Commodities

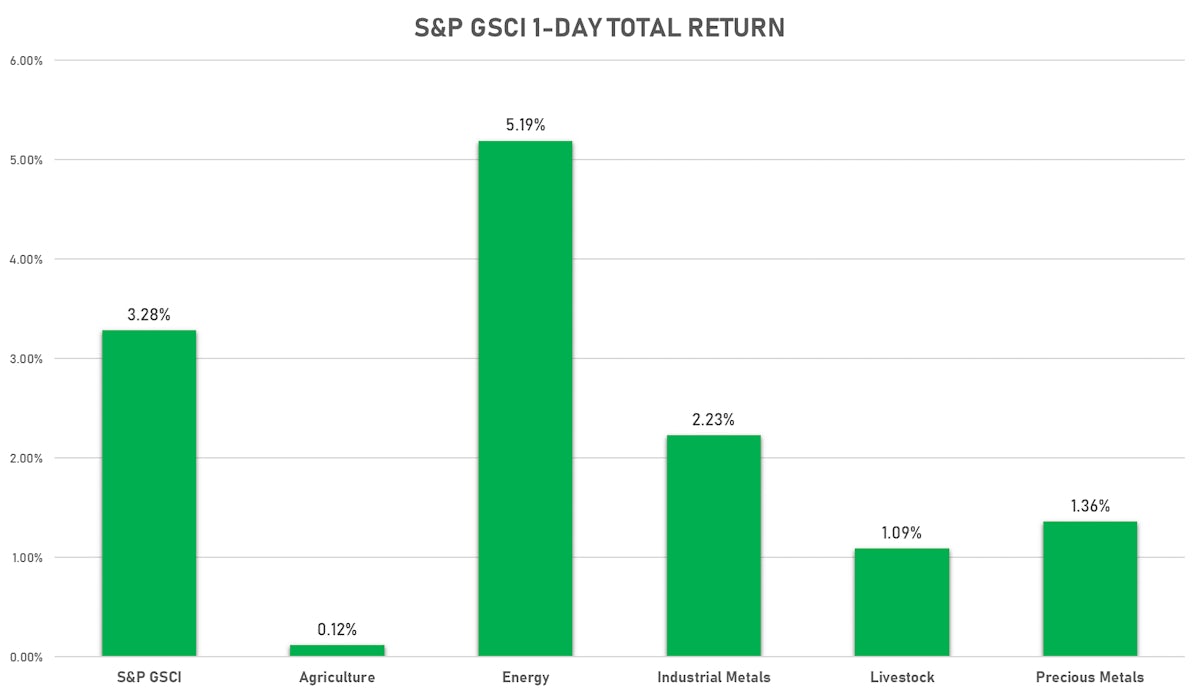

Weaker Dollar Helps Strong Rebound In Crude Oil, Industrial Metals

The negative macro data is encouraging a more dovish take on upcoming central bank policies, which is pushing risky assets higher

Published ET

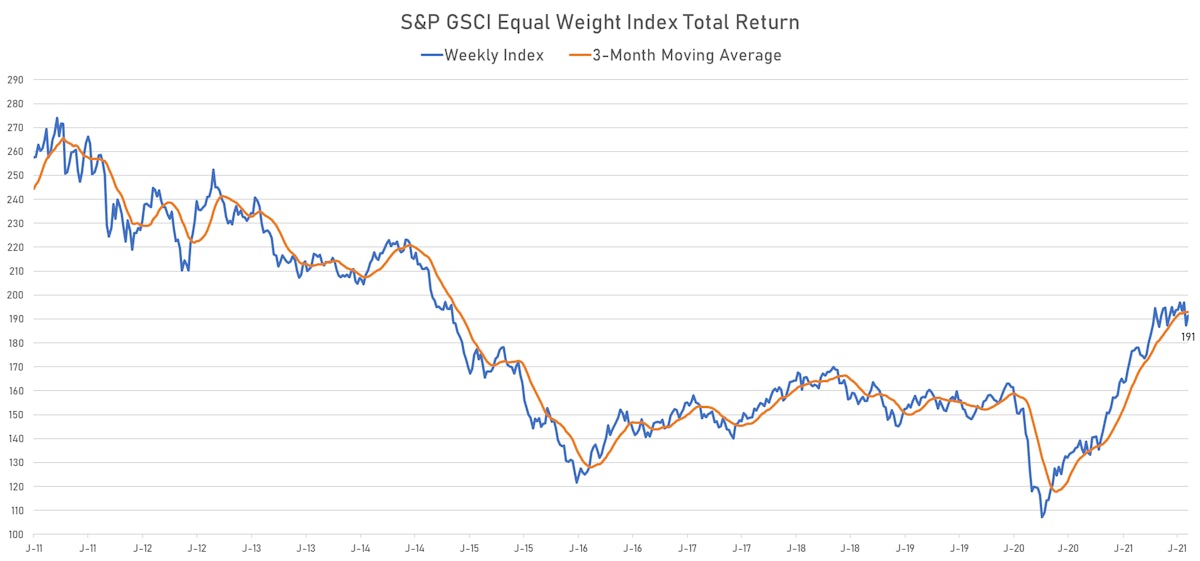

Commodities 10-year total returns are still very poor | Sources: ϕpost, FactSet data

MACRO HEADLINES

- China reported a decline in its daily Covid-19 infection rate, reducing worries about a broader economic slowdown

- DOE announced it intends to sell up to 20 million barrels of crude oil from the SPR

- IHS Markit Flash PMIs in the US and Eurozone came in below expectations

NOTABLE GAINERS TODAY

- ICE Europe Brent Crude up 5.5% (YTD: 32.7%)

- NYMEX Light Sweet Crude Oil (WTI) up 5.3% (YTD: 35.3%)

- Palladium spot up 5.2% (YTD: -2.1%)

- NYMEX NY Harbor ULSD up 5.1% (YTD: 35.8%)

- CME Random Length Lumber up 5.1% (YTD: -42.9%)

- NYMEX RBOB Gasoline up 4.9% (YTD: 50.8%)

- ICE Europe Low Sulphur Gasoil up 4.2% (YTD: 35.3%)

- CBoT Soybean Oil up 3.1% (YTD: 36.7%)

- Silver spot up 2.7% (YTD: -10.4%)

- NYMEX Henry Hub Natural Gas up 2.4% (YTD: 55.4%)

- COMEX Copper up 2.4% (YTD: 20.5%)

- Platinum spot up 2.3% (YTD: -4.7%)

NOTABLE LOSERS TODAY

- Johnson Matthey Rhodium New York 0930 down -5.6% (YTD: -0.3%)

- CBoT Soybean Meal down -1.9% (YTD: -20.2%)

- CME Lean Hogs down -1.3% (YTD: 24.5%)

- SHFE Bitumen Continuation Month 1 down -1.2% (YTD: 27.4%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -0.7% (YTD: 2.3%)

- CME Cattle(Feeder) down -0.5% (YTD: 13.9%)

- Freightos Baltic China/East Asia To North Europe 40 Container Index down -0.5% (YTD: 147.5%)

- Shanghai International Exchange TSR 20 Rubber down -0.5% (YTD: 10.4%)

- Coffee Arabica Colombia Excelso EP Spot down -0.3% (YTD: 36.6%)

- CME Dry Whey down -0.3% (YTD: 25.2%)

- SHFE Zinc down -0.2% (YTD: 7.0%)

- ICE-US Cocoa down -0.2% (YTD: -1.1%)

- SHFE Rubber down -0.2% (YTD: -2.4%)

- CBoT Corn down -0.1% (YTD: 11.2%)

- SGX Iron Ore 62% China CFR Swap Monthly down -0.1% (YTD: -1.1%)

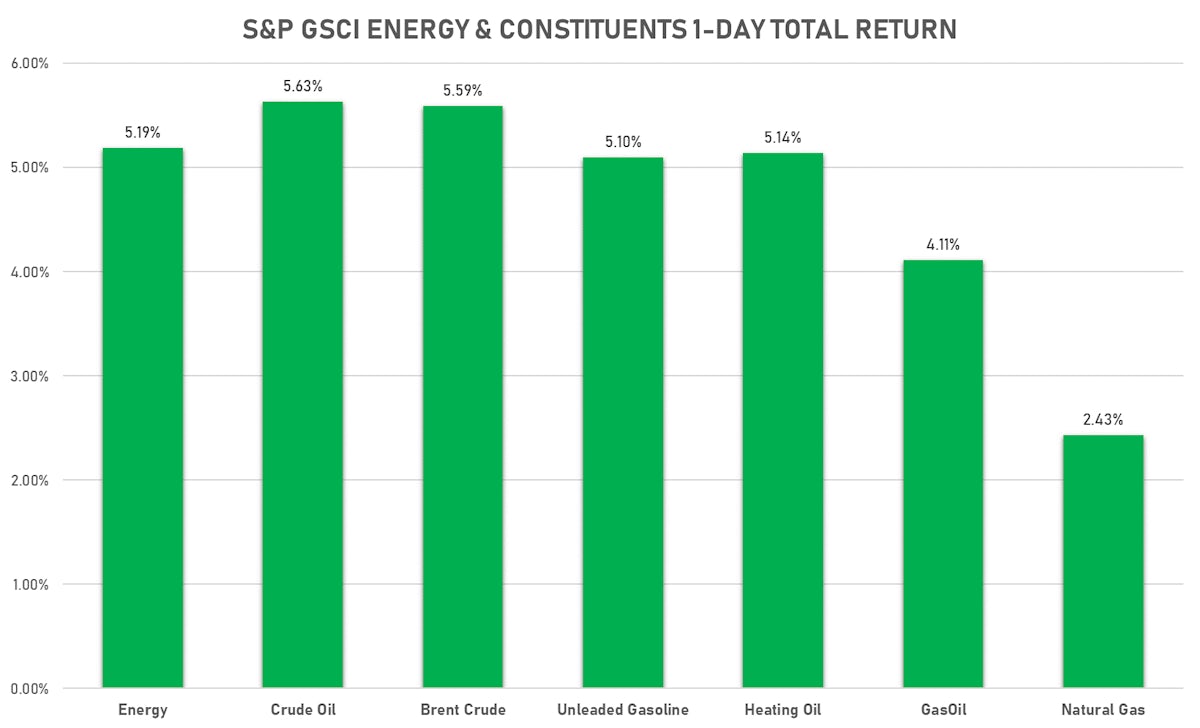

ENERGY SEES BROAD RISE TODAY

- WTI crude front month currently at US$ 65.53 per barrel, up 5.3% (YTD: +35.3%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 68.63 per barrel, up 5.5% (YTD: +32.7%); 6-month term structure in widening backwardation

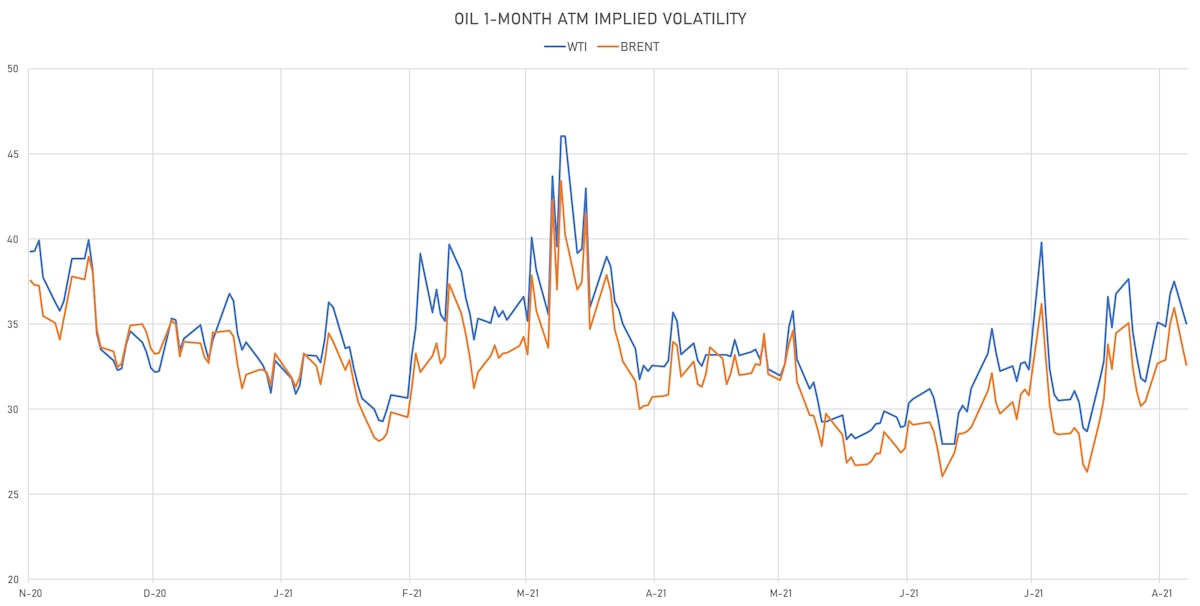

- Brent volatility at 32.6, down -9.4% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 170.00 per tonne, up 1.3% (YTD: +111.2%)

- Natural Gas (Henry Hub) currently at US$ 3.93 per MMBtu, up 2.4% (YTD: +55.4%)

- Gasoline (NYMEX) currently at US$ 2.12 per gallon, up 4.9% (YTD: +50.8%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 568.00 per tonne, up 4.2% (YTD: +35.3%)

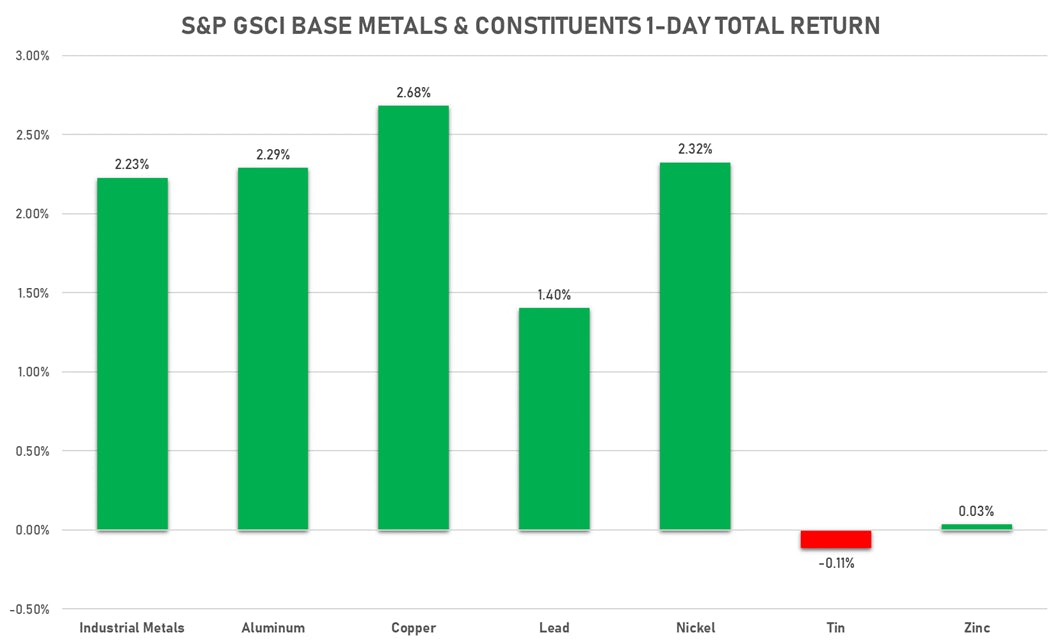

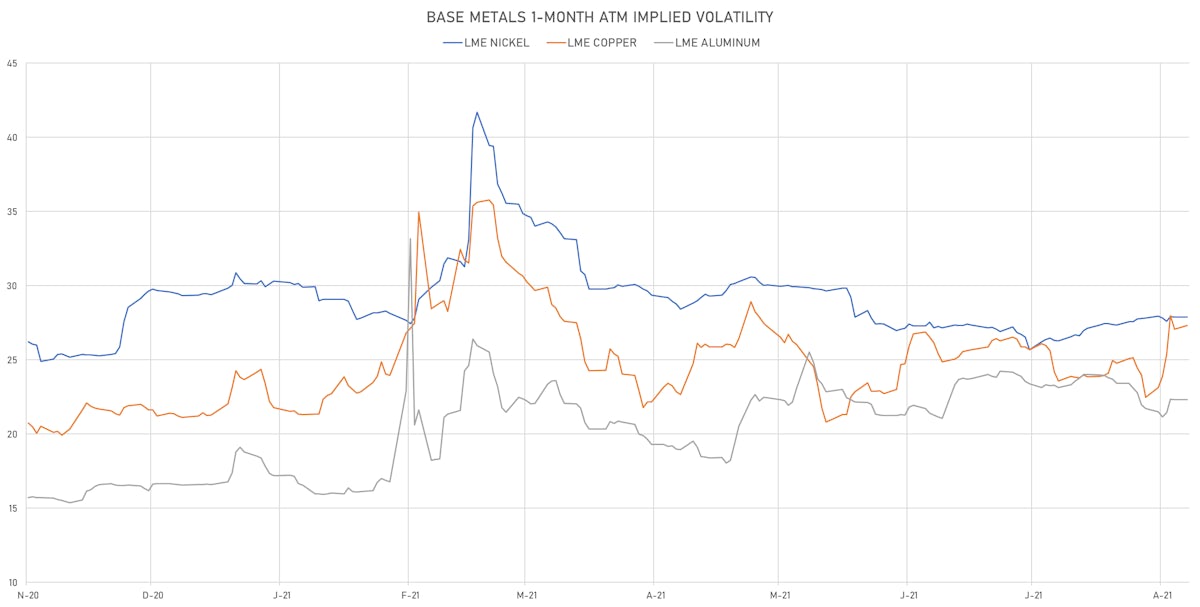

BASE METALS MOSTLY HIGHER TODAY

- Copper (COMEX) currently at US$ 4.23 per pound, up 2.4% (YTD: +20.5%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 905.50 per tonne, up 1.8% (YTD: -17.1%)

- Aluminum (Shanghai) currently at CNY 20,375 per tonne, up 1.5% (YTD: +29.3%)

- Nickel (Shanghai) currently at CNY 141,910 per tonne, up 0.6% (YTD: +13.6%)

- Lead (Shanghai) currently at CNY 15,440 per tonne, up 0.8% (YTD: +4.3%)

- Rebar (Shanghai) currently at CNY 5,130 per tonne, up 2.3% (YTD: +20.1%)

- Tin (Shanghai) currently at CNY 234,960 per tonne, up 0.5% (YTD: +54.5%)

- Zinc (Shanghai) currently at CNY 22,250 per tonne, down -0.2% (YTD: +7.0%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 705,000 per tonne, unchanged (YTD: +45.4%)

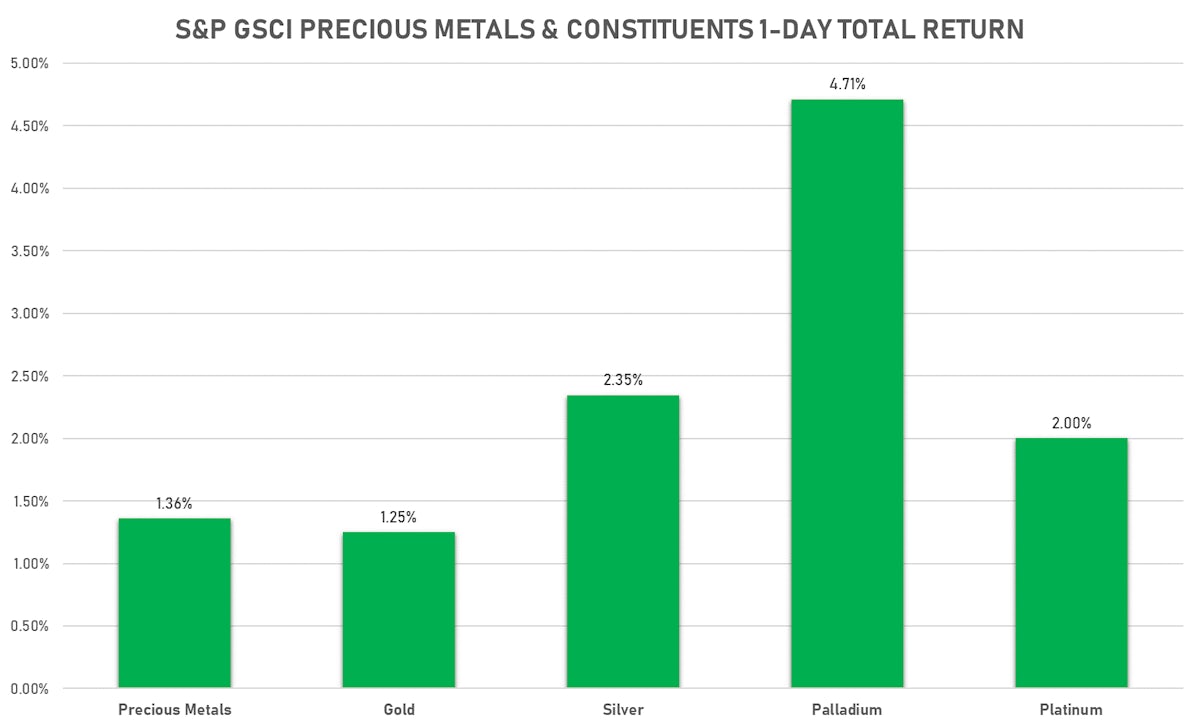

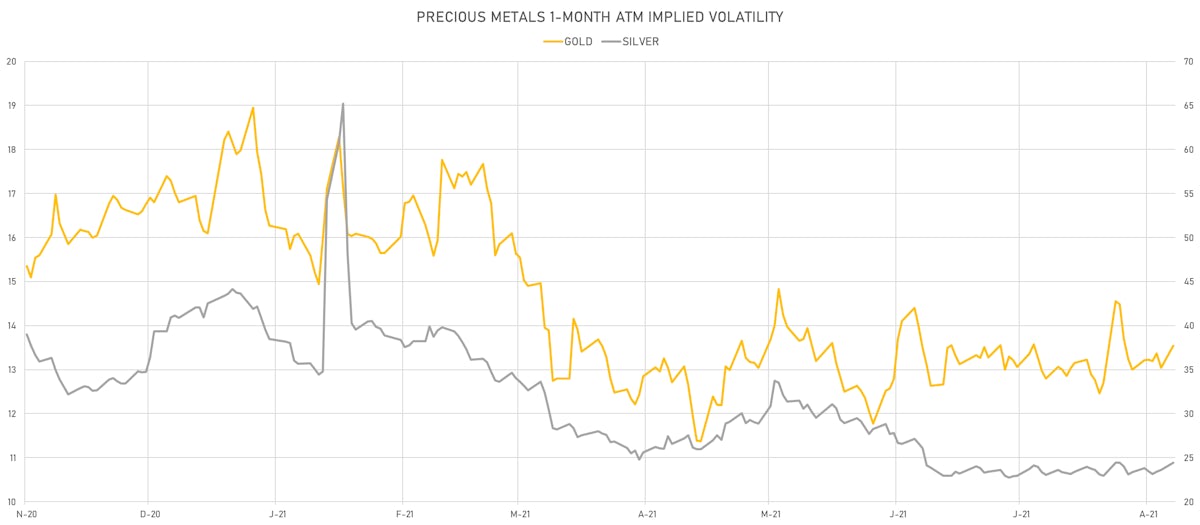

PRECIOUS METALS UP TODAY

- Gold spot currently at US$ 1,802.16 per troy ounce, up 1.4% (YTD: -4.9%)

- Gold 1-Month ATM implied volatility currently at 13.26, up 4.0% (YTD: -15.8%)

- Silver spot currently at US$ 23.54 per troy ounce, up 2.7% (YTD: -10.4%)

- Silver 1-Month ATM implied volatility currently at 23.54, up 3.7% (YTD: -42.4%)

- Palladium spot currently at US$ 2,401.02 per troy ounce, up 5.2% (YTD: -2.1%)

- Platinum spot currently at US$ 1,014.41 per troy ounce, up 2.3% (YTD: -4.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,000 per troy ounce, down -5.6% (YTD: -0.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

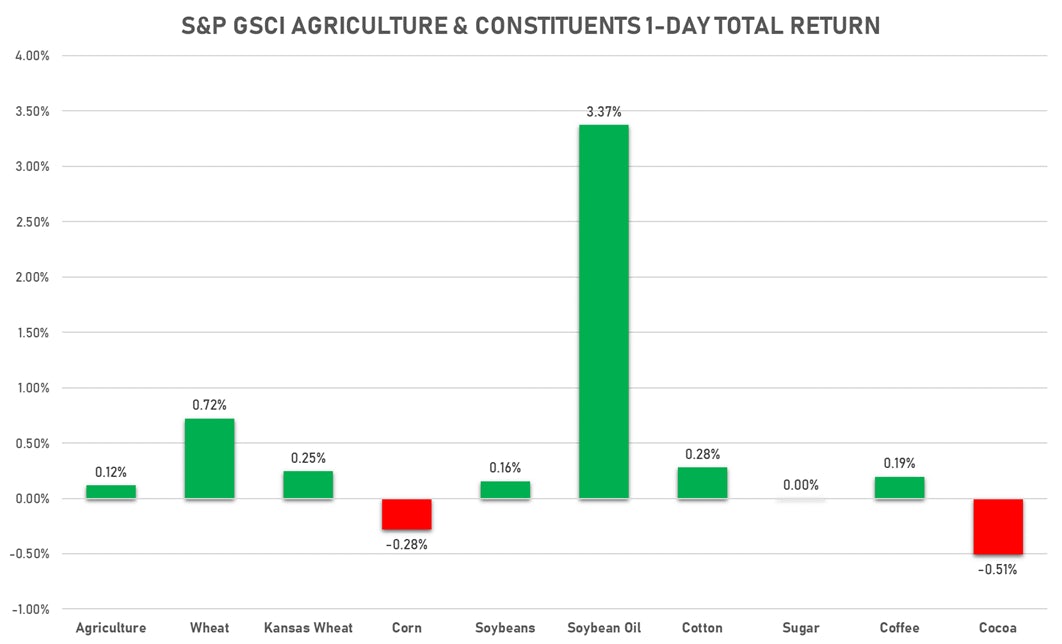

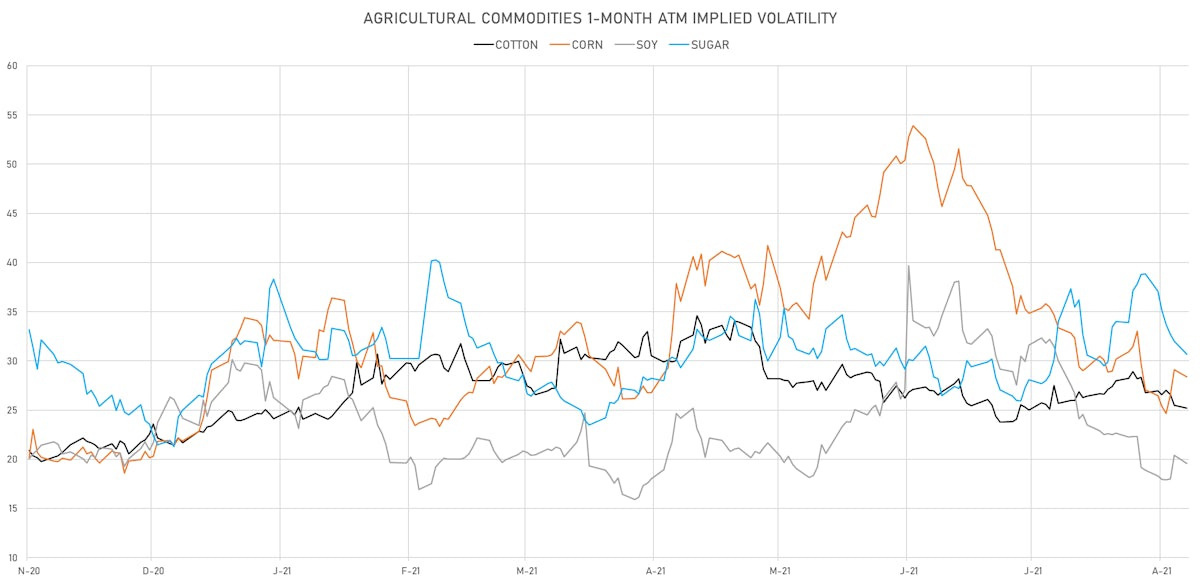

AGS MOSTLY UP TODAY

- Live Cattle (CME) currently at US$ 126.45 cents per pound, up 1.8% (YTD: +12.0%)

- Lean Hogs (CME) currently at US$ 87.48 cents per pound, down -1.3% (YTD: +24.5%)

- Rough Rice (CBOT) currently at US$ 13.41 cents per hundredweight, up 0.9% (YTD: +8.0%)

- Soybeans Composite (CBOT) unchanged at US$ 1,295.25 cents per bushel (YTD: -1.6%)

- Corn (CBOT) currently at US$ 538.75 cents per bushel, down -0.1% (YTD: +11.2%)

- Wheat Composite (CBOT) currently at US$ 719.00 cents per bushel, up 0.8% (YTD: +12.4%)

- Sugar No.11 (ICE US) unchanged at US$ 19.58 cents per pound (YTD: +26.4%)

- Cotton No.2 (ICE US) currently at US$ 94.54 cents per pound, up 0.7% (YTD: +21.0%)

- Cocoa (ICE US) currently at US$ 2,574 per tonne, down -0.2% (YTD: -1.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,323 per tonne, down -0.3% (YTD: +36.6%)

- Random Length Lumber (CME) currently at US$ 498.80 per 1,000 board feet, up 5.1% (YTD: -42.9%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,030 per tonne, down -0.5% (YTD: +10.4%)

- Soybean Oil Composite (CBOT) currently at US$ 59.09 cents per pound, up 3.1% (YTD: +36.7%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,552 per tonne, up 0.8% (YTD: +17.0%)

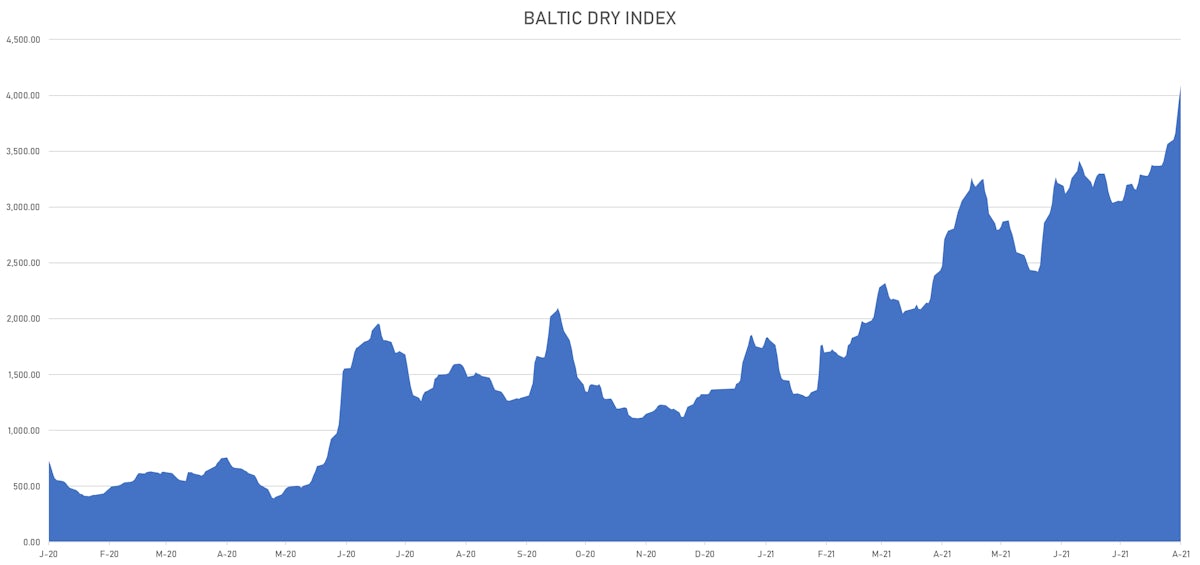

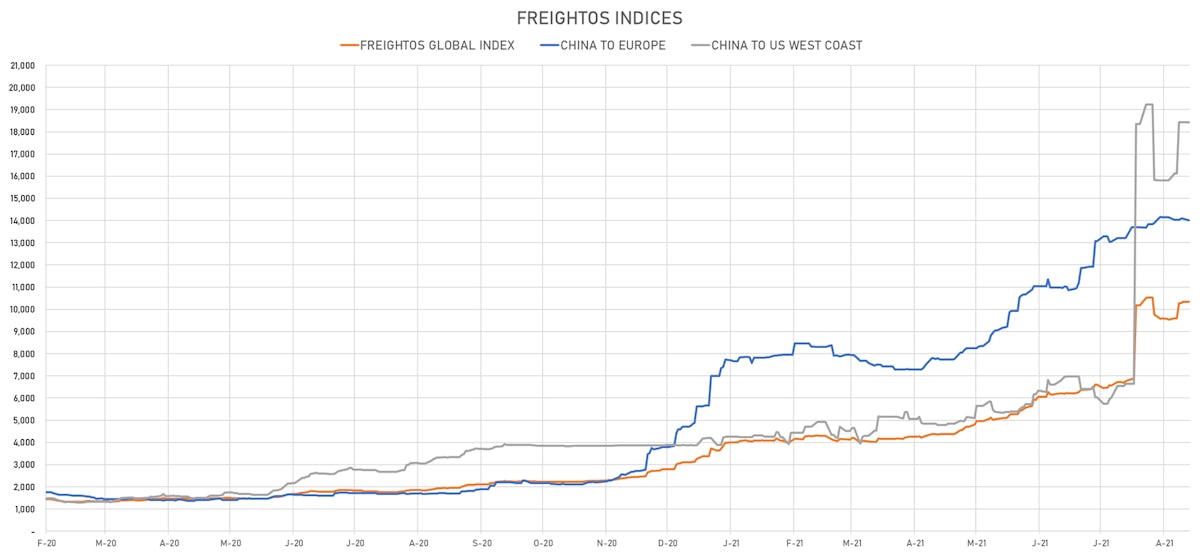

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,092, up 2.9% (YTD: +199.6%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 911, unchanged (YTD: +76.0%)

- Freightos North America East Coast To Europe Container Index currently at 463, unchanged (YTD: +27.6%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 14,016, down -0.5% (YTD: +147.5%)

- Freightos North Europe To China Container Index currently at 1,549, unchanged (YTD: +12.6%)

- Freightos Europe To South America West Coast Container Index currently at 5,361, unchanged (YTD: +216.9%)

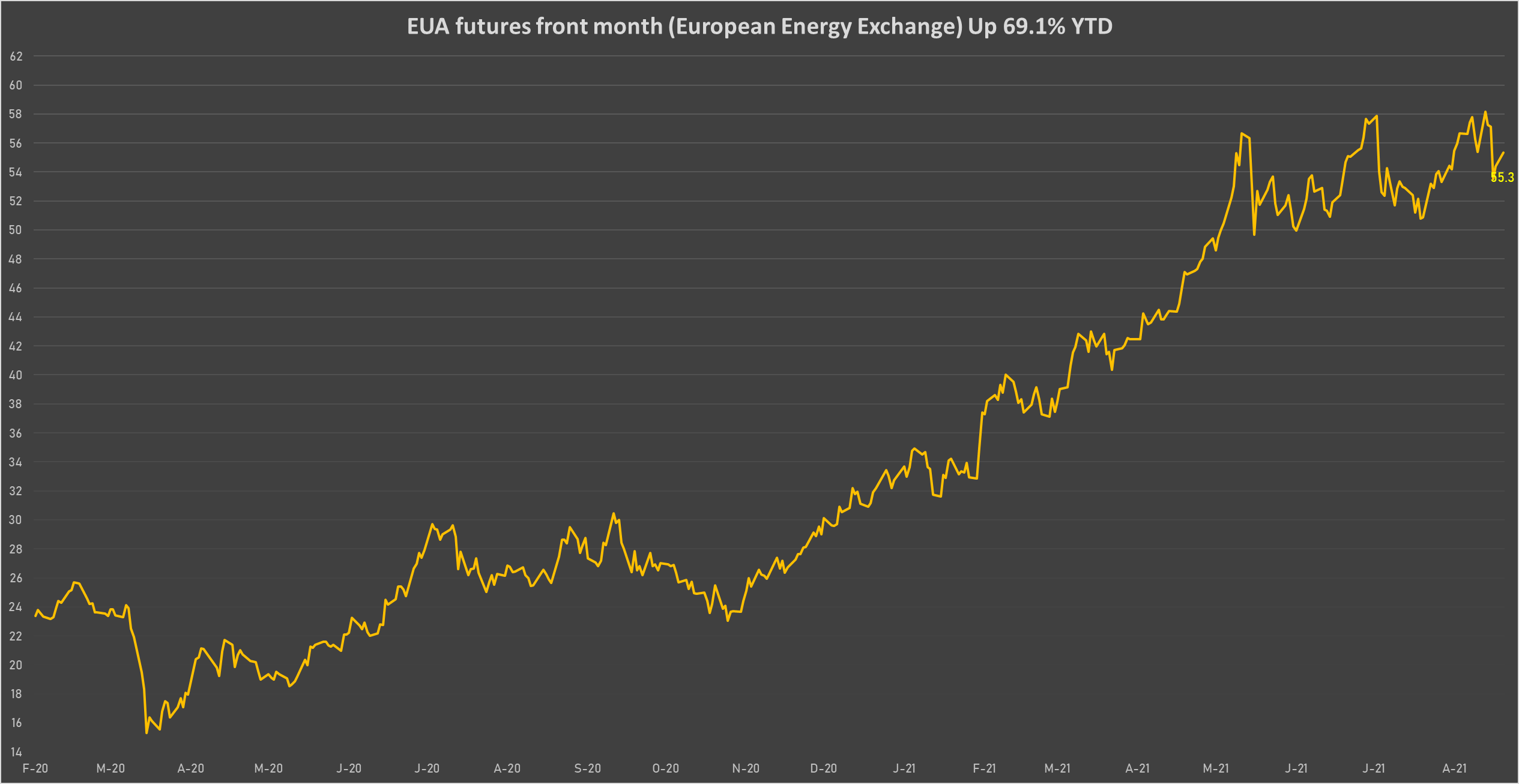

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 55.34 per tonne, up 1.8% (YTD: +69.1%)