Commodities

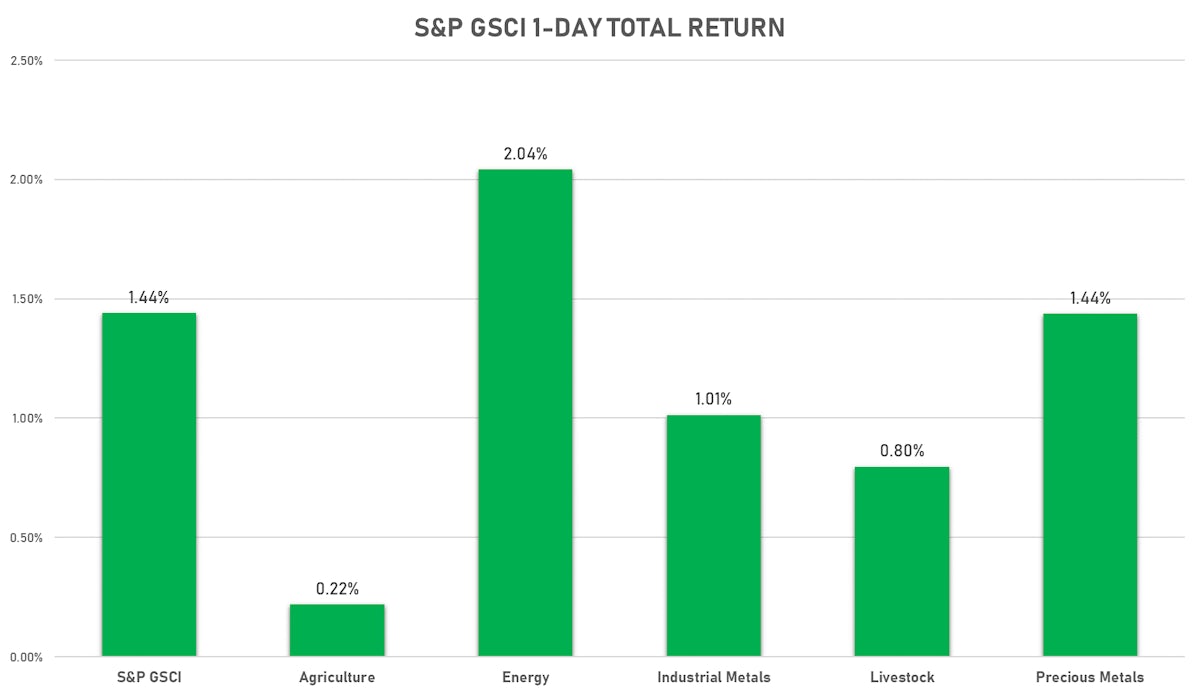

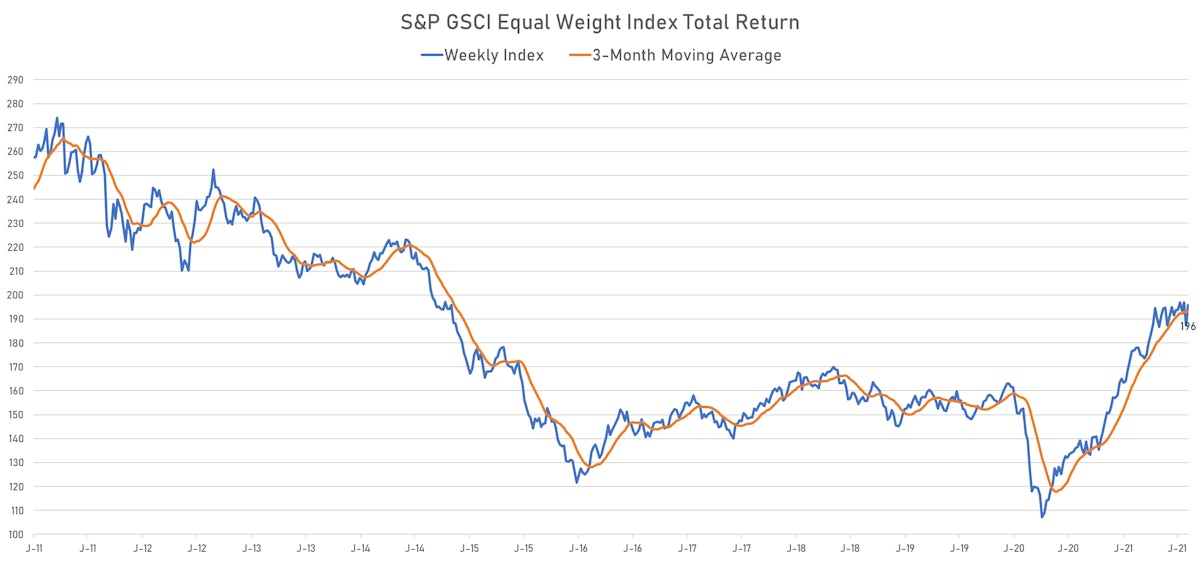

Commodities Rise Broadly On Weaker Dollar, Risk-On Trade

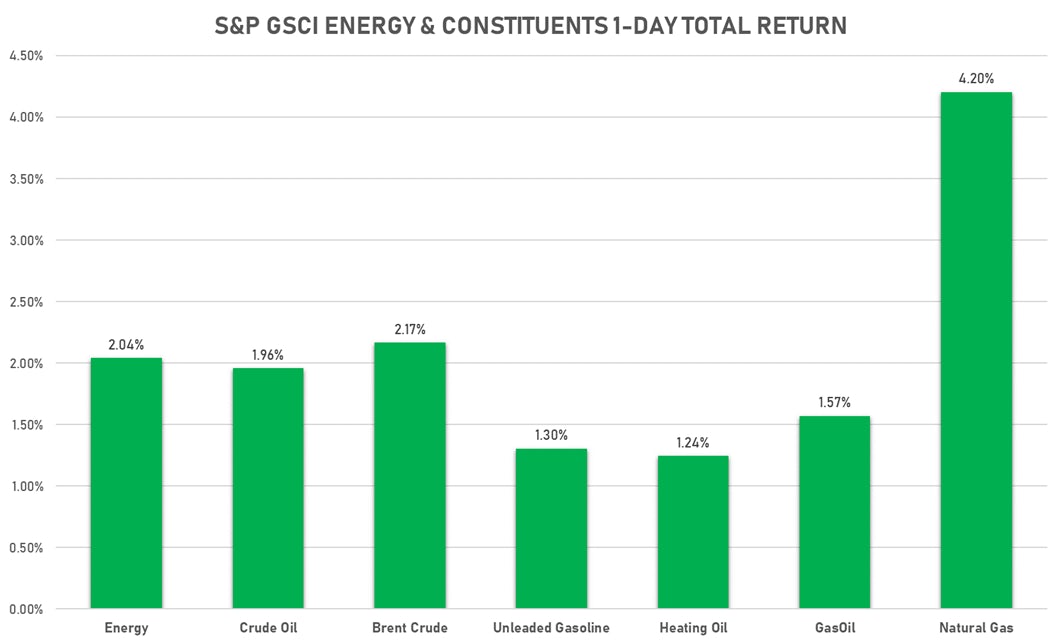

Natural gas was up another 4% today and has gained over 13% in the past week, with tropical storm Ida shutting down many offshore gas production facilities

Published ET

Natural Gas Front-Month Futures Prices | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- Freightos Baltic North America East Coast To China/East Asia 40 Container Index up 16.6% (YTD: 70.0%)

- NYMEX Henry Hub Natural Gas up 4.4% (YTD: 72.1%)

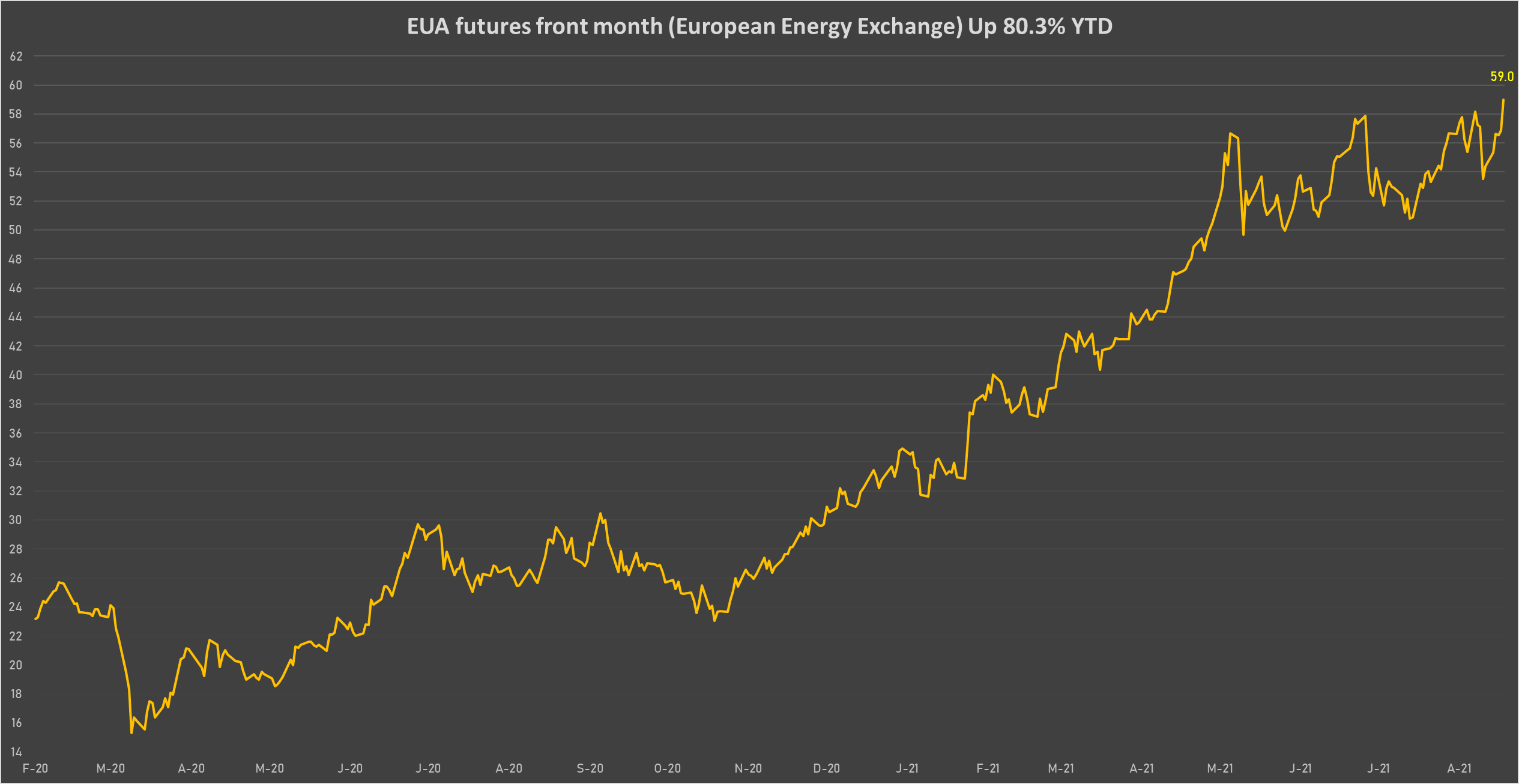

- EEX European-Carbon- Secondary Trading up 3.8% (YTD: 84.0%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly up 3.8% (YTD: 80.3%)

- Platinum spot up 3.3% (YTD: -5.5%)

- CME Cattle(Feeder) up 3.3% (YTD: 18.5%)

- CME Lean Hogs up 3.2% (YTD: 29.1%)

- ICE Europe Brent Crude up 2.3% (YTD: 40.3%)

- ICE-US Coffee C up 2.1% (YTD: 47.8%)

- NYMEX Light Sweet Crude Oil (WTI) up 2.0% (YTD: 41.7%)

- Silver spot up 1.9% (YTD: -9.0%)

- ICE-US Sugar No. 11 up 1.8% (YTD: 29.4%)

- Freightos Baltic North America West Coast To China/East Asia 40 Container Index up 1.8% (YTD: 79.1%)

NOTABLE LOSERS TODAY

- Freightos Baltic North America East Coast To Europe 40 Container Index down -22.0% (YTD: -0.5%)

- Shanghai International Exchange TSR 20 down -3.8% (YTD: 5.4%)

- SMM Erbium Oxide Spot Price Daily down -3.5% (YTD: 25.1%)

- Freightos Baltic Europe To South America West Coast Container Index down -3.2% (YTD: 206.8%)

- SHFE Rubber down -2.9% (YTD: -4.7%)

- CME Random Length Lumber down -2.0% (YTD: -44.4%)

- DCE Coking Coal Continuation Month 1 down -1.8% (YTD: 86.9%)

- ICE-US Cocoa down -1.6% (YTD: 0.0%)

- DCE RBD Palm Oil down -1.5% (YTD: 21.6%)

- SHFE Nickel down -1.5% (YTD: 14.8%)

- DCE Coke down -1.5% (YTD: 19.5%)

- SHFE Rebar down -1.2% (YTD: 20.2%)

- SMM Rare Earth Neodymium Oxide Spot Price Daily down -1.2% (YTD: 21.1%)

- SMM Rare Earth Gadolinium Oxide Spot Price Daily down -1.2% (YTD: 42.1%)

- CME Live Cattle down -1.0% (YTD: 8.0%)

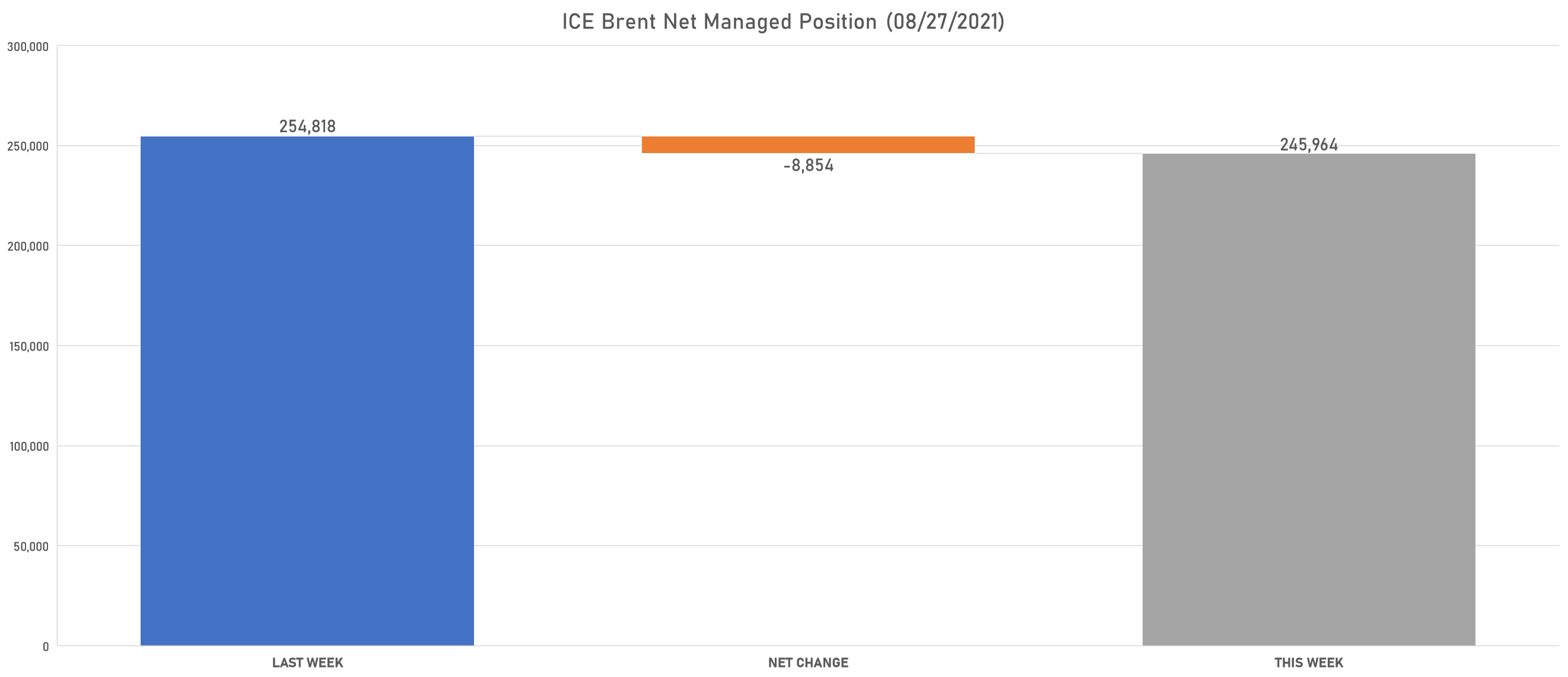

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent reduced net long position

- Gasoline RBOB reduced net long position

- No.2 Heating Oil reduced net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum reduced net short position

- Palladium reduced net long position

- Copper-Grade#1 reduced net long position

AGRICULTURE

- Wheat reduced net long position

- Corn reduced net long position

- Rough Rice increased net short position

- Oats reduced net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa reduced net long position

- Coffee C reduced net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar increased net long position

ENERGY COMPLEX RISES TODAY

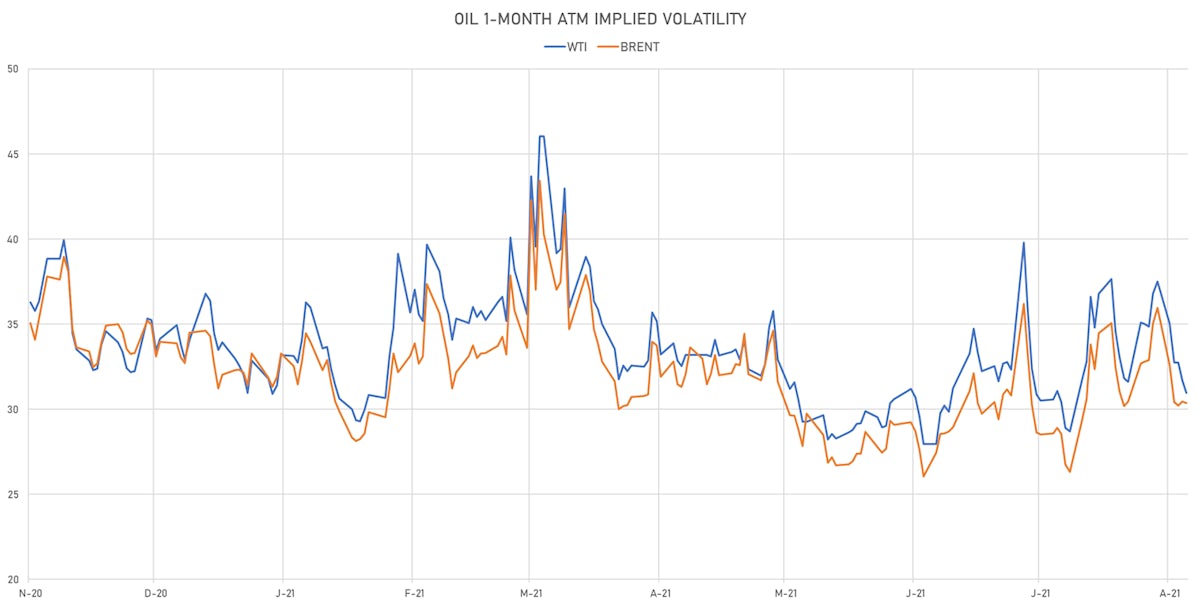

- WTI crude front month currently at US$ 68.74 per barrel, up 2.0% (YTD: +41.7%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 72.70 per barrel, up 2.3% (YTD: +40.3%); 6-month term structure in widening backwardation

- Brent volatility at 30.4, down -0.2% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) unchanged at US$ 171.00 per tonne (YTD: +112.4%)

- Natural Gas (Henry Hub) currently at US$ 4.39 per MMBtu, up 4.4% (YTD: +72.1%)

- Gasoline (NYMEX) currently at US$ 2.27 per gallon, up 0.8% (YTD: +61.5%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 598.50 per tonne, up 1.7% (YTD: +42.2%)

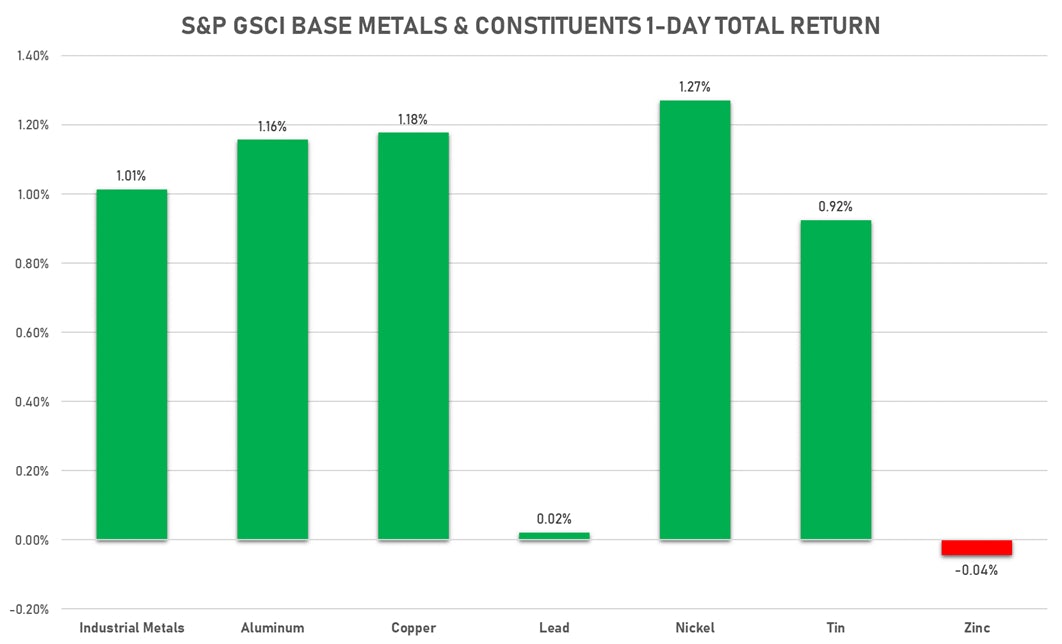

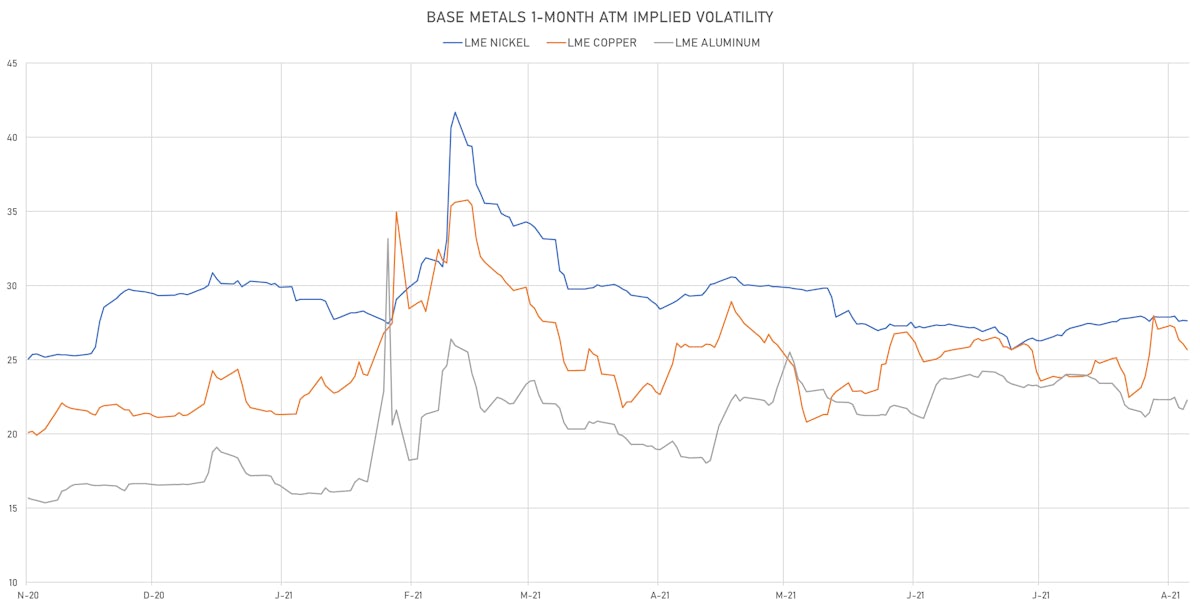

BASE METALS UP TODAY

- Copper (COMEX) currently at US$ 4.32 per pound, up 1.7% (YTD: +22.8%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 970.00 per tonne, up 0.3% (YTD: -11.9%)

- Aluminum (Shanghai) currently at CNY 20,870 per tonne, up 0.8% (YTD: +31.8%)

- Nickel (Shanghai) currently at CNY 144,380 per tonne, down -1.5% (YTD: +14.8%)

- Lead (Shanghai) currently at CNY 15,235 per tonne, down -0.6% (YTD: +4.3%)

- Rebar (Shanghai) currently at CNY 5,105 per tonne, down -1.2% (YTD: +20.2%)

- Tin (Shanghai) unchanged at CNY 242,850 per tonne (YTD: +61.0%)

- Zinc (Shanghai) currently at CNY 22,430 per tonne, down -0.9% (YTD: +7.3%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 725,000 per tonne, unchanged (YTD: +49.5%)

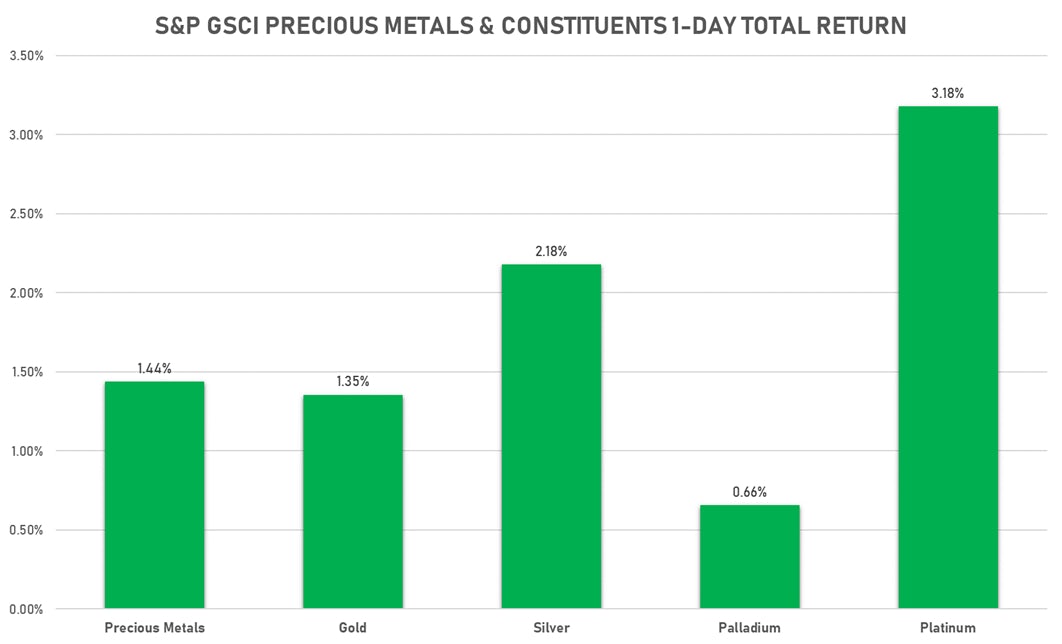

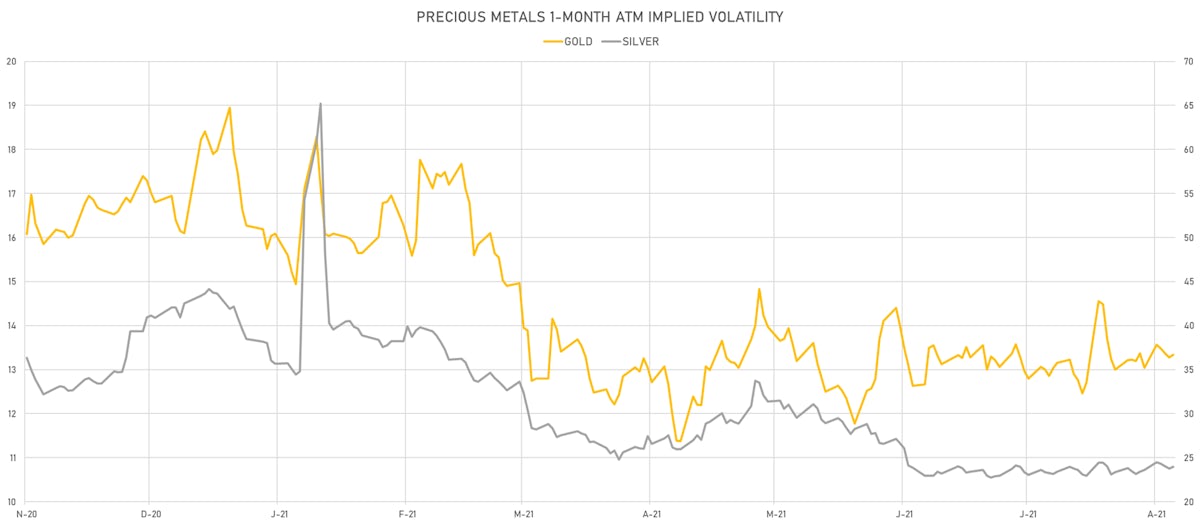

PRECIOUS METALS UP TODAY

- Gold spot currently at US$ 1,816.67 per troy ounce, up 1.4% (YTD: -4.3%)

- Gold 1-Month ATM implied volatility currently at 12.99, up 0.5% (YTD: -17.1%)

- Silver spot currently at US$ 24.00 per troy ounce, up 1.9% (YTD: -9.0%)

- Silver 1-Month ATM implied volatility currently at 22.96, up 0.9% (YTD: -43.6%)

- Palladium spot currently at US$ 2,418.17 per troy ounce, up 1.2% (YTD: -1.1%)

- Platinum spot currently at US$ 1,009.94 per troy ounce, up 3.3% (YTD: -5.5%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,500 per troy ounce, up 1.2% (YTD: +2.6%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

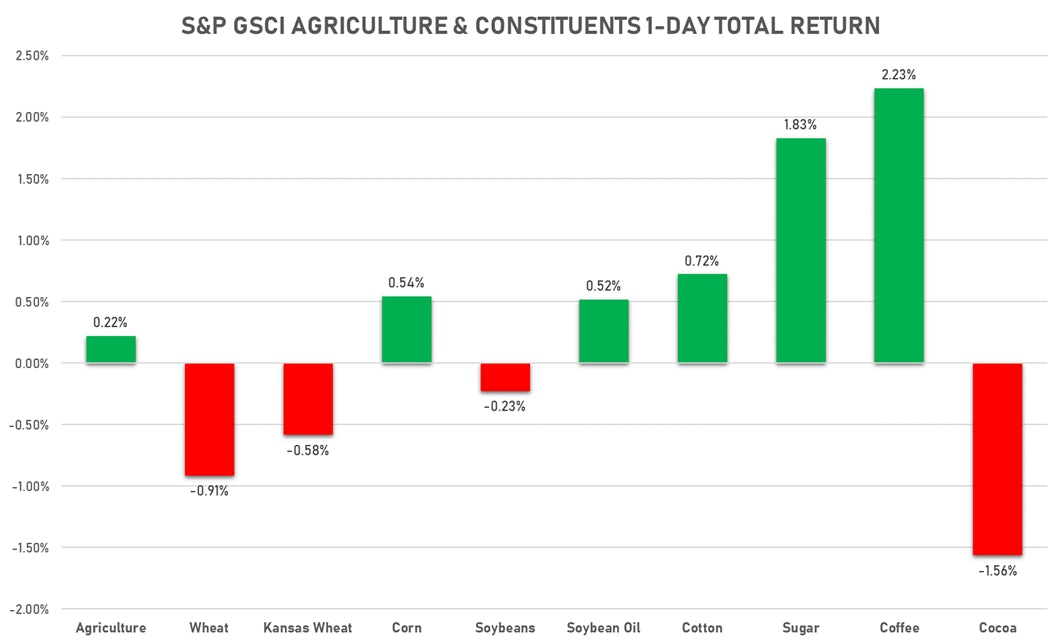

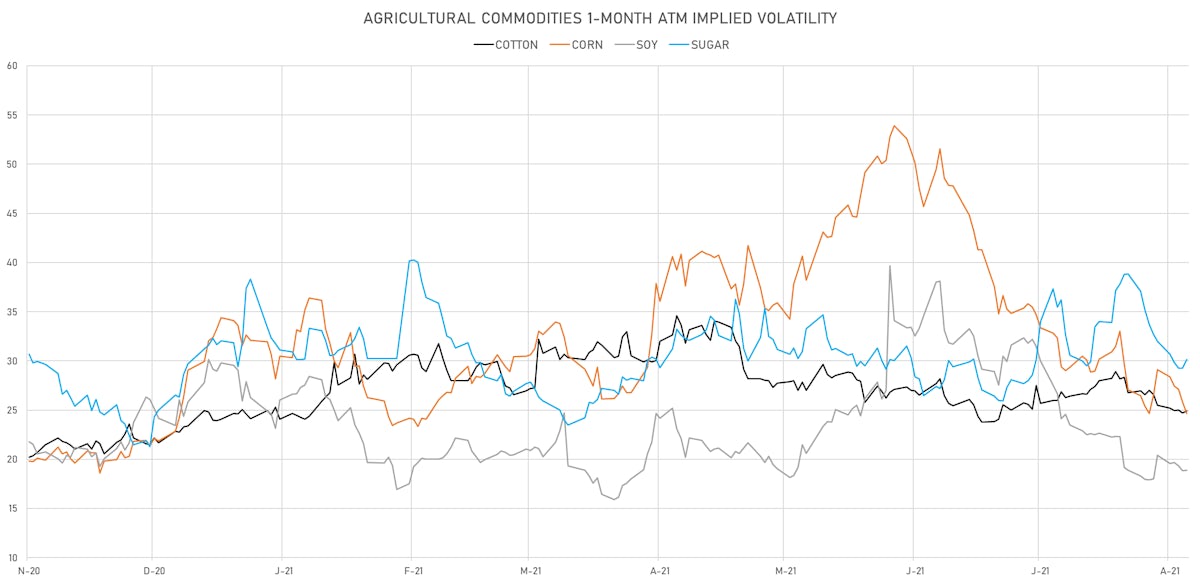

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 122.00 cents per pound, down 1.0% (YTD: +8.0%)

- Lean Hogs (CME) currently at US$ 90.73 cents per pound, up 3.2% (YTD: +29.1%)

- Rough Rice (CBOT) currently at US$ 13.23 cents per hundredweight, down -0.6% (YTD: +6.7%)

- Soybeans Composite (CBOT) currently at US$ 1,359.25 cents per bushel, down -0.6% (YTD: +3.3%)

- Corn (CBOT) currently at US$ 558.00 cents per bushel, up 0.9% (YTD: +15.3%)

- Wheat Composite (CBOT) currently at US$ 718.50 cents per bushel, down -0.9% (YTD: +12.2%)

- Sugar No.11 (ICE US) currently at US$ 20.03 cents per pound, up 1.8% (YTD: +29.4%)

- Cotton No.2 (ICE US) currently at US$ 96.31 cents per pound, up 1.0% (YTD: +23.2%)

- Cocoa (ICE US) currently at US$ 2,643 per tonne, down -1.6% (YTD: 0.0%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,439 per tonne, up 0.3% (YTD: +40.3%)

- Random Length Lumber (CME) currently at US$ 485.20 per 1,000 board feet, down -2.0% (YTD: -44.4%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,585 per tonne, down -3.8% (YTD: +5.4%)

- Soybean Oil Composite (CBOT) currently at US$ 61.30 cents per pound, down 0.0% (YTD: +41.5%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,560 per tonne, down -0.8% (YTD: +17.2%)

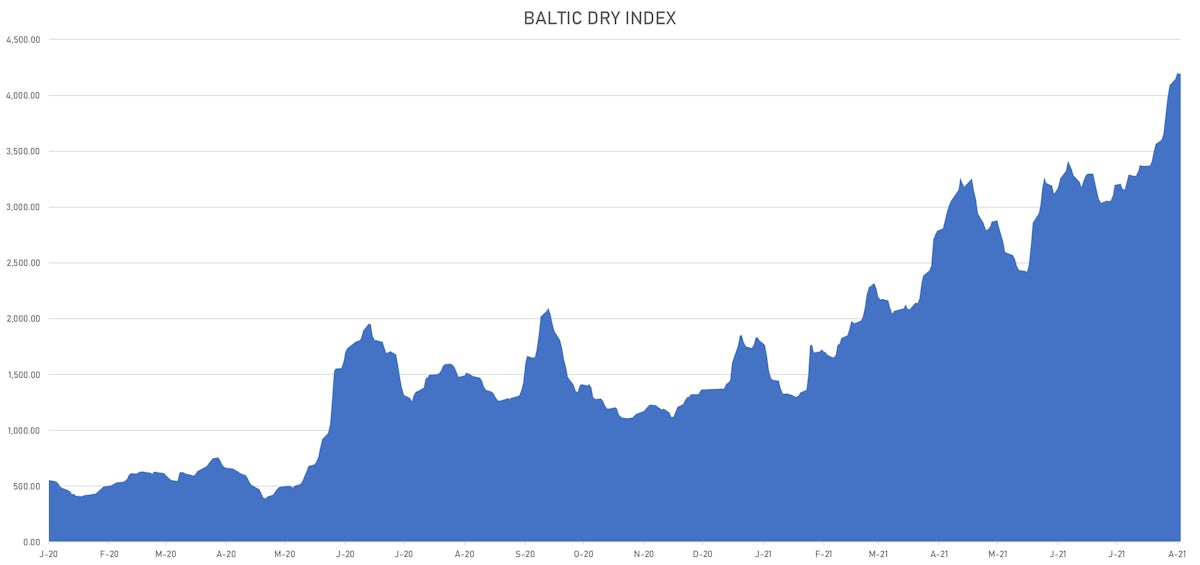

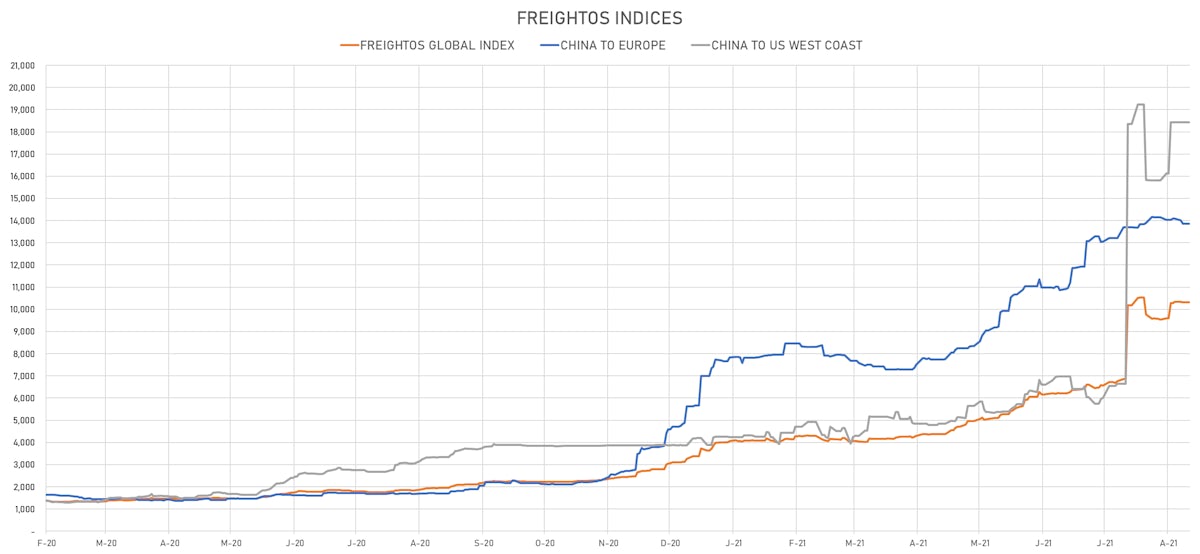

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) at 4,195 (YTD: +207.1%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 927, up 1.8% (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 361, down -22.0% (YTD: -0.5%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 13,855, unchanged (YTD: +144.7%)

- Freightos North Europe To China Container Index currently at 1,600, unchanged (YTD: +16.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,190, down -3.2% (YTD: +206.8%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 59.00 per tonne, up 3.8% (YTD: +80.3%)