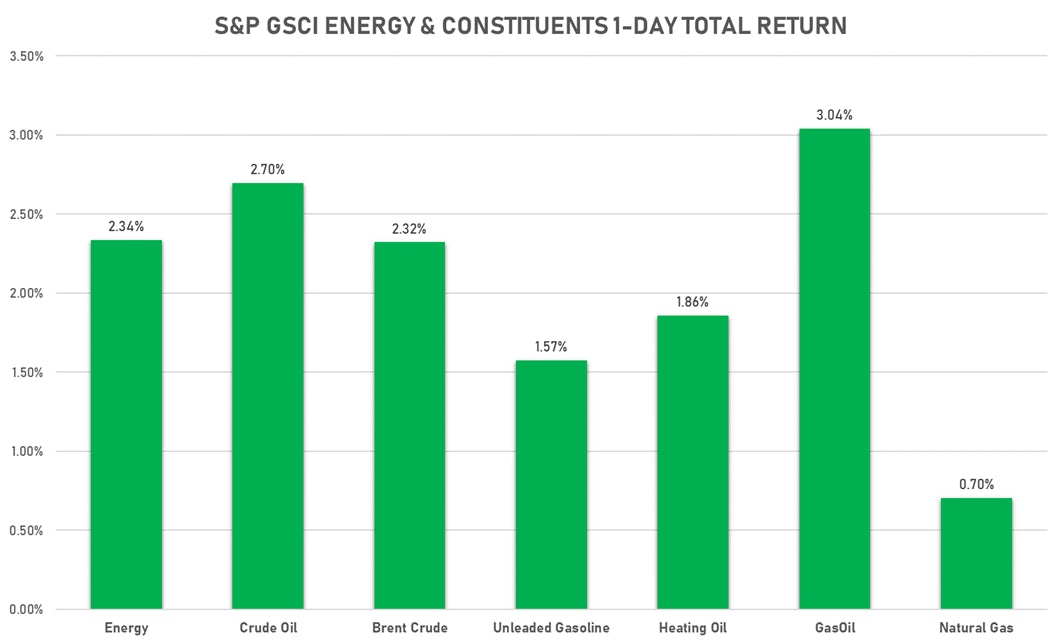

ENERGY TODAY

- WTI crude front month currently at US$ 68.56 per barrel, up 2.7% (YTD: +40.7%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 70.86 per barrel, up 2.3% (YTD: +36.4%); 6-month term structure in widening backwardation

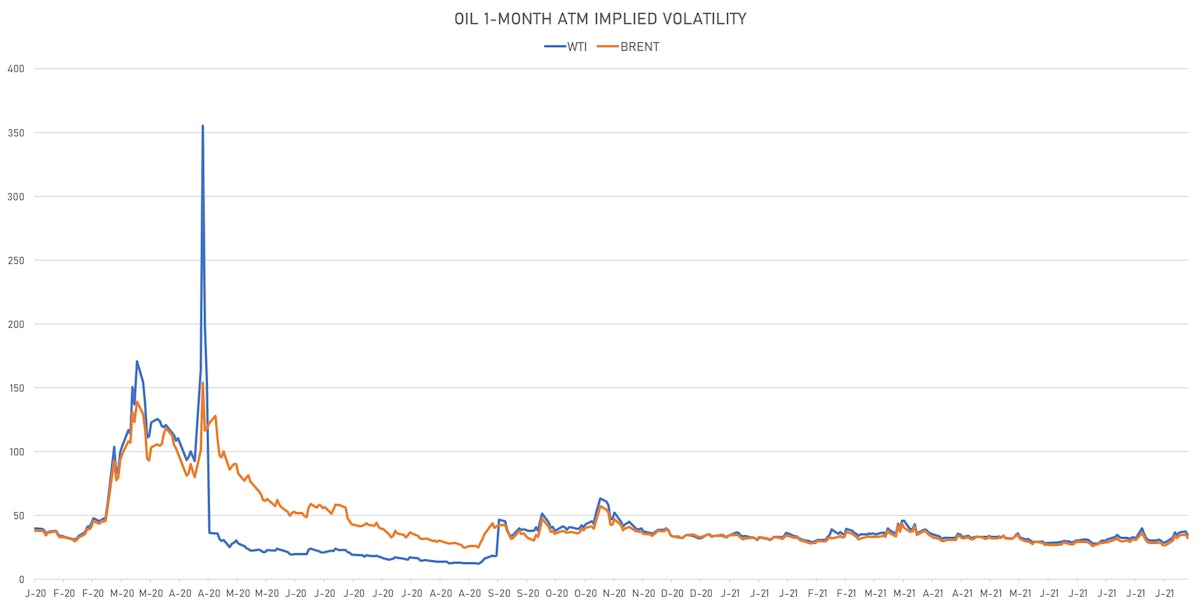

- Brent volatility at 32.5, down -7.4% (12-month range: 24.7 - 57.6)

- Newcastle Coal (ICE Europe) unchanged at US$ 167.10 per tonne (YTD: +107.6%)

- Natural Gas (Henry Hub) currently at US$ 4.11 per MMBtu, up 0.7% (YTD: +61.0%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, up 1.5% (YTD: +61.0%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 579.00 per tonne, up 3.1% (YTD: +37.7%)

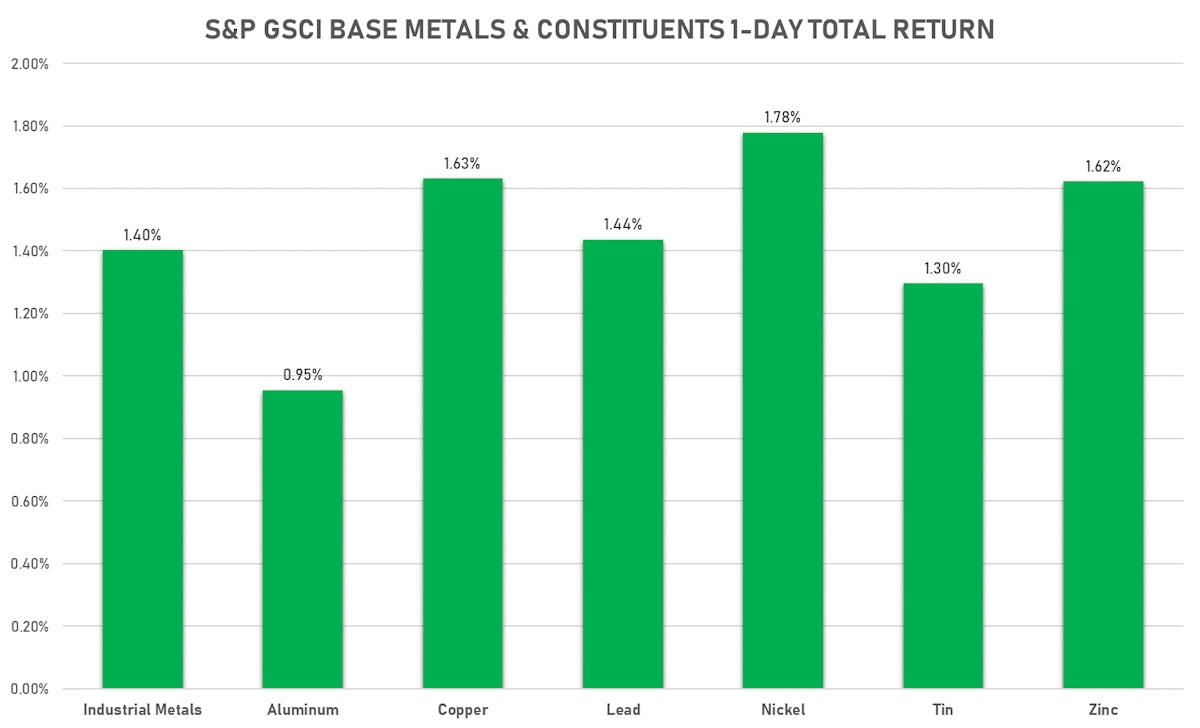

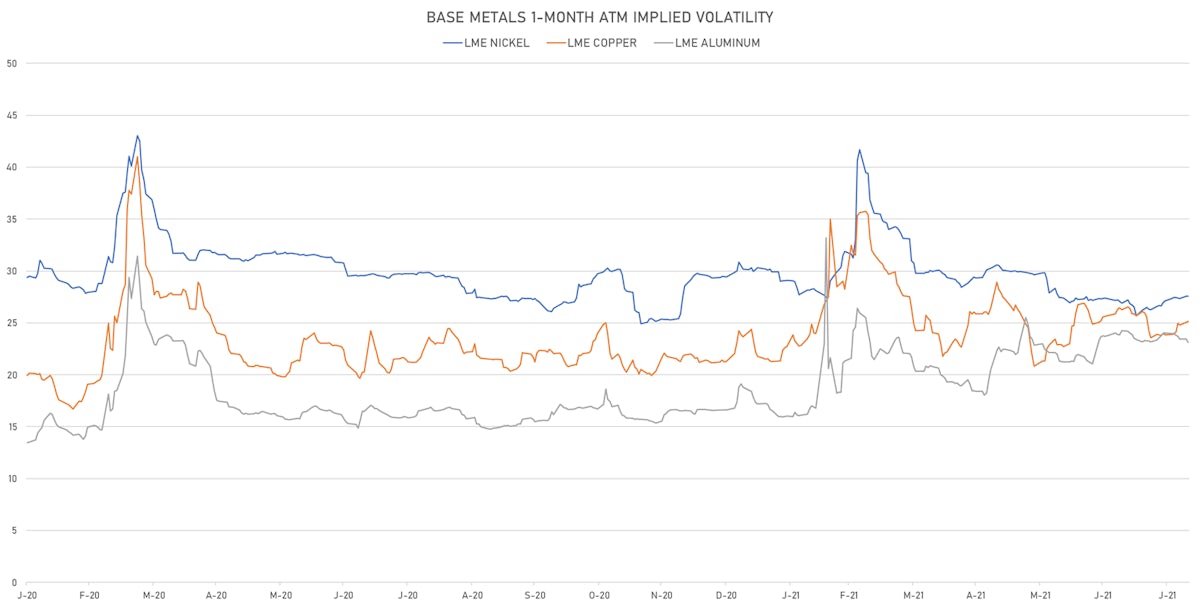

BASE METALS TODAY

- Copper (COMEX) currently at US$ 4.35 per pound, up 1.5% (YTD: +23.8%)

- Iron Ore (Dalian Commodity Exchange) unchanged at CNY 1,135.00 per tonne (YTD: +5.2%)

- Aluminum (Shanghai) currently at CNY 20,180 per tonne, down -0.3% (YTD: +26.7%)

- Nickel (Shanghai) currently at CNY 141,980 per tonne, down -1.4% (YTD: +13.0%)

- Lead (Shanghai) currently at CNY 15,450 per tonne, down -0.7% (YTD: +4.5%)

- Rebar (Shanghai) currently at CNY 5,365 per tonne, up 0.1% (YTD: +25.9%)

- Tin (Shanghai) currently at CNY 240,000 per tonne, up 1.0% (YTD: +56.2%)

- Zinc (Shanghai) currently at CNY 22,485 per tonne, down -0.2% (YTD: +7.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 367,000 per tonne, down -1.3% (YTD: +33.9%)

- Lithium (Shanghai) spot price currently at CNY 630,000 per tonne, unchanged (YTD: +29.9%)

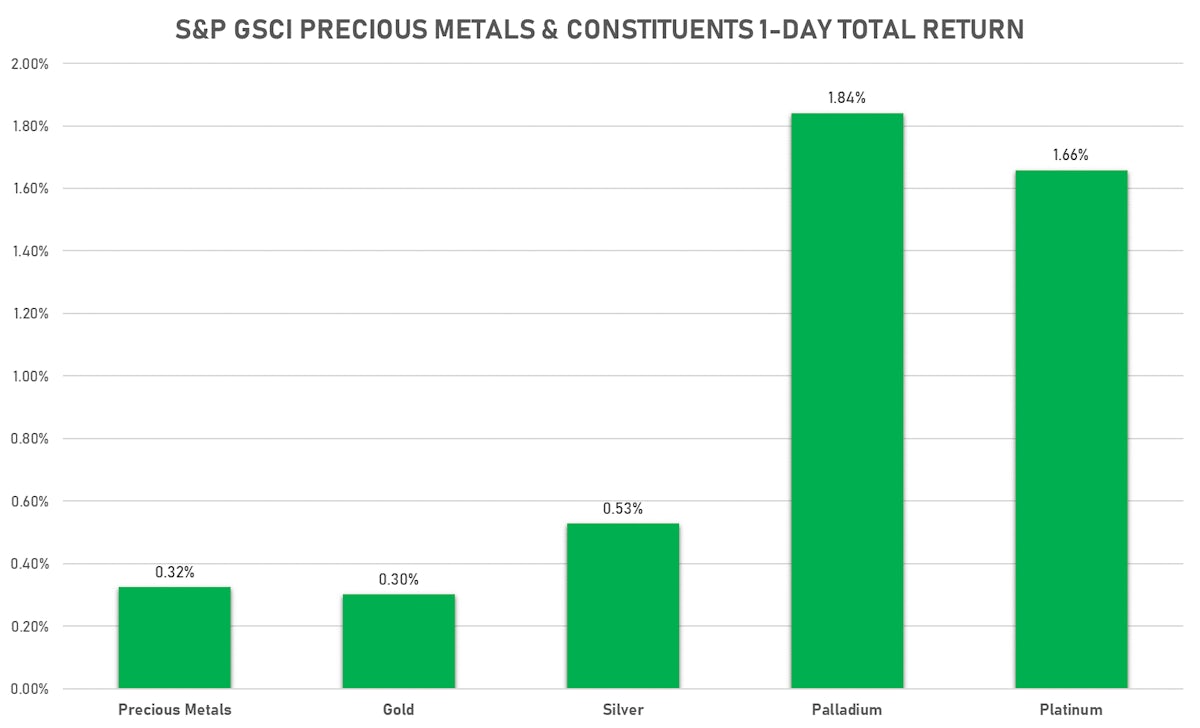

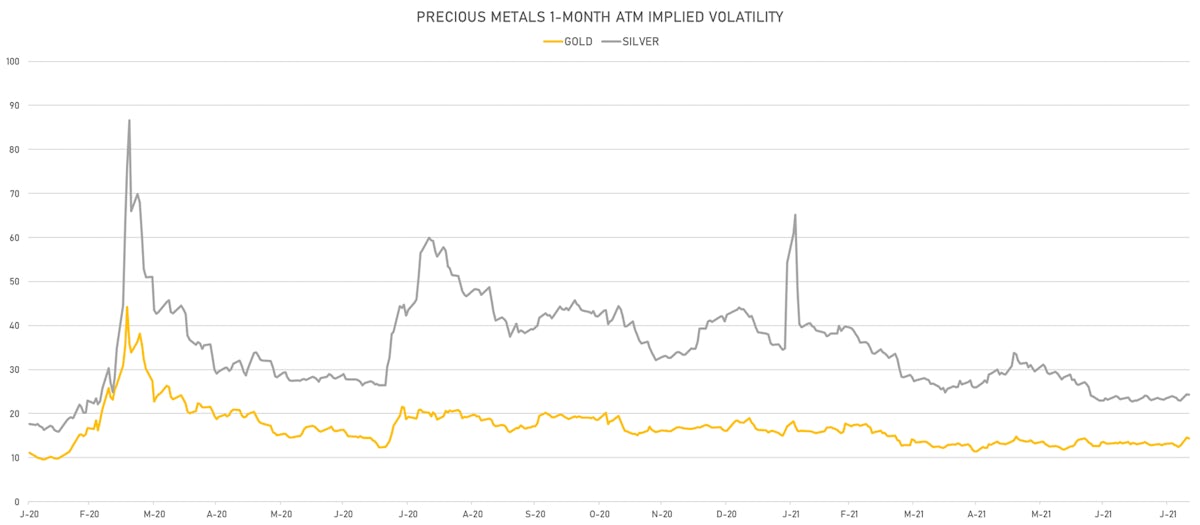

PRECIOUS METALS TODAY

- Gold spot unchanged at US$ 1,726.44 per troy ounce (YTD: -8.9%)

- Gold 1-Month ATM implied volatility currently at 14.21, down -0.5% (YTD: -10.1%)

- Silver spot currently at US$ 23.31 per troy ounce, down -0.5% (YTD: -11.6%)

- Silver 1-Month ATM implied volatility currently at 23.53, down -0.1% (YTD: -42.6%)

- Palladium spot currently at US$ 2,641.80 per troy ounce, up 1.6% (YTD: +8.2%)

- Platinum spot currently at US$ 1,002.25 per troy ounce, up 1.8% (YTD: -6.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,300 per troy ounce, unchanged (YTD: +103.8%)

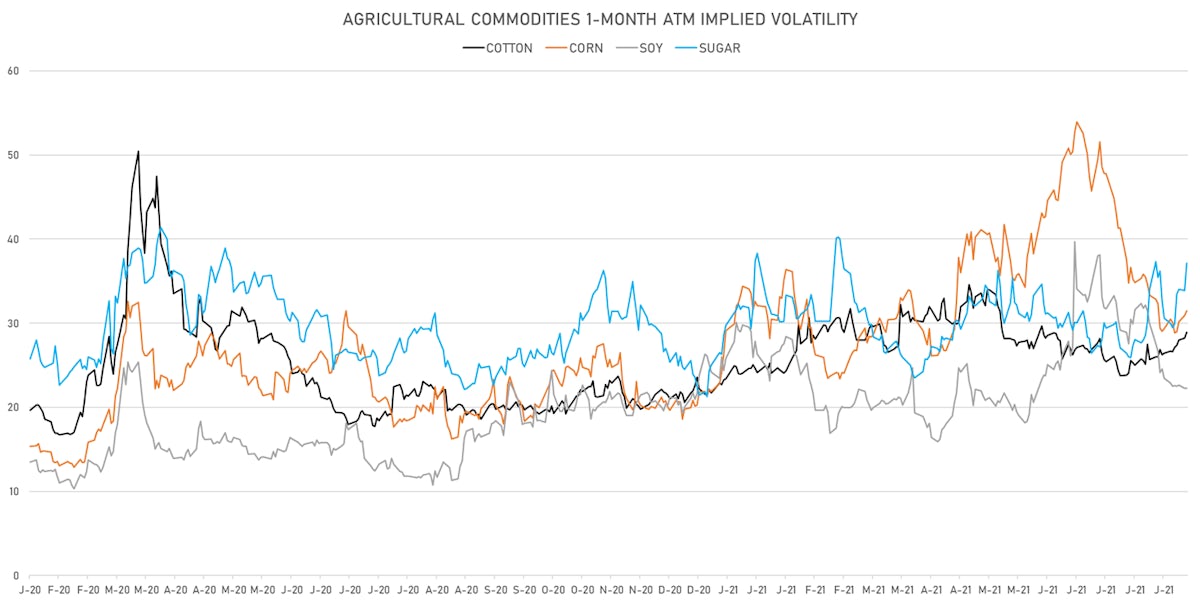

AGS TODAY

- Live Cattle (CME) currently at US$ 123.65 cents per pound, up 0.5% (YTD: +9.5%)

- Lean Hogs (CME) currently at US$ 109.68 cents per pound, up 0.7% (YTD: +56.1%)

- Rough Rice (CBOT) currently at US$ 13.45 cents per hundredweight, up 0.7% (YTD: +8.7%)

- Soybeans Composite (CBOT) currently at US$ 1,447.50 cents per bushel, up 1.0% (YTD: +10.1%)

- Corn (CBOT) currently at US$ 549.75 cents per bushel, down -0.2% (YTD: +13.5%)

- Wheat Composite (CBOT) currently at US$ 722.75 cents per bushel, up 2.2% (YTD: +13.5%)

- Sugar No.11 (ICE US) currently at US$ 19.59 cents per pound, up 6.1% (YTD: +26.5%)

- Cotton No.2 (ICE US) currently at US$ 92.74 cents per pound, up 1.6% (YTD: +18.7%)

- Cocoa (ICE US) currently at US$ 2,468 per tonne, up 2.4% (YTD: -5.2%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,333 per tonne, up 1.7% (YTD: +36.9%)

- Random Length Lumber (CME) currently at US$ 505.10 per 1,000 board feet, down -4.7% (YTD: -42.1%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,975 per tonne, up 0.5% (YTD: +10.1%)

- Soybean Oil Composite (CBOT) currently at US$ 65.41 cents per pound, down -0.5% (YTD: +51.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,453 per tonne, down -1.5% (YTD: +14.4%)

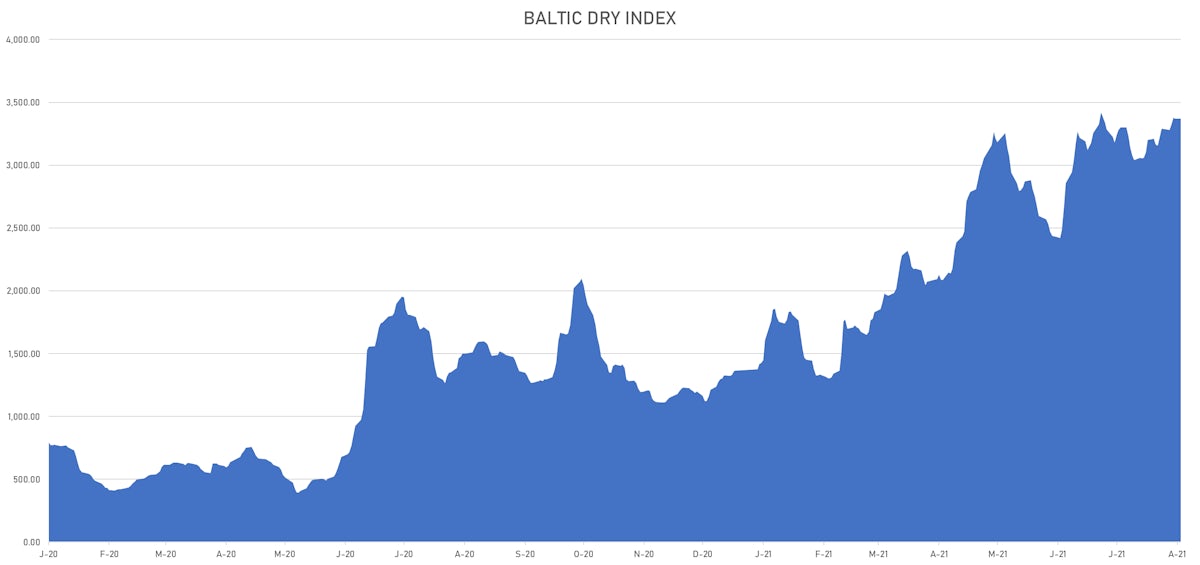

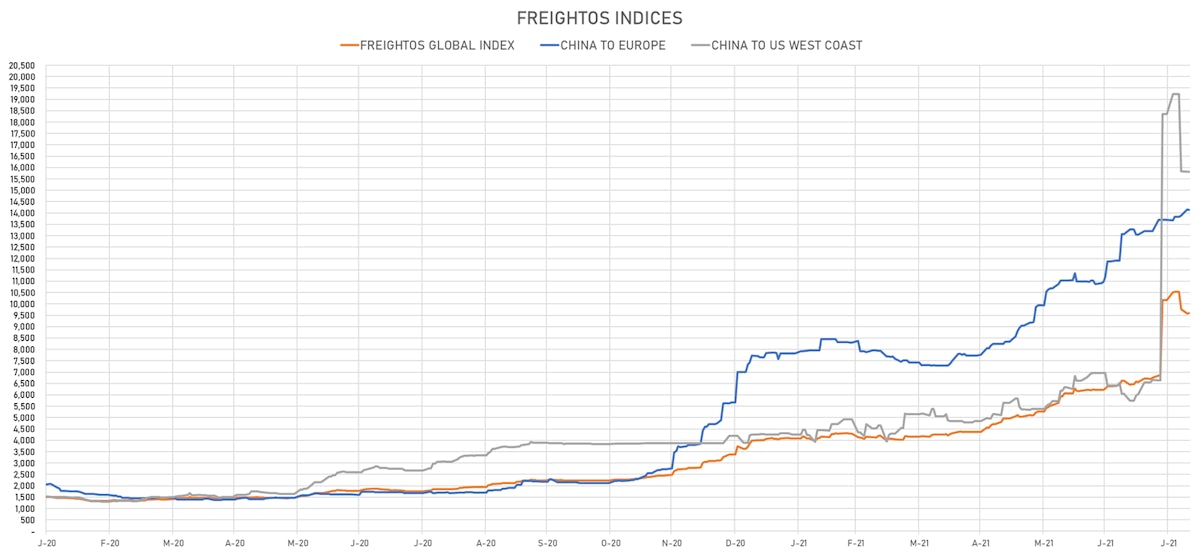

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,371, unchanged (YTD: +146.8%)

- Freightos China To North America West Coast Container Index currently at 15,809, unchanged (YTD: +276.4%)

- Freightos North America West Coast To China Container Index currently at 993, unchanged (YTD: +91.8%)

- Freightos North America East Coast To Europe Container Index currently at 547, unchanged (YTD: +50.7%)

- Freightos Europe To North America East Coast Container Index currently at 6,801, up 5.2% (YTD: +263.9%)

- Freightos China To North Europe Container Index currently at 14,141, down -0.2% (YTD: +149.7%)

- Freightos North Europe To China Container Index currently at 1,544, up 2.4% (YTD: +12.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,255, unchanged (YTD: +210.6%)

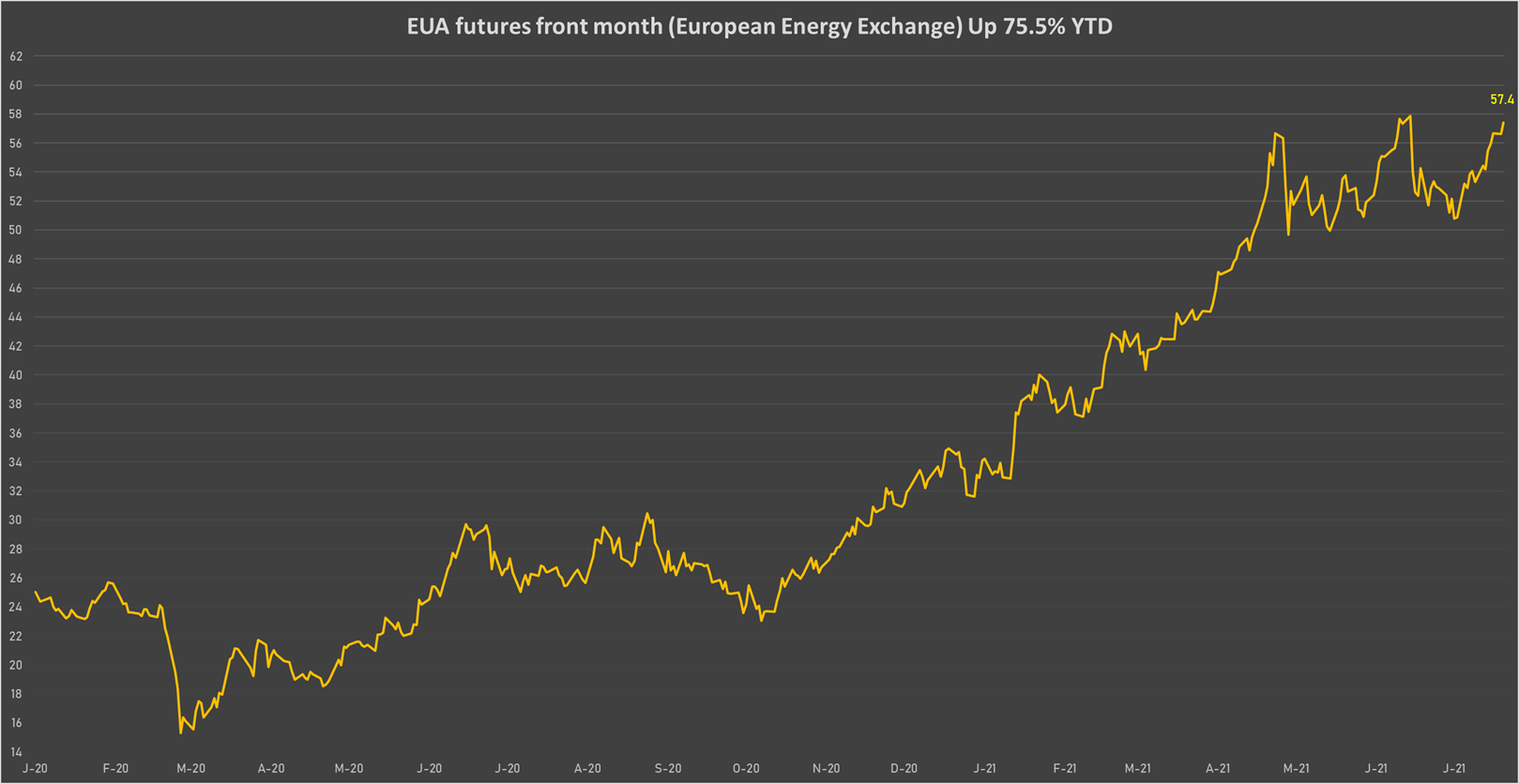

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 57.41 per tonne, up 1.4% (YTD: +75.5%)