Commodities

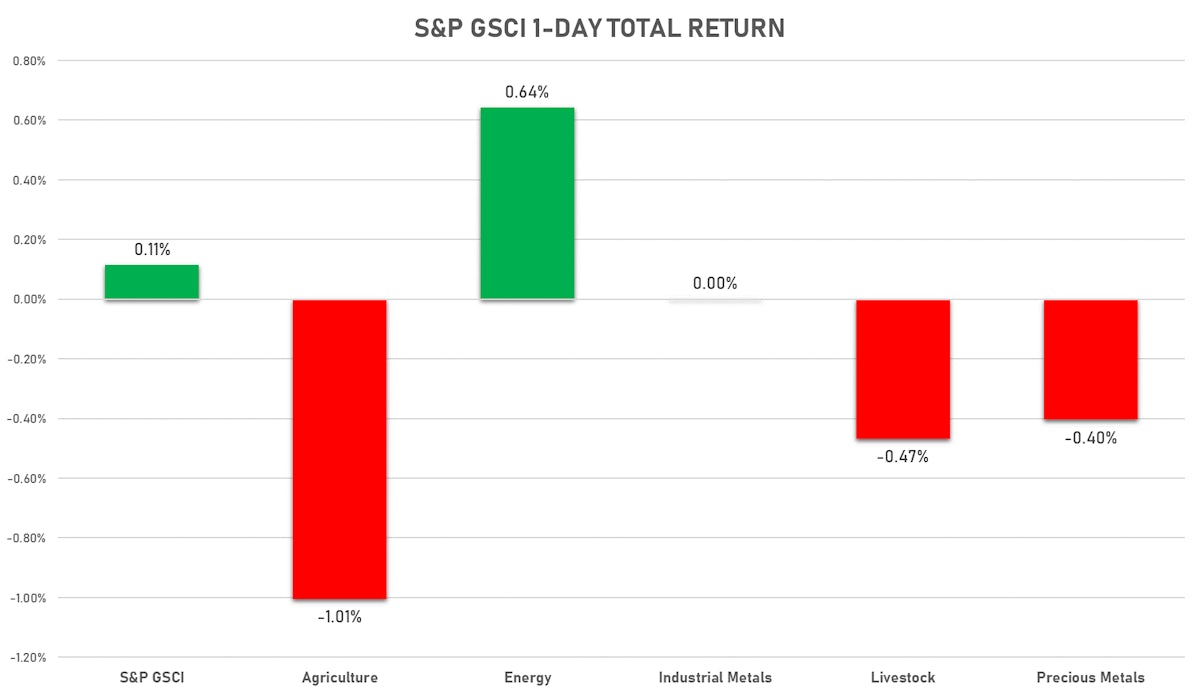

Commodities Mixed Today: Energy Up, Ags And Precious Metals Down

EU CO2 permits (EUA front-month futures) broke out above €60 for the first time ever, while natural gas fell from multi-year highs as producers inspect damages in the Gulf of Mexico

Published ET

EUA Front-Month Futures Daily Prices | Source: Refinitiv

NOTABLE GAINERS TODAY

- ICE-US Coffee C up 4.2% (YTD: 53.9%)

- Palladium spot up 3.1% (YTD: 2.0%)

- EEX European-Carbon- Secondary Trading up 3.0% (YTD: 89.5%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly up 3.0% (YTD: 85.7%)

- SHFE Rebar up 2.6% (YTD: 23.4%)

- SHFE Nickel up 2.4% (YTD: 17.6%)

- SHFE Hot Rolled Coil up 2.2% (YTD: 26.9%)

- SHFE Aluminum up 2.1% (YTD: 34.7%)

- NYMEX RBOB Gasoline up 1.7% (YTD: 64.2%)

- Coffee Arabica Colombia Excelso EP Spot up 1.6% (YTD: 42.5%)

- NYMEX NY Harbor ULSD up 1.5% (YTD: 45.0%)

- Zhengzhou Exchange Thermal Coal up 1.3% (YTD: 26.7%)

- SHFE Copper up 1.3% (YTD: 20.7%)

- Coffee Robusta Vietnam Grade 1 Wet Pol Spot up 1.3% (YTD: 28.1%)

- COMEX Copper up 1.0% (YTD: 24.1%)

NOTABLE LOSERS TODAY

- CBoT Soybeans down -4.0% (YTD: -0.8%)

- CBoT Corn down -3.2% (YTD: 11.6%)

- CBoT Soybean Meal down -1.9% (YTD: -20.0%)

- CBoT Soybean Oil down -1.7% (YTD: 39.1%)

- NYMEX Henry Hub Natural Gas down -1.5% (YTD: 69.6%)

- CME Live Cattle down -1.4% (YTD: 6.5%)

- CBoT Wheat down -1.4% (YTD: 10.7%)

- Bursa Malaysia Crude Palm Oil down -1.3% (YTD: 15.7%)

- SHFE Lead Continuation Month 1 down -0.7% (YTD: 3.6%)

- ICE-US Cotton No. 2 down -0.7% (YTD: 22.4%)

- CME Lean Hogs down -0.6% (YTD: 28.3%)

- CBoT Rough Rice down -0.5% (YTD: 6.1%)

- Gold spot down -0.4% (YTD: -4.6%)

- CME Cattle(Feeder) down -0.4% (YTD: 18.1%)

- CME Random Length Lumber down -0.4% (YTD: -44.6%)

ENERGY UP TODAY, NAT GAS LONE LOSER

- WTI crude front month currently at US$ 69.09 per barrel, up 0.7% (YTD: +42.6%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 73.41 per barrel, up 2.3% (YTD: +40.3%); 6-month term structure in widening backwardation

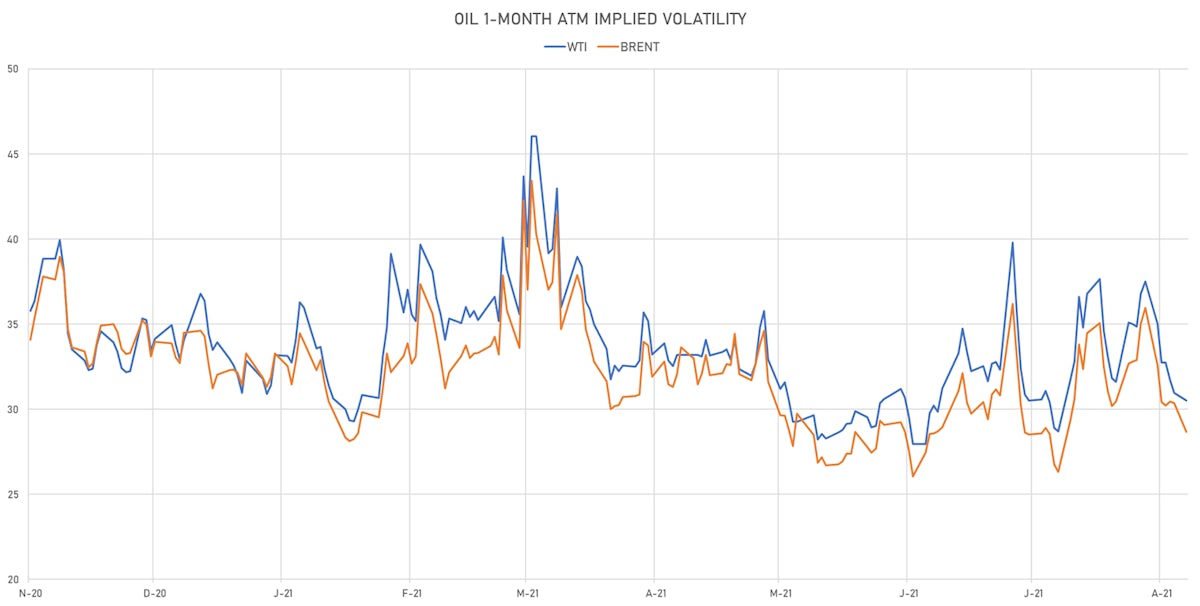

- Brent volatility at 28.7, down -5.6% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) unchanged at US$ 171.35 per tonne (YTD: +112.4%)

- Natural Gas (Henry Hub) currently at US$ 4.31 per MMBtu, down -1.5% (YTD: +69.6%)

- Gasoline (NYMEX) currently at US$ 2.31 per gallon, up 1.7% (YTD: +64.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 605.00 per tonne, up 1.7% (YTD: +42.2%)

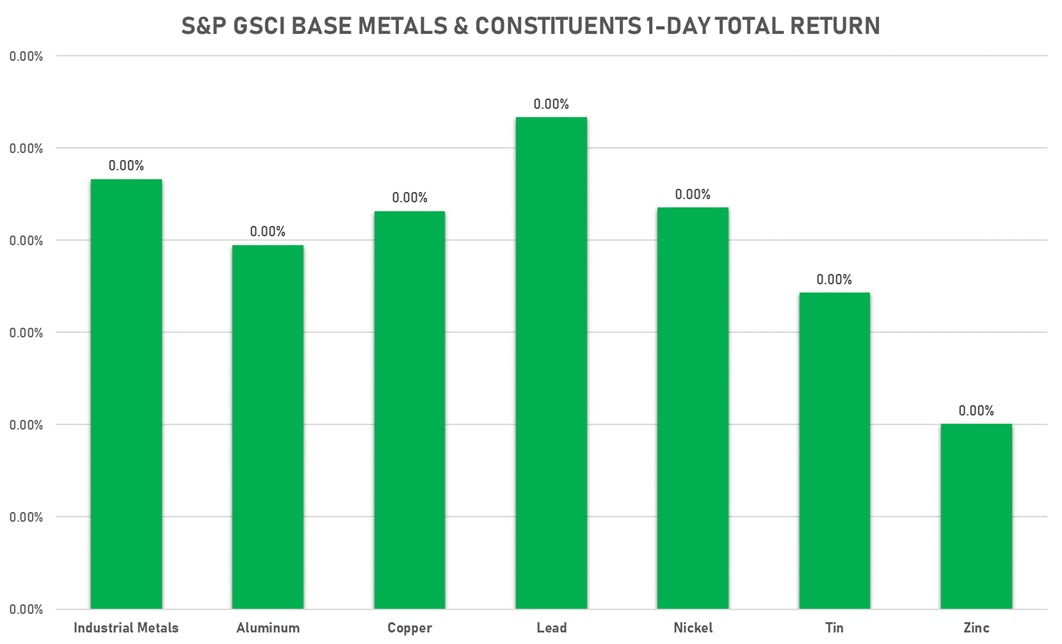

BROAD RISE FOR BASE METALS TODAY

- Copper (COMEX) currently at US$ 4.35 per pound, up 1.0% (YTD: +24.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 949.00 per tonne, up 1.0% (YTD: -11.0%)

- Aluminum (Shanghai) currently at CNY 21,350 per tonne, up 2.1% (YTD: +34.7%)

- Nickel (Shanghai) currently at CNY 150,810 per tonne, up 2.4% (YTD: +17.6%)

- Lead (Shanghai) currently at CNY 15,070 per tonne, down -0.7% (YTD: +3.6%)

- Rebar (Shanghai) currently at CNY 5,249 per tonne, up 2.6% (YTD: +23.4%)

- Tin (Shanghai) currently at CNY 248,970 per tonne, up 0.6% (YTD: +62.1%)

- Zinc (Shanghai) currently at CNY 22,520 per tonne, up 0.5% (YTD: +7.9%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 725,000 per tonne, unchanged (YTD: +49.5%)

PRECIOUS METALS MOSTLY DOWN TODAY

- Gold spot currently at US$ 1,811.06 per troy ounce, down -0.4% (YTD: -4.6%)

- Gold 1-Month ATM implied volatility currently at 13.40, up 2.3% (YTD: -15.2%)

- Silver spot currently at US$ 24.02 per troy ounce, up 0.1% (YTD: -8.9%)

- Silver 1-Month ATM implied volatility currently at 23.71, up 2.5% (YTD: -42.2%)

- Palladium spot currently at US$ 2,467.37 per troy ounce, up 3.1% (YTD: +2.0%)

- Platinum spot currently at US$ 1,003.12 per troy ounce, down -0.3% (YTD: -5.7%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,600 per troy ounce, up 0.6% (YTD: +3.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

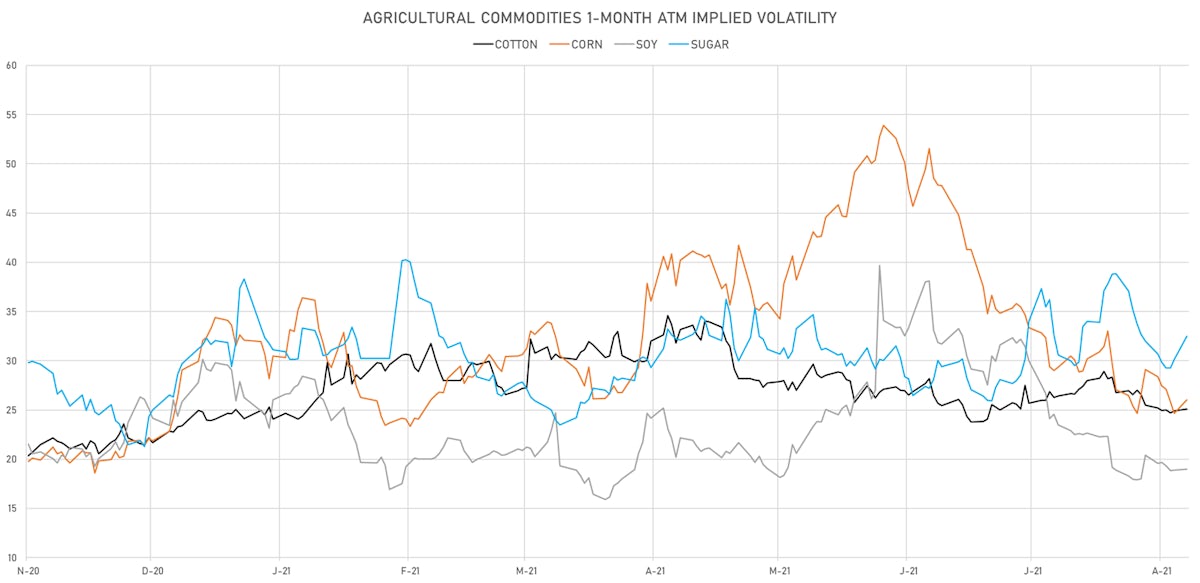

AGS MIXED TODAY

- Live Cattle (CME) currently at US$ 120.25 cents per pound, down 1.4% (YTD: +6.5%)

- Lean Hogs (CME) currently at US$ 90.15 cents per pound, down -0.6% (YTD: +28.3%)

- Rough Rice (CBOT) currently at US$ 13.16 cents per hundredweight, down -0.5% (YTD: +6.1%)

- Soybeans Composite (CBOT) currently at US$ 1,309.75 cents per bushel, down -4.0% (YTD: -0.8%)

- Corn (CBOT) currently at US$ 539.50 cents per bushel, down -3.2% (YTD: +11.6%)

- Wheat Composite (CBOT) currently at US$ 706.75 cents per bushel, down -1.4% (YTD: +10.7%)

- Sugar No.11 (ICE US) currently at US$ 20.22 cents per pound, up 0.9% (YTD: +30.5%)

- Cotton No.2 (ICE US) currently at US$ 95.61 cents per pound, down -0.7% (YTD: +22.4%)

- Cocoa (ICE US) currently at US$ 2,617 per tonne, up 0.6% (YTD: +0.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,511 per tonne, up 1.6% (YTD: +42.5%)

- Random Length Lumber (CME) currently at US$ 483.50 per 1,000 board feet, down -0.4% (YTD: -44.6%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,500 per tonne, up 0.1% (YTD: +5.5%)

- Soybean Oil Composite (CBOT) currently at US$ 59.67 cents per pound, down -1.7% (YTD: +39.1%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,500 per tonne, down -1.3% (YTD: +15.7%)

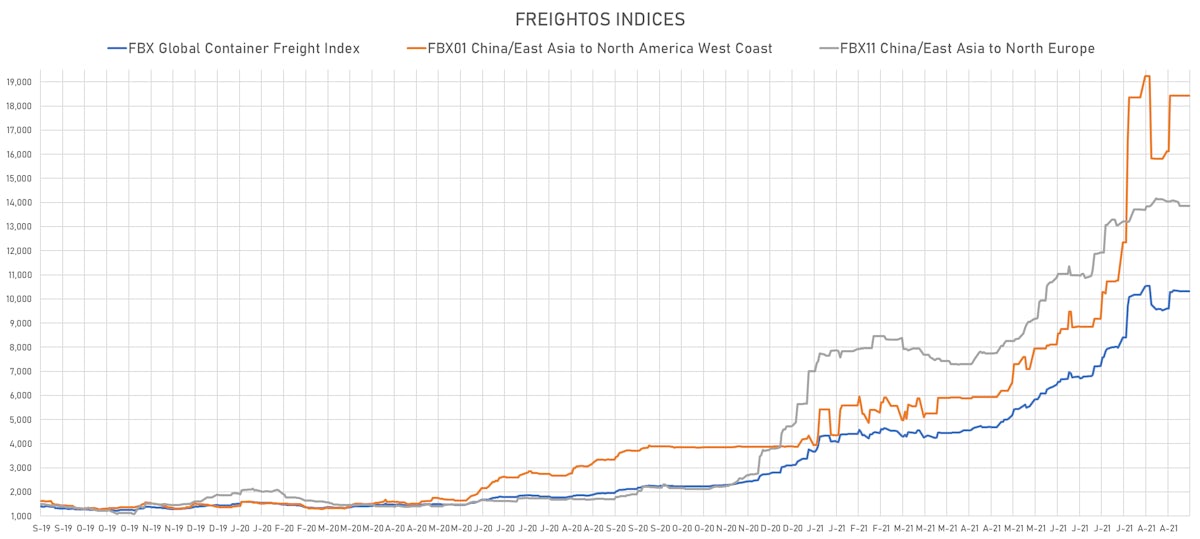

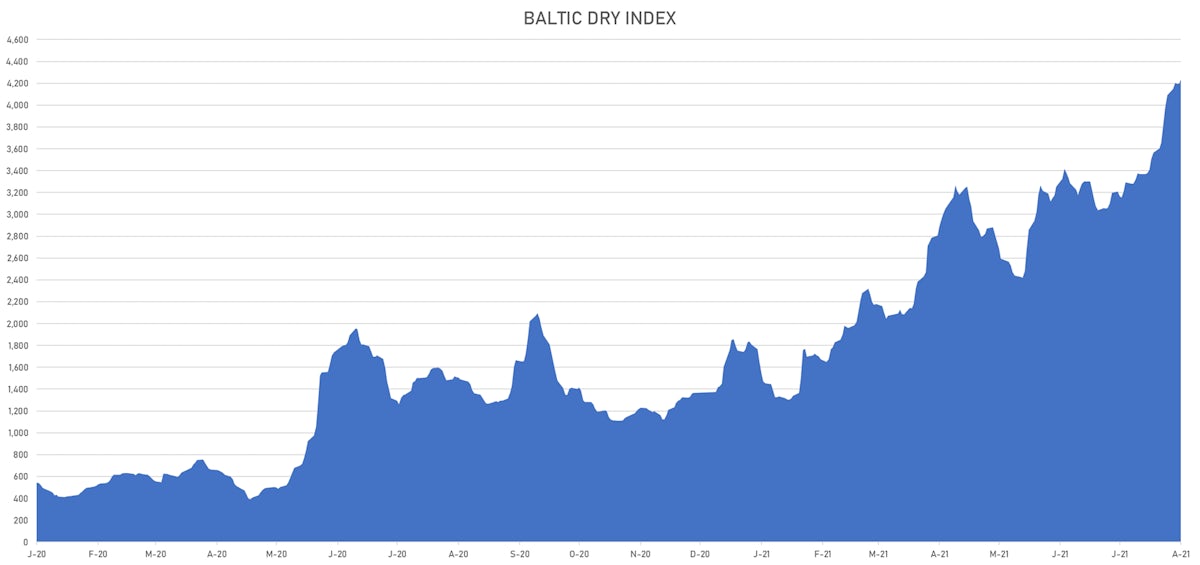

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,235, up 1.0% (YTD: +210.0%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 927, unchanged (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 361, unchanged (YTD: -0.5%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 13,855, unchanged (YTD: +144.7%)

- Freightos North Europe To China Container Index currently at 1,600, unchanged (YTD: +16.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,190, unchanged (YTD: +206.8%)

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 60.76 per tonne, up 3.0% (YTD: +85.7%)