Commodities

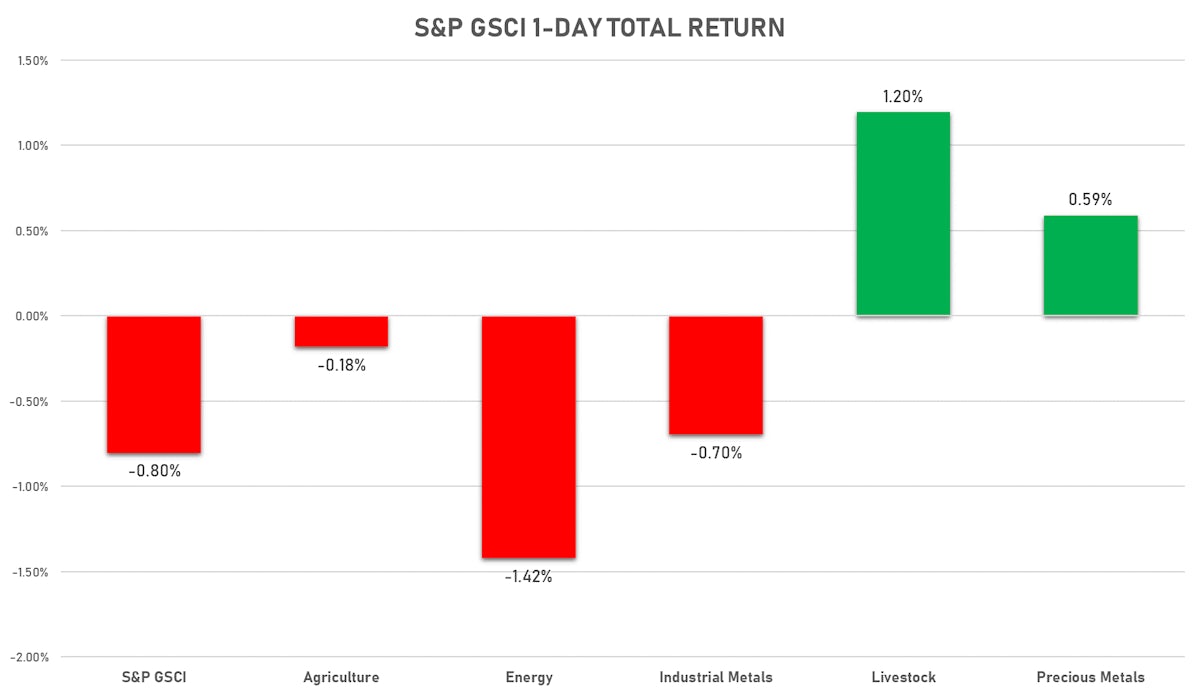

Energy And Base Metals Fall On Disappointing Chinese Economic Data

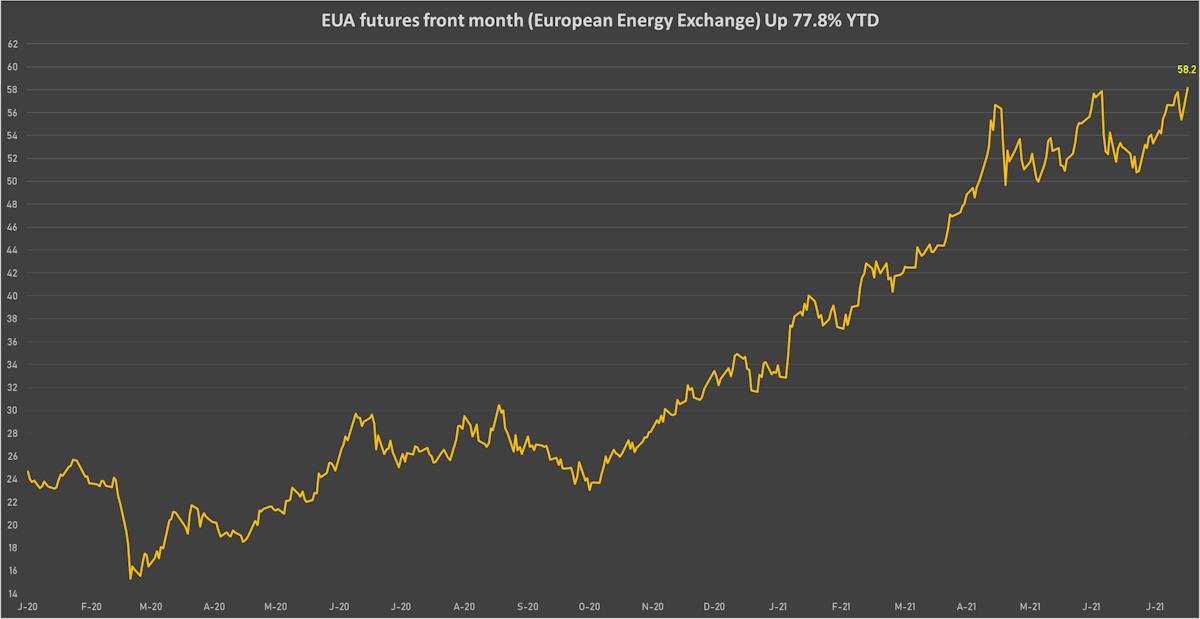

In Europe, CO2 emission permits keep rising, with EUA futures now up close to 80% year to date

Published ET

EU CO2 Permits Front-Month Futures Prices | Sources: ϕpost, Refinitiv data

HEADLINES & MACRO

- OPEC+ sees no need to boost output more than planned in coming months despite White House pleas (Reuters)

- Chinese economic indicators, including below-consensus July industrial production, showed the nation’s recovery is cooling, suggesting less demand for commodities (DJN)

- Weekly USDA crop progress report showed that 62% of corn crops are in good or excellent condition (vs. 64% last week and 69% in the same week last year)

NOTABLE GAINERS TODAY

- DCE Coking Coal Continuation Month 1 up 12.0% (YTD: 60.9%)

- Intercontinental Exchange CO2 European Union Allowance (EUA) Yearly up 5.0% (YTD: 77.8%)

- EEX European-Carbon- Secondary Trading up 5.0% (YTD: 81.2%)

- Bursa Malaysia Crude Palm Oil up 2.9% (YTD: 19.8%)

- Freightos Baltic Europe To South America East Coast 40 Container Index up 2.6% (YTD: 315.4%)

- NYMEX Henry Hub Natural Gas up 2.2% (YTD: 55.4%)

- Freightos Baltic China/East Asia To North America West Coast 40 Container Index up 2.0% (YTD: 284.1%)

- Silver/US Dollar 1 Month ATM Option IV up 2.0% (YTD: -43.9%)

- Gold/US Dollar 1 Month ATM Option IV up 1.6% (YTD: -17.9%)

- SMM Lithium Metal Spot Price Daily up 1.5% (YTD: 39.2%)

- Freightos Baltic China/East Asia To North America East Coast 40 Container Index up 1.1% (YTD: 229.0%)

- SHFE Aluminum up 0.9% (YTD: 29.0%)

NOTABLE LOSERS TODAY

- CME Lean Hogs down -18.9% (YTD: 26.6%)

- DCE Iron Ore Continuation Month 1 down -13.5% (YTD: -10.3%)

- DCE RBD Palm Oil down -6.3% (YTD: 23.3%)

- CME Random Length Lumber down -4.9% (YTD: -46.1%)

- CBoT Soybeans down -3.4% (YTD: 4.6%)

- NYMEX RBOB Gasoline down -2.7% (YTD: 56.3%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily down -2.1% (YTD: 40.2%)

- ICE Europe Low Sulphur Gasoil down -1.9% (YTD: 35.8%)

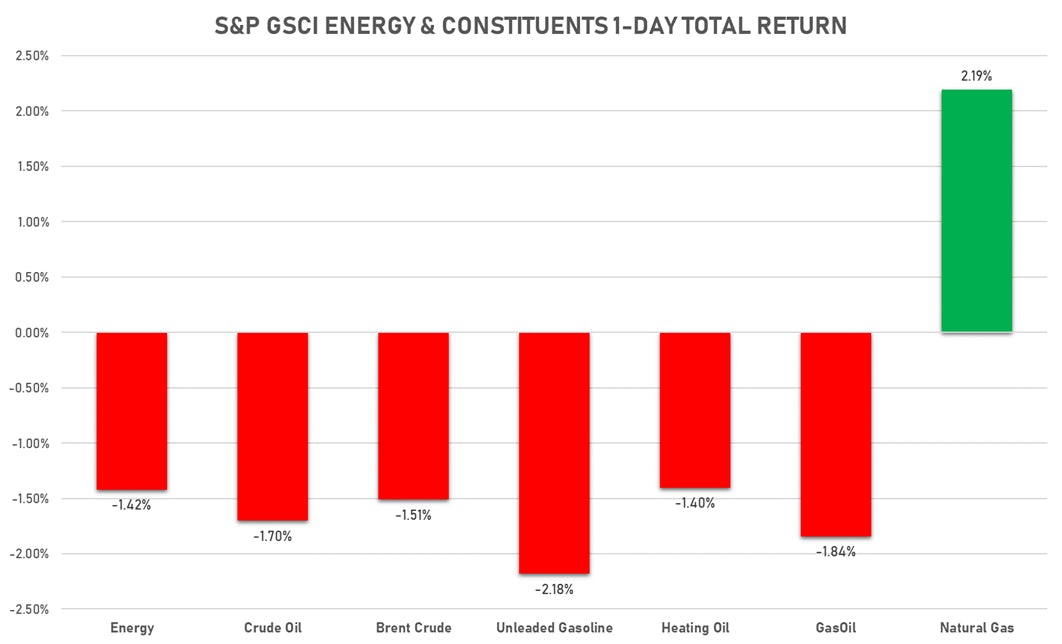

ENERGY: CRUDE DOWN, NAT GAS UP TODAY

- WTI crude front month currently at US$ 67.53 per barrel, down -1.7% (YTD: +38.7%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 69.73 per barrel, down -1.5% (YTD: +34.2%); 6-month term structure in tightening backwardation

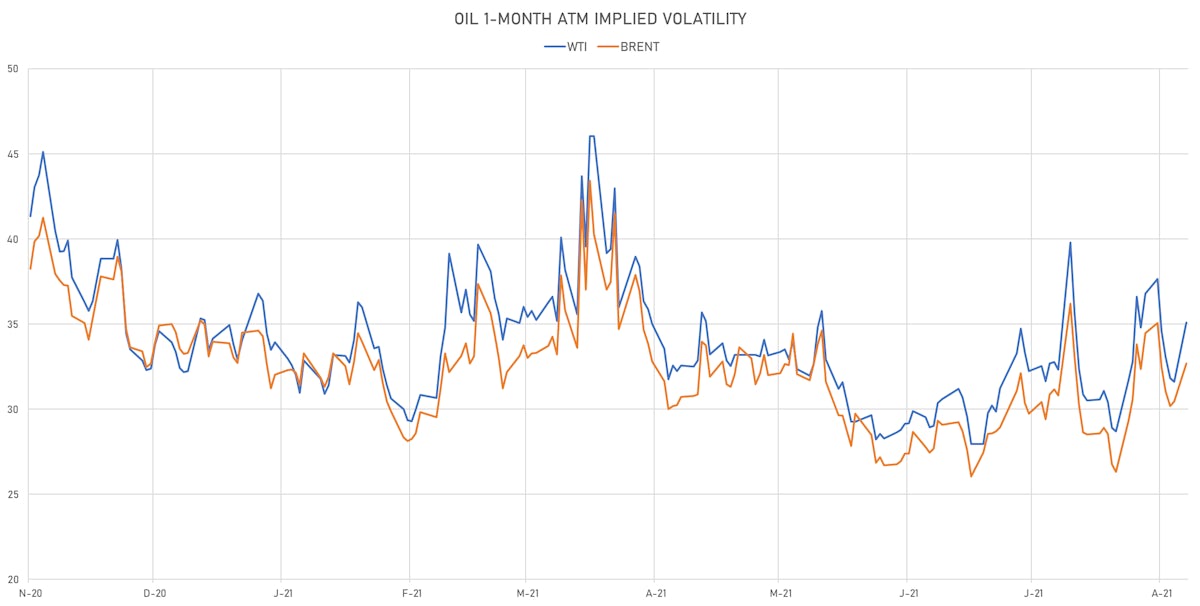

- Brent volatility at 32.7, up 7.4% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 173.40 per tonne, up 0.4% (YTD: +115.4%)

- Natural Gas (Henry Hub) currently at US$ 3.94 per MMBtu, up 2.2% (YTD: +55.4%)

- Gasoline (NYMEX) currently at US$ 2.21 per gallon, down -2.7% (YTD: +56.3%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 571.25 per tonne, down -1.9% (YTD: +35.8%)

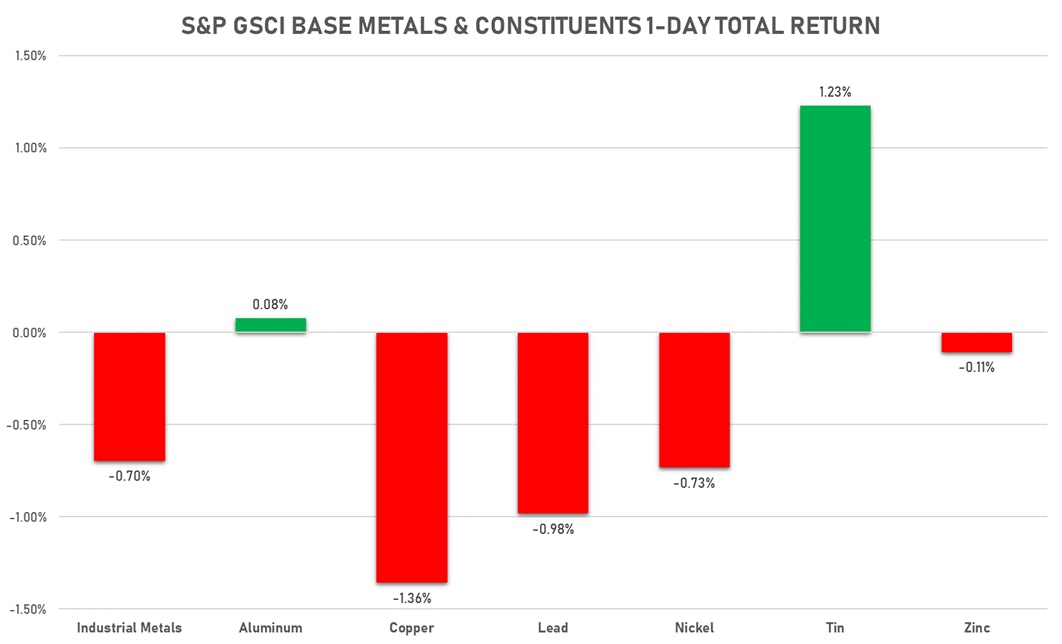

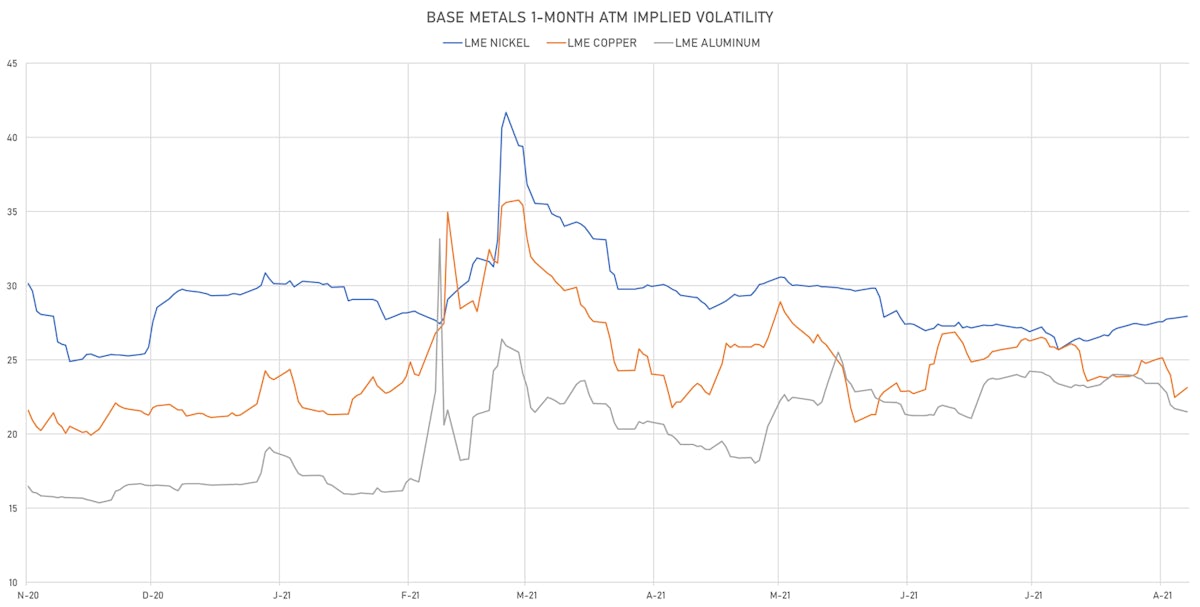

BASE METALS MOSTLY DOWN TODAY

- Copper (COMEX) currently at US$ 4.33 per pound, down -1.5% (YTD: +23.0%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 972.50 per tonne, down -13.5% (YTD: -10.3%)

- Aluminum (Shanghai) currently at CNY 20,190 per tonne, up 0.9% (YTD: +29.0%)

- Nickel (Shanghai) currently at CNY 146,800 per tonne, down -0.3% (YTD: +19.6%)

- Lead (Shanghai) unchanged at CNY 15,435 per tonne (YTD: +4.4%)

- Rebar (Shanghai) currently at CNY 5,229 per tonne, down -0.9% (YTD: +25.5%)

- Tin (Shanghai) currently at CNY 241,030 per tonne, down -0.5% (YTD: +59.0%)

- Zinc (Shanghai) currently at CNY 22,635 per tonne, up 0.4% (YTD: +7.6%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 675,000 per tonne, up 1.5% (YTD: +39.2%)

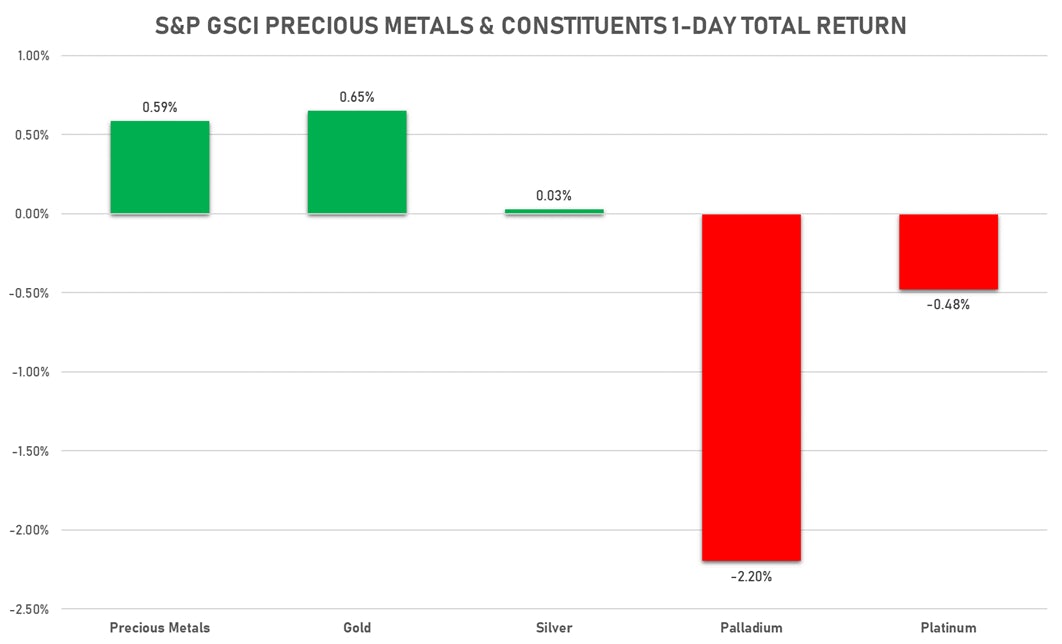

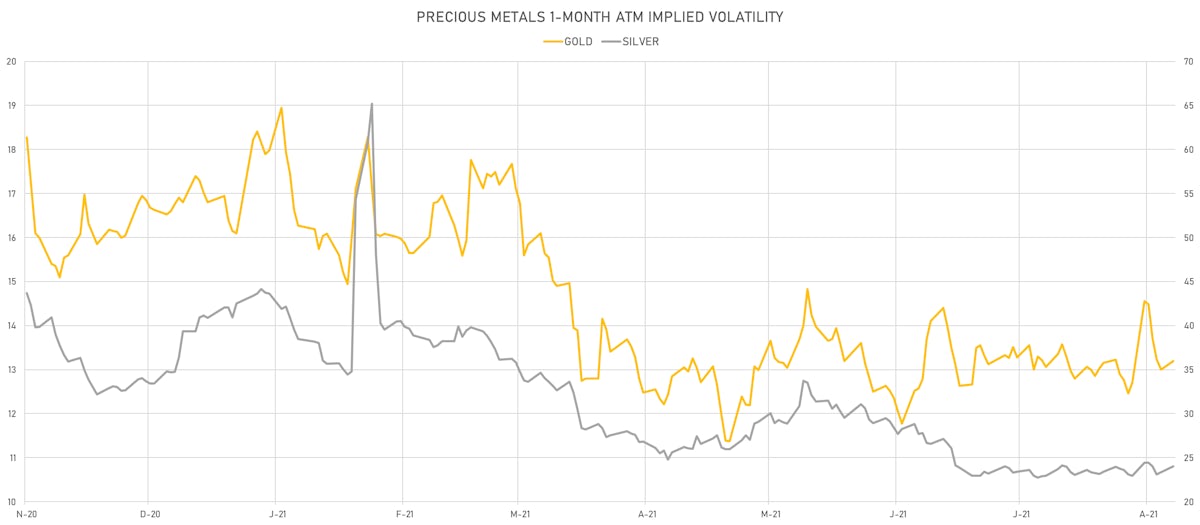

PRECIOUS METALS: GOLD UP, PLATINUM GROUP DOWN TODAY

- Gold spot currently at US$ 1,786.26 per troy ounce, up 0.3% (YTD: -5.9%)

- Gold 1-Month ATM implied volatility currently at 12.92, up 1.6% (YTD: -17.9%)

- Silver spot currently at US$ 23.84 per troy ounce, up 0.4% (YTD: -9.7%)

- Silver 1-Month ATM implied volatility currently at 23.13, up 2.0% (YTD: -43.9%)

- Palladium spot currently at US$ 2,602.49 per troy ounce, down -1.7% (YTD: +6.5%)

- Platinum spot currently at US$ 1,023.43 per troy ounce, down -0.5% (YTD: -4.2%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 19,000 per troy ounce, unchanged (YTD: +11.4%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,300 per troy ounce, unchanged (YTD: +103.8%)

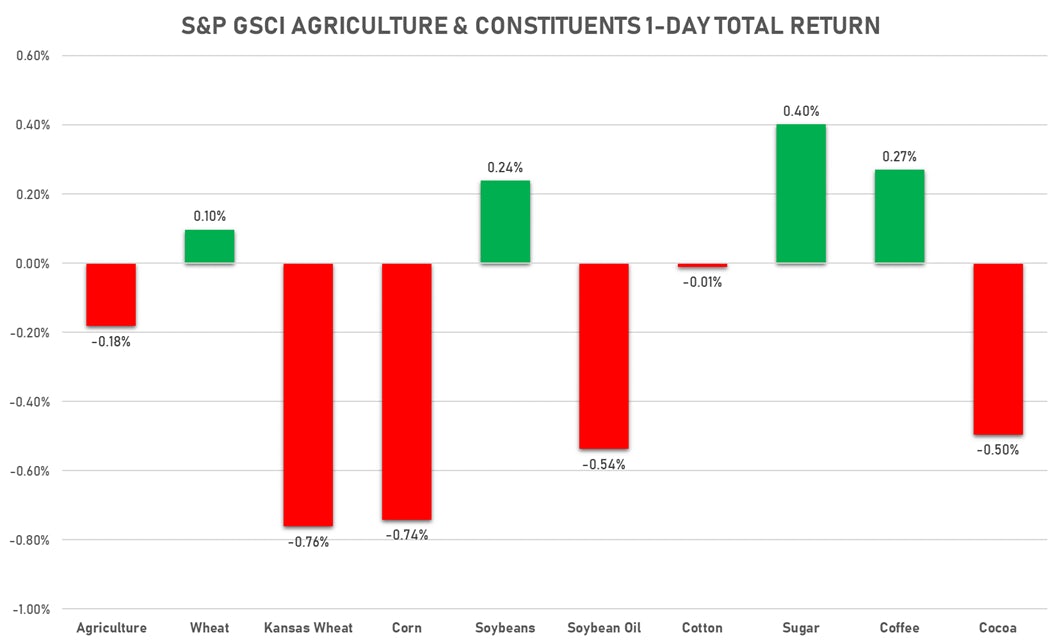

AGS TODAY

- Live Cattle (CME) currently at US$ 123.53 cents per pound, up 0.6% (YTD: +9.4%)

- Lean Hogs (CME) currently at US$ 89.00 cents per pound, down -18.9% (YTD: +26.6%)

- Rough Rice (CBOT) currently at US$ 13.55 cents per hundredweight, up 0.1% (YTD: +9.3%)

- Soybeans Composite (CBOT) currently at US$ 1,382.50 cents per bushel, down -3.4% (YTD: +4.6%)

- Corn (CBOT) currently at US$ 567.00 cents per bushel, down -0.6% (YTD: +16.7%)

- Wheat Composite (CBOT) currently at US$ 763.50 cents per bushel, down -0.2% (YTD: +18.7%)

- Sugar No.11 (ICE US) currently at US$ 20.03 cents per pound, up 0.4% (YTD: +29.3%)

- Cotton No.2 (ICE US) currently at US$ 94.85 cents per pound, down -0.4% (YTD: +21.4%)

- Cocoa (ICE US) currently at US$ 2,544 per tonne, down -0.1% (YTD: -2.3%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,394 per tonne, down -1.4% (YTD: +38.8%)

- Random Length Lumber (CME) currently at US$ 470.90 per 1,000 board feet, down -4.9% (YTD: -46.1%)

- TSR 20 Rubber (Shanghai) unchanged at CNY 11,515 per tonne (YTD: +9.6%)

- Soybean Oil Composite (CBOT) currently at US$ 63.45 cents per pound, down -0.3% (YTD: +46.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,663 per tonne, up 2.9% (YTD: +19.8%)

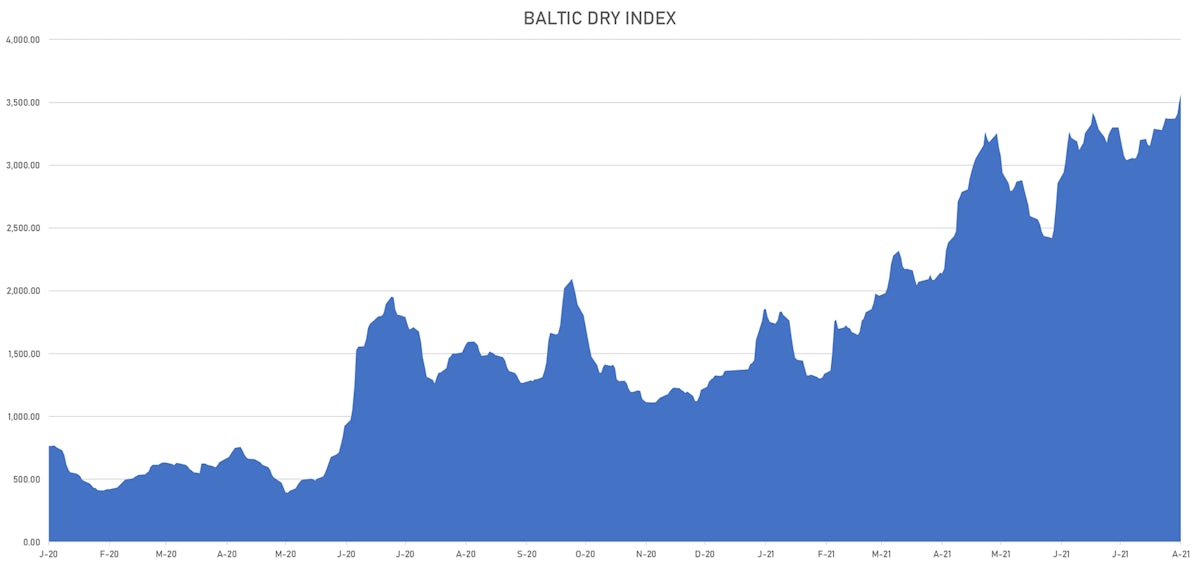

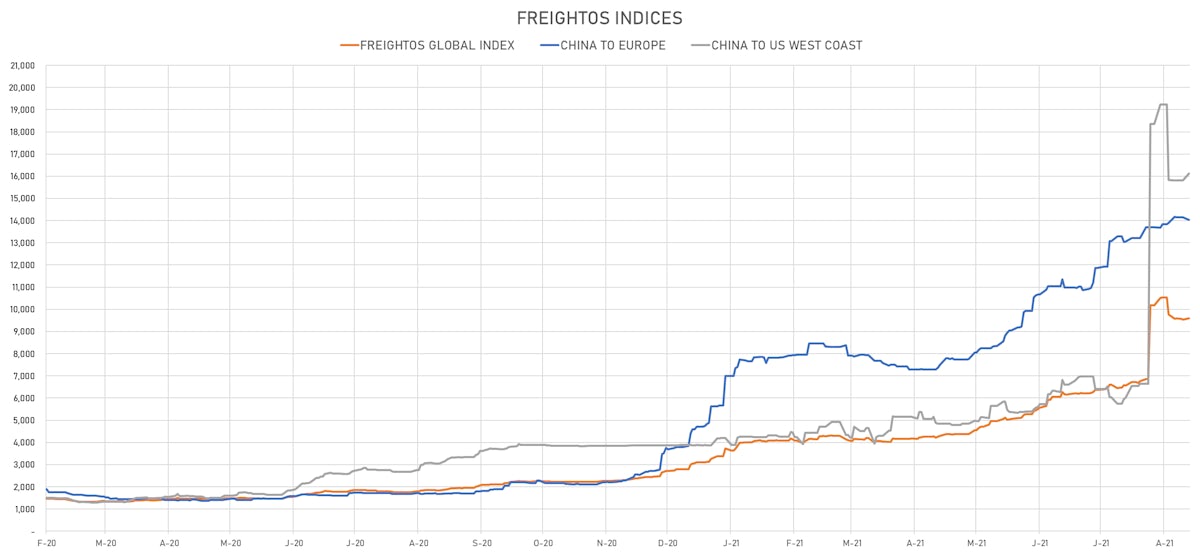

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,566, up 1.8% (YTD: +161.1%)

- Freightos China To North America West Coast Container Index currently at 16,131, up 2.0% (YTD: +284.1%)

- Freightos North America West Coast To China Container Index currently at 967, unchanged (YTD: +86.8%)

- Freightos North America East Coast To Europe Container Index currently at 547, unchanged (YTD: +50.7%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 14,038, down -0.7% (YTD: +147.9%)

- Freightos North Europe To China Container Index currently at 1,549, up 0.3% (YTD: +12.6%)

- Freightos Europe To South America West Coast Container Index currently at 5,255, unchanged (YTD: +210.6%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 58.16 per tonne, up 5.0% (YTD: +77.8%)