Commodities

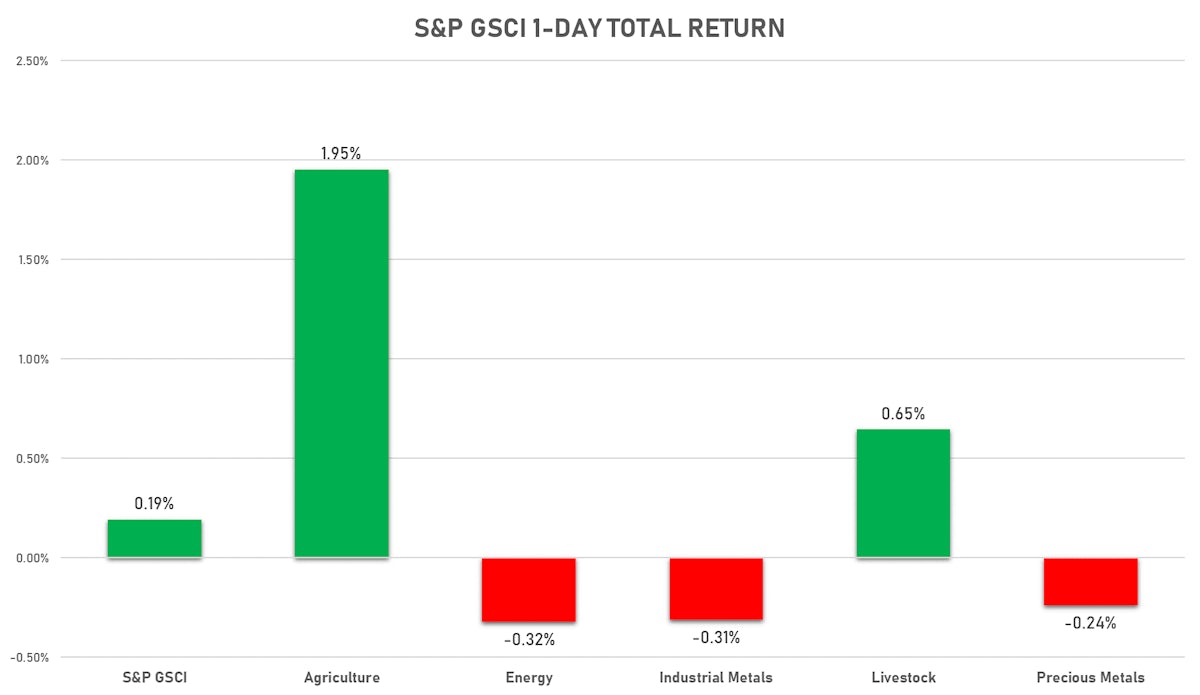

Crude Oil, Natural Gas And Base Metals Fell Today As Markets Priced In A Less Bullish Outlook For The Second Half Of The Year

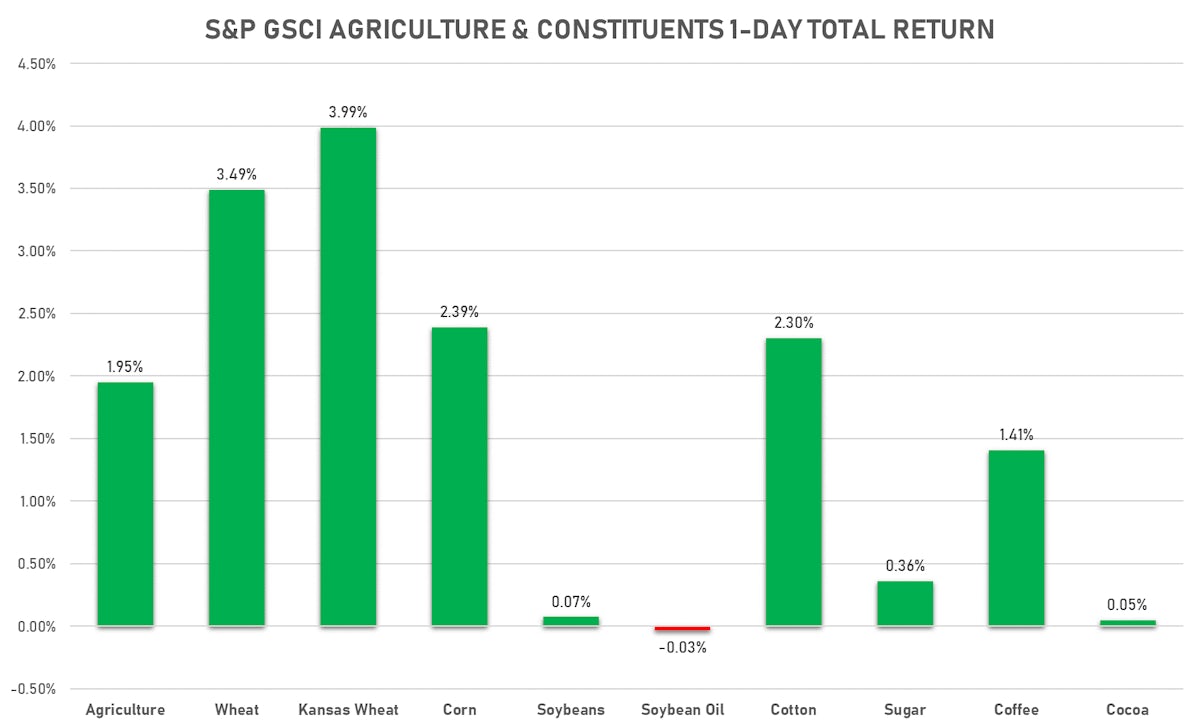

Corn and wheat prices jumped today after the USDA's WASDE report forecast lower yields and annual production than the market expected

Published ET

Despite doubling in the past 5 years, wheat prices are still well off their 2008 record | Source: Refinitiv

HEADLINES & MACRO

- IEA and OPEC monthly oil market reports were bearish compared to previous updates, pointing to rising supply and slowing demand due to the delta variant in 2H2021

- EIA Nat gas storage falls exactly in line with market expectations: Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 06 Aug (EIA, United States) at 49.00 bcf, in line with consensus estimate

NOTABLE GAINERS TODAY

- SHFE Nickel up 4.6% (YTD: 19.3%)

- CBoT Wheat up 3.6% (YTD: 17.6%)

- SMM Tungsten Carbide-99.7% FB Spot Price Daily up 2.5% (YTD: 28.6%)

- CME Cash settled Butter up 2.4% (YTD: 14.6%)

- ICE-US Cotton No. 2 up 2.3% (YTD: 20.0%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily up 2.0% (YTD: 24.5%)

- SHFE Stannum up 2.0% (YTD: 63.3%)

- CBoT Corn up 1.9% (YTD: 17.1%)

- SMM Lithium Metal Spot Price Daily up 1.6% (YTD: 34.0%)

- CME Dry Whey up 1.6% (YTD: 25.6%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 1.5% (YTD: 42.5%)

- ICE-US Coffee C up 1.5% (YTD: 45.5%)

- CME Random Length Lumber up 1.3% (YTD: -42.7%)

- Coffee Arabica Colombia Excelso EP Spot up 1.3% (YTD: 39.9%)

- ICE Europe Newcastle Coal Monthly up 1.1% (YTD: 112.7%)

NOTABLE LOSERS TODAY

- Pork Primal Cutout Butt down -9.4% (YTD: 47.4%)

- DCE Coking Coal Continuation Month 1 down -7.8% (YTD: 35.9%)

- Silver/US Dollar 1 Month ATM Option IV down -4.0% (YTD: -45.7%)

- Gold/US Dollar 1 Month ATM Option IV down -3.4% (YTD: -17.8%)

- NYMEX Henry Hub Natural Gas down -3.1% (YTD: 54.9%)

- EEX European-Carbon- Secondary Trading down -2.6% (YTD: 75.3%)

- Intercontinental Exchange European Union Allowance (EUA) down -2.6% (YTD: 71.9%)

- SGX Iron Ore 62% China CFR Swap Monthly down -2.1% (YTD: 5.9%)

- Silver spot down -1.5% (YTD: -12.2%)

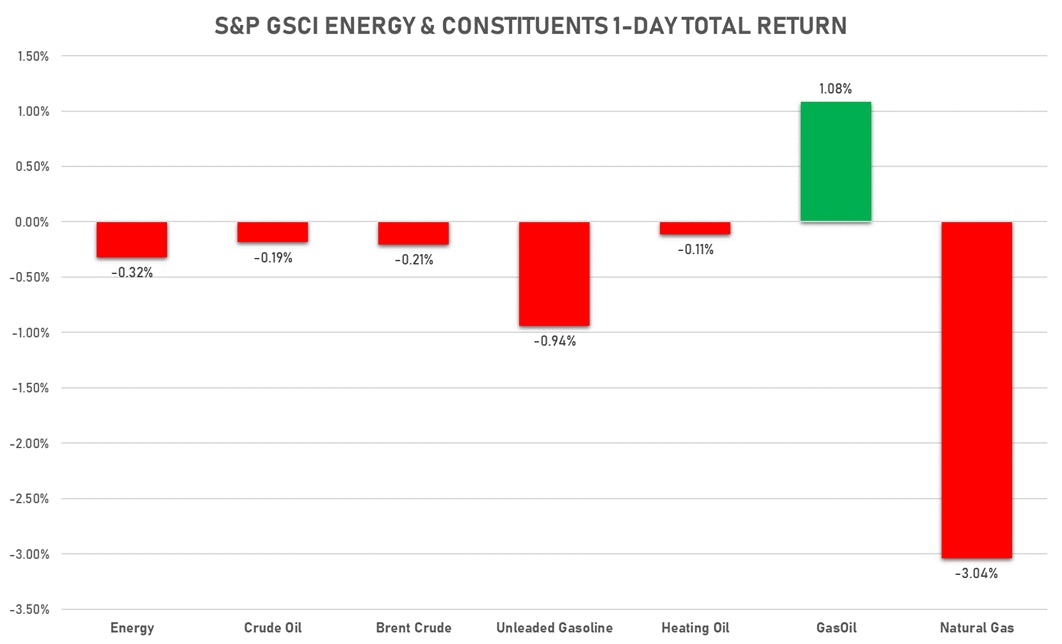

ENERGY BROADLY DOWN TODAY

- WTI crude front month currently at US$ 68.81 per barrel, down -0.2% (YTD: +42.4%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 71.31 per barrel, down -0.2% (YTD: +37.7%); 6-month term structure in widening backwardation

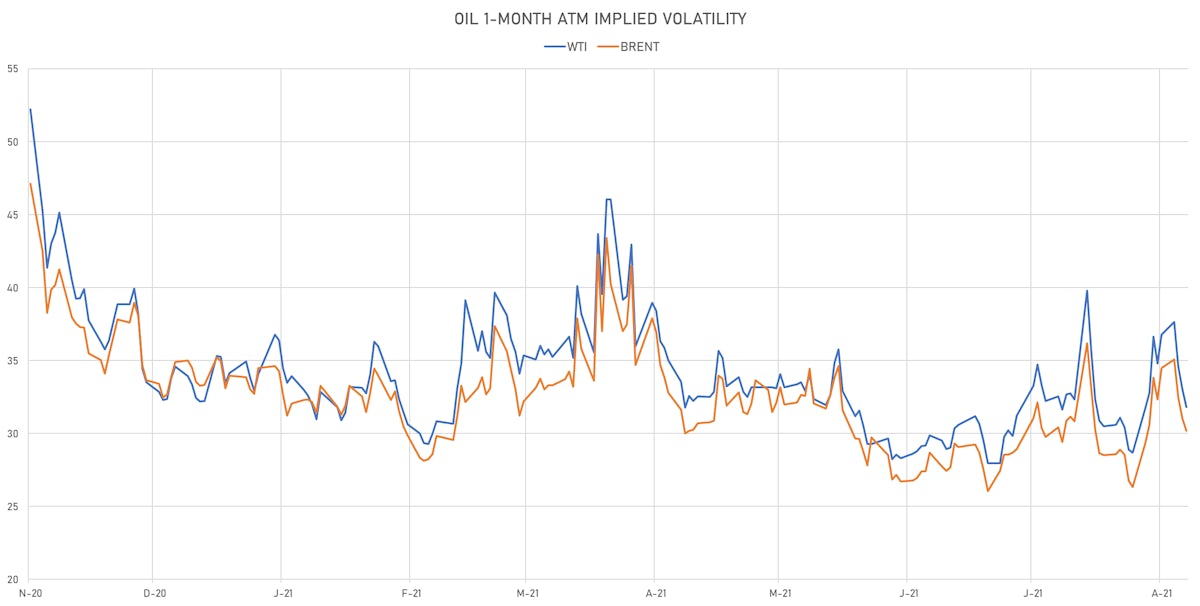

- Brent volatility at 30.2, down -2.8% (12-month range: 26.1 - 47.1)

- Newcastle Coal (ICE Europe) currently at US$ 171.25 per tonne, up 1.1% (YTD: +112.7%)

- Natural Gas (Henry Hub) currently at US$ 3.92 per MMBtu, down -3.1% (YTD: +54.9%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, down -1.2% (YTD: +61.6%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) unchanged at US$ 583.50 per tonne (YTD: +36.8%)

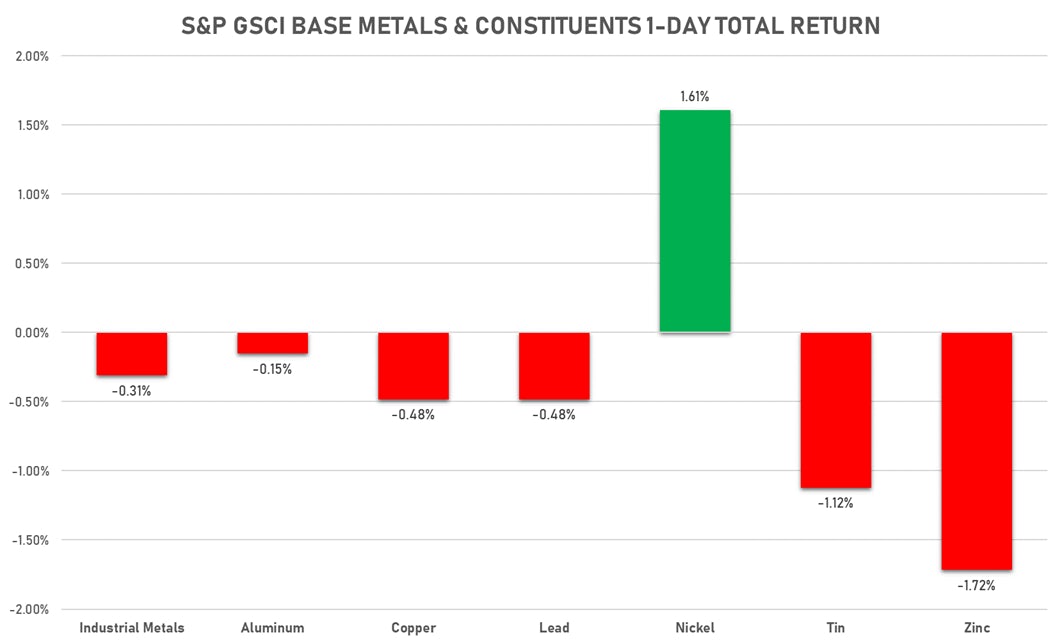

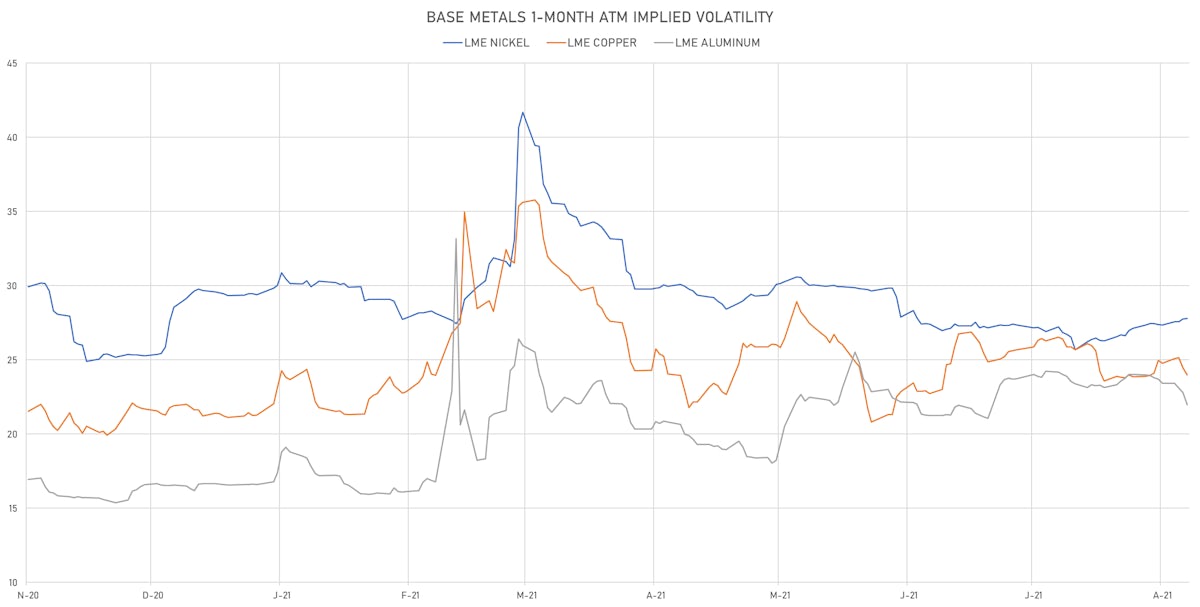

GSCI BASE METALS FELL TODAY

- Copper (COMEX) currently at US$ 4.36 per pound, down -0.2% (YTD: +24.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 1,106.00 per tonne, up 0.2% (YTD: +2.5%)

- Aluminum (Shanghai) currently at CNY 20,005 per tonne, down -0.1% (YTD: +28.1%)

- Nickel (Shanghai) currently at CNY 148,900 per tonne, up 4.6% (YTD: +19.3%)

- Lead (Shanghai) currently at CNY 15,360 per tonne, up 0.2% (YTD: +4.8%)

- Rebar (Shanghai) currently at CNY 5,411 per tonne, up 1.1% (YTD: +28.2%)

- Tin (Shanghai) currently at CNY 240,040 per tonne, up 2.0% (YTD: +63.3%)

- Zinc (Shanghai) currently at CNY 22,350 per tonne, up 1.0% (YTD: +8.8%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, down -0.5% (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 650,000 per tonne, up 1.6% (YTD: +34.0%)

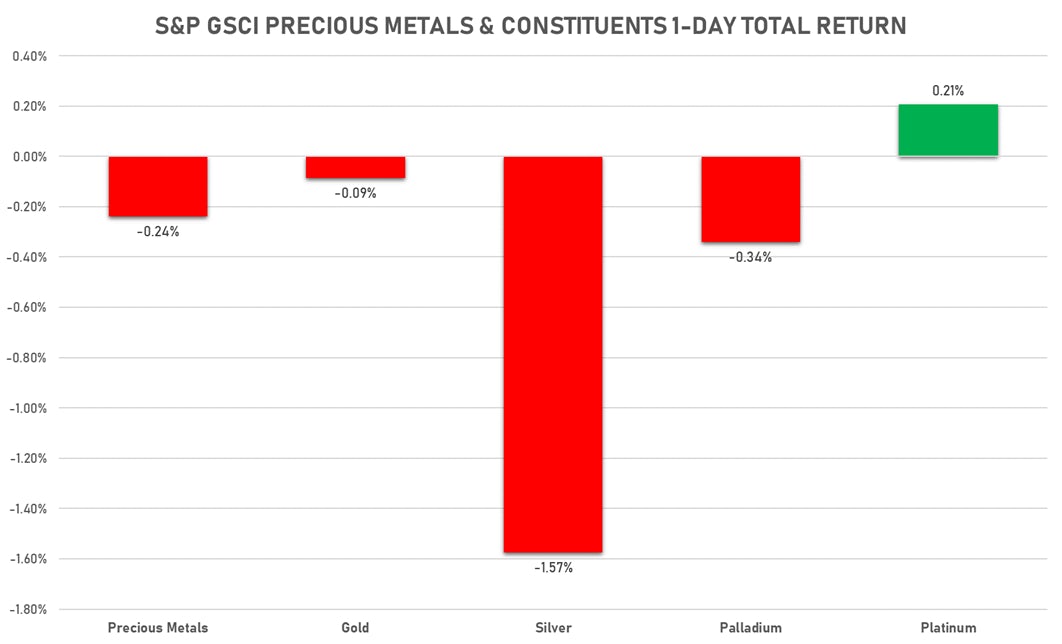

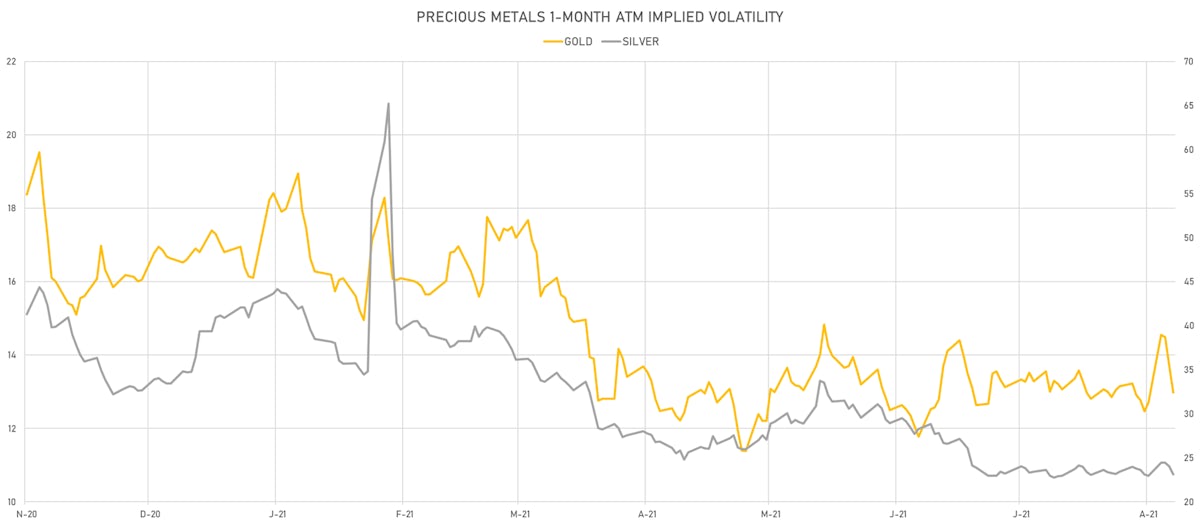

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot unchanged at US$ 1,752.04 per troy ounce (YTD: -7.7%)

- Gold 1-Month ATM implied volatility currently at 12.82, down -3.4% (YTD: -17.8%)

- Silver spot currently at US$ 23.16 per troy ounce, down -1.5% (YTD: -12.2%)

- Silver 1-Month ATM implied volatility currently at 22.08, down -4.0% (YTD: -45.7%)

- Palladium spot currently at US$ 2,620.31 per troy ounce, down -0.4% (YTD: +7.4%)

- Platinum spot currently at US$ 1,016.12 per troy ounce, down -0.1% (YTD: -4.6%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,300 per troy ounce, unchanged (YTD: +103.8%)

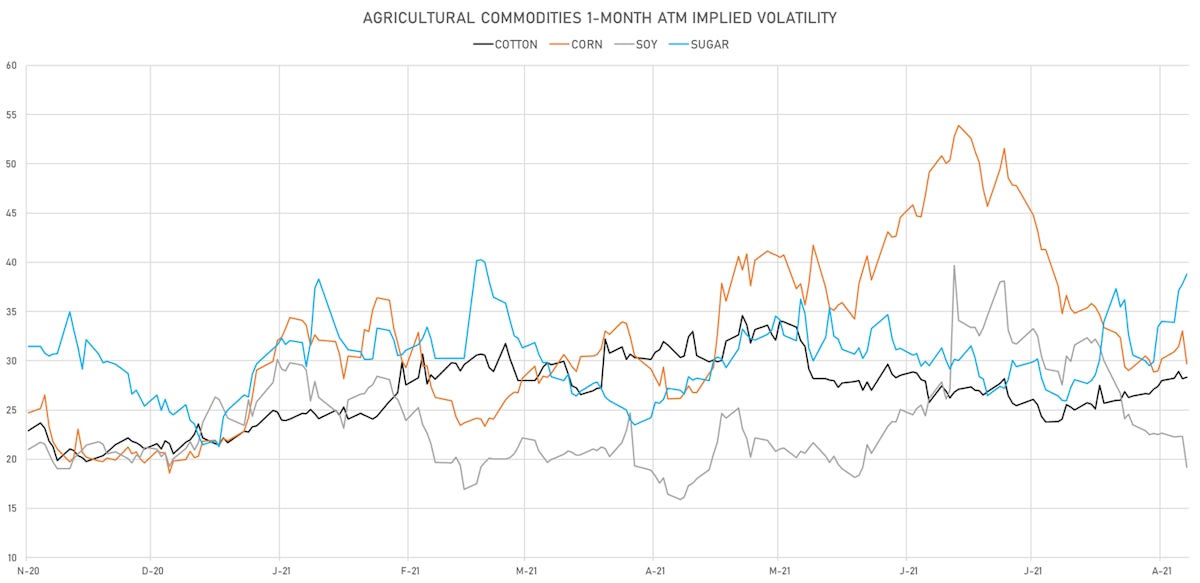

AGS UP TODAY, LED BY GRAINS

- Live Cattle (CME) currently at US$ 123.15 cents per pound, up 0.2% (YTD: +9.0%)

- Lean Hogs (CME) currently at US$ 110.13 cents per pound, up 0.5% (YTD: +56.7%)

- Rough Rice (CBOT) currently at US$ 13.53 cents per hundredweight, up 0.7% (YTD: +9.1%)

- Soybeans Composite (CBOT) currently at US$ 1,401.50 cents per bushel, down -0.3% (YTD: +6.6%)

- Corn (CBOT) currently at US$ 567.00 cents per bushel, up 1.9% (YTD: +17.1%)

- Wheat Composite (CBOT) currently at US$ 753.50 cents per bushel, up 3.6% (YTD: +17.6%)

- Sugar No.11 (ICE US) currently at US$ 19.54 cents per pound, up 0.4% (YTD: +26.1%)

- Cotton No.2 (ICE US) currently at US$ 93.77 cents per pound, up 2.3% (YTD: +20.0%)

- Cocoa (ICE US) currently at US$ 2,507 per tonne, down -0.1% (YTD: -3.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,428 per tonne, up 1.3% (YTD: +39.9%)

- Random Length Lumber (CME) currently at US$ 500.40 per 1,000 board feet, up 1.3% (YTD: -42.7%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,950 per tonne, up 0.1% (YTD: +9.6%)

- Soybean Oil Composite (CBOT) unchanged at US$ 63.51 cents per pound (YTD: +46.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,584 per tonne, down -1.2% (YTD: +17.8%)

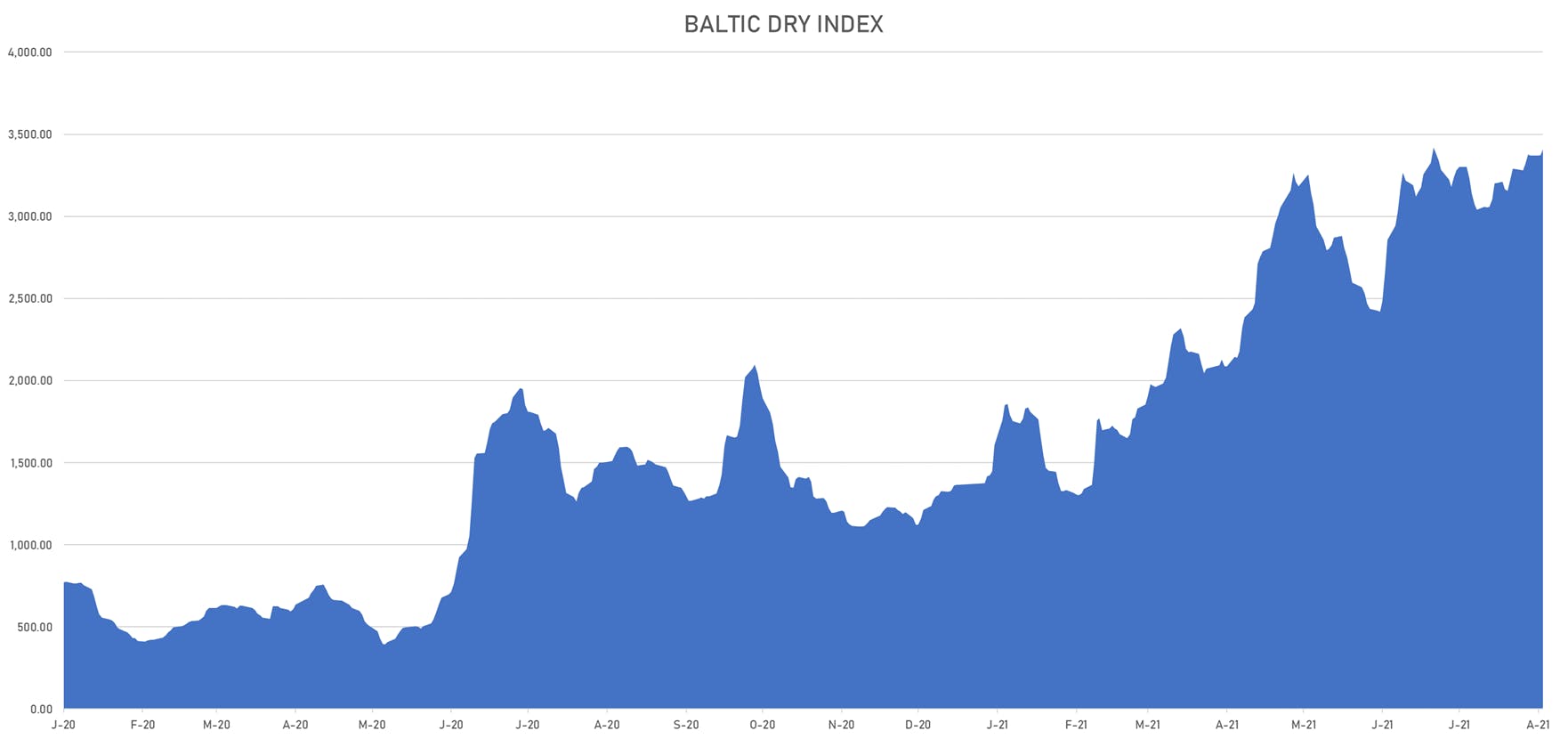

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,410, up 1.0% (YTD: +149.6%)

- Freightos China To North America West Coast Container Index currently at 15,809, unchanged (YTD: +276.4%)

- Freightos North America West Coast To China Container Index currently at 993, unchanged (YTD: +91.8%)

- Freightos North America East Coast To Europe Container Index currently at 547, unchanged (YTD: +50.7%)

- Freightos Europe To North America East Coast Container Index currently at 6,658, unchanged (YTD: +256.2%)

- Freightos China To North Europe Container Index currently at 14,141, unchanged (YTD: +149.7%)

- Freightos North Europe To China Container Index currently at 1,544, unchanged (YTD: +12.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,255, unchanged (YTD: +210.6%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 56.26 per tonne, down -2.6% (YTD: +71.9%)