Commodities

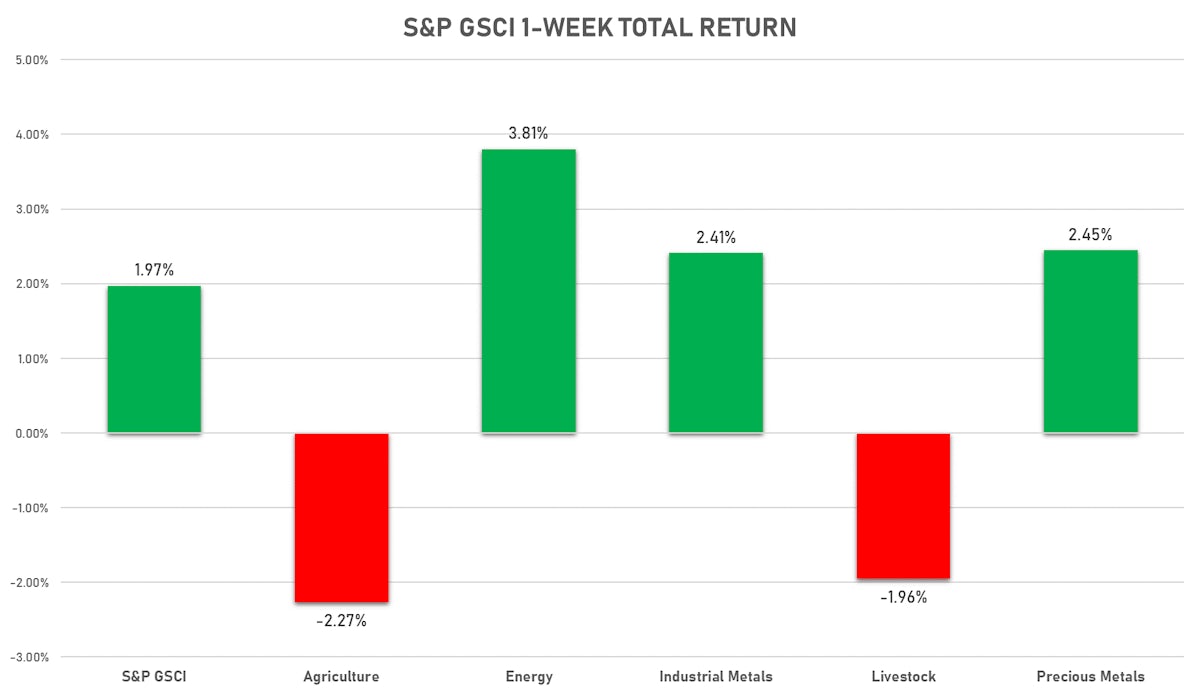

Good Week For Commodities With All Groups Making Sizeable Gains Except Ags

The Chinese domestic coking coal market remains very tight and prices have soared to all-time highs in the past month, with supply constrained by the suspension of overland imports from Mongolia as well as China’s ban on Australian coal

Published ET

Coking Coal Up Over 10% This Week | Sources: ϕpost, Refinitiv data

NOTABLE GAINERS TODAY

- CME Random Length Lumber up 5.9% (YTD: -37.3%)

- Silver spot up 3.5% (YTD: -6.3%)

- SGX Iron Ore 62% China CFR Swap Monthly up 3.2% (YTD: -6.9%)

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) up 3.1% (YTD: -7.1%)

- Platinum spot up 2.6% (YTD: -4.3%)

- DCE Coke up 2.4% (YTD: 31.7%)

- DCE Coking Coal Continuation Month 1 up 2.2% (YTD: 111.3%)

- ICE-US Cocoa up 1.6% (YTD: 2.7%)

- Bursa Malaysia Crude Palm Oil up 1.6% (YTD: 16.9%)

- NYMEX Henry Hub Natural Gas up 1.5% (YTD: 85.6%)

- DCE Iron Ore Continuation Month 1 up 1.5% (YTD: -16.4%)

- CBoT Wheat up 1.5% (YTD: 11.6%)

- SHFE Rebar up 1.5% (YTD: 25.6%)

- CME Cash settled Butter up 1.3% (YTD: 19.9%)

- Gold spot up 1.0% (YTD: -3.7%)

NOTABLE LOSERS TODAY

- CBoT Corn down -1.6% (YTD: 5.0%)

- SMM Rare Earth Dysprosium Metal Spot Price Daily down -1.5% (YTD: 33.1%)

- SMM Rare Earth Terbium Metal Spot Price Daily down -1.5% (YTD: 9.0%)

- Zhengzhou Exchange Thermal Coal down -1.5% (YTD: 38.9%)

- ICE-US Sugar No. 11 down -1.4% (YTD: 26.7%)

- CME Cattle(Feeder) down -1.1% (YTD: 14.1%)

- Crude Oil WTI Cushing US FOB down -1.0% (YTD: 43.4%)

- NYMEX Light Sweet Crude Oil (WTI) down -1.0% (YTD: 42.8%)

- CME Live Cattle down -1.0% (YTD: 10.5%)

- SMM Rare Earth Carbonate Domestic Spot Price Daily down -0.8% (YTD: 111.4%)

- SHFE Nickel down -0.8% (YTD: 19.1%)

- SMM Rare Earth Dysprosium Iron Alloy Spot Price Daily down -0.8% (YTD: 31.5%)

- SMM Rare Earth Dysprosium Oxide Spot Price Daily down -0.8% (YTD: 30.4%)

- Coffee Arabica Colombia Excelso EP Spot down -0.8% (YTD: 42.7%)

- ICE-US Coffee C down -0.7% (YTD: 48.6%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC REPORT)

ENERGY

- Light Sweet Crude reduced net long position

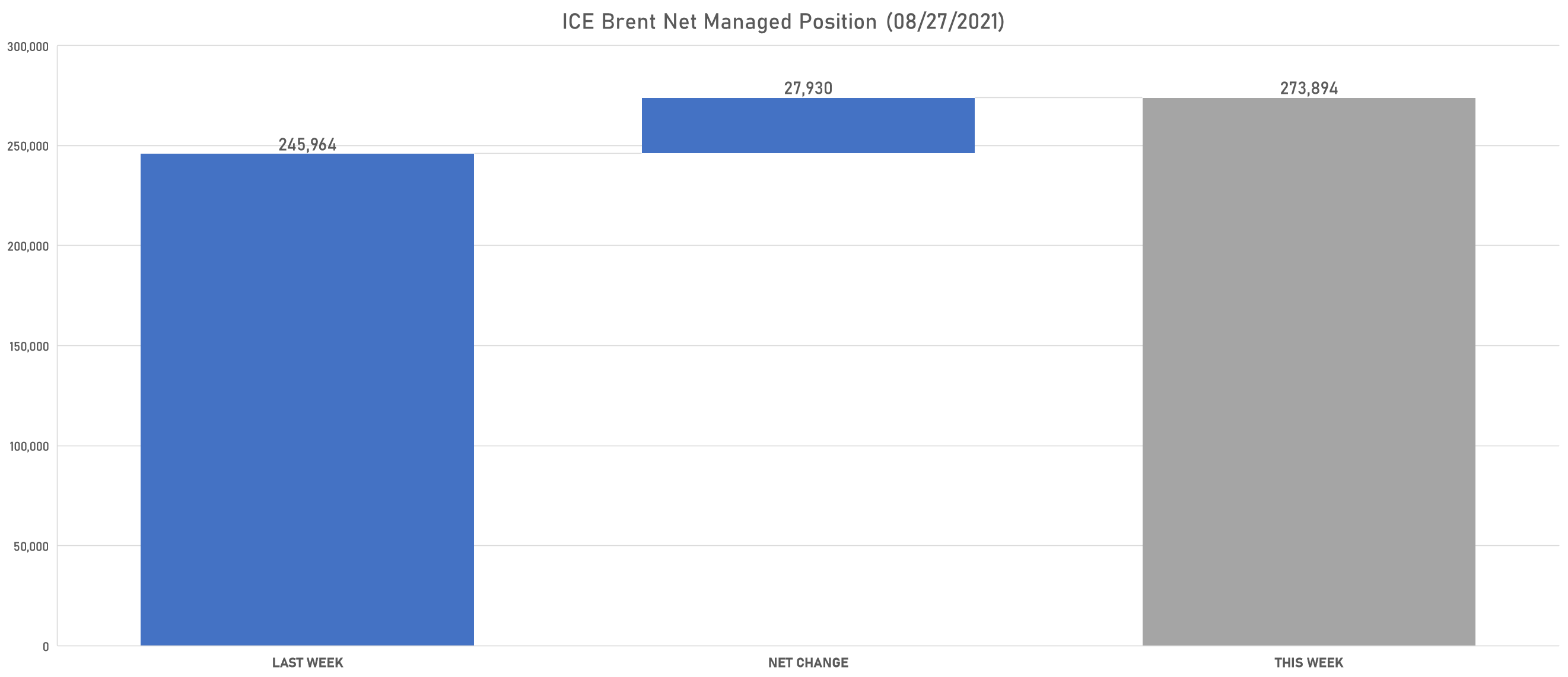

- Ice Brent increased net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil increased net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum increased net short position

- Palladium increased net long position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat reduced net long position

- Corn reduced net long position

- Rough Rice increased net short position

- Oats increased net long position

- Soybeans reduced net long position

- Soybean Oil reduced net long position

- Soybean Meal reduced net long position

- Lean Hogs increased net long position

- Live Cattle reduced net long position

- Feeder Cattle reduced net long position

- Cocoa reduced net long position

- Coffee C increased net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice increased net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position

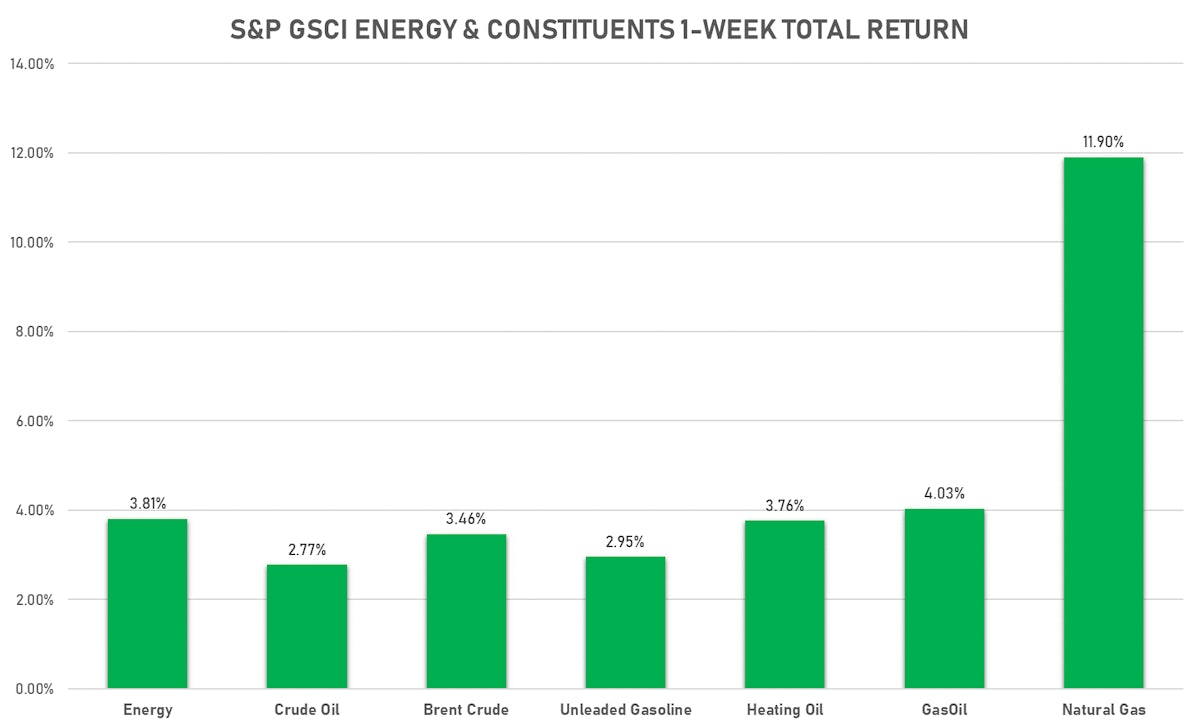

ENERGY UP THIS WEEK

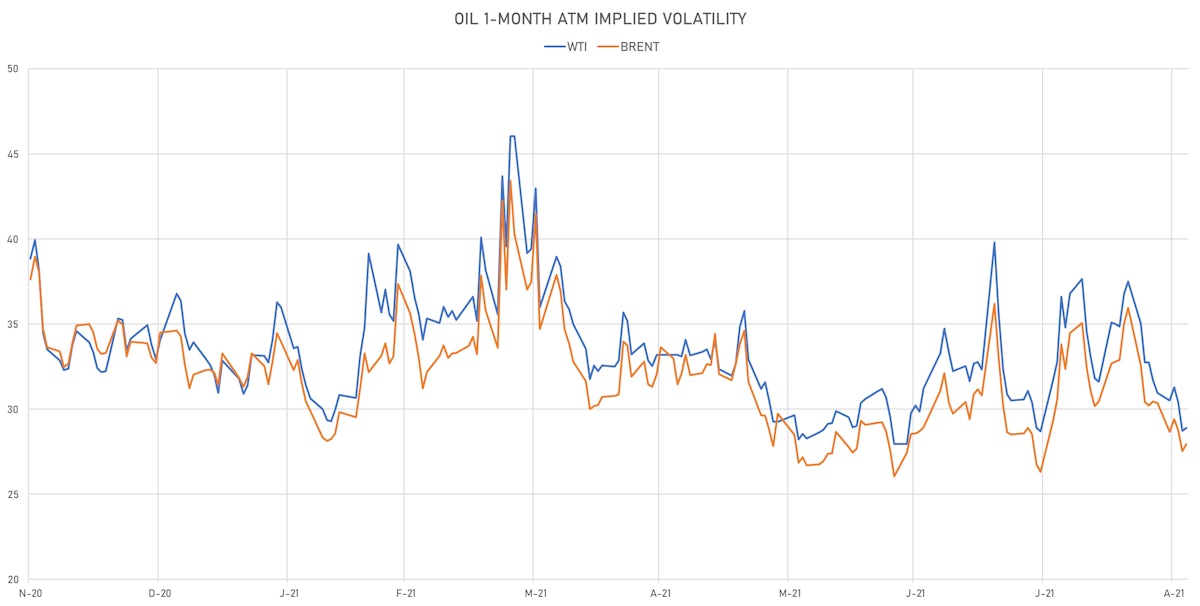

- WTI crude front month currently at US$ 69.29 per barrel, down -1.0% (YTD: +42.8%); 6-month term structure in tightening backwardation

- Brent crude front month currently at US$ 72.61 per barrel, down -0.6% (YTD: +40.2%); 6-month term structure in tightening backwardation

- Brent volatility at 28.0, up 1.5% (12-month range: 26.1 - 43.4)

- Newcastle Coal (ICE Europe) currently at US$ 179.00 per tonne, up 0.8% (YTD: +122.4%)

- Natural Gas (Henry Hub) currently at US$ 4.71 per MMBtu, up 1.5% (YTD: +85.6%)

- Gasoline (NYMEX) currently at US$ 2.15 per gallon, down -0.4% (YTD: +52.9%); 6-month term structure in tightening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 613.25 per tonne, down -0.6% (YTD: +45.8%)

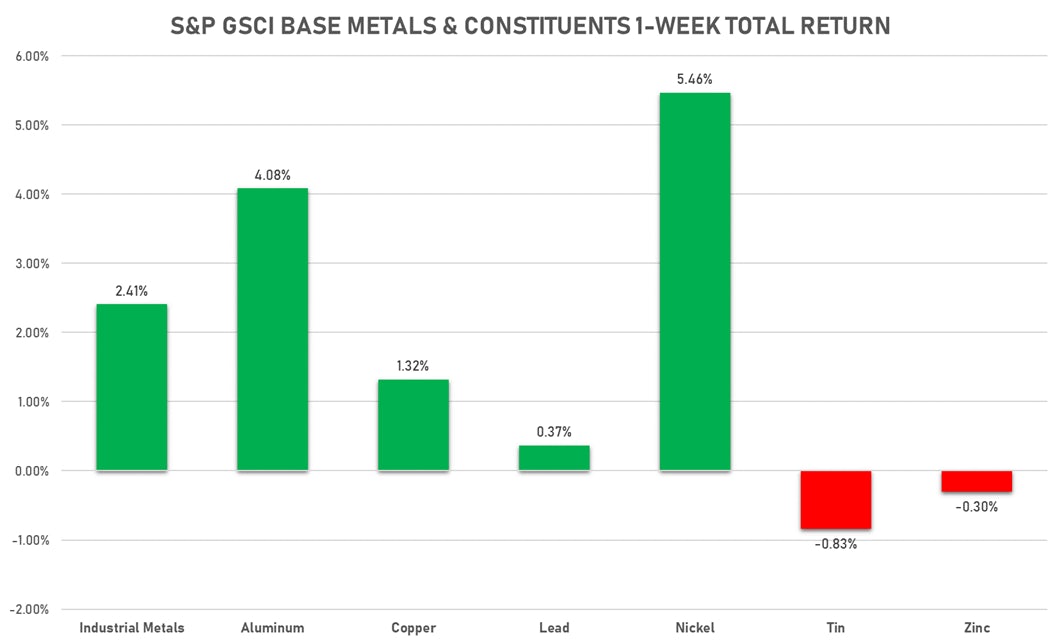

BASE METALS MOSTLY UP THIS WEEK

- Copper (COMEX) currently at US$ 4.33 per pound, up 0.8% (YTD: +23.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 909.00 per tonne, up 1.5% (YTD: -16.4%)

- Aluminum (Shanghai) currently at CNY 21,480 per tonne, up 0.6% (YTD: +35.9%)

- Nickel (Shanghai) currently at CNY 148,880 per tonne, down -0.8% (YTD: +19.1%)

- Lead (Shanghai) currently at CNY 15,000 per tonne, up 0.6% (YTD: +1.9%)

- Rebar (Shanghai) currently at CNY 5,302 per tonne, up 1.5% (YTD: +25.6%)

- Tin (Shanghai) currently at CNY 249,210 per tonne, down -0.4% (YTD: +65.2%)

- Zinc (Shanghai) currently at CNY 22,425 per tonne, up 0.6% (YTD: +7.1%)

- Refined Cobalt (Shanghai) spot price currently at CNY 365,500 per tonne, unchanged (YTD: +33.4%)

- Lithium (Shanghai) spot price currently at CNY 735,000 per tonne, unchanged (YTD: +51.5%)

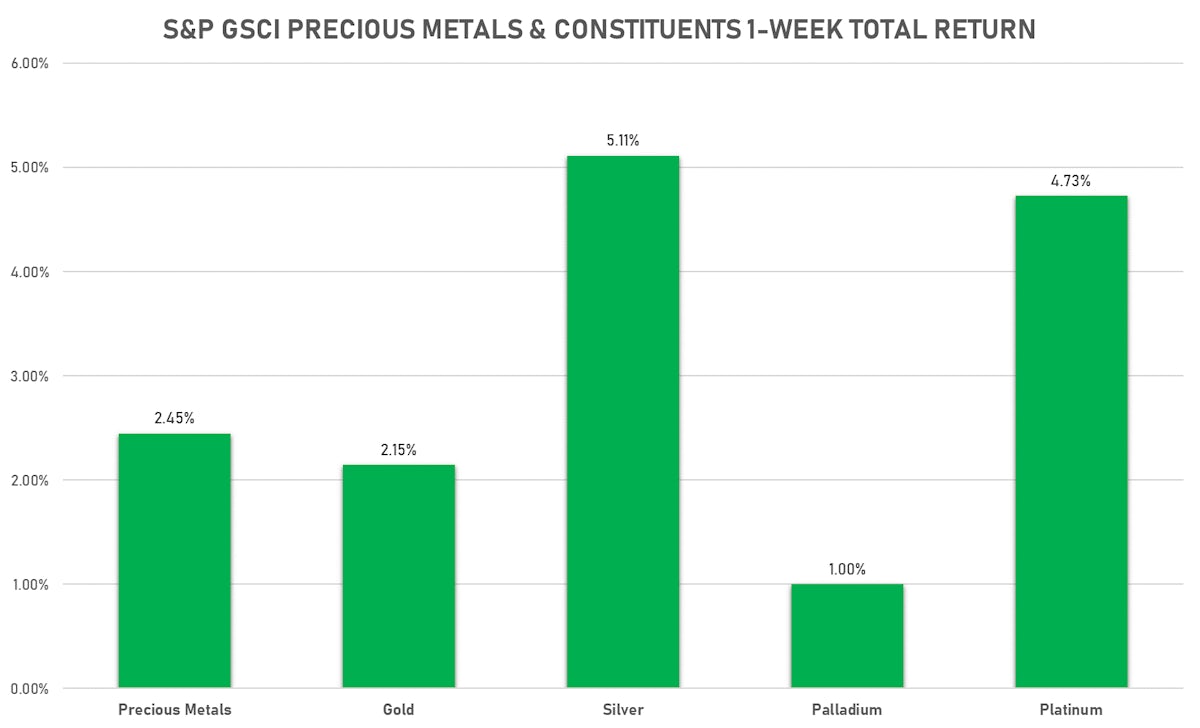

PRECIOUS METALS UP BIG THIS WEEK ON DOLLAR WEAKNESS

- Gold spot currently at US$ 1,827.55 per troy ounce, up 1.0% (YTD: -3.7%)

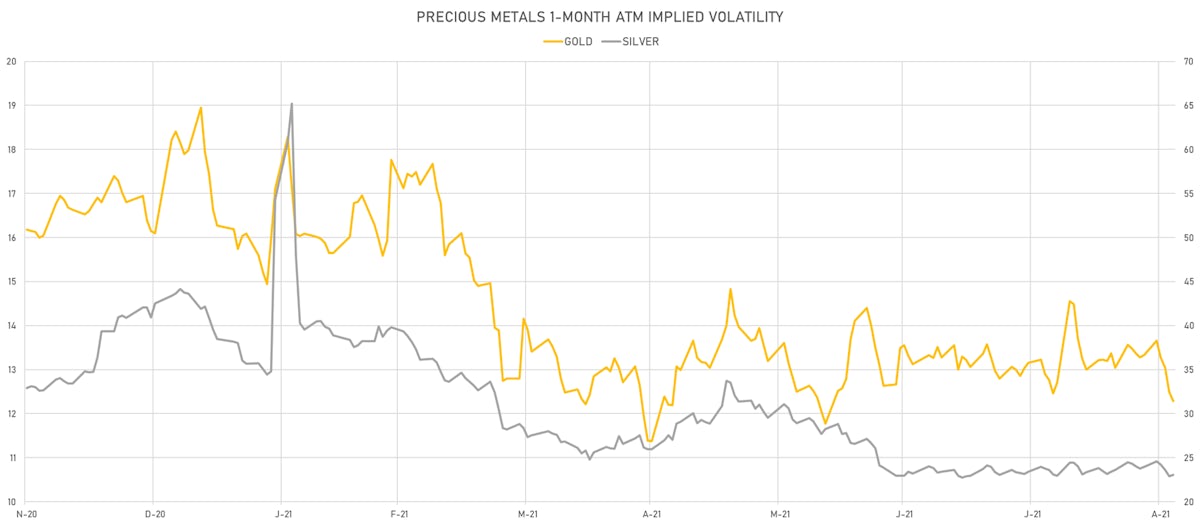

- Gold 1-Month ATM implied volatility currently at 12.04, down -1.6% (YTD: -23.7%)

- Silver spot currently at US$ 24.71 per troy ounce, up 3.5% (YTD: -6.3%)

- Silver 1-Month ATM implied volatility currently at 22.05, up 0.7% (YTD: -45.8%)

- Palladium spot currently at US$ 2,423.34 per troy ounce, up 0.6% (YTD: -0.9%)

- Platinum spot currently at US$ 1,023.25 per troy ounce, up 2.6% (YTD: -4.3%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 17,000 per troy ounce, unchanged (YTD: -0.3%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 5,200 per troy ounce, unchanged (YTD: +100.0%)

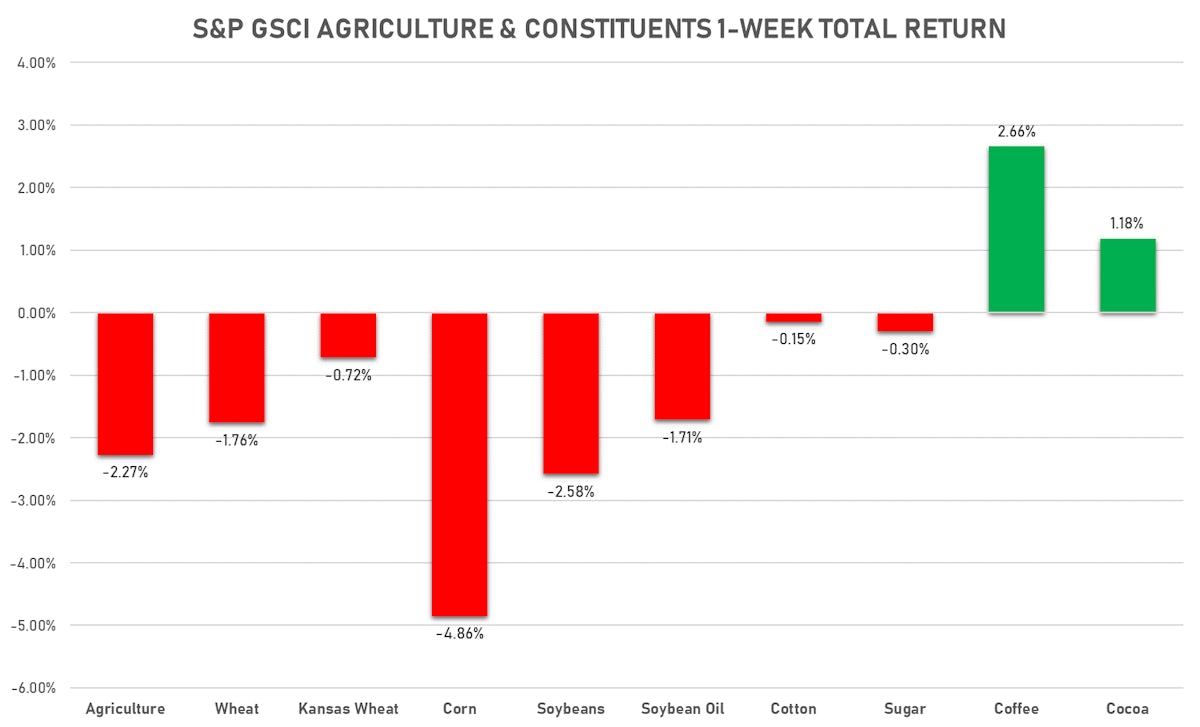

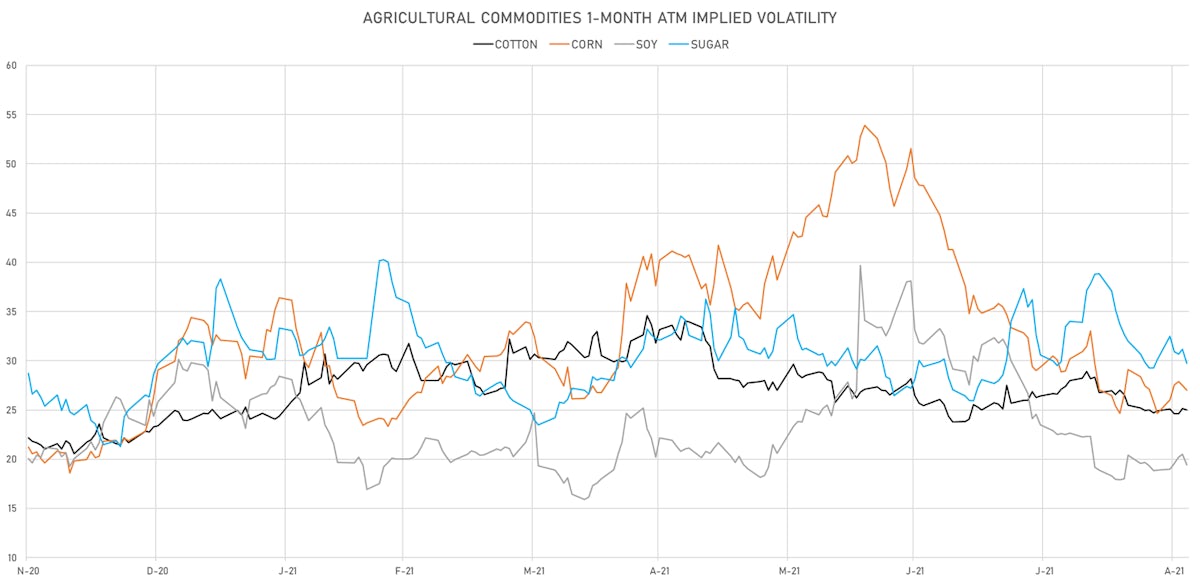

AGS MOSTLY DOWN THIS WEEK

- Live Cattle (CME) currently at US$ 124.80 cents per pound, down 1.0% (YTD: +10.5%)

- Lean Hogs (CME) currently at US$ 89.58 cents per pound, down -0.3% (YTD: +27.5%)

- Rough Rice (CBOT) currently at US$ 13.07 cents per hundredweight, up 0.1% (YTD: +5.4%)

- Soybeans Composite (CBOT) currently at US$ 1,283.00 cents per bushel, up 0.3% (YTD: -2.5%)

- Corn (CBOT) currently at US$ 508.00 cents per bushel, down -1.6% (YTD: +5.0%)

- Wheat Composite (CBOT) currently at US$ 714.50 cents per bushel, up 1.5% (YTD: +11.6%)

- Sugar No.11 (ICE US) currently at US$ 19.58 cents per pound, down -1.4% (YTD: +26.7%)

- Cotton No.2 (ICE US) currently at US$ 95.38 cents per pound, up 0.5% (YTD: +22.4%)

- Cocoa (ICE US) currently at US$ 2,631 per tonne, up 1.6% (YTD: +2.7%)

- Coffee Arabica (Colombia Excelso) currently at EUR 4,518 per tonne, down -0.8% (YTD: +42.7%)

- Random Length Lumber (CME) currently at US$ 547.20 per 1,000 board feet, up 5.9% (YTD: -37.3%)

- TSR 20 Rubber (Shanghai) currently at CNY 10,490 per tonne, down -0.3% (YTD: +5.0%)

- Soybean Oil Composite (CBOT) unchanged at US$ 59.00 cents per pound (YTD: +36.2%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 4,550 per tonne, up 1.6% (YTD: +16.9%)

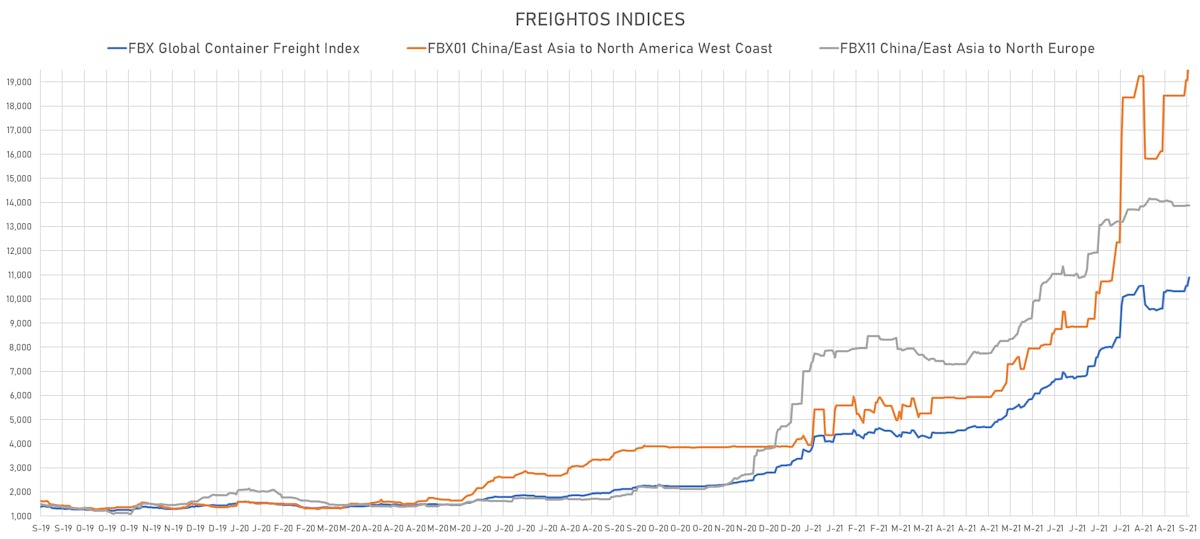

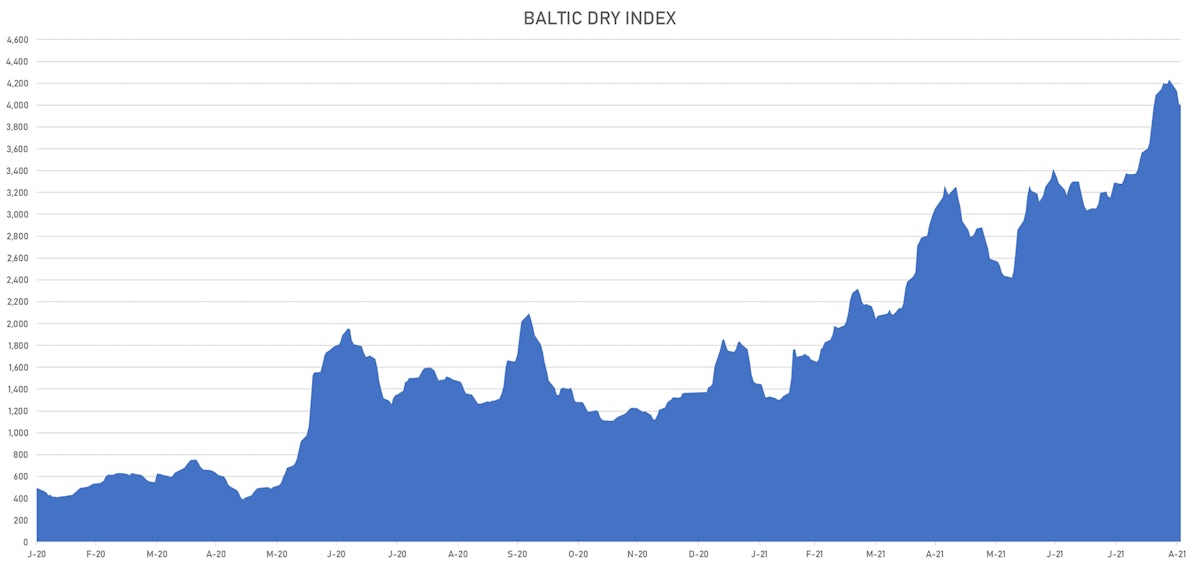

SHIPPING TODAY

- Baltic Dry Index (Baltic Exchange) currently at 4,001, down -0.3% (YTD: +192.9%)

- Freightos China To North America West Coast Container Index currently at 20,188, up 5.8% (YTD: +380.7%)

- Freightos North America West Coast To China Container Index currently at 907, unchanged (YTD: +75.2%)

- Freightos North America East Coast To Europe Container Index currently at 364, unchanged (YTD: +0.3%)

- Freightos Europe To North America East Coast Container Index currently at 6,415, up 9.7% (YTD: +243.2%)

- Freightos China To North Europe Container Index currently at 13,878, unchanged (YTD: +145.1%)

- Freightos North Europe To China Container Index currently at 1,537, unchanged (YTD: +11.8%)

- Freightos Europe To South America West Coast Container Index currently at 5,288, unchanged (YTD: +212.6%)

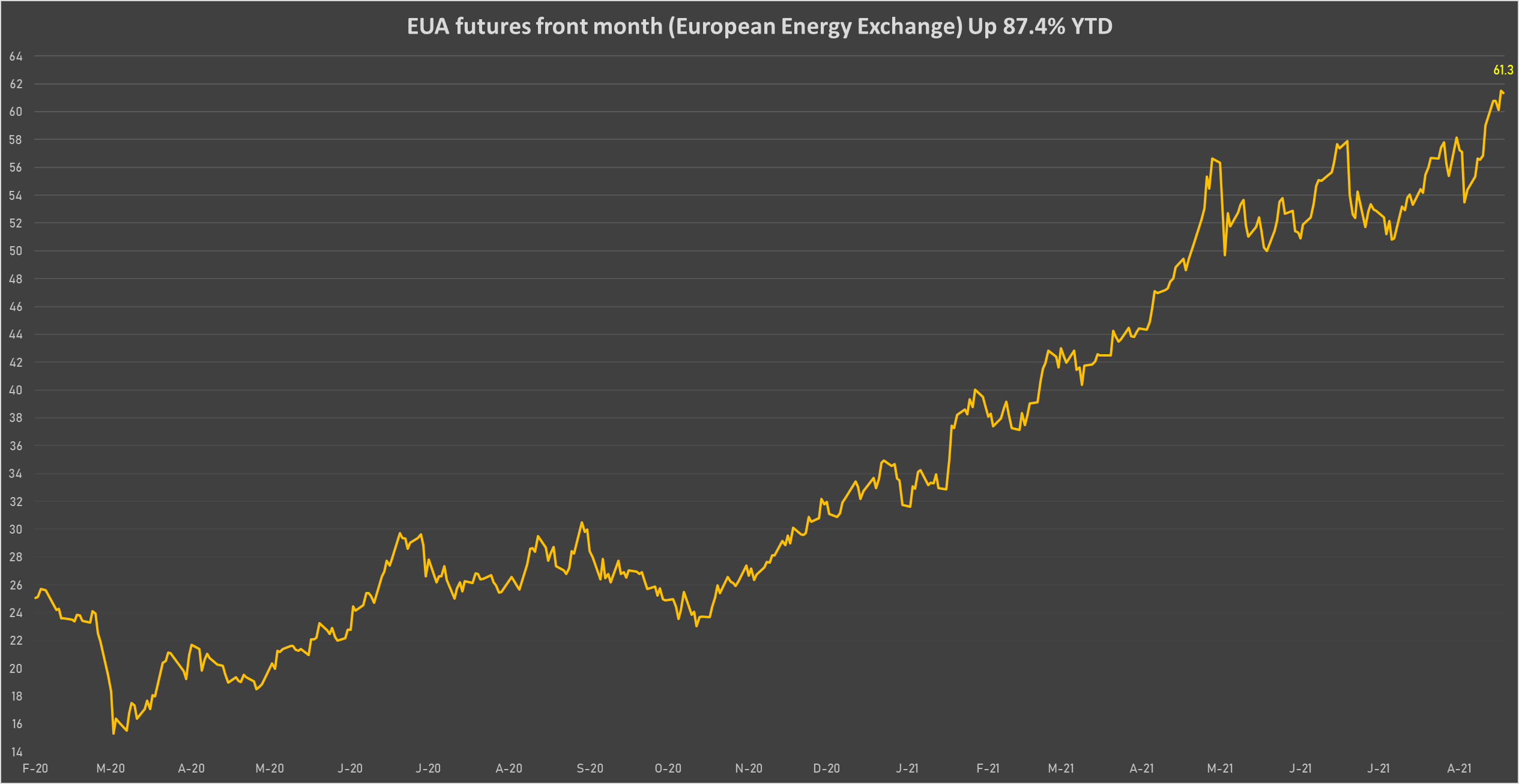

CARBON EMISSION ALLOWANCES (CO2)

- EUA futures front month (European Energy Exchange) currently at EUR 61.32 per tonne, down -0.3% (YTD: +87.4%)