Commodities

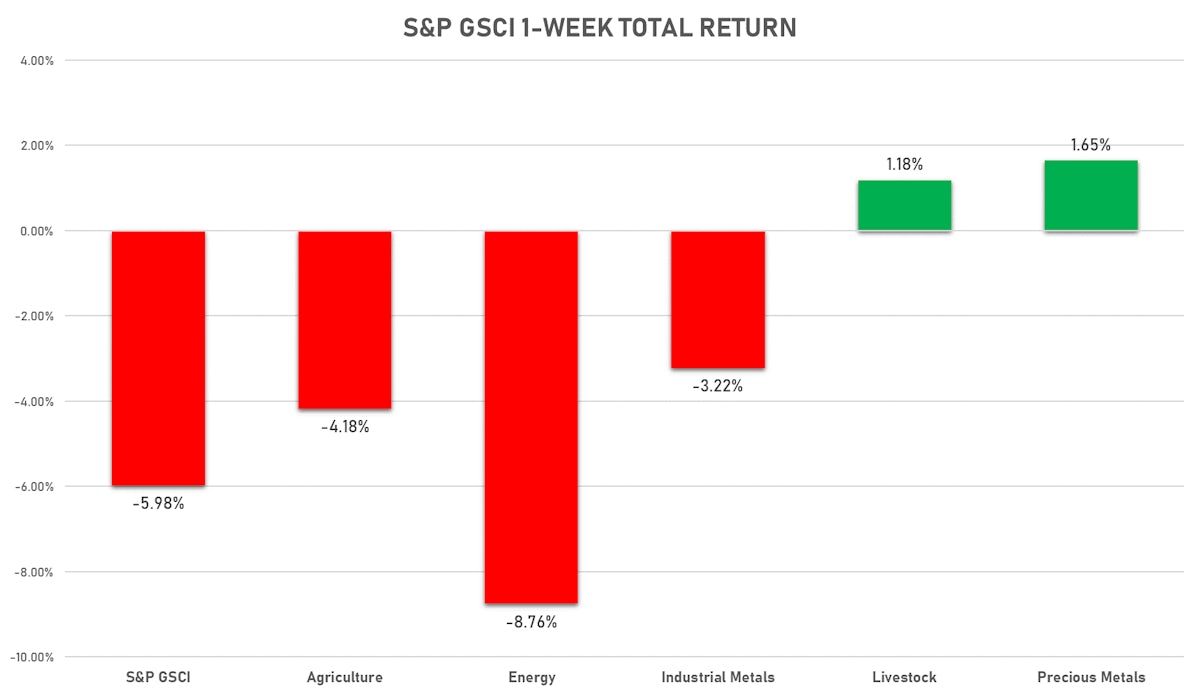

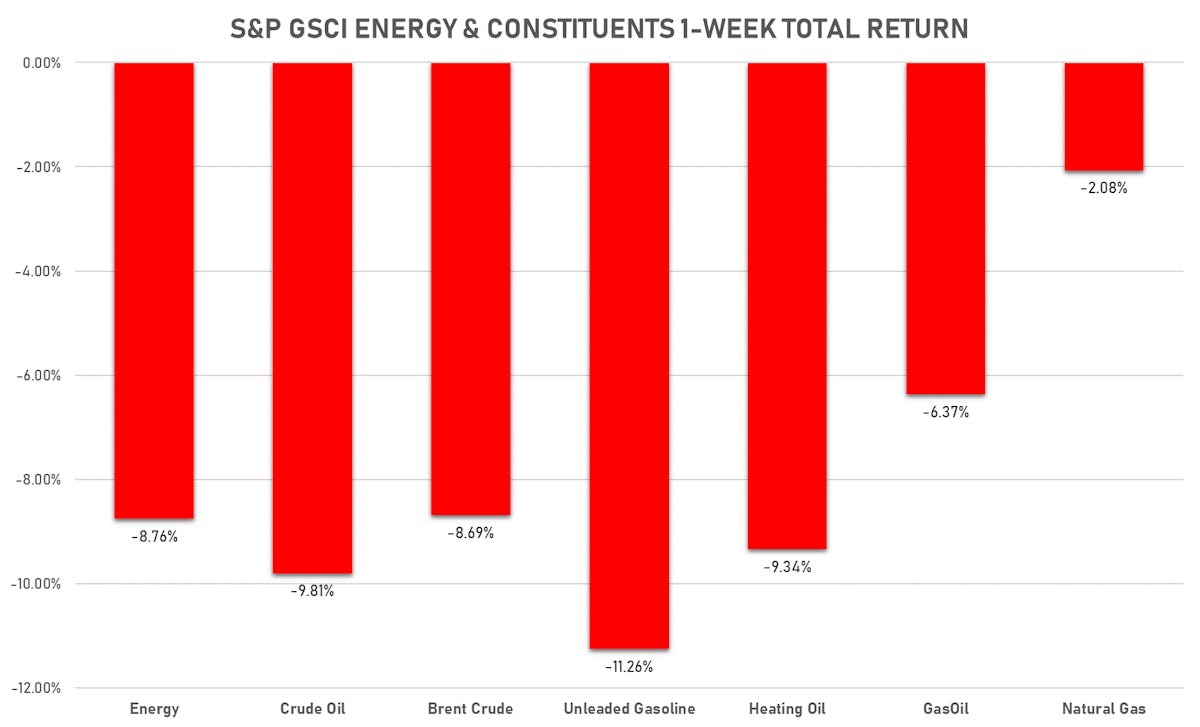

Big Drops Across Industrial Commodities This Week, With Energy Leading The Way

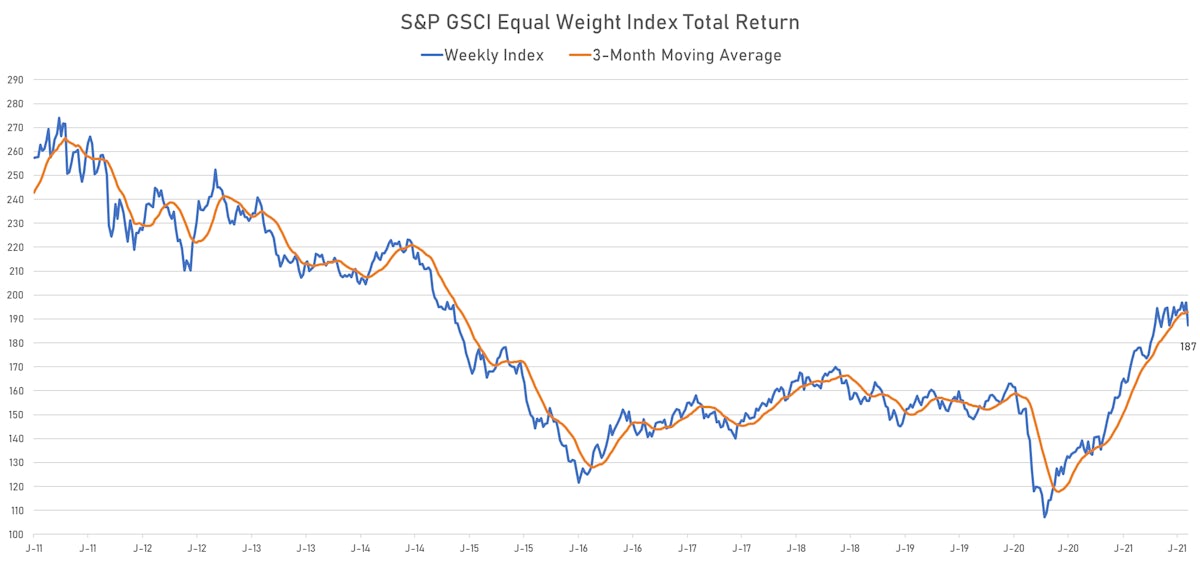

The GSCI Equal Weight Total Return Index closed the week below its 3-month moving average, with uncertainty likely to weigh further in the coming weeks

Published ET

Coking coal rose over 30% this week in China | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- DCE Coking Coal Continuation Month 1 up 6.0% (YTD: 87.4%)

- CME Random Length Lumber up 4.5% (YTD: -45.6%)

- Freightos Baltic China/East Asia To Mediterranean 40 Container Index up 4.4% (YTD: 127.5%)

- Zhengzhou Exchange Thermal Coal up 2.7% (YTD: 20.5%)

- DCE Coke up 2.4% (YTD: 16.3%)

- COMEX Copper up 2.4% (YTD: 17.7%)

- Platinum spot up 2.1% (YTD: -6.9%)

- CME Lean Hogs up 2.0% (YTD: 26.1%)

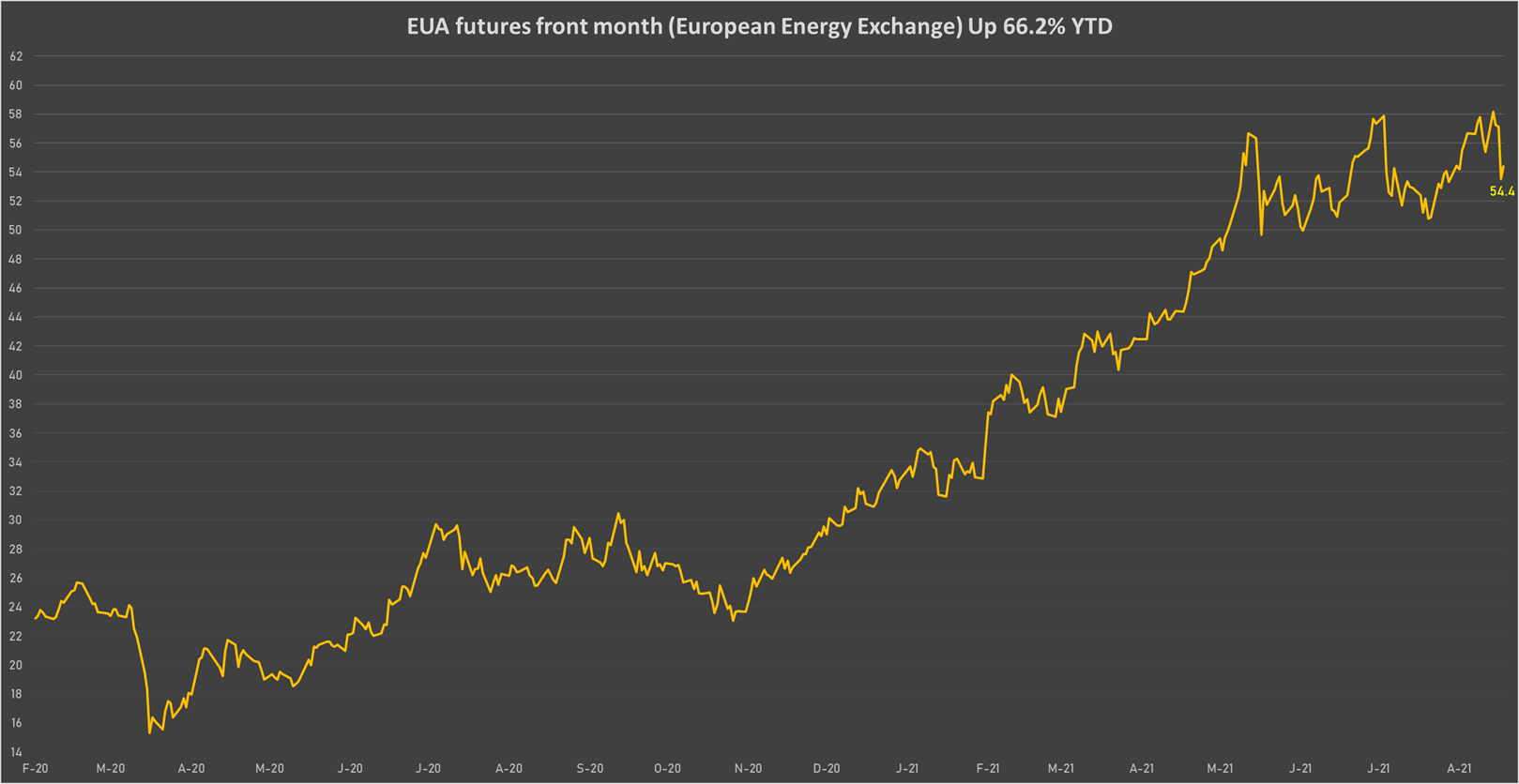

- EEX European-Carbon- Secondary Trading up 1.6% (YTD: 69.5%)

- Intercontinental Exchange CO2 European Union Allowance (EUA) Yearly up 1.6% (YTD: 66.2%)

- SGX Iron Ore 62% China CFR Swap Monthly up 1.5% (YTD: -1.0%)

- CME Live Cattle up 0.7% (YTD: 10.0%)

- CBoT Rough Rice up 0.6% (YTD: 7.0%)

- Freightos Baltic Global Index up 0.6% (YTD: 206.4%)

- ICE Europe Low Sulphur Gasoil up 0.6% (YTD: 29.8%)

NOTABLE LOSERS TODAY

- CBoT Soybean Oil down -5.1% (YTD: 32.7%)

- SHFE Stannum (Tin) down -4.2% (YTD: 53.7%)

- Johnson Matthey Rhodium New York 0930 down -3.7% (YTD: 5.6%)

- NYMEX NY Harbor ULSD down -3.1% (YTD: 29.3%)

- NYMEX RBOB Gasoline down -2.8% (YTD: 43.7%)

- Shanghai International Exchange TSR 20 Rubber down -2.6% (YTD: 10.9%)

- Brent Forties and Oseberg Dated FOB Northsea Crude down -2.3% (YTD: 27.7%)

- SHFE Rubber down -2.3% (YTD: -2.2%)

- ICE-US Cocoa down -2.3% (YTD: -0.9%)

- Crude Oil WTI Cushing US FOB down -2.3% (YTD: 28.7%)

- CBoT Soybeans down -2.2% (YTD: -1.6%)

- NYMEX Light Sweet Crude Oil (WTI) down -2.2% (YTD: 28.4%)

- CBoT Corn down -2.0% (YTD: 11.3%)

- ICE Europe Brent Crude down -1.9% (YTD: 25.8%)

- ICE Europe Newcastle Coal Monthly down -1.8% (YTD: 108.4%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

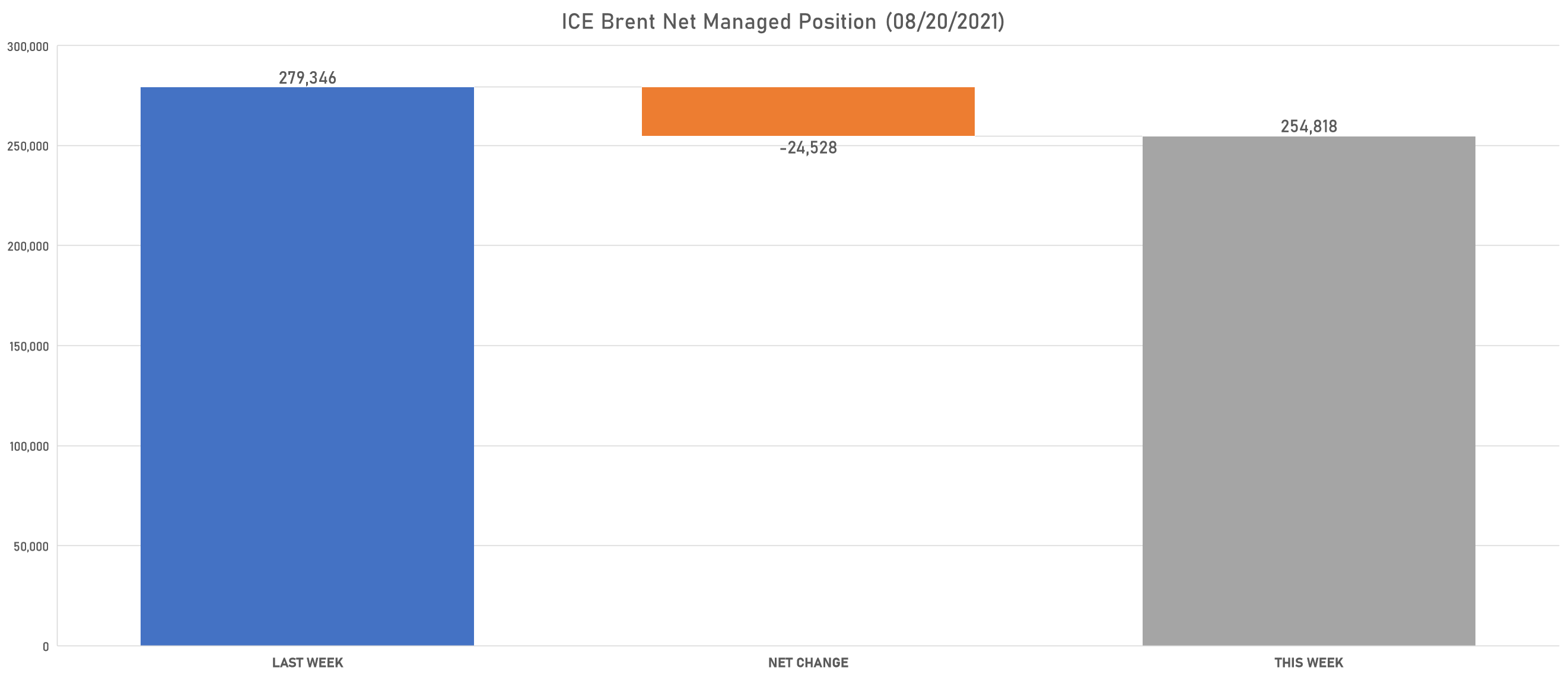

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver reduced net long position

- Platinum reduced net short position

- Palladium reduced net long position

- Copper-Grade#1 reduced net long position

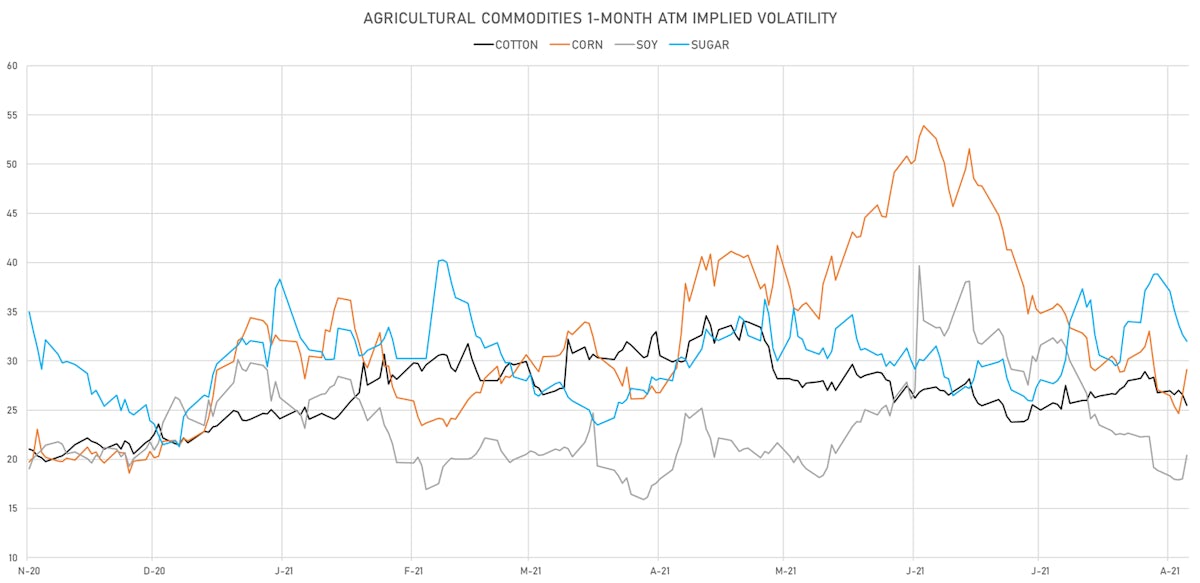

AGRICULTURE

- Wheat increased net long position

- Corn increased net long position

- Rough Rice reduced net short position

- Oats increased net long position

- Soybeans increased net long position

- Soybean Oil increased net long position

- Soybean Meal increased net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa turned to net long

- Coffee C increased net long position

- Robusta Coffee reduced net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 increased net long position

- White Sugar increased net long position

ENERGY DOWN AGAIN TODAY

- WTI crude front month currently at US$ 62.14 per barrel, down -2.2% (YTD: +28.4%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 65.18 per barrel, down -1.9% (YTD: +25.8%); 6-month term structure in tightening backwardation

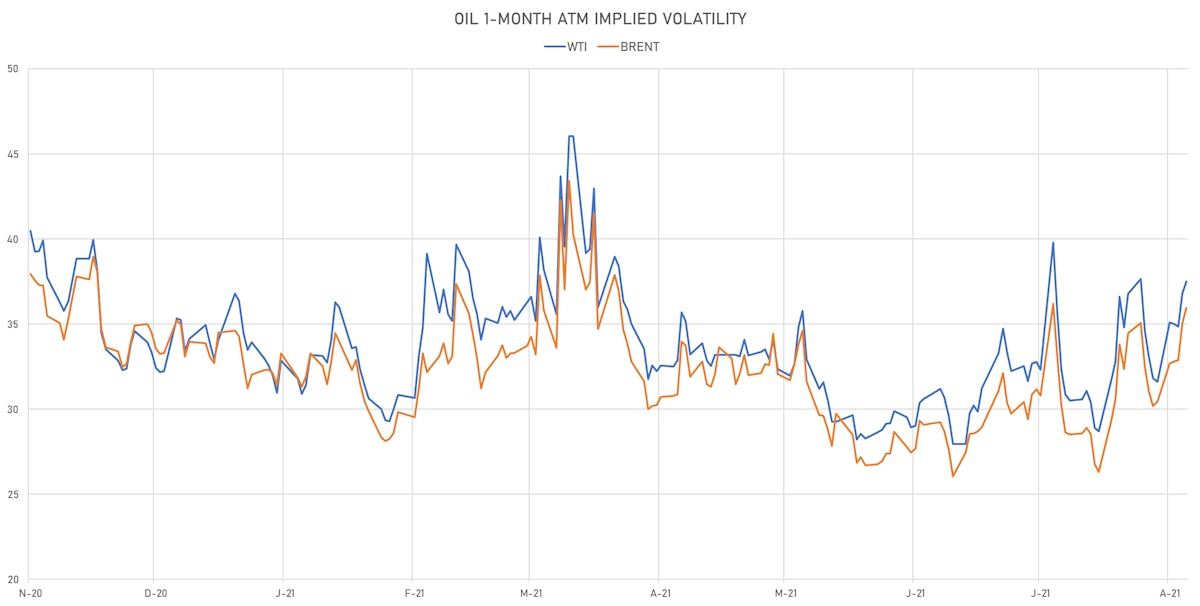

- Brent volatility at 36.0, up 2.7% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 167.75 per tonne, down -1.8% (YTD: +108.4%)

- Natural Gas (Henry Hub) currently at US$ 3.85 per MMBtu, up 0.5% (YTD: +51.7%)

- Gasoline (NYMEX) currently at US$ 2.02 per gallon, down -2.8% (YTD: +43.7%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 546.25 per tonne, up 0.6% (YTD: +29.8%)

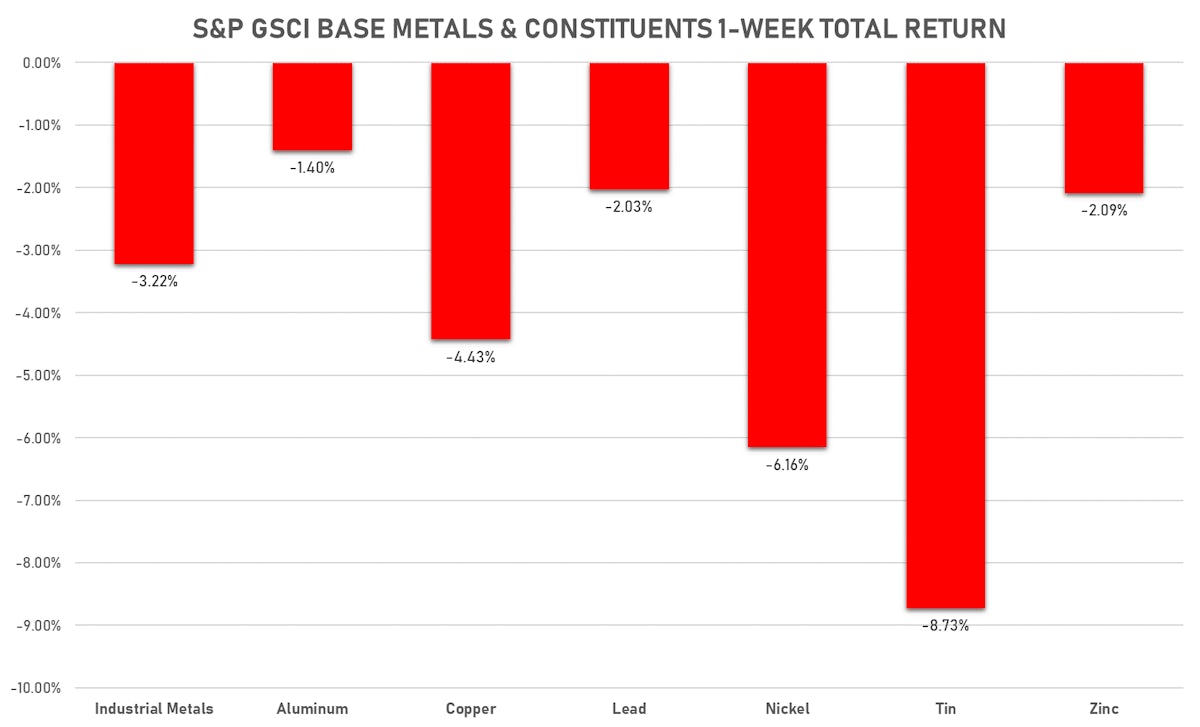

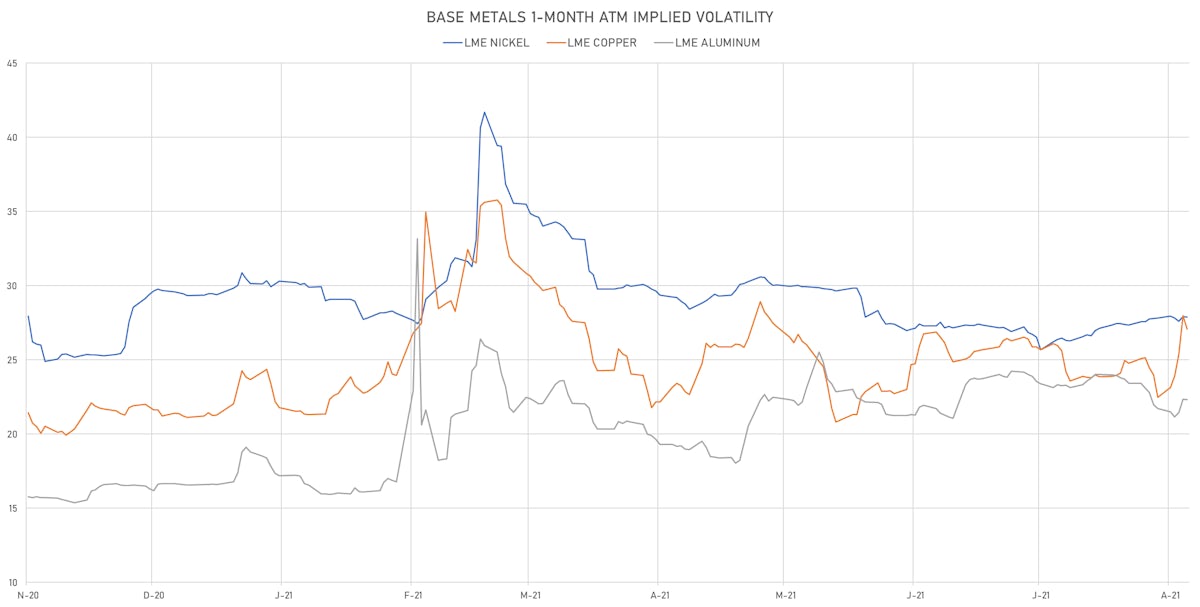

BASE METALS MIXED TODAY

- Copper (COMEX) currently at US$ 4.13 per pound, up 2.4% (YTD: +17.7%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 907.00 per tonne, down -1.3% (YTD: -18.5%)

- Aluminum (Shanghai) currently at CNY 20,180 per tonne, down -0.3% (YTD: +27.4%)

- Nickel (Shanghai) currently at CNY 138,650 per tonne, down -1.1% (YTD: +13.0%)

- Lead (Shanghai) currently at CNY 15,240 per tonne, down -1.1% (YTD: +3.5%)

- Rebar (Shanghai) currently at CNY 5,060 per tonne, up 0.2% (YTD: +17.5%)

- Tin (Shanghai) currently at CNY 230,560 per tonne, down -4.2% (YTD: +53.7%)

- Zinc (Shanghai) currently at CNY 22,265 per tonne, down -0.6% (YTD: +7.2%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 705,000 per tonne, up 1.4% (YTD: +45.4%)

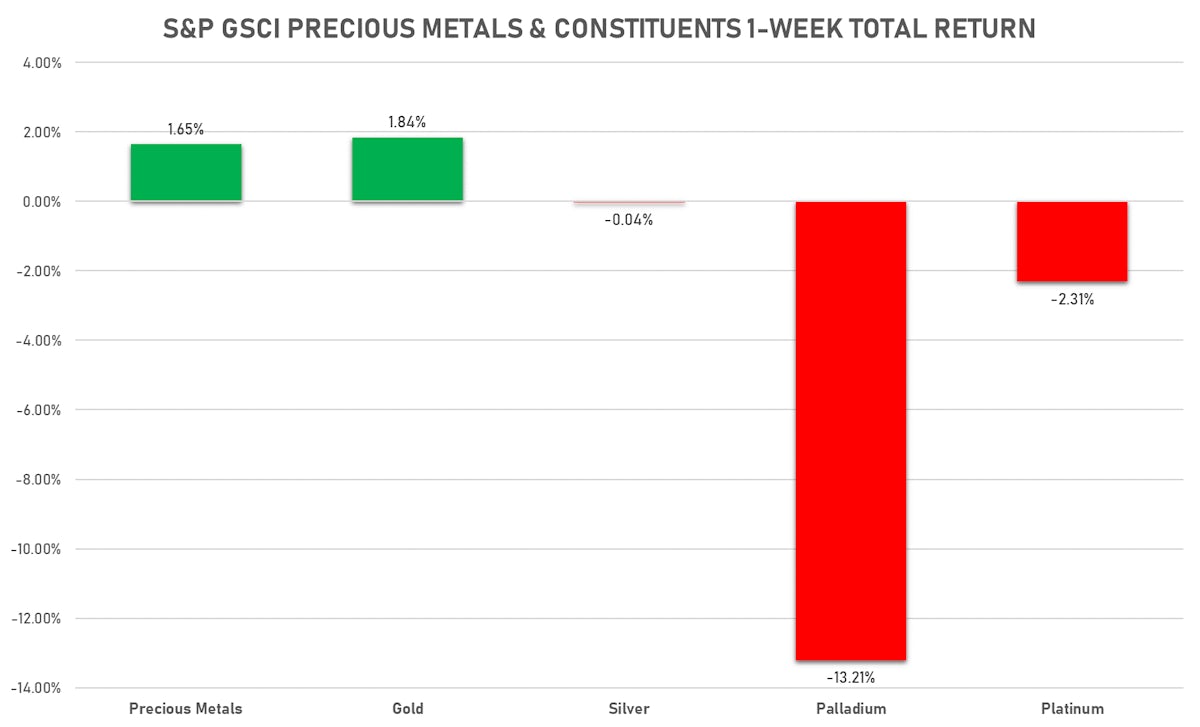

PRECIOUS METALS MIXED TODAY

- Gold spot currently at US$ 1,780.87 per troy ounce, up 0.1% (YTD: -6.1%)

- Gold 1-Month ATM implied volatility currently at 12.75, down -2.4% (YTD: -19.0%)

- Silver spot currently at US$ 23.01 per troy ounce, down -0.9% (YTD: -12.7%)

- Silver 1-Month ATM implied volatility currently at 22.65, up 0.9% (YTD: -44.4%)

- Palladium spot currently at US$ 2,275.02 per troy ounce, down -1.5% (YTD: -7.0%)

- Platinum spot currently at US$ 995.13 per troy ounce, up 2.1% (YTD: -6.9%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,000 per troy ounce, down -3.7% (YTD: +5.6%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

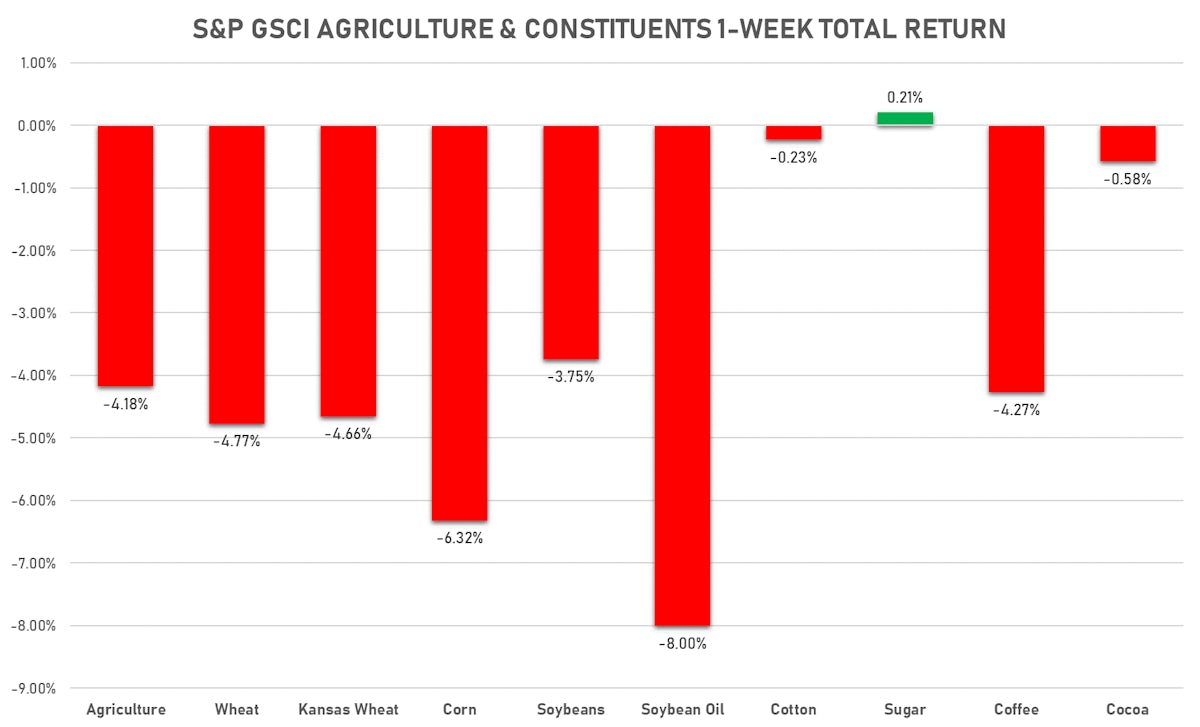

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 124.28 cents per pound, up 0.7% (YTD: +10.0%)

- Lean Hogs (CME) currently at US$ 88.63 cents per pound, up 2.0% (YTD: +26.1%)

- Rough Rice (CBOT) currently at US$ 13.27 cents per hundredweight, up 0.6% (YTD: +7.0%)

- Soybeans Composite (CBOT) currently at US$ 1,293.75 cents per bushel, down -2.2% (YTD: -1.6%)

- Corn (CBOT) currently at US$ 538.75 cents per bushel, down -2.0% (YTD: +11.3%)

- Wheat Composite (CBOT) currently at US$ 714.25 cents per bushel, down -1.8% (YTD: +11.5%)

- Sugar No.11 (ICE US) currently at US$ 19.49 cents per pound, down -1.1% (YTD: +26.4%)

- Cotton No.2 (ICE US) currently at US$ 93.63 cents per pound, up 0.5% (YTD: +20.2%)

- Cocoa (ICE US) currently at US$ 2,633 per tonne, down -2.3% (YTD: -0.9%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,338 per tonne, down -0.8% (YTD: +37.1%)

- Random Length Lumber (CME) currently at US$ 474.70 per 1,000 board feet, up 4.5% (YTD: -45.6%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,055 per tonne, down -2.6% (YTD: +10.9%)

- Soybean Oil Composite (CBOT) currently at US$ 57.49 cents per pound, down -5.1% (YTD: +32.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,510 per tonne, up 0.2% (YTD: +16.0%)

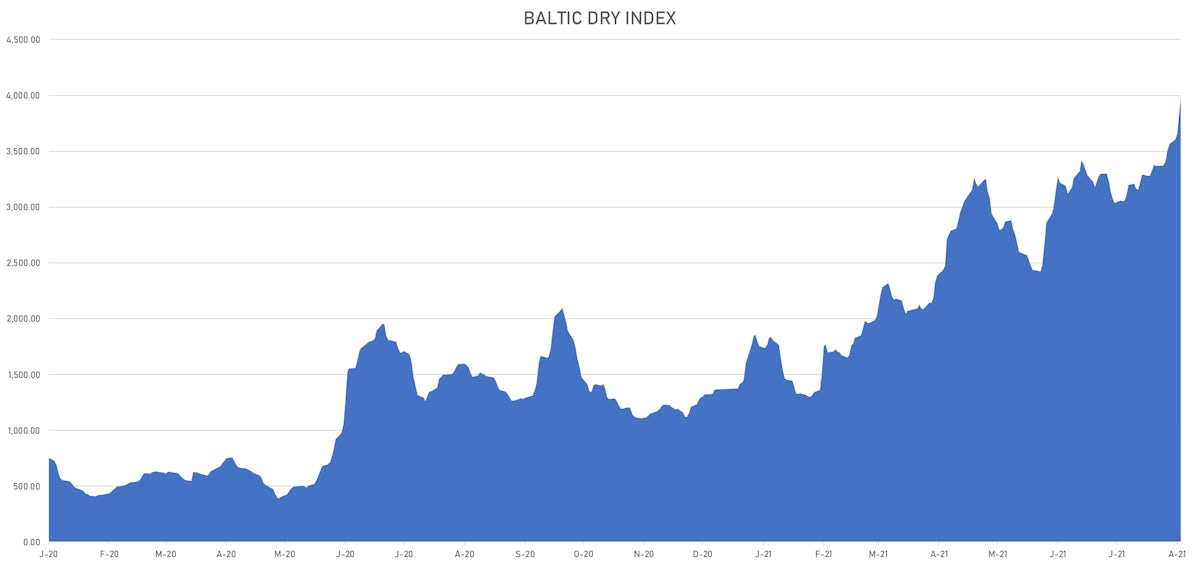

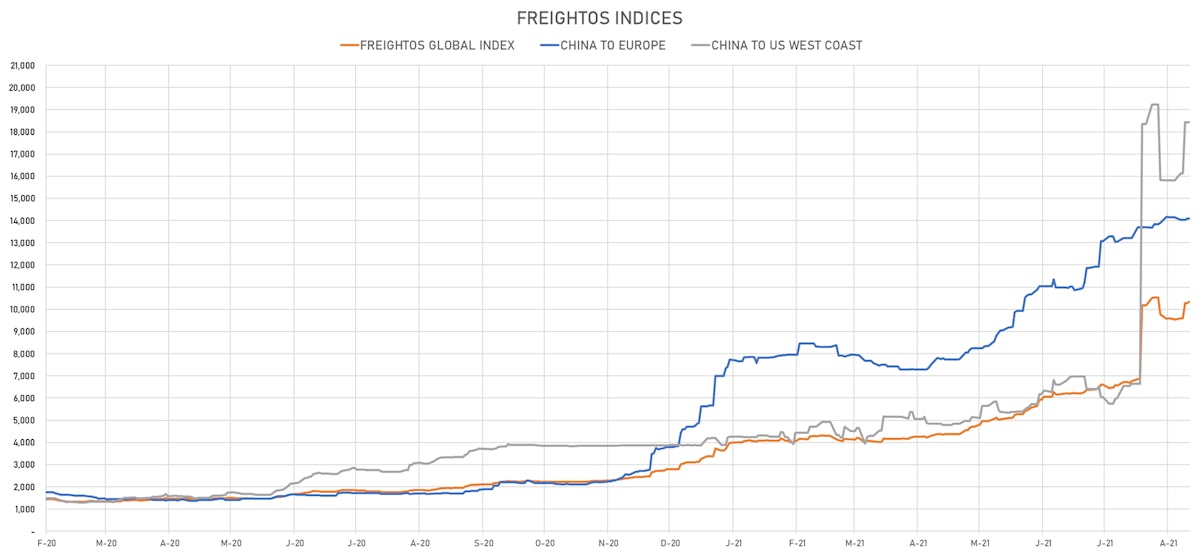

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 3,976, up 3.7% (YTD: +191.1%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 911, unchanged (YTD: +76.0%)

- Freightos North America East Coast To Europe Container Index currently at 463, unchanged (YTD: +27.6%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 14,086, unchanged (YTD: +148.8%)

- Freightos North Europe To China Container Index currently at 1,549, unchanged (YTD: +12.6%)

- Freightos Europe To South America West Coast Container Index currently at 5,361, unchanged (YTD: +216.9%)

CARBON EMISSION ALLOWANCES UP ON FRIDAY (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 54.38 per tonne, up 1.6% (YTD: +66.2%)