Commodities

Gasoline Jumps And Crude Makes Further Gains As EIA Report Shows Strong Demand

Gold fell 1% after a good bounce in the last two weeks, closing below US$ 1,800 an ounce; weaker technicals point to more consolidation in the short term

Published ET

RBOB Gasoline Front Month Futures Prices | Sources: ϕpost, Refinitiv data

WEEKLY EIA REPORT

- Stock Levels, EIA, Total Crude Oil excluding SPR, Absolute change, Volume for W 20 Aug (EIA, United States) at -2.98 Mln, below consensus estimate of -2.68 Mln

- Stock Levels, EIA, Total Distillate, Absolute change, Volume for W 20 Aug (EIA, United States) at 0.65 Mln, above consensus estimate of -0.27 Mln

- Stock Levels, EIA, Gasoline, Absolute change, Volume for W 20 Aug (EIA, United States) at -2.24 Mln, below consensus estimate of -1.56 Mln

- Production, EIA, Refinery Capacity Utilization, Absolute change, Volume for W 20 Aug (EIA, United States) at 0.20 % (vs 0.40 % prior)

NOTABLE GAINERS TODAY

- NYMEX RBOB Gasoline up 5.5% (YTD: 63.4%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 3.4% (YTD: 29.2%)

- NYMEX NY Harbor ULSD up 2.5% (YTD: 43.5%)

- CME Random Length Lumber up 2.3% (YTD: -43.8%)

- CME Lean Hogs up 2.0% (YTD: 26.3%)

- DCE Iron Ore Continuation Month 1 up 1.8% (YTD: -13.3%)

- ICE Europe Brent Crude up 1.7% (YTD: 39.5%)

- ICE-US Cocoa up 1.6% (YTD: 1.1%)

- SHFE Stannum up 1.6% (YTD: 59.1%)

- DCE RBD Palm Oil up 1.6% (YTD: 21.5%)

- Crude Oil WTI Cushing US FOB up 1.5% (YTD: 41.8%)

- Coffee Arabica Colombia Excelso EP Spot up 1.4% (YTD: 39.4%)

- Bursa Malaysia Crude Palm Oil up 1.3% (YTD: 17.9%)

- CBoT Soybean Oil up 1.3% (YTD: 42.8%)

- CBoT Corn up 1.2% (YTD: 13.9%)

NOTABLE LOSERS TODAY

- SMM Rare Earth Terbium Oxide Spot Price Daily down -2.4% (YTD: 11.0%)

- SHFE Bitumen Continuation Month 1 down -1.9% (YTD: 26.4%)

- Palladium spot down -1.8% (YTD: -0.8%)

- Platinum spot down -1.5% (YTD: -6.8%)

- CME Live Cattle down -1.1% (YTD: 10.2%)

- SMM Rare Earth Terbium Metal Spot Price Daily down -1.0% (YTD: 10.7%)

- CBoT Wheat down -0.9% (YTD: 11.0%)

- CBoT Soybean Meal down -0.7% (YTD: -18.9%)

- Gold spot down -0.7% (YTD: -5.6%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily down -0.6% (YTD: 34.5%)

- Shanghai International Exchange TSR 20 Rubber down -0.3% (YTD: 10.2%)

- SHFE Lead Continuation Month 1 down -0.2% (YTD: 5.0%)

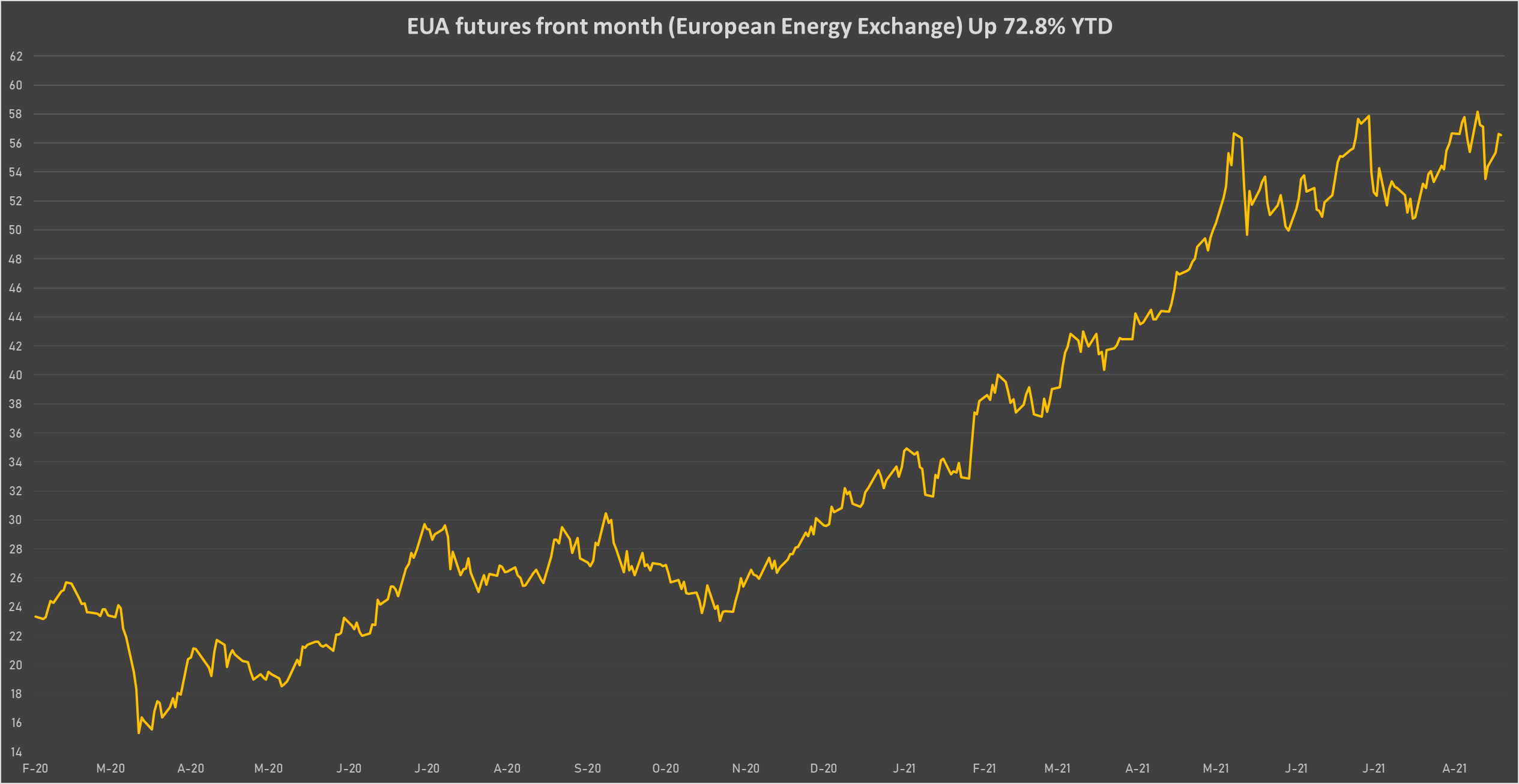

- EEX European-Carbon- Secondary Trading down -0.2% (YTD: 76.3%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -0.2% (YTD: 72.8%)

- CBoT Rough Rice down -0.1% (YTD: 7.7%)

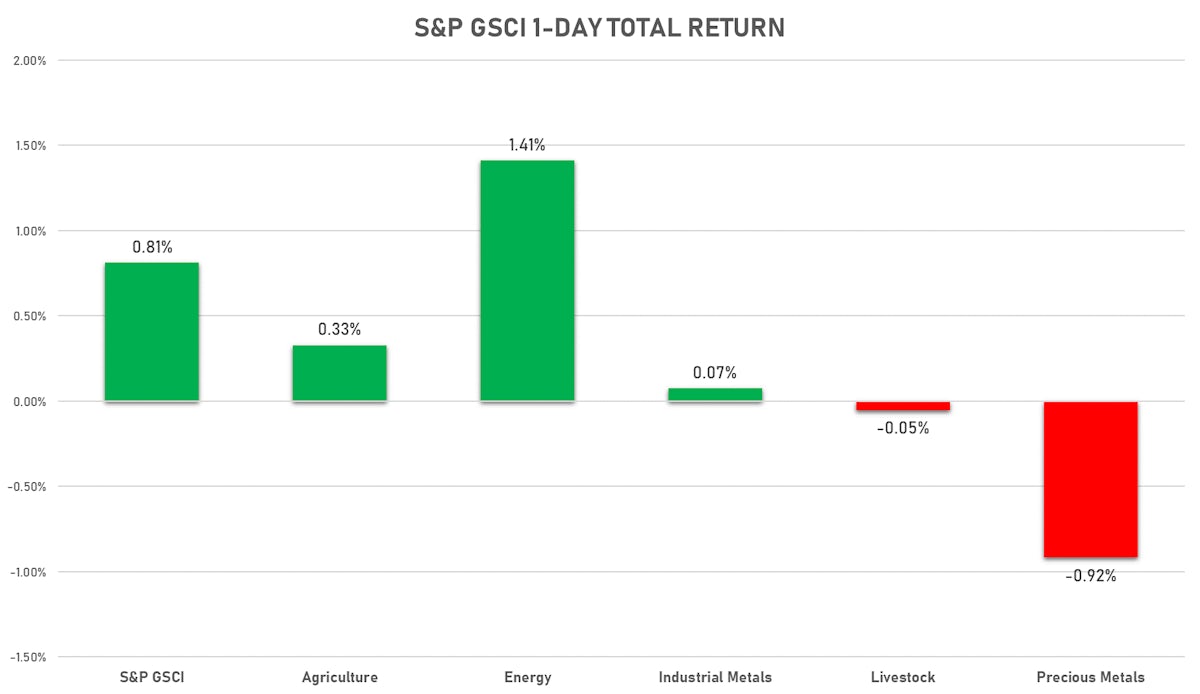

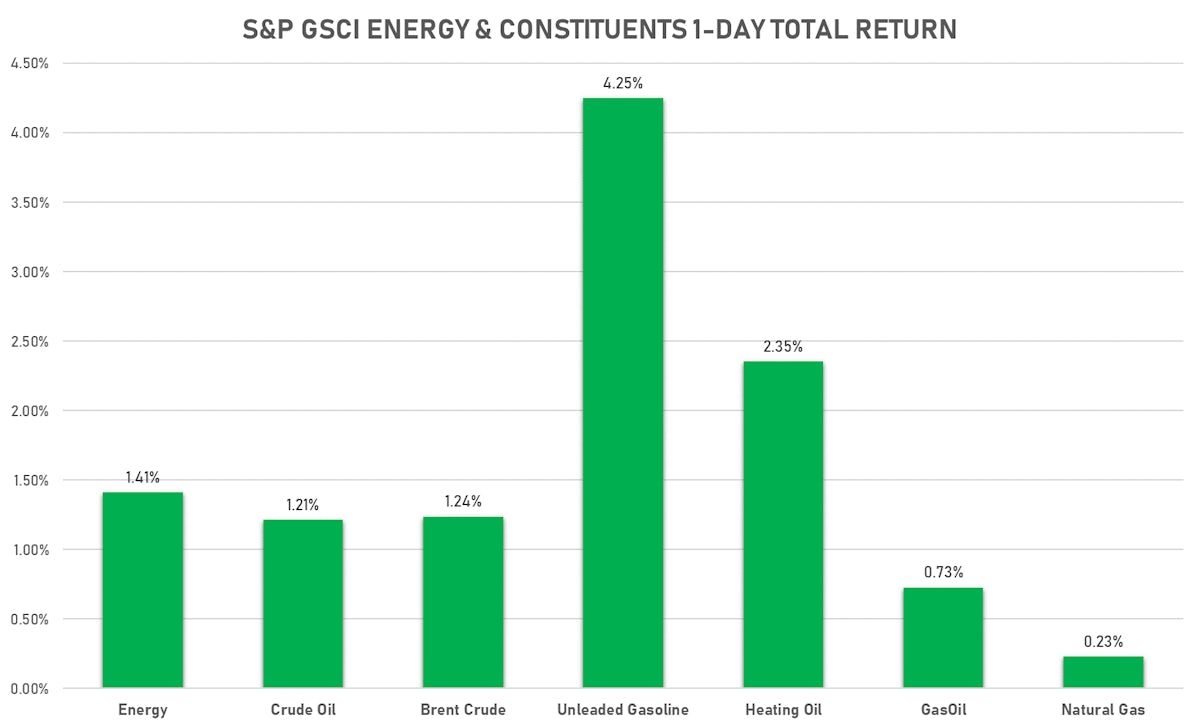

ENERGY UP STRONGLY TODAY

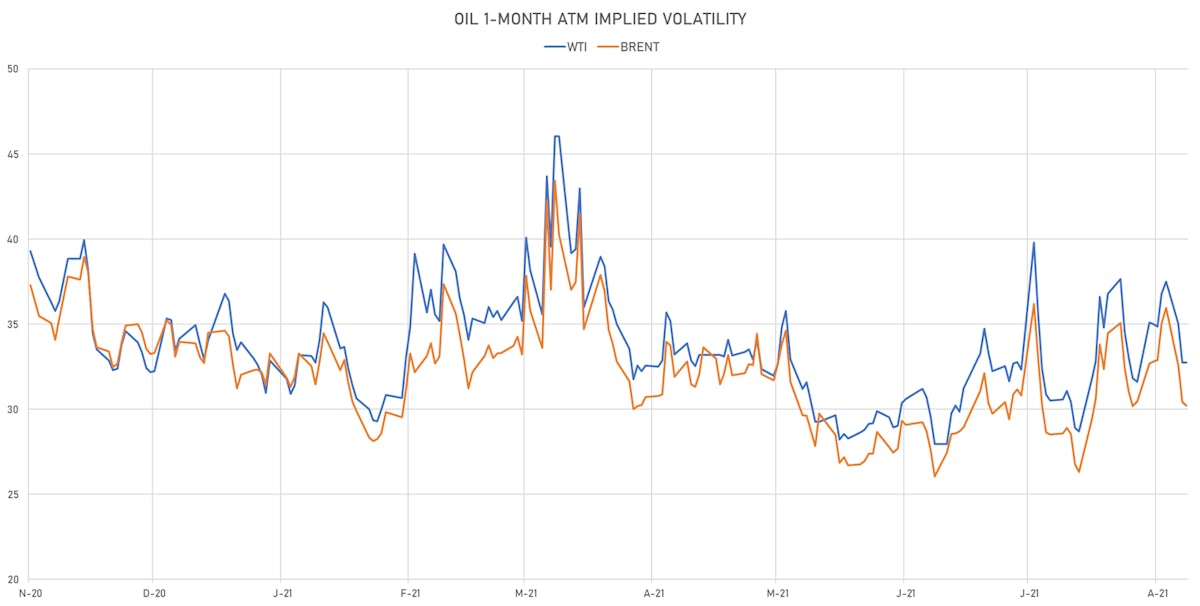

- WTI crude front month currently at US$ 67.94 per barrel, up 1.2% (YTD: +40.9%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 72.25 per barrel, up 1.7% (YTD: +39.5%); 6-month term structure in widening backwardation

- Brent volatility at 30.2, down -0.6% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 170.75 per tonne, up 0.4% (YTD: +112.1%)

- Natural Gas (Henry Hub) currently at US$ 3.91 per MMBtu, up 0.0% (YTD: +53.5%)

- Gasoline (NYMEX) currently at US$ 2.30 per gallon, up 5.5% (YTD: +63.4%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 589.00 per tonne, up 0.8% (YTD: +40.0%)

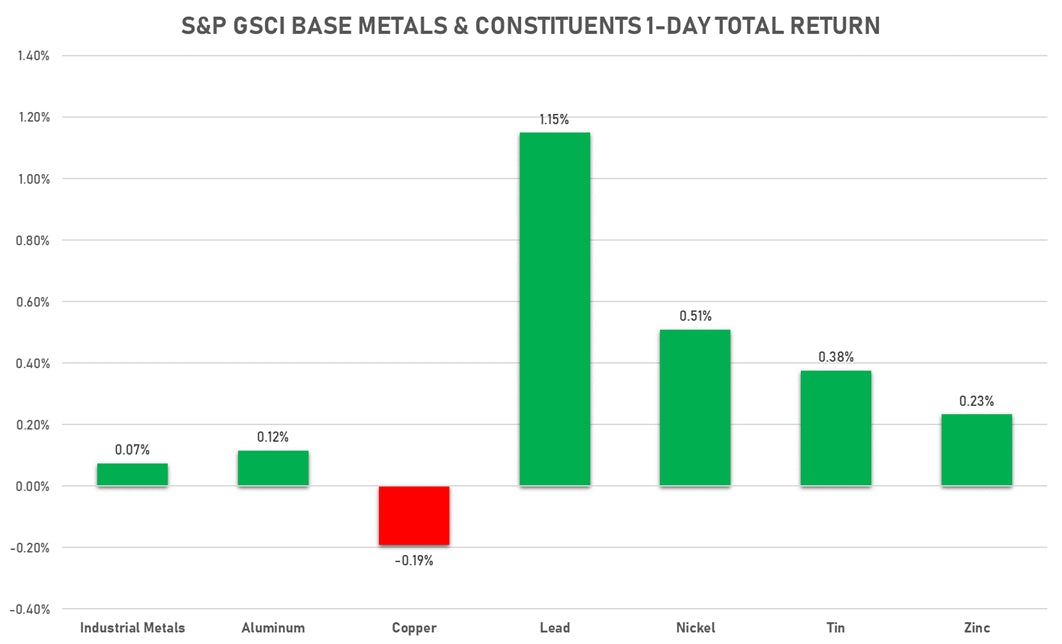

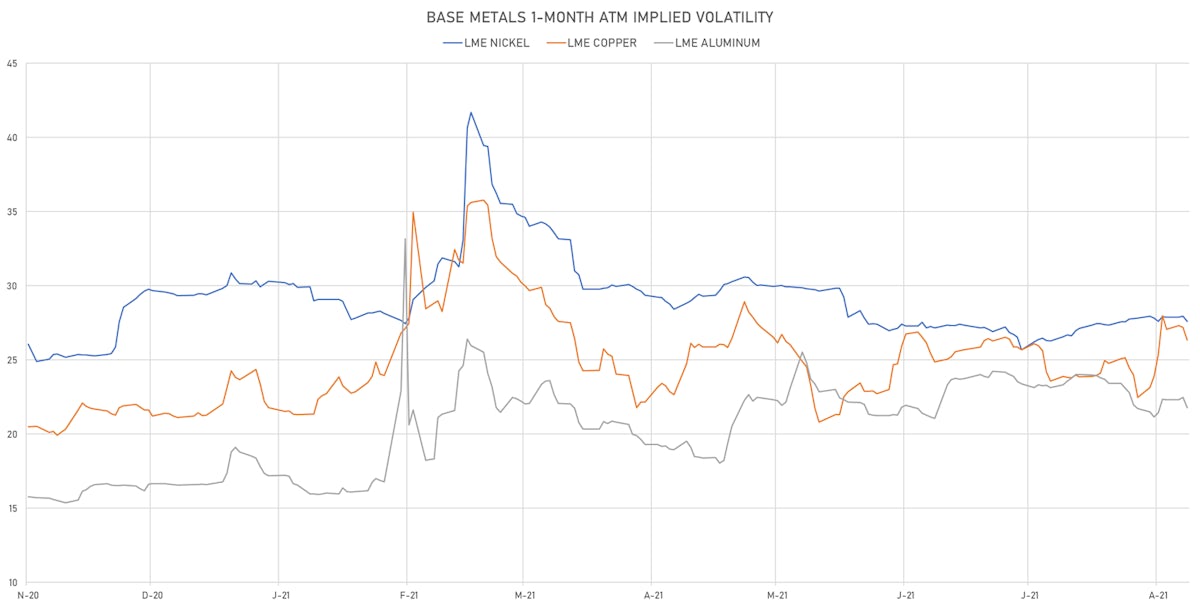

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) currently at US$ 4.27 per pound, up 0.2% (YTD: +21.4%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 947.00 per tonne, up 1.8% (YTD: -13.3%)

- Aluminum (Shanghai) currently at CNY 20,530 per tonne, up 0.9% (YTD: +31.2%)

- Nickel (Shanghai) currently at CNY 144,440 per tonne, up 1.0% (YTD: +16.1%)

- Lead (Shanghai) currently at CNY 15,430 per tonne, down -0.2% (YTD: +5.0%)

- Rebar (Shanghai) currently at CNY 5,162 per tonne, up 0.3% (YTD: +22.3%)

- Tin (Shanghai) currently at CNY 242,970 per tonne, up 1.6% (YTD: +59.1%)

- Zinc (Shanghai) currently at CNY 22,595 per tonne, up 1.1% (YTD: +8.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 715,000 per tonne, unchanged (YTD: +47.4%)

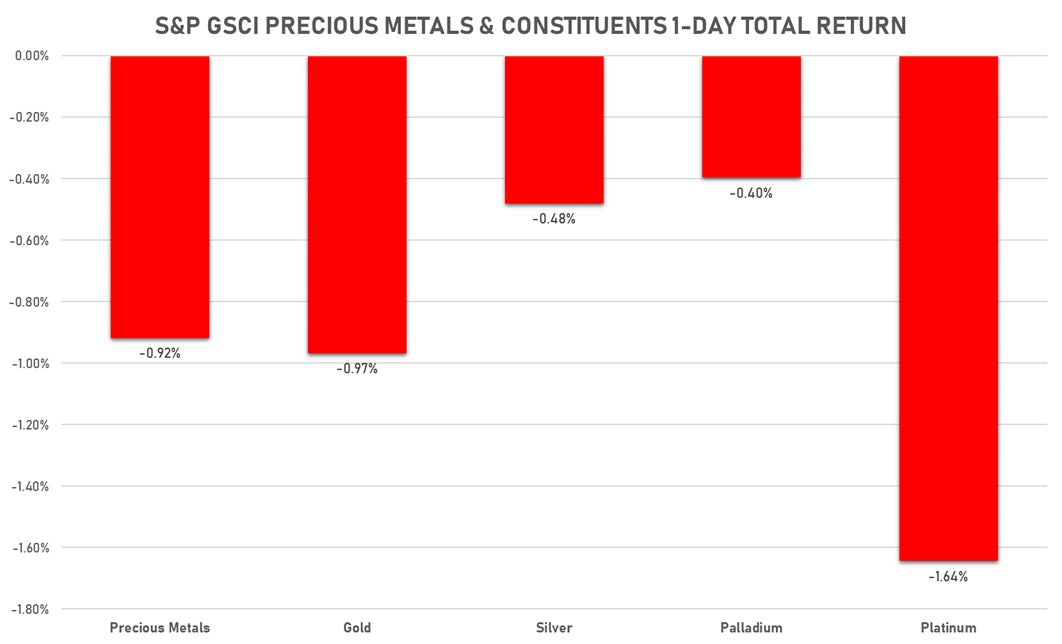

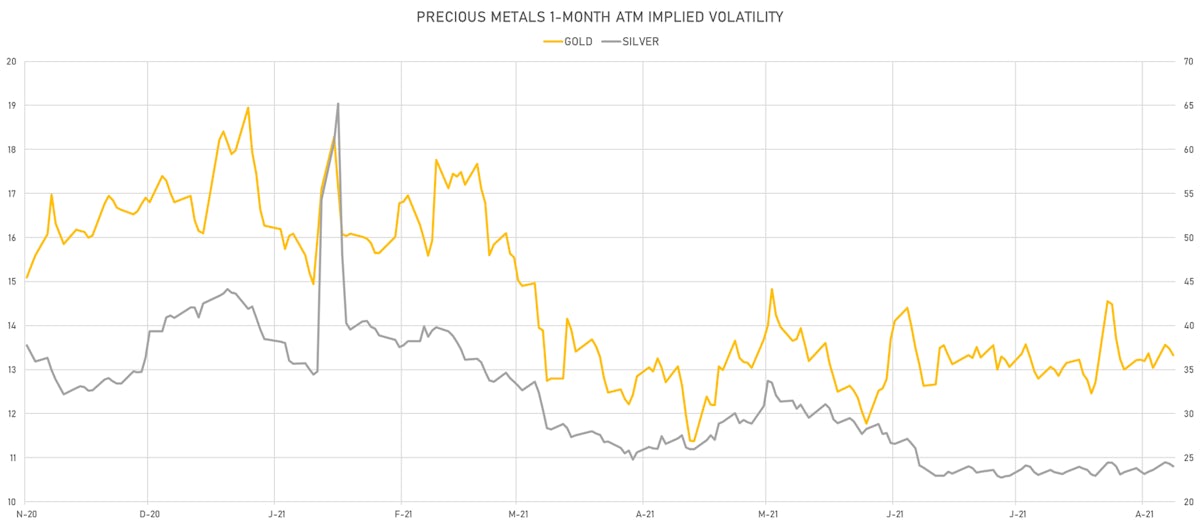

PRECIOUS METALS TODAY

- Gold spot currently at US$ 1,791.18 per troy ounce, down -0.7% (YTD: -5.6%)

- Gold 1-Month ATM implied volatility currently at 13.10, down -0.8% (YTD: -16.9%)

- Silver spot currently at US$ 23.84 per troy ounce, down -0.1% (YTD: -9.7%)

- Silver 1-Month ATM implied volatility currently at 23.04, down -1.1% (YTD: -43.4%)

- Palladium spot currently at US$ 2,427.35 per troy ounce, down -1.8% (YTD: -0.8%)

- Platinum spot currently at US$ 996.84 per troy ounce, down -1.5% (YTD: -6.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,100 per troy ounce, up 0.6% (YTD: +0.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

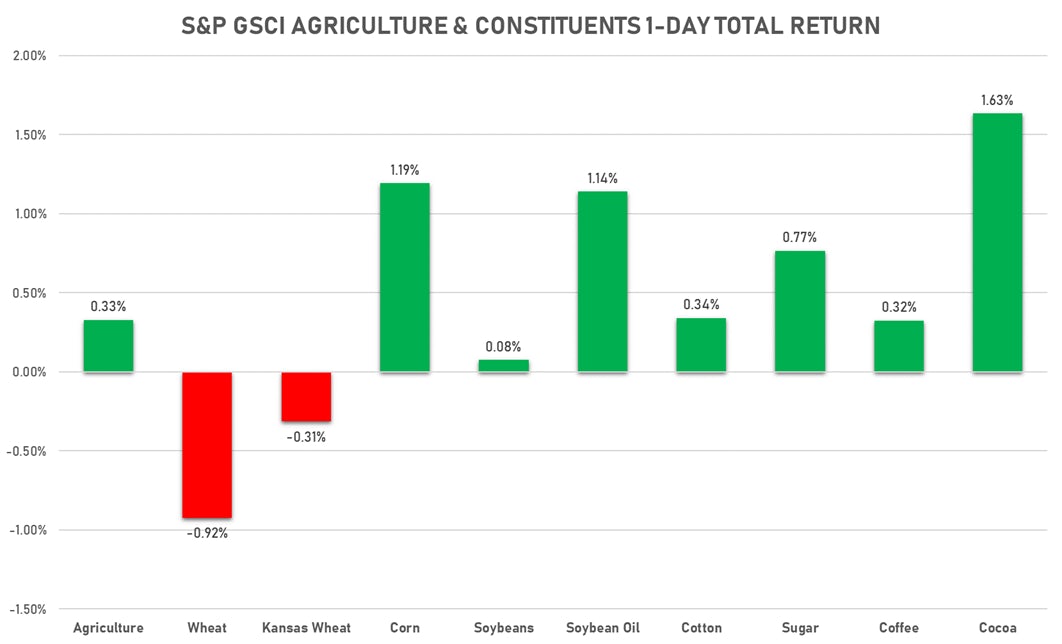

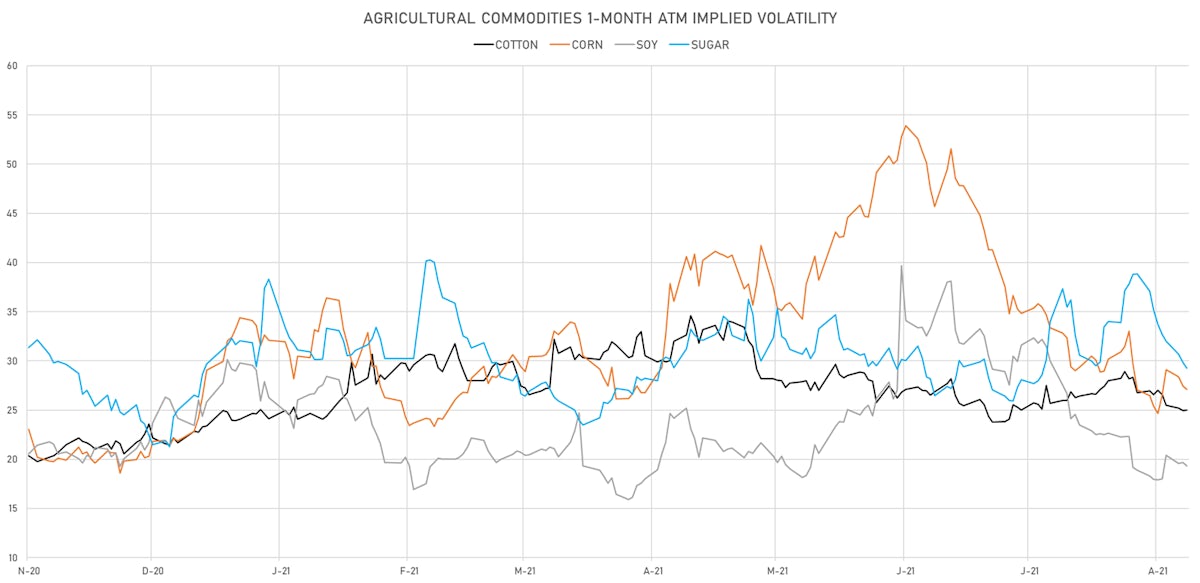

AGS TODAY

- Live Cattle (CME) currently at US$ 124.43 cents per pound, down 1.1% (YTD: +10.2%)

- Lean Hogs (CME) currently at US$ 88.75 cents per pound, up 2.0% (YTD: +26.3%)

- Rough Rice (CBOT) currently at US$ 13.36 cents per hundredweight, down -0.1% (YTD: +7.7%)

- Soybeans Composite (CBOT) currently at US$ 1,346.00 cents per bushel, up 0.7% (YTD: +2.3%)

- Corn (CBOT) currently at US$ 551.25 cents per bushel, up 1.2% (YTD: +13.9%)

- Wheat Composite (CBOT) currently at US$ 711.25 cents per bushel, down -0.9% (YTD: +11.0%)

- Sugar No.11 (ICE US) currently at US$ 19.73 cents per pound, up 0.8% (YTD: +27.4%)

- Cotton No.2 (ICE US) currently at US$ 95.95 cents per pound, up 0.2% (YTD: +22.8%)

- Cocoa (ICE US) currently at US$ 2,632 per tonne, up 1.6% (YTD: +1.1%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,412 per tonne, up 1.4% (YTD: +39.4%)

- Random Length Lumber (CME) currently at US$ 491.10 per 1,000 board feet, up 2.3% (YTD: -43.8%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,035 per tonne, down -0.3% (YTD: +10.2%)

- Soybean Oil Composite (CBOT) currently at US$ 61.89 cents per pound, up 1.3% (YTD: +42.8%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,589 per tonne, up 1.3% (YTD: +17.9%)

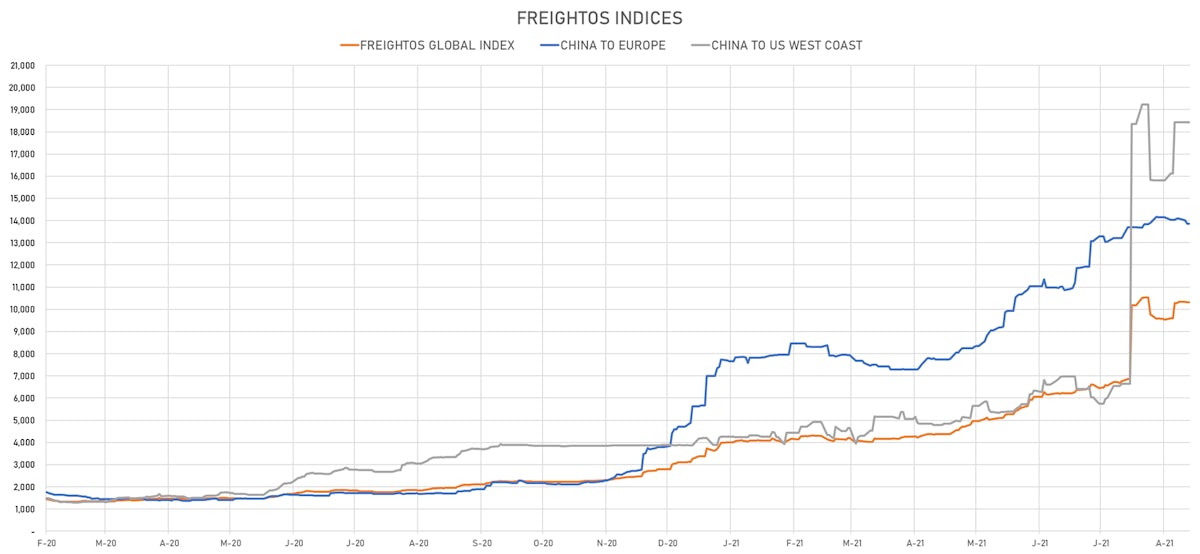

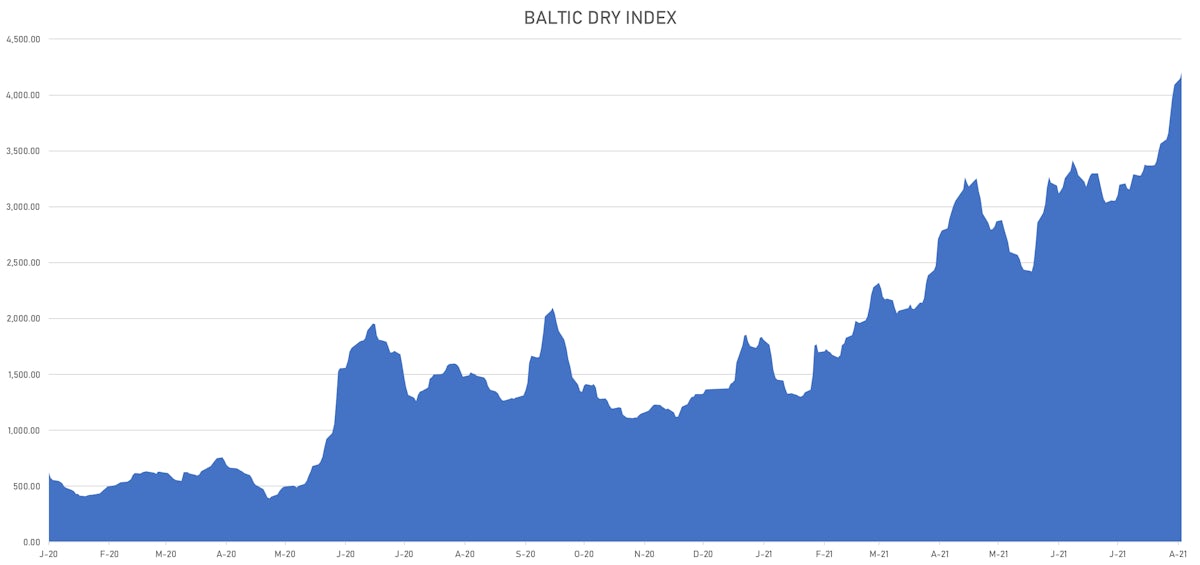

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,201, up 1.3% (YTD: +207.5%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 911, unchanged (YTD: +76.0%)

- Freightos North America East Coast To Europe Container Index currently at 463, unchanged (YTD: +27.6%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 13,858, unchanged (YTD: +144.7%)

- Freightos North Europe To China Container Index currently at 1,549, unchanged (YTD: +12.6%)

- Freightos Europe To South America West Coast Container Index currently at 5,361, unchanged (YTD: +216.9%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 56.54 per tonne, down -0.2% (YTD: +72.8%)