Commodities

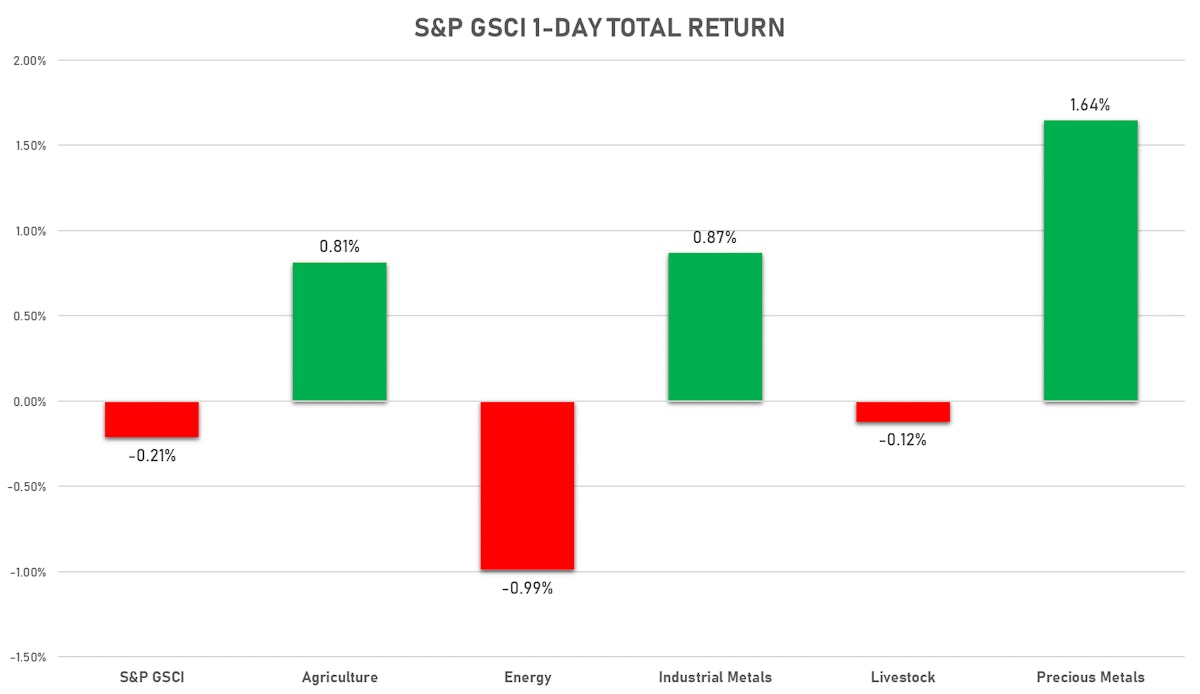

Energy Drops On Growth Concerns, Precious Metals Rise On Dollar Weakness

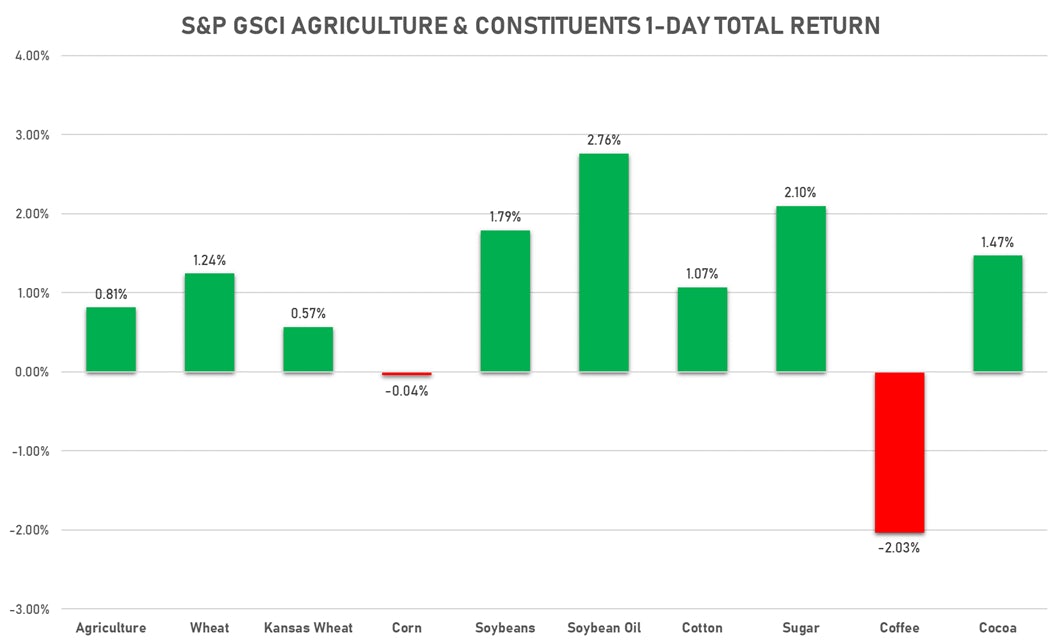

Agricultural commodities capped a good weak with further gains: wheat, corn, sugar, cotton all up on the day

Published ET

S&P GSCI Total Returns | Sources: ϕpost, FactSet data

NOTABLE GAINERS TODAY

- DCE Coking Coal Continuation Month 1 up 5.7% (YTD: 43.7%)

- Silver spot up 2.4% (YTD: -10.1%)

- Shanghai International Exchange Bonded Copper up 2.3% (YTD: 19.9%)

- SMM Lithium Metal Spot Price Daily up 2.3% (YTD: 37.1%)

- ICE-US Sugar No. 11 up 2.1% (YTD: 28.8%)

- CBoT Soybeans up 1.6% (YTD: 8.3%)

- ICE-US Cocoa up 1.6% (YTD: -2.2%)

- Gold spot up 1.5% (YTD: -6.2%)

NOTABLE LOSERS TODAY

- Freightos Baltic Europe To North America East Coast 40 Container Index down -10.9% (YTD: 217.2%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index down -2.6% (YTD: 86.8%)

- SHFE Stannum down -2.2% (YTD: 59.8%)

- ICE-US Coffee down -2.0% (YTD: 42.5%)

- SHFE Rubber down -2.0% (YTD: -1.4%)

- NYMEX Henry Hub Natural Gas down -1.8% (YTD: 52.1%)

- Gold/US Dollar 1 Month ATM Option IV down -1.8% (YTD: -19.2%)

- EEX European-Carbon- Secondary Trading down -1.5% (YTD: 72.6%)

- SHFE Zinc down -1.4% (YTD: 7.2%)

- SHFE Rebar down -1.3% (YTD: 26.6%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

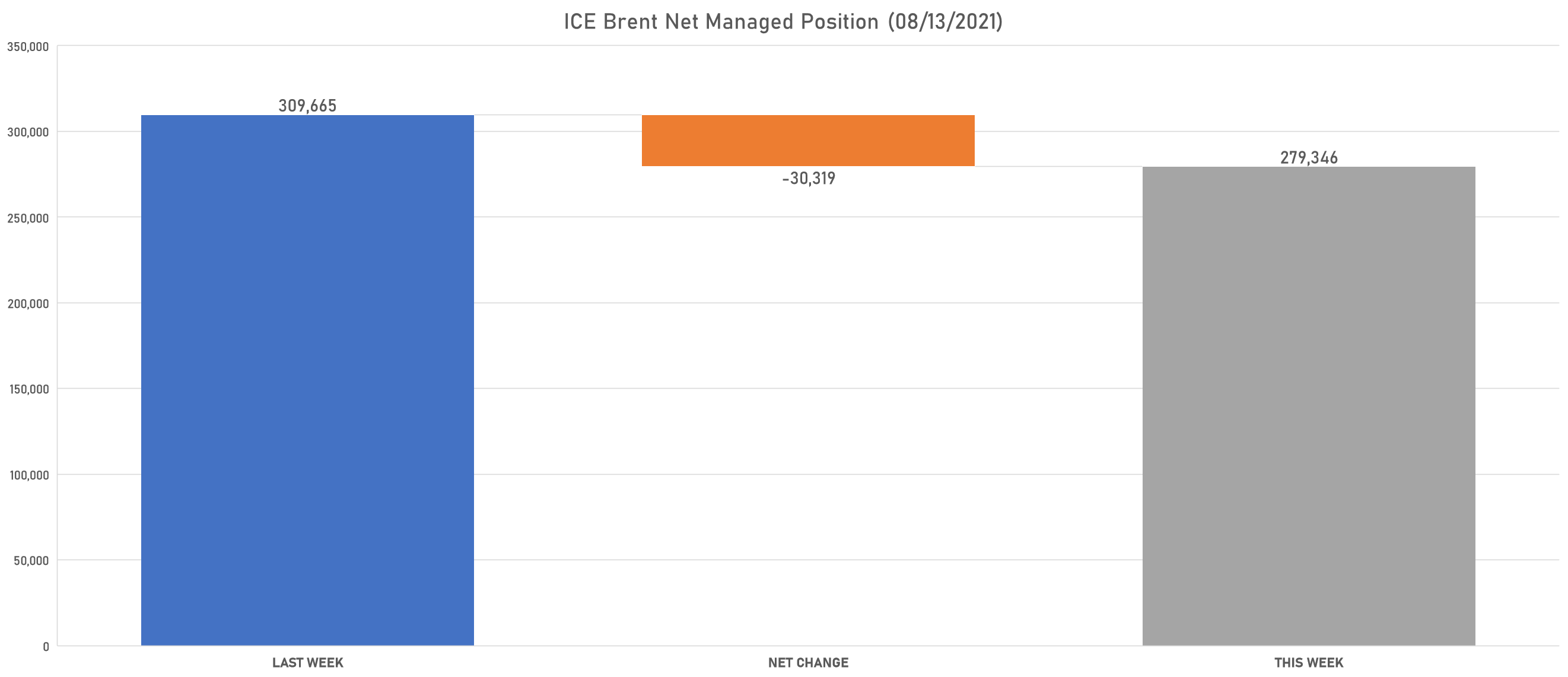

- Ice Brent reduced net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice increased net long position

METALS

- Gold reduced net long position

- Silver reduced net long position

- Platinum increased net short position

- Palladium increased net long position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat increased net long position

- Corn increased net long position

- Rough Rice increased net short position

- Oats increased net long position

- Soybeans increased net long position

- Soybean Oil reduced net long position

- Soybean Meal increased net long position

- Lean Hogs reduced net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa reduced net short position

- Coffee C reduced net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice reduced net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position

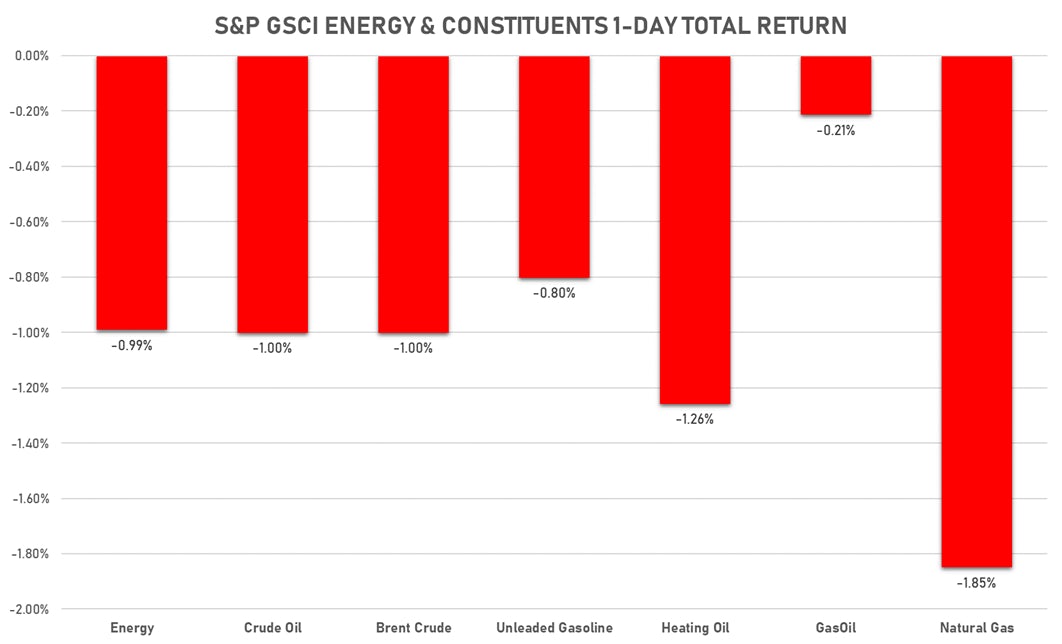

ENERGY DOWN TODAY

- WTI crude front month currently at US$ 68.44 per barrel, down -0.9% (YTD: +41.1%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 70.59 per barrel, down -1.0% (YTD: +36.3%); 6-month term structure in tightening backwardation

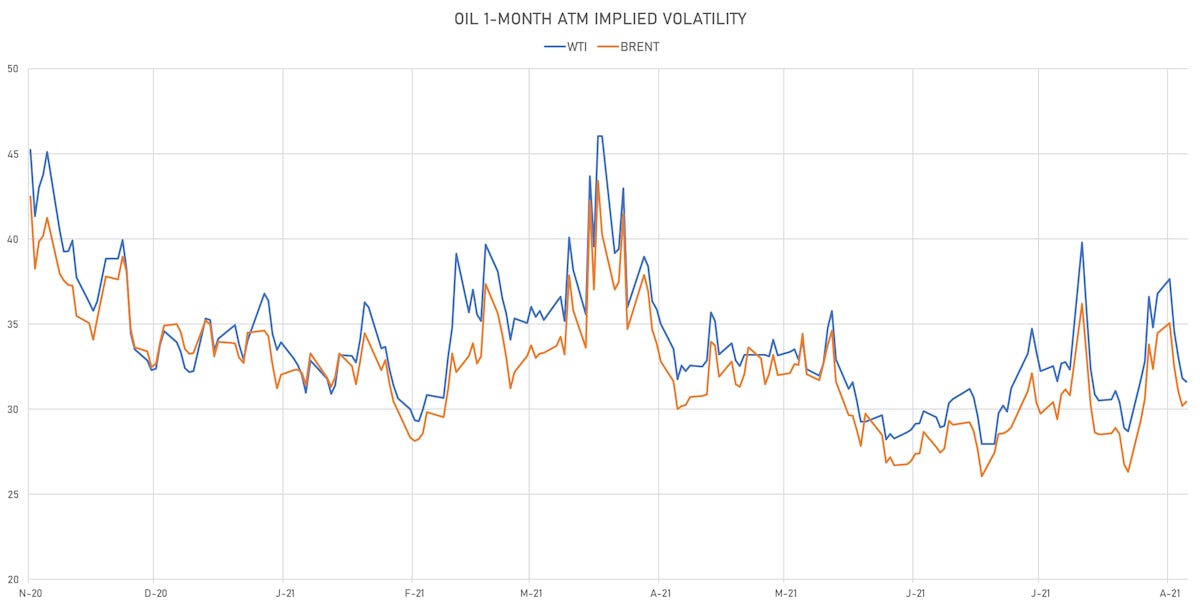

- Brent volatility at 30.5, up 0.9% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 172.75 per tonne, up 0.9% (YTD: +114.6%)

- Natural Gas (Henry Hub) currently at US$ 3.86 per MMBtu, down -1.8% (YTD: +52.1%)

- Gasoline (NYMEX) currently at US$ 2.26 per gallon, down -0.6% (YTD: +60.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 582.50 per tonne, up 1.2% (YTD: +38.4%)

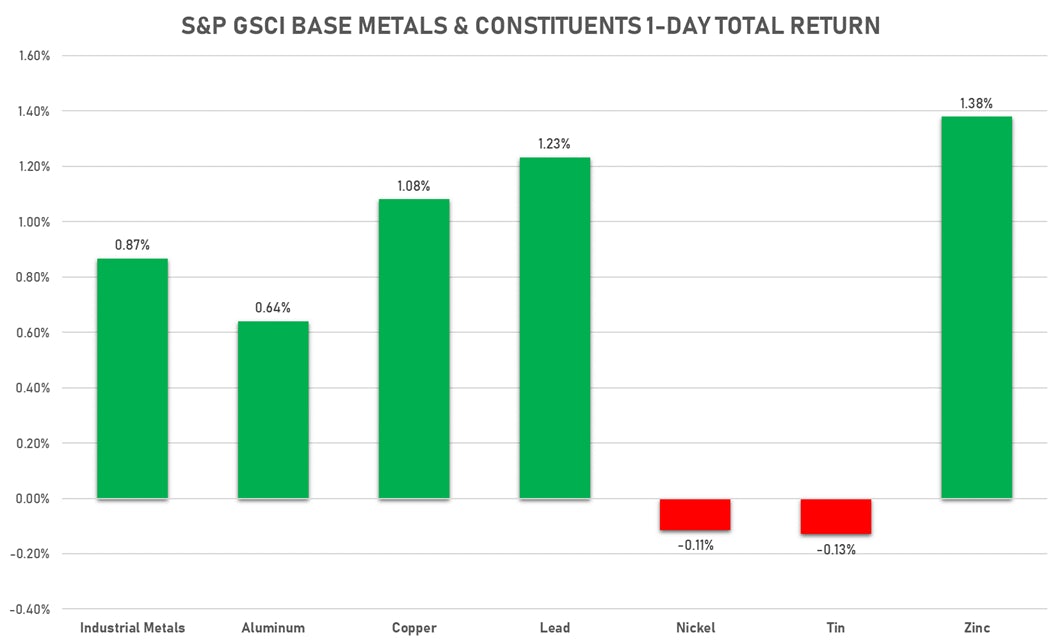

BASE METALS MIXED TODAY

- Copper (COMEX) currently at US$ 4.40 per pound, up 0.7% (YTD: +24.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 973.50 per tonne, up 1.2% (YTD: +3.7%)

- Aluminum (Shanghai) currently at CNY 20,400 per tonne, down -0.2% (YTD: +27.8%)

- Nickel (Shanghai) currently at CNY 148,390 per tonne, up 0.5% (YTD: +19.9%)

- Lead (Shanghai) currently at CNY 15,510 per tonne, down -0.4% (YTD: +4.4%)

- Rebar (Shanghai) currently at CNY 5,343 per tonne, down -1.3% (YTD: +26.6%)

- Tin (Shanghai) currently at CNY 240,340 per tonne, down -2.2% (YTD: +59.8%)

- Zinc (Shanghai) currently at CNY 22,510 per tonne, down -1.4% (YTD: +7.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 665,000 per tonne, up 2.3% (YTD: +37.1%)

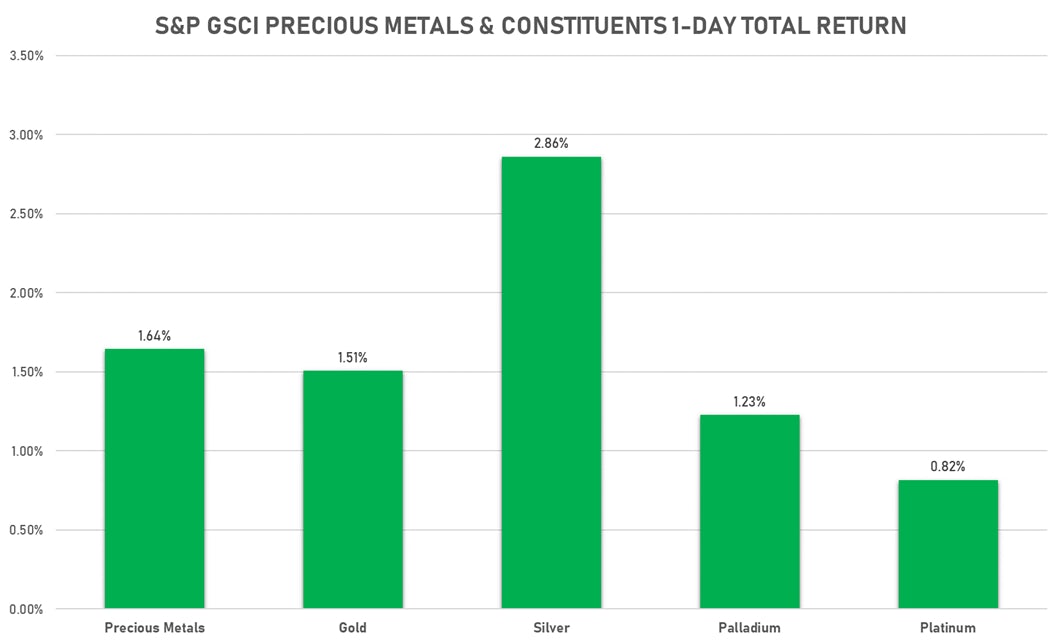

PRECIOUS METALS RISE BROADLY TODAY

- Gold spot currently at US$ 1,779.15 per troy ounce, up 1.5% (YTD: -6.2%)

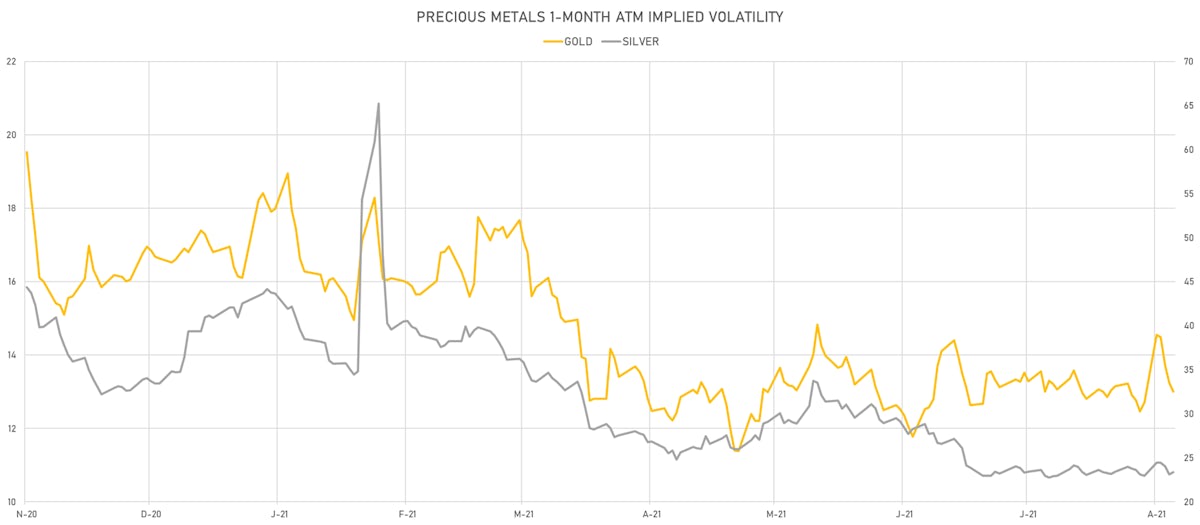

- Gold 1-Month ATM implied volatility currently at 12.73, down -1.8% (YTD: -19.2%)

- Silver spot currently at US$ 23.72 per troy ounce, up 2.4% (YTD: -10.1%)

- Silver 1-Month ATM implied volatility currently at 22.45, up 1.2% (YTD: -45.1%)

- Palladium spot currently at US$ 2,649.58 per troy ounce, up 0.9% (YTD: +8.4%)

- Platinum spot currently at US$ 1,028.48 per troy ounce, up 0.8% (YTD: -3.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,300 per troy ounce, unchanged (YTD: +103.8%)

AGS MOSTLY UP TODAY

- Live Cattle (CME) currently at US$ 122.75 cents per pound, down 0.3% (YTD: +8.7%)

- Lean Hogs (CME) currently at US$ 86.53 cents per pound, down -0.3% (YTD: +56.2%)

- Rough Rice (CBOT) currently at US$ 13.53 cents per hundredweight, up 0.0% (YTD: +9.1%)

- Soybeans Composite (CBOT) currently at US$ 1,373.00 cents per bushel, up 1.6% (YTD: +8.3%)

- Corn (CBOT) currently at US$ 568.25 cents per bushel, up 0.2% (YTD: +17.4%)

- Wheat Composite (CBOT) currently at US$ 762.25 cents per bushel, up 1.2% (YTD: +19.0%)

- Sugar No.11 (ICE US) currently at US$ 20.10 cents per pound, up 2.1% (YTD: +28.8%)

- Cotton No.2 (ICE US) currently at US$ 95.50 cents per pound, up 1.5% (YTD: +21.9%)

- Cocoa (ICE US) currently at US$ 2,540 per tonne, up 1.6% (YTD: -2.2%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,456 per tonne, up 0.6% (YTD: +40.8%)

- Random Length Lumber (CME) currently at US$ 495.20 per 1,000 board feet, down -1.0% (YTD: -43.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,950 per tonne, down 0.0% (YTD: +9.6%)

- Soybean Oil Composite (CBOT) currently at US$ 63.72 cents per pound, down 0.0% (YTD: +46.6%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,615 per tonne, down -1.2% (YTD: +16.4%)

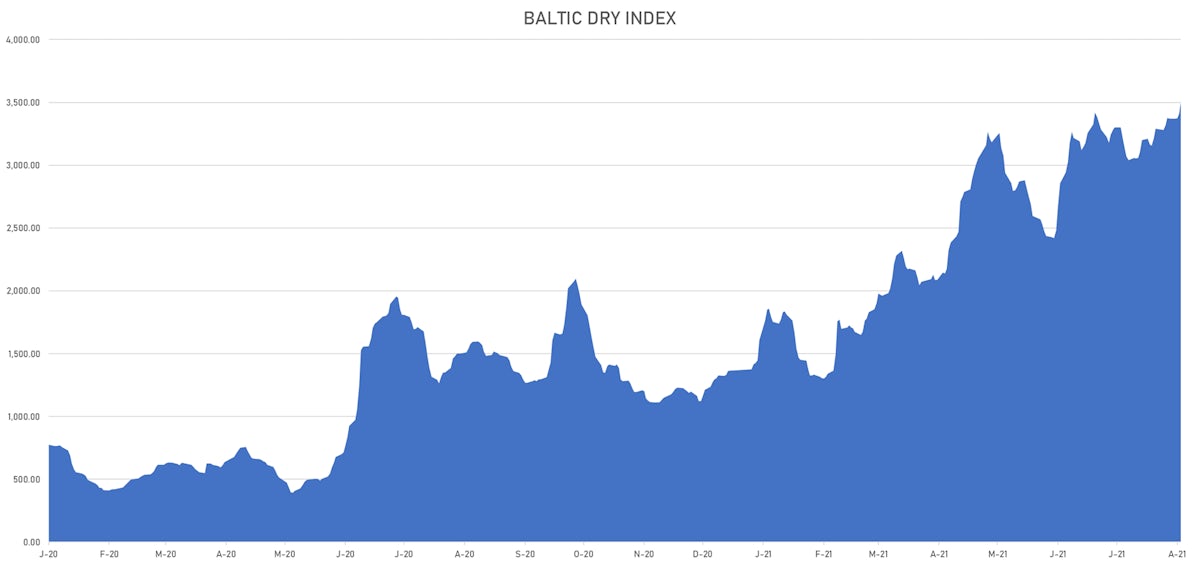

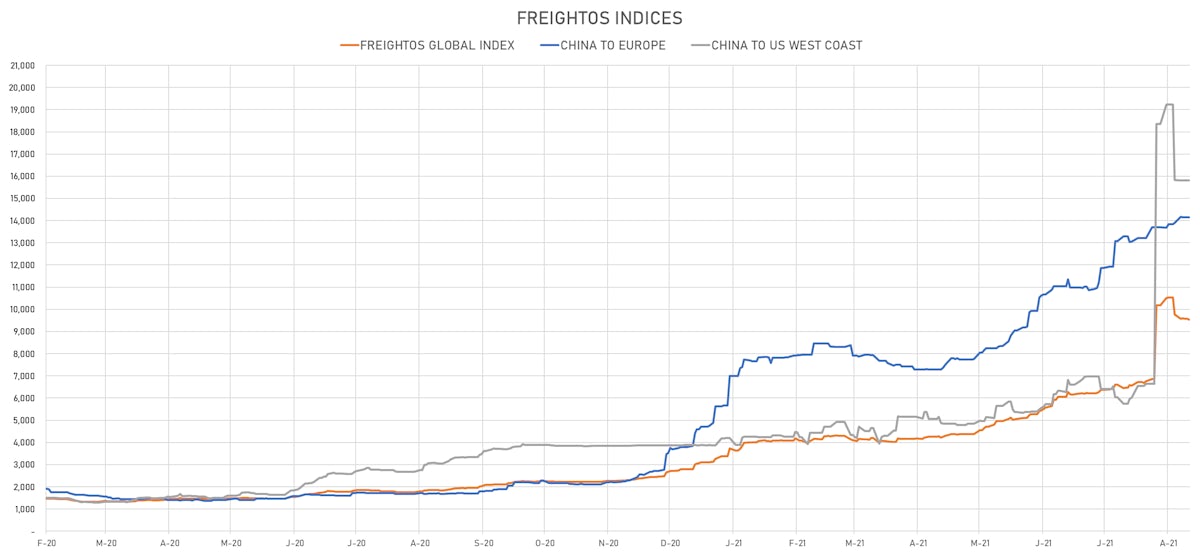

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,503, up 2.7% (YTD: +156.4%)

- Freightos China To North America West Coast Container Index currently at 15,809, unchanged (YTD: +276.4%)

- Freightos North America West Coast To China Container Index currently at 967, down -2.6% (YTD: +86.8%)

- Freightos North America East Coast To Europe Container Index currently at 547, unchanged (YTD: +50.7%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, down -10.9% (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 14,141, unchanged (YTD: +149.7%)

- Freightos North Europe To China Container Index currently at 1,544, unchanged (YTD: +12.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,255, unchanged (YTD: +210.6%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 55.38 per tonne, down -1.6% (YTD: +69.3%)