Commodities

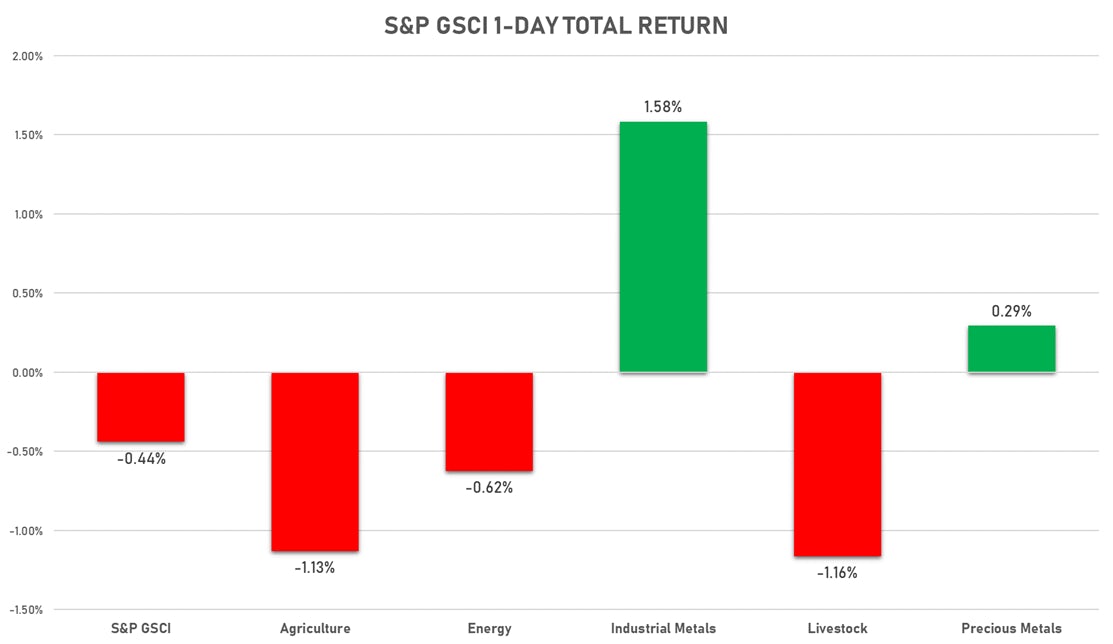

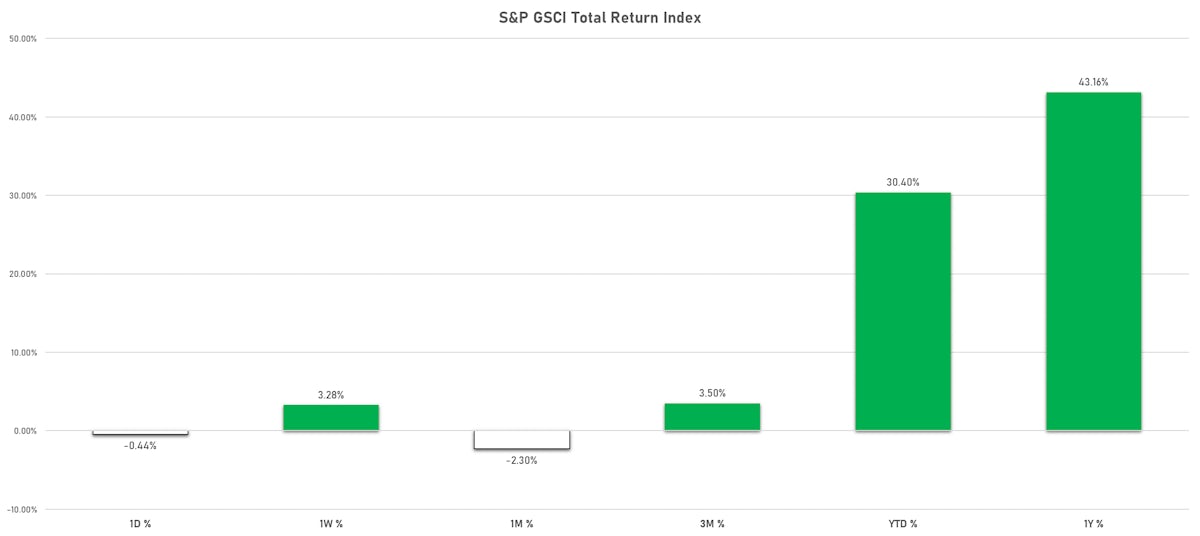

Base Metals Rose, Other Commodities Groups Fell Today

Coal prices keep rising on high demand as well as supply issues: China's Australian imports are banned and Mongolian imports suspended because of Covid

Published ET

Newcastle Coal Prices Have More Than Doubled This Year | Sources: ϕpost, Refinitiv data

HEADLINES & MACRO

- API inventories data: crude draw of 4.05m barrels, gasoline build of 2.71m barrels, distillates draw of 1.96m barrels, Cushing build of 2.13m barrels

- OPEC+ meeting tomorrow, with the market considering a continuation of the existing agreement as the most likely option. Although the White House has pushed for a supply increase, that is unlikely considering the uncertainty around economic growth with the delta variant.

NOTABLE GAINERS TODAY

- DCE Coke up 4.3% (YTD: 25.6%)

- Zhengzhou Exchange Thermal Coal up 3.7% (YTD: 31.3%)

- DCE Coking Coal Continuation Month 1 up 3.3% (YTD: 94.1%)

- Coffee Arabica Colombia Excelso EP Spot up 3.2% (YTD: 47.1%)

- SHFE Nickel up 2.9% (YTD: 21.0%)

- SHFE Stannum (Tin) up 2.3% (YTD: 65.9%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 2.3% (YTD: 46.4%)

- ICE Europe Newcastle Coal Monthly up 1.9% (YTD: 116.5%)

- Brent Forties and Oseberg Dated FOB North Sea Crude up 1.7% (YTD: 43.9%)

- NYMEX Henry Hub Natural Gas up 1.7% (YTD: 72.4%)

- SHFE Aluminum up 0.9% (YTD: 35.9%)

- DCE RBD Palm Oil up 0.7% (YTD: 23.5%)

- Platinum spot up 0.6% (YTD: -5.1%)

- SHFE Hot Rolled Coil up 0.6% (YTD: 27.6%)

- ICE Europe Low Sulphur Gasoil up 0.5% (YTD: 43.0%)

NOTABLE LOSERS TODAY

- SMM Rare Earth Yttrium Oxide Spot Price Daily down -8.2% (YTD: 90.2%)

- DCE Iron Ore Continuation Month 1 down -2.8% (YTD: -13.5%)

- ICE-US Cocoa down -2.2% (YTD: -1.7%)

- ICE-US Coffee C down -2.0% (YTD: 50.8%)

- ICE-US Sugar No. 11 down -1.9% (YTD: 28.1%)

- ICE-US Cotton No. 2 down -1.8% (YTD: 20.2%)

- CBoT Soybean Oil down -1.5% (YTD: 37.0%)

- CME Lean Hogs down -1.5% (YTD: 26.4%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily down -1.5% (YTD: 35.2%)

- SHFE Lead Continuation Month 1 down -1.4% (YTD: 2.1%)

- NYMEX RBOB Gasoline down -1.3% (YTD: 62.1%)

- SMM Rare Earth Terbium Oxide Spot Price Daily down -1.3% (YTD: 8.3%)

- Crude Oil WTI Cushing US FOB down -1.2% (YTD: 41.5%)

- CBoT Corn down -1.2% (YTD: 10.3%)

- CME Live Cattle down -1.1% (YTD: 5.3%)

ENERGY TODAY: OIL DOWN, NAT GAS UP

- WTI crude front month currently at US$ 68.56 per barrel, down -1.0% (YTD: +41.2%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 71.65 per barrel, up 0.4% (YTD: +40.9%); 6-month term structure in widening backwardation

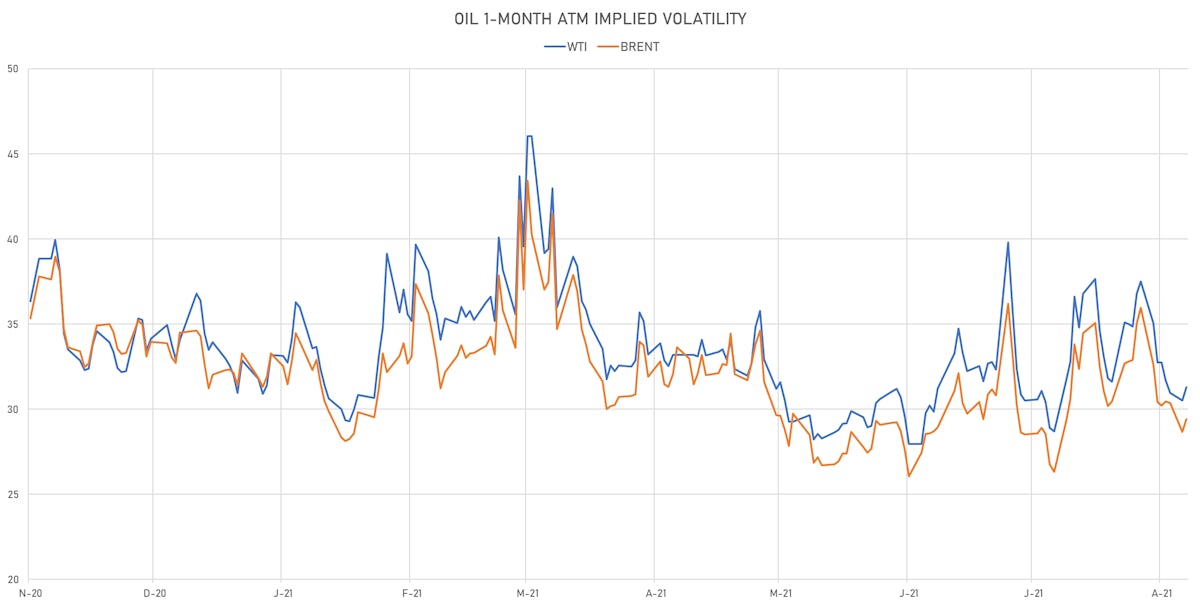

- Brent volatility at 29.4, up 2.5% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 174.25 per tonne, up 1.9% (YTD: +116.5%)

- Natural Gas (Henry Hub) currently at US$ 4.40 per MMBtu, up 1.7% (YTD: +72.4%)

- Gasoline (NYMEX) currently at US$ 2.13 per gallon, down -1.3% (YTD: +62.1%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 600.75 per tonne, up 0.5% (YTD: +43.0%)

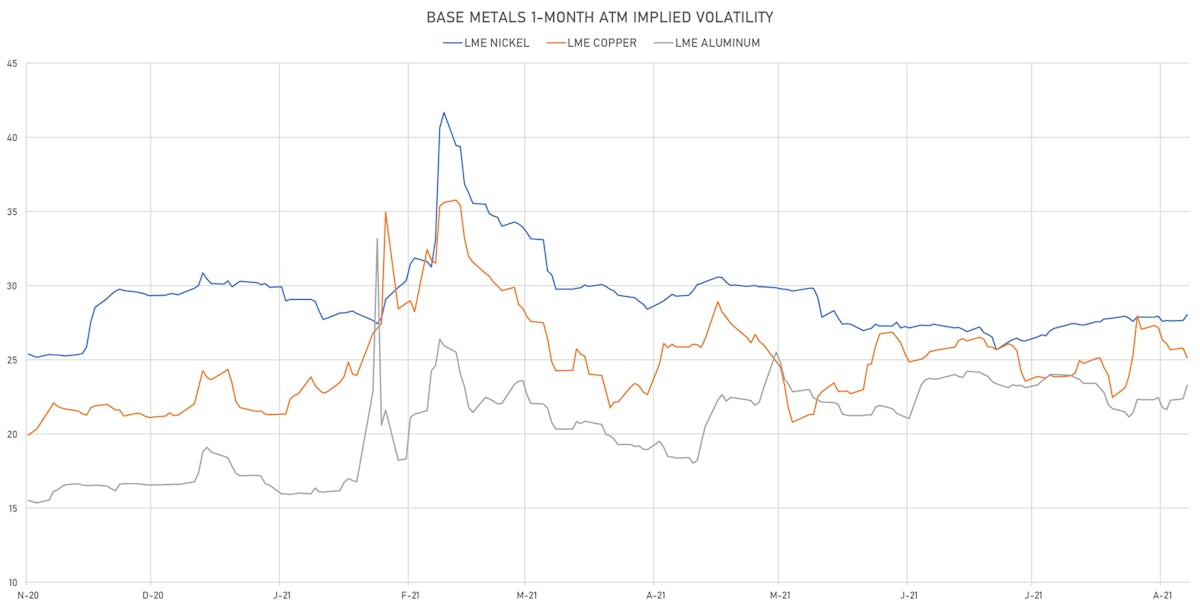

BASE METALS MOSTLY UP TODAY

- Copper (COMEX) unchanged at US$ 4.35 per pound (YTD: +24.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 880.00 per tonne, down -2.8% (YTD: -13.5%)

- Aluminum (Shanghai) currently at CNY 21,200 per tonne, up 0.9% (YTD: +35.9%)

- Nickel (Shanghai) currently at CNY 150,200 per tonne, up 2.9% (YTD: +21.0%)

- Lead (Shanghai) currently at CNY 14,880 per tonne, down -1.4% (YTD: +2.1%)

- Rebar (Shanghai) currently at CNY 5,250 per tonne, up 0.5% (YTD: +24.0%)

- Tin (Shanghai) currently at CNY 249,870 per tonne, up 2.3% (YTD: +65.9%)

- Zinc (Shanghai) currently at CNY 22,300 per tonne, down -0.4% (YTD: +7.5%)

- Refined Cobalt (Shanghai) spot price currently at CNY 362,500 per tonne, unchanged (YTD: +32.3%)

- Lithium (Shanghai) spot price currently at CNY 725,000 per tonne, unchanged (YTD: +49.5%)

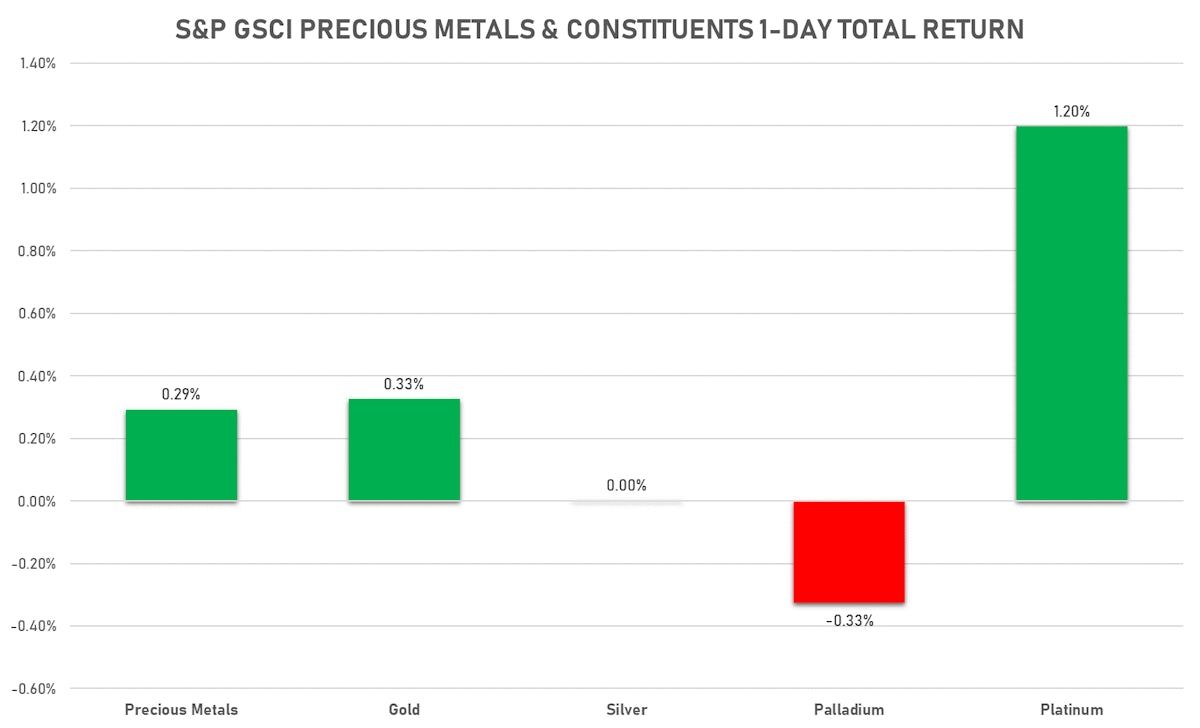

PRECIOUS METALS MIXED TODAY

- Gold spot currently at US$ 1,812.45 per troy ounce, up 0.2% (YTD: -4.4%)

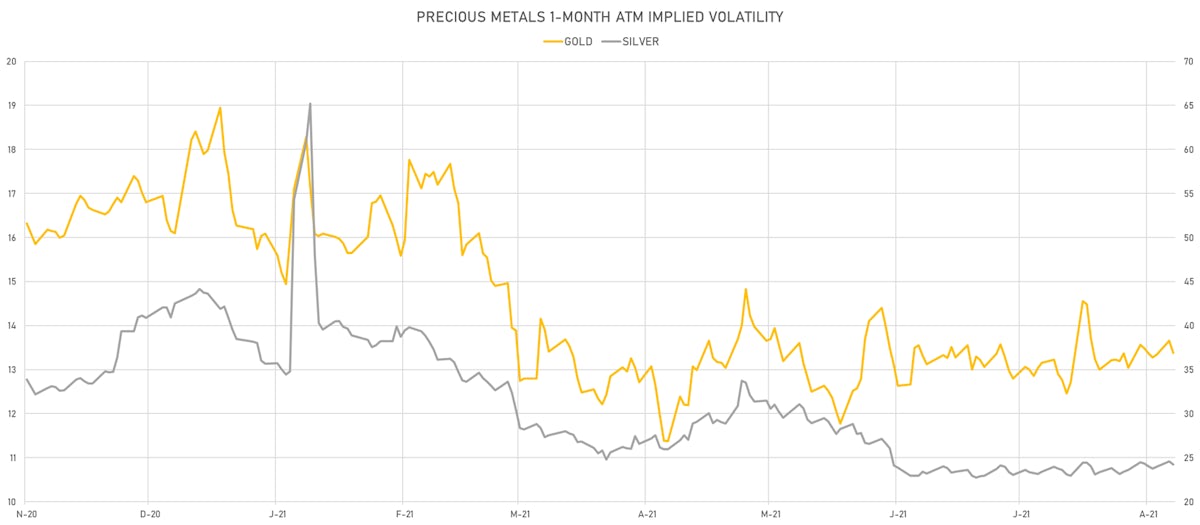

- Gold 1-Month ATM implied volatility currently at 12.95, down -2.7% (YTD: -17.5%)

- Silver spot currently at US$ 23.85 per troy ounce, down -0.6% (YTD: -9.5%)

- Silver 1-Month ATM implied volatility currently at 23.25, down -1.4% (YTD: -43.1%)

- Palladium spot currently at US$ 2,477.32 per troy ounce, down -0.8% (YTD: +1.1%)

- Platinum spot currently at US$ 1,015.66 per troy ounce, up 0.6% (YTD: -5.1%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,600 per troy ounce, unchanged (YTD: +3.2%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

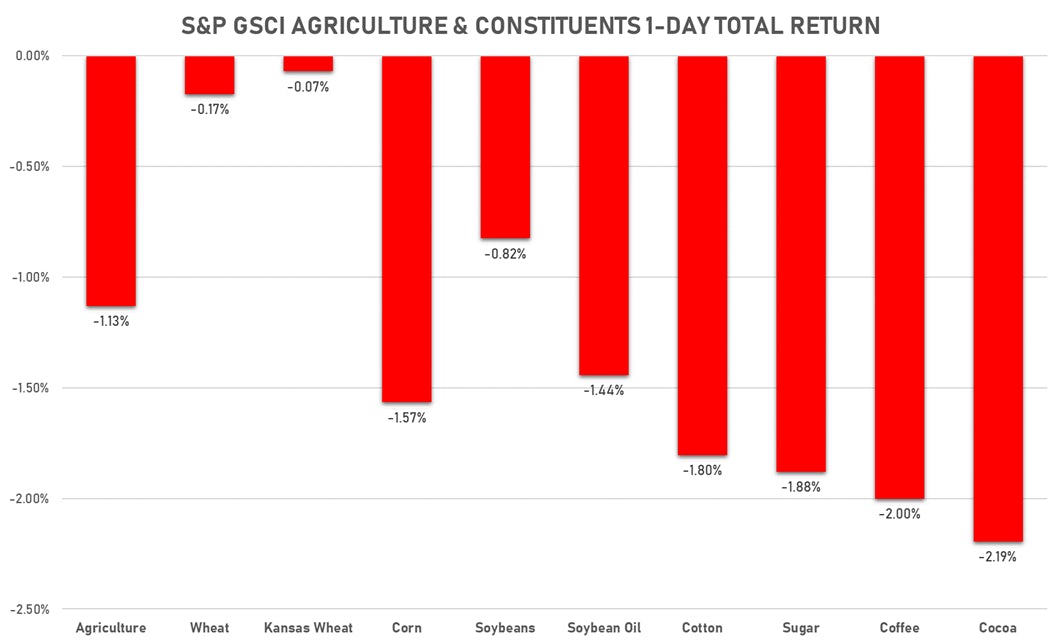

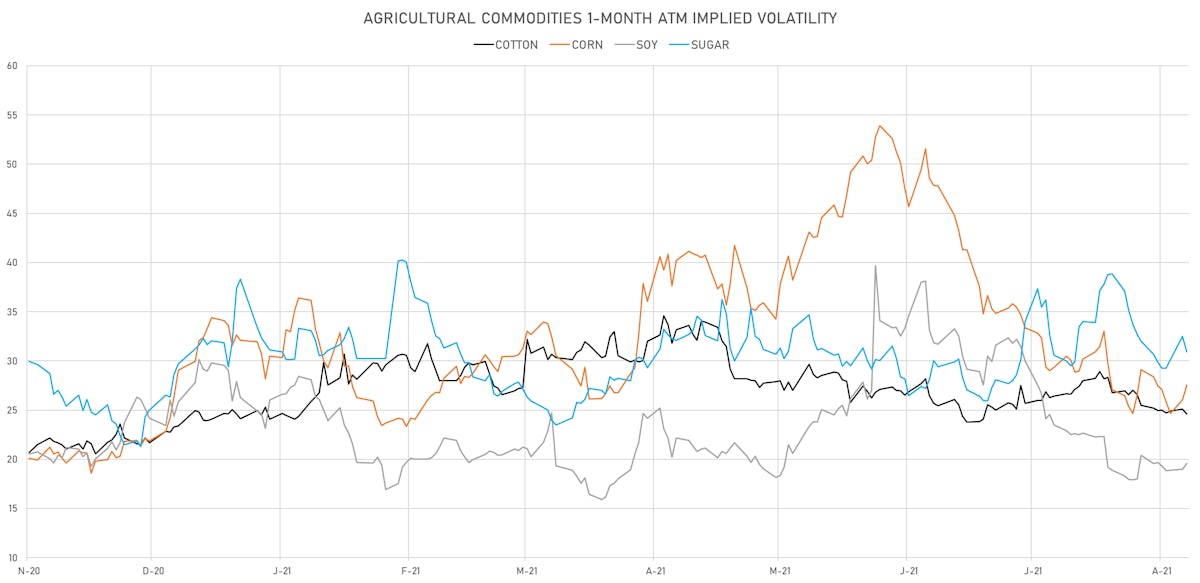

AGS DOWN TODAY

- Live Cattle (CME) currently at US$ 126.90 cents per pound, down 1.1% (YTD: +5.3%)

- Lean Hogs (CME) currently at US$ 88.80 cents per pound, down -1.5% (YTD: +26.4%)

- Rough Rice (CBOT) currently at US$ 13.13 cents per hundredweight, down -0.2% (YTD: +5.9%)

- Soybeans Composite (CBOT) currently at US$ 1,298.75 cents per bushel, down -0.5% (YTD: -1.3%)

- Corn (CBOT) currently at US$ 530.00 cents per bushel, down -1.2% (YTD: +10.3%)

- Wheat Composite (CBOT) currently at US$ 706.75 cents per bushel, down -0.3% (YTD: +10.3%)

- Sugar No.11 (ICE US) currently at US$ 19.84 cents per pound, down -1.9% (YTD: +28.1%)

- Cotton No.2 (ICE US) currently at US$ 93.91 cents per pound, down -1.8% (YTD: +20.2%)

- Cocoa (ICE US) currently at US$ 2,560 per tonne, down -2.2% (YTD: -1.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,655 per tonne, up 3.2% (YTD: +47.1%)

- Random Length Lumber (CME) currently at US$ 482.80 per 1,000 board feet, down -0.1% (YTD: -44.7%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,565 per tonne, up 0.1% (YTD: +5.7%)

- Soybean Oil Composite (CBOT) currently at US$ 59.59 cents per pound, down -1.5% (YTD: +37.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,500 per tonne, down -1.3% (YTD: +15.7%)

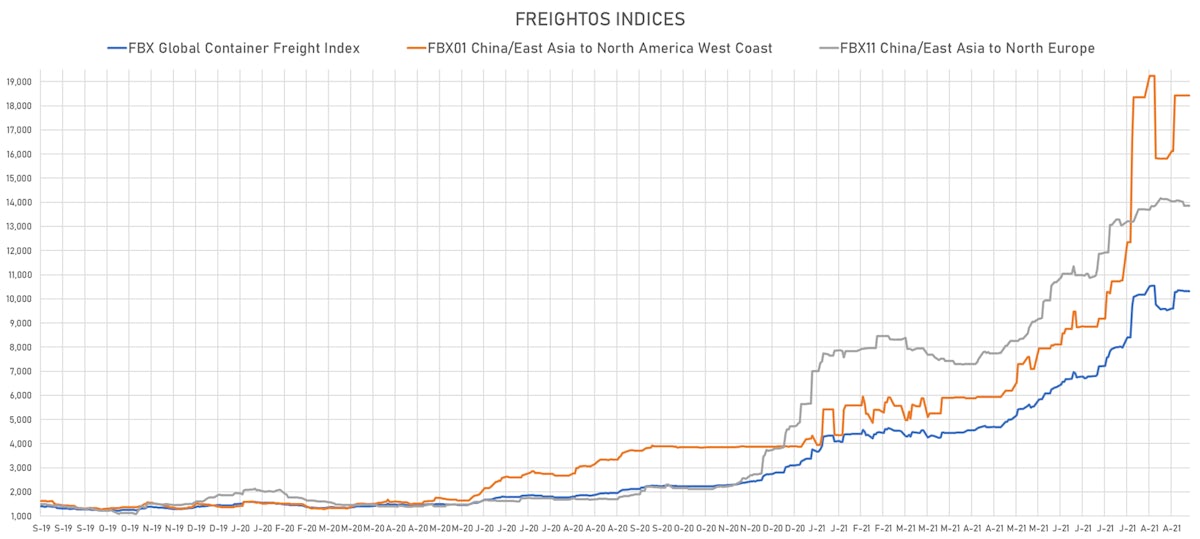

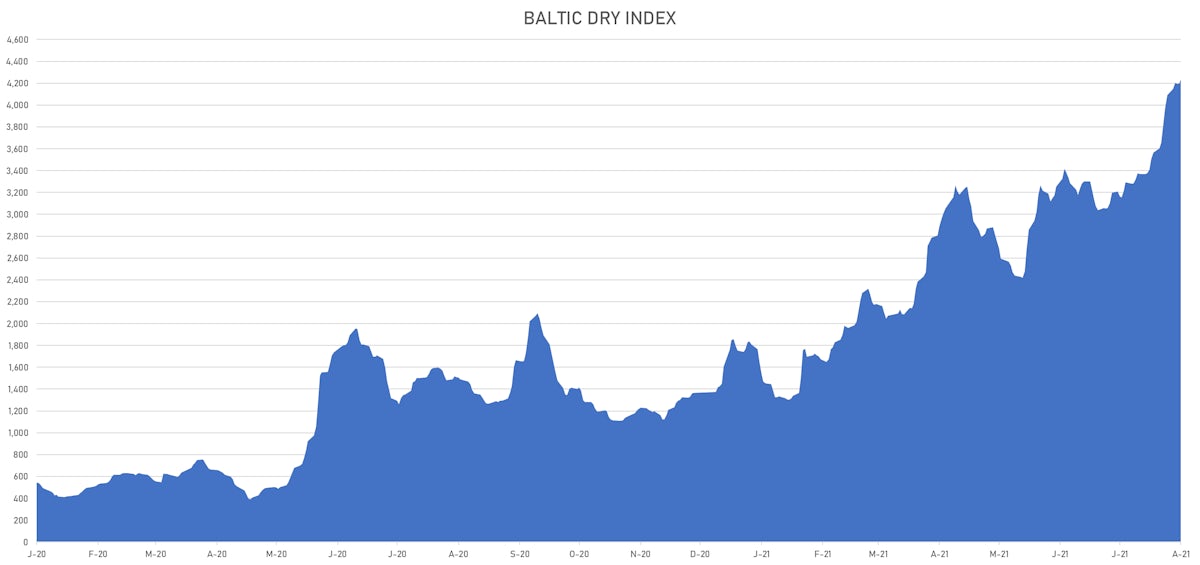

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,235, up 1.0% (YTD: +210.0%)

- Freightos China To North America West Coast Container Index currently at 18,425, unchanged (YTD: +338.7%)

- Freightos North America West Coast To China Container Index currently at 927, unchanged (YTD: +79.1%)

- Freightos North America East Coast To Europe Container Index currently at 364, up 0.8% (YTD: +0.3%)

- Freightos Europe To North America East Coast Container Index currently at 5,929, unchanged (YTD: +217.2%)

- Freightos China To North Europe Container Index currently at 13,855, unchanged (YTD: +144.7%)

- Freightos North Europe To China Container Index currently at 1,600, unchanged (YTD: +16.3%)

- Freightos Europe To South America West Coast Container Index currently at 5,190, unchanged (YTD: +206.8%)

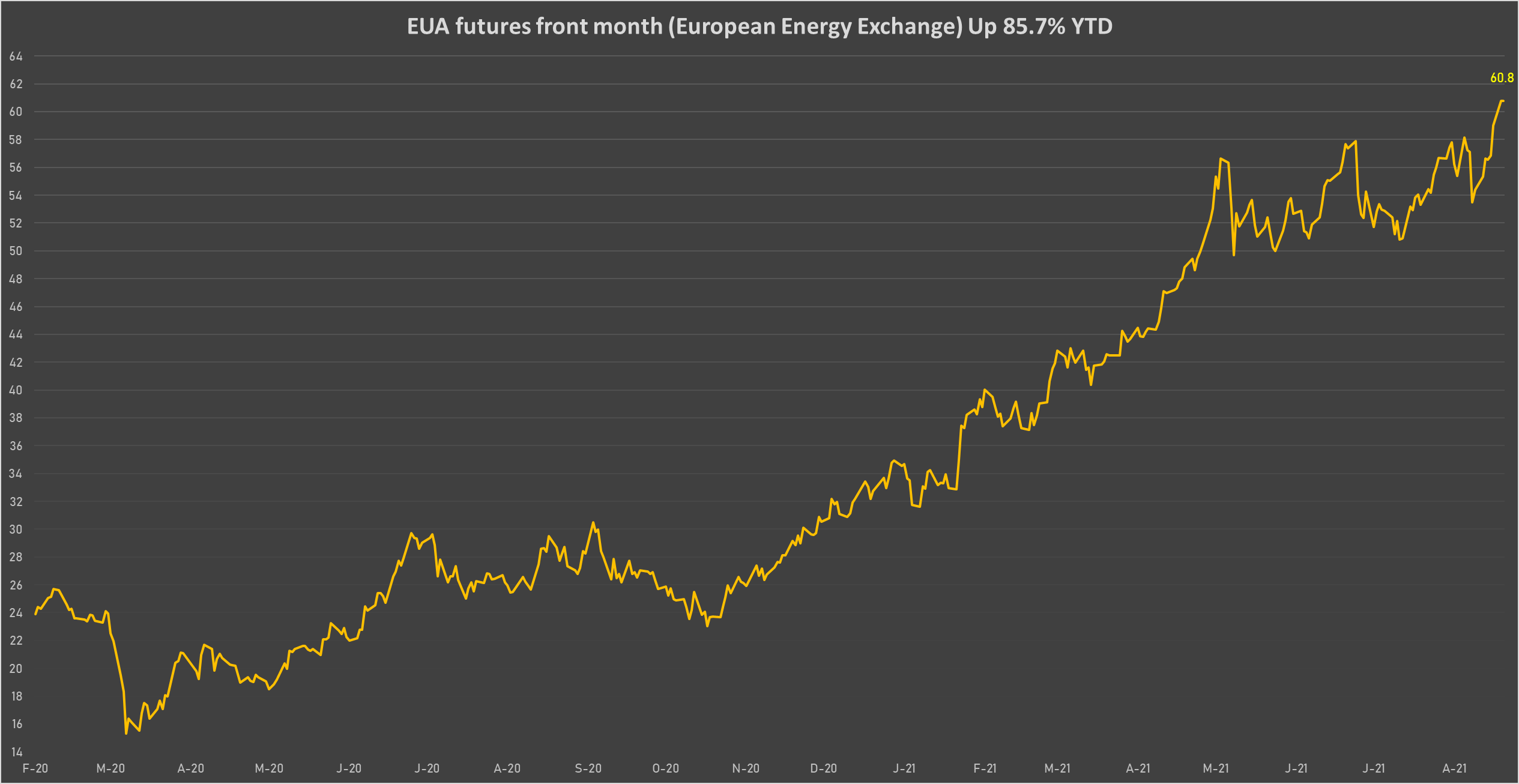

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) unchanged at EUR 60.76 per tonne (YTD: +85.7%)